The Aaron’s Company, Inc. Q1 2023 Earnings Results April 24, 2023 Exhibit 99.2

Special Note Regarding Forward-Looking Information Statements in this presentation regarding our business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “remain,” “believe,” “outlook,” “expect,” “assume,” “assumed,” , “plan” and similar expressions. These risks and uncertainties include factors such as (i) factors impacting consumer spending, including the current inflationary environment, general macroeconomic conditions and rising interest rates; (ii) any ongoing impact of the COVID-19 pandemic due to new variants or efficacy and rate of vaccinations, as well as related measures taken by governmental or regulatory authorities to combat the pandemic; (iii) the possibility that the operational, strategic and shareholder value creation opportunities expected from the separation and spin-off of the Aaron’s Business into what is now The Aaron’s Company, Inc. may not be achieved in a timely manner, or at all; (iv) the failure of that separation to qualify for the expected tax treatment; (v) the risk that the Company may fail to realize the benefits expected from the acquisition of BrandsMart U.S.A., including projected synergies; (vi) risks related to the disruption of management time from ongoing business operations due to the BrandsMart U.S.A. acquisition; (vii) failure to promptly and effectively integrate the BrandsMart U.S.A. acquisition; (viii) the effect of the BrandsMart U.S.A. acquisition on our operating results and businesses and on the ability of Aaron's and BrandsMart to retain and hire key personnel or maintain relationships with suppliers; (ix) changes in the enforcement and interpretation of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business; (x) legal and regulatory proceedings and investigations, including those related to consumer protection laws and regulations, customer privacy, third party and employee fraud, and information security; (xi) the risks associated with our strategy and strategic priorities not being successful, including our e-commerce and real estate repositioning and optimization initiatives or being more costly than anticipated; (xii) risks associated with the challenges faced by our business, including the commoditization of consumer electronics, our high fixed-cost operating model and the ongoing labor shortage; (xiii) increased competition from traditional and virtual lease-to-own competitors, as well as from traditional and online retailers and other competitors; (xiv) financial challenges faced by our franchisees; (xv) increases in lease merchandise write-offs, and the potential limited duration and impact of government stimulus and other government payments made by Federal and State governments to counteract the economic impact of the pandemic; (xvi) the availability and prices of supply chain resources, including products and transportation; (xvii) business disruptions due to political or economic instability due to the ongoing conflict between Russia and Ukraine; and (xviii) the other risks and uncertainties discussed under “Risk Factors” in the Company’s most recent Annual Report on Form 10-K. Statements in this presentation that are “forward-looking” include without limitation statements about: (i) the execution of our key strategic priorities; (ii) the growth and other benefits we expect from executing those priorities; (iii) our financial performance outlook; and (iv) the Company’s goals, plans, expectations, and projections regarding the expected benefits of the BrandsMart acquisition. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. 1

“I am pleased that we delivered consolidated company results ahead of our earnings expectations despite a softer tax refund season and continued economic pressure on our customer. Our lease portfolio size ended the quarter larger than expected and continues to benefit from our lease decisioning optimization. We’ve updated our outlook for 2023 to reflect first quarter results, and we remain focused on enhancing profitability of the company through execution of our strategic growth and cost reduction initiatives.” Douglas Lindsay CEO, The Aaron’s Company, Inc. CEO Comments 2

Q1 2023 Key Themes 3 ▪ Earnings were ahead of internal expectations, due in part to reduced lease merchandise write-offs (“write-offs”) and continued implementation of improved expense controls, despite lower revenues in both segments ▪ Demand at Aaron’s and BrandsMart was impacted in the quarter due to cautious consumer sentiment resulting from a softer than expected tax refund season, recent banking sector disruptions, and ongoing inflationary and other economic pressures ▪ Lease portfolio size ended the quarter larger than internal expectations due to fewer exercises of early purchase options and reduced write-offs ▪ Enhancements to our lease decisioning model contributed to sequential improvements in write-offs and 32+ day customer lease non-renewal rate (“32+ day non-renewal rate”) ▪ Progress on our market optimization and cost reduction initiatives contributed meaningfully to our bottom line in the quarter

4 Q1 Highlights

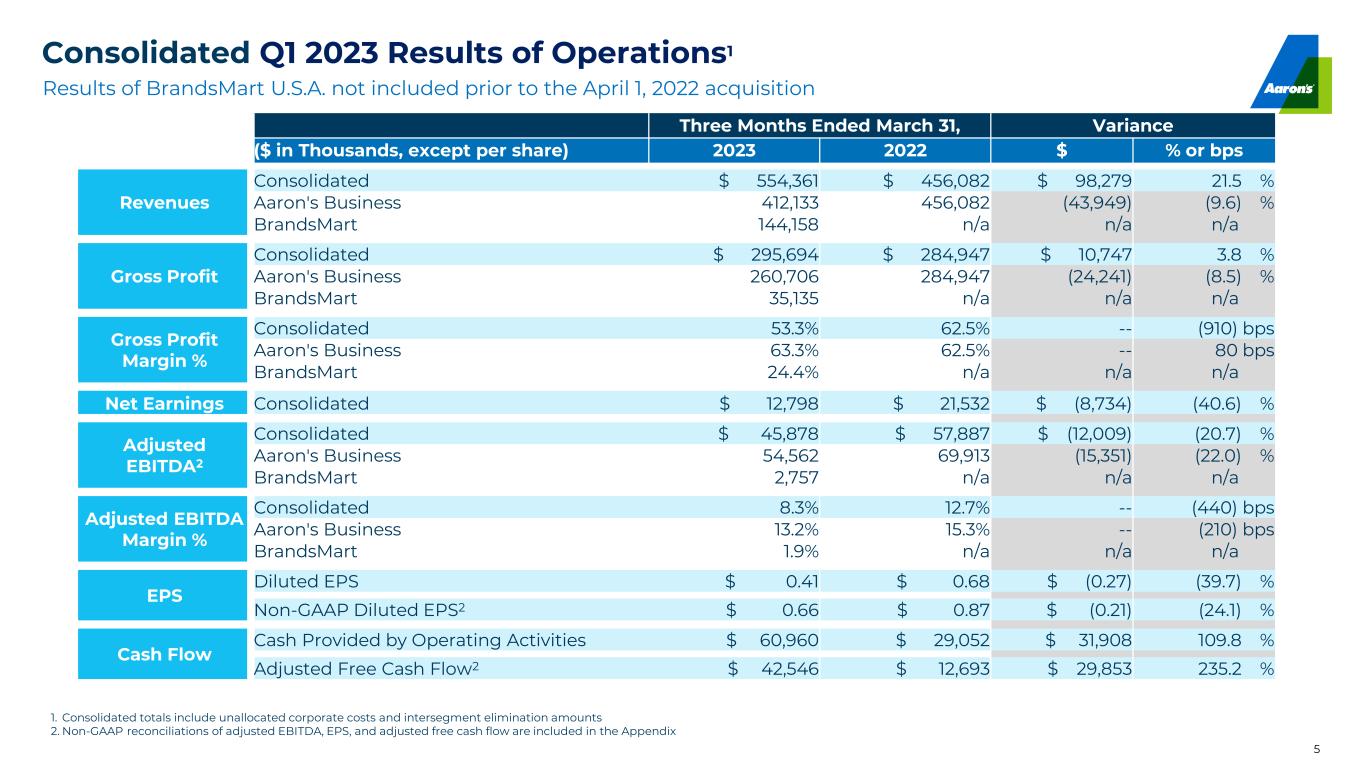

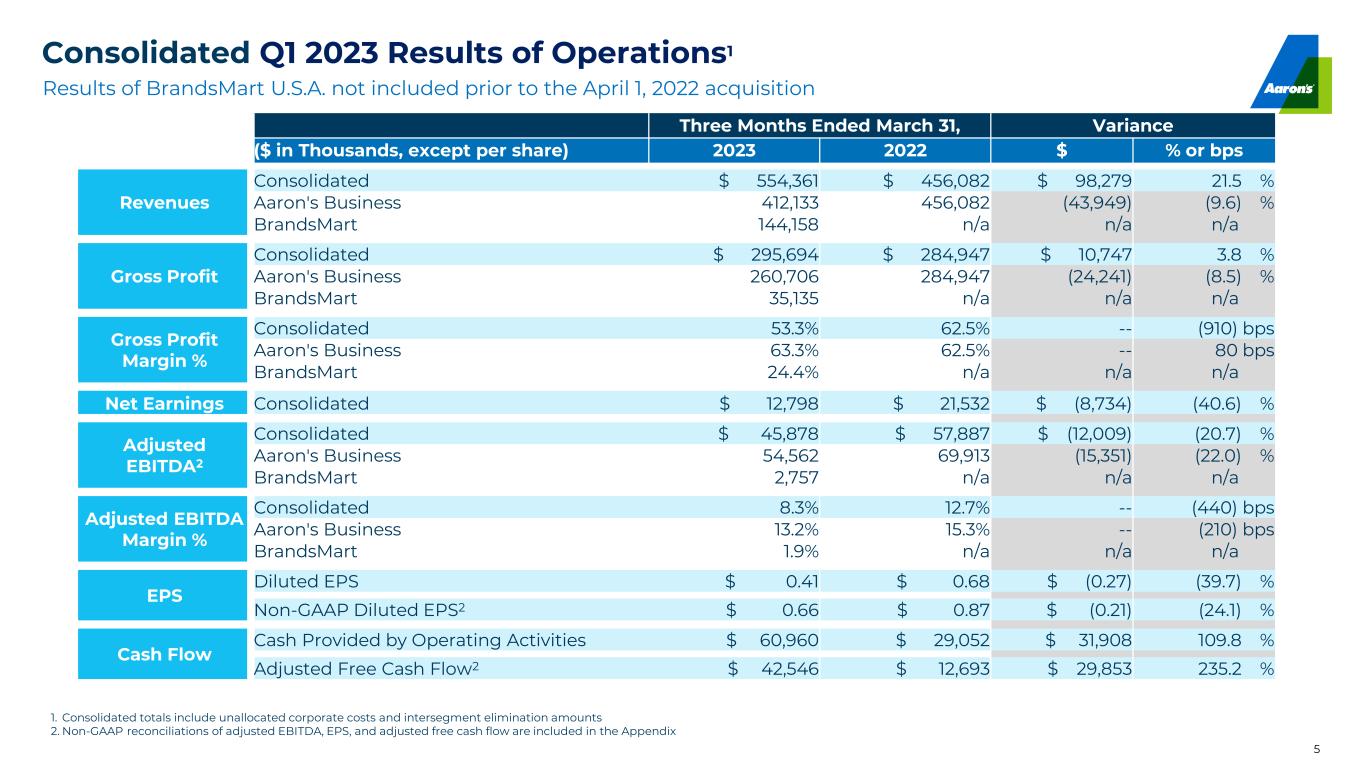

Consolidated Q1 2023 Results of Operations1 5 Three Months Ended March 31, Variance ($ in Thousands, except per share) 2023 2022 $ % or bps Revenues Consolidated $ 554,361 $ 456,082 $ 98,279 21.5 % Aaron's Business 412,133 456,082 (43,949) (9.6) % BrandsMart 144,158 n/a n/a n/a Gross Profit Consolidated $ 295,694 $ 284,947 $ 10,747 3.8 % Aaron's Business 260,706 284,947 (24,241) (8.5) % BrandsMart 35,135 n/a n/a n/a Gross Profit Margin % Consolidated 53.3% 62.5% -- (910) bps Aaron's Business 63.3% 62.5% -- 80 bps BrandsMart 24.4% n/a n/a n/a Net Earnings Consolidated $ 12,798 $ 21,532 $ (8,734) (40.6) % Adjusted EBITDA2 Consolidated $ 45,878 $ 57,887 $ (12,009) (20.7) % Aaron's Business 54,562 69,913 (15,351) (22.0) % BrandsMart 2,757 n/a n/a n/a Adjusted EBITDA Margin % Consolidated 8.3% 12.7% -- (440) bps Aaron's Business 13.2% 15.3% -- (210) bps BrandsMart 1.9% n/a n/a n/a EPS Diluted EPS $ 0.41 $ 0.68 $ (0.27) (39.7) % Non-GAAP Diluted EPS2 $ 0.66 $ 0.87 $ (0.21) (24.1) % Cash Flow Cash Provided by Operating Activities $ 60,960 $ 29,052 $ 31,908 109.8 % Adjusted Free Cash Flow2 $ 42,546 $ 12,693 $ 29,853 235.2 % 1. Consolidated totals include unallocated corporate costs and intersegment elimination amounts 2. Non-GAAP reconciliations of adjusted EBITDA, EPS, and adjusted free cash flow are included in the Appendix Results of BrandsMart U.S.A. not included prior to the April 1, 2022 acquisition

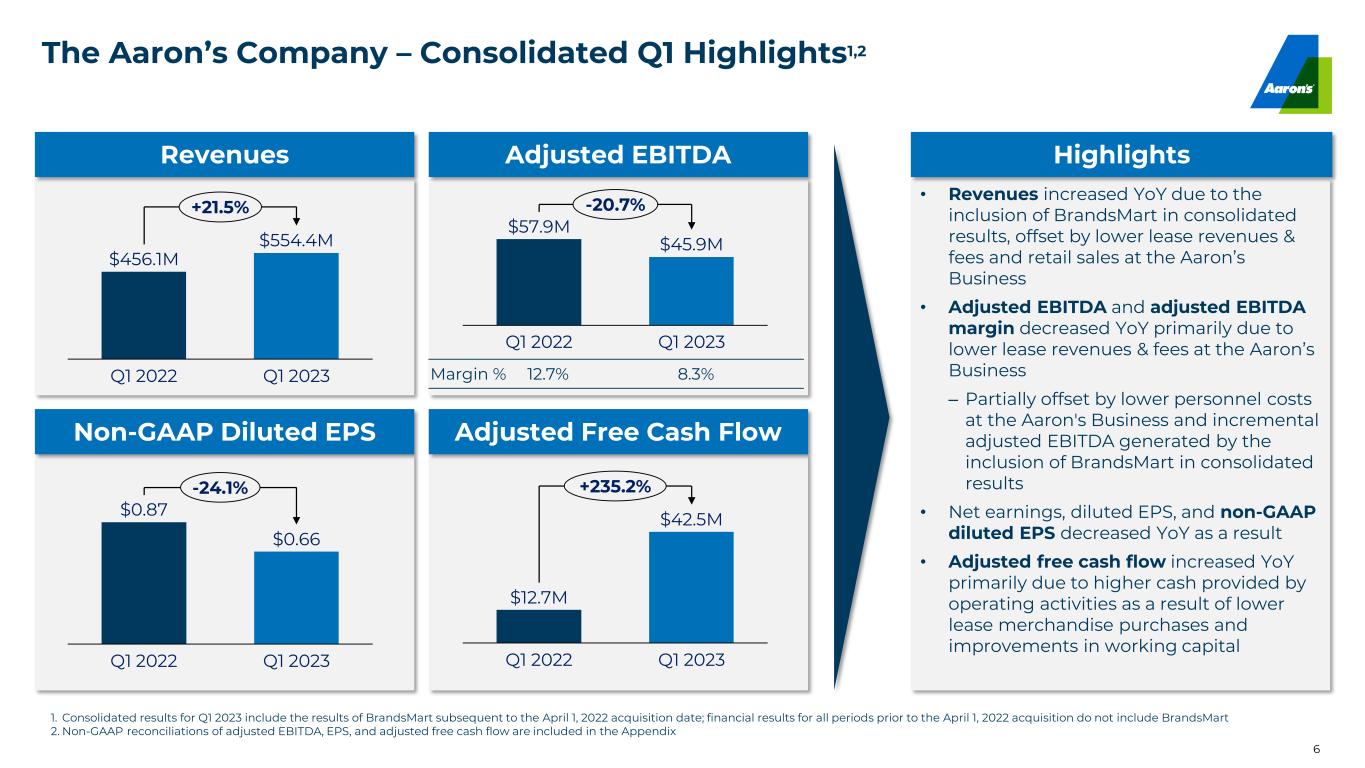

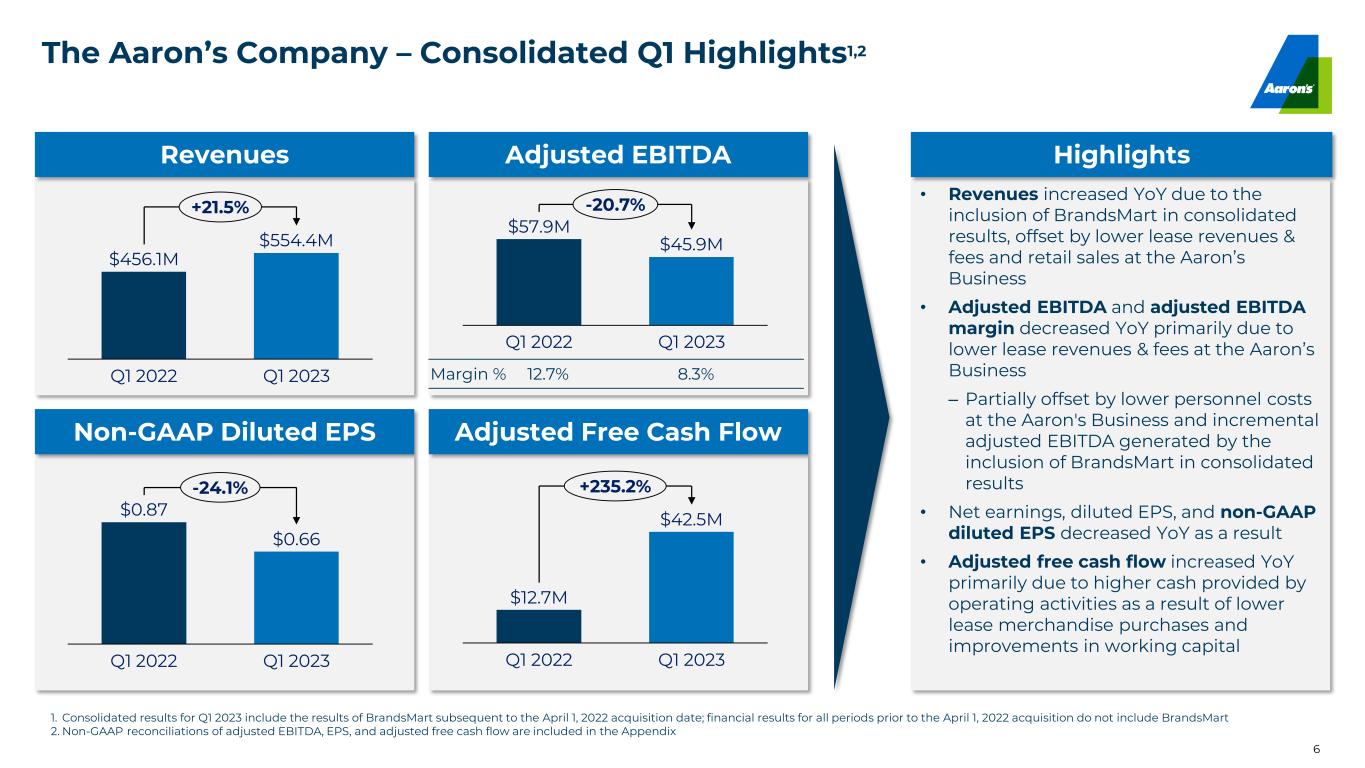

The Aaron’s Company – Consolidated Q1 Highlights1,2 6 Revenues Adjusted EBITDA Non-GAAP Diluted EPS Adjusted Free Cash Flow • Revenues increased YoY due to the inclusion of BrandsMart in consolidated results, offset by lower lease revenues & fees and retail sales at the Aaron’s Business • Adjusted EBITDA and adjusted EBITDA margin decreased YoY primarily due to lower lease revenues & fees at the Aaron’s Business ‒ Partially offset by lower personnel costs at the Aaron's Business and incremental adjusted EBITDA generated by the inclusion of BrandsMart in consolidated results • Net earnings, diluted EPS, and non-GAAP diluted EPS decreased YoY as a result • Adjusted free cash flow increased YoY primarily due to higher cash provided by operating activities as a result of lower lease merchandise purchases and improvements in working capital Highlights $456.1M $554.4M Q1 2022 Q1 2023 +21.5% $57.9M $45.9M Q1 2022 Q1 2023 -20.7% $0.87 $0.66 Q1 2022 Q1 2023 -24.1% $12.7M $42.5M Q1 2022 Q1 2023 +235.2% Margin % 12.7% 8.3% 1. Consolidated results for Q1 2023 include the results of BrandsMart subsequent to the April 1, 2022 acquisition date; financial results for all periods prior to the April 1, 2022 acquisition do not include BrandsMart 2. Non-GAAP reconciliations of adjusted EBITDA, EPS, and adjusted free cash flow are included in the Appendix

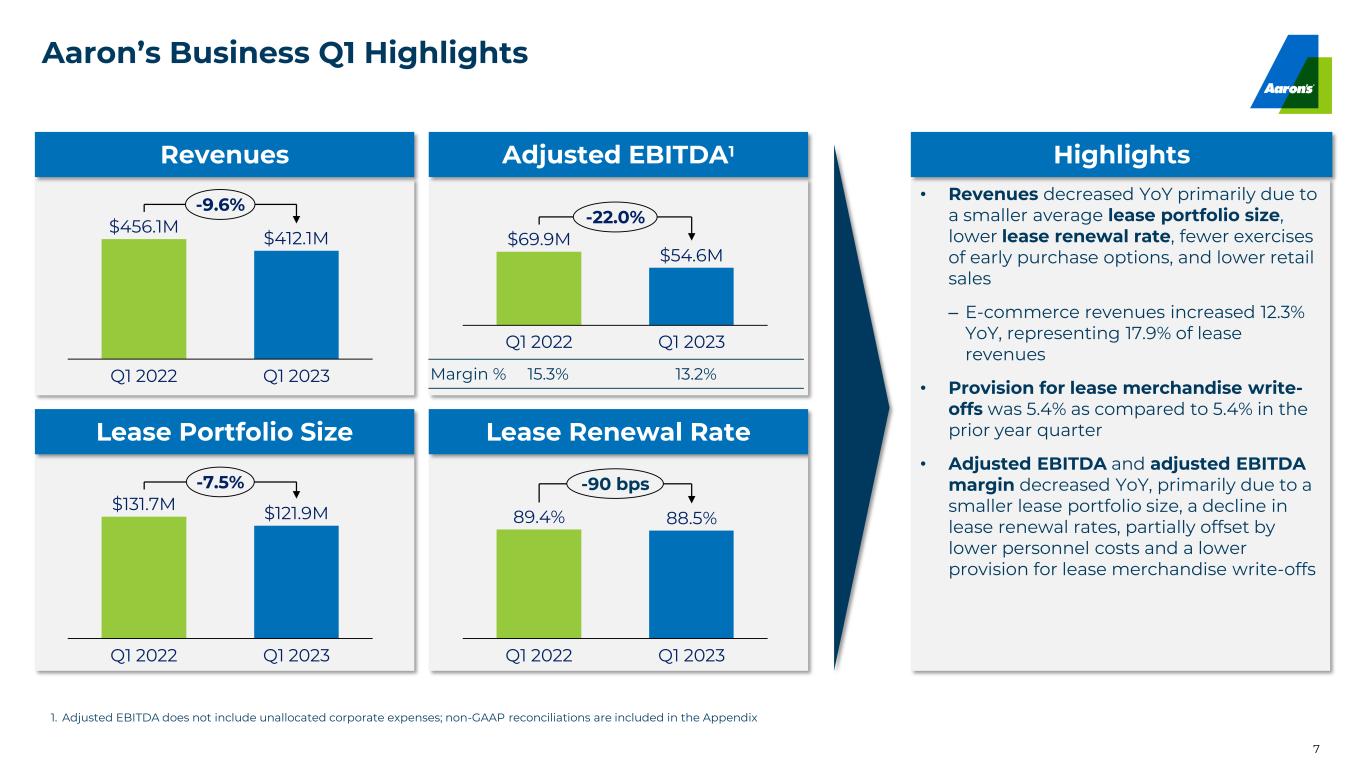

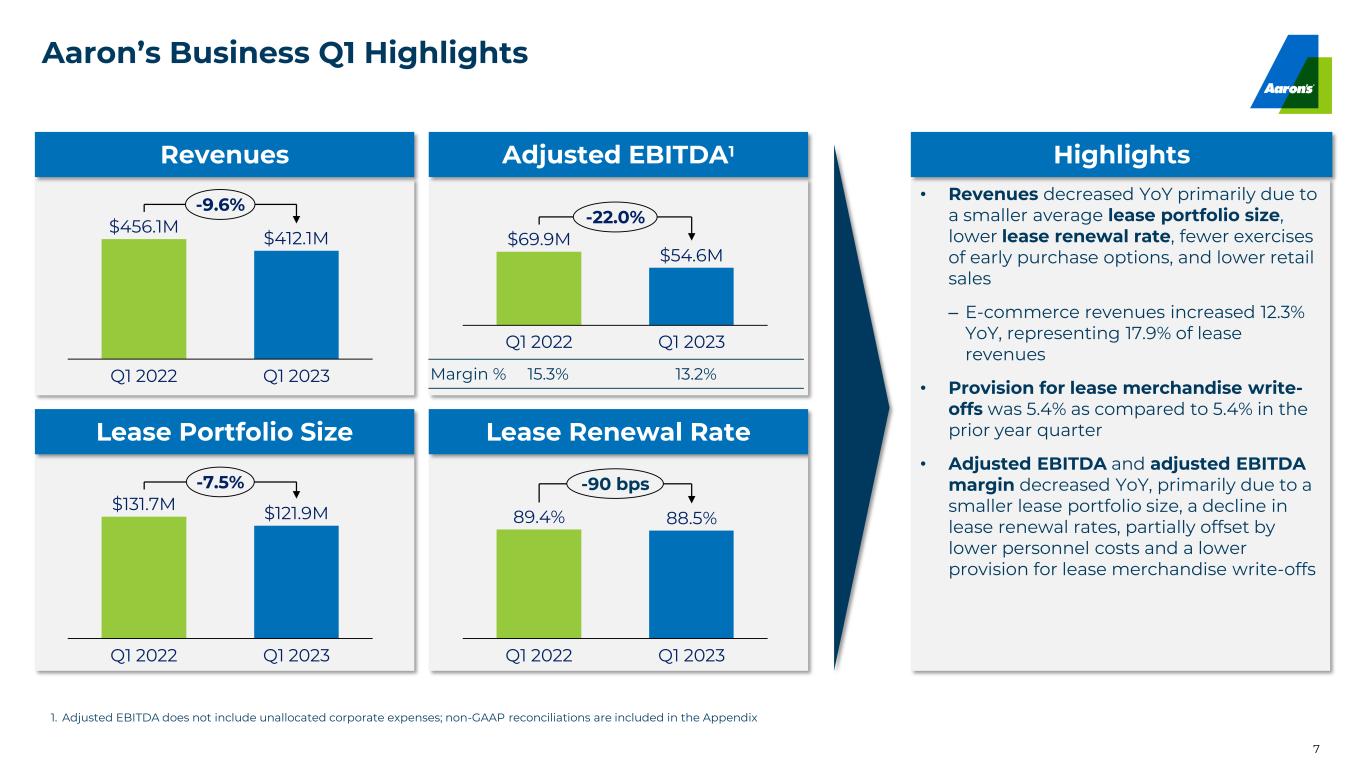

Aaron’s Business Q1 Highlights 7 Revenues Adjusted EBITDA1 Lease Portfolio Size Lease Renewal Rate • Revenues decreased YoY primarily due to a smaller average lease portfolio size, lower lease renewal rate, fewer exercises of early purchase options, and lower retail sales ‒ E-commerce revenues increased 12.3% YoY, representing 17.9% of lease revenues • Provision for lease merchandise write- offs was 5.4% as compared to 5.4% in the prior year quarter • Adjusted EBITDA and adjusted EBITDA margin decreased YoY, primarily due to a smaller lease portfolio size, a decline in lease renewal rates, partially offset by lower personnel costs and a lower provision for lease merchandise write-offs Highlights $456.1M $412.1M Q1 2023Q1 2022 -9.6% $69.9M $54.6M Q1 2022 Q1 2023 -22.0% $131.7M Q1 2023Q1 2022 $121.9M -7.5% 89.4% 88.5% Q1 2022 Q1 2023 -90 bps Margin % 15.3% 13.2% 1. Adjusted EBITDA does not include unallocated corporate expenses; non-GAAP reconciliations are included in the Appendix

Aaron’s Business Q1 Highlights – E-commerce & GenNext Store Strategy 8 % of Lease Revenues 15.2%3 17.9% Q1 2023Q1 2022 +12.3% 14.7% 26.7% Q1 2022 Q1 2023 Q1 2023Q1 2022 -5.5% 116 21119 Q1 2023Q1 2022 135 11 222 Opened in the Quarter Q1’23 Initial Count Q1’22 Initial Count E-commerce Highlights1 GenNext Store Highlights New Lease Originations2 Revenues % of Revenues4 GenNext Store Count 1. Based on open stores as of March 31, 2023 2. Monthly recurring revenue written into the portfolio resulting from new lease agreements 3. The % of lease revenues based on open stores as of March 31, 2022 was 15.4% 4.As a percent of lease and retail revenues; excludes GenNext stores open less than one month

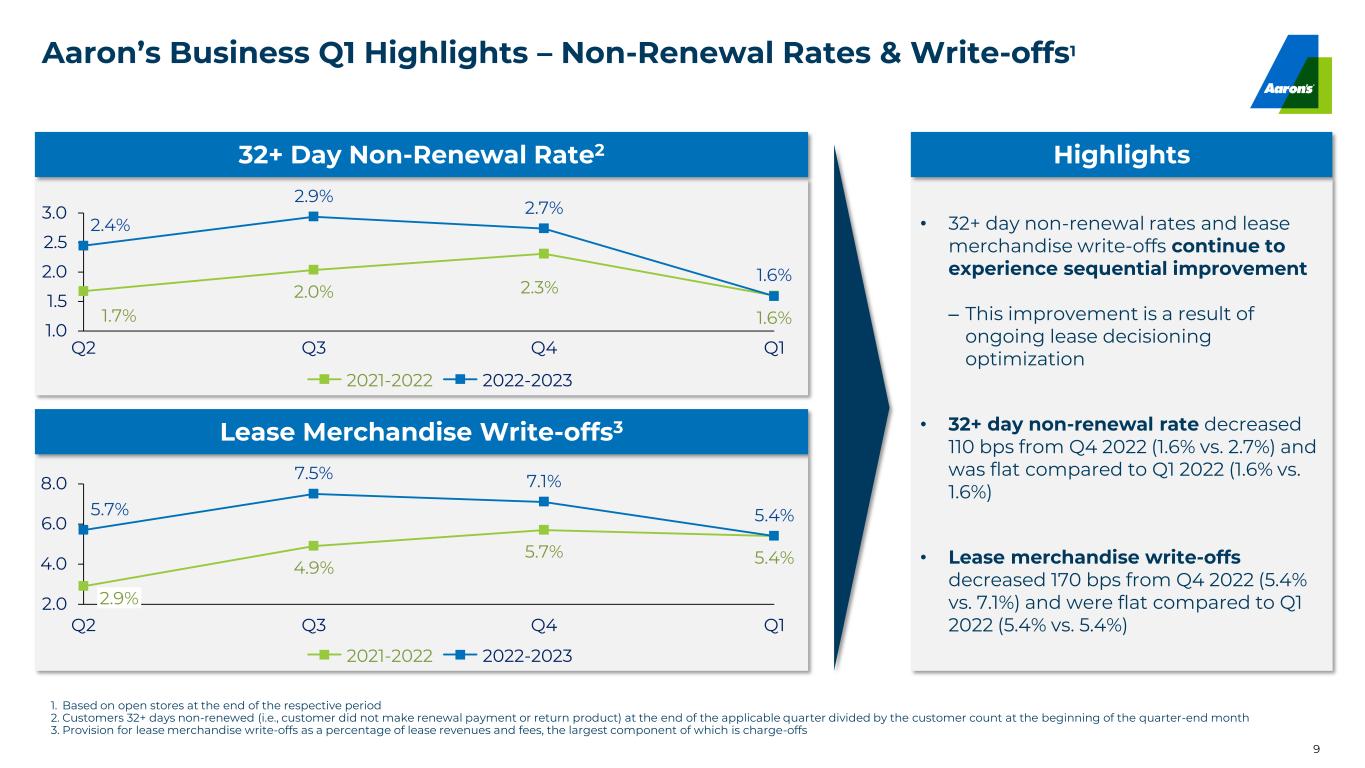

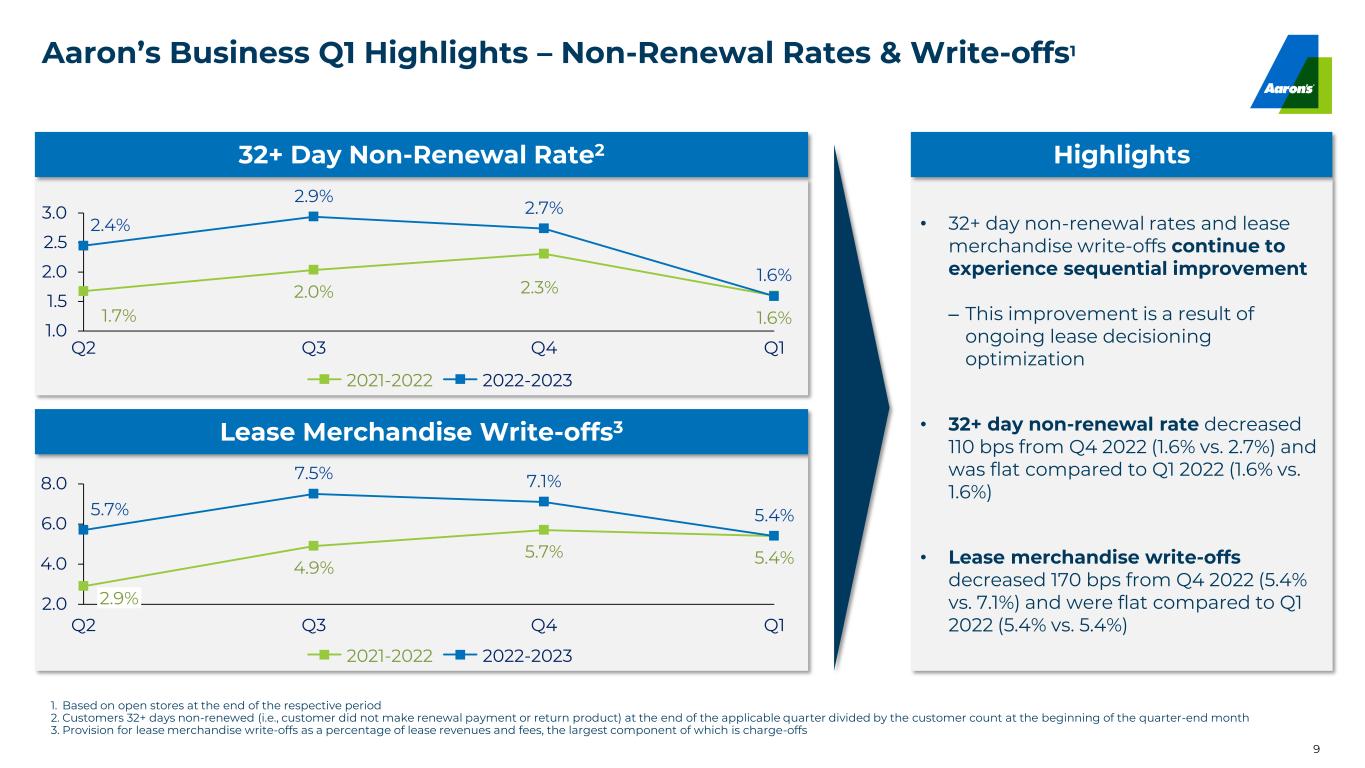

Aaron’s Business Q1 Highlights – Non-Renewal Rates & Write-offs1 9 32+ Day Non-Renewal Rate2 Lease Merchandise Write-offs3 1. Based on open stores at the end of the respective period 2. Customers 32+ days non-renewed (i.e., customer did not make renewal payment or return product) at the end of the applicable quarter divided by the customer count at the beginning of the quarter-end month 3. Provision for lease merchandise write-offs as a percentage of lease revenues and fees, the largest component of which is charge-offs • 32+ day non-renewal rates and lease merchandise write-offs continue to experience sequential improvement ‒ This improvement is a result of ongoing lease decisioning optimization • 32+ day non-renewal rate decreased 110 bps from Q4 2022 (1.6% vs. 2.7%) and was flat compared to Q1 2022 (1.6% vs. 1.6%) • Lease merchandise write-offs decreased 170 bps from Q4 2022 (5.4% vs. 7.1%) and were flat compared to Q1 2022 (5.4% vs. 5.4%) Highlights 1.7% 2.0% 2.3% 1.6% 2.4% 2.9% 2.7% 1.6% 1.0 1.5 2.0 2.5 3.0 Q1Q2 Q3 Q4 4.9% 5.7% 5.4%5.7% 7.5% 7.1% 5.4% 2.0 4.0 6.0 8.0 Q1Q4Q2 Q3 2.9% 2021-2022 2022-2023 2021-2022 2022-2023

BrandsMart Q1 Highlights 10 Revenues Gross Profit Adjusted EBITDA2 Product Mix3 • Product sales were down YoY driven primarily by lower store traffic and customer trade down to lower priced products across all major categories ‒ Average transaction value decreased 8.6% YoY ‒ E-commerce product sales were 9.2% of total product sales • Gross profit and gross profit margin % continued to benefit from direct procurement savings and strategic pricing actions • Adjusted EBITDA and adjusted EBITDA margin % exceeded internal expectations despite lower revenues as a result of continued pressure on customer demand • First new store planned to open in Augusta, GA in Q4 2023 Highlights $144.2M Q1 2022 Q1 2023 $2.8M Q1 2022 Q1 2023 Margin % n/a 1.9% $35.1M Q1 2022 Q1 2023 Margin % n/a 24.4% 1. Financial results for Q1 2022 are prior to the acquisition by The Aaron’s Company, Inc. and were not audited; included for comparison purposes only 2. Adjusted EBITDA does not include unallocated corporate expenses; non-GAAP reconciliations are included in the Appendix 3. Based on merchandise product sales posted in Q1 2023; excludes warranty, installation, delivery, and other service revenues Pre-acquisition results not reported Pre-acquisition results not reported Pre-acquisition results not reported 55%34% 7%4% Major Appliances Electronics Furniture & Mattresses Other Product Sales YoY +2.6%1 (18.0%)

11 Balance Sheet and Outlook

$352.0 million $3.4 million$222.1 million Balance Sheet and Shareholder Returns Debt (As of 3/31/23) Liquidity2 (As of 3/31/23) Shareholder Returns3 12 1. Non-GAAP reconciliation of net debt is included in the Appendix 2. As of March 31, 2023, the Company had $44.3 million of cash and cash equivalents and $307.8 million of availability under its $375.0 million unsecured revolving credit facility 3. For the three months ended March 31, 2023, the Company paid $3.4 million in dividends and did not repurchase any shares of common stock $44.3 million Cash and Cash Equivalents (As of 3/31/23) Company reduced net debt1 by $36.9 million from the end of the fourth quarter

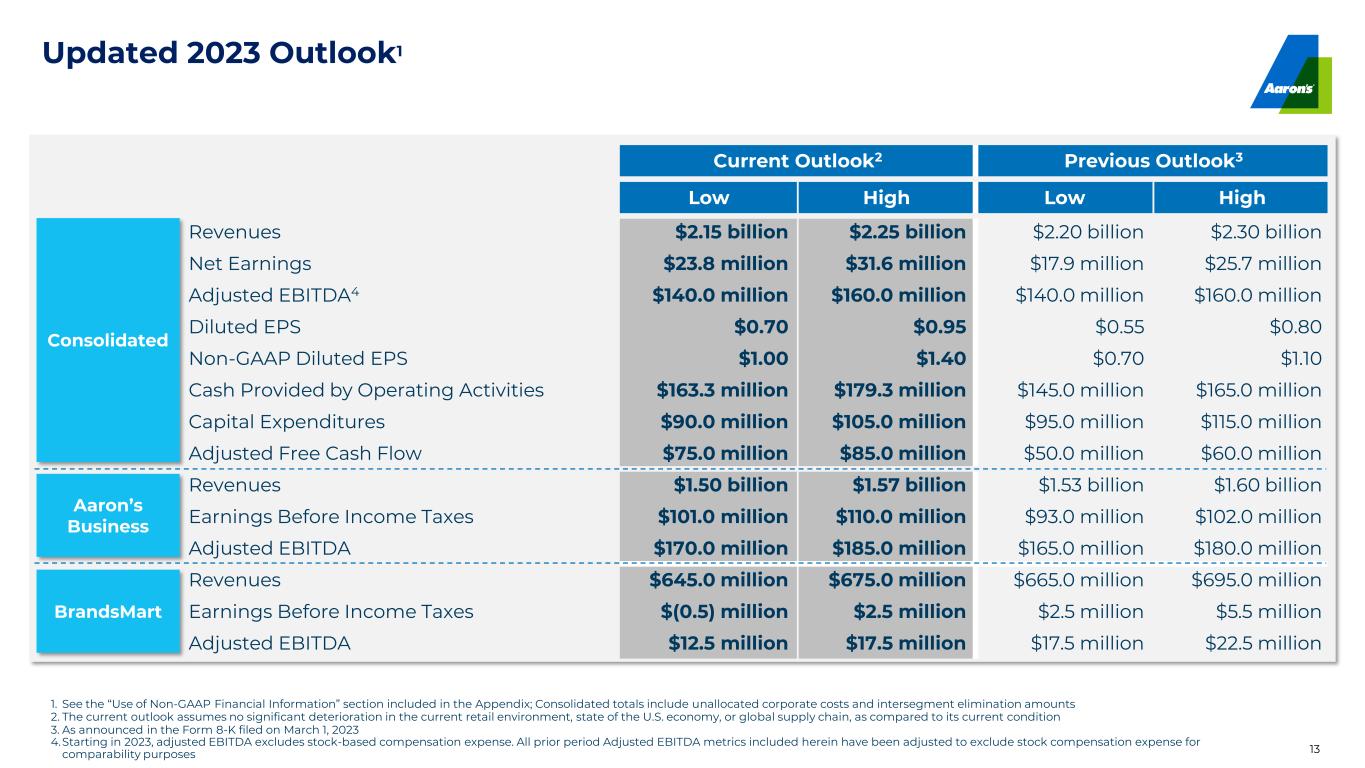

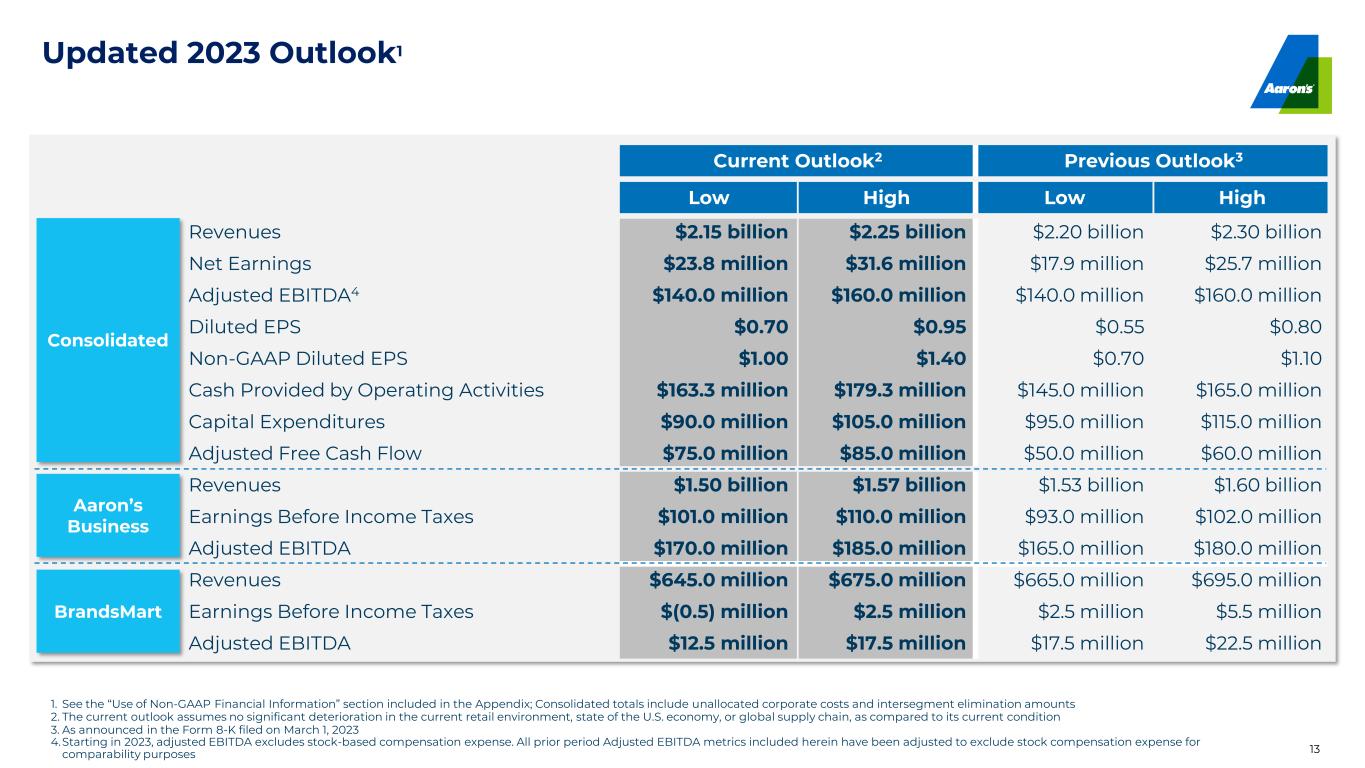

Updated 2023 Outlook1 13 Current Outlook2 Previous Outlook3 Low High Low High Revenues $2.15 billion $2.25 billion $2.20 billion $2.30 billion Net Earnings $23.8 million $31.6 million $17.9 million $25.7 million Adjusted EBITDA4 $140.0 million $160.0 million $140.0 million $160.0 million Diluted EPS $0.70 $0.95 $0.55 $0.80 Non-GAAP Diluted EPS $1.00 $1.40 $0.70 $1.10 Cash Provided by Operating Activities $163.3 million $179.3 million $145.0 million $165.0 million Capital Expenditures $90.0 million $105.0 million $95.0 million $115.0 million Adjusted Free Cash Flow $75.0 million $85.0 million $50.0 million $60.0 million Revenues $1.50 billion $1.57 billion $1.53 billion $1.60 billion Earnings Before Income Taxes $101.0 million $110.0 million $93.0 million $102.0 million Adjusted EBITDA $170.0 million $185.0 million $165.0 million $180.0 million Revenues $645.0 million $675.0 million $665.0 million $695.0 million Earnings Before Income Taxes $(0.5) million $2.5 million $2.5 million $5.5 million Adjusted EBITDA $12.5 million $17.5 million $17.5 million $22.5 million Consolidated Aaron’s Business BrandsMart 1. See the “Use of Non-GAAP Financial Information” section included in the Appendix; Consolidated totals include unallocated corporate costs and intersegment elimination amounts 2. The current outlook assumes no significant deterioration in the current retail environment, state of the U.S. economy, or global supply chain, as compared to its current condition 3. As announced in the Form 8-K filed on March 1, 2023 4.Starting in 2023, adjusted EBITDA excludes stock-based compensation expense. All prior period Adjusted EBITDA metrics included herein have been adjusted to exclude stock compensation expense for comparability purposes

14 Appendix

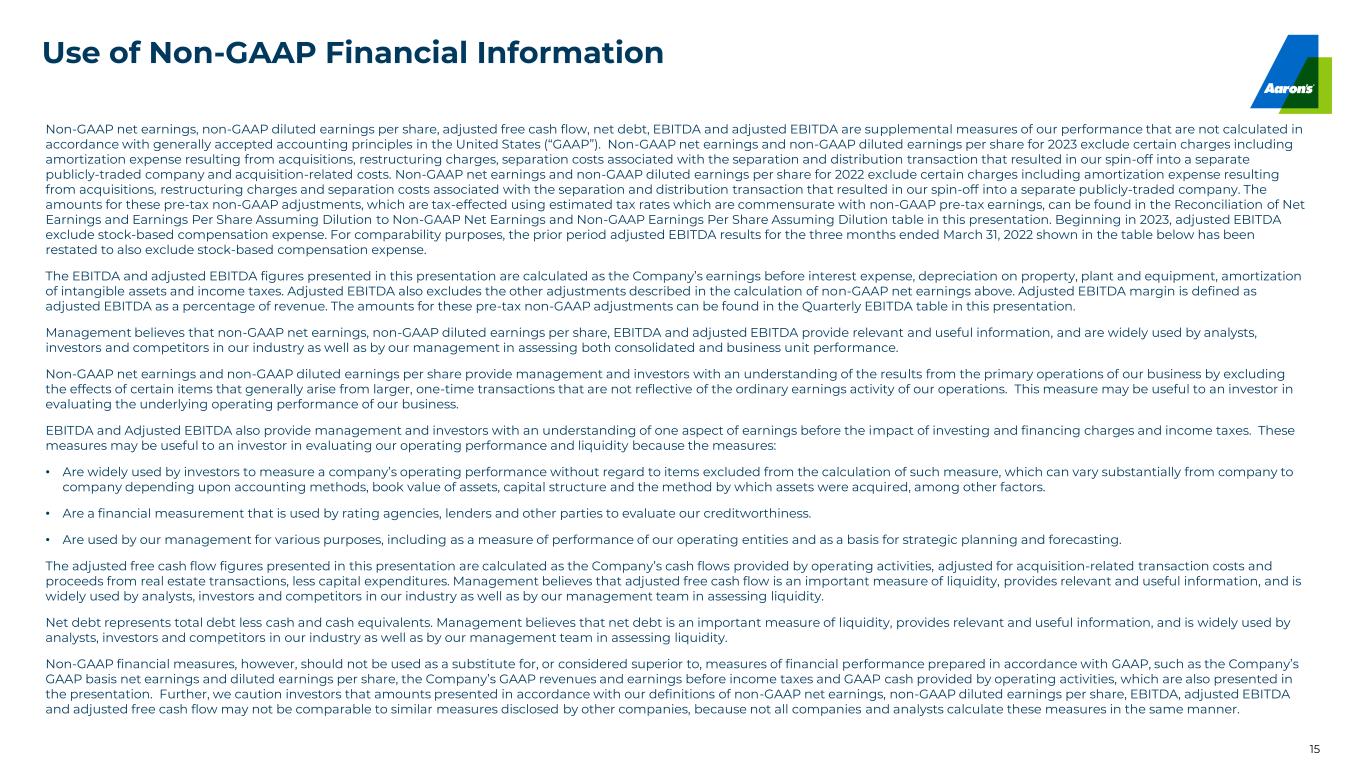

Use of Non-GAAP Financial Information Non-GAAP net earnings, non-GAAP diluted earnings per share, adjusted free cash flow, net debt, EBITDA and adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”). Non-GAAP net earnings and non-GAAP diluted earnings per share for 2023 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company and acquisition-related costs. Non-GAAP net earnings and non-GAAP diluted earnings per share for 2022 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges and separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company. The amounts for these pre-tax non-GAAP adjustments, which are tax-effected using estimated tax rates which are commensurate with non-GAAP pre-tax earnings, can be found in the Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to Non-GAAP Net Earnings and Non-GAAP Earnings Per Share Assuming Dilution table in this presentation. Beginning in 2023, adjusted EBITDA exclude stock-based compensation expense. For comparability purposes, the prior period adjusted EBITDA results for the three months ended March 31, 2022 shown in the table below has been restated to also exclude stock-based compensation expense. The EBITDA and adjusted EBITDA figures presented in this presentation are calculated as the Company’s earnings before interest expense, depreciation on property, plant and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA also excludes the other adjustments described in the calculation of non-GAAP net earnings above. Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of revenue. The amounts for these pre-tax non-GAAP adjustments can be found in the Quarterly EBITDA table in this presentation. Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA and adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance. Non-GAAP net earnings and non-GAAP diluted earnings per share provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arise from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations. This measure may be useful to an investor in evaluating the underlying operating performance of our business. EBITDA and Adjusted EBITDA also provide management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance and liquidity because the measures: • Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. • Are a financial measurement that is used by rating agencies, lenders and other parties to evaluate our creditworthiness. • Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting. The adjusted free cash flow figures presented in this presentation are calculated as the Company’s cash flows provided by operating activities, adjusted for acquisition-related transaction costs and proceeds from real estate transactions, less capital expenditures. Management believes that adjusted free cash flow is an important measure of liquidity, provides relevant and useful information, and is widely used by analysts, investors and competitors in our industry as well as by our management team in assessing liquidity. Net debt represents total debt less cash and cash equivalents. Management believes that net debt is an important measure of liquidity, provides relevant and useful information, and is widely used by analysts, investors and competitors in our industry as well as by our management team in assessing liquidity. Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share, the Company’s GAAP revenues and earnings before income taxes and GAAP cash provided by operating activities, which are also presented in the presentation. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA, adjusted EBITDA and adjusted free cash flow may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. 15

16 (Unaudited) Three Months Ended March 31, (In Thousands, except per share amounts) 2023 2022 Net Earnings $ 12,798 $ 21,532 Income Taxes (3,906) 7,373 Earnings Before Income Taxes $ 8,892 $ 28,905 Acquisition-Related Intangible Amortization Expense 2,646 641 Restructuring Expenses, Net 5,289 3,335 Separation Costs 129 540 Acquisition-Related Costs 1,848 3,464 Non-GAAP Earnings Before Income Taxes 18,804 36,885 Income Taxes, calculated using a non-GAAP Effective Tax Rate (1,670) 9,409 Non-GAAP Net Earnings $ 20,474 $ 27,476 Earnings Per Share Assuming Dilution $ 0.41 $ 0.68 Acquisition-Related Intangible Amortization Expense 0.08 0.02 Restructuring Expenses, Net 0.17 0.11 Separation Costs — 0.02 Acquisition-Related Costs 0.06 0.11 Tax Effect of Non-GAAP adjustments (0.07) (0.06) Non-GAAP Earnings Per Share Assuming Dilution2 $ 0.66 $ 0.87 Weighted Average Shares Outstanding Assuming Dilution 31,239 31,760 1. The Company's financial results do not include the results of BrandsMart U.S.A. prior to the April 1, 2022 acquisition 2. In some cases, the sum of individual EPS amounts may not equal total non-GAAP EPS calculations due to rounding Reconciliation to Non-GAAP Net Earnings and Non-GAAP Earnings Per Share1

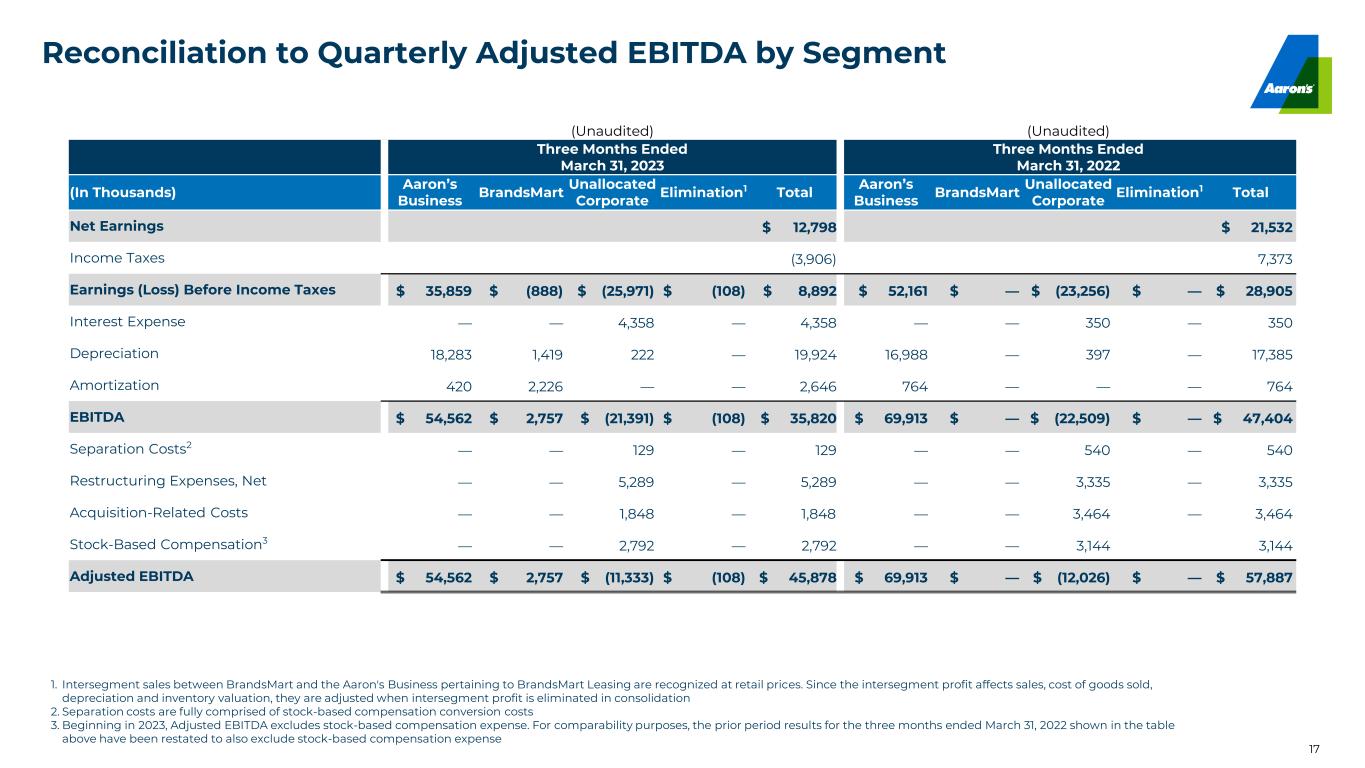

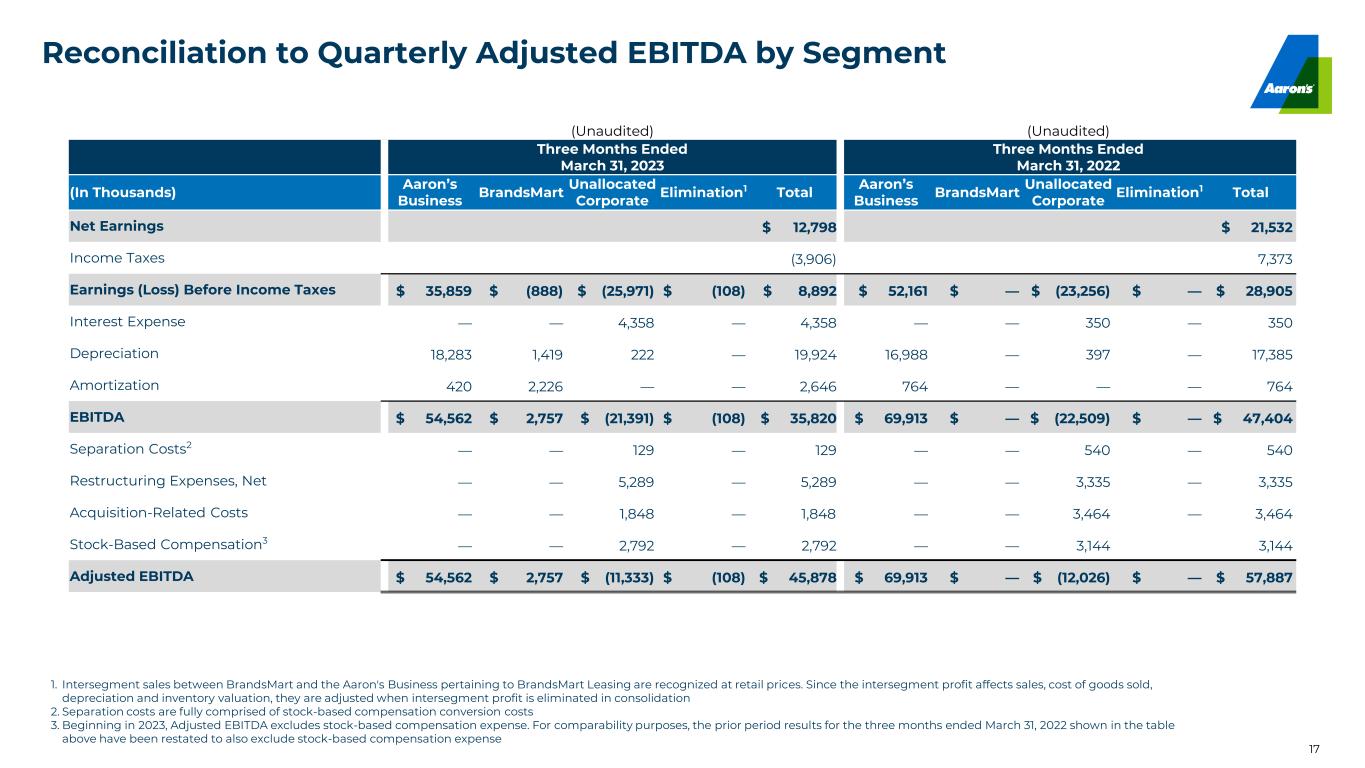

Reconciliation to Quarterly Adjusted EBITDA by Segment 17 (Unaudited) (Unaudited) Three Months Ended March 31, 2023 Three Months Ended March 31, 2022 (In Thousands) Aaron’s Business BrandsMart Unallocated Corporate Elimination1 Total Aaron’s Business BrandsMart Unallocated Corporate Elimination1 Total Net Earnings $ 12,798 $ 21,532 Income Taxes (3,906) 7,373 Earnings (Loss) Before Income Taxes $ 35,859 $ (888) $ (25,971) $ (108) $ 8,892 $ 52,161 $ — $ (23,256) $ — $ 28,905 Interest Expense — — 4,358 — 4,358 — — 350 — 350 Depreciation 18,283 1,419 222 — 19,924 16,988 — 397 — 17,385 Amortization 420 2,226 — — 2,646 764 — — — 764 EBITDA $ 54,562 $ 2,757 $ (21,391) $ (108) $ 35,820 $ 69,913 $ — $ (22,509) $ — $ 47,404 Separation Costs2 — — 129 — 129 — — 540 — 540 Restructuring Expenses, Net — — 5,289 — 5,289 — — 3,335 — 3,335 Acquisition-Related Costs — — 1,848 — 1,848 — — 3,464 — 3,464 Stock-Based Compensation3 — — 2,792 — 2,792 — — 3,144 3,144 Adjusted EBITDA $ 54,562 $ 2,757 $ (11,333) $ (108) $ 45,878 $ 69,913 $ — $ (12,026) $ — $ 57,887 1. Intersegment sales between BrandsMart and the Aaron's Business pertaining to BrandsMart Leasing are recognized at retail prices. Since the intersegment profit affects sales, cost of goods sold, depreciation and inventory valuation, they are adjusted when intersegment profit is eliminated in consolidation 2. Separation costs are fully comprised of stock-based compensation conversion costs 3. Beginning in 2023, Adjusted EBITDA excludes stock-based compensation expense. For comparability purposes, the prior period results for the three months ended March 31, 2022 shown in the table above have been restated to also exclude stock-based compensation expense

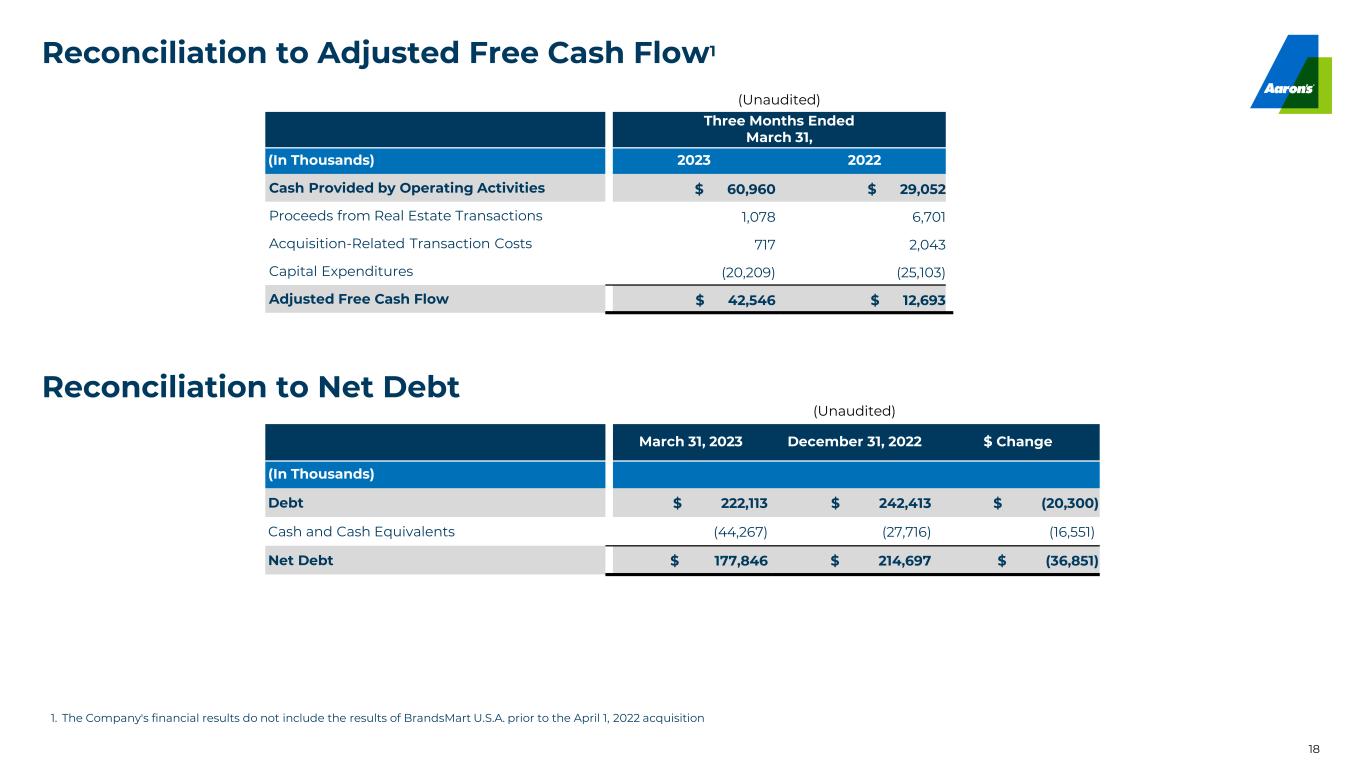

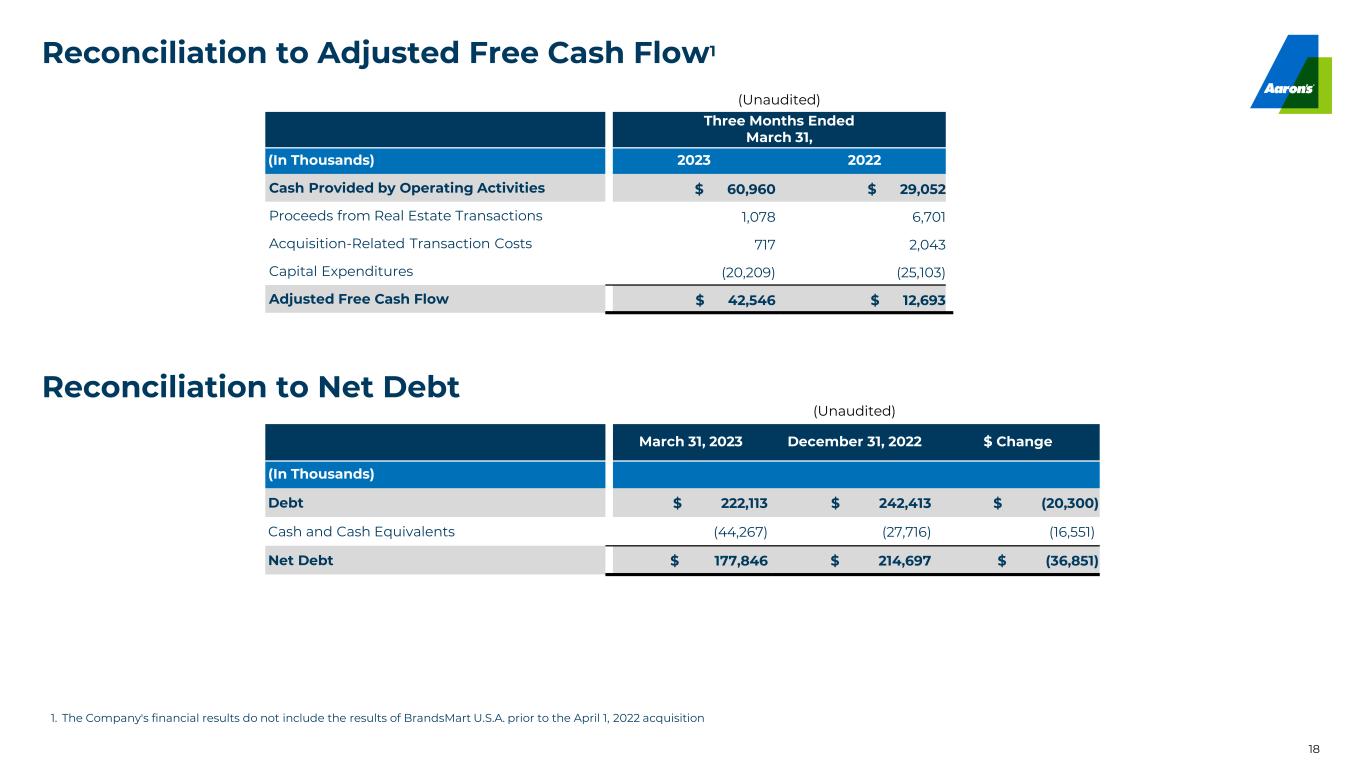

Reconciliation to Adjusted Free Cash Flow1 18 Reconciliation to Net Debt (Unaudited) Three Months Ended March 31, (In Thousands) 2023 2022 Cash Provided by Operating Activities $ 60,960 $ 29,052 Proceeds from Real Estate Transactions 1,078 6,701 Acquisition-Related Transaction Costs 717 2,043 Capital Expenditures (20,209) (25,103) Adjusted Free Cash Flow $ 42,546 $ 12,693 1. The Company's financial results do not include the results of BrandsMart U.S.A. prior to the April 1, 2022 acquisition (Unaudited) March 31, 2023 December 31, 2022 $ Change (In Thousands) Debt $ 222,113 $ 242,413 $ (20,300) Cash and Cash Equivalents (44,267) (27,716) (16,551) Net Debt $ 177,846 $ 214,697 $ (36,851)

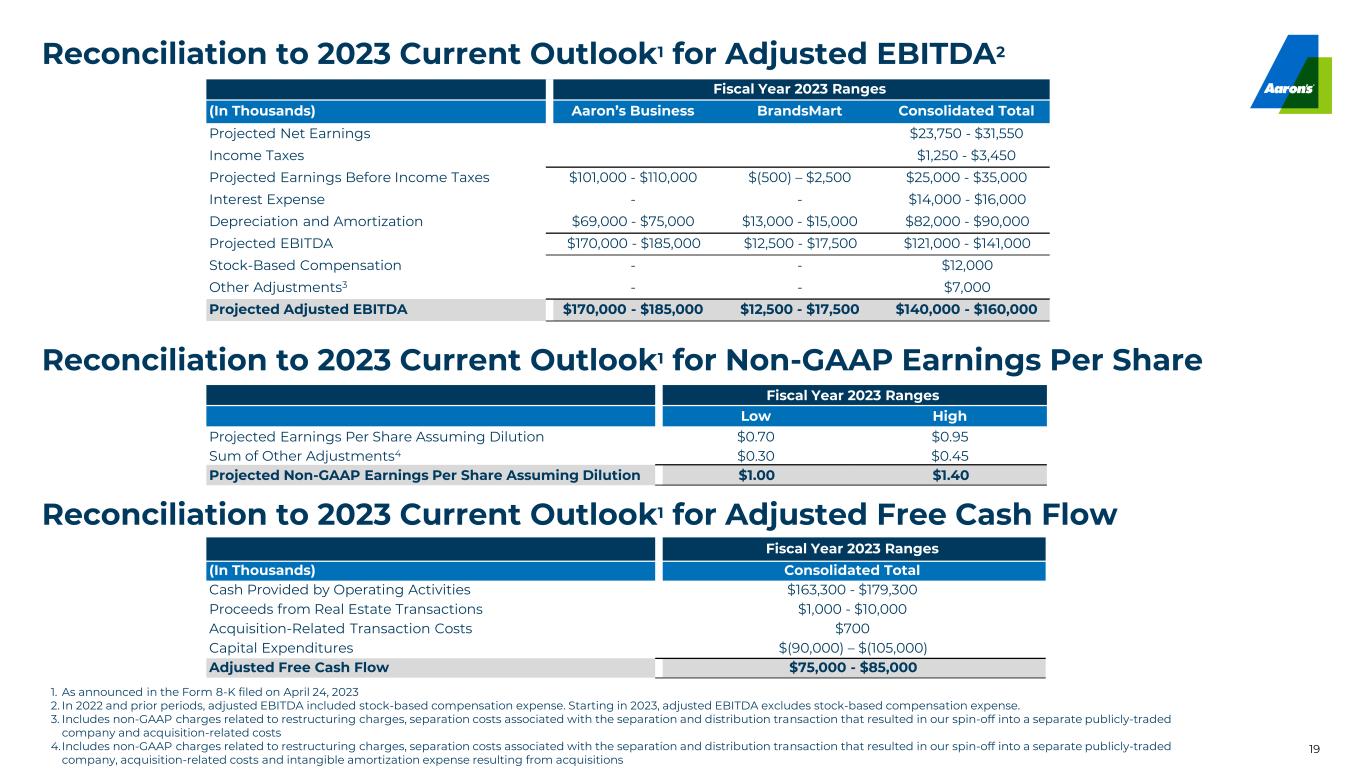

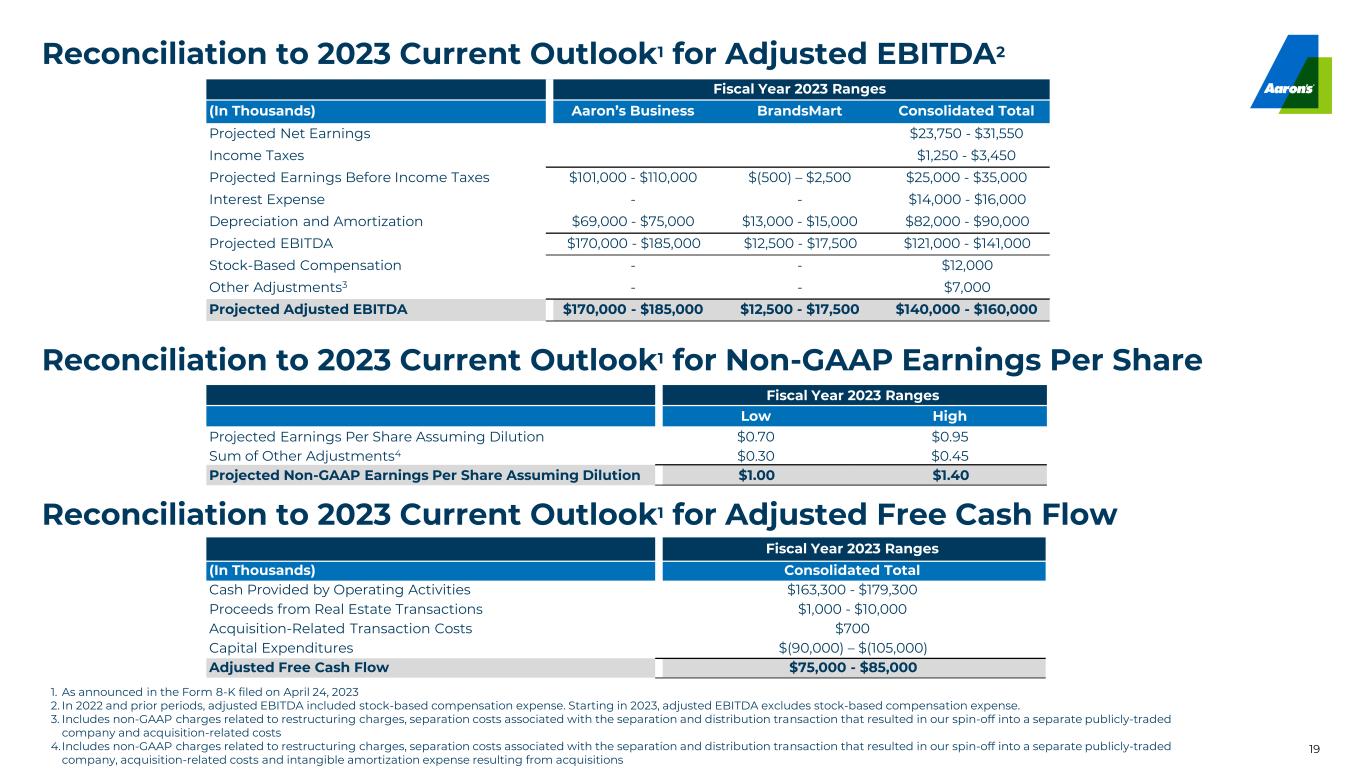

Fiscal Year 2023 Ranges (In Thousands) Aaron’s Business BrandsMart Consolidated Total Projected Net Earnings $23,750 - $31,550 Income Taxes $1,250 - $3,450 Projected Earnings Before Income Taxes $101,000 - $110,000 $(500) – $2,500 $25,000 - $35,000 Interest Expense - - $14,000 - $16,000 Depreciation and Amortization $69,000 - $75,000 $13,000 - $15,000 $82,000 - $90,000 Projected EBITDA $170,000 - $185,000 $12,500 - $17,500 $121,000 - $141,000 Stock-Based Compensation - - $12,000 Other Adjustments3 - - $7,000 Projected Adjusted EBITDA $170,000 - $185,000 $12,500 - $17,500 $140,000 - $160,000 Fiscal Year 2023 Ranges Low High Projected Earnings Per Share Assuming Dilution $0.70 $0.95 Sum of Other Adjustments4 $0.30 $0.45 Projected Non-GAAP Earnings Per Share Assuming Dilution $1.00 $1.40 19 Reconciliation to 2023 Current Outlook1 for Adjusted EBITDA2 Fiscal Year 2023 Ranges (In Thousands) Consolidated Total Cash Provided by Operating Activities $163,300 - $179,300 Proceeds from Real Estate Transactions $1,000 - $10,000 Acquisition-Related Transaction Costs $700 Capital Expenditures $(90,000) – $(105,000) Adjusted Free Cash Flow $75,000 - $85,000 Reconciliation to 2023 Current Outlook1 for Non-GAAP Earnings Per Share Reconciliation to 2023 Current Outlook1 for Adjusted Free Cash Flow 1. As announced in the Form 8-K filed on April 24, 2023 2. In 2022 and prior periods, adjusted EBITDA included stock-based compensation expense. Starting in 2023, adjusted EBITDA excludes stock-based compensation expense. 3. Includes non-GAAP charges related to restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company and acquisition-related costs 4.Includes non-GAAP charges related to restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company, acquisition-related costs and intangible amortization expense resulting from acquisitions

Fiscal Year 2023 Ranges (In Thousands) Aaron’s Business BrandsMart Consolidated Total Projected Net Earnings $17,900 - $25,700 Income Taxes $6,100 - $8,800 Projected Earnings Before Income Taxes $93,000 - $102,000 $2,500 – $5,500 $24,000 - $34,500 Interest Expense - - $16,000 - $17,500 Depreciation and Amortization $72,000 - $78,000 $15,000 - $17,000 $87,000 - $95,000 Projected EBITDA $165,000 - $180,000 $17,500 - $22,500 $127,000 - $147,000 Stock-Based Compensation - - $13,000 Projected Adjusted EBITDA $165,000 - $180,000 $17,500 - $22,500 $140,000 - $160,000 Fiscal Year 2023 Ranges Low High Projected Earnings Per Share Assuming Dilution $0.55 $0.80 Sum of Other Adjustments3 $0.15 $0.30 Projected Non-GAAP Earnings Per Share Assuming Dilution $0.70 $1.10 20 Reconciliation to 2023 Previous Outlook1 for Adjusted EBITDA2 Fiscal Year 2023 Ranges (In Thousands) Consolidated Total Cash Provided by Operating Activities $145,000 - $165,000 Proceeds from Real Estate Transactions $0 - $10,000 Capital Expenditures $(95,000) – $(115,000) Adjusted Free Cash Flow $50,000 - $60,000 Reconciliation to 2023 Previous Outlook1 for Non-GAAP Earnings Per Share Reconciliation to 2023 Previous Outlook1 for Adjusted Free Cash Flow 1. As announced in the Form 8-K filed on March 1, 2023 2. In 2022 and prior periods, adjusted EBITDA included stock-based compensation expense. Starting in 2023, adjusted EBITDA excludes stock-based compensation expense. 3. Includes acquisition related amortization expense

21 investor.aarons.com