Confidential Treatment Requested by Caliber Home Loans, Inc.

Pursuant to 17 C.F.R. Section 200.83

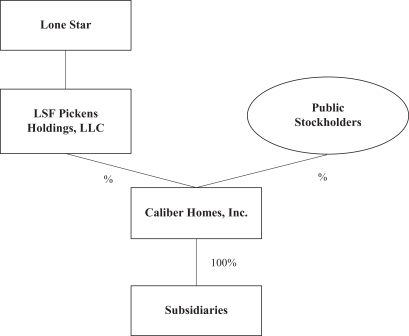

for certain of the loans that Lone Star has securitized anticipates continuing under the COLT Securitizations. We service such loans pursuant to servicing agreements with the COLT Securitization transaction parties, including, Lone Star, which servicing agreement contain customary terms and provisions, including representations and warranties, covenants and indemnities among the parties.

In performing the servicing functions for loans that have been securitized under the COLT Securitizations, we earn servicing-related fees. We earned approximately $7.3 million, $7.3 million, $4.3 million and $2.3 million in servicing-related fees related to the COLT Securitizations during the years ended December 31, 2019, 2018 and 2017 and for the six months ended June 30, 2020, respectively.

Servicing Lone Star Loans That Have Been Securitized Under the VOLT Securitization Program

In addition to mortgage loans that it securitizes under the COLT Securitizations, Lone Star securitizes certain mortgage loans under its VOLT securitization program, or the VOLT Securitizations. The VOLT Securitizations are comprised of reperforming mortgage loans, or RPLs, non-performing mortgage loans, or NPLs, and real estate owned properties, or REOs, that Lone Star has acquired from third-party originators other than us. We provide customary servicing for certain of the loans that have been securitized under the VOLT Securitizations pursuant to servicing agreements with the VOLT Securitization transaction parties, including, Lone Star, which contain customary terms and provisions, including representations and warranties, covenants and indemnities among the parties.

In performing the servicing functions for loans securitized under the VOLT Securitizations, we earn servicing-related fees and collect incentive fees for other loss mitigation activities related to servicing of RPLs and NPLs. We earned approximately $49.4 million, $76.2 million, $100.0 million and $15.1 million in servicing-related fees from Lone Star during the years ended December 31, 2019, 2018 and 2017 and for the six months ended June 30, 2020, respectively, with respect to the VOLT Securitizations.

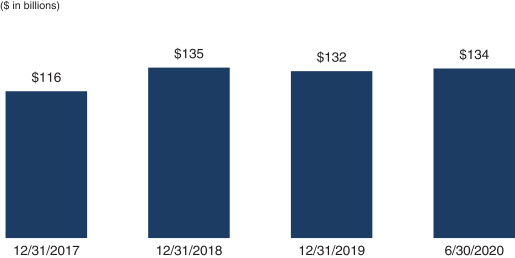

In addition to receiving servicing-related fees, we are required under the servicing agreements with respect to both the COLT Securitizations and the VOLT Securitizations, in certain circumstances, to advance funds to, among other things, to pay property taxes, insurance premiums, legal expenses and other protective advances during any period in which a borrower is not making payments. In addition, with respect to the COLT Securitizations, we are generally required under the servicing agreements to advance funds to meet contractual principal and interest remittance requirements for investors. When an advance is made, we are generally permitted to withdraw the outstanding advance amount from the general collection account amounts available for the related particular securitization and, in some instances, may be reimbursed by Lone Star for outstanding advances in excess of such general collection account amounts. At December 31, 2019, 2018 and 2017 and June 30, 2020, we had outstanding advances to the Lone Star securitizations of $2.0 million, $3.5 million, $13.3 million and $1.1 million, respectively. Reimbursements for advances made on loans in such securitizations are generally recovered from the related general collection account amounts within one to two days.

We also incur costs associated with due diligence performed on behalf of Lone Star. At December 31, 2019, 2018 and 2017 and June 30, 2020, we had receivables of $0.5 million, $0.4 million, $0.8 million and $0.2 million, respectively, for due diligence costs incurred on behalf of Lone Star.

Certain Lone Star entities own all intellectual property and other rights with respect to the VOLT, COLT and associated names and anticipates continuing to issue securitizations under both the COLT and VOLT monikers following this offering. We have no intellectual property or other rights with respect to the VOLT, COLT and associated names.

Ancillary Services Agreement

In 2018, we entered into an asset sale transaction with Hudson Homes Management LLC, or HHM, a subsidiary of Hudson, for the sale of certain assets and liabilities of our subsidiary entity, Caliber Real Estate

158