| | | Per share | | | Total | |

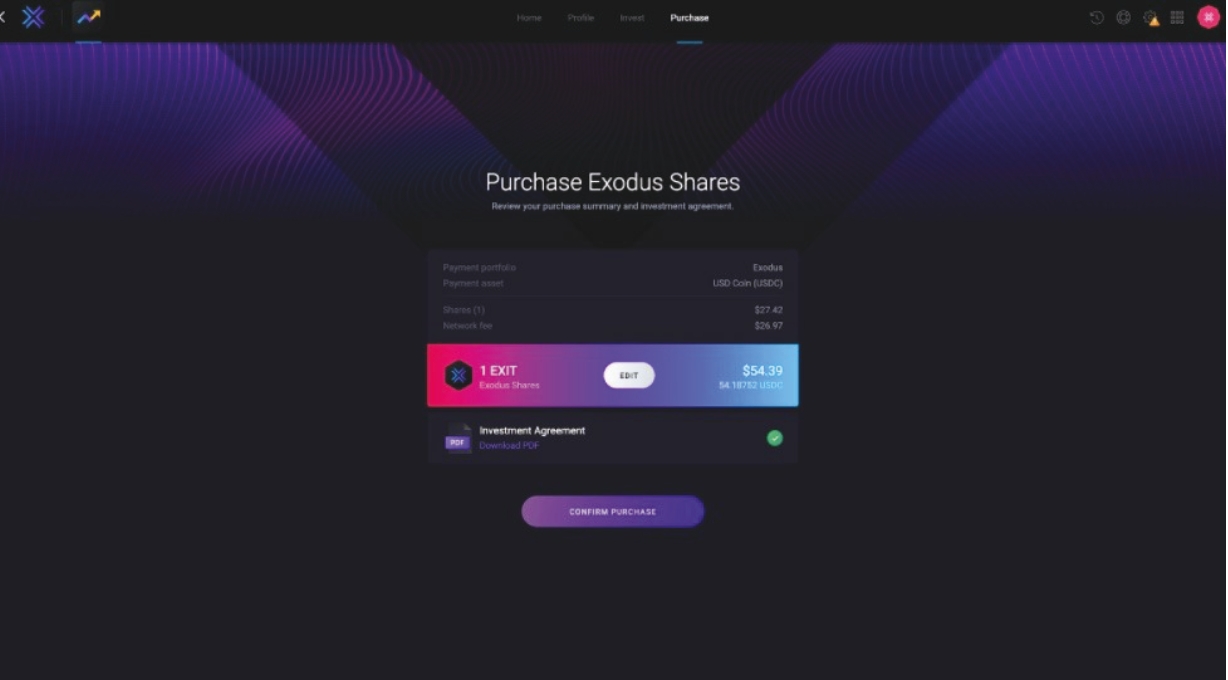

Initial offering price | | | $27.42 | | | $75,000,000 |

Proceeds to Exodus Movement, Inc., before expenses | | | $27.42 | | | $52,500,000 |

Proceeds to the selling stockholders, before expenses | | | $27.42 | | | $22,500,000 |

| | | Per share | | | Total | |

Initial offering price | | | $27.42 | | | $75,000,000 |

Proceeds to Exodus Movement, Inc., before expenses | | | $27.42 | | | $52,500,000 |

Proceeds to the selling stockholders, before expenses | | | $27.42 | | | $22,500,000 |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| • | Custodial key management: In this structure, a company or platform generates the private keys for their customers and administers any and all funds sent to the addresses tied to those private keys. Custodial key management solutions become custodians of their customers funds and in that respect are extremely similar to centralized banks. |

| • | Non-custodial key management: In this solution, a person or entity generates (using software or other means) and secures (often on their own computer or written down on a piece of paper) their own private keys and all funds are sent to the address tied to those private keys. Non-custodial key management solutions are not custodians of their users’ funds, but are merely repositories for the funds, similar to the way a physical safety box or leather wallet provides a means for people to secure their own wealth. |

| • | helping to ensure that our customers retain full control over the crypto assets held in their Exodus wallet by encrypting the private keys locally on our customers’ own devices; |

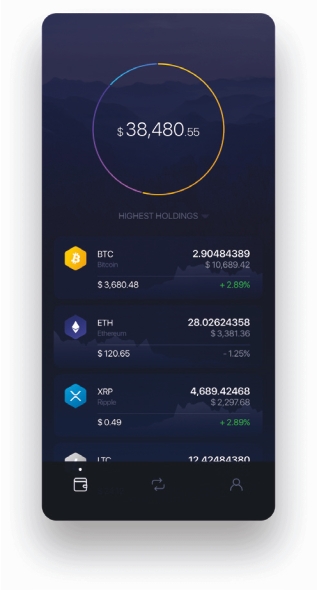

| • | streamlining the process of creating wallets for transacting in over 100 crypto assets, as well as offering a range of wallet options to hold customers’ private keys (including hot and cold wallets) so customers can quickly access the features they want without being distracted by unnecessary or confusing technical information; |

| • | hosting and maintaining our own robust server infrastructure to ensure near 100% uptime, 24/7, for all crypto assets and services offered on our platform; |

| • | integrating cutting-edge third-party apps seamlessly into our highly functional platform to provide our customers with a rich ecosystem of ways to use and manage their crypto assets, as well as providing us with potential additional avenues for monetizing our platform; |

| • | producing reliable, straightforward information on our website and YouTube channel regarding blockchain cryptography, crypto assets and our platform that is relevant for both new and experienced crypto asset users; |

| • | providing fast and smooth purchasing of crypto assets using fiat currency through Apple Pay on iOS devices (our customers can purchase up to USD $500 of Bitcoin at the touch of a button, which is made available on their Exodus wallet immediately); and |

| • | continually adapting and innovating the Exodus Platform to support our customers’ ability to store other types of valuable assets, including personal information, traditional fiat currencies, and, potentially, traditional securities in tokenized form alongside other tokenized financial products in the future. |

| • | The Exchange Aggregator allows users to swap one crypto asset for another within the Exodus Platform without having to send assets to and from centralized exchanges or trade across multiple order books. For example, if a customer wants to swap Digibyte for DASH inside of Exodus, this trade can be easily executed, while on a centralized exchange, a customer would have to trade Digibyte for Bitcoin and then Bitcoin for DASH. Through the Exodus Platform, customers can access the ability to directly exchange over 10,000 pairs of crypto assets. |

| • | The Compound Finance app permits Exodus Platform customers to use an algorithmic smart contract protocol to earn interest (in the form of additional crypto asset tokens) on certain supported crypto assets held in their Exodus wallets. |

| • | SportX allows users in certain jurisdictions outside of the United States and its territories to place wagers on select sporting events using a third-party smart contract protocol on the Ethereum Blockchain. SportX is only available to our customers outside the United States and its territories, in jurisdictions where online sports gambling is permitted by applicable law. All gambling activities conducted through SportX are operated by SportX’s developer, NextGen, and we do not set odds, place or accept bets, pay out winnings or otherwise facilitate, operate or manage any gambling activities conducted on SportX. |

| • | Rewards allows users to “stake” supported crypto assets held in their Exodus wallets by participating in blockchain validation through a third-party entity that monitors or creates staking pools. |

| • | We have developed the Exodus Platform to facilitate customers independently holding their crypto assets as an alternative to traditional centralized financial institutions. Once customers are able to easily hold their crypto assets, we seek to expand the opportunities for customers to manage and interact with those assets. As part of that goal, when we decided to sell shares of our Class A common stock in this offering, we chose to represent shares of our Class A common stock in digital format by our Common Stock Tokens. The Common Stock Tokens are a digital representation of how many shares of Class A common stock are owned by an individual or entity, Common Stock Tokens contain no voting, governance, economic or other rights, and cannot be traded independently of the Class A common stock. We are creating several apps in our app store to facilitate these Common Stock Tokens, and are exploring the possibility of offering versions of these apps for other companies who might also be interested in issuing their securities with a digital representation. For further information on our Common Stock Tokens and the new apps which we will add to our app store, please see “Plan of Distribution.” |

| • | our business depends on attracting and retaining new wallet customers, and any failure of our platform to satisfy customer demands, achieve increased market acceptance or adapt to changing market dynamics would adversely affect our business, results of operations, financial condition and growth prospects; |

| • | our business depends in part on third-party services integrated with the Exodus Platform, and, if these third-party services fail to provide adequate functionality for our customers, our business, results of operations and financial condition could be adversely affected; |

| • | our business depends, in part, on our ability to make Common Stock Tokens available to the holders of our Class A common stock and we may incur significant damage to our reputation and financial condition if we are not successful; |

| • | because our business is dependent, in part, on the continued market acceptance and development of crypto assets and blockchain technology by consumers, any declines or negative trends affecting crypto assets or blockchain technology will adversely affect our business operations; |

| • | our ability to maintain customer satisfaction depends in part on the quality of our customer support, and any failure to maintain high-quality customer support could have an adverse effect on our business, results of operation, and financial condition; |

| • | our relatively limited operating history makes it difficult to evaluate our current business and prospects and may increase the risk that we will not be successful; |

| • | any actual or perceived failure of the Exodus Platform to block malware or prevent failures or security breaches or incidents could harm our reputation, cause the Exodus Platform to be perceived as insecure, underperforming, or unreliable, impede our efforts to attract and retain customers, and otherwise negatively impact our business, results of operations and financial condition; |

| • | our holdings of crypto assets expose us to potential risks, including exchange, security and liquidity risks, which could negatively affect our business, financial condition, and results of operations; |

| • | our risk management efforts may not be effective to prevent fraudulent activities by third-party providers or other parties, which could expose us to material financial losses and liability and otherwise harm our business; |

| • | customer or third-party activities may subject us to liability or cause us to experience adverse political, business, and reputational consequences with customers, employees, third parties, government entities, and others; |

| • | the offering price of our Class A common stock has been determined independently by us and should not be considered as an indication of our present or future value; |

| • | we believe our long-term value as a company will be greater if we focus on improving our customers’ experience with our platform, rather than growth or profitability, which may negatively impact our profitability; |

| • | if our customers’ or contractual providers’ access to our platform is interrupted or delayed for any reason, our business could suffer; |

| • | our Class A common stock initially will not be listed on any securities exchange or available to trade on any ATS, we do not intend to apply for the listing of our Class A common stock on any securities exchange, and we cannot provide any assurance that we will be successful in enabling our Class A common stock to be available to trade on any ATS; |

| • | even if we are successful in making our Class A common stock available to trade on an ATS, this ATS may experience limited volume and liquidity; |

| • | the trading ledger showing trades in our Common Stock Tokens is publicly available, which may give rise to privacy concerns; |

| • | there is no guarantee that our Class A common stock will hold its value or increase in value, and you may lose the amount of your investment in our Class A common stock in whole or in part; |

| • | an active trading market for our Class A common stock may not develop or be sustained following this offering; |

| • | the dual class structure of our common stock will have the effect of concentrating voting capital with our executive officers and directors and it may depress the trading price of our Class A common stock; |

| • | the regulatory regime governing blockchain technologies, cryptocurrencies, tokens and token offerings such as the Exodus Platform and the Common Stock Tokens is uncertain, and new regulations or policies may materially adversely affect the development and utilization of the Exodus Platform; |

| • | we operate an interface that allows our customers to connect to exchanges on which the customers can trade crypto assets, and we receive compensation from these exchanges. Certain crypto assets traded using our platform could be viewed as “securities” for purposes of state or federal regulations, and regulators might determine that the payments we receive from the exchanges would cause us or the third-party app providers that offer apps through our platform to be in violation of federal and state securities laws, which would negatively affect our business, financial condition and results of operation; and |

| • | we are subject to export control, import, and sanctions laws and regulations that could impair our ability to compete in international markets or subject us to liability if we violate such laws and regulations. |

| | | Actual(1)(2) | | | Pro Forma(1)(2)(3)(4)(5) | | | Pro Forma As Adjusted(1)(2)(3)(4)(5) | |

Class A Common Stock | | | — | | | 818,568 | | | 2,733,229 |

Class B Common Stock | | | 20,011,830 | | | 22,399,557 | | | 22,399,557 |

| (1) | Reflects the filing of a certificate of amendment to our amended and restated certificate of incorporation in February 2021, which increased the number of authorized shares of our capital stock and effected a two-for-one forward stock split of our outstanding common stock (the “Forward Stock Split”). |

| (2) | Excludes (a) 2,737,008 shares of our Class B common stock issuable upon exercise of options outstanding, at a weighted average exercise price of $2.39 per share, as of December 31, 2020 and (b) 262,992 shares of our Class B common stock reserved for future issuance under our 2019 Equity Incentive Plan as of December 31, 2020. |

| (3) | Reflects the exercise of options to purchase 296,997 shares of Class B common stock in connection with, and contingent upon, the consummation of this offering and the automatic conversion of 818,568 shares of Class B common stock (including 296,997 shares of Class B common stock issued upon exercise of outstanding options) upon their sale by the selling stockholders in this offering. |

| (4) | Reflects the conversion of $0.5 million aggregate principal amount of simple agreements for future equity (“SAFEs”) into 2,904,498 shares of Class B common stock in February 2021. |

| (5) | Reflects the issuance of 4,800 shares of Class B common stock to COHAGEN WILKINSON, INC., a selling stockholder in this offering, in January 2021. |

| | | Year ended December 31, | ||||

| | | 2020 | | | 2019 | |

| | | (amounts in thousands, except per share data) | ||||

Revenues | | | $21,251 | | | $7,922 |

Cost of revenues | | | | | ||

Software development | | | 3,465 | | | 3,000 |

Customer support | | | 1,824 | | | 1,044 |

Security and wallet operations | | | 3,517 | | | 2,578 |

Total cost of revenues | | | 8,806 | | | 6,622 |

Gross profit | | | 12,445 | | | 1,300 |

Operating expenses | | | | | ||

General and administrative | | | 3,802 | | | 2,235 |

Advertising and marketing | | | 1,081 | | | 569 |

Depreciation and amortization | | | 736 | | | 103 |

Impairment of digital assets | | | 2,430 | | | 1,738 |

Total operating expenses | | | 8,049 | | | 4,645 |

Operating income (loss) | | | 4,396 | | | (3,345) |

Other income | | | | | ||

Gain on sale or transfer of digital assets | | | 5,017 | | | 3,118 |

Interest expense | | | (6) | | | (3) |

Interest income | | | 80 | | | 55 |

Total other income | | | 5,091 | | | 3,170 |

Income (loss) before income taxes | | | 9,487 | | | (175) |

Income tax (expense) benefit | | | (1,310) | | | (55) |

Net income (loss) | | | $8,177 | | | $(230) |

Foreign currency translation adjustment | | | 248 | | | — |

Comprehensive income (loss) | | | $8,425 | | | $(230) |

Basic net income (loss) per share of common stock | | | $0.41 | | | $(0.01) |

Diluted net income (loss) per share of common stock | | | $0.36 | | | $(0.01) |

Weighted average shares and share equivalents outstanding | | | | | ||

Basic | | | 20,012 | | | 20,000 |

Diluted | | | 22,749 | | | 20,000 |

| | | As of December 31, 2020 | |||||||

| | | Actual | | | Pro Forma(1) | | | Pro Forma As Adjusted(2) | |

| | | | | (in thousands) | |||||

Cash and cash equivalents | | | $2,612 | | | $3,322 | | | $3,322 |

Working capital(3) | | | 7,725 | | | 8,435 | | | 8,435 |

Digital assets | | | 7,668 | | | 7,668 | | | 58,668 |

Total assets | | | 20,751 | | | 21,461 | | | 72,461 |

Other liabilities, non-current | | | 1,391 | | | 853 | | | 853 |

Stockholders' equity | | | 17,823 | | | 19,071 | | | 70,071 |

| (1) | The pro forma consolidated balance sheet data gives effect to (a) the exercise of options to purchase 296,997 shares of Class B common stock in connection with, and contingent upon, the consummation of this offering and the automatic conversion of 818,568 shares of Class B common stock (including 296,997 shares of Class B common stock issued upon exercise of outstanding options) upon their sale by the selling stockholders in this offering and (b) the conversion of $0.5 million aggregate principal amount of SAFEs into 2,904,498 shares of Class B common stock in February 2021. |

| (2) | The pro forma as adjusted consolidated balance sheet data reflects (a) the items described in footnote (1) above and (b) our receipt of estimated net proceeds from the sale of shares of Class A common stock that we are offering at the initial public offering price of $27.42 per share, after deducting estimated offering expenses. |

| (3) | We define working capital as current assets less current liabilities. See our consolidated financial statements and related notes included elsewhere in this offering circular for further details regarding our current assets and current liabilities. |

| • | Scalability is a challenge for platforms working with large blockchains, because addition of records to a blockchain requires the network to achieve consensus through a transaction validation mechanism, which often involves redundant and extensive computation; processing of transactions is slower than that achieved by a central clearing-house; and delays and bottlenecks in the clearance of transactions may result as the crypto assets expand to a greater number of users. |

| • | Because some crypto assets may be considered securities, the fees we receive from exchanges could potentially raise regulatory issues related to whether the recipient of the fees is required to register as a broker-dealer under the Securities Exchange Act of 1934, as amended (“Exchange Act”). We believe that our fee structure does not require us to register as a broker-dealer, as discussed in the section of this offering circular captioned “Business”; however, there is no guarantee that regulatory agencies will agree with our position. |

| • | Blockchain technology can have complex validation processes, and confirmation of a transaction may not always be instantaneous. Users of any crypto asset wallet who do not wait a sufficient period before treating blockchain as permanently written may lose assets and funds in exchange for blockchain payments that are never completed. While this risk is not unique to the Exodus Platform, and is not due to any feature of the Exodus Platform, customers may blame us for such transaction errors, which could harm our reputation and make it difficult to retain customers or persuade new customers to use our platform. |

| • | Although blockchains are generally considered reliable, they are subject to certain attacks as described below under “Risk Factors—Risks Related to the Digital Token Representing Shares of Our Common Stock—The distributed ledger technology used by the ATS is novel with respect to digital securities and has been subject to limited testing and usage.” |

| • | Because many blockchains are public, malicious users may freely view, access and interact with key components of the networks on these blockchains. For example, some of the applications on our platform rely on “smart contracts” written to the Ethereum Blockchain, an open-source, public, distributed ledger that is secured using cryptography (the “Ethereum Blockchain”), and malicious users will be able to freely access this code in ways that could allow them to steal or otherwise affect crypto asset transactions. |

| • | worldwide growth in the adoption and use of digital assets and other blockchain technologies; |

| • | government and quasi-government regulation of digital assets and their use, or restrictions on or regulation of access to and operation of blockchain networks or similar systems; |

| • | the maintenance and development of the open source software protocol of blockchain networks; |

| • | changes in consumer demographics and public tastes and preferences; |

| • | the availability and popularity of other forms or methods of buying and selling goods and services, or trading assets including new means of using government-backed currencies or existing networks; |

| • | the extent to which current interest in crypto assets represents a speculative “bubble”; |

| • | general economic conditions in the United States and the world; |

| • | the regulatory environment relating to crypto assets and blockchains; and |

| • | a decline in the popularity or acceptance of crypto assets or other blockchain-based tokens. |

| • | A loss of existing or potential customers or third-party relationships; |

| • | Harm to our financial condition and results of operations; |

| • | Delay or inability to attain market acceptance of our platform; |

| • | Expenditure of significant financial resources in efforts to analyze, correct, eliminate, remediate, or work around errors or defects, to address and eliminate vulnerabilities, and to address any applicable legal or contractual obligations relating to any actual or perceived security breach or incident; |

| • | Negative publicity and damage to our reputation and brand; and |

| • | Legal claims and demands (including for stolen assets or information, repair of system damages, and compensation to customers), litigation, regulatory audits, proceedings or investigations, and other liabilities. |

| • | The development, maintenance, and functioning of the infrastructure of the Internet as a whole; |

| • | The performance and availability of third-party telecommunications services with the necessary speed, data capacity, and security for providing reliable Internet access and services; |

| • | Decisions by the owners and operators of facilities through which our platform is deployed or by global telecommunications service providers who provide us with network bandwidth to terminate our contracts, discontinue services to us, shut down operations or facilities, increase prices, change service levels, limit bandwidth, declare bankruptcy, or prioritize the traffic of other parties; |

| • | The occurrence of earthquakes, floods, fires, power loss, system failures, physical or electronic break-ins, acts of war or terrorism, human error or interference (including by disgruntled employees, former employees, or contractors), pandemics, and other catastrophic events; |

| • | Cyberattacks targeted at us, facilities where our platform infrastructure is located, our global telecommunications service providers, or the infrastructure of the Internet; |

| • | Errors, defects, or performance problems in the software we use to operate our platform to our customers; |

| • | Our customers’ or contractual providers’ improper deployment or configuration of our customers’ access to our platform; |

| • | The maintenance of the APIs in our systems that our providers use to interact with our platform; |

| • | The failure of our redundancy systems, in the event of a service disruption at one of the facilities hosting our platform infrastructure, to redistribute load to other components of our platform; and |

| • | The failure of our disaster recovery and business continuity arrangements. |

| • | maintaining the integrity of our core business purpose, to design the best customer experience for crypto assets; |

| • | maintaining high levels of customer support; |

| • | ensuring the integrity and security of our platform and IT infrastructure; |

| • | identifying and continuing to expand strategic relationships with third-party API providers and executing agreements to integrate third-party software into the Exodus Platform; |

| • | further improving our key business applications, processes, and IT infrastructure; and |

| • | enhancing our information and communication systems to ensure that our employees around the world are well coordinated and can effectively communicate with each other and our growing base of third-party API providers and customers. |

| • | It was determined that as of December 31, 2018, Exodus’s financial close process was not sufficient which caused a material weakness in financial reporting and disclosure controls |

| • | building out and documenting policies and procedures related to financial reporting and accounting practices. |

| • | hiring additional finance and accounting personnel and/or consultants |

| • | increased management, travel, infrastructure and legal compliance costs associated with having operations in multiple jurisdictions; |

| • | providing our platform and operating our business across a significant distance, in different languages, among different cultures and time zones, including the potential need to modify our platform to ensure that they are culturally appropriate and relevant in different countries; |

| • | compliance with foreign privacy, data protection, and security laws and regulations, including data localization requirements, and the risks and costs of non-compliance; |

| • | greater difficulty in enforcing contracts and accounts receivable collection, and longer collection periods; |

| • | limitations on our ability to market our platform and for our solution to be effective in foreign markets that have different cultural norms and related business practices that de-emphasize the importance of positive customer and employee experiences; |

| • | differing technical standards, existing or future regulatory and certification requirements and required features and functionality; |

| • | political and economic conditions and uncertainty in each country or region in which we operate and general economic and political conditions and uncertainty around the world; |

| • | compliance with laws and regulations for foreign operations, including anti-bribery laws, import and export control laws, tariffs, trade barriers, economic sanctions and other regulatory or contractual limits on our ability to acquire new customers in certain foreign markets, and the risks and costs of noncompliance; |

| • | changes in a specific country’s or region’s political or economic conditions; |

| • | reduced or uncertain protection for intellectual property rights in some countries; |

| • | greater risk of unexpected changes in regulatory practices, tariffs, and tax laws and treaties; |

| • | greater risk of a failure of foreign personnel and third-party API providers to comply with both U.S. and foreign laws, including antitrust regulations, anti-bribery laws, export and import control laws, and any applicable trade regulations ensuring fair trade practices; |

| • | differing employment practices and labor relations issues; |

| • | Exchanges that specialize in crypto assets, including Binance US, Bittrex, Coinbase, Gemini, Kraken, Paxos, and ShapeShift; |

| • | Crypto asset wallets, such as Bitpay Wallet, Bread Wallet, Coinbase Wallet, Coinomi Wallet, Jaxx Wallet, and Trust Wallet; |

| • | Banks, non-depository trust companies and other chartered financial institutions that offer crypto asset custody services, including Gemini, Paxos and Prime Trust; |

| • | Custodial financial applications such as Venmo and Cash App, which may in the future seek to create a non-custodial model; and |

| • | Exchanges or other fintech companies with substantial infrastructure and market share that decide to and may be legally able to offer crypto assets, such as NYSE, Nasdaq and Robinhood. |

| • | greater name recognition; |

| • | longer operating histories and larger customer bases; |

| • | larger sales and marketing budgets and capital resources; |

| • | broader distribution and established relationships with providers and customers; |

| • | greater customer support resources; |

| • | greater resources to make acquisitions and enter into strategic relationships; |

| • | lower labor and software development costs; |

| • | range of supported crypto assets; |

| • | lower customer acquisition costs; and |

| • | substantially greater financial, technical, and other resources. |

| • | implement usage-based pricing; |

| • | discount pricing for competitive products; |

| • | otherwise materially change their pricing rates or schemes; |

| • | charge us to deliver our traffic at certain levels or at all; |

| • | throttle traffic based on its source or type; |

| • | implement bandwidth caps or other usage restrictions; or |

| • | otherwise try to monetize or control access to their networks. |

| • | issue additional equity securities that would dilute our stockholders; |

| • | use cash that we may need in the future to operate our business; |

| • | incur debt on terms unfavorable to us or that we are unable to repay; |

| • | incur large charges or substantial liabilities; |

| • | encounter difficulties integrating diverse business cultures; and |

| • | become subject to adverse tax consequences, substantial depreciation, or deferred compensation charges. |

| • | a rapidly-evolving regulatory landscape focused on digital tokens and, potentially, on the technology underlying distributed ledgers, which might include security, privacy or other regulatory concerns that could require the Transfer Agent to implement changes to its trading system for securities represented by digital tokens that could disrupt trading in our Class A common stock, or could shut down the Transfer Agent; |

| • | the possibility of undiscovered technical flaws, including in the process by which system participants come to agreement on the state of the distributed ledger and the ownership of our Common Stock Tokens recorded on the ledger; |

| • | the possibility that cryptographic security measures that authenticate transactions and the distributed ledger could be compromised, which could allow an attacker to alter the distributed ledger and the ownership of Common Stock Tokens recorded on the ledger, resulting in a corresponding loss of the holder’s Class A common stock represented by the Common Stock Tokens; |

| • | the possibility of breakdowns and trading halts as a result of undiscovered flaws in the Transfer Agent that could prevent trades for a period of time; |

| • | the possibility that changes to policies of the ledger limit the ability to withdraw and deposit fiat currency; |

| • | the possibility that new technologies or services inhibit access to the blockchain network used by the Common Stock Tokens; |

| • | the possibility that the Transfer Agent does not competently manage transfers, potentially disrupting transfers of Common Stock Tokens; |

| • | the possibility that other participants in the ledger could collude to manipulate the share price or limit liquidity in our Class A common stock which could restrict your ability to divest your holdings of our Class A common stock; and |

| • | the possibility that an investor’s private key is lost or stolen and Exodus is unable to verify the loss or theft could result in irreversible client losses. |

| • | eliminate the ability of our stockholders to call special meetings of our stockholders; |

| • | establish advance notice procedures for stockholders seeking to bring business before our meetings of stockholders or to nominate candidates for election as directors at our meetings of stockholders; |

| • | do not provide for cumulative voting; |

| • | authorize the issuance up to 1,000,000 shares of “blank check” preferred stock by our board of directors without further action by the stockholders; |

| • | reflect the dual class structure for our common stock; and |

| • | restrict the forum for certain litigation against us to certain federal or Delaware state courts. |

| • | permit the board of directors to establish the number of directors and fill any vacancies and newly created directorships; |

| • | establish a board of directors classified into three classes of directors; |

| • | require cause to remove a director; |

| • | require super-majority voting to amend some provisions in our amended and restated certificate of incorporation and amended and restated bylaws; |

| • | provide that our amended and restated bylaws may be amended by a simple majority vote of our board of directors; |

| • | prohibit stockholder action by written consent, which requires all stockholder actions to be taken at a meeting of our stockholders; |

| • | changes in the treatment of crypto assets under tax laws; |

| • | changes in the relative amounts of income before taxes in the various jurisdictions in which we operate due to differing statutory tax rates in various jurisdictions; |

| • | changes in tax laws, tax treaties, and regulations or the interpretation of them, including the Tax Cuts and Jobs Act (“Tax Act”) and the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”); |

| • | changes to our assessment about our ability to realize our deferred tax assets that are based on estimates of our future results, the prudence and feasibility of possible tax planning strategies, and the economic and political environments in which we do business; |

| • | the outcome of current and future tax audits, examinations, or administrative appeals; and |

| • | imitations or adverse findings regarding our ability to do business in some jurisdictions. |

| • | our future financial performance, including our expectations regarding our revenue, cost of revenue, gross profit, operating expenses, |

| • | our use of the net proceeds from this offering; |

| • | changes in general and administrative expenses (including any components of the foregoing), advertising and marketing expenses, depreciation and amortization expenses, impairment of digital asset expenses, and stock-based compensation expenses, and our ability to achieve, and maintain, future profitability; |

| • | our business plan and our ability to effectively manage our growth; |

| • | our market opportunity, including our total addressable market; |

| • | anticipated trends, growth rates, and challenges in our business and in the markets in which we operate; |

| • | beliefs and objectives for future operations; |

| • | our ability to further attract, retain, and expand our customer base; |

| • | our ability to develop new products and services and bring them to market in a timely manner; |

| • | our expectations concerning relationships with third parties, including strategic partners; |

| • | our ability to maintain, protect, and enhance our intellectual property; |

| • | our response to emerging and future cybersecurity risks; |

| • | the effects of increased competition in our markets and our ability to compete effectively; |

| • | future acquisitions or investments in complementary companies, products, services, or technologies; |

| • | our ability to maintain compliance with laws and regulations that currently apply or become applicable to our business; |

| • | economic and industry trends, projected growth, or trend analysis; |

| • | our ability to attract and retain qualified employees; and |

| • | the estimates and methodologies used in preparing our consolidated financial statements. |

| | | 25% | | | 50% | | | 75% | | | 100% | |

Gross proceeds | | | $18.8 | | | $37.5 | | | $52.5 | | | $52.5 |

Offering expenses1 | | | $1.5 | | | $1.5 | | | $1.5 | | | $1.5 |

Net proceeds to Exodus Movement, Inc. | | | $17.3 | | | $36.0 | | | $51.0 | | | $51.0 |

1 | Offering expenses were paid out of working capital previously allocated for those expenditures. Offering expenses consisting primarily of legal and accounting fees which we estimate to be approximately $1.5 million. |

| | | 25% | | | 50% | | | 75% | | | 100% | |

Software development | | | $11.5 | | | $24.0 | | | $29.1 | | | $29.1 |

Marketing | | | $4.6 | | | $9.6 | | | $14.6 | | | $14.6 |

Operations/Cash reserves | | | $1.2 | | | $2.4 | | | $7.3 | | | $7.3 |

| • | an actual basis; |

| • | a pro forma basis to give effect to (1) the conversion of $0.5 million aggregate principal amount of SAFEs into 2,904,498 shares of Class B common stock in February 2021; (2) the issuance of 4,800 shares of Class B common stock to COHAGEN WILKINSON, INC., a selling stockholder in this offering, in January 2021 and (3) the exercise of options to purchase 296,997 shares of Class B common stock in connection with, and contingent upon, the consummation of this offering and the automatic conversion of 818,568 shares of Class B common stock (including 296,997 shares of Class B common stock issued upon exercise of outstanding options) upon their sale by the selling stockholders in this offering; and |

| • | a pro forma as adjusted basis to give effect to the sale and issuance by us of 1,914,661 shares of Class A common stock in this offering and the receipt of the net proceeds from our sale of these shares at the offering price of $27.42 per share, after deducting offering expenses. |

| | | As of December 31, 2020 | |||||||

| | | Actual | | | Pro Forma | | | Pro Forma As Adjusted | |

| | | (in thousands, except share data) | |||||||

Cash and cash equivalents | | | $2,612 | | | $3,322 | | | $3,322 |

Digital assets | | | 7,668 | | | 7,668 | | | 58,668 |

Stockholders’ equity: | | | | | | | |||

Preferred stock, par value $0.000001 per share: 5,000,000 shares authorized, no shares issued and outstanding, actual, pro forma and pro forma as adjusted | | | — | | | — | | | — |

Class A common stock, par value $0.000001 per share: 32,500,000 shares authorized; no shares issued and outstanding, actual; 818,568 issued and outstanding, pro forma, 2,733,229 shares issued and outstanding, pro forma as adjusted | | | — | | | — | | | — |

Class B common stock, par value $0.000001 per share: 27,500,000 shares authorized; 20,011,830 shares issued and outstanding, actual; 22,399,557 issued and outstanding, pro forma and pro forma as adjusted | | | — | | | — | | | — |

Additional paid-in capital | | | 2,621 | | | 3,869 | | | 54,869 |

Accumulated other comprehensive income | | | 248 | | | 248 | | | 248 |

Retained earnings | | | 14,954 | | | 14,954 | | | 14,954 |

Total stockholders’ equity | | | 17,823 | | | 19,071 | | | 70,071 |

Total capitalization | | | $17,823 | | | $19,071 | | | $70,071 |

| | | Actual(1)(2) | | | Pro Forma(1)(2)(3)(4)(5) | | | Pro Forma As Adjusted(1)(2)(3)(4)(5) | |

Class A Common Stock | | | — | | | 818,568 | | | 2,733,229 |

Class B Common Stock | | | 20,011,830 | | | 22,399,557 | | | 22,399,557 |

| (1) | Reflects the filing of a certificate of amendment to our amended and restated certificate of incorporation in February 2021, which increased the number of authorized shares of our capital stock and effected the Forward Stock Split. |

| (2) | Excludes (a) 2,737,008 shares of our Class B common stock issuable upon exercise of options outstanding, at a weighted average exercise price of $2.39 per share, as of December 31, 2020 and (b) 262,992 shares of our Class B common stock reserved for future issuance under our 2019 Equity Incentive Plan as of December 31, 2020. |

| (3) | Reflects the exercise of options to purchase 296,977 shares of Class B common stock in connection with, and contingent upon, the consummation of this offering and the automatic conversion of 818,568 shares of Class B common stock (including 296,997 shares of Class B common stock issued upon exercise of outstanding options) upon their sale by the selling stockholders in this offering. |

| (4) | Reflects the conversion of $0.5 million aggregate principal amount of SAFEs into 2,904,498 shares of Class B common stock in February 2021. |

| (5) | Reflects the issuance of 4,800 shares of Class B common stock to COHAGEN WILKINSON, INC., a selling stockholder in this offering, in January 2021. |

Price per share of Class A common stock in this offering | | | | | $27.42 | |

Historical pro forma net tangible book value per share as of December 31, 2020 | | | $0.82 | | | |

Increase per share attributable to new investors purchasing shares in this offering | | | $1.97 | | | |

Pro forma as adjusted net tangible book value per share after this offering | | | | | $2.79 | |

Dilution per share to new investors purchasing shares in this offering | | | | | $24.63 |

| | | Shares Purchased | | | Total Consideration | | | Average Price Per Share | |||||||

| | | Number | | | Percent | | | Amount | | | Percent | | |||

| | | (in thousands, except per share data and percentages) | |||||||||||||

Existing stockholders | | | 818,568 | | | 30% | | | $22,445 | | | 30% | | | $27.42 |

New investors participating in this offering | | | 1,914,661 | | | 70% | | | $52,500 | | | 70% | | | 27.42 |

Total | | | 2,733,229 | | | 100% | | | $74,945 | | | 100% | | | 27.42 |

| | | Actual(1)(2) | | | Pro Forma(1)(2)(3)(4)(5) | | | Pro Forma As Adjusted(1)(2)(3)(4)(5) | |

Class A Common Stock | | | — | | | 818,568 | | | 2,733,229 |

Class B Common Stock | | | 20,011,830 | | | 22,399,557 | | | 22,399,557 |

| (1) | Reflects the filing of a certificate of amendment to our amended and restated certificate of incorporation in February 2021, which increased the number of authorized shares of our capital stock and effected the Forward Stock Split. |

| (2) | Excludes (a) 2,737,008 shares of our Class B common stock issuable upon exercise of options outstanding, at a weighted average exercise price of $2.39 per share, as of December 31, 2020 and (b) 262,992 shares of our Class B common stock reserved for future issuance under our 2019 Equity Incentive Plan as of December 31, 2020. |

| (3) | Reflects the exercise of options to purchase 296,997 shares of Class B common stock in connection with, and contingent upon, the consummation of this offering and the automatic conversion of 818,568 shares of Class B common stock (including 296,997 shares of Class B common stock issued upon exercise of outstanding options) upon their sale by the selling stockholders in this offering. |

| (4) | Reflects the SAFE Conversion. |

| (5) | Reflects the issuance of 4,800 shares of Class B common stock to COHAGEN WILKINSON, INC., a selling stockholder in this offering, on January 14, 2021. |

| | | 2020 | | | 2019 | |

| | | (amounts in thousands) | ||||

Revenues | | | $21,251 | | | $7,922 |

Cost of revenues | | | | | ||

Software development | | | 3,465 | | | 3,000 |

Customer support | | | 1,824 | | | 1,044 |

Security and wallet operations | | | 3,517 | | | 2,578 |

Total cost of revenues | | | 8,806 | | | 6,622 |

Gross profit | | | 12,445 | | | 1,300 |

Operating expenses | | | | | ||

General and administrative | | | 3,802 | | | 2,235 |

Advertising and marketing | | | 1,081 | | | 569 |

Depreciation and amortization | | | 736 | | | 103 |

Impairment of digital assets | | | 2,430 | | | 1,738 |

Income (loss) from operations | | | 4,396 | | | (3,345) |

Other income (expense) | | | | | ||

Gain on sale or transfer of digital assets | | | 5,017 | | | 3,118 |

Interest expense | | | (6) | | | (3) |

Interest income | | | 80 | | | 55 |

Total other income and expense | | | 5,091 | | | 3,170 |

Income (loss) before income taxes | | | 9,487 | | | (175) |

Income tax (expense) benefit | | | (1,310) | | | (55) |

Net income (loss) | | | $8,177 | | | $(230) |

Other comprehensive income (loss) | | | | | ||

Foreign Currency Translation Adjustment | | | 248 | | | — |

Comprehensive income (loss) | | | $8,425 | | | $(230) |

| | | For the year ended December 31, | | | | |||||||

| | | 2020 | | | 2019 | | | Percent Change | | |||

| | | (amounts in thousands) | | | | | ||||||

Revenue | | | $21,251 | | | $7,922 | | | 168% | | ||

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Software development expense | | | $3,465 | | | $3,000 | | | 15% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Customer support expense | | | $1,824 | | | $1,044 | | | 75% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Security and wallet operations expense | | | $3,517 | | | $2,578 | | | 36% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

General and administrative expense | | | $3,802 | | | $2,235 | | | 70% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Advertising and marketing expense | | | $1,081 | | | $569 | | | 90% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Depreciation and amortization | | | $736 | | | $103 | | | 615% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Impairment of digital assets | | | $2,430 | | | $1,738 | | | 40% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Gains on sale or transfer of digital assets | | | $5,017 | | | $3,118 | | | 61% |

| | | For the year ended December 31, | | | |||||

| | | 2020 | | | 2019 | | | Percent Change | |

| | | (amounts in thousands) | | | |||||

Interest income | | | $80 | | | $55 | | | 45% |

| | | For the year ended December 31, | ||||

| | | 2020 | | | 2019 | |

| | | (amounts in thousands) | ||||

Net cash provided by (used in) operating activities | | | $2,668 | | | $(2,409) |

Net cash used in investing activities | | | $(2,043) | | | $(1,169) |

Net cash provided by (used in) financing activities | | | $(1,386) | | | $220 |

| | | Bitcoin (BTC) | ||||

| | | As of December 31, | ||||

| | | 2020 | | | 2019 | |

Units | | | 694 | | | 513 |

Book Value (in thousands) | | | $7,159 | | | $3,382 |

Market Value (in thousands)(1) | | | $20,141 | | | $3,691 |

| | | Ethereum (ETH) | ||||

| | | As of December 31, | ||||

| | | 2020 | | | 2019 | |

Units | | | 1,613 | | | 809 |

Book Value (in thousands) | | | $498 | | | $64 |

Market Value (in thousands)(1) | | | $1,190 | | | $105 |

| | | Other Digital Assets | ||||

| | | As of December 31, | ||||

| | | 2020 | | | 2019 | |

Units | | | 21,688 | | | 17,869 |

Book Value (in thousands) | | | $11 | | | $31 |

Market Value (in thousands)(1) | | | $15 | | | $46 |

| (1) | Market rate represents a determination of fair market value derived from publicly available information. |

| • | Store of value crypto assets are primarily used to pay for goods and services and are often considered a substitute for gold, cash, or forms of electronic payment. Merchants have begun to accept these types of crypto assets as payment, although often the crypto asset is converted to a fiat currency, such as the U.S. dollar, immediately upon acceptance by the merchant. Examples of store of value and payment crypto assets are Bitcoin and Litecoin. |

| • | Crypto assets that comprise part of a blockchain economy or blockchain platform typically have more functionality than a payment currency. Blockchain economies permit the use of the crypto asset to create other digital assets, or tokens, run decentralized applications on the blockchain platform and build various types of functionality and features on the blockchain platform. Examples of crypto assets that are part of blockchain economies include Ether, EOS and TRON. |

| • | Privacy coins are crypto assets created to focus on privacy and security. Privacy coin transaction details are typically encrypted, so that only the sender and receiver of the coins knows how many coins were involved in the transaction. In addition, the balance of a privacy coin wallet is known only to the owner of the wallet and is not able to be viewed on the public blockchain record. An example of a privacy coin is Monero. |

| • | Utility tokens are digital tokens used solely to power or connect to a blockchain-based product or service. These crypto assets run on their blockchain platform but are only used to “pay for” or “power” products or services on that platform. Examples of utility tokens include Golem and Basic Attention Token. |

| • | Stablecoins are crypto assets whose value is tied to some other asset so that the value of the stablecoin will not greatly fluctuate relative to the underlying asset. Different stablecoins have adopted different methods of stabilization. Examples of stablecoins are USDC and DAI. |

| • | Certain crypto assets allow holders to interact with the crypto asset through “staking.” In doing so, the staker takes part in the crypto asset’s blockchain consensus mechanism and receives part of a reward for such participation. Third-party entities monitor staking pools or create their own so as to provide stakers with a controlled, safe environment to stake crypto assets and receive their rewards. An example of a crypto asset that can be staked is Tezos. |

| • | Custodial key management: In this structure, a company or platform generates the private keys for their customers and administers any and all funds sent to the addresses tied to those private keys. Custodial key management solutions become custodians of their customers funds and in that respect are extremely similar to centralized banks. |

| • | Non-custodial key management: In this solution, a person or entity generates (using software or other means) and secures (often on their own computer or written down on a piece of paper) their own private keys and all funds are sent to the address tied to those private keys. Non-custodial key management solutions are not custodians of their users’ funds, but are merely repositories for the funds, similar to the way a physical safety box or leather wallet provides a means for people to secure their own wealth. |

| • | helping to ensure that our customers retain full control over the crypto assets held in their Exodus wallet by encrypting the private keys locally on our customers’ own devices; |

| • | streamlining customer set up process for transacting in over 100 crypto assets, as well as offering a range of wallet options to hold customers’ private keys (including hot and cold wallets) so customers can quickly access the features they want without being distracted by unnecessary or confusing technical information; |

| • | hosting and maintaining our own robust server infrastructure to ensure near 100% uptime, 24/7, for all crypto assets and services offered on our platform; |

| • | integrating cutting-edge third-party apps seamlessly into our highly functional platform to provide our customers with a rich ecosystem of ways to use and manage their crypto assets, as well as providing us with potential additional avenues for monetizing our platform; |

| • | producing reliable, straightforward information on our website and YouTube channel regarding blockchain cryptography, crypto assets and our platform that is relevant for both new and experienced crypto asset users; |

| • | providing fast and smooth purchasing of crypto assets using fiat currency through Apple Pay on iOS devices (our customers can purchase up to USD $500 of Bitcoin at the touch of a button, which is made available on their Exodus wallets immediately); and |

| • | continually adapting and innovating the Exodus Platform to support our customers’ ability to store other types of valuable assets, including personal information, traditional fiat currencies, and, potentially, traditional securities in tokenized form alongside other tokenized financial products in the future. |

| • | The Exchange Aggregator allows users to swap one crypto asset for another within the Exodus Platform without having to send assets to and from centralized exchanges or trade across multiple order books. For example, if a customer wants to swap Digibyte for DASH inside of Exodus, this trade can be easily executed, while on a centralized exchange, a customer would have to trade Digibyte for Bitcoin and then Bitcoin for DASH. Through the Exodus Platform, customers can access the ability to directly exchange over 10,000 pairs of crypto assets. |

| • | The Compound Finance app permits Exodus Platform customers to use an algorithmic smart contract protocol to earn interest (in the form of additional crypto asset tokens) on certain supported crypto assets held in their Exodus wallets. |

| • | SportX allows users in certain jurisdictions outside of the United States and its territories to place wagers on select sporting events using a third-party smart contract protocol on the Ethereum Blockchain. SportX is only available to our customers outside the United States and its territories, in jurisdictions where online sports gambling is permitted by applicable law. All gambling activities conducted through SportX are operated by SportX’s developer, NextGen, and we do not set odds, place or accept bets, pay out winnings or otherwise facilitate, operate or manage any gambling activities conducted on SportX. |

| • | Rewards allows users to “stake” supported crypto assets held in their Exodus wallets by participating in blockchain validation through a third-party entity that monitors or creates staking pools. |

| • | platform features, quality, functionality and design; |

| • | product pricing; |

| • | breadth of features offered by a platform; |

| • | quality of customer support; |

| • | security and trust; |

| • | brand awareness and reputation; |

| • | ease of adoption and use; |

| • | accessibility of platform on multiple devises; |

| • | customer acquisition costs; and |

| • | range of supported crypto assets. |

Name | | | Age | | | Position | | | Term of Office(1) |

Executive Officers and Directors | | | | | | | |||

Jon Paul Richardson | | | 37 | | | Chief Executive Officer and Director | | | Chief Executive Officer: July 2016-present; President: July 2016-June 2019; Director: July 2016-present |

Daniel Castagnoli | | | 44 | | | President and Director | | | Chief Financial Officer: July 2016-March 2019; Secretary: July 2016-June 2019; President: June 2019-present; Director: July 2016-present |

| | | | | | | ||||

Executive Officers | | | | | | | |||

Sebastian Milla | | | 29 | | | Chief Operating Officer | | | April 2019-present |

James Gernetzke | | | 45 | | | Chief Financial Officer and Secretary | | | March 2019-present |

Sean Coonce | | | 40 | | | Vice President of Engineering | | | May 2020-present |

David Berson | | | 56 | | | General Counsel | | | February 2021-present |

Sonja McIntosh | | | 60 | | | Vice President of Community Support | | | August 2019-present |

| (1) | All terms of office are indefinite. |

Name and Principal Position | | | Year | | | Cash Compensation(1) | | | All Other Compensation | | | Total |

John Paul Richardson Chief Executive Officer, Director | | | 2020 | | | $307,358 | | | $— | | | $307,358 |

Daniel Castagnoli President, Director | | | 2020 | | | $313,588 | | | $— | | | $313,588 |

James Gernetzke Chief Financial Officer | | | 2020 | | | $225,000 | | | $— | | | $225,000 |

| (1) | Amounts represent the payment of base salary and cash incentive bonuses paid upon completion of pre-determined tasks. Cash compensation is paid to our named executive officers in Bitcoin, with the U.S. dollar value of such Bitcoin determined by the prevailing U.S. dollar/Bitcoin exchange rate on the date of payment. |

| | | Option Awards | | | Stock Awards | ||||||||||||||||

Name | | | Vesting Commencement Date | | | Number of Shares of Class B Common Stock Underlying Unexercised Options (#) Exercisable | | | Number of Shares of Class B Common Stock Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Prices ($) | | | Option Expiration Date | | | Number of Shares of Class B Common Stock that Have Not Vested(#) | | | Market Value of Shares of Class B Common Stock that Have Not Vested ($)(1) |

Jon Paul Richardson | | | 01/17/2017 | | | | | | | | | | | 135,418(2) | | | $3,713,161.56 | ||||

Daniel Castagnoli | | | 01/17/2017 | | | | | | | | | | | 135,418(3) | | | $3,713,161.56 | ||||

James Gernetzke | | | 03/21/2019 | | | 62,500(4) | | | 87,500 | | | 2.39 | | | 09/29/2029 | | | | | ||

| | | 03/21/2019 | | | 874(4) | | | 1,126 | | | 2.39 | | | 10/20/2029 | | | | | |||

| (1) | This column represents the market value of the shares of restricted stock as of December 31, 2020, based on an assumed offering price of $27.42 per share of our common stock. |

| (2) | Mr. Richardson purchased 9,500,000 shares of restricted Class B common stock through a restricted stock purchase agreement on January 1, 2017. 3,000,000 of the shares subject to the restricted stock purchase agreement immediately vested on January 1, 2017, with 1/48th of the remaining shares vesting monthly thereafter, subject to continued service as an employee, consultant, advisor, officer or director through each such vesting date. |

| (3) | Mr. Castagnoli purchased 9,500,000 shares of restricted Class B common stock through a restricted stock purchase agreement on January 1, 2017. 3,000,000 of the shares subject to the restricted stock purchase agreement immediately vested on January 1, 2017, with 1/48th of the remaining shares vesting monthly thereafter, subject to continued service as an employee, consultant, advisor, officer or director through each such vesting date. |

| (4) | One-fourth of the shares subject to the option vest on the one-year anniversary of the vesting commencement date, with the 1/48th of the total number of shares vesting monthly thereafter, subject to continued service through each such vesting date. |

| • | all executive officers and directors as a group, individually naming each director or executive officer who beneficially owns more than 10% of our common stock or who is a selling stockholder; |

| • | any other securityholder who beneficially owns more than 10% of our common stock; and |

| • | the selling stockholders. |

| | | Beneficial Ownership Before the Offering | | | | | Beneficial Ownership After the Offering | ||||||||||||||||||||||||||

| | | Class A | | | Class B | | | of Total Voting Power(1) | | | Number of Shares Being Offered | | | Class A | | | Class B | | | of Total Voting Power(1) | |||||||||||||

Name of Beneficial Owner | | | Shares | | | % | | | Shares | | | % | | | % | | | | | Shares | | | % | | | Shares | | | % | | | % | |

Directors and Executive Officers: | | | | | | | | | | | | | | | | | | | | | | | |||||||||||

Jon Paul Richardson(2)§ | | | — | | | — | | | 9,500,000 | | | 41.4 | | | 41.4 | | | 202,463 | | | — | | | — | | | 9,297,537 | | | 41.5 | | | 41.0 |

Daniel Castagnoli(3)§ | | | — | | | — | | | 9,500,000 | | | 41.4 | | | 41.4 | | | 45,587 | | | — | | | — | | | 9,454,413 | | | 42.2 | | | 41.7 |

James Gernetzke(4)† | | | — | | | — | | | 72,832 | | | * | | | * | | | 2,000 | | | — | | | — | | | 70,832 | | | * | | | * |

Sonja McIntosh(5)† | | | — | | | — | | | 38,250 | | | * | | | * | | | 36,124 | | | — | | | — | | | 2,126 | | | * | | | * |

All directors and executive officers as a group (7 persons)(6) | | | — | | | — | | | 19,234,320(2) | | | 83.1 | | | 83.1 | | | 286,174 | | | — | | | — | | | 18,948,146 | | | 83.7 | | | 82.7 |

Selling Stockholders: | | | | | | | | | | | | | | | | | | | | | | | |||||||||||

Ain Sal(7) † | | | — | | | — | | | 29,562 | | | * | | | * | | | 20,633 | | | — | | | — | | | 8,929 | | | * | | | * |

Aliah Church(8) † | | | — | | | — | | | 4,774 | | | * | | | * | | | 4,066 | | | — | | | — | | | 708 | | | * | | | * |

Asya Kostanyan(9) † | | | — | | | — | | | 20,870 | | | * | | | * | | | 14,000 | | | — | | | — | | | 6,870 | | | * | | | * |

Conway Jones(10) † | | | — | | | — | | | 6,072 | | | * | | | * | | | 5,000 | | | — | | | — | | | 1,072 | | | * | | | * |

David Zelaya(11) † | | | — | | | — | | | 19,442 | | | * | | | * | | | 19,442 | | | — | | | — | | | — | | | — | | | — |

Diana Dumitru-Staker(12) † | | | — | | | — | | | 22,570 | | | * | | | * | | | 13,890 | | | — | | | — | | | 8,680 | | | * | | | * |

Giovanni Coutinho(13) † | | | — | | | — | | | 2,988 | | | * | | | * | | | 2,206 | | | — | | | — | | | 782 | | | * | | | * |

Henderikus de Ram(14) † | | | — | | | — | | | 3,914 | | | * | | | * | | | 3,914 | | | — | | | — | | | — | | | — | | | — |

Jeremy Winkler(15) † | | | — | | | — | | | 4,236 | | | * | | | * | | | 4,000 | | | — | | | — | | | 236 | | | * | | | * |

John Staker(16) † | | | — | | | — | | | 38,246 | | | * | | | * | | | 22,390 | | | — | | | — | | | 15,856 | | | * | | | * |

Konnor Klashinsky(17) † | | | — | | | — | | | 49,822 | | | * | | | * | | | 32,000 | | | — | | | — | | | 17,822 | | | * | | | * |

Kris Merkel(18) † | | | — | | | — | | | 34,346 | | | * | | | * | | | 20,000 | | | — | | | — | | | 14,346 | | | * | | | * |

Marcos Casagrande(19) † | | | — | | | — | | | 3,000 | | | * | | | * | | | 2,824 | | | — | | | — | | | 176 | | | * | | | * |

| | | Beneficial Ownership Before the Offering | | | | | Beneficial Ownership After the Offering | ||||||||||||||||||||||||||

| | | Class A | | | Class B | | | of Total Voting Power(1) | | | Number of Shares Being Offered | | | Class A | | | Class B | | | of Total Voting Power(1) | |||||||||||||

Name of Beneficial Owner | | | Shares | | | % | | | Shares | | | % | | | % | | | | | Shares | | | % | | | Shares | | | % | | | % | |

Matias Olivera(20) † | | | — | | | — | | | 6,264 | | | * | | | * | | | 5,846 | | | — | | | — | | | 418 | | | * | | | * |

Maxwell Ogden(21) † | | | — | | | — | | | 9,612 | | | * | | | * | | | 9,176 | | | — | | | — | | | 436 | | | * | | | * |

Michael Čečetka(22) † | | | — | | | — | | | 25,648 | | | * | | | * | | | 20,000 | | | — | | | — | | | 5,648 | | | * | | | * |

Nareg Aslanian(23) † | | | — | | | — | | | 26,820 | | | * | | | * | | | 23,550 | | | — | | | — | | | 3,270 | | | * | | | * |

Rocco Musolino(24) † | | | — | | | — | | | 18,528 | | | * | | | * | | | 10,000 | | | — | | | — | | | 8,528 | | | * | | | * |

Victor Bonini(25) † | | | — | | | — | | | 6,476 | | | * | | | * | | | 6,136 | | | — | | | — | | | 340 | | | * | | | * |

Leah Petrowski(26) † | | | — | | | — | | | 20,656 | | | * | | | * | | | 19,800 | | | — | | | — | | | 856 | | | * | | | * |

Bnk to the Future Exodus SP, a Segregated Portfolio of Bnk To The Future Capital SPC(27)‡ | | | — | | | — | | | 1,689,210 | | | 7.4 | | | 7.4 | | | 213,416 | | | — | | | — | | | 1,475,794 | | | 6.6 | | | 6.5 |

Bitcoin Capital 3 SP, a Segregated Portfolio of Bnk To The Future Capital SPC(28)‡ | | | — | | | — | | | 143,992 | | | * | | | * | | | 18,192 | | | — | | | — | | | 125,800 | | | * | | | * |

Ricardo Hernandez(29)‡ | | | — | | | — | | | 322,540 | | | 1.4 | | | 1.4 | | | 40,600 | | | — | | | — | | | 281,940 | | | 1.3 | | | 1.2 |

COHAGEN WILKINSON, INC.† | | | — | | | — | | | 4,800 | | | * | | | * | | | 606 | | | — | | | — | | | 4,194 | | | * | | | * |

Michal Cymbalisty(31)‡ | | | — | | | — | | | 5,600 | | | * | | | * | | | 707 | | | — | | | — | | | 4,893 | | | * | | | * |

| * | Represents beneficial ownership or voting power of less than 1%. |

| † | Indicates a participant in Group 1 of the Secondary Offering. See “Plan of Distribution—Securities being issued.” |

| ‡ | Indicates a participant in Group 2 of the Secondary Offering. See “Plan of Distribution—Securities being issued.” |

| § | Indicates a participant in Group 3 of the Secondary Offering. See “Plan of Distribution—Securities being issued.” |

| (1) | Percentage total voting power represents voting power with respect to all outstanding shares of our Class A common stock and Class B common stock, voting as a single class. Each holder of Class A common stock shall be entitled to one per share of Class A common stock and each holder of Class B common stock shall be entitled to ten votes per share of Class B common stock. Holders of Class A common stock and Class B common stock will vote together as a single class on all matters (including the election of directors) submitted to a vote of stockholders, unless otherwise required by law or our amended and restated certificate of incorporation. The Class B common stock is convertible at any time by the holder into shares of Class A common stock on a share-for-share basis. |

| (2) | Consists of 9,500,000 shares of Class B common stock held of record. |

| (3) | Consists of 9,500,000 shares of Class B common stock held of record. |

| (4) | Consists of options to purchase 72,832 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (5) | Consists of options to purchase 38,250 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (6) | Consists of 9,500,000 shares of Class B common stock held of record and options to purchase 234,320 shares of our Class B common stock exercisable within 60 days of December 31, 2020. |

| (7) | Consists of options to purchase 29,562 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (8) | Consists of options to purchase 4,774 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (9) | Consists of options to purchase 20,870 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (10) | Consists of options to purchase 6,072 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (11) | Consists of options to purchase 19,442 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (12) | Consists of options to purchase 22,570 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (13) | Consists of options to purchase 2,988 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (14) | Consists of options to purchase 3,914 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (15) | Consists of options to purchase 4,236 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (16) | Consists of options to purchase 38,246 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (17) | Consists of options to purchase 49,822 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (18) | Consists of options to purchase 34,346 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (19) | Consists of options to purchase 3,000 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (20) | Consists of options to purchase 6,264 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (21) | Consists of options to purchase 9,612 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (22) | Consists of options to purchase 25,648 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (23) | Consists of options to purchase 26,820 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (24) | Consists of options to purchase 18,528 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (25) | Consists of options to purchase 6,476 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (26) | Consists of options to purchase 20,656 shares of Class B common stock exercisable within 60 days of December 31, 2020. |

| (27) | Consists of 1,689,210 shares of Class B common stock held of record. |

| (28) | Consists of 143,992 shares of Class B common stock held of record. |

| (29) | Consists of 322,540 shares of Class B common stock held of record. |

| (30) | Consists of 4,800 shares of Class B common stock held of record. |

| (31) | Consists of 5,600 shares of Class B common stock held of record. |

Purchase Amount | | | Valuation Cap | | | Discount Rate |

$368,284 | | | $4,000,000 | | | 20% |

$170,000 | | | $5,000,000 | | | 80% |

| • | Special Meetings of Stockholders. Our amended and restated certificate of incorporation and our amended and restated bylaws provide that special meetings of our stockholders may be called only by a majority of our board of directors, the chairperson of our board of directors, or our chief executive officer or president, thus prohibiting a stockholder from calling a special meeting. These provisions might delay the ability of our stockholders to force consideration of a proposal or for stockholders to take any action, including the removal of directors. |

| • | Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our amended and restated bylaws provide advance notice procedures for stockholders seeking to bring business before our meetings of stockholders or to nominate candidates for election as directors at our meetings of stockholders. Our amended and restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions may preclude our stockholders from bringing matters before our meetings of stockholders or from making nominations for directors at our meetings of stockholders. We expect that these provisions might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company. |

| • | No Cumulative Voting. The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless a corporation’s certificate of incorporation provides otherwise. Our amended and restated certificate of incorporation and amended and restated bylaws do not provide for cumulative voting. |

| • | Issuance of Undesignated Preferred Stock. Our board has the authority, without further action by the stockholders, to issue up to 1,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred stock enables our board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest, or otherwise. |

| • | Choice of Forum. Our amended and restated bylaws provide that, to the fullest extent permitted by law, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the DGCL, our amended and restated certificate of incorporation or amended and restated bylaws; or any action asserting a claim against us that is governed by the internal affairs doctrine. This exclusive forum provision does not apply to claims as to which the Court of Chancery of the State of Delaware determines that there is an indispensable party not subject to the jurisdiction of such court (and the indispensable party does not consent to the personal jurisdiction of such court within 10 days following such determination), claims that are vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery of the State of Delaware, or claims for which the Court of Chancery of the State of Delaware does not have subject matter jurisdiction. For instance, the provision does not preclude the filing of claims brought to enforce any liability or duty created by the Exchange Act or Securities Act or the rules and regulations thereunder in federal court. In addition, our amended and restated bylaws provide that the federal district courts of the United States shall be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. The enforceability of similar exclusive federal forum provisions in other companies’ organizational documents has been challenged in legal proceedings, and while the Delaware Supreme Court has ruled that this type of exclusive federal forum provision is facially valid under Delaware law, there is uncertainty as to whether other courts would enforce such provisions and that investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder. |

| • | Board Vacancies. Our amended and restated bylaws and certificate of incorporation authorize our board of directors to fill vacant directorships resulting from any cause or created by the expansion of our board of directors. In addition, the number of directors constituting our board of directors may be set only by resolution adopted by our board of directors. After the Class B Threshold Date such vacancies may not be filled by stockholders. These provisions prevent a stockholder from increasing the size of our board of directors and gaining control of our board of directors by filling the resulting vacancies with its own nominees. |

| • | Classified Board. Our amended and restated certificate of incorporation provides that after the Class B Threshold Date our board of directors is classified into three classes of directors. The existence of a classified board of directors could delay a successful tender offeror from obtaining majority control of our board of directors, and the prospect of that delay might deter a potential offeror. |

| • | Directors Removable Only for Cause. Our amended and restated certificate of incorporation provides that after the Class B Threshold Date stockholders may remove directors only for cause. |

| • | Supermajority Requirements for Amendments of Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws. Our amended and restated certificate of incorporation further provides that, after the Class B Threshold Date, the affirmative vote of holders of at least 66 2/3% of our outstanding stockholder voting power is required to amend certain provisions of our amended and restated certificate of incorporation, including provisions relating to the classified board, the size of the board of directors, removal of directors, special meetings, actions by written |

| • | Stockholder Action. Our amended and restated certificate of incorporation provides that after the Class B Threshold Date our stockholders may not take action by written consent but may only take action at annual or special meetings of our stockholders. As a result, holders of our capital stock would not be able to amend our amended and restated bylaws or remove directors without holding a meeting of our stockholders called in accordance with our amended and restated bylaws. |

| • | banks, insurance companies, regulated investment companies, real estate investment trusts or other financial institutions; |

| • | persons subject to the alternative minimum tax or the Medicare surtax on net investment income; |

| • | tax-exempt organizations; |

| • | pension plans and tax-qualified retirement plans; |

| • | controlled foreign corporations, passive foreign investment companies and corporations that accumulate earnings to avoid U.S. federal income tax; |

| • | brokers or dealers in securities or currencies; |

| • | traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; |

| • | persons that own, or are deemed to own, more than five percent of our capital stock (except to the extent specifically set forth below); |

| • | certain former citizens or long-term residents of the United States; |

| • | partnerships (or entities classified as such for U.S. federal income tax purposes), other pass-through entities, and investors therein; |

| • | persons who hold our Class A common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; |

| • | persons who hold or receive our Class A common stock pursuant to the exercise of any option or otherwise as compensation; |

| • | persons subject to special tax accounting rules as a result of any item of gross income with respect to our Class A common stock being taken into account in an “applicable financial statement” as defined in Section 451(b) of the Code; |

| • | persons who do not hold our Class A common stock as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment); or |

| • | persons deemed to sell our Class A common stock under the constructive sale provisions of the Code. |

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation or other entity taxable as a corporation created or organized in the United States or under the laws of the United States or any political subdivision thereof, or otherwise treated as such for U.S. federal income tax purposes; |

| • | an estate whose income is subject to U.S. federal income tax regardless of its source; or |

| • | a trust (x) whose administration is subject to the primary supervision of a U.S. court and that has one or more U.S. persons who have the authority to control all substantial decisions of the trust or (y) that has made a valid election under applicable Treasury Regulations to be treated as a U.S. person. |