Exhibit 99.2

Stratim Cloud Acquisition Corp Investor Presentation March 2023 1 Strictly Private & Confidential

Disclaimers 2 Strictly Private & Confidential This information contained in this presentation is confidential information regarding Force Pressure Control, LLC (“Force” or the “Company”) and Stratim Cloud Acquisition Corp. (“SCAQ”). Such information is being provided on a strictly confidential basis and may not be published, reproduced, copied or disclosed to any other party without the prior written approval of Force. The information contained herein does not purport to be all - inclusive and this presentation is made solely for informational purposes and delivered to assist interested parties in making their own evaluation with respect to investing in a proposed business combination (the “Business Combination”) between SCAQ and Force, and no representation or warranty, express or implied, is made by Force or any of its representatives as to the information contained in these materials or disclosed during any related presentation or discussions. By accepting this presentation, each recipient acknowledges that it will be solely responsible for making its own investigations, including all costs and expenses incurred in connection with such investigations or its investment, if any, and forming its own view as to the condition and prospects of such investment, and the accuracy and completeness of the statements contained herein. This presentation should not be considered a recommendation by Force, SCAQ, or its respective affiliates, advisors or representatives to invest in SCAQ or Force, and recipients interested in investing are recommended to seek their own independent financial, legal and other advice from persons authorized and specializing, as necessary, in investments of the kind in question and should rely solely on their own judgment, review, and analysis in evaluating the investment. Recipients should be aware that any investment activity exposes them to risk of losing some or all of their investment. Cautionary Note Regarding Forward - Looking Statements. This presentation contains statements which describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate,” “should,” “could,” “potential,” “projection,” “forecast,” “plan,” “trend,” “assumption,” “opportunity,” or similar terminology. Statements other than historical facts, including, but not limited to, those concerning (i) the proposed Business Combination, (ii) any private placement of securities in connection with the Business Combination, (iii) market conditions, (iv) the revenues, earnings, performance, strategies, prospects, anticipated product development timing, market opportunities, and other aspects of the businesses of the Company or (v) trends, consumer or customer preferences or other similar concepts with respect to SCAQ, the Company or the proposed Business Combination, are based upon management’s current expectations, assumptions and estimates, and are not guarantees of future results or the timing thereof and should not be relied upon as such. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties related to the business of Force and SCAQ, including, but not limited to, (1) changes in domestic and foreign business, market, financial, political, and legal conditions, (2) the inability of the parties to successfully or timely negotiate and consummate the proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination, (3) that approval of stockholders is not obtained, (4) failure to realize the anticipated benefits of the proposed Business Combination, (5) risks relating to the uncertainty of the projected financial information of the Company, (6) the effects of competition on the Company’s business, (7) the amount of redemption requests made by SCAQ’s public stockholders, (8) the ability of SCAQ or the combined company to issue equity or equity - linked securities in connection with the proposed Business Combination or in the future, (9) the impact of the global COVID - 19 pandemic, and (10) other risks discussed in SCAQ’s Registration Statement on Form S - 1 (File No. 333 - 253174) under the heading “Risk Factors” and other documents that SCAQ has filed or will file with the Securities and Exchange Commission. Neither SCAQ nor the Company commits to update or revise the forward looking statements set forth herein, whether as a result of new information, future events or otherwise, except as may be required by law. Financial Data, Performance, Statistics and Use of Non - GAAP Financial Measures. The financial information and data contained in this presentation has not been audited in accordance with the standards of the Public Company Oversight Board (“PCAOB”) or prepared in accordance with Regulation S - X promulgated under the Securities Act (“Regulation S - X”). Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement, prospectus or other report or document filed or to be filed or furnished by the Company or SCAQ with the SEC. Neither SCAQ nor the Company can assure you that, had the financial information and data included in this presentation been compliant with Regulation S - X and audited in accordance with PCAOB standards, there would not be differences, which differences could be material. This presentation includes certain financial information of the Company that has not been audited or reviewed by the Company’s independent auditor. In addition, certain projections or forecasts for the Company included in this presentation are based on such unaudited and unreviewed financial information. Upon completion of the Company auditors renew or audit of the financial information included in this presentation, it is possible that changes to the financial information and/or protections or forecasts included in this presentation may be necessary. Therefore, undue reliance should not be placed on such financial information, projection or forecasts. Past performance is not indicative of future results. This presentation includes certain management estimates or predictions that are not intended to predict the Company’s or SCAQ’s future results, including expected future revenue and revenue growth, expected gross profit margins, expected operating expenses, expected EBITDA, EBITDA Profitability and EBITDA Margin. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or back - testing or any other information contained herein. Unless otherwise specified herein, performance figures included herein are presented on a forward - looking, pro forma basis giving effect to the Business Combination and do not reflect any events subsequent to the date hereof. These estimates have been developed based on a variety of estimates and assumptions about future events that rely significantly on management’s judgment and that, while presented with numerical specificity and considered reasonable by management, are inherently subject to significant business, economic, competitive, regulatory and other uncertainties and contingencies, all of which are difficult to predict and many of which are beyond the Company’s, SCAQ’s or any other person’s control, and on estimates and assumptions with respect to future business decisions that are subject to change.

Disclaimers 3 Strictly Private & Confidential Some of the data contained herein is derived from information provided by SCAQ or the Company and various third - party sources and is included herein for illustrative purposes only. The delivery of this presentation shall not under any circumstances, create any implication that the presentation is correct in all respects, including as of any time subsequent to the date hereof, and SCAQ and the Company do not undertake any obligation to update such information at any time after such date. Certain information in this presentation may be based upon information from third - party sources which we consider reliable, but neither SCAQ nor the Company represents that such information is accurate, complete or sufficient for any purpose and it should not be relied upon as such. There is no guarantee that these estimates or predictions will be ultimately realized or that the Company or SCAQ will achieve the results reflected therein. As a result, you should not rely on these estimates or predictions. Neither the Company’s independent auditors, nor the independent registered public accounting firm of SCAQ have audited, reviewed, compiled or performed any procedures with respect to the projections for purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. This presentation includes certain financial measures of Force not presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”), including, but not limited to, gross profit, operating expenses, operating income, EBTIDA, EBITDA Margin and EBITDA Profitability in each case presented on a non - GAAP basis. These non - GAAP measures of financial performance may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to revenue, gross profit or net income or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarity - titled measures used by other companies. The Company believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the usage of those non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing the Company’s financial measures with those of similar companies, many of which present similar non - GAAP financial measures to investors. These non - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income items are excluded or included in determining these non - GAAP financial measures. This presentation has been provided solely for information purposes and does not constitute investment, legal, tax or other advice and nor is it to be relied upon in making an investment decision. The information contained in this presentation is provided only as of the date on which this presentation is made and is subject to change. None of the Company, SCAQ, or their respective affiliates, advisors or representatives shall have any liability whatsoever for any loss arising from any use of this presentation or its contents or otherwise arising in connection with this presentation. Additional Information and Where To Find It. In connection with the Business Combination, SCAQ intends to file a proxy statement with the Securities and Exchange Commission (the “SEC”) to be distributed to holders of SCAQ’s common stock in connection with SCAQ’s solicitation of proxies for the vote by SCAQ’s stockholders with respect to the Business Combination and other matters as described in the proxy statement. After the proxy statement has been filed and reviewed by the SEC, SCAQ will mail a definitive proxy statement, when available, to holders of its common stock as of the record date to be established for voting on the Business Combination. SCAQ will also file other documents regarding the Business Combination with the SEC. Investors and security holders of SCAQ are urged to read the proxy statement, the definitive proxy statement and all other relevant documents filed or that will be filed with the SEC in connection with the Business Combination, including any amendments or supplements to these documents, carefully and in their entirety when they become available because they will contain important information about the Business Combination. Investors and security holders will be able to obtain free copies of the proxy statement (when available) and all other relevant documents that are filed or that will be filed with the SEC by SCAQ through the website maintained by the SEC at www.sec.gov. The documents filed by SCAQ with the SEC also may be obtained by contacting SCAQ at 369 Pine St Suite 103, San Francisco, CA 94104, or by calling (415) 674 - 5800.

Disclaimers 4 Strictly Private & Confidential Trademarks. This presentation contains trademarks and tradenames of Force and of other parties, and are the property of their respective owners. Third - party logos included herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either SCAQ or the Company will work, or continue to work, with any of the firms or businesses whose logos a re included herein in the future. Participants in Solicitation. SCAQ and Force and their respective directors and certain of their respective executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the transaction. Information about the directors and executive officers of SCAQ is set forth in its Annual Report on Form 10 - K for the fiscal year ended December 31, 2021. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation of the stockholders of SCAQ and a description of their direct and indirect interests in SCAQ, by security holdings or otherwise, will be included in the proxy statement and other relevant materials to be filed with the SEC regarding the transaction when they become available. Stockholders, potential investors and other interested persons should read the proxy statement carefully when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge from the sources indicated above. Distribution, No Offer or Solicitation. The distribution of this presentation may also be restricted by law, and persons into whose possession this presentation comes should inform themselves about and observe any such restrictions. You acknowledge that you are (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company o r from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third party to use this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b - 5 thereunder. By accepting this presentation, you agree that you will, and will cause your representatives and advisors to, use this presentation, as well as any information derived by you from this presentation, only for initial due diligence regarding SCAQ and the Company in connection with (a) the proposed Business Combination and (b) any proposed private offering of securities to a limited number of investors that qualify as QIBs and Institutional Accredited Investors (each as defined below) and for no other purpose and you will not, and you will cause your representatives and advisors not to, divulge this presentation to any other party . This presentation may not be reproduced or used for any other purpose . No securities commission or securities regulatory authority in the United States or any other jurisdiction has in any way passed upon the merits of the Business Combination if it occurs or the accuracy or adequacy of this presentation. This presentation is being distributed to selected recipients only and is not intended for distribution to, or use by any person or entity in, any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Neither this presentation nor any part or copy of it may be taken or transmitted into the United States or published, released, disclosed or distributed, directly or indirectly, in the United States, except to a limited number of qualified institutional buyers (“QIBs”), as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or institutional “accredited investors” (“Institutional Accredited Investors”) within the meaning of Regulation D under the Securities Act. This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of SCAQ, the Company or any of their respective affiliates. You should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation, and you should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision.

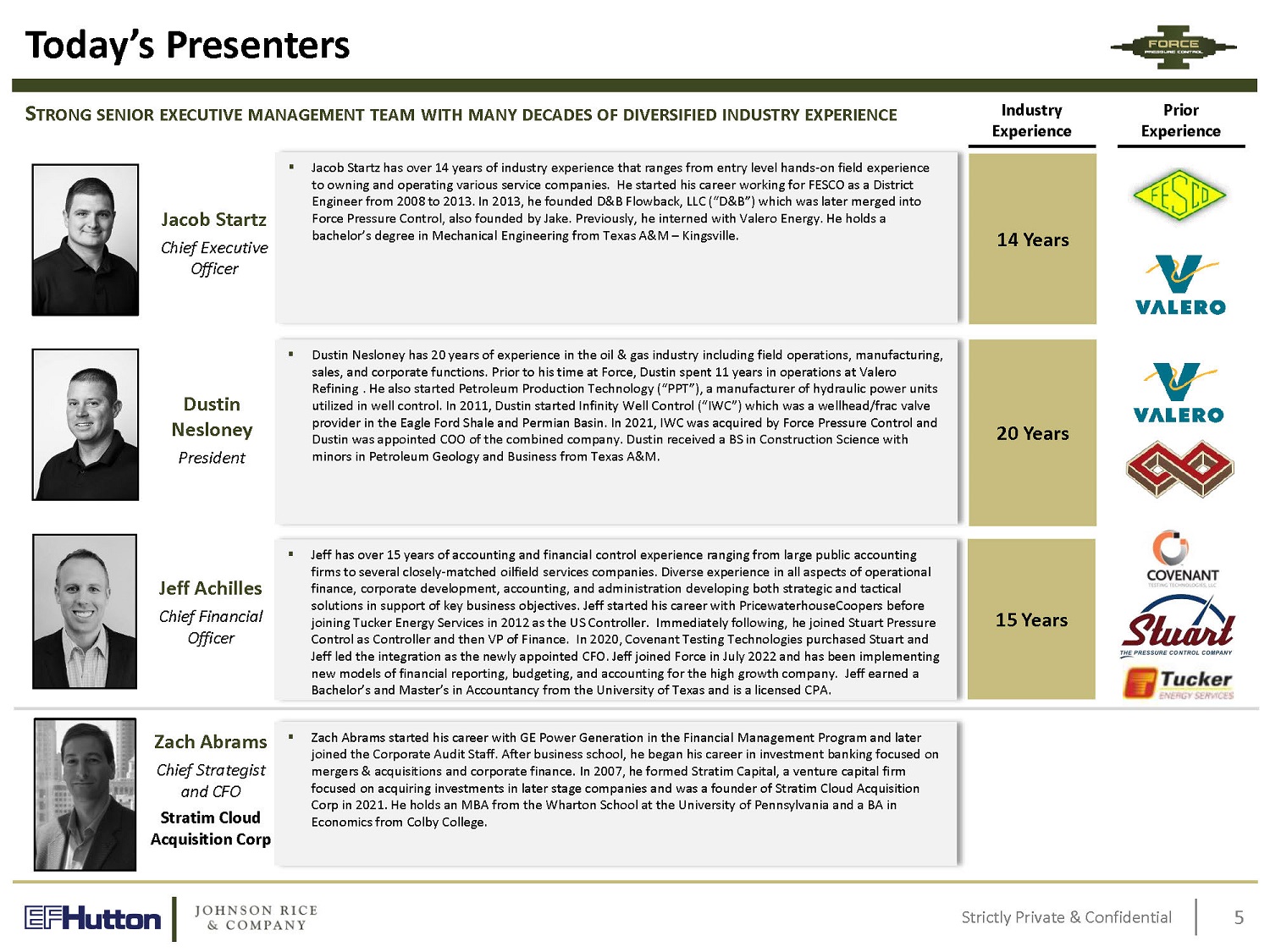

Jacob Startz Chief Executive Officer ▪ Jacob Startz has over 14 years of industry experience that ranges from entry level hands - on field experience to owning and operating various service companies. He started his career working for FESCO as a District Engineer from 2008 to 2013. In 2013, he founded D&B Flowback, LLC (“D&B”) which was later merged into Force Pressure Control, also founded by Jake. Previously, he interned with Valero Energy. He holds a bachelor’s degree in Mechanical Engineering from Texas A&M – Kingsville. Today’s Presenters ▪ Dustin Nesloney has 20 years of experience in the oil & gas industry including field operations, manufacturing, sales, and corporate functions. Prior to his time at Force, Dustin spent 11 years in operations at Valero Refining . He also started Petroleum Production Technology (“PPT”), a manufacturer of hydraulic power units utilized in well control. In 2011, Dustin started Infinity Well Control (“IWC”) which was a wellhead/frac valve provider in the Eagle Ford Shale and Permian Basin. In 2021, IWC was acquired by Force Pressure Control and Dustin was appointed COO of the combined company. Dustin received a BS in Construction Science with minors in Petroleum Geology and Business from Texas A&M. Prior Experience S TRONG SENIOR EXECUTIVE MANAGEMENT TEAM WITH MANY DECADES OF DIVERSIFIED INDUSTRY EXPERIENCE Industry Experience 14 Years 20 Years Dustin Nesloney President ▪ Jeff has over 15 years of accounting and financial control experience ranging from large public accounting firms to several closely - matched oilfield services companies. Diverse experience in all aspects of operational finance, corporate development, accounting, and administration developing both strategic and tactical solutions in support of key business objectives. Jeff started his career with PricewaterhouseCoopers before joining Tucker Energy Services in 2012 as the US Controller. Immediately following, he joined Stuart Pressure Control as Controller and then VP of Finance. In 2020, Covenant Testing Technologies purchased Stuart and Jeff led the integration as the newly appointed CFO. Jeff joined Force in July 2022 and has been implementing new models of financial reporting, budgeting, and accounting for the high growth company. Jeff earned a Bachelor’s and Master’s in Accountancy from the University of Texas and is a licensed CPA. 15 Years Jeff Achilles Chief Financial Officer ▪ Zach Abrams started his career with GE Power Generation in the Financial Management Program and later joined the Corporate Audit Staff. After business school, he began his career in investment banking focused on mergers & acquisitions and corporate finance. In 2007, he formed Stratim Capital, a venture capital firm focused on acquiring investments in later stage companies and was a founder of Stratim Cloud Acquisition Corp in 2021. He holds an MBA from the Wharton School at the University of Pennsylvania and a BA in Economics from Colby College. Zach Abrams Chief Strategist and CFO Stratim Cloud Acquisition Corp 5 Strictly Private & Confidential

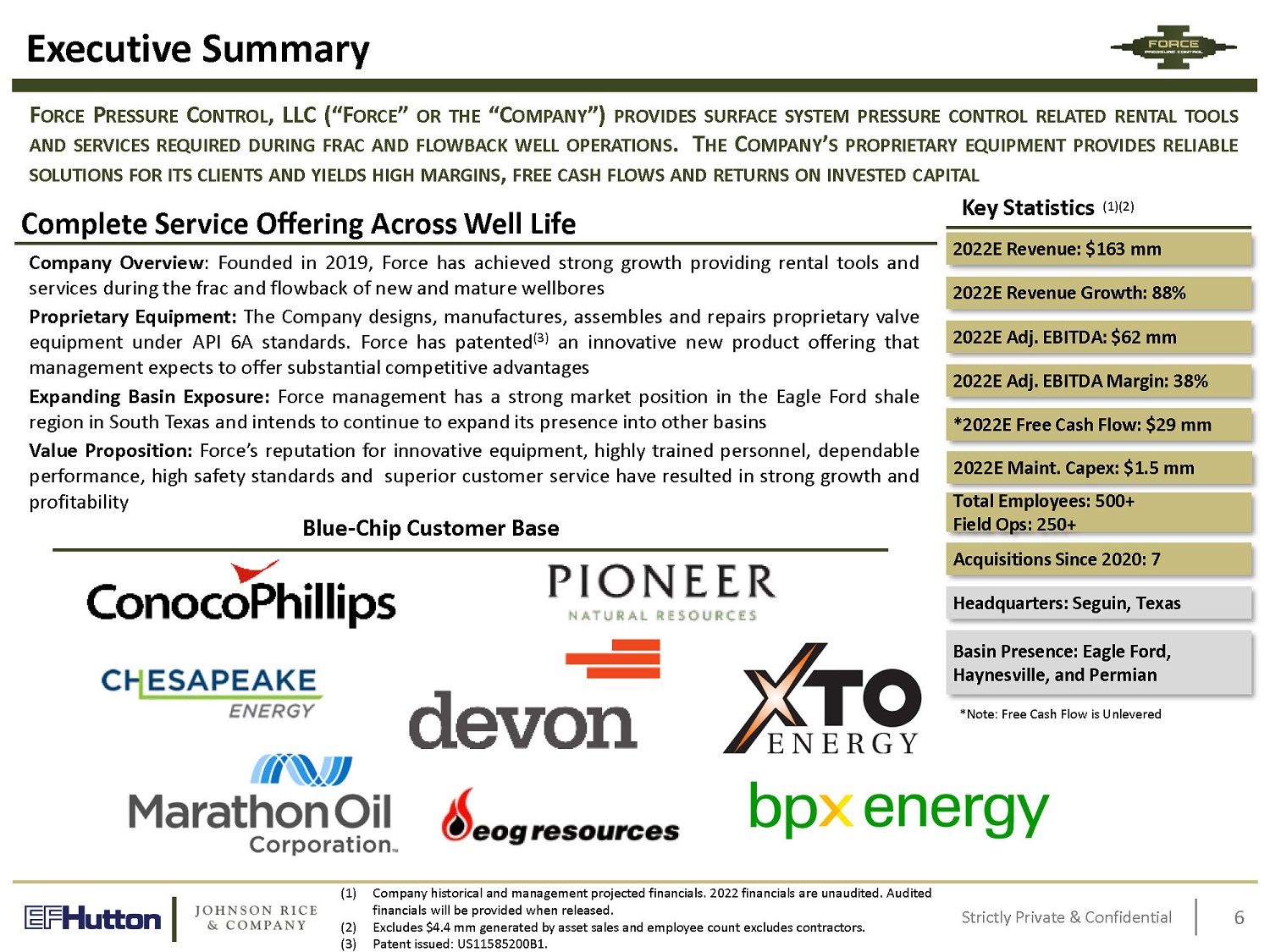

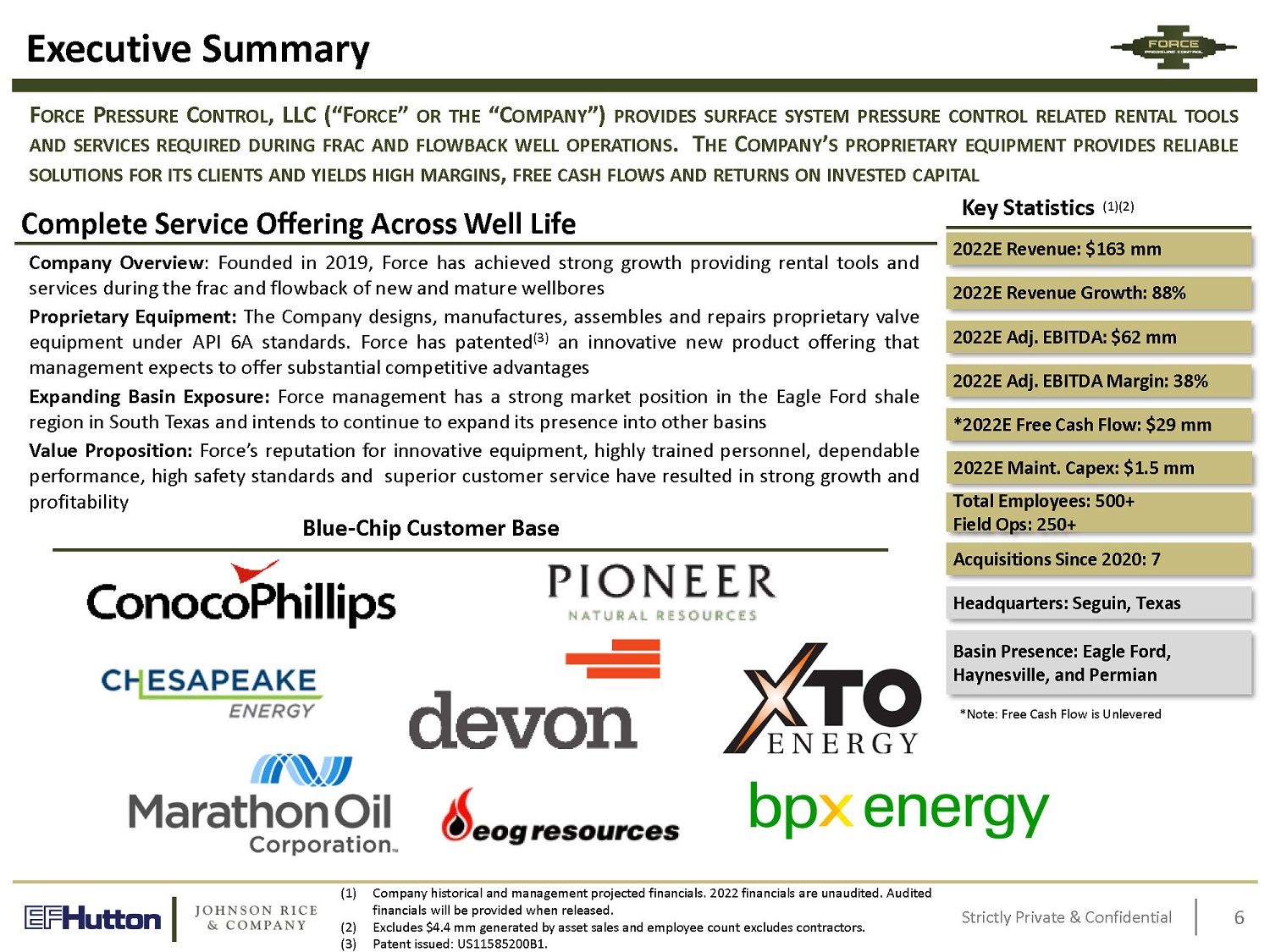

6 Strictly Private & Confidential Executive Summary F ORCE P RESSURE C ONTROL , LLC (“F ORCE ” OR THE “C OMPANY ”) PROVIDES SURFACE SYSTEM PRESSURE CONTROL RELATED RENTAL TOOLS AND SERVICES REQUIRED DURING FRAC AND FLOWBACK WELL OPERATIONS . T HE C OMPANY ’ S PROPRIETARY EQUIPMENT PROVIDES RELIABLE SOLUTIONS FOR ITS CLIENTS AND YIELDS HIGH MARGINS , FREE CASH FLOWS AND RETURNS ON INVESTED CAPITAL Complete Service Offering Across Well Life Company Overview : Founded in 2019 , Force has achieved strong growth providing rental tools and services during the frac and flowback of new and mature wellbores Proprietary Equipment : The Company designs, manufactures, assembles and repairs proprietary valve equipment under API 6 A standards . Force has patented ( 3 ) an innovative new product offering that management expects to offer substantial competitive advantages Expanding Basin Exposure : Force management has a strong market position in the Eagle Ford shale region in South Texas and intends to continue to expand its presence into other basins Value Proposition : Force’s reputation for innovative equipment, highly trained personnel, dependable performance, high safety standards and superior customer service have resulted in strong growth and profitability Blue - Chip Customer Base Key Statistics (1)(2) Total Employees: 500+ Field Ops: 250+ *2022E Free Cash Flow: $29 mm Headquarters: Seguin, Texas Basin Presence: Eagle Ford, Haynesville, and Permian 2022E Revenue: $163 mm 2022E Revenue Growth: 88% 2022E Adj. EBITDA: $62 mm 2022E Adj. EBITDA Margin: 38% Acquisitions Since 2020: 7 (1) Company historical and management projected financials. 2022 financials are unaudited. Audited financials will be provided when released. (2) Excludes $4.4 mm generated by asset sales and employee count excludes contractors. (3) Patent issued: US11585200B1. *Note: Free Cash Flow is Unlevered 2022E Maint. Capex: $1.5 mm

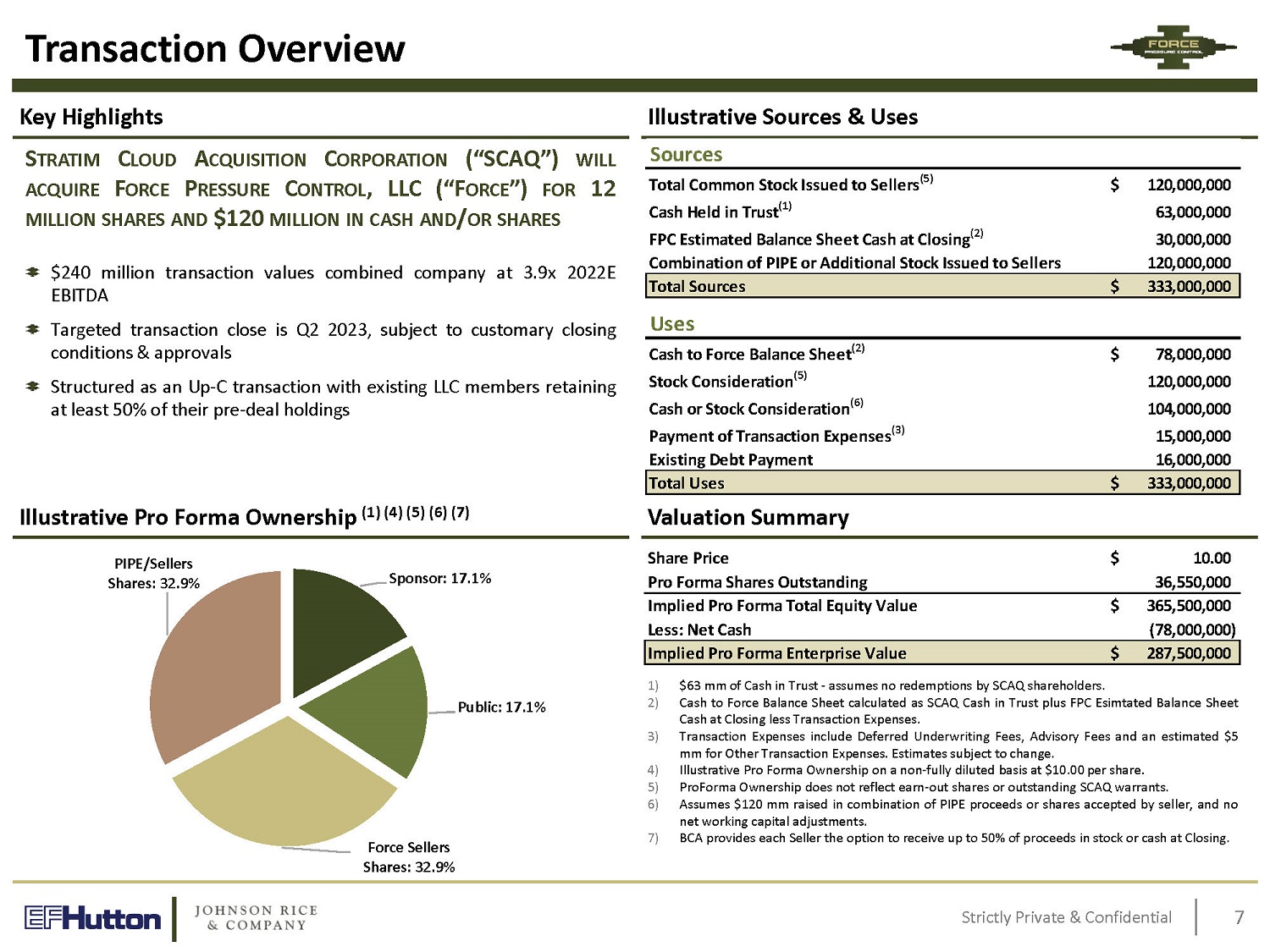

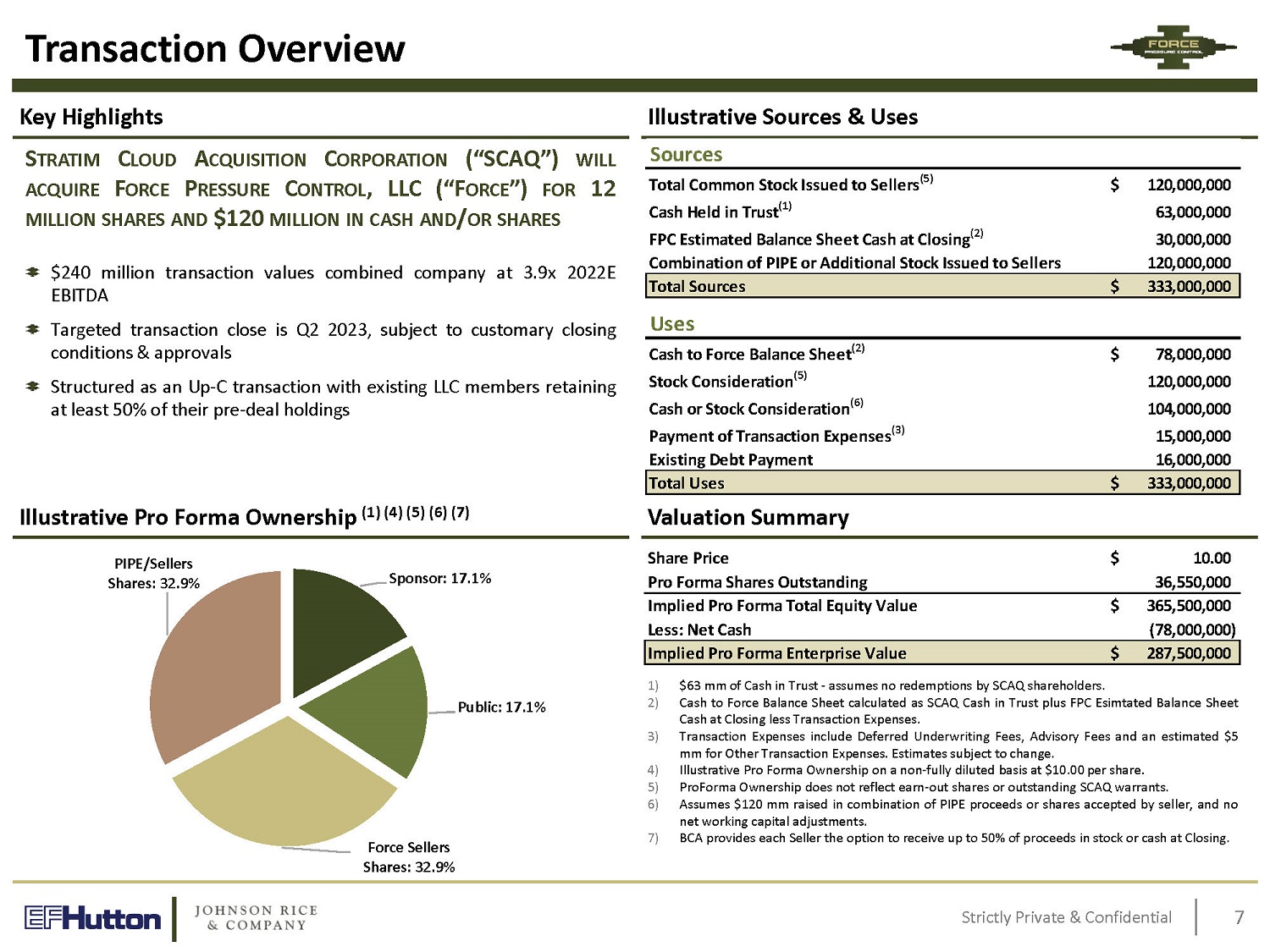

7 Strictly Private & Confidential Sponsor: 17.1% Public: 17.1% Force Sellers Shares: 32.9% PIPE/Sellers Shares: 32.9% Transaction Overview S TRATIM C LOUD A CQUISITION C ORPORATION (“SCAQ”) WILL ACQUIRE F ORCE P RESSURE C ONTROL , LLC (“F ORCE ”) FOR 12 MILLION SHARES AND $ 120 MILLION IN CASH AND / OR SHARES Key Highlights Illustrative Sources & Uses $240 million transaction values combined company at 3.9x 2022E EBITDA Targeted transaction close is Q2 2023, subject to customary closing conditions & approvals Structured as an Up - C transaction with existing LLC members retaining at least 50% of their pre - deal holdings Cash or Stock Consideration (6) 104,000,000 Payment of Transaction Expenses (3) 15,000,000 Existing Debt Payment 16,000,000 Total Uses $ 333,000,000 Illustrative Pro Forma Ownership (1) (4) (5) (6) (7) Valuation Summary 1) $63 mm of Cash in Trust - assumes no redemptions by SCAQ shareholders. 2) Cash to Force Balance Sheet calculated as SCAQ Cash in Trust plus FPC Esimtated Balance Sheet Cash at Closing less Transaction Expenses. 3) Transaction Expenses include Deferred Underwriting Fees, Advisory Fees and an estimated $5 mm for Other Transaction Expenses. Estimates subject to change. 4) Illustrative Pro Forma Ownership on a non - fully diluted basis at $10.00 per share. 5) ProForma Ownership does not reflect earn - out shares or outstanding SCAQ warrants. 6) Assumes $120 mm raised in combination of PIPE proceeds or shares accepted by seller, and no net working capital adjustments. 7) BCA provides each Seller the option to receive up to 50% of proceeds in stock or cash at Closing. Share Price Pro Forma Shares Outstanding Implied Pro Forma Total Equity Value Less: Net Cash Implied $ Total Common Stock Issued to Sellers (5) $ 120,000,000 Cash Held in Trust (1) 63,000,000 FPC Estimated Balance Sheet Cash at Closing (2) 30,000,000 Combination of PIPE or Additional Stock Issued to Sellers 120,000,000 Total Sources $ 333,000,000 Sources Uses Cash to Force Balance Sheet (2) $ Stock Consideration (5) 78,000,000 120,000,000

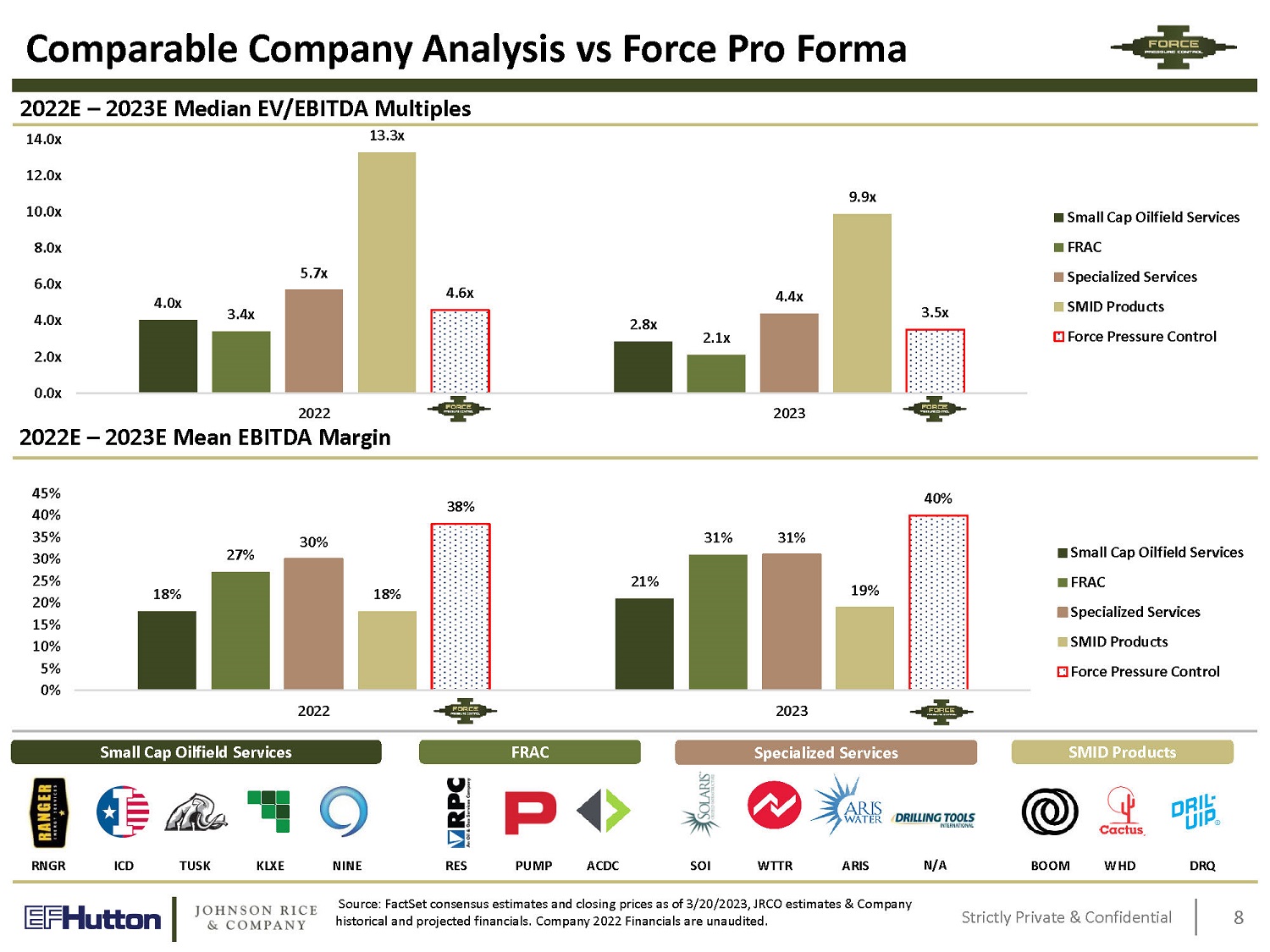

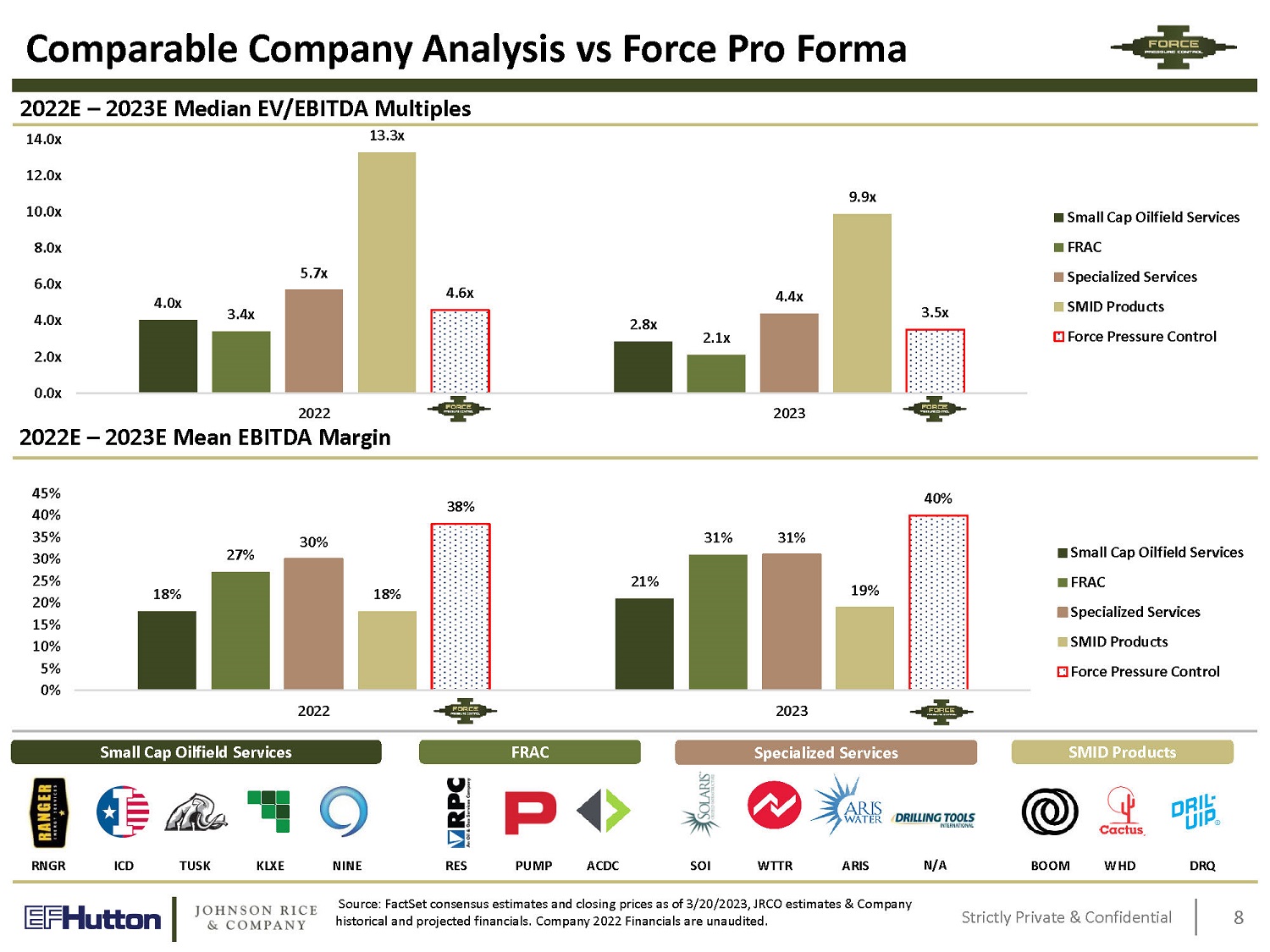

8 Strictly Private & Confidential 18% 21% 27% 31% 30% 31% 18% 19% 38% 40% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 2022 2023 Small Cap Oilfield Services FRAC Specialized Services SMID Products Force Pressure Control Comparable Company Analysis vs Force Pro Forma Small Cap Oilfield Services FRAC SMID Products 2022E – 2023E Median EV/EBITDA Multiples NINE RES PUMP ACDC SOI WTTR ARIS Source: FactSet consensus estimates and closing prices as of 3/20/2023, JRCO estimates & Company historical and projected financials. Company 2022 Financials are unaudited. 4.0x 2.8x 3.4x 2.1x 5.7x 4.4x 13.3x 9.9x 4.6x 3.5x 2.0x 0.0x 2022 2022E – 2023E Mean EBITDA Margin 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 2023 Small Cap Oilfield Services FRAC Specialized Services SMID Products Force Pressure Control Specialized Services RNGR ICD TUSK KLXE BOOM WHD DRQ N/A

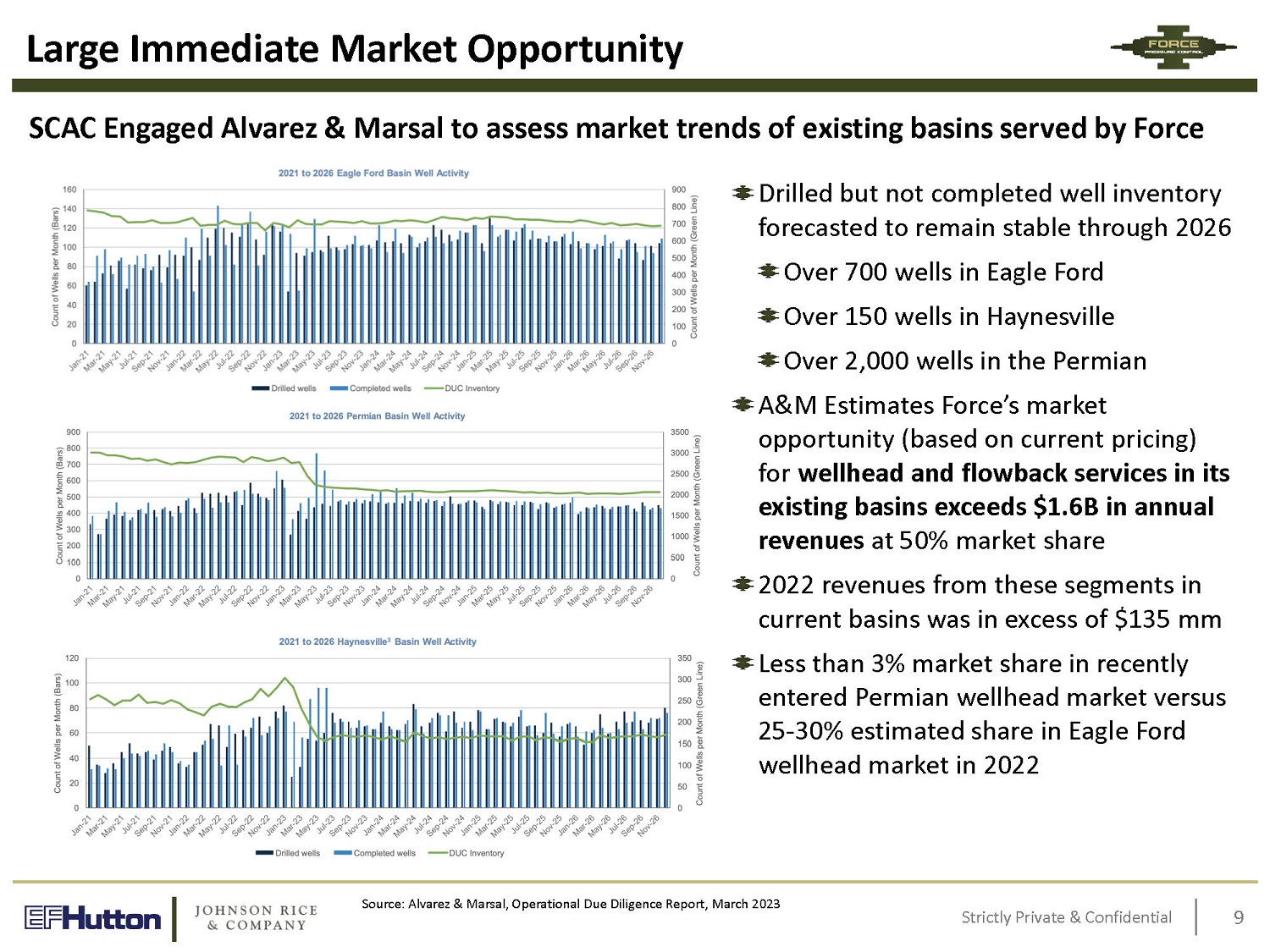

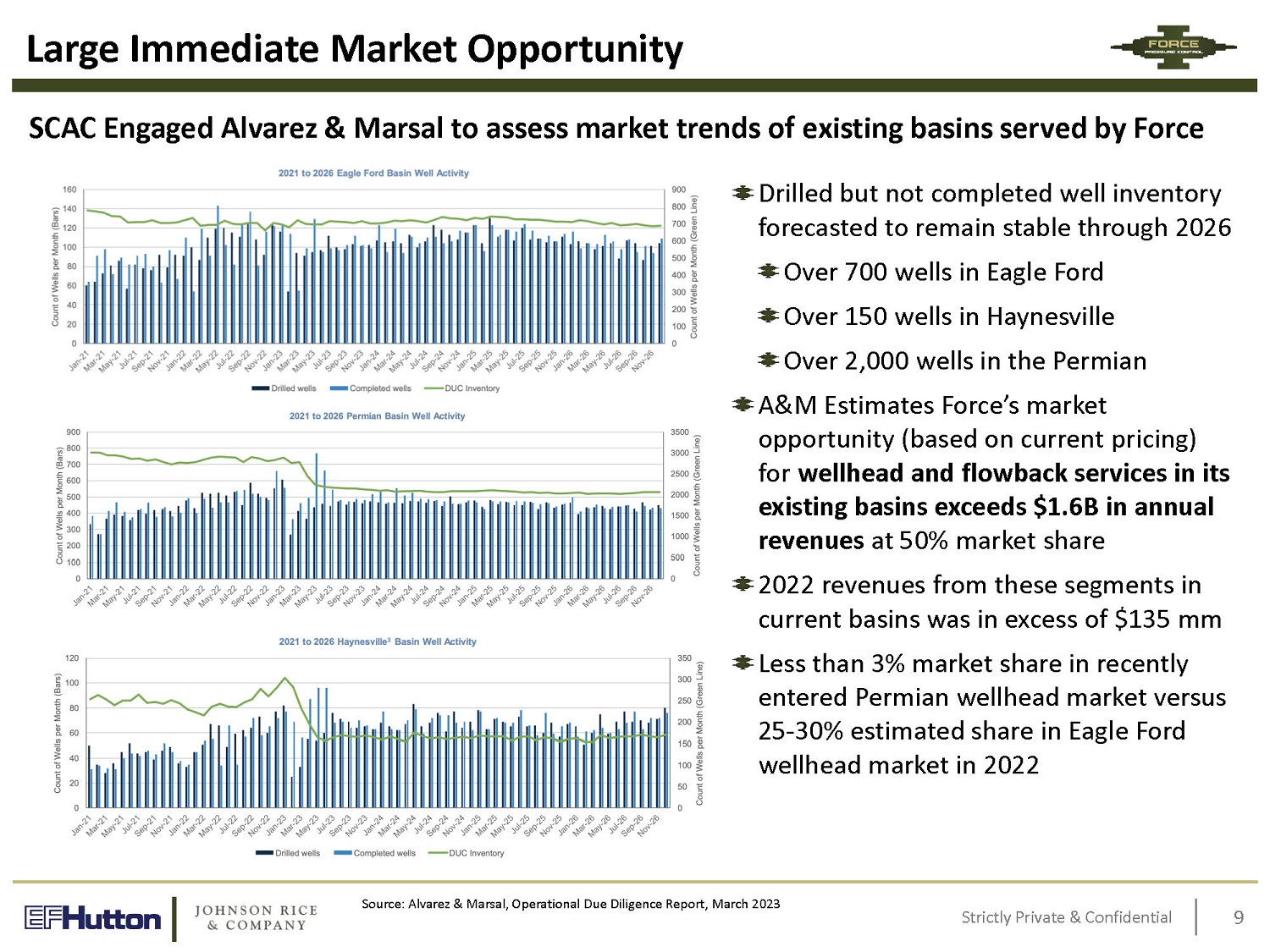

Large Immediate Market Opportunity SCAC Engaged Alvarez & Marsal to assess market trends of existing basins served by Force Drilled but not completed well inventory forecasted to remain stable through 2026 Over 700 wells in Eagle Ford Over 150 wells in Haynesville Over 2,000 wells in the Permian A&M Estimates Force’s market opportunity (based on current pricing) for wellhead and flowback services in its existing basins exceeds $1.6B in annual revenues at 50% market share 2022 revenues from these segments in current basins was in excess of $135 mm Less than 3% market share in recently entered Permian wellhead market versus 25 - 30% estimated share in Eagle Ford wellhead market in 2022 9 Strictly Private & Confidential Source: Alvarez & Marsal, Operational Due Diligence Report, March 2023

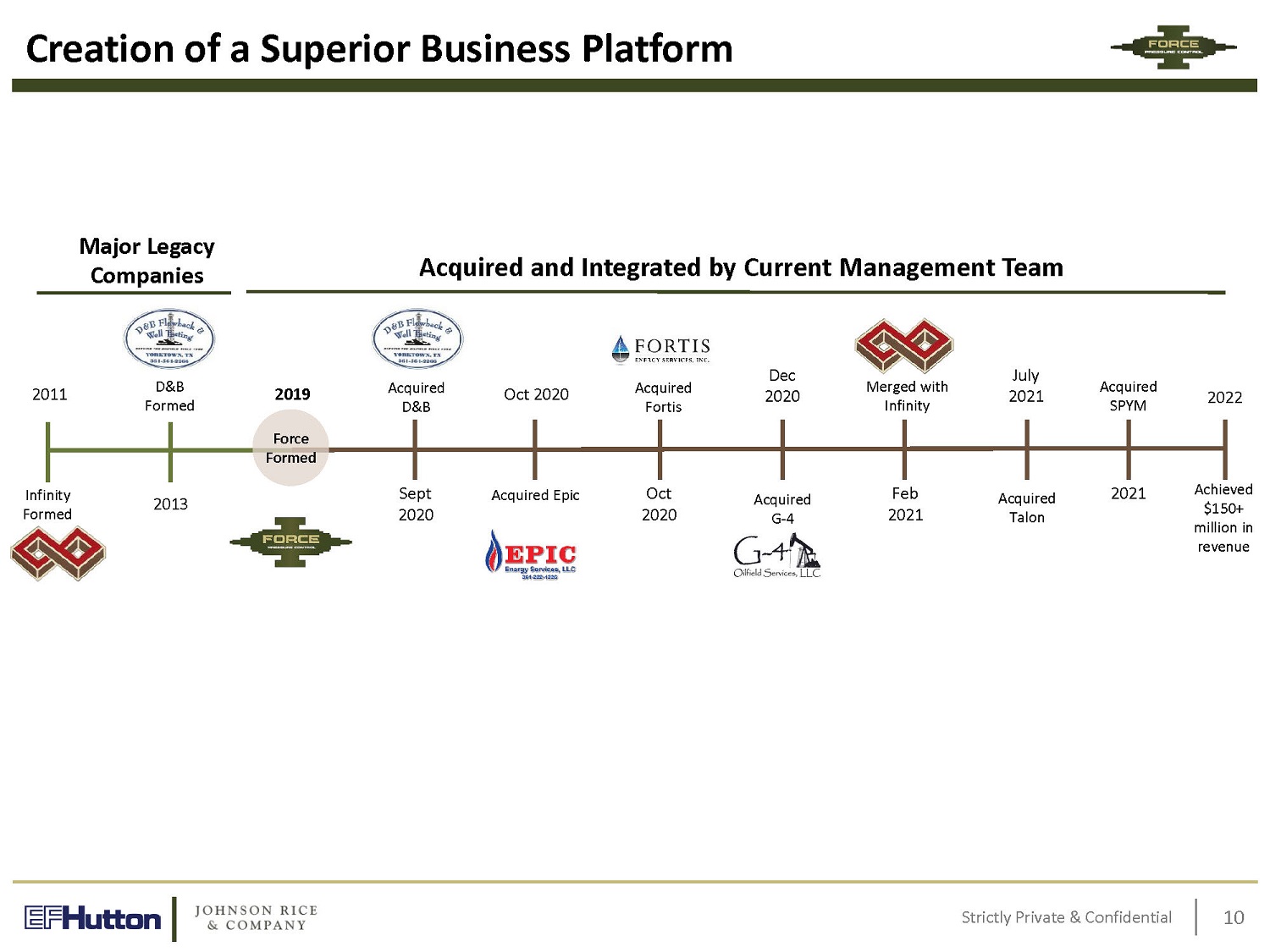

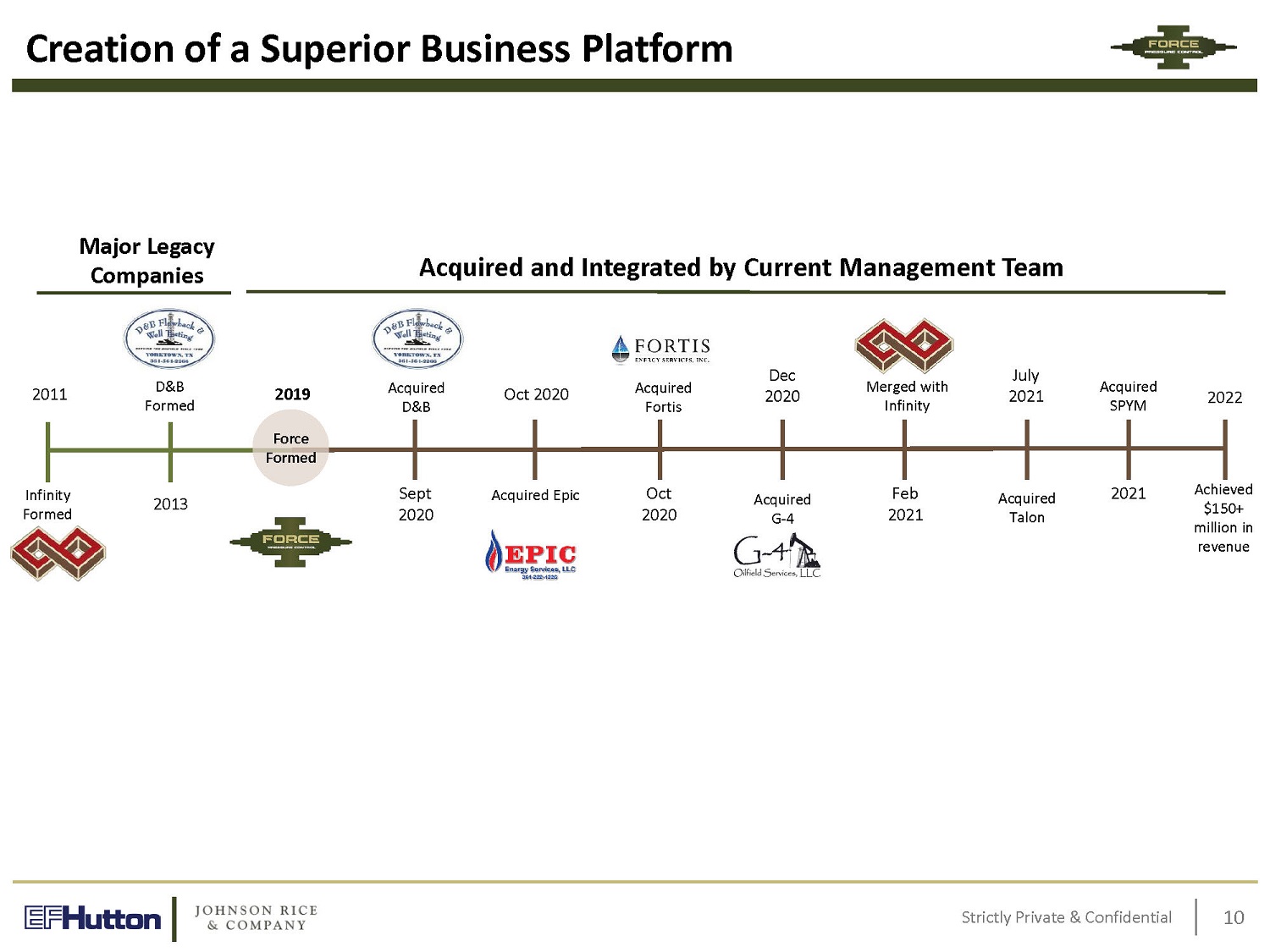

Creation of a Superior Business Platform Major Legacy Companies 2013 Infinity Formed 2019 Sept 2020 Oct 2020 2011 Oct 2020 Dec 2020 Feb 2021 Acquired Talon July 2021 2021 Acquired and Integrated by Current Management Team Force Formed Acquired Epic Acquired Fortis Acquired G - 4 Acquired SPYM D&B Formed 2022 Achieved $150+ million in revenue Acquired D&B Merged with Infinity 10 Strictly Private & Confidential

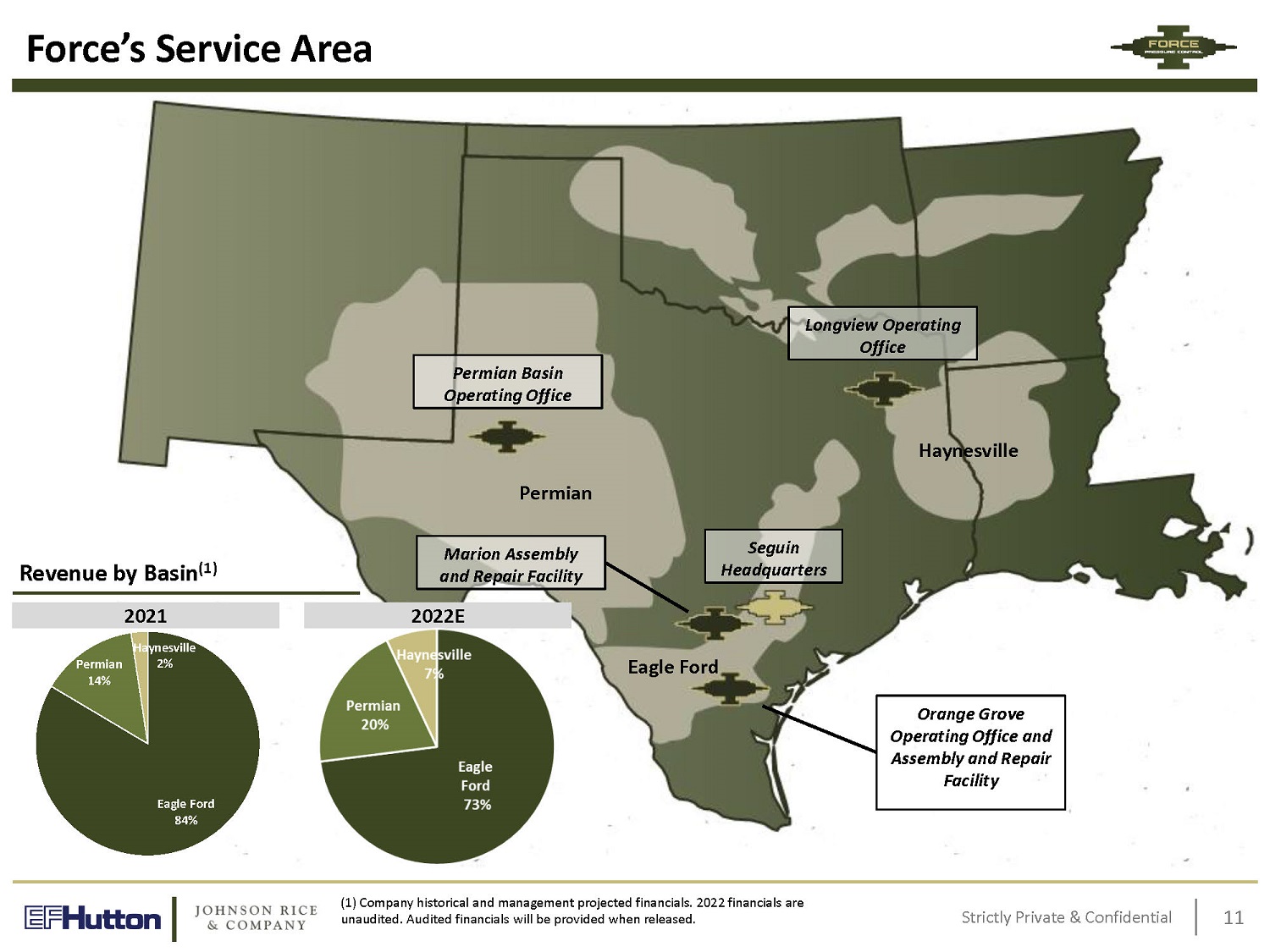

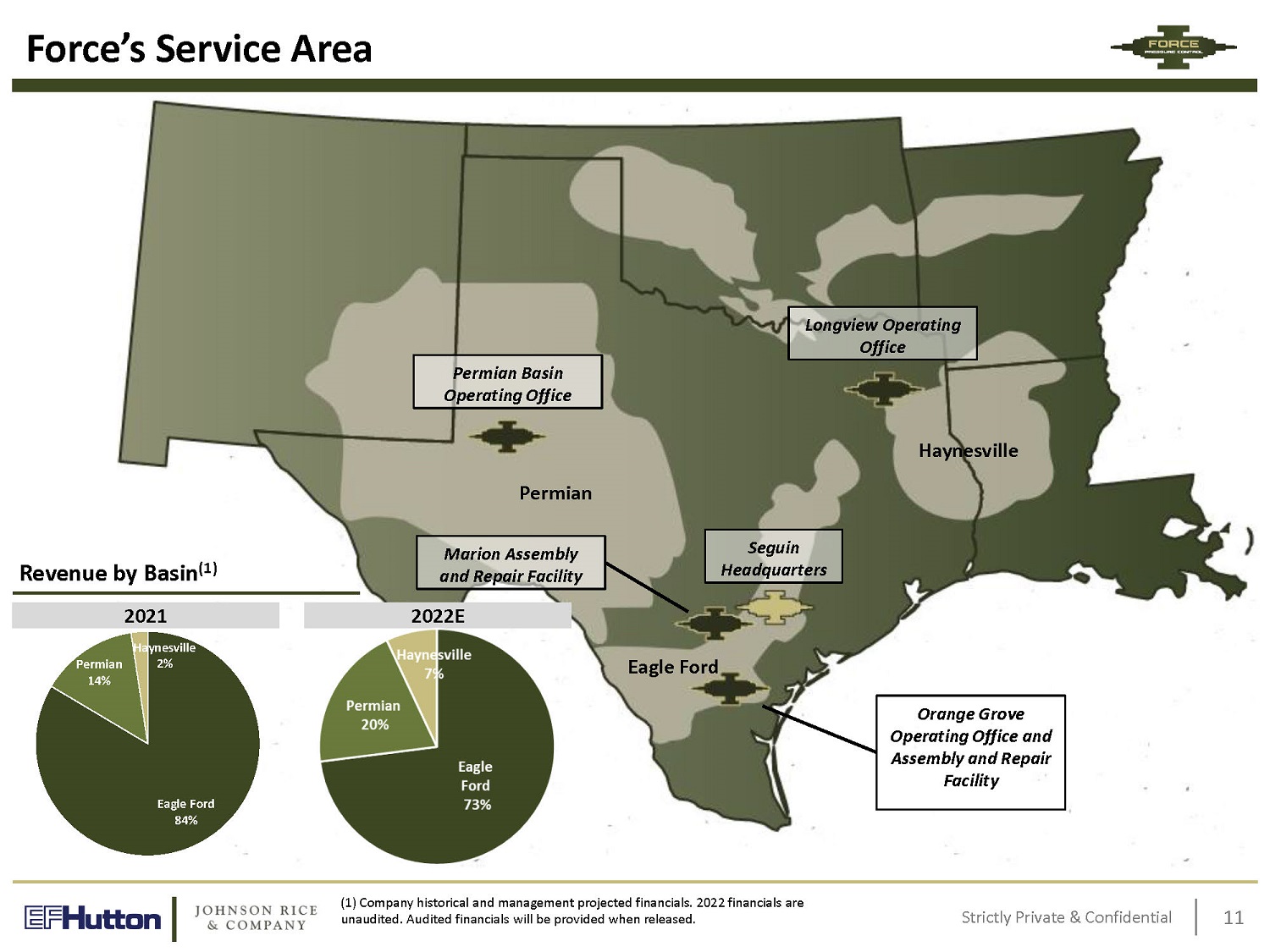

11 Strictly Private & Confidential Force’s Service Area Eagle Ford Permian Eagle Ford 84% Haynesville Permian 2% 14% Haynesville Permian Basin Operating Office Longview Operating Office Seguin Headquarters Orange Grove Operating Office and Assembly and Repair Facility Marion Assembly and Repair Facility Revenue by Basin (1) 2021 2022E (1) Company historical and management projected financials. 2022 financials are unaudited. Audited financials will be provided when released.

12 Strictly Private & Confidential Service Lines Across the Lifecycle of a Well Service Line Frac Rental Tools and Services Flowback Rental Tools and Services Hydraulics Completion Fluids BOPs Special Services F ORCE RENTAL TOOLS AND SERVICES ARE REQUIRED DURING FRAC AND FLOWBACK OPERATIONS FOR NEWLY DRILLED AND MATURE WELLBORES Solutions Across Well Life Pre - Frac Frac Drill - out Flowback & Well Testing Production Post - Production

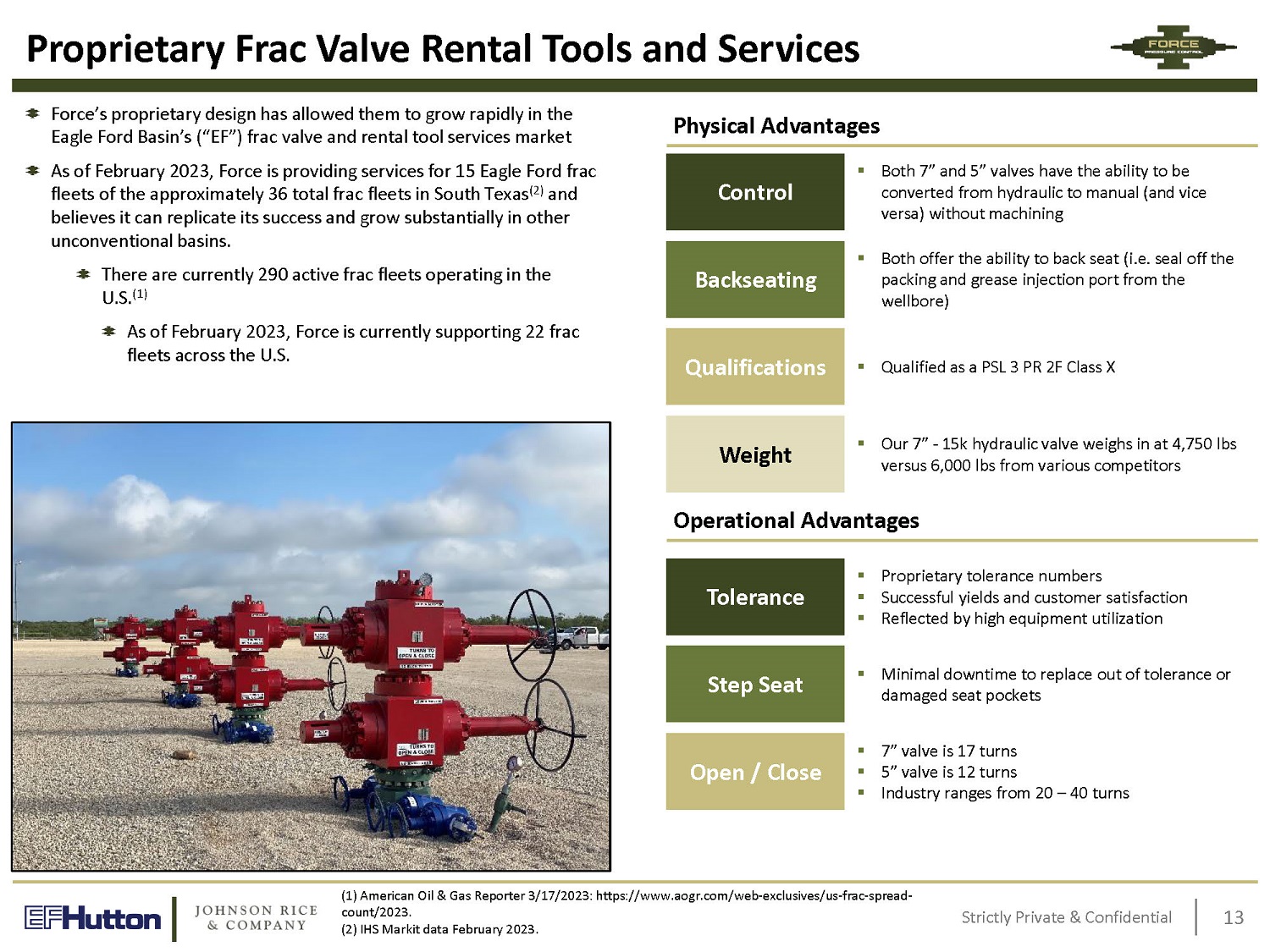

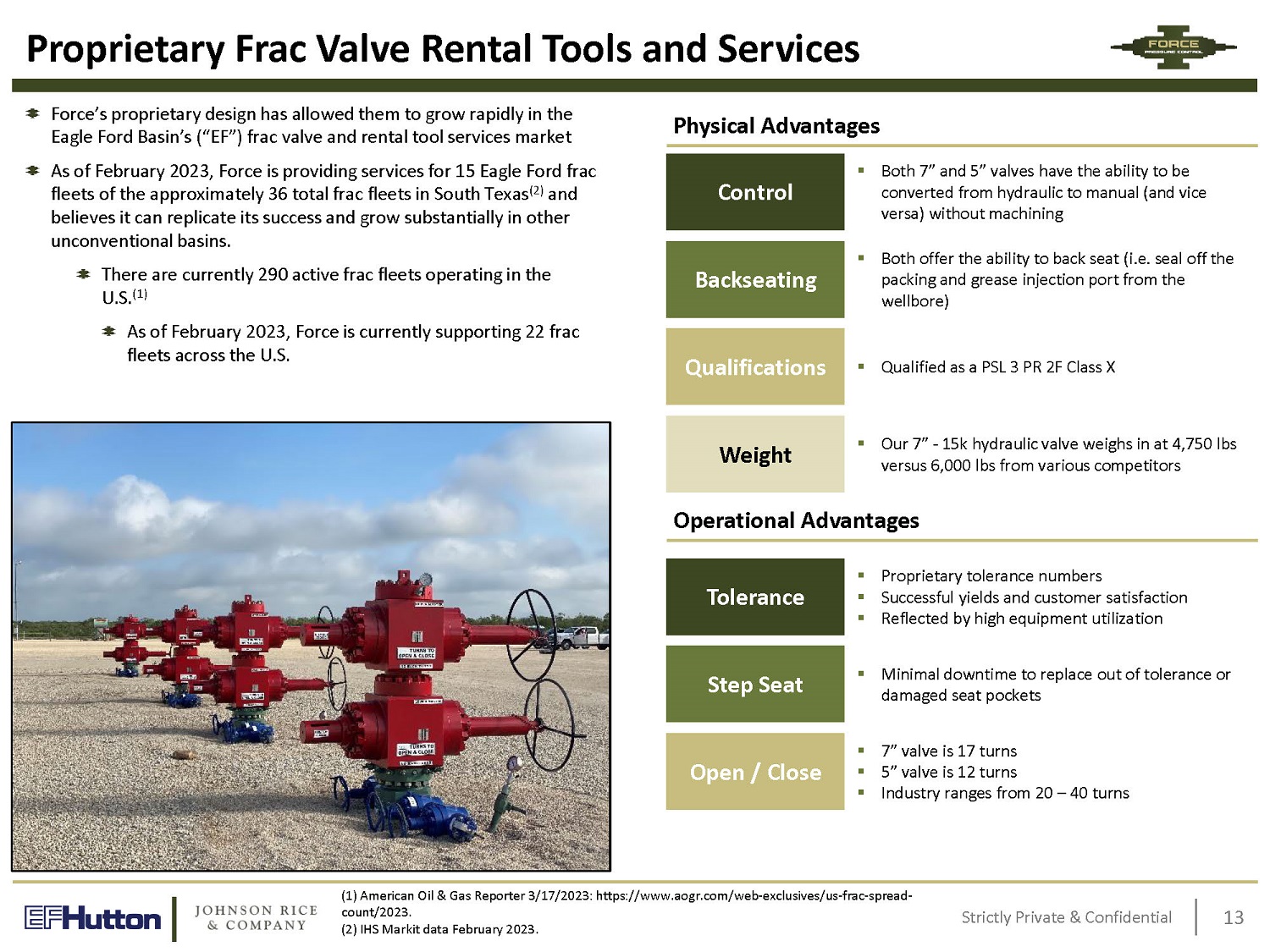

13 Strictly Private & Confidential Proprietary Frac Valve Rental Tools and Services Force’s proprietary design has allowed them to grow rapidly in the Eagle Ford Basin’s (“EF”) frac valve and rental tool services market As of February 2023, Force is providing services for 15 Eagle Ford frac fleets of the approximately 36 total frac fleets in South Texas (2) and believes it can replicate its success and grow substantially in other unconventional basins. There are currently 290 active frac fleets operating in the U.S. (1) As of February 2023, Force is currently supporting 22 frac fleets across the U.S. Physical Advantages Backseating Qualifications Weight Control Operational Advantages ▪ Both 7” and 5” valves have the ability to be converted from hydraulic to manual (and vice versa) without machining ▪ Both offer the ability to back seat (i.e. seal off the packing and grease injection port from the wellbore) ▪ Qualified as a PSL 3 PR 2F Class X ▪ Our 7” - 15k hydraulic valve weighs in at 4,750 lbs versus 6,000 lbs from various competitors Step Seat Open / Close Tolerance ▪ Proprietary tolerance numbers ▪ Successful yields and customer satisfaction ▪ Reflected by high equipment utilization ▪ Minimal downtime to replace out of tolerance or damaged seat pockets ▪ 7” valve is 17 turns ▪ 5” valve is 12 turns ▪ Industry ranges from 20 – 40 turns (1) American Oil & Gas Reporter 3/17/2023: https:// www.aogr.com/web - exclusives/us - frac - spread - count/2023. (2) IHS Markit data February 2023.

14 Strictly Private & Confidential Superior Technology and Manufacturing Operations Engineering Experience ▪ In - house engineered product models allow for standard product designs and consistent build quality ▪ Patented continuous frac system can increase field efficiency ▪ Force invests substantial resources in R&D and product improvement Manufacturing Expertise ▪ ~80 work - stations across all Force regions/districts (~40 in Orange Grove) specifically engineered for valve assembly and re - work to limit shop time and increase turnaround time ▪ Hyundai horizontal boring machine provides heavy duty cutting for high accuracy, rigidity and heavy cutting performance ▪ Valve components outsourced globally Project Execution ▪ Delivered 8,294 valves in 2022 out of Orange Grove ▪ Recently acquired new shop in East Texas (100 large valves* / mo. capacity) to service Haynesville in 2022 ▪ Building new facility in West Texas to expand service capabilities; currently (150 large valves* / mo. capacity) to service Permian in 2023 ▪ Consistent safety record *Estimated monthly large valve rebuilds are based on Orange Grove – STX 2H 2022 production data and number of stations per facility.

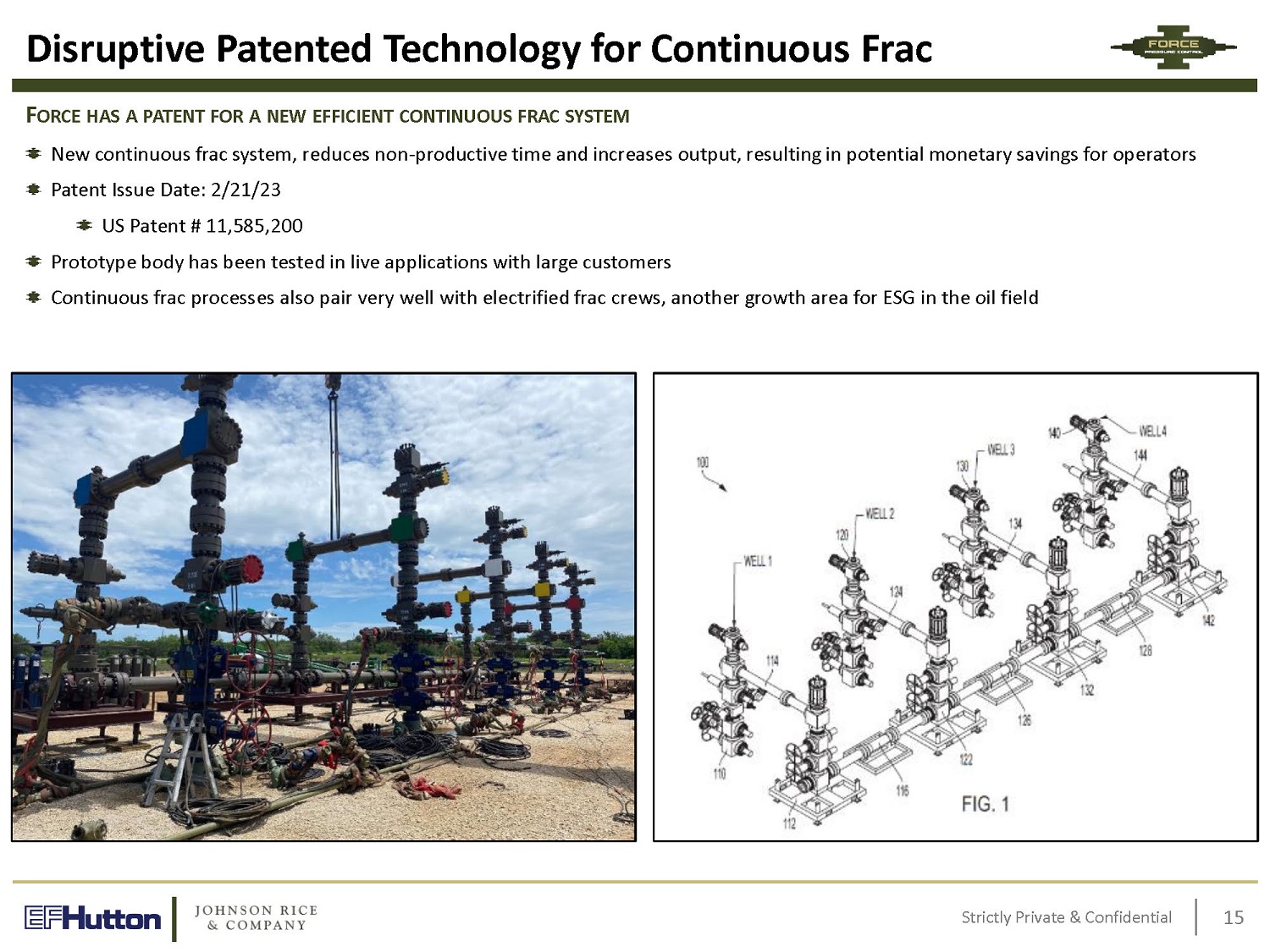

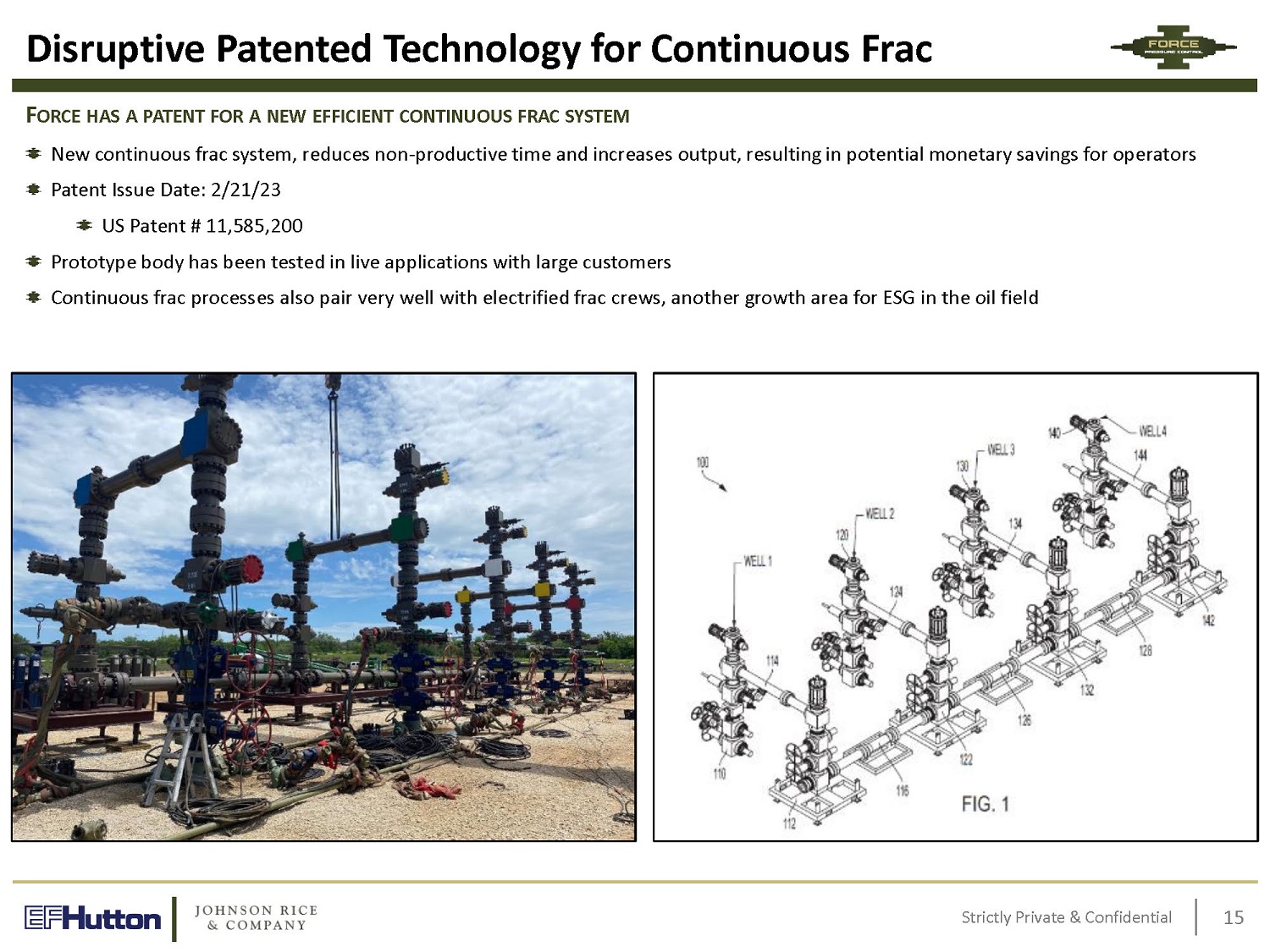

15 Strictly Private & Confidential Disruptive Patented Technology for Continuous Frac F ORCE HAS A PATENT FOR A NEW EFFICIENT CONTINUOUS FRAC SYSTEM New continuous frac system, reduces non - productive time and increases output, resulting in potential monetary savings for operators Patent Issue Date: 2/21/23 US Patent # 11,585,200 Prototype body has been tested in live applications with large customers Continuous frac processes also pair very well with electrified frac crews, another growth area for ESG in the oil field

16 Strictly Private & Confidential Multiple Revenue Streams F ORCE RENTAL TOOLS AND SERVICES ARE REQUIRED DURING FRAC AND FLOWBACK OPERATIONS FOR NEWLY DRILLED AND MATURE WELLBORES Service Line Equipment & Services provided Est. EBITDA Margin 2H22 (1) % of Revenue 2022E (1) Frac Rental Tools and Services 50% 60% Flowback Rental Tools and Services 31% 23% Hydraulics 27% 9% Completion Fluids 26% 3% BOPs 53% 4% Special Services 31% 1% Valves Manifolds Separators Mixing Plants Blowout Preventers Iron & Connections Torque & Test Services Greasing Services Special Services Maint. Services (1) Company historical and management projected financials. 2022 financials are unaudited. Audited financials will be provided when released; excel workbook ’12 - 22 Force Region IS’.

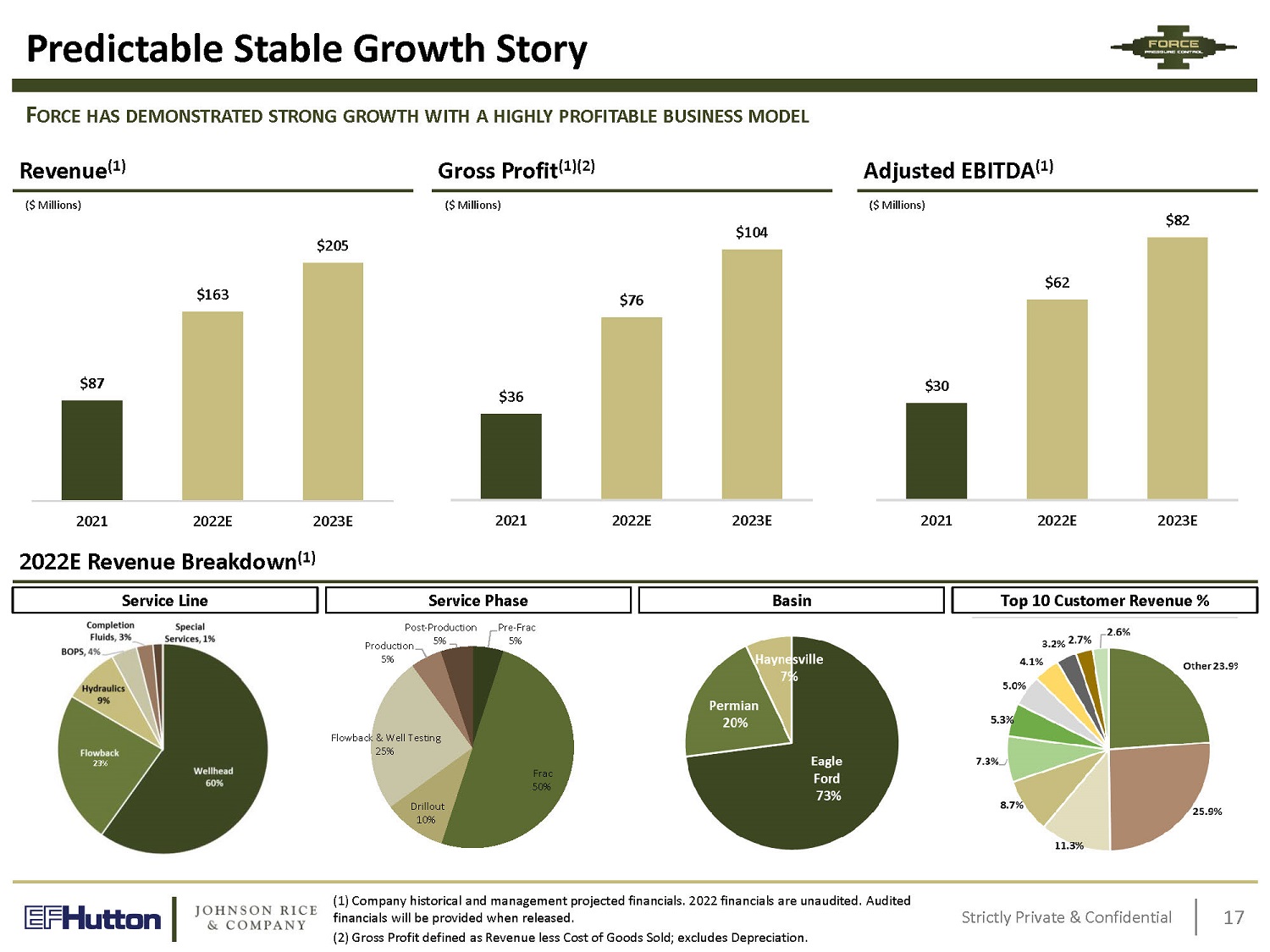

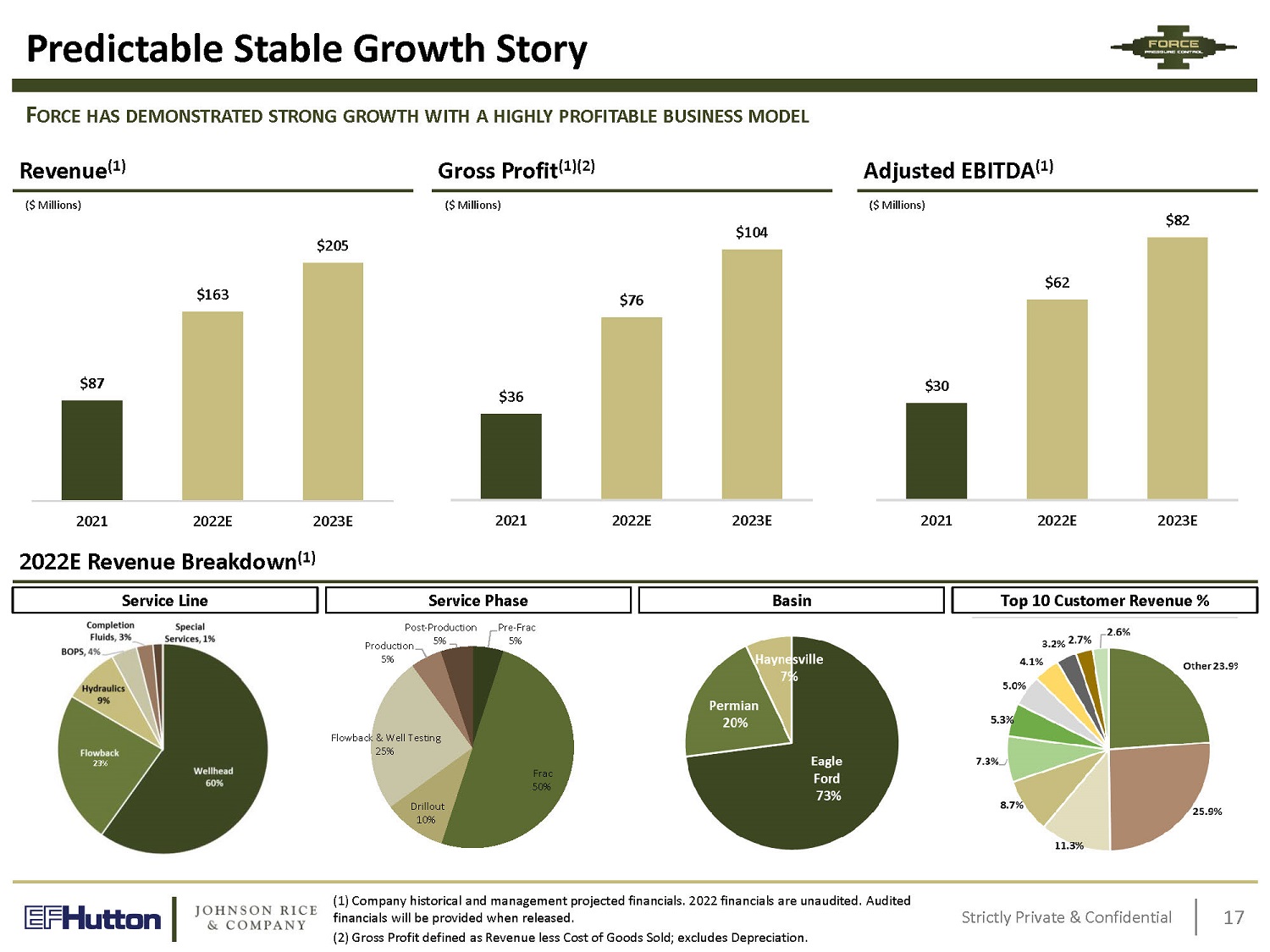

17 Strictly Private & Confidential Predictable Stable Growth Story Adjusted EBITDA (1) F ORCE HAS DEMONSTRATED STRONG GROWTH WITH A HIGHLY PROFITABLE BUSINESS MODEL Revenue (1) Gross Profit (1)(2) ($ Millions) ($ Millions) Pre - Frac 5% Frac 50% Drillout 10% Flowback & Well Testing 25% Production 5% Post - Production 5% Service Line Service Phase Basin Top 10 Customer Revenue % ($ Millions) $87 $163 2021 2022E 2023E 2022E Revenue Breakdown (1) $205 $36 $76 $104 2021 2022E 2023E $30 $62 $82 2021 2022E 2023E (1) Company historical and management projected financials. 2022 financials are unaudited. Audited financials will be provided when released. (2) Gross Profit defined as Revenue less Cost of Goods Sold; excludes Depreciation. 23%

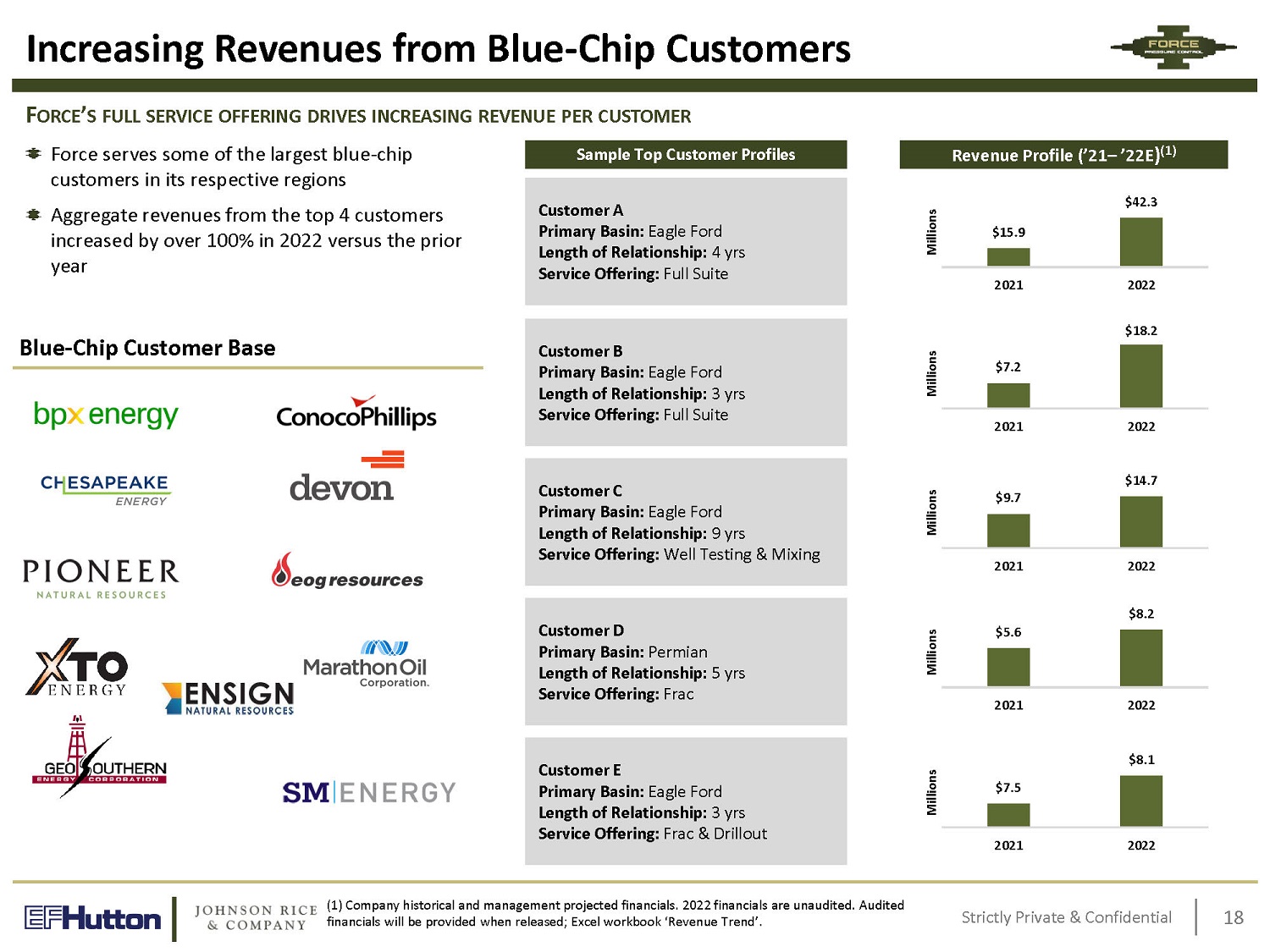

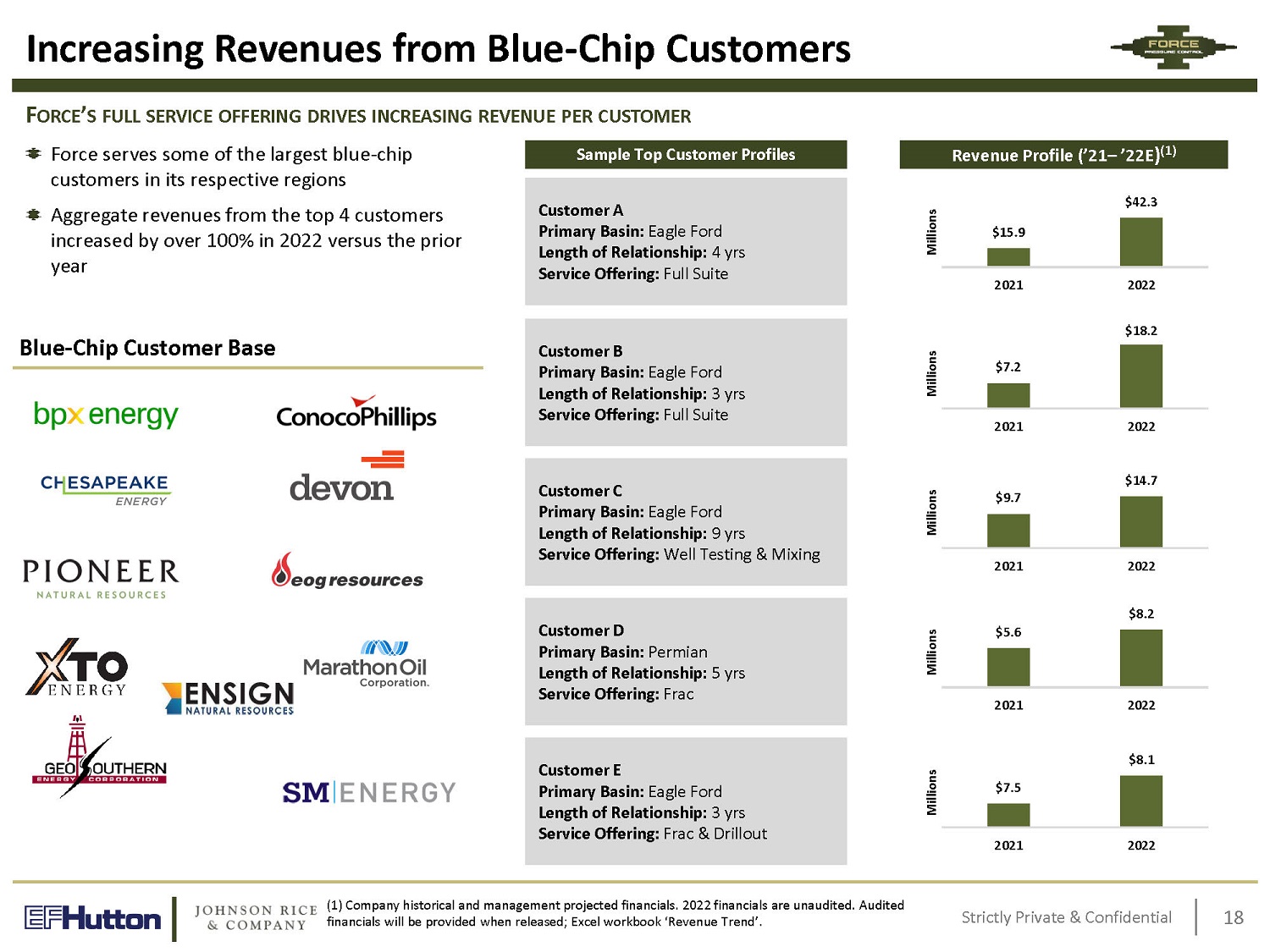

18 Strictly Private & Confidential Force serves some of the largest blue - chip customers in its respective regions Aggregate revenues from the top 4 customers increased by over 100% in 2022 versus the prior year Increasing Revenues from Blue - Chip Customers F ORCE ’ S FULL SERVICE OFFERING DRIVES INCREASING REVENUE PER CUSTOMER Blue - Chip Customer Base Revenue Profile (’21 – ’22E ) (1) Sample Top Customer Profiles Customer B Primary Basin: Eagle Ford Length of Relationship: 3 yrs Service Offering: Full Suite Customer A Primary Basin: Eagle Ford Length of Relationship: 4 yrs Service Offering: Full Suite Customer D Primary Basin: Permian Length of Relationship: 5 yrs Service Offering: Frac Customer E Primary Basin: Eagle Ford Length of Relationship: 3 yrs Service Offering: Frac & Drillout Customer C Primary Basin: Eagle Ford Length of Relationship: 9 yrs Service Offering: Well Testing & Mixing (1) Company historical and management projected financials. 2022 financials are unaudited. Audited financials will be provided when released; Excel workbook ‘Revenue Trend’. $15.9 2021 2022 $18.2 $7.2 2021 2022 $9.7 $14.7 $42.3 Millions Millions 2021 2022 $8.2 $5.6 2021 2022 $8.1 $7.5 2021 2022 Millions Millions Millions

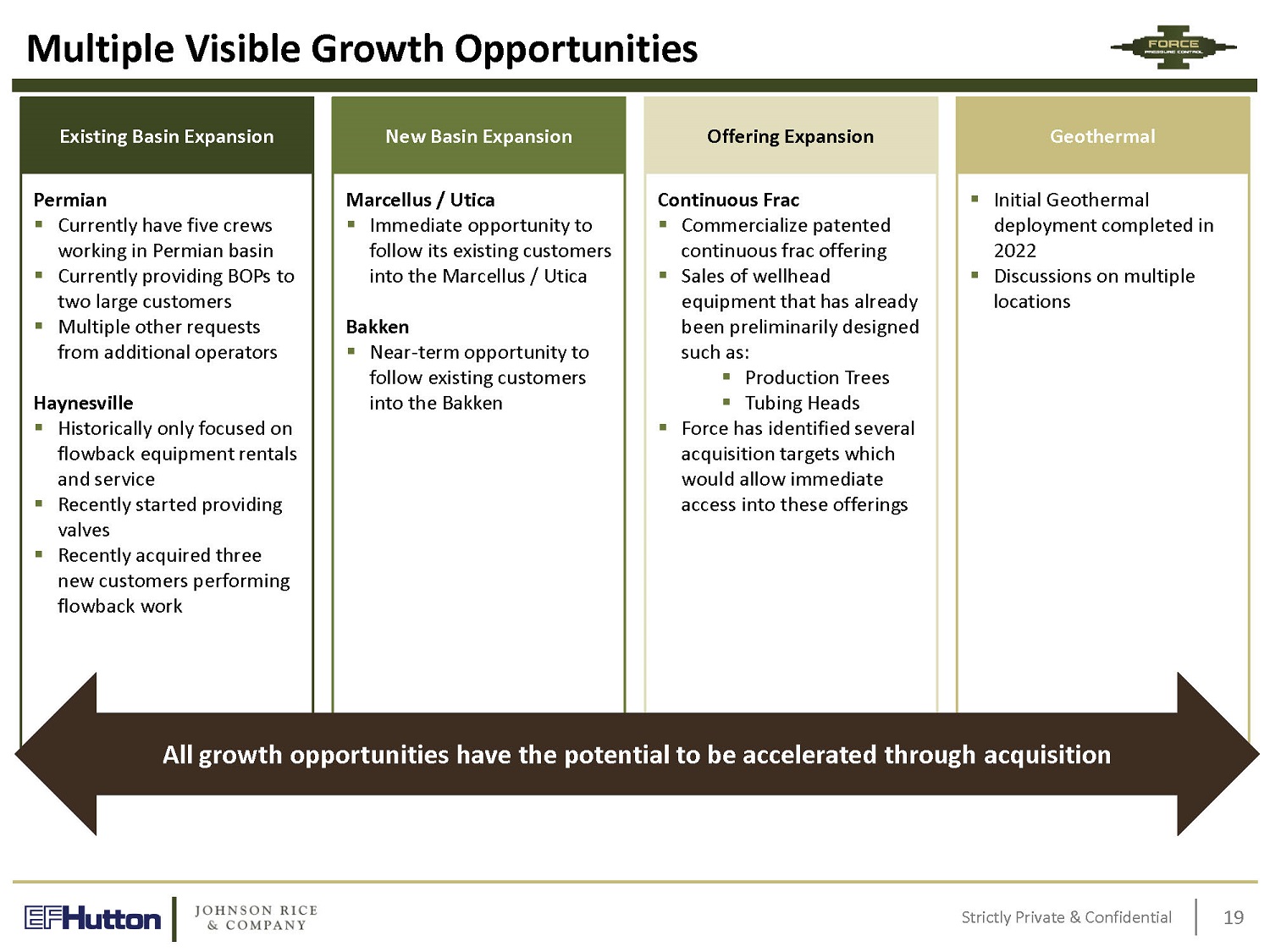

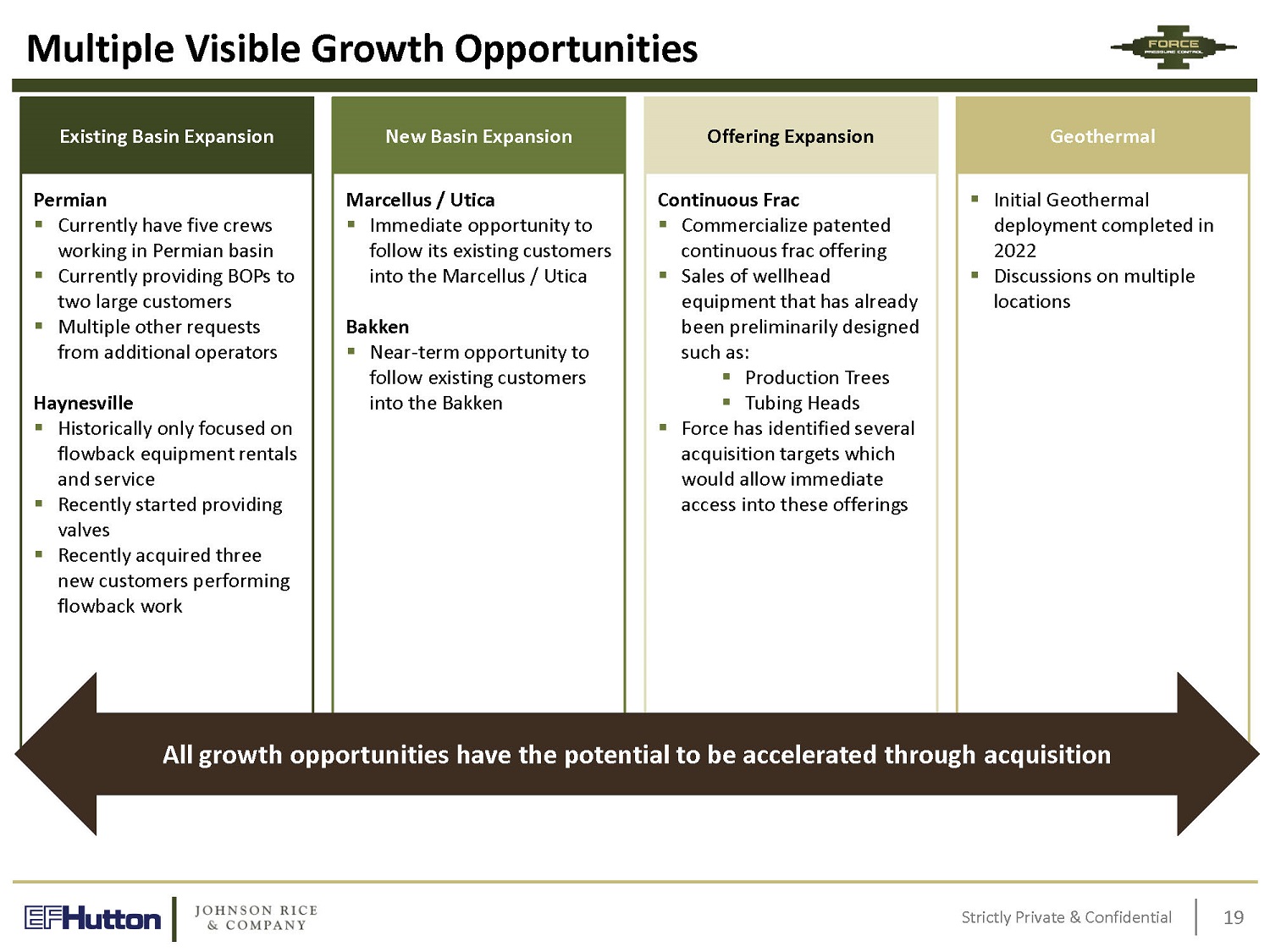

Existing Basin Expansion New Basin Expansion Offering Expansion Geothermal Permian ▪ Currently have five crews working in Permian basin ▪ Currently providing BOPs to two large customers ▪ Multiple other requests from additional operators Haynesville ▪ Historically only focused on flowback equipment rentals and service ▪ Recently started providing valves ▪ Recently acquired three new customers performing flowback work Marcellus / Utica ▪ Immediate opportunity to follow its existing customers into the Marcellus / Utica Bakken ▪ Near - term opportunity to follow existing customers into the Bakken Continuous Frac ▪ Commercialize patented continuous frac offering ▪ Sales of wellhead equipment that has already been preliminarily designed such as: ▪ Production Trees ▪ Tubing Heads ▪ Force has identified several acquisition targets which would allow immediate access into these offerings ▪ Initial Geothermal deployment completed in 2022 ▪ Discussions on multiple locations Multiple Visible Growth Opportunities All growth opportunities have the potential to be accelerated through acquisition 19 Strictly Private & Confidential

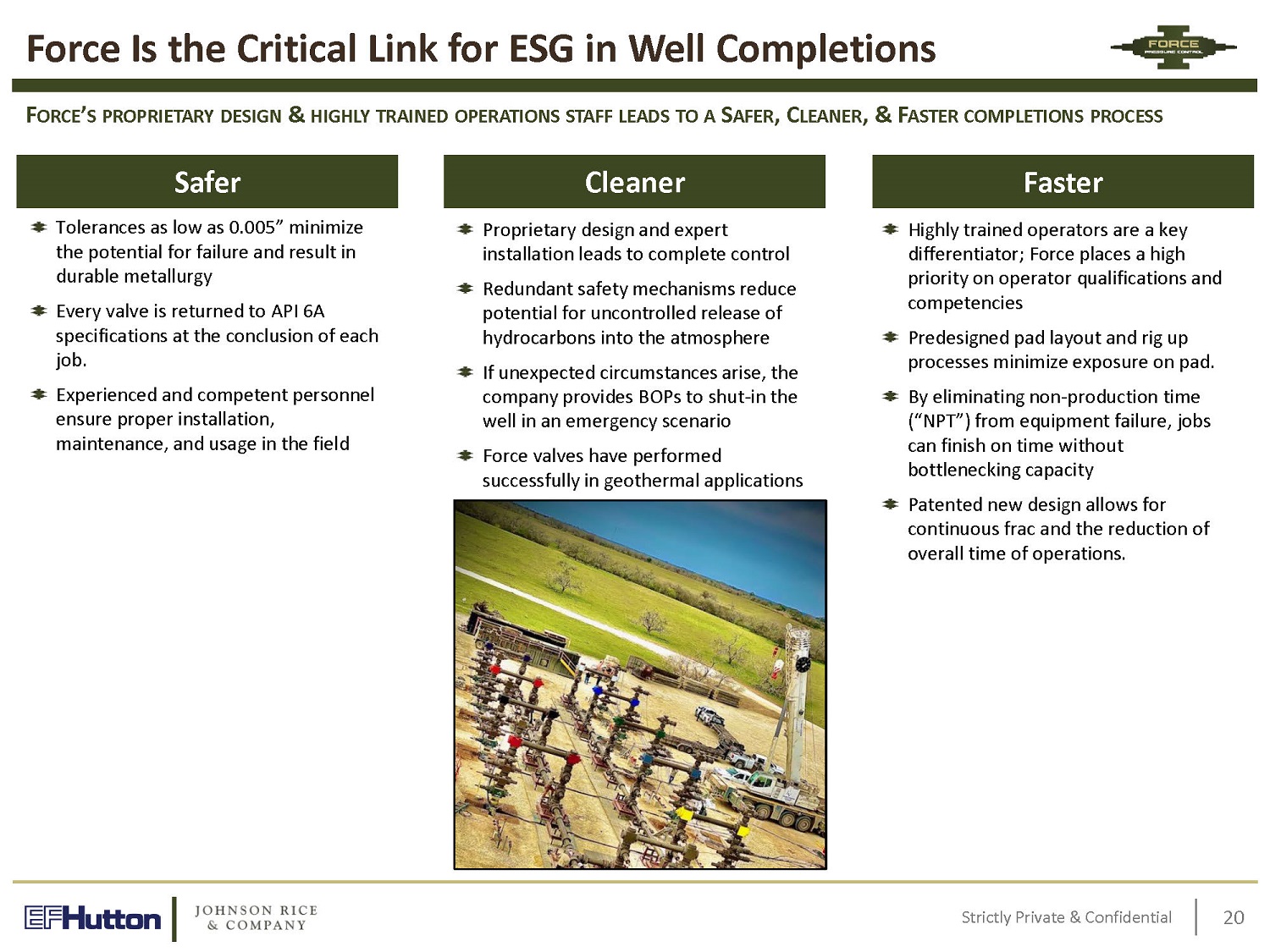

Force Is the Critical Link for ESG in Well Completions F ORCE ’ S PROPRIETARY DESIGN & HIGHLY TRAINED OPERATIONS STAFF LEADS TO A S AFER , C LEANER , & F ASTER COMPLETIONS PROCESS Tolerances as low as 0.005” minimize the potential for failure and result in durable metallurgy Every valve is returned to API 6A specifications at the conclusion of each job. Experienced and competent personnel ensure proper installation, maintenance, and usage in the field Proprietary design and expert installation leads to complete control Redundant safety mechanisms reduce potential for uncontrolled release of hydrocarbons into the atmosphere If unexpected circumstances arise, the company provides BOPs to shut - in the well in an emergency scenario Force valves have performed successfully in geothermal applications Highly trained operators are a key differentiator; Force places a high priority on operator qualifications and competencies Predesigned pad layout and rig up processes minimize exposure on pad. By eliminating non - production time (“NPT”) from equipment failure, jobs can finish on time without bottlenecking capacity Patented new design allows for continuous frac and the reduction of overall time of operations. Cleaner Faster Safer 20 Strictly Private & Confidential

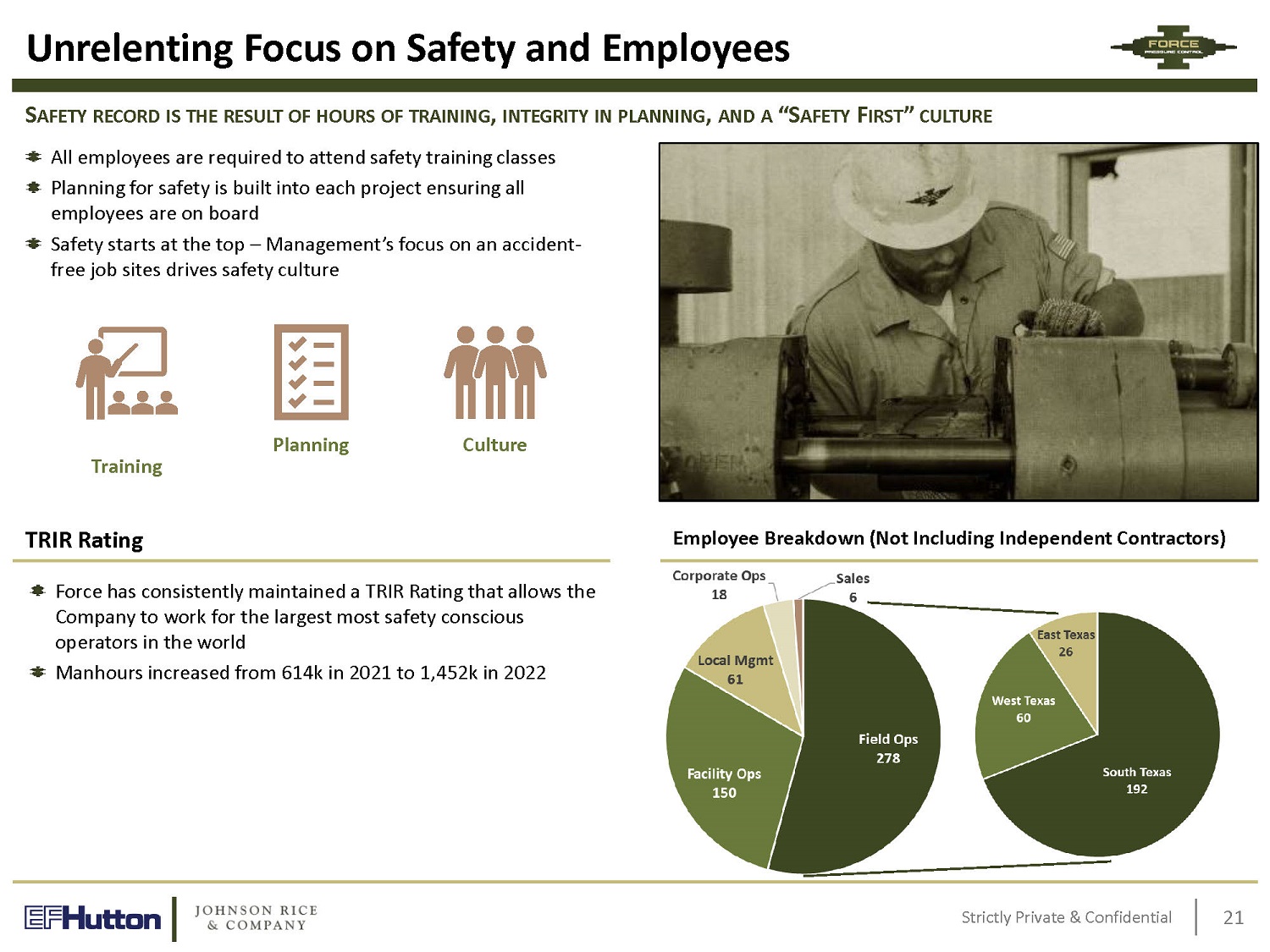

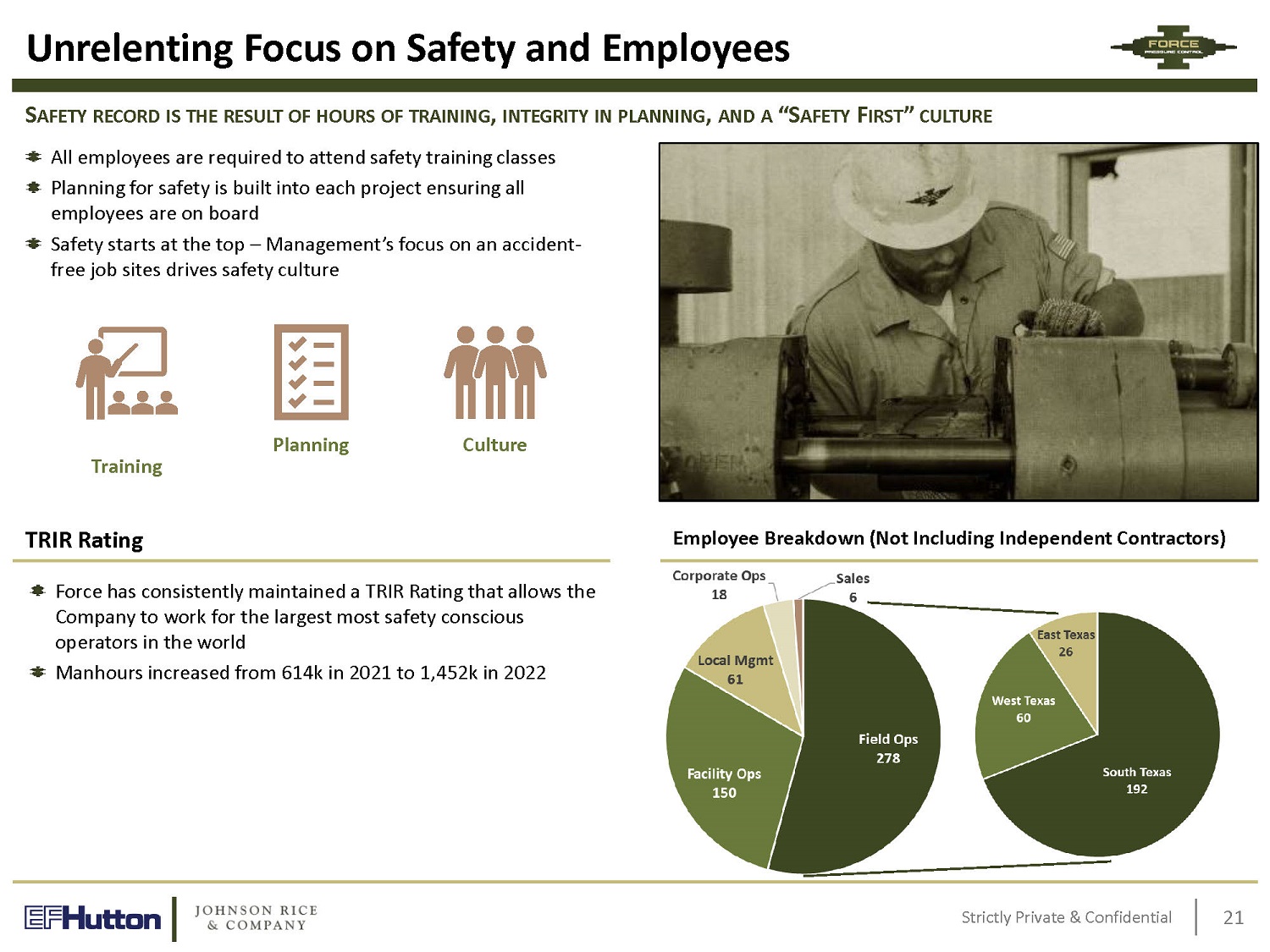

Unrelenting Focus on Safety and Employees S AFETY RECORD IS THE RESULT OF HOURS OF TRAINING , INTEGRITY IN PLANNING , AND A “S AFETY F IRST ” CULTURE All employees are required to attend safety training classes Planning for safety is built into each project ensuring all employees are on board Safety starts at the top – Management’s focus on an accident - free job sites drives safety culture Training Planning Culture TRIR Rating Employee Breakdown (Not Including Independent Contractors) Force has consistently maintained a TRIR Rating that allows the Company to work for the largest most safety conscious operators in the world Manhours increased from 614k in 2021 to 1,452k in 2022 21 Strictly Private & Confidential

Investment Highlights Proprietary Frac Valve and Flowback Rental Tool Design Positions Force as a Unique and Leading Solutions Provider to Oil and Gas Operators Vertically Integrated Business Model Yields Segment Leading Margins, Returns and Free Cash Flows Patented Continuous Frac Solution Positioned for Rapid Market Adoption Loyal Blue Chip Customer Base Drives Basin Expansion Opportunities Experienced and Aligned Management Team Strong Pro Forma Balance Sheet 22 Strictly Private & Confidential

A PPENDIX

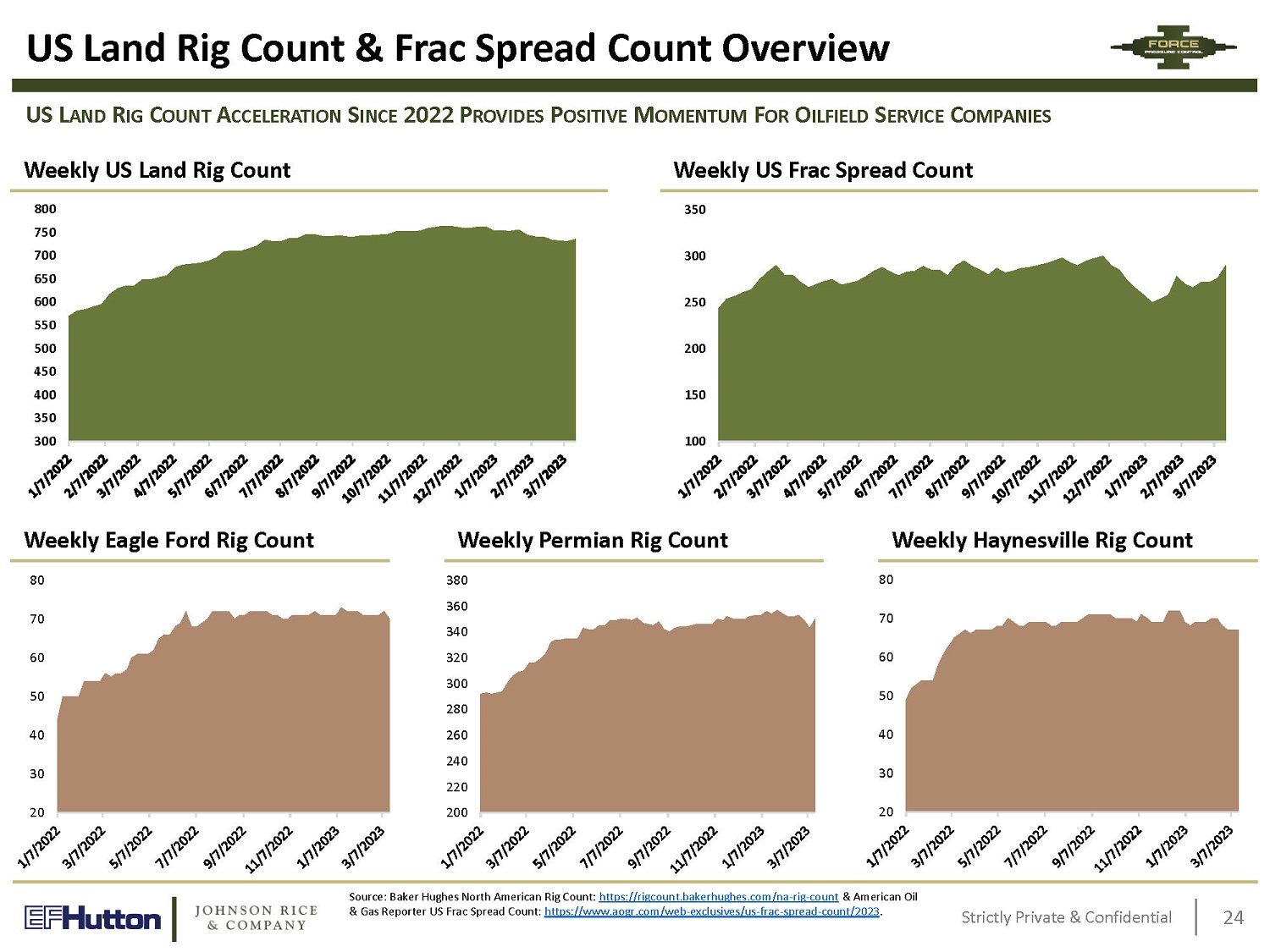

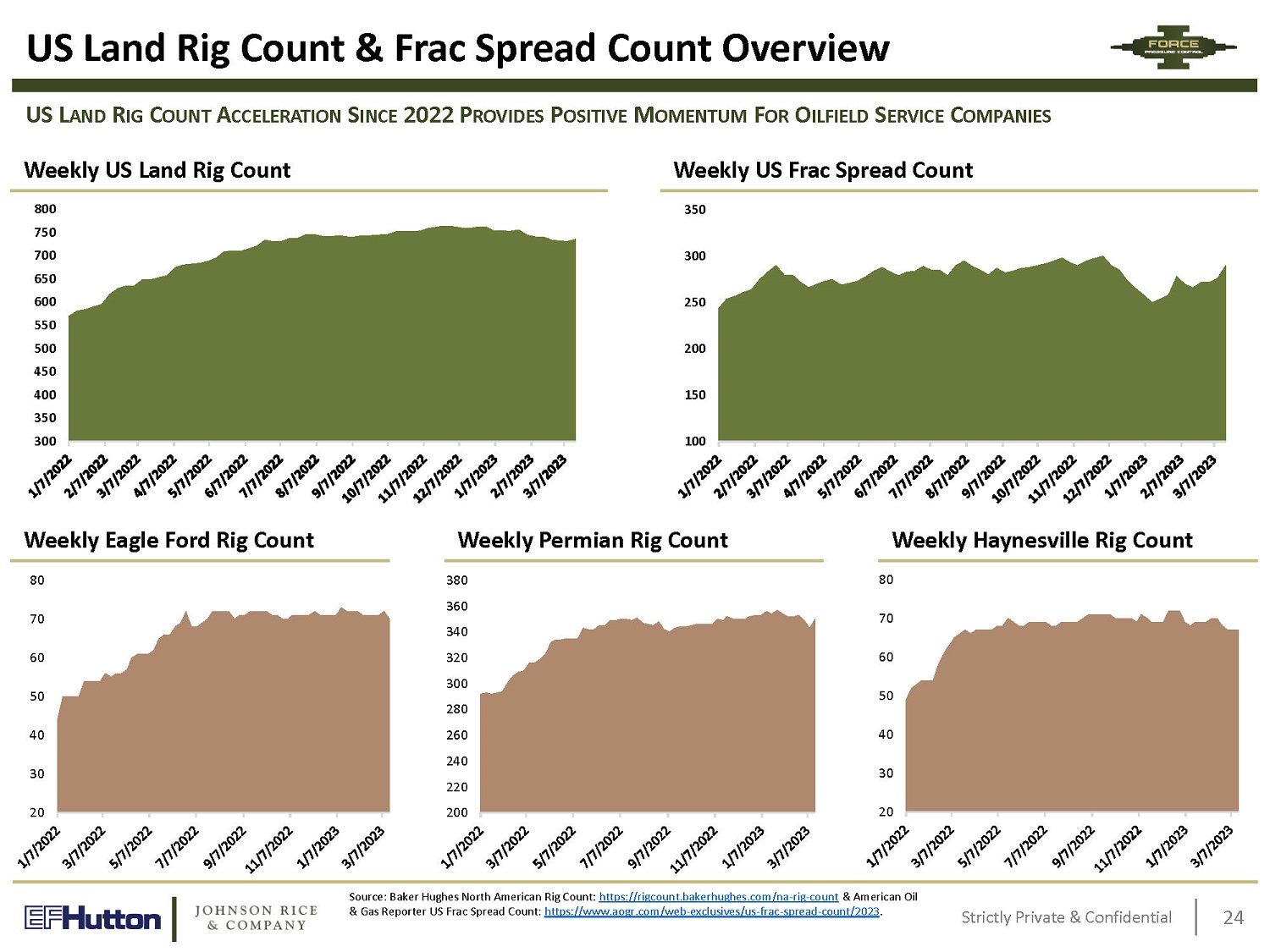

24 Strictly Private & Confidential US Land Rig Count & Frac Spread Count Overview US L AND R IG C OUNT A CCELERATION S INCE 2022 P ROVIDES P OSITIVE M OMENTUM F OR O ILFIELD S ERVICE C OMPANIES Weekly US Land Rig Count Weekly US Frac Spread Count Weekly Eagle Ford Rig Count Weekly Permian Rig Count Weekly Haynesville Rig Count 800 750 700 650 600 550 500 450 400 350 300 100 150 200 250 300 350 380 360 80 30 220 30 20 200 20 70 340 70 60 320 60 50 300 50 280 40 260 40 240 80 Source: Baker Hughes North American Rig Count: https://rigcount.bakerhughes.com/na - rig - count & American Oil & Gas Reporter US Frac Spread Count: https://www.aogr.com/web - exclusives/us - frac - spread - count/2023 .

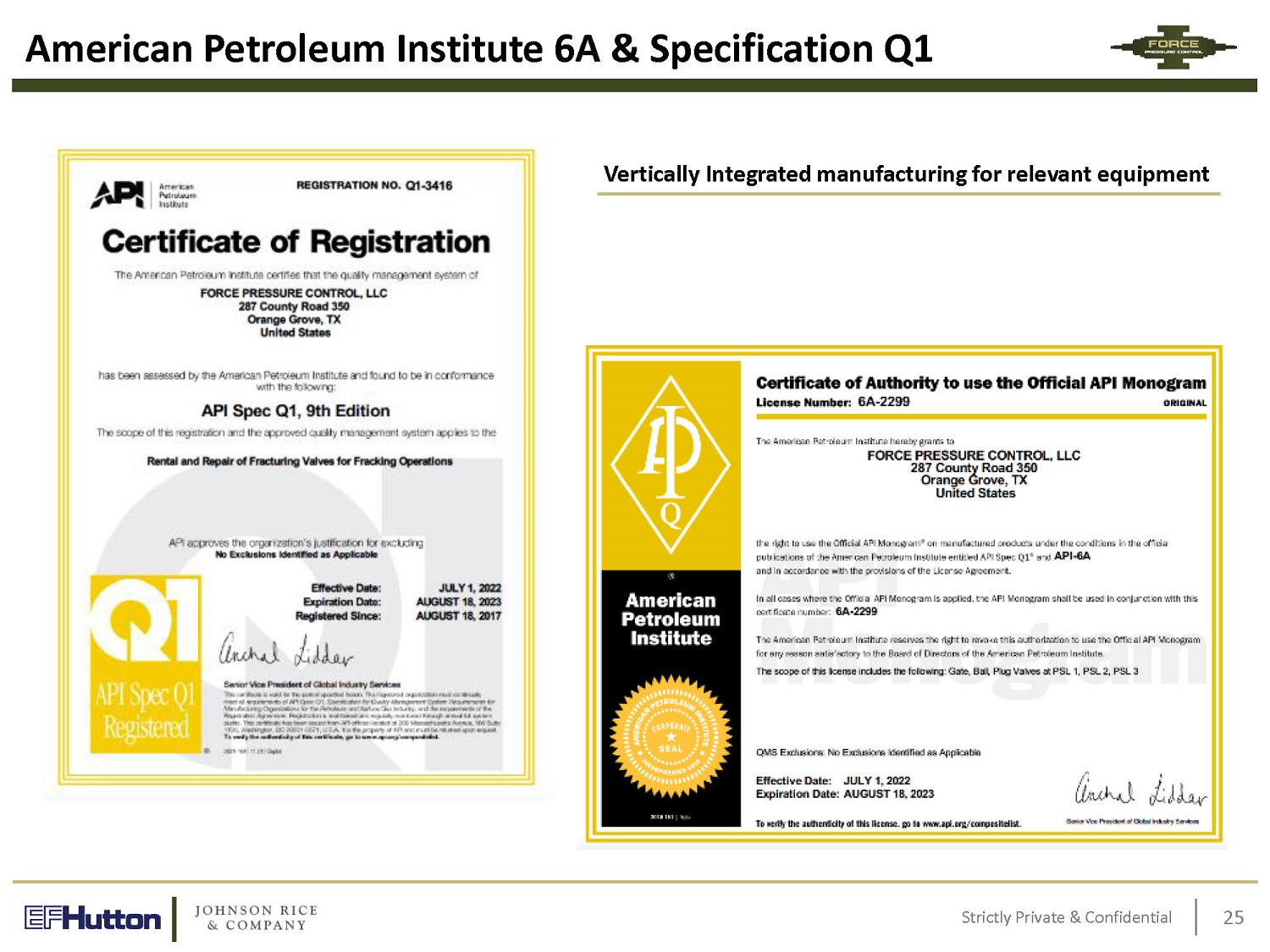

American Petroleum Institute 6A & Specification Q1 Vertically Integrated manufacturing for relevant equipment 25 Strictly Private & Confidential

Illustrative Equipment On Site – Frac Rental Tools F ORCE PROVIDES THE FULL SUITE OF EQUIPMENT NEEDED DURING THE PRE - FRAC AND FRAC STAGE OF WELL COMPLETIONS Frac Package: ▪ The typical frac package is comprised of master valves, frac stack, zipper manifold, spooling, greasing system, accumulators, choke manifold, and flow iron ▪ Requires 2 – 6 personnel depending on job size and includes torque and test service ▪ Equipment on site for approximately 5 – 7 days per well 1 2 3 4 5 26 Strictly Private & Confidential Master Valve Zipper Leg Flowback Frac Assist Accumulators Equipment / Service

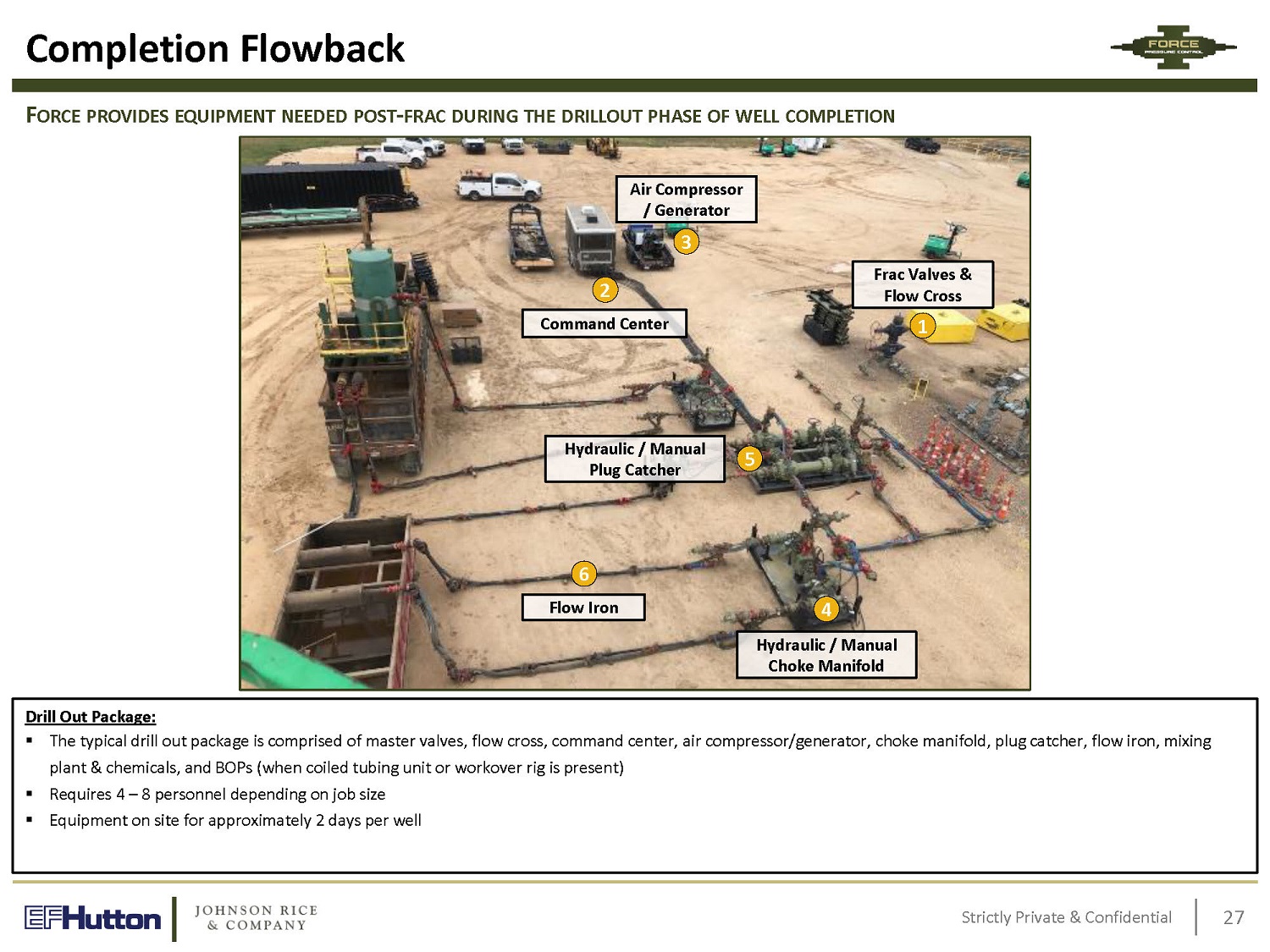

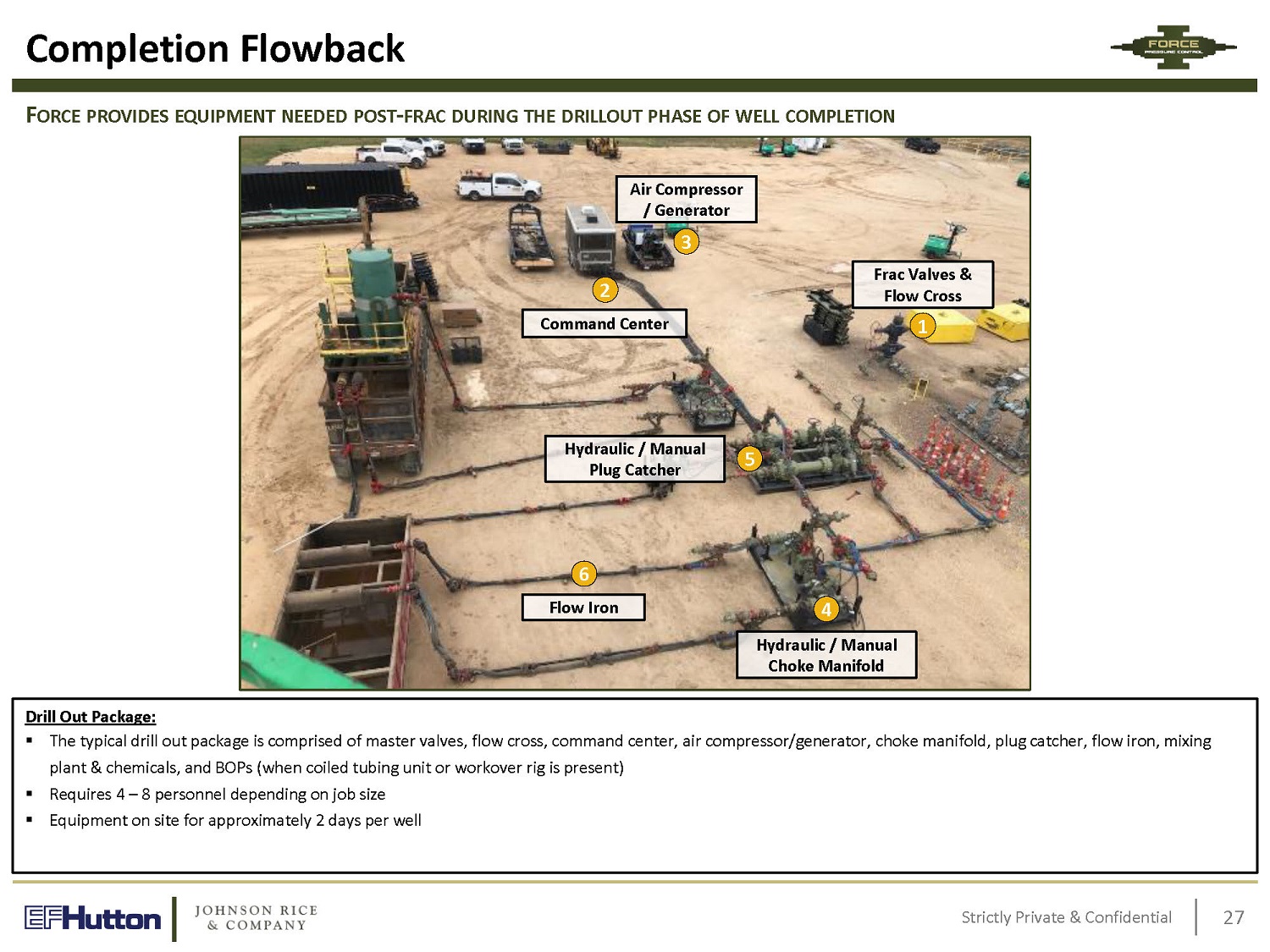

Completion Flowback F ORCE PROVIDES EQUIPMENT NEEDED POST - FRAC DURING THE DRILLOUT PHASE OF WELL COMPLETION Drill Out Package: ▪ The typical drill out package is comprised of master valves, flow cross, command center, air compressor/generator, choke manifold, plug catcher, flow iron, mixing plant & chemicals, and BOPs (when coiled tubing unit or workover rig is present) ▪ Requires 4 – 8 personnel depending on job size ▪ Equipment on site for approximately 2 days per well Frac Valves & Flow Cross Command Center 27 Strictly Private & Confidential Air Compressor / Generator Hydraulic / Manual Choke Manifold Hydraulic / Manual Plug Catcher 3 2 1 5 6 4 Flow Iron

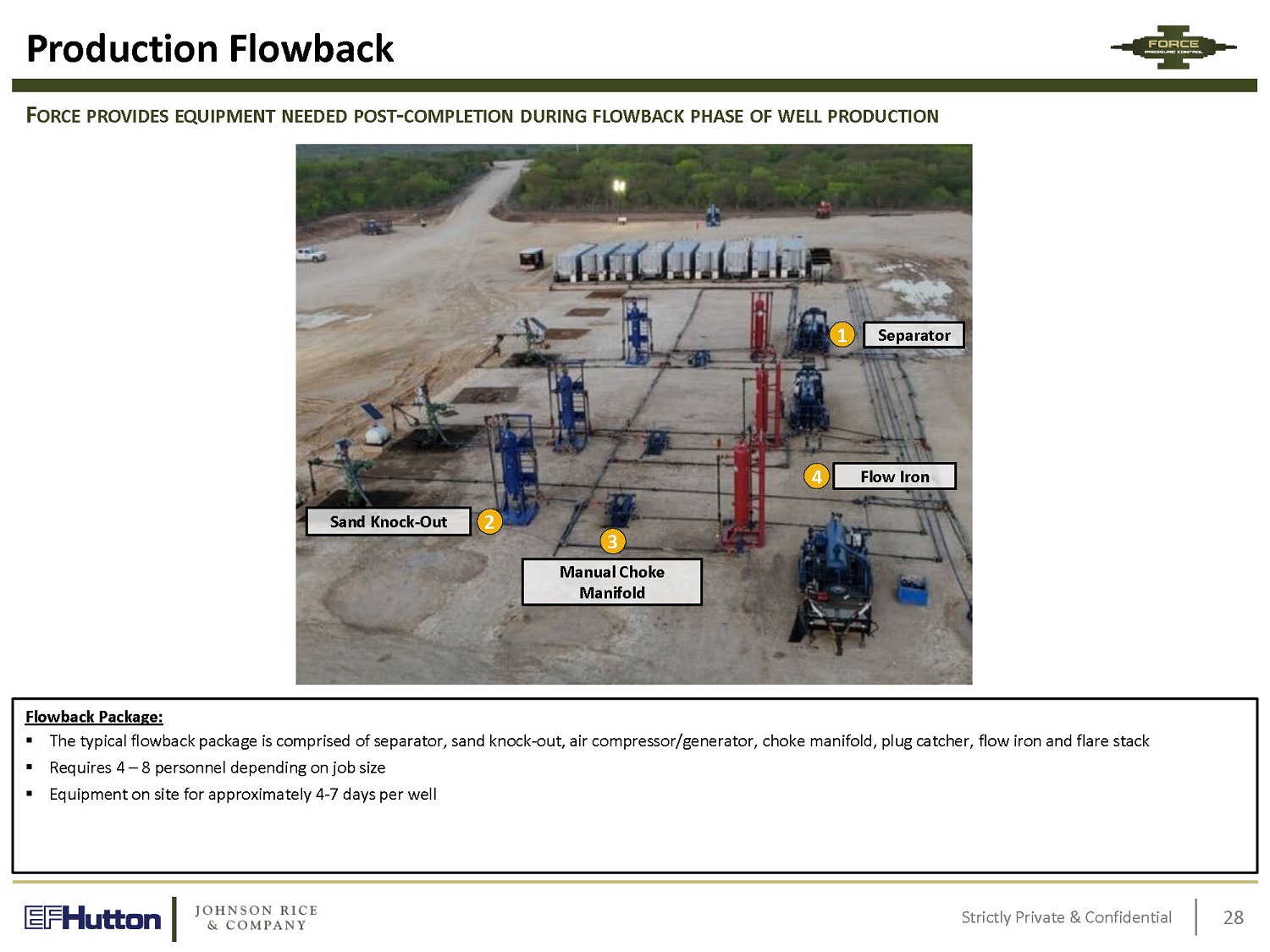

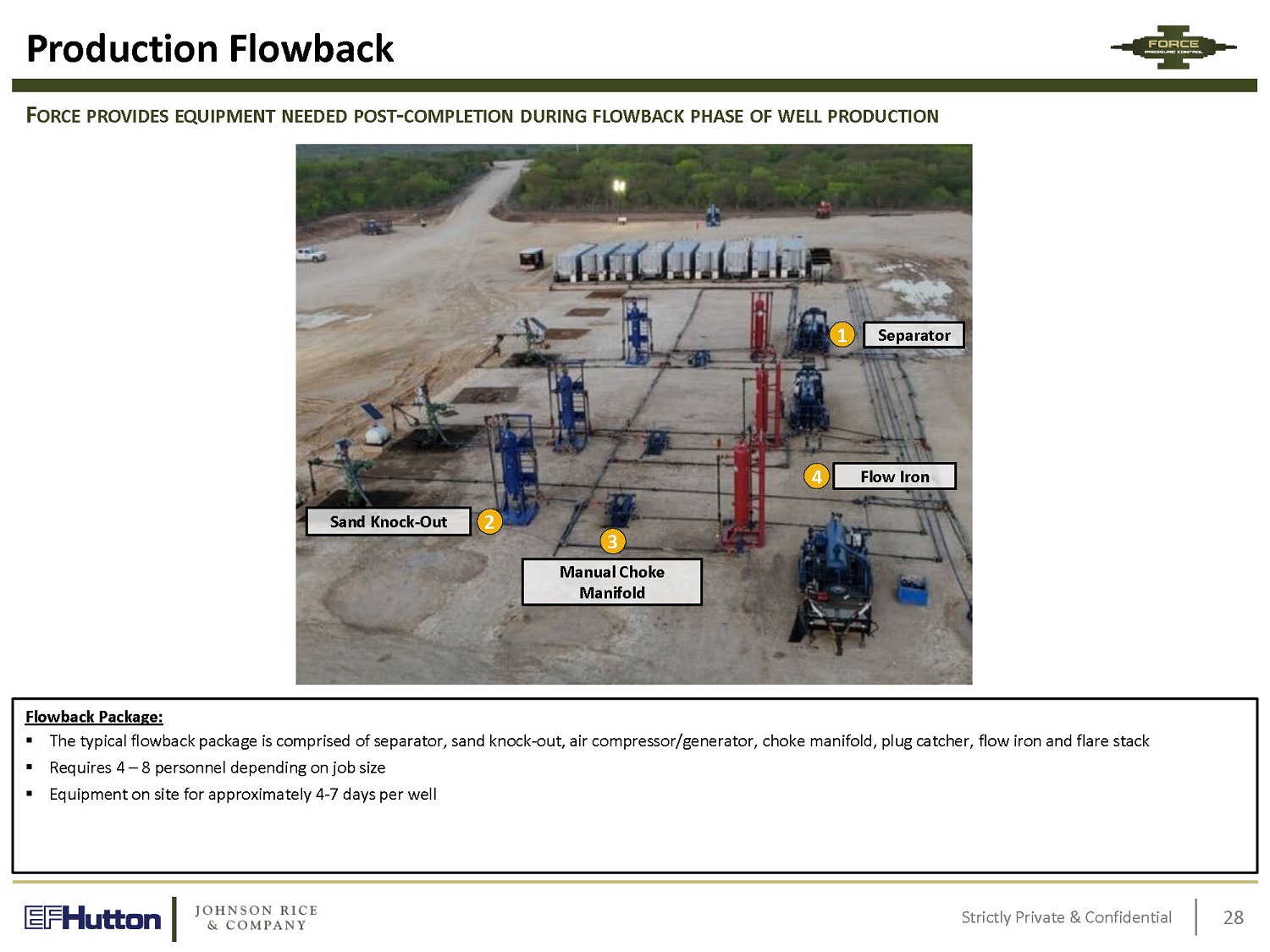

Production Flowback F ORCE PROVIDES EQUIPMENT NEEDED POST - COMPLETION DURING FLOWBACK PHASE OF WELL PRODUCTION Flowback Package: ▪ The typical flowback package is comprised of separator, sand knock - out, air compressor/generator, choke manifold, plug catcher, flow iron and flare stack ▪ Requires 4 – 8 personnel depending on job size ▪ Equipment on site for approximately 4 - 7 days per well 1 Separator 2 Sand Knock - Out 3 Manual Choke Manifold 4 28 Strictly Private & Confidential Flow Iron

Support Services F ORCE SPECIALIZES IN PROVIDING BLOWOUT PREVENTERS AND SPECIAL SERVICES TO PREVENT AND MITIGATE POTENTIAL WELL CONTROL SITUATIONS Support Services: ▪ Support Services are comprised of a BOPs, Special Services, mixing plants, closing units (accumulator), grease systems, and torque and test packages. Services are offered as support equipment across all service lines. Support services may also be offered as stand - alone rentals/services. ▪ Requires 1 – 4 personnel ▪ Equipment on site for approximately 2 – 14 days per well (varies depending on job scope) 1 4 2 BOP Flow Cross Accumulator MIXING PLANT Special Services 29 Strictly Private & Confidential

Risk Factors 30 Strictly Private & Confidential Unless otherwise stated or the context otherwise requires, all references to “we," us”, “our” or the “Company” prior to consummation of the business combination refer to Force Pressure Control, LLC (“Force”), and following the consummation of the business combination described herein, refer to the combined entities of Force and Stratim Cloud Acquisition Corp . (“SCAQ”) . We have identified the following risks and uncertainties that may have a material adverse effect on our business, financial condition, results of operations or reputation . The risks described below are not the only risks we face . Additional risks not presently known to us or that we currently believe are not material may also significantly affect our business, financial condition, results of operations or reputation . Our business could be harmed by any of these risks . In making your decision to invest in the Company, you have relied solely upon independent investigation made by you . You acknowledge that you are not relying upon, and have not relied upon, any of the following summary of risks or any other statement, representation or warranty made by any person, firm or corporation, other than the statements, representations and warranties of the Company explicitly contained in any subscription agreement you enter into in connection with an investment in the Company or any Investor Presentation prepared in connection with such Investment . You have such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an Investment in the Company, and you have sought such accounting, legal and tax advice as you have considered necessary to make an informed investment decision . The list below is qualified in its entirety by disclosures contained in the final prospectus for SCAQ’s initial public offering, filed with the U . S . Securities and Exchange Commission (the “SEC”) on March 15 , 2021 , and in future documents filed or furnished by the Company, or by third parties, including SCAQ, with respect to the Company, with the SEC, including the documents filed or furnished in connection with the proposed transactions between the Company and SCAQ . All information provided in this summary of risks is as of the date hereof and the Company undertakes no duty to update this information except as required by law . The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business and securities of the Company and SCAQ and the proposed transactions between the Company and SCAQ, and may differ significantly from, and be more extensive than, those presented below . Risks Relating to Our Business and Industry Our limited operating history makes it difficult to evaluate our current business and future prospects. Our financial projections may not prove accurate. We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy. Our business is concentrated in certain geographic markets. Exposure to local economies, regional downturns or severe weather or catastrophic occurrences or other disruptions or events could have a material adverse effect on our business and results of operations. We may face increased competition and any failure to keep up with technological developments and changing customer preferences could have a material adverse effect on our business. We rely on the experience and expertise of our senior management team, key technical employees and other highly skilled personal and the failure to retain, motivate or integrate any of these individuals (or their death or incapacity) could have an adverse effect on our business, financial condition or results of operation. [We depend on a limited number of third - party suppliers, manufacturers and licensors to supply some of the parts and equipment necessary to provide some of our products and services, and any disruption in our relationships with these parties could have a material adverse effect on our business and results of operations.] Shortages of or difficulties in hiring qualified personnel and other labor market factors could increase our labor costs and affect our revenue, growth rate, profitability, and cash flows. Lack of availability or increased costs of component raw materials may affect manufacturing processes for our equipment and increase our overall costs and negatively impact our business. Manufacturing and transportation of key equipment may be dependent on open global supply chains. Supply chain issues could negatively impact our business and ability to meet demand for our product and services. We may not be able to accurately estimate the future demand for our product and services, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict market demand, we could incur additional costs or experience delays, adversely impacting our business and financial condition. Our facilities and operations could be damaged or adversely affected as a result of natural disasters and other catastrophic events, which would negatively impact our business.

Risk Factors 31 Strictly Private & Confidential Our exposure to the economic conditions of our current and potential customers, vendors and third parties could adversely affect our cash flow, results of operations and financial condition. Our decision to expand existing product and service offerings into new markets or to launch new product or service offerings may consume significant financial and other resources and may not achieve the desired results . International expansion of our business would expose us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States. Our business is subject to extensive governmental legislation and regulation, which could adversely affect our business, increase our operational and administrative expenses and limit our revenues. From time to time, we may be involved in legal proceedings and commercial contractual or intellectual property disputes, which could have an adverse impact on our profitability and consolidated financial position. We may become subject to product liability claims, which could harm our financial condition and liquidity. Our insurance coverage may not be adequate to protect from all business risks, adversely impacting our business and financial condition. We may fail to adequately protect our intellectual property rights or may be accused of infringing upon intellectual property rights of third parties. Risks Relating to Our Financial Reporting We rely on assumptions, estimates, and business data to calculate our key performance indicators and other business metrics, and real or perceived inaccuracies in these metrics may harm our reputation and negatively affect our business . Our results of operations and financial condition are subject to management’s accounting judgments and estimates, as well as changes in accounting policies. Our management will be required to evaluate the effectiveness of our internal control over financial reporting . If we are unable to maintain effective internal control over financial reporting, investors may lose confidence in the accuracy of our financial reports . We are currently an emerging growth company and a smaller reporting company within the meaning of the Securities Act, and to the extent we have taken advantage of certain exemptions from disclosure requirements available to emerging growth companies or smaller reporting companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies . The Company is presently a private company and requires significant enhancement of its financial reporting function to satisfy the requirements of public company reporting. The SCAQ warrants are accounted for as liabilities and the changes in value of the warrants could have a material effect on the Company’s financial results.

Risk Factors 32 Strictly Private & Confidential Risks Related to the Business Combination and SCAQ The exercise of SCAQ’s directors’ and executive officers’ discretion in agreeing to changes or waivers in the terms of the business combination may result in a conflict of interest when determining whether changes to the terms of the business combination or waivers of conditions are appropriate and in SCAQ’s stockholders’ best interest. SCAQ’s Sponsor and independent directors have agreed to vote in favor of the business combination, regardless of how the public stockholders vote. If the conditions to the business combination agreement are not met or suits to enjoin the transaction are successful, the business combination may not occur. If some or all of the PIPE investment fails to close and/or sufficient stockholders exercise their redemption rights in connection with the business combination, SCAQ may lack sufficient funds to consummate the business combination. In connection with the business combination, SCAQ’s Sponsor, initial stockholders, directors, executive officers, advisors and their affiliates may elect to purchase shares or public warrants from public stockholders, which may influence a vote on the business combination and reduce the public “float” of SCAQ’s Class A common stock. SCAQ’s directors may decide not to enforce the indemnification obligations of SCAQ’s Sponsor, resulting in a reduction in the amount of funds in the trust account available for distribution to the public stockholders. SCAQ may not have sufficient funds to satisfy indemnification claims of its directors and executive officers. Compliance obligations under the Sarbanes - Oxley Act may make it more difficult for SCAQ to effectuate the business combination, require substantial financial and management resources, and increase the time and costs of completing an acquisition. The announcement of the proposed business combination could disrupt the Company’s relationships with its customers, suppliers, business partners and others, as well as its operating results and business generally. The public stockholders of SCAQ will experience immediate dilution as a consequence of the issuance of common stock as consideration in the business combination and the private placement and due to future issuances pursuant to the Force equity plan. The ability of SCAQ’s stockholders to exercise redemption rights with respect to a large number of outstanding SCAQ Class A common stock could increase the probability that the business combination will not occur. The business combination is subject to conditions, including certain conditions that may not be satisfied on a timely basis, if at all.

Risk Factors 33 Strictly Private & Confidential Risks Related to the Business Combination and SCAQ Current SCAQ stockholders will own a smaller proportion of the post - closing company than they currently own . In addition, following the closing of the business combination, the Company may issue additional shares or other equity securities without the approval of its stockholders, which would further dilute their ownership interests and may depress the market price of its shares . Legal proceedings in connection with the business combination, the outcomes of which are uncertain, could delay or prevent the completion of the business combination. Nasdaq may not list the Company’s securities on its exchange, and the Company may not be able to comply with the continued listing standards of Nasdaq, which could limit investors’ ability to make transactions in the Company’s securities and subject it to additional trading restrictions. Risks Related to the Company following the Business Combination Upon completion of the business combination, we may be a “controlled company” within the meaning of the rules of the Nasdaq, and, as a result, we may qualify for, and rely on, exemptions from certain corporate governance requirements . If we do qualify for and rely on these exemptions, you will not have the same protections as those afforded to stockholders of companies that are subject to such governance requirements . Subsequent to the completion of the business combination, we may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition and its share price, which could cause you to lose some or all of your investment. Our business and operations could be negatively affected if we become subject to any securities litigation or stockholder activism, which could cause us to incur significant expense, hinder execution of business and growth strategy and impact our stock price . The grant of registration rights to our stockholders, holders of our private placement warrants and PIPE Investors and the future exercise of such rights may adversely affect the market price of our Class A common stock . The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business. If the business combination’s benefits do not meet the expectations of investors or securities analysts, the market price of SCAQ’s securities or, following the closing, the Company’s securities, may decline. The SCAQ warrants may have an adverse effect on the market price of our Class A common stock.

Risk Factors 34 Strictly Private & Confidential Risks Relating to Ownership of Our Securities following the Business Combination The price of our securities may be volatile. We do not intend to pay cash dividends for the foreseeable future. Future resales of our common stock may cause the market price of its securities to drop significantly, even if the Company’s business is doing well. If analysts do not publish research about our business or if they publish inaccurate or unfavorable research, our stock price and trading volume could decline. The obligations associated with being a public company will involve significant expenses and will require significant resources and management attention, which may divert from the Company’s business operations . Provisions in our charter and Delaware law may inhibit a takeover of us, which could limit the price investors might be willing to pay in the future for our common stock and could entrench management . Our amended and restated certificate of incorporation is expected to provide, subject to limited exceptions, that the Court of Chancery of the State of Delaware will be the sole and exclusive forum for certain stockholder litigation matters, which could limit stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees or stockholders . We may issue additional common stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our common stock . Our ability to meet expectations and projections in any research or reports published by securities or industry analysts, or a lack of coverage by securities or industry analysts, could result in a depressed market price and limited liquidity for our common stock . Risks Relating to the Private Placement Our financial information provided to private placement investors is unaudited, does not conform to Regulation S - X or PCAOB standards and includes estimates of certain financial metrics adjusted to reflect PCAOB standards, and such information may not be included, may be adjusted or may be presented differently in filings made with the SEC.