Exhibit 99.2

[Organon] Confidential Q3 2022 Earnings Organon

[Organon] Confidential Disclaimer statement Safe Harbor for Forward - Looking Statements Except for historical information herein, this presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectati ons about Organon’s future financial performance and prospects. Forward - looking statements may be identified by words such as “expects,” “intends,” “antici pates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning. These statements are based upon the current beliefs and ex pectations of the company’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or ri sks or uncertainties materialize, actual results may differ materially from those set forth in the forward - looking statements. Risks and uncertaintie s include, but are not limited to, an inability to execute on our business development strategy or realize the benefits of our planned acquisitions; general ec onomic factors, including interest rate and currency exchange rate fluctuations; general industry conditions and competition; the impact of the ongoing CO VID - 19 pandemic and emergence of variant strains; the impact of pharmaceutical industry regulation and health care legislation in the United Stat es and internationally; global trends toward health care cost containment; technological advances; new products and patents attained by competitors; challen ges inherent in new product development, including obtaining regulatory approval; the company’s ability to accurately predict its future financia l r esults and performance; the company’s ability to accurately predict future market conditions; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; difficulties developing and sustaining relationships with commercial counterparties; dependence on the effect ive ness of the company’s patents and other protections for innovative products; and the exposure to litigation, including patent litigation, and/or re gul atory actions. The company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in the company’s filings with the Securities and Exchange Commission (SEC), including the company's Annual Report on Form 10 - K for the year ended December 31, 202 1 and subsequent SEC filings, available at the SEC’s Internet site (www.sec.gov). This text should be viewed in conjunction with Organon’s Q3 2022 earnings call 2

[Organon] Confidential Disclaimer statement, cont. Non - GAAP Information This presentation contains “non - GAAP financial measures,” which are financial measures that either exclude or include amounts th at are not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally acce pte d accounting principles (“GAAP”). Specifically, the company makes use of the non - GAAP financial measures Adjusted EBITDA, Adjusted Net Income, and Adjusted diluted EPS, which are not recognized terms under GAAP and are presented only as a supplement to the com pan y’s GAAP financial statements. This presentation also provides certain measures that excludes the impact of foreign exchange. We cal culate foreign exchange impacts by converting our current - period local currency financial results using prior period average currency r ates and comparing these adjusted amounts to our current - period results. The company believes that these non - GAAP financial measures help to enhance an understanding of the company’s financial performance. However, the presentation of these measures has limitations as an analytical tool and should not be considered in isolation, or as a substitute for the company’s results as reported under GAA P. Because not all companies use identical calculations, the presentations of these non - GAAP measures may not be comparable to other similarly titl ed measures of other companies. You should refer to the appendix of this presentation for relevant definitions and reconciliations of non - GA AP financial measures contained herein to the most directly comparable GAAP measures. In addition, the company’s full - year 2022 guidance meas ures (other than revenues) are provided on a non - GAAP basis because the company is unable to reasonably predict certain items contain ed in the GAAP measures. Such items include, but are not limited to, acquisition related expenses, restructuring and related expenses, sto ck - based compensation and other items not reflective of the company's ongoing operations. The company uses non - GAAP financial measures in its operational and financial decision making, and believes that it is useful to exclude certain items in order to focus on what it regards to be a more meaningful representation of the underlying operating performance of the business. 3

[Organon] Confidential Third quarter 2022 highlights 4 • Revenue of $ 1.5 billion, growth of 3% at constant currency • Third consecutive quarter of revenue growth on constant currency basis • Adjusted EBITDA of $546 million inclusive of $10M in acquired IPR&D and milestones • $1.32 Adjusted EPS from continuing operations, inclusive of negative $0.04 impact from acquired IPR&D and milestones See Slides 21 - 25 of this presentation for a reconciliation of non - GAAP measures.

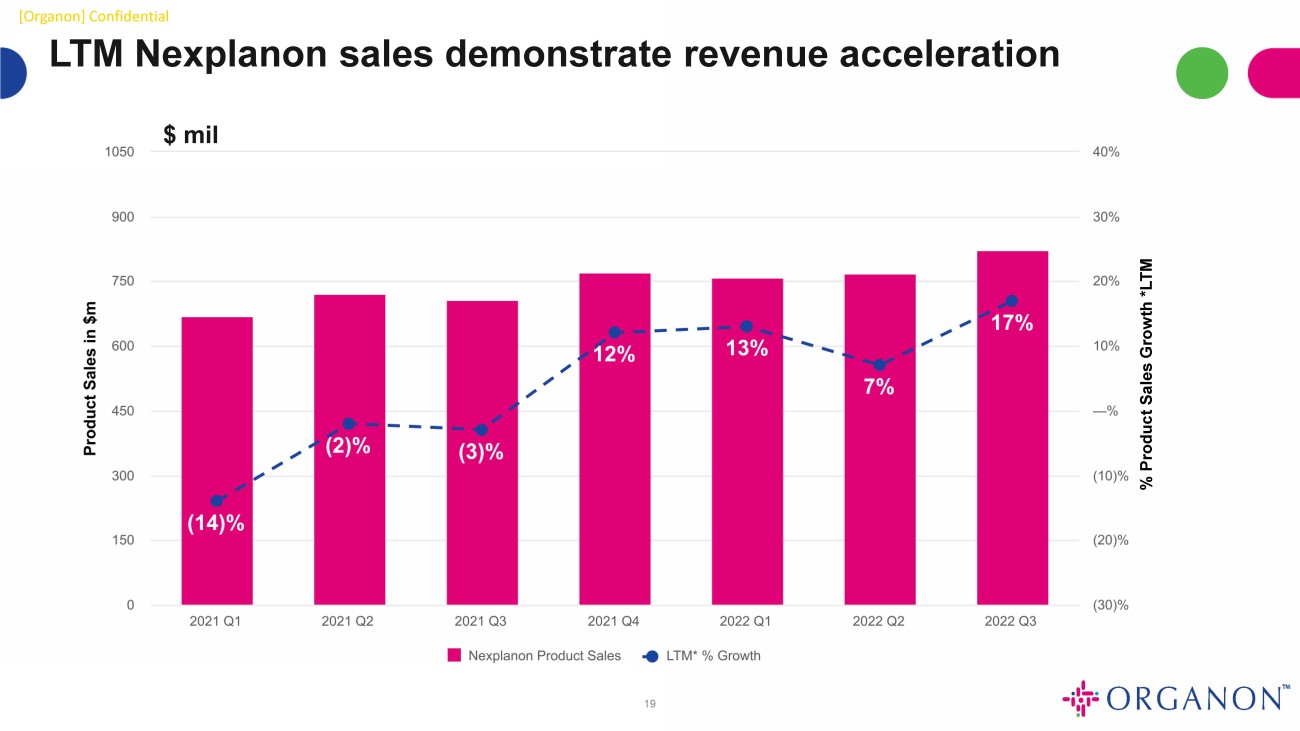

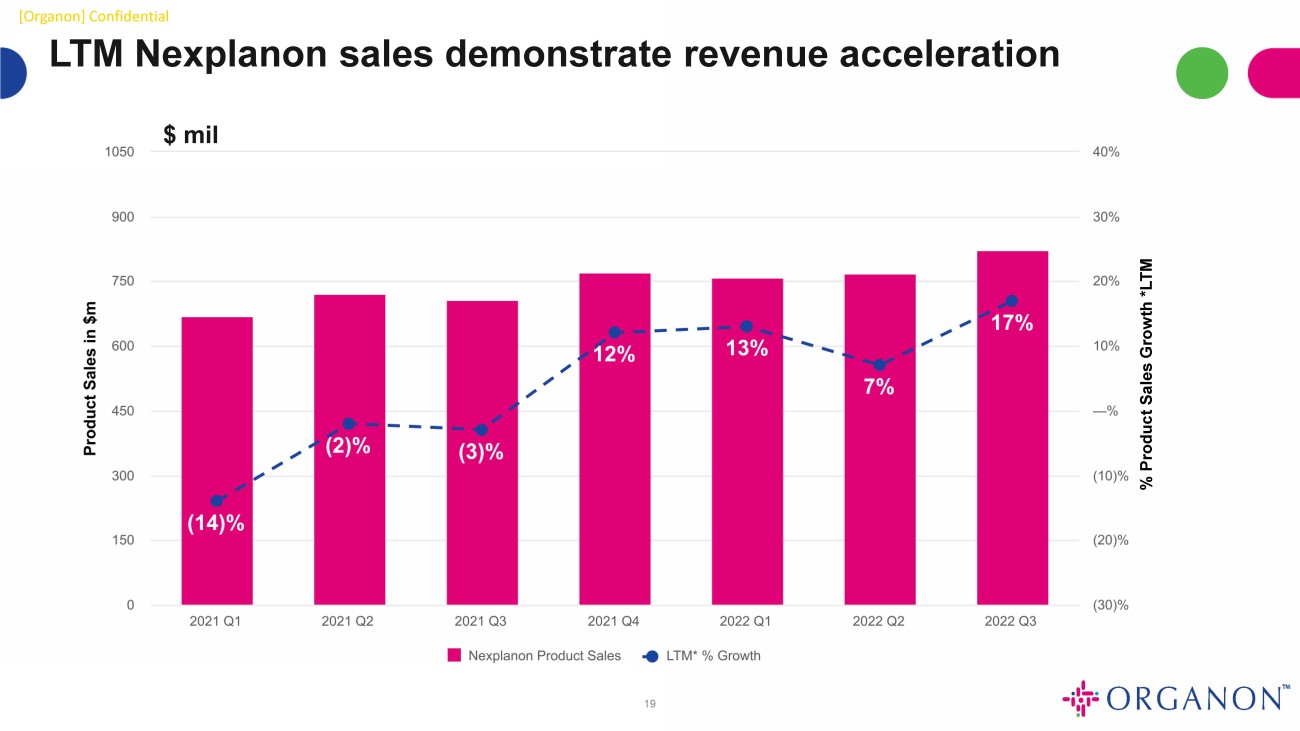

[Organon] Confidential Each franchise contributed to growth Women's Health Biosimilars Established Brands • Nexplanon record - setting quarter • Franchise growth of 23% on constant currency basis • Double digit growth in fertility • Building pipeline for future growth; first patient in OG - 6219 • Continued uptake in Renflexis and Ontruzant in U.S. • Tender phasing visible in quarterly results, but delivering double growth digit YTD • Delivered 6% constant currency growth YTD, anticipating modest growth in 2022 on constant currency basis 5

[Organon] Confidential Delivering stability in Established Brands $ mil 6 % Product Sales Growth *LTM

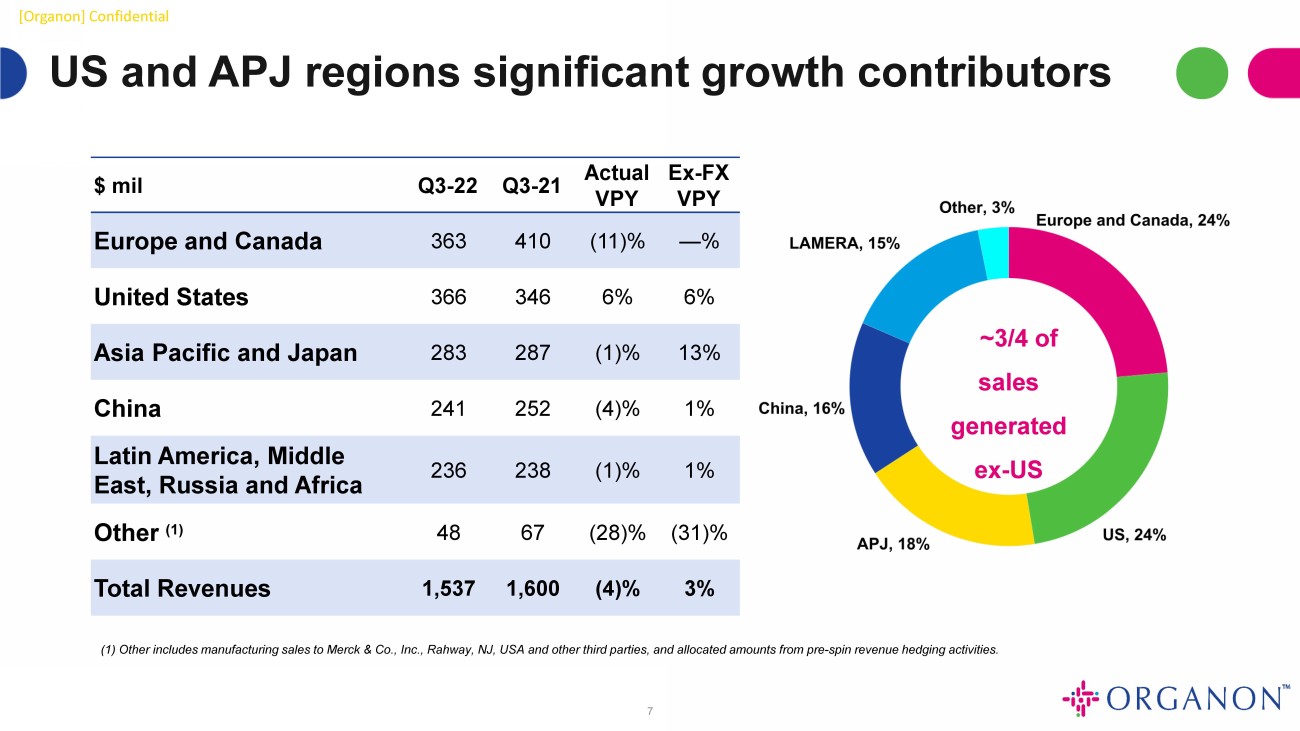

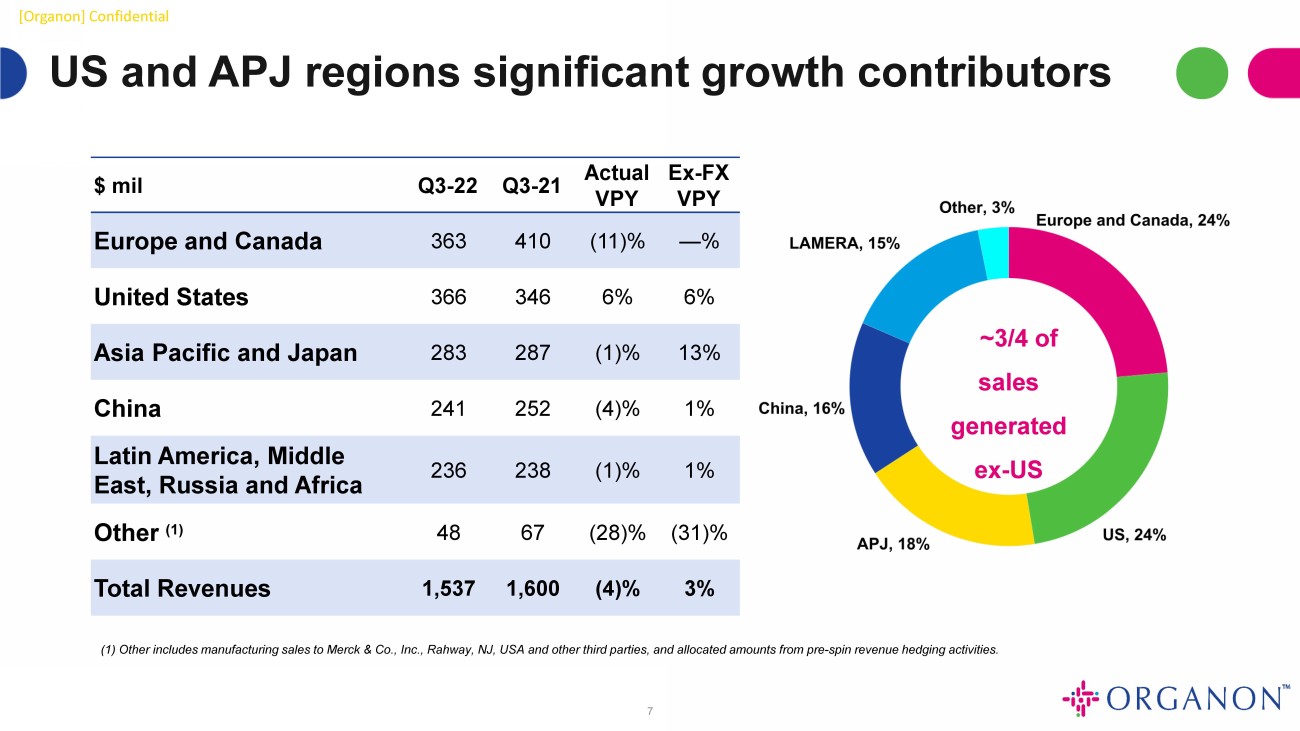

[Organon] Confidential US and APJ regions significant growth contributors $ mil Q3 - 22 Q3 - 21 Actual VPY Ex - FX VPY Europe and Canada 363 410 (11)% — % United States 366 346 6% 6% Asia Pacific and Japan 283 287 (1)% 13% China 241 252 (4)% 1% Latin America, Middle East, Russia and Africa 236 238 (1)% 1% Other (1) 48 67 (28)% (31)% Total Revenues 1,537 1,600 (4)% 3% 7 ~3/4 of sales generated ex - US (1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties, and allocated amounts f rom pre - spin revenue hedging activities.

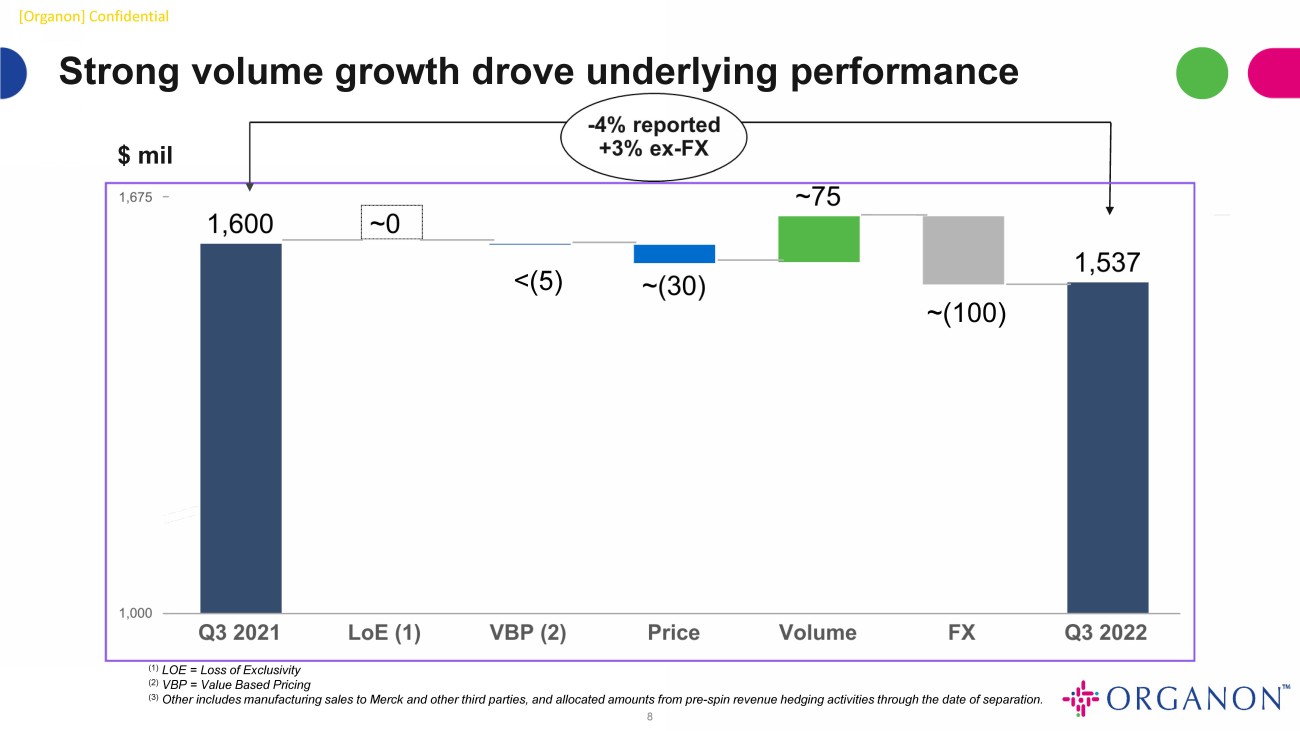

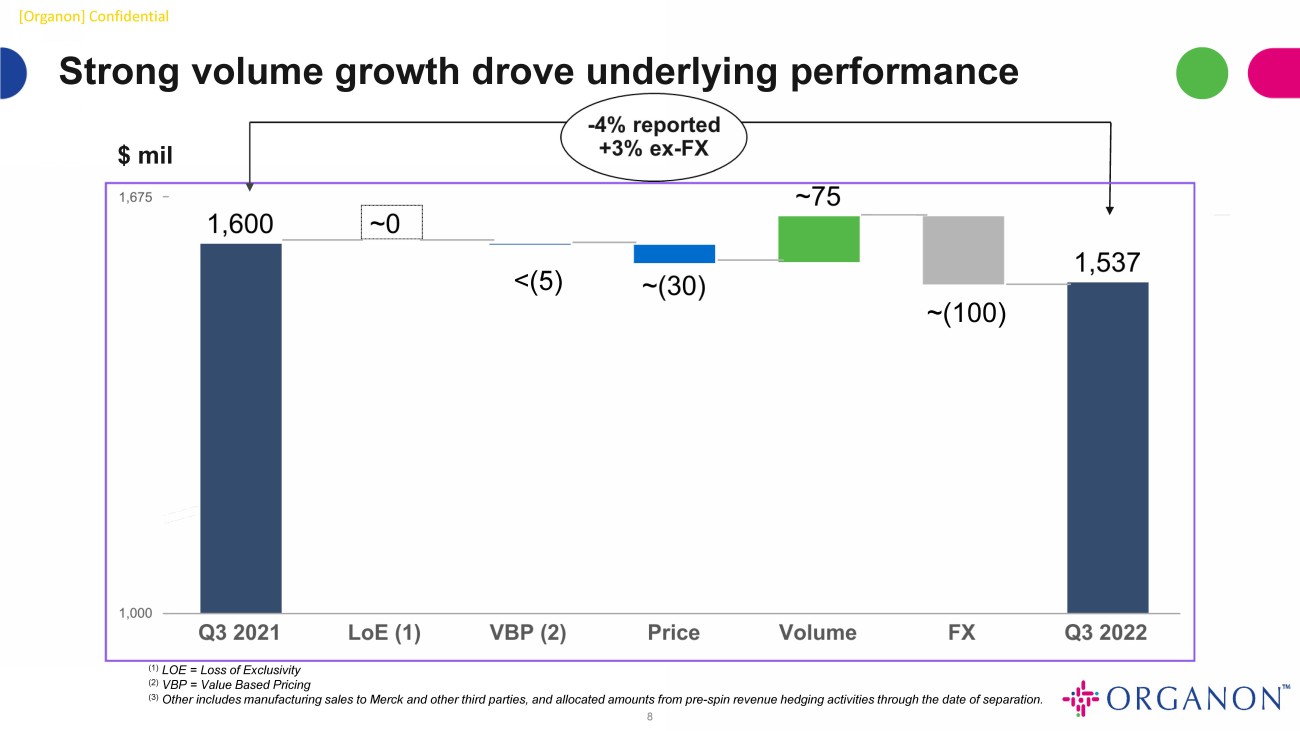

[Organon] Confidential Strong volume growth drove underlying performance $ mil 8 (1) LOE = Loss of Exclusivity (2) VBP = Value Based Pricing (3) Other includes manufacturing sales to Merck and other third parties, and allocated amounts from pre - spin revenue hedging activit ies through the date of separation. <(5) ~(100)

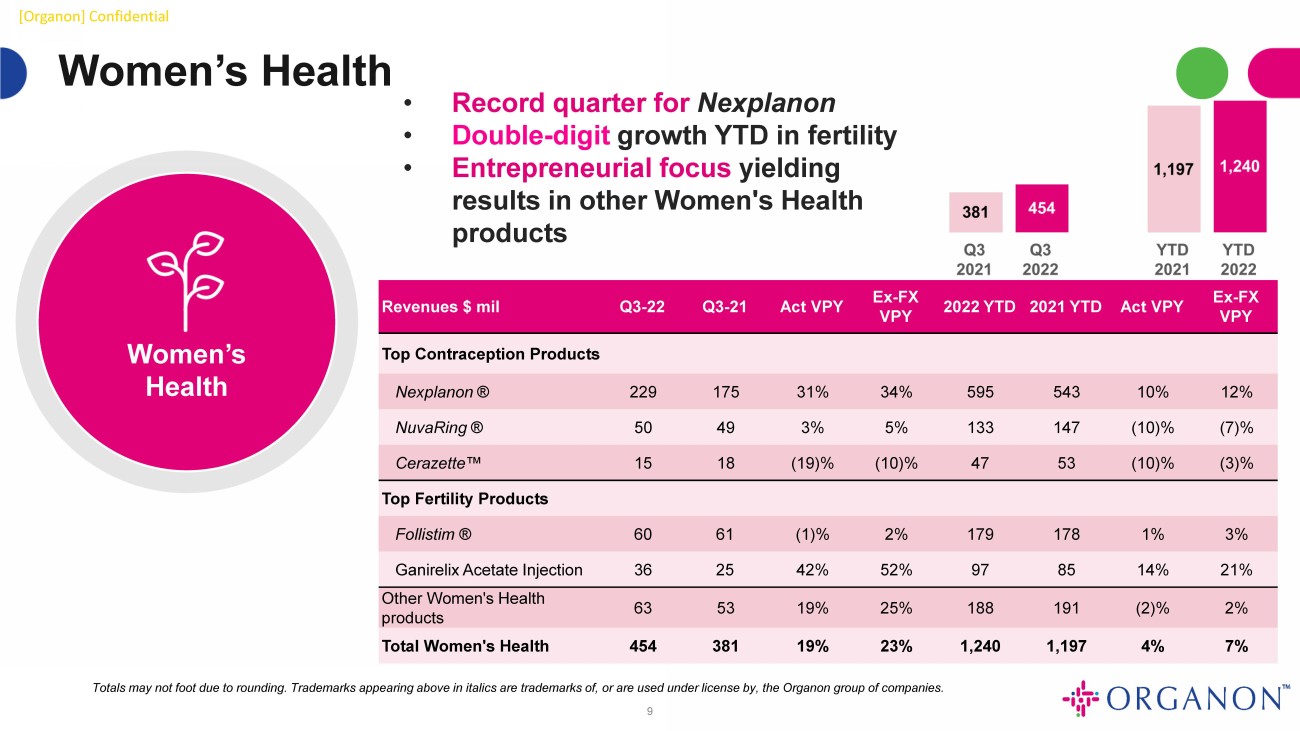

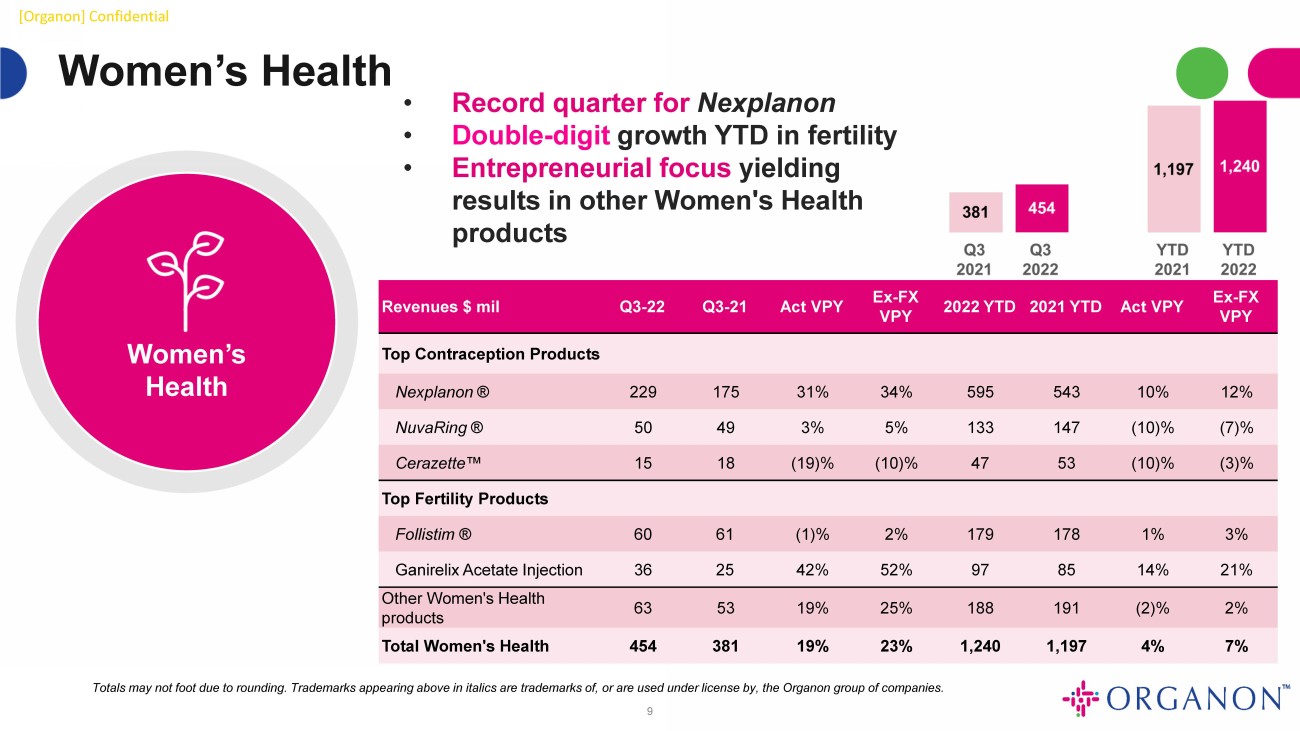

[Organon] Confidential Women’s Health Women’s Health Revenues $ mil Q3 - 22 Q3 - 21 Act VPY Ex - FX VPY 2022 YTD 2021 YTD Act VPY Ex - FX VPY Top Contraception Products Nexplanon ® 229 175 31% 34% 595 543 10% 12% NuvaRing ® 50 49 3% 5% 133 147 (10)% (7)% Cerazette Œ 15 18 (19)% (10)% 47 53 (10)% (3)% Top Fertility Products Follistim ® 60 61 (1)% 2% 179 178 1% 3% Ganirelix Acetate Injection 36 25 42% 52% 97 85 14% 21% Other Women's Health products 63 53 19% 25% 188 191 (2)% 2% Total Women's Health 454 381 19% 23% 1,240 1,197 4% 7% 9 • Record quarter for Nexplanon • Double - digit growth YTD in fertility • Entrepreneurial focus yielding results in other Women's Health products Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

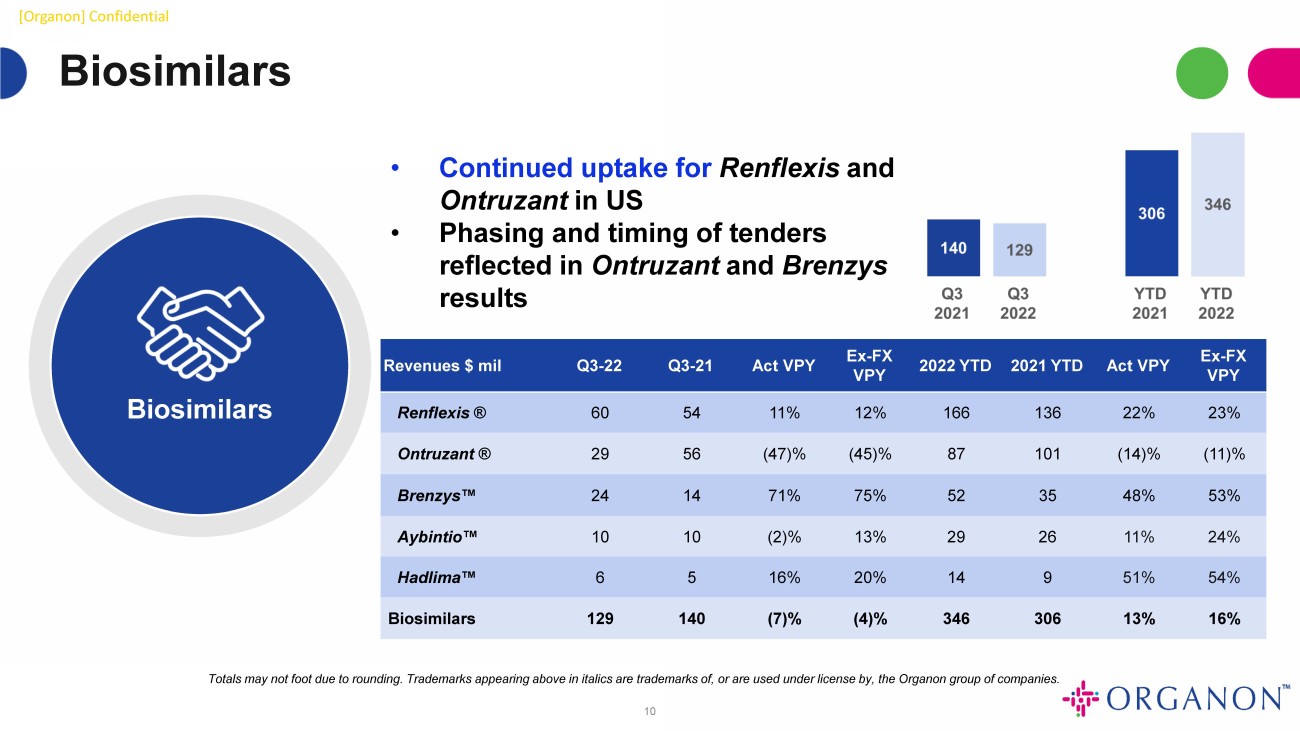

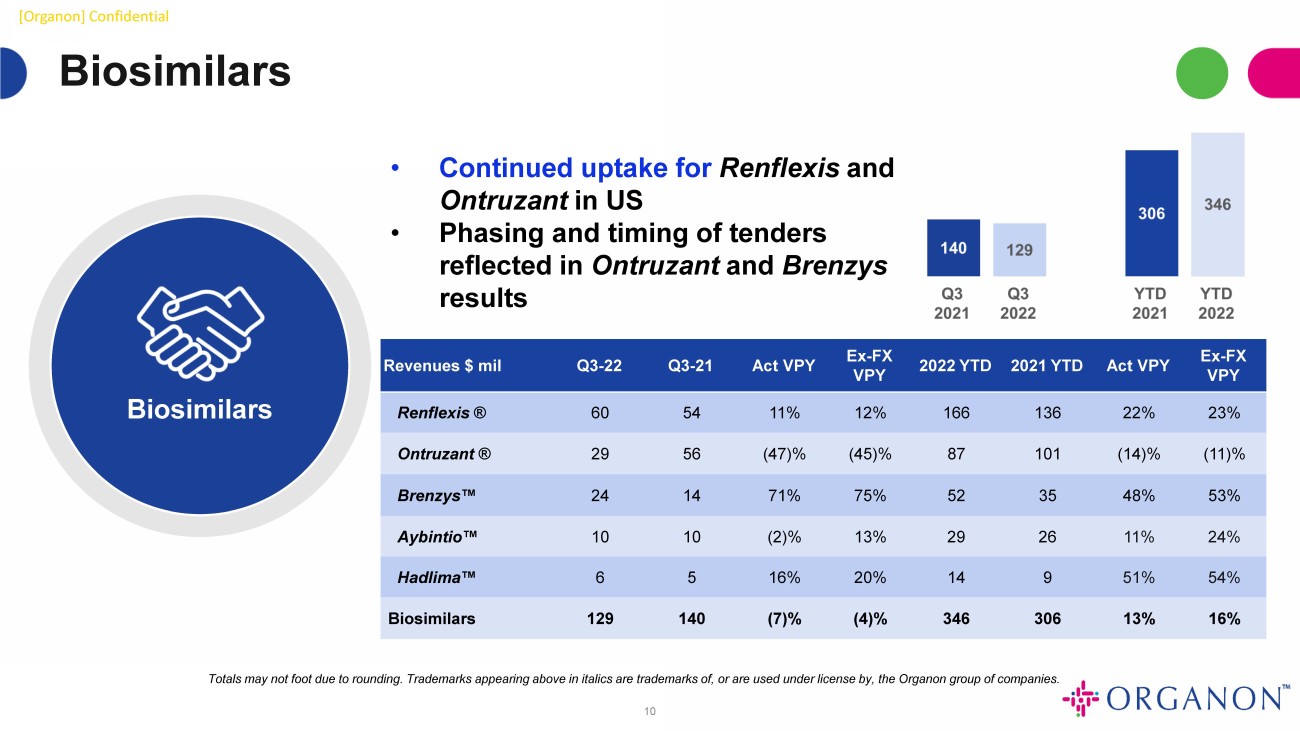

[Organon] Confidential Biosimilars Biosimilars Revenues $ mil Q3 - 22 Q3 - 21 Act VPY Ex - FX VPY 2022 YTD 2021 YTD Act VPY Ex - FX VPY Renflexis ® 60 54 11% 12% 166 136 22% 23% Ontruzant ® 29 56 (47)% (45)% 87 101 (14)% (11)% Brenzys Œ 24 14 71% 75% 52 35 48% 53% Aybintio Œ 10 10 (2)% 13% 29 26 11% 24% Hadlima Œ 6 5 16% 20% 14 9 51% 54% Biosimilars 129 140 (7)% (4)% 346 306 13% 16% 10 • Continued uptake for Renflexis and Ontruzant in US • Phasing and timing of tenders reflected in Ontruzant and Brenzys results Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

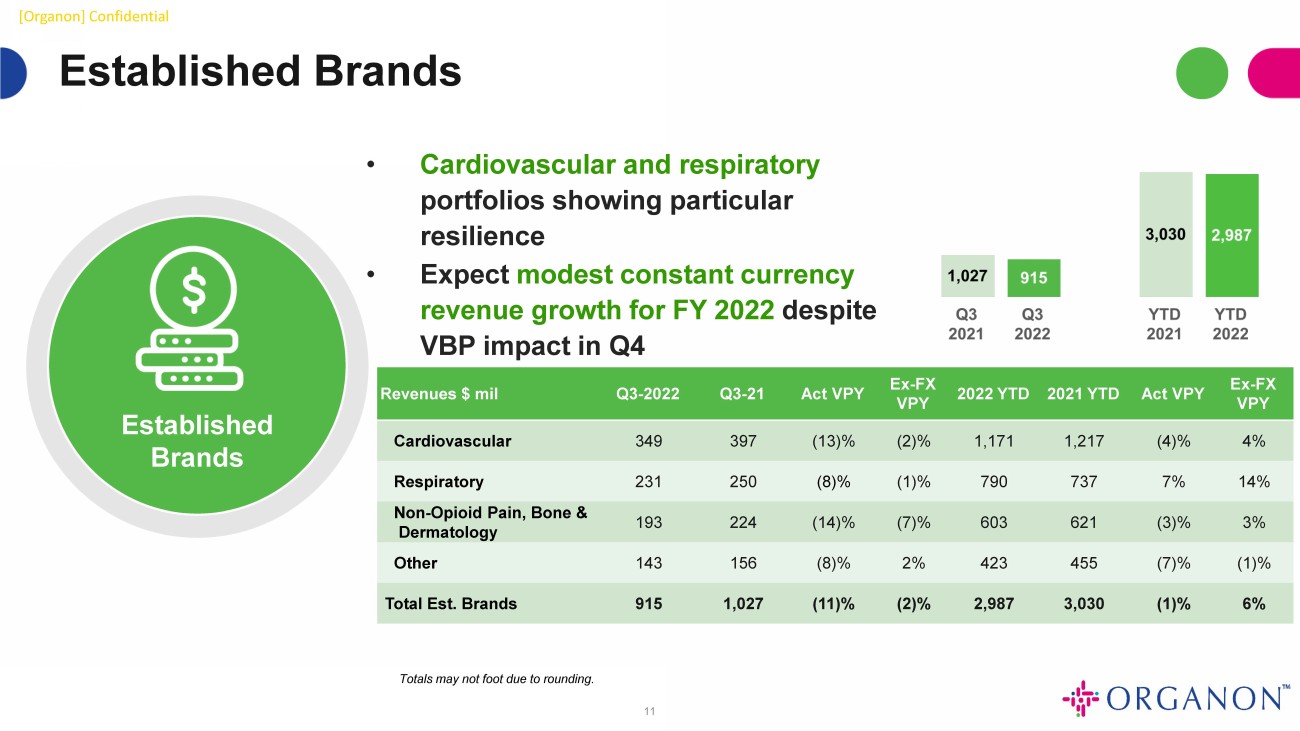

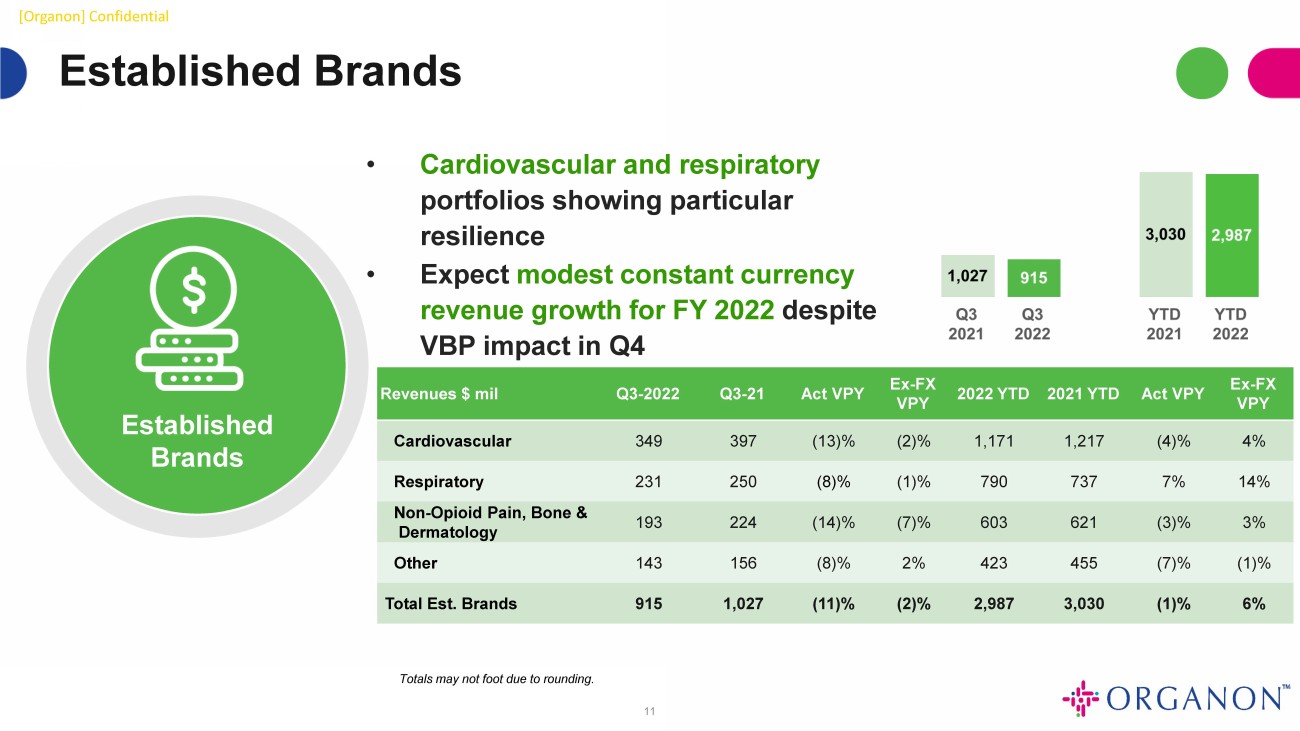

[Organon] Confidential Established Brands Established Brands Revenues $ mil Q3 - 2022 Q3 - 21 Act VPY Ex - FX VPY 2022 YTD 2021 YTD Act VPY Ex - FX VPY Cardiovascular 349 397 (13)% (2)% 1,171 1,217 (4)% 4% Respiratory 231 250 (8)% (1)% 790 737 7% 14% Non - Opioid Pain, Bone & Dermatology 193 224 (14)% (7)% 603 621 (3)% 3% Other 143 156 (8)% 2% 423 455 (7)% (1)% Total Est. Brands 915 1,027 (11)% (2)% 2,987 3,030 (1)% 6% 11 • Cardiovascular and respiratory portfolios showing particular resilience • Expect modest constant currency revenue growth for FY 2022 despite VBP impact in Q4 Totals may not foot due to rounding .

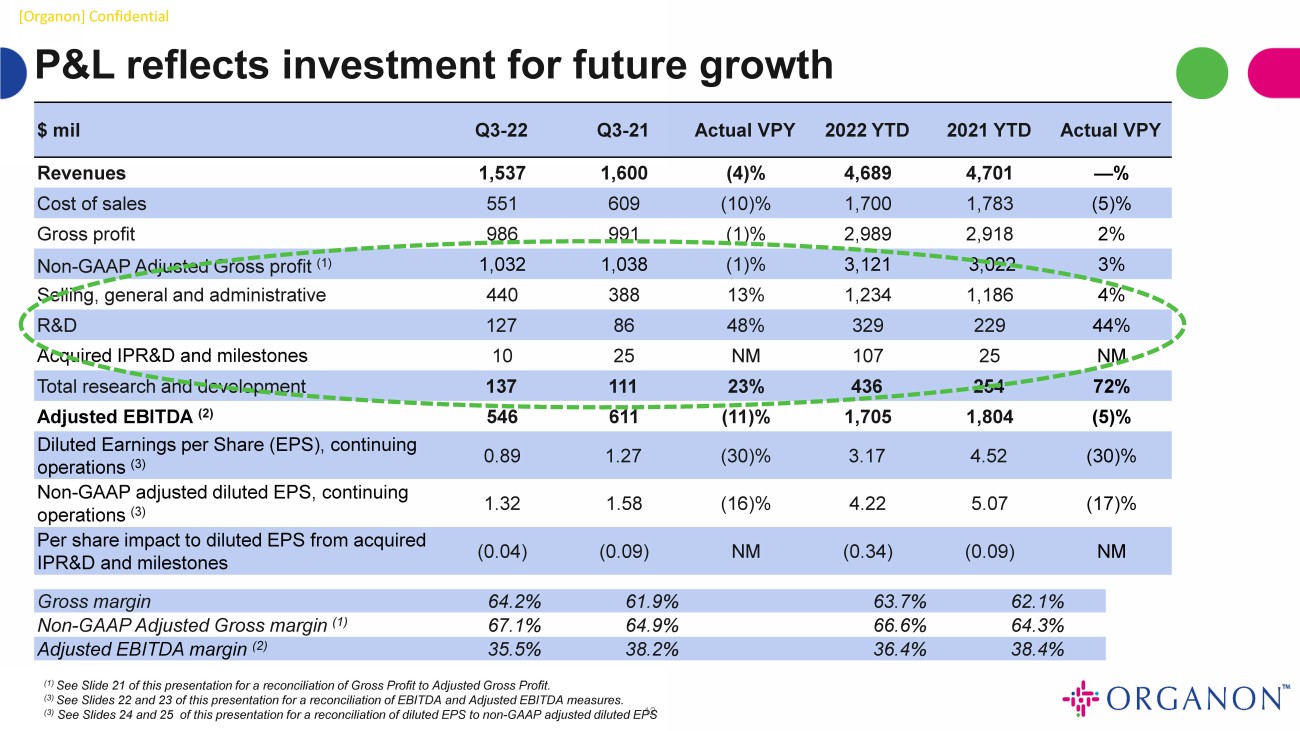

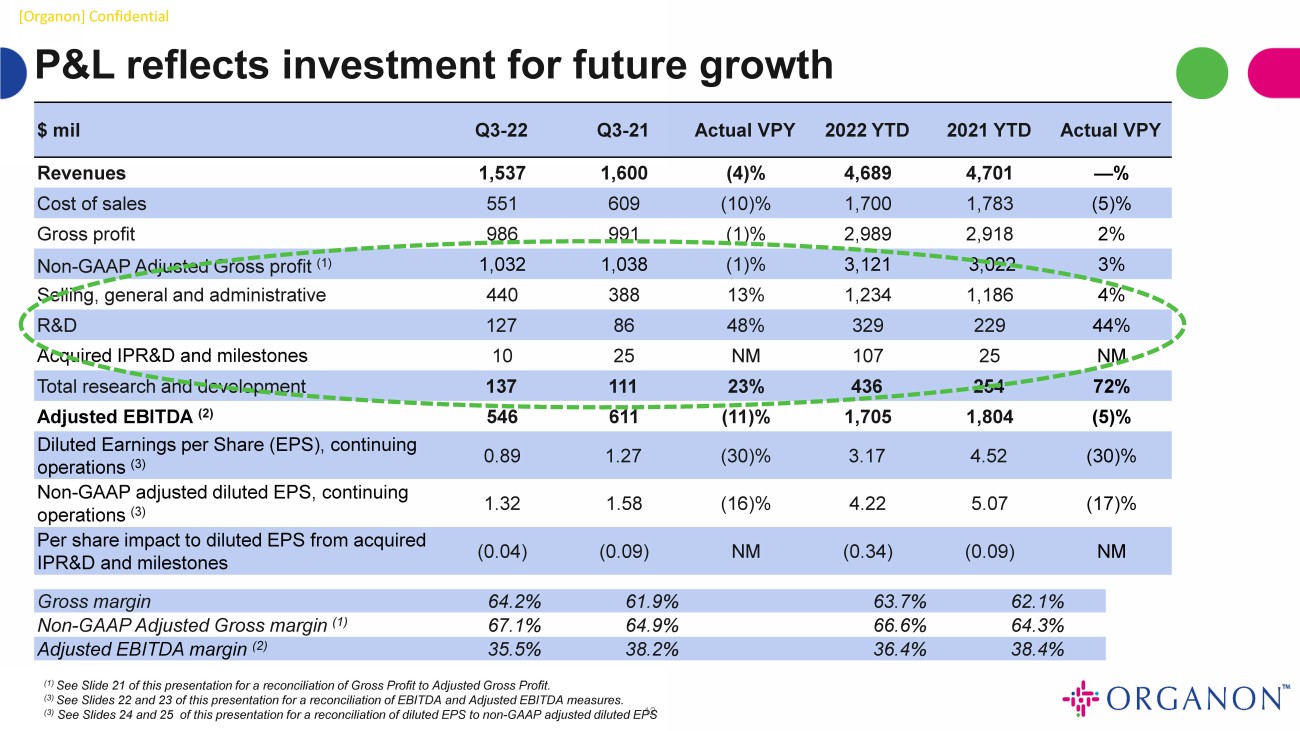

[Organon] Confidential P&L reflects investment for future growth $ mil Q3 - 22 Q3 - 21 Actual VPY 2022 YTD 2021 YTD Actual VPY Revenues 1,537 1,600 (4)% 4,689 4,701 — % Cost of sales 551 609 (10)% 1,700 1,783 (5)% Gross profit 986 991 (1)% 2,989 2,918 2% Non - GAAP Adjusted Gross profit (1) 1,032 1,038 (1)% 3,121 3,022 3% Selling, general and administrative 440 388 13% 1,234 1,186 4% R&D 127 86 48% 329 229 44% Acquired IPR&D and milestones 10 25 NM 107 25 NM Total research and development 137 111 23% 436 254 72% Adjusted EBITDA (2) 546 611 (11)% 1,705 1,804 (5)% Diluted Earnings per Share (EPS), continuing operations (3) 0.89 1.27 (30)% 3.17 4.52 (30)% Non - GAAP adjusted diluted EPS, continuing operations (3) 1.32 1.58 (16)% 4.22 5.07 (17)% Per share impact to diluted EPS from acquired IPR&D and milestones (0.04) (0.09) NM (0.34) (0.09) NM 12 (1) See Slide 21 of this presentation for a reconciliation of Gross Profit to Adjusted Gross Profit. (3) See Slides 22 and 23 of this presentation for a reconciliation of EBITDA and Adjusted EBITDA measures. (3) See Slides 24 and 25 of this presentation for a reconciliation of diluted EPS to non - GAAP adjusted diluted EPS Gross margin 64.2% 61.9% 63.7% 62.1% Non - GAAP Adjusted Gross margin (1) 67.1% 64.9% 66.6% 64.3% Adjusted EBITDA margin (2) 35.5% 38.2% 36.4% 38.4%

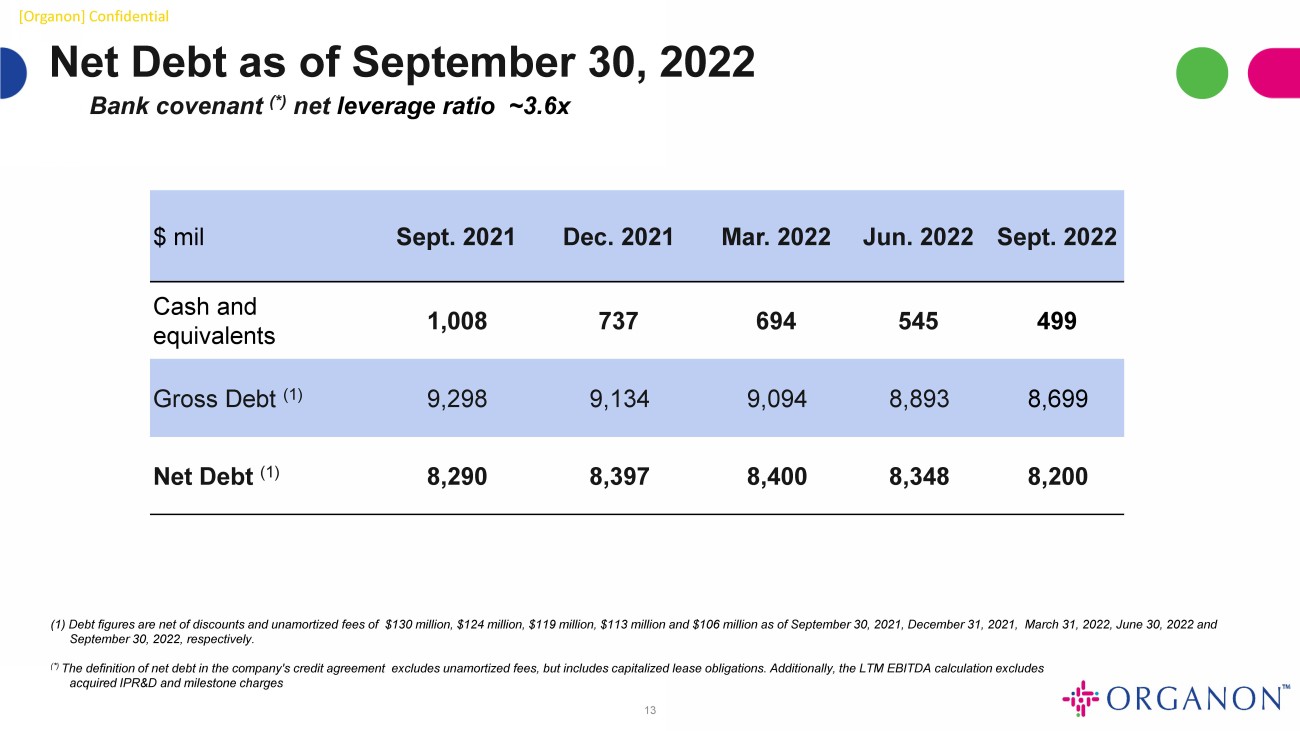

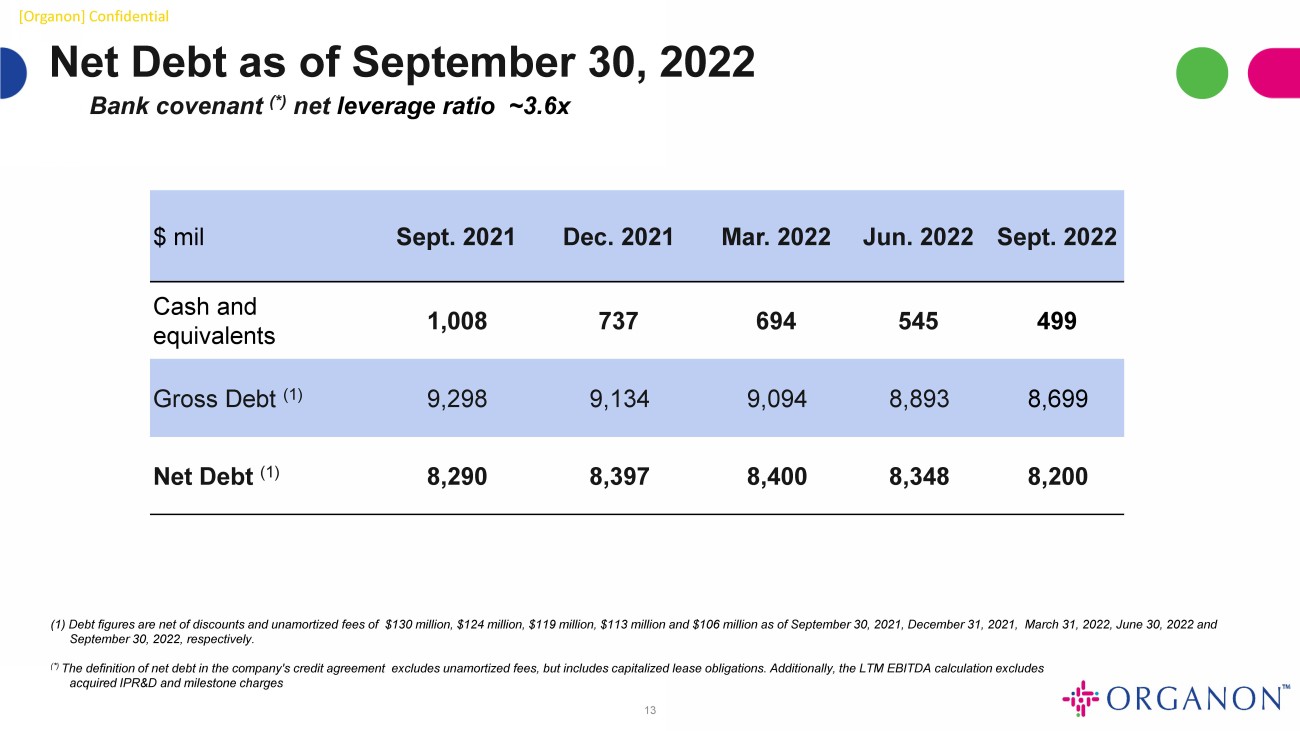

[Organon] Confidential 13 Bank covenant (*) net leverage ratio ~3.6x Net Debt as of September 30, 2022 $ mil Sept. 2021 Dec. 2021 Mar. 2022 Jun. 2022 Sept. 2022 Cash and equivalents 1,008 737 694 545 499 Gross Debt (1) 9,298 9,134 9,094 8,893 8,699 Net Debt (1) 8,290 8,397 8,400 8,348 8,200 (1) Debt figures are net of discounts and unamortized fees of $130 million, $124 million, $119 million, $113 million and $10 6 m illion as of September 30, 2021, December 31, 2021, March 31, 2022, June 30, 2022 and September 30, 2022, respectively. (*) The definition of net debt in the company's credit agreement excludes unamortized fees, but includes capitalized lease oblig ati ons. Additionally, the LTM EBITDA calculation excludes acquired IPR&D and milestone charges

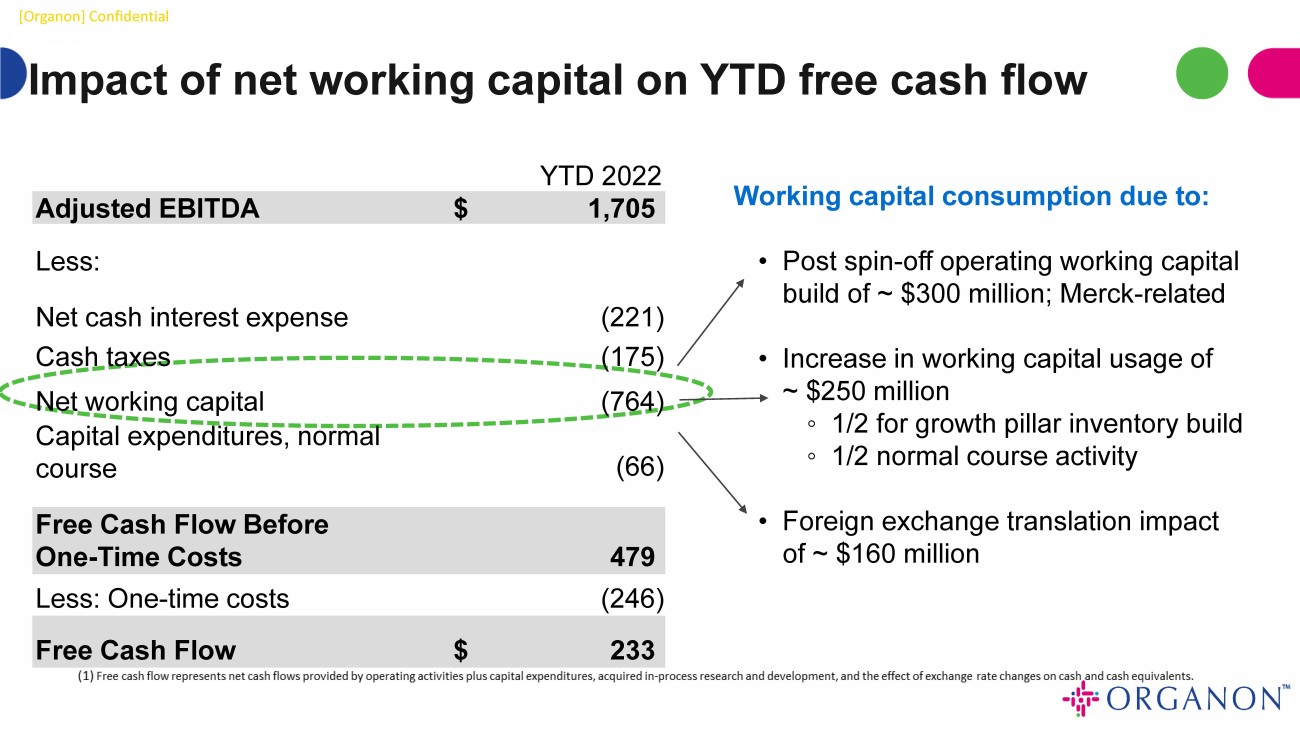

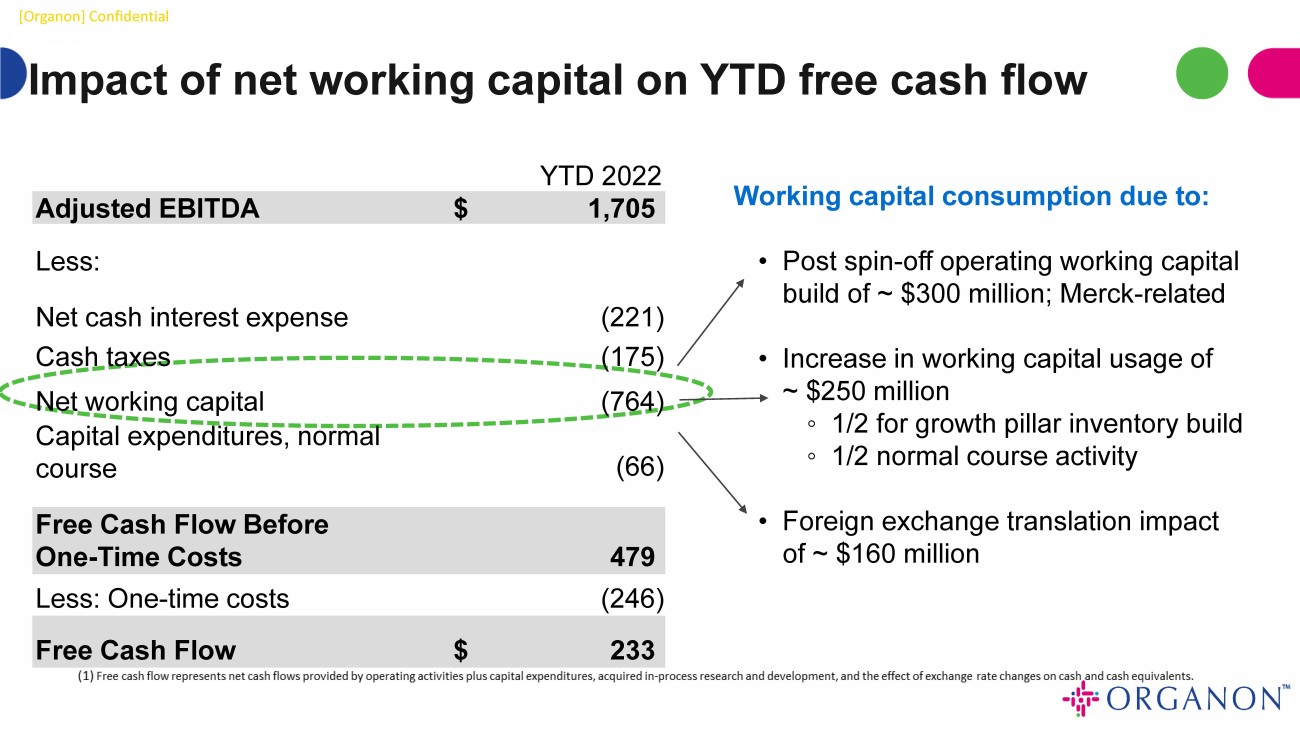

[Organon] Confidential Impact of net working capital on YTD free cash flow YTD 2022 Adjusted EBITDA $ 1,705 Less: Net cash interest expense (221) Cash taxes (175) Net working capital (764) Capital expenditures, normal course (66) Free Cash Flow Before One - Time Costs 479 Less: One - time costs (246) Free Cash Flow $ 233 Working capital consumption due to: • Post spin - off operating working capital build of ~ $300 million; Merck - related • Increase in working capital usage of ~ $250 million ◦ 1/2 for growth pillar inventory build ◦ 1/2 normal course activity • Foreign exchange translation impact of ~ $160 million

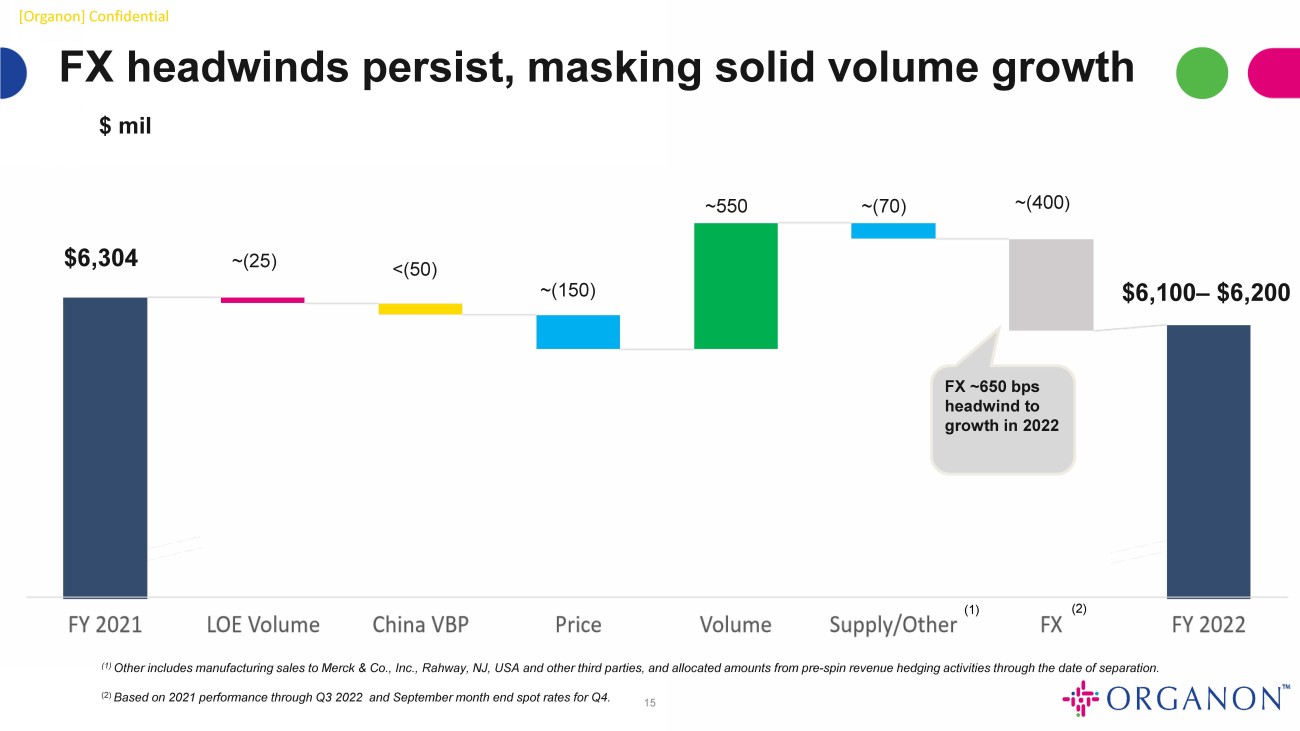

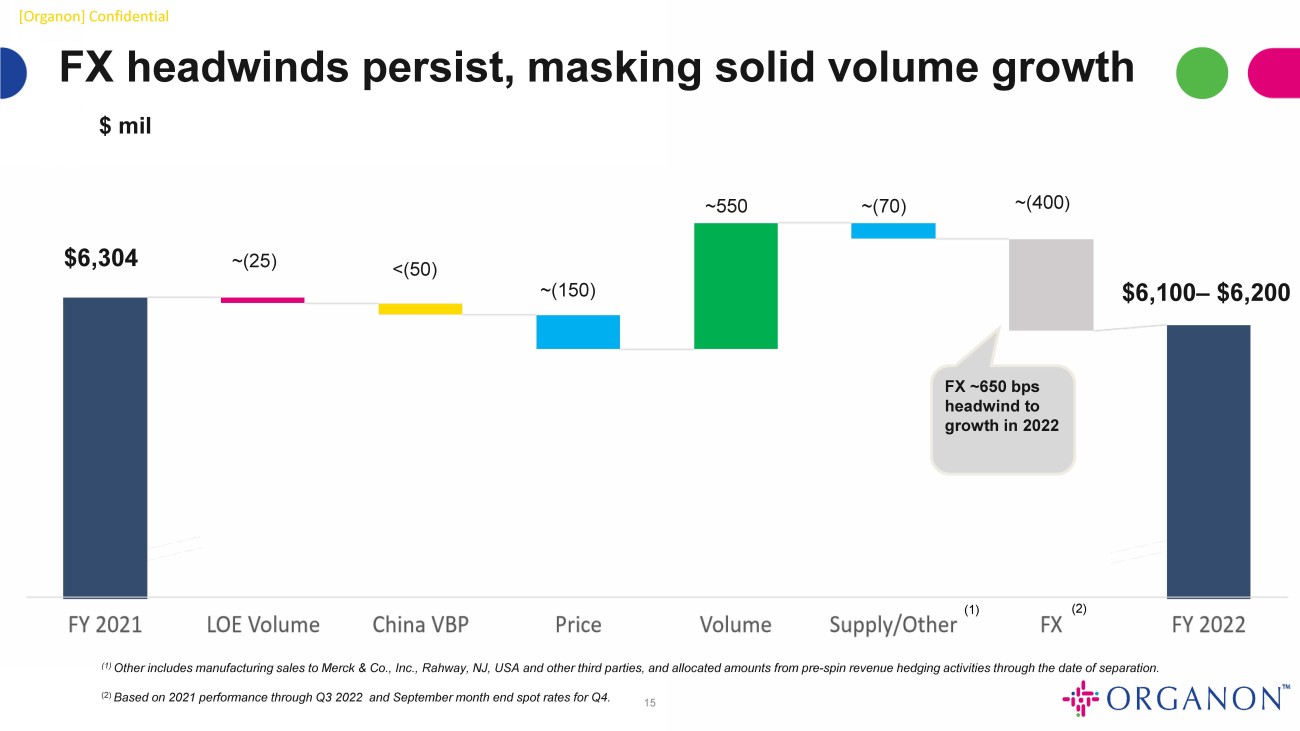

[Organon] Confidential $ mil 15 FX headwinds persist, masking solid volume growth (1) (2) $6,304 $6,100 – $6,200 ~(25) <(50) ~(150) ~550 ~(70) ~(400 ) FX ~650 bps headwind to growth in 2022 (1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties, and allocated amounts from pre - spin revenue hedging activities through the date of separation. (2) Based on 2021 performance through Q3 2022 and September month end spot rates for Q4.

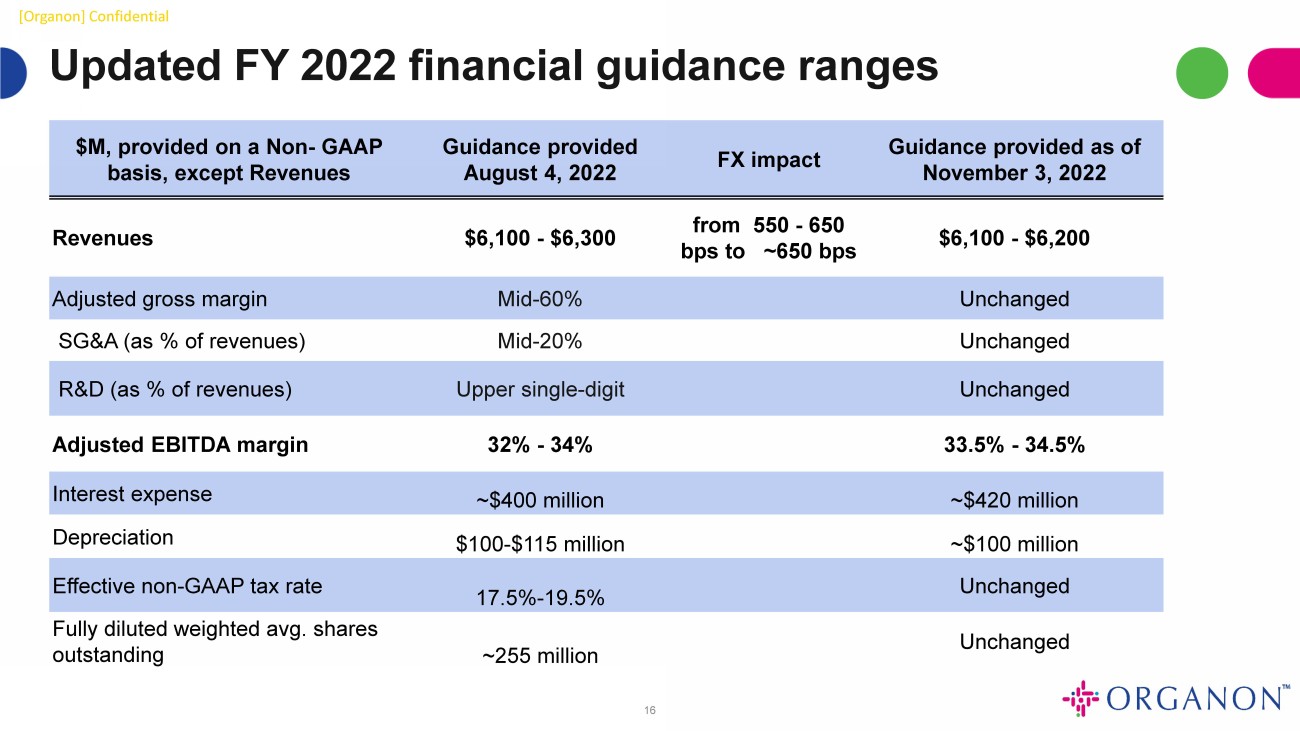

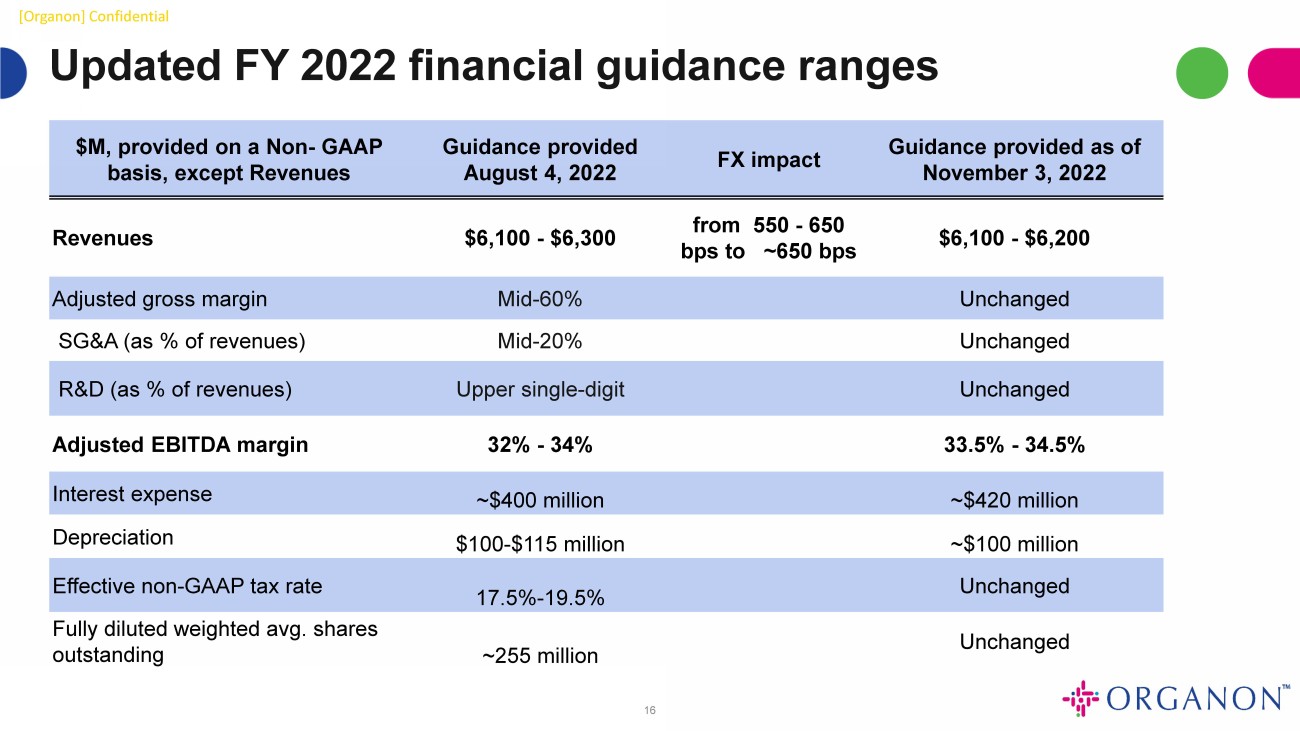

[Organon] Confidential Updated FY 2022 financial guidance ranges 16 $M, provided on a Non - GAAP basis, except Revenues Guidance provided August 4, 2022 FX impact Guidance provided as of November 3, 2022 Revenues $6,100 - $6,300 from 550 - 650 bps to ~650 bps $6,100 - $6,200 Adjusted gross margin Mid - 60% Unchanged SG&A (as % of revenues) Mid - 20% Unchanged R&D (as % of revenues) Upper single - digit Unchanged Adjusted EBITDA margin 32% - 34% 33.5% - 34.5% Interest expense ~$400 million ~$420 million Depreciation $100 - $115 million ~$100 million Effective non - GAAP tax rate 17.5% - 19.5% Unchanged Fully diluted weighted avg. shares outstanding ~255 million Unchanged

[Organon] Confidential Q&A

[Organon] Confidential Appendix

[Organon] Confidential LTM Nexplanon sales demonstrate revenue acceleration $ mil 19 % Product Sales Growth *LTM

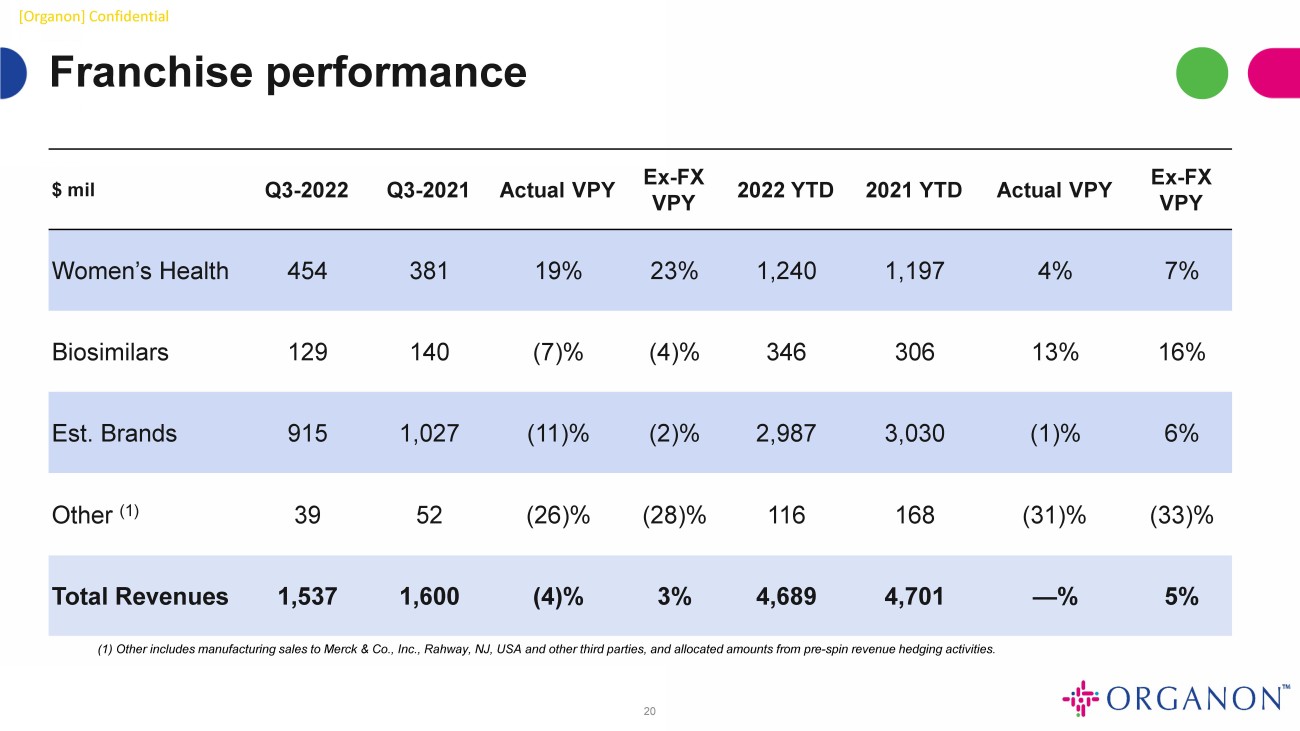

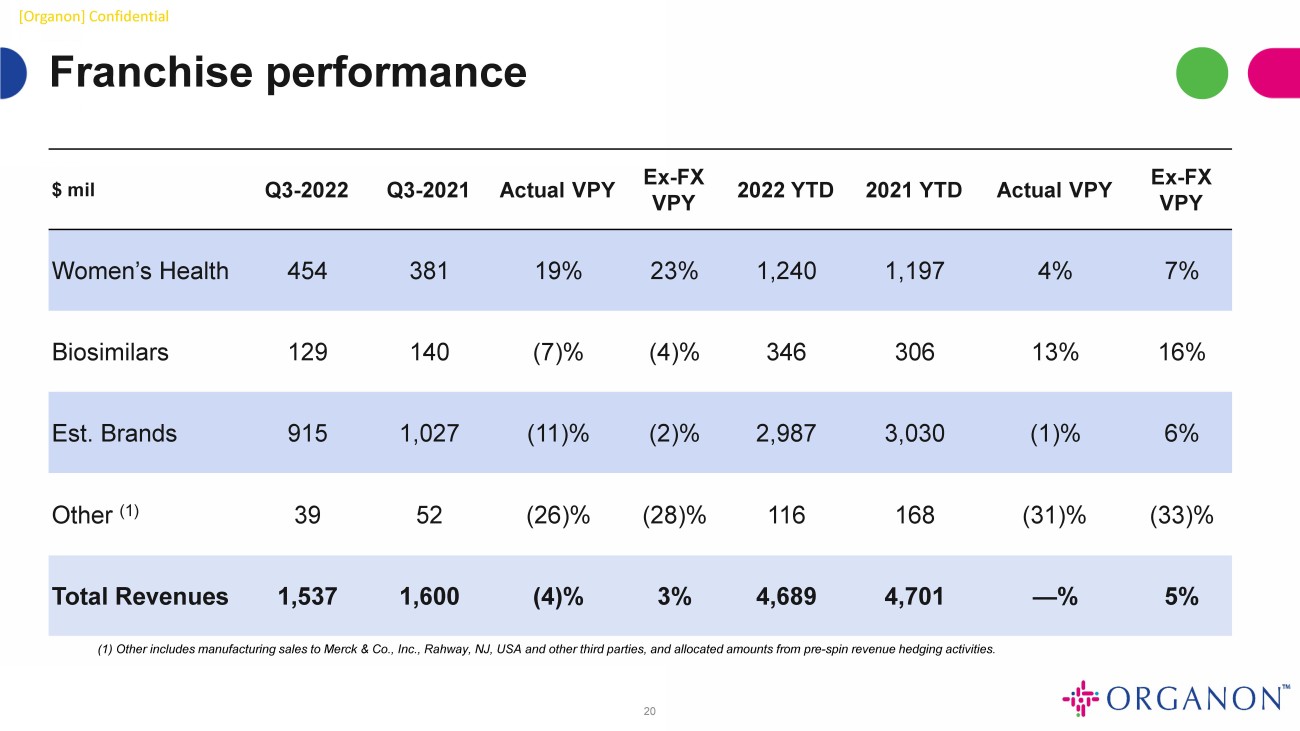

[Organon] Confidential Franchise performance $ mil Q3 - 2022 Q3 - 2021 Actual VPY Ex - FX VPY 2022 YTD 2021 YTD Actual VPY Ex - FX VPY Women’s Health 454 381 19% 23% 1,240 1,197 4% 7% Biosimilars 129 140 (7)% (4)% 346 306 13% 16% Est. Brands 915 1,027 (11)% (2)% 2,987 3,030 (1)% 6% Other (1) 39 52 (26)% (28)% 116 168 (31)% (33)% Total Revenues 1,537 1,600 (4)% 3% 4,689 4,701 — % 5% (1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties, and allocated amounts f rom pre - spin revenue hedging activities. 20

[Organon] Confidential Gross margin reconciliation $ mil Q3 - 2022 Q3 - 2021 2022 YTD 2021 YTD Revenues 1,537 1,600 4,689 4,701 Cost of sales 551 609 1,700 1,783 Gross Profit 986 991 2,989 2,918 Gross Margin 64.2% 61.9% 63.7% 62.1% Amortization 32 27 88 69 One - time costs (1) 11 17 35 27 Stock - based compensation 3 3 9 8 Non - GAAP Adjusted Gross Profit (2) 1,032 1,038 3,121 3,022 Non - GAAP Adjusted Gross Margin 67.1% 64.9% 66.6% 64.3% (1) One - time costs for the three months ended September 30, 2022 primarily include costs to stand up the company and inventory s tep - up adjustments. One - time costs for the nine months ended September 30, 2022 primarily include costs to stand up the company and inventory step - up adjustments as well as a $9 million impairment charge rela ted to a licensed intangible asset. ( 2 ) Non - GAAP Adjusted Gross Profit is calculated by excluding amortization, one - time costs, and the portion of stock - based compensation expense allocated to Cost of sales . 21

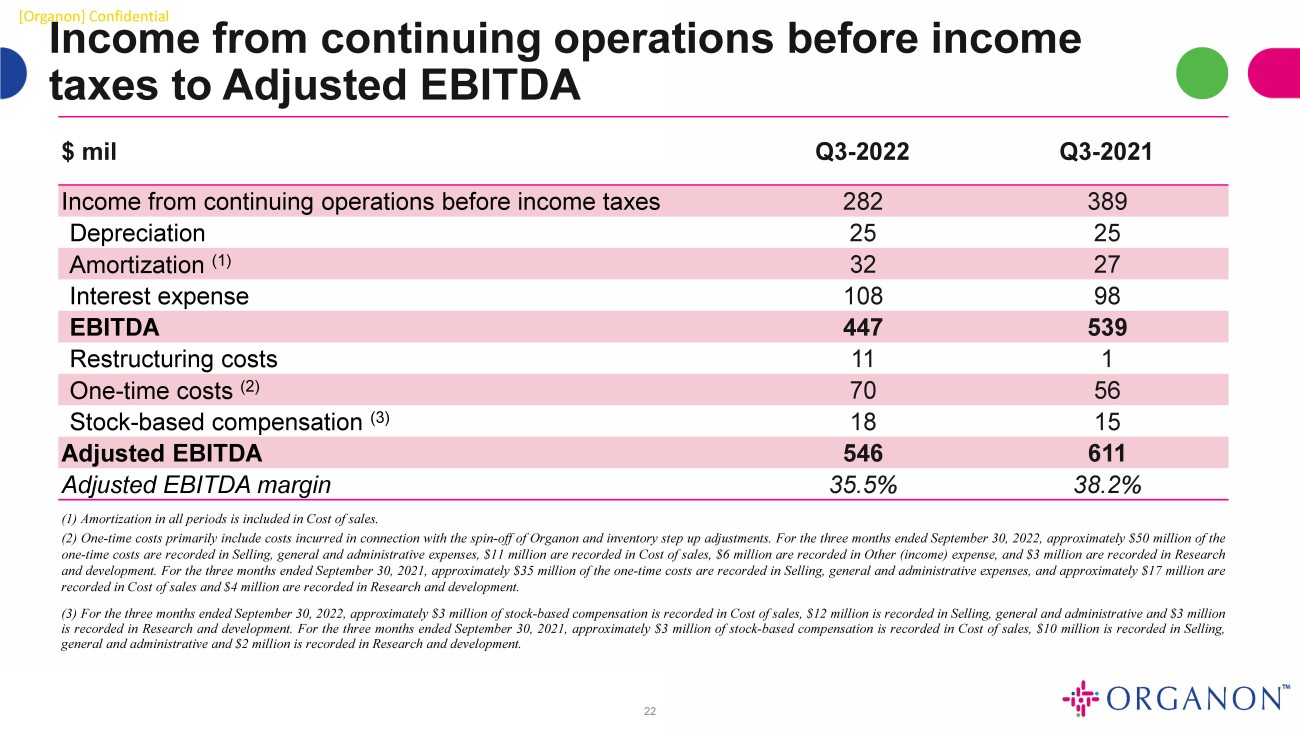

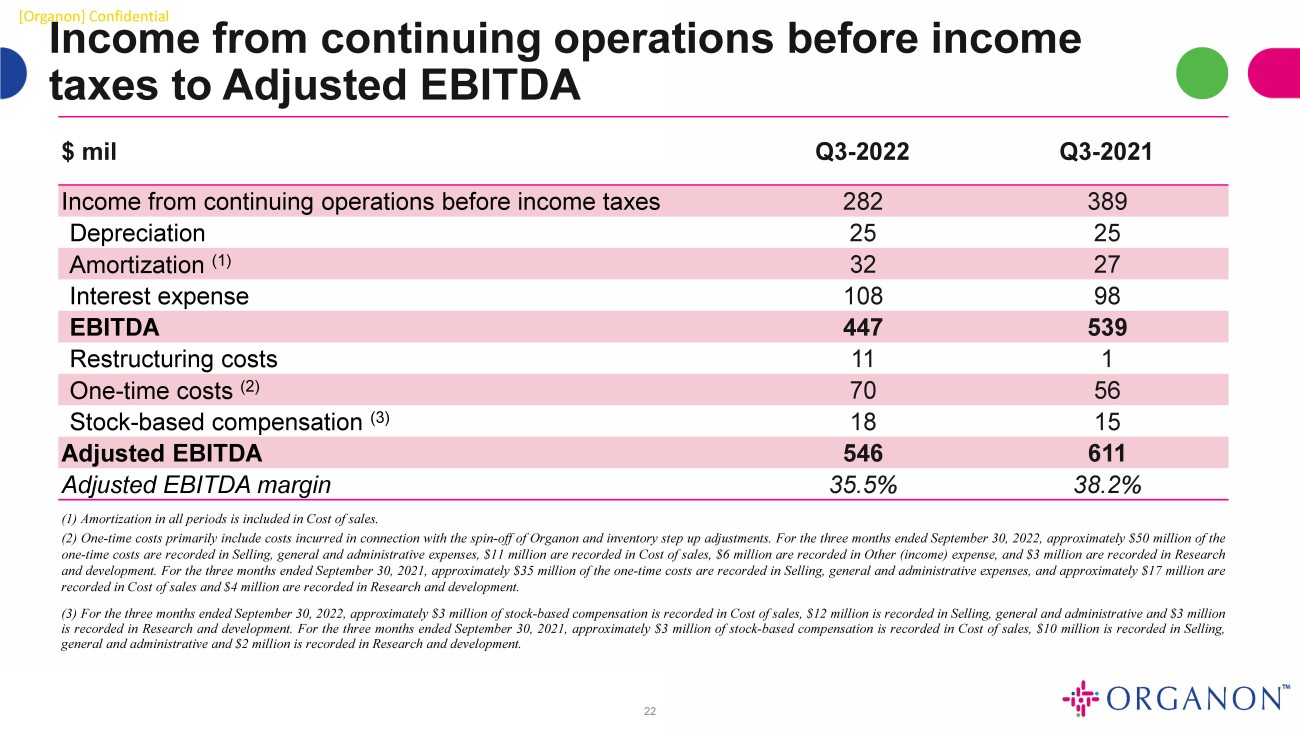

[Organon] Confidential Income from continuing operations before income taxes to Adjusted EBITDA $ mil Q3 - 2022 Q3 - 2021 Income from continuing operations before income taxes 282 389 Depreciation 25 25 Amortization (1) 32 27 Interest expense 108 98 EBITDA 447 539 Restructuring costs 11 1 One - time costs (2) 70 56 Stock - based compensation (3) 18 15 Adjusted EBITDA 546 611 Adjusted EBITDA margin 35.5% 38.2% (1) Amortization in all periods is included in Cost of sales. ( 2 ) One - time costs primarily include costs incurred in connection with the spin - off of Organon and inventory step up adjustments . For the three months ended September 30 , 2022 , approximately $ 50 million of the one - time costs are recorded in Selling, general and administrative expenses, $ 11 million are recorded in Cost of sales, $ 6 million are recorded in Other (income) expense, and $ 3 million are recorded in Research and development . For the three months ended September 30 , 2021 , approximately $ 35 million of the one - time costs are recorded in Selling, general and administrative expenses, and approximately $ 17 million are recorded in Cost of sales and $ 4 million are recorded in Research and development . ( 3 ) For the three months ended September 30 , 2022 , approximately $ 3 million of stock - based compensation is recorded in Cost of sales, $ 12 million is recorded in Selling, general and administrative and $ 3 million is recorded in Research and development . For the three months ended September 30 , 2021 , approximately $ 3 million of stock - based compensation is recorded in Cost of sales, $ 10 million is recorded in Selling, general and administrative and $ 2 million is recorded in Research and development . 22

[Organon] Confidential Income from continuing operations before income taxes to Adjusted EBITDA $ mil 2022 YTD 2021 YTD Income from continuing operations before income taxes 1,011 1,293 Depreciation 72 64 Amortization (1) 88 69 Interest expense 303 160 EBITDA 1,474 1,586 Restructuring costs 11 3 One - time costs (2) 168 171 Stock - based compensation (3) 52 44 Adjusted EBITDA 1,705 1,804 Adjusted EBITDA margin 36.4% 38.4% (1) Amortization in all periods is included in Cost of sales. ( 2 ) One - time costs primarily include costs incurred in connection with the spin - off of Organon, an impairment of a licensed intangible asset, and inventory step - up adjustments . For the nine months ended September 30 , 2022 , approximately $ 103 million of the one - time costs are recorded in Selling, general and administrative expenses, approximately $ 35 million are recorded in Cost of sales, $ 20 million are recorded in Other (income) expense, and $ 10 million are recorded in Research and development . For the nine months ended September 30 , 2021 , approximately $ 139 million of the one - time costs are recorded in Selling, general and administrative expenses, approximately $ 27 million are recorded in Cost of sales and $ 5 million are recorded in Research and development . (3) For the nine months ended September 30, 2022, approximately $9 million of stock - based compensation is recorded in Cost of sa les, $35 million is recorded in Selling, general and administrative and $8 million is recorded in Research and development. For the nine months ended September 30, 2021, approximately $8 million of stock - based compensation is recorded in Cost of sales, $26 million is recorded in Selling, general and administrative and $10 million is recorded in Research and development. 23

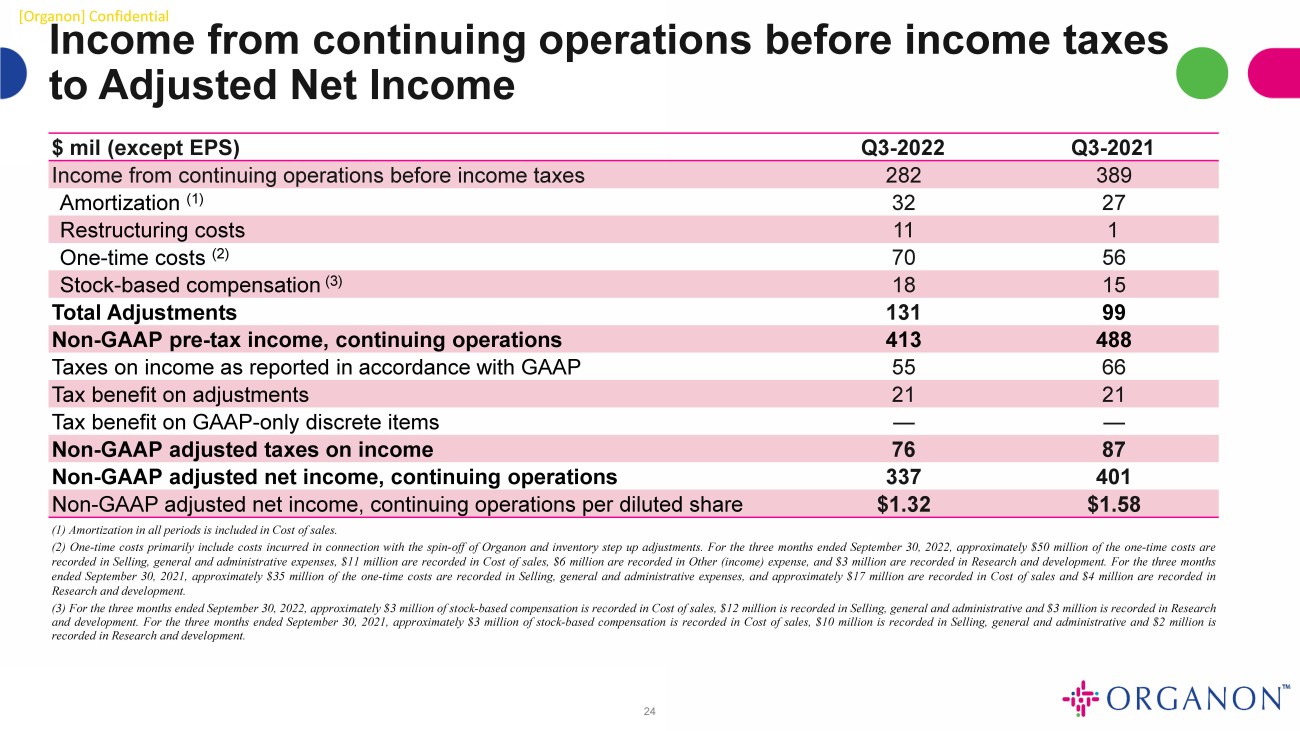

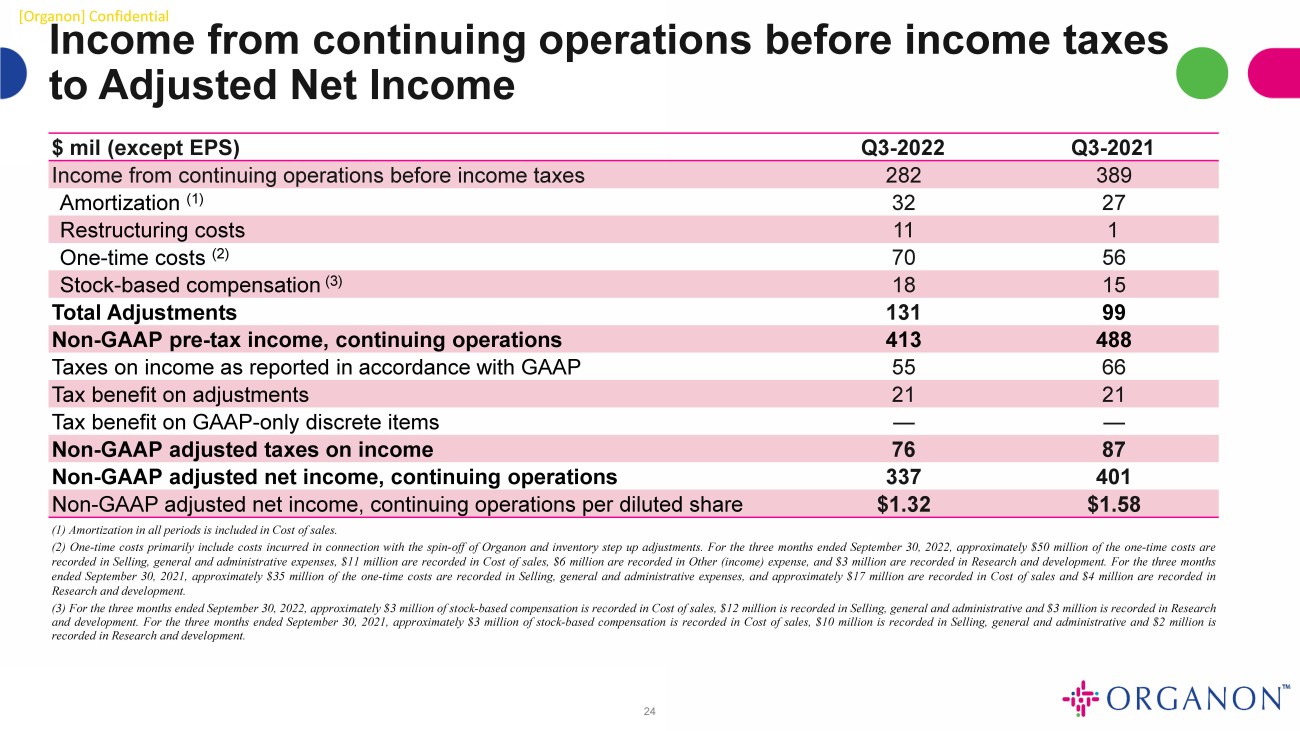

[Organon] Confidential Income from continuing operations before income taxes to Adjusted Net Income $ mil (except EPS) Q3 - 2022 Q3 - 2021 Income from continuing operations before income taxes 282 389 Amortization (1) 32 27 Restructuring costs 11 1 One - time costs (2) 70 56 Stock - based compensation (3) 18 15 Total Adjustments 131 99 Non - GAAP pre - tax income, continuing operations 413 488 Taxes on income as reported in accordance with GAAP 55 66 Tax benefit on adjustments 21 21 Tax benefit on GAAP - only discrete items — — Non - GAAP adjusted taxes on income 76 87 Non - GAAP adjusted net income, continuing operations 337 401 Non - GAAP adjusted net income, continuing operations per diluted share $1.32 $1.58 ( 1 ) Amortization in all periods is included in Cost of sales . ( 2 ) One - time costs primarily include costs incurred in connection with the spin - off of Organon and inventory step up adjustments . For the three months ended September 30 , 2022 , approximately $ 50 million of the one - time costs are recorded in Selling, general and administrative expenses, $ 11 million are recorded in Cost of sales, $ 6 million are recorded in Other (income) expense, and $ 3 million are recorded in Research and development . For the three months ended September 30 , 2021 , approximately $ 35 million of the one - time costs are recorded in Selling, general and administrative expenses, and approximately $ 17 million are recorded in Cost of sales and $ 4 million are recorded in Research and development . ( 3 ) For the three months ended September 30 , 2022 , approximately $ 3 million of stock - based compensation is recorded in Cost of sales, $ 12 million is recorded in Selling, general and administrative and $ 3 million is recorded in Research and development . For the three months ended September 30 , 2021 , approximately $ 3 million of stock - based compensation is recorded in Cost of sales, $ 10 million is recorded in Selling, general and administrative and $ 2 million is recorded in Research and development . 24

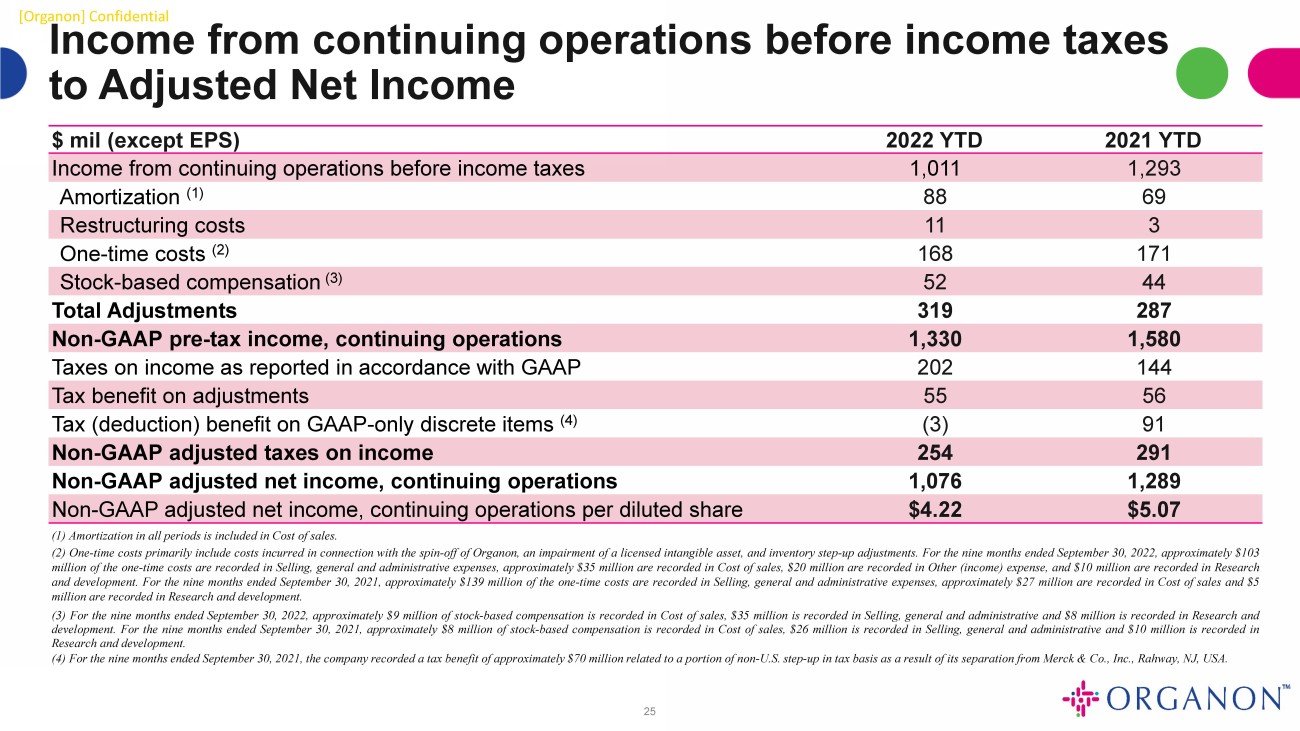

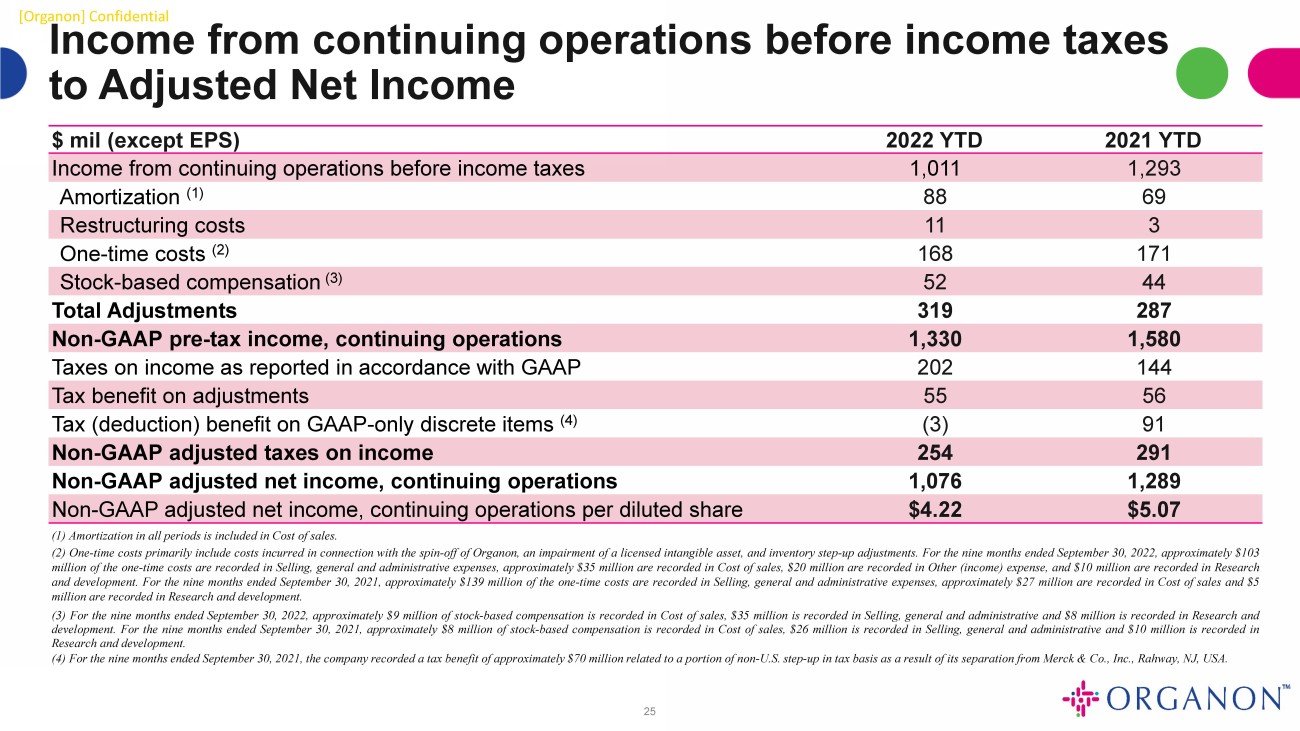

[Organon] Confidential Income from continuing operations before income taxes to Adjusted Net Income $ mil (except EPS) 2022 YTD 2021 YTD Income from continuing operations before income taxes 1,011 1,293 Amortization (1) 88 69 Restructuring costs 11 3 One - time costs (2) 168 171 Stock - based compensation (3) 52 44 Total Adjustments 319 287 Non - GAAP pre - tax income, continuing operations 1,330 1,580 Taxes on income as reported in accordance with GAAP 202 144 Tax benefit on adjustments 55 56 Tax (deduction) benefit on GAAP - only discrete items (4) (3) 91 Non - GAAP adjusted taxes on income 254 291 Non - GAAP adjusted net income, continuing operations 1,076 1,289 Non - GAAP adjusted net income, continuing operations per diluted share $4.22 $5.07 ( 1 ) Amortization in all periods is included in Cost of sales . ( 2 ) One - time costs primarily include costs incurred in connection with the spin - off of Organon, an impairment of a licensed intangible asset, and inventory step - up adjustments . For the nine months ended September 30 , 2022 , approximately $ 103 million of the one - time costs are recorded in Selling, general and administrative expenses, approximately $ 35 million are recorded in Cost of sales, $ 20 million are recorded in Other (income) expense, and $ 10 million are recorded in Research and development . For the nine months ended September 30 , 2021 , approximately $ 139 million of the one - time costs are recorded in Selling, general and administrative expenses, approximately $ 27 million are recorded in Cost of sales and $ 5 million are recorded in Research and development . ( 3 ) For the nine months ended September 30 , 2022 , approximately $ 9 million of stock - based compensation is recorded in Cost of sales, $ 35 million is recorded in Selling, general and administrative and $ 8 million is recorded in Research and development . For the nine months ended September 30 , 2021 , approximately $ 8 million of stock - based compensation is recorded in Cost of sales, $ 26 million is recorded in Selling, general and administrative and $ 10 million is recorded in Research and development . (4) For the nine months ended September 30, 2021, the company recorded a tax benefit of approximately $70 million related to a p ortion of non - U.S. step - up in tax basis as a result of its separation from Merck & Co., Inc., Rahway, NJ, USA. 25

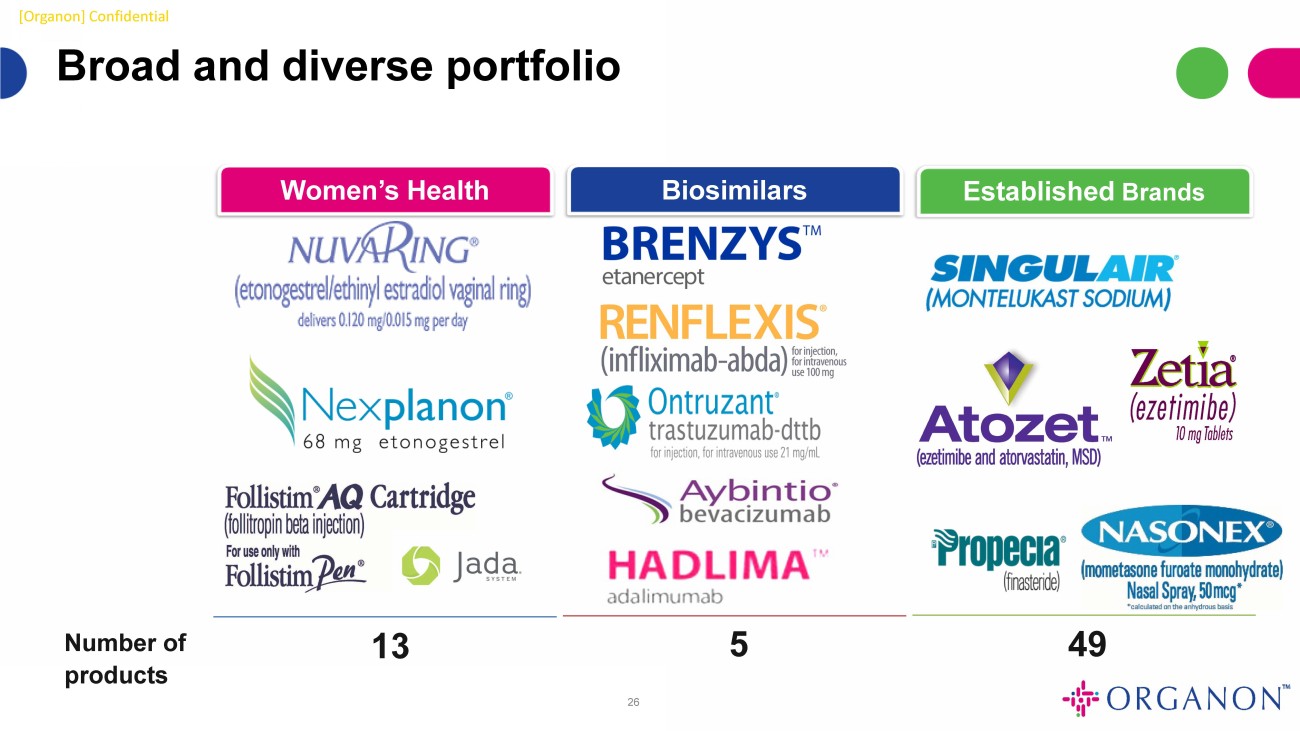

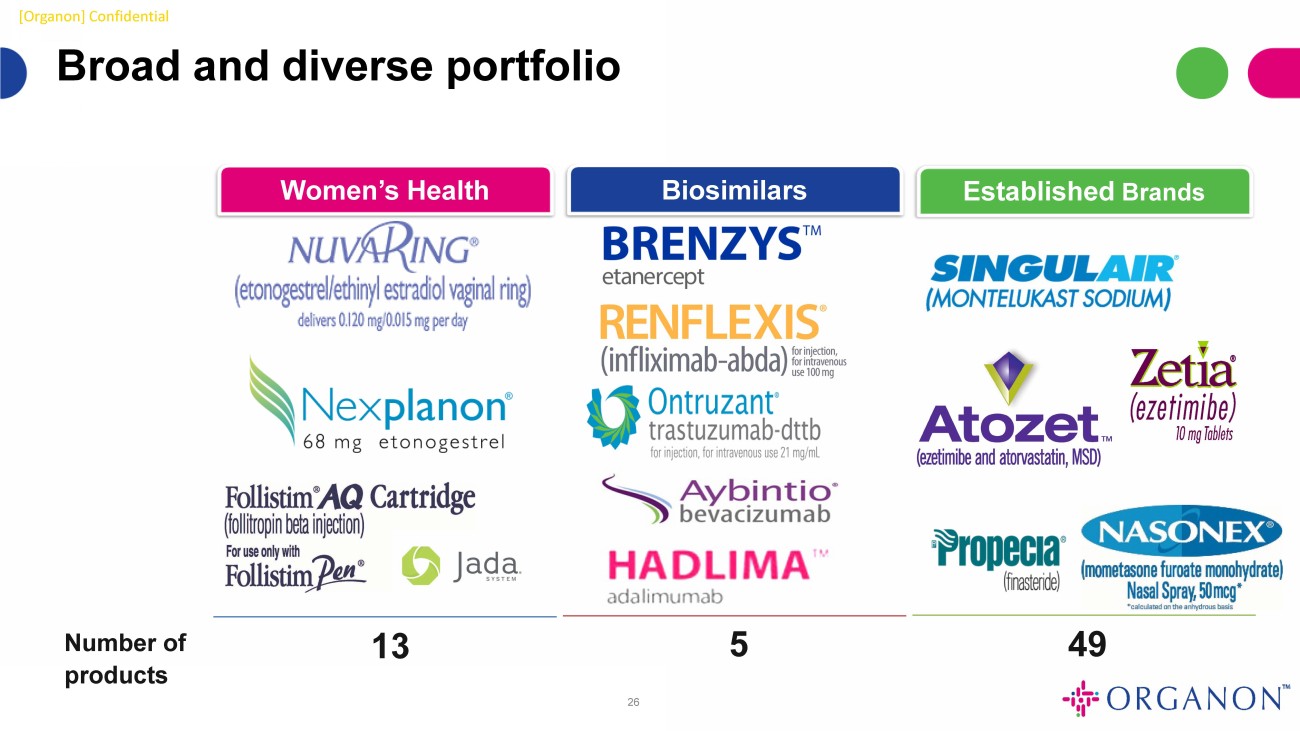

[Organon] Confidential Number of products 13 5 49 Women’s Health Biosimilars Established Brands Broad and diverse portfolio 26

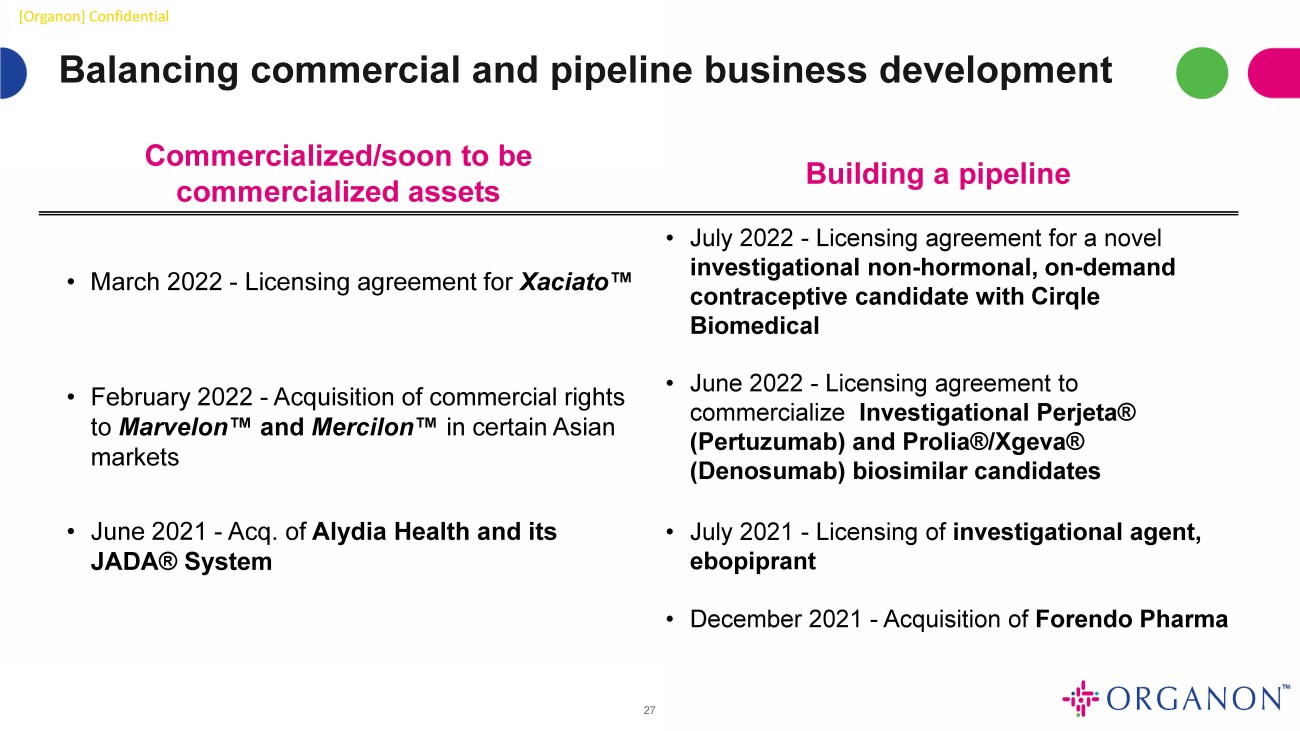

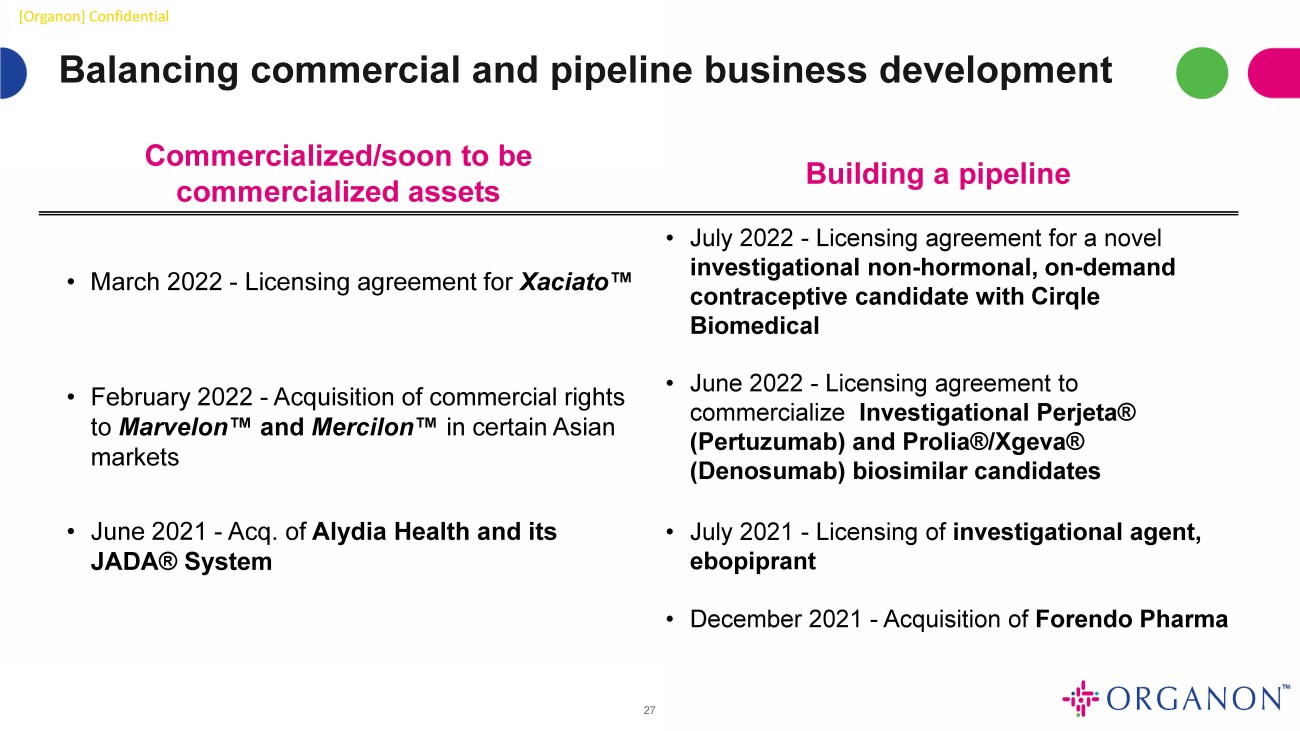

[Organon] Confidential Balancing commercial and pipeline business development Commercialized/soon to be commercialized assets Building a pipeline • March 2022 - Licensing agreement for Xaciato Œ • July 2022 - Licensing agreement for a novel investigational non - hormonal, on - demand contraceptive candidate with Cirqle Biomedical • February 2022 - Acquisition of commercial rights to Marvelon Œ and Mercilon Œ in certain Asian markets • June 2022 - Licensing agreement to commercialize Investigational Perjeta® (Pertuzumab) and Prolia®/Xgeva® (Denosumab) biosimilar candidates • June 2021 - Acq. of Alydia Health and its JADA® System • July 2021 - Licensing of investigational agent, ebopiprant • December 2021 - Acquisition of Forendo Pharma 27