- OGN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Organon & Co. (OGN) DEF 14ADefinitive proxy

Filed: 27 Apr 23, 4:12pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

Message from Our Chairman of the Board

| ||||

| ||||

Dear Organon Shareholders,

On behalf of my fellow Directors, I want to thank you for your trust and investment in Organon. We look forward to continuing to represent you. To that end, I am pleased to invite you to our 2023 Annual Meeting of Shareholders on Tuesday, June 6, 2023, at 9:00 a.m. (Eastern Daylight Time).

The Board is exceptionally proud of Organon’s first full year as a standalone company. We believe Organon is a special company with a long runway for growth.

Our company has a compelling vision and purpose. We strive to help ensure that every woman can achieve her full potential, or as we like to call it, Her Promise. The Board has been closely involved in the development of the strategy to support this purpose, and our 2022 results are encouraging.

In 2022, we had strong growth from our Women’s Health franchise, fueled by our contraceptive and fertility portfolios. �� We also marked two consecutive years of double-digit growth in our Biosimilars franchise and added a new R&D partner.

Our Established Brands portfolio consists of many well-known products that are long-trusted by millions around the world for their quality and efficacy. In 2022, the company grew Established Brands 3% on a constant currency basis, demonstrating the durability of the portfolio. |  |

| The Board remains strongly committed to the effective oversight of Organon’s business and to appropriate risk management. Our standing Board committees (i.e., Audit, ESG, and Talent) represent a key mechanism through which we evaluate and address potential risks.

I am especially proud of our company’s commitment to long-term sustainability and transparency. We have adopted many best-in-class governance practices and policies, as well as specific social and environmental goals that relate to our business interests and our mission. We are making progress toward these goals by harnessing innovation in women’s health to address unmet health needs, expanding access to treatments and reducing our environmental footprint. Efforts like these lay the foundation for strong business performance, proactive risk mitigation, and long-term stakeholder value.

On behalf of the Board, I’d like to thank you for your continued confidence, and I look forward to our future engagement.

Sincerely,

Carrie S. Cox Chairman of the Board |

| i | 2023 Proxy Statement |

Message from Our CEO

| ||||||

| ||||||

Dear Organon Shareholders,

2022 marked Organon’s first full year as an independent company — one in which we delivered strong results while advancing our vision for a better and healthier every day for every woman around the world. It was a year of important milestones as we demonstrated we are building a purpose-driven company that can deliver sustainable growth.

Here are a few key financial highlights from 2022 that reinforce my confidence in our strategy and path forward:

| • | Delivered $6.2 billion in revenue, an increase of 4%1 over the prior year on a constant currency basis; |

| • | Demonstrated strong profitability, generating Adjusted EBITDA of $2.1 billion1; and |

| • | Deployed over $200 million of capital across four promising transactions to drive future revenue growth, proactively retired $100 million of debt and returned $290 million in cash dividends to shareholders. |

With our rapid pace of business development, we are excited about the potential of our growing pipeline to help transform women’s health.

Importantly, we also introduced Her Promise, our comprehensive ESG strategy and associated goals across the environment, social and governance areas. One of our more ambitious goals is to help prevent 120 million unintended pregnancies in low- and middle-income countries by 2030. By working with partners to provide education and training, and increasing access to contraception, we aim to empower girls and women around the world to prevent unplanned pregnancies.

Our 2022 performance would not be possible without our 10,000 employees worldwide. Their commitment to be Here for her health and the culture we are building together continue to propel us forward as we seize important business opportunities.

Charting the Path Forward

We stood up Organon — not to walk, but to run. Our aim now is to accelerate the momentum we gained in 2022 and to deploy capital in a manner that creates value for our shareholders and creates a better and healthier every day for every woman around the world. I am excited for the future, and the tremendous opportunities in front of us.

Thank you for your continued investment and support in Organon.

| ‘‘ | It was a year of important milestones as we demonstrated we are building a purpose-driven company that can deliver sustainable growth.” | Sincerely,

Kevin Ali Chief Executive Officer |  |

| 1 | For further explanation of these adjustments, our GAAP versus non-GAAP results and a reconciliation to the most directly comparable U.S. GAAP measure, please refer to Appendix A. |

| ii | 2023 Proxy Statement |

Business Overview

| ||||

| ||||

Our Business Performance1

Organon delivered strong business results in 2022, our first full year as a standalone company. Revenue grew 4% excluding the impact of foreign exchange translation, with all three of our franchises contributing to that performance. In our journey to become a leader in women’s health, we are maximizing our foundational strengths within reproductive health, while expanding our therapeutic areas through business development.

Fiscal Year 2022 Business Performance

$6.2B

Full year revenue | $2.1B

Adjusted EBITDA | $5.03

Non-GAAP Adjusted Diluted EPS | ||||||

Women’s Health

| Biosimilars

| Established Brands

| ||||||

Other highlights from 2022 include2:

• The Women’s Health franchise grew 7%

• Our lead product, Long-Acting Reversible Contraceptive Nexplanon, grew 11%; its second consecutive year of double-digit growth • Our fertility portfolio grew 9% • We expanded our portfolio with the reacquisition of rights to combined oral contraceptives Marvelon and Mercilon in certain markets in Asia • We entered into a licensing agreement for Xaciato, an FDA-approved treatment for bacterial vaginosis in females 12 years and older • We entered into a research collaboration with Cirqle Biomedical for a preclinical, non-hormonal contraceptive candidate

• Our Biosimilars franchise grew 17%, marking its second consecutive year of double-digit growth

• We expanded our biosimilar collaborations by entering into an agreement with Shanghai Henlius Biotech Inc. whereby Organon will license commercialization rights for two biosimilar candidates

• The Established Brands franchise, a portfolio of medicines largely beyond exclusivity, delivered revenue growth of 3%, demonstrating the durability of the portfolio

• Each of Organon’s five geographic regions demonstrated positive revenue growth, including China, which faced challenges from the implementation of Volume Based Procurement initiatives.

• We strategically deployed capital with our investment of over $200 million across four promising transactions to drive future revenue growth. We proactively retired $100 million of debt, and we returned $290 million in cash dividends to shareholders.

• On our one-year anniversary, Organon introduced our Global ESG Strategy and Commitments with the publication of our inaugural ESG report.

|

| 1 | For further explanation of the below non-GAAP measures versus non-GAAP results and a reconciliation to the most directly comparable U.S. GAAP measure, please refer to Appendix A. |

| 2 | All growth rates are excluding the impact of foreign exchange translation. |

| iii | 2023 Proxy Statement |

Notice of 2023 Annual Meeting of Shareholders | ||||

| ||||

To Organon Shareholders:

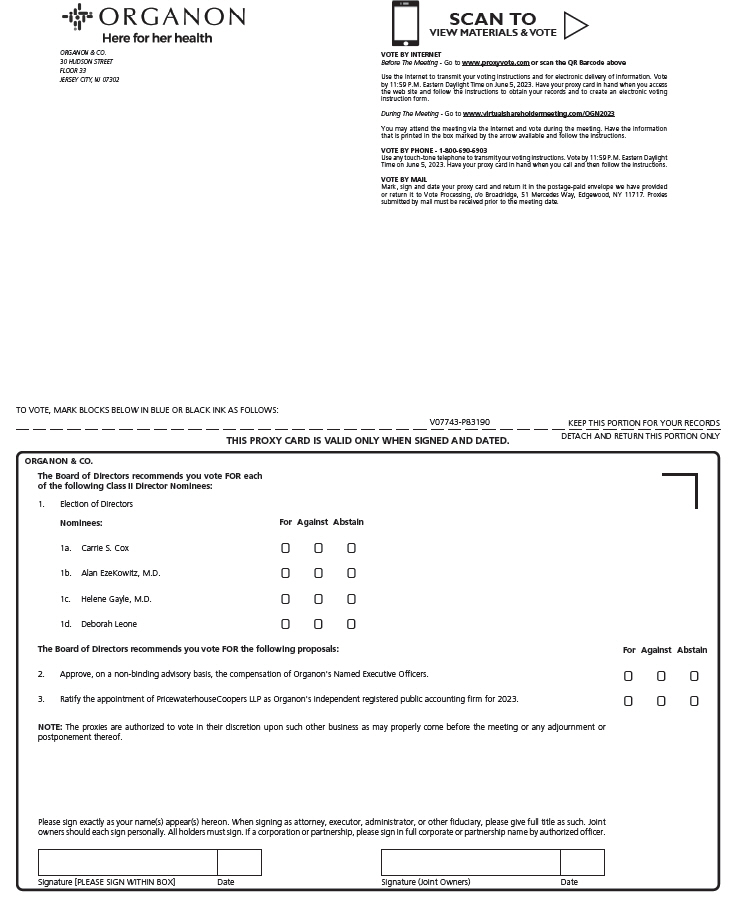

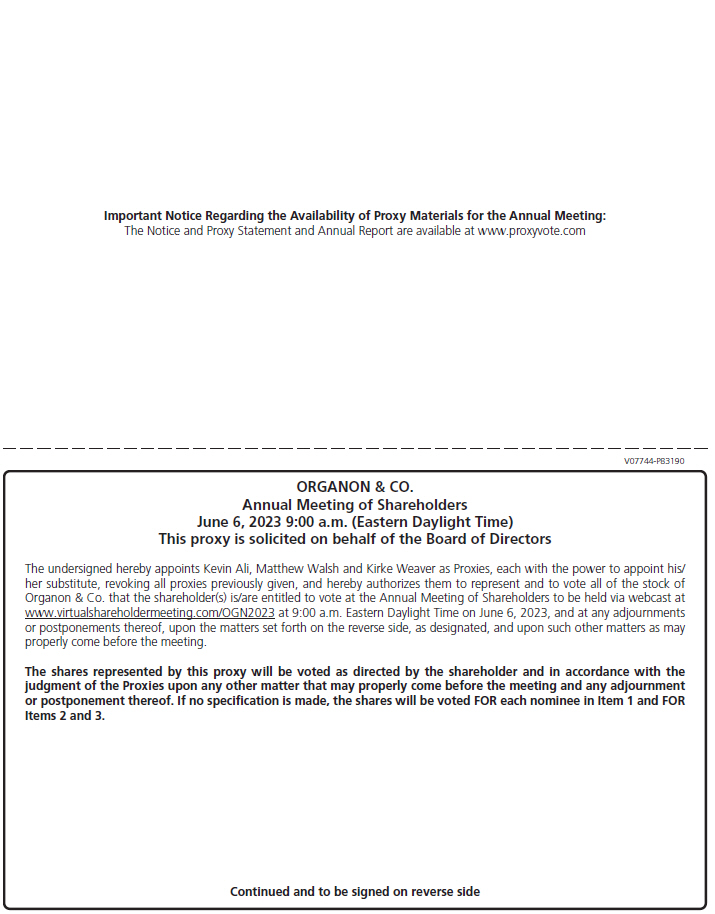

You are cordially invited to the Annual Meeting of Shareholders of Organon & Co. to be held on Tuesday, June 6, 2023, at 9:00 a.m. (Eastern Daylight Time), where we will vote on the matters below. You will be able to attend the Annual Meeting, vote and submit questions via a live webcast by visiting www.virtualshareholdermeeting.com/OGN2023.

Items of Business:

| • | Elect the four Class II directors named in the accompanying proxy statement to hold office until the 2025 annual meeting of shareholders; |

| • | Approve, on a non-binding advisory basis, the compensation of our Named Executive Officers; |

| • | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023; and |

| • | Consider such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Thank you for your continued support of and interest in Organon.

Sincerely,

Kirke Weaver

General Counsel and Corporate Secretary

April 27, 2023

Your Vote is Important—Vote Right Away

We encourage you to read the accompanying proxy statement with care and vote right away using any of the following methods, even if you intend to attend the Annual Meeting webcast. Voting early will help avoid additional solicitation costs and will not prevent you from voting during the Annual Meeting, if you wish to do so.

| BY INTERNET | www.proxyvote.com | ||

| BY PHONE | In the U.S. or Canada, dial toll-free 1-800-690-6903 | ||

| BY QR CODE | Scan this QR code to vote with your mobile device (may require free app) | ||

| BY MAIL | If you received printed copies of the proxy materials, cast your ballot, sign your proxy card and send in our prepaid envelope | ||

|

| ||||||

To vote by Internet or telephone, have the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form in hand and follow the instructions. Internet and telephone voting facilities will close at 11:59 p.m. Eastern Daylight Time on June 5, 2023. If your shares are held in a stock brokerage account or by a bank or other nominee, your ability to vote by Internet or telephone depends on your broker’s voting process. Please follow the directions provided to you by your broker, bank, or nominee. For additional information, please refer to the Questions and Answers About the Annual Meeting and Voting section beginning on page 82.

To be admitted to the virtual meeting, have the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form in hand and visit www.virtualshareholdermeeting.com/OGN2023.

Only shareholders listed on Organon’s records at the close of business on April 10, 2023, the record date, are entitled to vote. A list of shareholders of record as of the record date will be available during regular business hours starting 10 days prior to the Annual Meeting at the Office of Corporate Secretary at our corporate headquarters located at 30 Hudson Street, Floor 33, Jersey City, New Jersey 07302.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 6, 2023:

The Notice of Annual Meeting of Shareholders, proxy statement, and Organon’s 2022 Annual Report on Form 10-K are available free of charge at www.proxyvote.com.

If you have any questions or need assistance voting your shares, please contact Morrow Sodali LLC, our proxy solicitor, by calling 800-662-5200 (or banks and brokers can call collect at 203-658-9400), or by emailing OGN.info@investor.morrowsodali.com.

| 2023 Proxy Statement |

Table of Contents

| ||||

| ||||

| Shareholder Proposals and Director Nominations for the 2024 Annual Meeting of Shareholders | 88 | |||

| Other Matters | 89 | |||

| Appendix A | A-1 | |||

| Index of Frequently Referenced Pages _______

|

| ||||||

| Board Meeting Attendance | 13 | |||||||

| Board Skills and Experience Matrix | 20-21 | |||||||

| Board Diversity | 21-22 | |||||||

| Board Evaluation | 22-23 | |||||||

| 79-80 | ||||||||

| How to Vote | 84-85 | |||||||

| Compensation Highlights _______

|

| ||||||

| 42 | ||||||||

| Executive Compensation Practices | 52 | |||||||

| How Compensation Decisions are Made | 53 | |||||||

| Elements of 2022 Compensation Program | 55 | |||||||

| Clawback Policy | 62 | |||||||

| Hedging and Pledging | 62 | |||||||

|

Forward-Looking Statements

| ||||||

| ||||||

This proxy statement includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectations about Organon’s ESG strategy, future financial performance and prospects. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning. These statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited to, an inability to execute upon our ESG strategy within expected timeframes, if at all, an inability to execute on our business development strategy or realize the benefits of our planned acquisitions; efficacy, safety, or other quality concerns with respect to marketed products, including market actions such as recalls, withdrawals, or declining sales; general economic factors, including interest rate, inflation, recessionary pressures, and currency exchange rate fluctuations; general industry conditions and competition; the impact of the ongoing COVID-19 pandemic and emergence of variant strains; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment; technological advances; new products and patents attained by competitors; challenges inherent in new product development, including obtaining regulatory approval; the company’s ability to accurately predict its future financial results and performance; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; difficulties developing and sustaining relationships with commercial counterparties; dependence on the effectiveness of the company’s patents and other protections for innovative products; and the exposure to litigation, including patent litigation, and/or regulatory actions.

The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the company’s filings with the Securities and Exchange Commission (“SEC”), including the company’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent SEC filings, available at the SEC’s Internet site (www.sec.gov).

Website References

Throughout this proxy statement, we identify certain materials that are available in full on our website and refer the reader to additional information available on our website. The information contained on, or available through Organon’s internet website, is not and shall not be deemed to be incorporated by reference in this proxy statement.

| 1 | 2023 Proxy Statement |

Proxy Statement Summary

| ||||||

| ||||||

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) for use at the 2023 Annual Meeting of Shareholders of Organon & Co. (“Organon,” the “company,” “we,” “us,” or “our”). Please review the entire proxy statement and Organon’s 2022 Annual Report on Form 10-K (the “Annual Report”) before voting. The voting items expected to be proposed at the meeting are listed below along with the Board’s voting recommendations.

2023 Annual Meeting of Shareholders

|

|

| ||||||

Time

| Meeting Date

| Location

| ||||||

9:00 a.m.

| Tuesday June 6, 2023

Record Date April 10, 2023 | Via webcast at www.virtualshareholder

| ||||||

Voting Matters | Page | Board’s Recommendation | ||||

Proposal 1 | Election of Directors | 28 | FOR each Nominee | |||

Proposal 2 | Approve, on a Non-Binding Advisory Basis, the Compensation of Organon’s Named Executive Officers | 44 | FOR | |||

Proposal 3 | Ratify the Appointment of PricewaterhouseCoopers LLP as Organon’s Independent Registered Public Accounting Firm for 2023 | 79 | FOR | |||

| 2 |

| Proxy Statement Summary | ||||||

| ||||||

Who We Are

Organon is a global healthcare company formed to focus on improving the health of women throughout their lives. Organon has a portfolio of more than 60 medicines and products across a range of therapeutic areas. Organon is the only global company of its size dedicated to women’s health.

We focus on three key areas to achieve our vision of a better and healthier every day for every woman:

|

Women’s Health We believe that women are the foundation of a healthier world, and we know that women need more choices when it comes to their health care. We plan to continue building on our strengths in reproductive health and fertility as we assemble a suite of health options that help address the areas of high unmet needs for women.

| |

| Biosimilars Biosimilars, which are approved by regulators as being highly similar to approved biologic medicines, are used to treat a range of serious conditions. They offer patients more treatment options and reduce costs compared to biologics—potentially helping expand access to biologic medicines.

| |

| Established Brands Our established brands include well-known products, which generally are beyond market exclusivity, across a range of therapeutic areas including respiratory, cardiovascular, dermatology, non-opioid pain, and more.

| |

Led by the women’s health portfolio coupled with an expanding biosimilars business and stable franchise of established medicines, Organon’s products produce strong cash flows that will support investments in innovation and future growth opportunities. In addition, Organon is pursuing opportunities to collaborate with biopharmaceutical innovators looking to commercialize their products by leveraging its scale and presence in fast growing international markets.

Organon has a global footprint with significant scale and geographic reach, and world-class commercial capabilities. As of December 31, 2022, Organon had approximately 10,000 employees worldwide and is headquartered in Jersey City, New Jersey.

On June 2, 2021, Organon separated from Merck & Co., Inc. (“Merck”; known as MSD outside the U.S. and Canada) as a result of a pro rata distribution of Organon’s common stock to shareholders of Merck. We refer to this transaction as the “spinoff.” Since 2021, Organon has been a standalone public company with common stock trading on the New York Stock Exchange (the “NYSE”) under the ticker symbol “OGN.” Organon is also a member of the S&P 500 index.

| 3 | 2023 Proxy Statement |

| ||||||

Executive Compensation Highlights (Page 50)

The Talent Committee reviews our executive compensation program to evaluate whether it supports our executive compensation philosophy and objectives, and is aligned with shareholder interests and our ongoing business strategy. The Talent Committee will review and consider modifications to our executive compensation program to reflect our business strategy, performance, and evolving corporate governance practices.

Our executive compensation practices, which are further described on page 52, demonstrate our commitment to responsible pay and governance principles. For additional information on the components of our 2022 executive compensation, please refer to the Compensation Discussion and Analysis (“CD&A”), beginning on page 50.

Say-on-Pay Advisory Vote (Page 53)

In 2022, shareholders demonstrated their support for our executive compensation programs with approximately 93% of the votes cast voted in favor of approving the say-on-pay proposal. Consistent with Organon’s strong interest in shareholder engagement and our pay-for-performance approach, the Talent Committee continues to evaluate our executive compensation program to ensure alignment between the respective interests of our executives and shareholders.

We ask that our shareholders approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) as further described in Proposal 2 on page 44.

| 4 |

| Proxy Statement Summary | ||||||

| ||||||

Corporate Governance Highlights (Page 9)

We actively monitor our corporate governance practices to ensure we continue to manage our business in accordance with high standards of ethics, business integrity, and corporate governance. Our corporate governance practices are designed to enable the Board to set objectives and monitor performance and to strengthen the accountability of the Board and management. For this reason, we devote considerable time and resources to making sure that:

· our policies reflect our values and business goals;

· we operate in an open, honest, and transparent way; and

· we have an effective corporate governance structure.

| We highlight some significant aspects of our corporate governance practices and policies below. | ||||

Independent Leadership

• The Chairman of the Board is independent.

• Twelve of our 13 directors are independent.

• Our independent directors hold regular executive sessions.

• All three of our standing Board committees are composed solely of independent directors.

Director Accountability

• Directors are elected by majority vote.

• Directors who do not receive a majority vote are required to submit their resignation from the Board.

• Annual election of all directors starting at Organon’s 2025 annual meeting of shareholders.

Best Practices

• We conduct Board, Board committee and individual director evaluations annually.

• The Board actively engages in succession planning for the CEO.

• Directors may not stand for re-election after age 75.

• We have an overboarding policy that limits the number of public company boards on which directors may serve.

• The Board is diverse in terms of gender, ethnicity, experience, and skills.

• Our Principles of Corporate Governance include a comprehensive Diversity Policy.

• The Board and its committees have a robust risk oversight program.

• Our classified Board will sunset in 2025.

Alignment with Shareholder Interests

• We have a proxy access provision in our Bylaws under which shareholders who own 3% of Organon common stock for at least three years may nominate up to 20% of the members of our Board.

• We do not have a shareholder rights plan (also known as a poison pill).

• We do not have any supermajority voting provisions.

|

• Directors and executive officers are subject to stock ownership guidelines.

• We have an active shareholder engagement program, as described more fully on page 23.

Environmental, Social, and Governance (ESG)

• Proactive management of ESG risks and opportunities is integrated into our long-term business strategy.

• The Board’s committees have robust, independent oversight of various ESG topics, including the Audit Committee’s oversight of cybersecurity and compliance matters, the Talent Committee’s oversight of human capital management, and the ESG Committee’s oversight of governance, product quality, corporate reputation and other sustainability matters.

• We have established clear ESG goals and are taking action to make progress toward them over time. We have embedded certain ESG metrics into the Company Scorecard.

• We actively engage shareholders and other stakeholders to understand their ESG priorities and and address any questions or concerns.

• Our first ESG Report was published in June 2022. We are preparing our second ESG Report, which we expect to publish in June 2023.

|

| 5 | 2023 Proxy Statement |

| ||||||

Our Directors and Director Nominees (Page 29)

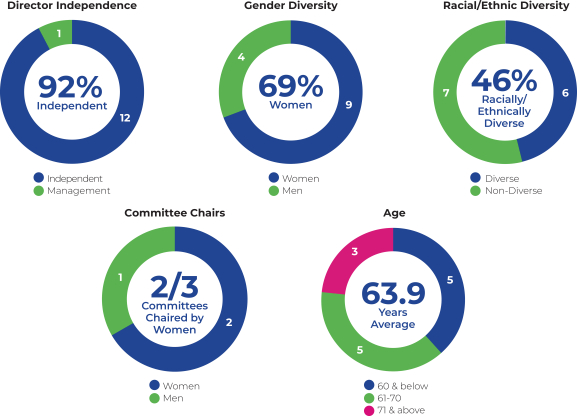

Our directors and director nominees possess broad expertise, skills, experience, and perspectives to provide the strong oversight and strategic direction required to govern Organon’s business and strengthen and support senior management. As illustrated by the following charts, our directors and director nominees consist of individuals with expertise in fields that align with Organon’s business and long-term strategy and reflect the Board’s commitment to diverse perspectives.

The following provides summary information about each director nominee and continuing director. Detailed information about each individual’s background, skill sets, and areas of expertise can be found beginning on page 29.

| Committee Memberships | ||||||||||||||||||||||||||||

|

| Name | Age | Director Since | Term Expiring | Primary Occupation | Audit | Talent | ESG | ||||||||||||||||||||

Class II Directors Standing for Election at the Annual Meeting |

|

|

|

| ||||||||||||||||||||||||

| Carrie S. Cox Board Chairman | 65 | 2021 | 2023 | Former Chief Executive Officer of Humacyte, Inc. and current Chairman, Selecta Biosciences, Inc. | ● | · | |||||||||||||||||||||

| Alan Ezekowitz, M.D. | 69 | 2021 | 2023 | Advisory Partner, Third Rock Ventures, LLC, Former CEO and Co - Founder of Abide Therapeutics, and Former SVP and Franchise Head Merck Research Laboratories | · | ||||||||||||||||||||||

| Helene Gayle, M.D. | 67 | 2021 | 2023 | President of Spelman College | · | ||||||||||||||||||||||

| Deborah Leone | 58 | 2021 | 2023 | Former Partner & Chief Operating Officer, Investment Management, Goldman Sachs Group, Inc. | · | ||||||||||||||||||||||

● = Committee Chair

| 6 |

| Proxy Statement Summary | ||||||

| ||||||

| Committee Memberships | ||||||||||||||||||||||||||||

|

| Name | Age | Director Since | Term Expiring | Primary Occupation | Audit | Talent | ESG | ||||||||||||||||||||

Directors Continuing in Office |

|

|

|

| ||||||||||||||||||||||||

| Robert Essner | 75 | 2021 | 2025 | Former Chairman, Chief Executive Officer and President, Wyeth Pharmaceuticals, Inc. |

|

|

|

|

|

| ● | ||||||||||||||||

| Rochelle “Shelly” B. Lazarus | 75 | 2021 | 2025 | Chairman Emeritus of Ogilvy & Mather |

|

|

|

|

|

| · | ||||||||||||||||

| Cynthia M. Patton | 61 | 2021 | 2025 | General Counsel and Corporate Secretary, Tessera Therapeutics | · |

|

|

|

|

|

| ||||||||||||||||

| Grace Puma | 60 | 2021 | 2025 | Former Executive Vice President, Chief Operations Officer, PepsiCo, Inc. |

|

|

| · |

|

|

| ||||||||||||||||

| Kevin Ali | 62 | 2021 | 2024 | Chief Executive Officer, Organon & Co. |

|

|

|

|

|

|

|

|

| ||||||||||||||

| Ma. Fatima de Vera Francisco | 54 | 2021 | 2024 | Chief Executive Officer, Global Baby, Feminine & Family Care sector and Executive Sponsor for Gender Equality, The Procter & Gamble Company |

|

|

| · |

|

|

| ||||||||||||||||

| Martha E. McGarry | 71 | 2021 | 2024 | Partner, Mayer Brown LLP |

|

|

| · |

|

|

| ||||||||||||||||

| Philip Ozuah, M.D., Ph.D. | 60 | 2021 | 2024 | President and Chief Executive Officer, Montefiore Medicine |

|

|

|

|

|

| · | ||||||||||||||||

| Shalini Sharp | 48 | 2021 | 2024 | Former Executive Vice President and Chief Financial Officer, Ultragenyx Pharmaceutical Inc. | ● |

|

|

|

|

|

| ||||||||||||||||

● = Committee Chair

| 7 | 2023 Proxy Statement |

| ||||||

Director Qualifications and Expertise

Our directors are responsible for overseeing the company’s business consistent with their fiduciary duties. This significant responsibility requires highly skilled individuals with various qualities, attributes, and professional experiences. We believe the Board is well-rounded, with a balance of relevant perspectives and experience, as illustrated by the following chart.

Executive Leadership / | · | · | · | · | · | · | · | · | · | · | · | · | · | 100% | ||||||||||||||||||

Financial / Accounting | · | · | · | · | · | · | · | · | · | · | · | · | · | 92% | ||||||||||||||||||

Global Healthcare | · | · | · | · | · | · | · | · | · | · | · | · | · | 85% | ||||||||||||||||||

Marketing, Sales or | · | · | · | · | · | · | · | · | · | · | · | · | · | 46% | ||||||||||||||||||

Public Policy / Regulatory | · | · | · | · | · | · | · | · | · | · | · | · | · | 100% | ||||||||||||||||||

Corporate Governance / Public Company | · | · | · | · | · | · | · | · | · | · | · | · | · | 85% | ||||||||||||||||||

Global Business Experience | · | · | · | · | · | · | · | · | · | · | · | · | · | 100% | ||||||||||||||||||

| 8 |

Corporate Governance

| ||||||

| ||||||

The Board has the legal responsibility for overseeing the management of Organon and its business. The Board’s primary mission is to represent and protect the interests of our shareholders. To that end, the Board selects the CEO and oversees the senior management team, which is charged with conducting Organon’s daily business.

The Board has adopted corporate governance principles (the “Principles of Corporate Governance”) that, together with our Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws, and Board committee charters, form the governance framework for the Board and its committees. The Principles of Corporate Governance cover a wide range of subjects, including the role and composition of the Board; functioning of the Board and Board committees; director qualifications; diversity, overboarding, resignation, and retirement age policies; director compensation; share ownership guidelines; succession planning; evaluation of the CEO; director orientation and continuing education; Board, committee, and director performance evaluations; and shareholder engagement.

The Principles of Corporate Governance and Board committee charters are reviewed at least annually and revised, as appropriate, in response to changing legal, regulatory and stock exchange listing requirements, evolving best practices and the perspectives of our shareholders and other constituents.

Governance Materials

The following items relating to corporate governance at Organon are available on our website at https://www.organon.com/about-organon/leadership/corporate-governance/

| ● | Amended and Restated Certificate of Incorporation | ● | Amended and Restated Bylaws | |||||

| ● | Principles of Corporate Governance | ● | Board Committee Charters | |||||

In addition, as part of our ethics and compliance program, our Board has approved a Code of Conduct, which is available on our website at www.organon.com/about-organon/mission-vision-and-values/code-of-conduct. The information contained on or accessible through our website does not constitute a part of this proxy statement.

Board’s Role in Strategic Planning

The Board — acting both as a whole and through its three standing committees — is fully engaged and involved in Organon’s strategic planning process. Each director has an obligation to keep informed about Organon’s business and strategies, so they can provide guidance to management in formulating and developing plans and knowledgeably exercise their decision-making authority on matters of importance to Organon.

The Board’s oversight and guidance are inextricably linked to the development and review of Organon’s strategic plan. By exercising sound and independent business judgment on the strategic issues important to Organon’s business, the Board facilitates its long-term success.

Risk Oversight

The Board’s oversight of Organon’s risk is an important component of the Board’s engagement on strategic planning, and the Board has two primary methods of overseeing risk. The first method is through Organon’s Enterprise Risk Management (“ERM”) process, which allows for Board oversight of the most significant risks facing Organon. The second method is through the functioning of the three standing committees of the Board — the Talent Committee, the Audit Committee, and the Environmental, Social and Governance Committee (“ESG Committee”).

| 9 | 2023 Proxy Statement |

| ||||||

Management has established the ERM process to ensure a complete company-wide approach to evaluating risk over six distinct but overlapping risk areas:

Responsibility and Reputation | Risks that may impact the well-being of Organon and its employees, customers, patients, communities, or reputation | |

Strategy | Macro risks that may impact our ability to achieve long-term business objectives | |

Operations | Risks related to our operations, cybersecurity and climate change that may impact our ability to achieve business objectives | |

Compliance | Risks related to compliance with laws, regulations, and Organon’s values, ethics, and policies | |

Reporting | Risks to maintaining accurate financial statements and timely, complete public company financial reporting | |

Safety | Risks to employee, patient, customer, or community health and safety | |

The goal of the ERM process is to provide an ongoing effort, implemented across Organon and aligned to its values and ethics, to identify and assess risk and to monitor risk and agreed-upon mitigating actions. If the ERM process identifies a material risk, it is elevated to the CEO, the Executive Leadership Team, and the Board for review. The Audit Committee periodically reviews the ERM process to ensure it is robust and functioning effectively.

Each Board committee oversees specific areas of risk relevant to the committee through direct interactions with the CEO, the Executive Leadership Team, the heads of business franchises, and/or compliance and corporate functions. A committee may address risks directly with management or, where appropriate, may elevate a risk for consideration by the Board or another Board committee. The following are examples of Board committees’ responsibilities in risk oversight:

| • | The Audit Committee has primary responsibility for overseeing Organon’s risk-management program relating to cybersecurity, although the Board participates in periodic reviews and discussion dedicated to cyber risks, threats, and protections, as discussed under Board Oversight of Information Security, including Cybersecurity and Data Privacy. The Audit Committee also oversees risk relating to finance, business integrity, compliance, and internal controls, disclosure controls, and related financial reporting through its interactions with the Chief Financial Officer, the General Counsel, the Chief Ethics and Compliance Officer, the Controller, and the Head of Internal Audit. |

| • | The Talent Committee has risk oversight responsibilities over our policies and practices with respect to our executive compensation program. The Talent Committee also has oversight of Organon’s programs, policies, and practices related to its management of human capital resources, including talent and diversity. |

| • | The ESG Committee oversees Organon’s corporate governance, including the practices, policies, and procedures of the Board and its committees, considers the size, structure, and needs of the Board, reviews possible candidates for the Board, recommends director nominees to the Board for approval, and plays a role in ESG-related risk and compliance oversight, including in the areas of environmental health and safety and manufacturing quality systems. |

The ERM process and Board committee approach to risk management leverages the Board’s leadership structure to ensure the Board oversees risk on both an enterprise-wide approach and through specific areas of competency.

| 10 |

| Corporate Governance | ||||||

| ||||||

Board Oversight of Information Security, Including Cybersecurity and Data Privacy

Our information security and privacy programs provide that the Board receives an annual report from our Chief Information Security Officer and Chief Ethics and Compliance Officer to discuss our program for managing information security risks, including cyber and data security risks. The Audit Committee also receives regular briefings on both information security and data privacy from the Chief Information Security Officer and Chief Ethics and Compliance Officer, respectively. Both the Board and the Audit Committee receive periodic reports on our cyber readiness, security controls and our cybersecurity investments. In addition, our directors are apprised of incident simulations and response plans, including for cyber and data breaches.

Program Highlights

Commitment to Transparency | We are committed to responsible handling of personal information under data privacy laws. We balance the need to operate and grow our business against our commitment to transparency and control, fairness, non-discrimination, and accountability. | |

Security Programs | Our multi-layered information security and data privacy programs and practices are designed to foster the safe, secure, and responsible use of the information and data our stakeholders entrust to us. | |

Governance | We work with our customers, governments, policymakers, and others to help develop and implement standards for safe and secure transactions, as well as privacy-centric data practices. | |

Security | Independent third parties test our cyber capabilities and audit our cloud security. | |

System Tests | We regularly test our systems to discover and address any potential vulnerabilities. | |

Employee Training | We conduct annual cybersecurity training for employees. | |

Insurance Coverage | We maintain a business continuity program and cyber insurance coverage. | |

Independence of Directors

The Principles of Corporate Governance require a substantial majority of our directors to be independent. In making independence determinations, the Board observes all relevant criteria established by the SEC and the NYSE. The Board considers all relevant facts and circumstances in making an independence determination.

To be considered independent, an outside director must meet the bright-line independence tests established by the NYSE, and the Board must affirmatively determine that the director has no direct or indirect material relationship with Organon.

The Board also rigorously considers the heightened independence requirements for members of the Audit Committee and the Talent Committee. The ESG Committee reviews the Board’s approach to determining director independence periodically and recommends changes, as appropriate, for consideration and approval by the Board.

Independence Determinations

The Board has determined that each of Organon’s directors and director nominees, with the exception of our CEO, Kevin Ali, are independent under the NYSE Listing Standards. All members of the Board’s Audit Committee, Talent Committee, and ESG Committee are independent under these standards, and all members of the Audit Committee and Talent Committee meet the enhanced independence requirements for audit committee members and compensation committee members, respectively in the NYSE Listing Standards.

| 11 | 2023 Proxy Statement |

| ||||||

In making these determinations, the Board considered relationships that exist between Organon and other organizations where each director serves, as well as the fact that in the ordinary course of business, transactions may occur between such organizations and Organon or one of our subsidiaries. The Board also evaluated whether there were any other facts or circumstances that might impair a director’s independence.

Related Person Transactions

Related Person Transaction Policies and Procedures

The Board has adopted written Related Person Transaction Policies and Procedures (the “Related Person Policy”). The Related Person Policy, which is administered by the Audit Committee, governs the review, approval, ratification, or disapproval by the Audit Committee of transactions between us or any of our subsidiaries and any “related person” in which the amount involved since the beginning of our last completed fiscal year will or may be expected to exceed $100,000 and in which one or more of such related persons has a direct or indirect material interest. The Related Person Policy defines a “related person” to include anyone who served as a director, director nominee, or executive officer since the beginning of Organon’s last fiscal year, any greater than 5% shareholder, or any immediate family member of any of those persons.

Pursuant to the Related Person Policy, management will provide the Audit Committee all material information relevant to transactions that require the Audit Committee’s approval. In approving or disapproving any such transaction, the Audit Committee will consider all relevant factors, including, as applicable, Organon’s business rationale for entering into the transaction, the alternatives to entering into the transaction, whether the transaction is on terms comparable to those generally available to an unaffiliated third party under the same or similar circumstances, the extent of the related person’s interest in the transaction, and the potential for the transaction to lead to an actual or apparent conflict of interest. Any member of the Audit Committee who is deemed a related person with respect to a transaction under review will not be permitted to participate in the discussion or approval of the transaction.

The Audit Committee will review and assess ongoing related person transactions as necessary throughout the duration of their term, but no less than annually, to ensure that the transactions are in compliance with any Audit Committee guidelines and the transactions remain fair and reasonable to Organon and consistent with the interests of Organon and its shareholders.

Certain Related Person Transactions

Each director, director nominee and executive officer of Organon is required to annually complete a Director & Officer (“D&O”) Questionnaire. The D&O Questionnaire requests, among other things, information regarding whether any director, director nominee, executive officer, or their immediate family members had an interest in any related person transaction or proposed transaction with Organon or its subsidiaries or has a relationship with a company that has entered or proposes to enter into such a transaction.

After review of the D&O Questionnaires by the Office of Corporate Secretary, the responses are collected, summarized, and distributed to responsible areas within Organon to identify any potential related person transactions. All relevant relationships and any transactions, along with payables and receivables, are compiled for each person and affiliation. Management submits a report of the affiliations, relationships, transactions, and appropriate supplemental information to the Audit Committee for its review. Based on this information for 2022, the Audit Committee has determined that no transactions require disclosure under Item 404(a) of SEC Regulation S-K.

| 12 |

| Corporate Governance | ||||||

| ||||||

Board Leadership Structure

|

| |||||||||

| The Board annually reviews its leadership structure to evaluate whether it remains appropriate for Organon. | ||||||||||

Carrie S. Cox serves as independent Chairman of the Board and Kevin Ali serves as our CEO. The Board believes that this leadership structure, which separates the Chairman and CEO roles, is optimal at this time. With separate Chairman and CEO roles, our independent Chairman can lead the Board in the performance of its duties by establishing agendas, presiding at all meetings of the Board and executive sessions of non-management directors, engaging with the CEO and executive leadership team between Board meetings on business developments, and providing overall guidance to our CEO as to the Board’s views and perspectives, particularly on the strategic direction of Organon. Meanwhile, our CEO can focus his time and energy on setting Organon’s strategic direction, overseeing daily operations, engaging with external constituents, developing our leaders, and promoting employee engagement at all levels of the organization. The Board believes our governance practices ensure that skilled and experienced independent directors provide independent leadership.

| ||||||||||

Board Meetings and Committees

Under the Principles of Corporate Governance, directors are expected to attend regular Board meetings, applicable Board committee meetings, and the annual meetings of shareholders. All directors attended at least 75% of the meetings of the Board and of the Board committees on which they served in 2022. Organon held its 2022 annual shareholder meeting on June 7, 2022. Twelve of the thirteen directors then serving on the Board attended the 2022 annual meeting of shareholders.

The Board met five times in 2022 and the independent directors of the Board met in five executive sessions in 2022. Ms. Cox, Chairman of the Board, presided over the executive sessions.

The Board’s three standing committees, each of which is made up solely of independent directors, are the Audit, Talent and ESG Committees. In addition, the Board from time to time may establish special purpose committees. All standing committees are governed by Board-approved charters, which are available on our website at https://www.organon.com/about-organon/leadership/corporate-governance/. Each committee evaluates its performance and reviews its charter annually. Additional information about the committees is provided on the following pages. Our CEO, Mr. Ali, is not an independent director under NYSE Listing Standards and is therefore not a member of any standing Board committee with an independence requirement. The primary functions, current committee membership and the number of meetings each committee held in 2022 are further described below.

| 13 | 2023 Proxy Statement |

| ||||||

Audit Committee

Shalini Sharp Chair

Other Members Alan Ezekowitz, M.D. Deborah Leone Cynthia M. Patton

Financial Experts on Audit Committee

The Board has determined that each member of the Audit Committee is financially literate and that each of Mss. Leone and Sharp is an “audit committee financial expert” as defined by the SEC and has accounting or related financial management expertise as required by the NYSE Listing Standards. | Overview

The Audit Committee oversees our accounting and financial reporting processes, internal controls and audits, and Organon’s risk management process. The Audit Committee also consults with management, the internal auditors, and our independent auditors on, among other items, matters related to the annual audit, the published financial statements, and the accounting principles applied. The Audit Committee has established policies and procedures for the pre-approval of all services provided by our independent auditors (as described on page 80 of this proxy statement).

The Audit Committee’s Report is included on page 81 of this proxy statement.

The Primary Functions of this Committee Include:

• Assisting our Board in fulfilling its oversight responsibility relating to: (i) the integrity of our financial statements and financial statement audits; (ii) our and our subsidiaries’ accounting and financial reporting processes and system of internal controls over financial reporting and disclosures; (iii) our compliance with legal and regulatory requirements; (iv) the independent public accountants’ qualifications and independence; (v) the performance of our internal audit function and our independent public accountants; (vi) our risk management processes; and (vii) preparation of the annual report required by the SEC rules to be included in our annual proxy statement;

• Being directly responsible for the appointment (subject to ratification by our shareholders), compensation, retention and oversight of the work of our independent public accountants (including the resolution of disagreements between management and the independent public accountants regarding financial reporting);

• Evaluating the independent public accountants’ qualifications, performance and independence, including a review and evaluation of the lead partner and partner rotation requirements;

• Monitoring our compliance program with respect to legal and regulatory requirements, our code(s) of conduct and our policies on ethical business practices and reporting on these items to the Board;

• Establishing and periodically reviewing policies and procedures for the review, approval, and ratification of related person transactions, as defined in applicable SEC rules and the NYSE Listing Standards, and reviewing and approving, disapproving, or ratifying related person transactions in accordance with these policies and procedures, and overseeing other related person transactions governed by applicable accounting standards;

• Establishing and overseeing procedures for handling (receipt, retention and treatment, on a confidential basis) of complaints of potential misconduct, including: (i) violations of law or our code(s) of conduct; (ii) complaints regarding accounting, internal accounting controls, auditing, and federal securities law matters; and (iii) the confidential, anonymous submission of concerns by employees regarding accounting, internal accounting controls, auditing, and federal securities law matters; and

• Periodically reviewing our enterprise risk assessment policies and processes, including meeting at least annually with our Chief Information Security Officer regarding our information technology and receiving periodic updates regarding our cybersecurity risk management program, and reporting to the Board on the principal risks facing us and the steps being taken to manage and mitigate these risks. | |||||

| 14 |

| Corporate Governance | ||||||

| ||||||

Talent Committee

Carrie S. Cox Chair

Other Members Ma. Fatima de Vera Francisco Martha E. McGarry Grace Puma

Compensation Committee Interlocks and Insider Participation

There were no Talent Committee interlocks or insider (employee) participation during 2022. | Overview

The Talent Committee oversees our overall compensation philosophy, policies and programs, and assesses whether the company’s compensation philosophy establishes appropriate incentives for management and employees. The Talent Committee also oversees our human capital management, including leadership development, diversity and inclusion, and workplace culture. The details of the processes and procedures involved are described in the CD&A beginning on page 50. The Talent Committee may delegate its duties and responsibilities to one or more subcommittees as it determines appropriate. The independent members of the Board ultimately make the final decisions regarding the CEO’s compensation.

The Talent Committee’s Report is included on page 62 of this proxy statement.

The Primary Functions of this Committee Include:

• Reviewing and approving corporate goals and objectives relevant to the compensation of the CEO and the other executive officers, evaluating their performance against these goals and objectives, and, based on this evaluation, recommending to the independent directors of the Board the CEO’s compensation level and approving the compensation of the other executive officers;

• Overseeing succession planning for positions held by executive officers, and reviewing succession planning and management development at least annually with the Board, including recommendations and evaluations of potential successors to fill these positions;

• Regularly reviewing the form and amount of compensation of directors for service on the Board and its committees and recommending changes in compensation to the Board as appropriate;

• Reviewing and recommending for inclusion executive compensation disclosures made in our annual proxy statement, including the Compensation Discussion and Analysis and the Talent Committee Report;

• Reviewing our strategies and programs for leadership development (including considerations of diversity) and for maintaining a talent pipeline for executive roles;

• Reviewing and discussing with management our diversity and inclusion initiatives, objectives, and progress; and

• Reviewing and discussing with management our organizational development activities, including key policies, practices, and trends related to: (i) the recruitment, development, and retention of our personnel; (ii) employee engagement and effectiveness; and (iii) workplace environment and culture. |

| 15 | 2023 Proxy Statement |

| ||||||

Environmental,

Social and

Governance

Committee

|

Robert A. Essner Chair

Other Members Carrie S. Cox Helene Gayle, M.D. Shelly Lazarus Philip Ozuah, M.D., Ph.D.

|

| Overview

The ESG Committee performs a leadership role in shaping Organon’s corporate governance, including by overseeing succession planning for the Board and its committees. The ESG Committee annually reviews the size, structure, and needs of the Board and Board committees, reviews possible candidates for the Board, and recommends director nominees to the Board for approval. The details of the review process and assessment of candidates are described under Criteria for Board Membership and Director Nomination Process beginning on page 19 of this proxy statement.

The Primary Functions of this Committee Include:

• Engaging in succession planning for the Board;

• Identifying individuals to become qualified Board members (consistent with criteria approved by the Board);

• Recommending to the Board director candidates for election at our annual meeting of shareholders;

• Reviewing and recommending changes to the Board of our corporate governance principles;

• Considering and making recommendations to the Board on other matters pertaining to the effectiveness of the Board;

• Periodically reviewing and recommending to the Board the skills, experience, characteristics, and other criteria for identifying and evaluating directors;

• Overseeing the annual evaluation of the Board, its committees, and individual directors;

• Overseeing compliance with the GxP requirements (i.e., regulations and guidelines applicable to life sciences organizations);

• Overseeing our shareholder engagement program and making recommendations to the Board regarding its involvement in shareholder engagement;

• Advising the Board and management on our policies and practices that pertain to our responsibilities as a global corporate citizen, our special obligations as a healthcare company whose products and services affect the health and quality of life around the world, and our commitment to the highest standards of ethics and integrity in all our dealings; and

• Reviewing public policy positions, strategy regarding political engagement, and corporate responsibility initiatives with significant financial or reputational impact, as appropriate, and overseeing and making recommendations to the Board regarding environmental, social, governance, and other sustainability matters and risks relevant to our business. |

| 16 |

| Corporate Governance | ||||||

| ||||||

Our Environmental, Social, and Governance Approach

At Organon, our vision is to create a better and healthier every day for every woman. Our mission is to deliver impactful medicines and solutions for a healthier every day. We focus on the material ESG issues that matter most to our business, our stakeholders and women around the world.

In addition to the governance matters discussed within this proxy statement and the foundational elements that we believe are essential to conducting our business in an ethical, compliant, and transparent manner, there are focus areas within our ESG strategy that demonstrate our commitment to being a purpose-driven company1:

|

|  |

|  |

|  |

|  |

|  | |||||||||

| Working together with our partners, we aim to prevent an estimated 120 million unintended pregnancies by 2030. |

| We aim to redefine and harness innovation in women’s health by dedicating a majority of our pre-clinical and clinical development activity toward areas that address the unmet health needs of women and girls.

We will work with partners to expand access to treatment options that improve her health and help secure her promise. |

| We aim to achieve balanced gender representation through all levels of the company globally by 2030, and achieve pay equity. |

| We aim to support the transition to a sustainable economy, with an ambition to achieve net zero green house gas (“GHG”) emissions and the integration of water stewardship and circular economy principles into our business models.

To meet these ambitions, we have set quantitative goals to reduce GHG emissions, water usage and waste in our operations and in our supply chain. |

| We are committed to upholding the highest levels of ethics and integrity throughout our business.

Our highly capable Board of Directors is one of the most diverse in the healthcare industry. We aspire to maintain the expertise as well as the gender and racial diversity that characterizes our Board today. | |||||||||

1 Please refer to the Forward-Looking Statements on page 1. |

| |||||||||||||||||

Importance of ESG at Organon

At Organon, we are guided by our purpose — to help women achieve their promise through better health. Our ESG strategy helps to advance this purpose and is embedded into our business strategy. Building a strong, sustainable and resilient company requires that we consider long-term risks and opportunities presented by social, environmental and governance matters. Successfully navigating these challenges helps to mitigate political and reputational risk, drives employee engagement, and enhances our reputation as a responsible partner, all of which help create long-term value for shareholders and other stakeholders. Moreover, by addressing gender-related disparities in health, we are helping to build a more sustainable future for women, families, and society.

| 17 | 2023 Proxy Statement |

| ||||||

ESG Governance at Organon

We have developed practices and policies designed to ensure strong Board oversight over the entirety of our ESG program.

Board of Directors

The full Board has oversight of Organon’s ESG strategy and performance and receives regular updates from management on these topics. | Audit Committee engages on specific ESG topics such as cybersecurity, ethics and compliance.

| |||

| ESG Committee advises on policies and practices that pertain to our responsibilities as a global corporate citizen, and our special obligations as a healthcare company whose products and services affect health and quality of life around the world. The ESG Committee also reviews feedback from shareholder engagements on ESG, market and peer ESG reporting and disclosure practices, and the company’s performance on priority ESG issues including environmental and product quality matters. As needed, the ESG Committee receives information from third-party consultants and other experts on relevant ESG topics to inform the Committee’s thought process and to ensure continuous knowledge building in support of its ESG oversight role. | ||||

Management

The entire Executive Leadership Team is responsible for implementing Organon’s ESG strategy and is accountable for making progress against the goals and targets that have been set.

| Talent Committee plays an important governance role on matters related to human capital management including executive compensation, employee engagement and workplace culture, and Organon’s diversity and inclusion programs. As discussed in the CD&A, beginning on page 58 under the heading “Organizational Health Priorities,” ESG performance is also embedded into the Company Scorecard, which impacts annual incentive payouts. The Talent Committee plays a role in the selection and oversight of the specific metrics from the ESG strategy that are included in the Company Scorecard.

| |||

Executive Leadership Team is supported by a Public Policy and ESG Council consisting of senior leaders within each function with direct responsibility for key areas of the ESG strategy. The Head of External Affairs and ESG reports directly to the CEO, is a member of the Executive Leadership Team and also chairs the Public Policy and ESG Council. She has a dedicated team of professionals that collaborate with internal stakeholders across the company to support progress and ensure timely and transparent ESG reporting.

|

Organon’s ESG Strategy

In 2021, immediately after the company’s spinoff, Organon embarked upon a robust process to develop its ESG strategy. We analyzed leading ESG reporting standards and frameworks including the Sustainability Accounting Standards Board (“SASB”), the Global Reporting Initiative (“GRI”), and the Task Force on Climate-Related Financial Disclosures (“TCFD”), conducted an ESG prioritization assessment, interviewed internal subject-matter experts, engaged our top shareholders, and sought input from a broad base of our employees. The Public Policy and ESG Council, the Executive Leadership Team, and the ESG Committee of the Board were consulted regularly during this process, and each approved the final plan, as did the full Board.

Organon published its first ESG Report in June 2022. The report included extensive disclosures, aligned with SASB and GRI standards, as well as our U.S. Equal Employment Opportunity Commission EEO-1 data for our U.S.-based workforce.

As part of this strategy, Organon recognized that our business partners play an important role in our overall success. Accordingly, we strive to conduct business with individuals and organizations who share our commitment to high ethical standards and who operate in a socially and environmentally responsible manner. To reinforce the standards to which we are committed, Organon developed the Business Partner Code of Conduct founded upon the Pharmaceutical Supply Chain Initiative’s (PSCI) Pharmaceutical Industry Principles, the 10 Principles of the United Nations Global Compact, and our Code of Conduct, as well as a set of Supplier Performance Expectations.

| 18 |

| Corporate Governance | ||||||

| ||||||

During 2022, as part of our proactive shareholder engagement program, we discussed our 2022 ESG Report with our largest shareholders. During these meaningful exchanges, we heard from many shareholders that they have appreciated our efforts as a new company to provide a high level of transparency on the full range of priority ESG topics. We are taking this feedback into account as we prepare to publish our next ESG Report in Summer 2023.

For more information about Organon’s ESG strategy and initiatives, please review our 2021 data published in our 2022 ESG Report, which is available on our website, and more generally, visit the ESG section of our website at www.organon.com/about-organon/environmental-social-governance.

Criteria for Board Membership and Director Nomination Process

The ESG Committee is responsible for screening and nominating director candidates to be considered for election by the Board. As part of this process, the ESG Committee considers the composition of the Board at the time, including the depth of experience, balance of professional skills, expertise, and diversity of perspectives represented by its members. The ESG Committee evaluates prospective nominees identified on its own initiative as well as candidates recommended by other Board members, management, shareholders, or search consultants. From time to time, the ESG Committee may also retain a search firm to identify possible candidates who meet the Board’s qualifications, to interview and screen such candidates (including conducting reference checks), and to assist in scheduling candidate interviews with Board members.

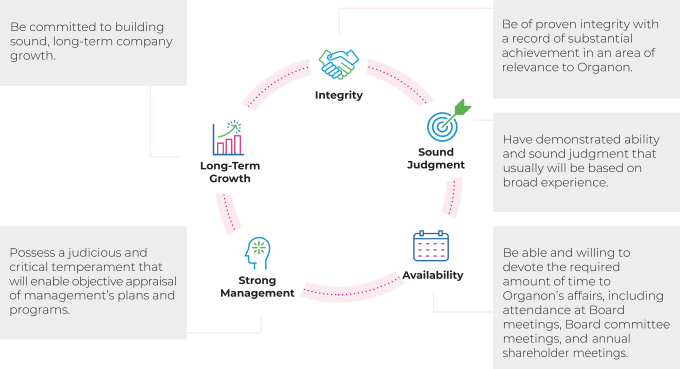

To be considered for membership on the Board, a candidate must meet the following minimum criteria:

| 19 | 2023 Proxy Statement |

| ||||||

Individual Experience, Qualifications, Attributes, and Skills

The ESG Committee evaluates the composition of the Board annually to assess whether the skills, experience, characteristics, and other criteria established by the Board are currently represented on the Board as a whole, and in individual directors, and to assess the criteria that may be needed in the future in light of Organon’s anticipated needs. The Board should have a balanced membership, with representation of relevant areas of experience, types of expertise, and backgrounds. These include pharmaceutical industry expertise, global management experience, marketing, sales and public relations skills, public company governance expertise, women’s health experience, medical expertise, risk management experience, and financial expertise. The ESG Committee uses this input in its planning and director search process.

Each of our current directors initially joined the Board in connection with our spinoff from Merck, and the Class I directors subsequently stood for election at our 2022 annual shareholders meeting. None of the Class II director nominees nor any current Class III directors have been elected by our public shareholders. Beginning with our 2025 annual shareholders meeting, the term for each class of directors shall expire and all directors will be subject to annual election. As noted in the director biographies that follow this section, our directors have experience, qualifications, and skills across a wide range of public and private companies, possessing a broad spectrum of experience both individually and collectively. The following chart highlights the key background, experience, and skills the Board considered for qualification. These attributes are amply represented by our directors and director nominees.

Board Key Skills and Experience | ||||||||||||||||||||||||||||

|

|

| Ali | Cox | Essner | Ezekowitz | Francisco | Gayle | Lazarus | Leone | McGarry | Ozuah | Patton | Puma | Sharp | ||||||||||||||

| Executive Leadership / CEO Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Financial / Accounting | ● | ● | ● | ● | ● |

| ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Global Healthcare | ● | ● | ● | ● | ● | ● | ● |

| ● | ● | ● |

| ● | ||||||||||||||

| Marketing, Sales or Public Relations | ● | ● | ● |

| ● |

| ● |

|

| ● |

|

|

| ||||||||||||||

| Public Policy / Regulatory | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Corporate Governance / Public Company | ● | ● | ● | ● |

| ● | ● | ● | ● |

| ● | ● | ● | ||||||||||||||

| Global Business Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

Skills Categories:

| • | Executive Leadership / CEO Experience – Leadership experience for a significant enterprise, resulting in a practical understanding of organizations, processes, strategic development, and risk management. Demonstrated strengths in driving change and long-term growth, developing talent and planning succession. |

| • | Financial / Accounting – Significant experience in financial accounting and reporting processes or the financial management of a major organization. |

| • | Global Healthcare – Experience with global complex issues within the healthcare industry. |

| • | Marketing, Sales or Public Relations – Strategic or management experience involving the marketing, advertising and branding of products. |

| 20 |

| Corporate Governance | ||||||

| ||||||

| • | Public Policy / Regulatory – Experience with public policy and regulation in the healthcare industry or other highly-regulated industries. |

| • | Corporate Governance / Public Company – Experience as a board member of another publicly-traded company or current or former executive officer of a publicly-traded company. |

| • | Global Business Experience – Extensive leadership experience leading an organization that operates internationally on a broad basis and/or in the geographic regions in which the company operates. |

Board Diversity Policy

The Board endorses the principle that it should have a balance of skills, experience, and diversity of perspectives appropriate to Organon’s current and future global business and strategic initiatives, opportunities, and challenges. The Board recognizes that maintaining a diverse membership with varying backgrounds, skills, expertise, and other differentiating personal characteristics promotes inclusiveness, fosters a breadth of thinking, enhances the Board’s deliberations, and contributes to the Board’s overall effectiveness to better represent the long-term interests of Organon and its shareholders.

The ESG Committee, acting on behalf of the Board, is committed to actively identifying and recruiting highly qualified, diverse candidates in the search process. In evaluating the suitability of potential candidates to the Board, the ESG Committee (or any search firm acting under the direction of the ESG Committee) considers the benefits of diversity, including diversity of thought, viewpoints, educational and professional background, gender, race, age, sexual orientation, and ethnic or national background, among other characteristics.

The ESG Committee and the Board have adopted a Board diversity policy as part of the Principles of Corporate Governance that formalizes Organon’s approach to Board diversity. The ESG Committee and the Board believe that the Board’s current membership — 9 of the 13 members are women and 6 directors are racially or ethnically diverse — strongly reflects their commitment to diversity.

Gender Diversity | ||||||||||||||||||||||||||||

| 69% | · | · | · | · | · | · | · | · | · | · | · | · | · | |||||||||||||||

As a company with a vision of a better and healthier every day for every woman, our Board values gender diversity in its membership. Organon is a leader in Board gender diversity, with women constituting nearly 70% of the Board.

Racial/Ethnic Diversity | ||||||||||||||||||||||||||||

| 46% | · | · | · | · | · | · | · | · | · | · | · | · | · | |||||||||||||||

Organon is committed to racial and ethnic diversity. Our Board is 46% ethnically or racially diverse.

Independence | ||||||||||||||||||||||||||||

| 92% | · | · | · | · | · | · | · | · | · | · | · | · | · | |||||||||||||||

Organon’s Principles of Corporate Governance require that a substantial majority of the Board be made up of independent directors. The Board has determined that each of Organon’s directors and director nominees, with the exception of our CEO, Kevin Ali, is independent under the NYSE Listing Standards.

Average Age

The average age of our directors and director nominees is 63.9 years, with ages ranging from 48 to 75 years old. The median age is 62 years.

| 21 | 2023 Proxy Statement |

| ||||||

Total Number of Directors: 13 | Female | Male | ||

Directors | 9 | 4 | ||

African American or Black | 2 | 1 | ||

Alaskan Native or Native American | — | — | ||

Asian | 2 | — | ||

Hispanic or Latinx | 1 | — | ||

Native Hawaiian or Pacific Islander | — | — | ||

White | 4 | 3 | ||

The ESG Committee will consider recommendations for director candidates made by shareholders and will evaluate those individuals using the same criteria applied to other candidates. Shareholder recommendations must be sent to the Office of Corporate Secretary, 30 Hudson Street, Floor 33, Jersey City, New Jersey 07302, and must include detailed background information regarding the recommended candidate that demonstrates how that candidate meets the Board membership criteria. Shareholders may make recommendations at any time, but recommendations for consideration as nominees at Organon’s annual meeting of shareholders must be received no less than 120 days before the first anniversary of the date of the previous year’s annual meeting.

Candidates are evaluated initially based on materials submitted by them or on their behalf. If a proposed or recommended candidate continues to be of interest to the ESG Committee, the ESG Committee obtains additional information through inquiries to various sources and, if warranted, interviews.

Management Succession Planning

The Talent Committee is responsible for oversight of succession planning for certain senior management positions. At least annually, the Talent Committee reviews with the Board succession planning and management development, including recommendations and evaluations of potential successors to fill the CEO and other senior management positions. The succession planning process includes consideration of both ordinary course succession, in the event of planned promotions and retirements, and planning for situations where the CEO or another member of senior management unexpectedly becomes unable to perform the duties of their position.

Board Succession Planning

The Board also considers its own composition and succession plans. In director succession planning, the ESG Committee and the Board will consider, among other things, the needs of the Board and Organon in light of the overall composition of the Board, with a view toward achieving a balance of the skills, experience, and attributes that are essential to the Board’s oversight role. In particular, the Board is deliberate in ensuring the Board has the right mix of diverse perspectives, skills, and expertise to address Organon’s current and anticipated needs as opportunities and challenges facing it evolve. In addition, the Principles of Corporate Governance provide that non-management directors may not stand for re-election to the Board after they reach the age of 75, unless the Board determines that it is in the best interests of Organon and its shareholders to extend the director’s service for an additional period of time. The Board believes this policy promotes regular refreshment of the Board.

Annual Board, Committee, and Individual Director Evaluations

The Board conducts an annual self-evaluation to assess its performance and the performance of individual directors. The Audit, Talent, and ESG Committees also conduct annual self-evaluations to assess their performance. In the event it is believed an individual director is not making meaningful contributions to the overall effectiveness of the Board, the Chairman of the Board or another Board member should raise the matter with the ESG Committee, which will then seek the views of the other Board members and, if appropriate, make a recommendation to the Board regarding the future role of the director in question.

| 22 |

| Corporate Governance | ||||||

| ||||||

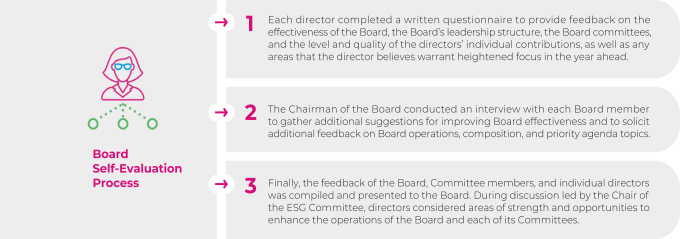

The ESG Committee is responsible for developing, administering and overseeing processes for conducting evaluations. The most recent evaluations were conducted in December 2022 through January 2023, as follows:

Shareholder Engagement and Feedback

Organon regularly communicates with shareholders to better understand their perspectives and has established a shareholder engagement program that is proactive and cross-functional. Throughout the year, our CEO, CFO, members of our Investor Relations department and the EVP for External Affairs and ESG, as well as other subject-matter experts within Organon, engage with our shareholders to remain well-informed regarding their perspectives on current issues and to address any questions or concerns. These teams serve as liaisons among shareholders, members of senior management, and the Board.

We engaged with more than two-thirds of our 50 largest shareholders, representing approximately 60% of our shares outstanding as of December 31, 2022. ESG continued to be a focal point in many of the shareholder engagements we had in 2022. We also engaged with our shareholders on various topics relating to our Board governance, executive compensation, human rights and product safety. Organon intends to remain engaged with its shareholders through frequent meetings during the year.