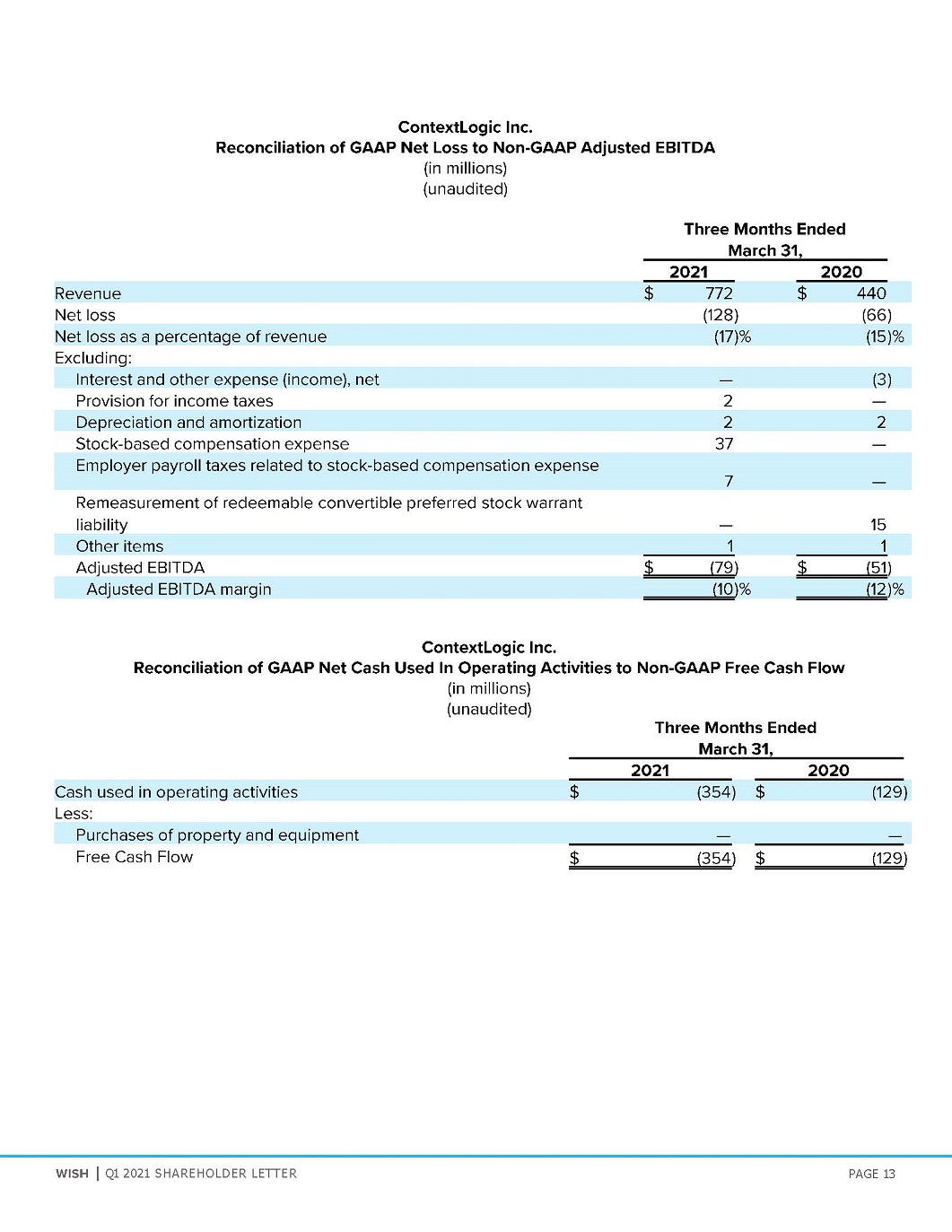

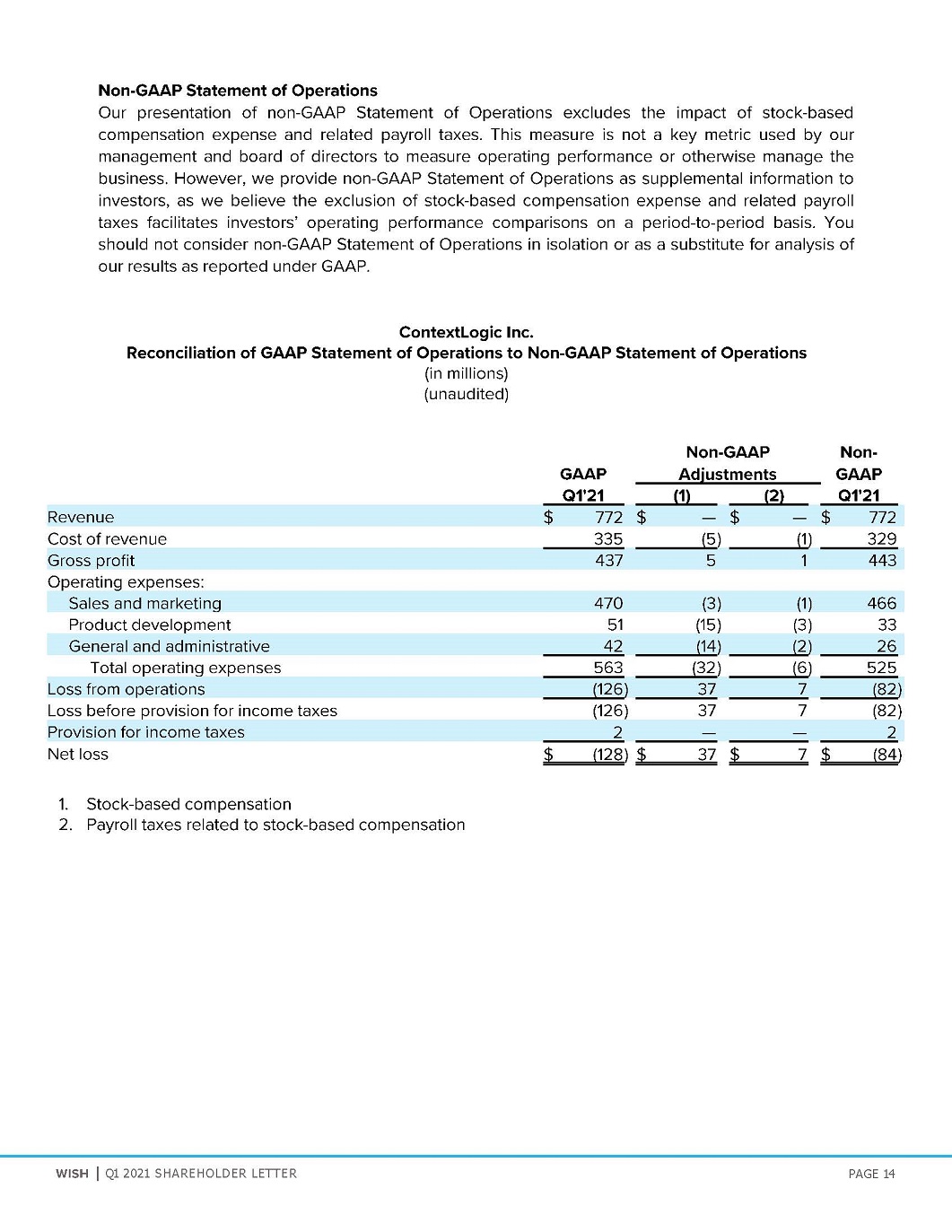

Conference Call and Webcast InformationWish will host a live conference call and webcast to discuss the results today, Wednesday, May 12 at 2 p.m. PT / 5 p.m. ET. A link to the live webcast and a recorded replay of the conference call, will be made available on the company’s investor relations website at https://ir.wish.com. The live call may also be accessed via telephoneat (833) 664-1138 toll-free domestically and at (470) 414-9349 internationally. Please reference conference ID: 4862975.Use of Non-GAAP Financial MeasuresWish provides Adjusted EBITDA, a non-GAAP financial measure that represents net income (loss) before interest and other income (expense), net (which includes foreign exchange gain or loss, and gain or loss on one time transactions recognized), income tax expense, and depreciation and amortization, adjusted to eliminate stock-based compensation expense and remeasurement of redeemable convertible preferred stock warrant liability, and to add back certain recurring other items. Additionally, in these prepared remarks, we provide Adjusted EBITDA Margin, a non-GAAP financial measure that represents Adjusted EBITDA divided by revenue. The reconciliation between historical GAAP and non-GAAP results of operations is provided in our earnings news release, which is available on our investor relations website. Our management uses Adjusted EBITDA in conjunction with GAAP and other operating performance measures as part of its overall assessment of the company’s performance for planning purposes, including the preparation of its annual operating budget, to evaluate the effectiveness of its business strategies and to communicate with its board of directors concerning its financial performance. Adjusted EBITDA should not be considered as an alternative financial measure to net loss attributable to common stockholders, which is the most directly comparable financial measure calculated in accordance with GAAP, or any other measure of financial performance calculated in accordance with GAAP.Wish also provides Free Cash Flow, a non-GAAP financial measure that represents net cash provided by (used in) operating activities less purchases of property and equipment. The reconciliation of Free Cash Flow to net cash provided by (used in) operating activities, the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP is provided below. Wish believes that Free Cash Flow provides investors with additional useful information to measure operating liquidity because it reflects the amount of cash generated by the company’s operations after the purchasesof property and equipment. Free Cash Flow should not be considered as an alternative financial measure to net cash provided by (used in) operating activities, which is the most directly comparable financial measure calculated in accordance with GAAP, or any other measure of financial performance calculated in accordance with GAAP.Forward-Looking StatementsThis letter and related call contain forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding Wish’s outlook, priorities, expectations of growth in ProductBoost revenue throughout 2021, expectations regarding the new Executive Chair role, improving customer service, reducing delivery times and growth opportunities. In some cases, forward-looking statements can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “guidance,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” or similar expressions and the negatives of those terms. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Risks include, but are not limited to: our ability to attract, retain and monetize users; risks associated with software updates to the platform; increasing requirements on collection of sales and value added taxes; compromises in security; changes by third-parties that restrict our access or ability to identify users; competition; disruption, degradation or interference with the hosting services we use and infrastructure; our financial performance and fluctuations in operating results; pressure and fluctuation in our stock price, including as a result of the expiration of the IPO lockup and short selling; challenges in our logistics programs; challenges in growing our Wish Local program and other new initiatives; the continued services of Piotr Szulczewskior other members of our senior management team; our ability to offer and promote our app on the Apple App Store and the Google Play Store; our brand; legal matters; the COVID-19 pandemic; and economic tension between the United States and China. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Further information on these and additional risks that could affect Wish’s results is included in its filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed with the SEC on March 25, 2021, and future reports that Wish may file with the SEC from time to time, which could cause actual results to vary from expectations. Any forward-looking statements made by Wish in this Shareholder Letter are as of today, May 12. Wish assumes no obligation to, and does not currently intend to, update any such forward-looking statements.The unaudited financial results set forth in this Shareholder Letter are estimates based on information currently available to Wish. While Wish believes these estimates are meaningful, they could differ from the actual amounts that the company ultimately reports in its Quarterly Report on Form 10-Q for the quarter ended March 31, 2021. Wish assumes no obligation and does not intend to update these estimates prior to filing its Quarterly Report on Form 10-Q for the quarter ended March 31, 2021.A Note About MetricsThe numbers for some of our metrics, including MAUs, are calculated and tracked with internal tools, which are not independently verified by any third party. We use these metrics to assess the growth and health of our overall business. While these numbers are based on what we believe to be reasonable estimates of our user or merchant base for the applicable period of measurement, there are inherent challenges in measurement as the methodologies used require significant judgment and may be susceptible to algorithm or other technical errors. In addition, we regularly review and adjust our processes for calculating metrics to improve their accuracy, and our estimates may change due to improvements or changes in technology or our methodology. WISH Q1 2021 SHAREHOLDER LETTER 10