Net Revenues

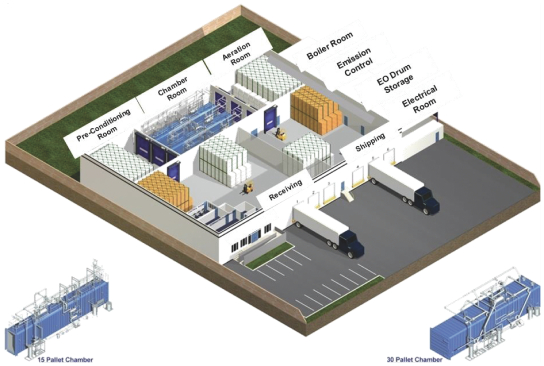

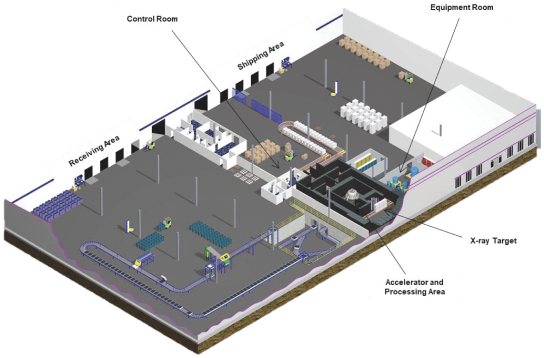

Sterigenics net revenues were $471.7 million for the year ended December 31, 2019, an increase of $36.0 million, or 8.3%, as compared to the prior year. The increase was driven by favorable impacts from organic volume growth and pricing of 6.4% and 3.8%, respectively. This was partially offset by a 3.3% headwind associated with the closure of the Willowbrook facility.

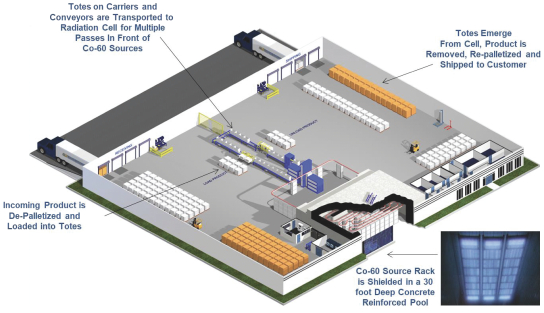

Nordion net revenues were $116.2 million for the year ended December 31, 2019, a decrease of $2.7 million, or 2.2%, as compared to the prior year. The decrease reflects a 3.8% impact from lower volumes of industrial use Co-60 and a 1.6% impact from the weakening of the Canadian dollar compared to the U.S. dollar in 2019 as compared to the prior year, partially offset by a 3.7% impact from favorable pricing.

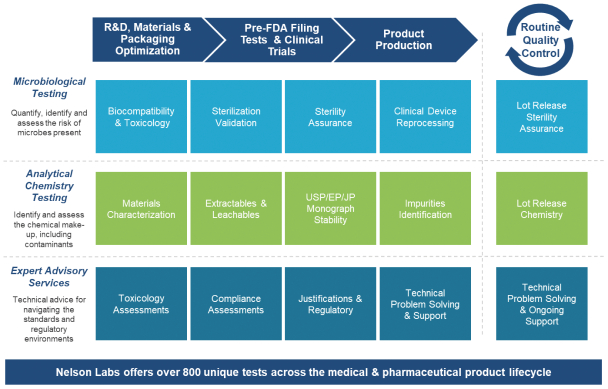

Nelson Labs net revenues were $190.5 million for the year ended December 31, 2019, an increase of $24.2 million, or 14.6%, as compared to the prior year. The increase is primarily attributable to a 6.6% impact from the acquisition of Gibraltar Laboratories, coupled with favorable pricing and growth in organic volumes of 3.9% and 3.0%, respectively.

We divested the Medical Isotopes business in July 2018 and as a result, no sales were recorded for the year ended December 31, 2019, as compared to net revenues of $25.4 million for the year ended December 31, 2018.

Segment Income

Sterigenics segment income was $244.9 million for the year ended December 31, 2019, an increase of $28.4 million, or 13.1%, as compared to the prior year. The 2.2% increase in segment margin was driven by improved operating leverage as facilities operate at higher levels of utilization due to organic volume growth referenced above as well as the favorable pricing referenced above.

Nordion segment income was $62.2 million for the year ended December 31, 2019, an increase of $1.9 million, or 3.2%, as compared to the prior year. The increase in segment income was driven by the favorable pricing impact referenced above.

Nelson Labs segment income was $72.8 million for the year ended December 31, 2019, an increase of $13.9 million, or 23.6%, as compared to the prior year. The increase in segment income was driven by the acquisition of Gibraltar Laboratories, coupled with favorable pricing and improved operating leverage due to an increase in organic volume as referenced above.

LIQUIDITY AND CAPITAL RESOURCES

The primary sources of liquidity for our business are cash flows from operations and borrowings under our credit facilities. We expect that our primary liquidity requirements will be to service our debt, to invest in fixed assets to build and/or expand existing facilities, to fund selective business acquisitions, make capital expenditures and for other general corporate purposes.

As of June 30, 2020, we had $86.4 million of cash and cash equivalents, of which $0.2 million was restricted cash. This is an increase of $23.3 million from the balance at December 31, 2019. Our foreign subsidiaries held cash of approximately $63.2 million at June 30, 2020 and $43.4 million at December 31, 2019, to meet their liquidity needs. No material restrictions exist to accessing cash held by our foreign subsidiaries.

Our capital expenditure program is a component of our long-term strategy. This program includes, among other things, investments in new and existing facilities, business expansion projects, Co-60 used by Sterigenics at its gamma irradiation facilities and information technology enhancements. During 2019, our capital expenditures amounted to $57.3 million, compared to $72.6 million in 2018. In 2021, we expect to continue to invest in our supply relationships including Co-60 development projects, facility expansions and in ongoing maintenance for existing facilities, including enhancements to our emissions controls in anticipation of changes to environmental requirements. We may choose to temporarily defer planned capital expenditures due to fluctuations in demand for our products and services resulting from the COVID-19 pandemic and the needs of our customers.

78