- SHC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3ASR Filing

Sotera Health (SHC) S-3ASRAutomatic shelf registration

Filed: 27 Feb 24, 5:06pm

Exhibit 5.1

D: +1212 225 2632 dlopez@cgsh.com |

February 27, 2024

Sotera Health Company

9100 South Hills Blvd, Suite 300

Broadview Heights, Ohio 44147

Ladies and Gentlemen:

We have acted as special counsel to Sotera Health Company, a corporation organized under the laws of Delaware (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”) of the Company’s registration statement on Form S-3 (including the documents incorporated by reference therein, the “Registration Statement”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the offering from time to time by the Company or the selling stockholders contemplated thereby (the “Selling Stockholders”) of shares of the Company’s common stock, par value $0.01 per share (the “Securities”). The Securities being registered under the Registration Statement will have an indeterminate aggregate initial offering price and will be offered on a continuous or delayed basis pursuant to the provisions of Rule 415 under the Securities Act.

In arriving at the opinions expressed below, we have reviewed the following documents:

| (a) | the Registration Statement; and |

| (b) | the Amended and Restated Certificate of Incorporation of the Company, certified by the Secretary of State of the State of Delaware. |

In addition, we have reviewed the originals or copies certified or otherwise identified to our satisfaction of all such corporate records of the Company and such other documents, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinions expressed below.

In rendering the opinions expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified the accuracy as to factual matters of each document we have reviewed.

Based on the foregoing and subject to the further assumptions and qualifications set forth below, it is our opinion that:

| 1. | The Securities to be offered and sold by the Company will be validly issued by the Company and fully paid and nonassessable. |

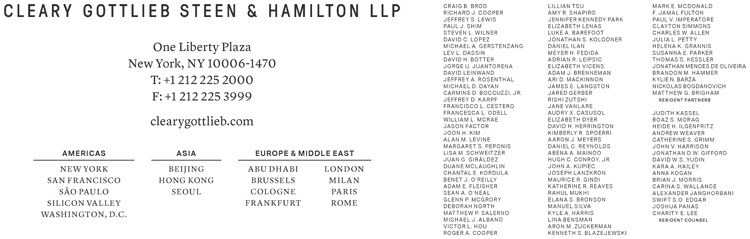

Cleary Gottlieb Steen & Hamilton LLP or an affiliated entity has an office in each of the locations listed above.

| 2. | The Securities to be offered and sold by the Selling Stockholders are validly issued by the Company and fully paid and nonassessable. |

In rendering the opinion in numbered paragraph 1, we have further assumed that (i) prior to any issuance of Securities by the Company, the Company will authorize the offering and issuance of such Securities; (ii) the Securities will be offered, issued, sold and delivered in compliance with applicable law and any requirements therefor set forth in any corporate action authorizing such Securities and in the manner contemplated by the Registration Statement; (iii) the Securities will be offered, sold and delivered to, and paid for by, the purchasers thereof at the price specified in, and in accordance with the terms of, an agreement or agreements duly authorized, executed and delivered by the parties thereto, which price shall not be less than the par value thereof; and (iv) if issued in certificated form, certificates representing the Securities will be duly executed and delivered by the Company and duly countersigned and registered by the transfer agent and registrar of the Company, and if issued in book-entry form, the Securities will be duly registered or otherwise established in the systems of The Depository Trust Company. In rendering the opinion in numbered paragraph 2, we have further assumed that (i) the Securities will be offered, sold and delivered in compliance with applicable law and in the manner contemplated by the Registration Statement and (ii) the Securities will be offered, sold and delivered to, and paid for by, the purchasers thereof at the price specified in, and in accordance with the terms of, an agreement or agreements duly authorized, executed and delivered by the parties thereto.

The foregoing opinions are limited to the General Corporation Law of the State of Delaware, including the applicable provisions of the Delaware Constitution and reported judicial decisions interpreting such laws.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the reference to this firm under the heading “Legal Matters” in the Registration Statement and the related prospectus included in the Registration Statement. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| Very truly yours, | ||

| CLEARY GOTTLIEB STEEN & HAMILTON LLP | ||

| By | /s/ David Lopez | |

| David Lopez, a Partner | ||