Exhibit 99.1

Welcome to Next Generation GPS

Disclaimer and Cautionary Note Regarding Forward - looking Statements This presentation (together with oral statements made in connection herewith, this “ Presentation ”) contains selected confidential information about NextNav, LLC (“ NextNav ”) and Spartacus Acquisition Corporation (“ Spartacus ”). By participating in this Presentation, you expressly agree to keep confidential all otherwise non - public information disclosed by us, whether orally or in writing, during this Presentation or in these Presentation materials. You also agree not to distribute, disclose or use such information for any purpose, other than for the purpose of your firm’s participation in the potential financing and to return to NextNav or Spartacus, delete or destroy this Presentation upon request. You are also being advised that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. This Presentation relates to the potential financing of a portion of a contemplated business combination of NextNav and Spartacus through a private placement of Spartacus’ Class A common stock. This Presentation shall not constitute a “solicitation” as defined in Rule 14a - 1 of the Securities Exchange Act of 1934, as amended. N o O ff e r o r S o l i c i t a t i o n This Presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. Any offering of securities (the “ Securities ”) will not be registered under the Securities Act of 1933, as amended (the “ Act ”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Act or “qualified institutional buyers” as defined in Rule 144A under the Act. Accordingly, the Securities must continue to be held unless the Securities are registered under the Act or a subsequent disposition is exempt from the registration requirements of the Act. Investors should consult with their legal counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. Neither NextNav nor Spartacus is making an offer of the Securities in any state where the offer is not permitted. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. This Presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. No representation, express or implied, is or will be given by NextNav, Spartacus or their respective affiliates and advisors and any placement agent as to the accuracy or completeness of the information contained in this Presentation. I n d u s t r y a n d M a r k e t I n f o r m a t i o n I n f o r m a t i o n c o n t a i n e d i n t h i s P r e s e n t a t i o n c o n c e r n i n g Ne xt Na v ’ s i n d u s t r y a n d t h e m a r k e t s in w hi c h it operates, including NextNav’s general expectations and market position, market opportunity and market size, is based on information from NextNav’s management’s estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. In some cases, we may not expressly refer to the sources from which this information is derived. Management estimates are derived from industry and general publications and research, surveys and studies conducted by third parties and NextNav’s knowledge of its industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of NextNav’s and its industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause NextNav’s future performance and actual market growth, opportunity and size and the like to differ materially from our assumptions and estimates. 1 Trademarks All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and NextNav’s or Spartacus’ use thereof does not imply an affiliation with, or endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. Solely for convenience, trademarks and trade names referred to in this Presentation may not appear with the ® or Œ symbols, but such references are not intended to indicate, in any way, that NextNav or Spartacus will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. U s e o f P r o j ec t i o n s This Presentation contains estimated or projected information including financial information with respect to NextNav, including NextNav’s projected revenue, gross margin, EBITDA, and unlevered free cash flow for 2021 - 2026 . Such estimated or projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such estimated or projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward - Looking Statements” below. Actual results may differ materially from the results contemplated by the estimated or projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such estimates and projections will be achieved. Neither the independent registered public accounting firm of Spartacus nor the independent registered public accounting firm of NextNav, audited, reviewed, compiled, or performed any procedures with respect to the estimates or projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. Use of Non - GAAP Financial Measures This Presentation includes certain non - GAAP financial measures, including EBITDA and unlevered free cash flow, that are not prepared in accordance with accounting principles generally accepted in the United States (“ GAAP ”) and that may be different from non - GAAP financial measures used by other companies. NextNav and Spartacus believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends of NextNav. These non - GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. Forward - looking non - GAAP financial measures are provided; they are presented on a non - GAAP basis without reconciliations of such forward - looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. F o r w a r d - L oo k i n g S t a t e m e n t s This Presentation includes “forward - looking statements” within the meaning of the “safe harbor’’ provisions of the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward - looking statements with respect to revenues, earnings, performance, strategies, the market, prospects and other aspects of the businesses of NextNav, Spartacus or a combined company after completion of the proposed business combination are based on current expectations that are subject to risks and uncertainties. A number of factors, many of which are outside of the control of NextNav and Spartacus, could cause actual results or outcomes to differ materially from those indicated by such f o r w a r d - l o o k i n g s t a t e m e n t s . T h e s e f o r w a r d - l o o k i n g s t a t e m e n t s a r e s u b j e c t t o a nu m b e r o f r i s k s a n d uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the NextNav and Spartacus to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the stockholders of Spartacus or equity holders of NextNav is not obtained; (iii) failure to realize the anticipated benefits of the proposed business combination; (iv) risks relating to the uncertainty of the projected financial information with respect to NextNav; (v) risks related to the rollout of NextNav’s technologies; (vi) the effects of competition on NextNav’s business; (vii) the level of product service or product failures that could lead customers to use competitors’ services; (viii) developments and changes in laws and regulations; (ix) the impact of significant investigative, regulatory or legal proceedings; (x) the amount of redemption requests made by Spartacus’ public stockholders; (xi) the ability of Spartacus or the combined company to issue equity or equity - linked securities in connection with the proposed business combination or in the future; and (xii) those factors discussed in Spartacus’ Annual Report on Form 10 - K for the fiscal year ended December 31, 2020, under the heading “Risk Factors,” and other documents of Spartacus filed, or to be filed, with the Securities and Exchange Commission (“ SEC ”). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that neither Spartacus nor NextNav presently know or that Spartacus and NextNav currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Spartacus’ and NextNav’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Spartacus and NextNav anticipate that subsequent events and developments will cause Spartacus’ and NextNav’s assessments to change. You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. NextNav and Spartacus undertake no commitment to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. A dd i t i o n a l I n f o r m a t i o n If the contemplated business combination is pursued, Spartacus Acquisition Shelf Corp. intends to file a Registration Statement on Form S - 4 with the SEC, which will include a preliminary proxy statement/prospectus. Spartacus will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. INVESTORS AND SECURITY HOLDERS OF SPARTACUS ARE ADVISED TO READ, WHEN AVAILABLE, THE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH SPARTACUS’ SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE CONTEMPLATED BUSINESS COMBINATION AND THE PARTIES THERETO. The definitive proxy statement/prospectus will be mailed to stockholders of Spartacus as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain copies of the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov. P a r t i c i p a n t s i n t h e S o l i c i t a t i o n Spartacus, NextNav and certain of their respective directors, executive officers, other members of management, and employees, under SEC rules may be deemed to be participants in the solicitation of proxies of Spartacus’ stockholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Spartacus’ directors and officers in Spartacus’ filings with the SEC, including Spartacus’ Annual Report on Form 10 - K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 24, 2021, and such information and names of NextNav’s and Spartacus’ directors and executive officers will also be in the Registration Statement on Form S - 4 to be filed with the SEC by Spartacus Acquisition Shelf Corp. B. Riley Securities, Inc. and PJT Partners LP are acting as placement agents and financial advisors and will receive compensation from Spartacus for such service. In addition, B. Riley Securities, Inc. is entitled to a deferred underwriting fee from Spartacus upon the closing of the transaction contemplated therein. An affiliate of B. Riley Securities, Inc. has indirect interests in Spartacus through Spartacus Sponsor LLC as described in the Spartacus’ prospectus dated October 15, 2020 available at www.sec.gov. D i s c l a i m e r

Unique sponsor & target partnership SPARTACUS • Extensive history with NextNav’s people and assets • Nearly three decades of telecom experience • A history of transformational investments in wireless • High conviction in NextNav’s generational opportunity to transform GPS and drive topline growth Strong Strategic Partner Experienced Leadership Team Impressive Track Record Robust Business Plan Our key prior successes (I n c l u d e s i n v e s t m e n t s b y a ff i l i a t e s o f S p a r t a c u s ) 2

Today’s presenters Ganesh Pa tt a b ir a m a n C O - F O U N D E R , P R E S I D E N T & C E O Chris G a t es CFO Gary Pa r s o n s CHAIRMAN N e x t Nav S p a r t a c u s Peter A q u i n o C HA I R M A N & C E O Neil S u b in C I O , M I L F A M 3

GPS impact on the US economy approaching $ 1 Trillion annually and doubling every 2 - 3 years GPS is a single point of failure — we rely on it for aviation, agriculture, telecommunications, power grids, financial transactions, maps and more. 4 Source: NextNav extrapolation of NIST sponsored study, conducted by RTI International.

Industry needs have evolved beyond tech created in the 60’s Increased accuracy and availability in urban environments Indoor tracking and mapping A l t i t u d e d a ta ( 3 D l o c a t i o n ) Increased resilience and redundancy Increased security We need 5

Today’s economy requires Next Generation GPS • A p p s — r i d e s h a r e , d e l i v e r y , a n d o t h e r s • Indoor mapping • Autonomous vehicles, eVTOLs and UAVs • C r i t i c a l i n f r a s t r u c t u r e • Public Safety 6

NEXTNAV IS NEXT GENERATION GPS MORE AVAILABLE MORE RESILIENT MORE ACCURATE 7

NextNav is targeting a >$100 Billion addressable market today $4 Billion Mission - critical public safety and e911 $24 Billion Mass market, mobile apps, and data analytics $ 1 1 B illi o n Enterprise, IoT, and critical infrastructure >$50 Billion Upside from global expansion (1) $10 Billion Autonomous vehicles, eVTOLs and UAVs US OPPORTUNITIES GLOBAL OPPORTUNITIES Source: Gartner, McKinsey, ABI Research, Apptopia, and public information. (1) Excludes China and Russia. 8

Making smart cities safe cities • Partners with AT&T and FirstNet to provide r e a l ti m e , 3 D s i tu a ti o n a l a w a r e n e s s to F ir s t Responders • NextNav technology proven to exceed FCC’s e 9 11 ve r ti ca l l o ca ti o n a cc u r a cy m a n d a te 240 MILLION 9 11 ca ll s r e l y o n G P S a nnu a ll y S o u r c e : N E N A MARKET OPPORTUNITY: 9

NextNav enables the app economy • Inaccurate location and spoofing plagues apps today • F ir s t s o l u ti o n to p r o vi d e f l oo r l e ve l a cc u r a cy • A u g m e n te d r e a l i ty r e q u ir e s p r e ci s e location data • L a r g e un i ve r s e o f a pp s u ti l i z e l o ca ti o n data to enhance user experience and target advertising • 1 i n 3 a pp s i n th e G oo g l e P l a y S t o r e u s e location services $3.7 TRILLION global app e co n o m y i n 2 0 2 1 S o u r c e : A n d r o i d . MARKET OPPORTUNITY: 10

Autonomous vehicles require resilient and precise location data • M o r e p r e ci s e a n d r e s i l i e n t n a vi g a ti o n , p a r ti c u l a r l y i n u r b a n a r e a s • Li a b i l i ty co n c e r n s i n f l u e n ce f a i l - s a f e system design • Quicker detection and more precise correction of sensor driven error • In - vehicle systems require synchronized internal clocking US autonomous vehicle market expected to include over 5 MILLION vehicles by 2030 MARKET OPPORTUNITY: 11 S o u r c e : G a r t n e r .

(1) Projections informed by Booz Allen Executive Briefing to NASA. eVTOLs and UAVs raise the stakes higher • R e l i a b l e n a vi g a ti o n i n u r b a n a r e a s r e q u ir e s precise location awareness • 3D situational awareness required for urban air mobility • S e l e cte d b y N A S A f o r U r b a n UAV operations 350 MILLION eVTOL TRIPS in the US per year in the near future (1) MARKET OPPORTUNITY: 12

The enterprise IoT will be powered by Next Generation GPS • A ss e t t r a c k i n g & I o T r e q u ir e precise 3D location • Tracking high - value assets • S m a r t w a r e h o u s e s • Lone and industrial worker productivity and safety 1.2 BILLION IoT connections in the US by 2024 (1) (1) Projection from ABI Research. Connections include asset tracking, inventory mgmt., patient monitoring, pet tracking, smart grid, smart parking and wellbeing wearables. MARKET OPPORTUNITY: 13

Bringing resiliency to critical infrastructure • R e s i l i e n t ti m i n g / l o ca ti o n s e r vi c es f o r cr i ti ca l infrastructure is a national security priority • Active Congressional legislation and Presidential directives create opportunity f o r N e xt G e n e r a ti o n G P S e n a b l e m e n t • Significant opportunity for Next Generation GPS • NextNav’s solution identified by US Gov’t as highest performing GPS backup provider 5G and ELECTRICAL UTILITY PROVIDERS rely on GPS for precise timing MARKET OPPORTUNITY: S o u r c e : D OT R e p o r t. 14

NextNav’s long - term vision NextNav Next Generation GPS will be the global gold standard for location and timing services • Irreplaceable deployed nationwide network • Vi t a l a n d f u ll y i n t e g r a t e d s e r v i c e • C r i t i c a l f o r s a f e ty a n d t h e mo b i l e e c o n o my Resulting in a robust long - term financial profile with a significant underlying asset base • Revenue of >$1.5 Billion • EBITDA margin of >70% • Limited go - forward capital requirements • Valuable spectrum asset underpinning deployed network 15

NextNav is Next Generation GPS S O L U T I O N PR O F I LE : 16

Pinnacle “ Ne x tN a v ’ s P i nn a c l e i s t h e m o s t reliable z - axis service available.” - Scott Agnew ASSISTANT VICE PRESIDENT OF PRODUCT MARKETING AT&T S O L U T I O N PR O F I LE : • V e r ti ca l l o ca ti o n + / - 3 m e te r “ f l oo r l e ve l ” accuracy 94% of time • Ubiquitous Network Coverage (90% of 3+ story structures in 4,400 cities today) S o u r c e : C TI A / F CC . Note: NextNav’s current system returns coordinates which can be mapped to specific floor. “ With near real - time vertical location d a t a , I n t r e p i d R e s po n s e w i l l g i v e incident commanders the most comprehensive information available to make informed operational decisions.” - Bruce Dowlen DIRECTOR OF MARKETING AT INTREPID NETWORKS 17

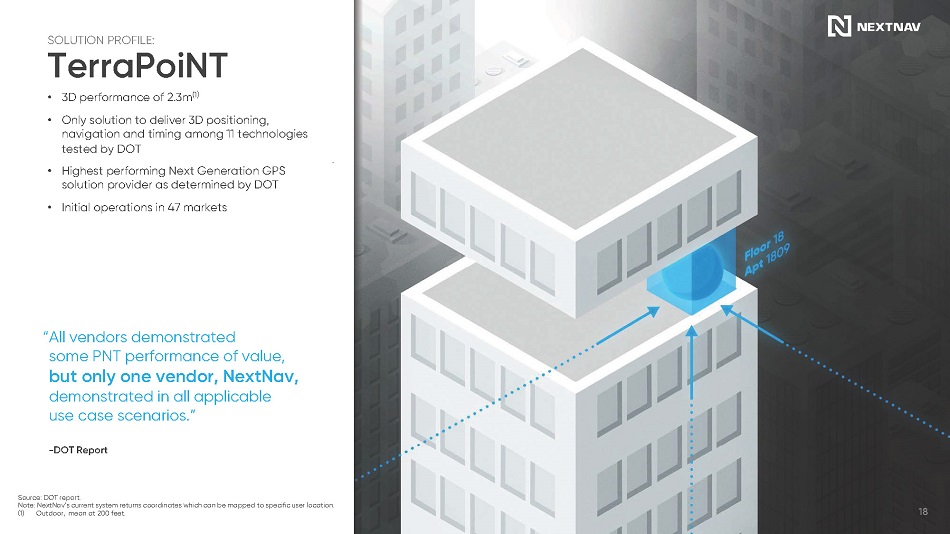

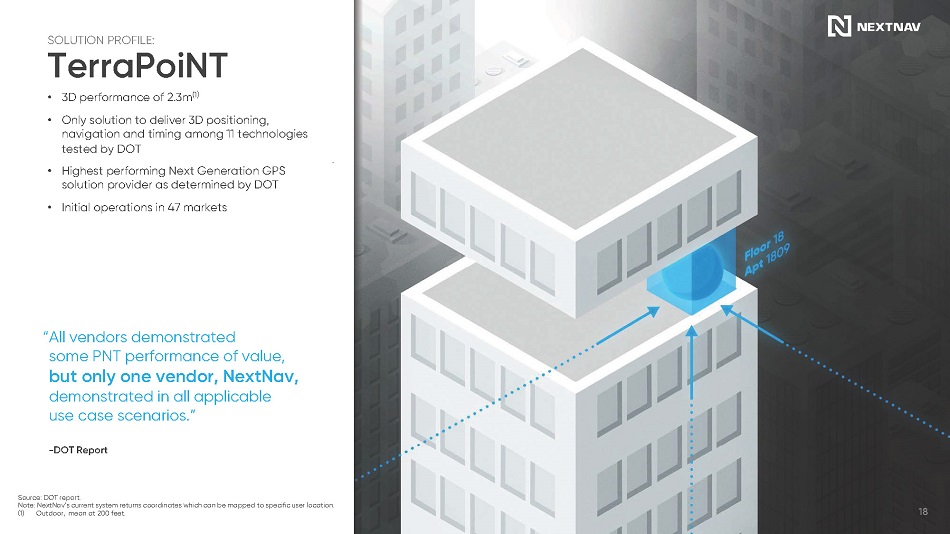

Te r r a P o i N T “ A l l v e n do r s d e m o n s t r a te d some PNT performance of value, but only one vendor, NextNav, d e m o n s t r a te d i n a l l a pp l i c a b l e use case scenarios.” - DOT Report S O L U T I O N PR O F I LE : • 3D performance of 2.3m (1) • Only solution to deliver 3D positioning, navigation and timing among 11 technologies tested by DOT • Highest performing Next Generation GPS solution provider as determined by DOT • I n i ti a l o p e r a ti o n s i n 4 7 m a r k e ts 18 S o u r c e : D OT r e p o r t. Note: NextNav’s current system returns coordinates which can be mapped to specific user location. (1) Outdoor, mean at 200 feet.

Sequential go - to - market plan Market Pe ne t r a t i o n P a r tn e r s h i p w i th A T &T to launch NextNav services a c r o s s U S f o r F i r s tN e t 1 Global S t a n d a r d Provider of highly reliable, c r i t i c a l , l o c a t i o n s e r v i c e s 3 Service P r o li f e r a t i o n Become key provider of location services to a wide range of apps 2 > 200 OPPORTUNITIES in rapidly growing customer pipeline 19

The NextNav opportunity set is global • Target developed markets with similar characteristics to the US • I n cl u d e s c e r t a i n m a r k e ts i n th e A m e ri ca s , Western Europe, and East Asia • Near - term vertical opportunities in Canada, EU and Japan • Joint venture with Metcom (Sony and Kyocera) to deliver NextNav services i n J a p a n • Internationally accepted standard (3GPP) MARKET OPPORTUNITY: GLOBAL ECONOMY would be impacted from any disruption to GPS 20

Deep competitive moat 100+ Patents G l o b a l i n t e ll e c t u a l property portfolio 2.4bn MHz - PoPs One - of - a - kind nationwide spectrum license portfolio 4,400 Cities Covered by NextNav deployed network 21

Spectrum license at core of competitive advantage V i r t u a ll y n a t i o n w i d e , c o v e r i n g 93 % o f U S p o p u l a t i o n S o l e c o mm e r c i a l l i c e n s e e / o p e r a to r i n L MS b a n d Generous power limits L e v e r a g e s c e ll u l a r b a n d 8 R F i n d e v i c e s Scarce low - band spectrum 9 0 2 9 1 9 . 7 5 927.75 9 2 8 f r e q ( M H z ) US Location and Monitoring Services (LMS) Band NextNav 8 M H z Contiguous 9 0 0 M H z Broadband 9 0 0 M H z Broadband 22

Ganesh Pattabiraman C O - F O U N D E R , C E O , P R E S I D E N T Chris Gates CFO David Knutson SVP OF NETWORK OPS AND DEPLOYMENT Dan Hight V P O F S A L E S & B U S I N E SS DEVELOPMENT Arun Raghupathy C O - F O U N D E R & S V P O F ENGINEERING NextNav Management PIONEERS IN LOCATION - BASED SERVICES 23

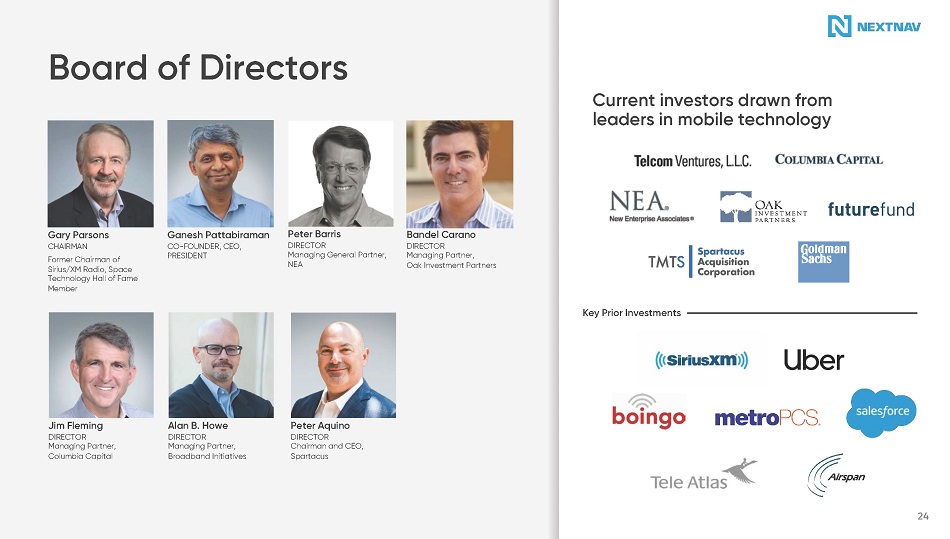

Ganesh Pattabiraman CO - FOUNDER, CEO, PRESIDENT Gary Parsons CHAIRMAN Former Chairman of Sirius/XM Radio, Space T e c hn o l o g y H a l l o f F a m e Member Peter Barris DIRECTOR M a n a g i n g G e n e r a l P a r tn e r , NEA Bandel Carano DIRECTOR M a n a g i n g P a r tn e r , O a k I n v e s t m e n t P a r tn e r s Board of Directors Key Prior Investments Jim Fleming DIRECTOR M a n a g i n g P a r tn e r , Columbia Capital Current investors drawn from leaders in mobile technology Alan B. Howe DIRECTOR M a n a g i n g P a r tn e r , B r o a db a n d I n i t i a t i v e s Peter Aquino DIRECTOR Chairman and CEO, Spartacus 24

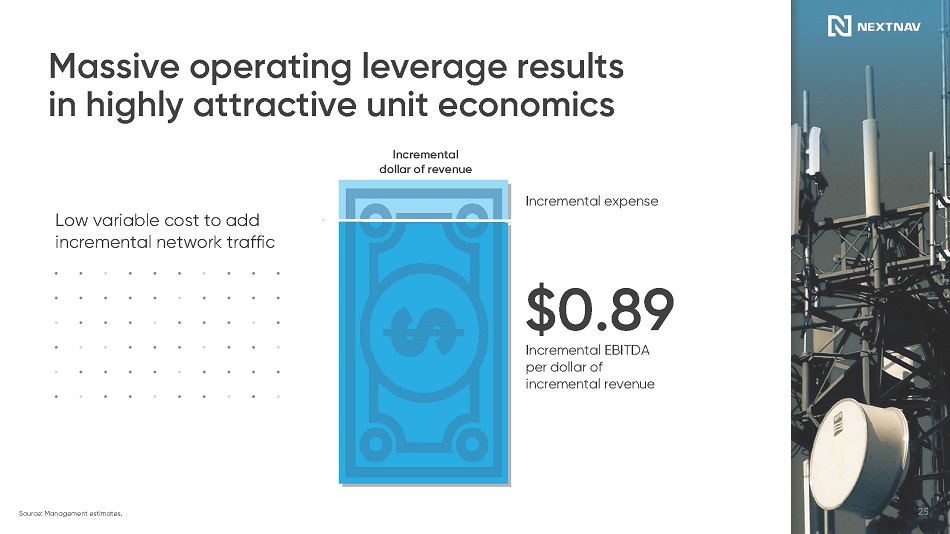

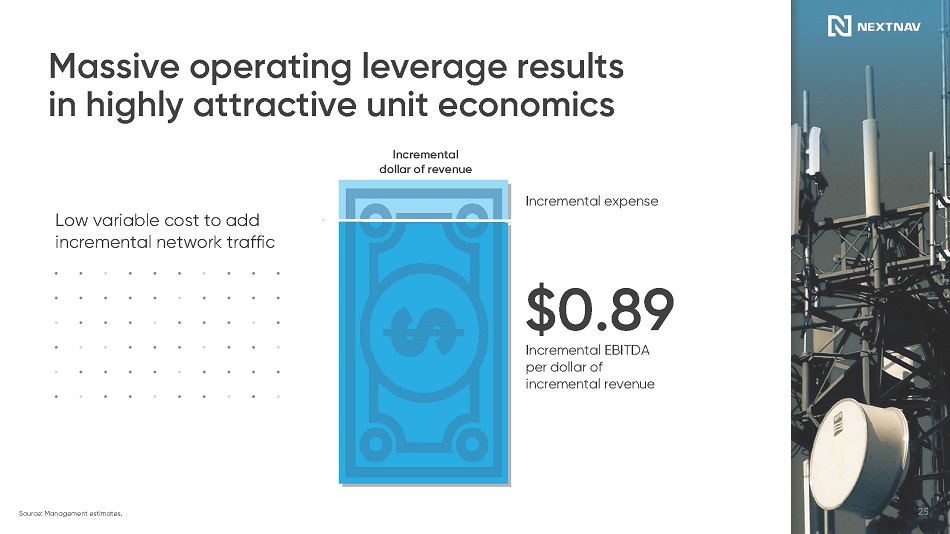

Massive operating leverage results in highly attractive unit economics Low variable cost to add incremental network traffic S o u r c e : M a n a g e m e n t e s t i m a te s . $0.89 Incremental EBITDA per dollar of i n c r em e n t a l r e v e nu e Incremental dollar of revenue Incremental expense 25

Key commentary Total revenue forecast • Mass Market apps becomes l a r g e s t d ri ve r o f r e ve nu e i n 2022E • Revenue opportunity significantly expands once T e rr a P o i N T n e tw o r k b u i l d - o u t i s co m p l e te i n 2 0 2 5 E • Model excludes upside from commercial UAVs and international TerraPoiNT S o u r c e : M a n a g e m e n t e s t i m a te s . Note: Pie chart does not equal 100% due to rounding. $2 $ 2 4 $ 7 5 $1 6 2 $3 0 8 $5 0 6 20 2 1 E 20 22E 20 23 E 20 24E 20 2 5 E 20 2 6 E $ IN MILLIONS 2026E Mass market, mobile apps, and data analytics 41% Enterprise, IoT, and critical infrastructure 21% Autonomous v e h i c l e s a n d eV T O L s 14% I n te r n a t i o n a l 17% M i ss i o n - c r i t i c a l p u b l i c safety and e911 6% 26

2021E 2022E 2023E 2024E 2025E 2026E Total revenue $2 $24 $75 $162 $308 $506 % Gr o w th NM 857% 215% 115% 90% 64% 7 3 % 46% ( 2 6 7 ) ( 4 9 ) (1 1 ) $ 2 2 4 ( - ) C OG S (2) (6) (47) (103) (132) (138) Gross margin $0 $18 $28 $59 $176 $367 % Ma r g i n 18% 75% 37% 36% 57% 73% ( - ) R & D (26) (38) (46) (55) (65) (76) ( - ) SG & A (18) (23) (31) (40) (50) (59) EBITDA ($44) ($43) ($49) ($37) $61 $233 % Ma r g i n NM (182%) (66%) (23%) 20% 46% ( - ) ∆ W o r k i ng c ap i tal 6 4 10 9 7 2 ( - ) C ap E x (1) (1) (67) (267) (49) (11) Unlevered free cash flow ($39) ($40) ($107) ($295) $19 $224 % Ma r g i n NM (168%) (142%) (182%) 6% 44% Financial projections overview $ IN MILLIONS Expected long - term E B IT D A m a r g i n o f ~ 7 0 % F u t u r e c a p e x s p e n d m a i n l y l i m i t e d to m a i nt e n a n c e c a p e x Significant cash generation after T e rr a P o i N T n e t w o r k deployment S o u r c e : M a n a g e m e n t e s t i m a te s . Expected long - t e r m g r o ss p r o f i t m a r g i n o f ~8 5 % 27

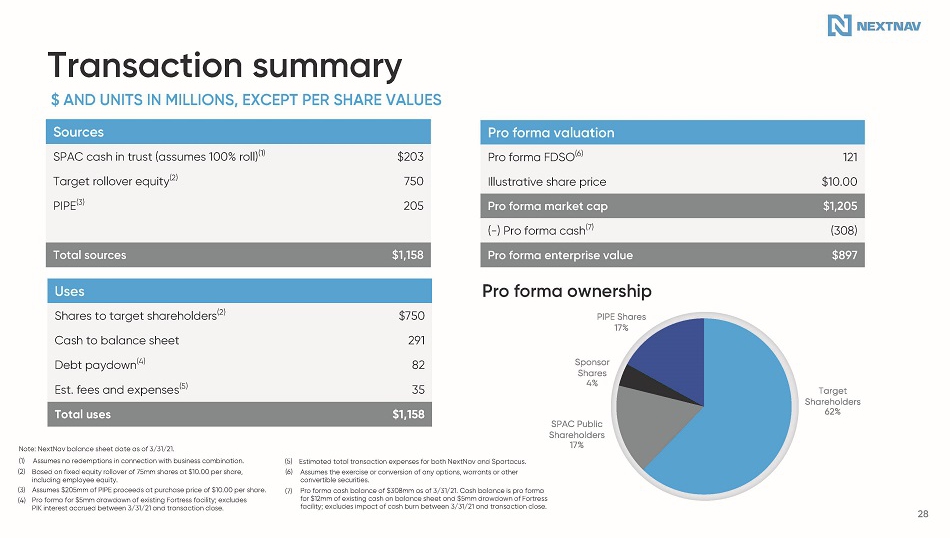

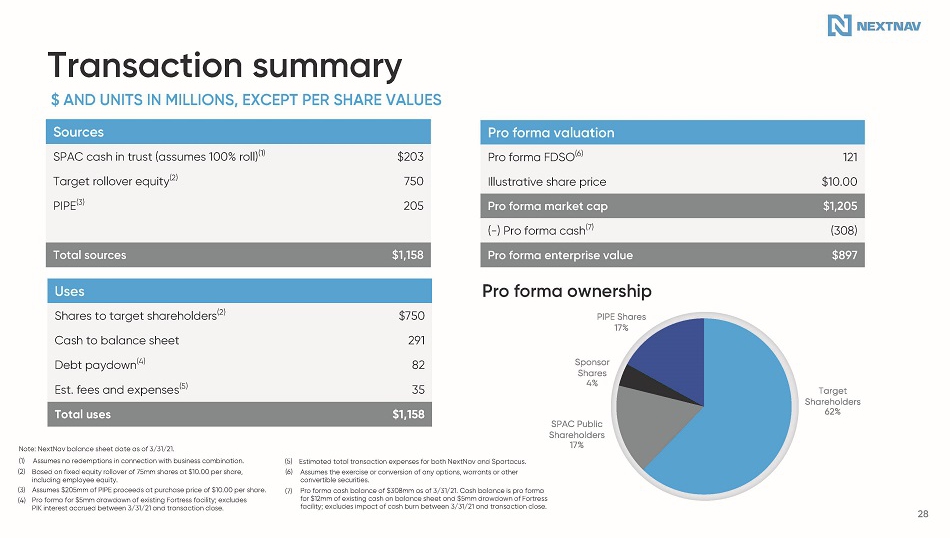

Transaction summary Sources S PA C ca s h i n t r u s t ( a ss u m e s 1 00 % r o ll ) ( 1 ) T a r g e t r o ll o ve r e q u i ty ( 2 ) PIPE (3) $ 2 0 3 750 225 Total sources $1 , 1 7 8 Pro forma valuation Pro forma FDSO (6) I ll us t ra tive sh ar e pr ice 123 $10.00 Pro forma market cap $1,225 ( - ) P r o f or m a c a sh (7 ) (328) Pro forma enterprise value $897 Uses Shares to target shareholders (2) $750 Cash to balance sheet 311 Deb t pa y do w n (4 ) 82 E s t. f ee s a n d e x pe ns e s ( 5 ) 35 Total uses $1,178 $ AND UNITS IN MILLIONS, EXCEPT PER SHARE VALUES Pro forma ownership PIPE Shares 19% 28 Note: NextNav balance sheet date as of 3/31/21. (1) Assumes no redemptions in connection with business combination. (2) Based on fixed equity rollover of 75mm shares at $10.00 per share, including employee equity. (3) Assumes $225mm of PIPE proceeds at purchase price of $10.00 per share. (4) Pro forma for $5mm drawdown of existing Fortress facility; excludes PIK interest accrued between 3/31/21 and transaction close. (5) Estimated total transaction expenses for both NextNav and Spartacus. (6) Assumes the exercise or conversion of any options, warrants or other convertible securities. (7) Pro forma cash balance of $328mm as of 3/31/21. Cash balance is pro forma for $12mm of existing cash on balance sheet and $5mm drawdown of Fortress facility; excludes impact of cash burn between 3/31/21 and transaction close. Target Shareholders 61% SPAC Public Shareholders 16% Sponsor Shares 4%

95% NA 100% 100% 80% 24% 97% 94% (4 ) 91% 88% 98% 81% 66% 55% ( 6 ) NM 189% 400% 629% (2) 198% 96% 38% 23% 23% 14% 9% 7% 0% (4 )(5 ) (4 )(5 ) Operational benchmarking (1) Reflects CY2020E - CY2022E Revenue CAGR. (2) Reflects CY2024E - CY2026E Revenue CAGR. (3) Reflects CY2021E - CY2025E Revenue CAGR. (4) Reflects CY2025E EBITDA Margin / UFCF Conversion. (5) Assumes no capex; capex not publicly disclosed. (6) UFCF projections remain negative through 2026E. CY2021E – CY2026E REVENUE CAGR CY2026E UFCF CONVERSION CY2026E EBITDA MARGIN M E D I A N : 2 3 5 % M E D I A N : 3 8 % Y2020E – CY2022E REVENUE CAGR M E D I A N : 8 % M E D I A N : 9 0 % 20 % 21 % 4 0 % M E D I A N : 9 2 % 38% 21 % M E D I A N : 7 2 % CY2021E UFCF CONVERSION Sources: CapIQ and Bloomberg research consensus estimates, company filings. Market data as of 06/03/21. Note: UFCF Conversion defined as EBITDA less Capex divided by EBITDA. 46% NA 11% (4) 21% (4) 13% 29% 40% 50% (4) 39% 3 4 % ( 1 ) 272% (3) 57% ( 3 ) 296% ( 2 ) 9 0 0 M H z w i r e l e s s Recent tech fwd SPACs W i r e l e s s C u s t om e r v e r t i c a l s 29

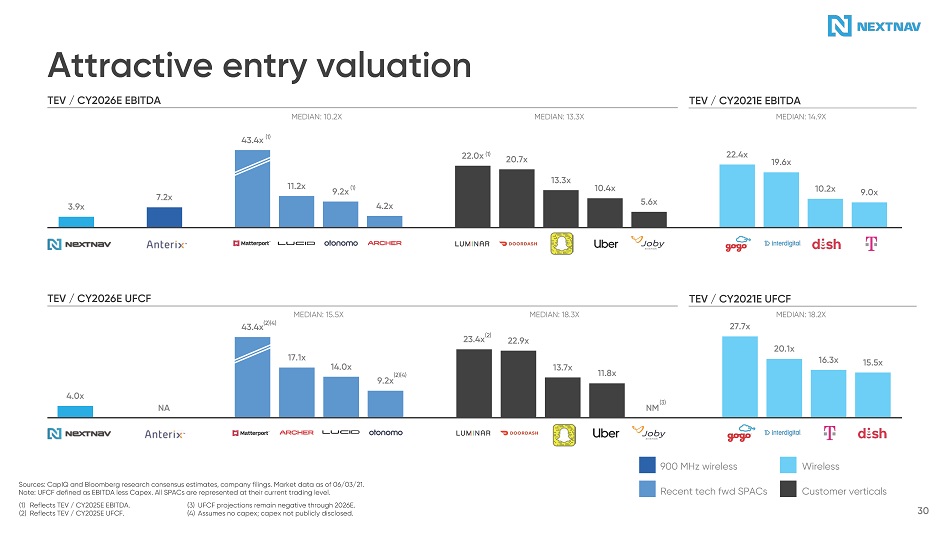

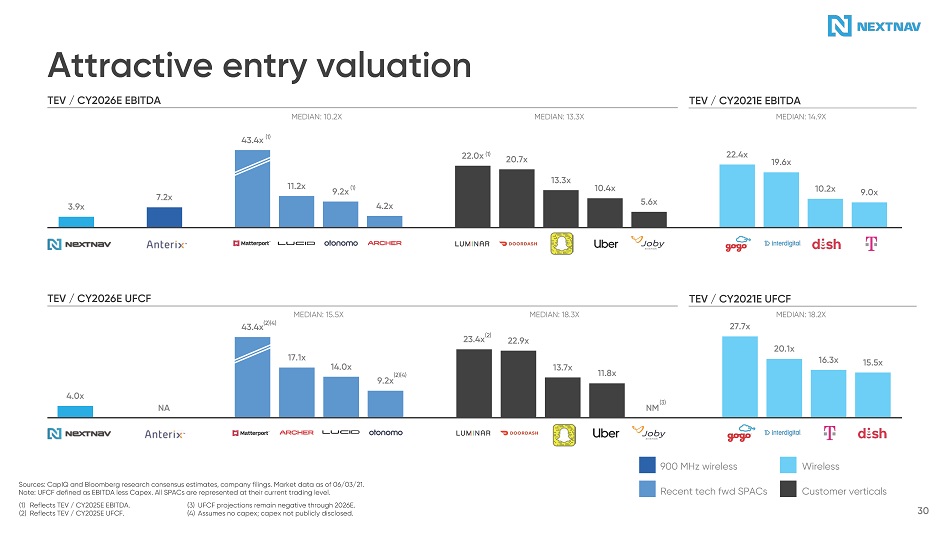

3.9x 7.2x 43.4x (1) 11.2x 9.2x 4.2x 22.0 x ( 1 ) 20.7x 13.3x 10.4x 5.6x 22.4x 19.6x 10.2x 9.0x 4.0x NA 43.4x (2)(4) 17.1x 14.0x 9.2x 22.9x 13.7x 11.8x 27.7x 20.1x 16.3x 15.5x ( 1 ) (2)(4) 23.4x (2) NM (3) Attractive entry valuation (1) R e f l e c ts T E V / C Y 2 0 2 5 E E B IT D A . (2) R e f l e c ts T E V / C Y 2 0 2 5 E U F C F . (3) UFCF projections remain negative through 2026E. (4) Assumes no capex; capex not publicly disclosed. M E D I A N : 1 5 . 5X M E D I A N : 1 8 . 3 X M E D I A N : 1 8 . 2 X TEV / CY2026E EBITDA M E D I A N : 1 0 . 2 X M E D I A N : 1 3 . 3 X TEV / CY2021E EBITDA M E D I A N : 1 4 . 9 X TEV / CY2026E UFCF TEV / CY2021E UFCF Sources: CapIQ and Bloomberg research consensus estimates, company filings. Market data as of 06/03/21. Note: UFCF defined as EBITDA less Capex. All SPACs are represented at their current trading level. 9 0 0 M H z w i r e l e s s Recent tech fwd SPACs W i r e l e s s C u s t om e r v e r t i c a l s 30

$3,880 $1,708 $897 $2,196 Transaction represents attractive discount to peers $ IN MILLIONS Summary of approach • 2026E UFCF includes benefit of T e rr a P o i N T n e tw o r k , b u t w i th r o b u s t g r o w th th e r e a f te r as network utilization continues to ramp • T h e a pp l i e d m u l ti p l e r a n g e o f 1 7 . 5 x – 22 . 5 x i s i n l i n e w i th th a t of NextNav’s peers • The Implied Future Enterprise V a l u e i s d i s co un te d b a ck 4 . 5 years at a 20% discount rate to a rri ve a t a n I m p l i e d C u rr e n t Enterprise Value Discounted back 4.5 years at 20% discount rate 54% discount 80% discount 1 7 . 5 x – 22. 5 x 2026E UFCF of $222mm (Implies 16.7x – 21.4x 2026E EBITDA (1) ) 4.0x 2026E UFCF Source: Management estimates, Company filings, Wall Street Research. Note: UFCF defined as EBITDA less Capex. Assumes transaction date of 6/30/21. Market data as of 06/03/21. (1) Based on 2026E EBITDA of $233mm. (2) Per Wall Street research estimate based on $0.80 per MHz - PoP. $4 , 9 8 9 31 Pro forma enterprise value Implied current enterprise value Implied future enterprise value $8,848 (2) $ 2 , 4 3 2 $8 1 5 Enterprise value

Investment highlights Next Generation GPS solution w i l l s i t a t t h e c o r e o f the app economy >$100 Billion to t a l a dd r e ss a b l e m a r k e t G r o w i n g l i s t o f Blue - chip customers i n c l u d i n g A T & T a n d F i r s tN e t Sequential d e p l o y m e n t l i m i ts r i s k Unrivaled ca p a b ili t i e s powered by bullet proof technology C o m p e t i t i ve moat deepened by IP, spectrum, and network World class management, board, and shareholders w i th l e a d e r s i n w i r e l e ss a n d l o c a t i o n s e r v i c e s 32

Next Generation GPS is here.

NextNav + AT&T FirstNet • N e xt N a v h a s p a r tn e r e d w i th A T & T to bring full 3D situational awareness to first responders • Vertical location is essential to incident management and responder safety • Enhances applications and, as early adopter, improves core FirstNet LTE service differentiation • S e r vi ce m a r k e te d b y A T & T a n d a va i l a b l e to all public safety mobile applications on FirstNet through FirstNet API Catalog • NextNav Pinnacle service embedded in R e s p o n s e f o r F ir s t N e t a pp l i ca ti o n • Monthly per - user fees billed to AT&T and public safety app developers From this To this 34

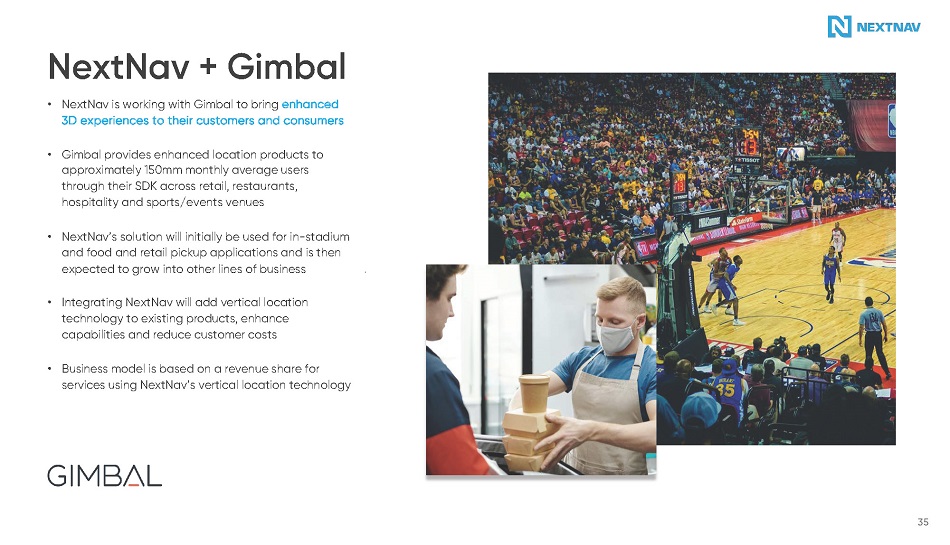

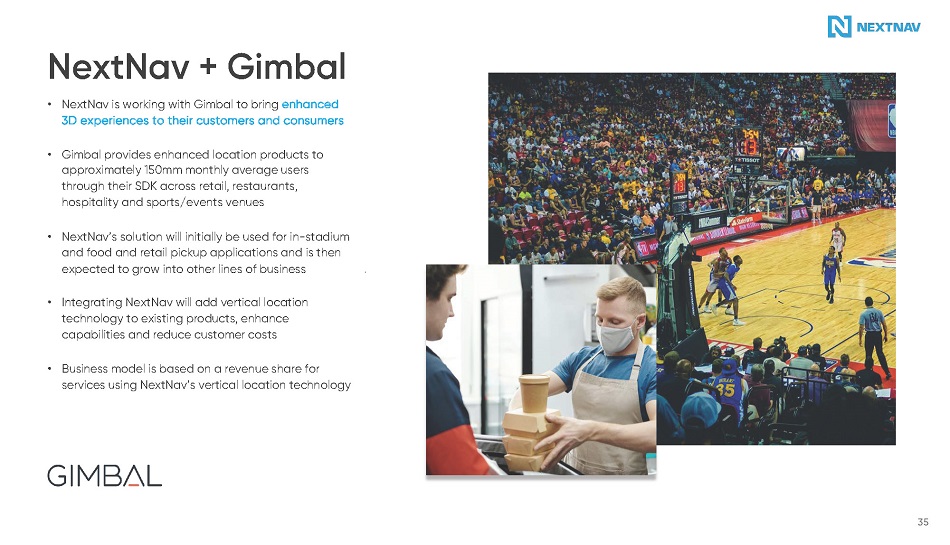

NextNav + Gimbal • NextNav is working with Gimbal to bring enhanced 3D experiences to their customers and consumers • Gimbal provides enhanced location products to approximately 150mm monthly average users th r o u g h th e i r S D K a cr o s s r e t a i l , r e s t a u r a nt s , hospitality and sports/events venues • NextNav’s solution will initially be used for in - stadium and food and retail pickup applications and is then expected to grow into other lines of business • I n te g r a ti n g N e xt N a v w i ll a d d ve r ti ca l l o ca ti o n technology to existing products, enhance capabilities and reduce customer costs • Business model is based on a revenue share for services using NextNav’s vertical location technology 35

NextNav + Joby • NextNav is working with Joby Aviation to deploy TerraPoiNT technology on Joby Aviation aircraft • GPS degradation and vulnerabilities (e.g., jamming, spoofing) drives need for positioning source, including accurate altitude • TerraPoiNT’s encryption and 100,000x signal s t r e n g th co m p a r e d to G P S i s w e ll s u i te d to aerospace applications where safety, redundancy and reliability are paramount • Solution would integrate TerraPoiNT signal with Joby Aviation’s navigation systems 36

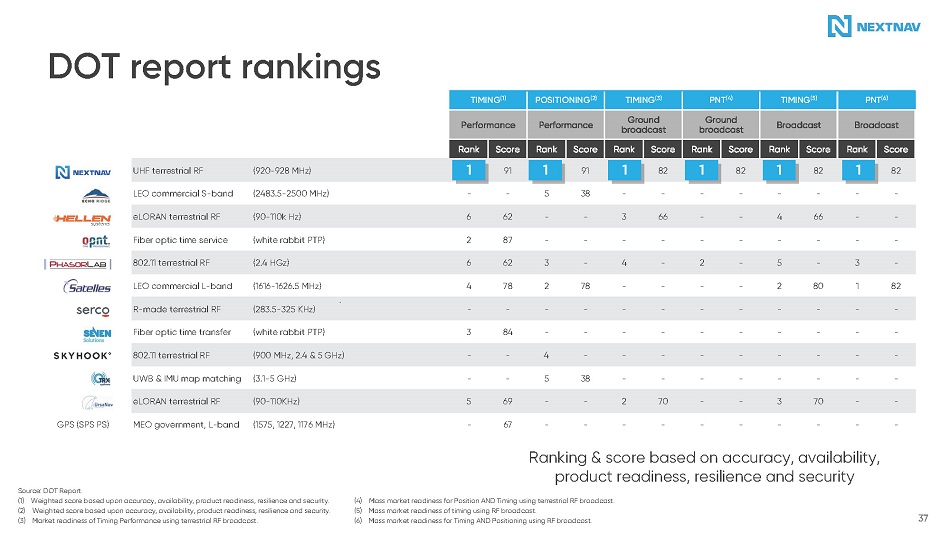

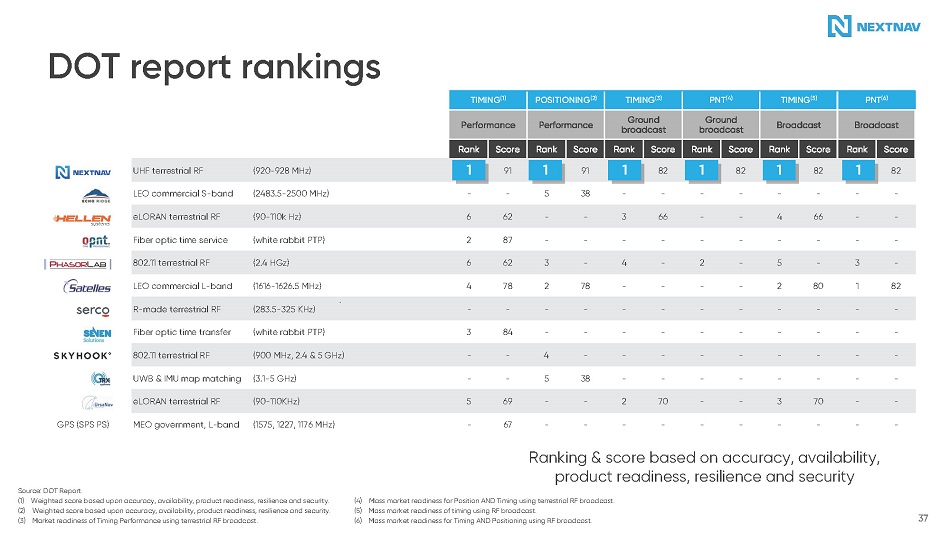

S o u r c e : D OT R e p o r t. (1) Weighted score based upon accuracy, availability, product readiness, resilience and security. (2) Weighted score based upon accuracy, availability, product readiness, resilience and security. (3) Market readiness of Timing Performance using terrestrial RF broadcast. Ranking & score based on accuracy, availability, product readiness, resilience and security (4) Mass market readiness for Position AND Timing using terrestrial RF broadcast. (5) Mass market readiness of timing using RF broadcast. (6) Mass market readiness for Timing AND Positioning using RF broadcast. DOT report rankings TIMING (1) POSITIONING (2) TIMING (3) PNT (4) TIMING (5) PNT (6) Performance Performance Rank Score Rank Score Ground br o adc as t Rank Score Ground br o adc as t Rank Score Broadcast Broadcast Rank Score Rank Score U H F t e rr e s tr i a l R F (92 0 - 92 8 M H z ) 1 91 1 91 1 82 1 82 1 82 1 82 LEO commercial S - band ( 2 4 8 3 . 5 - 2 5 0 0 M H z ) - - 5 38 - - - - - - - - eL O R A N t e rr e s tr i a l R F (90 - 11 0 k H z ) 6 62 - - 3 66 - - 4 66 - - F i b e r o p ti c ti m e s e r v i c e ( w h i te r a bb i t P T P ) 2 87 - - - - - - - - - - 8 0 2 . 1 1 t e rr e s tr i a l RF ( 2 . 4 H G z ) 6 62 3 - 4 - 2 - 5 - 3 - LEO commercial L - band ( 1 6 1 6 - 1 626 . 5 M H z ) 4 78 2 78 - - - - 2 80 1 82 R - m a d e t e rr e s tr i a l R F ( 2 8 3 . 5 - 32 5 K H z ) - - - - - - - - - - - - F i b e r o p ti c ti m e tr a n s f e r ( w h i te r a bb i t P T P ) 3 84 - - - - - - - - - - 8 0 2 . 1 1 t e rr e s tr i a l R F ( 9 0 0 M H z , 2 . 4 & 5 G H z ) - - 4 - - - - - - - - - U WB & I M U m a p m a tc h i n g (3 . 1 - 5 G H z ) - - 5 38 - - - - - - - - e L O R A N t e rr e s tr i a l R F (90 - 11 0 K H z ) 5 69 - - 2 70 - - 3 70 - - G P S ( S P S P S ) MEO government, L - band ( 1 5 7 5 , 1 22 7 , 11 7 6 M H z ) - 67 - - - - - - - - - - 37 1 1 1 1 1 1

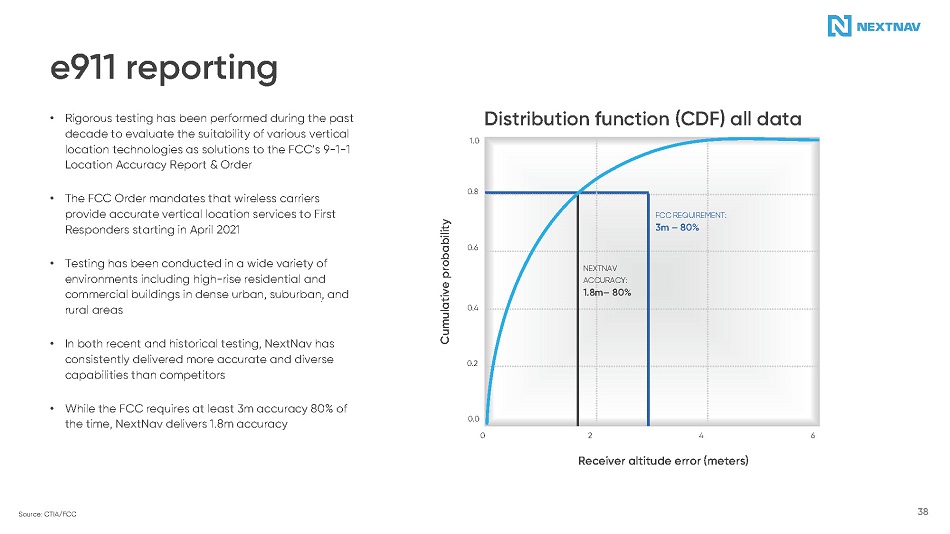

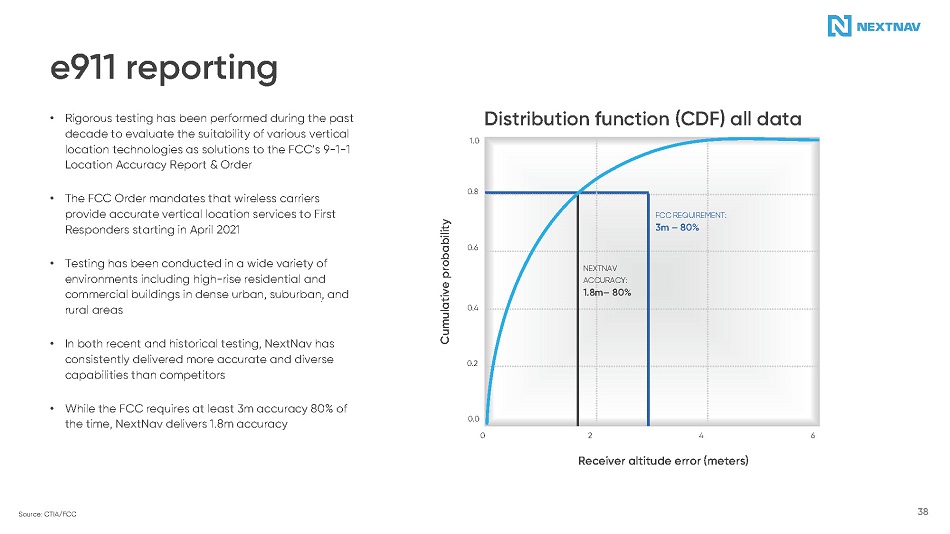

e911 reporting • Rigorous testing has been performed during the past decade to evaluate the suitability of various vertical location technologies as solutions to the FCC’s 9 - 1 - 1 L o ca ti o n A cc u r a cy R e p o r t & O r d e r • The FCC Order mandates that wireless carriers provide accurate vertical location services to First R e s p o n d e r s s t a r ti n g i n A p ri l 2 0 2 1 • T e s ti n g h a s b ee n co n d u cte d i n a w i d e va ri e ty o f environments including high - rise residential and co mm e r ci a l b u i l d i n g s i n d e n s e u r b a n , s u b u r b a n , a n d r u r a l a r e a s • In both recent and historical testing, NextNav has consistently delivered more accurate and diverse capabilities than competitors • While the FCC requires at least 3m accuracy 80% of the time, NextNav delivers 1.8m accuracy Distribution function (CDF) all data 2 4 Receiver altitude error (meters) Cumulative probability 0 6 0 . 0 0 . 2 0 . 4 0 . 6 0 . 8 1. 0 F CC R E Q U I R E M E N T : 3m – 80% NEXTNAV ACCURACY: 1.8m – 80% S o u r c e : C TI A / F CC 38

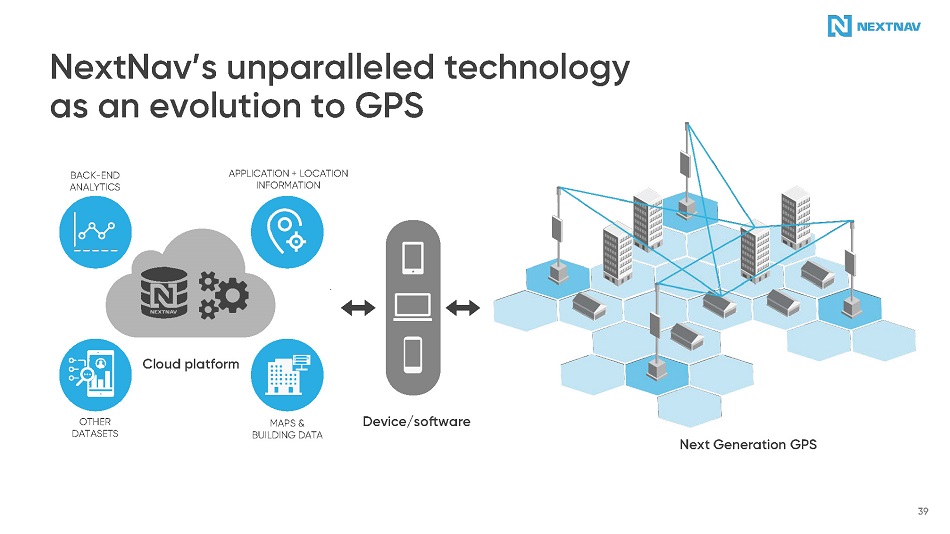

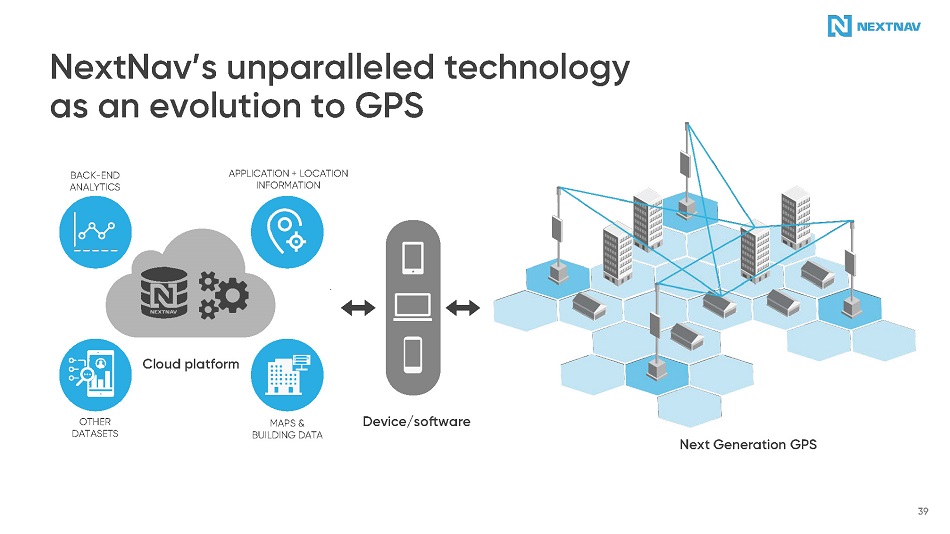

NextNav’s unparalleled technology as an evolution to GPS 39 Cloud platform Device/software MAPS & B U I L D I N G D A T A B A C K - END ANAL Y T I C S APPLICATION + LOCATION INFORMATION Next Generation GPS OTHER D A T A S E T S

$700 $600 $500 $ 4 0 0 $300 $200 $100 - Pr e - 2 0 0 0 2 0 0 0 A 2 0 0 1 A 2 0 0 2A 2 0 03A 2 0 0 4 A 2 0 0 5 A 2 0 06A 2 0 0 7 A 2008A 2 0 09A 2 0 1 0 A 2011A 2 0 1 2A 2 0 1 3A 2 0 1 4 A 2015A 2 0 1 6A 2017A 2018E 2019E 2020E 2021E NextNav extrapolation (1) (33%) 20% 8% 8% 7% 20% 17% 10% 9% 4% 27% 36% 78% 56% 28% 31% 24% 17% 24% 24% 24% 24% GPS impact on the US economy approaching $1 Trillion annually 40 $ IN BILLIONS YOY GROWTH RATE: A ct u a l Source: NextNav extrapolation of NIST sponsored study, conducted by RTI International. (1) 2018E - 2021E growth rate assumption based on average % growth between 2015A – 2017A.

$0.37 $0.65 $0.80 $0.81 $0.93 $1.02 $1.07 $1.62 $2.32 @ D e a l V a l u e @ P u b l i c M a r k e t V a l u e @ P r i v a t e M a r k e t V a l u e @ 6 0 0 M Hz Auction @ 3 . 8 - 3 . 9 G H z C - B a n d A u c t i o n ( 1 ) @ P r i v a t e M a r k e t V a l u e @ 3 . 7 - 3 . 8 G H z C - B a n d A u c t i o n ( 1 ) @ P r i v a t e M a r k e t V a l u e > 8 M H z o f 9 0 0 M H z spectrum > 11 . 5 M H z o f 2 . 4 G H z s p e c t r u m > 1 . 5 - 1 . 6 G H z spectrum > 1 4 M H z o f 80 0 M H z spectrum > 7 0 M H z o f 6 0 0 M H z spectrum > 1 8 0 M H z o f 3 . 8 - 3 . 9 G H z spectrum (B a n d C B l o c k ) > 6 M H z o f 9 0 0 M H z spectrum 1 0 0 M H z o f 3 . 7 - 3 . 8 G H z spectrum (A B l o c k ) > 6 M H z o f 9 0 0 M H z spectrum Relevant spectrum data points 41 S o u r c e : C o m p a n y f i l i n g s , F CC d i s c l o s u r e s , p r e s s r e l e a s e s . Note: Market data as of 06/03/21. (1) Fully - Loaded prices include an estimated $9.7bn in accelerated clearing payments and $3.3bn in relocation costs. VARIOUS $ / MHz - POP Buyer / Seller B a nd $8 9 7 m m T E V · 8 M H z · 3 0 0 m m P O P VARIOUS VARIOUS