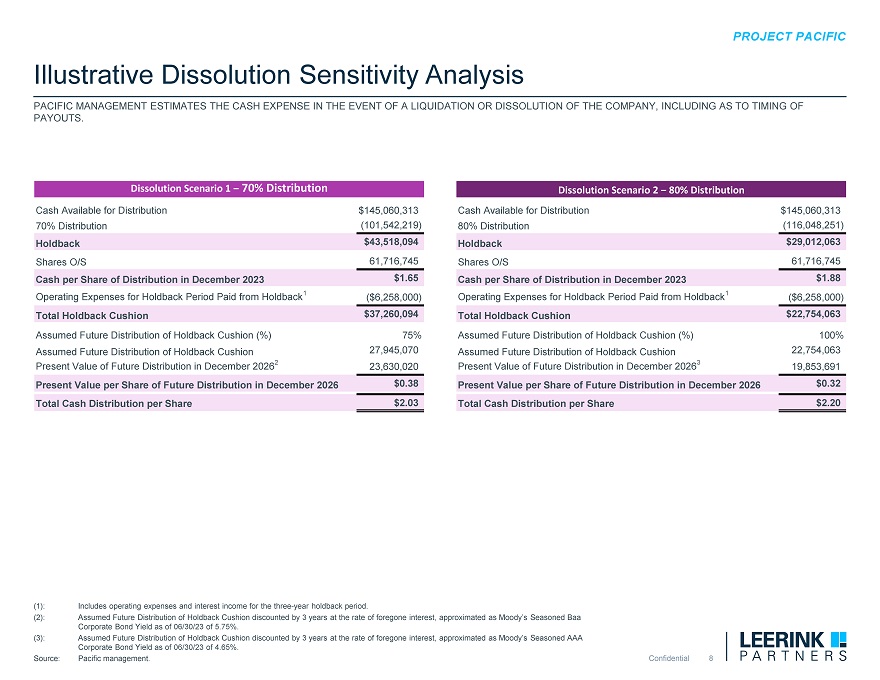

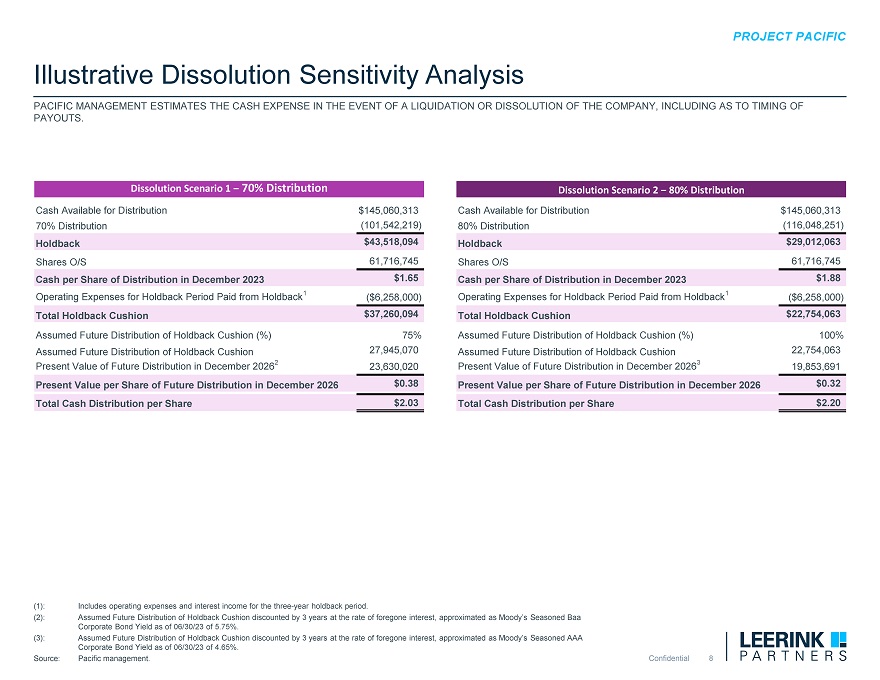

Illustrative Dissolution Sensitivity Analysis PACIFIC MANAGEMENT ESTIMATES THE CASH EXPENSE IN THE EVENT OF A LIQUIDATION OR DISSOLUTION OF THE COMPANY, INCLUDING AS TO TIMING OF PAYOUTS. Dissolution Scenario 1 – 70% Distribution Dissolution Scenario 2 – 80% Distribution Cash Available for Distribution$145,060,313Cash Available for Distribution$145,060,313 70% Distribution(101,542,219)80% Distribution(116,048,251) Holdback$43,518,094Holdback$29,012,063 Shares O/S61,716,745Shares O/S61,716,745 Cash per Share of Distribution in December 2023$1.65Cash per Share of Distribution in December 2023$1.88 Operating Expenses for Holdback Period Paid from Holdback1($6,258,000)Operating Expenses for Holdback Period Paid from Holdback1($6,258,000) Total Holdback Cushion$37,260,094Total Holdback Cushion$22,754,063 Assumed Future Distribution of Holdback Cushion (%)75%Assumed Future Distribution of Holdback Cushion (%)100% Assumed Future Distribution of Holdback Cushion27,945,070Assumed Future Distribution of Holdback Cushion22,754,063 Present Value of Future Distribution in December 2026223,630,020Present Value of Future Distribution in December 2026319,853,691 Present Value per Share of Future Distribution in December 2026$0.38Present Value per Share of Future Distribution in December 2026$0.32 Total Cash Distribution per Share$2.03Total Cash Distribution per Share$2.20 (1): Includes operating expenses and interest income for the three-year holdback period. (2): Assumed Future Distribution of Holdback Cushion discounted by 3 years at the rate of foregone interest, approximated as Moody’s Seasoned Baa Corporate Bond Yield as of 06/30/23 of 5.75%. (3): Assumed Future Distribution of Holdback Cushion discounted by 3 years at the rate of foregone interest, approximated as Moody’s Seasoned AAA Corporate Bond Yield as of 06/30/23 of 4.65%. Source: Pacific management.