(b) Joint Holders. If any of the Shares tendered hereby are held of record by two or more persons, all such persons must sign this Letter of Transmittal.

(c) Different Names on Certificates. If any of the Shares tendered hereby are registered in different names on different Certificates, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of Certificates.

(d) Endorsements. If this Letter of Transmittal is signed by the registered holder(s) of the Shares tendered hereby, no endorsements of Certificates or separate stock powers are required unless payment of the Offer Price (as defined in the Merger Agreement) is to be made, or Shares not tendered or not purchased are to be returned, in the name of any person other than the registered holder(s). Signatures on any such Certificates or stock powers must be guaranteed by an Eligible Institution.

(e) Stock Powers. If this Letter of Transmittal is signed by a person other than the registered holder(s) of the Shares tendered hereby, Certificates must be endorsed or accompanied by appropriate stock powers, in either case, signed exactly as the name(s) of the registered holder(s) appear(s) on the Certificates for such Shares. Signature(s) on any such Certificates or stock powers must be guaranteed by an Eligible Institution. See Instruction 1.

(f) Evidence of Fiduciary or Representative Capacity. If this Letter of Transmittal or any Certificate or stock power is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other legal entity or other person acting in a fiduciary or representative capacity, such person should so indicate when signing, and proper evidence satisfactory to the Depositary and Paying Agent of the authority of such person so to act must be submitted. Proper evidence of authority includes a power of attorney, a letter of testamentary or a letter of appointment.

6. STOCK TRANSFER TAXES. Except as otherwise provided in this Instruction 6, the Surviving Corporation (as defined in the Merger Agreement) will pay all stock transfer taxes with respect to the transfer and sale of any Shares pursuant to the Offer (for the avoidance of doubt, transfer taxes do not include U.S. federal income taxes or withholding taxes). If, however, consideration is to be paid to, or if Certificate(s) for Shares not tendered or not accepted for payment are to be registered in the name of, any person(s) other than the registered holder(s), or if tendered Certificate(s) for Share(s) are registered in the name of any person(s) other than the person(s) signing this Letter of Transmittal, the Surviving Corporation will not be responsible for any stock transfer or similar taxes (whether imposed on the registered holder(s) or such other person(s) or otherwise) payable on account of the transfer to such other person(s) and no consideration shall be paid in respect of such Share(s) unless evidence satisfactory to the Surviving Corporation of the payment of such taxes, or the inapplicability of such taxes, is submitted.

7. SPECIAL PAYMENT AND DELIVERY INSTRUCTIONS. If a check is to be issued for the Cash Amount of any Shares tendered by this Letter of Transmittal in the name of, and, if appropriate, Certificates for Shares not tendered or not accepted for payment are to be issued or returned to, any person(s) other than the signer of this Letter of Transmittal or if a check and, if appropriate, such Certificates are to be returned to any person(s) other than the person(s) signing this Letter of Transmittal or to an address other than that shown in this Letter of Transmittal, the appropriate boxes on this Letter of Transmittal must be completed.

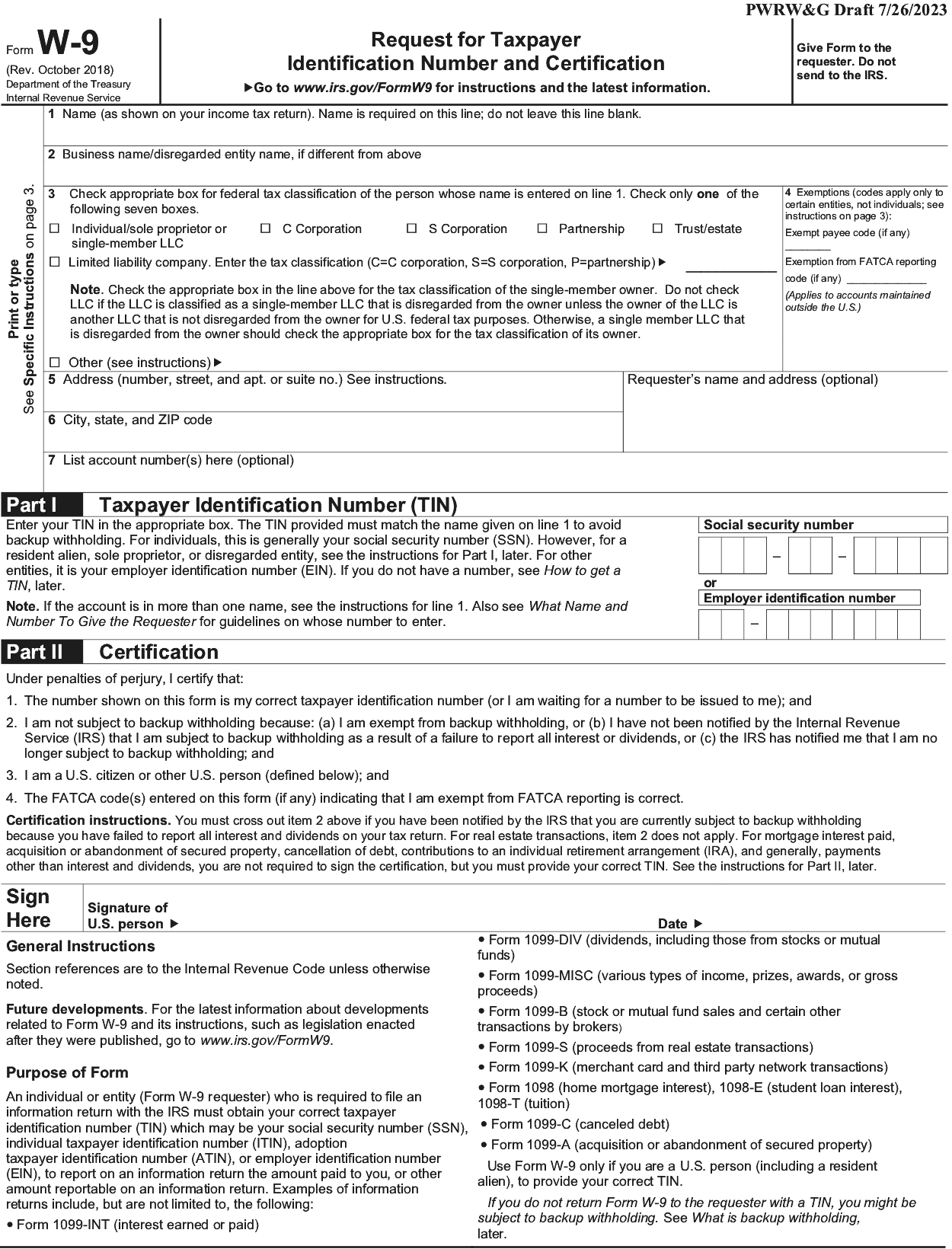

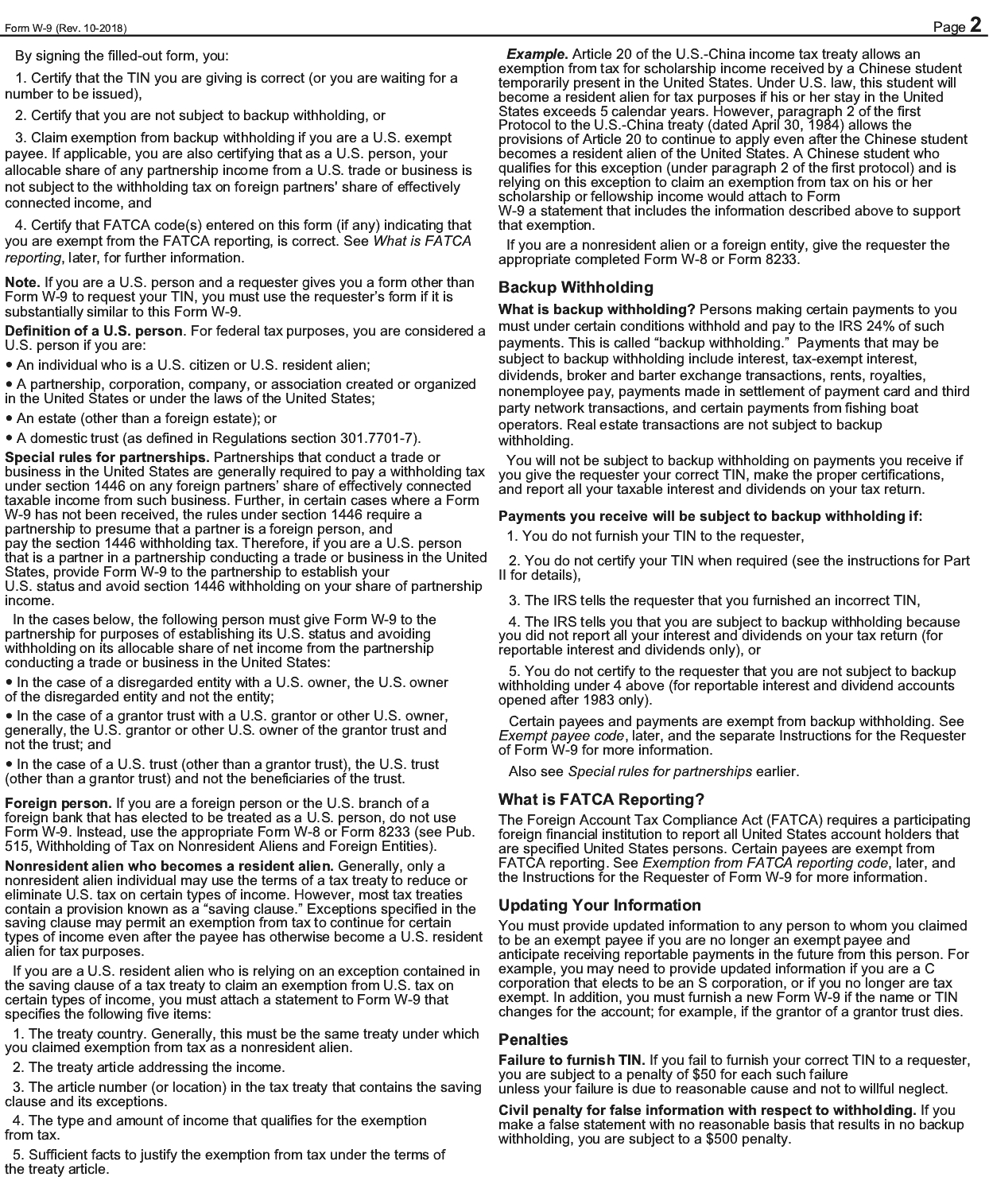

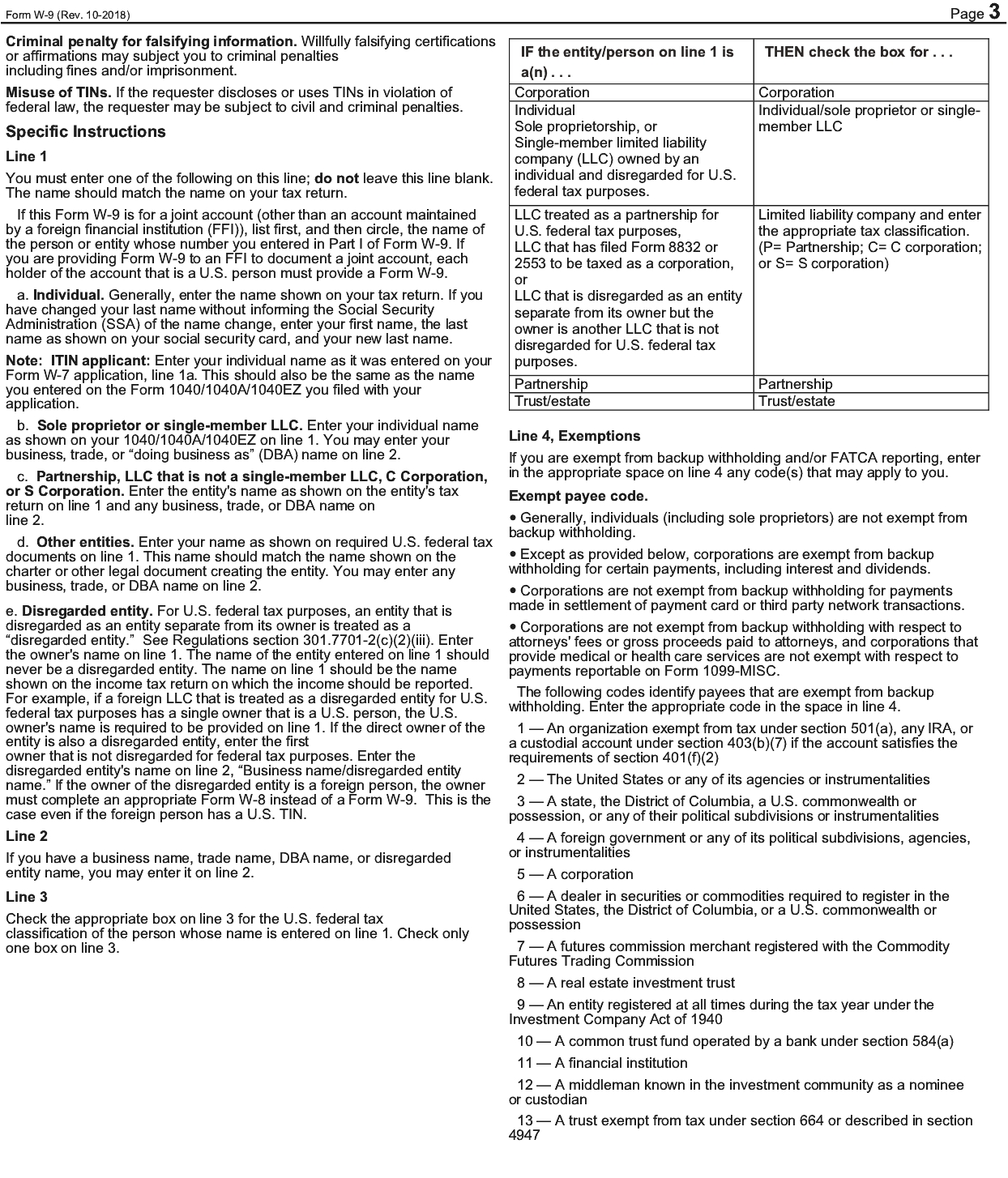

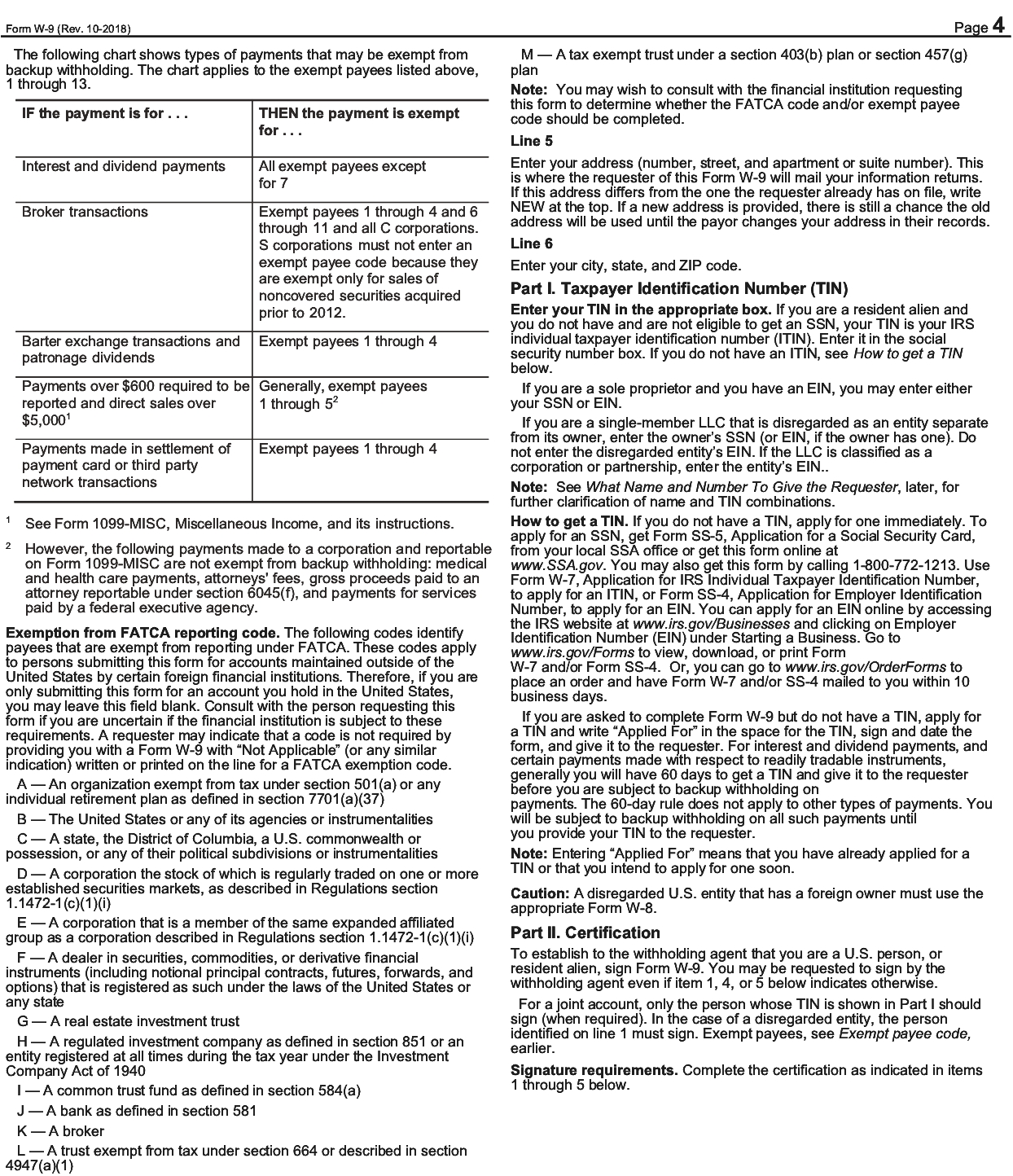

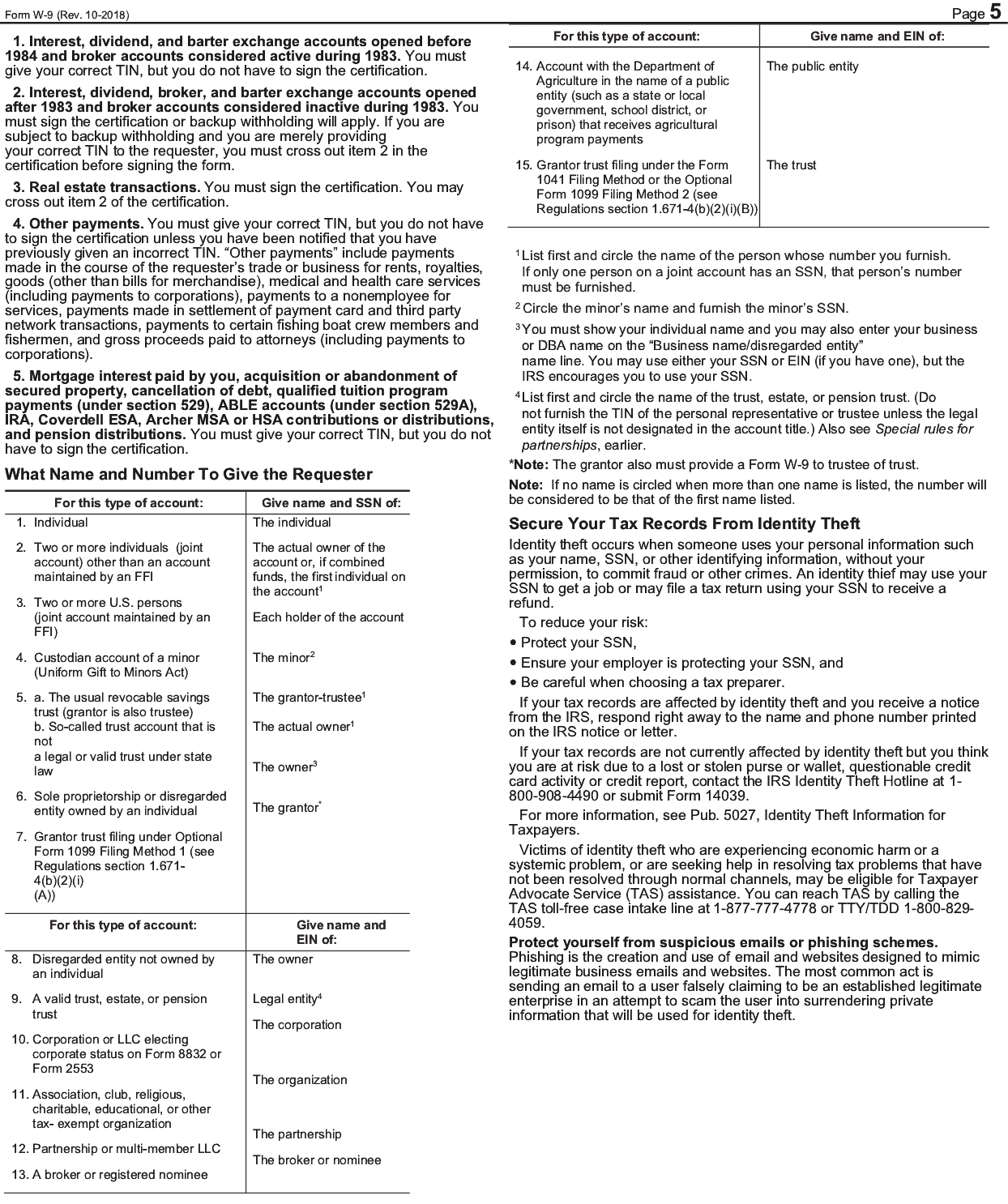

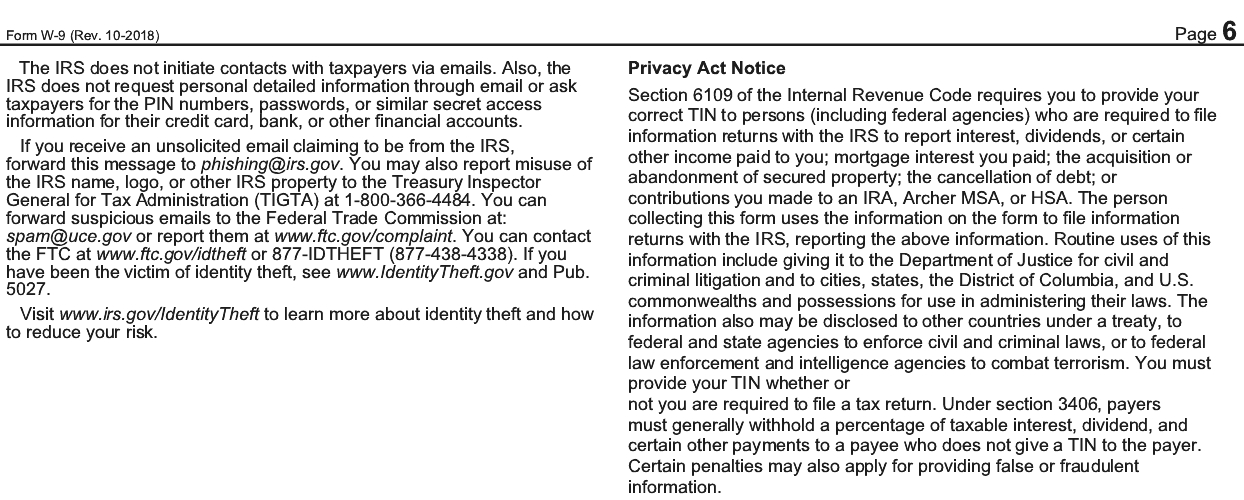

8. TAX WITHHOLDING. Under U.S. federal income tax laws, the Depositary and Paying Agent may be required to withhold a portion of any payments made to certain stockholders pursuant to the Offer. To avoid such backup withholding, a tendering stockholder that is a United States person (as defined for in the instructions to IRS Form W-9, a “United States person”), and, if applicable, each other U.S. payee, is required to: (a) provide the Depositary and Paying Agent with a correct Taxpayer Identification Number (“TIN”) on IRS Form W-9, which is included herein, and to certify, under penalty of perjury, that such number is correct and that such stockholder or payee is not subject to backup withholding of U.S. federal income tax; or (b) otherwise establish a basis for exemption from backup withholding. Failure to provide the information on the IRS Form W-9 may subject the tendering stockholder or payee to backup withholding at the applicable rate (currently 24%), and such stockholder or payee may be subject to a penalty imposed by the IRS. See the enclosed IRS Form W-9 and the instructions thereto for additional information.

Certain stockholders or payees (including, among others, corporations) may not be subject to backup withholding. Exempt stockholders or payees that are United States persons should furnish their TIN, check the