The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described herein until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS — SUBJECT TO COMPLETION DATED APRIL 22, 2022

PROXY STATEMENT/PROSPECTUS

| | |

| UE Resorts International, Inc. | | 26 Capital Acquisition Corp. |

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS OF

26 CAPITAL ACQUISITION CORP.

PROSPECTUS FOR UP TO 34,375,000 COMMON SHARES, 24,250,000 WARRANTS AND 24,250,000 COMMON SHARES UNDERLYING WARRANTS OF UE RESORTS INTERNATIONAL, INC.

The board of directors of 26 Capital Acquisition Corp., a Delaware corporation (“26 Capital”), has approved the agreement and plan of merger and share acquisition (the “Merger and Share Acquisition Agreement”), dated as of October 15, 2021, by and among Tiger Resort Asia Ltd., a Hong Kong private limited company (“TRA”), UE Resorts International, Inc. (formerly known as Okada Manila International, Inc.), a Philippine corporation (“UERI”), Project Tiger Merger Sub, Inc., a Delaware corporation (“Merger Sub”), Tiger Resort, Leisure and Entertainment, Inc., a Philippine corporation (“TRLEI”), and 26 Capital. Pursuant to the Merger and Share Acquisition Agreement, Merger Sub will merge with and into 26 Capital and stockholders of 26 Capital will acquire the right to subscribe for UERI common shares (the “Merger and Share Acquisition”). For stockholders of 26 Capital who elect to subscribe for UERI common shares, the subscription price for the UERI common shares will be paid, on behalf of each subscribing 26 Capital stockholder, by 26 Capital, as described under “The Merger and Share Acquisition Agreement — The Subscription”, and 26 Capital stockholders will not be required to pay any additional consideration for the UERI common shares beyond exchanging their shares in the Merger and Share Acquisition. As a result of the Merger and Share Acquisition, and upon consummation thereof and the other transactions contemplated by the Merger and Share Acquisition Agreement, 26 Capital will become a wholly owned subsidiary of UERI, with securityholders of 26 Capital becoming securityholders of UERI.

26 Capital stockholders are being asked to consider a vote upon the Merger and Share Acquisition and certain proposals related thereto as described in this proxy statement/prospectus.

As a result of, and upon consummation of, the Merger and Share Acquisition, all outstanding shares of 26 Capital common stock (except for (i) any shares owned by 26 Capital, Merger Sub or any subsidiary of 26 Capital (“Excluded Shares”), which will be canceled without consideration, (ii) any shares of 26 Capital common shares that are held by stockholders who have made a valid redemption election (“Redeemed Shares”), which shares will be redeemed in accordance with 26 Capital’s organizational documents, and (iii) any shares of 26 Capital common shares that are held by stockholders who have perfected and not withdrawn a demand for appraisal rights pursuant to the applicable provision of the DGCL (“Dissenting Shares”)), shall be converted into and shall for all purposes represent only the right to subscribe for and purchase, pursuant to the Subscription Agreement and a letter of transmittal and subscription confirmation, one validly issued, fully paid and non-assessable share of common stock of UERI.

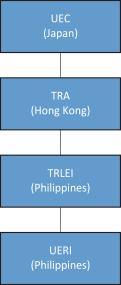

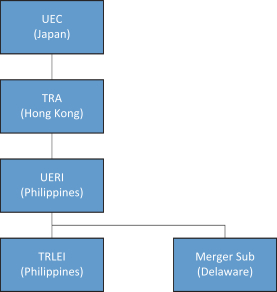

Further, at the Effective Time (as defined below), each warrant to acquire shares of 26 Capital that is outstanding and unexercised immediately prior to the Effective Time, whether or not vested, shall be converted into and become a warrant to purchase an equal number of UERI common shares, and UERI shall assume each warrant in accordance with its terms as in effect as of the date of the Merger and Share Acquisition Agreement. Immediately prior to the Effective Time, and subject to the receipt of requisite approvals of the applicable shareholders, the UEC Parties (as defined below) intend to effect a reorganization whereby TRLEI, then a consolidated subsidiary of TRA and beneficial owner of 100% of the issued and outstanding shares in UERI (“UERI Sale Shares”), will sell to TRA the UERI Sale Shares pursuant to a deed of absolute sale of shares. TRA will thereafter subscribe for additional shares in UERI in cash and contribute 100% of the issued and outstanding shares beneficially owned by TRA in TRLEI, including certain receivables due from TRLEI, as additional paid in capital in UERI, pursuant to subscription and contribution agreements (“Reorganization”). At the Effective Time, as a result of the Reorganization, and subject to the receipt of requisite approvals from government agencies to implement the Reorganization, UERI will become a direct wholly owned subsidiary of TRA, with TRLEI becoming a direct wholly owned subsidiary of UERI. The Reorganization is further described in the Merger and Share Acquisition Agreement. See “Information About UERI — Corporate Structure Charts” beginning on page 160 for more information.

The registration statement includes a prospectus of UERI that covers (i) the UERI common shares issuable to the 26 Capital stockholders in the Merger and Share Acquisition, as discussed above, (ii) the UERI warrants that will be issued in exchange for the 26 Capital warrants, as discussed above, and (iii) the UERI common shares that may become issuable upon the exercise of such UERI warrants. Accordingly, UERI is registering up to an aggregate of 34,375,000 UERI common shares, 24,250,000 UERI warrants and 24,250,000 UERI common shares issuable upon the exercise of the UERI warrants.

Proposals to approve the Merger and Share Acquisition Agreement and the other matters discussed in this proxy statement/prospectus will be presented at the special meeting of 26 Capital stockholders scheduled to be held on , 2022 in virtual format.

Although UERI is not currently a public reporting company, following the effectiveness of the registration statement of which this proxy statement/prospectus is a part and the closing of the Merger and Share Acquisition, UERI will become subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). UERI intends to apply for listing of the UERI common shares and UERI warrants on Nasdaq under the proposed symbols “UERI” and “UERIW”, respectively, to be effective at the consummation of the Merger and Share Acquisition. It is a condition of the consummation of the Merger and Share Acquisition that the UERI common shares are approved for listing on Nasdaq (subject only to official notice of issuance thereof). While trading on Nasdaq is expected to begin on the first business day following the date of completion of the Merger and Share Acquisition, there can be no assurance that UERI’s securities will be listed on Nasdaq or that a viable and active trading market will develop. See “Risk Factors ” beginning on page 41 for more information.

UERI will be an “emerging growth company” as defined in the JOBS Act and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

UERI will also be a “foreign private issuer” as defined in the Exchange Act and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, UERI’s officers, directors and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, UERI will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

In addition, UERI will be a “controlled company” under Nasdaq corporate governance rules since more than 50% of the voting power for the election of UERI’s directors will held by TRA.

The accompanying proxy statement/prospectus provides 26 Capital stockholders with detailed information about the Merger and Share Acquisition and other matters to be considered at the special meeting of 26 Capital stockholders. We encourage you to read the entire accompanying proxy statement/prospectus, including the annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 41 of the accompanying proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE MERGER AND SHARE ACQUISITION, PASSED UPON THE MERITS OR FAIRNESS OF THE MERGER AND SHARE ACQUISITION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated and is first being mailed to shareholders of 26 Capital on or about , 2022.