- HLLY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Holley (HLLY) POS AMProspectus update (post-effective amendment)

Filed: 4 Feb 22, 9:11am

Delaware | 87-1727560 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Page | ||||

| i | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 8 | ||||

| 9 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 41 | ||||

| 54 | ||||

| 62 | ||||

| 68 | ||||

| 76 | ||||

| 78 | ||||

| 81 | ||||

| 84 | ||||

| 93 | ||||

| 95 | ||||

| 97 | ||||

| 101 | ||||

| 101 | ||||

| 101 | ||||

| F-1 | ||||

| • | up to 106,117,871 shares of Common Stock, consisting of: (i) 6,250,000 shares of Common Stock issued to holders of the Founder Shares in connection with the Domestication; (ii) 4,666,667 shares of Common Stock issuable upon the exercise of the Private Warrants; (iii) 20,860,653 shares of Common Stock issued to the PIPE Investors pursuant to the PIPE Subscription Agreements; (iv) 5,000,000 shares of Common Stock issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor; (v) 1,666,667 shares of Common Stock issuable upon exercise of Public Warrants issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor; and (vi) 67,673,884 shares of Common Stock issued to the Holley Stockholder in connection with the Business Combination; and |

| • | up to 6,333,334 Warrants, consisting of (i) 1,666,667 Public Warrants issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor, and (ii) 4,666,667 Private Warrants issued to the Sponsor. |

| • | access, collect and use personal data about consumers; |

| • | execute its business strategy, including monetization of services provided and expansions in and into existing and new lines of business; |

| • | anticipate the impact of the coronavirus disease 2019 (“COVID-19”) pandemic and its effect on business and financial conditions; |

| • | manage risks associated with operational changes in response to the COVID-19 pandemic; |

| • | recognize the anticipated benefits of and successfully deploy the proceeds from the Business Combination (as defined below), which may be affected by, among other things, competition, the ability to integrate the combined businesses and the ability of the combined business to grow and manage growth profitably; |

| • | anticipate the uncertainties inherent in the development of new business lines and business strategies; |

| • | retain and hire necessary employees; |

| • | increase brand awareness; |

| • | attract, train and retain effective officers, key employees or directors; |

| • | upgrade and maintain information technology systems; |

| • | respond to cyber-attacks, security breaches, or computer viruses: |

| • | acquire and protect intellectual property; |

| • | meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| • | effectively respond to general economic and business conditions; |

| • | maintain proper and effective internal controls; |

| • | maintain the listing on, or the delisting of the Company’s securities from, the NYSE or an inability to have our securities listed on another national securities exchange; |

| • | obtain additional capital, including use of the debt market; |

| • | enhance future operating and financial results; |

| • | anticipate rapid technological changes; |

| • | comply with laws and regulations applicable to its business, including laws and regulations related to environmental health and safety; |

| • | stay abreast of modified or new laws and regulations; |

| • | anticipate the impact of, and response to, new accounting standards; |

| • | respond to fluctuations in foreign currency exchange rates and political unrest and regulatory changes in international markets from various events; |

| • | anticipate the rise in interest rates which would increase the cost of capital; |

| • | anticipate the significance and timing of contractual obligations; |

| • | maintain key strategic relationships with partners and resellers; |

| • | respond to uncertainties associated with product and service development and market acceptance; |

| • | manage to finance operations on an economically viable basis; |

| • | anticipate the impact of new U.S. federal income tax law, including the impact on deferred tax assets; |

| • | litigation, complaints, product liability claims and/or adverse publicity; |

| • | anticipate the time during which we will be an emerging growth company under the JOBS Act; |

| • | anticipate the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; and |

| • | comply with privacy and data protection laws, and respond to privacy or data breaches, or the loss of data. |

| • | Performance products for existing electric vehicles |

| • | Electric drivetrain conversion products. |

| • | The COVID-19 pandemic could adversely affect the Company’s financial condition and results of operations. |

| • | A downturn in consumer spending, including as a result of a severe or prolonged economic downturn, could adversely impact the Company’s financial condition and results of operations. |

| • | Failure to compete effectively or to develop and market new products and a reduction in demand for the Company’s products could reduce the Company’s business, financial condition and results of operations. |

| • | Increased electric vehicles ownership could impact the Company’s financial condition and results of operations. |

| • | Inaccurate forecasting of product demand could harm the Company’s financial performance. |

| • | The Company may not be able to effectively manage its growth. |

| • | The Company’s growth partially depends on attracting new customers in a cost-effective manner and expanding into additional consumer markets and it may not successfully do so. |

| • | The Company’s failure to protect its brand could harm its financial condition and results of operations. |

| • | The Company’s profitability may decline as a result of increasing pressure on pricing. |

| • | Disruptions in the Company’s manufacturing facilities or distribution centers could have a material adverse effect on its sales, profitability and results of operations. |

| • | Increases in cost, disruption of supply or shortage of raw materials could harm the Company’s business. |

| • | The Company’s current and future products may experience quality problems, which could result in negative publicity, litigation, product recalls, and warranty claims, resulting in decreased sales. |

| • | The Company’s failure to maintain relationships with retail partners or increase sales through its DTC channel could harm its business. |

| • | The Company’s success depends on the continuing efforts of its employees and retention of skilled personnel. |

| • | The Company’s failure to upgrade and maintain information technology systems, to respond to cyber-attacks, security breaches, or computer viruses, or to comply with privacy and data protections laws, and respond to privacy or data breaches could adversely impact its business. |

| • | If the Company’s estimates relating to its accounting policies prove to be incorrect, its results of operations could be harmed. |

| • | The Company may become involved in legal or regulatory proceedings, including intellectual property claims or lawsuits that could cause it to incur significant costs or that could prohibit it from selling its products. |

| • | Unauthorized sales of the Company’s products could harm its reputation. |

| • | The Company is subject to environmental, health and safety laws and regulations as well as privacy laws, regulations, and standards, which could subject it to liabilities, increase its costs or restrict its operations in the future. |

| • | The Company’s insurance policies may not provide adequate levels of coverage against all claims and the Company may incur losses that are not covered by its insurance. |

| • | Potential for litigation or other disputes may arise from the restatement of our previously issued financial statements and material weakness in our internal controls over financial reporting and the preparation of our financial statements. |

| • | Certain of the Company’s stockholders, including the Holley Stockholder and the Sponsor, may have conflicts of interest with other stockholders and may limit your ability to influence corporate matters. |

| • | Warrants are exercisable for Common Stock, which would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders. |

| • | The Warrants may never be in the money, and they may expire worthless and the terms of the Warrants may be amended in a manner adverse to a holder if holders of at least 50% of the then-outstanding Warrants approve of such amendment. |

| • | The market price and trading volume of Common Stock and Warrants may be volatile. |

| • | If securities or industry analysts do not publish research, publish inaccurate or unfavorable research or cease publishing research about the Company, its share and Warrant price and trading volume could decline significantly. |

| Issuer | Holley Inc. | |

| Shares of Common Stock offered by us | Up to 6,333,334 shares of Common Stock issuable upon exercise of the Warrants. | |

| Shares of Common Stock offered by the Selling Securityholders | Up to 106,117,871 shares of Common Stock. | |

| Warrants Offered by the Selling Securityholders | Up to 6,333,334 Warrants. | |

| Exercise Price of Warrants | $11.50 per share, subject to adjustment as described herein. | |

| Shares of Common Stock outstanding prior to exercise of all Warrants | 117,993,139 shares of Common Stock (as of January 25, 2022). | |

| Shares of Common Stock outstanding assuming exercise of all Warrants | 132,659,783 (based on total shares outstanding as of January 25, 2022 plus 14,666,644 warrants). | |

| Use of Proceeds | We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the Selling Securityholders. We will receive up to an aggregate of approximately $72.8 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. See “ Use of Proceeds | |

| Redemption | The Warrants are redeemable in certain circumstances. See “ Description of Securities — Warrants | |

| Business Combination - Related Lock-Up Agreements | Certain of our securityholders, including certain of the Selling Securityholders, are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Securities Eligible for Resale—Lock-Up Agreements | |

| Market for Common Stock and Warrants | Our Common Stock and Warrants are currently traded on the NYSE under the symbols “HLLY” and “HLLY WS,” respectively. | |

| Risk Factors | See “ Risk Factors | |

Thirteen Weeks Ended | Thirty-Nine Weeks Ended | Years Ended December 31, | ||||||||||||||||||||||

September 26, 2021 | September 27, 2020 | September 26, 2021 | September 27, 2020 | 2020 | 2019 | |||||||||||||||||||

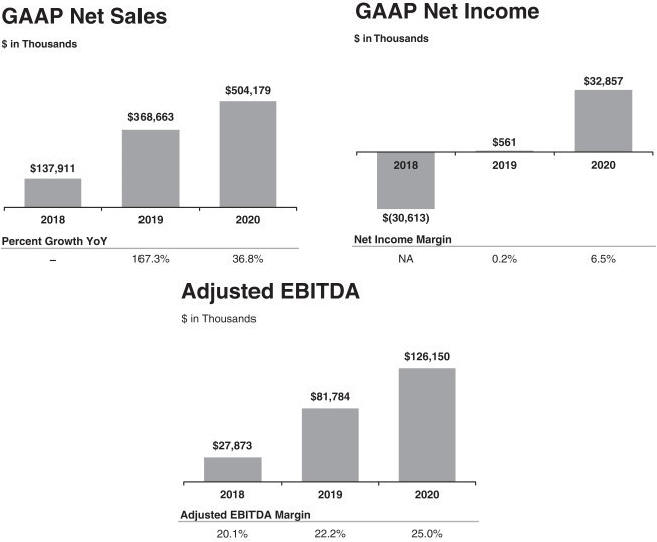

Net sales | $ | 159,673 | $ | 133,307 | $ | 513,046 | $ | 365,760 | $ | 504,179 | $ | 368,663 | ||||||||||||

Cost of goods sold | 94,475 | 77,778 | 300,969 | 212,070 | 295,935 | 219,884 | ||||||||||||||||||

Gross profit | 65,198 | 55,529 | 212,077 | 153,690 | 208,244 | 148,779 | ||||||||||||||||||

Selling, general, and administrative | 28,891 | 17,303 | 79,093 | 48,790 | 70,875 | 62,371 | ||||||||||||||||||

Research and development costs | 7,133 | 5,982 | 20,167 | 17,198 | 23,483 | 20,630 | ||||||||||||||||||

Amortization of intangible assets | 3,553 | 2,699 | 10,391 | 8,099 | 11,082 | 10,456 | ||||||||||||||||||

Acquisition and restructuring costs | 368 | 1,092 | 21,877 | 5,624 | 9,743 | 4,942 | ||||||||||||||||||

Related party acquisition and management fee costs | 23,250 | 894 | 25,789 | 2,665 | 6,089 | 3,662 | ||||||||||||||||||

Other operating expense (income) | 89 | (821 | ) | 3 | (1,089 | ) | 1,517 | 644 | ||||||||||||||||

Operating income | 1,914 | 28,380 | 54,757 | 72,403 | 85,455 | 46,074 | ||||||||||||||||||

Change in fair value of warrant liability | 17,273 | — | 17,273 | — | — | — | ||||||||||||||||||

Change in fair value of earn-out liability | 6,866 | — | 6,866 | — | — | — | ||||||||||||||||||

Loss on early extinguishment of debt | 1,425 | — | 1,425 | — | — | — | ||||||||||||||||||

Interest expense | 9,851 | 9,325 | 31,096 | 31,843 | 43,772 | 50,386 | ||||||||||||||||||

Income (loss) before income taxes | (33,501 | ) | 19,055 | (1,903 | ) | 40,560 | 41,683 | (4,312 | ) | |||||||||||||||

Income tax expense (benefit) | (3,301 | ) | 5,512 | 7,255 | 9,656 | 8,826 | (4,873 | ) | ||||||||||||||||

Net income (loss) | (30,200 | ) | 13,543 | (9,158 | ) | 30,904 | 32,857 | 561 | ||||||||||||||||

Foreign currency translation adjustment | (31 | ) | — | (12 | ) | — | 16 | — | ||||||||||||||||

Pension liability loss | — | — | — | — | (293 | ) | (123 | ) | ||||||||||||||||

Total comprehensive income (loss) | $ | (30,231 | ) | $ | 13,543 | $ | (9,170 | ) | $ | 30,904 | $ | 32,580 | $ | 438 | ||||||||||

Thirteen Weeks Ended | Thirty-Nine Weeks Ended | Years Ended December 31, | ||||||||||||||||||||||

September 26, 2021 | September 27, 2020 | September 26, 2021 | September 27, 2020 | 2020 | 2019 | |||||||||||||||||||

Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA ($ in thousands) | ||||||||||||||||||||||||

Net income (loss) | $ | (30,200 | ) | $ | 13,543 | $ | (9,158 | ) | $ | 30,904 | $ | 32,857 | $ | 561 | ||||||||||

Depreciation | 2,875 | 2,026 | 7,328 | 6,039 | 7,886 | 8,827 | ||||||||||||||||||

Amortization of intangible assets | 3,553 | 2,699 | 10,391 | 8,099 | 11,082 | 10,456 | ||||||||||||||||||

Interest expense | 9,851 | 9,325 | 31,096 | 31,843 | 43,772 | 50,386 | ||||||||||||||||||

Income tax expense (benefit) | (3,301 | ) | 5,512 | 7,255 | 9,656 | 8,826 | (4,873 | ) | ||||||||||||||||

EBITDA | (17,222 | ) | 33,105 | 46,912 | 86,541 | 104,423 | 65,357 | |||||||||||||||||

Notable items | 938 | 205 | 10,513 | 1,643 | 4,378 | 7,179 | ||||||||||||||||||

Equity-based compensation expense | 2,486 | 121 | 2,748 | 356 | — | — | ||||||||||||||||||

Acquisition and restructuring costs | 368 | 1,092 | 21,877 | 5,624 | 9,743 | 4,942 | ||||||||||||||||||

Change in fair value of warrant liability | 17,273 | — | 17,273 | — | — | — | ||||||||||||||||||

Change in fair value of earn-out liability | 6,866 | — | 6,866 | — | — | — | ||||||||||||||||||

Loss on early extinguishment of debt | 1,425 | — | 1,425 | — | — | — | ||||||||||||||||||

Related party acquisition and management fee costs | 23,250 | 894 | 25,789 | 2,665 | 6,089 | 3,662 | ||||||||||||||||||

Other expense (benefit) | 89 | (821 | ) | 3 | (1,089 | ) | 1,517 | 644 | ||||||||||||||||

Adjusted EBITDA | $ | 35,473 | $ | 34,596 | $ | 133,406 | $ | 95,740 | $ | 126,150 | $ | 81,784 | ||||||||||||

Thirty-Nine Weeks Ended | Years Ended December 31, | |||||||||||

September 26, 2021 | 2020 | 2019 | ||||||||||

Cash and cash equivalents | $ | 53,927 | $ | 71,674 | $ | 8,335 | ||||||

Working capital 1 | 180,986 | 175,971 | 117,268 | |||||||||

Total assets | 1,136,686 | 1,065,330 | 829,213 | |||||||||

Total liabilities | 816,863 | 824,949 | 623,799 | |||||||||

Total stockholder’s equity | 319,823 | 240,381 | 205,414 | |||||||||

Thirty-Nine Weeks Ended | Years Ended December 31, | |||||||||||||||

September 26, 2021 | September 27, 2020 | 2020 | 2019 | |||||||||||||

Net cash from operating activities | $ | 24,917 | $ | 75,604 | $ | 88,413 | $ | 9,418 | ||||||||

Net cash used in investing activities | (71,931 | ) | (6,703 | ) | (165,618 | ) | (14,479 | ) | ||||||||

Net cash (used in) from financing activities | 29,267 | (22,500 | ) | 140,544 | 2,433 | |||||||||||

Net change in cash and cash equivalents | $ | (17,747 | ) | $ | 46,401 | $ | 63,339 | $ | (2,628 | ) | ||||||

| 1 | We define working capital as current assets less current liabilities. |

For the six months ended June 30, 2021 (Unaudited) | For the Period from August 19, 2020 (Inception) through December 31, 2020 (Restated) | |||||||

Formation and operating costs | $ | 4,592,939 | $ | 273,915 | ||||

Loss from operations | (4,592,939 | ) | (273,915 | ) | ||||

Other income: | ||||||||

Interest earned on marketable securities held in trust account | 56,360 | 49,118 | ||||||

Unrealized gain on marketable securities held in trust account | — | 3,788 | ||||||

Change in fair value of warrant liability | (10,143,333 | ) | (1,690,000 | ) | ||||

Change in fair value of forward purchase agreement liability | (1,200,000 | ) | (2,050,000 | ) | ||||

Transaction costs | — | (482,885 | ) | |||||

Other expenses, net | (11,283,973 | ) | (4,169,979 | ) | ||||

Net loss | $ | (15,876,912 | ) | $ | (4,443,894 | ) | ||

Weighted average Class A ordinary shares | 25,000,000 | 15,601,504 | ||||||

Basic and diluted net loss per Class A ordinary share | $ | (0.51 | ) | $ | (0.20 | ) | ||

Weighted average shares outstanding, Class B | 6,250,000 | 6,250,000 | ||||||

Basic and diluted net loss per Class B ordinary share | $ | (0.51 | ) | $ | (0.20 | ) | ||

As of | ||||||||

June 30, 2021 (Unaudited) | December 31, 2020 (Restated) | |||||||

Current Assets | ||||||||

Cash | $ | 704,009 | $ | 1,080,629 | ||||

Prepaid expenses | 259,850 | 379,166 | ||||||

Total Current Assets | 963,859 | 1,459,795 | ||||||

Cash and marketable securities held in trust account | 250,112,265 | 250,052,906 | ||||||

Total Assets | $ | 251,076,124 | $ | 251,512,701 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

Current liabilities — accrued expenses | $ | 4,270,875 | $ | 173,873 | ||||

Warrant liability | 25,233,333 | 15,090,000 | ||||||

Forward purchase agreement liability | 3,250,000 | 2,050,000 | ||||||

Deferred underwriting fee payable | 8,750,000 | 8,750,000 | ||||||

Total Liabilities | 41,504,208 | 26,063,873 | ||||||

Commitments | ||||||||

Class A ordinary shares subject to possible redemption, 25,000,000 shares at redemption value | 250,112,265 | 250,052,906 | ||||||

Shareholders’ Equity | ||||||||

Preference shares, $0.0001 par value; 5,000,000 shares authorized; none issued and outstanding | — | — | ||||||

Class A ordinary shares, $0.0001 par value; 500,000,000 shares authorized; no shares issued and outstanding (excluding 25,000,000 shares subject to possible redemption) | — | — | ||||||

Class B ordinary shares, $0.0001 par value; 50,000,000 shares authorized; 6,250,000 shares issued and outstanding | 625 | 625 | ||||||

Additional paid-in capital | — | — | ||||||

Accumulated deficit | (40,540,974 | ) | (24,604,703 | ) | ||||

Total Shareholders’ Deficit | (40,540,349 | ) | (24,604,078 | ) | ||||

Total Liabilities and Shareholders’ Deficit | $ | 251,076,124 | $ | 251,512,701 | ||||

Summary Unaudited Pro Forma Condensed Combined Statement of Comprehensive Income (Loss) for the 39 Weeks Ended September 26, 2021 | ||||

Revenue | $ | 513,046 | ||

Weighted average shares outstanding, basic and diluted | 115,805,639 | |||

Basic and diluted net income per share | $ | (0.18 | ) | |

Summary Unaudited Pro Forma Condensed Combined Statement of Comprehensive Income (Loss) for the Year Ended December 31, 2020 | ||||

Revenue | $ | 504,179 | ||

Weighted average shares outstanding, basic and diluted | 115,805,639 | |||

Basic and diluted net income per share | $ | 0.32 | ||

| • | the possibility of renewed retail store closures or reduced operating hours and/or decreased retail traffic; |

| • | disruption to the Company’s distribution centers and other vendors, including the effects of facility closures as a result of outbreaks of COVID-19 or measures taken by federal, state or local governments to reduce its spread, reductions in operating hours, labor shortages, and real time changes in operating procedures, including for additional cleaning and disinfection procedures; and |

| • | significant disruption of global financial markets, which could have an adverse impact on the Company ability to access capital in the future. |

| • | respond more quickly than the Company can to new or emerging technologies and changes in customer requirements by devoting greater resources than we can to the development, promotion and sale of automotive aftermarket products; |

| • | engage in more extensive research and development; and |

| • | spend more money and resources on marketing and promotion. |

| • | significant delays in the delivery of cargo due to port security considerations; |

| • | imposition of duties, taxes, tariffs or other charges on imports; |

| • | potential recalls or cancellations of orders for any product that does not meet the Company’s quality standards; |

| • | disruption of imports by labor disputes or strikes and local business practices; |

| • | heightened terrorism security concerns, which could subject imported goods to additional, more frequent or more thorough inspections, leading to delays in deliveries or impoundment of goods for extended periods; |

| • | natural disasters, disease epidemics and health related concerns, which could result in closed factories, reduced workforces, scarcity of raw materials and scrutiny or embargoing of goods produced in infected areas; |

| • | inability of the Company’s non-U.S. suppliers to obtain adequate credit or access liquidity to finance its operations; and |

| • | the Company’s ability to enforce any agreements with its foreign suppliers. |

| • | earthquake, fire, flood, hurricane and other natural disasters; |

| • | power loss, computer systems failure, Internet and telecommunications or data network failure; and |

| • | hackers, computer viruses, software bugs or glitches. |

| • | increases the Company’s and its subsidiaries’ vulnerability to adverse economic or industry conditions; |

| • | limits the Company’s and its subsidiaries’ flexibility in planning for, or reacting to, changes in the Company’s and its subsidiaries’ business or markets; |

| • | makes the Company and its subsidiaries more vulnerable to increases in interest rates, as borrowings under the Credit Agreement bear interest at variable rates; |

| • | limits the Company’s and its subsidiaries’ ability to obtain additional financing in the future for working capital or other purposes; and |

| • | potentially places the Company and its subsidiaries at a competitive disadvantage compared to the Company’s and its subsidiaries’ competitors that have less indebtedness. |

| • | the realization of any of the risk factors presented in this prospectus; |

| • | actual or anticipated differences in the Company’s estimates, or in the estimates of analysts, for the Company’s revenues, results of operations, level of indebtedness, liquidity or financial condition; |

| • | additions and departures of key personnel; |

| • | failure to comply with the requirements of the NYSE; |

| • | failure to comply with the Sarbanes-Oxley Act or other laws or regulations; |

| • | future issuances, sales or resales, or anticipated issuances, sales or resales, of Common Stock; |

| • | perceptions of the investment opportunity associated with Common Stock relative to other investment alternatives; |

| • | the performance and market valuations of other similar companies; |

| • | future announcements concerning the Company’s business or its competitors’ businesses; |

| • | broad disruptions in the financial markets, including sudden disruptions in the credit markets; |

| • | speculation in the press or investment community; |

| • | actual, potential or perceived control, accounting or reporting problems; |

| • | changes in accounting principles, policies and guidelines; and |

| • | general economic and political conditions, such as the effects of the COVID-19 outbreak, recessions, interest rates, local and national elections, fuel prices, international currency fluctuations, corruption, political instability and acts of war or terrorism. |

| • | a majority of the board of directors consist of independent directors; |

| • | the nominating and governance committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the compensation committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. |

| • | a limited availability of market quotations for our securities; |

| • | reduced liquidity for our securities; |

| • | a determination that our Common Stock is a “penny stock” which will require brokers trading in our Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | a classified board of directors with staggered, three-year terms; |

| • | prevent stockholders from acting by written consent; |

| • | limit the ability of stockholders to amend our certificate of incorporation; |

| • | limit the ability of stockholders to remove directors; |

| • | prevent stockholders from calling special meetings of stockholders; |

| • | the ability of the board of directors to issue shares of preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder; |

| • | the certificate of incorporation prohibits cumulative voting in the election of directors; |

| • | the limitation of the liability of, and the indemnification of, the Company’s directors and officers; |

| • | the ability of the board of directors to amend the bylaws; and |

| • | advance notice procedures with which stockholders must comply to nominate candidates to the board of directors or to propose matters to be acted upon at a stockholders’ meeting. |

Empower (Historical) | Holley (Historical) | Pro Forma Transaction Accounting Adjustments | Financing Transaction Accounting Adjustments | Pro Forma Adjustments For A&R FPA | Pro Forma Consolidated | Note | ||||||||||||||||||||||

Revenue | $ | — | $ | 513,046 | $ | — | $ | — | $ | — | $ | 513,046 | ||||||||||||||||

Cost of goods sold | — | 300,969 | — | — | — | 300,969 | ||||||||||||||||||||||

Operating Expenses | ||||||||||||||||||||||||||||

Selling, general and administrative | — | 79,093 | — | — | — | 79,093 | ||||||||||||||||||||||

Research and development costs | — | 20,167 | — | — | — | 20,167 | ||||||||||||||||||||||

Formation and operational costs | 4,593 | — | — | — | — | 4,593 | ||||||||||||||||||||||

Amortization of intangibles | — | 10,391 | — | — | — | 10,391 | ||||||||||||||||||||||

Acquisition, restructuring and management fee costs | — | 21,877 | — | — | — | 21,877 | ||||||||||||||||||||||

Related party acquisition and management fee costs | — | 25,789 | — | — | — | 25,789 | ||||||||||||||||||||||

Other income | — | 3 | — | — | — | 3 | ||||||||||||||||||||||

Total operating expenses | 4,593 | 157,320 | — | — | — | 161,913 | ||||||||||||||||||||||

Operating income | (4,593 | ) | 54,757 | — | — | — | 50,164 | |||||||||||||||||||||

Interest expense | — | (31,096 | ) | — | 4,704 | — | (26,392 | ) | AA | |||||||||||||||||||

Interest income | 59 | — | (59 | ) | — | — | — | AB | ||||||||||||||||||||

Change in fair value of warrant liability | (10,143 | ) | (17,273 | ) | — | — | — | (27,416 | ) | |||||||||||||||||||

Change in fair value of forward purchase agreement liability | (1,200 | ) | — | — | — | 1,200 | — | AC | ||||||||||||||||||||

Change in fair value of earn-out liability | — | (6,866 | ) | — | — | — | (6,866 | ) | ||||||||||||||||||||

Loss on early extinguishment of debt | — | (1,425 | ) | — | — | — | (1,425 | ) | ||||||||||||||||||||

Income (loss) before income taxes | (15,877 | ) | (1,903 | ) | (59 | ) | 4,704 | (11,935 | ) | |||||||||||||||||||

Income tax expense (benefit) | — | 7,255 | — | 1,186 | — | 8,441 | AD | |||||||||||||||||||||

Net loss | $ | (15,877 | ) | $ | (9,158 | ) | $ | (59 | ) | $ | 3,518 | $ | 1,200 | $ | (20,376 | ) | ||||||||||||

Comprehensive income (loss): | ||||||||||||||||||||||||||||

Foreign currency translation adjustment | — | (12 | ) | — | — | — | (12 | ) | ||||||||||||||||||||

Pension liability loss | — | — | — | — | — | — | ||||||||||||||||||||||

Total comprehensive income (loss) | $ | (15,877 | ) | $ | (9,170 | ) | $ | (59 | ) | $ | 3,518 | $ | 1,200 | $ | (20,388 | ) | ||||||||||||

Weighted average shares Class A ordinary shares | 25,000,000 | |||||||||||||||||||||||||||

Basic and diluted net loss per Class A ordinary share | $ | (0.51 | ) | |||||||||||||||||||||||||

Weighted average shares outstanding, Class B | 6,250,000 | |||||||||||||||||||||||||||

Basic and diluted net loss per Class B ordinary share | $ | (0.51 | ) | |||||||||||||||||||||||||

Weighted average shares outstanding, basic and diluted | 115,805,639 | |||||||||||||||||||||||||||

Basic and diluted net income per share | $ | (0.18 | ) | |||||||||||||||||||||||||

Empower (Historical) (Restated) | Holley (Historical) | Pro Forma Transaction Accounting Adjustments | Financing Transaction Accounting Adjustments | Pro Forma Adjustments for A&R FPA | Pro Forma Consolidated | Note | ||||||||||||||||||||||

Revenue | $ | — | $ | 504,179 | $ | — | $ | — | $ | — | $ | 504,179 | ||||||||||||||||

Cost of goods sold | — | 295,935 | — | — | — | 295,935 | ||||||||||||||||||||||

Operating Expenses | — | — | — | — | — | |||||||||||||||||||||||

Selling, general and administrative | — | 70,875 | — | — | — | 70,875 | ||||||||||||||||||||||

Research and development costs | — | 23,483 | — | — | — | 23,483 | ||||||||||||||||||||||

Formation and operational costs | 274 | — | �� | — | — | — | 274 | |||||||||||||||||||||

Amortization of intangibles | — | 11,082 | — | — | — | 11,082 | ||||||||||||||||||||||

Acquisition, restructuring and management fee costs | — | 9,743 | — | — | — | 9,743 | ||||||||||||||||||||||

Related party acquisition and management fee costs | — | 6,089 | — | — | — | 6,089 | ||||||||||||||||||||||

Other income | — | 1,517 | — | — | — | 1,517 | ||||||||||||||||||||||

Total operating expenses | 274 | 122,789 | — | — | — | 123,063 | ||||||||||||||||||||||

Operating income | (274 | ) | 85,455 | — | — | — | 85,181 | |||||||||||||||||||||

Interest expense | — | (43,772 | ) | — | (9,513 | ) | — | (34,259 | ) | AA | ||||||||||||||||||

Interest income | 49 | — | (49 | ) | — | — | — | AB | ||||||||||||||||||||

Unrealized gain on other marketable securities | 4 | — | — | — | — | 4 | ||||||||||||||||||||||

Change in fair value of warrant liability | (1,690 | ) | — | — | — | — | (1,690 | ) | ||||||||||||||||||||

Change in fair value of purchase agreement liability | (2,050 | ) | — | — | — | 2,050 | — | AC | ||||||||||||||||||||

Transaction costs | (483 | ) | — | — | — | — | (483 | ) | ||||||||||||||||||||

Income (loss) before income taxes | (4,444 | ) | 41,683 | (49 | ) | 9,513 | 2,050 | 48,753 | ||||||||||||||||||||

Income tax expense (benefit) | — | 8,826 | — | 2,399 | — | 11,225 | AD | |||||||||||||||||||||

Net income (loss) | $ | (4,444 | ) | $ | 32,857 | $ | (49 | ) | $ | 7,114 | $ | 2,050 | $ | 37,528 | ||||||||||||||

Comprehensive income (loss): | — | |||||||||||||||||||||||||||

translation adjustment | — | 16 | — | — | — | 16 | ||||||||||||||||||||||

Pension liability loss | — | (293 | ) | — | — | — | (293 | ) | ||||||||||||||||||||

Total comprehensive income (loss) | $ | (4,444 | ) | $ | 32,580 | $ | (49 | ) | $ | 7,114 | $ | 2,050 | $ | 37,251 | ||||||||||||||

Weighted average shares Class A ordinary shares | 15,601,504 | |||||||||||||||||||||||||||

Basic and diluted net loss per Class A ordinary share | $ | (0.20 | ) | |||||||||||||||||||||||||

Weighted average shares outstanding, Class B | 6,250,000 | |||||||||||||||||||||||||||

Basic and diluted net loss per Class B ordinary share | $ | (0.20 | ) | |||||||||||||||||||||||||

Weighted average shares outstanding, basic and diluted | 115,805,639 | |||||||||||||||||||||||||||

Basic and diluted net income per share | 0.32 | |||||||||||||||||||||||||||

| • | The pre-merger equity holders of Holley hold the majority of voting rights in the Company; |

| • | The pre-merger equity holders of Holley have the right to appoint the majority of members of the Company’s board of directors; |

| • | Senior management of Holley comprise the senior management of the Company; and |

| • | Operations of Holley comprise the ongoing operations of the Company. |

Shares | % | |||||||

Empower public shareholders | 15,069,255 | 13.01 | % | |||||

Holley Stockholder | 67,673,884 | 58.44 | % | |||||

Sponsor and related parties | 9,062,500 | 7.83 | % | |||||

PIPE Investors | 24,000,000 | 20.72 | % | |||||

Closing Shares | 115,805,639 | 100.00 | % | |||||

Period | Amount | Rate | Interest | |||||||||

1/1/2021 to 2/26/2021 | $ | 100,000 | 8.73 | % | $ | 1,383 | ||||||

2/27/2021 to 5/28/2021 | 100,000 | 8.61 | % | 2,176 | ||||||||

5/29/2021 to 7/15/2021 | 100,000 | 8.59 | % | 1,145 | ||||||||

Total | $ | 4,704 | ||||||||||

Period | Amount | Rate | Interest | |||||||||

1/1/2020 to 2/28/2020 | $ | 100,000 | 10.41 | % | $ | 1,706 | ||||||

3/1/2020 to 5/29/2020 | 100,000 | 10.11 | % | 2,528 | ||||||||

5/30/2020 to 8/28/2020 | 100,000 | 8.86 | % | 2,240 | ||||||||

8/28/2020 to 11/30/2020 | 100,000 | 8.76 | % | 2,287 | ||||||||

12/1/2020 to 12/31/2020 | 100,000 | 8.73 | % | 752 | ||||||||

Total | $ | 9,513 | ||||||||||

Adjustment | Amount | Tax Rate | Tax Benefit | |||||||||

Partial debt paydown | $ | 4,704 | 25.22 | % | $ | 1,186 | ||||||

Adjustment | Amount | Tax Rate | Tax Benefit | |||||||||

Partial debt paydown | $ | 9,513 | 25.22 | % | $ | 2,399 | ||||||

Thirty-nine weeks ended September 26, 2021 | ||||

Numerator | ||||

Pro forma total comprehensive loss | $ | (20,376 | ) | |

Denominator | ||||

Empower shareholders | 15,069,255 | |||

Sellers | 67,673,884 | |||

Sponsor and related parties | 9,062,500 | |||

PIPE Investors | 24,000,000 | |||

Basic and diluted weighted average shares outstanding | 115,805,639 | |||

Loss per share — basic and diluted | $ | (0.18 | ) | |

Year ended December 31, 2020 | ||||

Numerator | ||||

Pro forma total comprehensive income | $ | 37,528 | ||

Denominator | ||||

Empower shareholders | 15,069,255 | |||

Sellers | 67,673,884 | |||

Sponsor and related parties | 9,062,500 | |||

PIPE Investors | 24,000,000 | |||

Basic and diluted weighted average shares outstanding | 115,805,639 | |||

Earnings per share — basic and diluted | $ | 0.32 | ||

| • | AEM Performance Electronics |

| • | Drake Automotive Group: |

| • | Simpson: |

For the thirteen weeks ended | Change | |||||||||||||||

September 26, 2021 | September 27, 2020 | $ | % | |||||||||||||

Net sales | $ | 159,673 | $ | 133,307 | $ | 26,366 | 19.8 | % | ||||||||

Cost of goods sold | 94,475 | 77,778 | 16,697 | 21.5 | % | |||||||||||

Gross profit | 65,198 | 55,529 | 9,669 | 17.4 | % | |||||||||||

Selling, general, and administrative | 28,891 | 17,303 | 11,588 | 67.0 | % | |||||||||||

Research and development costs | 7,133 | 5,982 | 1,151 | 19.2 | % | |||||||||||

Amortization of intangible assets | 3,553 | 2,699 | 854 | 31.6 | % | |||||||||||

Acquisition and restructuring costs | 368 | 1,092 | (724 | ) | (66.3 | %) | ||||||||||

Related party acquisition and management fee costs | 23,250 | 894 | 22,356 | 2,501 | % | |||||||||||

Other expense (income) | 89 | (821 | ) | 910 | n/a | |||||||||||

Operating income | 1,914 | 28,380 | (26,466 | ) | (93.3 | %) | ||||||||||

Change in fair value of warrant liability | 17,273 | — | 17,273 | n/a | ||||||||||||

Change in fair value of earn-out liability | 6,866 | — | 6,866 | n/a | ||||||||||||

Loss on early extinguishment of debt | 1,425 | — | 1,425 | n/a | ||||||||||||

Interest expense | 9,851 | 9,325 | 526 | 5.6 | % | |||||||||||

Income before income taxes | (33,501 | ) | 19,055 | (52,556 | ) | (275.8 | %) | |||||||||

Income tax expense | (3,301 | ) | 5,512 | (8,813 | ) | (159.9 | %) | |||||||||

Net income | (30,200 | ) | 13,543 | (43,743 | ) | (323.0 | %) | |||||||||

Foreign currency translation adjustment | (31 | ) | — | (31 | ) | n/a | ||||||||||

Total comprehensive income | $ | (30,231 | ) | $ | 13,543 | $ | (43,774 | ) | (323.2 | %) | ||||||

For the thirty-nine weeks ended | Change | |||||||||||||||

September 26, 2021 | September 27, 2020 | $ | % | |||||||||||||

Net sales | $ | 513,046 | $ | 365,760 | $ | 147,286 | 40.3 | % | ||||||||

Cost of goods sold | 300,969 | 212,070 | 88,899 | 41.9 | % | |||||||||||

Gross profit | 212,077 | 153,690 | 58,387 | 38.0 | % | |||||||||||

Selling, general, and administrative | 79,093 | 48,790 | 30,303 | 62.1 | % | |||||||||||

Research and development costs | 20,167 | 17,198 | 2,969 | 17.3 | % | |||||||||||

Amortization of intangible assets | 10,391 | 8,099 | 2,292 | 28.3 | % | |||||||||||

Acquisition and restructuring costs | 21,877 | 5,624 | 16,253 | 289.0 | % | |||||||||||

Related party acquisition and management fee costs | 25,789 | 2,665 | 23,124 | 867.7 | % | |||||||||||

Other income | 3 | (1,089 | ) | 1,092 | n/a | |||||||||||

Operating income | 54,757 | 72,403 | (17,646 | ) | (24.4 | %) | ||||||||||

Change in fair value of warrant liability | 17,273 | — | 17,273 | n/a | ||||||||||||

Change in fair value of earn-out liability | 6,866 | — | 6,866 | n/a | ||||||||||||

Loss on early extinguishment of debt | 1,425 | — | 1,425 | n/a | ||||||||||||

Interest expense | 31,096 | 31,843 | (747 | ) | (2.3 | %) | ||||||||||

Income before income taxes | (1,903 | ) | 40,560 | (42,463 | ) | (104.7 | %) | |||||||||

Income tax expense | 7,255 | 9,656 | (2,401 | ) | (24.9 | %) | ||||||||||

Net income | (9,158 | ) | 30,904 | (40,062 | ) | (129.6 | %) | |||||||||

Foreign currency translation adjustment | (12 | ) | — | (12 | ) | n/a | ||||||||||

Total comprehensive income | $ | (9,170 | ) | $ | 30,904 | $ | (40,074 | ) | (129.7 | %) | ||||||

Thirteen Weeks Ended | Thirty-Nine Weeks Ended | |||||||||||||||

September 26, 2021 | September 27, 2020 | September 26, 2021 | September 27, 2020 | |||||||||||||

Net income (loss) | $ | (30,200 | ) | $ | 13,543 | $ | (9,158 | ) | $ | 30,904 | ||||||

Adjustments: | ||||||||||||||||

Depreciation | 2,875 | 2,026 | 7,328 | 6,039 | ||||||||||||

Amortization of intangible assets | 3,553 | 2,699 | 10,391 | 8,099 | ||||||||||||

Interest expense | 9,851 | 9,325 | 31,096 | 31,843 | ||||||||||||

Income tax expense (benefit) | (3,301 | ) | 5,512 | 7,255 | 9,656 | |||||||||||

EBITDA | (17,222 | ) | 33,105 | 46,912 | 86,541 | |||||||||||

Notable items | 938 | 205 | 10,513 | 1,643 | ||||||||||||

Equity-based compensation expense | 2,486 | 121 | 2,748 | 356 | ||||||||||||

Acquisition and restructuring costs | 368 | 1,092 | 21,877 | 5,624 | ||||||||||||

Change in fair value of warrant liability | 17,273 | — | 17,273 | — | ||||||||||||

Change in fair value of earn-out liability | 6,866 | — | 6,866 | — | ||||||||||||

Loss on early extinguishment of debt | 1,425 | — | 1,425 | — | ||||||||||||

Related party acquisition and management fee costs | 23,250 | 894 | 25,789 | 2,665 | ||||||||||||

Other expense | 89 | (821 | ) | 3 | (1,089 | ) | ||||||||||

Adjusted EBITDA | 35,473 | 34,596 | 133,406 | 95,740 | ||||||||||||

For the thirty-nine weeks ended | ||||||||

September 26, 2021 | September 27, 2020 | |||||||

Cash flows from operating activities | $ | 24,917 | $ | 75,604 | ||||

Cash flows used in investing activities | (71,931 | ) | (6,703 | ) | ||||

Cash (used in) from financing activities | 29,267 | 22,500 | ||||||

Net increase (decrease) in cash and cash equivalents | $ | (17,747 | ) | 46,401 | ||||

| • | Performance products for existing electric vehicles |

| • | Electric drivetrain conversion products. |

| • | Holley EFI: |

| • | Holley |

| • | MSD: |

| • | Powerteq: |

| • | Flowmaster: |

| • | Multi-product category providers |

| • | Single-product category providers |

| • | E-Tailer Private LabelsE-tailer private labels generally occupy the value end of the market and have a greater presence in less engineered categories with less product-specific brand strength. |

| • | Niche custom manufacturers |

| • | Brand that resonates with enthusiasts |

| • | Innovative, product development |

| • | Operational ability that enables efficient order execution |

| • | Differentiated go-to-market |

Name | Age | Position | ||

Matthew Rubel | 64 | Chairman | ||

Tom Tomlinson | 61 | Director and Chief Executive Officer | ||

James D. Coady | 52 | Director | ||

Owen M. Basham | 35 | Director | ||

Gina Bianchini | 49 | Director | ||

Ginger M. Jones | 57 | Director | ||

Michelle Gloeckler | 55 | Director | ||

Dominic Bardos | 57 | Chief Financial Officer | ||

Sean Crawford | 39 | Chief Marketing Officer | ||

Vinod Nimmagadda | 29 | Executive Vice President, Corporate Development & New Ventures | ||

Terrill M. Rutledge | 53 | Chief Information Officer | ||

Patrick Lee Pierce | 41 | Chief Human Resources Officer | ||

Stephen Trussell | 54 | Vice President, Finance | ||

Jason Richard Bruce | 51 | Vice President, Business Development |

| • | assisting our board of directors in its oversight responsibilities regarding the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent accountant’s qualifications and independence, and our accounting and financial reporting processes of and the audits of our financial statements; |

| • | preparing the report required by the SEC for inclusion in our annual proxy or information statement; |

| • | approving audit and non-audit services to be performed by the independent accountants; and |

| • | performing such other functions as our board of directors may from time to time assign to the audit committee. |

| • | reviewing the compensation and benefits of our Chief Executive Officer and other executive officers and recommending such compensation for approval by the independent directors of the board or the board, as applicable; |

| • | recommending the amount and form of non-employee director compensation; |

| • | appointing and overseeing any compensation consultant; and |

| • | performing such other functions as our board of directors may from time to time assign to the compensation committee. |

| • | identifying individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors; and |

| • | developing and recommending to our board of directors a set of corporate governance guidelines and principles. |

| • | Thomas W. Thomlinson, Chief Executive Officer; |

| • | Dominic Bardos, Chief Financial Officer; and |

| • | Vinod Nimmagadda, EVP of Corporate Development &New Ventures. |

Name and Principal Position | Year | Salary ($) (1) | Option Awards ($) (2)(3) | Stock Awards (4) | Nonequity Incentive Plan Compensation (5) | All Other Compensation ($) (6) | Total ($) | |||||||||||||||||||||

Thomas W. Tomlinson President and Chief Executive Officer | 2021 | 465,654 | 6,296,244 | 2,412,000 | — | 161,852 | 9,335,723 | |||||||||||||||||||||

Dominic Bardos Chief Financial Officer | 2021 | 283,846 | 765,146 | 1,706,490 | — | 6,095 | 2,761,577 | |||||||||||||||||||||

Vinod Nimmagadda EVP of Corporate Development & New Ventures | 2021 | 186,250 | 620,542 | 587,925 | — | 2,750 | 1,397,467 | |||||||||||||||||||||

| (1) | Mr. Tomlinson’s base salary post-combination is $500,000. Mr. Bardos joined Holley in July 2021, and his base salary reflects such partial year of employment. Mr Bardos’ annual base salary is $410,000. Mr. Nimmagadda joined Holley in July 2021, and his base salary reflects such partial year of employment. Mr. Nimmagadda’s annual base salary is $325,000. For 2021, base salaries reflect both the pre- and post-combination periods. |

| (2) | The amounts reported in this column include the aggregate grant date fair value of the Class C Units, Class D-1 Units,Class D-2 Units andClass D-3 Units of the Holley Stockholder granted to Mr. Tomlinson, Mr. Bardos, and Mr. Nimmagadda during the fiscal year ended December 31, 2021, in accordance with FASB ASC 718. The determination with respect to the value of theClass D-1 Units,Class D-2 Units andClass D-3 Units assumes that theClass D-1 Units,Class D-2 Units andClass D-3 Units will be earned at target performance levels, which is also the highest level of performance for such awards, and is consistent with the estimated aggregate compensation cost to be recognized over the performance period determined as of the grant date. See Note 13 to Holley’s consolidated financial statements for the 39 weeks ended September 26, 2021 for a discussion of the assumptions used to calculate these values. |

| (3) | The amounts reported in this column include the grant date fair value computed in accordance with FASB ASC 718 of stock option awards granted under our Incentive Plan and do not reflect whether the recipient has actually realized a financial gain from such awards (such as by exercising stock options). These options were granted on July 16, 2021, concurrent with the Closing and each executive’s appointment as an executive officer of Holley, at which time the board of directors of Holley approved the grant of options to purchase shares of Common Stock, respectively, under the Incentive Plan. Each option will vest in three equal installments on each of the first three anniversaries of the Closing, subject to the executive’s continued employment through the applicable vesting date. The fair value for the stock option awards was determined using a Black-Scholes option pricing model. See Note 13 to Holley’s consolidated financial statements for the 39 weeks ended September 26, 2021 for a discussion of the assumptions used to calculate these values. |

| (4) | The amounts shown represent the grant date fair value computed in accordance with FASB ASC 718 of restricted stock awards granted under our Incentive Plan and do not reflect whether the recipient has actually realized a financial gain from such awards (such as a lapse in a restricted stock award). The fair value of restricted stock units was determined based on the $12.06 closing price of the underlying common stock on the date of grant. |

| (5) | The amount of bonus with respect to 2021 has not been determined as of the date of this filing. |

| (6) | The amounts reported as earned by each named executive officer in this column represent: (i) for Mr. Tomlinson, $126,271 for use of warehouse space, $13,050 in employer matching contributions made under the 401(k) plan, $15,756 paid for life and disability insurance premiums, and $6,748 paid for country club dues, (ii) for Mr. Bardos, $2,750 in employer matching contributions made under the 401(k) plan and $3,345 paid for country club dues, and (iii) for Mr. Nimmagadda $2,750 in employer matching contributions made under the 401(k) plan. |

Name | Number of Shares or Units of Stock That Have Not Vested (#) (1) | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) | ||||||

Thomas W. Tomlinson | 200,000 | 2,598,000 | ||||||

Dominic Bardos | 141,500 | 1,838,085 | ||||||

Vinod Nimmigadda | 48,750 | 633,263 | ||||||

| (1) | The value is based upon the closing price on the Company’s common stock on the New York Stock Exchange on December 31, 2021 of $12.99. |

| (2) | These restricted stock units will vest in equal, or nearly equal, installments on July 16 of each of 2022, 2023 and 2024, subject to the executive’s continuous employment through such date |

Option Awards (1) | ||||||||||||||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) exercisable (2) | Number of Securities Underlying Unexercised Options (#) unexercisable (2)(3) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) (4) | Option Exercise Price ($) (5) | Option Expiration Date | ||||||||||||||||||

Tom Tomlinson | July 16, 2021 | — | 584,622.00 | — | $ | 10.50 | July 16, 2031 | |||||||||||||||||

| July 13, 2021 | — | 688,476.90 | 2,388,672.39 | N/A | N/A | |||||||||||||||||||

| December 31, 2018 | 1,660,986.54 | 1,107,324.36 | 8,753,686.25 | N/A | N/A | |||||||||||||||||||

Dominic Bardos | July 16, 2021 | — | 179,771.00 | — | $ | 10.50 | July 16, 2031 | |||||||||||||||||

| July 13, 2021 | — | 11,560.47 | 40,109.08 | N/A | N/A | |||||||||||||||||||

Vinod Nimmagadda | July 16, 2021 | — | 142,502.00 | — | $ | 10.50 | July 16, 2031 | |||||||||||||||||

| July 13, 2021 | — | 11,560.47 | 40,109.08 | N/A | N/A | |||||||||||||||||||

| (1) | The Incentive Units are intended to constitute profits interests for federal income tax purposes. Despite the fact that the Incentive Units do not require the payment of an exercise price, they are most similar economically to stock options due to the fact that they only have value as the value of the underlying security appreciates. Accordingly, they are classified as “options” under the definition provided in Item 402(a)(6)(i) of Regulation S-K as an instrument with an “option-like feature.” |

| (2) | Represents December 2018 grant of Class C Units that vest 20% on the first anniversary of the grant date and then in equal monthly installments thereafter for the following 48 months, provided that the named executive officer remains employed with Holley through each vesting date. Class C Units fully vest in connection with a sale of the Holley Stockholder, provided that the named executive officer remains employed with Holley through such date. |

| (3) | The July 13, 2021 grants represent the grant of Class C Units that vest upon the earlier to occur of (i) the second anniversary of the Closing, and (ii) in connection with a sale of the Holley Stockholder, provided that the named executive officer remains employed with Holley through such date. The July 16, 2021 grants represent the grant of stock option awards under the Incentive Plan, which vest in three equal installments on each of the first three anniversaries of the Closing, subject to the executive’s continued employment through the applicable vesting date. |

| (4) | The July 13, 2021 grants represent, (i) for Mr. Tomlinson, the grant of 811,834.33 Class D-1 Units, 874,830.61Class D-2 Units and 702,007.45Class D-3 Units; (II) for Mr. Bardos, the grant of 13,631.81Class D-1 Units, 14,689.60Class D-2 Units and |

| 11,787.67 Class D-3 Units, and (iii) for Mr. Nimmagadda, the grant of 13,631.81Class D-1 Units, 14,689.60Class D-2 Units and 11,787.67Class D-3 Units. The December 31, 2018 grant, represents for Mr. Tomlinson, the grant of 2,975,101.58Class D-1 Units, 3,205,961.92Class D-2 Units and 2,572,622.75Class D-3 Units. TheClass D-1 Units,Class D-2 Units, andClass D-3 Units vest at such time that the Sentinel Investors achieve a return on their investment of 2.0 times, 2.5 times and 3 times, respectively. |

| (5) | The Incentive Unit awards are not traditional options, and therefore, there is no exercise price or expiration date associated with them. |

Type of Fee | ||||

Non-employee Director (other than the Chairman) | $ | 70,000 | ||

Chairman of the Board of Directors | $ | 110,000 | ||

Chairman of the Audit Committee | $ | 25,000 | ||

Member of the Audit Committee | $ | 10,000 | ||

Chairman of the Compensation Committee | $ | 15,000 | ||

Member of the Compensation Committee | $ | 10,000 | ||

Chairman or Member of the Nominating and Governance Committee | $ | 10,000 | ||

Matt Rubel | Giana Bianchini | Michelle Gloeckler | Ginger M. Jones | Owen Basham (1) | James Coady (1) | Tom Tomlinson (2) | ||||||||||||||||||||||

Cash Retainer | $ | 70,000 | $ | 70,000 | $ | 70,000 | $ | 70,000 | $ | 70,000 | $ | 70,000 | — | |||||||||||||||

Restricted Stock Units (3) | $ | 220,830 | $ | 220,830 | $ | 220,830 | $ | 220,830 | $ | 220,830 | $ | 220,830 | — | |||||||||||||||

Board Chair | $ | 40,000 | — | — | — | — | — | — | ||||||||||||||||||||

Audit Committee Member | $ | 10,000 | $ | 10,000 | — | $ | 25,000 | (4) | — | — | — | |||||||||||||||||

Nominating and Governance Committee Member | — | — | $ | 10,000 | (5) | — | $ | 10,000 | $ | 10,000 | — | |||||||||||||||||

Compensation and Talent Committee Member | — | — | $ | 15,000 | (6) | — | $ | 10,000 | $ | 10,000 | — | |||||||||||||||||

Total | $ | 340,830 | $ | 300,830 | $ | 315,830 | $ | 315,830 | $ | 310,830 | $ | 310,830 | — | |||||||||||||||

| (1) | Director cash compensation attributable to Mr. Basham’s and Mr. Coady’s service was paid to Sentinel Capital Partners. |

| (1) | Employee directors did not receive compensation for their service on the board of directors of Holley. |

| (2) | On September 23, 2021, each director was issued 17,000 restricted stock units that vest in full on July 16, 2022. The value is based upon the closing price on the Company’s common stock on the New York Stock Exchange on December 31, 2021 of $12.99. |

| (3) | Ms. Gloeckler did not receive additional compensation for her services as chair of the Nominations Committee. |

| (4) | Ms. Jones received $25,000 for her services as chair of the Audit Committee. |

| (5) | Ms. Gloeckler received $15,000 for her services as chair of the Compensation Committee. |

| • | each person who is known by us to be the beneficial owner of more than five percent (5%) of the outstanding shares of Common Stock; |

| • | each of our named executive officers and directors; and |

| • | all current executive officers and directors as a group. |

Name and Address of Beneficial Owners (1) | Number of Shares of Common Stock Beneficially Owned | Percentage of Outstanding Common Stock | ||||||

5% Stockholders: | ||||||||

Holley Parent Holdings, LLC (2) | 67,673,884 | 57.4 | % | |||||

MidOcean (3) | 18,683,333 | 15.0 | % | |||||

Wasatch Advisors, Inc. (4) | 10,542,559 | 8.9 | % | |||||

Allspring Special Small Cap Value Fund, A series of Allspring Funds Trust ( f/k/a Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust (5) | 7,704,728 | 6.5 | % | |||||

Named Executive Officers and Directors: | ||||||||

Matthew Rubel ( 6 ) | — | — | % | |||||

Gina Bianchini ( 6 ) | — | — | % | |||||

Thomas W. Tomlinson ( 7 ) | — | — | % | |||||

Owen M. Basham ( 7 ) | — | — | % | |||||

James D. Coady ( 7 ) | — | — | % | |||||

Ginger M. Jones | — | — | % | |||||

Michelle Gloeckler | — | — | % | |||||

Dominic Bardos ( 7 ) | — | — | % | |||||

Vinod Nimmagadda ( 7 ) | 2,584 | * | % | |||||

Sean Crawford ( 7 ) | — | — | % | |||||

Terrill M. Rutledge ( 7 ) | — | — | % | |||||

Patrick Lee Pierce | — | — | % | |||||

All directors and executive officers as a group (12 individuals) | 2,584 | * | % | |||||

| (1) | Unless otherwise noted, the business address of each of the named executive officers and directors of Holley is c/o Holley Inc., 1801 Russellville Rd, Bowling Green, Kentucky 42101. |

| (2) | Consists of shares of Common Stock that is held by the Holley Stockholder. The Holley Stockholder is governed by the Holley Stockholder LLCA among the Sentinel Investors and the other members party thereto. By virtue of (a) the ability of the Sentinel Investors under the Holley Stockholder LLCA to appoint and remove a majority of the members of the board of directors of the Holley Stockholder and (b) the ability of a majority of the board of directors of the Holley Stockholder to control investment and voting power over the shares of Common Stock held by the Holley Stockholder, the Sentinel Investors may be deemed to have beneficial ownership over the shares of Common Stock held of record by the Holley Stockholder. The Sentinel Investors are controlled by Sentinel Partners V, L.P. (“Sentinel Partners V”), their general partner, which is controlled by Sentinel Managing Company V, Inc. (“Sentinel Managing Company”), its general partner, which is controlled by David S. Lobel, its president and sole shareholder. Accordingly, each of Sentinel Partners V, Sentinel Managing Company and Mr. Lobel may be |

| deemed to have beneficial ownership over the shares of Common Stock held by the Holley Stockholder. Each of the Sentinel Investors, Sentinel Partners V, Sentinel Managing Company and Mr. Lobel disclaims beneficial ownership of the shares of Common Stock held by the Holley Stockholder other than to the extent of their pecuniary interest therein. The address for each of the foregoing is c/o Sentinel Capital Partners, L.L.C., 330 Madison Avenue, 27th Floor, New York, NY 10017. |

| (3) | Amount includes 6,333,333 shares of Common Stock underlying 4,666,667 Private Placement Warrants and 1,666,666 Public Warrants that are exercisable within 60 days of the date hereof. The managing member of the Sponsor is MidOcean Associates V, L.P., a Delaware limited partnership (“Associates”). The general partner of MidOcean Partners V, L.P., a Delaware limited partnership (“Partners”) and MidOcean Partners Executive V, L.P., a Delaware limited partnership (“Executive”) is Associates. The general partner of Associates is Ultramar Capital, Ltd, a Cayman Islands company (“Ultramar”), which is controlled by James Edward Virtue (“Virtue”). Accordingly, (i) each of Partners, Associates, Ultramar, and Virtue may be deemed to have beneficial ownership of the securities held by Sponsor, and (ii) each of Associates, Ultramar, and Virtue may be deemed to have beneficial ownership of the securities held by Partners and Executive, and in each case, each of Sponsor, Partners, Executive, Associates, Ultramar and Virtue disclaims beneficial ownership of such securities except to the extent of their pecuniary interest therein. The business address of each of Sponsor, Executive, Partners, Associates, Ultramar and Virtue is 245 Park Avenue, 38th Floor, New York, NY 10167. |

| (4) | See footnote 4 to the table in the section entitled “ Selling Securityholders |

| (5) | Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust, is a registered investment company under the Investment Company Act of 1940. |

| (6) | Does not include any shares indirectly owned by this individual as a result of the individual’s membership interest in the Sponsor. Each of these individuals disclaims beneficial ownership of any shares except to the extent of their pecuniary interest therein. |

| (7) | Does not include any shares indirectly owned by this individual as a result of the individual’s securities interest in the Holley Stockholder. Each of these individuals disclaims beneficial ownership of any shares except to the extent of their pecuniary interest therein. |

Common Stock | Warrants | |||||||||||||||||||||||||||||||||||

Name of Selling Securityholder | Beneficial Ownership Before the Offering | Shares to be Sold in the Offering | Beneficial Ownership After the Offering | Beneficial Ownership Before the Offering | Warrants to be Sold in the Offering | Beneficial Ownership After the Offering | ||||||||||||||||||||||||||||||

Number of Shares | Number of Shares | Number of Shares | % ** | Number of Warrants | Number of Warrants | Number of Warrants | % | |||||||||||||||||||||||||||||

Holley Parent Holdings, LLC | (1 | ) | 67,673,884 | 67,673,884 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Empower Sponsor Holdings LLC | (2 | ) | 6,250,000 | 6,250,000 | — | — | 4,666,667 | 4,666,667 | — | — | ||||||||||||||||||||||||||

MidOcean Partners Executive V, LP | (2 | ) | 25,000 | 25,000 | — | — | 8,333 | 8,333 | — | — | ||||||||||||||||||||||||||

MidOcean Partners V, LP | (2 | ) | 6,075,000 | 6,075,000 | — | — | 1,658,333 | 1,658,333 | — | — | ||||||||||||||||||||||||||

Allspring Special Small Cap Value Fund, A series of Allspring Funds Trust ( f/k/a Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust | (3 | ) | 7,704,728 | 5,500,000 | 2,204,728 | 1.9 | % | — | — | — | — | |||||||||||||||||||||||||

Wasatch Microcap Fund | (4 | ) | 1,732,747 | 1,600,000 | 132,747 | * | % | — | — | — | — | |||||||||||||||||||||||||

Wasatch Core Growth Fund | (4 | ) | 5,211,633 | 3,500,000 | 1,711,633 | 1.5 | % | — | — | — | — | |||||||||||||||||||||||||

Clearlake Flagship Plus Partners Master Fund, L.P. | (5 | ) | 2,750,000 | 2,750,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Baron Small Cap Fund | (6 | ) | 4,250,000 | 2,500,000 | 1,750,000 | 1.5 | % | — | — | — | — | |||||||||||||||||||||||||

CVI Investments, Inc. | (7 | ) | 311,607 | 311,607 | — | — | 152,730 | — | 152,730 | 1.0 | % | |||||||||||||||||||||||||

Polar Long/Short Master Fund | (8 | ) | 798,837 | 798,837 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Polar Multi-Strategy Master Fund | (8 | ) | 600,209 | 600,209 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Glenn J. Krevlin Revocable Trust dated July 25, 2007 | (9 | ) | 600,000 | 450,000 | 150,000 | * | % | 33,333 | — | 33,333 | * | % | ||||||||||||||||||||||||

Nina P. Krevlin Irrevocable Trust FBO Michael Krevlin dated October 22, 2007 | (9 | ) | 50,000 | 50,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Stewart J. Rahr Revocable Trust | (10 | ) | 400,000 | 400,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Indaba Capital Management, L.P. | (11 | ) | 2,188,188 | 250,000 | 1,938,188 | 1.6 | % | 669,159 | — | 669,159 | 4.6 | % | ||||||||||||||||||||||||

Kepos Alpha Master Fund L.P. | (12 | ) | 250,000 | 250,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Chelt Trading Limited | (13 | ) | 100,000 | 100,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

John R. Muse | 50,000 | 50,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||||

FMAB Partners, LP | (14 | ) | 50,000 | 50,000 | — | — | — | — | — | |||||||||||||||||||||||||||

Americo Life, Inc. | (15 | ) | 300,000 | 300,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

The Maddox Family Trust | (16 | ) | 100,000 | 100,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Staysail 16 LLC | (17 | ) | 200,000 | 200,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||

| * | Less than 1%. |

| ** | Based upon 117,993,139 shares of Common Stock outstanding as of January 25, 2022. |

| (1) | The Holley Stockholder is governed by the Holley Stockholder LLCA among the Sentinel Investors and the other members party thereto. By virtue of (a) the ability of the Sentinel Investors under the Holley Stockholder LLCA to appoint and remove a majority of the members of the board of directors of the Holley Stockholder and (b) the ability of a majority of the board of directors of the Holley Stockholder to control investment and voting power over the shares of our Common Stock held by the Holley Stockholder, the Sentinel Investors may be deemed to have beneficial ownership over the shares of Common Stock held of record by the Holley Stockholder. The Sentinel Investors are controlled by Sentinel Partners V, their general partner, which is controlled by Sentinel Managing Company, its general partner, which is controlled by David S. Lobel, its president and sole shareholder. Accordingly, each of Sentinel Partners V, Sentinel Managing Company and Mr. Lobel may be deemed to have beneficial ownership over the shares of Common Stock held by the Holley Stockholder. Each of the Sentinel Investors, Sentinel Partners V, Sentinel Managing Company and Mr. Lobel disclaims beneficial ownership of the shares of Common Stock held by the Holley Stockholder other than to the extent of their pecuniary interest therein. The address for each of the foregoing is c/o Sentinel Capital Partners, L.L.C., 330 Madison Avenue, 27th Floor, New York, NY 10017. For information regarding certain transactions between the Holley Stockholder, and its affiliates, and the Company, see the sections entitled “ Management Certain Relationships and Related Party Transactions Executive Compensation |

| (2) | The managing member of the Sponsor is Associates. The general partner of Partners and Executive is Associates. The general partner of Associates is Ultramar, which is controlled by Virtue. Accordingly, (i) each of Partners, Associates, Ultramar, and Virtue may be deemed to have beneficial ownership of the securities held by Sponsor, and (ii) each of Associates, Ultramar, and Virtue may be deemed to have beneficial ownership of the securities held by Partners and Executive, and in each case, each of Sponsor, Partners, Executive, Associates, Ultramar and Virtue disclaims beneficial ownership of such securities except to the extent of their pecuniary interest therein. The business address of each of Sponsor, Executive, Partners, Associates, Ultramar and Virtue is 245 Park Avenue, 38th Floor, New York, NY 10167. For information regarding certain transactions between the Sponsor, and its affiliates, and the Company, see the sections entitled “ Management Certain Relationships and Related Party Transactions Executive Compensation |

| (3) | Allspring Special Small Cap Value Fund, A series of Allspring Funds Trust (f/k/a Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust), is a registered investment company under the Investment Company Act of 1940. |

| (4) | Each of Wasatch Micro Cap Fund and Wasatch Core Growth Fund is a registered investment company under the Investment Company Act of 1940 (the “Wasatch Funds”). Each of the Wasatch Funds is advised by Wasatch Advisors, Inc., a registered investment advisor, which has voting power over an additional 3,598,179 shares of Common Stock not reflected in the above table. The business address of Wasatch Advisors, Inc. and the Wasatch Funds is 505 Wakara Way, Salt Lake City, UT 84108. |

| (5) | Clearlake Flagship Plus Partners Master Fund, L.P. is a registered investment company under the Investment Company Act of 1940. |

| (6) | Baron Small Cap Fund is a registered investment company under the Investment Company Act of 1940. BAMCO, Inc., a registered investor advisor, is the investment advisor of Baron Small Cap Fund. Mr. Ronald Baron has voting and/or investment control over the shares of our Common Stock held by Baron Small Cap Fund and, accordingly, may be deemed to have beneficial ownership of such shares. Mr. Baron disclaims beneficial ownership of the shares held by Baron Small Cap Fund. |

| (7) | Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares of our Common Stock held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. |

| (8) | Each of Polar Long/Short Master Fund (“PLSMF”) and Polar Multi-Strategy Master Fund is managed by Polar Asset Management Partners Inc. (“Polar Management”). Polar Management is an investment advisor to PLSMF and PMSMF. Paul Sabourin, in his capacity as Chief Investment Officer of Polar Management, has voting and investment control over the shares of our Common Stock held by PLSMF and PMSMF and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (9) | Each of the Glenn J Krevlin Revocable Trust dated July 25, 2007 (“G. Krevlin Trust”) and Nina P. Krevlin Irrevocable Trust FBO Michael Krevlin (“N. Krevlin Trust”) is managed by Glenn J. Krevlin, as trustee. Mr. Krevlin has voting and investment control over the shares of our Common Stock held by the G. Krevlin Trust and N. Krevlin Trust and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (10) | The Stewart J. Rahr Revocable Trust (“S. Rahr Trust”) is managed by Stewart Rahr, as grantor and trustee and Steven Burns, as trustee. Each of Mr. Rahr and Mr. Burns has voting and investment control over the shares of our Common Stock held by the S. Rahr Trust and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (11) | The shares of our Common Stock are held directly by Indaba Capital Fund, L.P. (“Indaba Fund”). Indaba Capital Management, L.P. (“Indaba Management”) is Indaba Fund’s investment manager. Pursuant to an Investment Management Agreement, Indaba Fund and its general partner have delegated all voting and investment power over securities held by Indaba Fund to Indaba Management and, accordingly, Indaba Management may be deemed to have beneficial ownership of such securities. IC GP, LLC, as the general partner of Indaba Management, and Derek Schrier, as Managing Member of IC GP, LLC, may be deemed to exercise voting and investment power over and have beneficial ownership of the securities held by Indaba Fund. Indaba Fund specifically disclaims beneficial ownership of the securities that are directly held by it by virtue of its inability to vote or dispose of such securities as a result of the delegation of voting and investment power to Indaba Management. |

| (12) | Kepos Capital LP is the investment manager of Kepos Alpha Master Fund L.P. and Kepos Partners LLC is the General Partner of Kepos Alpha Master Fund L.P. and each may be deemed to have voting and dispositive power with respect to the shares. The general partner of Kepos Capital LP is Kepos Capital GP LLC (the “Kepos GP”) and the Managing Member of Kepos Partners LLC is Kepos Partners MM LLC (“Kepos MM”). Mark Carhart controls Kepos GP and Kepos MM and, accordingly, may be deemed to have voting and dispositive power with respect to the shares of our Common Stock held by Kepos Alpha Master Fund L.P. Mr. Carhart disclaims beneficial ownership of the shares held by Kepos Alpha Master Fund L.P. |

| (13) | Chelt Trading Limited (“Chelt”) is managed by Jaime Javier Montealegre Lacayo. Mr. Montealegre has voting and investment control over the shares of our Common Stock held by Chelt and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (14) | FMAB Partners LP (“FMAB”) is managed by JAJO, LLC (“JAJO”). Each of Jack D. Furst, John S. Furst and Robert S. Furst have voting and investment control over the shares of our Common Stock held by FMAB and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (15) | Michael A Merriman and Mary Beth Sotos each have voting or investment control over the shares of our Common Stock held by Americo Life, Inc. and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (16) | Matthew Maddox and Katherine Maddox each have voting or investment control over the shares of our Common Stock held by The Maddox Family Trust (“Maddox Trust”) and, accordingly, may be deemed to have beneficial ownership of such shares. |

| (17) | Staysail 16 LLC (“Staysail”) is managed by Spinnaker Capital 2018 GP LLC. Anastasios Parafestas has voting and investment control over the shares of our Common Stock held by Staysail and, accordingly, may be deemed to have beneficial ownership of such shares. |

Executive Officers: | Title | Grant Date Fair Value of Grant | Number of C Units | Number of D-1 Units | Number of D-2 Units | Number of D-3 Units | ||||||||||||||||

Tom Tomlinson | Chief Executive Officer | $ | 4,027,910.53 | 688,476.90 | 811,834.33 | 874,830.61 | 702,007.45 | |||||||||||||||

Dominic Bardos | Chief Financial Officer | $ | 67,634.13 | 11,560.47 | 13,631.81 | 14,689.60 | 11,787.67 | |||||||||||||||

Vinod Nimmagadda | Executive Vice President of Corporate Development & New Ventures | $ | 67,634.13 | 11,560.47 | 13,631.81 | 14,689.60 | 11,787.67 | |||||||||||||||

Sean Crawford | Chief Marketing Officer | $ | 1,194,085.61 | 204,100.95 | 240,670.61 | 259,346.04 | 208,112.12 | |||||||||||||||

Terrill M. Rutledge | Chief Information Officer | $ | 799,645,41 | 136,680.64 | 161,170.31 | 173,676.72 | 139,366.81 | |||||||||||||||

Stephen Trussell | VP Finance | $ | 898,387.07 | 153,558.21 | 181,071.91 | 195,122.64 | 156,576.08 | |||||||||||||||

Jason Richard Bruce | VP Business Development | $ | 865,782.63 | 147,985.25 | 174,500.41 | 188,041.21 | 150,893.58 | |||||||||||||||

Redemption Date (period to expiration of Warrants) | Fair Market Value of share of Common Stock | |||||||||||||||||||||||||||||||||||

£ 10.00 | 11.00 | 12.00 | 13.00 | 14.00 | 15.00 | 16.00 | �� | 17.00 | ³ 18.00 | |||||||||||||||||||||||||||

60 months | 0.261 | 0.281 | 0.297 | 0.311 | 0.324 | 0.337 | 0.348 | 0.358 | 0.361 | |||||||||||||||||||||||||||

57 months | 0.257 | 0.277 | 0.294 | 0.310 | 0.324 | 0.337 | 0.348 | 0.358 | 0.361 | |||||||||||||||||||||||||||

54 months | 0.252 | 0.272 | 0.291 | 0.307 | 0.322 | 0.335 | 0.347 | 0.357 | 0.361 | |||||||||||||||||||||||||||

51 months | 0.246 | 0.268 | 0.287 | 0.304 | 0.320 | 0.333 | 0.346 | 0.357 | 0.361 | |||||||||||||||||||||||||||

48 months | 0.241 | 0.263 | 0.283 | 0.301 | 0.317 | 0.332 | 0.344 | 0.356 | 0.361 | |||||||||||||||||||||||||||

45 months | 0.235 | 0.258 | 0.279 | 0.298 | 0.315 | 0.330 | 0.343 | 0.356 | 0.361 | |||||||||||||||||||||||||||

42 months | 0.228 | 0.252 | 0.274 | 0.294 | 0.312 | 0.328 | 0.342 | 0.355 | 0.361 | |||||||||||||||||||||||||||

39 months | 0.221 | 0.246 | 0.269 | 0.290 | 0.309 | 0.325 | 0.340 | 0.354 | 0.361 | |||||||||||||||||||||||||||

36 months | 0.213 | 0.239 | 0.263 | 0.285 | 0.305 | 0.323 | 0.339 | 0.353 | 0.361 | |||||||||||||||||||||||||||

33 months | 0.205 | 0.232 | 0.257 | 0.280 | 0.301 | 0.320 | 0.337 | 0.352 | 0.361 | |||||||||||||||||||||||||||

30 months | 0.196 | 0.224 | 0.250 | 0.274 | 0.297 | 0.316 | 0.335 | 0.351 | 0.361 | |||||||||||||||||||||||||||

27 months | 0.185 | 0.214 | 0.242 | 0.268 | 0.291 | 0.313 | 0.332 | 0.350 | 0.361 | |||||||||||||||||||||||||||

24 months | 0.173 | 0.204 | 0.233 | 0.260 | 0.285 | 0.308 | 0.329 | 0.348 | 0.361 | |||||||||||||||||||||||||||

21 months | 0.161 | 0.193 | 0.223 | 0.252 | 0.279 | 0.304 | 0.326 | 0.347 | 0.361 | |||||||||||||||||||||||||||

18 months | 0.146 | 0.179 | 0.211 | 0.242 | 0.271 | 0.298 | 0.322 | 0.345 | 0.361 | |||||||||||||||||||||||||||

15 months | 0.130 | 0.164 | 0.197 | 0.230 | 0.262 | 0.291 | 0.317 | 0.342 | 0.361 | |||||||||||||||||||||||||||

12 months | 0.111 | 0.146 | 0.181 | 0.216 | 0.250 | 0.282 | 0.312 | 0.339 | 0.361 | |||||||||||||||||||||||||||

9 months | 0.090 | 0.125 | 0.162 | 0.199 | 0.237 | 0.272 | 0.305 | 0.336 | 0.361 | |||||||||||||||||||||||||||

6 months | 0.065 | 0.099 | 0.137 | 0.178 | 0.219 | 0.259 | 0.296 | 0.331 | 0.361 | |||||||||||||||||||||||||||

3 months | 0.034 | 0.065 | 0.104 | 0.150 | 0.197 | 0.243 | 0.286 | 0.326 | 0.361 | |||||||||||||||||||||||||||

0 months | — | — | 0.042 | 0.115 | 0.179 | 0.233 | 0.281 | 0.323 | 0.361 | |||||||||||||||||||||||||||

| • | 1% of the total number of shares of our Common Stock or Warrants then outstanding (117,993,139 shares or 14,666,644 Warrants as of January 25, 2022); or |

| • | the average weekly reported trading volume of our Common Stock or Warrants during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

| • | the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| • | the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| • | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |