SUBJECT TO COMPLETION, DATED March 20, 2023

PRELIMINARY PROSPECTUS

228,011,646 Shares of Class A Common Stock

8,900,000 Warrants to Purchase Shares of Class A Common Stock

NUSCALE POWER CORPORATION

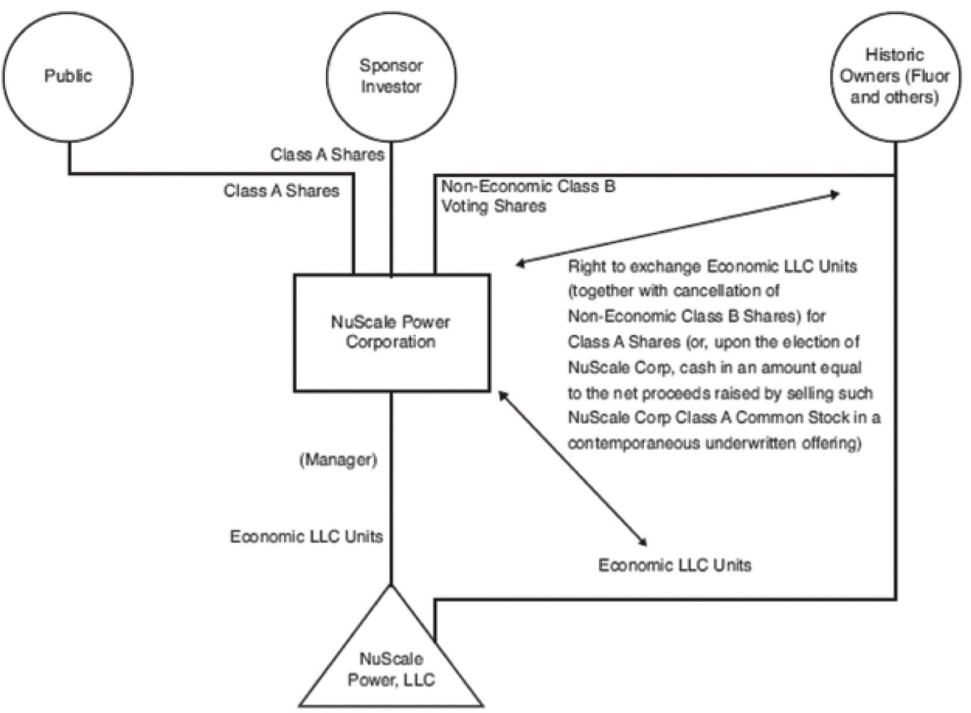

This prospectus relates to (1) the issuance by us of up to 178,396,711 shares (“Exchange Shares”) of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), of NuScale Power Corporation, a Delaware corporation (“NuScale Corp,” “we,” “our” or “us”), upon exchange (on a one-for-one basis, subject to adjustment) of Class B Units of NuScale Power, LLC, an Oregon limited liability company (“NuScale LLC”) (which Class B Units were originally purchased at various times since 2007 for ascribed prices per unit ranging from approximately $0.00 (for certain incentive awards) to $7.76 per unit, and which collectively have a weighted average ascribed purchase price of $4.74 per unit) and cancellation of a corresponding number of shares of Class B Common Stock, par value $0.0001 per share, of NuScale Corp, and the resale of 171,755,372 Exchange Shares, the resale of which might otherwise be limited by the resale restrictions imposed on “control securities” under Rule 144 under the Securities Act; (2) the issuance by us of up to 11,500,000 shares of Class A Common Stock upon the exercise of the Public Warrants (as defined below); (3) the issuance by us of up to 8,900,000 shares of Class A Common Stock upon the exercise of Private Placement Warrants (defined below) and the resale of such shares; and (4) the resale from time to time by the selling securityholders named in this prospectus or their permitted transferees of up to: 8,900,000 Private Placement Warrants (as defined below) to purchase Class A Common Stock, which Private Placement Warrants were originally purchased for $1.00 per warrant; 23,700,002 shares of Class A Common Stock, which were originally purchased for approximately $10.00 per share by PIPE Investors (defined below) immediately prior to the consummation of the Merger (defined below) pursuant to the terms of the Subscription Agreements (defined below); and 5,514,933 shares of Class A Common Stock held by Spring Valley Acquisition Sponsor Sub, LLC and its affiliates and the former officers and directors of Spring Valley Acquisition Corp (“Spring Valley Founders”) , which were originally purchased for approximately $0.003 per share.

On May 2, 2022 (the “Closing Date”), Spring Valley Acquisition Corp., formerly a blank check company incorporated as a Cayman Islands exempted company (“Spring Valley”), completed the previously announced transactions pursuant to the Agreement and Plan of Merger dated December 13, 2021 (as amended) between Spring Valley, Spring Valley Merger Sub, LLC, an Oregon limited liability company (“Merger Sub”) and NuScale LLC, including: (a) the domestication of Spring Valley as a Delaware corporation (the “Domestication”) and the change of its name to “NuScale Power Corporation”; and (b) the merger (“Merger”) of Merger Sub with and into NuScale LLC, with NuScale LLC as the surviving business entity in the Merger, through which the combined company was reorganized in an “UP-C” structure, with NuScale Corp now serving as the sole manager of NuScale LLC. NuScale LLC is now owned in part, indirectly through NuScale Corp, by former public and private shareholders of Spring Valley and in part directly by continuing equity owners of NuScale LLC (the “Legacy NuScale Equityholders”).

After the Domestication and immediately before completion of the Merger, Spring Valley issued to certain selling securityholders, in private placements, 23,700,002 shares of Class A Common Stock at approximately $10.00 per share, for an aggregate purchase price of $235,000,000.

In connection with the special meeting at which shareholders approved the Merger, holders of 8,599,631 shares of our Class A Common Stock, or 37.5% of the shares with redemption rights, exercised their right to redeem their shares for cash at a redemption price of approximately $10.10 per share, for an aggregate redemption amount of $86.9 million. The shares of common stock being offered for resale pursuant to this prospectus by the selling securityholders represent approximately 85.5% of shares outstanding on a fully diluted basis as of March 15, 2023, assuming the exercise of all outstanding options to purchase Class A Common Stock. The sale of shares by the selling securityholders, or the perception in the market that the selling securityholders intend to sell a large number of shares, could increase the volatility of the market price of our Class A Common Stock or result in a significant decline in the public trading price of our Class A Common Stock. Even if our trading price is significantly below $10.00, the offering price for the Spring Valley Units offered in our initial public offering, certain of the selling securityholders, including the Spring Valley Founders and the Legacy NuScale Equityholders, may still have an incentive to sell shares of our Class A Common Stock because they purchased the shares at prices lower than the price paid by the Public Shareholders (defined below) or the current trading price of our Class A Common Stock. For example, based on the closing price of our Class A Common Stock of $9.00 as of March 15, 2023, the Spring Valley Founders could experience a potential profit of approximately $9.00 per share, or $49.6 million in the aggregate; the PIPE Investors would realize a potential loss of approximately $1.00 per share, or $23.1 million in the aggregate; and the Legacy NuScale Equityholders would realize a potential profit (on average) of approximately $4.72 per share, or $725.1 million in the aggregate. Similarly, if the Spring Valley Founders sold Private Placement Warrants for $1.63 per warrant, the closing price of our warrants on March 15, 2023, the Spring Valley Founders would realize a potential profit of approximately $0.63 per warrant, or $6.2 million in the aggregate.

The selling securityholders may offer, sell or distribute all or a portion of the Private Placement Warrants and the shares of Class A Common Stock registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices.

We provide more information about how the selling securityholders may sell their shares in the section entitled “Plan of Distribution.”

We paid certain offering fees and expenses and fees in connection with the registration of the Private Placement Warrants and the Class A Common Stock and will not receive proceeds from the exchange of NuScale LLC Class B Units (and cancellation of a corresponding number of shares of Class B Common Stock) for Class A Common Stock or from the sale of the Private Placement Warrants or shares of Class A Common Stock by the selling securityholders, except with respect to any amounts received by us upon exercise of any Warrants. We believe the likelihood that warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive from such exercises, depends on the trading price of our Class A Common Stock, which may not exceed the $11.50 warrant exercise price before the warrants expire. In certain circumstances, the Warrants can be exercised on a cashless basis. See “Description of Capital Stock — Warrants.” The selling securityholders will bear all commissions and discounts, if any, attributable to their respective sales of warrants or Class A Common Stock.

Our Class A Common Stock is listed on the New York Stock Exchange (“NYSE”) and trades under the symbol “SMR.” On March 15, 2023, the closing sale price of our Class A Common Stock was $9.00 per share. Our public warrants are listed on the NYSE and trade under the symbol “SMR.WT.” On March 15, 2023, the closing sale price of our public warrants was $1.64 per warrant.

We are an “emerging growth company” as defined under applicable federal securities laws, and therefore are subject to certain reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 8 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.