122398546.2 0034163-00079 EXHIBIT 4.3 DESCRIPTION OF REGISTRANT’S SECURITIES The following summary of certain provisions of the capital stock, and warrants to purchase capital stock, of NuScale Power Corporation, a Delaware corporation (“NuScale Corp”, the “Company”, “we”, “us”, or “our”), and the non-voting Class B Units (“NuScale LLC Class B Units”) of NuScale Power, LLC, an Oregon limited liability company (“NuScale LLC”), does not purport to be complete and is subject to: (i) NuScale Corp’s certificate of incorporation (the “Charter”); (ii) NuScale Corp’s bylaws (the “Bylaws”, and together with the Charter, the “Organizational Documents”); (iii) the Amended and Restated Registration Rights Agreement, dated May 2, 2022, among NuScale Corp, Spring Valley Acquisition Sponsor, LLC, SV Acquisition Sponsor Sub, LLC, and certain members of NuScale LLC and stockholders of NuScale Corp (the “Registration Rights Agreement”); (iv) the Sixth Amended and Restated Limited Liability Company Agreement of NuScale LLC, dated May 2, 2022, among NuScale Corp, NuScale LLC, and the members of NuScale LLC (the “A&R NuScale LLC Agreement”); (v) the Warrant Agreement (as defined below); and (vi) the provisions of applicable law. Authorized Capitalization General Our Charter authorizes the issuance of 512,000,000 shares of capital stock, par value $0.0001 per share, of NuScale Corp, consisting of: • 332,000,000 shares of Class A common stock (“Class A Common Stock”); • 179,000,000 shares of Class B common stock (“Class B Common Stock, and together with Class A Common Stock, “Common Stock”); and • 1,000,000 shares of preferred stock (“NuScale Corp Preferred Stock”). The following summary describes all material provisions of our capital stock. We urge you to read the Charter, the Bylaws, the Registration Rights Agreement, and the A&R NuScale LLC Agreement for further details. Common Stock Class A Common Stock Voting rights. Each holder of Class A Common Stock is entitled to one vote for each share of Class A Common Stock held of record by such holder on all matters on which stockholders generally are entitled to vote. The holders of Common Stock will vote together as a single class on all matters (or, if any holders of NuScale Corp Preferred Stock are entitled to vote together with the holders of Common Stock, as a single class with the holders of NuScale Corp Preferred Stock); provided, that the holders of the outstanding shares of Class A Common Stock will be entitled to vote separately upon any amendment to the Charter (including by merger, consolidation, reorganization or similar event) that would alter or change the powers, preferences or special rights of Class A Common Stock in a manner that is disproportionately adverse compared to Class B Common Stock. Subject to the rights of the holders of any one or more series of NuScale Corp Preferred Stock then outstanding, the number of authorized shares of Class A Common Stock may be increased or decreased by the affirmative vote of the holders of a majority of the total voting power of the outstanding shares of capital stock of NuScale Corp entitled to vote thereon, voting together as a single class, irrespective of the provisions of Section 242(b)(2) of the General Corporation Law of the State of Delaware (the “DGCL”), and no vote of the holders of Class A Common Stock voting separately as a class will be required therefor; provided, that the number of authorized shares of any particular class may not be decreased below the number of shares of such class then outstanding, plus the number of shares of Class A Common Stock issuable in connection with (x) the exchange of all outstanding NuScale LLC Class B Units, and the

122398546.2 0034163-00079 cancellation of all Class B Common Stock, pursuant to the A&R NuScale LLC Agreement and (y) the exercise of outstanding options, warrants, exchange rights, conversion rights or similar rights for Class A Common Stock. Holders of Class A Common Stock do not have the ability to cumulate votes for the election of directors. The Charter does not require the election of the directors to be by written ballot. Notwithstanding the foregoing, to the fullest extent permitted by law and subject to the Charter, holders of shares of Class A Common Stock, as such, will have no voting power with respect to, and will not be entitled to vote on, any amendment to the Charter (including any certificate of designations relating to any series of NuScale Corp Preferred Stock) that relates solely to the terms of any outstanding NuScale Corp Preferred Stock if the holders of such NuScale Corp Preferred Stock are entitled to vote as a separate class thereon under our Charter (including any certificate of designations relating to any series of NuScale Corp Preferred Stock) or pursuant to the DGCL. Dividend Rights. Subject to applicable law and the rights, if any, of the holders of any outstanding series of NuScale Corp Preferred Stock or any class or series of stock having a preference senior to or the right to participate with Class A Common Stock with respect to the payment of dividends, such dividends and other distributions of cash, stock or property may be declared and paid on Class A Common Stock out of the assets of the Company that are by law available therefor, at the times and in the amounts as NuScale Corp’s board of directors (the “Board”) in its discretion may determine. Rights upon liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding-up of the affairs of NuScale Corp, after payment or provision for payment of the debts and other liabilities of NuScale Corp and of the preferential and other amounts, if any, to which the holders of NuScale Corp Preferred Stock are entitled, if any, the holders of all outstanding shares of Class A Common Stock will be entitled to receive, pari passu, an amount per share equal to the par value thereof, and thereafter the holders of all outstanding shares of Class A Common Stock will be entitled to receive the remaining assets of NuScale Corp available for distribution ratably in proportion to the number of shares of Class A Common Stock. Other rights. Except as provided in the Registration Rights Agreement (as applicable), the holders of Class A Common Stock will have no preemptive or conversion rights or other subscription rights. There will be no redemption or sinking fund provisions applicable to Class A Common Stock. The rights, preferences and privileges of holders of Class A Common Stock will be subject to those of the holders of any shares of the NuScale Corp Preferred Stock that NuScale Corp may issue in the future and to the Registration Rights Agreement, as applicable. Subject to the transfer and exchange restrictions set forth in the A&R NuScale LLC Agreement, holders of NuScale LLC Class B Units may exchange them for shares of Class A Common Stock (or cash), subject to certain restrictions. Class B Common Stock Shares of Class B Common Stock have no economic rights, and entitle the holder only to cast one vote per share on matters submitted to the stockholders of NuScale Corp. Each share of Class B Common Stock is paired with one NuScale LLC Class B Unit. The voting rights of Class B Common Stock are intended to be identical to the voting rights of Class A Common Stock. Voting Rights. Each holder of Class B Common Stock is entitled to one vote for each share of Class B Common Stock held of record by such holder on all matters on which stockholders generally are entitled to vote. The holders of Common Stock vote together as a single class on all matters (or, if any holders of NuScale Corp Preferred Stock are entitled to vote together with the holders of Common Stock, as a single class with the holders of NuScale Corp Preferred Stock); provided, that the holders of the outstanding shares of Class B Common Stock are entitled to vote separately on any amendment to the Charter (including by merger, consolidation, reorganization or similar event) that would alter or change the rights of Class B Common Stock in a manner that is disproportionately adverse compared to Class A Common Stock.

122398546.2 0034163-00079 Subject to the rights of the holders of any one or more series of NuScale Corp Preferred Stock then outstanding, the number of authorized shares of Class B Common Stock may be increased or decreased by the affirmative vote of the holders of a majority of the total voting power of the outstanding shares of capital stock of NuScale Corp entitled to vote thereon, voting together as a single class, irrespective of the provisions of Section 242(b)(2) of the DGCL, and no vote of the holders of Class B Common Stock voting separately as a class will be required therefor. Holders of Class B Common Stock do not have the ability to cumulate votes for the election of directors. Our Charter does not require the election of the directors to be by written ballot. Notwithstanding the foregoing, to the fullest extent permitted by law and subject to our Charter, holders of shares of Class B Common Stock, as such, will have no voting power with respect to, and will not be entitled to vote on, any amendment to the Charter (including any certificate of designations relating to any series of NuScale Corp Preferred Stock) that relates solely to the terms of any outstanding NuScale Corp Preferred Stock if the holders of such NuScale Corp Preferred Stock are entitled to vote as a separate class thereon under the Charter (including any certificate of designations relating to any series of NuScale Corp Preferred Stock) or pursuant to the DGCL. Dividend Rights. Except in the event of any voluntary or involuntary liquidation, dissolution or winding-up of the affairs of NuScale Corp, dividends of cash or property may not be declared or paid on shares of Class B Common Stock, and then, only to the extent of the par value thereof. Rights upon liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding-up of the affairs of NuScale Corp, holders of shares of Class B Common Stock will not be entitled to receive, with respect to such shares, any assets of NuScale Corp in excess of the par value thereof. Other rights. To the extent NuScale LLC Class B Units are issued pursuant to the A&R NuScale LLC Agreement to anyone other than NuScale Corp or a wholly owned subsidiary of NuScale Corp, an equivalent number of shares of Class B Common Stock (subject to adjustment as set forth herein) shall be issued to the same Person to which such NuScale LLC Class B Units are issued at par. Conversion and Retirement of Class B Common Stock. Subject to the transfer and exchange restrictions set forth in the A&R NuScale LLC Agreement and the Merger Agreement, holders of NuScale LLC Class B Units may exchange such units, together with the cancelation for no consideration of an equal number of shares of Class B Common Stock, for shares of Class A Common Stock. Notwithstanding the foregoing, no holder of Class B Common Stock may transfer shares of Class B Common Stock to any person unless such holder transfers a corresponding number of NuScale LLC Class B Units to the same person in accordance with the provisions of the A&R NuScale LLC Agreement. If any outstanding share of Class B Common Stock ceases to be held by a holder of a corresponding NuScale LLC Class B Unit, such share shall automatically and without further action on the part of NuScale Corp or any holder of Class B Common Stock be transferred to NuScale Corp for no consideration and retired. A&R NuScale LLC Agreement In its capacity as the manager of NuScale LLC, NuScale Corp controls all of NuScale LLC’s business and affairs. Any time NuScale Corp issues a share of Class A Common Stock for cash, the net proceeds received by NuScale Corp will be promptly used to acquire a Class A Unit of NuScale LLC (“NuScale LLC Class A Unit”) unless used to settle an exchange of a NuScale LLC Class B Unit for cash, as described below. Any time NuScale Corp issues a share of Class A Common Stock upon an exchange of a NuScale LLC Class B Unit or settles such an exchange for cash, NuScale Corp will contribute the exchanged unit to NuScale LLC and NuScale LLC will issue to NuScale Corp a NuScale LLC Class A Unit. If NuScale Corp issues other classes or series of equity securities, NuScale LLC will issue to NuScale Corp an equal amount of equity securities of NuScale LLC with designations, preferences and other rights and terms that are substantially the same as NuScale’s newly issued equity securities. If NuScale Corp repurchases, redeems or retires any shares of Class A Common Stock (or equity securities of other classes or series), NuScale LLC will, immediately prior to such repurchase, redemption or retirement, repurchase, redeem or retire an equal number of NuScale LLC Class A Units (or its equity securities of the corresponding classes or series) held by NuScale Corp, upon the same terms and for the same consideration as the shares of Class A Common Stock (or equity securities of such other classes or series) are repurchased, redeemed or retired. In addition, all membership units of NuScale LLC

122398546.2 0034163-00079 (“NuScale LLC Units”), as well as Class A Common Stock and Class B Common Stock, are subject to equivalent stock splits, dividends, reclassifications and other subdivisions. In the event NuScale Corp acquires NuScale LLC Class A Units without issuing a corresponding number of shares of Class A Common Stock, it will make appropriate adjustments to the exchange ratio of NuScale LLC Class B Units to Class A Common Stock. NuScale Corp will have the right to determine when distributions will be made to holders of NuScale LLC Units and the amount of any such distributions, other than with respect to tax distributions as described below. If a distribution is authorized, except as described below, such distribution will be made to the holders of NuScale LLC Class A Units and NuScale LLC Class B Units on a pro rata basis in accordance with the number of units held by such holder. The holders of NuScale LLC Units, including NuScale Corp, will incur U.S. federal, state and local income taxes on their proportionate share of any taxable income of NuScale LLC. Net profits and net losses of NuScale LLC will generally be allocated to holders of NuScale LLC Units (including NuScale Corp) on a pro rata basis in accordance with the number of NuScale LLC Units held by such holder; however, under applicable tax rules, NuScale LLC will be required to allocate net taxable income disproportionately to its members in certain circumstances. The A&R NuScale LLC Agreement provides for quarterly cash distributions, which we refer to as “tax distributions,” to the holders of NuScale LLC Units generally equal to the taxable income allocated to each holder of units (with certain adjustments) multiplied by an assumed tax rate. Generally, these tax distributions will be computed based on our estimate of the net taxable income of NuScale LLC allocable per NuScale LLC Unit (based on the member which is allocated the largest amount of taxable income on a per unit basis) multiplied by an assumed tax rate equal to the highest combined U.S. federal and applicable state and local tax rate applicable to any natural person residing in, or corporation doing business in, Portland, Oregon, San Francisco, California or New York, New York (whichever results in the application of the highest state and local tax rate for a given type of income) that is taxable on that income (taking into account certain other assumptions, and subject to adjustment to the extent that state and local taxes are deductible for U.S. federal income tax purposes). The A&R NuScale LLC Agreement generally requires tax distributions to be pro rata based on the ownership of NuScale LLC Class A Units and NuScale LLC Class B Units. However, if the amount of tax distributions to be made exceeds the amount of funds available for distribution, NuScale Corp shall receive a tax distribution before the other members receive any distribution and the balance, if any, of funds available for distribution shall be distributed first to the other members pro rata in accordance with their assumed tax liabilities, and then to all members (including NuScale Corp) pro rata until each member receives the full amount of its tax distribution using the individual tax rate. NuScale LLC will also make non-pro rata payments to NuScale Corp to reimburse it for corporate and other overhead expenses (which payments from NuScale LLC are not to be treated as distributions under the A&R NuScale LLC Agreement). Notwithstanding the foregoing, no distribution will be made pursuant to the A&R NuScale LLC Agreement to any unitholder if such distribution would violate applicable law or result in NuScale LLC or any of its subsidiaries being in default under any material agreement. The A&R NuScale LLC Agreement provides that it may generally be amended, supplemented, waived or modified by NuScale Corp in its sole discretion without the approval of any other holder of NuScale LLC Units, except in the case of amendments that would modify the limited liability of a member or increase the obligation of a member to make capital contributions, adversely affect the right of a member to receive distributions or cause NuScale LLC to be treated as a corporation for tax purposes. The A&R NuScale LLC Agreement also entitles members to exchange their NuScale LLC Class B Units, together with the cancellation for no consideration of an equal number of shares of Class B Common Stock, for shares of Class A Common Stock on a one-for-one basis or, at NuScale Corp’s election in its sole discretion, subject to certain restrictions, for cash. The exchange ratio is subject to appropriate adjustment by NuScale Corp in the event NuScale LLC Class A Units are issued to NuScale Corp without issuance of a corresponding number of shares of Class A Common Stock or in the event of certain reclassifications, reorganizations, recapitalizations or similar transactions. The A&R NuScale LLC Agreement permits the NuScale LLC Class B unitholders to exercise their exchange rights subject to an exchange policy containing certain timing procedures and other conditions. The A&R NuScale LLC Agreement provides that an owner will not have the right to exchange NuScale LLC Class B Units if we determine that such exchange would be prohibited by law or regulation or would violate other agreements with NuScale Corp, NuScale LLC or any of their subsidiaries to which the NuScale LLC unitholder is subject. We intend

122398546.2 0034163-00079 to impose additional restrictions on exchanges that we determine to be necessary or advisable so that NuScale LLC is not treated as a “publicly traded partnership” for U.S. federal income tax purposes. The A&R NuScale LLC Agreement also provides for mandatory exchanges under certain circumstances, including at the option of NuScale LLC, if the number of NuScale LLC Class A Units and NuScale LLC Class B Units outstanding and held by its members (other than those held by NuScale Corp) is less than 15% of the outstanding NuScale LLC Class A Units and NuScale LLC Class B Units or in the discretion of NuScale Corp, with the consent of holders of at least 50% of the outstanding NuScale LLC Class B Units. Preferred Stock No shares of NuScale Corp Preferred Stock are currently issued or outstanding. Our Charter authorizes the Board to establish one or more series of NuScale Corp Preferred Stock in one or more classes or series and to fix the rights, preferences, privileges and related restrictions, including dividend rights, dividend rates, conversion rights, voting rights, the right to elect directors, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any class or series, or the designation of the class or series, without the approval of our stockholders; provided, that the aggregate number of shares issued and not retired of any and all such series shall not exceed the total number of shares of NuScale Corp Preferred Stock authorized by our Charter, i.e., 1,000,000 shares of NuScale Corp Preferred Stock. The authority of the Board to issue NuScale Corp Preferred Stock without approval of our stockholders may have the effect of delaying, deferring or preventing a change in control of our company and may adversely affect the voting and other rights of the holders of our Common Stock. The issuance of NuScale Corp Preferred Stock with voting and conversion rights may adversely affect the voting power of the holders of our Common Stock, including the loss of voting control to others. As a result of these or other factors, the issuance of NuScale Corp Preferred Stock could have an adverse impact on the market price of Class A Common Stock. At present, we have no plans to issue any NuScale Corp Preferred Stock. Anti-Takeover Effects of Provisions of Delaware Law and our Organizational Documents Certain provisions of our Organizational Documents could discourage potential acquisition proposals and could delay or prevent a change in control. These provisions are intended to enhance the likelihood of continuity and stability in the composition of the Board and in the policies formulated by the Board and to discourage certain types of transactions that may involve an actual or threatened change of control. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal or proxy fight. Such provisions could have the effect of discouraging others from making tender offers for our shares and, as a consequence, they also may inhibit fluctuations in the market price of Class A Common Stock that could result from actual or rumored takeover attempts. Such provisions also may have the effect of preventing changes in our management or delaying or preventing a transaction that might benefit you or other minority stockholders. These provisions include: Action by Written Consent; Special Meetings of Stockholders. The DGCL permits stockholder action by written consent unless otherwise provided by our Charter. Our Charter permits stockholder action by written consent until such time as NuScale Corp is no longer a “Controlled Company” pursuant to Section 303A.00 of the New York Stock Exchange (“NYSE”) Listed Company Manual. Our Organizational Documents provide that special meetings of stockholders may be called only (i) by the chairperson of the Board, (ii) by our chief executive officer, (iii) at the direction of the Board pursuant to a written resolution adopted by a majority of the total number of directors that NuScale Corp would have if there were no vacancies, or, (iv) until such time as NuScale Corp is no longer a “Controlled Company” pursuant to Section 303A.00 of the NYSE Listed Company Manual, pursuant to a written resolution adopted by holders of a majority of the total voting power of the outstanding shares of capital stock of NuScale Corp entitled to vote generally in the election of directors, voting together as a single class; provided, that only proposals included in our notice of meeting may be considered at such special meetings.

122398546.2 0034163-00079 Election and Removal of Directors. The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless our Charter provides otherwise. Our Charter disallows cumulative voting. Any directors or the entire Board may be removed at any time, but only for cause, upon the affirmative vote of the holders of at least a majority of the total voting power of the outstanding shares of capital stock of NuScale Corp entitled to vote generally in the election of directors, voting together as a single class. In addition, the certificate of designation pursuant to which a particular series of NuScale Corp Preferred Stock is issued may provide holders of that series of NuScale Corp Preferred Stock with the right to elect additional directors. These provisions could delay a successful tender offeror from obtaining majority control of the Board, and the prospect of that delay might deter a potential offeror. Authorized but Unissued Shares. Delaware law does not require stockholder approval for any issuance of authorized shares. However, the listing requirements of the NYSE, which apply if and so long as the Class A Common Stock (or warrants to purchase Class A Common Stock) remains listed on the NYSE, require stockholder approval of certain issuances equal to or exceeding 20% of the then-outstanding voting power or then- outstanding number of shares of Class A Common Stock. Additional shares that may be issued in the future may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. The existence of authorized but unissued and unreserved Common Stock and NuScale Corp Preferred Stock could make more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise and thereby protect the continuity of NuScale Corp management and possibly deprive stockholders of opportunities to sell their shares of Class A Common Stock at prices higher than prevailing market prices. See the “Preferred Stock” section above. Business Combinations with Interested Stockholders. In general, Section 203 of the DGCL, an anti-takeover law, prohibits a publicly held Delaware corporation from engaging in a business combination, such as a merger, with a person or group owning 15% or more of the corporation’s voting stock, which person or group is considered an interested stockholder under the DGCL, for a period of three years following the date the person became an interested stockholder, unless (with certain exceptions) the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Other Limitations on Stockholder Actions. Our Bylaws also impose procedural requirements on stockholders who wish to: • make nominations for the election of directors; • propose that a director be removed; or • propose any other business to be brought before an annual or special meeting of stockholders. Under these procedural requirements, in order to bring a proposal before a meeting of stockholders, a stockholder must deliver timely notice of a proposal pertaining to a proper subject for presentation at the meeting to our corporate secretary containing, among other things, the following: • the stockholder’s name and address; • the number of shares beneficially owned by the stockholder and evidence of such ownership; • the names of all persons with whom the stockholder is acting in concert and a description of all arrangements and understandings with those persons; • a description of any agreement, arrangement or understanding reached with respect to shares of our stock, such as borrowed or loaned shares, short positions, hedging or similar transactions; • a description of the business or nomination to be brought before the meeting and the reasons for conducting such business at the meeting; and

122398546.2 0034163-00079 • any material interest of the stockholder in such business. Our Bylaws set out the timeliness requirements for delivery of notice. Limitations on Liability and Indemnification of Officers and Directors Our Organizational Documents provide indemnification for our directors and officers to the fullest extent permitted by the DGCL. We have entered into indemnification agreements with each of our directors and executive officers that may, in some cases, be broader than the specific indemnification provisions contained under Delaware law. In addition, as permitted by Delaware law, our Charter includes provisions that eliminate the personal liability of our directors and officers for monetary damages resulting from breaches of certain fiduciary duties as a director or officer. The effect of this provision is to restrict our rights and the rights of our stockholders in derivative suits to recover monetary damages against a director or officer for breach of fiduciary duties as a director or officer. These provisions may be held to be not enforceable for violations of the federal securities laws of the United States. Exclusive Forum The Charter provides that, unless the Company consents in writing to the selection of an alternative forum, (i) the sole and exclusive forum for any complaint asserting any internal corporate claims (as defined below), to the fullest extent permitted by law, and subject to applicable jurisdictional requirements, shall be the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have, or declines to accept, jurisdiction, another state court or a federal court located within the State of Delaware); and (ii) the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act of 1933, as amended (the “Securities Act”), to the fullest extent permitted by law, shall be the federal district courts of the United States of America; provided, that the Charter’s forum selection provision does not apply to suits brought to enforce a duty or liability created by the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For purposes of the Charter’s forum selection provision, “internal corporate claims” means claims, including claims in the right of NuScale Corp, that are based upon a violation of a duty by a current or former director, officer, employee or stockholder in such capacity, or as to which the DGCL confers jurisdiction upon the Court of Chancery. Any person or entity purchasing or otherwise acquiring or holding any interest in any shares of NuScale Corp’s capital stock shall be deemed to have notice of and to have consented to the forum provisions in the Charter. However, it is possible that a court could find NuScale Corp’s forum selection provisions to be inapplicable or unenforceable. Although the Company believes this provision benefits it by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against the Company’s directors, officers and other employees. Stockholder Registration Rights The Registration Rights Agreement provides certain NuScale Corp stockholders with certain registration rights whereby, in certain circumstances, subject to certain lockup restrictions and the other terms and conditions of the Registration Rights Agreement, they have the right to require us to register under the Securities Act certain Registrable Securities (as defined in the Registration Rights Agreement). The Registration Rights Agreement will also provide for “piggyback” registration rights for certain other parties thereto, subject to certain conditions and exceptions. Warrants NuScale Corp Warrants. At the time of its initial public offering on November 27, 2020 (the “IPO”), NuScale Corp was a Cayman Islands exempt company named Spring Valley Acquisition Corp. (“Spring Valley”). Spring Valley issued 11,500,000 warrants to purchase Spring Valley stock in the IPO (the “Spring Valley Public Warrants”) and concurrently sold 8,900,000 warrants to purchase Spring Valley stock in a private placement (the “Spring Valley Private Placement Warrants”). At the consummation of the merger transactions (the “Transactions”) with NuScale LLC, as part of which Spring Valley converted to a Delaware corporation, changed its name to NuScale Power Corporation, and became NuScale LLC’s parent, the Spring Valley Public Warrants and Spring Valley Private Placement Warrants converted into warrants to purchase shares of Class A Common Stock (as so converted,

122398546.2 0034163-00079 respectively, “NuScale Corp Public Warrants” and “NuScale Corp Private Placement Warrants”, and together, “NuScale Corp Warrants”). As of March 8, 2024, there are 9,558,703 NuScale Corp Public Warrants and 8,900,000 NuScale Corp Private Placement Warrants outstanding. Each whole NuScale Corp Warrant entitles the registered holder to purchase one share of Class A Common Stock at a price of $11.50 per share, subject to adjustment as discussed below, at any time, except as discussed in the immediately succeeding paragraph. Pursuant to the Warrant Agreement (the “Warrant Agreement”), dated November 23, 2020, between Spring Valley and Continental Stock Transfer & Trust Company (the “Warrant Agent”), a warrant holder may exercise its NuScale Corp Warrants only for a whole number of shares of Class A Common Stock. This means only a whole NuScale Corp Warrant may be exercised at a given time by a warrant holder. The NuScale Corp Warrants will expire on May 2, 2027 at 5:00 p.m., New York City time, or earlier upon redemption or liquidation. We will not be obligated to issue any shares of Class A Common Stock pursuant to the exercise of a NuScale Corp Warrant and will have no obligation to settle such warrant exercise unless a registration statement under the Securities Act with respect to the Class A Common Stock underlying the warrants is then effective and a prospectus relating thereto is current, subject to our satisfying our obligations described below with respect to registration, or a valid exemption from registration is available. No NuScale Corp Warrant will be exercisable and we will not be obligated to issue a share of Class A Common Stock upon exercise of a NuScale Corp Warrant unless the share of Class A Common Stock issuable upon such warrant exercise has been registered, qualified or deemed to be exempt under the securities laws of the state of residence of the registered holder of such NuScale Corp Warrant. In the event that the conditions in the two immediately preceding sentences are not satisfied with respect to a NuScale Corp Warrant, the holder of such warrant will not be entitled to exercise such warrant and such warrant may have no value and expire worthless. In no event will we be required to net cash settle any NuScale Corp Warrant. The shares of Class A Common Stock issuable upon exercise of the NuScale Corp Warrants have been registered on NuScale Corp’s registration statement on Form S-1, effective June 30, 2022, as amended by Post-Effective Amendment No. 1, to Form S-1, effective March 23, 2023, and Post-Effective Amendment No. 2 to Form S-1 on Form S-3, effective June 2, 2023 (the “Registration Statement”). Pursuant to the Warrant Agreement, we have agreed to use our commercially reasonable efforts to maintain the effectiveness of the Registration Statement and a current prospectus relating to those shares of Class A Common Stock until the NuScale Corp Warrants expire or are redeemed, as specified in the Warrant Agreement; provided, that if shares of Class A Common Stock are at the time of any exercise of a NuScale Corp Warrant not listed on a national securities exchange such that they satisfy the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of NuScale Corp Warrants who exercise their NuScale Corp Warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement under the Securities Act, but we will use our commercially reasonably efforts to register or qualify the shares under applicable state securities laws to the extent an exemption thereunder is not available. During any period when we will have failed to maintain an effective registration statement under the Securities Act, holders of NuScale Corp Warrants may exercise them on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act or another exemption, but we will use our commercially reasonably efforts to register or qualify the shares under applicable state securities laws to the extent an exemption is not available. In the case of a cashless exercise, each holder would pay the exercise price by surrendering the NuScale Corp Warrants for that number of shares of Class A Common Stock equal to the lesser of (A) the quotient obtained by dividing (x) the product of the number of shares of Class A Common Stock underlying the NuScale Corp Warrants, multiplied by the excess of the “fair market value” (defined below) less the exercise price of the NuScale Corp Warrants by (y) the fair market value and (B) 0.361 per warrant. The “fair market value” as used in this paragraph shall mean the volume weighted average price (“VWAP”) of the Class A Common Stock for the 10 trading days ending on the trading day prior to the date on which the notice of exercise is received by the Warrant Agent. Redemption of NuScale Corp Warrants when the price per share of Class A Common Stock equals or exceeds $18.00. Once the NuScale Corp Warrants become exercisable, we may redeem the outstanding NuScale Corp Warrants (except as described herein with respect to the NuScale Corp Private Warrants): • in whole and not in part;

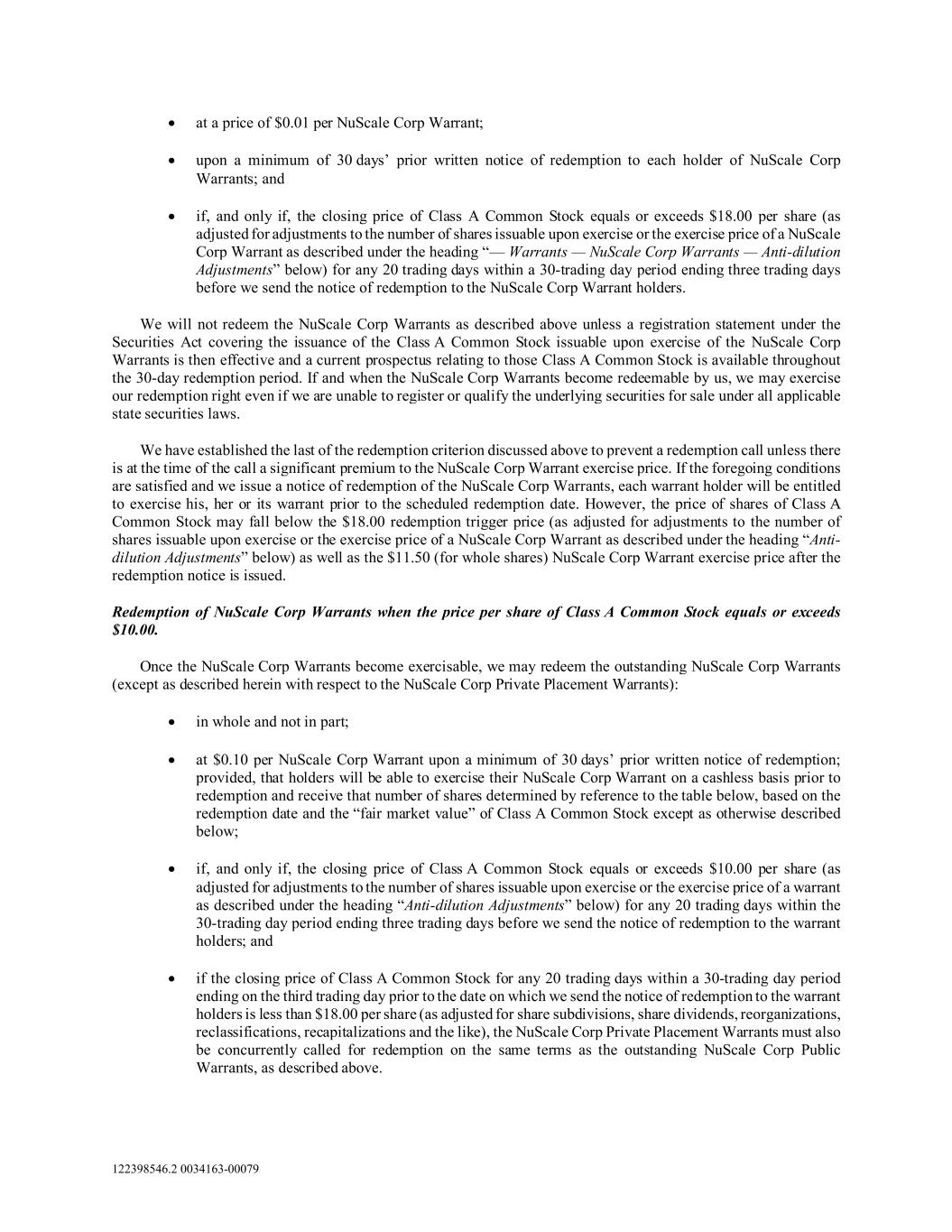

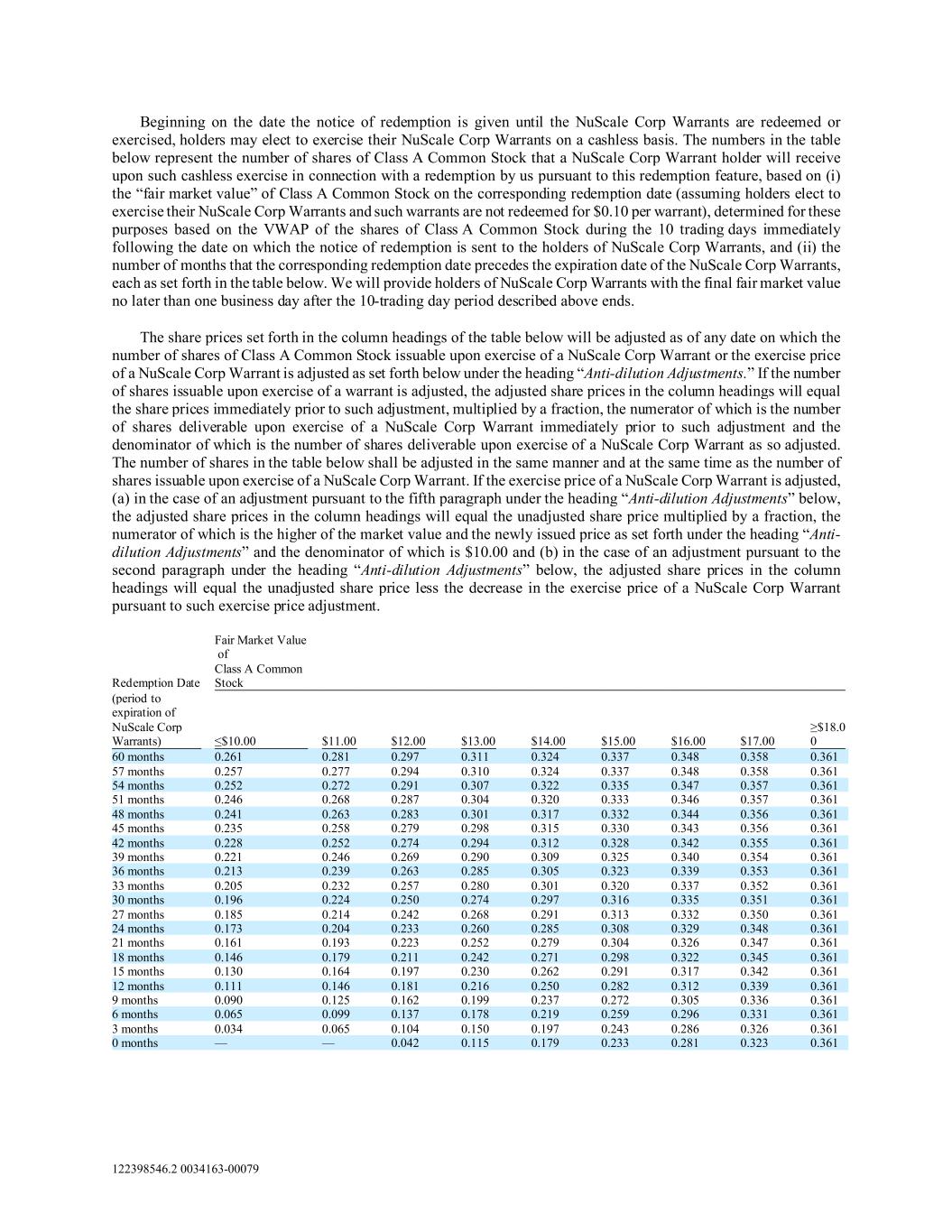

122398546.2 0034163-00079 • at a price of $0.01 per NuScale Corp Warrant; • upon a minimum of 30 days’ prior written notice of redemption to each holder of NuScale Corp Warrants; and • if, and only if, the closing price of Class A Common Stock equals or exceeds $18.00 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a NuScale Corp Warrant as described under the heading “— Warrants — NuScale Corp Warrants — Anti-dilution Adjustments” below) for any 20 trading days within a 30-trading day period ending three trading days before we send the notice of redemption to the NuScale Corp Warrant holders. We will not redeem the NuScale Corp Warrants as described above unless a registration statement under the Securities Act covering the issuance of the Class A Common Stock issuable upon exercise of the NuScale Corp Warrants is then effective and a current prospectus relating to those Class A Common Stock is available throughout the 30-day redemption period. If and when the NuScale Corp Warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws. We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the NuScale Corp Warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the NuScale Corp Warrants, each warrant holder will be entitled to exercise his, her or its warrant prior to the scheduled redemption date. However, the price of shares of Class A Common Stock may fall below the $18.00 redemption trigger price (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a NuScale Corp Warrant as described under the heading “Anti- dilution Adjustments” below) as well as the $11.50 (for whole shares) NuScale Corp Warrant exercise price after the redemption notice is issued. Redemption of NuScale Corp Warrants when the price per share of Class A Common Stock equals or exceeds $10.00. Once the NuScale Corp Warrants become exercisable, we may redeem the outstanding NuScale Corp Warrants (except as described herein with respect to the NuScale Corp Private Placement Warrants): • in whole and not in part; • at $0.10 per NuScale Corp Warrant upon a minimum of 30 days’ prior written notice of redemption; provided, that holders will be able to exercise their NuScale Corp Warrant on a cashless basis prior to redemption and receive that number of shares determined by reference to the table below, based on the redemption date and the “fair market value” of Class A Common Stock except as otherwise described below; • if, and only if, the closing price of Class A Common Stock equals or exceeds $10.00 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant as described under the heading “Anti-dilution Adjustments” below) for any 20 trading days within the 30-trading day period ending three trading days before we send the notice of redemption to the warrant holders; and • if the closing price of Class A Common Stock for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders is less than $18.00 per share (as adjusted for share subdivisions, share dividends, reorganizations, reclassifications, recapitalizations and the like), the NuScale Corp Private Placement Warrants must also be concurrently called for redemption on the same terms as the outstanding NuScale Corp Public Warrants, as described above.

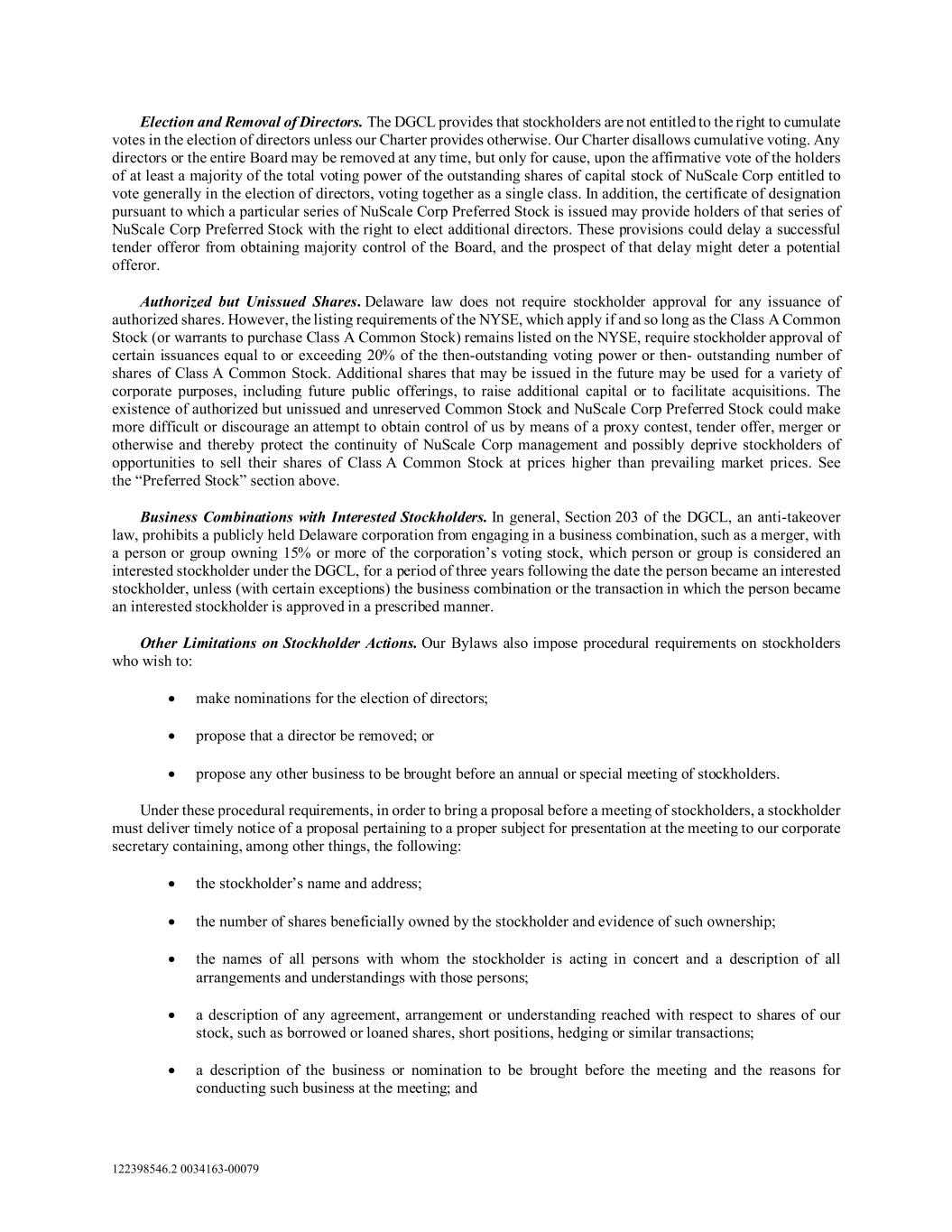

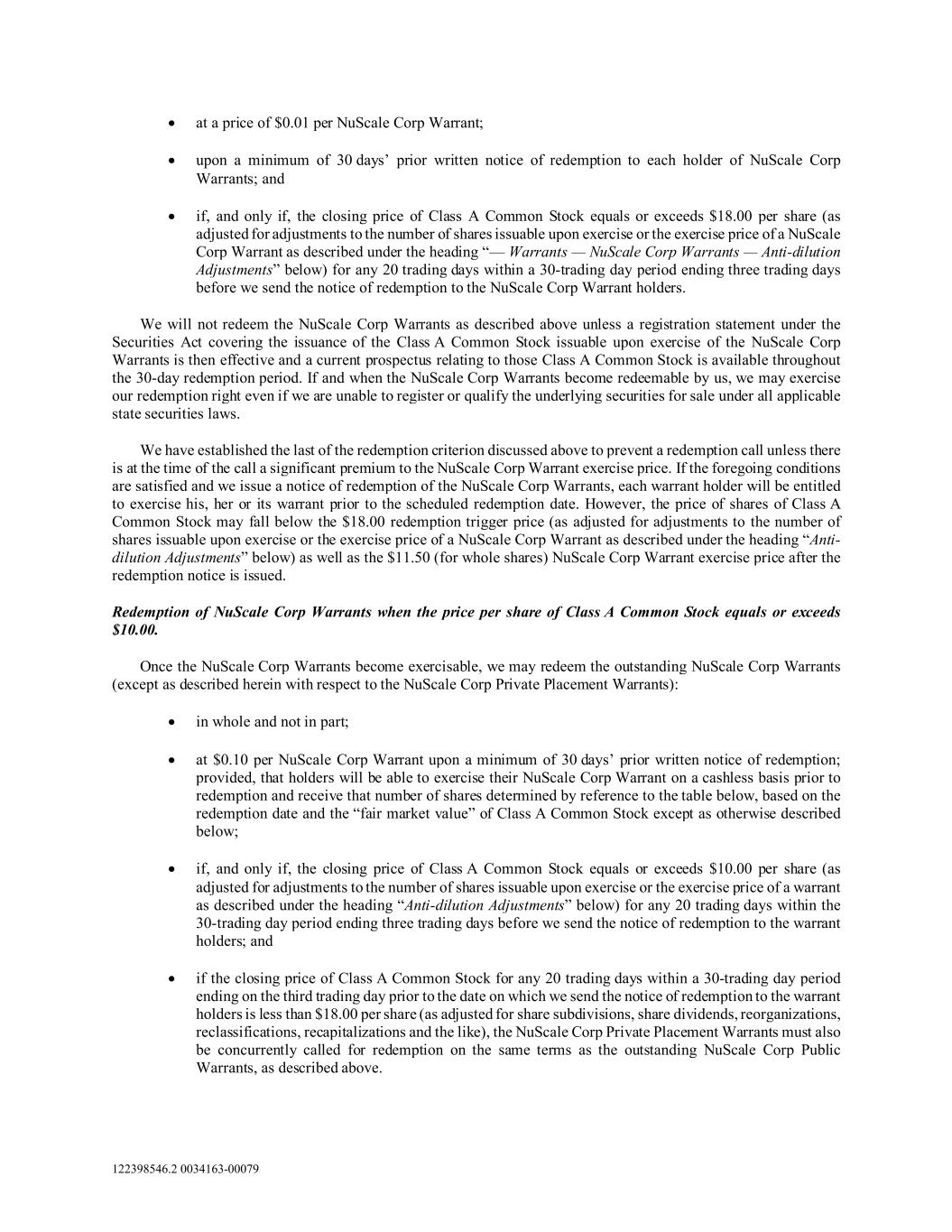

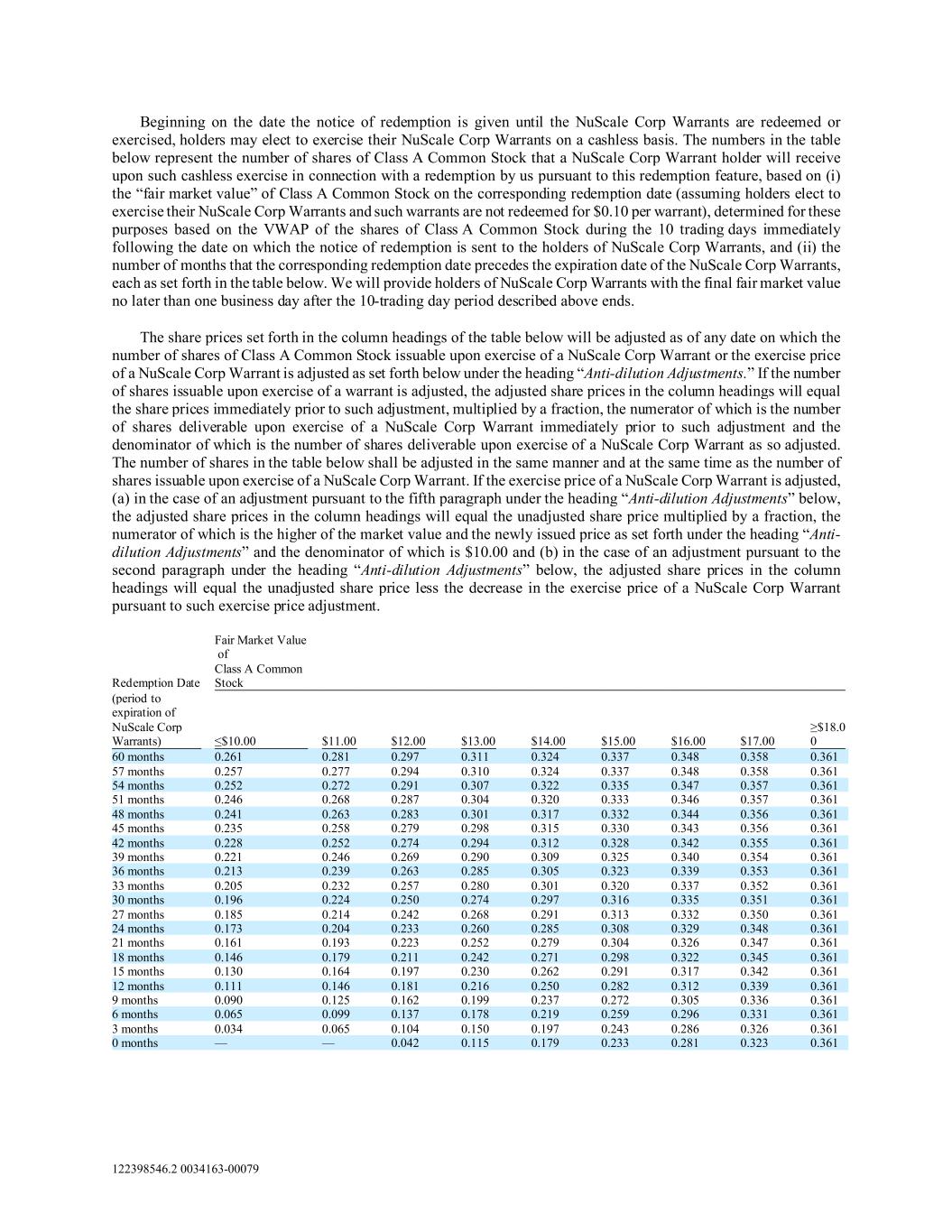

122398546.2 0034163-00079 Beginning on the date the notice of redemption is given until the NuScale Corp Warrants are redeemed or exercised, holders may elect to exercise their NuScale Corp Warrants on a cashless basis. The numbers in the table below represent the number of shares of Class A Common Stock that a NuScale Corp Warrant holder will receive upon such cashless exercise in connection with a redemption by us pursuant to this redemption feature, based on (i) the “fair market value” of Class A Common Stock on the corresponding redemption date (assuming holders elect to exercise their NuScale Corp Warrants and such warrants are not redeemed for $0.10 per warrant), determined for these purposes based on the VWAP of the shares of Class A Common Stock during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of NuScale Corp Warrants, and (ii) the number of months that the corresponding redemption date precedes the expiration date of the NuScale Corp Warrants, each as set forth in the table below. We will provide holders of NuScale Corp Warrants with the final fair market value no later than one business day after the 10-trading day period described above ends. The share prices set forth in the column headings of the table below will be adjusted as of any date on which the number of shares of Class A Common Stock issuable upon exercise of a NuScale Corp Warrant or the exercise price of a NuScale Corp Warrant is adjusted as set forth below under the heading “Anti-dilution Adjustments.” If the number of shares issuable upon exercise of a warrant is adjusted, the adjusted share prices in the column headings will equal the share prices immediately prior to such adjustment, multiplied by a fraction, the numerator of which is the number of shares deliverable upon exercise of a NuScale Corp Warrant immediately prior to such adjustment and the denominator of which is the number of shares deliverable upon exercise of a NuScale Corp Warrant as so adjusted. The number of shares in the table below shall be adjusted in the same manner and at the same time as the number of shares issuable upon exercise of a NuScale Corp Warrant. If the exercise price of a NuScale Corp Warrant is adjusted, (a) in the case of an adjustment pursuant to the fifth paragraph under the heading “Anti-dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share price multiplied by a fraction, the numerator of which is the higher of the market value and the newly issued price as set forth under the heading “Anti- dilution Adjustments” and the denominator of which is $10.00 and (b) in the case of an adjustment pursuant to the second paragraph under the heading “Anti-dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share price less the decrease in the exercise price of a NuScale Corp Warrant pursuant to such exercise price adjustment. Redemption Date Fair Market Value of Class A Common Stock (period to expiration of NuScale Corp Warrants) ≤$10.00 $11.00 $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 ≥$18.0 0 60 months 0.261 0.281 0.297 0.311 0.324 0.337 0.348 0.358 0.361 57 months 0.257 0.277 0.294 0.310 0.324 0.337 0.348 0.358 0.361 54 months 0.252 0.272 0.291 0.307 0.322 0.335 0.347 0.357 0.361 51 months 0.246 0.268 0.287 0.304 0.320 0.333 0.346 0.357 0.361 48 months 0.241 0.263 0.283 0.301 0.317 0.332 0.344 0.356 0.361 45 months 0.235 0.258 0.279 0.298 0.315 0.330 0.343 0.356 0.361 42 months 0.228 0.252 0.274 0.294 0.312 0.328 0.342 0.355 0.361 39 months 0.221 0.246 0.269 0.290 0.309 0.325 0.340 0.354 0.361 36 months 0.213 0.239 0.263 0.285 0.305 0.323 0.339 0.353 0.361 33 months 0.205 0.232 0.257 0.280 0.301 0.320 0.337 0.352 0.361 30 months 0.196 0.224 0.250 0.274 0.297 0.316 0.335 0.351 0.361 27 months 0.185 0.214 0.242 0.268 0.291 0.313 0.332 0.350 0.361 24 months 0.173 0.204 0.233 0.260 0.285 0.308 0.329 0.348 0.361 21 months 0.161 0.193 0.223 0.252 0.279 0.304 0.326 0.347 0.361 18 months 0.146 0.179 0.211 0.242 0.271 0.298 0.322 0.345 0.361 15 months 0.130 0.164 0.197 0.230 0.262 0.291 0.317 0.342 0.361 12 months 0.111 0.146 0.181 0.216 0.250 0.282 0.312 0.339 0.361 9 months 0.090 0.125 0.162 0.199 0.237 0.272 0.305 0.336 0.361 6 months 0.065 0.099 0.137 0.178 0.219 0.259 0.296 0.331 0.361 3 months 0.034 0.065 0.104 0.150 0.197 0.243 0.286 0.326 0.361 0 months — — 0.042 0.115 0.179 0.233 0.281 0.323 0.361

122398546.2 0034163-00079 The exact fair market value and redemption date may not be set forth in the table above, in which case, if the fair market value is between two values in the table or the redemption date is between two redemption dates in the table, the number of shares of Class A Common Stock to be issued for each NuScale Corp Warrant exercised will be determined by a straight-line interpolation between the number of shares set forth for the higher and lower fair market values and the earlier and later redemption dates, as applicable, based on a 365 or 366-day year, as applicable. For example, if the VWAP of the shares of Class A Common Stock during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of the NuScale Corp Warrants is $11.00 per share, and at such time there are 57 months until the expiration of the NuScale Corp Warrants, holders may choose to, in connection with this redemption feature, exercise their NuScale Corp Warrants for 0.277 shares of Class A Common Stock for each whole NuScale Corp Warrant. For an example where the exact fair market value and redemption date are not as set forth in the table above, if the VWAP of the shares of Class A Common Stock during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of the NuScale Corp Warrants is $13.50 per share, and at such time there are 38 months until the expiration of the NuScale Corp Warrants, holders may choose to, in connection with this redemption feature, exercise their NuScale Corp Warrants for 0.298 shares of Class A Common Stock for each whole NuScale Corp Warrant. In no event will the warrants be exercisable on a cashless basis in connection with this redemption feature for more than 0.361 shares of Class A Common Stock per NuScale Corp Warrant (subject to adjustment). Finally, as reflected in the table above, if the NuScale Corp Warrants are out of the money and about to expire, they cannot be exercised on a cashless basis in connection with a redemption by us pursuant to this redemption feature, since they will not be exercisable for any shares of Class A Common Stock. This redemption feature is structured to allow for all of the outstanding NuScale Corp Warrants to be redeemed when the shares of Class A Common Stock are trading at or above $10.00 per share, which may be at a time when the trading price of shares of Class A Common Stock is below the exercise price of the NuScale Corp Warrants. We have established this redemption feature to provide us with the flexibility to redeem the NuScale Corp Warrants without the NuScale Corp Warrants having to reach the $18.00 per share threshold set forth above under the heading “Redemption of NuScale Corp Warrants when the price per share of Class A Common Stock equals or exceeds $18.00.” Holders choosing to exercise their NuScale Corp Warrants in connection with a redemption pursuant to this feature will, in effect, receive a number of shares of Class A Common Stock for their NuScale Corp Warrants based on an option pricing model with a fixed volatility input as of the date of the IPO. This redemption right provides us with an additional mechanism by which to redeem all of the outstanding NuScale Corp Warrants, and therefore have certainty as to our capital structure as the warrants would no longer be outstanding and would have been exercised or redeemed. We will be required to pay the applicable redemption price to warrant holders if we choose to exercise this redemption right and it will allow us to quickly proceed with a redemption of the NuScale Corp Warrants if we determine it is in our best interest to do so. As such, we would redeem the NuScale Corp Warrants in this manner when we believe it is in our best interest to update our capital structure to remove the warrants and pay the redemption price to the warrant holders. As stated above, we can redeem the NuScale Corp Warrants when the shares of Class A Common Stock are trading at a price starting at $10.00, which is below the exercise price of $11.50, because it will provide certainty with respect to our capital structure and cash position while providing warrant holders with the opportunity to exercise their NuScale Corp Warrants on a cashless basis for the applicable number of shares. If we choose to redeem the NuScale Corp Warrants when the shares of Class A Common Stock are trading at a price below the exercise price of the NuScale Corp Warrants, this could result in the warrant holders receiving fewer shares of Class A Common Stock than they would have received if they had chosen to wait to exercise their NuScale Corp Warrants for shares of Class A Common Stock if and when such shares of Class A Common Stock were trading at a price higher than the exercise price of $11.50. No fractional shares of Class A Common Stock will be issued upon exercise of the NuScale Corp Warrants. If, upon exercise, a holder would be entitled to receive a fractional interest in a share, we will round down to the nearest whole number of the number of shares of Class A Common Stock to be issued to the holder. If, at the time of redemption, the NuScale Corp Warrants are exercisable for a security other than the shares of Class A Common Stock pursuant to the warrant agreement, the NuScale Corp Warrants may be exercised for such security. At such time as the NuScale Corp Warrants become exercisable for a security other than the shares of Class A Common Stock, NuScale Corp (or any surviving company) will use its commercially reasonable efforts to register under the Securities Act the security issuable upon the exercise of the NuScale Corp Warrants.

122398546.2 0034163-00079 Redemption Procedures. A holder of a NuScale Corp Warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the Warrant Agent’s actual knowledge, would beneficially own in excess of 9.8% (or such other amount as a holder may specify) of the shares of Class A Common Stock issued and outstanding immediately after giving effect to such exercise. Anti-dilution Adjustments. If the number of outstanding shares of Class A Common Stock is increased by a capitalization or share dividend payable in shares of Class A Common Stock, or by a split-up of common stock or other similar event, then, on the effective date of such capitalization or share dividend, split-up or similar event, the number of shares of Class A Common Stock issuable on exercise of each NuScale Corp Warrant will be increased in proportion to such increase in the outstanding shares of Class A Common Stock. A rights offering made to all or substantially all holders of NuScale Corp’s common stock entitling holders to purchase shares of Class A Common Stock at a price less than the “historical fair market value” (as defined below) will be deemed a share dividend of a number of shares of Class A Common Stock equal to the product of (i) the number of shares of Class A Common Stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for shares of Class A Common Stock) and (ii) one minus the quotient of (x) the price per share of Class A Common Stock paid in such rights offering and (y) the historical fair market value. For these purposes, (i) if the rights offering is for securities convertible into or exercisable for Class A Common Stock, in determining the price payable for shares of Class A Common Stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) “historical fair market value” means the VWAP of shares of Class A Common Stock as reported during the 10 trading day period ending on the trading day prior to the first date on which the shares of Class A Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights. In addition, if we, at any time while the warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to all or substantially all of the holders of share of Class A Common Stock on account of such Class A Common Stock (or other securities into which the warrants are convertible), other than (a) as described above, (b) any cash dividends or cash distributions which, when combined on a per share basis with all other cash dividends and cash distributions paid on the shares of Class A Common Stock during the 365-day period ending on the date of declaration of such dividend or distribution does not exceed $0.50 (as adjusted to appropriately reflect any other adjustments and excluding cash dividends or cash distributions that resulted in an adjustment to the exercise price or to the number of shares of Class A Common Stock issuable on exercise of each warrant) but only with respect to the amount of the aggregate cash dividends or cash distributions equal to or less than $0.50 per share, or (c) to satisfy the redemption rights of the holders of shares of Class A Common Stock in connection with the Transactions, then the warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each share of Class A Common Stock in respect of such event. If the number of outstanding shares of Class A Common Stock is decreased by a consolidation, combination, reverse share sub-division or reclassification of shares of Class A Common Stock or other similar event, then, on the effective date of such consolidation, combination, reverse share sub-division, reclassification or similar event, the number of shares of Class A Common Stock issuable on exercise of each warrant will be decreased in proportion to such decrease in outstanding shares of Class A Common Stock. Whenever the number of shares of Class A Common Stock purchasable upon the exercise of the NuScale Corp Warrants is adjusted, as described above, the NuScale Corp Warrant exercise price will be adjusted by multiplying the warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of shares of Class A Common Stock purchasable upon the exercise of the warrants immediately prior to such adjustment and (y) the denominator of which will be the number of shares of Class A Common Stock so purchasable immediately thereafter.

122398546.2 0034163-00079 In case of any reclassification or reorganization of the outstanding shares of Class A Common Stock (other than those described above or that solely affects the par value of such shares of Class A Common Stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our outstanding shares of Class A Common Stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the NuScale Corp Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the NuScale Corp Warrants and in lieu of the shares of Class A Common Stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of Class A Common Stock or other securities or property (including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the NuScale Corp Warrants would have received if such holder had exercised their NuScale Corp Warrants immediately prior to such event. However, if such holders were entitled to exercise a right of election as to the kind or amount of securities, cash or other assets receivable upon such consolidation or merger, then the kind and amount of securities, cash or other assets for which each NuScale Corp Warrant will become exercisable will be deemed to be the weighted average of the kind and amount received per share by such holders in such consolidation or merger that affirmatively make such election, and if a tender, exchange or redemption offer has been made to and accepted by such holders under circumstances in which, upon completion of such tender or exchange offer, the maker thereof, together with members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange Act) of which such maker is a part, and together with any affiliate or associate of such maker (within the meaning of Rule 12b- 2 under the Exchange Act) and any members of any such group of which any such affiliate or associate is a part, own beneficially (within the meaning of Rule 13d-3 under the Exchange Act) more than 50% of the issued and outstanding Class A Common Stock, the holder of a NuScale Corp Warrant will be entitled to receive the highest amount of cash, securities or other property to which such holder would actually have been entitled as a shareholder if such warrant holder had exercised the NuScale Corp Warrant prior to the expiration of such tender or exchange offer, accepted such offer and all of the Class A Common Stock held by such holder had been purchased pursuant to such tender or exchange offer, subject to adjustment (from and after the consummation of such tender or exchange offer) as nearly equivalent as possible to the adjustments provided for in the Warrant Agreement. If less than 70% of the consideration receivable by the holders of shares of Class A Common Stock in such a transaction is payable in the form of shares of Class A Common Stock in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the warrant properly exercises the NuScale Corp Warrant within thirty days following public disclosure of such transaction, the warrant exercise price will be reduced as specified in the Warrant Agreement based on the Black-Scholes value (as defined in the Warrant Agreement) of the NuScale Corp Warrant. The purpose of such exercise price reduction is to provide additional value to holders of the NuScale Corp Warrants when an extraordinary transaction occurs during the exercise period of the NuScale Corp Warrants pursuant to which the holders of the NuScale Corp Warrants otherwise do not receive the full potential value of the NuScale Corp Warrants. The purpose of such exercise price reduction is to provide additional value to holders of the NuScale Corp Warrants when an extraordinary transaction occurs during the exercise period of the NuScale Corp Warrants pursuant to which the holders of the NuScale Corp Warrants otherwise do not receive the full potential value of the NuScale Corp Warrants. The NuScale Corp Warrants have been issued in registered form under the Warrant Agreement. The Warrant Agreement provides that the terms of the NuScale Corp Warrants may be amended without the consent of any holder for the purpose of (i) curing any ambiguity or correct any mistake, including to conform the provisions of the Warrant Agreement to the description of the terms of the NuScale Corp Warrants and the Warrant Agreement set forth in Spring Valley’s IPO prospectus, or defective provision, (ii) amending the provisions relating to cash dividends on ordinary shares as contemplated by and in accordance with the Warrant Agreement or (iii) adding or changing any provisions with respect to matters or questions arising under the Warrant Agreement as the parties to the Warrant Agreement may deem necessary or desirable and that the parties deem to not adversely affect the rights of the registered holders of the NuScale Corp Warrants; provided, that the approval by the holders of at least 50% of the then-outstanding NuScale Corp Public Warrants is required to make any change that adversely affects the interests of the registered holders. You should review a copy of the Warrant Agreement, which is filed as an exhibit to the Registration Statement, for a complete description of the terms and conditions applicable to the warrants.

122398546.2 0034163-00079 The holders of NuScale Corp Warrants do not have the rights or privileges of holders of shares of Class A Common Stock or any voting rights until they exercise their NuScale Corp Warrants and receive shares of Class A Common Stock. After the issuance of Class A Common Stock upon exercise of the NuScale Corp Warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by shareholders. If, upon exercise of the NuScale Corp Warrants, a holder would be entitled to receive a fractional interest in a share, we will, upon exercise, round down to the nearest whole number the number of shares of Class A Common Stock to be issued to the warrant holder. We have agreed that, subject to applicable law, any action, proceeding or claim against us arising out of or relating in any way to the Warrant Agreement will be brought and enforced in the courts of the State of New York or the United States District Court for the Southern District of New York, and we irrevocably submit to such jurisdiction, which jurisdiction will be the exclusive forum for any such action, proceeding or claim. This provision applies to claims under the Securities Act but does not apply to claims under the Exchange Act or any claim for which the federal district courts of the United States of America are the sole and exclusive forum. NuScale Corp Private Placement Warrants Except as described below, the NuScale Corp Private Placement Warrants have terms and provisions that are identical to those of the NuScale Corp Public Warrants. The NuScale Corp Private Placement Warrants will not be redeemable by us, except as described above when the price per share of Class A Common Stock equals or exceeds $10.00, so long as they are held by Spring Valley Acquisition Sponsor, LLC, a Delaware limited liability company (the “Sponsor”) or its permitted transferees (except as otherwise set forth herein). The Sponsor, or its permitted transferees, has the option to exercise the NuScale Corp Private Placement Warrants on a cashless basis. If the NuScale Corp Private Placement Warrants are held by holders other than the Sponsor or its permitted transferees, the NuScale Corp Private Placement Warrants will be redeemable by us in all redemption scenarios and exercisable by the holders on the same basis as the NuScale Corp Public Placement Warrants. Any amendment to the terms of the NuScale Corp Private Placement Warrants or any provision of the Warrant Agreement with respect to the NuScale Corp Private Placement Warrants will require a vote of holders of at least 60% of the number of the then outstanding NuScale Corp Private Placement Warrants. Except as described above regarding redemption procedures and cashless exercise in respect of the NuScale Corp Public Warrants, if holders of the NuScale Corp Private Placement Warrants elect to exercise them on a cashless basis, they would pay the exercise price by surrendering his, her or its warrants for that number of shares of Class A Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares of Class A Common Stock underlying the warrants, multiplied by the excess of the “Sponsor fair market value” (defined below) over the exercise price of the warrants by (y) the historical fair market value. The “Sponsor fair market value” will mean the average reported closing price of the shares of Class A Common Stock for the 10 trading days ending on the third trading day prior to the date on which the notice of warrant exercise is sent to the Warrant Agent. The reason that we have agreed that these warrants will be exercisable on a cashless basis so long as they are held by the Sponsor and its permitted transferees is because it was not known at the time we entered into the Warrant Agreement whether the Sponsor would be affiliated with us following the Transactions. If the Sponsor had remained affiliated with us, its ability to sell our securities in the open market would have been significantly limited. We have policies in place that restrict insiders from selling our securities except during specific periods of time. Even during such periods of time when insiders are permitted to sell our securities, an insider cannot trade in our securities if he or she is in possession of material non- public information. Accordingly, unlike unaffiliated stockholders who may exercise their warrants and sell their shares of Class A Common Stock received upon such exercise freely in the open market in order to recoup the cost of such exercise, the insiders could be significantly restricted from selling such securities. As a result, we believe that allowing the holders to exercise such warrants on a cashless basis is appropriate. Transfer Agent, Warrant Agent and Registrar The transfer agent and registrar for the Common Stock and the warrant agent for the NuScale Corp Warrants is Continental Stock Transfer & Trust Company. Listing

122398546.2 0034163-00079 Class A Common Stock and NuScale Corp Warrants trade on the NYSE under the symbols “SMR” and “SMR- WT,” respectively.