Exhibit 99.1

LETTER OF TRANSMITTAL

JACKSON FINANCIAL INC.

OFFER TO EXCHANGE

$600,000,000 aggregate principal amount of its 1.125% Senior Notes due 2023 that have been

registered under the Securities Act of 1933 (the “New 2023 Notes”) for any and all of its

outstanding 1.125% Senior Notes due 2023 (the “Old 2023 Notes”)

$500,000,000 aggregate principal amount of its 3.125% Senior Notes due 2031 that have been

registered under the Securities Act of 1933 (the “New 2031 Notes”) for any and all of its

outstanding 3.125% Senior Notes due 2031 (the “Old 2031 Notes”)

$500,000,000 aggregate principal amount of its 4.000% Senior Notes due 2051 that have been

registered under the Securities Act of 1933 (the “New 2051 Notes” and, together with the New

2023 Notes and the New 2031 Notes, the “New Notes”) for any and all of its outstanding 4.000%

Senior Notes due 2051 (the “Old 2051 Notes” and, together with the Old 2023 Notes and the Old

2031 Notes, the “Old Notes”)

THE EXCHANGE OFFER WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON

, 2022, UNLESS EXTENDED BY JACKSON FINANCIAL INC.

The Exchange Agent for the Exchange Offer is:

The Bank of New York Mellon

By Hand, Overnight Delivery or Mail

(Registered or Certified Mail Recommended): | By Facsimile Transmission; |

The Bank of New York Mellon, as Exchange

Agent c/o The Bank of New York Mellon Corporation Corporate Trust Operations–Reorganization Unit 2001 Bryan Street, 10th Floor Dallas, Texas 75201 Attention: Sherma Thomas | (732) 667-9408 Attention: Sherma Thomas Your fax cover sheet should provide a call-

back number and request a call back, upon

receipt. |

To confirm receipt or for more information, call: (315) 414-3362 Or use email: CT_REORG_UNIT_INQUIRIES@bnymellon.com |

DELIVERY OF THIS LETTER OF TRANSMITTAL TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE OR TRANSMISSION OF THIS LETTER OF TRANSMITTAL VIA FACSIMILE TO A FACSIMILE NUMBER OTHER THAN AS SET FORTH ABOVE DOES NOT CONSTITUTE A VALID DELIVERY OF THIS LETTER OF TRANSMITTAL.

The undersigned acknowledges receipt of the prospectus dated , 2022 (the “Prospectus”) of Jackson Financial Inc., a Delaware corporation (the “Company”), and this Letter of Transmittal (this “Letter of Transmittal”), which together constitute the Company’s offer to exchange (the “Exchange Offer”) up to $600,000,000 aggregate principal amount of 1.125% Senior Notes due 2023, up to $500,000,000 aggregate principal amount of 3.125% Senior Notes due 2031 and up to $500,000,000 aggregate principal amount of 4.000% Senior Notes due 2051, which have been registered under the Securities Act of 1933, as amended, in each case in exchange for a like aggregate principal amount of Old Notes of the corresponding series that are validly tendered and not validly withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date (as defined below). The Bank of New York Mellon is acting as exchange agent (the “Exchange Agent”) for the Exchange Offer. The term “Expiration Date”, as used herein, means , 2022 except that if the Company, in its sole and absolute discretion, extends the period of time during which the Exchange Offer is open, “Expiration Date” shall mean the latest date to which the Exchange Offer has been extended. Capitalized terms not defined herein shall have the respective meanings ascribed to them in the Prospectus.

For each Old Note validly tendered and not validly withdrawn by the holder thereof prior to 5:00 p.m., New York City time, on the Expiration Date of the Exchange Offer and accepted for exchange by the Company, all on the terms and subject to the conditions set forth in this Letter of Transmittal and the Prospectus, the tendering holder will receive New Notes in an aggregate principal amount and series corresponding to the aggregate principal amount and series of the Old Notes so tendered and accepted by the Company. Tenders of Old Notes may be withdrawn no later than 5:00 p.m., New York City time, on the Expiration Date by following the procedures set forth in the Prospectus and in this Letter of Transmittal.

This Letter of Transmittal is to be completed by a holder of Old Notes if certificates for such Old Notes are to be forwarded herewith and may be used if a tender is to be made by book-entry transfer of Old Notes to the account maintained by the Exchange Agent at The Depository Trust Company (“DTC”) pursuant to DTC’s Automated Tender Offer Program (“ATOP”) and an Agent’s Message (as defined below) is not delivered to the Exchange Agent. If Old Notes are tendered by book-entry transfer pursuant to DTC’s ATOP procedures, the tendering holder may cause DTC to deliver an Agent’s Message to the Exchange Agent in lieu of this Letter of Transmittal. The term “Agent’s Message” means a computer-generated message, transmitted by DTC to and received by the Exchange Agent and forming a part of a Book-Entry Confirmation (as defined below), which states that the holder of the Old Notes acknowledges and agrees to be bound by the terms of this Letter of Transmittal. The term “Book-Entry Confirmation” means an electronic confirmation from DTC of the book-entry transfer of Old Notes into the Exchange Agent’s account at DTC.

Delivery of documents to DTC does not constitute delivery to the Exchange Agent.

The method of delivery (whether physical or electronic) of Old Notes, Letters of Transmittal, Agent’s Messages, Book-Entry Confirmations and all other required documents is at your risk and election, provided that Old Notes in book-entry form must be tendered through DTC’s ATOP procedures. If such delivery is by mail, it is recommended that you use registered mail, properly insured, with return receipt requested. In all cases, you should allow sufficient time to assure timely delivery. You may request the broker, dealer, bank or other financial institution or nominee through which you may hold Old Notes to effect these transactions for you. No Letters of Transmittal, Old Notes or other documents should be sent to the Company.

The undersigned has completed the appropriate boxes below and signed this Letter of Transmittal to indicate the action the undersigned desires to take with respect to the Exchange Offer.

List below the Old Notes to which this Letter of Transmittal relates. If the space provided below is inadequate, the certificate numbers and principal amount of Old Notes should be listed on a separate signed schedule affixed hereto.

| DESCRIPTION OF OLD NOTES |

Name(s) and Address(es)

of Registered Holder(s)

(Please fill in, if blank) | | 1

Certificate

Number(s)* | 2

Aggregate

Principal

Amount

Represented | 3

Principal

Amount

Tendered** |

| | ¨ 1.125% Senior Notes due 2023 | | | |

| ¨ 3.125% Senior Notes due 2031 | | | |

| ¨ 4.000% Senior Notes due 2051 | | | |

| | Total Principal

Amount Tendered: | | |

* Need not be completed if Old Notes are being tendered by book-entry transfer. ** Unless otherwise indicated in this column, a holder will be deemed to have tendered ALL of the Old Notes represented by the Old Notes indicated in column 2. See Instruction 2. Old Notes tendered hereby must be in denominations of $2,000 and integral multiples of $1,000 in excess thereof, and if any Old Note is tendered in part, the untendered portion of such Old Note must be a denomination of $2,000 or an integral multiple of $1,000 in excess thereof. See Instruction 1. |

| ¨ | CHECK HERE IF TENDERED OLD NOTES ARE BEING DELIVERED BY BOOK-ENTRY TRANSFER MADE TO THE ACCOUNT MAINTAINED BY THE EXCHANGE AGENT WITH DTC AND COMPLETE THE FOLLOWING: |

| Name of Tendering Institution: | |

| | |

By causing DTC to credit the Old Notes being tendered to the Exchange Agent’s account at DTC using ATOP and by complying with applicable ATOP procedures with respect to the Exchange Offer, including causing DTC to transmit to the Exchange Agent an Agent’s Message stating that the holder of the Old Notes acknowledges and agrees to be bound by the terms of this Letter of Transmittal, the participant in DTC tendering the Old Notes confirms on behalf of itself and each beneficial owners of such Old Notes all provisions of this Letter of Transmittal (including all representations, warranties and agreements) applicable to it and each such beneficial owner as fully as if it and each such beneficial owner had completed the information required herein and executed and delivered this Letter of Transmittal to the Exchange Agent.

| ¨ | CHECK HERE IF TENDERED OLD NOTES ARE ENCLOSED HEREWITH. |

| ¨ | CHECK HERE IF YOU ARE A PARTICIPATING BROKER-DEALER (AS DEFINED BELOW) that, as described in this Letter of transmittal, will be required to deliver the prospectus, as amended or supplemented from time to time, in connection with resales or other transfers of New Notes received in the Exchange Offer and you therefore WISH TO RECEIVE 10 ADDITIONAL COPIES OF THE PROSPECTUS AND 10 COPIES OF ANY AMENDMENTS OR SUPPLEMENTS THERETO AND INDICATE THE NAME AND ADDRESS TO WHICH THOSE DOCUMENTS SHOULD BE DELIVERED; PROVIDED THAT, IF YOU HAVE SET FORTH AN EMAIL ADDRESS IN THE SPACE BELOW, YOU WILL BE DEEMED TO HAVE CONSENTED TO DELIVERY OF THE FOREGOING DOCUMENTS BY EMAIL, IN WHICH CASE ONE COPY OF EACH SUCH DOCUMENT WILL BE SENT TO YOU AT THE EMAIL ADDRESS YOU HAVE SET FORTH BELOW. |

PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY

Ladies and Gentlemen:

1. Upon the terms and subject to the conditions of the Exchange Offer, the undersigned hereby tenders to the Company the aggregate principal amount of Old Notes indicated above. Subject to, and effective upon, the acceptance for exchange of the Old Notes tendered hereby by the Company, the undersigned hereby sells, assigns and transfers to, or upon the order of, the Company all right, title and interest in and to such Old Notes as are being tendered hereby.

The undersigned hereby irrevocably constitutes and appoints the Exchange Agent as the undersigned’s true and lawful agent and attorney-in-fact with respect to such tendered Old Notes (with full knowledge that the Exchange Agent also acts as the agent of the Company in connection with the Exchange Offer), with full power of substitution, without limitation, to assign, transfer and deliver the Old Notes, or cause the Old Notes to be assigned, transferred and delivered, to the Company, and to deliver all accompanying evidences of transfer and authenticity, and present such Old Notes for transfer on the books of the Company and to receive all benefits and otherwise exercise all rights of beneficial ownership of such Old Notes, all in accordance with the terms of the Exchange Offer.

2. The undersigned hereby acknowledges, represents and warrants to and agrees with the Company that the undersigned and each beneficial owner of Old Notes tendered hereby has full right, power and authority to tender, sell, assign and transfer all right, title and interest in and to the Old Notes tendered hereby, and to acquire the New Notes issuable upon the exchange of such tendered Old Notes, and that, if and when such Old Notes are accepted by the Company for exchange, the Company will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances and not subject to any adverse claim. The undersigned hereby further acknowledges, represents and warrants to, and agrees with, the Company that (i) neither the undersigned nor any beneficial owner of the Old Notes being tendered hereby is an “affiliate” (as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”)) of the Company; (ii) any New Notes received in the Exchange Offer by the undersigned or any beneficial owner of any Old Notes tendered hereby will be acquired by it in the ordinary course of its business; (iii) neither the undersigned nor any beneficial owner of Old Notes tendered hereby has any arrangement or understanding with any person to engage in, and neither the undersigned nor any such beneficial owner is engaged in or intends to engage in, the distribution (within the meaning of the Securities Act) of the New Notes in violation of the Securities Act; (iv) neither the undersigned nor any such beneficial owner is a broker-dealer that will receive New Notes in the Exchange Offer in exchange for Old Notes that it purchased from the Company for resale pursuant to Rule 144A under the Securities Act or any other available exemption from registration under the Securities Act; and (v) if the undersigned or any such beneficial owner is a broker-dealer holding Old Notes acquired for its own account as a result of its market-making or other trading activities (a “Participating Broker-Dealer”), it will deliver (or, to the extent permitted by applicable law, make available) a prospectus meeting the requirements of the Securities Act to purchasers and other transferees in connection with any resale or other transfer of the New Notes it receives in exchange for such Old Notes pursuant to the Exchange Offer (provided, however, that by so acknowledging and by delivering (or making available as aforesaid) a prospectus, it will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act).

The undersigned acknowledges and agrees that, if the undersigned or any beneficial owner of Old Notes tendered hereby is unable to make the representations and warranties set forth in the immediately preceding paragraph or elsewhere in this Letter of Transmittal, or if the undersigned or any such beneficial owner is participating in the Exchange Offer for the purpose of participating in a distribution (within the meaning of the Securities Act) of the New Notes to be acquired in the Exchange Offer, or if the undersigned or any such beneficial owner is a broker-dealer that will receive New Notes in the Exchange Offer in exchange for Old Notes that it acquired from the Company for resale pursuant to Rule 144A under the Securities Act or any other available exemption from registration under the Securities Act, neither the undersigned nor any such beneficial owner will be permitted to tender its Old Notes in the Exchange Offer. The undersigned, if it is not the beneficial owner of the Old Notes being tendered hereby, acknowledges and agrees that all of the representations, warranties, acknowledgements and agreements set forth herein are being made by it on its own behalf and on behalf of each such beneficial owner for the benefit of the Company.

3. The undersigned, on behalf of itself and each beneficial owner of any Old Notes tendered hereby, acknowledges and agrees that the Exchange Offer is being made in reliance on interpretations by the staff of the Securities and Exchange Commission (the “SEC”), as set forth in no-action letters issued to third parties and referred to in the Prospectus under the caption “The Exchange Offer—Resales of New Notes” and, as a result, the Company believes that, except as provided in the next sentence and in the next paragraph, the New Notes received pursuant to the Exchange Offer in exchange for the Old Notes may be offered for resale, resold or otherwise transferred by a holder thereof, without compliance with the registration and prospectus delivery requirements of the Securities Act, unless (1) such holder is an “affiliate” (as defined in Rule 405 under the Securities Act) of the Company, (2) the New Notes received by such holder in the Exchange Offer will not be acquired by such holder in the ordinary course of its business or (3) such holder has an arrangement or understanding with any person to engage in, or is engaged in or intends to engage in, the distribution (within the meaning of the Securities Act) of the New Notes in violation of the Securities Act. However, the undersigned, on behalf of itself and each beneficial owner of Old Notes tendered hereby, acknowledges and agrees that, if the undersigned or any such beneficial owner is a Participating Broker-Dealer holding Old Notes acquired for its own account as a result of market-making or other trading activities and who receives New Notes in exchange for such Old Notes in the Exchange Offer, it may be an “underwriter” within the meaning of the Securities Act and it must (and the undersigned, on behalf of itself and each such beneficial owner, acknowledges and agrees that it will) deliver (or, to the extent permitted by applicable law, make available) a prospectus meeting the requirements of the Securities Act to purchasers and other transferees in connection with any resale or other transfer of such New Notes. However, by so acknowledging and delivering a prospectus, a Participating Broker-Dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. The undersigned, on behalf of itself and each beneficial owner of Old Notes tendered hereby, further acknowledges and agrees that, if it is a Participating Broker-Dealer, it may use the Prospectus, as amended or supplemented from time to time, in connection with resales or other transfers of New Notes received for its own account in the Exchange Offer in exchange for Old Notes that it acquired for its own account as a result of market-making or other trading activities for a period ending on the earlier of (i) 180 days after the registration statement of which the Prospectus is a part becomes effective and (ii) the date on which such Participating Broker-Dealer is no longer required to deliver a prospectus in connection with resales of New Notes (subject, in each case, to the Company’s right to suspend use of the Prospectus under the circumstances described in the Prospectus under the caption “Plan of Distribution”), so long as such Participating Broker-Dealer has notified the Company by completing, executing and delivering this Letter of Transmittal to the Exchange Agent at the address set forth above prior to 5:00 p.m., New York City time, on the Expiration Date in which such broker-dealer indicates, by checking the appropriate box set forth above in this Letter of Transmittal, that it will use the Prospectus for such purpose.

The undersigned, on behalf of itself and each beneficial owner of Old Notes being tendered hereby, acknowledges and agrees that if the undersigned or any beneficial owner of the Old Notes being tendered falls into one or more of the categories set forth in clauses (1) through (3) of the immediately preceding paragraph, or if the undersigned or any such beneficial owner is participating in the Exchange Offer for the purpose of participating in a distribution (within the meaning of the Securities Act) of the New Notes to be acquired in the Exchange Offer, or if the undersigned or any such beneficial owner is a broker-dealer that will receive New Notes in the Exchange Offer in exchange for Old Notes that it acquired from the Company for resale pursuant to Rule 144A under the Securities Act or any other available exemption from registration under the Securities Act, (i) it will not be able to rely on the interpretations of the SEC staff enunciated in the no-action letters mentioned above or in other interpretive letters of similar effect, (ii) it will not be permitted to tender its Old Notes in the Exchange Offer, (iii) in the absence of an applicable exemption, it must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer, sale or other transfer of Notes, and (iv) any registration statement used in connection with such offer, sale or other transfer of Notes must contain the selling security holder information required by Item 507 of Regulation S-K under the Securities Act. Failure to comply with such registration and prospectus delivery requirements may result in liability under the Securities Act and the Company will not be responsible for, or indemnify the undersigned or any such beneficial owner against, any such liability. The undersigned, on behalf of itself and each beneficial owner of Old Notes tendered hereby, acknowledges and agrees that each broker-dealer that receives New Notes for its own account pursuant to the Exchange Offer will be deemed to acknowledge and agree that it will deliver (or, to the extent permitted by applicable law, make available) to purchasers and other transferees a prospectus meeting the requirements of the Securities Act in connection with any resale or other transfer of New Notes received in the Exchange Offer as aforesaid, but only Participating Broker-Dealers will be entitled, subject to the limitations described above, to use the Prospectus, as amended or supplemented from time to time, in connection with resales or other transfers of New Notes received in the Exchange Offer.

The undersigned and each beneficial owner of Old Notes tendered hereby is aware that the SEC has not considered the Exchange Offer in the context of a no-action letter and there can be no guarantee that the staff of the SEC would make a similar determination with respect to the Exchange Offer as in the circumstances described in the no action letters referred to above.

4. The undersigned will, upon request, execute and deliver any additional documents deemed by the Company to be necessary or desirable to complete the tender, exchange, sale, assignment and transfer of the Old Notes tendered hereby or to further evidence the accuracy or performance of any of the representations, warranties, acknowledgements or agreements made by the undersigned herein. All authority conferred or agreed to be conferred in this Letter of Transmittal and every obligation and agreement hereunder of the undersigned and each beneficial owner of Old Notes tendered hereby shall survive the death, incapacity or dissolution of the undersigned and of any such beneficial owner and shall be binding upon the successors, assigns, heirs, executors, administrators, trustees in bankruptcy and personal and legal representatives of the undersigned and each such beneficial owner. This tender may be withdrawn only in accordance with the procedures set forth under the caption “The Exchange Offer—Withdrawal Rights” in the Prospectus and in Instruction 9 in this Letter of Transmittal.

5. Unless otherwise indicated herein in the box entitled “Special Issuance Instructions” below, please deliver the New Notes (and, if applicable, substitute certificates representing Old Notes for any Old Notes not exchanged) registered in the name of the undersigned or, in the case of a book-entry delivery of Old Notes, please credit the account indicated above maintained at DTC. Similarly, unless otherwise indicated under the box entitled “Special Delivery Instructions” below, please send the New Notes (and, if applicable, substitute certificates representing Old Notes for any Old Notes not exchanged) to the undersigned at the address shown above in the box entitled “Description of Old Notes” or, in the case of book-entry delivery of Old Notes, please credit the New Notes to the account indicated above maintained at DTC.

THE UNDERSIGNED, BY COMPLETING THE BOX ENTITLED “DESCRIPTION OF OLD NOTES” ABOVE AND SIGNING THIS LETTER OF TRANSMITTAL, WILL BE DEEMED TO HAVE TENDERED THE OLD NOTES AS SET FORTH IN SUCH BOX ABOVE.

THE UNDERSIGNED ACKNOWLEDGES THAT THE EXCHANGE OFFER IS SUBJECT TO THE MORE DETAILED TERMS SET FORTH IN THE PROSPECTUS.

BY USING THE ATOP PROCEDURES TO TENDER OLD NOTES, THE UNDERSIGNED WILL NOT BE REQUIRED TO DELIVER THIS LETTER OF TRANSMITTAL PHYSCIALLY TO THE EXCHANGE AGENT. HOWEVER, IN THAT CIRCUMSTANCE THE UNDERSIGNED WILL BE DEEMED TO AGREE TO BE BOUND BY THE TERMS OF THIS LETTER OF TRANSMITTAL AND TO HAVE MADE ALL OF THE REPRESENTATIONS, WARRANTIES, ACKNOWLEDGEMENTS AND AGREEMENTS SET FORTH HEREIN, BOTH ON BEHALF OF ITSELF AND ON BEHALF OF THE BENEFICIAL OWNERS OF THE OLD NOTES BEING TENDERED.

IMPORTANT: THIS LETTER OF TRANSMITTAL OR AN AGENT’S MESSAGE IN LIEU THEREOF (TOGETHER WITH THE CERTIFICATES FOR OLD NOTES OR A BOOK- ENTRY CONFIRMATION AND ALL OTHER REQUIRED DOCUMENTATION) MUST BE RECEIVED BY THE EXCHANGE AGENT PRIOR TO 5:00 P.M., NEW YORK CITY TIME, ON THE EXPIRATION DATE.

PLEASE READ THIS ENTIRE LETTER OF TRANSMITTAL AND THE PROSPECTUS CAREFULLY BEFORE COMPLETING ANY BOX ABOVE.

SPECIAL ISSUANCE INSTRUCTIONS

(See Instructions 3 and 4)

To be completed ONLY if certificates for Old Notes not exchanged and/or New Notes are to be issued in the name of someone other than the person or persons whose signature(s) appear(s) on this Letter of Transmittal below, or if Old Notes delivered by book-entry transfer which are not accepted for exchange are to be returned by credit to an account maintained at DTC other than the account indicated above. See Instruction 3.

Issue New Notes and/or Old Notes to:

| Name(s): | |

| (Please type or print) |

| Address: | |

| (Please type or print) |

| Taxpayer or Employer Identification or Social Security No(s): | |

(Complete Form W-9 or the applicable Form W-8)

¨ Credit unexchanged Old Notes delivered by book-entry transfer to the DTC account set forth below.

SPECIAL DELIVERY INSTRUCTIONS

(See Instructions 3 and 4)

To be completed ONLY if certificates for Old Notes not exchanged and/or New Notes are to be sent to someone other than the person or persons whose signature(s) appear(s) on this Letter of Transmittal below or to such person or persons at an address other than shown in the box entitled “Description of Old Notes” on this Letter of Transmittal above.

Mail New Notes and/or Old Notes to:

| Name(s): | |

| (Please type or print) |

| Address: | |

| (Please type or print) |

| Taxpayer or Employer Identification or Social Security No(s).: | |

PLEASE SIGN HERE

(To be Completed by All Tendering Holders)

(Complete Enclosed Form W-9)

| , | | , 2022 |

| | , | | , 2022 |

| Signature(s) of Owner(s) | | (Date) | |

Area Code and Telephone No.:

This Letter of Transmittal must be signed by the registered holder(s) as their name(s) appear(s) on the certificate(s) for the Old Notes hereby tendered or on a security position listing or by any person(s) authorized to become registered holder(s) by endorsements on such certificate(s) or by bond powers transmitted herewith. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in fiduciary or representative capacity, please set forth full title. See Instruction 3.

(Please type or print)

| Name(s): | |

| |

| Capacity: | |

| |

| Address: | |

| | |

| Principal place of business (if different from address listed above): | |

| Area Code and Telephone No.: | |

| Taxpayer or Employer Identification or Social Security No(s).: | |

SIGNATURE GUARANTEE

(If required by Instruction 3)

| Signature(s) Guaranteed by An Eligible Institution:1 | |

| | (Authorized Signature) |

| | |

| Print Name and Title: | |

| | |

| Print Name of Firm: | |

1 An “Eligible Institution” means a firm which is a member of the Securities Transfer Agent Medallion Program, the Stock Exchanges Medallion Program or the New York Stock Exchange Medallion Program.

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Offer to Exchange

1. DELIVERY OF THIS LETTER OF TRANSMITTAL AND OLD NOTES.

This Letter of Transmittal is to be completed by holders of Old Notes if certificates for such Old Notes are to be forwarded herewith and may be used if tenders are to be made by book-entry transfer of Old Notes to the account maintained by the Exchange Agent at DTC pursuant to DTC’s Automated Tender Offer Program (“ATOP”) and an Agent’s Message is not delivered to the Exchange Agent. If Old Notes are tendered by book-entry transfer pursuant to DTC’s ATOP procedures, the tendering holder may cause DTC to deliver an Agent’s Message to the Exchange Agent in lieu of this Letter of Transmittal. The term “Agent’s Message” means a computer-generated message, transmitted by DTC to and received by the Exchange Agent and forming a part of a Book-Entry Confirmation (as defined below), which states that the holder of the Old Notes acknowledges and agrees to be bound by the terms of this Letter of Transmittal. The term “Book-Entry Confirmation” means an electronic confirmation from DTC of the book-entry transfer of the holder’s Old Notes into the Exchange Agent’s account at DTC. Certificates for all physically tendered Old Notes, or Book-Entry Confirmation that the Old Notes being tendered through DTC’s ATOP procedures have been delivered to the applicable account of the Exchange Agent at DTC, as the case may be, as well as a properly completed and duly executed Letter of Transmittal (or an Agent’s Message in lieu thereof) and any other documents required by this Letter of Transmittal and the Prospectus, must be received by the Exchange Agent (at the address set forth herein in the case of documents delivered physically), prior to 5:00 p.m., New York City time, on the Expiration Date. Old Notes tendered hereby must be in denominations of $2,000 and integral multiples of $1,000 in excess thereof, provided that, if any Old Note is tendered in part, the untendered portion of such Old Note must be a denomination of $2,000 or an integral multiple of $1,000 in excess thereof.

The method of delivery (whether physical or electronic) of Old Notes, Letters of Transmittal, Agent’s Messages, Book-Entry Confirmations and all other required documents is at the election and risk of the tendering holders, provided that Old Notes in book-entry form must be tendered through DTC’s ATOP procedures. If such delivery is by mail, it is recommended that the mailing be by registered mail, properly insured, with return receipt requested. In all cases, the holder should allow sufficient time to insure delivery to the Exchange Agent before 5:00 p.m., New York City time, on the Expiration Date. The holder may request the broker, dealer, bank or other financial institution or nominee through which it may hold Old Notes to effect these transactions for it. No Letters of Transmittal, Old Notes or other documents should be sent to the Company.

See “The Exchange Offer” section of the Prospectus.

2. PARTIAL TENDERS (NOT APPLICABLE TO NOTE HOLDERS WHO TENDER BY BOOK-ENTRY TRANSFER).

If less than all of the Old Notes evidenced by a submitted certificate are to be tendered, the tendering holder(s) should fill in the aggregate principal amount of Old Notes to be tendered in the box above entitled “Description of Old Notes—Principal Amount Tendered.” A reissued certificate representing the non-tendered Old Notes (which must be in a denomination of $2,000 or an integral multiple of $1,000 in excess thereof) will be sent to such tendering holder, unless otherwise provided in the appropriate box on this Letter of Transmittal, promptly after the Expiration Date. All of the Old Notes delivered to the Exchange Agent will be deemed to have been tendered unless otherwise indicated.

3. SIGNATURES ON THIS LETTER OF TRANSMITTAL; BOND POWERS AND ENDORSEMENTS; GUARANTEE OF SIGNATURES.

If this Letter of Transmittal is signed by the registered holder(s) of the Old Notes tendered hereby, the signature(s) must correspond exactly with the name(s) as written on the face of the certificate(s) without any change whatsoever. In the case of Old Notes tendered by book-entry transfer, the signature on this Letter of Transmittal must correspond exactly with the name appearing on DTC’s security position listing without any change whatsoever.

If any tendered Old Notes are owned of record by two or more joint owners, all of such owners must sign this Letter of Transmittal.

If any tendered Old Notes are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate copies of this Letter of Transmittal as there are different registrations of certificates.

When this Letter of Transmittal is signed by the registered holder or holders of the Old Notes specified herein and tendered hereby, no endorsements of the certificate(s) evidencing such Old Notes or separate bond powers are required. If, however, the New Notes are to be issued, or any untendered Old Notes are to be reissued, in the name(s) of any person(s) other than such registered holder(s), then such certificate(s) must be endorsed or accompanied by appropriate bond powers (satisfactory to the Company and the Exchange Agent in their sole and absolute discretion), in each case signed exactly as the name(s) of the registered holder(s) appear(s) on the certificate(s), and the signature(s) on such certificate(s) or bond powers must be guaranteed by an Eligible Institution.

If this Letter of Transmittal is signed by a person or persons other than the registered holder(s) of any certificate(s) specified herein, such certificate(s) must be endorsed or accompanied by appropriate bond powers (satisfactory to the Company and the Exchange Agent in their sole and absolute discretion), in each case signed exactly as the name(s) of the registered holder(s) appear(s) on the certificate(s), and the signature(s) on such certificate(s) or bond powers must be guaranteed by an Eligible Institution.

If this Letter of Transmittal or any certificates or bond powers are signed by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing, and, unless waived by the Company or the Exchange Agent, proper evidence satisfactory to the Company and to the Exchange Agent of their authority to so act must be submitted with this Letter of Transmittal.

Endorsements on certificates for Old Notes or signatures on bond powers or powers required by this Instruction 3 must be guaranteed by an Eligible Institution. As used herein, “Eligible Institution” means a firm which is a member of the Securities Transfer Agent Medallion Program, the Stock Exchanges Medallion Program or the New York Stock Exchange Medallion Program.

Signatures on this Letter of Transmittal need not be guaranteed by an Eligible Institution, provided the Old Notes are tendered: (i) by the registered holder(s) of such Old Notes (which term, for purposes of this Letter of Transmittal, includes any participant in DTC’s system whose name appears on a security position listing as the holder of such Old Notes) who has not completed the box entitled “Special Issuance Instructions” or “Special Delivery Instructions” on this Letter of Transmittal, or (ii) for the account of an Eligible Institution.

4. SPECIAL ISSUANCE AND DELIVERY INSTRUCTIONS.

Tendering holders of Old Notes should indicate in the applicable box the name and address to which New Notes issued pursuant to the Exchange Offer and/or substitute certificates evidencing Old Notes not exchanged are to be issued or sent, if different from the name or address of the person signing this Letter of Transmittal. In the case of issuance in a different name, the taxpayer or employer identification number or social security number of each person named also must be indicated. Holders tendering Old Notes by book-entry transfer may request that Old Notes not exchanged be credited to such account maintained at DTC as such holder may designate hereon. If no such instructions are given, such Old Notes not exchanged will be returned to the name and address or DTC account of the person signing this Letter of Transmittal.

5. TRANSFER TAXES.

The Company will pay all transfer taxes, if any, applicable to the transfer of Old Notes to it or upon its order pursuant to the Exchange Offer. If, however, New Notes and/or Old Notes not exchanged are to be delivered to, or are to be registered or issued in the name of, any person other than the registered holder(s) of the Old Notes tendered hereby, if tendered Old Notes are registered in the name of any person(s) other than the person(s) signing this Letter of Transmittal, or if a transfer tax is imposed for any reason other than the transfer of Old Notes to, or upon the order of, the Company pursuant to the Exchange Offer, the amount of any such transfer taxes (whether imposed on the registered holder(s) or any other persons) will be payable by the tendering holder(s). If satisfactory evidence of payment of such taxes or exemption therefrom is not submitted herewith or, in the case of Old Notes tendered by book-entry transfer, contemporaneously with the tender of such Old Notes, the amount of such transfer taxes will be billed to such tendering holder(s) or the Company may refuse to accept the Old Notes tendered by such holder.

6. WAIVER OF CONDITIONS.

The Company reserves the right, in its sole and absolute discretion, to waive, at any time and from time to time, satisfaction of any or all conditions of the Exchange Offer enumerated in the Prospectus.

7. NO CONDITIONAL TENDERS; DEFECTS.

No alternative, conditional, irregular or contingent tenders will be accepted. All tendering holders of Old Notes, by execution of this Letter of Transmittal or delivery of an Agent’s Message in lieu thereof, shall waive any right to receive notice of the acceptance of their Old Notes for exchange.

The undersigned acknowledges and agrees that neither the Company, the Exchange Agent nor any other person is under any duty to notify the undersigned or any other person of any defect or irregularity with respect to its tender of Old Notes for exchange, or if any Old Notes, Letters of Transmittal, Agent’s Messages, Book-Entry Confirmations or other documents are or are not received by the Exchange Agent, and no one will be liable for failing to provide such notification.

8. MUTILATED, LOST, STOLEN OR DESTROYED OLD NOTES.

Any holder whose Old Notes have been mutilated, lost, stolen or destroyed should contact the Exchange Agent at the address or telephone number indicated above for further instructions.

9. WITHDRAWAL RIGHTS.

Tenders of Old Notes may be withdrawn no later than 5:00 p.m., New York City time, on the Expiration Date.

For a withdrawal of tendered Old Notes to be effective, the Exchange Agent must receive, in the case of Old Notes tendered pursuant to DTC’s ATOP procedures, an electronic notice of withdrawal transmitted by DTC on behalf of the DTC participant that tendered such Old Notes or, in the case of Old Notes in certificated form, if any, tendered by physical delivery, a written (which may be given by telegram), electronic mail or facsimile notice of withdrawal at the address, electronic mail address or facsimile number above, in each case no later than 5:00 p.m., New York City time, on the Expiration Date. The notice of withdrawal must:

| · | specify the name(s) of the person(s) having tendered the Old Notes to be withdrawn and, if different, the name of the registered holder(s) of such Old Notes (or, in the case of Old Notes tendered by book-entry transfer, the name and DTC account number of the DTC participant that tendered such Old Notes), |

| · | identify the Old Notes to be withdrawn (including the CUSIP numbers and, in the case of Old Notes in certificated form, the certificate numbers thereof) and principal amount of such Old Notes, |

| · | in the case of Old Notes tendered through DTC’s ATOP procedures, specify the name and account number at DTC to which withdrawn Old Notes should be credited, |

| · | in the case of Old Notes in certificated form physically delivered to the Exchange Agent, be signed by the same person(s) and in the same manner as this Letter of Transmittal, including any signature guarantees (or, in the case of Old Notes tendered by book-entry transfer, be signed by or transmitted on behalf of the same DTC participant that tendered such Old Notes), or be accompanied by evidence satisfactory to the Company and the Exchange Agent that the person(s) withdrawing the tender has succeeded to the beneficial ownership of those Old Notes, |

| · | contain a statement that the holder or holders, as the case may be, are withdrawing their election to have the Old Notes exchanged, and |

| · | if this Letter of Transmittal was executed by a person or persons other than the registered holder(s), be accompanied by a properly completed irrevocable proxy authorizing such person(s) to effect such withdrawal on behalf of such registered holder(s). |

The signature(s) on a notice of withdrawal must be guaranteed by an Eligible Institution unless the applicable Old Notes were tendered by an Eligible Institution and the notice of withdrawal is being signed by the same Eligible Institution, and the signature(s) on any such irrevocable proxy must be guaranteed by an Eligible Institution unless the signatory to such proxy is an Eligible Institution.

Properly withdrawn Old Notes may be retendered by following the procedures described in this Letter of Transmittal and the Prospectus at any time prior to 5:00 p.m., New York City time, on the Expiration Date.

All questions as to the validity, form and eligibility (including time of receipt) of such notices of withdrawal and all other documents submitted and procedures followed in connection therewith will be determined by the Company in its sole and absolute discretion (which power may be delegated to the Exchange Agent), which determination shall be final and binding on all parties. Any Old Notes so withdrawn will be deemed not to have been validly tendered for exchange for purposes of the Exchange Offer and no New Notes will be issued with respect thereto unless the Old Notes so withdrawn are validly retendered and not validly withdrawn and are accepted by us.

Any Old Notes that have been tendered for exchange but which are not exchanged for any reason (including, without limitation, because the tender of those Old Notes has been properly withdrawn, because the Company did not accept those Old Notes for exchange or terminated the Exchange Offer, or if the tendering holder properly indicates that only a portion of the Old Notes being tendered are to be exchanged for New Notes), such Old Notes will be returned to the holder thereof (or, in the case of Old Notes tendered by book-entry transfer, will be credited to the accounts at DTC of the applicable DTC participant), unless the holder completed the box entitled “Special Delivery Instructions” in this Letter of Transmittal, in which case such Old Notes will be returned to the person specified in such instructions, without cost to such holder, promptly after withdrawal of such Old Notes or expiration or termination of the Exchange Offer, as the case may be.

10. REQUESTS FOR ASSISTANCE OR ADDITIONAL COPIES.

Questions relating to the procedure for tendering, as well as requests for additional copies of the Prospectus, this Letter of Transmittal and other related documents may be directed to the Exchange Agent at the address and telephone number indicated above.

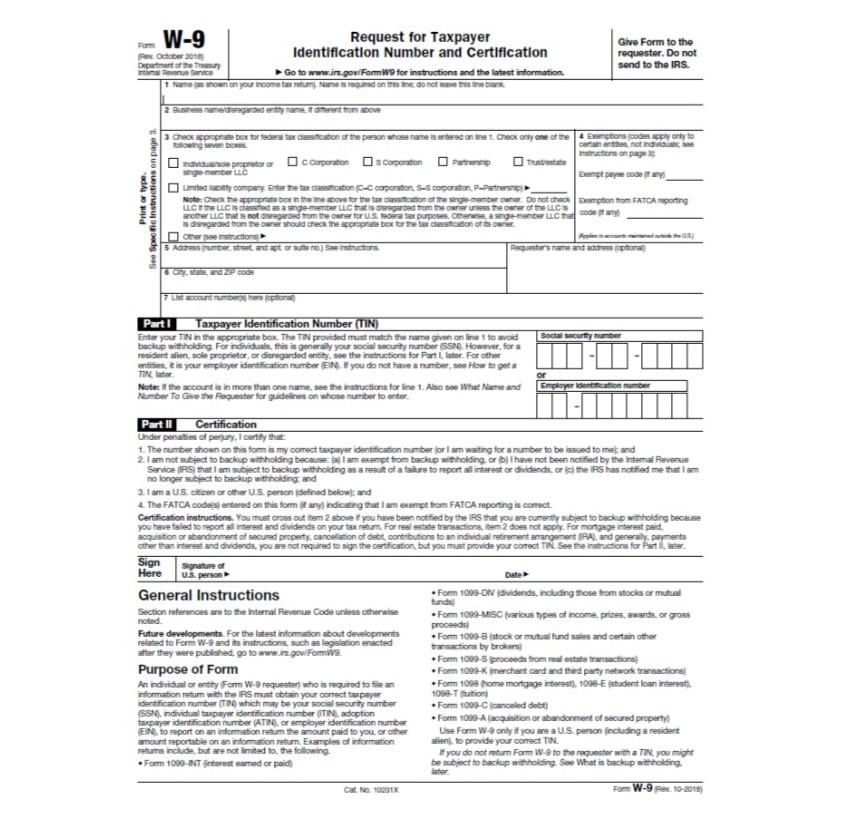

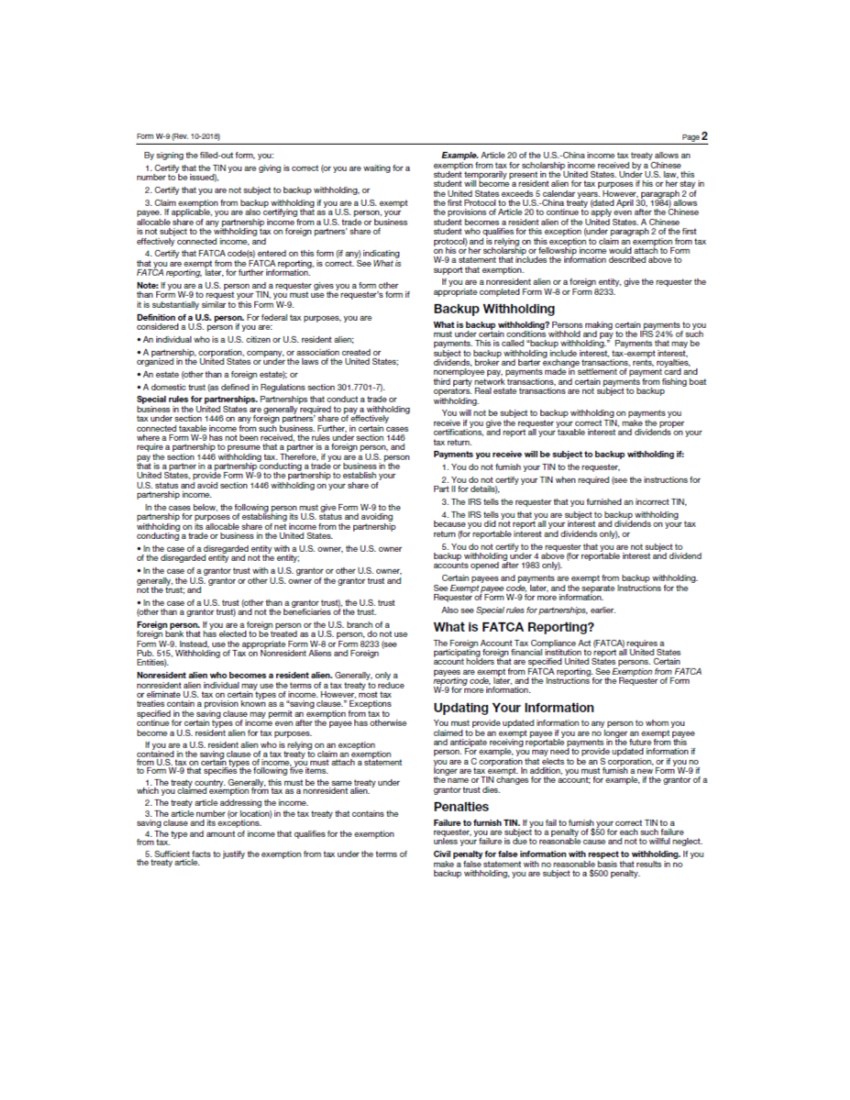

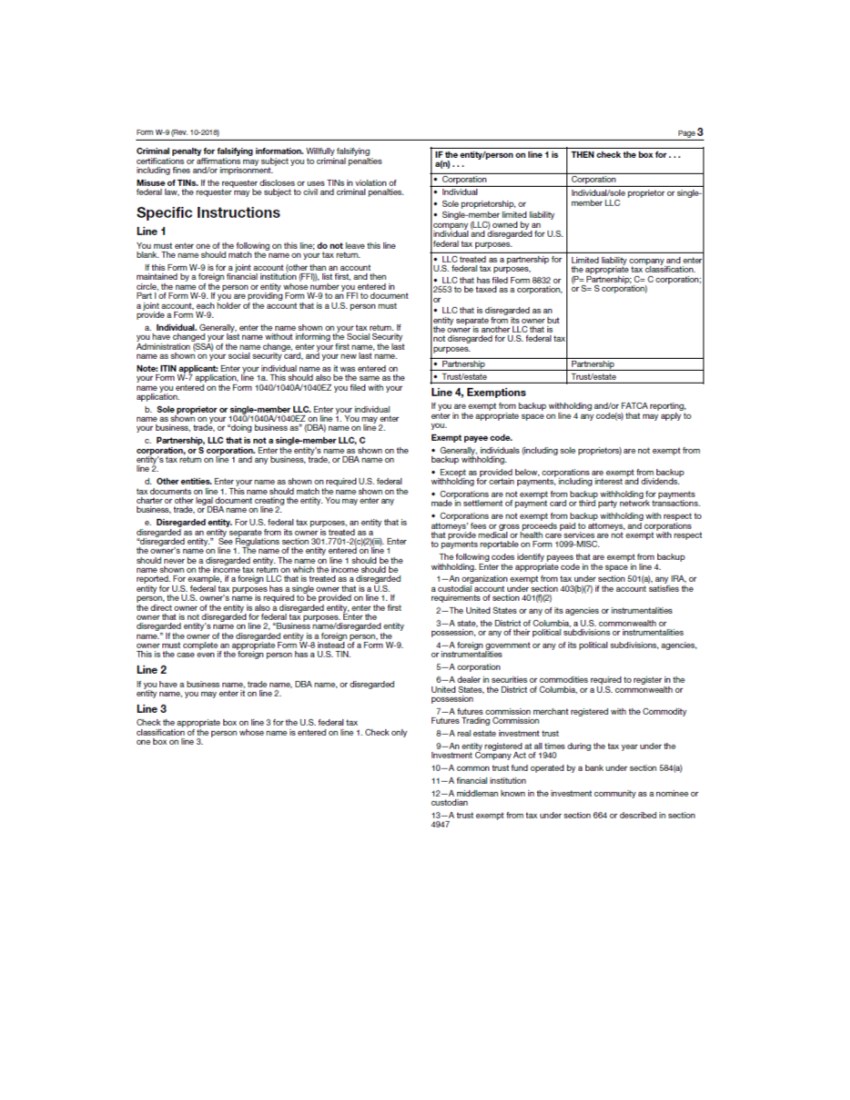

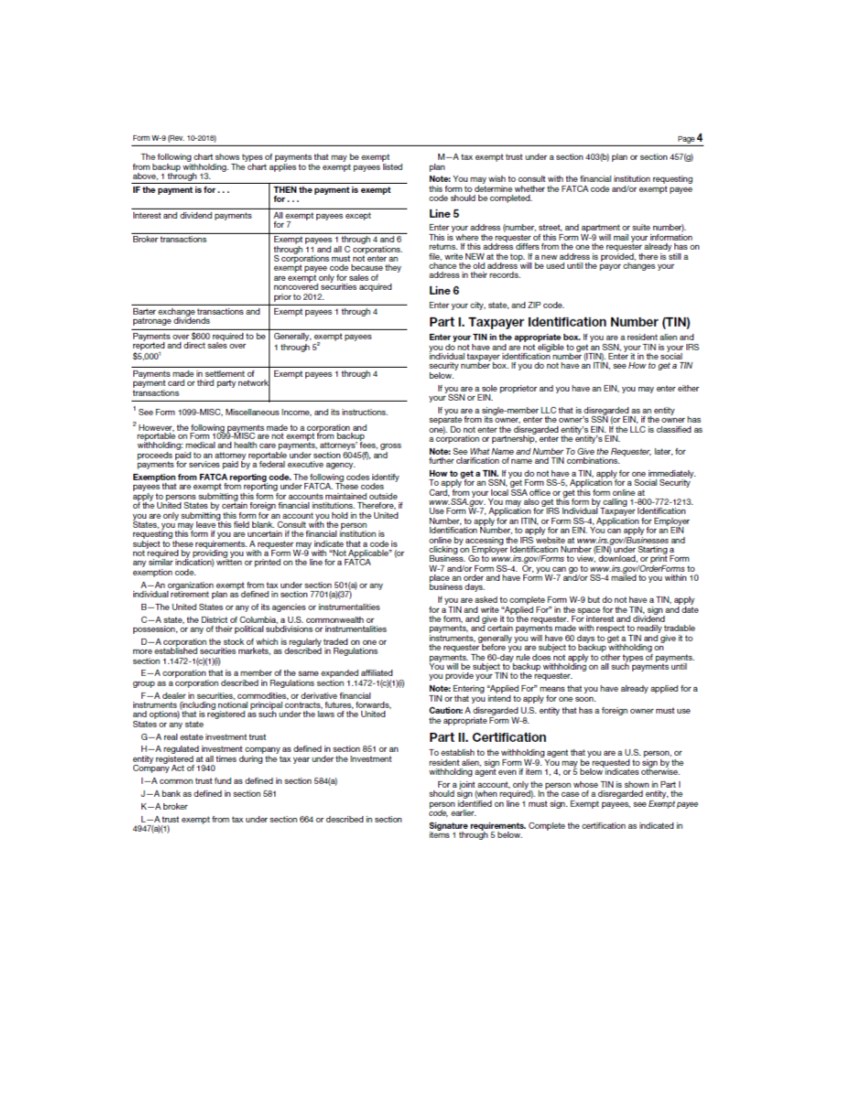

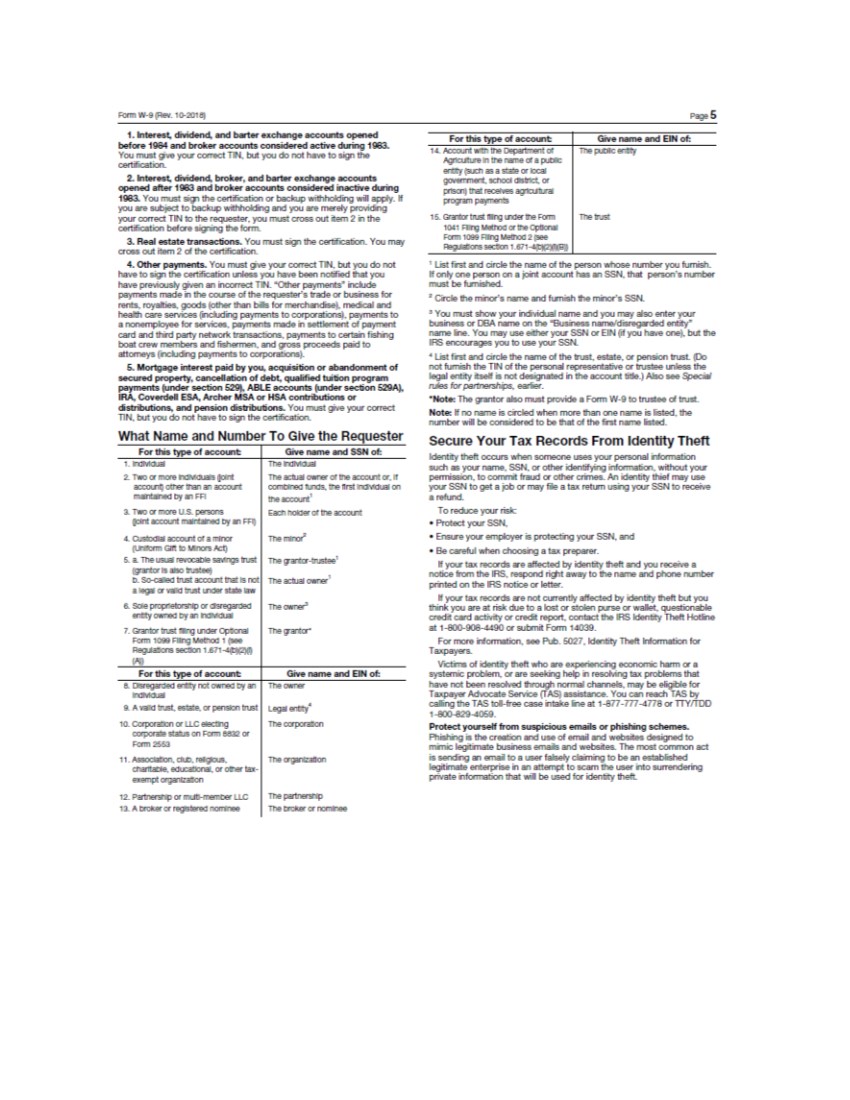

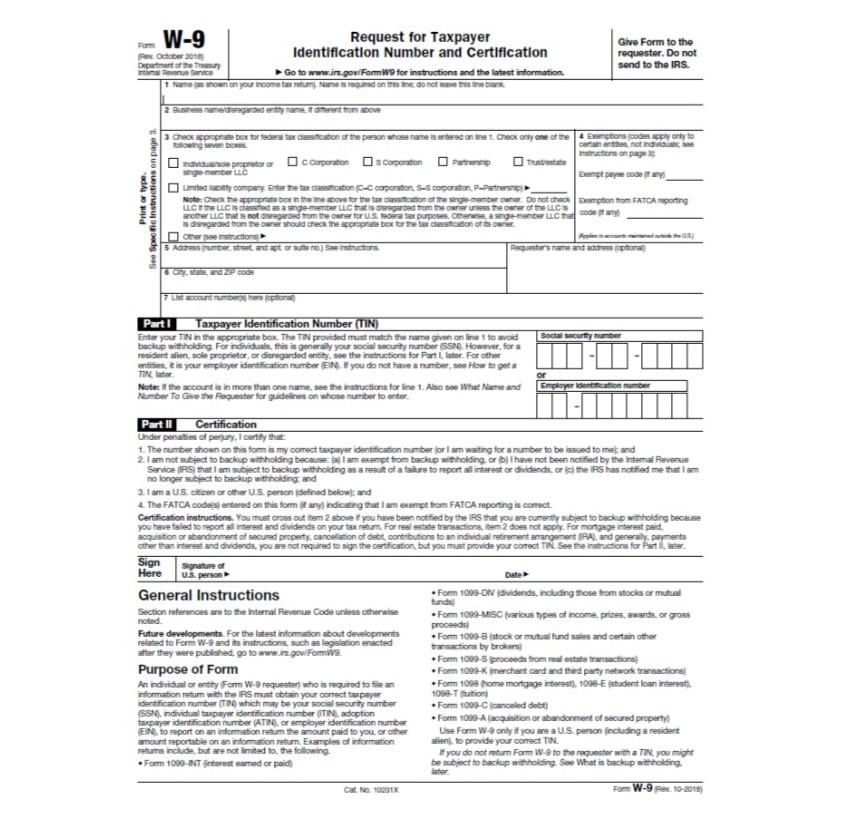

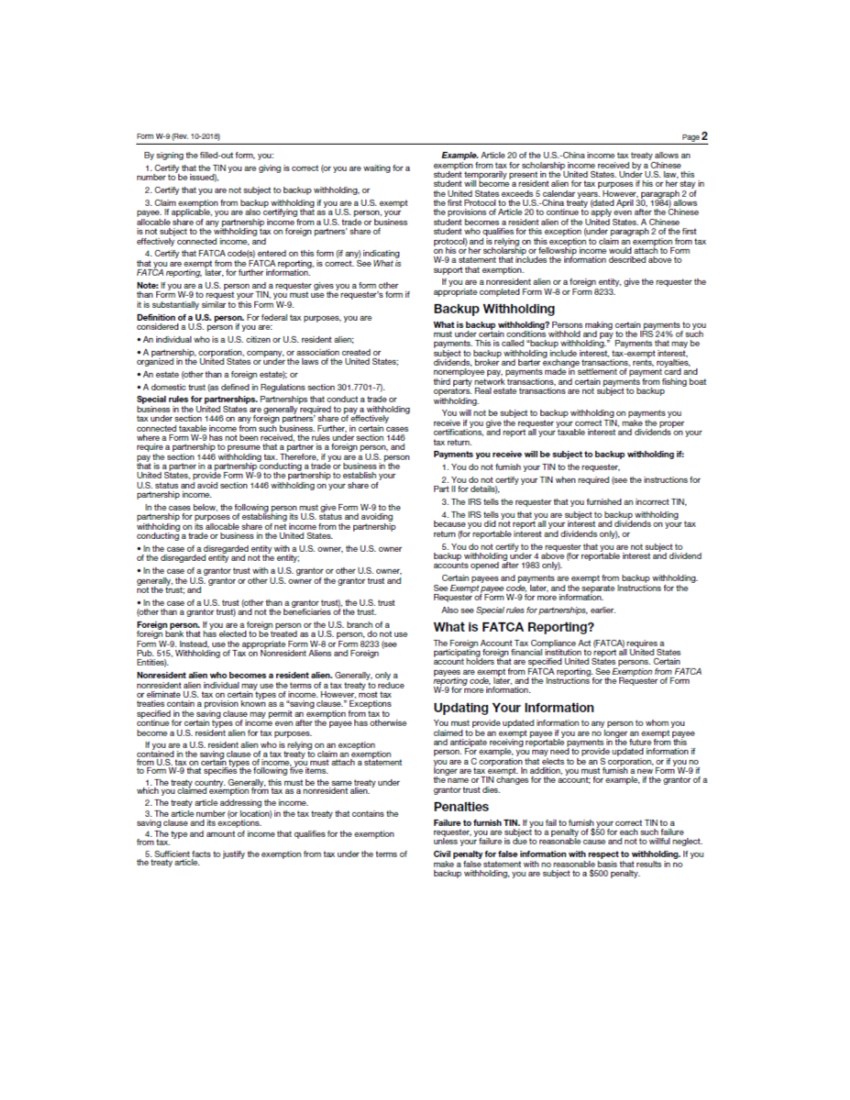

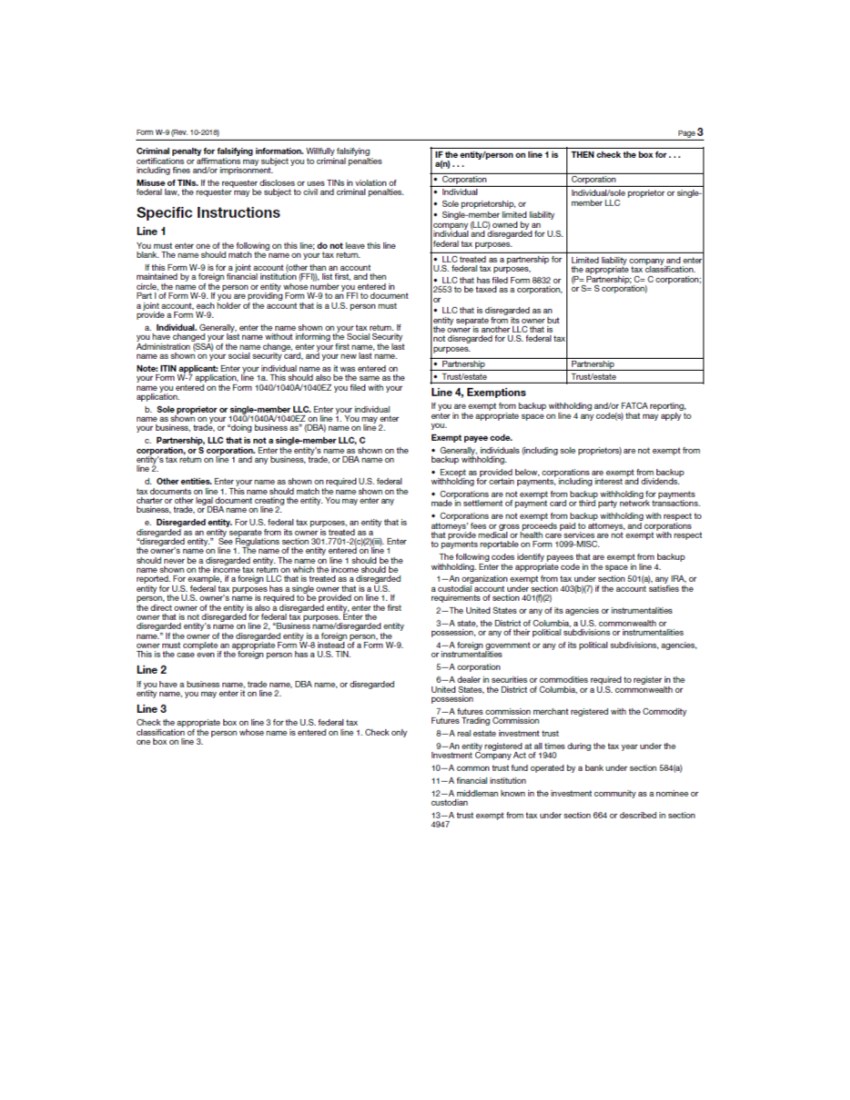

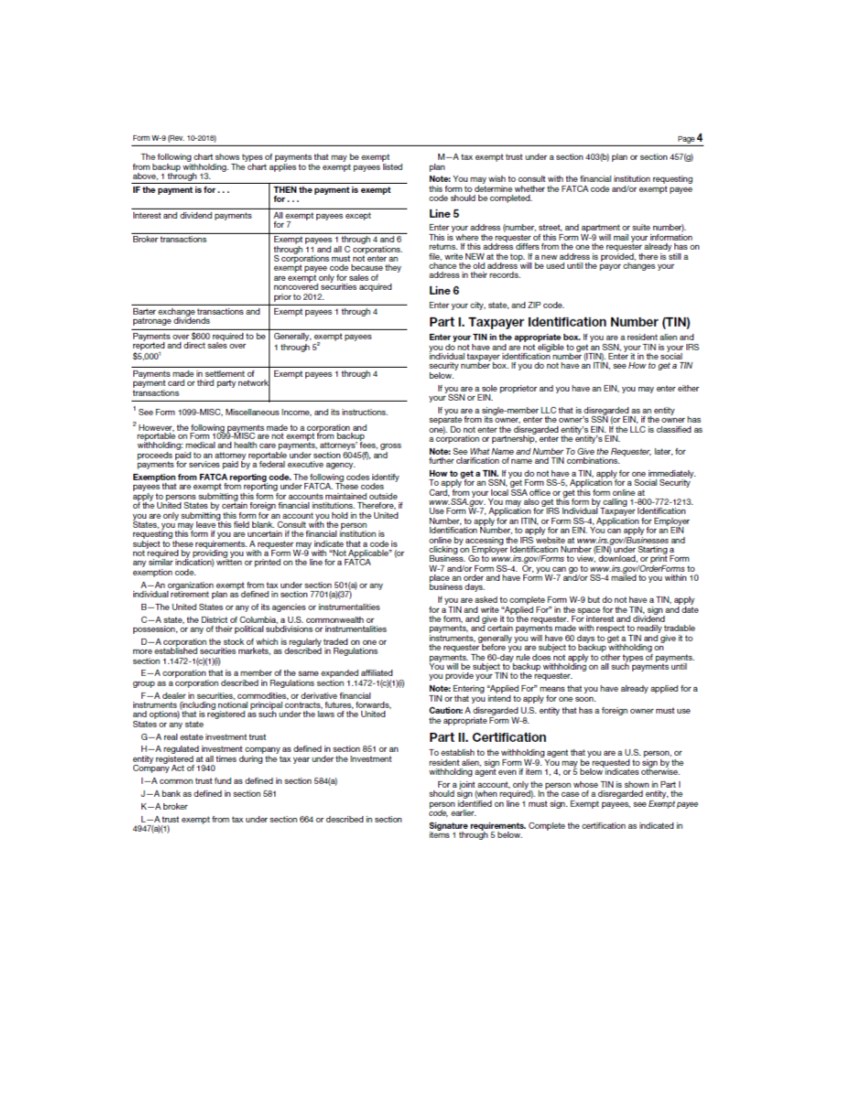

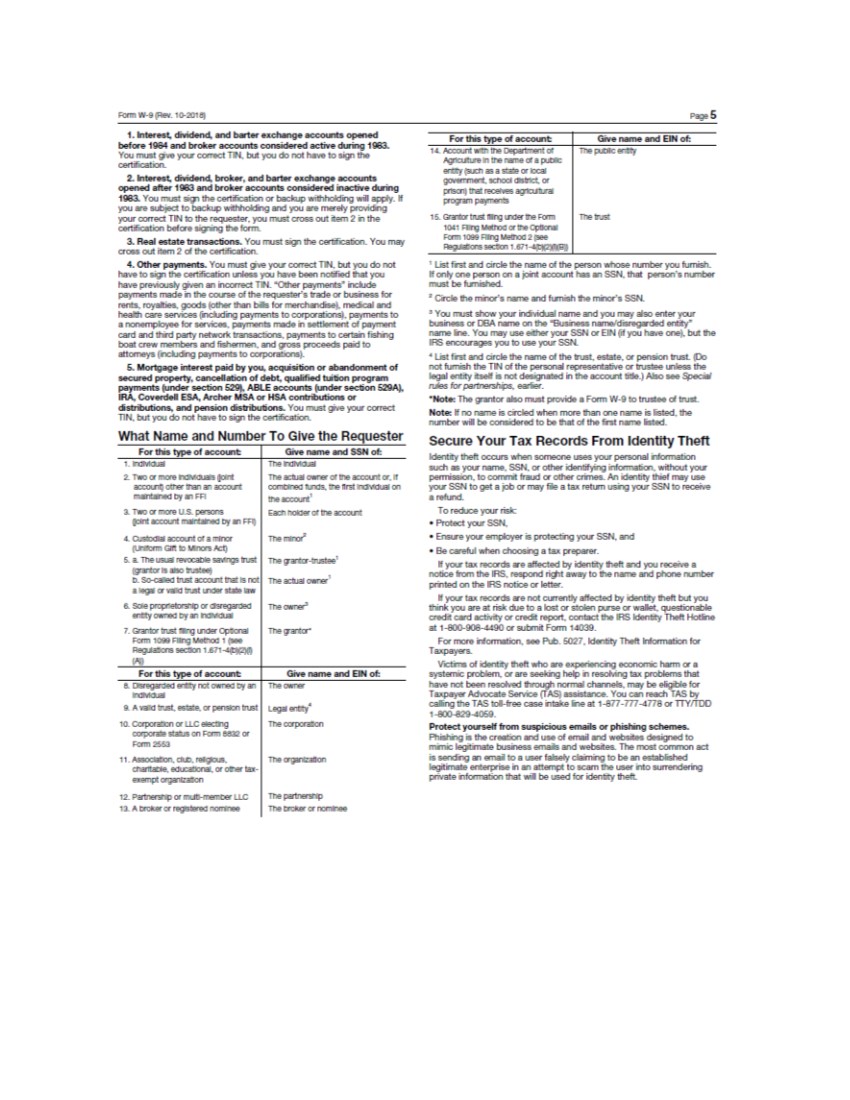

11. TAXPAYER IDENTIFICATION NUMBER AND BACKUP WITHHOLDING.

Under U.S. federal income tax law, a tendering holder whose Old Notes are accepted for exchange may be subject to backup withholding. To prevent backup withholding, each tendering holder must provide such holder’s correct Taxpayer Identification Number (“TIN”), which, in the case of a holder who is an individual, is generally such holder’s social security number, by completing the enclosed Form W-9, “Request for Taxpayer Identification Number and Certification,” and generally must certify under penalties of perjury that (i) the TIN provided is correct (or that such holder is awaiting a TIN), and (ii) (a) the holder is exempt from backup withholding, (b) the holder has not been notified by the IRS that such holder is subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified the holder that such holder is no longer subject to backup withholding, and (iii) the holder is a United States Holder. In addition, the holder must date and sign the Form W-9 as indicated. If the Exchange Agent is not provided with the correct TIN or a complete and executed Form W-9 evidencing a complete exemption from backup withholding by the time of the exchange, such holder may be subject to a $50 penalty imposed by the Internal Revenue Service and backup withholding at the applicable rate, 24% as of the date of the Prospectus, upon the amount of any reportable payments made after the exchange to such tendering holder. If withholding results in an overpayment of taxes, a refund may be obtained.

If a holder that is a United States Holder does not have a TIN, such holder should consult the enclosed Form W-9 instructions (the “W-9 Instructions”) for instructions on applying for a TIN, write “Applied For” in the space for the TIN, and sign and date the Form W-9. If the holder does not provide such holder’s TIN to the Exchange Agent by the time of payment, backup withholding will apply to payments made to such holder. Note: Writing “Applied For” on the form means that the holder has already applied for a TIN or that such holder intends to apply for one in the near future.

If the Old Notes are held in more than one name or are not in the name of the actual owner, consult the W-9 Instructions for information on which TIN to report.

Exempt holders (including, among others, all corporations and certain foreign persons) are not subject to these backup withholding and reporting requirements. To prevent possible erroneous backup withholding, an exempt holder that is a United States Holder should check the “Exempt payee” box on Form W-9. See the W-9 Instructions for additional instructions. In order for a holder that is not a United States Holder to qualify as exempt, such person must submit a completed Form W-8BEN, “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals),” or Form W-8BEN-E, “Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities),” signed under penalty of perjury attesting to such exempt status. Special rules apply to foreign partnerships. In general, the foreign partnership will be required to provide a properly executed Form W-8IMY, “Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting,” and attach thereto an appropriate certification from each partner. Finally, if a holder that is not a United States Holder is engaged in a U.S. trade or business, and if interest on a New Note will be effectively connected with the conduct of such trade or business, such holder should provide a properly executed Form W-8ECI, “Certificate of Foreign Person’s Claim that Income is Effectively Connected with the Conduct of a Trade or Business in the United States.” To the extent applicable, the appropriate Form W-8 may be obtained from the Exchange Agent. Holders (including Holders that are not United States Holders) are urged to consult their tax advisors with respect to the tax treatment of the exchange of tendered Old Notes for New Notes pursuant to the Exchange Offer, and to consider the discussion under “U.S. Federal Income Tax Considerations” in the Prospectus.

For purposes of these instructions, a “United States Holder” means a beneficial owner of a note that, for U.S. federal income tax purposes, is (i) a citizen or an individual who is a resident of the United States, (ii) a corporation created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income tax regardless of its source or (iv) a trust (x) with respect to which a court within the United States is able to exercise primary supervision over its administration and one or more U.S. persons have the authority to control all of its substantial decisions or (y) that has in effect a valid election under applicable U.S. Treasury regulations to be treated as a U.S. person.

| Fo<m W-9 R equest for Taxpayer Give Fonn to the !,'Rev. octODer 2018) Identification Number and certification requester. Do not Departmenl Cf the Tree.suy send to the IRS. JltEmal Rev«YJe S8Mce ► Goto www.irs.gov/FonnW9tor instructions and the latest information. 1 N a-ne (as snown on yoti" lnocme tax rectrn). Name is recJJlreo on tra 11ne: ao not ieave tnls 1 rie Clank.. 2 BLF.ffle5S name1c11 sregaroeo entity nwne. n omererrt trom aocwe .,; • 3 Chec:t( appropnale DOX ror 1 eoetS1 tax ctassmcatron Cf tne person wrose nane 1 s enleeeo en 1 rie 1 . Q'leCt( oniy one or tne 4 Exemptrons(cooes~iyor11to ~ f'OIOWlllQ SeYenDOXM • certain en lltles. not rie1Maua,s; ll88 • " '1StrUCtlons 00 page 3): C D 1 roaM~ ~ propffelor or D cco,po,- 0 S Corporatron 0 Partner8llp 0 T MVesta::e 0 .. srig•memt>er u. c E:nmpt payee cooeor a'IY) 11. . --- ~ti D umrteo 1at111 rtyoanpany. Etrt.er Irie taxciassmcatron(C..c oapcrauoo, s.s corpora:on, p ... ~ ) ►--- ~i Note: Olea( Ille apc:ropnate DOX ,n tne ane aoc,,,e fOf tne tax claSSlllc8tlon or tne SlllQIIHl'!Efntlef 0'Aner. Do noc en~ EXemptlcWl rom F'.AT CA reportlrg I! C LLC n tne UC IS CI~ asa Slr'Q~ «ntl« UC Nt l:S<l!St~eCI aom tne O\\net Lllle5S h Owr« Of tne UC t$ oooe praiy, ~- anotnet LLC tnat is not a1Stegaroeo iron, tne O'Aner1 or u.s. rean tax pt.rp05e9. ocner11_se, a 9rl!1@-memt>er u. c Illa: .. u IS d~tr omtneO'M'lef"ShCUCI CheCktne~a:.eDOXtortnetaxctas ~ orrtsowner . ,. §. □ Otr'Ef ('See lnstn.ctlcWl~ ► ,..,,_,,._ ....... ......, ......... !lS.) "' 5 Aoaree.s(r1.1rroec. street. ano apt. or ute no.)seemtruc11ons. Requestn name ano 8Cl<lress (opllorw) ; "' 6 City, sta:e, at'll ZJPcooe 7 US1 acooun l'l.lmDE!r($ ) nere (O pt!CW'lal) -· Taxpayer Identification Number (TIN) 1 soe1a1 secunty numoer I Enter you~ TIN in.the app . ro~~e box. ~'.8 TIN provided mus t.match t ':1e name giv en on line 110 avoid backup withholding. FOJ ind1 viduals, this is generally your social secuJty number (SSN). However, tor a residen t alien, sole proprietor, Of Orsregarded entity, see the iinsaruclions for Part I, later. For other entities. it is your empbyer identificalioo number (El~ . If you do not bav e a number. see How to get a TIN, later. [II] -[I] - I I I I I or Note:: ff the 8CCOU"Jt is in more than one nsrne. see the instructions for line 1. Also see What Name and Number To Give the F«Jqvester for guidelines on whose number to enter. I Employer ldenttncatlon numoer Certification Lhder penalties of perjury. I certify that: 1. The number shO\W'I on this form is my correct taxpayer idootificatiooi nunber (or I am waiting tor a nunber to be issued t o me): and 2.1 am no1 subject 1 0 backup withholding because: {a) I am exemp1 from backup v.ithholdilg. or (b) I have no1 been nocified by the rntemal Rev en1.e Service -ORS) that I am subject to backup withhokting as a result ofa tailur e to repon all interest or dividends., Of {c) the &RS has notified me that I am no longer subject to backup wi!N1oldilg; and 3.1 am a U.S. citizen or other U.S. person (defi ned below,: erid 4. The FATCA code(s) entered on this form (if any) incfica1ing lhal I ar. exempl from FATCA repott:ng is correct. Certification instructions. You must cross out item 2 above if you have been notified by lhe (RS that you are CUITently SLbject to backt.p withholding because you have failed torepat all rderest and dividends on your tax retum. Fos rea1 esta1e transactions, item 2 does no! apply. For mortgage i-rterest paid, acquisition or abandonment of secured property, caroellation of debt. contributions to an individual retiremenl arrangement ORA}. and _gen«ally, payments other than int!.Ye5 1 and dividends, you are n01 required to sign lhe ceri:ification, bul you musl provide ycu carecl Tlfil. See the mtruct10ns for Part ll, lat et. Sign Here I Signature OI U.S. person ► General Instructions Section references are to the Internal Revenue Code unless otherwiS>l notoo. Fl.lhKe developments. For the lates1 intonnalion about developments rela':ed to Form W-9 and its instructions. such as legislation enac1ed after they were published. go to www.irs.gov /FonnW'9. Purpose of Form An individual Of en tity (Fonn W-9 requester) \\ho is requ:i'ed to file an infonnation retum with the IRS must obtain your correct taxpayer identificalion number (rlN) which may be your social s.ectXity numbec (SSN). individual taxpayer identifica tion rumber {ITIN}. adoption taxpayer identification rumber (A TIN). or employer identif ication num:ier (E&N). to repon on an inf ormation return the emoun1 paid to you, or ol1er amoun.t reportable on an infonna1ion retum. Examples of information returns include, but are noc limited to. the foDowing. • Form 1099-INT (intere~ earned or paid} cat. NO. 102:31'.< Date ► • Fonn 1099-0 IV (dividends, inauding those from stocks or mutual fl.J"lds) • Fonn 1099-MJSC (vSl'ious types of income, prizes, awards, Of g-o» p<ooHds ) • Fonn 1099-8 (stock or mutual fund sales and certain other trerisac1ions by br okers) • Fonn 1099-S {proceeds from real es&ate transactions) • Fonn 1099-K (mercharu card erid third party network transactions) • Fonn 1098 Q1ome mortgage interest). 1098-E (studen.t loan intere&t). 1 ooerr (tuition ) • Fonn 1099-C (canceled debt ) • Form 1099- A (acquisition or absndonment of secur ed property ) Use Form W-9 only ii you are a U.S. person (ll"lciuding a resident alien). to P"Ovide y<:M correct TIN. H you do not rel.Urn Form W-9 to the requester with a TIN. you m~t be subject to backup withhola' Jf19. See \~ t is backup withholdi"lg. Ja.rer . F"orm W-9 {Rev . 10-2016) |

| By sigling the filled-out fonn. you: 1. Certify th81 the TIN you are giving is carec1 (or you are waitng foe' a number 10 be issued}. 2. Certify th81 you are no1 subject 1 0 backup withholding. or 3. Claim exemption frcm backup withholdi"lg if you are a U.S. exempt payee. ff applicable, you are also certifying lh81 as a U.S. person, your allocable shar e of any partnership income from a U.S. trade or business is not subj ect to the wi:hholding lax on foreign partners' share of effeaively connected inoome. and 4. Certify that F ATCA code(s) entered on this form (d any) indicatng that you are exempt from the FATCA reporting. is oorrect. See What is FA TCA reportjng. la ter. foe' funher information. Note:: ff you are a U.S. person and a requester gives you a fonn OCher than Form W-9 to request your TIN, you must use the requester's fonn it i1 is Wbstantialty similar to this Form W-9. Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are: • An individual v.tiO is a U.S. citizen or U.S. resident alien: • A pennership, oorporation, company. or association created or organized in the United Sca~es or under lhe laws of the United States.; • An estrue (other than a toreigl estate): or • A domestic in.m (as defi ned in Regulations section 301. 7701-7). Special rules for partn,e.rshjps. Partnerships that oonduct a trade Of business in the United Scates are generally required to pay a withholding tax under sec6on 1446 on any foreign partners' share of effectively connected 1 axabJe incane from such business. Further , in certan cases where a Form W- 9 has not been received. the rules oocler section 1446 require a pennership 1 0 presume that a partner is a fOfeign person, and pay the section 1446 withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership conducting a 1 rade °' busnes8 in the l.hited Stat es., provide Fonn W-9 to lhe partnership 1 0 establish your U.S. status and avoid section 1446 withholdng on yoot shar e of partnership inoome. .-. lhe cases below, the follov.ing person musa give Fonn W-9 to the partnership fOf pwposes of establishng its U.S. status end avoiding withholding on ils allocable share of net income from lhe pennership conducting a trade°' busness in the United Slates. • .-. me case of a disregarded entity with a U.S. owner , the U.S. owner of the d' rsregarded entity and not me entity; • .-. me case of a grantor 1 rust with a U.S. grantOf °' other U.S. owner, generally, 1 he U.S. gantor« other U.S. owner of thegrantor trust and not the ~ and • .-. me case of a U.S.1rust (ocher than a gran tOf 1 rust}. the U.S.1rust (other 1 han a grant or trust) and not the beneficiaries of the trust. Foreign person. If you area foreigl person°' me U.S. b'anch of a foreigl bank that has elected to be lreated as a U.S. person, do not use Fonn W-9. Instead, use me appropriate FOfm W-8 or Fonn 8233 (see Pub. S1S, Withholding of Tax on Nonresident Aliens and Foreign Entities). Nonresident alten who becomes a resident alien. Generally, onty a nawesident arien individual may use the 1 enns of a 1 ax treaty to reduce or eliminate U.S. tax on certain types of incane. However, most tax treaties contain a provision known as a "saving clause.• Exceptions specified in the saving clause may permit an exemption from tax to continue for certan 1ypes of income even after 1 he payee has otherwise become a U.S. resident alien for tax purposes. If you are a U.S. resident af ien who is retying on an exception contained in me saving clause of a lax treety to claim an exempcion from U.S. tax on cena,n types of inoome, you must anach a statement 1 0 Fonn W-9 that specifies the following five items. 1. The tre..-y country. Generally, this must be the same 1 reary under which you cJained exempcion from tax as a nonresident alien. 2. The treay article addressing the income. 3. The articJe number (or location) in the 1 ax treaty that contains the saving clause and its exceptions. ~~type and amount of inoome lh8I qualifies for the exemption S. Sufficien1 facss to justify the exempcion from tax under me terms of the trea ty articJe. Page 2 Example. Article 20 of the U.S.-OW'la inoome tax lreaty allows an exemption from 1 ax fOf scholarship incane received by a Chinese a udent temporarily present in the United States.. Under U.S. Jaw, this a udent wil beoome a resident alien for tax pu'l)OSes ii his or her stay in the United States exceeds S calendar years.. However, peragaph 2 of the first Protocol to the U.S. 4 China treaty (da ted April 30, 1984) allows the provisions of ArticJe 20 to continue to apply even after the Ctmese a udent becomes a resident alien of the United States.. A OW'lese a udent \\ho qualifies for this exception (under paragraph 2 of lhe first protocol) and is retying on this exception 1 0 claim an exempcion from tax on his°' her scholarship or fellowship inoome WOUid attach 1 0 Fonn W-9 a statemen1 that includes 1 he information described aboYe 1 0 &Jpport lh81 exemption. If you are a nonresident af ien Of a foreign entity, give the requester lhe appropriate completed Form W-l!> °' Form 8233. Bacl<up Witllholding What is backup withholding? Persons making certain payments to you mua under certain oond' ll:ions withhold end pay to me IRS 24% of such paymeots. This is called "backup wi!N1oldi"lg. • Payments lh8I may be &Jbject to backup wi!N1oldi"lg inaude interest, tax-exempt interest, dividends, broker and barter exd\ange transaclioos, rents. royalties, nonemployee pay, payments made in senlemenl of payment card and lhird party network 1 ransactions, and certain paymeots from fishing boat operat ors.. Real estate 1 ransactions are noc &Jbject 1 0 backup withholding. You will noc be subject to backup withholding on pa-;ments you receive if you give 1 he requester yoot correct TIN, make the proper certifca1ions., and report all yoot 1 axable interest and dividends on your tax return. Payments you receive wiJI be subject to backup withholding if: 1. You do not furnish your TIN to 1 herequester, 2. You do not certify your TIN when required (see the instruc1ioos for Pert II fOf details ), 3. The IRS tells the reqooster that you hxnished an inoorrect TIN, 4. The IRS tells you that you are &Jbject 1 0 backup wi!N1oldi"lg because you did not repon an your interest and dividends on yoot 1 ax return {for reportable interest and dividends only), or S. You do not certify 1 0 the requester lh8I you are noc subject 1 0 backup withholding under 4 above por reportable interest and dividend aooounts opened after 1983 only). Certail PS'fOOS and payments are exempl from backup withholdi"lg. See Exempt payee code , later, and lhe sepsrate hsll\JClioos for the Requester of Form W- 9 for more f'Jformation. Also see Special rules for partnerships, earlier. What Is FATCA Reporting? The Foreigl Accou,t Tax Compli ance Act (FATCA)requiresa penicipatng foreign financial institution to report all United Scates aoooun1 holders that are specified United Sca~es persons.. Cer&ain payees are exempt from F AT CA reporting. See Exemption frrm FATCA reporting code , laer, and the hslruc1ioos for the Requester of Form W-9 fOf mOfe information. Updating Your Information You ITll.m provide updated information 1 0 any person 1 0 whom you claimed to be an exempt payee if you are no longer an exempt payee erid anticipate receiving reponable payments in the M ure from this person. For example, you ma y need to provide updated f'Jformation if you are a C oorporation that elects 1 0 be an S corporation, or if you no longer are tax exempt. In addition., you must furnish a new Form W-9 if lhe name or TIN changes for the accou,t; for example, if the grant or of a granlOf trust dies. Penalties Failure to furnish TIN. If you tail to fumish your correct TIN to a requester, you are subj ect to a penalty of $SO for each such faiue unless your failure is due 1 0 reasonabJe cause and not 1 0 willful neglect. Civil penalty for false infonnation with respect to withholding, If you make a false statement with no reasonable basis that resutts in no backup withholding, you are subject to a SSO0 penalty. |

| Form W4(Rev. 1~20 18) Criminal penalty for falsifying information. Willfully falsifying certifications Of aff .rma6ons may subjecl you to criminal penalties including f.nes and/or imprisonment. Misuse of TINs. If the requester discJoses or uses TINs in violation of federal law, the requester may be subjecl to civil and criminal penalties. Specific Instructions Line 1 You must enter one of the follolNing oo this Jne: do not leave this line blank. The nan-.e should match the name on ycAX tax return. ff this Form w .9 is for a joint account (other than an accoun.t maintained by a foreigl financial institution {FFO ), list first. and then circle, the name of the person or entity \\hose number you entered in Pan I of FOfm W•9. If you are providing Form w .910 an FA 1 0 doc:umoot a joint aooount, each holder a the account th81 is a U.S. person m,sa P"Ovide a Fonn W•9. a. Individual. Generslty, enter the name shO'YITI oo your tax retum. If you have changed your last name without inf OfrTif'lg the Social Security Adminislra!ion (SSA) of the nan-.e change, enter your f.-sa nsrne, the last name as shovm oo your social security card, and your new last name. Note:: ITIN applicant Enter Y04X individual name as it was entered on your Fonn w.7 app]ication, line 1a. This should also be the same as the name you en tered oo dle Fom, 1040/H)40A/1040EZ you filed with your application. b. Sole proprietor or single•member UC. En.ter your individual name asshovm oo your 1~ 0/1040A/1040EZ on Jne 1. Y ou may enter your business, trade, or "dong business as " {OBA) name oo li ne 2. c. Partnership, UC that is not a singl~member UC, C corporation. , or S corporation. Enter the en tity's nan-.e as shown on the entity's tax rehm oo lne 1 and any business, trade,°' OBA nan-.e on li ne 2. d. Other entities. Enter your name as shown on requi'ed U.S. federal lax documents on Jne 1. This name should match the name shown on the charter or other legal document creating the eniity. You may enter eny business, trade, or O BA name on li ne 2. e. Disregarded entity. For U.S. federal tax purposes., an entity dl81 is O rsregarded as an entity separate fr om its owner is treated as a "disregarded entity." See Regula1ions sec1ioo 301.n o1.2(c)C2)(i:). Enter dleowner's name oo li ne 1. The name of the entity entered on line 1 should never be a O rsregarded entity. The nsrne on li ne 1 shoUld be the name shovm oo the income tax retum on v.tiich the income should be reported. For example, if a fOfeign LLC dl81 is treated as a disregarded entity for U.S. federal tax pwposes has a &ngleownerthat is a U.S. pe('SOO, the U.S. owner's name is required 1 0 be provided on line 1. 11 dle direct owner of the eotity is also a disregarded entity, enter the fna a,;ner dlat is no1 disregarded fOf federal tax purposes. Enter the O rsregarded entity's name on line 2, "Business nsme/disregarded entity name." If the owner of the disregarded en tity is a foreigl person, the a,;ner must complete an appropriate Fonn w .a instead of a Fom, W-9. This is the case even rf the foreign person has a U.S. TIN. Line 2 ff you have a busines5 name. trade name, OBA nan-.e. or disregarded entity name, you may enter it on line 2. Line 3 Oieck the apP"Opriate box on line 3 fOf the U.S. federal tax classification of the pe('SOO whose name is entered oo line 1. Check ooty one box oo li ne 3. IF the entity/pe,rson on line 1 is a(n} •• . THEN check the box for . •• . Corporation Corporation . Individual Individual/sole proprietor or single• . Sole proprietorship, or member LLC . Single-member wnited liability company (LI.C) °"""" by an individual and disregarded fOf U.S. federal tax pu-poses. • U C treated as a pannership for U.S. federal lax purposes, Limited liability company and enter the 8PP'Opria';e tax d assification. • U C 0181 has filed Fonn 8832 or (P= Pannership; C= C oorporation; 2553 10 be taxed as a cotp01'81ioo, or S= S cotp0ration ) a • U C 0181 is disregarded as an entity separate from ics owner but dle owner is anolher U C 0181 is not disregarded for U.S. federal tax pu-poses. • Partnership Pertnership • Trust/estate Trust/estate Line 4, Exemptions 11 you are exempt from backup withhokling and/or F ATCA reporting, enter in dle appropriate space oo line 4 eny code(s) that may apply 1 0 you. Exempt payee code. • Geoeralty. individuals (lnclUO n g soJe P"Oprietors) are no1 exempt fr om backup withhokting. • Excepc as provided below, oorporations are exempt from backup withholding for certain payments, includi"lg interesi and dividends. • Cotporations are not exempc from backup withhola n g for payments made in settlement of pa~ card Of dlird party network transactions. • Cotporations are not exempc from backup withhola n g with respect to attorneys' fees°' g-oss proceeds paid 1 0 attomeys. and corporations that provide medical or health care services are not exempt with respect to payments reportable oo Form 1099..MISC. The following codes ideotify payees that are exempt from backup withholding. Enter the appropriate code in the space in li ne 4. 1-An organization exempt from tax under section 501(8), any IRA. or a custOO ial 8CCOU'lt under section 403(b)(7} if the account 681isfies the requiremen. ts of section 401(f){2) 2 - The lki ited Stal:es « any of ics ageocies or instn.r ne nt a[ities 3 -A state, the District of Columbia., a U.S. commonwealth or possession, or any of thei r political subdivisions or instrumentafllies 4-A fOfeign govemmoot Of any of its political subdivisions, agencies, or instnr nenta[ities 5-A corporation 6-A dealer in securities or commoarties requ:i'ed to regisler in the lki ited States, the District a Columbia.,°' a U.S. commonwealth or possession 7 -A futures conmission merchsrit regislered with the Commodity Futures Trading Commission 8-A real estate invesiment trusl 9 -An entity registered at all tines duri ng the tax 'feal under the lnvestmeni Company A.Cf: of 1940 10-A common trust fund operated by a bank under section 584(8) 11 -A f.nanc:ial institution 12-A middleman kna,;n in the investment community as a na"ri nee or custodian 13-A trust exempt from tax under section 664 or described in section 4947 |

| The followng chart shows types of pa yments that may be exempt from backup withholding. The chan applies to the exempc payees listed above, 1 through 13 IF the payment is for. lrcerest and dividend payments B'Oker transactions Saner exchange uansactions and puronage dividends THEN the payment is exempt for . . . AH exempt payees excep1 fo,7 Exempt payees 1 througl 4 and 6 thrc>Ugl 11 and all C corporations.. S corporations must not enter an exempt payee code because they are exempt only f OJ sales oC noncovered securities acqui'ed prior 1 0 201 2. Exempt payees 1 thrc>Ugl 4 Payments over S600 requi'ed to be Generally. exen,pt payees rEpotted and direct sales over 1 ttwougi 51 ss. 0001 Payments made in settlement of Exempt payees 1 thrc>Ugl 4 payment card Of 1 hird party network transactions 1 See Fonn 1099-MlSC. Miscebsrieous Income, and its instrucCioos.. 2 However. the following payments made to a corporation and ,e,ponable on Form 1099-M ISC are not exempt from backup withholding: medical and health care paymeot:S-, anomeys' fees., goss proceeds paid 1 0 an attomey reportable under section 604S(1). end payments foe' services paid by a federal executive agency. E< emPUOn from FATCA reoortino code. The followino codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this fonn tor aooounts maintained outside ol the lklited Sta tes by certain foreign f.nsncial insaitutioos.. Therefore, if you are only submittng this form for an aooount you hokl in the lklited Sa t es., you may leave this field blank. Consult with the person requesting this form if you are uncertain it the f.nancial insaitution is subject to these requirements. A requesier may indicate that a code is no1 r~~ir~ by ??vicliOQ you with.a Fonn w.g with "NOi Applicable" (or any S1md ar f1dication) wnnen or pnnted on the line foe' a F ATCA exemption code. A-An organization exempt from tax under seccion S01{a ) or any in::fividual recirement plan as defined in section n o1(a)(37) 8-The United Sca~es or any of its agencies or insarumentalities C-A Slate, the District of Columbia, a U.S. commonwealth or posses.sion, or any of < heir political subdivisioos or instrumeotafllies 0-A corpora1ion the stock of v.tiic:h isregulatfy b'8ded on one or rrore es&abfrshed securities markets, as described in Regulations s«:1ion 1.1472•1{cK1 }(1} E -A corporation that is a member of the same e.xpanded affiliated group as a corporation described in Regulations seaion 1 .14 72• 1 {cK1 }(i} F-A dealer in securities, convnodities, or derivative f.nancial ir&t:n.Jneots (Including nc:ciooal principal contracts, futures, forwards, and options) that is regisaered as such under the laws of the lklited Sa t es. or any stal:e G-A real estate investment trust H-A regulated invesament oompany as def.ned in section 851 or an entity registered at all times duri"lg the tax year ooder the tlvestment O:,mpany Ace of 1940 1-A convnon 1 rust fund as def.ned in seccion S84(a ) J-A bank as defined in seccion 581 K-Abroker L-A trust exemp1 from tax under seccion 664 or described in section 4947(a)(1) Page 4 M-A tax exen,pt trust ooder a section 403(b) plan or secton 457(9) plan Note: You may wish to consult with the financial institution requesting this form 1 0 determine whe:tier the FATCA code and/or exenpt payee oode should be completed. Line 5 E nter your address ~ mber, street. and apenment or suite rumber). This is v.here the requester of this Fam W-9 will mail your in'onnation retixns. If this address d' rffers from the ooe the requester U&ady has on file, write NEW 81 lhe top. If a new address is provided. there is still a chance~ ol<:S address will be used until the payor changes your address ,n their reoords. Line 6 E nter your city, state, and ZIP code. Part I. Taxpayer Identification Number (TIN) Enter your TIN in the appropriate box. If you are a residentafien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification romber -OTIN}. Enter it in thf social security m.m ber box. If you do n01 have an ITTN, see How to get a TIN below. 11 you are a sole proprietor and you have an EIN, you may enter either ycuSSNorEIN. 11 you are a single-member LLC that is disregarded as an rotity separate from its owner , enter lhe owner's SSN (or EIN, if the owner has one). Do n01 eoter the disregarded eotity's EIN. 11 the LLC is dassified as a corpora1ion or partnership, enter the entity's EIN. Note: See Wha.r Name and Number To Gve rhe Requester, li ter, for further clarification oC name and TIN comtwlations. How to ge t a TIN. If you do not have a TIN, apply for one inmediately. To app,y ror an SSN, get Form ss.s. Appncauon 1 or a SOc:talsecun:ry Card, from your local SSA office or get this fonn onJne 81 w.vw.SSA.gov. You may also get this form by c.allng 1.80().772.1213. Use Form w. 7, Application for IRS Individual Tax.payer ldent fication Number, to apply for an ITIN, or Form SS..t, Application for E mployer Identification ~ mber, 1 0 apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/Bus.inesses· end clicking on Employer ldeotification Number (EIN) under Slaniig a Business. Go to w.vw.irs..gov/Fotms· to viE'N, dolNnload, or print Form W•7 and/or Fonn SS..t. Or, you can go towww .irs..gov/Ordt:tForms to place an order and have Fonn w.7 erid/or SS-4 mai.led to yru within 10 business days.. 11 you are asked to oomplete Fonn w.g but do not have a TIN, apply for a TIN and ...,..ite "Applied For" in the space for the TIN, sicn and date the form, and give it 1 0 the requester. For interest and divicle - nd payments. and certain payments made with roopea to readi~ tradable insarumenta, generally you win have 60 days 1 0 get a TIN and giv e it 1 0 the reqoosaer before you are subject to backup withhold' n g on payments. The 60-day rule does not apply 1 0 other types oC payments.. Y ou wiU be subjecl to backup withhdding on all such payments until you provide ycu TIN 1 0 the requester. Note: E ntering •Applied For" means that you have already applied for a TIN or thal you intend to apply for one soon. Caution: A disregarded U.S. entity that has a foreigl owner must use the appropriate Form w..a. Part II. Certification To esaabli sh to the wilhholding agent that you are a U.S. peoon, or resideot alien:., sigl Form W-9. You may be requested to sign by the withhold'ng agent even if item 1, 4, or 5 below indiaues othewise. For a joint account, only the person whose TIN is shown fl Pan I shoUld sign (when required}. .-. the case of a disregarded entity, the person identified on line 1 must sig,. Exempt payees, see &smpt payee code, earlier. Signature requiremeots. Complete the certification as indicated in it~ 1 through 5 below. |