- JXN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Jackson Financial (JXN) 8-KRegulation FD Disclosure

Filed: 7 Aug 24, 4:24pm

Exhibit 99.1

August 8, 2024 Jackson Financial Inc. Second Quarter 2024 Financial Results

Forward - Looking Statements and Non - GAAP Measures The information in this document contains forward - looking statements about future events and circumstances and their effects upo n revenues, expenses and business opportunities. Generally speaking, any statement in this document not based upon historical fact is a forward - looking statement. Forward - lookin g statements can also be identified by the use of forward - looking or conditional words, such as “could,” “should,” “can,” “continue,” “estimate,” “forecast,” “intend,” “look,” “m ay,” “will,” “expect,” “believe,” “anticipate,” “plan,” “remain,” “confident” and “commit” or similar expressions. In particular, statements regarding plans, strategies, prospects, tar gets and expectations regarding the business and industry are forward - looking statements. They reflect expectations, are not guarantees of performance and speak only as of the dates the statements are made. We caution investors that these forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ mate rially from those projected, expressed, or implied. Factors that could cause actual results to differ materially from those in the forward - looking statements include those reflecte d in Part I, Item 1A, Risk Factors and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in the Form 10 - K for the year ended Decemb er 31, 2023, as filed with the U.S. Securities and Exchange Commission (“SEC”) on February 28, 2024, and elsewhere in Jackson Financial Inc.’s filings filed with the SEC. Excep t a s required by law, Jackson Financial Inc. does not undertake to update such forward - looking statements. You should not rely unduly on forward - looking statements. Certain financial data included in this document consists of non - GAAP (Generally Accepted Accounting Principles) financial measu res. These non - GAAP financial measures may not be comparable to similarly titled measures presented by other entities, nor should they be construed as an alternative to other fin ancial measures determined in accordance with U.S. GAAP. Although the Company believes these non - GAAP financial measures provide useful information to investors in measuring the f inancial performance and condition of its business, investors are cautioned not to place undue reliance on any non - GAAP financial measures and ratios included in this document. A r econciliation of the non - GAAP financial measures to the most directly comparable U.S. GAAP financial measure can be found under “Non - GAAP Financial Measures” in the Appendix of thi s document. Certain financial data included in this document consists of statutory accounting principles (“statutory”) financial measures , i ncluding “total adjusted capital.” These statutory financial measures are included in or derived from the Jackson National Life Insurance Company annual and/or quarterly statements filed wi th the Michigan Department of Insurance and Financial Services and available in the investor relations section of the Company’s website at investors.jackson.com/financia ls/ statutory - filings. We routinely use our investor relations website as a primary channel for disclosing key information to our investors, some of wh ich may contain material and previously non - public information. We may also use social media channels to communicate with our investors and the public about our Company and oth er matters, and those communications could be deemed to be material information. The information contained on, or that may be accessed through, our website or social media ch annels is not incorporated by reference into and is not part of this document. 2

2Q 2024 Financial Results Key Highlights $264M GAAP earnings $410M Non - GAAP earnings 1 $3.43 GAAP Earnings per share $5.32 Non - GAAP earnings per share 1 $144M Capital return $750M increase to common share repurchase authorization, adding to the $95 million of authorization remaining as of June 30, 2024 $0.70 cash dividend approval Per share of common stock 550 - 570% Statutory capital position 36% Retail annuity sales Net income attributable to Jackson Financial Inc. common shareholders Net income per common share Common share dividends and repurchases JNLIC e stimated risk - based capital (RBC) ratio Adjusted Operating Earnings 1 Adjusted Operating Earnings per common share 1 Retail annuity sales up over prior year quarter, which included record 2Q24 RILA sales 3 1) See the Appendix for the non - U.S. GAAP financial measures, definitions and reconciliations to most comparable U.S. GAAP measu re. 3Q24 announcements

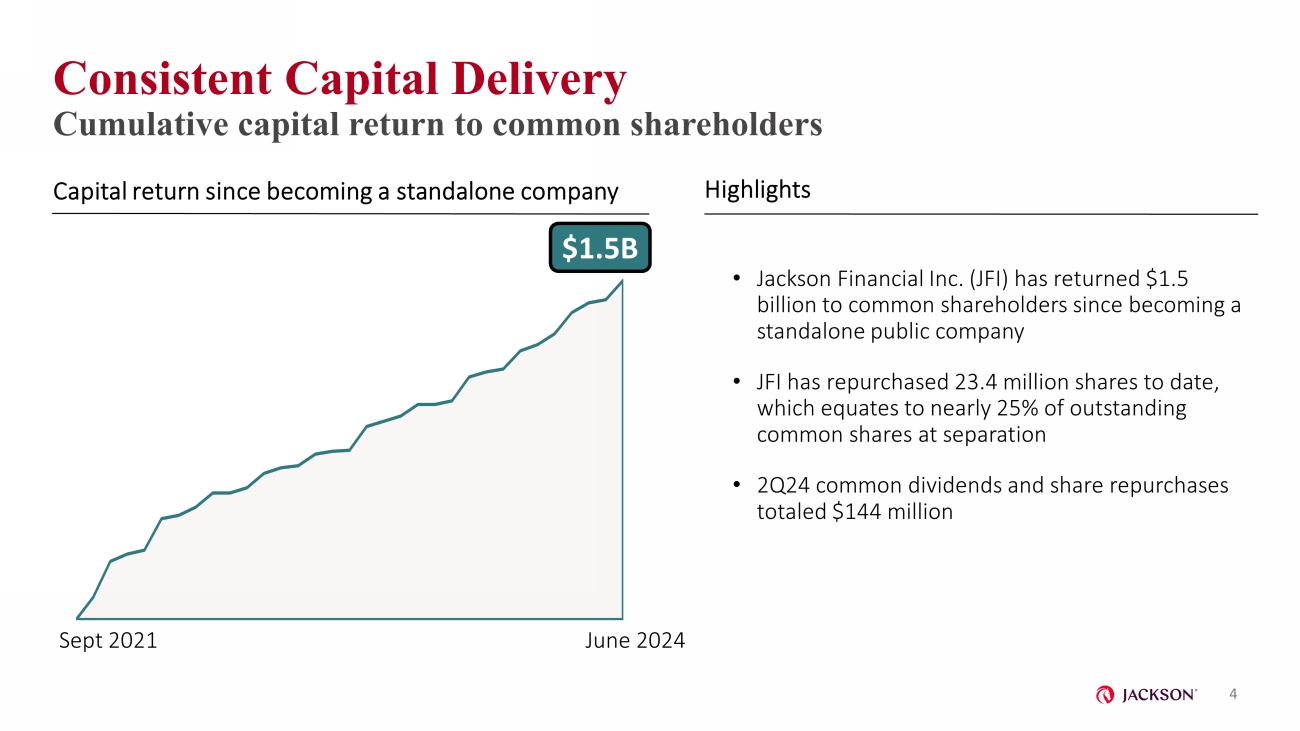

Consistent Capital Delivery Cumulative capital return to common shareholders 4 • Jackson Financial Inc. (JFI) has returned $1.5 billion to common shareholders since becoming a standalone public company • JFI has repurchased 23.4 million shares to date, which equates to nearly 25% of outstanding common shares at separation • 2Q24 common dividends and share repurchases totaled $144 million Capital return since becoming a standalone company Highlights $1.5B Sept 2021 June 2024 - 200,000,000 400,000,000 600,000,000 800,000,000 1,000,000,000 1,200,000,000 1,400,000,000 1,600,000,000 Oct 2021 Dec 2021 Mar 2022 Jun 2022 Sep 2022 Dec 2022 Mar 2023 Jun 2023 Sep 2023 Dec 2023 Mar 2024 Jun 2024

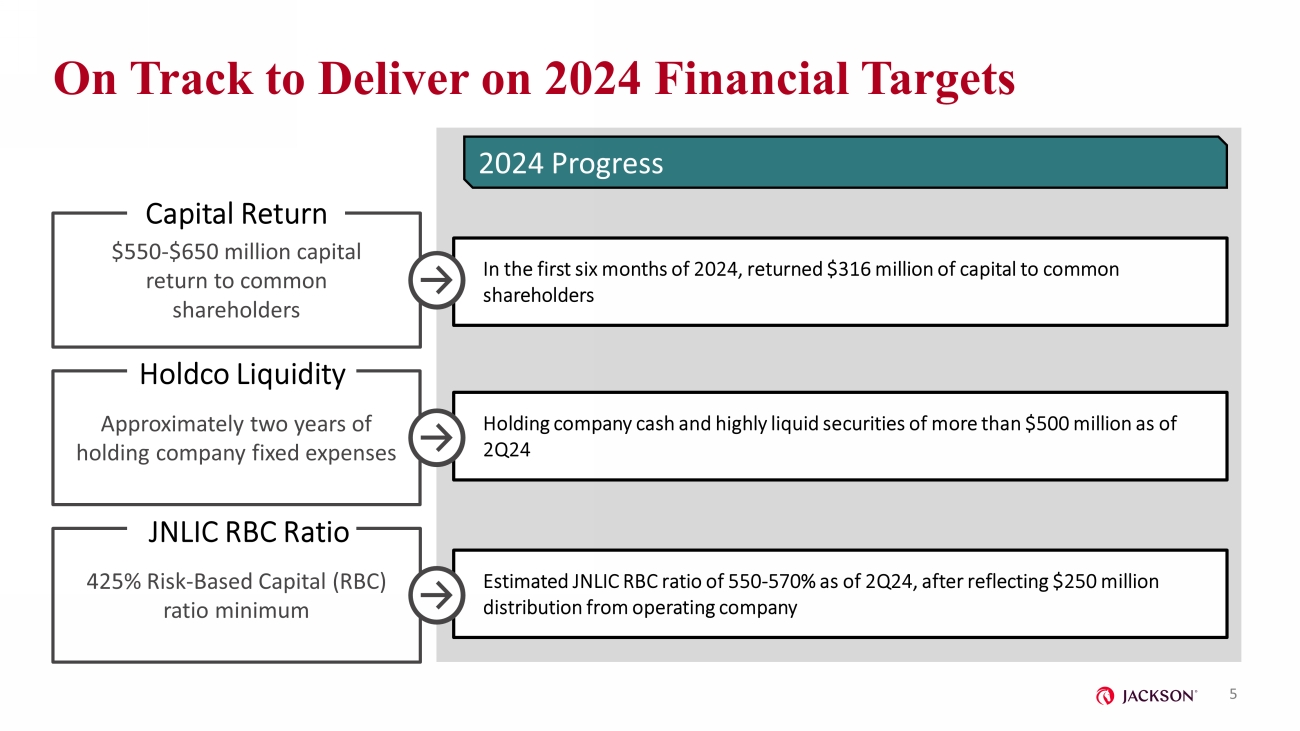

425% Risk - Based Capital (RBC) ratio minimum Approximately two years of holding company fixed expenses Estimated JNLIC RBC ratio of 550 - 570% as of 2Q24, after reflecting $250 million distribution from operating company Holding company cash and highly liquid securities of more than $500 million as of 2Q24 $550 - $650 million capital return to common shareholders In the first six months of 2024, returned $316 million of capital to common shareholders On Track to Deliver on 2024 Financial Targets 5 Capital Return Holdco Liquidity JNLIC RBC Ratio 2024 Progress

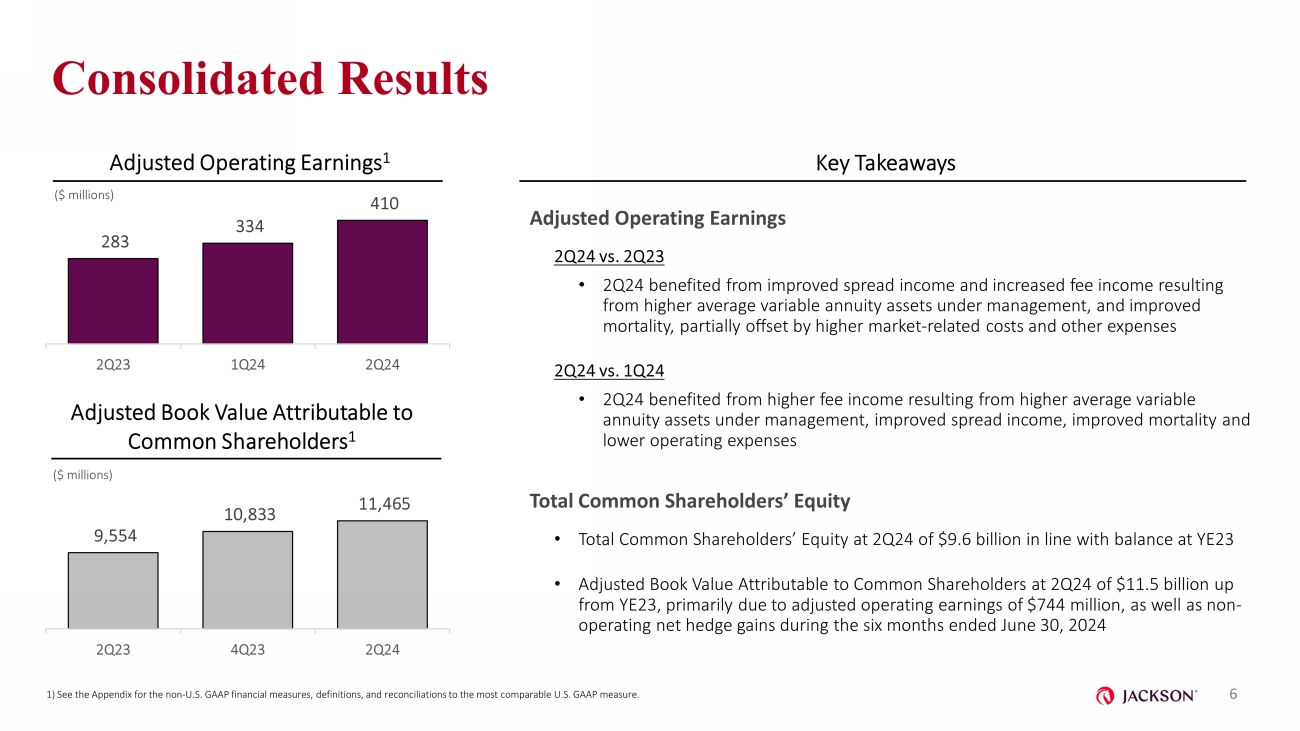

283 334 410 2Q23 1Q24 2Q24 9,554 10,833 11,465 2Q23 4Q23 2Q24 Consolidated Results Adjusted Operating Earnings 2Q24 vs. 2Q23 • 2Q24 benefited from improved spread income and increased fee income resulting from higher average variable annuity assets under management, and improved mortality, partially offset by higher market - related costs and other expenses 2Q24 vs. 1Q24 • 2Q24 benefited from higher fee income resulting from higher average variable annuity assets under management, improved spread income, improved mortality and lower operating expenses Total Common Shareholders’ Equity • Total Common Shareholders’ Equity at 2Q24 of $9.6 billion in line with balance at YE23 • Adjusted Book Value Attributable to Common Shareholders at 2Q24 of $11.5 billion up from YE23, primarily due to adjusted operating earnings of $744 million, as well as non - operating net hedge gains during the six months ended June 30, 2024 Adjusted Operating Earnings 1 ($ millions) Adjusted Book Value Attributable to Common Shareholders 1 ($ millions) Key Takeaways 1) See the Appendix for the non - U.S. GAAP financial measures, definitions, and reconciliations to the most comparable U.S. GAAP measure. 6

Notable Items Second Quarter 2024 2Q23 2Q24 ($ millions, except per share amounts) Pretax After - tax 1 EPS - Diluted Pretax After - tax 1,2 EPS - Diluted Adjusted Operating Earnings 3 305 283 $3.34 473 410 $5.32 Notable Items Included in Adjusted Operating Earnings Out performance/(Under performance) from Limited Partnership Income 4 (23) (22) (0.26) 5 4 0.06 Allowance for Reinsurance Credit Losses 5 (25) (24) (0.29) - - - Payout Annuity Reserve Release Due to Deaths - - - 27 24 0.31 Adjusted Pretax Operating Earnings, Excluding Notable Items 353 441 Impact from Effective Tax Rate versus a 15% Tax Rate Guidance 0.35 0.08 Adjusted Earnings Per Share, Excluding Notables and Adjusted for Tax Impact $3.54 $4.87 1) After - tax results for Notable Items were calculated using the corresponding quarter’s effective tax rate for adjusted operating earnings (2Q23 of 3.0%; 2Q24 of 10.9%). 2) Includes preferred stock dividends of $11m. 3) See the Appendix for the non - U.S. GAAP financial measures, definitions, and reconciliations to the most comparable U.S. GAAP mea sure. 4) Limited Partnership (LP) income assumes an annualized 10% return and excludes income and assets attributable to non - controlling interests. Income from LPs is reported on a one - quarter lag. Operating LP return of 5% and 11% for 2Q23 and 2Q24, respectively. Total LP returns (including non - operating) of - 6% and 13% for 2Q23 and 2Q24, respectively. 5) During 2Q23 the Company increased its allowance for credit losses related to a specific reinsurer, which was ordered into liq uid ation. The recognized ACL represented our best estimate of remaining loss exposure with this reinsurer. 7

Stable Non - Operating Results Pretax income attributable to Jackson Financial Inc. (U.S. GAAP) Pretax adjusted operating earnings (Non - GAAP) 1 Income on funds withheld 4 311 1) See the Appendix for the non - U.S. GAAP financial measures, definitions, and reconciliations to the most comparable U.S. GAAP measure. 2) Represents non - operating Total Guaranteed Benefits and Hedging Results. 3) Net reserve and embedded derivative movements includes guaranteed benefit claims. 4) Includes $214m net realized investment losses and $ 285 m net investment income. 5) Associated with non - operating items at date of transition to LDTI. (32) 473 2Q24 Pretax Adjusted Operating Earnings Reconciliation ($ millions) (201) 8 71 Net hedge loss 2 Net realized investment losses and other, net • Stable guarantee fee stream supports hedging needs • Economic hedging better aligns with U.S. GAAP accounting following the establishment and funding of Brooke Re, leading to a better alignment between adjusted earnings and GAAP earnings • Market risk benefits gain driven primarily by increases in interest rates and positive fund performance, as well as slight decrease in implied volatility • Freestanding derivative loss driven primarily by increased interest rates and higher equity markets • Reserve and embedded derivative movements mainly the result of a growing RILA block, which provides an equity hedging offset to VA guarantees Highlights 2Q24 YTD Fees attributable to guarantee benefit reserves $780 $1,568 Net movement in freestanding derivatives (1,083) (3,659) Market risk benefits gains, net 516 3,234 Net reserve and embedded derivative movements 3 (278) (642) Net Hedge (Loss)/Gain Excluding Amortization of DAC 5 (65) 501 Amortization of DAC 5 (136) (275) Net Hedge (Loss)/Gain ($201) $226

3.1 3.7 4.2 2Q23 1Q24 2Q24 568 1,140 1,413 2Q23 1Q24 2Q24 Continued Progress on Retail Sales Diversification 1 • 2Q24 retail annuity sales up 15% and 36% from 1Q24 and 2Q23, respectively, with an increasingly diversified product mix • More than half of retail annuity sales without lifetime benefit riders • Record 2Q24 RILA sales grew 23% from 1Q24 and 163% from 2Q23 • Continued momentum in non - VA net flows, which grew 24% from 1Q24 and more than doubled when compared to 2Q23 Retail Sales ($ billions) Non - VA Net Flows 2 Highlights 1) Excludes the FA/FIA business ceded to Athene. (2) Includes net - flows related to FIA, FA, Payout annuities and RILA. Variable Annuities RILA FA / FIA 9 ($ millions)

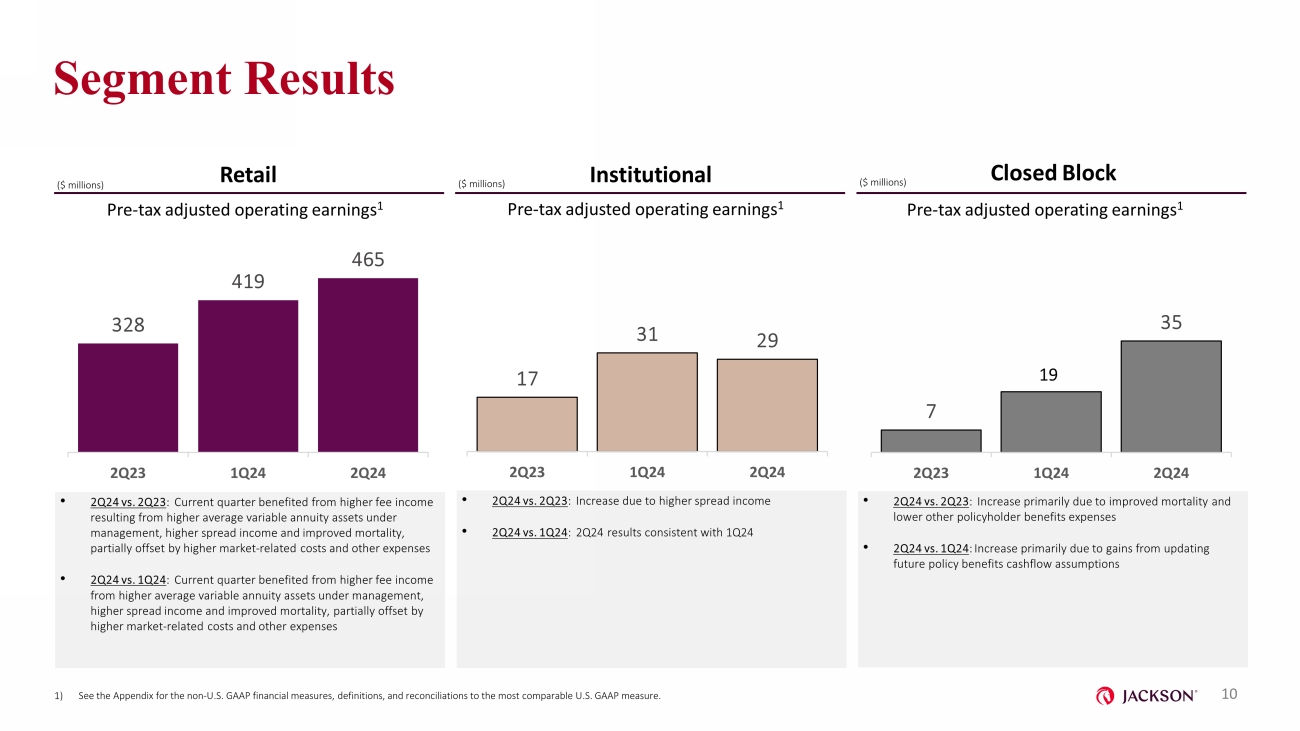

Segment Results Retail Institutional Closed Block • 2Q24 vs. 2Q23 : Increase primarily due to improved mortality and lower other policyholder benefits expenses • 2Q24 vs. 1Q24 : Increase primarily due to gains from updating future policy benefits cashflow assumptions • 2Q24 vs. 2Q23 : Current quarter benefited from higher fee income resulting from higher average variable annuity assets under management, higher spread income and improved mortality, partially offset by higher market - related costs and other expenses • 2Q24 vs. 1Q24 : Current quarter benefited from higher fee income from higher average variable annuity assets under management, higher spread income and improved mortality, partially offset by higher market - related costs and other expenses ($ millions) ($ millions) ($ millions) 328 419 465 2Q23 1Q24 2Q24 7 19 35 2Q23 1Q24 2Q24 17 31 29 2Q23 1Q24 2Q24 ($ millions) ($ millions) ($ millions) Pre - tax adjusted operating earnings 1 Pre - tax adjusted operating earnings 1 Pre - tax adjusted operating earnings 1 • 2Q24 vs. 2Q23 : Increase due to higher spread income • 2Q24 vs. 1Q24 : 2Q24 results consistent with 1Q24 1) See the Appendix for the non - U.S. GAAP financial measures, definitions, and reconciliations to the most comparable U.S. GAAP mea sure. 10

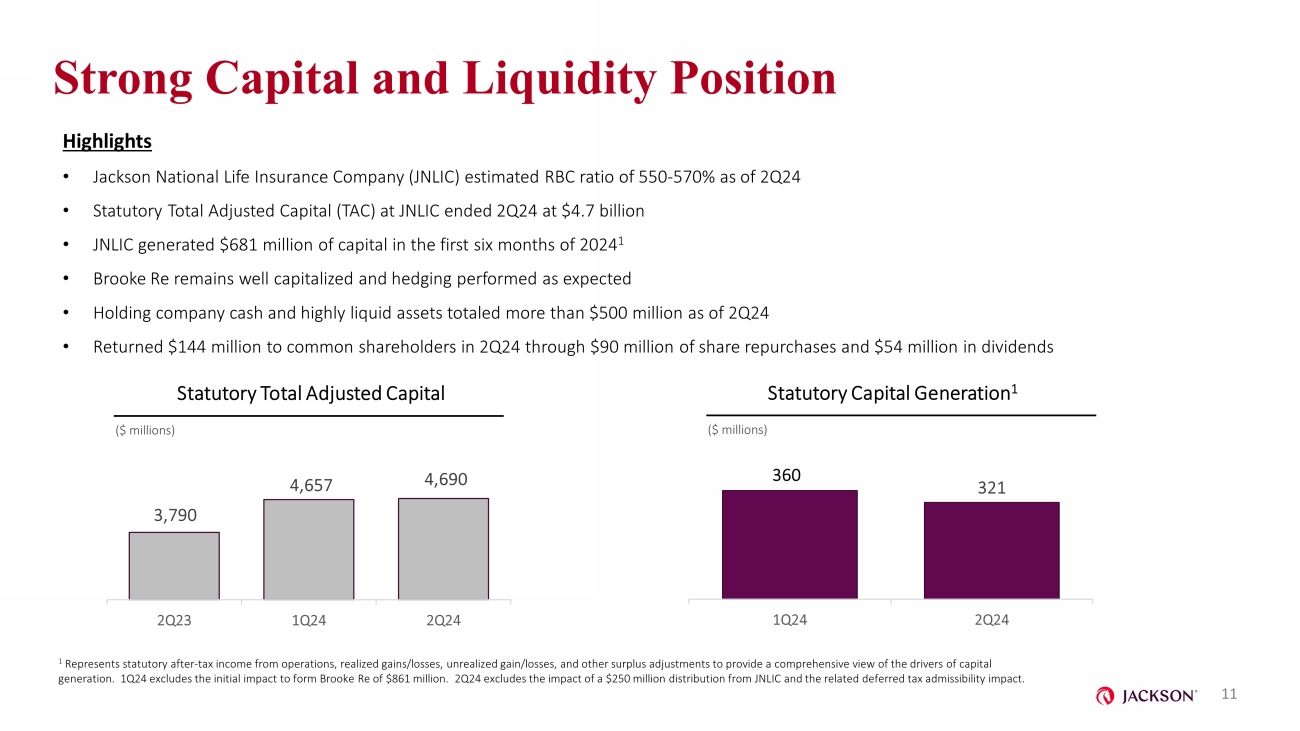

Strong Capital and Liquidity Position Highlights • Jackson National Life Insurance Company (JNLIC) estimated RBC ratio of 550 - 570% as of 2Q24 • Statutory Total Adjusted Capital (TAC) at JNLIC ended 2Q24 at $4.7 billion • JNLIC generated $681 million of capital in the first six months of 2024 1 • Brooke Re remains well capitalized and hedging performed as expected • Holding company cash and highly liquid assets totaled more than $500 million as of 2Q24 • Returned $144 million to common shareholders in 2Q24 through $90 million of share repurchases and $54 million in dividends 11 3,790 4,657 4,690 2Q23 1Q24 2Q24 360 321 1Q24 2Q24 Statutory Total Adjusted Capital ($ millions) Statutory Capital Generation 1 ($ millions) 1 Represents statutory after - tax income from operations, realized gains/losses, unrealized gain/losses, and other surplus adjustm ents to provide a comprehensive view of the drivers of capital generation. 1Q24 excludes the initial impact to form Brooke Re of $861 million. 2Q24 excludes the impact of a $250 million dis tribution from JNLIC and the related deferred tax admissibility impact.

12 Outlook for Continued Performance Against Targets Remains Positive 12 On track to deliver on 2024 key financial targets Maintained strong balance sheet and robust levels of liquidity Demonstrated strength of distribution franchise and consistent capital generation Well - positioned for continued long - term value creation for shareholders

Investments

14 High Quality, Diversified Investment Portfolio 14 Corporate portfolio is concentrated in investment - grade securities Highly rated and diversified commercial mortgage loan office portfolio, which is less than 2% of the general account portfolio Strategic, conservative underwriting across our portfolio

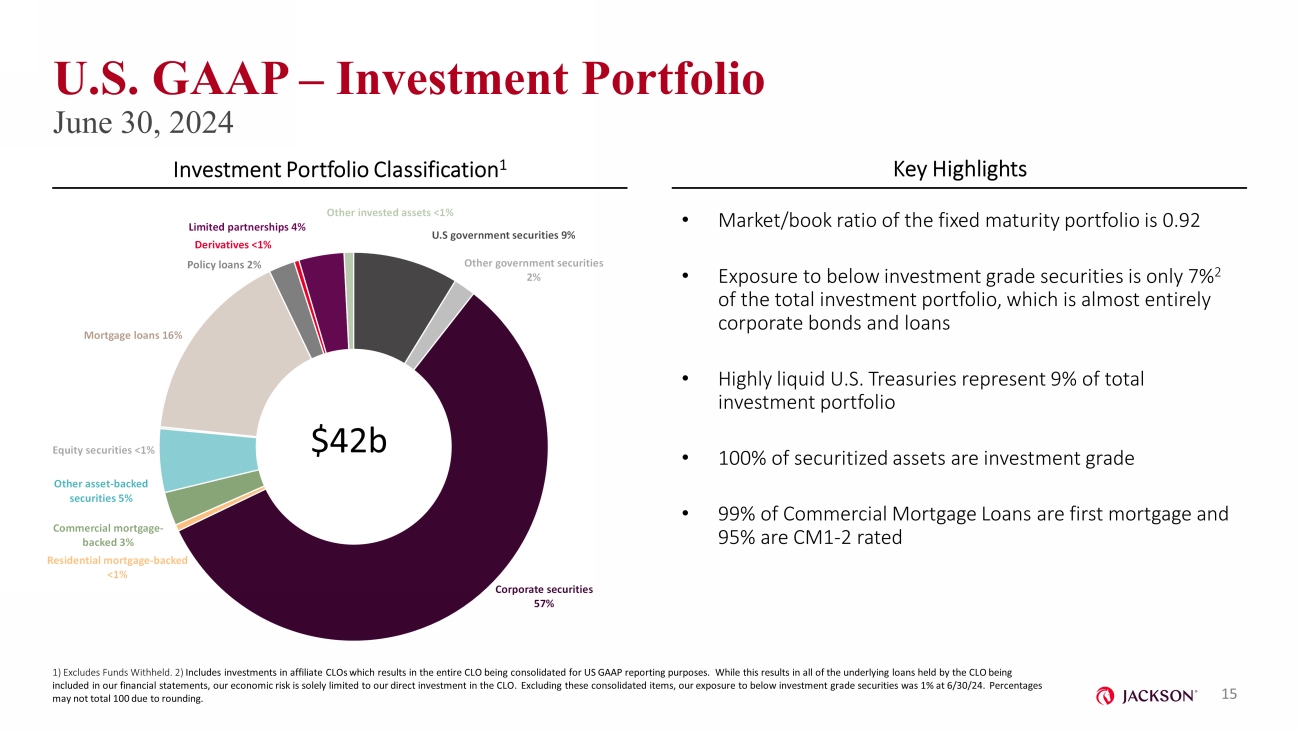

U.S government securities 9% Other government securities 2% Corporate securities 57% Residential mortgage - backed <1% Commercial mortgage - backed 3% Other asset - backed securities 5% Equity securities <1% Mortgage loans 16% Policy loans 2% Derivatives <1% Limited partnerships 4% Other invested assets <1% U.S. GAAP – Investment Portfolio June 30, 2024 • Market/book ratio of the fixed maturity portfolio is 0.92 • Exposure to below investment grade securities is only 7% 2 of the total investment portfolio, which is almost entirely corporate bonds and loans • Highly liquid U.S. Treasuries represent 9% of total investment portfolio • 100% of securitized assets are investment grade • 99% of Commercial Mortgage Loans are first mortgage and 95% are CM1 - 2 rated Investment Portfolio Classification 1 Key Highlights 1) Excludes Funds Withheld. 2) I ncludes investments in affiliate CLOs which results in the entire CLO being consolidated for US GAAP reporting purposes. While this results in all of the underlying loans held by the CLO being included in our financial statements, our economic risk is solely limited to our direct investment in the CLO. Excluding these consolidated items, our exposure to below investment grade securities was 1 % at 6/30/24. Percentages may not total 100 due to rounding. $42b 15

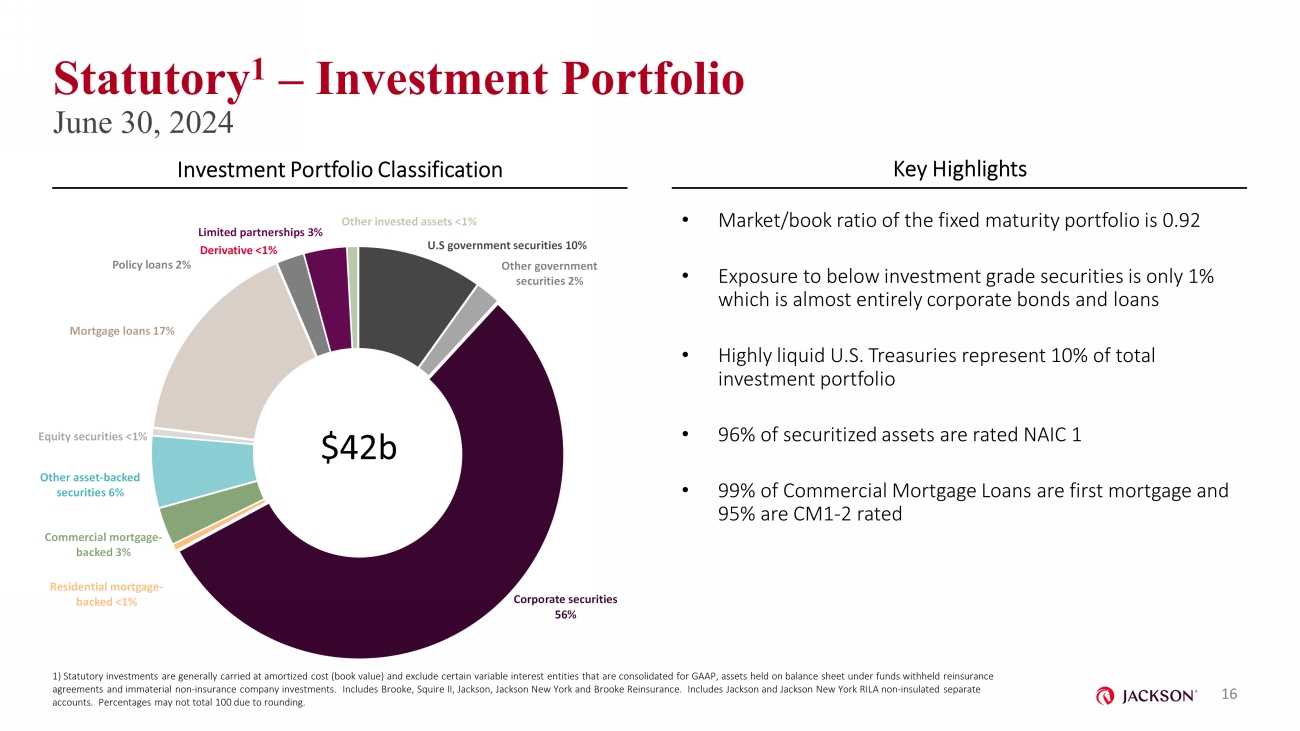

U.S government securities 10% Other government securities 2% Corporate securities 56% Residential mortgage - backed <1% Commercial mortgage - backed 3% Other asset - backed securities 6% Equity securities <1% Mortgage loans 17% Policy loans 2% Derivative <1% Limited partnerships 3% Other invested assets <1% Statutory 1 – Investment Portfolio June 30, 2024 Investment Portfolio Classification Key Highlights • Market/book ratio of the fixed maturity portfolio is 0.92 • Exposure to below investment grade securities is only 1% which is almost entirely corporate bonds and loans • Highly liquid U.S. Treasuries represent 10% of total investment portfolio • 96% of securitized assets are rated NAIC 1 • 99% of Commercial Mortgage Loans are first mortgage and 95% are CM1 - 2 rated 16 $42b 1) Statutory investments are generally carried at amortized cost (book value) and exclude certain variable interest entities tha t are consolidated for GAAP, assets held on balance sheet under funds withheld reinsurance agreements and immaterial non - insurance company investments. Includes Brooke, Squire II, Jackson, Jackson New York and Brooke R einsurance. Includes Jackson and Jackson New York RILA non - insulated separate accounts. Percentages may not total 100 due to rounding.

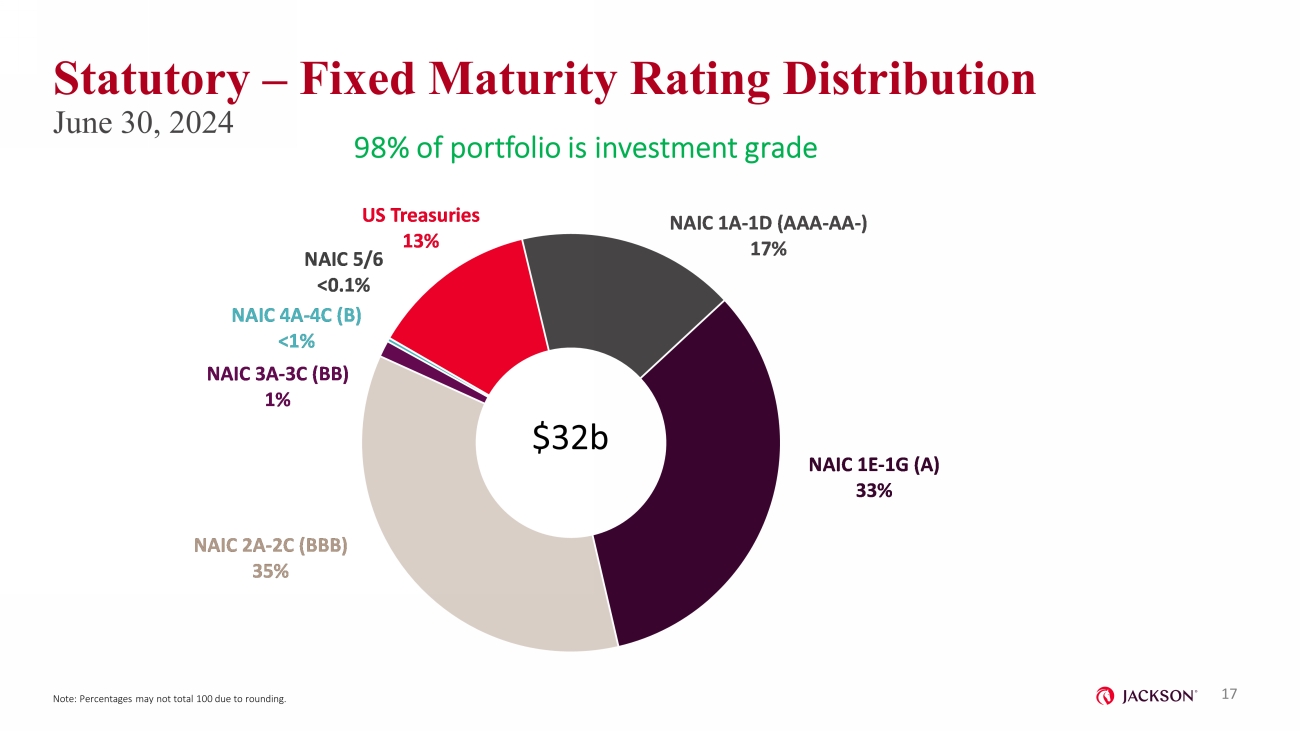

US Treasuries 13% NAIC 1A - 1D (AAA - AA - ) 17% NAIC 1E - 1G (A) 33% NAIC 2A - 2C (BBB) 35% NAIC 3A - 3C (BB) 1% NAIC 4A - 4C (B) <1% NAIC 5/6 <0.1% Statutory – Fixed Maturity Rating Distribution June 30, 2024 $32b 17 98% of portfolio is investment grade Note: Percentages may not total 100 due to rounding.

AAA: <1% AA: 7% A: 42% BBB: 48% BB: 2% B: <1% CCC and below: <0.1% Statutory – Corporate Portfolio June 30, 2024 Corporate Portfolio Rating Distribution 1 Key Highlights • Market/book ratio of the corporate portfolio is 0.94 • High - yield corporates account for 1% of the total investment portfolio and 2% of total corporate portfolio • Exposure to BBBs represents 27% of the total investment portfolio ‒ Highly diversified across 508 issuers with an average position size of $22m by statement value ‒ 79% of all BBBs are rated BBB or BBB+ ‒ 27% of BBBs are privates, which offer better covenant protection vs. publics $23b 18 1) Based on NAIC expanded ratings and statement value. Percentages may not total 100 due to rounding.

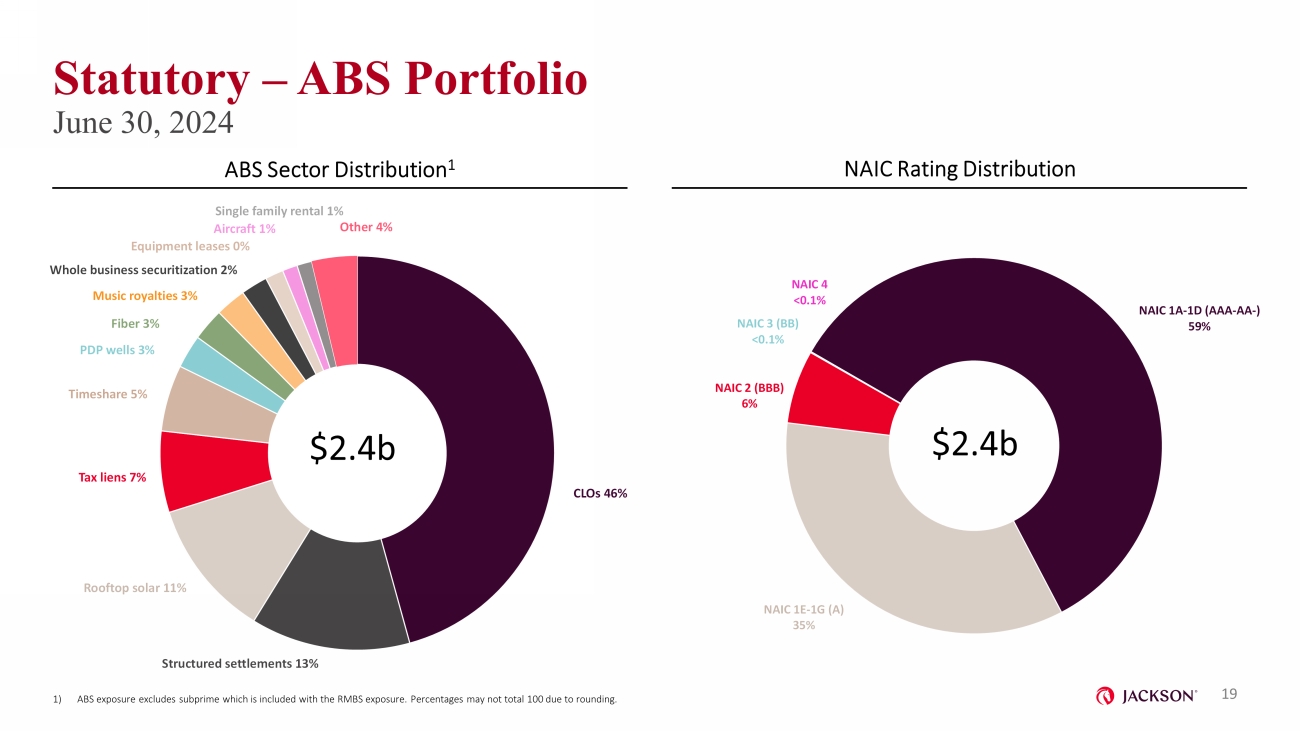

NAIC 1A - 1D (AAA - AA - ) 59% NAIC 1E - 1G (A) 35% NAIC 2 (BBB) 6% NAIC 3 (BB) <0.1% NAIC 4 <0.1% Statutory – ABS Portfolio June 30, 2024 $2.4b ABS Sector Distribution 1 NAIC Rating Distribution $2.4b 19 CLOs 46% Structured settlements 13% Rooftop solar 11% Tax liens 7% Timeshare 5% PDP wells 3% Fiber 3% Music royalties 3% Whole business securitization 2% Equipment leases 0% Aircraft 1% Single family rental 1% Other 4% 1) ABS exposure excludes subprime which is included with the RMBS exposure. Percentages may not total 100 due to rounding.

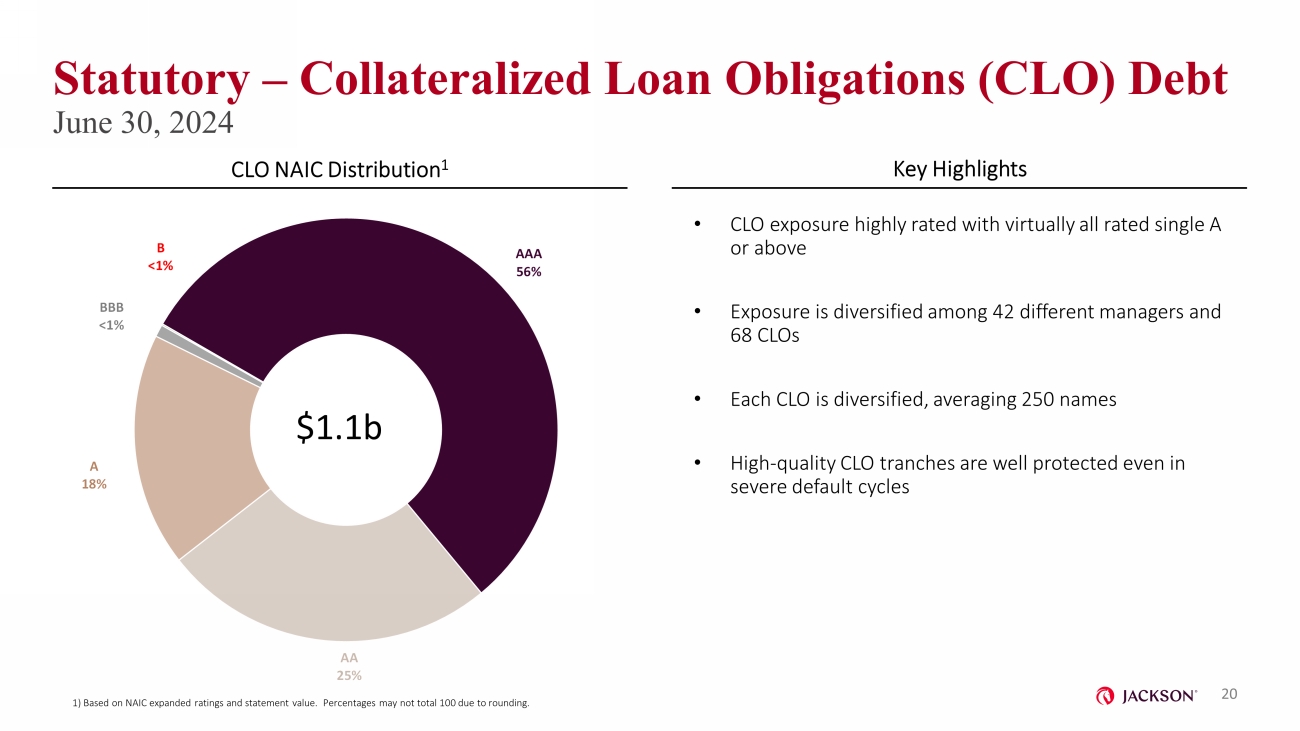

AAA 56% AA 25% A 18% BBB <1% B <1% Statutory – Collateralized Loan Obligations (CLO) Debt June 30, 2024 CLO NAIC Distribution 1 Key Highlights • CLO exposure highly rated with virtually all rated single A or above • Exposure is diversified among 42 different managers and 68 CLOs • Each CLO is diversified, averaging 250 names • High - quality CLO tranches are well protected even in severe default cycles $1.1b 20 1) Based on NAIC expanded ratings and statement value. Percentages may not total 100 due to rounding.

Single Asset/Single Borrower 37% Agency 5% Conduit 58% Office , 12% Retail , 9% Industrial , 6% Multi - family , 5% Hotel , 4% Other , 1% Statutory – Commercial Mortgage - Backed Securities (CMBS) June 30, 2024 CMBS Distribution Key Highlights • 97% are rated AA - or higher • 58% of CMBS portfolio are diversified pools of commercial mortgages (“Conduit) • 67% are senior AAA and guaranteed Agency tranches • 33% average credit enhancement for the portfolio (excluding guaranteed agency bonds) • Single Asset/Single Borrower ($465 million) ‒ 35% average credit enhancement and 44% in the senior tranche ‒ $157 million of Office related Single Asset/Single Borrower with 95% having the highest NAIC rating of 1A $1.2b 21 CMBS Single Asset/Single Borrower Distribution Note: Percentages may not total 100 due to rounding.

CM 1 69% CM 2 27% CM 3/4 4% Statutory – Commercial Mortgage Loan Portfolio 1 June 30, 2024 CML NAIC Distribution CML Property Type Distribution • Highly diversified with an average loan size of $19m • 99% are senior/first mortgage loans • 96% of the portfolio has the highest ratings of CM1 - 2 • Weighted average loan - to - value based on 2023 internal valuation is 52.3% • Weighted average debt service coverage is 2.2x • No delinquencies and no foreclosed/REO at end of 2Q24 $7.0b 22 Loan - to - Value / Debt Service Coverage 2 $7.0b Debt Service Coverage Ratio >1.5x 1.25x - 1.50x 1.0x - 1.25x <1.0x Total Loan - to - Value <60% 57.3% 7.1% 2.7% 0.5% 67.6% 60 - 70% 13.3% 4.6% 4.3% 0.9% 23.2% 70 - 80% 3.2% 0.8% 1.3% 0.3% 5.6% >80% 1.3% 0.8% 1.0% 0.7% 3.6% Total 75.0% 13.3% 9.3% 2.4% 100.0% 1) Based on NAIC expanded ratings and statement value. Percentages may not total 100 due to rounding. 2) Loan - to - value is calculated using an internal value, based on annual valuation process that uses the latest available property - l evel data combined with updated market vacancy, rental and capitalization rates. This valuation process is typically completed by the end of Q3. In addition, loans of elevated concern may be subject to either a broker opinion of value (BOV) or Mortgage Appraisal Institute (MAI) appraisal on an as - needed basis. Percentages may not sum, due to rounding. Multi - Family 28% Industrial 25% Retail 22% Office 10% Hotels 11% Other 4%

CM 1 86% CM 2 11% CM 3/4 3% Statutory – Commercial Mortgage Loan Office Exposure 1 June 30, 2024 NAIC Rating Distribution – Office Exposure Key Highlights $0.7b 23 Loan - to - Value / Debt Service Coverage 2 1) Based on NAIC expanded ratings and statement value. Shown net of $72m of impairment and specific reserves. Percentages may no t t otal 100 due to rounding. 2) Loan - to - value is calculated using an internal value based on annual valuation process that uses the latest available property - le vel data combined with updated market vacancy, rental and capitalization rates. This valuation process is typically completed by the end of Q3. In addition, loans of elevated concern may be subject to either a broker opinion of value (BOV) or Mortgage Appraisal Institute (MAI) appraisal on an as - needed basis. Percentages may not sum, due to rounding. Debt Service Coverage Ratio >1.5x 1.25x - 1.50x 1.0x - 1.25x <1.0x Total Loan - to - Value <60% 38.6% 0.0% 4.3% 0.0% 42.9% 60 - 70% 25.6% 0.7% 0.0% 0.0% 26.3% 70 - 80% 11.5% 0.0% 0.0% 1.3% 12.7% >80% 3.5% 7.4% 4.0% 3.1% 18.0% Total 79.2% 8.2% 8.2% 4.4% 100.0% • Highly diversified with an average loan size of $14m • 100% are senior/first mortgage loans • 97% of the portfolio has the highest ratings of CM1 - 2 • Weighted average loan - to - value based on 2023 internal valuation is 66.8% • Weighted average debt service coverage is 2.3x • 83% has a maturity date in 2026 or later Suburban 74% Urban 24% Single Story Office & R&D 1% Medical Office 1% Office Type – Office Exposure Geographic – Office Exposure $0.7b

Appendix

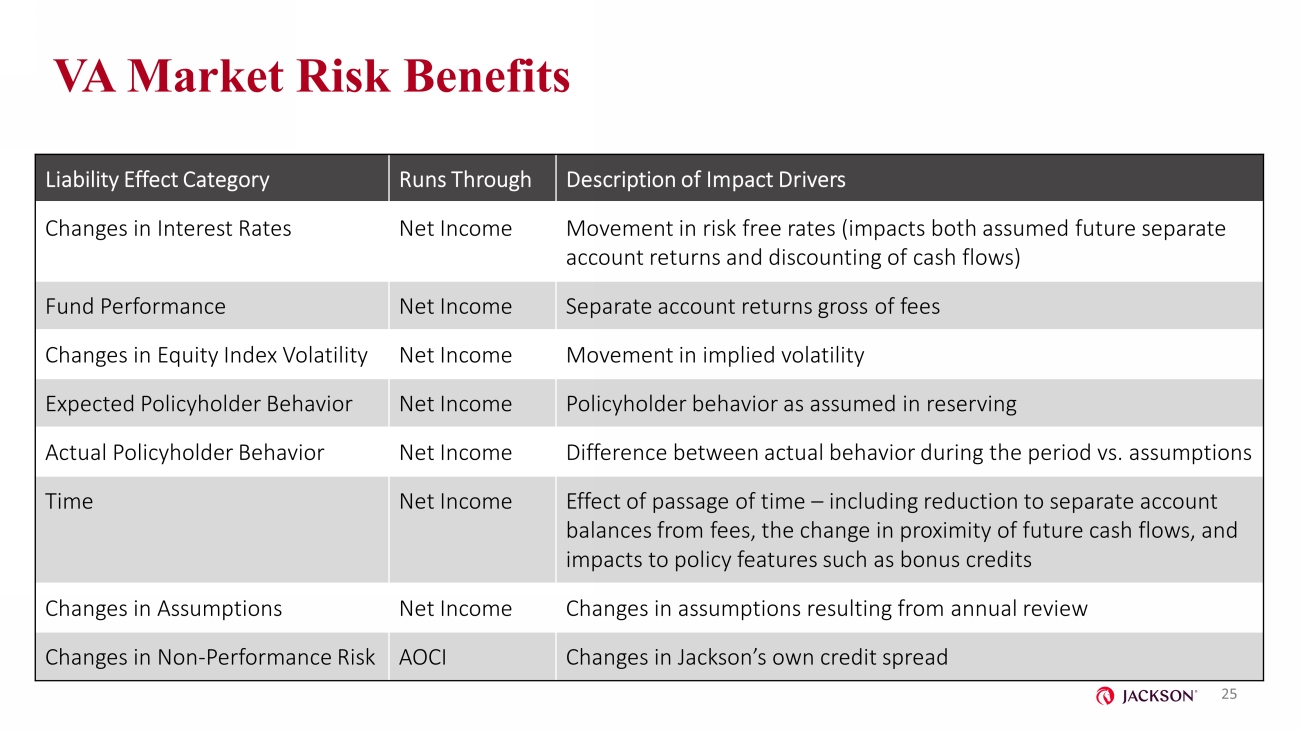

VA Market Risk Benefits 25 Liability Effect Category Runs Through Description of Impact Drivers Changes in Interest Rates Net Income Movement in risk free rates (impacts both assumed future separate account returns and discounting of cash flows) Fund Performance Net Income Separate account returns gross of fees Changes in Equity Index Volatility Net Income Movement in implied volatility Expected Policyholder Behavior Net Income Policyholder behavior as assumed in reserving Actual Policyholder Behavior Net Income Difference between actual behavior during the period vs. assumptions Time Net Income Effect of passage of time – including reduction to separate account balances from fees, the change in proximity of future cash flows, and impacts to policy features such as bonus credits Changes in Assumptions Net Income Changes in assumptions resulting from annual review Changes in Non - Performance Risk AOCI Changes in Jackson’s own credit spread

Non - GAAP Financial Measures In addition to presenting our results of operations and financial condition in accordance with U.S. GAAP, we use and report, sel ected non - GAAP financial measures. Management believes that the use of these non - GAAP financial measures, together with relevant U.S. GAAP financial measures, provides a better understanding of our results of op era tions, financial condition and the underlying performance drivers of our business. These non - GAAP financial measures should be considered supplementary to our results of operations and financial condition that are pres ent ed in accordance with U.S. GAAP and should not be viewed as a substitute for the U.S. GAAP financial measures. Other companies may use similarly titled non - GAAP financial measures that are calculated differently from th e way we calculate such measures. Consequently, our non - GAAP financial measures may not be comparable to similar measures used by other companies. These non - GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with U.S. GAAP. Adjusted Operating Earnings Adjusted Operating Earnings is an after - tax non - GAAP financial measure, which we believe should be used to evaluate our financia l performance on a consolidated basis by excluding certain items that may be highly variable from period to period due to accounting treatment under U.S. GAAP or that are non - recurring in nature, as well as certa in other revenues and expenses that we do not view as driving our underlying performance. Adjusted Operating Earnings should not be used as a substitute for net income as calculated in accordance with U .S. GAAP. However, we believe the adjustments to net income are useful for gaining an understanding of our overall results of operations. Adjusted Operating Earnings equals our Net income (loss) attributable to Jackson Financial Inc. common shareholders (which ex clu des income attributable to non - controlling interest and dividends on preferred stock) adjusted to eliminate the impact of the items described in the following numbered paragraphs. These items are excluded as th ey may vary significantly from period to period due to near - term market conditions or are otherwise not directly comparable or reflective of the underlying performance of our business. We believe these exclusions p rov ide investors a better picture of the drivers of our underlying performance. 1) Net Hedging Results: Comprised of: (i) fees attributed to guaranteed benefits; (ii) changes in the fair value of freestanding derivatives used to man age the risk associated with market risk benefits and other guaranteed benefit features, excluding earned income from periodic settlements and changes in settlement accruals on cross - curre ncy swaps; (iii) the movements in reserves, market risk benefits, guaranteed benefit features accounted for as embedded derivative instruments, and related claims and benefit payments; (iv) Amortization of the balance of unamortized deferred acquisition costs, at January 1, 2021, the date of transition to LDTI, associated with items excluded from adjusted operating earnings prior to transition; and (v) the impac t o n the valuation of Guaranteed Benefits and Net Hedging Results arising from changes in underlying actuarial assumptions. We believe excluding these items removes the impact to both revenue and related expenses as soc iated with Guaranteed Benefits and Net Hedging Results. 2) Net Realized Investment Gains and Losses: Comprised of: (i) realized investment gains and losses associated with the periodic sales or disposals of securities, excludi ng those held within our trading portfolio; and (ii) impairments of securities, after adjustment for the non - credit component of the impairment charges. 3) Change in Value of Funds Withheld Embedded Derivative and Net investment income on funds withheld assets: Comprised of (i) the change in fair value of funds withheld embedded derivatives; and (ii) net investment income on funds withheld assets related to funds withheld reinsurance transactions. 4) Other items: Comprised of: (i) the impact of investments that are consolidated in our financial statements due to U.S. GAAP accounting req uir ements, such as our investments in collateralized loan obligations (CLOs), but for which the consolidation effects are not consistent with our economic interest or exposure to those entities; and (ii) one - time or other non - recurring items, such as costs relating to our separation from Prudential. Operating income taxes are calculated using the prevailing corporate federal income tax rate of 21% while taking into account any items recognized d iff erently in our financial statements and federal income tax returns, including the dividends received deduction and other tax credits. For interim reporting periods, the Company uses an es timated annual effective tax rate ("ETR") in computing its tax provision including consideration of discrete items. 26

Non - GAAP Financial Measures Adjusted Book Value Attributable to Common Shareholders Adjusted Book Value Attributable to Common Shareholders excludes Preferred Stock and Accumulated Other Comprehensive Income ( Los s) (AOCI) attributable to Jackson Financial Inc (JFI), which does not include AOCI arising from investments held within the funds withheld account related to the Athene Reinsurance Transaction. We exclude AOC I a ttributable to JFI from Adjusted Book Value Attributable to Common Shareholders because our invested assets are generally invested to closely match the duration of our liabilities, which are longer duratio n i n nature, and therefore we believe period - to - period fair market value fluctuations in AOCI to be inconsistent with this objective. We believe excluding AOCI attributable to JFI is more useful to investors in analyzing t ren ds in our business. Changes in AOCI within the funds withheld account related to the Athene Reinsurance Transaction offset the related non - operating earnings from the Athene Reinsurance Transactions resulting in a minima l net impact on Adjusted Book Value of Jackson Financial Inc. Adjusted Operating Return on Equity Attributable to Common Shareholders We use Adjusted Operating Return on Equity (ROE) Attributable to Common Shareholders to manage our business and evaluate our fin ancial performance which: (i) excludes items that vary from period - to - period due to accounting treatment under U.S. GAAP or that are non - recurring in nature, as such items may distort the underlying performanc e of our business; and (ii) is calculated by dividing our Adjusted Operating Earnings by average Adjusted Book Value Attributable to Common Shareholders. Adjusted Book Value Attributable to Common Shareholders and Adjusted Operating ROE Attributable to Common Shareholders should no t be used as substitutes for total shareholders’ equity and ROE as calculated using annualized net income and average equity in accordance with U.S. GAAP. However, we believe the adjustments to equity and earn ing s are useful to gaining an understanding of our overall results of operations. Notable Items Notable items reflect the impact on our results of certain items or events that may or may not have been anticipated and resu lte d in volatility in the Company's earnings expectations. The presentation of notable items is intended to help investors better understand our results for the period and to evaluate and forecast those results. 27

Adjusted Operating Earnings Reconciliation $ millions, except effective tax rate For the Three Months Ended For the Six Months Ended 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 6/30/23 6/30/24 Net income (loss) attributable to Jackson Financial Inc. common shareholders 1,204 2,762 (1,570) 784 264 (293) 1,048 Add: dividends on preferred stock 13 11 11 11 11 13 22 Add: income tax expense (benefit) 245 712 (395) 101 36 (313) 137 Pretax income (loss) attributable to Jackson Financial Inc. 1,462 3,485 (1,954) 896 311 (593) 1,207 Non - Operating Adjustments (Income) Loss: Guaranteed benefits and hedging results: Fees attributable to guarantee benefit reserves (781) (784) (780) (788) (780) (1,561) (1,568) Net movement in freestanding derivatives 1 1,911 271 (43) 2,576 1,083 4,423 3,659 Market risk benefits (gains) losses, net (2,570) (2,376) 1,223 (2,718) (516) (2,744) (3,234) Net reserve and embedded derivative movements 194 (45) 449 364 278 383 642 Amortization of DAC associated with non - operating items at date of transition to LDTI 149 148 141 139 136 302 275 Total guaranteed benefits and hedging results (1,097) (2,786) 990 (427) 201 803 (226) Net realized investment (gains) losses 40 127 319 7 30 108 37 Net realized investment (gains) losses on funds withheld assets 134 (159) 1,153 201 214 807 415 Net investment income on funds withheld assets (252) (303) (312) (270) (285) (559) (555) Other items 18 (9) 7 (18) 2 41 (16) Total non - operating adjustments (1,157) (3,130) 2,157 (507) 162 1,200 (345) Pre - tax adjusted operating earnings 305 355 203 389 473 607 862 Less: operating income tax expense (benefit) 9 29 (12) 44 52 40 96 Adjusted operating earnings before dividends on preferred stock 296 326 215 345 421 567 766 Less: dividends on preferred stock 13 11 11 11 11 13 22 Adjusted operating earnings 283 315 204 334 410 554 744 Effective tax rates on adjusted operating earnings 3.0% 8.2% (5.9)% 11.3% 10.9% 6.6% 11.2% 28 1 Includes $17 million and $16 million loss related to interest rate swaps in 1Q and 2Q 2024, respectively

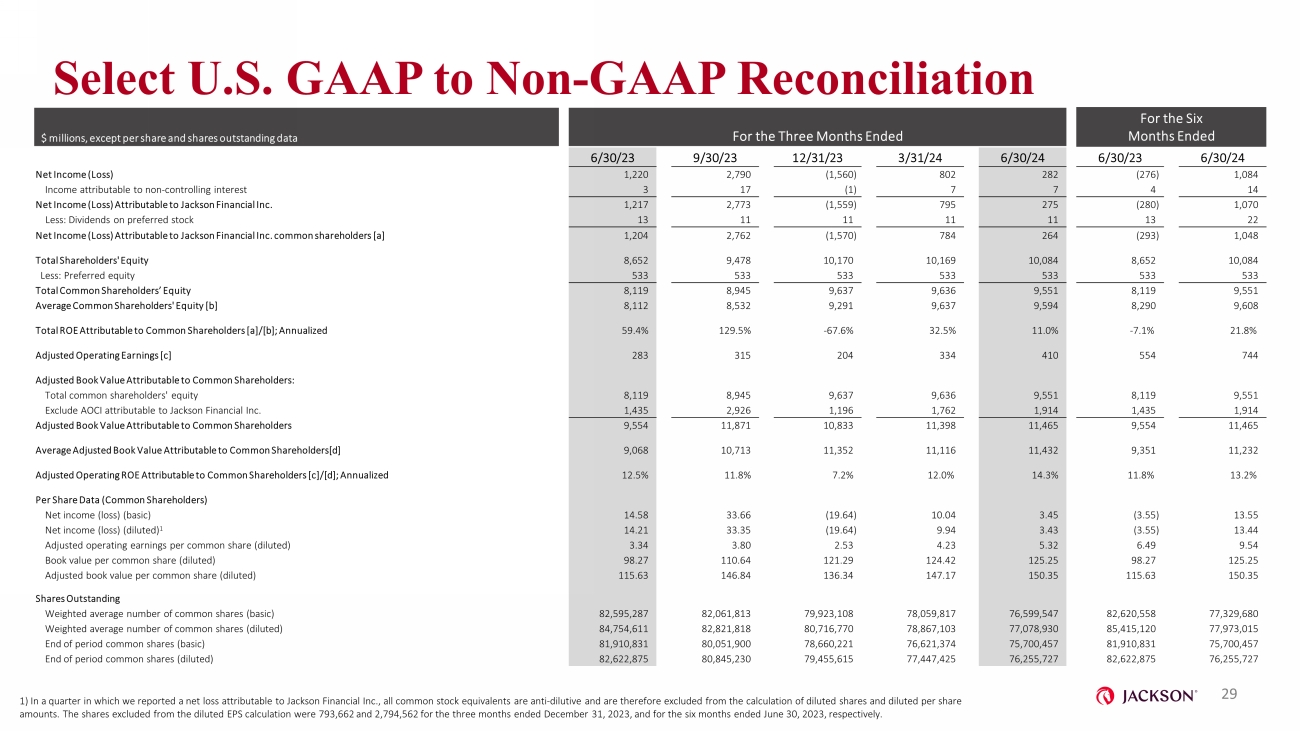

Select U.S. GAAP to Non - GAAP Reconciliation $ millions, except per share and shares outstanding data For the Three Months Ended For the Six Months Ended 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 6/30/23 6/30/24 Net Income (Loss) 1,220 2,790 (1,560) 802 282 (276) 1,084 Income attributable to non - controlling interest 3 17 (1) 7 7 4 14 Net Income (Loss) Attributable to Jackson Financial Inc. 1,217 2,773 (1,559) 795 275 (280) 1,070 Less: Dividends on preferred stock 13 11 11 11 11 13 22 Net Income (Loss) Attributable to Jackson Financial Inc. common shareholders [a] 1,204 2,762 (1,570) 784 264 (293) 1,048 Total Shareholders' Equity 8,652 9,478 10,170 10,169 10,084 8,652 10,084 Less: Preferred equity 533 533 533 533 533 533 533 Total Common Shareholders’ Equity 8,119 8,945 9,637 9,636 9,551 8,119 9,551 Average Common Shareholders' Equity [b] 8,112 8,532 9,291 9,637 9,594 8,290 9,608 Total ROE Attributable to Common Shareholders [a]/[b]; Annualized 59.4% 129.5% - 67.6% 32.5% 11.0% - 7.1% 21.8% Adjusted Operating Earnings [c] 283 315 204 334 410 554 744 Adjusted Book Value Attributable to Common Shareholders: Total common shareholders' equity 8,119 8,945 9,637 9,636 9,551 8,119 9,551 Exclude AOCI attributable to Jackson Financial Inc. 1,435 2,926 1,196 1,762 1,914 1,435 1,914 Adjusted Book Value Attributable to Common Shareholders 9,554 11,871 10,833 11,398 11,465 9,554 11,465 Average Adjusted Book Value Attributable to Common Shareholders[d] 9,068 10,713 11,352 11,116 11,432 9,351 11,232 Adjusted Operating ROE Attributable to Common Shareholders [c]/[d]; Annualized 12.5% 11.8% 7.2% 12.0% 14.3% 11.8% 13.2% Per Share Data (Common Shareholders) Net income (loss) (basic) 14.58 33.66 (19.64) 10.04 3.45 (3.55) 13.55 Net income (loss) (diluted) 1 14.21 33.35 (19.64) 9.94 3.43 (3.55) 13.44 Adjusted operating earnings per common share (diluted) 3.34 3.80 2.53 4.23 5.32 6.49 9.54 Book value per common share (diluted) 98.27 110.64 121.29 124.42 125.25 98.27 125.25 Adjusted book value per common share (diluted) 115.63 146.84 136.34 147.17 150.35 115.63 150.35 Shares Outstanding Weighted average number of common shares (basic) 82,595,287 82,061,813 79,923,108 78,059,817 76,599,547 82,620,558 77,329,680 Weighted average number of common shares (diluted) 84,754,611 82,821,818 80,716,770 78,867,103 77,078,930 85,415,120 77,973,015 End of period common shares (basic) 81,910,831 80,051,900 78,660,221 76,621,374 75,700,457 81,910,831 75,700,457 End of period common shares (diluted) 82,622,875 80,845,230 79,455,615 77,447,425 76,255,727 82,622,875 76,255,727 29 1) In a quarter in which we reported a net loss attributable to Jackson Financial Inc., all common stock equivalents are anti - di lutive and are therefore excluded from the calculation of diluted shares and diluted per share amounts. The shares excluded from the diluted EPS calculation were 793,662 and 2,794,562 for the three months ended December 31, 2023, and for the six months ended June 30, 2023, respectively.

Glossary Assets Under Management (AUM) - Investment assets that are managed by one of our subsidiaries and includes: (i) assets managed by PPM America, Inc. (PPM), in c luding our investment portfolio (but excludes assets held in funds withheld accounts for reinsurance transactions), (ii) third - party assets (including our former parent and its affiliates, and (i ii) the separate account assets of our retail annuities managed and administered by Jackson National Asset Management LLC (JNAM). Athene Reinsurance Transaction - The funds withheld coinsurance agreement with Athene, entered on June 18, 2020, and effective June 1, 2020, to reinsure a 100 % quota share of a block of our in - force fixed and fixed index annuity liabilities in exchange for approximately $1.2 billion in ceding commissions. Deferred Acquisition Cost (DAC) - Represent the incremental costs related directly to the successful acquisition of new, and certain renewal, insurance policie s and annuity contracts. The recognition of these costs has been deferred, and the deferred amounts are shown on the balance sheet as an asset, which is subject to amortization over the estimated lives of th ose policies and contracts. Derivative Instruments - Jackson Financial Inc.'s (JFI) business model includes the acceptance, monitoring and mitigation of risk. Specifically, JFI c onsiders, among other factors, exposures to interest rate and equity market movements, foreign exchange rates and other asset or liability prices. JFI uses derivative instruments to mitigate or reduce these risk s i n accordance with established policies and goals. JFI's derivative holdings, while effective in managing defined risks, are not structured to meet accounting requirements to be designated as hedging instruments. As a result, freestanding de rivatives are carried at fair value with changes each period recorded in net gains or losses on derivatives and investments. Earnings per Share (EPS) - Basic earnings per share is calculated by dividing net income (loss) attributable to JFI common shareholders by the weighted - a verage number of common shares outstanding during the period. Diluted earnings per share is calculated by dividing the net income (loss) attributable to JFI common shareholders, by the weighted - average numbe r of shares of common stock outstanding for the period, plus shares representing the dilutive effect of share - based awards. Fixed Annuity (FA) - An annuity that guarantees a set annual rate of return with interest at rates we determine, subject to specified minimums. C r edited interest rates are guaranteed not to change for certain limited periods of time, after which rates may reset. Fixed Index Annuity (FIA) - An annuity with an ability to share in the upside from certain financial markets such as equity indices and provides downside protection. Guaranteed Minimum Accumulation Benefit (GMAB) - An add - on benefit (enhanced benefits available for an additional cost) that entitles an owner to a minimum payment, typically in lump - sum, after a set period of time, referred to as the accumulation period. The minimum payment is based on the benefit base, which could be greater than the underlying accoun t v alue. Guaranteed Minimum Death Benefit (GMDB) - An add - on benefit (enhanced benefits available for an additional cost) that guarantees an owner's beneficiaries are entitled t o a minimum payment based on the benefit base, which could be greater than the underlying account value, upon the death of the owner. Guaranteed Minimum Income Benefit (GMIB) - An add - on benefit (available for an additional cost) where an owner is entitled to annuitize the policy and receive a minimum payment stream based on the benefit base, which could be greater than the payment stream resulting from current annuitization of the underlying account value. Guaranteed Minimum Withdrawal Benefit (GMWB) - An add - on benefit (available for an additional cost) where an owner is entitled to withdraw a maximum amount of their benefit base each year, for which cumulative payments to the owner could be greater than the underlying account value. Guaranteed Minimum Withdrawal Benefit for Life (GMWB for Life) - An add - on benefit (available for an additional cost) where an owner is entitled to withdraw the guaranteed annual withdrawal a mount each year for the duration of the policyholder's life, regardless of account performance. LDTI - Accounting Standards Update 2018 - 12, “Targeted Improvements to the Accounting for Long - Duration Contracts”, effective January 1, 2023, with a transition date of January 1, 2021. Net Amount at Risk (NAR) - The greater of Death Benefit NAR (DBNAR) and Living Benefit NAR (LBNAR), as applicable, where DBNAR is the GMDB benefit base i n excess of the account value, and the LBNAR is the actuarial present value of guaranteed living benefits in excess of the account value. 30

Glossary Net Flows - The net change in customer account balances during a period, including gross premiums, surrenders, withdrawals and benefits. Net flows exclude investment performance, interest credited to customer accounts and policy charges. Registered Index - Linked Annuity (RILA) - A registered index - linked annuity, which offers market index - linked investment options, subject to a cap, and offers a variety of guarantees designed to modify or limit losses. Return of Premium (ROP) Death Benefit - This death benefit pays the greater of the account value at the time of a claim following the owner's death or the total cont r ibutions to the contract (subject to adjustment for withdrawals). The charge for this benefit is usually included in the Mortality and Expense fee that is deducted daily from the net assets in ea ch variable investment option. We also refer to this death benefit as the Return of Principal death benefit. Risk Based Capital (RBC) - Statutory minimum level of capital that is required by regulators for an insurer to support its operations. Segment - Retail Annuities JFI's Retail Annuities segment offers a variety of retirement income and savings products through its diverse suite of produc ts, consisting primarily of variable annuities, fixed index annuities, fixed annuities, payout annuities and registered index - linked annuities (RILA). These products are distributed through various wirehouses, insurance brokers and inde pendent broker - dealers, as well as through banks and financial institutions, primarily to high - net - worth investors and the mass and affluent markets. The financial results of the variable annuity business within the Company’s Retail Annuities segment are largely dependent on th e performance of the contract holder account value, which impacts both the level of fees collected and the benefits paid to the contract holder. The financial results of the Company’s fixed annuities, including the fixed option on var iable annuities, RILA and fixed index annuities, are largely dependent on the Company's ability to earn a spread between earned investment rates on general account assets and the interest credited to contract holders. Segment - Institutional Products JFI's Institutional Products consist of traditional guaranteed investment contracts (GICs), funding agreements (including agr eem ents issued in conjunction with JFI's participation in the U.S. Federal Home Loan Bank (FHLB) program) and Medium - Term Note funding agreements. JFI's GIC products are marketed to defined contribution pension and profit - sharing retirem ent plans. Funding agreements are marketed to institutional investors, including corporate cash accounts and securities lending funds, as well as money market funds, and are issued to the FHLB in connection with its progr am. The financial results of JFI's Institutional Products business are primarily dependent on Company’s ability to earn a spread bet ween earned investment rates on general account assets and the interest credited on GICs and funding agreements. Segment - Closed Life and Annuity Blocks JFI’s Closed Life and Annuity Blocks segment is primarily composed of blocks of business that have been acquired since 2004. Th e segment includes various protection products, primarily whole life, universal life, variable universal life, and term life insurance products as well as fixed, fixed index, and payout annuities. The Closed Life and Annuity Blocks seg men t also includes a block of group payout annuities that we assumed from John Hancock Life Insurance Company (USA) and John Hancock Life Insurance Company of New York through reinsurance transactions in 2018 and 2019, respecti vel y. The Company historically offered traditional and interest - sensitive life insurance products but discontinued new sales of life insurance products in 2012, as we believe opportunistically acquiring mature blocks of life in sur ance policies is a more efficient means of diversifying our in - force business than selling new life insurance products. The profitability of JFI's Closed Life and Annuity Blocks segment is largely driven by its historical ability to appropriatel y p rice its products and purchase appropriately priced blocks of business, as realized through underwriting, expense and net gains (losses) on derivatives and investments, and the ability to earn an assumed rate of return on the assets suppor tin g that business. Variable Annuity (VA) - An annuity that offers tax - deferred investment into a range of asset classes and a variable return, which offers insurance fea tures related to potential future income payments. 31