UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-768

CATERPILLAR INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation) | 37-0602744 (IRS Employer I.D. No.) | |

100 NE Adams Street, Peoria, Illinois (Address of principal executive offices) | 61629 (Zip Code) | |

Registrant’s telephone number, including area code:

(309) 675-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At June 30, 2012, 653,268,696 shares of common stock of the registrant were outstanding.

Table of Contents

| Item 1A. | Risk Factors | * |

| Item 3. | Defaults Upon Senior Securities | * |

| Item 5. | Other Information | * |

* Item omitted because no answer is called for or item is not applicable.

2

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Caterpillar Inc.

Consolidated Statement of Results of Operations

(Unaudited)

(Dollars in millions except per share data)

| Three Months Ended June 30, | |||||||

| 2012 | 2011 | ||||||

| Sales and revenues: | |||||||

| Sales of Machinery and Power Systems | $ | 16,684 | $ | 13,535 | |||

| Revenues of Financial Products | 690 | 695 | |||||

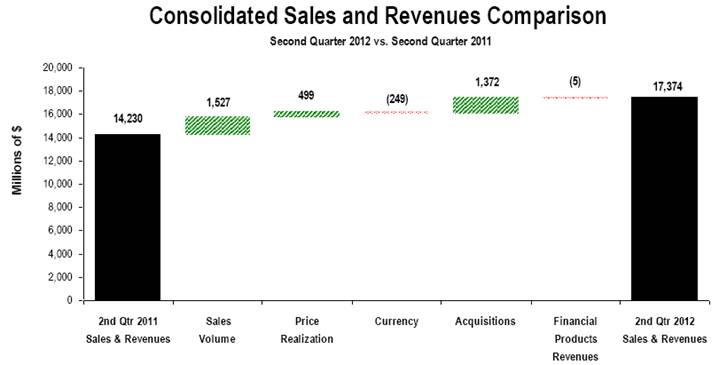

| Total sales and revenues | 17,374 | 14,230 | |||||

| Operating costs: | |||||||

| Cost of goods sold | 12,280 | 10,303 | |||||

| Selling, general and administrative expenses | 1,517 | 1,257 | |||||

| Research and development expenses | 632 | 584 | |||||

| Interest expense of Financial Products | 198 | 209 | |||||

| Other operating (income) expenses | 131 | 276 | |||||

| Total operating costs | 14,758 | 12,629 | |||||

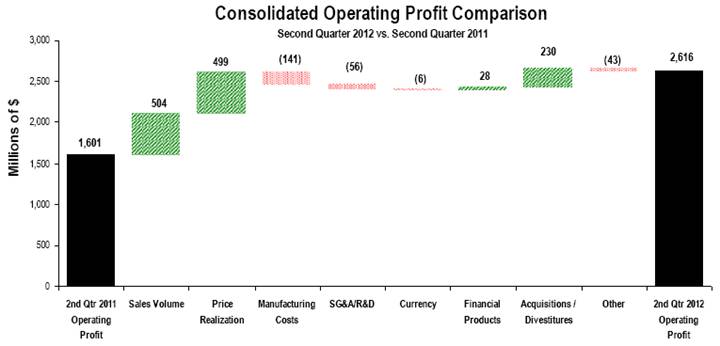

| Operating profit | 2,616 | 1,601 | |||||

| Interest expense excluding Financial Products | 110 | 90 | |||||

| Other income (expense) | 70 | (161 | ) | ||||

| Consolidated profit before taxes | 2,576 | 1,350 | |||||

| Provision for income taxes | 872 | 318 | |||||

| Profit of consolidated companies | 1,704 | 1,032 | |||||

| Equity in profit (loss) of unconsolidated affiliated companies | 5 | (10 | ) | ||||

| Profit of consolidated and affiliated companies | 1,709 | 1,022 | |||||

| Less: Profit attributable to noncontrolling interests | 10 | 7 | |||||

Profit 1 | $ | 1,699 | $ | 1,015 | |||

| Profit per common share | $ | 2.60 | $ | 1.57 | |||

Profit per common share — diluted 2 | $ | 2.54 | $ | 1.52 | |||

| Weighted-average common shares outstanding (millions) | |||||||

| – Basic | 652.9 | 645.5 | |||||

– Diluted 2 | 669.6 | 667.2 | |||||

| Cash dividends declared per common share | $ | 0.98 | $ | 0.90 | |||

1 Profit attributable to common stockholders.

2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method.

See accompanying notes to Consolidated Financial Statements.

3

Caterpillar Inc.

Consolidated Statement of Comprehensive Income

(Unaudited)

(Dollars in millions)

| Three Months Ended June 30, | |||||||

| 2012 | 2011 | ||||||

| Profit of consolidated and affiliated companies | $ | 1,709 | $ | 1,022 | |||

| Other comprehensive income (loss), net of tax: | |||||||

| Foreign currency translation, net of tax (expense)/benefit of: 2012 - ($33); 2011 - $21 | (339 | ) | 97 | ||||

| Pension and other postretirement benefits: | |||||||

| Current year actuarial gain (loss), net of tax (expense)/benefit of: 2012 - ($2); 2011 - $0 | 5 | — | |||||

| Amortization of actuarial (gain) loss, net of tax (expense)/benefit of: 2012 - ($60); 2011 - ($59) | 113 | 108 | |||||

| Amortization of prior service (credit) cost, net of tax (expense)/benefit of: 2012 - $4; 2011 - $3 | (7 | ) | (5 | ) | |||

| Derivative financial instruments: | |||||||

| Gains (losses) deferred, net of tax (expense)/benefit of: 2012 - $0; 2011 - $16 | (2 | ) | (30 | ) | |||

| (Gains) losses reclassified to earnings, net of tax (expense)/benefit of: 2012 - ($2); 2011 - ($5) | 3 | 11 | |||||

| Available-for-sale securities: | |||||||

| Gains (losses) deferred, net of tax (expense)/benefit of: 2012 - $4; 2011 - ($2) | (5 | ) | 4 | ||||

| (Gains) losses reclassifed to earnings, net of tax (expense)/benefit of: 2012 - $0; 2011 - $0 | — | (1 | ) | ||||

| Total other comprehensive income (loss), net of tax | (232 | ) | 184 | ||||

| Comprehensive income | 1,477 | 1,206 | |||||

| Less: comprehensive income attributable to the noncontrolling interests | (2 | ) | (11 | ) | |||

| Comprehensive income attributable to the company | $ | 1,475 | $ | 1,195 | |||

See accompanying notes to Consolidated Financial Statements.

4

Caterpillar Inc.

Consolidated Statement of Results of Operations

(Unaudited)

(Dollars in millions except per share data)

| Six Months Ended June 30, | |||||||

| 2012 | 2011 | ||||||

| Sales and revenues: | |||||||

| Sales of Machinery and Power Systems | $ | 31,972 | $ | 25,812 | |||

| Revenues of Financial Products | 1,383 | 1,367 | |||||

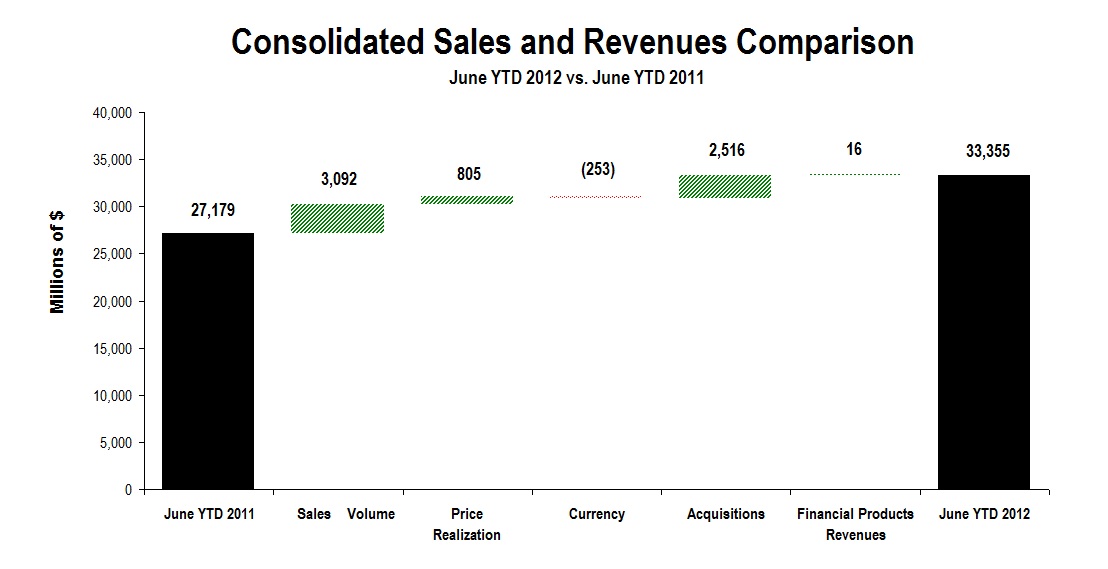

| Total sales and revenues | 33,355 | 27,179 | |||||

| Operating costs: | |||||||

| Cost of goods sold | 23,517 | 19,360 | |||||

| Selling, general and administrative expenses | 2,857 | 2,356 | |||||

| Research and development expenses | 1,219 | 1,109 | |||||

| Interest expense of Financial Products | 402 | 412 | |||||

| Other operating (income) expenses | 421 | 508 | |||||

| Total operating costs | 28,416 | 23,745 | |||||

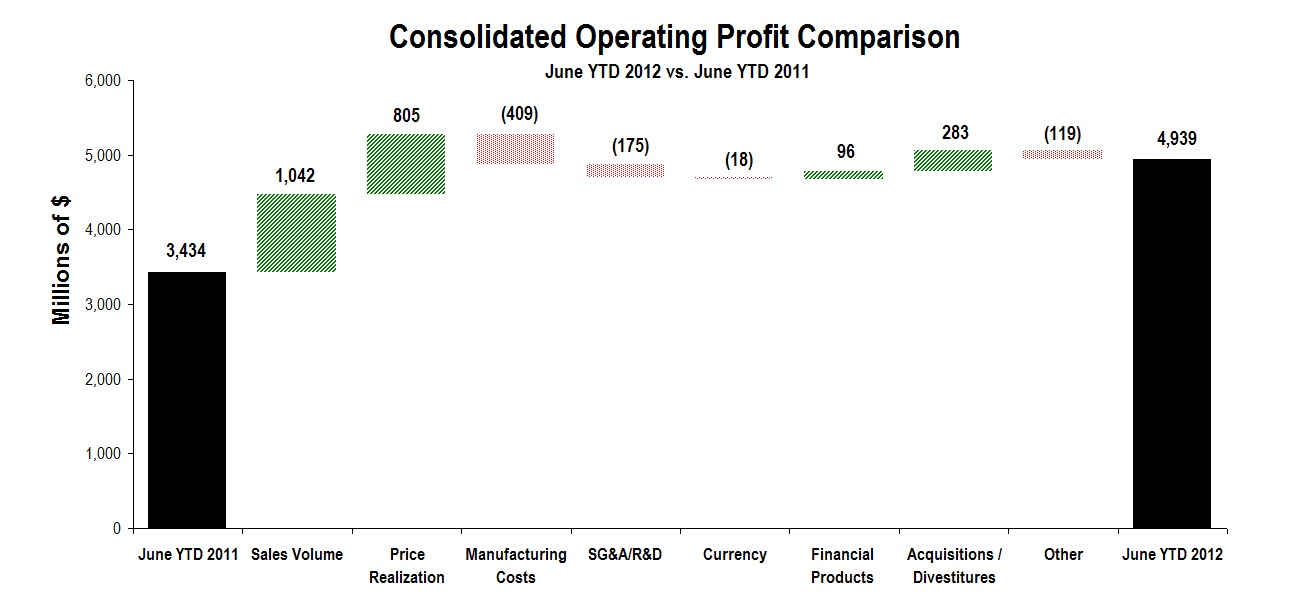

| Operating profit | 4,939 | 3,434 | |||||

| Interest expense excluding Financial Products | 223 | 177 | |||||

| Other income (expense) | 158 | (144 | ) | ||||

| Consolidated profit before taxes | 4,874 | 3,113 | |||||

| Provision for income taxes | 1,561 | 830 | |||||

| Profit of consolidated companies | 3,313 | 2,283 | |||||

| Equity in profit (loss) of unconsolidated affiliated companies | 7 | (18 | ) | ||||

| Profit of consolidated and affiliated companies | 3,320 | 2,265 | |||||

| Less: Profit attributable to noncontrolling interests | 35 | 25 | |||||

Profit 1 | $ | 3,285 | $ | 2,240 | |||

| Profit per common share | $ | 5.04 | $ | 3.48 | |||

Profit per common share — diluted 2 | $ | 4.90 | $ | 3.36 | |||

| Weighted-average common shares outstanding (millions) | |||||||

| – Basic | 651.3 | 643.3 | |||||

– Diluted 2 | 669.9 | 666.0 | |||||

| Cash dividends declared per common share | $ | 0.98 | $ | 0.90 | |||

1 Profit attributable to common stockholders.

2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method.

See accompanying notes to Consolidated Financial Statements.

5

Caterpillar Inc.

Consolidated Statement of Comprehensive Income

(Unaudited)

(Dollars in millions)

| Six Months Ended June 30, | |||||||

| 2012 | 2011 | ||||||

| Profit of consolidated and affiliated companies | $ | 3,320 | $ | 2,265 | |||

| Other comprehensive income (loss), net of tax: | |||||||

| Foreign currency translation, net of tax (expense)/benefit of: 2012 - ($16); 2011 - $84 | (158 | ) | 322 | ||||

| Pension and other postretirement benefits: | |||||||

| Current year actuarial gain (loss), net of tax (expense)/benefit of: 2012 - ($8); 2011 - $0 | 15 | — | |||||

| Amortization of actuarial (gain) loss, net of tax (expense)/benefit of: 2012 - ($120); 2011 - ($112) | 226 | 207 | |||||

| Current year prior service credit (cost), net of tax (expense)/benefit of: 2012 - $2; 2011 - $0 | (3 | ) | — | ||||

| Amortization of prior service (credit) cost, net of tax (expense)/benefit of: 2012 - $8; 2011 - $6 | (15 | ) | (10 | ) | |||

| Amortization of transition (asset) obligation, net of tax (expense)/benefit of: 2012 - $0; 2011 - $0 | 1 | 1 | |||||

| Derivative financial instruments: | |||||||

| Gains (losses) deferred, net of tax (expense)/benefit of: 2012 - $16; 2011 - $6 | (28 | ) | (13 | ) | |||

| (Gains) losses reclassified to earnings, net of tax (expense)/benefit of: 2012 - ($1); 2011 - $0 | 1 | 4 | |||||

| Available-for-sale securities: | |||||||

| Gains (losses) deferred, net of tax (expense)/benefit of: 2012 - ($5); 2011 - ($5) | 16 | 9 | |||||

| (Gains) losses reclassifed to earnings, net of tax (expense)/benefit of: 2012 - $0; 2011 - $0 | (2 | ) | (1 | ) | |||

| Total other comprehensive income (loss), net of tax | 53 | 519 | |||||

| Comprehensive income | 3,373 | 2,784 | |||||

| Less: comprehensive income attributable to the noncontrolling interests | (17 | ) | (37 | ) | |||

| Comprehensive income attributable to the company | $ | 3,356 | $ | 2,747 | |||

See accompanying notes to Consolidated Financial Statements.

6

Caterpillar Inc.

Consolidated Statement of Financial Position

(Unaudited)

(Dollars in millions)

| June 30, 2012 | December 31, 2011 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and short-term investments | $ | 5,103 | $ | 3,057 | |||

| Receivables – trade and other | 10,443 | 10,285 | |||||

| Receivables – finance | 8,383 | 7,668 | |||||

| Deferred and refundable income taxes | 1,685 | 1,580 | |||||

| Prepaid expenses and other current assets | 1,336 | 994 | |||||

| Inventories | 17,344 | 14,544 | |||||

| Total current assets | 44,294 | 38,128 | |||||

| Property, plant and equipment – net | 14,928 | 14,395 | |||||

| Long-term receivables – trade and other | 803 | 1,130 | |||||

| Long-term receivables – finance | 12,955 | 11,948 | |||||

| Investments in unconsolidated affiliated companies | 124 | 133 | |||||

| Noncurrent deferred and refundable income taxes | 2,032 | 2,157 | |||||

| Intangible assets | 4,236 | 4,368 | |||||

| Goodwill | 7,320 | 7,080 | |||||

| Other assets | 2,146 | 2,107 | |||||

| Total assets | $ | 88,838 | $ | 81,446 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Short-term borrowings: | |||||||

| Machinery and Power Systems | $ | 592 | $ | 93 | |||

| Financial Products | 4,455 | 3,895 | |||||

| Accounts payable | 8,470 | 8,161 | |||||

| Accrued expenses | 3,532 | 3,386 | |||||

| Accrued wages, salaries and employee benefits | 1,628 | 2,410 | |||||

| Customer advances | 3,132 | 2,691 | |||||

| Dividends payable | 339 | 298 | |||||

| Other current liabilities | 2,117 | 1,967 | |||||

| Long-term debt due within one year: | |||||||

| Machinery and Power Systems | 1,269 | 558 | |||||

| Financial Products | 5,739 | 5,102 | |||||

| Total current liabilities | 31,273 | 28,561 | |||||

| Long-term debt due after one year: | |||||||

| Machinery and Power Systems | 9,169 | 8,415 | |||||

| Financial Products | 18,092 | 16,529 | |||||

| Liability for postemployment benefits | 10,626 | 10,956 | |||||

| Other liabilities | 3,697 | 3,583 | |||||

| Total liabilities | 72,857 | 68,044 | |||||

| Commitments and contingencies (Notes 10 and 12) | |||||||

| Redeemable noncontrolling interest | — | 473 | |||||

| Stockholders’ equity | |||||||

| Common stock of $1.00 par value: | |||||||

| Authorized shares: 2,000,000,000 Issued shares: (6/30/12 and 12/31/11 – 814,894,624) at paid-in amount | 4,373 | 4,273 | |||||

| Treasury stock (6/30/12 – 161,625,928 shares; 12/31/11 – 167,361,280 shares) at cost | (10,139 | ) | (10,281 | ) | |||

| Profit employed in the business | 27,842 | 25,219 | |||||

| Accumulated other comprehensive income (loss) | (6,150 | ) | (6,328 | ) | |||

| Noncontrolling interests | 55 | 46 | |||||

| Total stockholders’ equity | 15,981 | 12,929 | |||||

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity | $ | 88,838 | $ | 81,446 | |||

See accompanying notes to Consolidated Financial Statements.

7

Caterpillar Inc.

Consolidated Statement of Changes in Stockholders’ Equity

(Unaudited)

(Dollars in millions)

Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) | Noncontrolling interests | Total | |||||||||||||||||||

| Six Months Ended June 30, 2011 | ||||||||||||||||||||||||

| Balance at December 31, 2010 | $ | 3,888 | $ | (10,397 | ) | $ | 21,384 | $ | (4,051 | ) | $ | 40 | $ | 10,864 | ||||||||||

| Profit of consolidated and affiliated companies | — | — | 2,240 | — | 25 | 2,265 | ||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | 312 | 10 | 322 | ||||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | 196 | 2 | 198 | ||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (9 | ) | — | (9 | ) | ||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | 8 | — | 8 | ||||||||||||||||||

| Dividends declared | — | — | (581 | ) | — | — | (581 | ) | ||||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (2 | ) | (2 | ) | ||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 7,243,608 | 10 | 86 | — | — | — | 96 | ||||||||||||||||||

| Stock-based compensation expense | 111 | — | — | — | — | 111 | ||||||||||||||||||

| Net excess tax benefits from stock-based compensation | 156 | — | — | — | — | 156 | ||||||||||||||||||

Cat Japan share redemption1 | — | — | 38 | — | (30 | ) | 8 | |||||||||||||||||

| Balance at June 30, 2011 | $ | 4,165 | $ | (10,311 | ) | $ | 23,081 | $ | (3,544 | ) | $ | 45 | $ | 13,436 | ||||||||||

| Six Months Ended June 30, 2012 | ||||||||||||||||||||||||

| Balance at December 31, 2011 | $ | 4,273 | $ | (10,281 | ) | $ | 25,219 | $ | (6,328 | ) | $ | 46 | $ | 12,929 | ||||||||||

| Profit of consolidated and affiliated companies | — | — | 3,285 | — | 35 | 3,320 | ||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | (134 | ) | (24 | ) | (158 | ) | |||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | 219 | 5 | 224 | ||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (27 | ) | — | (27 | ) | ||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | 13 | 1 | 14 | ||||||||||||||||||

| Change in ownership from noncontrolling interests | — | — | — | — | 7 | 7 | ||||||||||||||||||

| Dividends declared | — | — | (639 | ) | — | — | (639 | ) | ||||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (5 | ) | (5 | ) | ||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 5,735,352 | (117 | ) | 142 | — | — | — | 25 | |||||||||||||||||

| Stock-based compensation expense | 135 | — | — | — | — | 135 | ||||||||||||||||||

| Net excess tax benefits from stock-based compensation | 156 | — | — | — | — | 156 | ||||||||||||||||||

Cat Japan share redemption1 | (74 | ) | — | (23 | ) | 107 | (10 | ) | — | |||||||||||||||

| Balance at June 30, 2012 | $ | 4,373 | $ | (10,139 | ) | $ | 27,842 | $ | (6,150 | ) | $ | 55 | $ | 15,981 | ||||||||||

1 See Notes 1 and 16 regarding the Cat Japan share redemption.

See accompanying notes to Consolidated Financial Statements.

8

Caterpillar Inc.

Consolidated Statement of Cash Flow

(Unaudited)

(Millions of dollars)

| Six Months Ended June 30, | |||||||

| 2012 | 2011 | ||||||

| Cash flow from operating activities: | |||||||

| Profit of consolidated and affiliated companies | $ | 3,320 | $ | 2,265 | |||

| Adjustments for non-cash items: | |||||||

| Depreciation and amortization | 1,350 | 1,174 | |||||

| Other | (59 | ) | 337 | ||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||

| Receivables – trade and other | 37 | 45 | |||||

| Inventories | (2,939 | ) | (1,850 | ) | |||

| Accounts payable | 299 | 1,056 | |||||

| Accrued expenses | 115 | (41 | ) | ||||

| Accrued wages, salaries and employee benefits | (753 | ) | (91 | ) | |||

| Customer advances | 434 | 14 | |||||

| Other assets – net | 63 | 28 | |||||

| Other liabilities – net | 140 | 357 | |||||

| Net cash provided by (used for) operating activities | 2,007 | 3,294 | |||||

| Cash flow from investing activities: | |||||||

| Capital expenditures – excluding equipment leased to others | (1,508 | ) | (924 | ) | |||

| Expenditures for equipment leased to others | (787 | ) | (580 | ) | |||

| Proceeds from disposals of leased assets and property, plant and equipment | 543 | 621 | |||||

| Additions to finance receivables | (5,942 | ) | (4,294 | ) | |||

| Collections of finance receivables | 4,298 | 3,981 | |||||

| Proceeds from sale of finance receivables | 85 | 104 | |||||

| Investments and acquisitions (net of cash acquired) | (517 | ) | (68 | ) | |||

| Proceeds from sale of businesses and investments (net of cash sold) | 308 | 21 | |||||

| Proceeds from sale of available-for-sale securities | 177 | 122 | |||||

| Investments in available-for-sale securities | (199 | ) | (131 | ) | |||

| Other – net | 38 | (38 | ) | ||||

| Net cash provided by (used for) investing activities | (3,504 | ) | (1,186 | ) | |||

| Cash flow from financing activities: | |||||||

| Dividends paid | (598 | ) | (565 | ) | |||

| Distribution to noncontrolling interests | (5 | ) | (2 | ) | |||

| Common stock issued, including treasury shares reissued | 25 | 96 | |||||

| Excess tax benefit from stock-based compensation | 156 | 159 | |||||

| Acquisitions of redeemable noncontrolling interests | (444 | ) | — | ||||

| Proceeds from debt issued (original maturities greater than three months): | |||||||

| Machinery and Power Systems | 1,662 | 4,530 | |||||

| Financial Products | 7,357 | 5,799 | |||||

| Payments on debt (original maturities greater than three months): | |||||||

| Machinery and Power Systems | (211 | ) | (487 | ) | |||

| Financial Products | (4,822 | ) | (4,638 | ) | |||

| Short-term borrowings – net (original maturities three months or less) | 552 | 36 | |||||

| Net cash provided by (used for) financing activities | 3,672 | 4,928 | |||||

| Effect of exchange rate changes on cash | (129 | ) | 87 | ||||

| Increase (decrease) in cash and short-term investments | 2,046 | 7,123 | |||||

| Cash and short-term investments at beginning of period | 3,057 | 3,592 | |||||

| Cash and short-term investments at end of period | $ | 5,103 | $ | 10,715 | |||

All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents.

See accompanying notes to Consolidated Financial Statements.

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. A. Basis of Presentation

In the opinion of management, the accompanying financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated results of operations for the three and six month periods ended June 30, 2012 and 2011, (b) the consolidated comprehensive income for the three and six month periods ended June 30, 2012 and 2011, (c) the consolidated financial position at June 30, 2012 and December 31, 2011, (d) the consolidated changes in stockholders’ equity for the six month periods ended June 30, 2012 and 2011, and (e) the consolidated cash flow for the six month periods ended June 30, 2012 and 2011. The financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (U.S. GAAP) and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC). Certain amounts for prior periods have been reclassified to conform to the current period financial statement presentation.

Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with the audited financial statements and notes thereto included in our Company’s annual report on Form 10-K for the year ended December 31, 2011 (2011 Form 10-K).

The December 31, 2011 financial position data included herein is derived from the audited consolidated financial statements included in the 2011 Form 10-K but does not include all disclosures required by U.S. GAAP.

B. Nature of Operations

Information in our financial statements and related commentary are presented in the following categories:

Machinery and Power Systems – Represents the aggregate total of Construction Industries, Resource Industries, Power Systems, and All Other segments and related corporate items and eliminations.

Financial Products – Primarily includes the company’s Financial Products Segment. This category includes Caterpillar Financial Services Corporation (Cat Financial), Caterpillar Insurance Holdings Inc. (Cat Insurance) and their respective subsidiaries.

C. Accumulated Other Comprehensive Income (Loss)

Comprehensive income and its components are presented in the Consolidated Statement of Comprehensive Income. Accumulated other comprehensive income (loss), net of tax, included in the Consolidated Statement of Changes in Stockholders’ Equity, consisted of the following:

| (Millions of dollars) | June 30, 2012 | June 30, 2011 | |||||

| Foreign currency translation | $ | 239 | $ | 863 | |||

| Pension and other postretirement benefits | (6,410 | ) | (4,499 | ) | |||

| Derivative financial instruments | (37 | ) | 36 | ||||

| Available-for-sale securities | 58 | 56 | |||||

| Total accumulated other comprehensive income (loss) | $ | (6,150 | ) | 1 | $ | (3,544 | ) |

1 | In conjunction with the Cat Japan share redemption, to reflect the increase in our ownership interest in Cat Japan from 67 percent to 100 percent, $107 million was reclassified to Accumulated other comprehensive income (loss) from other components of stockholders' equity and was not included in Comprehensive income during the second quarter of 2012. The amount was comprised of foreign currency translation of $167 million, pension and other postretirement benefits of $(61) million and available-for-sale securities of $1 million. |

2. New Accounting Guidance

Disclosures about the credit quality of financing receivables and the allowance for credit losses – In July 2010, the Financial Accounting Standards Board (FASB) issued accounting guidance on disclosures about the credit quality of

10

financing receivables and the allowance for credit losses. The guidance expands disclosures for the allowance for credit losses and financing receivables by requiring entities to disclose information at disaggregated levels. It also requires disclosure of credit quality indicators, past due information and modifications of financing receivables. Also, in April 2011, the FASB issued guidance clarifying when a restructuring of a receivable should be considered a troubled debt restructuring by providing additional guidance for determining whether the creditor has granted a concession and whether the debtor is experiencing financial difficulties. For end of period balances, the new disclosures were effective December 31, 2010 and did not have a material impact on our financial statements. For activity during a reporting period, the disclosures were effective January 1, 2011 and did not have a material impact on our financial statements. The disclosures related to modifications of financing receivables, as well as the guidance clarifying when a restructured receivable should be considered a troubled debt restructuring were effective July 1, 2011 and did not have a material impact on our financial statements. See Note 15 for additional information.

Presentation of comprehensive income – In June 2011, the FASB issued accounting guidance on the presentation of comprehensive income. The guidance provides two options for presenting net income and other comprehensive income. The total of comprehensive income, the components of net income, and the components of other comprehensive income may be presented in either a single continuous statement of comprehensive income or in two separate but consecutive statements. We elected to present two separate statements. This guidance was effective January 1, 2012.

Goodwill impairment testing – In September 2011, the FASB issued accounting guidance on the testing of goodwill for impairment. The guidance allows entities testing goodwill for impairment the option of performing a qualitative assessment to determine the likelihood of goodwill impairment and whether it is necessary to perform the two-step impairment test currently required. This guidance was effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption was permitted. We elected to early adopt this guidance for the year ended December 31, 2011 and the guidance did not have a material impact on our financial statements. See Note 7 for additional information.

3. Stock-Based Compensation

Accounting for stock-based compensation requires that the cost resulting from all stock-based payments be recognized in the financial statements based on the grant date fair value of the award. Stock-based compensation primarily consists of stock options, restricted stock units (RSUs) and stock-settled stock appreciation rights (SARs). We recognized pretax stock-based compensation cost in the amount of $88 million and $135 million for the three and six months ended June 30, 2012, respectively; and $67 million and $111 million for the three and six months ended June 30, 2011, respectively.

The following table illustrates the type and fair value of the stock-based compensation awards granted during the six month periods ended June 30, 2012 and 2011, respectively:

| 2012 | 2011 | ||||||||||||

| # Granted | Fair Value Per Award | # Granted | Fair Value Per Award | ||||||||||

| Stock options | 3,224,203 | $ | 39.20 | 237,906 | $ | 36.73 | |||||||

| RSUs | 1,429,939 | $ | 104.61 | 1,082,032 | $ | 97.51 | |||||||

| SARs | — | $ | — | 2,722,689 | $ | 36.73 | |||||||

The stock price on the date of grant was $110.09 and $102.13 for 2012 and 2011, respectively.

The following table provides the assumptions used in determining the fair value of the stock-based awards for the six month periods ended June 30, 2012 and 2011, respectively:

| Grant Year | |||

| 2012 | 2011 | ||

| Weighted-average dividend yield | 2.16% | 2.22% | |

| Weighted-average volatility | 35.0% | 32.7% | |

| Range of volatilities | 33.3-40.4% | 20.9-45.4% | |

| Range of risk-free interest rates | 0.17-2.00% | 0.25-3.51% | |

| Weighted-average expected lives | 7 years | 8 years | |

11

As of June 30, 2012, the total remaining unrecognized compensation cost related to nonvested stock-based compensation awards was $293 million, which will be amortized over the weighted-average remaining requisite service periods of approximately 2.2 years.

4. Derivative Financial Instruments and Risk Management

Our earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates, interest rates and commodity prices. In addition, the amount of Caterpillar stock that can be repurchased under our stock repurchase program is impacted by movements in the price of the stock. Our Risk Management Policy (policy) allows for the use of derivative financial instruments to prudently manage foreign currency exchange rate, interest rate, commodity price and Caterpillar stock price exposures. Our policy specifies that derivatives are not to be used for speculative purposes. Derivatives that we use are primarily foreign currency forward and option contracts, interest rate swaps, commodity forward and option contracts, and stock repurchase contracts. Our derivative activities are subject to the management, direction and control of our senior financial officers. Risk management practices, including the use of financial derivative instruments, are presented to the Audit Committee of the Board of Directors at least annually.

All derivatives are recognized on the Consolidated Statement of Financial Position at their fair value. On the date the derivative contract is entered into, we designate the derivative as (1) a hedge of the fair value of a recognized asset or liability (fair value hedge), (2) a hedge of a forecasted transaction or the variability of cash flow to be paid (cash flow hedge), or (3) an undesignated instrument. Changes in the fair value of a derivative that is qualified, designated and highly effective as a fair value hedge, along with the gain or loss on the hedged recognized asset or liability that is attributable to the hedged risk, are recorded in current earnings. Changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge are recorded in Accumulated other comprehensive income (loss) (AOCI) to the extent effective on the Consolidated Statement of Financial Position until they are reclassified to earnings in the same period or periods during which the hedged transaction affects earnings. Changes in the fair value of undesignated derivative instruments and the ineffective portion of designated derivative instruments are reported in current earnings. Cash flow from designated derivative financial instruments are classified within the same category as the item being hedged on the Consolidated Statement of Cash Flow. Cash flow from undesignated derivative financial instruments are included in the investing category on the Consolidated Statement of Cash Flow.

We formally document all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities on the Consolidated Statement of Financial Position and linking cash flow hedges to specific forecasted transactions or variability of cash flow.

We also formally assess, both at the hedge’s inception and on an ongoing basis, whether the designated derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flow of hedged items. When a derivative is determined not to be highly effective as a hedge or the underlying hedged transaction is no longer probable, we discontinue hedge accounting prospectively, in accordance with the derecognition criteria for hedge accounting.

Foreign Currency Exchange Rate Risk

Foreign currency exchange rate movements create a degree of risk by affecting the U.S. dollar value of sales made and costs incurred in foreign currencies. Movements in foreign currency rates also affect our competitive position as these changes may affect business practices and/or pricing strategies of non-U.S.-based competitors. Additionally, we have balance sheet positions denominated in foreign currencies, thereby creating exposure to movements in exchange rates.

Our Machinery and Power Systems operations purchase, manufacture and sell products in many locations around the world. As we have a diversified revenue and cost base, we manage our future foreign currency cash flow exposure on a net basis. We use foreign currency forward and option contracts to manage unmatched foreign currency cash inflow and outflow. Our objective is to minimize the risk of exchange rate movements that would reduce the U.S. dollar value of our foreign currency cash flow. Our policy allows for managing anticipated foreign currency cash flow for up to five years.

We generally designate as cash flow hedges at inception of the contract any Australian dollar, Brazilian real, British pound, Canadian dollar, Chinese yuan, euro, Indian rupee, Japanese yen, Mexican peso, Singapore dollar or Swiss franc forward or option contracts that meet the requirements for hedge accounting and the maturity extends beyond the current

12

quarter-end. Designation is performed on a specific exposure basis to support hedge accounting. The remainder of Machinery and Power Systems foreign currency contracts are undesignated, including any hedges designed to protect our competitive exposure.

As of June 30, 2012, $18 million of deferred net losses, net of tax, included in equity (Accumulated other comprehensive income (loss) in the Consolidated Statement of Financial Position), are expected to be reclassified to current earnings (Other income (expense) in the Consolidated Statement of Results of Operations) over the next twelve months when earnings are affected by the hedged transactions. The actual amount recorded in Other income (expense) will vary based on exchange rates at the time the hedged transactions impact earnings.

In managing foreign currency risk for our Financial Products operations, our objective is to minimize earnings volatility resulting from conversion and the remeasurement of net foreign currency balance sheet positions. Our policy allows the use of foreign currency forward and option contracts to offset the risk of currency mismatch between our receivables and debt. All such foreign currency forward and option contracts are undesignated.

Interest Rate Risk

Interest rate movements create a degree of risk by affecting the amount of our interest payments and the value of our fixed-rate debt. Our practice is to use interest rate derivatives to manage our exposure to interest rate changes and, in some cases, lower the cost of borrowed funds.

Our Machinery and Power Systems operations generally use fixed-rate debt as a source of funding. Our objective is to minimize the cost of borrowed funds. Our policy allows us to enter into fixed-to-floating interest rate swaps and forward rate agreements to meet that objective with the intent to designate as fair value hedges at inception of the contract all fixed-to-floating interest rate swaps. Designation as a hedge of the fair value of our fixed-rate debt is performed to support hedge accounting.

Financial Products operations has a match-funding policy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate) of Cat Financial’s debt portfolio with the interest rate profile of their receivables portfolio within predetermined ranges on an ongoing basis. In connection with that policy, we use interest rate derivative instruments to modify the debt structure to match assets within the receivables portfolio. This matched funding reduces the volatility of margins between interest-bearing assets and interest-bearing liabilities, regardless of which direction interest rates move.

Our policy allows us to use fixed-to-floating, floating-to-fixed, and floating-to-floating interest rate swaps to meet the match-funding objective. We designate fixed-to-floating interest rate swaps as fair value hedges to protect debt against changes in fair value due to changes in the benchmark interest rate. We designate most floating-to-fixed interest rate swaps as cash flow hedges to protect against the variability of cash flows due to changes in the benchmark interest rate.

As of June 30, 2012, $3 million of deferred net losses, net of tax, included in equity (Accumulated other comprehensive income (loss) in the Consolidated Statement of Financial Position), related to Financial Products floating-to-fixed interest rate swaps, are expected to be reclassified to current earnings (Interest expense of Financial Products in the Consolidated Statement of Results of Operations) over the next twelve months. The actual amount recorded in Interest expense of Financial Products will vary based on interest rates at the time the hedged transactions impact earnings.

We have, at certain times, liquidated fixed-to-floating and floating-to-fixed interest rate swaps at both Machinery and Power Systems and Financial Products. The gains or losses associated with these swaps at the time of liquidation are amortized into earnings over the original term of the previously designated hedged item.

In anticipation of issuing debt for the planned acquisition of Bucyrus International, Inc., we entered into interest rate swaps to manage our exposure to interest rate changes. For the three and six months ended June 30, 2011, we recognized a net loss of $124 million and $149 million, respectively, included in Other income (expense) in the Consolidated Statement of Results of Operations. These contracts were not designated as hedging instruments, and therefore, did not receive hedge accounting treatment. The contracts were liquidated in conjunction with the debt issuance in May 2011.

Commodity Price Risk

Commodity price movements create a degree of risk by affecting the price we must pay for certain raw material. Our policy is to use commodity forward and option contracts to manage the commodity risk and reduce the cost of purchased

13

materials.

Our Machinery and Power Systems operations purchase base and precious metals embedded in the components we purchase from suppliers. Our suppliers pass on a share of the price changes in the commodity portion of the component cost. In addition, we are subject to price changes on energy products such as natural gas and diesel fuel purchased for operational use.

Our objective is to minimize volatility in the price of these commodities. Our policy allows us to enter into commodity forward and option contracts to lock in the purchase price of a portion of these commodities within a five-year horizon. All such commodity forward and option contracts are undesignated.

The location and fair value of derivative instruments reported in the Consolidated Statement of Financial Position are as follows:

| (Millions of dollars) | |||||||||

| Consolidated Statement of Financial | Asset (Liability) Fair Value | ||||||||

| Position Location | June 30, 2012 | December 31, 2011 | |||||||

| Designated derivatives | |||||||||

| Foreign exchange contracts | |||||||||

| Machinery and Power Systems | Receivables – trade and other | $ | 32 | $ | 54 | ||||

| Machinery and Power Systems | Long-term receivables – trade and other | 3 | 19 | ||||||

| Machinery and Power Systems | Accrued expenses | (60 | ) | (73 | ) | ||||

| Machinery and Power Systems | Other liabilities | (7 | ) | (10 | ) | ||||

| Interest rate contracts | |||||||||

| Financial Products | Receivables – trade and other | 15 | 15 | ||||||

| Financial Products | Long-term receivables – trade and other | 229 | 233 | ||||||

| Financial Products | Accrued expenses | (7 | ) | (6 | ) | ||||

| $ | 205 | $ | 232 | ||||||

| Undesignated derivatives | |||||||||

| Foreign exchange contracts | |||||||||

| Machinery and Power Systems | Receivables – trade and other | $ | 8 | $ | 27 | ||||

| Machinery and Power Systems | Accrued expenses | (35 | ) | (12 | ) | ||||

| Machinery and Power Systems | Other liabilities | (28 | ) | (85 | ) | ||||

| Financial Products | Receivables – trade and other | 11 | 7 | ||||||

| Financial Products | Accrued expenses | (11 | ) | (16 | ) | ||||

| Interest rate contracts | |||||||||

| Financial Products | Accrued expenses | (2 | ) | (1 | ) | ||||

| Commodity contracts | |||||||||

| Machinery and Power Systems | Receivables – trade and other | 1 | 2 | ||||||

| Machinery and Power Systems | Accrued expenses | (4 | ) | (9 | ) | ||||

| $ | (60 | ) | $ | (87 | ) | ||||

14

The effect of derivatives designated as hedging instruments on the Consolidated Statement of Results of Operations is as follows:

Fair Value Hedges (Millions of dollars) | |||||||||||||||||

| Three Months Ended June 30, 2012 | Six Months Ended June 30, 2012 | ||||||||||||||||

| Classification | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | |||||||||||||

| Interest rate contracts | |||||||||||||||||

| Financial Products | Other income (expense) | $ | 6 | $ | (5 | ) | $ | (3 | ) | $ | 10 | ||||||

| $ | 6 | $ | (5 | ) | $ | (3 | ) | $ | 10 | ||||||||

| Three Months Ended June 30, 2011 | Six Months Ended June 30, 2011 | ||||||||||||||||

| Classification | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | |||||||||||||

| Interest rate contracts | |||||||||||||||||

| Machinery and Power Systems | Other income (expense) | $ | — | $ | — | $ | (1 | ) | $ | 1 | |||||||

| Financial Products | Other income (expense) | 42 | (40 | ) | (11 | ) | 12 | ||||||||||

| $ | 42 | $ | (40 | ) | $ | (12 | ) | $ | 13 | ||||||||

15

Cash Flow Hedges (Millions of dollars) | ||||||||||||||

| Three Months Ended June 30, 2012 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI (Effective Portion) | Recognized in Earnings (Ineffective Portion) | |||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery and Power Systems | $ | — | Other income (expense) | $ | (4 | ) | $ | — | ||||||

| Interest rate contracts | — | |||||||||||||

| Financial Products | (2 | ) | Interest expense of Financial Products | (1 | ) | (1 | ) | 1 | ||||||

| $ | (2 | ) | $ | (5 | ) | $ | (1 | ) | ||||||

| Three Months Ended June 30, 2011 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI (Effective Portion) | Recognized in Earnings (Ineffective Portion) | |||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery and Power Systems | $ | (45 | ) | Other income (expense) | $ | (9 | ) | $ | — | |||||

| Interest rate contracts | ||||||||||||||

| Machinery and Power Systems | — | Other income (expense) | (1 | ) | — | |||||||||

| Financial Products | (1 | ) | Interest expense of Financial Products | (6 | ) | — | 1 | |||||||

| $ | (46 | ) | $ | (16 | ) | $ | — | |||||||

| Six Months Ended June 30, 2012 | |||||||||||||||

| Recognized in Earnings | |||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI (Effective Portion) | Recognized in Earnings (Ineffective Portion) | ||||||||||||

| Foreign exchange contracts | |||||||||||||||

| Machinery and Power Systems | $ | (42 | ) | Other income (expense) | $ | 1 | $ | — | |||||||

| Interest rate contracts | |||||||||||||||

| Machinery and Power Systems | — | Other income (expense) | (1 | ) | — | ||||||||||

| Financial Products | (2 | ) | Interest expense of Financial Products | (2 | ) | (1 | ) | 1 | |||||||

| $ | (44 | ) | $ | (2 | ) | $ | (1 | ) | |||||||

| Six Months Ended June 30, 2011 | |||||||||||||||

| Recognized in Earnings | |||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI (Effective Portion) | Recognized in Earnings (Ineffective Portion) | ||||||||||||

| Foreign exchange contracts | |||||||||||||||

| Machinery and Power Systems | $ | (18 | ) | Other income (expense) | $ | 9 | $ | — | |||||||

| Interest rate contracts | |||||||||||||||

| Machinery and Power Systems | — | Other income (expense) | (1 | ) | — | ||||||||||

| Financial Products | (1 | ) | Interest expense of Financial Products | (12 | ) | 1 | 1 | ||||||||

| $ | (19 | ) | $ | (4 | ) | $ | 1 | ||||||||

1 The ineffective portion recognized in earnings is included in Other income (expense).

16

The effect of derivatives not designated as hedging instruments on the Consolidated Statement of Results of Operations is as follows:

(Millions of dollars) | ||||||||||

| Classification of Gains (Losses) | Three Months Ended June 30, 2012 | Six Months Ended June 30, 2012 | ||||||||

| Foreign exchange contracts | ||||||||||

| Machinery and Power Systems | Other income (expense) | $ | (35 | ) | $ | 30 | ||||

| Financial Products | Other income (expense) | (5 | ) | 2 | ||||||

| Commodity contracts | ||||||||||

| Machinery and Power Systems | Other income (expense) | (6 | ) | — | ||||||

| $ | (46 | ) | $ | 32 | ||||||

(Millions of dollars) | |||||||||

| Classification of Gains (Losses) | Three Months Ended June 30, 2011 | Six Months Ended June 30, 2011 | |||||||

| Foreign exchange contracts | |||||||||

| Machinery and Power Systems | Other income (expense) | $ | 15 | $ | 47 | ||||

| Financial Products | Other income (expense) | (2 | ) | (2 | ) | ||||

| Interest rate contracts | |||||||||

| Machinery and Power Systems | Other income (expense) | (124 | ) | (149 | ) | ||||

| Commodity contracts | |||||||||

| Machinery and Power Systems | Other income (expense) | (2 | ) | 2 | |||||

| $ | (113 | ) | $ | (102 | ) | ||||

Stock Repurchase Risk

Payments for stock repurchase derivatives are accounted for as a reduction in stockholders’ equity. In February 2007, the Board of Directors authorized a $7.5 billion stock repurchase program, expiring on December 31, 2011. In December 2011, the Board of Directors extended the $7.5 billion stock repurchase program through December 31, 2015. The amount of Caterpillar stock that can be repurchased under the authorization is impacted by movements in the price of the stock. In August 2007, the Board of Directors authorized the use of derivative contracts to reduce stock repurchase price volatility. There were no stock repurchase derivatives outstanding for the three and six months ended June 30, 2012 or 2011.

5. Inventories

Inventories (principally using the last-in, first-out (LIFO) method) are comprised of the following:

| (Millions of dollars) | June 30, 2012 | December 31, 2011 | |||||

| Raw materials | $ | 4,143 | $ | 3,766 | |||

| Work-in-process | 3,504 | 2,959 | |||||

| Finished goods | 9,429 | 7,562 | |||||

| Supplies | 268 | 257 | |||||

| Total inventories | $ | 17,344 | $ | 14,544 | |||

6. Investments in Unconsolidated Affiliated Companies

Combined financial information of the unconsolidated affiliated companies accounted for by the equity method (generally on a lag of 3 months or less) was as follows:

17

Results of Operations of unconsolidated affiliated companies: (Millions of dollars) | |||||||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Sales | $ | 206 | $ | 241 | $ | 372 | $ | 439 | |||||||

| Cost of sales | 160 | 198 | 286 | 359 | |||||||||||

| Gross profit | $ | 46 | $ | 43 | $ | 86 | $ | 80 | |||||||

| Profit (loss) | $ | 12 | $ | (17 | ) | $ | 22 | $ | (34 | ) | |||||

Financial Position of unconsolidated affiliated companies: (Millions of dollars) | June 30, 2012 | December 31, 2011 | |||||

| Assets: | |||||||

| Current assets | $ | 332 | $ | 345 | |||

| Property, plant and equipment — net | 107 | 200 | |||||

| Other assets | 17 | 9 | |||||

| 456 | 554 | ||||||

| Liabilities: | |||||||

| Current liabilities | 197 | 220 | |||||

| Long-term debt due after one year | 50 | 72 | |||||

| Other liabilities | 9 | 17 | |||||

| 256 | 309 | ||||||

| Equity | $ | 200 | $ | 245 | |||

Caterpillar’s investments in unconsolidated affiliated companies: (Millions of dollars) | June 30, 2012 | December 31, 2011 | |||||

| Investments in equity method companies | $ | 108 | $ | 111 | |||

| Plus: Investments in cost method companies | 16 | 22 | |||||

| Total investments in unconsolidated affiliated companies | $ | 124 | $ | 133 | |||

7. Intangible Assets and Goodwill

A. Intangible assets

Intangible assets are comprised of the following:

18

| June 30, 2012 | |||||||||||||

| (Millions of dollars) | Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||

| Customer relationships | 15 | $ | 2,822 | $ | (272 | ) | $ | 2,550 | |||||

| Intellectual property | 11 | 1,787 | (317 | ) | 1,470 | ||||||||

| Other | 10 | 316 | (118 | ) | 198 | ||||||||

| Total finite-lived intangible assets | 14 | 4,925 | (707 | ) | 4,218 | ||||||||

| Indefinite-lived intangible assets - In-process research & development | 18 | — | 18 | ||||||||||

| Total intangible assets | $ | 4,943 | $ | (707 | ) | $ | 4,236 | ||||||

| December 31, 2011 | |||||||||||||

| (Millions of dollars) | Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||

| Customer relationships | 15 | $ | 2,811 | $ | (213 | ) | $ | 2,598 | |||||

| Intellectual property | 11 | 1,794 | (244 | ) | 1,550 | ||||||||

| Other | 11 | 299 | (97 | ) | 202 | ||||||||

| Total finite-lived intangible assets | 13 | 4,904 | (554 | ) | 4,350 | ||||||||

| Indefinite-lived intangible assets - In-process research & development | 18 | — | 18 | ||||||||||

| Total intangible assets | $ | 4,922 | $ | (554 | ) | $ | 4,368 | ||||||

During the second quarter of 2012, we acquired finite-lived intangible assets aggregating $194 million due to the purchase of ERA Mining Machinery Limited. During the first quarter of 2012, we acquired finite-lived intangible assets aggregating $8 million due to the purchase of Cat Tohoku. See Note 18 for details on these business combinations.

Customer relationship intangibles of $100 million, net of accumulated amortization of $4 million, were reclassified from Intangible assets to held for sale in the first half of 2012, primarily related to the divestiture of portions of the Bucyrus distribution business, and are not included in the June 30, 2012 balances in the table above. See Note 19 for additional information on assets held for sale.

Customer relationship intangibles of $51 million, net of accumulated amortization of $29 million, from the All Other segment were impaired during the second quarter of 2012. Fair value of the intangibles was determined using an income approach based on the present value of discounted cash flows. The impairment of $22 million was recognized in Other operating (income) expenses on the Consolidated Statement of Results of Operations and included in the All Other segment.

Amortization expense for the three and six months ended June 30, 2012 was $99 million and $193 million, respectively. Amortization expense for the three and six months ended June 30, 2011 was $22 million and $44 million respectively. Amortization expense related to intangible assets is expected to be:

| (Millions of dollars) | ||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | Thereafter | |||||

| $393 | $393 | $386 | $380 | $371 | $2,506 | |||||

B. Goodwill

During the second quarter of 2012, we recorded goodwill of $467 million related to the acquisition of ERA Mining Machinery Limited. During the first quarter of 2012, we recorded goodwill of $16 million related to the acquisition of Cat Tohoku. See Note 18 for details on these business combinations.

Goodwill of $152 million was reclassified to held for sale in the first half of 2012, primarily related to the divestiture of portions of the Bucyrus distribution business, and is not included in the June 30, 2012 balance in the table below. See

19

Note 19 for additional information on assets held for sale.

We test goodwill for impairment annually and whenever events or circumstances make it more likely than not that an impairment may have occurred. We perform our annual goodwill impairment test as of October 1 and monitor for interim triggering events on an ongoing basis. Goodwill is reviewed for impairment utilizing a qualitative assessment or a two-step process. We have an option to make a qualitative assessment of a reporting unit's goodwill for impairment. If we choose to perform a qualitative assessment and determine the fair value more likely than not exceeds the carrying value, no further evaluation is necessary. For reporting units where we perform the two-step process, the first step requires us to compare the fair value of each reporting unit, which we primarily determine using an income approach based on the present value of discounted cash flows, to the respective carrying value, which includes goodwill. If the fair value of the reporting unit exceeds its carrying value, the goodwill is not considered impaired. If the carrying value is higher than the fair value, there is an indication that an impairment may exist and the second step is required. In step two, the implied fair value of goodwill is calculated as the excess of the fair value of a reporting unit over the fair values assigned to its assets and liabilities. If the implied fair value of goodwill is less than the carrying value of the reporting unit's goodwill, the difference is recognized as an impairment loss. No goodwill for reporting units was impaired during the three and six months ended June 30, 2012 or 2011. See Note 19 for goodwill impairments relating to assets held for sale.

The changes in the carrying amount of the goodwill by reportable segment for the six months ended June 30, 2012 were as follows:

| (Millions of dollars) | |||||||||||||||||||

Construction Industries | Resource Industries | Power Systems | Other | Consolidated Total | |||||||||||||||

| Balance at December 31, 2011 | $ | 378 | $ | 4,099 | $ | 2,486 | $ | 117 | $ | 7,080 | |||||||||

Business acquisitions 1 | 16 | 467 | — | — | 483 | ||||||||||||||

Held for sale and business divestitures 2 | — | (152 | ) | — | — | (152 | ) | ||||||||||||

Other adjustments 3 | (5 | ) | (59 | ) | (27 | ) | — | (91 | ) | ||||||||||

| Balance at June 30, 2012 | $ | 389 | $ | 4,355 | $ | 2,459 | $ | 117 | $ | 7,320 | |||||||||

1 See Note 18 for additional details.

2 See Note 19 for additional details.

3 Other adjustments are comprised primarily of foreign currency translation.

8. Available-For-Sale Securities

We have investments in certain debt and equity securities, primarily at Cat Insurance, that have been classified as available-for-sale and recorded at fair value based upon quoted market prices. These investments are primarily included in Other assets in the Consolidated Statement of Financial Position. Unrealized gains and losses arising from the revaluation of available-for-sale securities are included, net of applicable deferred income taxes, in equity (Accumulated other comprehensive income (loss) in the Consolidated Statement of Financial Position). Realized gains and losses on sales of investments are generally determined using the FIFO (first-in, first-out) method for debt instruments and the specific identification method for equity securities. Realized gains and losses are included in Other income (expense) in the Consolidated Statement of Results of Operations.

20

| June 30, 2012 | December 31, 2011 | ||||||||||||||||||||||

| (Millions of dollars) | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | |||||||||||||||||

| Government debt | |||||||||||||||||||||||

| U.S. treasury bonds | $ | 10 | $ | — | $ | 10 | $ | 10 | $ | — | $ | 10 | |||||||||||

| Other U.S. and non-U.S. government bonds | 121 | 2 | 123 | 90 | 2 | 92 | |||||||||||||||||

| Corporate bonds | |||||||||||||||||||||||

| Corporate bonds | 588 | 35 | 623 | 542 | 30 | 572 | |||||||||||||||||

| Asset-backed securities | 96 | (1 | ) | 95 | 112 | (1 | ) | 111 | |||||||||||||||

| Mortgage-backed debt securities | |||||||||||||||||||||||

| U.S. governmental agency | 266 | 12 | 278 | 297 | 13 | 310 | |||||||||||||||||

| Residential | 29 | (3 | ) | 26 | 33 | (3 | ) | 30 | |||||||||||||||

| Commercial | 131 | 6 | 137 | 142 | 3 | 145 | |||||||||||||||||

| Equity securities | |||||||||||||||||||||||

| Large capitalization value | 139 | 29 | 168 | 127 | 21 | 148 | |||||||||||||||||

| Smaller company growth | 22 | 11 | 33 | 22 | 7 | 29 | |||||||||||||||||

| Total | $ | 1,402 | $ | 91 | $ | 1,493 | $ | 1,375 | $ | 72 | $ | 1,447 | |||||||||||

During the three and six months ended June 30, 2012, charges for other-than-temporary declines in the market value of securities were $1 million. These charges were accounted for as realized losses and were included in Other income (expense) in the Consolidated Statement of Results of Operations. The cost basis of the impacted securities was adjusted to reflect these charges. During the three and six months ended June 30, 2011, there were no charges for other-than-temporary declines in the market value of securities.

21

Investments in an unrealized loss position that are not other-than-temporarily impaired: | |||||||||||||||||||||||

| June 30, 2012 | |||||||||||||||||||||||

Less than 12 months 1 | 12 months or more 1 | Total | |||||||||||||||||||||

| (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||

| Corporate bonds | |||||||||||||||||||||||

| Asset-backed securities | $ | 3 | $ | — | $ | 19 | $ | 4 | $ | 22 | $ | 4 | |||||||||||

| Mortgage-backed debt securities | |||||||||||||||||||||||

| Residential | 2 | — | 15 | 3 | 17 | 3 | |||||||||||||||||

| Commercial | 2 | — | 8 | 1 | 10 | 1 | |||||||||||||||||

| Equity securities | |||||||||||||||||||||||

| Large capitalization value | 28 | 3 | 14 | 2 | 42 | 5 | |||||||||||||||||

| Total | $ | 35 | $ | 3 | $ | 56 | $ | 10 | $ | 91 | $ | 13 | |||||||||||

| December 31, 2011 | |||||||||||||||||||||||

Less than 12 months 1 | 12 months or more 1 | Total | |||||||||||||||||||||

| (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||

| Corporate bonds | |||||||||||||||||||||||

| Corporate bonds | $ | 54 | $ | 1 | $ | 1 | $ | — | $ | 55 | $ | 1 | |||||||||||

| Asset-backed securities | 1 | — | 20 | 5 | 21 | 5 | |||||||||||||||||

| Mortgage-backed debt securities | |||||||||||||||||||||||

| U.S. governmental agency | 51 | 1 | — | — | 51 | 1 | |||||||||||||||||

| Residential | 3 | — | 18 | 3 | 21 | 3 | |||||||||||||||||

| Commercial | 15 | — | 8 | 1 | 23 | 1 | |||||||||||||||||

| Equity securities | |||||||||||||||||||||||

| Large capitalization value | 36 | 5 | 6 | 1 | 42 | 6 | |||||||||||||||||

| Smaller company growth | 4 | 1 | — | — | 4 | 1 | |||||||||||||||||

| Total | $ | 164 | $ | 8 | $ | 53 | $ | 10 | $ | 217 | $ | 18 | |||||||||||

1 Indicates length of time that individual securities have been in a continuous unrealized loss position.

Corporate Bonds. The unrealized losses on our investments in corporate bonds and asset-backed securities relate primarily to changes in interest rates and credit-related yield spreads since time of purchase. We do not intend to sell the investments and it is not likely that we will be required to sell the investments before recovery of their amortized cost basis. We do not consider these investments to be other-than-temporarily impaired as of June 30, 2012.

Mortgage-Backed Debt Securities. The unrealized losses on our investments in mortgage-backed securities and mortgage-related asset-backed securities relate primarily to the continuation of elevated housing delinquencies and default rates, risk aversion and credit-related yield spreads since time of purchase. We do not intend to sell the investments and it is not likely that we will be required to sell these investments before recovery of their amortized cost basis. We do not consider these investments to be other-than-temporarily impaired as of June 30, 2012.

Equity Securities. Cat Insurance maintains a well-diversified equity portfolio consisting of two specific mandates: large capitalization value stocks and smaller company growth stocks. Overall U.S. equity valuations declined during the second quarter of 2012 due to a worsening European debt crisis and a global economic slowdown. In each case where unrealized losses exist, the respective company's management is taking action in order to increase shareholder value. We do not consider these investments to be other-than-temporarily impaired as of June 30, 2012.

The fair value of the available-for-sale debt securities at June 30, 2012, by contractual maturity, is shown below. Expected maturities will differ from contractual maturities because borrowers may have the right to prepay and creditors may have the right to call obligations.

22

| (Millions of dollars) | Cost Basis | Fair Value | |||||

| Due in one year or less | $ | 125 | $ | 127 | |||

| Due after one year through five years | 496 | 510 | |||||

| Due after five years through ten years | 149 | 171 | |||||

| Due after ten years | 45 | 43 | |||||

| U.S. agency mortgage-backed securities | 266 | 278 | |||||

| Residential mortgage-backed securities | 29 | 26 | |||||

| Commercial mortgage-backed securities | 131 | 137 | |||||

| Total debt securities – available-for-sale | $ | 1,241 | $ | 1,292 | |||

| Sales of Securities | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| (Millions of dollars) | 2012 | 2011 | 2012 | 2011 | |||||||||||

| Proceeds from the sale of available-for-sale securities | $ | 65 | $ | 56 | $ | 177 | $ | 122 | |||||||

| Gross gains from the sale of available-for-sale securities | $ | 1 | $ | 1 | $ | 3 | $ | 2 | |||||||

| Gross losses from the sale of available-for-sale securities | $ | — | $ | — | $ | — | $ | 1 | |||||||

9. Postretirement Benefits

A. Pension and postretirement benefit costs

In February 2012, we announced the closure of the Electro-Motive Diesel facility located in London, Ontario. As a result of the closure, we recognized a $37 million other postretirement benefits curtailment gain in the first quarter. This excludes a $21 million loss of a third party receivable for other postretirement benefits that was eliminated due to the closure. In addition, a $10 million special termination benefit expense was recognized related to statutory pension benefits required to be paid to certain affected employees.

23

(Millions of dollars) | U.S. Pension Benefits | Non-U.S. Pension Benefits | Other Postretirement Benefits | ||||||||||||||||||||

| June 30, | June 30, | June 30, | |||||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | ||||||||||||||||||

| For the three months ended: | |||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||

| Service cost | $ | 46 | $ | 38 | $ | 28 | $ | 28 | $ | 22 | $ | 20 | |||||||||||

| Interest cost | 154 | 162 | 46 | 44 | 56 | 63 | |||||||||||||||||

| Expected return on plan assets | (203 | ) | (199 | ) | (53 | ) | (50 | ) | (16 | ) | (17 | ) | |||||||||||

| Amortization of: | |||||||||||||||||||||||

Prior service cost (credit) 1 | 5 | 5 | — | — | (16 | ) | (13 | ) | |||||||||||||||

Net actuarial loss (gain) 1 | 124 | 113 | 24 | 18 | 25 | 27 | |||||||||||||||||

| Net periodic benefit cost | 126 | 119 | 45 | 40 | 71 | 80 | |||||||||||||||||

Curtailments, settlements and special termination benefits 2 | — | — | 12 | 9 | — | — | |||||||||||||||||

| Total cost included in operating profit | $ | 126 | $ | 119 | $ | 57 | $ | 49 | $ | 71 | $ | 80 | |||||||||||

| For the six months ended: | |||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||

| Service cost | $ | 92 | $ | 77 | $ | 56 | $ | 55 | $ | 46 | $ | 41 | |||||||||||

| Interest cost | 308 | 324 | 91 | 87 | 111 | 126 | |||||||||||||||||

| Expected return on plan assets | (406 | ) | (398 | ) | (107 | ) | (100 | ) | (32 | ) | (35 | ) | |||||||||||

| Amortization of: | |||||||||||||||||||||||

| Transition obligation (asset) | — | — | — | — | 1 | 1 | |||||||||||||||||

Prior service cost (credit) 1 | 10 | 10 | — | 1 | (33 | ) | (27 | ) | |||||||||||||||

Net actuarial loss (gain) 1 | 248 | 226 | 48 | 36 | 50 | 54 | |||||||||||||||||

| Net periodic benefit cost | 252 | 239 | 88 | 79 | 143 | 160 | |||||||||||||||||

Curtailments, settlements and special termination benefits 2 | — | — | 22 | 9 | (40 | ) | — | ||||||||||||||||

| Total cost included in operating profit | $ | 252 | $ | 239 | $ | 110 | $ | 88 | $ | 103 | $ | 160 | |||||||||||

| Weighted-average assumptions used to determine net cost: | |||||||||||||||||||||||

| Discount rate | 4.3 | % | 5.1 | % | 4.3 | % | 4.6 | % | 4.3 | % | 5.0 | % | |||||||||||

| Expected return on plan assets | 8.0 | % | 8.5 | % | 7.1 | % | 7.1 | % | 8.0 | % | 8.5 | % | |||||||||||

| Rate of compensation increase | 4.5 | % | 4.5 | % | 3.9 | % | 4.2 | % | 4.4 | % | 4.4 | % | |||||||||||

1 Prior service cost (credit) and net actuarial loss (gain) for both pension and other postretirement benefits are generally amortized using the straight-line method over the average remaining service period to the full retirement eligibility date of employees expected to receive benefits from the plan. For other postretirement benefit plans in which all or almost all of the plan's participants are fully eligible for benefits under the plan, prior service cost (credit) and net actuarial loss (gain) are amortized using the straight-line method over the remaining life expectancy of those participants. | |||||||||||||||||||||||

2 Curtailments, settlements and special termination benefits were recognized in Other operating (income) expenses in the Consolidated Statement of Results of Operations. | |||||||||||||||||||||||

We made $119 million and $293 million of contributions to our pension plans during the three and six months ended June 30, 2012, respectively. We currently anticipate full-year 2012 contributions of approximately $1 billion, of which $570 million are required contributions. We made $104 million and $235 million of contributions to our pension plans during the three and six months ended June 30, 2011, respectively.

B. Defined contribution benefit costs

On January 1, 2011, matching contributions to our U.S. 401(k) plan changed for certain employees that are still accruing benefits under a defined benefit pension plan. Matching contributions changed from 100 percent of employee contributions to the plan up to six percent of their compensation to 50 percent of employee contributions up to six percent of compensation. For U.S. employees whose defined benefit pension accruals were frozen as of December 31, 2010, we began providing a new annual employer contribution in 2011, which ranges from three to five percent of compensation, depending on years of service and age.

24

Total company costs related to our defined contribution plans were as follows:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| (Millions of dollars) | 2012 | 2011 | 2012 | 2011 | |||||||||||

| U.S. Plans | $ | 33 | $ | 50 | $ | 134 | $ | 132 | |||||||

| Non-U.S. Plans | 17 | 14 | 31 | 26 | |||||||||||

| $ | 50 | $ | 64 | $ | 165 | $ | 158 | ||||||||

10. Guarantees and Product Warranty

We have provided an indemnity to a third-party insurance company for potential losses related to performance bonds issued on behalf of Caterpillar dealers. The bonds are issued to insure governmental agencies against nonperformance by certain dealers. We also provided guarantees to a third party related to the performance of contractual obligations by certain Caterpillar dealers. The guarantees cover potential financial losses incurred by the third party resulting from the dealers’ nonperformance.

We provide loan guarantees to third-party lenders for financing associated with machinery purchased by customers. These guarantees have varying terms and are secured by the machinery. In addition, Cat Financial participates in standby letters of credit issued to third parties on behalf of their customers. These standby letters of credit have varying terms and beneficiaries and are secured by customer assets.

Cat Financial has provided a limited indemnity to a third-party bank resulting from the assignment of certain leases to that bank. The indemnity is for the possibility that the insurers of these leases would become insolvent. The indemnity expires December 15, 2012 and is unsecured.

No loss has been experienced or is anticipated under any of these guarantees. At June 30, 2012 and December 31, 2011 the related liability was $15 million and $7 million, respectively. The increase in liability is primarily due to guarantees acquired through the purchase of ERA Mining Machinery Limited. The maximum potential amount of future payments (undiscounted and without reduction for any amounts that may possibly be recovered under recourse or collateralized provisions) we could be required to make under the guarantees are as follows:

| (Millions of dollars) | June 30, 2012 | December 31, 2011 | |||||

| Guarantees with Caterpillar dealers | $ | 146 | $ | 140 | |||

| Guarantees with customers | 180 | 186 | |||||

| Limited indemnity | 8 | 11 | |||||

| Guarantees – other | 66 | 28 | |||||

| Total guarantees | $ | 400 | $ | 365 | |||

Cat Financial provides guarantees to repurchase certain loans of Caterpillar dealers from a special-purpose corporation (SPC) that qualifies as a variable interest entity. The purpose of the SPC is to provide short-term working capital loans to Caterpillar dealers. This SPC issues commercial paper and uses the proceeds to fund its loan program. Cat Financial has a loan purchase agreement with the SPC that obligates Cat Financial to purchase certain loans that are not paid at maturity. Cat Financial receives a fee for providing this guarantee, which provides a source of liquidity for the SPC. Cat Financial is the primary beneficiary of the SPC as their guarantees result in Cat Financial having both the power to direct the activities that most significantly impact the SPC’s economic performance and the obligation to absorb losses, and therefore Cat Financial has consolidated the financial statements of the SPC. As of June 30, 2012 and December 31, 2011, the SPC’s assets of $866 million and $586 million, respectively, are primarily comprised of loans to dealers and the SPC’s liabilities of $866 million and $586 million, respectively, are primarily comprised of commercial paper. No loss has been experienced or is anticipated under this loan purchase agreement. Cat Financial’s assets are not available to pay creditors of the SPC, except to the extent Cat Financial may be obligated to perform under the guarantee, and assets of the SPC are not available to pay Cat Financial’s creditors.

25

Our product warranty liability is determined by applying historical claim rate experience to the current field population and dealer inventory. Generally, historical claim rates are based on actual warranty experience for each product by machine model/engine size. Specific rates are developed for each product build month and are updated monthly based on actual warranty claim experience.

| (Millions of dollars) | 2012 | ||

| Warranty liability, January 1 | $ | 1,308 | |

| Reduction in liability (payments) | (460 | ) | |

| Increase in liability (new warranties) | 540 | ||

| Warranty liability, June 30 | $ | 1,388 | |

| (Millions of dollars) | 2011 | ||

| Warranty liability, January 1 | $ | 1,035 | |

| Reduction in liability (payments) | (926 | ) | |

| Increase in liability (new warranties) | 1,199 | ||

| Warranty liability, December 31 | $ | 1,308 | |

11. Computations of Profit Per Share

| (Dollars in millions except per share data) | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | ||||||||||||||

| I. | Profit for the period (A)1: | $ | 1,699 | $ | 1,015 | $ | 3,285 | $ | 2,240 | ||||||||

| II. | Determination of shares (in millions): | — | |||||||||||||||

| Weighted-average number of common shares outstanding (B) | 652.9 | 645.5 | 651.3 | 643.3 | |||||||||||||

| Shares issuable on exercise of stock awards, net of shares assumed to be purchased out of proceeds at average market price | 16.7 | 21.7 | 18.6 | 22.7 | |||||||||||||

Average common shares outstanding for fully diluted computation (C) 2 | 669.6 | 667.2 | 669.9 | 666.0 | |||||||||||||

| III. | Profit per share of common stock: | ||||||||||||||||

| Assuming no dilution (A/B) | $ | 2.60 | $ | 1.57 | $ | 5.04 | $ | 3.48 | |||||||||

Assuming full dilution (A/C) 2 | $ | 2.54 | $ | 1.52 | $ | 4.90 | $ | 3.36 | |||||||||

1 Profit attributable to common stockholders. 2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | |||||||||||||||||

SARs and stock options to purchase 6,091,056 common shares were outstanding for both the three and six months ended June 30, 2012, respectively, but were not included in the computation of diluted earnings per share because the effect would have been anti-dilutive. For both the three and six months ended June 30, 2011, there were outstanding SARs and stock options to purchase 2,940,143 common shares, but were not included in the computation of diluted earnings per share because the effect would have been anti-dilutive.

12. Environmental and Legal Matters

The company is regulated by federal, state and international environmental laws governing our use, transport and disposal of substances and control of emissions. In addition to governing our manufacturing and other operations, these laws often impact the development of our products, including, but not limited to, required compliance with air emissions standards applicable to internal combustion engines. Compliance with these existing laws has not had a material impact on our capital expenditures, earnings or global competitive position.

We are engaged in remedial activities at a number of locations, often with other companies, pursuant to federal and state laws. When it is probable we will pay remedial costs at a site and those costs can be reasonably estimated, the costs are

26

charged against our earnings. In formulating that estimate, we do not consider amounts expected to be recovered from insurance companies or others. The amount recorded for environmental remediation is not material and is included in Accrued expenses in the Consolidated Statement of Financial Position.

We cannot reasonably estimate costs at sites in the very early stages of remediation. Currently, we have a few sites in the very early stages of remediation, and there is no more than a remote chance that a material amount for remedial activities at any individual site, or at all sites in the aggregate, will be required.