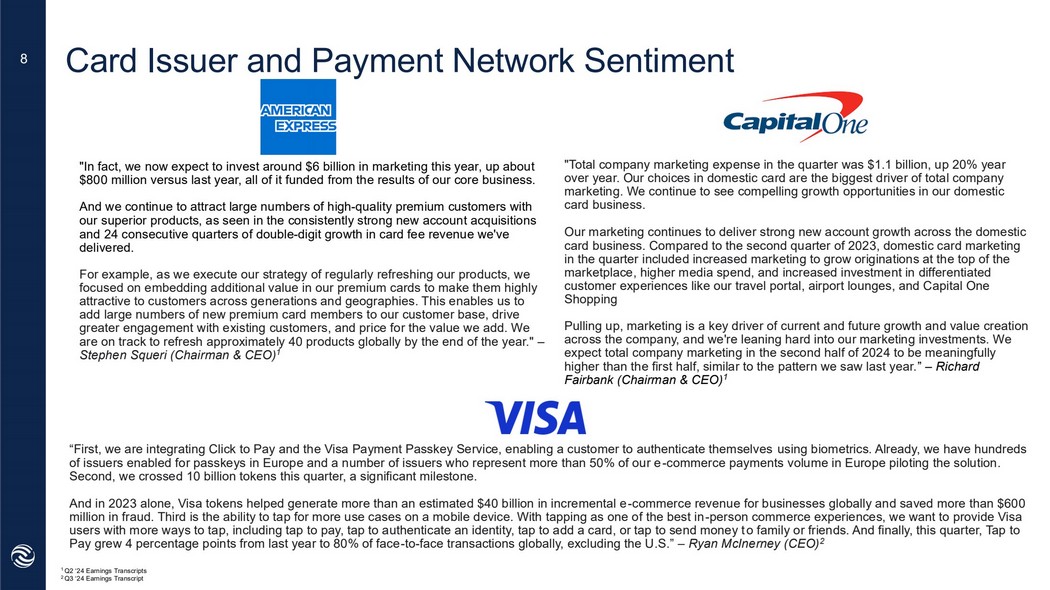

| Card Issuer and Payment Network Sentiment 1 Q2 ‘24 Earnings Transcripts 2 Q3 ‘24 Earnings Transcript "In fact, we now expect to invest around $6 billion in marketing this year, up about $800 million versus last year, all of it funded from the results of our core business. And we continue to attract large numbers of high-quality premium customers with our superior products, as seen in the consistently strong new account acquisitions and 24 consecutive quarters of double-digit growth in card fee revenue we've delivered. For example, as we execute our strategy of regularly refreshing our products, we focused on embedding additional value in our premium cards to make them highly attractive to customers across generations and geographies. This enables us to add large numbers of new premium card members to our customer base, drive greater engagement with existing customers, and price for the value we add. We are on track to refresh approximately 40 products globally by the end of the year." – Stephen Squeri (Chairman & CEO)1 8 “First, we are integrating Click to Pay and the Visa Payment Passkey Service, enabling a customer to authenticate themselves using biometrics. Already, we have hundreds of issuers enabled for passkeys in Europe and a number of issuers who represent more than 50% of our e-commerce payments volume in Europe piloting the solution. Second, we crossed 10 billion tokens this quarter, a significant milestone. And in 2023 alone, Visa tokens helped generate more than an estimated $40 billion in incremental e-commerce revenue for businesses globally and saved more than $600 million in fraud. Third is the ability to tap for more use cases on a mobile device. With tapping as one of the best in-person commerce experiences, we want to provide Visa users with more ways to tap, including tap to pay, tap to authenticate an identity, tap to add a card, or tap to send money to family or friends. And finally, this quarter, Tap to Pay grew 4 percentage points from last year to 80% of face-to-face transactions globally, excluding the U.S.” – Ryan McInerney (CEO) 2 "Total company marketing expense in the quarter was $1.1 billion, up 20% year over year. Our choices in domestic card are the biggest driver of total company marketing. We continue to see compelling growth opportunities in our domestic card business. Our marketing continues to deliver strong new account growth across the domestic card business. Compared to the second quarter of 2023, domestic card marketing in the quarter included increased marketing to grow originations at the top of the marketplace, higher media spend, and increased investment in differentiated customer experiences like our travel portal, airport lounges, and Capital One Shopping Pulling up, marketing is a key driver of current and future growth and value creation across the company, and we're leaning hard into our marketing investments. We expect total company marketing in the second half of 2024 to be meaningfully higher than the first half, similar to the pattern we saw last year.” – Richard Fairbank (Chairman & CEO) 1 |