UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39725

Maravai LifeSciences Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 8731 | | 85-2786970 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

| | | | |

10770 Wateridge Circle Suite 200 San Diego, California | | | | 92121 |

| (Address of principal executive offices) | | | | (Zip code) |

______________________________

Registrant’s telephone number, including area code: (858) 546-0004

______________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MRVI | | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ý | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates as of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $3,744.8 million, based on the closing price of the registrant’s common stock on the Nasdaq Global Select Market of $41.73 per share.

As of February 22, 2022, 131,489,384 shares of the registrant’s Class A common stock were outstanding and 123,669,196 shares of the registrant’s Class B common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2022, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENT

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Investors are cautioned that statements which are not strictly historical statements constitute forward looking statements, including, without limitation, statements under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and are identified by words like “believe,” “expect,” “may,” “will,” “should,” “seek,” “anticipate,” or “could” and similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated include those discussed under the heading “Summary of Risk Factors” and “Item 1A. Risk Factors” as well as those discussed elsewhere in this Annual Report on Form 10-K.

Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date of this report. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Part I.

Item 1. Business

Overview

Maravai LifeSciences Holdings, Inc. (also referred to in this document as “Maravai”, “we”, “us” or “the Company”) is a leading life sciences company providing critical products to enable the development of drug therapies, diagnostics, and novel vaccines and to support research on human diseases. Our customers include the top global biopharmaceutical companies ranked by research and development expenditures according to industry consultants, and many other emerging biopharmaceutical and life sciences research companies, as well as leading academic research institutions and in vitro diagnostics companies. Our products address the key phases of biopharmaceutical development spanning research to commercialization and include complex nucleic acids for diagnostic and therapeutic applications, and antibody-based products to detect impurities during the production of biopharmaceutical products.

Our businesses principally address high growth market segments in biopharmaceutical development. In particular, the field of cell and gene therapy has emerged as one of the fastest growing treatment modalities to address a host of human conditions. There are more than 1,600 cell and gene therapies in development or launched and sales in this category are expected to grow more than 5 times by 2024, according to industry consultants and management estimates. Our portfolio offers key products for each stage of the cell and gene therapy development lifecycle. For example, our messenger RNA (“mRNA”) products are used in drug development to assist in the production of immune-activating antigens; our CleanCap® technology is used to stabilize mRNA and streamlines mRNA manufacturing; and our plasmid DNA products are used as templates for the production of our ribonucleic acid (“RNA“) products. We also provide biologics safety testing technology used to ensure the safety of the biological drug manufacturing process and drug products. Developers of therapeutics and vaccines, including cell and gene therapies, comprise about 85% of our customer base.

Our proprietary capabilities and products underpin the value we aim to provide to our customers. Among other capabilities, we are experts in RNA and mRNA products, which are challenging and often unstable molecules requiring significant chemical modifications to ensure their stability and efficacy in our customers’ applications. Notably, according to research commissioned by us in November 2021 consisting of over 55 interviews with our current and former customers, our competitors and industry experts focused across our two ongoing business segments (the “Industry Analysis”), we believe CleanCap is viewed as a leading solution to incorporate the five prime (“5’”) cap into mRNA. CleanCap is a novel chemical approach to produce the 5’ cap analog, which, in addition to making mRNA more stable, aids in protein production and helps prevent an unwanted immune response to the mRNA. CleanCap had been incorporated into several mRNA programs targeting immunization against the novel strain of coronavirus, SARS-CoV-2 (“COVID-19”). These programs included two commercial programs led by Pfizer in partnership with BioNTech and one led by BioNTech in partnership with Fosun Pharma, one phase I clinical program led by Chulalongkorn University, one phase I/II clinical programs led by Imperial College London, one phase I/II clinical program led by the University of Tokyo in partnership with Daiichi-Sankyo, one phase III program led by CureVac, and two pre-clinical programs by eTheRNA Immunotherapies and Greenlight Biosciences. Given the early stage of these last two programs, there

can be no assurance they will continue to use CleanCap through commercialization. We believe our CleanCap products have also been incorporated into vaccine development programs for other infectious diseases, including Influenza.

In addition to vaccines for infectious disease, we estimate our mRNA and CleanCap products have also been incorporated in at least 59 therapeutic programs in development as of December 31, 2021. These therapeutic programs address a number of disease states, including ornithine transcarbamylase deficiency, glycogen storage disorders, Alpha-1 antitrypsin deficiency, acute lymphoblastic leukemia, Hurler syndrome, ovarian cancer and cardiovascular disease. These therapeutic programs also use multiple therapeutic modalities, including CRISPR/Cas-9, transcription activator-like effector nuclease (TALENS), enzyme replacement therapies, allogeneic CAR-T cells and base editing. Should one or more of these programs proceed to commercialization, we believe we will continue to supply our customers and our products will likely be incorporated in customer regulatory filings. Additionally, the U.S. Food and Drug Administration (“FDA”) issued policies on February 22, 2021 to guide medical product developers concerning the development of products to address the future of variants of the COVID-19 virus specifically covering vaccines and therapeutics. We believe this guidance may streamline the future development and approval of mRNA vaccines utilizing our products and that they would likely be incorporated into customer regulatory filings as a result.

mRNA is at the core of our capabilities. We developed our expertise in mRNA with a belief in its potential as a therapeutic modality. The first clinical trial for an mRNA therapeutic agent occurred in 2016. Now, more than 200 clinical trials are in the pipeline, principally focused on vaccines against viruses and cancer vaccines. With the COVID-19 pandemic, mRNA has shown its potential for more rapid vaccine design and manufacture when compared to traditional techniques involving culturing inactivated virus to elicit an immune response. According to the World Health Organization, there were nearly 350 COVID-19 vaccine development programs as of December 2021, with two candidates approved in the RNA class and 23 additional RNA lead candidates for approval with anticipated program data readouts, including results of preclinical studies and phase I/II and phase III clinical trials. COVID-19 has helped highlight the potential advantage of mRNA as a treatment modality and directed significant resources to the growing base of knowledge about mRNA. This knowledge is now being directed at future vaccine programs including for influenza, Lyme disease, malaria, HIV, tuberculosis, shingles, rabies, yellow fever, respiratory syncytial virus (“RSV”) and Zika, as well as for therapeutic agents for a host of human diseases. We are positioned to serve our biopharmaceutical customers in the fast-growing field of mRNA across a range of clinical programs for a variety of diseases.

Forming long-term partnerships with our customers is core to our strategy. Today, we primarily serve our customers during the product development and process development phases. During product development, we collaborate with our customers to develop and synthesize nucleic acids, which in some cases comprise the active pharmaceutical ingredient (“API”) of our customers’ products in development. We also provide our customers a host of chemically complex and highly specialized raw materials. Process development is a complex phase that establishes highly validated procedures and determines the investment in facilities and equipment required to bring biopharmaceutical products to market. These decisions impact the viability of our customers’ products for the long term. During process development, we provide enzyme-linked immunosorbent assays (“ELISAs”) that reduce the risk posed by impurities and contaminants in biological drugs, a critical step to ensure the safety of the drug product.

While we do not provide products that are themselves regulated as drugs or in vitro diagnostics, our customers frequently incorporate our products into their highly validated products and processes. For example, we provide oligonucleotides and antibody-based products used by in vitro diagnostic product manufacturers for their on-market products. Because of the extensive validation required for these products, these components are frequently purchased for the life of our customers’ products and we believe they are unlikely to be substituted. In addition, our analytical tools are used in the design and development of manufacturing processes and often will be used throughout the life cycle of our customers’ manufactured products. Once our services or products are qualified by our customers, we are written into regulatory documents and standard operating procedures. As a result, our customer relationships frequently span many years.

The nature of our products and their uses require that they be manufactured by highly trained personnel in state-of-the-art facilities following exacting procedures to ensure quality. As of December 31, 2021, approximately 19% of our workforce have earned advanced degrees and all receive rigorous training on our procedures. We manufacture our nucleic acid products at our San Diego, California facility (“Wateridge facility”), one of our three facilities in the United States. The Wateridge facility was purpose-built to address our customers’ needs for critical raw materials manufactured under certain good manufacturing practices (“GMP”) conditions and APIs for investigational use. Our raw material products are manufactured following the voluntary quality standards of ISO 9001:2015. Our GMP-grade raw materials follow ISO 9001:2015 standards, additional voluntary GMP quality standards and customer specific requirements. Our API products are manufactured following the voluntary quality standards of ISO 9001:2015, the International Council for Harmonisation’s GMP Guide, comparable GMP principles for the European Union and customer specific requirements. We believe our products are exempt from compliance with the current GMP (“cGMP”) regulations of the FDA, as our products are further processed or incorporated into final drug products by our customers and we do not make claims related to their safety or effectiveness. As of December 31, 2021, we had

invested $81.6 million in our Wateridge facility. Our other facilities are similarly designed for specific applications with quality systems to match our customers’ requirements. All of our facilities meet applicable ISO standards.

We built our business through a combination of acquisitions and subsequent investments in our acquired companies to grow their commercial capabilities, upgrade and expand their research and production facilities, deploy stringent quality systems, integrate their back-office functions, and develop the personnel and management to fuel continued growth. Today, we offer an integrated portfolio that enables innovation across the biopharmaceutical and academic markets. We completed our first acquisition in April 2016. Mergers, acquisitions and strategic partnerships that complement our capabilities in cell and gene therapy and biopharmaceutical production remain core to our strategy. Our strategy aims to augment our strong organic growth with the addition of synergistic products and capabilities.

Our Portfolio and Capabilities

We provide products that support our customers’ needs from discovery through commercialization of their vaccines, therapeutic agents and in vitro diagnostic products. Our products are frequently incorporated into our customers’ products, whether as research products or APIs used in development or research products incorporated as raw materials into on-market products. They may also be incorporated into the manufacturing process itself. We are therefore a critical part of our customers’ supply chain and they frequently seek to maintain their supply relationship with us for the life of their products or development programs.

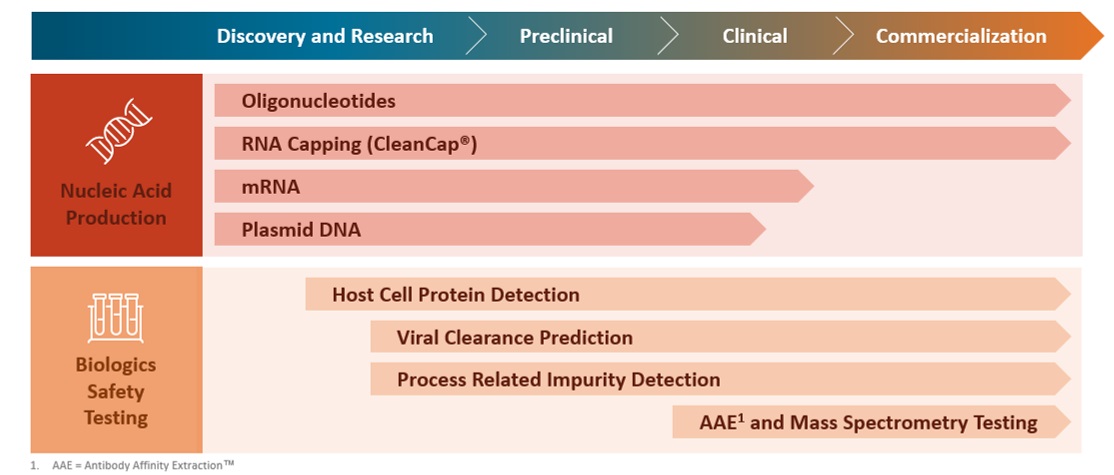

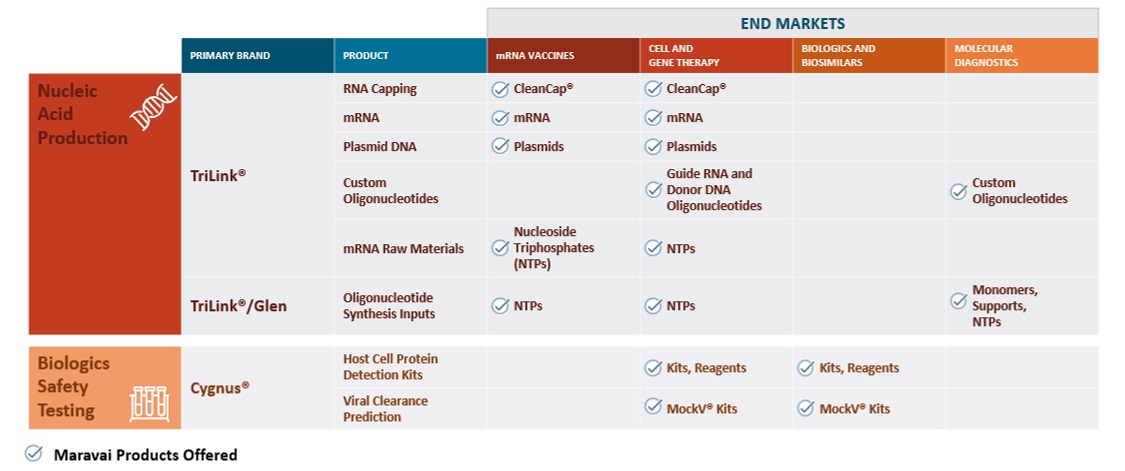

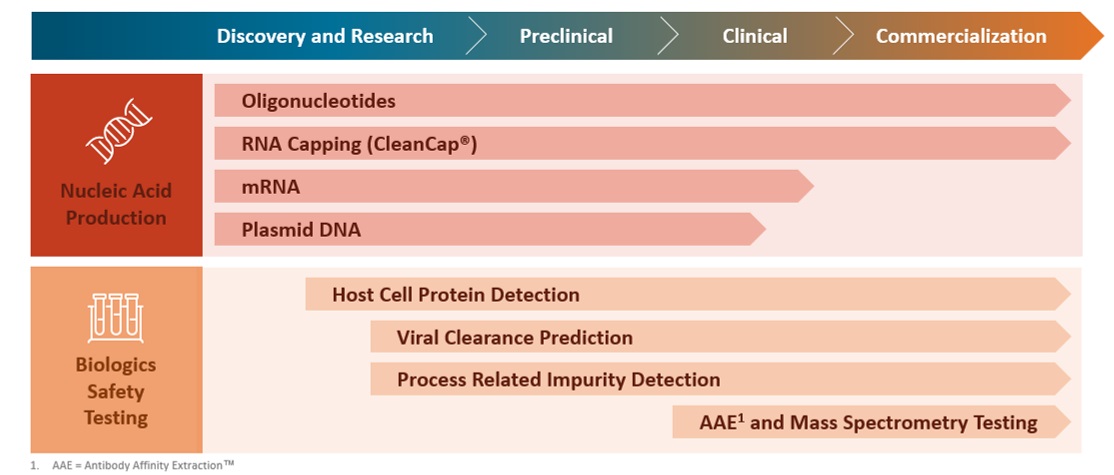

Our products address our customers’ needs for nucleic acid production and biologics safety testing, and our operations are aligned to these two segments. Our products and the end markets they serve are depicted in the following image:

Nucleic Acid Production (89% of Revenue for the Year Ended December 31, 2021)

We are a global provider of highly modified, complex nucleic acids and related products. We have recognized expertise in complex chemistries and products provided under exacting quality standards. Our core offerings include mRNA, long and short oligonucleotides, our proprietary CleanCap capping technology and oligonucleotide building blocks. Our offerings address key customer needs for critical components, from research to GMP-grade materials. We market our nucleic acid products under the TriLink BioTechnologies® and Glen Research brands.

The growth in our nucleic acid production business segment has been fueled by the significant growth in biological drugs in development, many of which are cell and gene therapies, and by the rapid rise in mRNA vaccines. mRNA as a treatment modality has been an area of acute interest for many years.

The success of COVID-19 vaccines has helped highlight the potential advantage of mRNA as a treatment modality and significant investments have been made industry wide to developing future mRNA vaccines as well as for therapeutic agents for a host of human diseases. We are positioned to serve our biopharmaceutical customers in the fast-growing field of mRNA across a range of clinical programs for a variety of diseases.

We further serve cell and gene therapies with our RNA and mRNA products and expect to supplement with our newly launched plasmid DNA capability. In addition to the vaccine programs above, our products have been incorporated in at least 59 therapeutic development programs including programs focused on CRISPR/Cas-9, CAR-T, base editing, and enzyme replacement therapies, among others, with over 50 utilizing CleanCap technology.

Our nucleic acid products fall into four main categories: mRNA, RNA Capping (CleanCap), oligonucleotides and plasmid DNA. We began offering our plasmid DNA products in the first quarter of 2021.

mRNA. mRNA is an intermediary molecule that translates the genetic information stored in DNA into proteins. The genetic information stored in DNA is transferred to mRNA in a cellular process called transcription. This process occurs in the nucleus of cells. DNA, a double stranded molecule, is unwound and copied as mRNA by the enzyme RNA polymerase. mRNA is then transferred out of the nucleus to the cytosol, a component of the cytoplasm of a cell, where it serves as a blueprint for making cellular proteins by a multi-component organelle complex called the ribosome.

mRNA has traditionally been a difficult molecule for vaccine and therapeutic purposes. mRNA is inherently unstable compared to DNA and is susceptible to degradation by ubiquitous enzymes called RNases. mRNAs are also physically and chemically fragile and can degrade at elevated temperatures and under shear forces that occur during downstream manufacturing processes. We have developed manufacturing processes that overcome many of these obstacles, resulting in highly effective mRNA.

We develop and manufacture mRNA products to support vaccine and therapeutic programs from pre-clinical development through and including clinical phases, including scale-up and analytical development services. The mRNA molecules may serve as APIs for diverse applications, such as enzyme replacement therapies, gene editing therapies and vaccines. We offer both research grade material and material made under GMP conditions for early phase clinical trials.

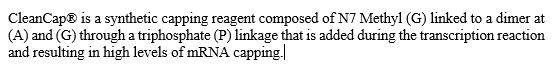

RNA Capping. Within the mRNA category, we also offer our CleanCap products. Our proprietary CleanCap analogs principally serve the mRNA vaccine and therapeutics markets, including vaccine candidates in development for immunizing against COVID-19. Cap analogs are a component of mRNA that aids in protein production as well as in making mRNA more stable inside cells. For mRNA to serve as a template to make a protein, it requires a special cap at the 5’ end of the molecule. The cap structure also affects the stability of the mRNA. Lack of a cap can result in activation of the innate immune system, which can affect the production of the desired protein or elicit undesired biological effects. We offer a suite of CleanCap analogs that are specifically made for therapeutics and vaccines. Based on the Industry Analysis, we believe our cap analogs are critical features of several mRNA vaccines in development.

Traditionally, the 5’ cap has been added in one of two ways. The cap can be added post mRNA synthesis by an enzymatic process. This enzymatic method has several drawbacks, including the high cost of the capping enzymes as well as the need to perform additional processing steps to the mRNA to remove enzymes and byproducts of the capping reaction. While capping efficiency is usually high, the extra processing steps typically result degredation and mRNA of poorer quality. The second method is to add a synthetic cap analog into the transcription reaction such that the mRNA is transcribed and capped in a single step. Anti-reverse cap analog (“ARCA”) is an example of a cap analog that is added to the transcription reaction. This avoids the workflow challenges of the enzymatic process, but typically results in lower yields.

Like ARCA, CleanCap is a synthetic, chemically-made mRNA 5’ cap analog added to the transcription process in a single step. Unlike ARCA, however, CleanCap results in significantly higher levels of capping efficiency, resulting in very low levels of uncapped mRNA, which in turn minimizes the risk of activation of the innate immune system. In addition, CleanCap’s higher mRNA yields compared to ARCA result in lower cost of goods. When compared to enzymatic capping, CleanCap removes the additional downstream purification steps required. We have developed a suite of CleanCap analogs that are specifically designed for therapeutics and vaccines. CleanCap is sold as a stand-alone reagent or bundled with other mRNA products.

mRNA products represented 90% of our nucleic acid production revenue for the year ended December 31, 2021 (including the revenue from CleanCap products).

Oligonucleotides. The oligonucleotide product category supports broad customer applications, including therapeutics, in vitro diagnostics, next generation sequencing (“NGS”) and CRISPR-based gene editing. Most of our TriLink BioTechnologies oligonucleotide products are custom manufactured DNA or RNA sequences, often highly modified and produced as research grade or under GMP conditions for use in development, clinical and commercial applications.

We also provide nucleoside triphosphates (“NTPs”). NTPs are the precursors to DNA and RNA. They are composed of a nitrogen base bound to either ribose or deoxyribose with three phosphate groups added to the sugar. We manufacture NTPs that are used in polymerase chain reactions (“PCR”), in sequencing reactions and in the manufacture of mRNA. The NTPs can be unmodified, composed of the four standard bases, or modified, with a base altered to enhance a particular biological property, such as the ability to evade the innate immune system in therapeutic applications. TriLink BioTechnologies NTPs are used by customers in both research and clinical trial applications.

Our product offerings also include reagents that form the building blocks of oligonucleotides with our Glen Research products, including high quality specialty chemicals and amidites.

Plasmid DNA. In December of 2020, we completed the manufacturing verification of plasmid DNA within our newly released manufacturing suite inside our San Diego facility. The manufacturing of beta customer plasmids began in the first quarter of 2021. Unlike genomic DNA, which constitutes the chromosome, plasmid DNA exists outside the chromosome and represents small circular double-stranded constructs. Plasmid DNA is frequently used as a vector for replicating nucleic acid products. Plasmid DNA is integral to the production of mRNA and our production of plasmid DNA will assist in ensuring the quality and timeliness of the mRNA we produce.

Biologics Safety Testing (9% of Revenue for the Year Ended December 31, 2021)

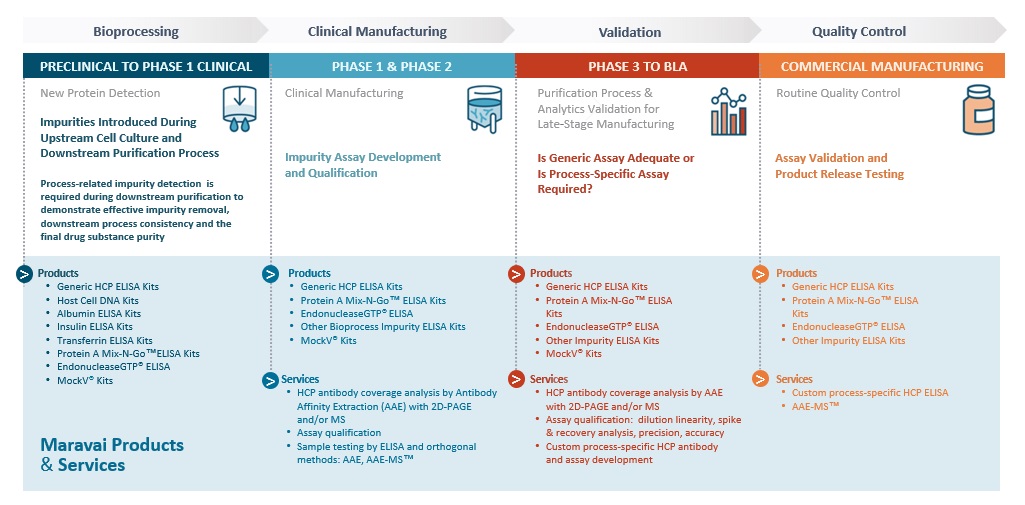

We provide products and services under the Cygnus Technologies®, LLC (“Cygnus Technologies”) brand that ensure the purity of our customers’ biopharmaceutical products, including biological drugs. For over 20 years, the Cygnus Technologies brand has been associated with products and services that enable the detection of impurities present in bioproduction. Our biologics safety testing products are used during development and scale-up, during the regulatory approval process and throughout commercialization. We are recognized globally for the detection of host cell proteins (“HCPs”) and process-related impurities during bioproduction.

Our customers in this segment manufacture a broad range of biopharmaceutical products. These include monoclonal antibodies and recombinant proteins, both as novel biologics and biosimilars, and recombinant vaccines, including vaccines to prevent COVID-19 and to treat cancer. We also provide products in support of the development of cell and gene therapies. Recombinant vaccines and cell and gene therapies rely on manufacturing of various viral vectors produced using recombinant nucleic acid and cell culture technologies. Viral vector manufacturing processes require rigorous analytics, including testing for process-related impurities such as HCPs, host cell DNA, purification leachates, growth media additives and enzymes used in viral vector purification processes.

ELISA is the benchmark method for monitoring levels of process-related impurities during the purification process and in product release testing. The advantages of well-developed ELISA kits include the ability to measure very low levels of impurities in the presence of high amounts of drug product, without requiring a high level of expertise to run, and are readily transferable across an organization from process development to manufacturing and quality control bioanalytical groups. Though relatively simple to run, these ELISA kits require a high level of expertise to design, develop and qualify.

Customers establishing biopharmaceutical manufacturing processes may use off-the-shelf or generic HCP kits provided by manufacturers like ourselves, or they may choose to design their own in-house assays for their specific processes. Some customers may choose to use generic assays early in development and migrate to process-specific assays later. The trend in recent years has been for customers to increasingly use generic assays throughout their development pathway, relying on our expertise and the established performance of our assays. If customers choose to develop process specific assays, we offer custom antibody production and assay development as well as characterization services to meet their needs.

Our comprehensive catalog of Cygnus Technologies HCP ELISA kits cover 23 expression platforms and provides the specificity and sensitivity to detect impurities with reproducibility, which supports regulatory compliance. Our reputation for quality is recognized by the industry and global regulatory agencies, with Cygnus Technologies assays used as reference methods throughout the industry and to support manufacturing and quality control of commercialized biologics.

Our customers in this segment are biopharmaceutical companies, contract research organizations (“CROs”), contract development and manufacturing organizations (“CDMOs”) and life science companies.

Cygnus Technologies product categories include HCP ELISA kits, other bioprocess impurity and contaminant ELISA kits, viral clearance prediction kits, ancillary reagents and custom services.

HCP ELISA kits. HCP ELISAs are kits used to detect residual proteins from the expression system used in bioproduction. HCPs constitute a major group of process-related impurities produced using cell culture technology no matter what cell expression platform is used. HCPs pose potential health risks for patients and the risk of failure of safety endpoints for drug manufacturers. When present in the administered product, even at low levels, HCPs can induce an undesired immune response, interfere with drug efficacy and impact drug stability. HCPs are a critical quality attribute for biologics safety testing development and must be adequately removed during the downstream purification process.

Other impurity and contaminant kits. Products in this category include kits for measuring Protein A leachate, which results from the affinity purification method used for monoclonal antibody therapeutic agents; ELISA kits for measuring additives in growth media, such as bovine serum albumin; ELISA kits for measuring host cell DNA; and ELISA kits to detect and quantify residual endonuclease impurities in recombinant viral vector and vaccine preparations.

Viral Clearance Prediction kits. In 2020, Cygnus Technologies introduced the MockV® Minute Virus of Mice (“MVM”) kit, a novel, proprietary viral clearance prediction tool that includes a non-infectious “mock virus particle” mimicking the physicochemical properties of live virus that may be present endogenously in the drug substance or introduced during bioproduction. The kit enables manufacturers to conduct viral clearance assessments easily and economically and to predict outcomes in-house ahead of costly and logistically challenging live viral clearance studies.

Ancillary reagents. These products include antibodies, antigens, sample diluents and other auxiliary products necessary to optimize applications for customer processes.

Custom services. We provide process-specific antibody and ELISA development, qualification and maintenance services. In addition, we have pioneered advanced orthogonal methods including antibody affinity extraction (AAE™) and mass spectrometry for HCP antibodies coverage analysis and HCP identification, which we provide as custom services.

Protein Detection (2% of Revenue for the Year Ended December 31, 2021)

The remaining 2% of revenue generated in the year ended December 31, 2021, was from the sale of products to detect the expression of proteins in tissues of various species by our Protein Detection segment. In September 2021, we completed the divestiture of Vector Laboratories, our Protein Detection segment which is not considered to be a significant part of our portfolio or capabilities.

Our Competitive Strengths

We believe we are a leader in providing nucleic acid products and biologics safety testing products and services to biopharmaceutical customers worldwide. Our success is built on the ability of our proprietary technologies and products, provided under exacting quality standards, to reliably serve our customers’ needs for critical raw materials.

Leading Supplier of Critical Solutions for Life Sciences from Discovery to Commercialization

We seek to be an important component of our customers’ supply chain by providing inputs that are central to the performance of their products and processes throughout the product lifecycle. By collaborating with customers early in the development phase, our products frequently follow our customers’ development path to commercialization and are likely to be incorporated as raw materials in their on-market products and processes. Our decades-long experience and track record, coupled with our ongoing investment in facilities and quality systems, allow our customers to rely on us for their critical products. Our approach is to be a trusted partner throughout the life cycle of our customers’ products.

Innovation, Proprietary Technologies and Expertise Underpin Our Portfolio

Our expertise in complex chemistries leads customers to seek our collaboration in designing complex products that meet high performance expectations. Based on the responses to the Industry Analysis, we believe the solutions we provide, in many cases, cannot be provided effectively by our competitors. In certain cases, like our CleanCap technology, our know-how is backed by intellectual property. In other cases, such as our HCP products, our antibodies are proprietary and therefore can only be supplied by us. We believe the proprietary nature of our expertise and products solidifies our long-term customer relationships.

Products with Outstanding Quality Performance

We believe our products stand out when compared to those of our competitors’ because they present innovative solutions to customer needs, as indicated by the responses to the Industry Analysis, while providing reliable performance and quality. CleanCap, for example, offers advantages over competing capping technologies in yield, stability and safety. Our oligonucleotides address complex chemistry challenges, which we believe few competitors can address. The results of the Industry Analysis indicate that our HCP ELISAs have defined the market for impurity detection and we believe they have become a de facto standard in biologics safety testing. Similarly, our protein detection assays have been recognized for their performance for over 40 years.

Trusted Brands

Our TriLink BioTechnologies, Glen Research, and Cygnus Technologies brands are well known in their respective markets for consistent quality and performance. This brand recognition has been earned over decades. Our manufacturing processes, quality standards, technical support and high-touch customer service ensure that we maintain the reputation of our brands.

State-of-the-Art Manufacturing Facilities

Our biopharmaceutical customers manufacture their products to meet stringent quality standards under strict regulatory guidelines and expect their critical suppliers to meet their exacting requirements. Our customers further expect that we have the production capacity to meet their needs in a timely manner. As of December 31, 2021, we had invested approximately $81.6 million into our flagship Wateridge facility and its five dedicated manufacturing suites to produce materials under GMP conditions, along with the required quality systems to meet requirements specified by our customers. Additionally, this investment in our Wateridge facility allows us to meet our customers demand for our nucleic acid products, including CleanCap. We similarly invest in our other sites to ensure we meet our customers’ expectations. We believe that the capacity to manufacture to stringent biopharmaceutical standards is constrained within the industry and our ability to meet this demand sets us apart from our competition.

Experienced Leaders and Talented Workforce

Our management includes experienced leaders with demonstrated records of success at Maravai and other highly regarded industry participants. In addition, as of December 31, 2021, approximately 19% of our workforce have earned advanced degrees and all receive rigorous on the job training. We believe the quality of our personnel is critical to ensuring the collaborative, long-standing relationships we maintain with many of our customers.

Our Markets

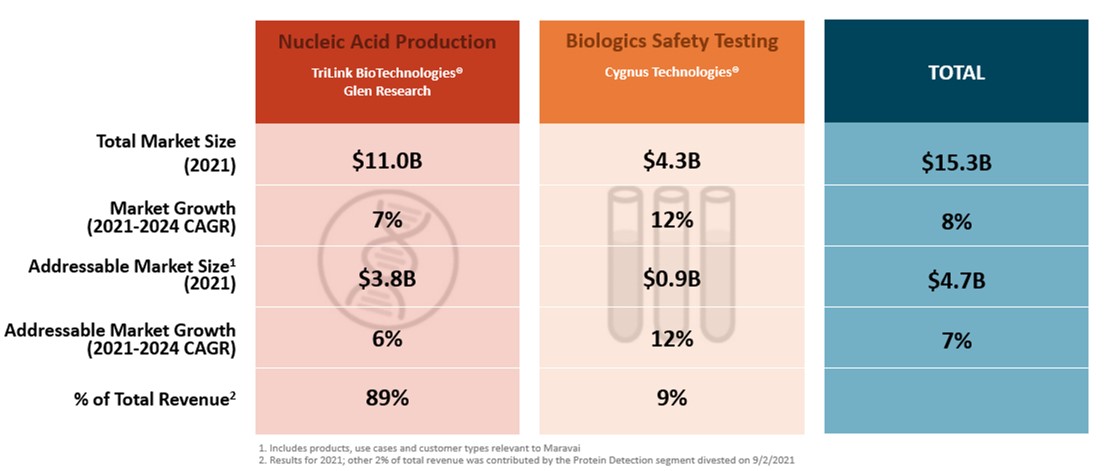

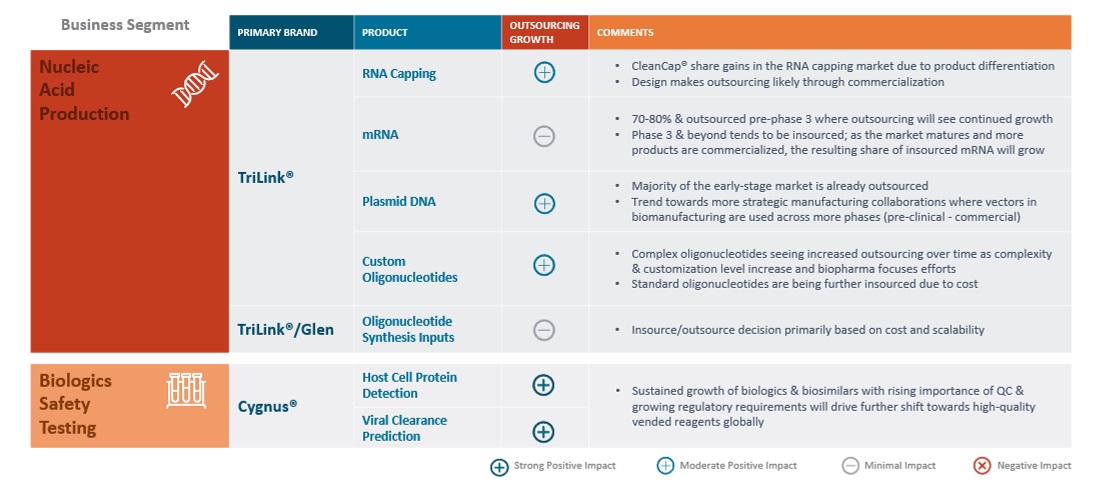

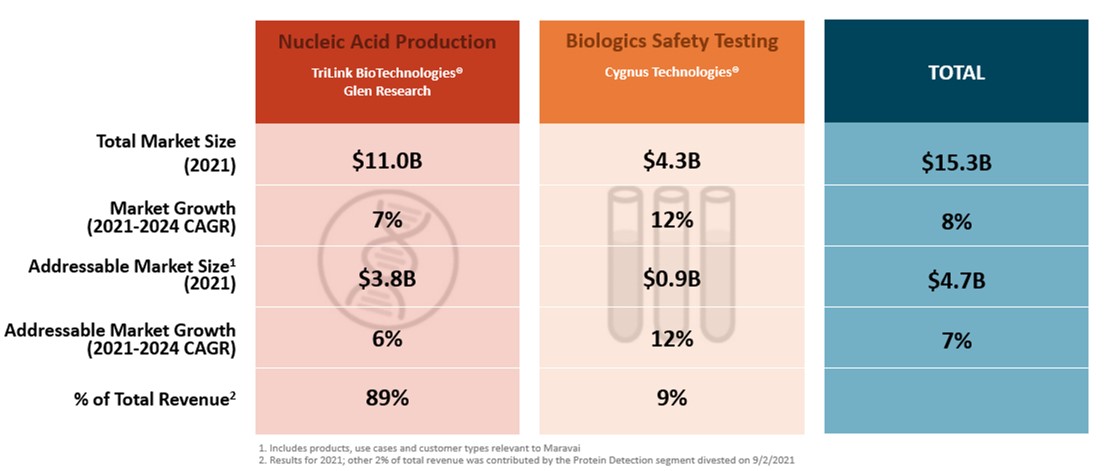

We participate in two distinct market segments: nucleic acid production and biologics safety testing, which, according to industry consultants, together represented approximately $15.3 billion in annual spending in 2021 and which are expected to

grow at a 8% compound annual growth rate (“CAGR”) through 2024. Of that combined market, we estimate our addressable portion represents approximately $4.7 billion. Our addressable segments as a whole, adjusted for the mix of products we offer, are expected to grow at a weighted average blended rate of 7% per annum through 2024, according to industry consultants and management estimates. We benefit from favorable industry dynamics in our broader market segments and specific growth drivers in our addressable market segments.

Biopharmaceutical customers are increasingly relying on outside parties to provide important inputs and services for their clinical research and manufacturing, a development driving growth for suppliers with unique capabilities and the ability to manufacture at an appropriate scale to support customer programs. We believe that suppliers like ourselves, with this rare combination of capabilities, proprietary products and the required investment in manufacturing and quality systems, are benefiting from rapid growth as biopharmaceutical customers seek to partner with a small number of trusted suppliers.

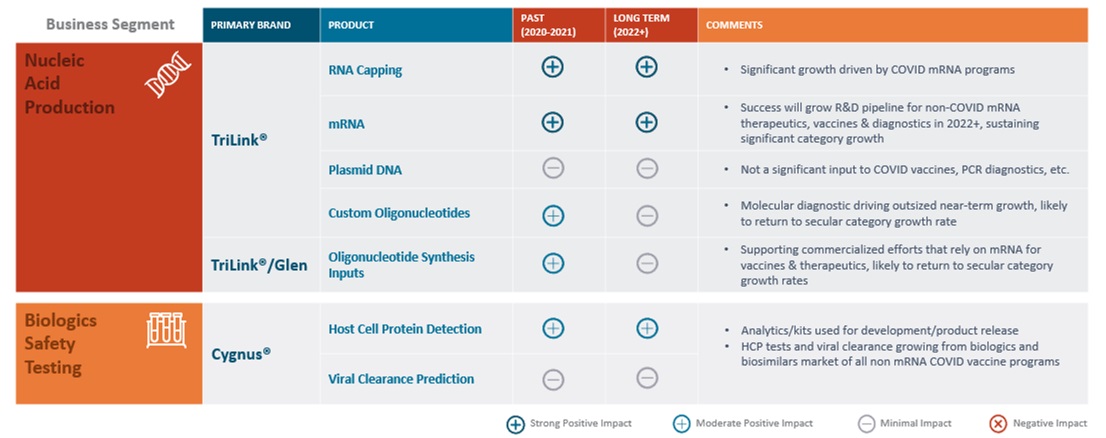

In addition to the continued trend toward outsourcing, several market developments are driving increased growth, above the broader market growth rates, in our addressable market segments, including:

•Pivot toward mRNA vaccines driven in part by COVID-19. The first two vaccines to be approved for use in combating the COVID-19 pandemic were mRNA vaccines, including the vaccine developed by Pfizer and BioNTech which uses our CleanCap product. According to the World Health Organization, there are 23 mRNA COVID-19 vaccines in the clinic and an additional 24 mRNA based COVID-19 vaccines in pre-clinical development. The mRNA

vaccine technology is gaining prominence as a result of its fast development time, lower relative manufacturing costs and improved safety because of the lower risk of unwanted immune responses. In addition to the COVID-19 vaccines, mRNA technology is being used for other infectious disease vaccines. There are four influenza vaccines in clinical trials and an additional 50 non-flu vaccines in the clinic and another 84 pre-clinical vaccine programs that have been disclosed. RNA expertise is highly specialized and customers seek partners to provide these complex products. A small number of providers, like ourselves, can provide this RNA capability.

•Rapid growth in development of cell and gene therapies. Sales of cell and gene therapy drugs are expected to exceed $30 billion in sales by 2024. A record number of recent approvals (Abecma, Brevanzi, Imlygic, Rethymic and Stratagraph) were all granted FDA approval in 2021 and have added clinical credibility to cell and gene therapies. We support the development of cell and gene therapies with products used in gene editing and cell therapy research. For example, our host cell protein assays are used during the manufacturing of viral vectors and plasmid DNA. Further, we participate by providing RNA guide strands or mRNA that encodes for gene-editing enzymes, such as Cas9.

•Large and growing pipeline of protein-based therapeutics. In addition to cell and gene therapies, an increase in protein-based therapies is driving the need for impurity testing during process development and manufacturing.

•Rise in molecular diagnostics driven by COVID-19. The market for molecular diagnostics is growing dramatically because of demand for new tests related to COVID-19. This growth is driving demand for our products, particularly oligonucleotides and related inputs.

•COVID-19 providing both short-term and expected long-term growth. Several of our product categories have experienced accelerated growth in 2021, notably our CleanCap and oligonucleotide products. We expect the impact of COVID-19 on our growth to sustain in the longer-term as the entire mRNA category benefits from lessons learned during the COVID-19 pandemic. We expect research in other mRNA vaccines and therapeutic categories to experience increased growth as research conducted for COVID-19 diffuses more broadly into other vaccines and therapies. The following table shows the impact COVID-19 has had on our business from 2020 through 2021 and its ongoing longer term impact.

Nucleic Acid Production Market

The nucleic acid production market includes the production and synthesis of reagents for research and manufacturing of DNA and RNA-based biologics. Nucleic acid production is a $11.0 billion market expected to grow at 7% annually through 2024. Growth has generally accelerated in recent years with continued innovation in cell and gene therapy, including mRNA therapeutics and synthetic biology approaches. Our addressable portion of the market is $3.8 billion with expected growth of 6% annually through 2024. This growth rate is driven by our exposure to high growth sub-markets including RNA cap analog production and mRNA. Capping and mRNA growth is fueled by the continued growth of nucleic acid vaccines and therapies, which we expect will accelerate because of research into COVID-19. That research has highlighted the benefits of mRNA vaccines and therapies more broadly.

The field of mRNA-based drugs and vaccines has advanced dramatically within a few short years. Capacity to manufacture these products when approved, however, remains in short supply. Providers of technical expertise and manufacturing

capabilities, like ourselves, with the facilities and quality systems demanded by biopharmaceutical customers, benefit from the demand created in the mRNA category.

COVID-19 is further accelerating growth in custom oligonucleotides and related inputs, which are used to manufacture diagnostic tests. New participants have entered the diagnostics market. Reference labs and hospitals have rapidly expanded their capacity. And demand for testing is increasing rapidly. These developments in turn lead to increased demand for our oligonucleotide products.

Biologics Safety Testing Market

The biologics safety testing market includes the detection and clearance of downstream bioprocessing product and process impurities. Biologics safety testing is a $4.3 billion market expected to grow at 12% annually through 2024. We participate in the HCP and other process related impurities and viral contamination segments of this market for biopharmaceutical vaccine and therapeutics manufacturing. These addressable segments account for $0.9 billion of the market and are expected to grow at 12% annually through 2024. The growth in this market is driven by continued growth of biologics and biosimilars and increased outsourcing of process development.

Our Strategy

Our customers strive to improve human health. Our goal is to provide them with products and services to accelerate their development efforts, from basic research through clinical trials and ultimately to commercialization for drugs, therapeutics, diagnostics and vaccines.

Supporting Biopharmaceutical Customers from Product Development Through to Commercialization

Our customers include both emerging and established biopharmaceutical leaders developing novel drugs, therapeutics, diagnostics and vaccines. Emerging biopharmaceutical customers frequently seek the support we can offer in our state-of-the-art facilities under our stringent quality standards, with the capabilities that result from the capital and process investments we have made over the last several years. We are capable of manufacturing reagents from research-grade to GMP-grade, which often exceeds the in-house capabilities of our pre-commercial customers. The results of the Industry Analysis indicate that our emerging and established customers also seek us out for our leading capabilities in nucleic acid chemistries and process control assays. We have expertise in complex chemistries, especially in highly modified nucleic acids and mRNA, and we believe we are a leader in applying these capabilities to the development of vaccines and therapeutics. We further support our customers as they transition from product development to commercialization by providing critical raw materials for their drugs. A core component of our strategy is the continued investment in facilities, quality standards and products and services that allow us to support our customers through the entire life cycle of their drugs.

Developing Proprietary Technologies that Deepen our Relationships with Our Customers

We believe we are experts in nucleic acids and our scientists aim to develop proprietary enabling technologies that become integral to our customers’ products. For example, CleanCap, our proprietary chemical capping technology, has demonstrated its advantages in terms of the stability of the associated mRNA and its efficiency in protein production when compared to traditional capping technologies. This efficiency has led biopharmaceutical customers to employ CleanCap in their vaccine and therapeutic programs. As those products proceed through development into commercialization, we believe CleanCap will be a critical input in on-market vaccines and therapeutics.

Forming Long-Term Partnerships for Critical Biopharmaceutical Components and Process Tests

Our products are frequently incorporated into regulated and highly validated therapeutic and diagnostic products and processes. Our biopharmaceutical customers expect us to provide them with consistent, high-quality products that meet narrow specifications, and that we ensure their supply chain for such products for the length of their programs. In many cases, we may be the sole source of the products we provide. We therefore take seriously our responsibility to our biopharmaceutical partners, and by extension the patients they serve. Our emphasis on partnership generally leads to long-term relationships with our customers.

Focusing Our Efforts on High Growth End Markets

While biopharmaceutical research and in vitro diagnostics markets are experiencing strong growth, we target the highest growth segments within those markets. Our product portfolio is well positioned to serve the biologic, cell and gene therapy and mRNA vaccine and therapeutic end markets, which are currently experiencing above-market growth. By investing in technologies at the forefront of biopharmaceutical and in vitro diagnostics, we aim to remain focused on the highest-growth applications.

Opportunistically Acquiring Leading Life Sciences Businesses and Supporting Their Continued Development

We built our business by acquiring established and emerging companies with strong scientific foundations in our target markets and investing in their systems, processes and people to accelerate their growth and expand their technologies. Going forward, we may opportunistically pursue strategic acquisitions that we believe meet, or could meet after being acquired and expanded, the following criteria:

•address our core target markets;

•have a demonstrated adherence to high quality standards;

•be leaders in their market niche(s);

•have differentiated or proprietary products and processes that provide clear value to our biopharmaceutical and other customers; and

•have a track record of attractive rates of growth and compelling returns on invested capital.

Our acquisition strategy is to invest significantly in our acquired businesses. We strive to rapidly integrate their information and financial systems. All of our companies share a common enterprise resource planning system, and we implement our financial controls and reporting systems soon after acquisition. We seek opportunities to invest in their facilities and personnel to provide an operating foundation for growth. We also augment their commercial capabilities through a combination of sales and marketing resources dedicated to each business, supported by our global marketing infrastructure.

We will continue to seek a balance between driving growth organically and inorganically through opportunistic acquisitions.

Commercial

We have relationships with the following categories of customers: developers of therapeutics and vaccines, other biopharmaceutical and life science research companies, academic institutions and molecular diagnostic companies. Developers of therapeutics and vaccines, including cell and gene therapies, comprise about 85% of our customer base. Our biopharmaceutical customers include startups, established biotechnology companies and large pharmaceutical companies developing enzyme replacement therapies, gene editing therapies, ex vivo therapies and vaccines.

Our commercial function includes direct sales, marketing, customer service, technical support and distributor management. We serve customers through direct sales in each business segment, with a primary focus on our larger biopharmaceutical and other industry customers. We serve our academic customers via web, email and phone ordering. We support all customers with live technical support and customer service.

We address customers outside the United States with a combination of direct sales and distributors. We serve many of our biopharmaceutical customers, especially in our nucleic acid production segment, via direct sales worldwide. Our distributors also sell our products in over 50 countries and provide customer service and local sales and marketing.

Competition

We compete with a range of companies across our segments.

Nucleic Acid Production

Within nucleic acid production, we compete with four primary types of companies: (1) chemistry companies that create and produce the basic monomers, amidites, and supports that go into the creation of an oligonucleotide; (2) oligonucleotide manufacturers that specialize in custom oligonucleotide development of varying complexities and scales; (3) mRNA biotechnology companies that create fully processed mRNA and specialize in custom, complex orders; and (4) CDMOs that have the capability to accept work from large biopharmaceutical companies and serve as the outsourcing entity for the development and manufacturing of nucleic acid products. However, it is important to note that CDMOs seldom offer proprietary products.

For mRNA capping analogs, we compete principally with Thermo Fisher and Hongene Biotech Corporation, who offer alternatives to CleanCap. Many biopharmaceutical companies produce capping solutions in-house using enzymatic or ARCA processes. However, given CleanCap’s high yield and process efficiency, many customers who previously insourced these processes have begun to partner with us. Based on the Industry Analysis, we believe our products and services are more effective than those of our competitors. Deep scientific expertise, intellectual property protection and specialty equipment serve as barriers to entry in this space.

For our mRNA offerings, we compete with Aldevron (a subsidiary of Danaher) and System Biosciences, among others. Based on the Industry Analysis, we believe we have a reputation for our expertise in the RNA space with talented scientists who are constantly pushing the frontier of RNA science. This scientific expertise and the required high-cost equipment serve as barriers to entry. In addition to our expertise, we believe our GMP cleanroom manufacturing process differentiates us from competitors.

For custom oligonucleotides, we compete with a number of manufacturers. Custom oligonucleotide providers include those that provide complex, highly modified oligonucleotides and those that provide less complex offerings. In the custom oligonucleotide space, complexity is based on the length of the sequence and level of modification to the phosphate backbone. Large manufacturers like Integrated DNA Technologies, Thermo Fisher and EMD Millipore Corporation (“Millipore Sigma”) serve less complex customer needs while we, LGC Biosearch Technologies and GenScript Biotech Corporation serve more complex customer needs. In the custom oligonucleotide market, we have a reputation for accepting complex orders and delivering high purity products that reduce researcher re-work and save money. Quick turnaround times and the ability to produce at scale are essential requirements in this segment.

In the oligonucleotide synthesis inputs market, we compete against large distributor-manufacturers like Thermo Fisher and Millipore Sigma while also serving them as customers. Our Glen Research brand has a long history in this industry, which drives customer loyalty, and has a reputation for high-fidelity technical service, focusing on supplying and sourcing highly modified inputs for its customers.

Biologics Safety Testing

For drugs in early development, we compete against other bioprocess impurity kit providers such as BioGenes (“BioGenes”) or Enzo Life Sciences (“Enzo”). Competitors generally offer fewer expression platforms (generally between one and three) compared to our offering of 23 expression platforms and a total of 78 different ELISA impurity detection kits. As a drug successfully moves forward to validation and approval stages, a customer may either continue with an off-the-shelf kit or they may begin the process to develop a custom assay that is tailored to meet their specific host cell and manufacturing process needs. During the entire drug development process, and especially during this decision, we are partners with the manufacturer and provide our expertise to help them make the best bioprocess quality control and testing-related decisions.

If a drug manufacturer continues with an off-the-shelf assay from development to validation and approval, they will generally stay with the incumbent kit provider due to the extensive validation they have conducted. For custom assay development, our main competitors are BioGenes, Rockland Immunochemicals and some CDMOs and CROs with custom assay development capabilities. The trend in recent years has been for CDMOs, CROs and large biopharmaceutical companies to focus on core competencies and outsource host cell protein assays or qualify off-the-shelf kits when possible.

Licenses and Collaborations

Broad Patent License Agreement

We (through TriLink BioTechnologies) entered into a Nonexclusive Patent License and Material Transfer Agreement with The Broad Institute, Inc. (“Broad”) effective as of July 5, 2017, and amended on September 29, 2017 (the “Broad Patent License Agreement”). Broad, together with a consortium of educational institutions (including Harvard University and the Massachusetts Institute of Technology), owns and controls certain patent rights relating to genome editing technology, including the CRISPR-Cas9 gene editing processes and have a licensing program for use and commercialization of technologies and products covered by the underlying patent rights. Under the Broad Patent License Agreement, Broad grants to us a non-exclusive, royalty-bearing, non-transferable and non-sublicensable, worldwide license under the licensed patent rights to manufacture and sell products and to perform certain in vitro processes or services on a fee-for-service basis, in each case, solely as research tools for research purposes (excluding human, clinical or diagnostic uses). We must use diligent efforts to develop products, introduce products into the commercial market and make products reasonably available to the public. We are obligated to pay a mid-five figure annual license maintenance fee and royalties in the range of 5% to 10% on net sales of covered products and processes.

The term of the Broad Patent License Agreement extends through the expiration of the last to expire claim of any of the licensed patents. We are entitled to terminate the Broad Patent License Agreement for convenience at any time on at least three (3) months written notice, in which case we must continue to pay license maintenance fees and royalties as noted above for the sale of products that are not covered by the specific claims of the licensed patent rights but are otherwise derived from such licensed patent rights or from products covered by such licensed patent rights. Broad may terminate the license for our uncured failure to make payments, for our uncured material breach or if we bring a patent challenge against any of the institutional rights holders.

LSU Patent License Agreement

We (through TriLink BioTechnologies) entered into a Patent License Agreement with the Board of Supervisors of Louisiana State University and Agricultural and Mechanical College and Dr. Edward Darzynkiewicz (collectively, “LSU”) effective as of July 7, 2010 (the “LSU Patent License Agreement”). Under the LSU Patent License Agreement, LSU grants to us a non-exclusive, royalty-bearing license under an issued U.S. patent and patents that claim priority thereto, directed to mRNA capping technology to make and sell reagents and kits for research use only (excluding use in humans or for diagnostic or therapeutic purposes) in the United States. We are required to use commercially reasonable efforts to commercialize the licensed products throughout the life of the LSU Patent License Agreement. We are obligated to pay a low four-figure annual license maintenance fee and royalties in the range of 5% to 10% on net sales of licensed products.

We must pay royalties to LSU until the expiration of the last to expire licensed patents. We are entitled to terminate the LSU Patent License Agreement for convenience at any time on at least sixty (60) days written notice, subject to paying in full all amounts due up to the date of termination and cessation of any exercise of the licensed rights thereafter. LSU may terminate the license for our uncured failure to make payments or our uncured material breach.

AmberGen Agreement

We (through Glen Research) entered into an Agreement with AmberGen, Inc. (“AmberGen”), dated May 11, 2000 (the “AmberGen Agreement”) under which AmberGen has appointed us the exclusive distributor of AmberGen’s proprietary photocleavable product offered under the name PC Phosphoramidite on a worldwide basis. We are limited to selling the product for research use only and are required to use good faith efforts to discontinue distribution to buyers making use of the product than purposes other than laboratory research.

We are entitled under the AmberGen Agreement to purchase product from AmberGen at AmberGen’s cost to manufacture the product. On a monthly basis, we are required to remit to AmberGen 50% of the gross profits on product sales for which payments were received in the preceding month.

The AmberGen Agreement was initially in effect for a five-year term but is now in a series of automatic one-year renewal terms. Either party may terminate the AmberGen Agreement on six (6) months written notice or immediately for material breach of the other party or, subject to a cure period, for certain bankruptcy-related events.

BTI Biosearch Dyes Agreement

We (through Glen Research) are a party to a Commercial Supply and License Agreement with Biosearch Technologies, Inc. (“BTI”), dated June 29, 2004, as amended on November 8, 2004 (the “BTI Biosearch Dyes Agreement”), under which BTI agrees to supply us with certain BTI dyes and we are granted a worldwide, non-exclusive license to sell certain BTI dyes and to use BTI’s product-related trademarks to do so. The BTI dyes can only be sold for the customer’s internal research and development use and inclusion in commercial kits or any commercial application is prohibited unless the customer has obtained a valid commercial license from BTI. The rights granted do not include sales to customers for use in human in vitro or clinical diagnosis. We are required to pay a per unit price for the licensed BTI products.

The BTI Biosearch Dyes Agreement was originally in effect for a term of two years and is now in a series of annual year-to-year renewals. Either party has the right to opt-out of such renewals upon ninety (90) days notice prior to the next renewal. Either party can terminate the agreement for convenience at any time on six months’ written notice. Either party can terminate the agreement for the other party’s uncured material breach or insolvency.

Manufacturing and Supply

We occupy facilities in San Diego, California, Southport, North Carolina and Sterling, Virginia. Except for our Sterling facility, all our facilities are engaged in the manufacture of reagents.

Our Wateridge facility in San Diego, in particular, was designed and built by us in conjunction with the building owner to contain fully functional chemical and biological manufacturing operations from material receiving to product distribution and has its own loading dock, manufacturing gas delivery system, solvent delivery and waste system, ISO 8 and ISO 7 designated customer manufacturing suites and integrated building management systems for required site control.

We continue to invest in our San Diego facility with recent expansions allowing for the manufacture of plasmid DNA and creation of ISO Class 8 and ISO Class 7 clean rooms providing for an expansion of the scale at which we can manufacture CleanCap and NTPs, supported by a pilot plant for development of large-scale manufacturing processes. This investment has allowed us to substantially increase our capacity for nucleic acid production and specifically CleanCap meeting the growing demand from our customers without interruption or constraints.

Our Southport operations are engaged in the manufacture and processing of antibody and ELISA kits. The facilities incorporate laboratory, manufacturing, bottling, shipping and waste handling capabilities. Our Sterling facility was designed to perform quality control, aliquoting, packaging and shipping and houses the appropriate space and systems.

Our supply chain relies on a network of specialized suppliers and transportation companies. We regularly review our supply chain for supplier quality and risks related to concentration of supply and we take appropriate action to manage these potential risks.

Government Regulation

We provide products used for basic research or as raw materials used by biopharmaceutical customers for further processing, and active pharmaceutical ingredients used for preclinical and clinical studies. The quality of our products is critical to researchers looking to develop novel vaccines and therapies and for biopharmaceutical customers who use our products as raw materials or who are engaged in preclinical studies and clinical trials. Biopharmaceutical customers are subject to extensive regulations by the FDA and similar regulatory authorities in other countries for conducting clinical trials and commercializing products for therapeutic, vaccine or diagnostic use. This regulatory scrutiny results in our customers imposing rigorous quality requirements on us as their supplier through supplier qualification processes and customer contracts.

Our nucleic acid and biologics safety testing segments produce materials used in research and biopharmaceutical production, clinical trial vaccines and vaccine support products. We produce materials in support of our customers’ manufacturing businesses and to fulfill their validation requirements, as applicable. These customer activities are subject to regulation and consequently require these businesses to be inspected by the FDA and other national regulatory agencies under their respective cGMP regulations. These regulations result in our customers imposing quality requirements on us for the manufacture of our products, and maintain records of our manufacturing, testing and control activities. In addition, the specific activities of some of our businesses require us to hold specialized licenses for the manufacture, distribution and/or marketing of particular products.

All of our sites are subject to licensing and regulation, as appropriate under federal, state and local laws relating to:

•the surface and air transportation of chemicals, biological reagents and hazardous materials;

•the handling, use, storage and disposal of chemicals (including toxic substances), biological reagents and hazardous waste;

•the procurement, handling, use, storage and disposal of biological products for research purposes;

•the safety and health of employees and visitors to our facilities; and

•protection of the environment and general public.

Regulatory compliance programs at each of our businesses are managed by a dedicated group responsible for regulatory affairs and compliance, including the use of outside consultants. Our compliance programs are also managed by quality management systems, such as vendor supplier programs and training programs. Within each business, we have established Quality Management Systems (“QMS”) responsible for risk based internal audit programs to manage regulatory requirements and client quality expectations. Our QMS program ensures that management has proper oversight of regulatory compliance and quality assurance, inclusive of reviews of our system practices to ensure that appropriate quality controls are in place and that a robust audit strategy confirms requirements for compliance and quality assurance.

Research Products

Our products and operations may be subject to extensive and rigorous regulation by the FDA and other federal, state, or local authorities, as well as foreign regulatory authorities. The FDA regulates, among other things, the research, development, testing, manufacturing, clearance, approval, labeling, storage, recordkeeping, advertising, promotion, marketing, distribution, post-market monitoring and reporting, and import and export of pharmaceutical drugs. Certain of our products are currently marketed as research use only (“RUO”).

We believe that our products that are marketed as RUO products are exempt from compliance with GMP regulations under the FDCA. RUO products cannot make any claims related to safety, effectiveness or diagnostic utility and they cannot be intended for human clinical diagnostic use. In November 2013, the FDA issued a final guidance on products labeled RUO, which, among other things, reaffirmed that a company may not make any clinical or diagnostic claims about an RUO product. The FDA will also evaluate the totality of the circumstances to determine if the product is intended for diagnostic purposes. If the FDA were to determine, based on the totality of circumstances, that our products labeled and marketed for RUO are intended for diagnostic purposes, they would be considered medical products that will require clearance or approval prior to commercialization.

We do not make claims related to safety or effectiveness and they are not intended for diagnostic or clinical use. However, the quality of our products is critical to meeting customer needs, and we therefore voluntarily follow the quality standards outlined by the International Organization for Standardization for quality management systems (ISO 9001:2015) for the design, development, manufacture, and distribution of our products. Some biopharmaceutical customers desire extra requirements including quality parameters and product specifications, which are outlined in customer-specific quality agreements. These products are further processed and validated by customers for their applications. Customers qualify us as part of their quality system requirements, which can include a supplier questionnaire and on-site audits. Customers requalify us on a regular basis to ensure our quality system, processes and facilities continue to meet their needs and we are meeting requirements outlined in relevant customer agreements.

Active Pharmaceutical Ingredients (“APIs”) for Clinical Trials

We provide APIs to customers for use in preclinical studies through and including clinical trials. We hold a drug manufacturing license with the California Food and Drug Branch of the California Department of Public Health for manufacture of APIs for clinical use and are subject to inspection to maintain licensure. Manufacture of APIs for use in clinical trials is regulated under § 501(a)(2)(B) of the FDCA, but is not subject to the current GMP regulations in 21 CFR § 211 by operation of 21 CFR § 210. We follow the principles detailed in the International Council for Harmonisation (“ICH”) Q7, Good Manufacturing Practice Guide for Active Pharmaceutical Ingredients (Section 19, APIs For Use in Clinical Trials) in order to comply with the applicable requirements of the FDCA, and the comparable GMP principles for Europe; European Community, Part II, Basic Requirements for Active Substances Used as Starting Materials (Section 19, APIs For Use in Clinical Trials). APIs are provided to customers under customer contracts that outline quality standards and product specifications. As products advance through the clinical phases, requirements become more stringent, and we work with customers to define and agree on requirements and risks associated with their product.

Customers’ biopharmaceutical products early in their development have a high failure rate and often do not advance through the clinical stages to commercialization. Our customers are required to follow regulatory pathways that are not always known, which may cause additional unforeseen requirements placed on us as their contract manufacturer and delays in advancing to the next stage of product development. We also provide novel compounds for cell and gene therapy applications, which result in additional challenges for our customers attempting to obtain regulatory approval given that this field is relatively new, and regulations are evolving. Customer clinical trials rely on approval from institutional review boards (“IRBs”) and patient and volunteer enrollment, which makes timelines unpredictable for advancing to the next stage in product development. Preclinical studies and clinical trials conducted by our customers are also expensive and data may be negative or inconclusive causing customers to abandon projects that were expected to continue. Regulatory requirements in both the United States and abroad are always evolving and compliance with future laws may require significant investment to ensure compliance.

Other Regulatory Requirements

Environmental laws and regulations. We believe that our operations comply in all material respects with applicable laws and regulations concerning environmental protection. There have been no material effects upon our earnings or competitive position resulting from compliance with applicable laws or regulations enacted or adopted relating to the protection of the environment. Our capital and operating expenditures for pollution control in 2020 and 2021 were not material and are not expected to be material in 2022.

Intellectual Property

Our success depends in part on our ability to obtain and maintain intellectual property protection for our products and services, defend and enforce our intellectual property rights, preserve the confidentiality of our trade secrets, and operate without infringing, misappropriating or otherwise violating valid and enforceable intellectual property rights of others. We seek to protect the investments made into the development of our products and services by relying on a combination of patents, trademarks, copyrights, trade secrets, including know-how, and license agreements. We also seek to protect our proprietary products and services, in part, by requiring our employees, consultants, contractors and other third parties to execute confidentiality agreements and invention assignment agreements.

Patents. Our intellectual property strategy is focused on protecting through patents and other intellectual property rights our core products and services, including CleanCap, and related instrumentation and applications. In addition, we protect our ongoing research and development into critical reagents for cell and gene therapy through patents and other intellectual property rights. Our patent portfolio generally includes patents and patent applications relating to compositions and methods for the production of oligonucleotides, nucleic acids, immunofluorescence assays, and mock viral particles. We may own provisional patent applications, and provisional patent applications are not eligible to become issued patents until, among other things, we

file national stage patent applications either directly or via the PCT within 12 or 30 to 32 months, respectively. If we do not timely file any national stage patent applications, we may lose our priority date with respect to our provisional patent applications and any patent protection on the inventions disclosed in such provisional patent applications. We cannot predict whether any such patent applications will result in the issuance of patents that provide us with any competitive advantage.

Issued patents extend for varying periods depending on the date of filing of the patent application or the date of patent issuance and the legal term of patents in the countries in which they are obtained. Generally, utility patents issued for applications are granted a term of 21 years from the earliest effective filing date of a non-provisional patent application. Issued patents may be extended beyond the natural 21 year term for regulatory or administrative delay in accordance with provisions of applicable local law. As a result, our patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours.

The following granted patents relate to our CleanCap products and technology.

| | | | | | | | | | | | | | | | | | | | |

| Jurisdiction | | Patent Number | | Title | | Expiration |

| United States | | 10494399 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

| United States | | 10519189 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

| United States | | 10913768 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

| Europe | | 3352584 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

| Australia | | 2016328645 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

| Japan | | 6814997 | | Compositions and methods for synthesizing 5′-Capped RNAs | | 2036 |

The following patent relates to our oligonucleotide synthesis support technology.

| | | | | | | | | | | | | | | | | | | | |

| Jurisdiction | | Patent Number | | Title | | Expiration |

| United States | | 7491817 | | Universal Supports for Oligonucleotide Synthesis | | 2022 |

The following patents relate to our MockV related products and technology.

| | | | | | | | | | | | | | | | | | | | |

| Jurisdiction | | Patent Number | | Title | | Expiration |

| United States | | 9632087 | | Methods for evaluating viral clearance from a biopharmaceutical solution employing mock viral particles | | 2034 |

| United States | | 10309963 | | Methods for evaluating viral clearance from a process solution employing mock viral particles | | 2034 |

| Europe | | 3044339 | | Methods and kits for quantifying the removal of mock virus particles from a purified solution | | 2034 |

| Australia | | 2014320015 | | Methods and kits for quantifying the removal of Mock Virus Particles from a purified solution | | 2034 |

| China | | 105899684 | | Method and kit for quantifying pseudoviral particles removed from purified solution | | 2034 |

Trademarks. Our trademark portfolio is designed to protect the brands of our current and future products and includes U.S. trademark registrations for our company name, Maravai LifeSciences®, subsidiary names Cygnus Technologies and TriLink Biotechnologies and various product names, such as CleanCap and MockV.

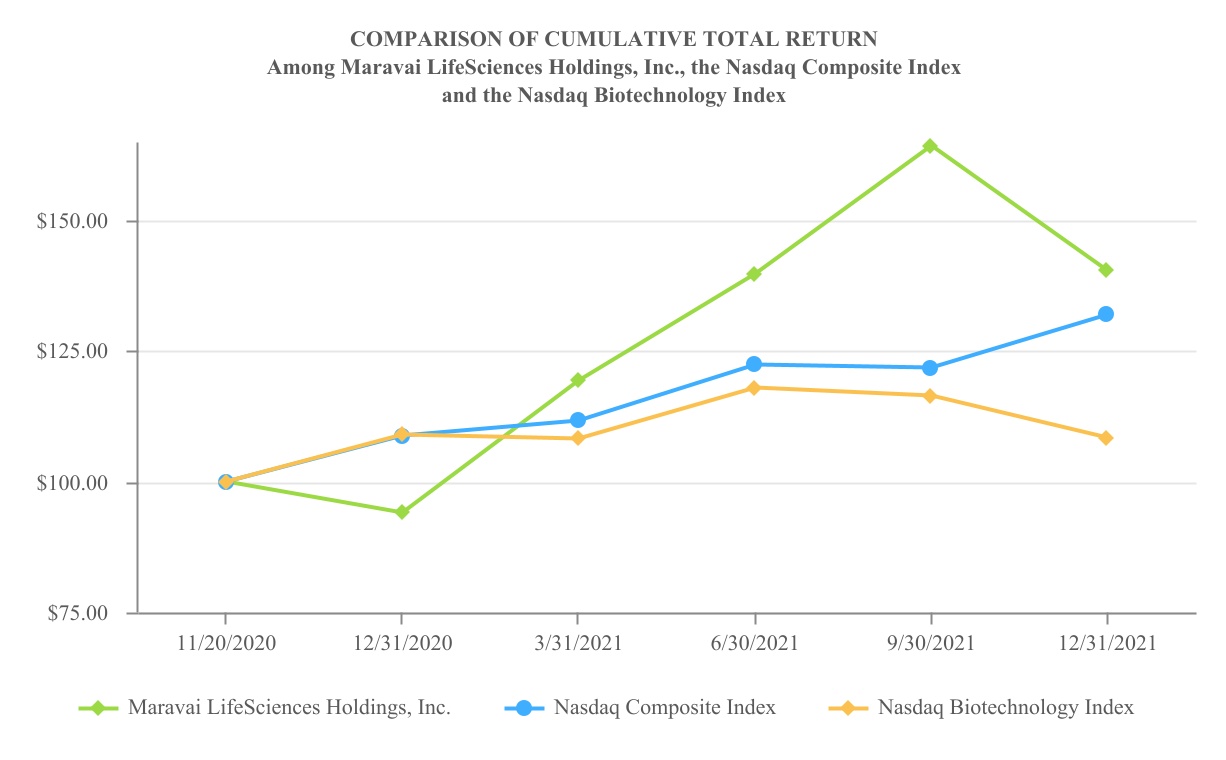

Trade Secrets. We also rely on trade secrets, including know-how, unpatented technology and other proprietary information, to strengthen our competitive position. We have determined that certain technologies, such as the production of antibodies for biologics safety testing, are better kept as trade secrets, rather than pursuing patent protection. To prevent disclosure of trade secrets to others, it is our policy to enter into nondisclosure, invention assignment and confidentiality agreements with parties who have access to trade secrets, such as our employees, collaborators, outside scientific collaborators, consultants, advisors and other third parties. These agreements also provide that all inventions resulting from work performed for us or relating to our business and conceived or completed during the period of employment or assignment, as applicable, are our exclusive property. In addition, we take other appropriate precautions, such as physical and technological security measures, to guard against misappropriation of our proprietary information by third parties.