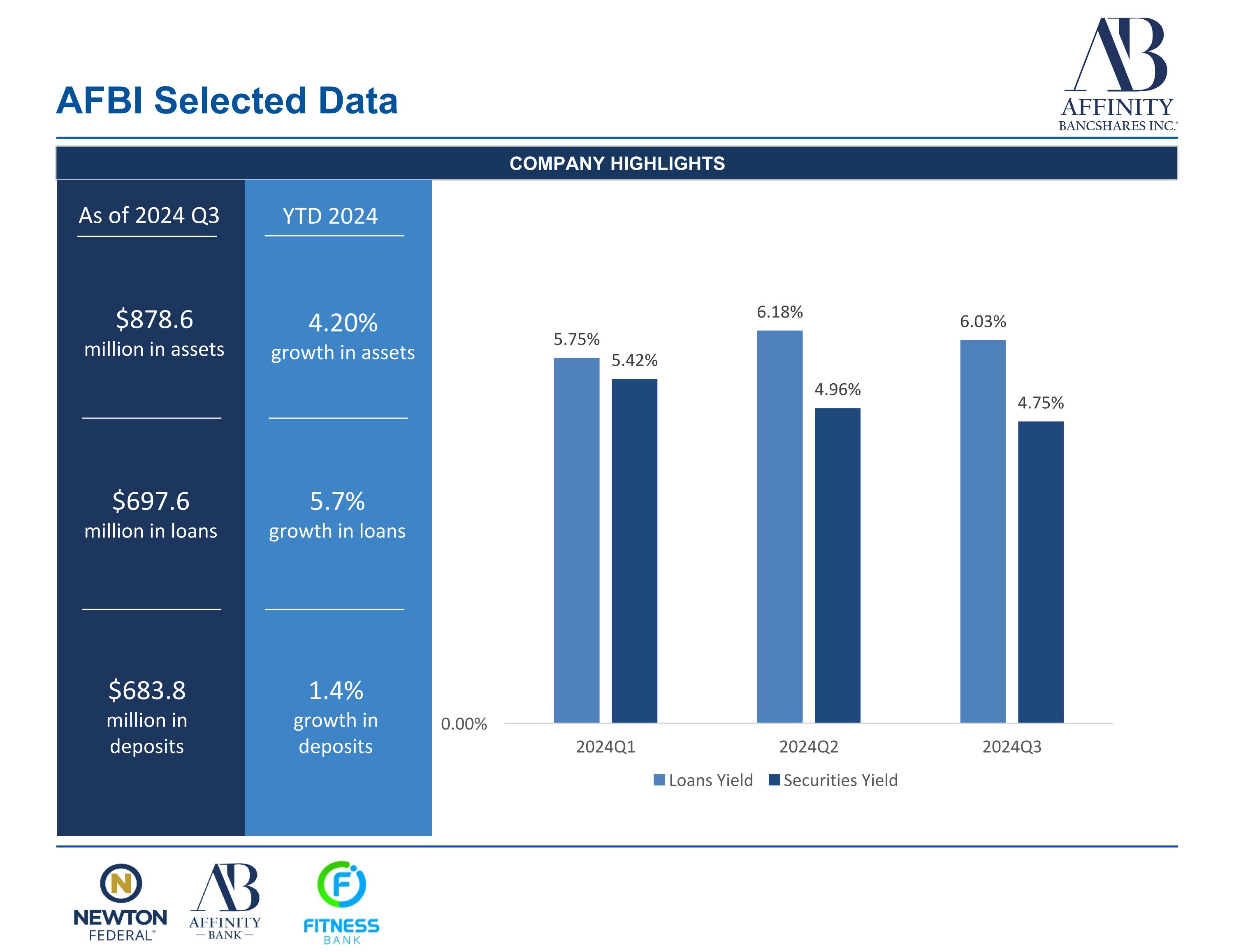

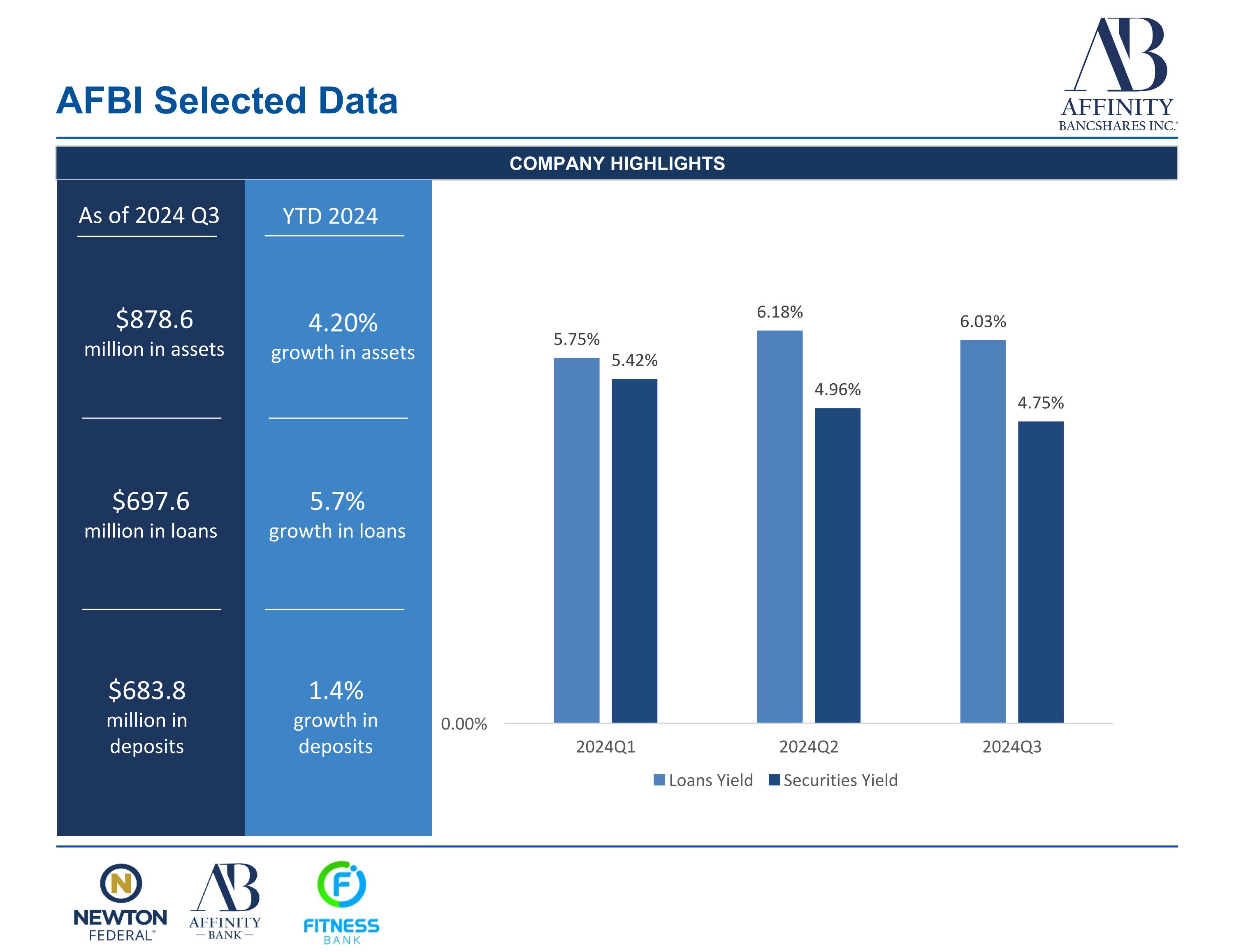

AFBI Selected Data COMPANY HIGHLIGHTS $878.6 million in assets $697.6 million in loans $683.8 million in deposits 4.20% growth in assets 5.7% growth in loans 1.4% growth in deposits As of 2024 Q3 YTD 2024

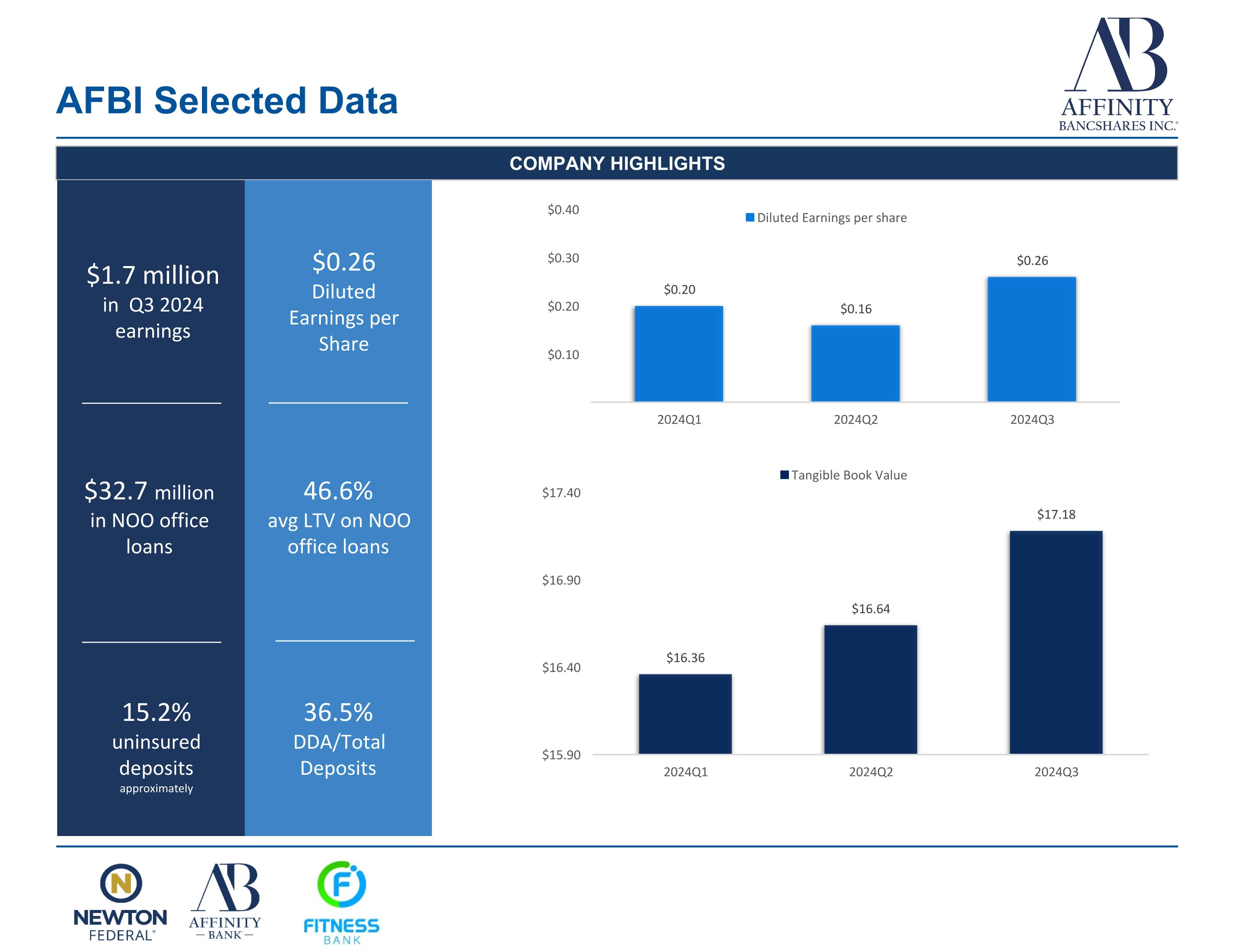

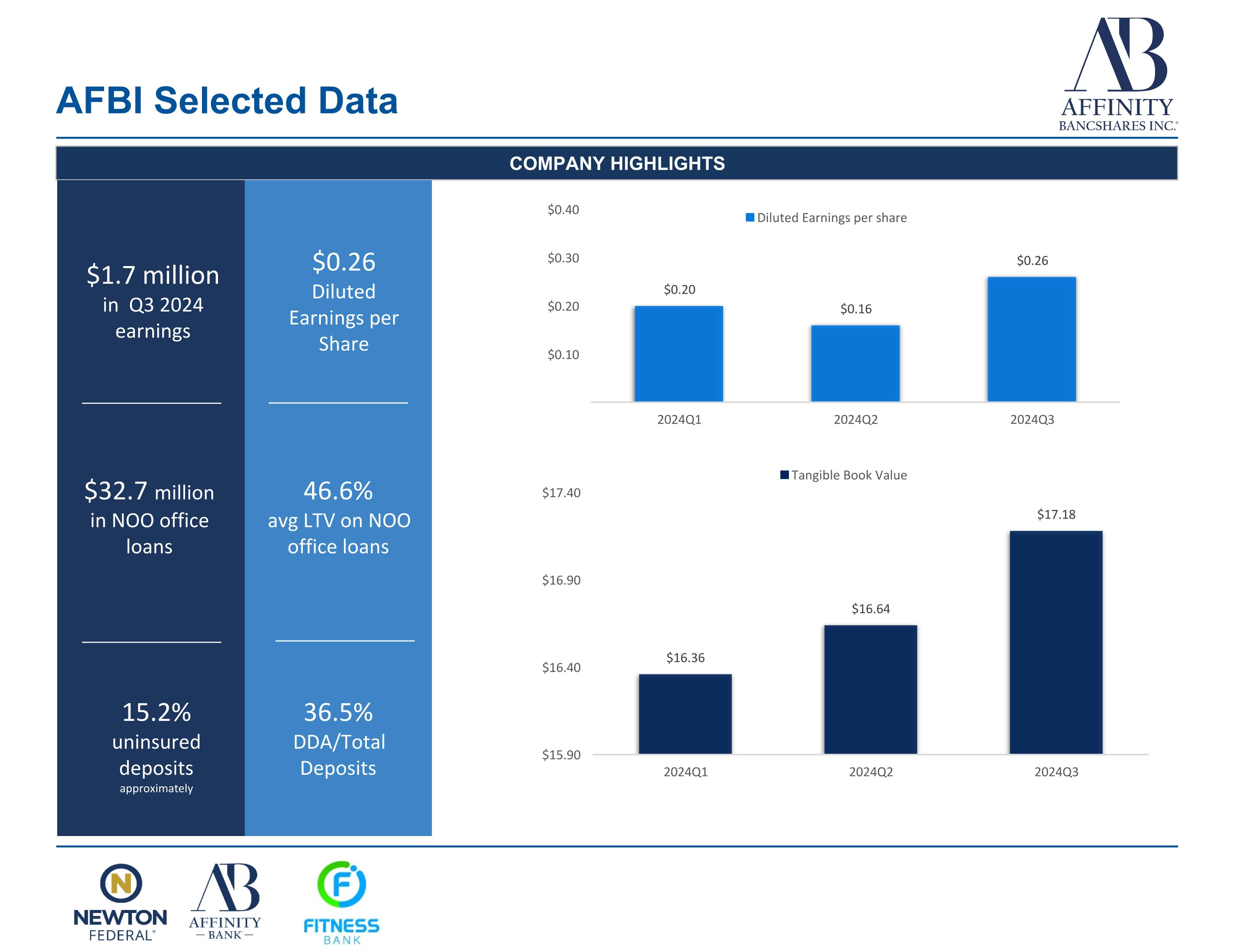

AFBI Selected Data COMPANY HIGHLIGHTS $32.7 million in NOO office loans 46.6% avg LTV on NOO office loans 36.5% DDA/Total Deposits $1.7 million in Q3 2024 earnings 15.2% uninsured deposits approximately $0.26 Diluted Earnings per Share

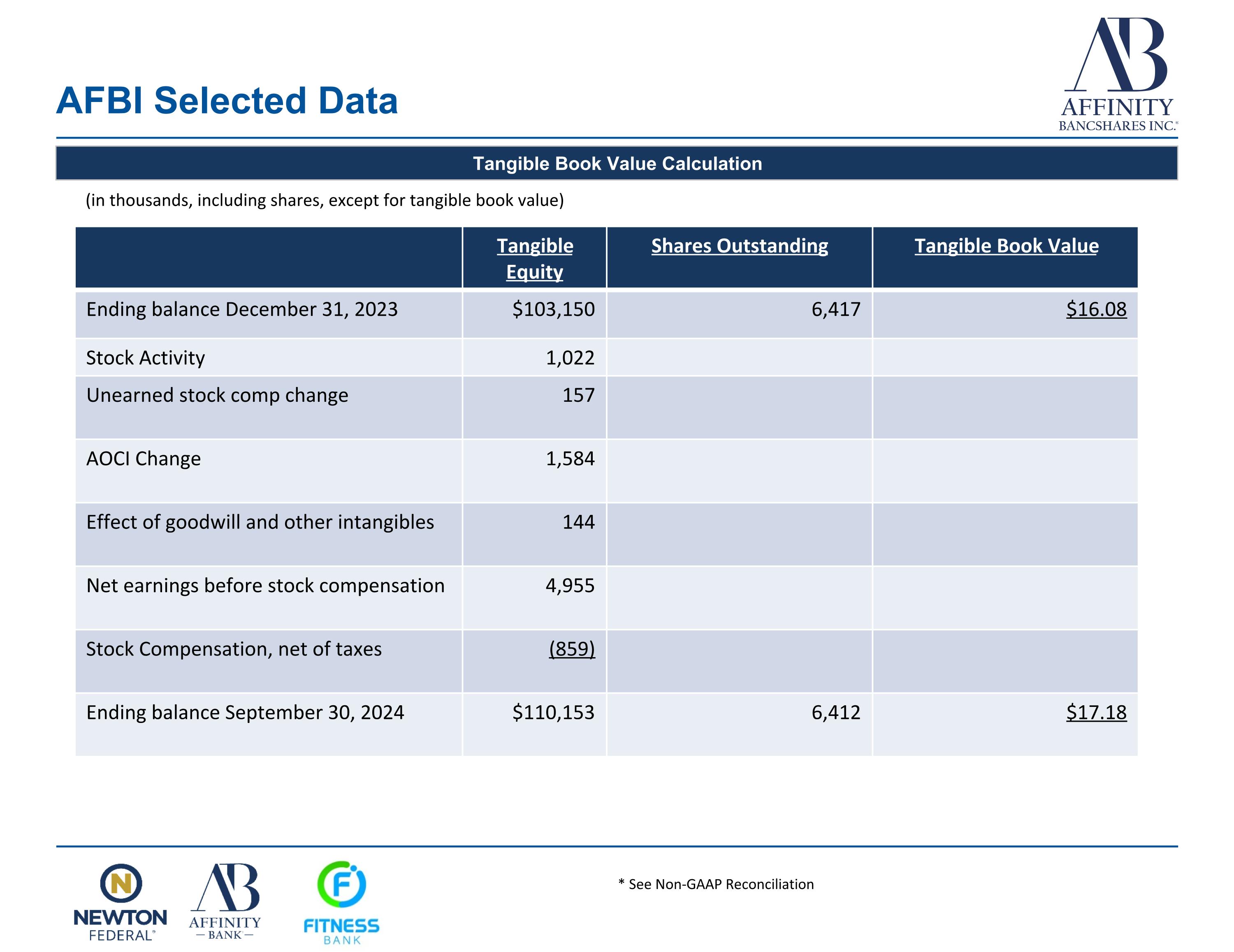

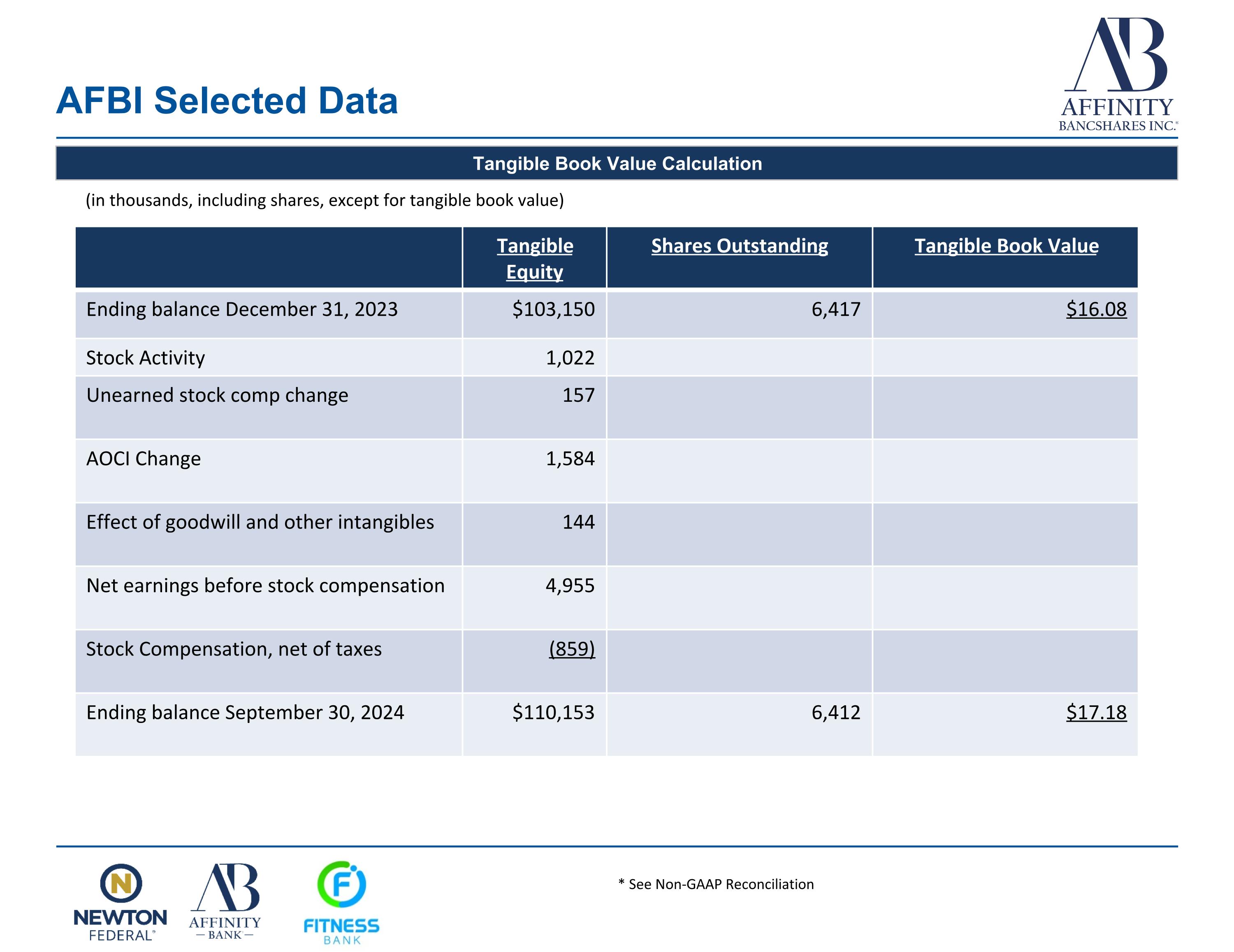

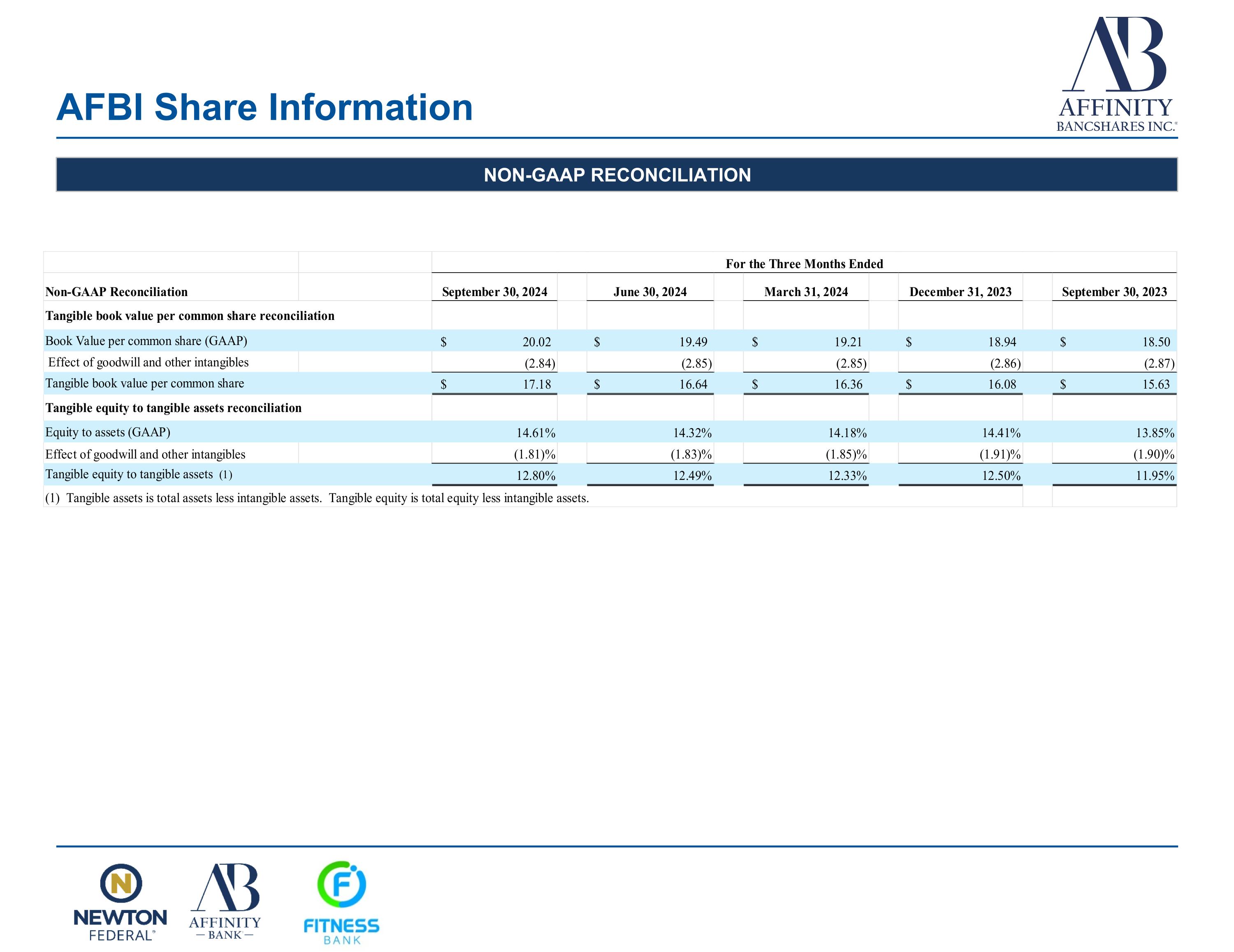

AFBI Selected Data Tangible Book Value Calculation Tangible Equity Shares Outstanding Tangible Book Value Ending balance December 31, 2023 $103,150 6,417 $16.08 Stock Activity 1,022 Unearned stock comp change 157 AOCI Change 1,584 Effect of goodwill and other intangibles 144 Net earnings before stock compensation 4,955 Stock Compensation, net of taxes (859) Ending balance September 30, 2024 $110,153 6,412 $17.18 (in thousands, including shares, except for tangible book value) * See Non-GAAP Reconciliation

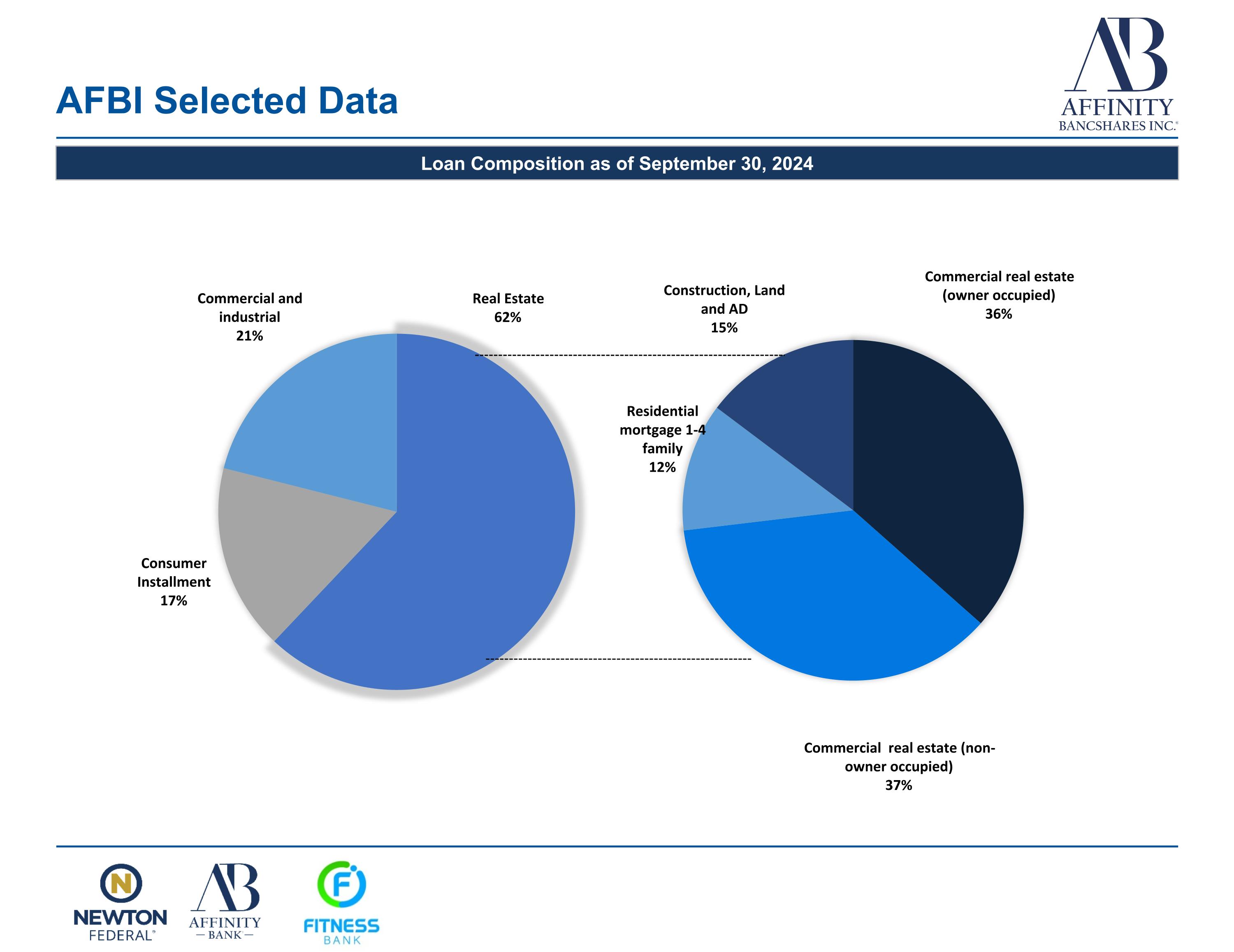

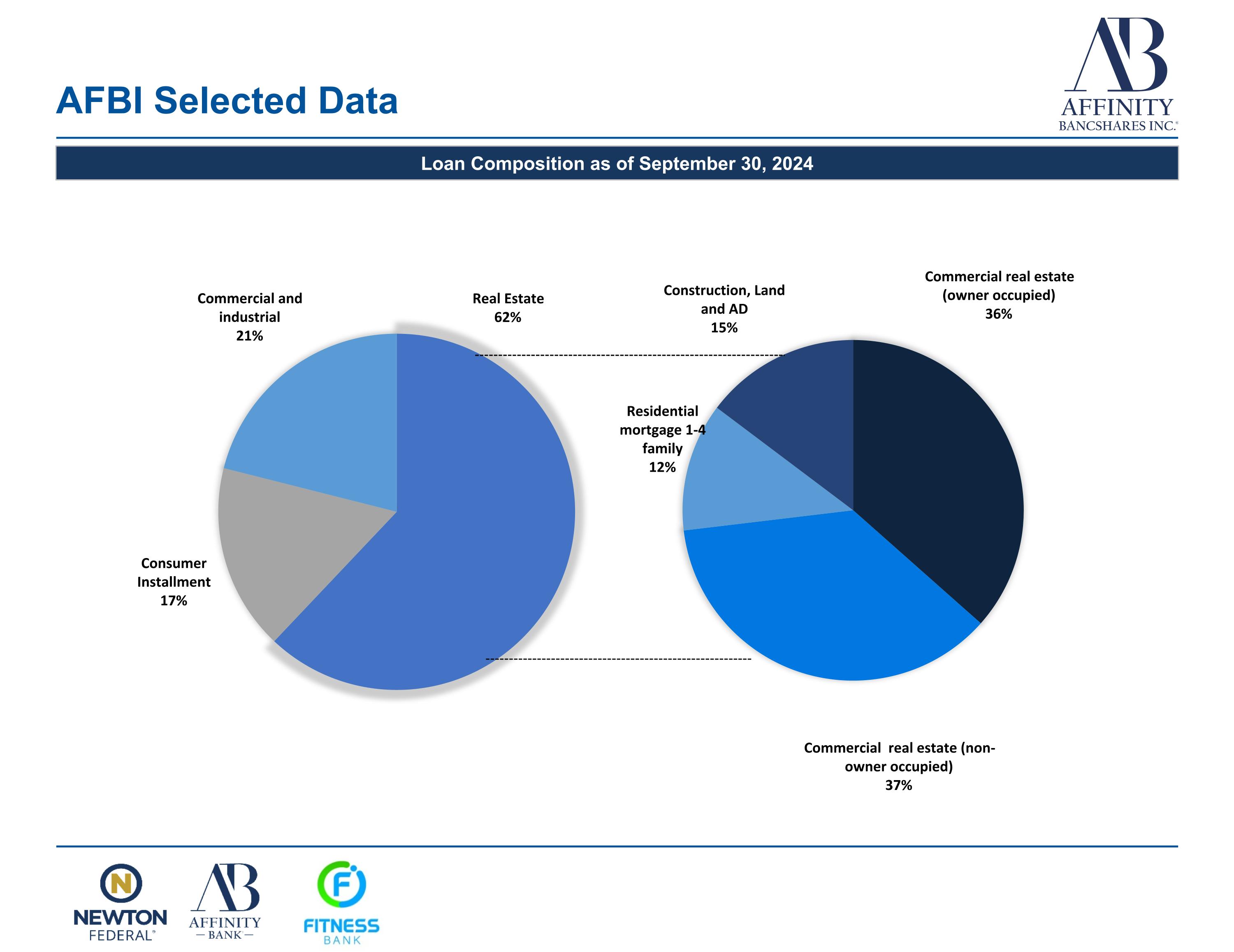

AFBI Selected Data Loan Composition as of September 30, 2024

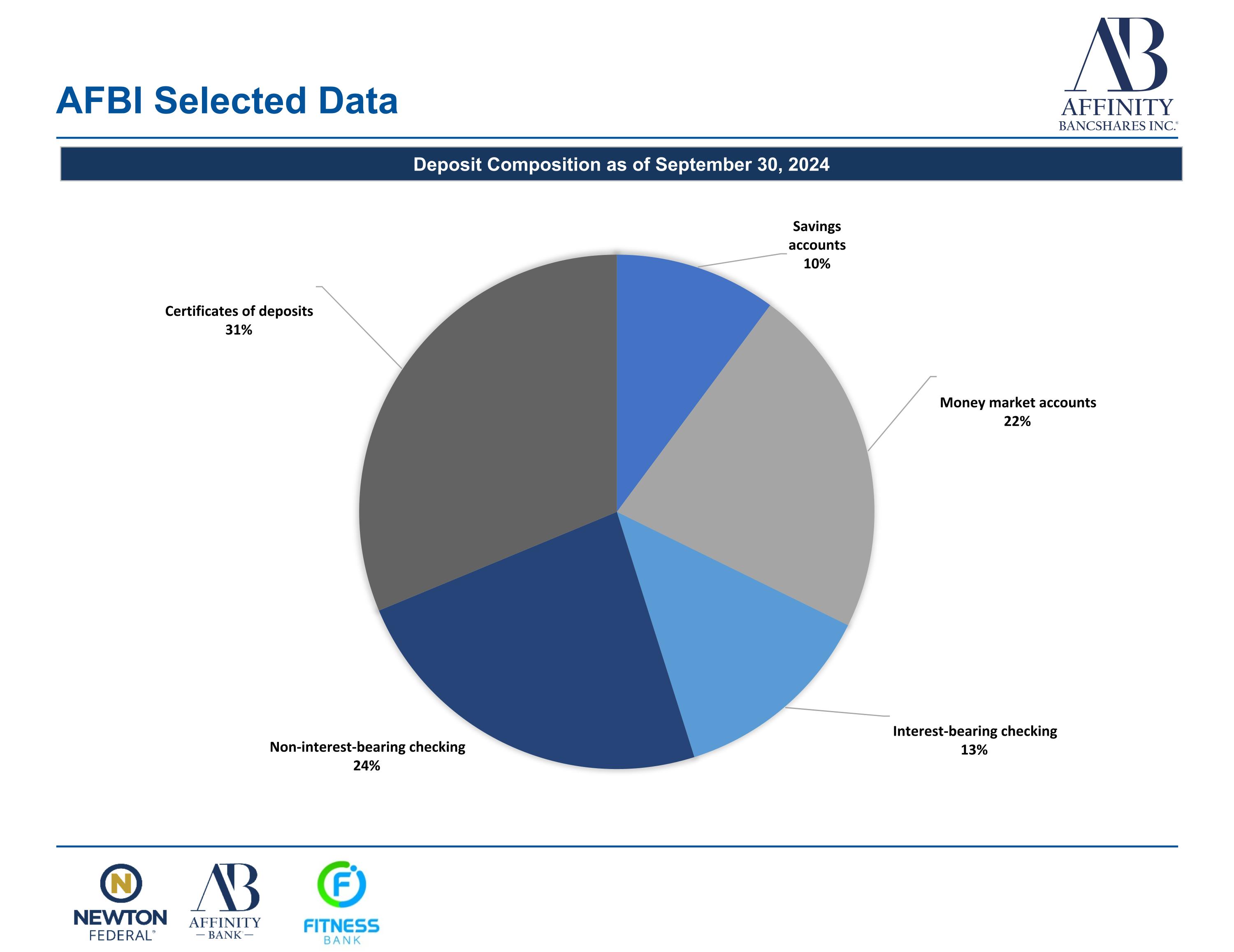

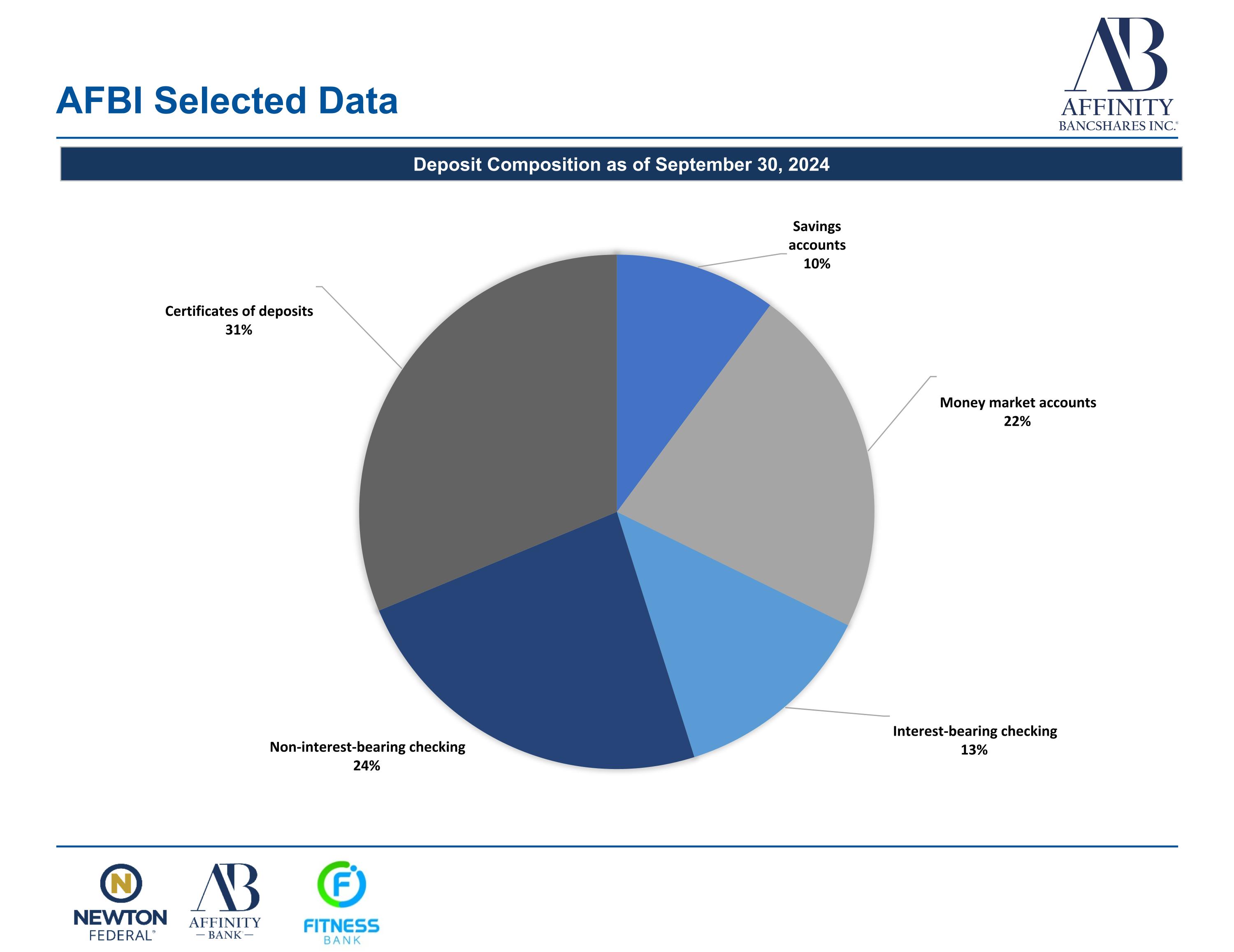

AFBI Selected Data Deposit Composition as of September 30, 2024

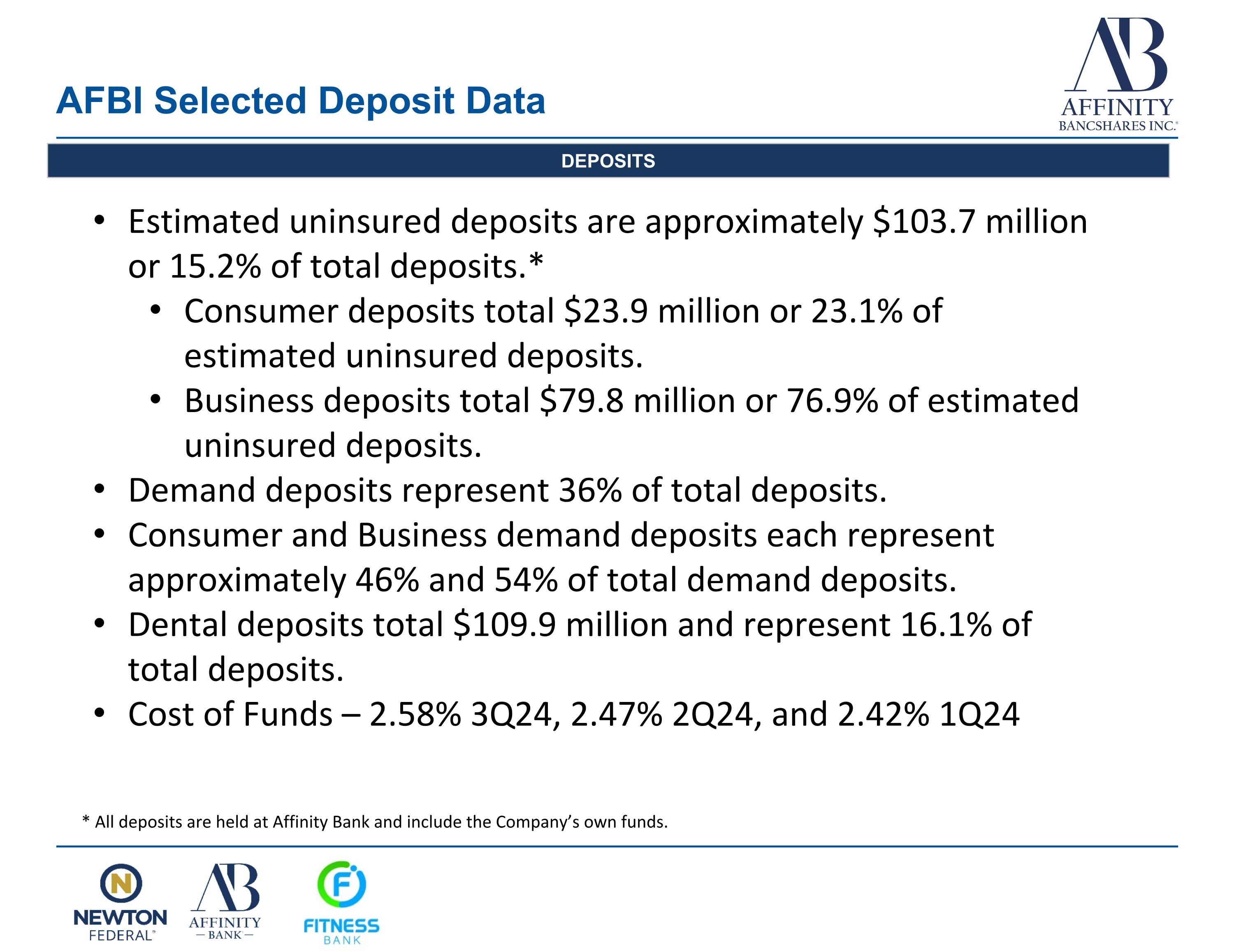

AFBI Selected Deposit Data DEPOSITS * All deposits are held at Affinity Bank and include the Company’s own funds. Estimated uninsured deposits are approximately $103.7 million or 15.2% of total deposits.* Consumer deposits total $23.9 million or 23.1% of estimated uninsured deposits. Business deposits total $79.8 million or 76.9% of estimated uninsured deposits. Demand deposits represent 36% of total deposits. Consumer and Business demand deposits each represent approximately 46% and 54% of total demand deposits. Dental deposits total $109.9 million and represent 16.1% of total deposits. Cost of Funds – 2.58% 3Q24, 2.47% 2Q24, and 2.42% 1Q24

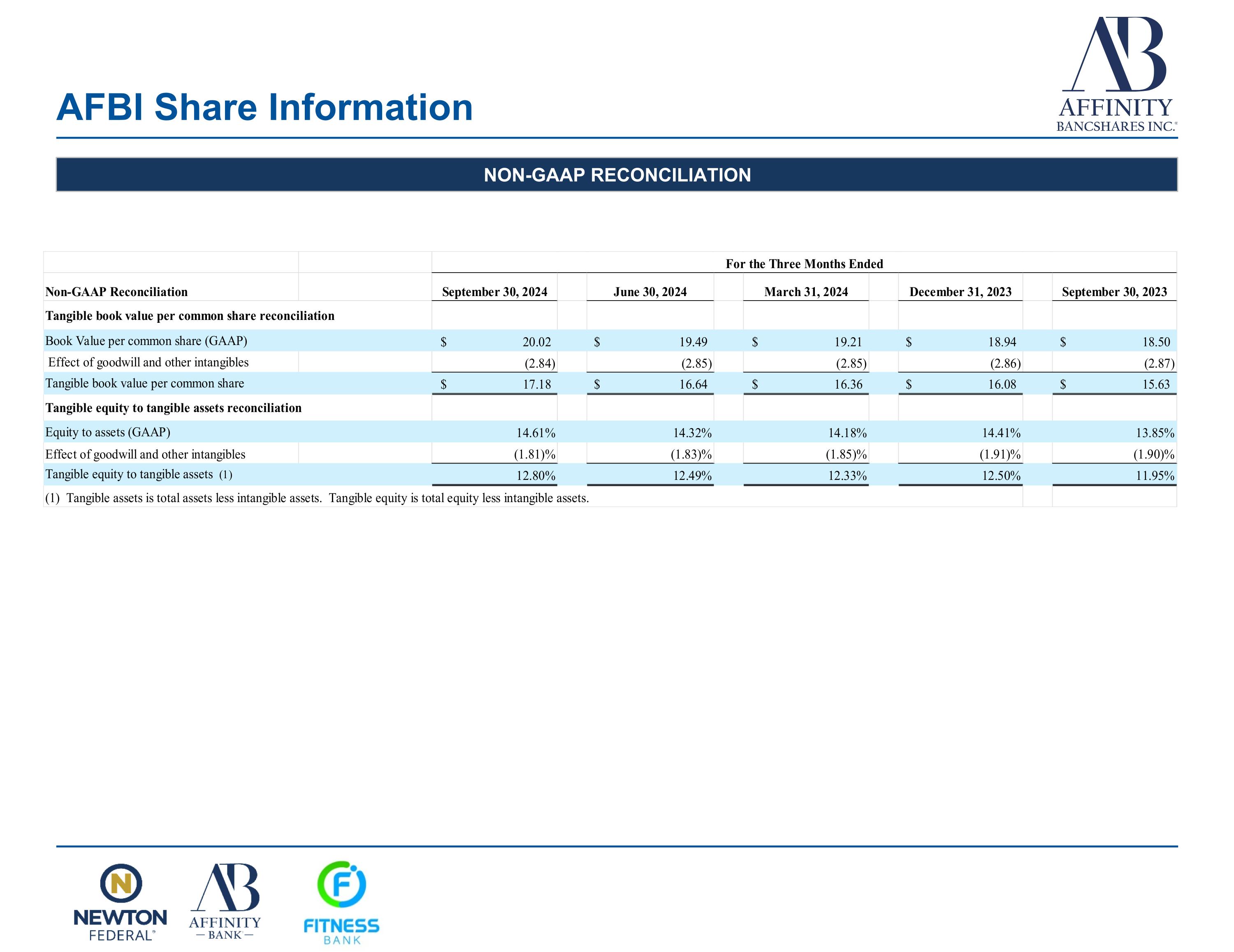

AFBI Share Information NON-GAAP RECONCILIATION