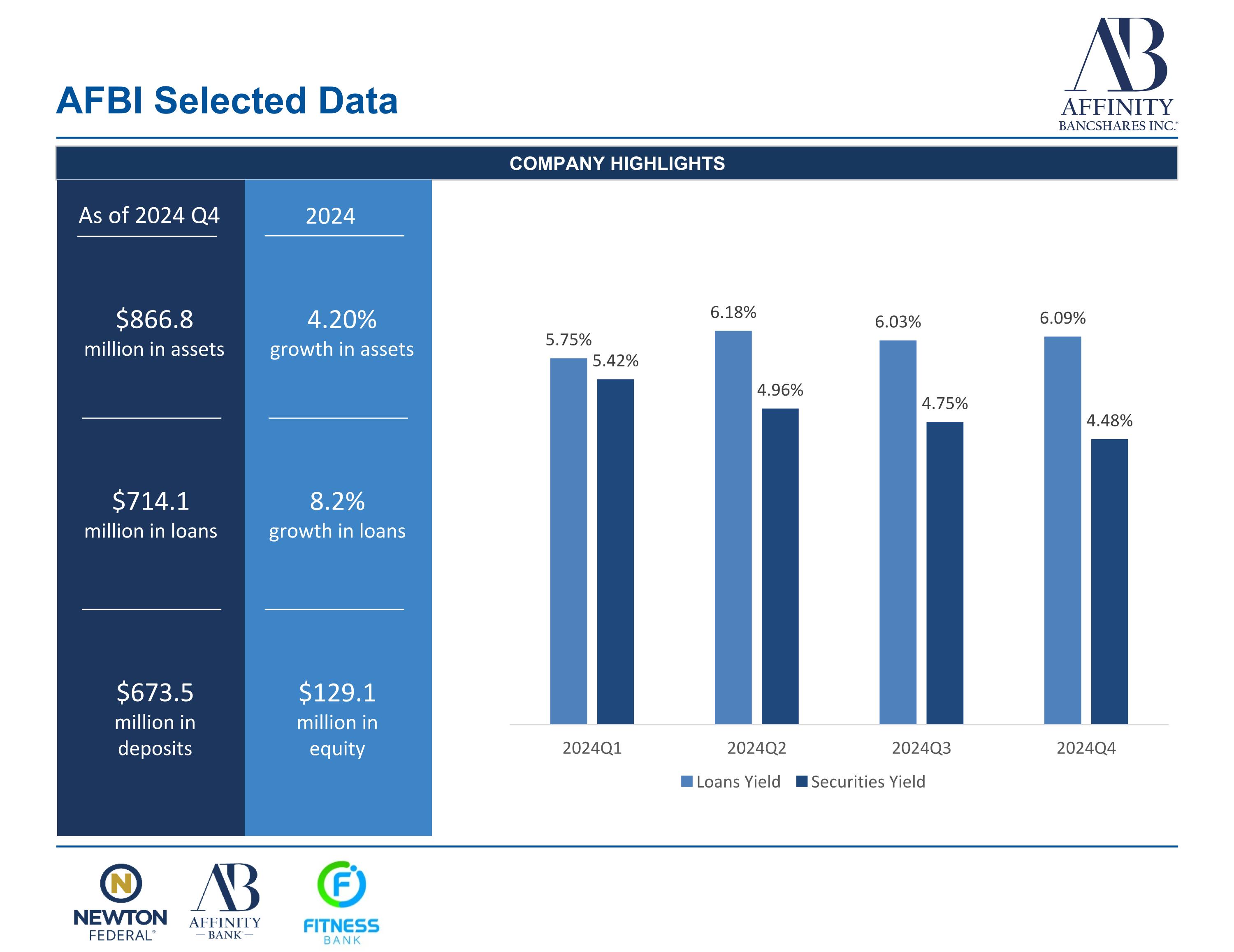

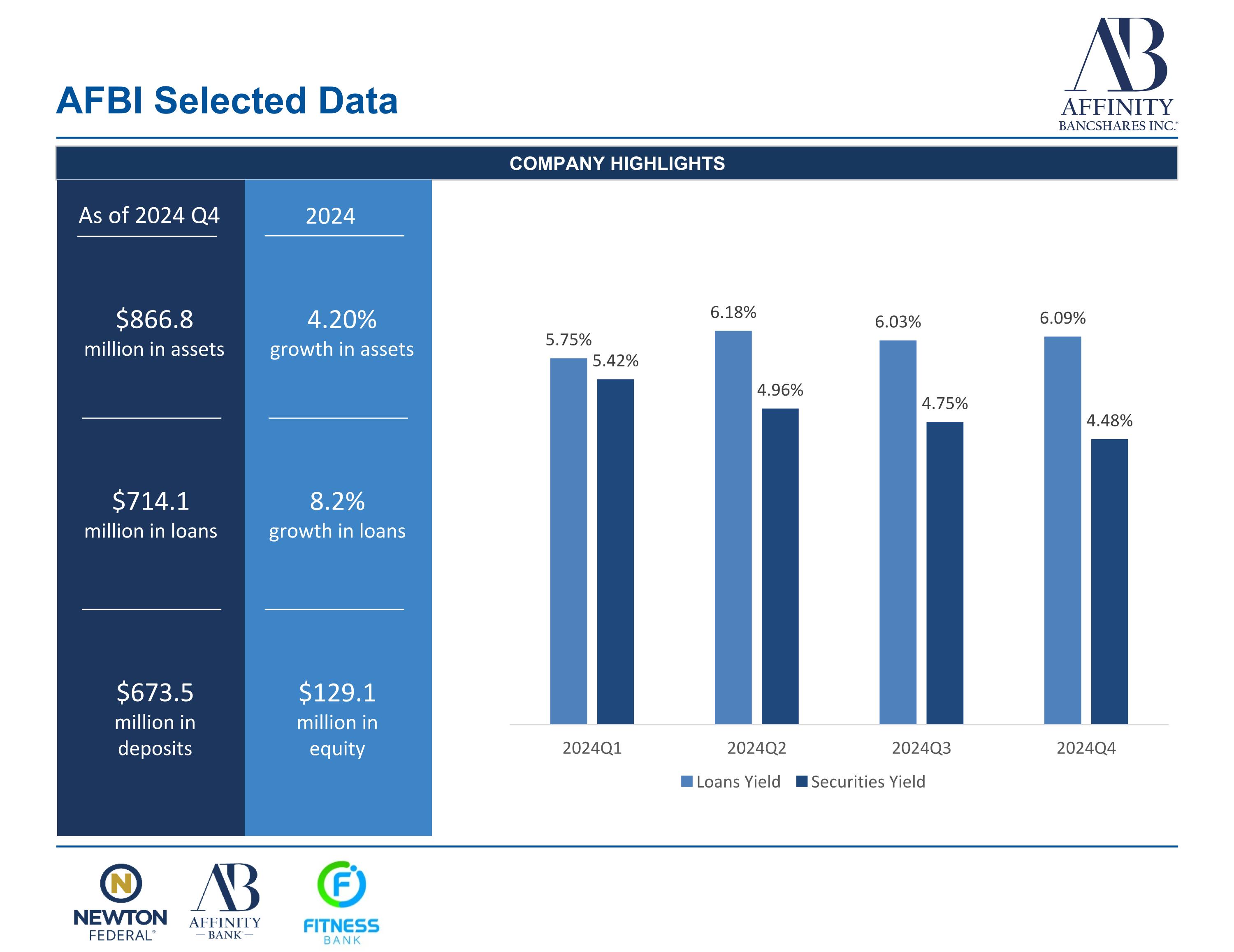

AFBI Selected Data COMPANY HIGHLIGHTS $866.8 million in assets $714.1 million in loans $673.5 million in deposits 4.20% growth in assets 8.2% growth in loans $129.1 million in equity As of 2024 Q4 2024

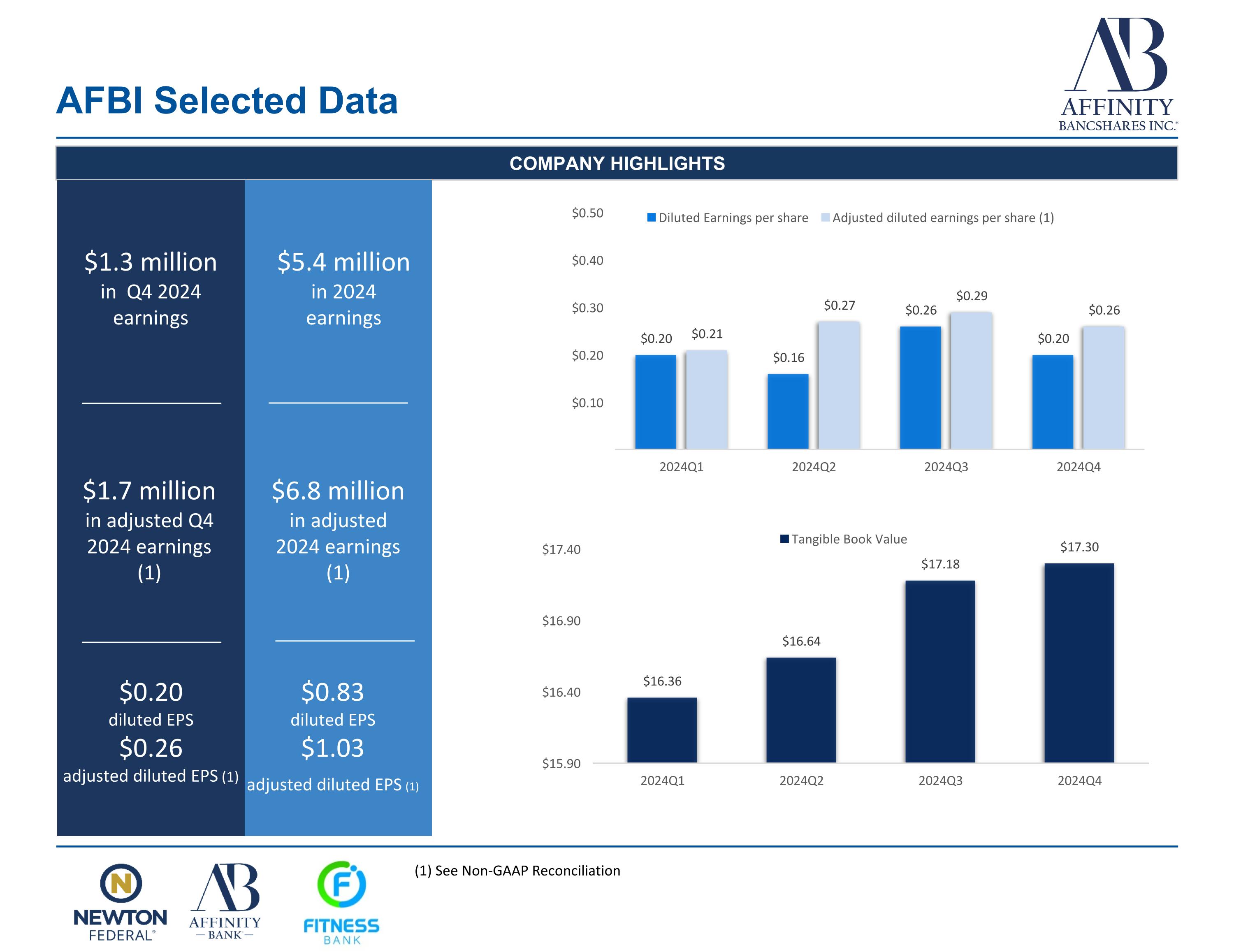

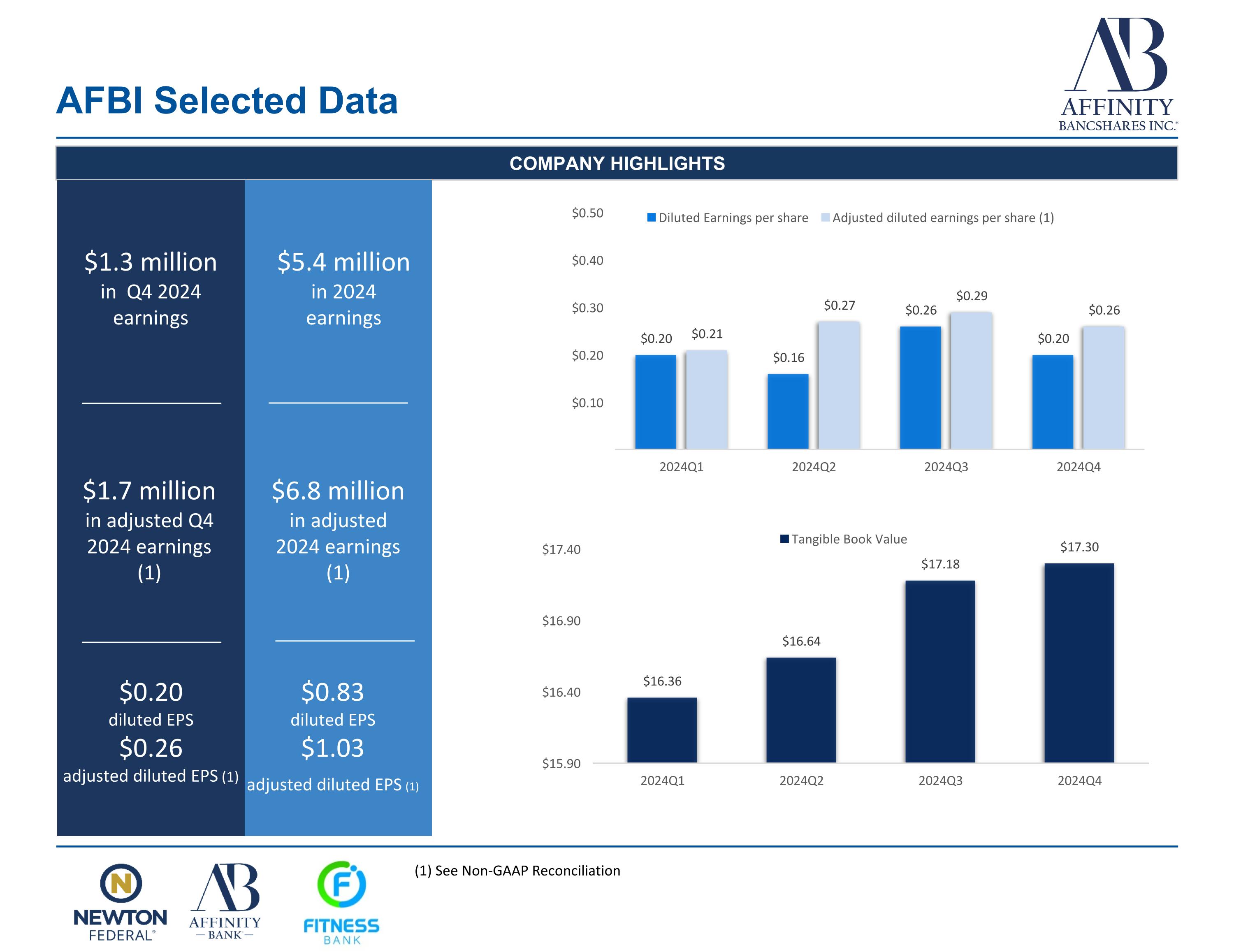

AFBI Selected Data COMPANY HIGHLIGHTS $1.7 million in adjusted Q4 2024 earnings (1) $6.8 million in adjusted 2024 earnings (1) $1.3 million in Q4 2024 earnings $0.20 diluted EPS $0.26 adjusted diluted EPS (1) $5.4 million in 2024 earnings $0.83 diluted EPS $1.03 adjusted diluted EPS (1) (1) See Non-GAAP Reconciliation

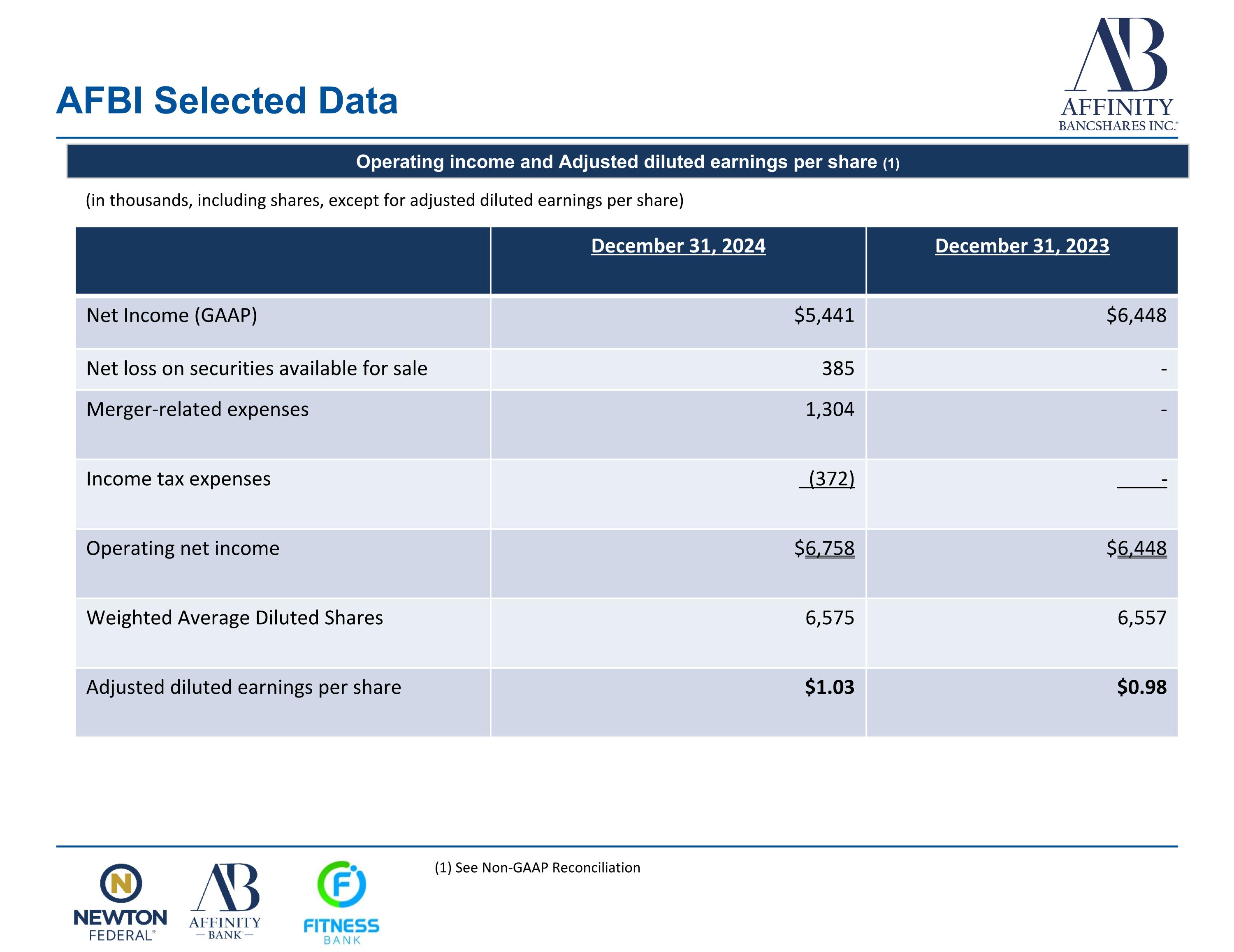

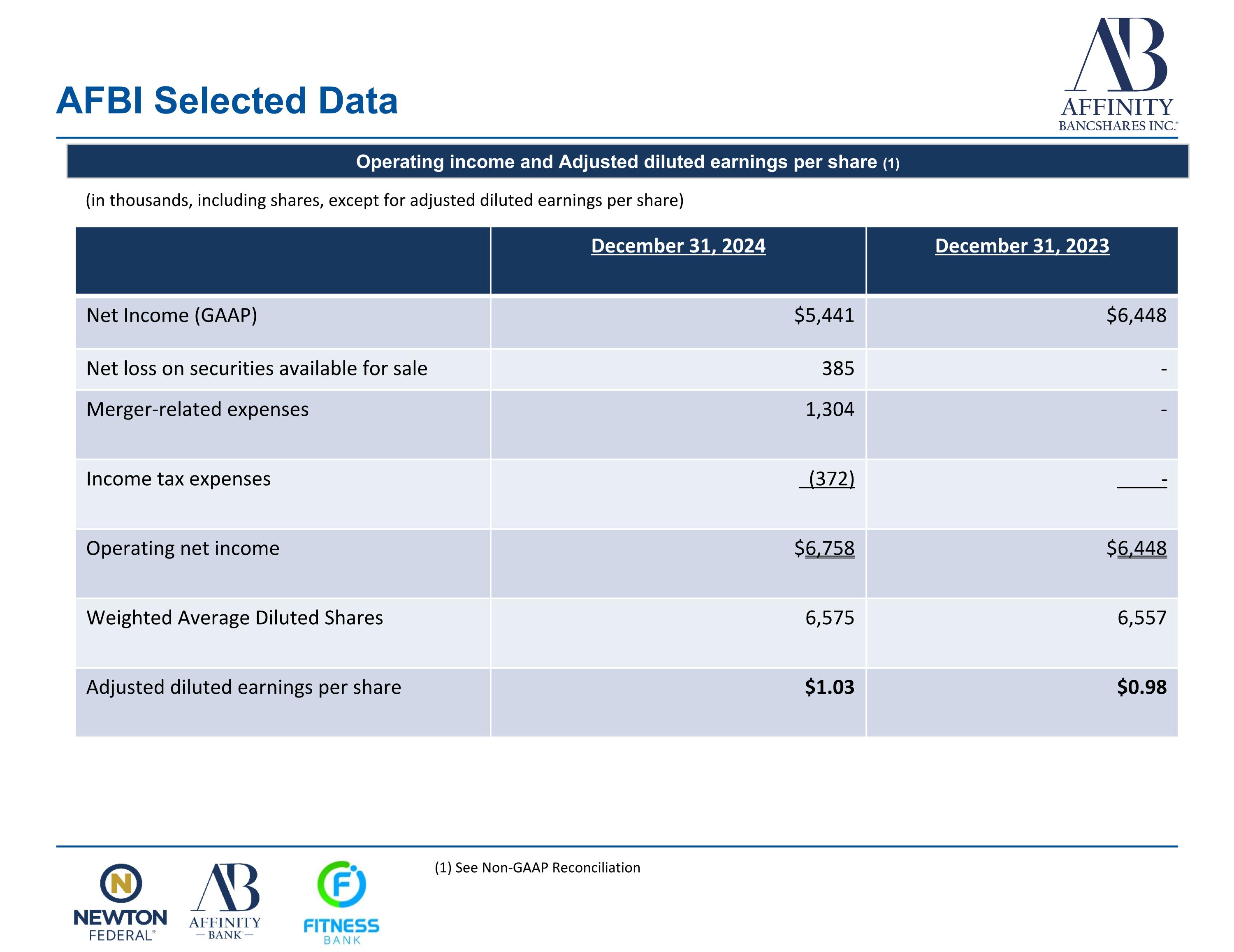

AFBI Selected Data Operating income and Adjusted diluted earnings per share (1) December 31, 2024 December 31, 2023 Net Income (GAAP) $5,441 $6,448 Net loss on securities available for sale 385 - Merger-related expenses 1,304 - Income tax expenses (372) - Operating net income $6,758 $6,448 Weighted Average Diluted Shares 6,575 6,557 Adjusted diluted earnings per share $1.03 $0.98 (in thousands, including shares, except for adjusted diluted earnings per share) (1) See Non-GAAP Reconciliation

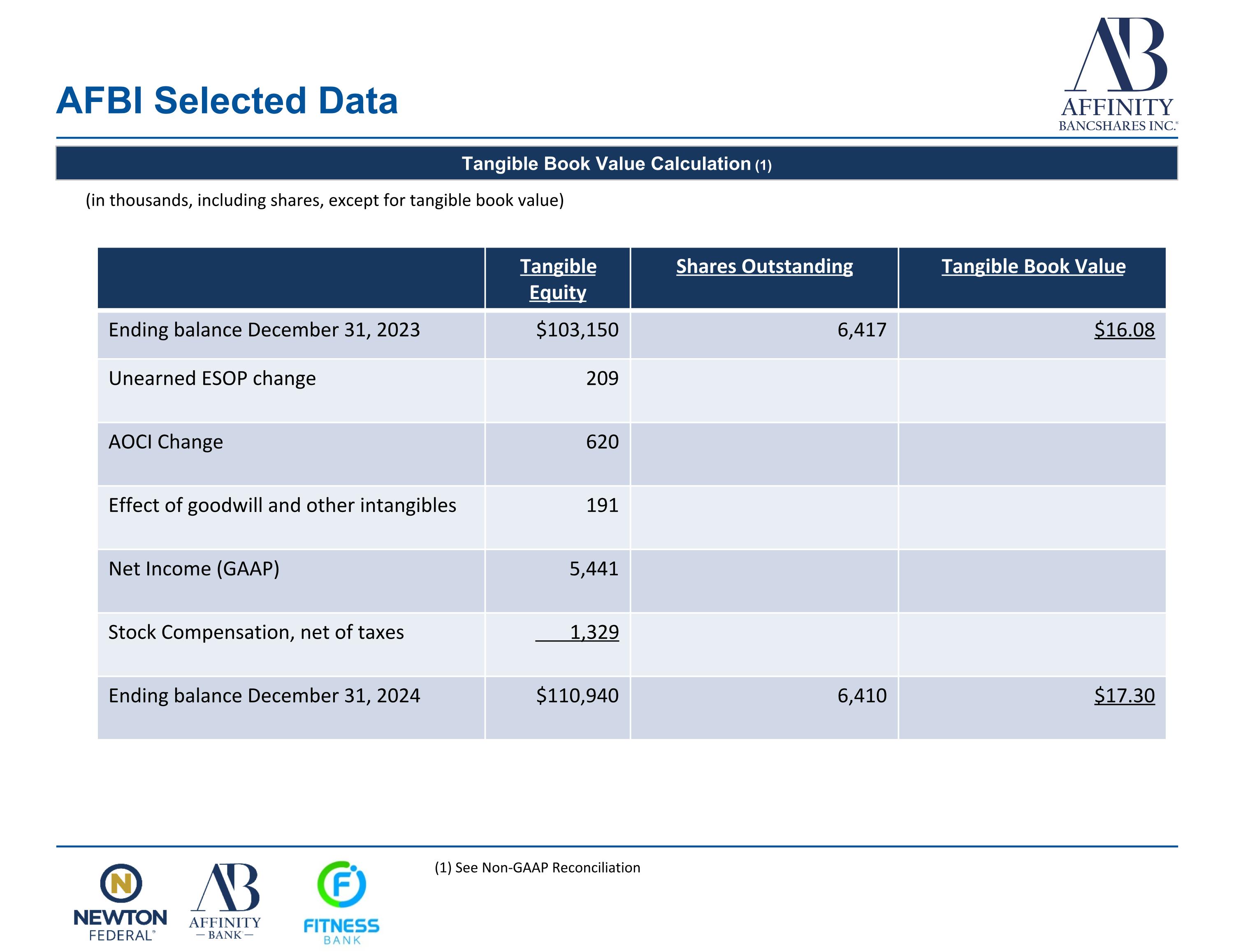

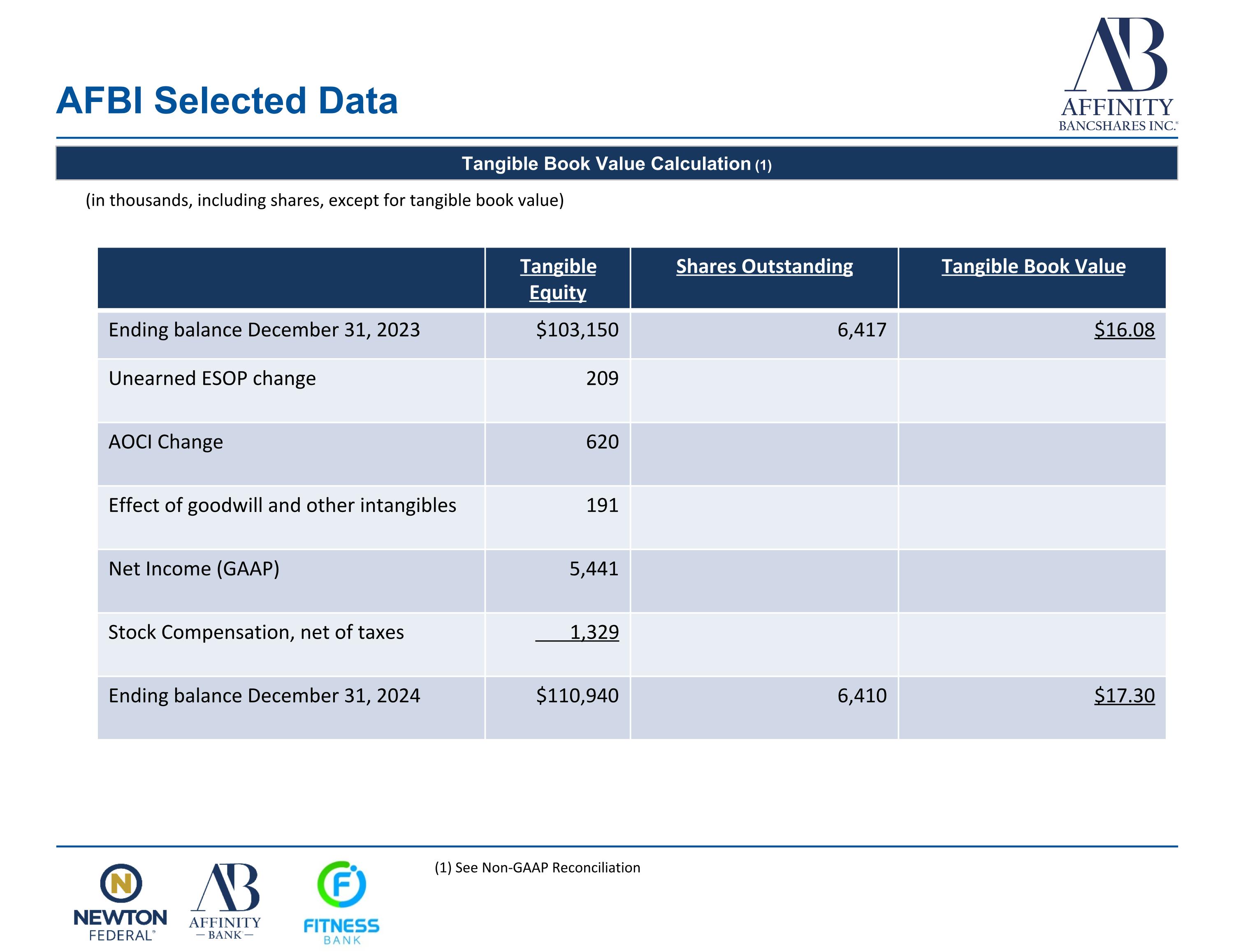

AFBI Selected Data Tangible Book Value Calculation (1) Tangible Equity Shares Outstanding Tangible Book Value Ending balance December 31, 2023 $103,150 6,417 $16.08 Unearned ESOP change 209 AOCI Change 620 Effect of goodwill and other intangibles 191 Net Income (GAAP) 5,441 Stock Compensation, net of taxes 1,329 Ending balance December 31, 2024 $110,940 6,410 $17.30 (in thousands, including shares, except for tangible book value) (1) See Non-GAAP Reconciliation

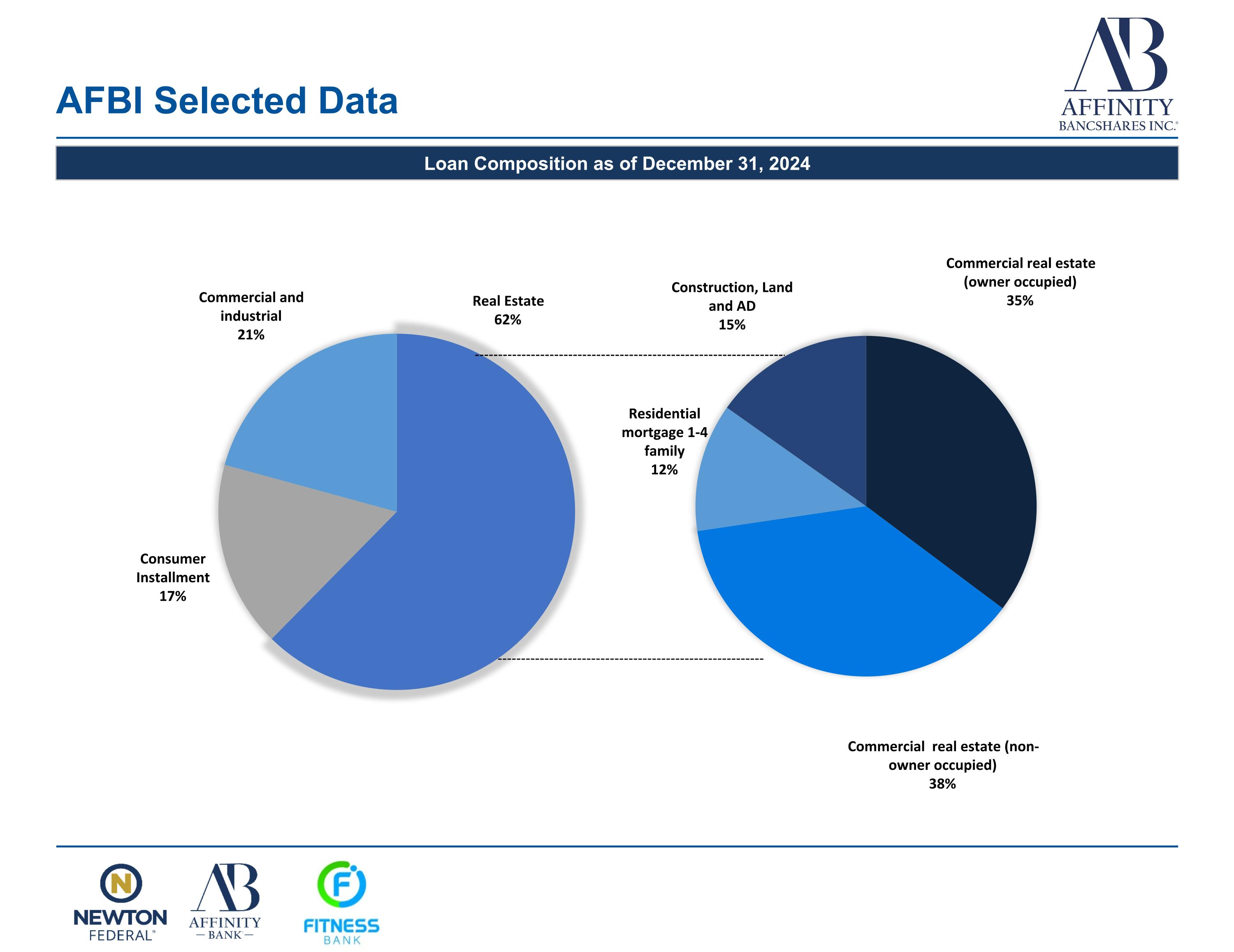

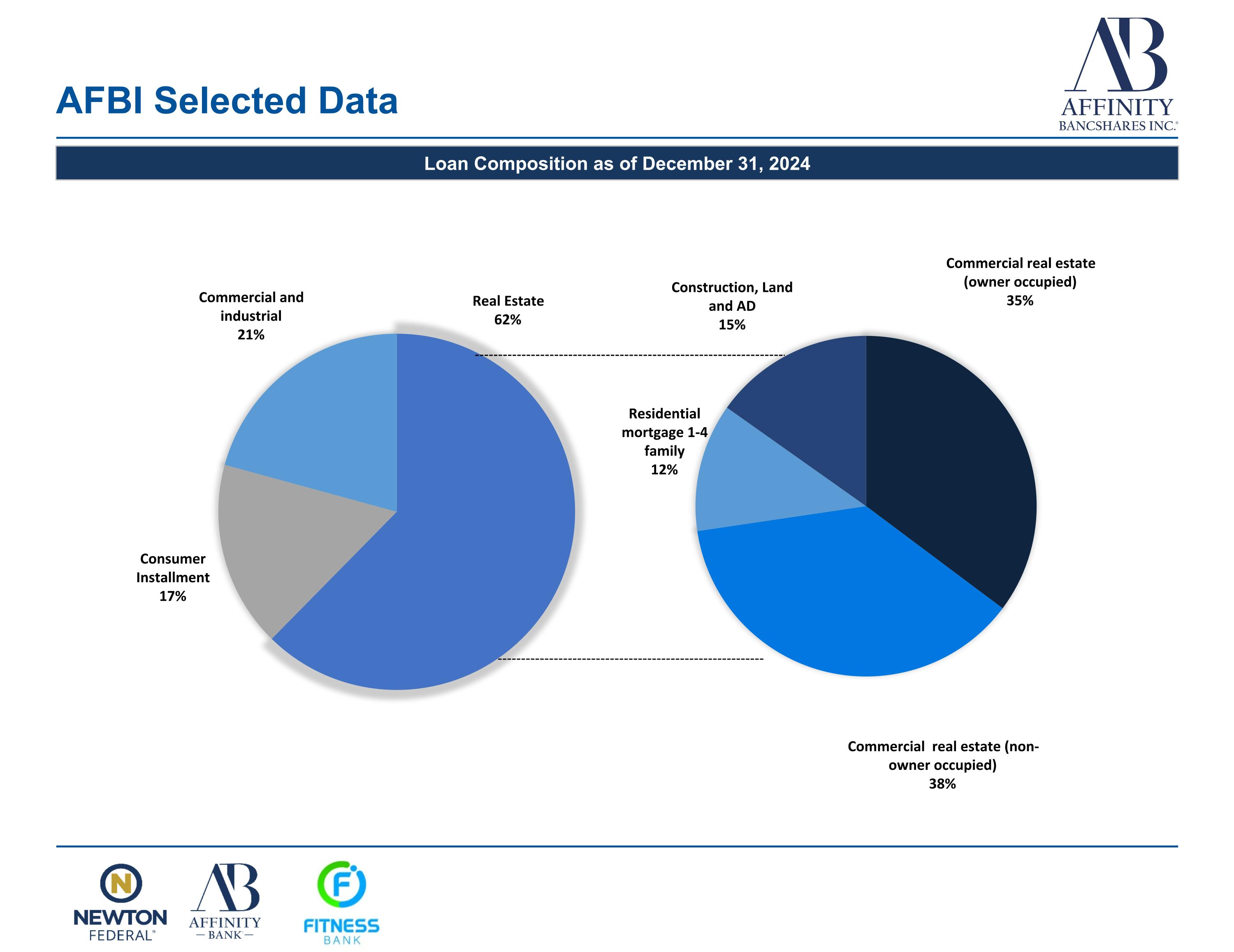

AFBI Selected Data Loan Composition as of December 31, 2024

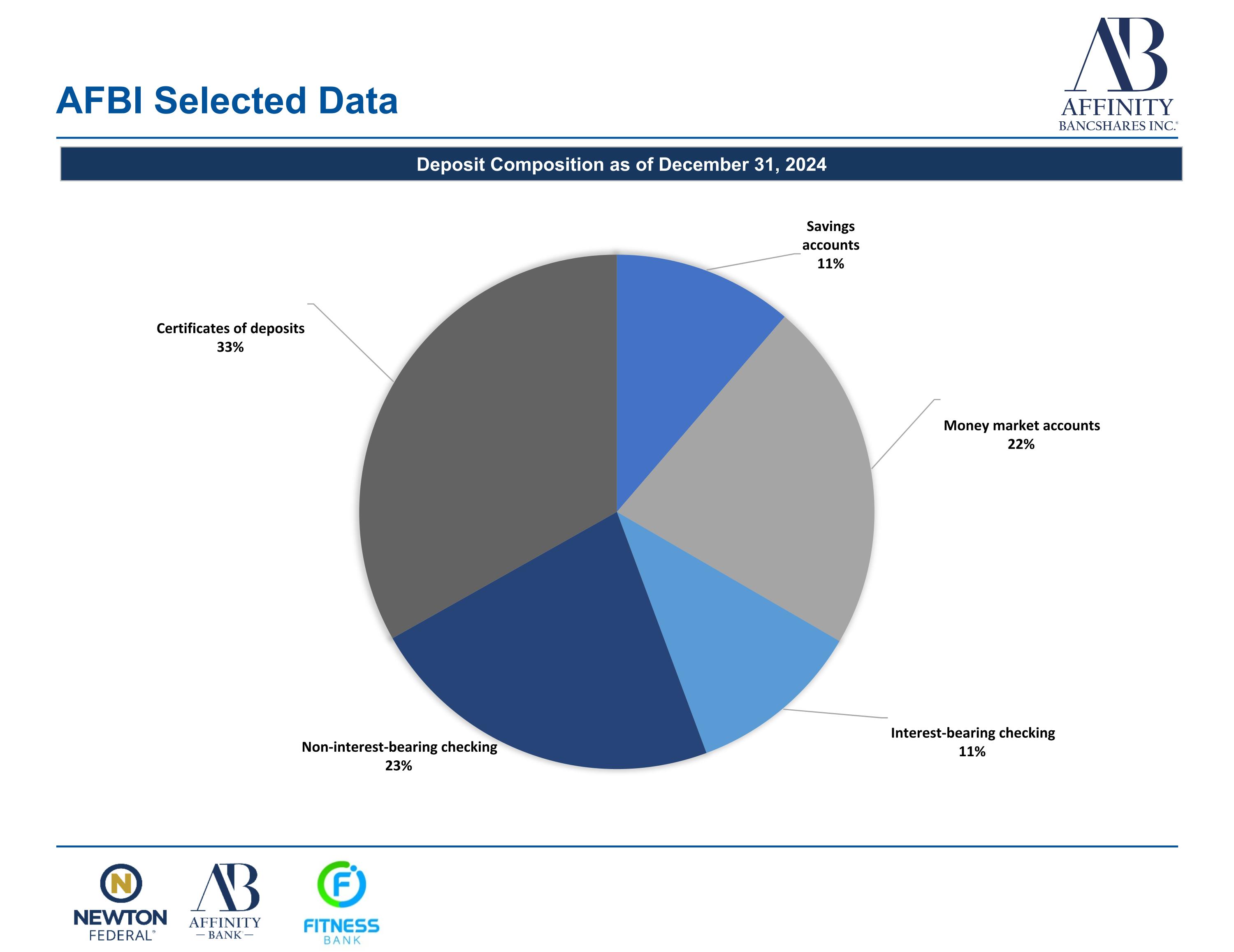

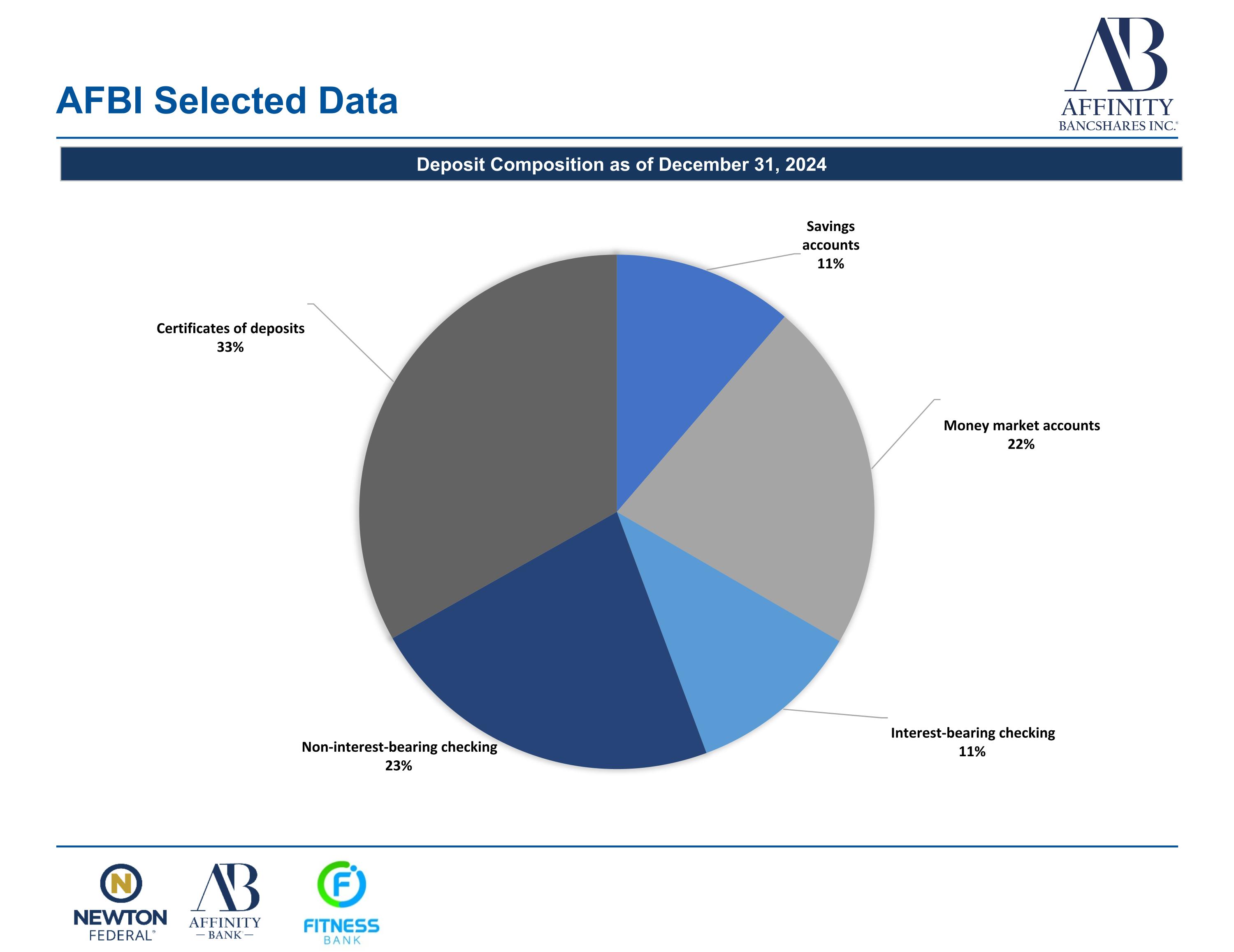

AFBI Selected Data Deposit Composition as of December 31, 2024

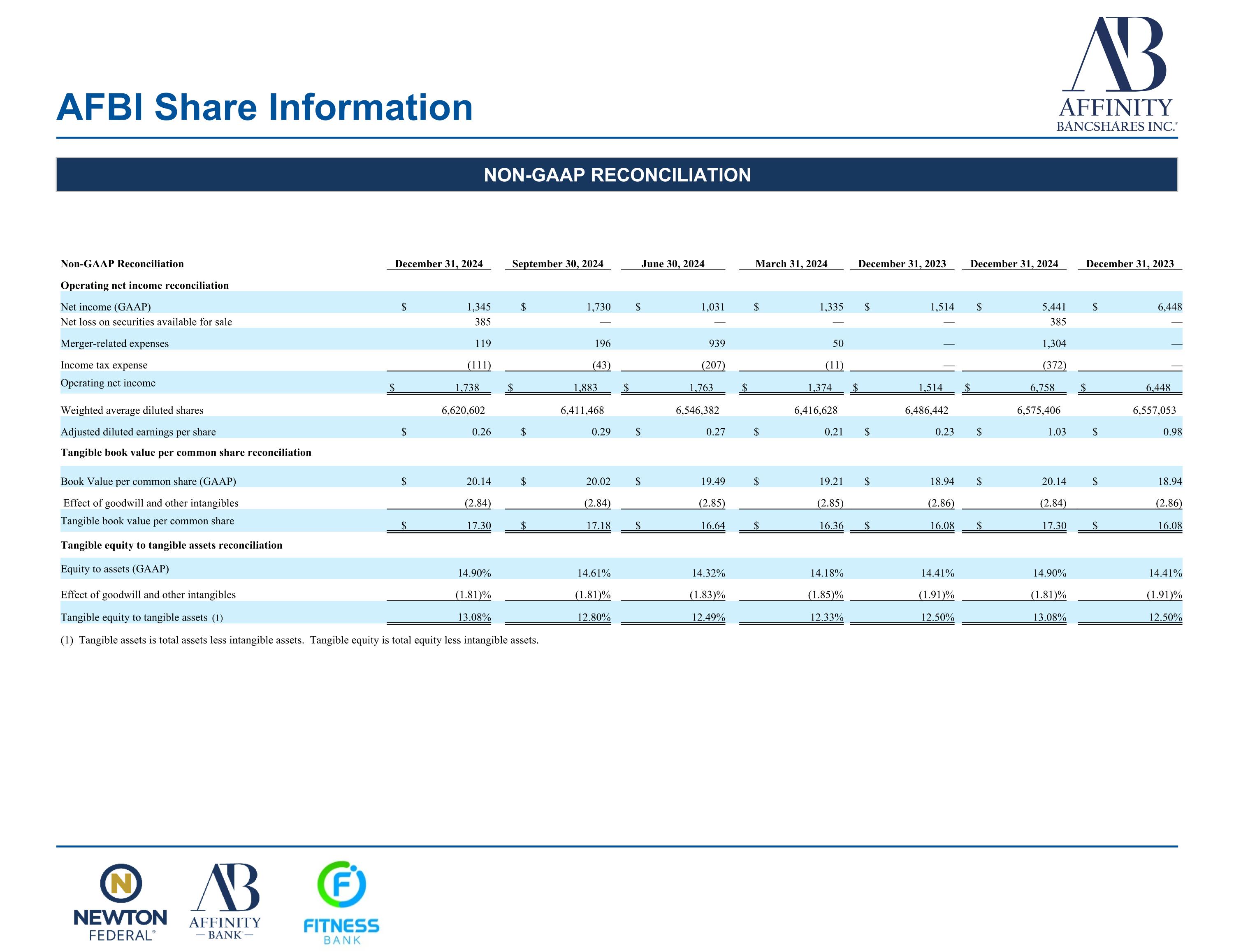

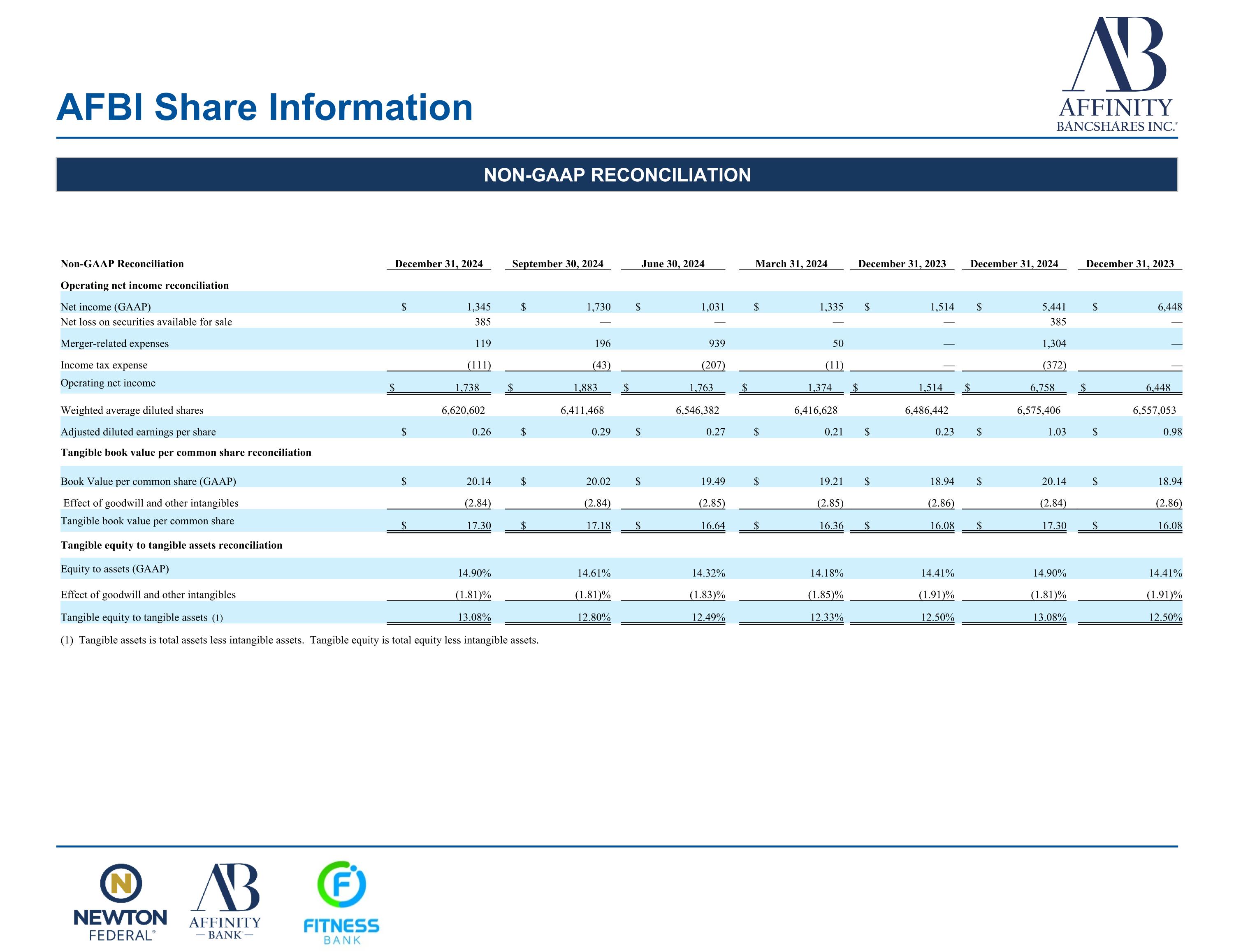

AFBI Share Information NON-GAAP RECONCILIATION Non-GAAP Reconciliation December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Operating net income reconciliation Net income (GAAP) $ 1,345 $ 1,730 $ 1,031 $ 1,335 $ 1,514 $ 5,441 $ 6,448 Net loss on securities available for sale 385 — — — — 385 — Merger-related expenses 119 196 939 50 — 1,304 — Income tax expense (111) (43) (207) (11) — (372) — Operating net income $ 1,738 $ 1,883 $ 1,763 $ 1,374 $ 1,514 $ 6,758 $ 6,448 Weighted average diluted shares 6,620,602 6,411,468 6,546,382 6,416,628 6,486,442 6,575,406 6,557,053 Adjusted diluted earnings per share $ 0.26 $ 0.29 $ 0.27 $ 0.21 $ 0.23 $ 1.03 $ 0.98 Tangible book value per common share reconciliation Book Value per common share (GAAP) $ 20.14 $ 20.02 $ 19.49 $ 19.21 $ 18.94 $ 20.14 $ 18.94 Effect of goodwill and other intangibles (2.84) (2.84) (2.85) (2.85) (2.86) (2.84) (2.86) Tangible book value per common share $ 17.30 $ 17.18 $ 16.64 $ 16.36 $ 16.08 $ 17.30 $ 16.08 Tangible equity to tangible assets reconciliation Equity to assets (GAAP) 14.90% 14.61% 14.32% 14.18% 14.41% 14.90% 14.41% Effect of goodwill and other intangibles (1.81)% (1.81)% (1.83)% (1.85)% (1.91)% (1.81)% (1.91)% Tangible equity to tangible assets (1) 13.08% 12.80% 12.49% 12.33% 12.50% 13.08% 12.50% (1) Tangible assets is total assets less intangible assets. Tangible equity is total equity less intangible assets.