UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 6, 2021

DUDDELL STREET ACQUISITION CORP.

(Exact Name of Registrant as specified in its Charter)

| Cayman Islands | 001-39672 | N/A | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

8/F Printing House, 6 Duddell Street Hong Kong | 00000 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: + 852 3468 6200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A ordinary shares, par value $0.0001 per share | DSAC | The Nasdaq Stock Market | ||

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 | DSACW | The Nasdaq Stock Market | ||

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant | DSACU | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is an updated investor presentation (the “Investor Presentation”) that will be used by Duddell Street Acquisition Corp., a Cayman Islands exempted company (the “Company” or “DSAC”), in making presentations to certain of the Company’s shareholders and other persons with respect to the transactions contemplated by the Agreement and Plan of Merger (as it may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”), by and among DSAC, Grassroots Merger Sub, Inc., a Delaware corporation, and FiscalNote Holdings, Inc., a Delaware corporation (“FiscalNote”).

The Investor Presentation is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On December 6, 2021, DSAC and FiscalNote issued a joint press release announcing the filing of a Registration Statement on Form S-4 (the “Form S-4”) for the transactions contemplated by the Business Combination Agreement (the “Business Combination”). The joint press release of DSAC and FiscalNote is attached as Exhibit 99.2 hereto and is incorporated into this Item 8.01 by reference.

Additional Information and Where to Find It

DSAC has filed the Form S-4 with the Securities and Exchange Commission (the “SEC”) containing a proxy statement/prospectus relating to the Business Combination, which will be mailed to its shareholders once definitive. This Current Report on Form 8-K does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. DSAC’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto and, when available, the definitive proxy statement/prospectus and other documents filed in connection with the Business Combination, as these materials contain or will contain important information about DSAC, FiscalNote and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of DSAC as of a record date to be established for voting on the Business Combination. Shareholders of DSAC will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a written request to: Duddell Street Acquisition Corp., 8/F Printing House, 6 Duddell Street, Hong Kong.

Participants in the Solicitation

DSAC and its directors and executive officers may be deemed participants in the solicitation of proxies from DSAC’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in is contained in DSAC’s filings with the SEC. To the extent that holdings of DSAC’s securities have changed since the amounts printed in DSAC’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such participants is contained in the proxy statement/prospectus for the Business Combination.

FiscalNote and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of DSAC in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination is included in the proxy statement/prospectus for the Business Combination.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K may be considered forward-looking statements. Forward-looking statements generally relate to future events or DSAC’s or FiscalNote’s future financial or operating performance. For example, statements about the expected timing of the completion of the Business Combination, the benefits of the Business Combination, the competitive environment, and the expected future performance (including future revenue, pro format enterprise value, and cash balance) and market opportunities of FiscalNote are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by DSAC and its management, and FiscalNote and its management, as the case may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the inability to enter into a definitive agreement with respect to the proposed Business Combination; matters discovered by FiscalNote or DSAC as they complete their respective due diligence investigation of the other; the inability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, the ability to meet the listing standards of the Nasdaq Stock Market following the consummation of the transactions contemplated by the proposed Business Combination; costs related to the proposed Business Combination; FiscalNote’s ability to manage growth; FiscalNote’s ability to execute its plans to develop and market new products and services and the timing and costs of these development programs; FiscalNote’s estimates of the size of the markets for its products and services; the rate and degree of market acceptance of FiscalNote’s products and services; the success of other competing legal and regulatory information services that exist or may become available; FiscalNote’s ability to identify and integrate acquisitions; the performance of FiscalNote’s products and services; rising costs adversely affecting FiscalNote’s profitability; potential litigation involving DSAC or FiscalNote or the validity or enforceability of FiscalNote’s intellectual property; and general economic and market conditions impacting demand for FiscalNote’s products and services. Other factors include the possibility that the proposed Business Combination does not close, including due to the failure to receive required security holder approvals, or the failure of other closing conditions. Risks and uncertainties that may affect the completeness or accuracy of these forward-looking statements are set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Form S-4.

Nothing in this Current Report on Form 8-K should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Except as may be required by law, neither DSAC nor FiscalNote undertakes any duty to update these forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description | |||

| 99.1 | Investor Presentation | |||

| 99.2 | Press Release, dated December 6, 2021 | |||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 6, 2021 | DUDDELL STREET ACQUISITION CORP. | |||

| By: | /s/ Manoj Jain | |||

| Name: | Manoj Jain | |||

| Title: | Chief Executive Officer | |||

| Management Presentation DECEMBER 2021 | STRICTLY PRIVATE AND CONFIDENTIAL |

| 2 Disclaimer This presentation contains proprietary and confidential information of FiscalNote Holdings, Inc (“FiscalNote”) and Duddell Street Acquisition Corp. (NASDAQ: DSAC,“Duddell Street”), and the entire content should be considered “Confidential Information.” Neither Duddell Street, FiscalNote, Citigroup Global Markets Inc. (“Citi”), J.P. Morgan Securities LLC (together with Citi, the “Placement Agents”) nor any of their respective affiliates, representatives, partners, directors, officers, employees, advisers or agents makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the transactions contemplated in this presentation. To the full extent permitted by law, no responsibility or liability whatsoever is accepted by any such person for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. This presentation is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Duddell Street or FiscalNote and is not intended to form the basis of any investment decision in Duddell Street or FiscalNote. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of an investment in Duddell Street or FiscalNote and the transactions contemplated in this presentation. By participating in this presentation, you expressly agree to keep confidential this presentation and all otherwise non-public information disclosed by us, whether orally or in writing, during this presentation or in these presentation materials. You also agree not to distribute, disclose or use such information for any purpose, other than for the purpose of evaluating your participation in the potential financing of the transactions contemplated in this presentation and to return to FiscalNote and Duddell Street, delete or destroy this presentation upon request. By participating in this presentation, you acknowledge that you are (i) aware that the United States securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (ii) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the "Exchange Act"), and that you will neither use, nor cause any third party to use, this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. This presentation relates to the potential financing of a portion of the transactions contemplated in this presentation through a private placement of equity securities. This presentation shall not constitute a “solicitation” as defined in Section 14 of the Exchange Act. This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. This presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. Neither FiscalNote nor Duddell Street is making an offer of the Securities in any state where the offer is not permitted. The information contained in this presentation is only addressed to and directed at persons in member states of the European Economic Area and the United Kingdom (each a “Relevant State”) who are “qualified investors” within the meaning of the Prospectus Regulation (Regulation (EU) 2017/1129) (“Qualified Investors”). In addition, in the United Kingdom, the presentation is being distributed only to, and is directed only at, Qualified Investors who are persons (i) having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) (ii) falling within Article 49(2)(a) to (d) of the Order, or (iii) to whom it may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). The information must not be acted on or relied on (i) in the United Kingdom, by persons who are not Relevant Persons, and (ii) in any Relevant State, by persons who are not Qualified Investors. Any investment or investment activity to which the information relates is available only to or will be engaged in only with, (i) Relevant Persons in the United Kingdom, and (ii) Qualified Investors in any Relevant State. This presentation is intended solely for the purposes of familiarizing investors. To the extent the terms of any potential transaction are included in this presentation, those terms are included for discussion purposes only. NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE OR TERRITORIAL SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Use of Data This presentation contains information concerning FiscalNote’s products, services and industry, including market size and growth rates of the markets in which FiscalNote participates, that are based on industry surveys and publications or other publicly available information, other third-party survey data and research reports. This information involves many assumptions and limitations; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. This modelling data is subject to change. Neither FiscalNote nor Duddell Street has independently verified this third-party information. Similarly, other third-party survey data and research reports commissioned by FiscalNote or Duddell Street, while believed by FiscalNote and Duddell Street to be reliable, are based on limited sample sizes and have not been independently verified by FiscalNote or Duddell Street. In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the industry in which FiscalNote operates, and its future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by FiscalNote and Duddell Street. None of Duddell Street, FiscalNote and the Placement Agents assumes any obligation to update the information in this presentation. Use of Projections The financial, operational, industry and market projections, estimates and targets in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Duddell Street’s and FiscalNote’s control. While all financial, operational, industry and market projections, estimates and targets are necessarily speculative, Duddell Street and FiscalNote believe that the preparation of prospective financial, operational, industry and market information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. FiscalNote’s independent auditors have not studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, they did not express an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial, operational, industry and market projections, estimates and targets, including assumptions, risks and uncertainties described in “Forward Looking Statements” below. The inclusion of financial, operational, industry and market projections, estimates and targets in this presentation should not be regarded as an indication that Duddell Street and FiscalNote, or their representatives, considered or consider such financial, operational, industry and market projections, estimates and targets to be a reliable prediction of future events. Further, investors should note that the projections or revenue targets for FY2022 to FY 2025 are based on management estimates of both organic growth and growth via acquisitions, inclusive of acquisitions in the Company's pipeline. These acquisitions may not be consummated, or if they are, they may not be done on terms that the Company currently expects. As a result, investors should not place undue reliance on projections or the revenue targets for FY2022 to FY2025. |

| 3 Disclaimer (Cont’d) Financial Information, Non-GAAP Measures The financial information and data contained in this presentation is unaudited and does not conform to Regulation S-X promulgated under the Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement or registration statement to be filed by Duddell Street with the SEC. This presentation contains “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Specifically, FiscalNote makes use of the non-GAAP financial measure Adjusted EBITDA. This is not a recognized term under GAAP and should not be considered as an alternative to net income (loss) as a measure of financial performance or cash provided by operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use as Adjusted EBITDA does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentations of Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. See Appendix for a reconciliation to the most directly comparable GAAP measures . Because not all companies use identical calculations, the presentations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. Additional Information If the contemplated business combination is pursued, Duddell Street will be required to file a preliminary and definitive proxy statement, which may be a part of a registration statement, and other relevant documents with the SEC. Shareholders and other interested persons are urged to read the preliminary and definitive proxy statement, prospectus, any other relevant documents filed with the SEC and any amendments thereto when they become available because they will contain important information about Duddell Street, FiscalNote and the contemplated business combination. Shareholders will be able to obtain a free copy of the proxy statement (when filed), as well as other filings containing information about Duddell Street, FiscalNote and the contemplated business combination, without charge, at the SEC’s website located at www.sec.gov. Duddell Street and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Duddell Street’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. This presentation does not contain all the information that should be considered in the contemplated business combination and shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the contemplated business combination. It is not intended to form any basis of any investment decision or any decision in respect to the contemplated business combination. The definitive proxy statement will be mailed to shareholders of Duddell Street as of a record date to be established for voting on the contemplated business combination when it becomes available. Forward Looking Statements Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, statements with respect to (i) FiscalNote’s projected operational performance, including relative to its competitors, (ii) trends in the enterprise information services and legal regulatory information markets, (iii) FiscalNote’s strategies and targets for customer growth, (iv) FiscalNote’s strategies and plans for mergers and acquisitions, and (v) other statements regarding Duddell Street’s or FiscalNote’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward- looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Duddell Street’s registration statement on Form S-1, any proxy statement/prospectus relating to the contemplated business combination, which is expected to be filed by Duddell Street with the SEC, other documents filed by Duddell Street from time to time with the SEC, and any risk factors made available to you in connection with Duddell Street, FiscalNote and the contemplated business combination. These forward-looking statements involve a number of risks and uncertainties (some of which are beyond the control of Duddell Street and FiscalNote), and other assumptions, that may cause FiscalNote’s or Duddell Street’s actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Such risks, uncertainties and assumptions include, but are not limited to, the risks, uncertainties and assumptions that will be described in any proxy statement/prospectus relating to the contemplated business combination, as well as the following: changes in domestic and foreign businesses, government regulation, and market, financial, political, and legal conditions; the risk that FiscalNote may be unable to successfully commercialize its products and services; the effects of competition on FiscalNote’s business; FiscalNote’s and Duddell Street’s exposure to litigation claims and other loss contingencies; FiscalNote’s ability to protect patents, trademarks, and other intellectual property rights; the uncertainty of the projected financial information with respect to FiscalNote; disruptions and other impacts to FiscalNote’s business as a result of the continuing COVID-19 pandemic and other global health or economic crises; changes in customer demand; the parties may be unable to successfully or timely consummate the contemplated business combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the contemplated business combination or that the approval of the shareholders of Duddell Street or stockholders of FiscalNote is not obtained; failure to realize the anticipated benefits of the contemplated business combination; and the amount of redemption requests made by Duddell Street’s shareholders. There may be additional risks that neither Duddell Street nor FiscalNote presently know or that Duddell Street and FiscalNote currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Duddell Street and FiscalNote assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Duddell Street nor FiscalNote gives any assurance that either Duddell Street or FiscalNote will achieve its expectations. This presentation is not intended to constitute, and should not be construed as, investment advice. Trademarks FiscalNote and Duddell Street own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with FiscalNote or Duddell Street, or an endorsement or sponsorship by or of FiscalNote or Duddell Street. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, * or © symbols, but such references are not intended to indicate, in any way, that FiscalNote or Duddell Street will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. |

| 4 Today’s Speakers Tim Hwang CEO & Co-Founder Jon Slabaugh Chief Financial Officer & SVP of Corporate Development Reed Fawell Chief Revenue Officer & Senior VP Manoj Jain Chairman, CEO & Co-Chief Investment Officer Co-Founder & Co-Chief Investment Officer Director Nominee1 Note: (1) Contingent on CFIUS clearance. |

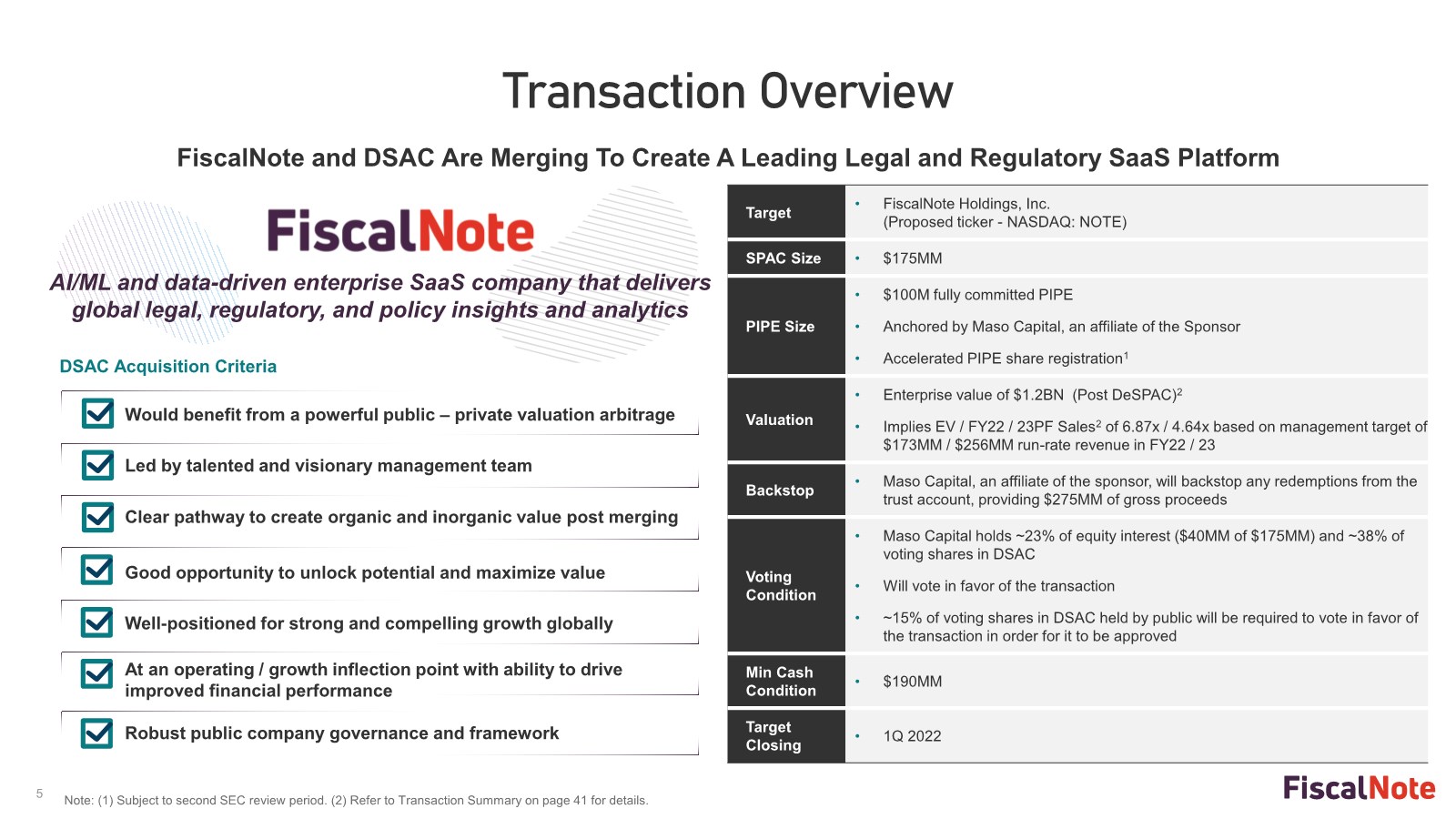

| 5 Transaction Overview AI/ML and data-driven enterprise SaaS company that delivers global legal, regulatory, and policy insights and analytics FiscalNote and DSAC Are Merging To Create A Leading Legal and Regulatory SaaS Platform Good opportunity to unlock potential and maximize value Led by talented and visionary management team Clear pathway to create organic and inorganic value post merging At an operating / growth inflection point with ability to drive improved financial performance Would benefit from a powerful public – private valuation arbitrage Well-positioned for strong and compelling growth globally Robust public company governance and framework DSAC Acquisition Criteria Note: (1) Subject to second SEC review period. (2) Refer to Transaction Summary on page 41 for details. Target • FiscalNote Holdings, Inc. (Proposed ticker - NASDAQ: NOTE) SPAC Size • $175MM PIPE Size • $100M fully committed PIPE • Anchored by Maso Capital, an affiliate of the Sponsor • Accelerated PIPE share registration1 Valuation • Enterprise value of $1.2BN (Post DeSPAC)2 • Implies EV / FY22 / 23PF Sales2 of 6.87x / 4.64x based on management target of $173MM / $256MM run-rate revenue in FY22 / 23 Backstop • Maso Capital, an affiliate of the sponsor, will backstop any redemptions from the trust account, providing $275MM of gross proceeds Voting Condition • Maso Capital holds ~23% of equity interest ($40MM of $175MM) and ~38% of voting shares in DSAC • Will vote in favor of the transaction • ~15% of voting shares in DSAC held by public will be required to vote in favor of the transaction in order for it to be approved Min Cash Condition • $190MM Target Closing • 1Q 2022 |

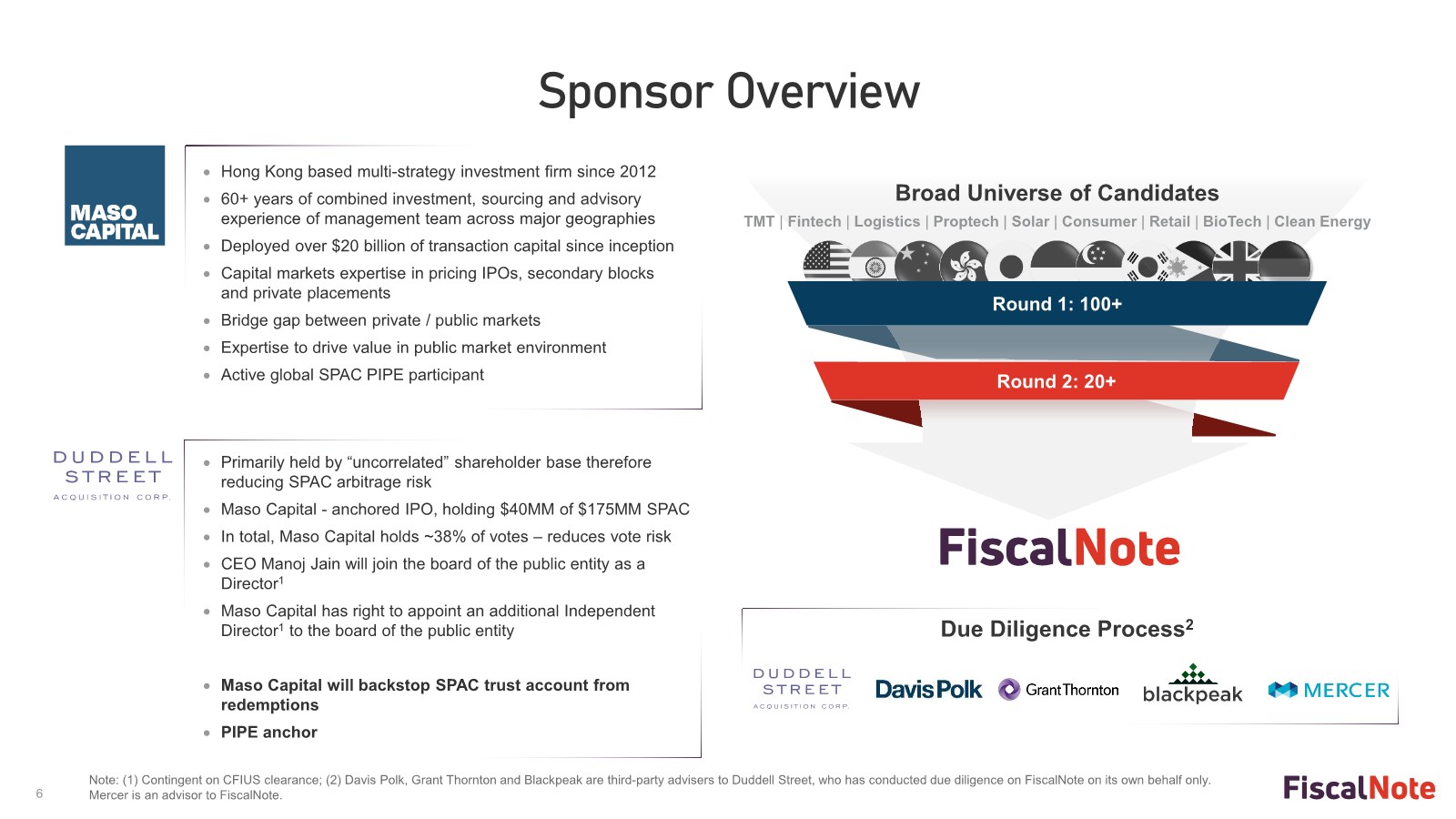

| 6 • Hong Kong based multi-strategy investment firm since 2012 • 60+ years of combined investment, sourcing and advisory experience of management team across major geographies • Deployed over $20 billion of transaction capital since inception • Capital markets expertise in pricing IPOs, secondary blocks and private placements • Bridge gap between private / public markets • Expertise to drive value in public market environment • Active global SPAC PIPE participant Broad Universe of Candidates TMT | Fintech | Logistics | Proptech | Solar | Consumer | Retail | BioTech | Clean Energy Round 2: 20+ Round 1: 100+ Due Diligence Process2 Sponsor Overview • Primarily held by “uncorrelated” shareholder base therefore reducing SPAC arbitrage risk • Maso Capital - anchored IPO, holding $40MM of $175MM SPAC • In total, Maso Capital holds ~38% of votes – reduces vote risk • CEO Manoj Jain will join the board of the public entity as a Director1 • Maso Capital has right to appoint an additional Independent Director1 to the board of the public entity • Maso Capital will backstop SPAC trust account from redemptions • PIPE anchor Note: (1) Contingent on CFIUS clearance; (2) Davis Polk, Grant Thornton and Blackpeak are third-party advisers to Duddell Street, who has conducted due diligence on FiscalNote on its own behalf only. Mercer is an advisor to FiscalNote. |

| 7 Agenda Investment Highlights Executive Summary Valuation Overview Financial Snapshot Appendix |

| 8 Executive Summary |

| 9 9 Technology Delivering Critical Legal Data and Insights in an Uncertain World |

| 10 Note: (1) Former Chairman and CEO; (2) PwC Global CEO Survey (https://www.pwc.com/gx/en/ceo-survey/2020/reports/pwc-23rd-global-ceo-survey.pdf). Boards and CEOs Face Increasing Global Regulations “…I don’t know if this is the end-all but clearly regulation relief would…help to grow private investment in US infrastructure” Regulatory Pressure — Allen’s interview, 20171 “…our business may be impacted by the adoption of new tax legislation…if we fail to… subject to significant sanctions” — Bradway’s letter to shareholders, 2020 “…legal ambiguity on the status of independent workers makes it difficult for platforms like Uber …” — Khosrowshahi’s email, 2021 “…People still want regulation, security amid tech competition… with all these competitors…we don't forget the basic principles” — Moynihan’s interview, 2019 ~1,500 Global CEOs say regulatory and policy issues are the biggest threats to their businesses2 |

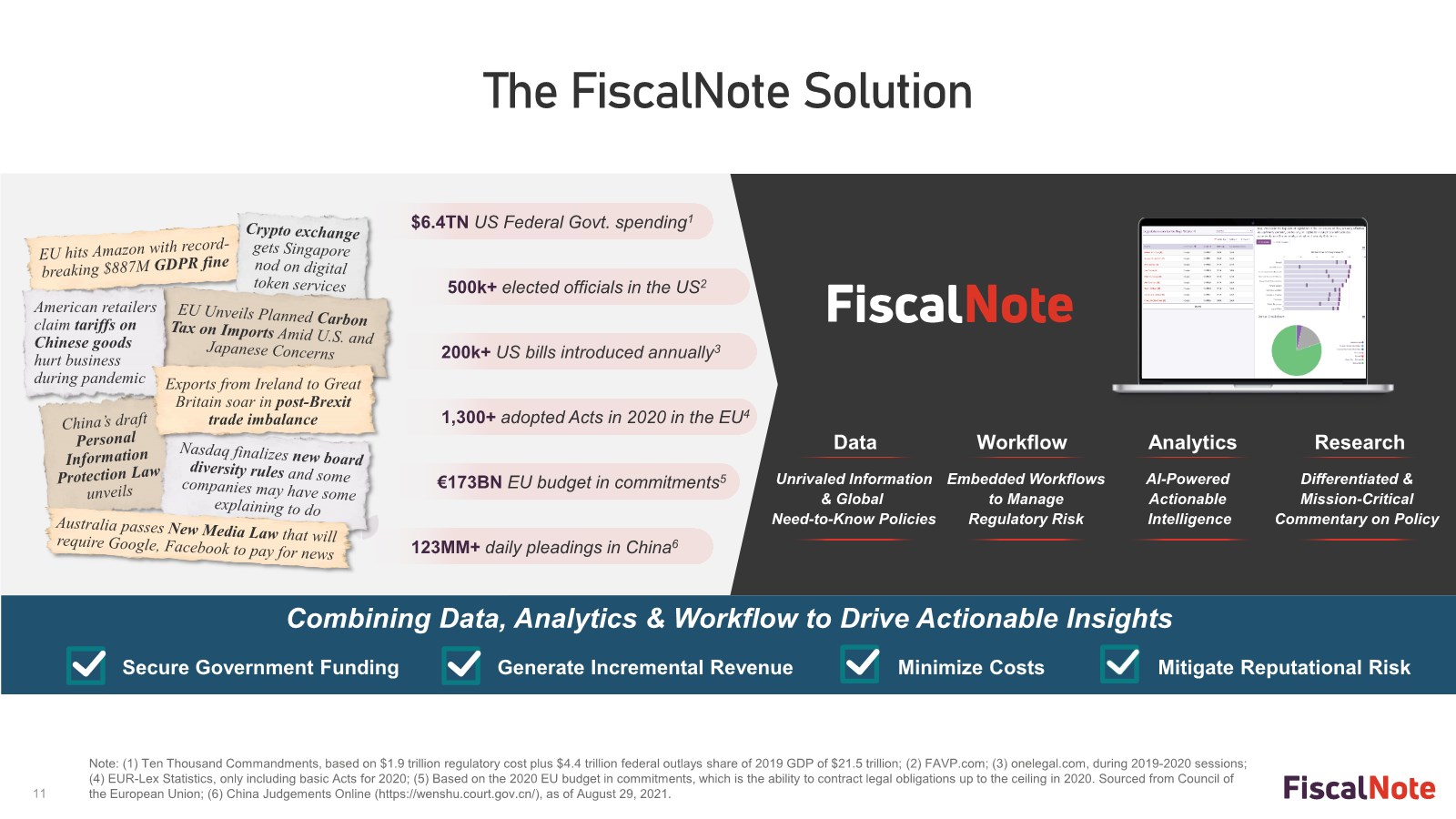

| 11 The FiscalNote Solution Embedded Workflows to Manage Regulatory Risk Workflow Unrivaled Information & Global Need-to-Know Policies Data AI-Powered Actionable Intelligence Analytics Secure Government Funding Minimize Costs Mitigate Reputational Risk Generate Incremental Revenue $6.4TN US Federal Govt. spending1 200k+ US bills introduced annually3 500k+ elected officials in the US2 1,300+ adopted Acts in 2020 in the EU4 €173BN EU budget in commitments5 123MM+ daily pleadings in China6 Note: (1) Ten Thousand Commandments, based on $1.9 trillion regulatory cost plus $4.4 trillion federal outlays share of 2019 GDP of $21.5 trillion; (2) FAVP.com; (3) onelegal.com, during 2019-2020 sessions; (4) EUR-Lex Statistics, only including basic Acts for 2020; (5) Based on the 2020 EU budget in commitments, which is the ability to contract legal obligations up to the ceiling in 2020. Sourced from Council of the European Union; (6) China Judgements Online (https://wenshu.court.gov.cn/), as of August 29, 2021. Differentiated & Mission-Critical Commentary on Policy Research American retailers claim tariffs on Chinese goods hurt business during pandemic Exports from Ireland to Great Britain soar in post-Brexit trade imbalance Combining Data, Analytics & Workflow to Drive Actionable Insights |

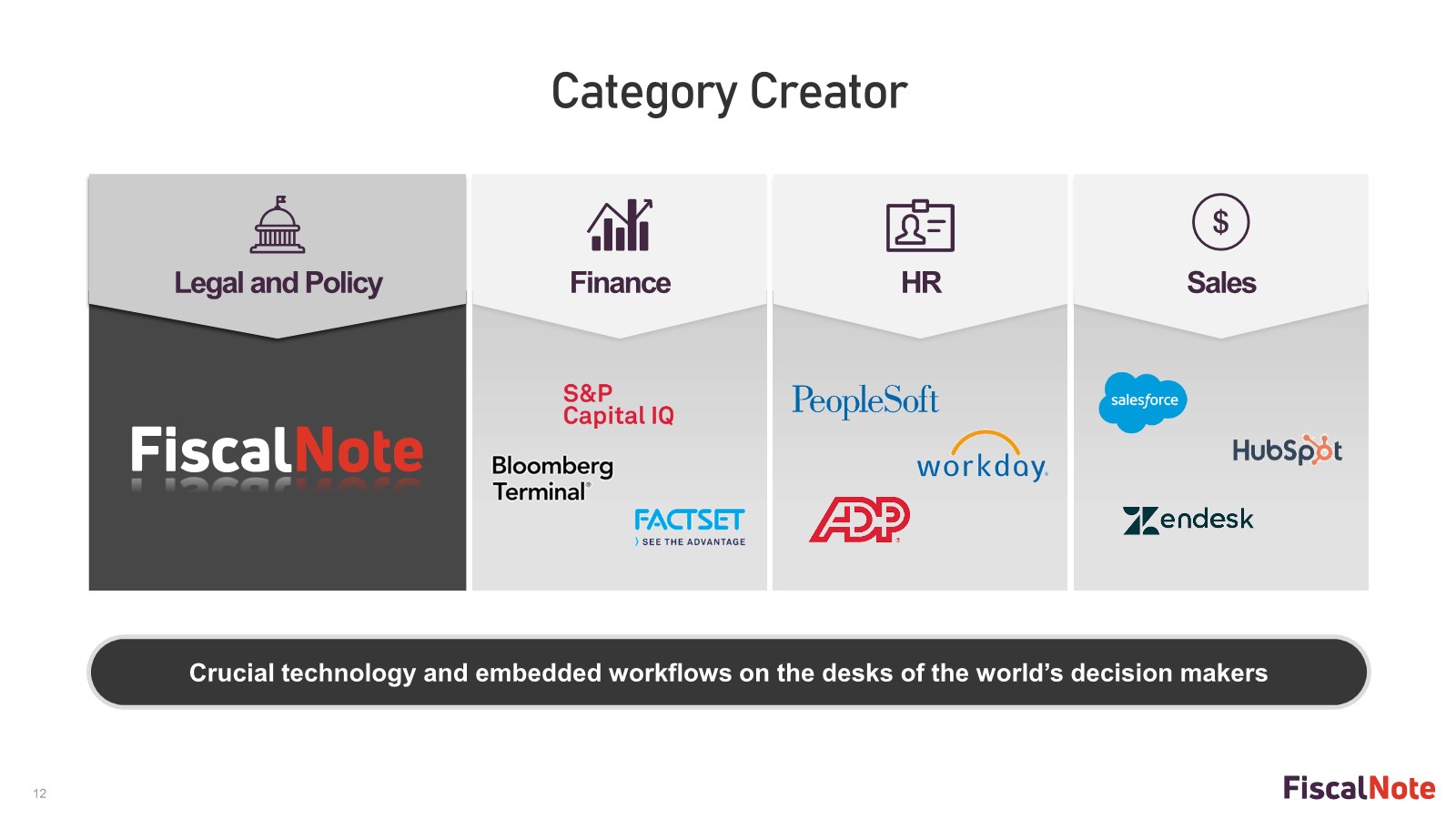

| 12 Category Creator Legal and Policy Crucial technology and embedded workflows on the desks of the world’s decision makers HR Sales Finance |

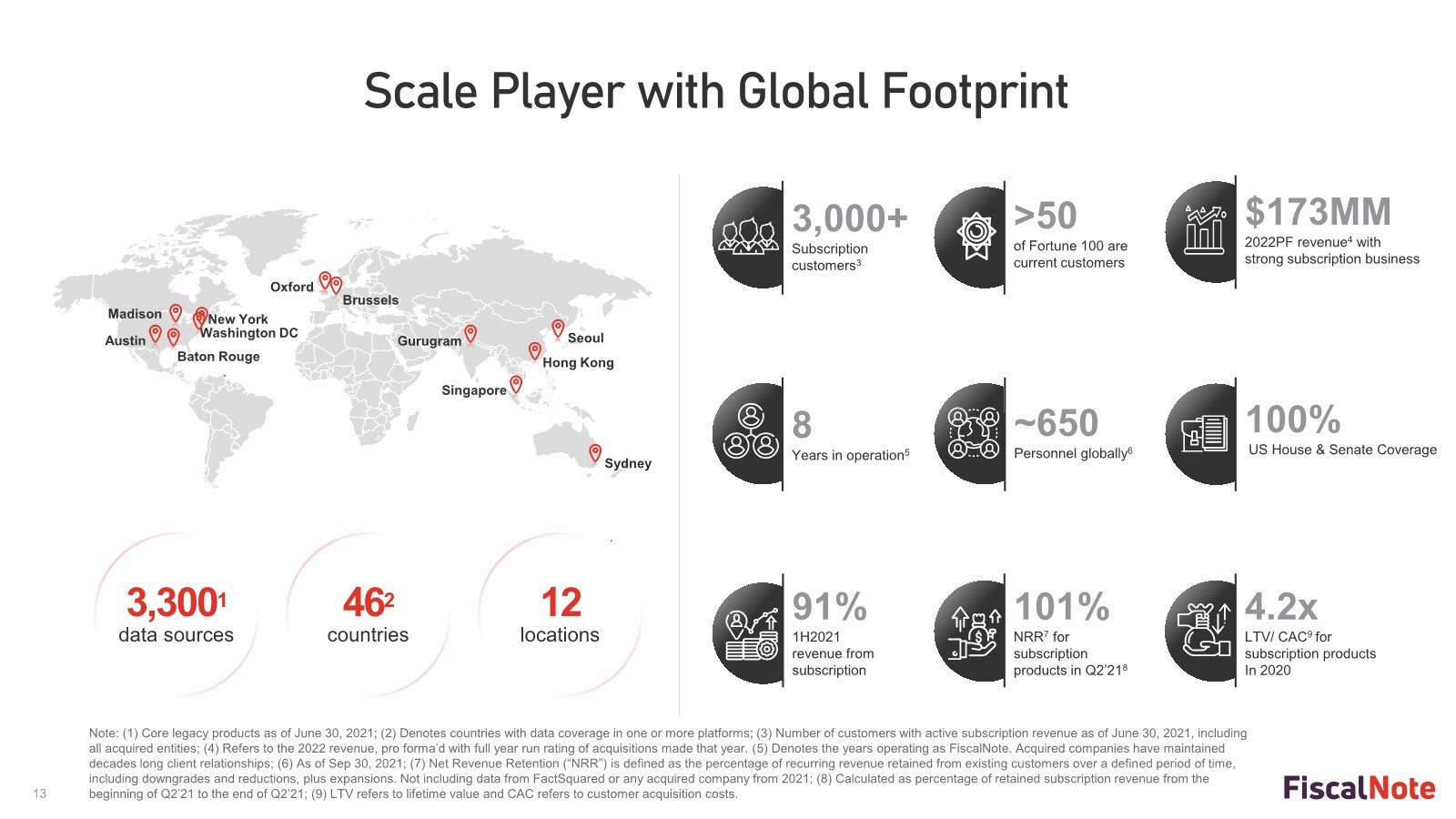

| 13 3,000+ Subscription customers3 8 Years in operation5 ~650 Personnel globally6 $173MM 2022PF revenue4 with strong subscription business 101% NRR7 for subscription products in Q2’218 4.2x LTV/ CAC9 for subscription products In 2020 91% 1H2021 revenue from subscription Scale Player with Global Footprint Austin Baton Rouge Washington DC New York Singapore Oxford Brussels Gurugram Hong Kong Seoul Sydney 3,3001 data sources 462 countries 12 locations Note: (1) Core legacy products as of June 30, 2021; (2) Denotes countries with data coverage in one or more platforms; (3) Number of customers with active subscription revenue as of June 30, 2021, including all acquired entities; (4) Refers to the 2022 revenue, pro forma’d with full year run rating of acquisitions made that year. (5) Denotes the years operating as FiscalNote. Acquired companies have maintained decades long client relationships; (6) As of Sep 30, 2021; (7) Net Revenue Retention (“NRR”) is defined as the percentage of recurring revenue retained from existing customers over a defined period of time, including downgrades and reductions, plus expansions. Not including data from FactSquared or any acquired company from 2021; (8) Calculated as percentage of retained subscription revenue from the beginning of Q2’21 to the end of Q2’21; (9) LTV refers to lifetime value and CAC refers to customer acquisition costs. 100% US House & Senate Coverage >50 of Fortune 100 are current customers Madison |

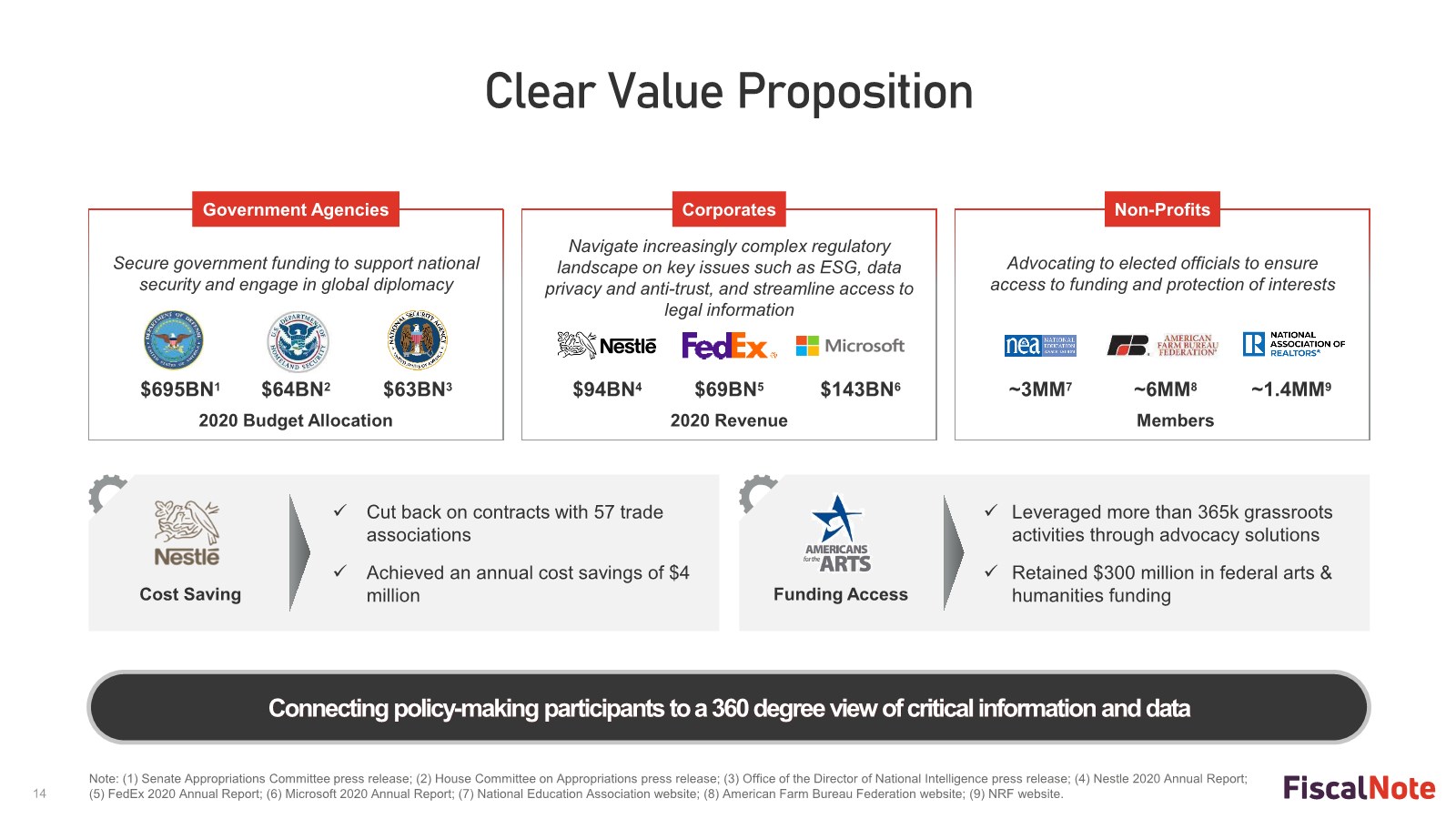

| 14 Note: (1) Senate Appropriations Committee press release; (2) House Committee on Appropriations press release; (3) Office of the Director of National Intelligence press release; (4) Nestle 2020 Annual Report; (5) FedEx 2020 Annual Report; (6) Microsoft 2020 Annual Report; (7) National Education Association website; (8) American Farm Bureau Federation website; (9) NRF website. Clear Value Proposition Secure government funding to support national security and engage in global diplomacy Navigate increasingly complex regulatory landscape on key issues such as ESG, data privacy and anti-trust, and streamline access to legal information Advocating to elected officials to ensure access to funding and protection of interests $695BN1 $64BN2 $63BN3 Government Agencies Corporates Non-Profits 2020 Budget Allocation 2020 Revenue Members $94BN4 $69BN5 $143BN6 ~3MM7 ~6MM8 ~1.4MM9 Cost Saving Funding Access ✓ Cut back on contracts with 57 trade associations ✓ Achieved an annual cost savings of $4 million ✓ Leveraged more than 365k grassroots activities through advocacy solutions ✓ Retained $300 million in federal arts & humanities funding Connecting policy-making participants to a 360 degree view of critical information and data |

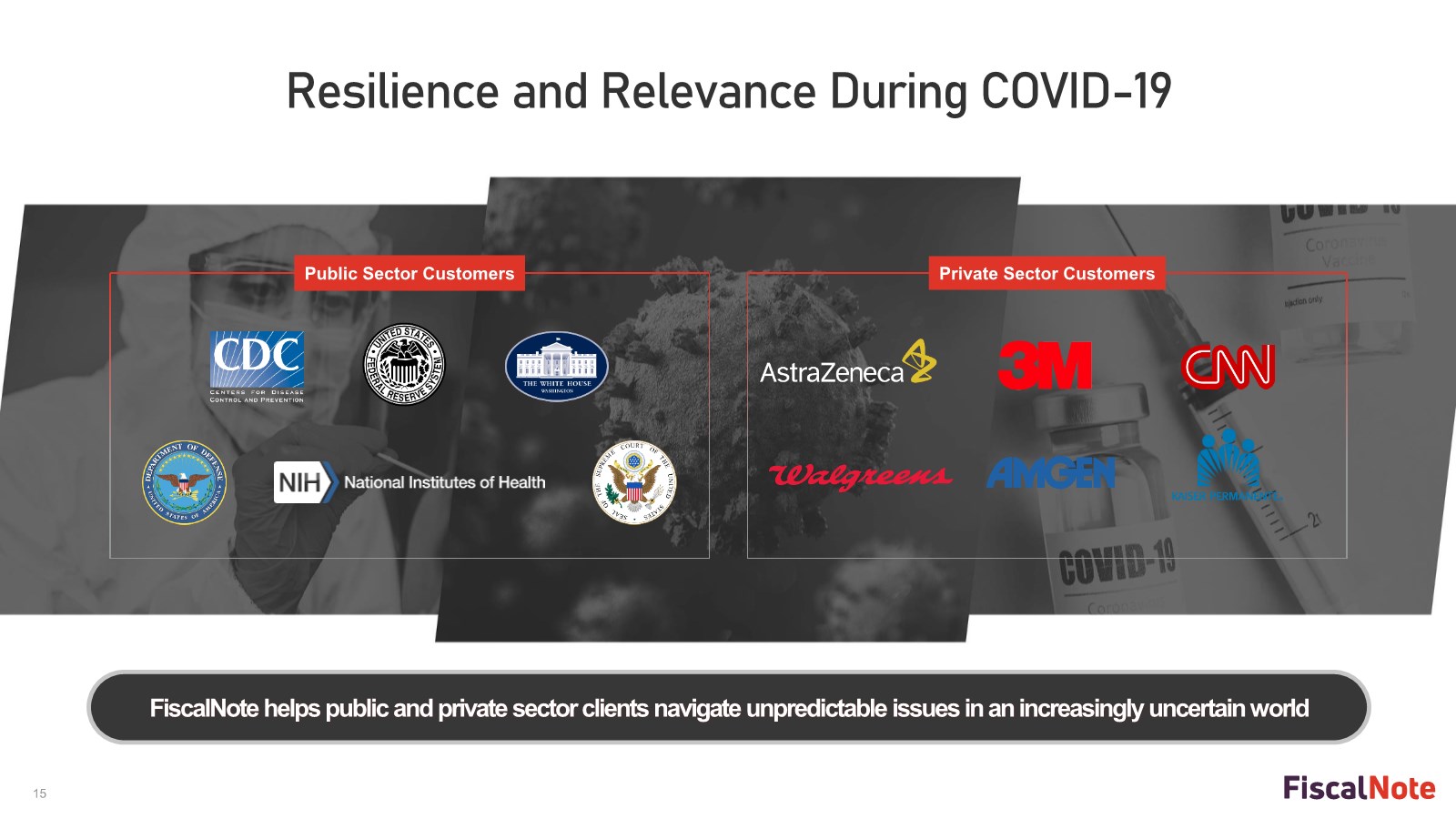

| 15 Resilience and Relevance During COVID-19 FiscalNote helps public and private sector clients navigate unpredictable issues in an increasingly uncertain world Public Sector Customers Private Sector Customers |

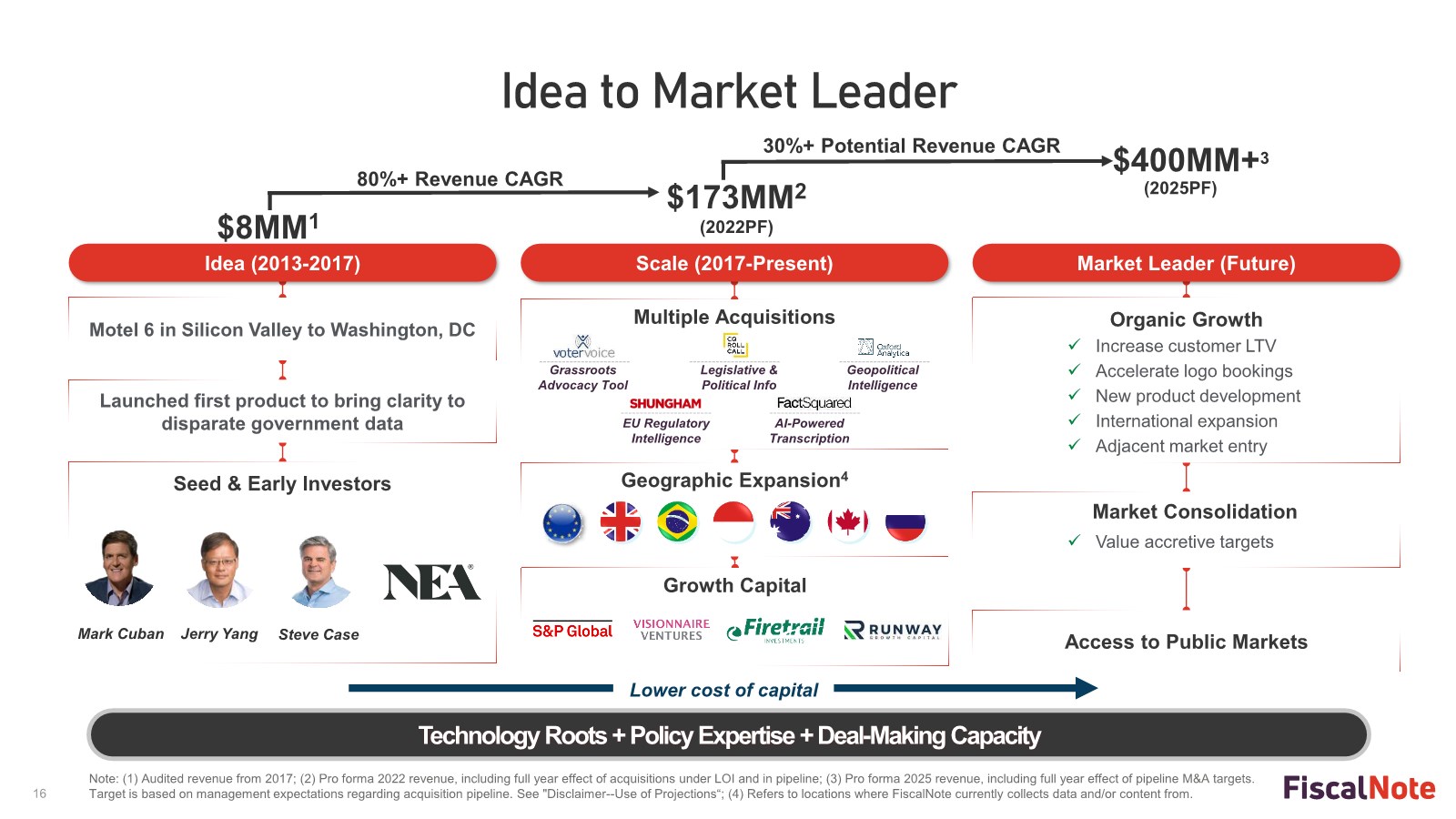

| 16 Idea to Market Leader Idea (2013-2017) $400MM+3 (2025PF) 80%+ Revenue CAGR $173MM2 (2022PF) Scale (2017-Present) Market Leader (Future) $8MM1 30%+ Potential Revenue CAGR Growth Capital Motel 6 in Silicon Valley to Washington, DC Multiple Acquisitions Seed & Early Investors Mark Cuban Jerry Yang EU Regulatory Intelligence Legislative & Political Info AI-Powered Transcription Geographic Expansion4 Organic Growth ✓ Increase customer LTV ✓ Accelerate logo bookings ✓ New product development ✓ International expansion ✓ Adjacent market entry Market Consolidation ✓ Value accretive targets Grassroots Advocacy Tool Geopolitical Intelligence Launched first product to bring clarity to disparate government data Access to Public Markets Lower cost of capital Steve Case Technology Roots + Policy Expertise + Deal-Making Capacity Note: (1) Audited revenue from 2017; (2) Pro forma 2022 revenue, including full year effect of acquisitions under LOI and in pipeline; (3) Pro forma 2025 revenue, including full year effect of pipeline M&A targets. Target is based on management expectations regarding acquisition pipeline. See "Disclaimer--Use of Projections“; (4) Refers to locations where FiscalNote currently collects data and/or content from. |

| 17 Investment Highlights |

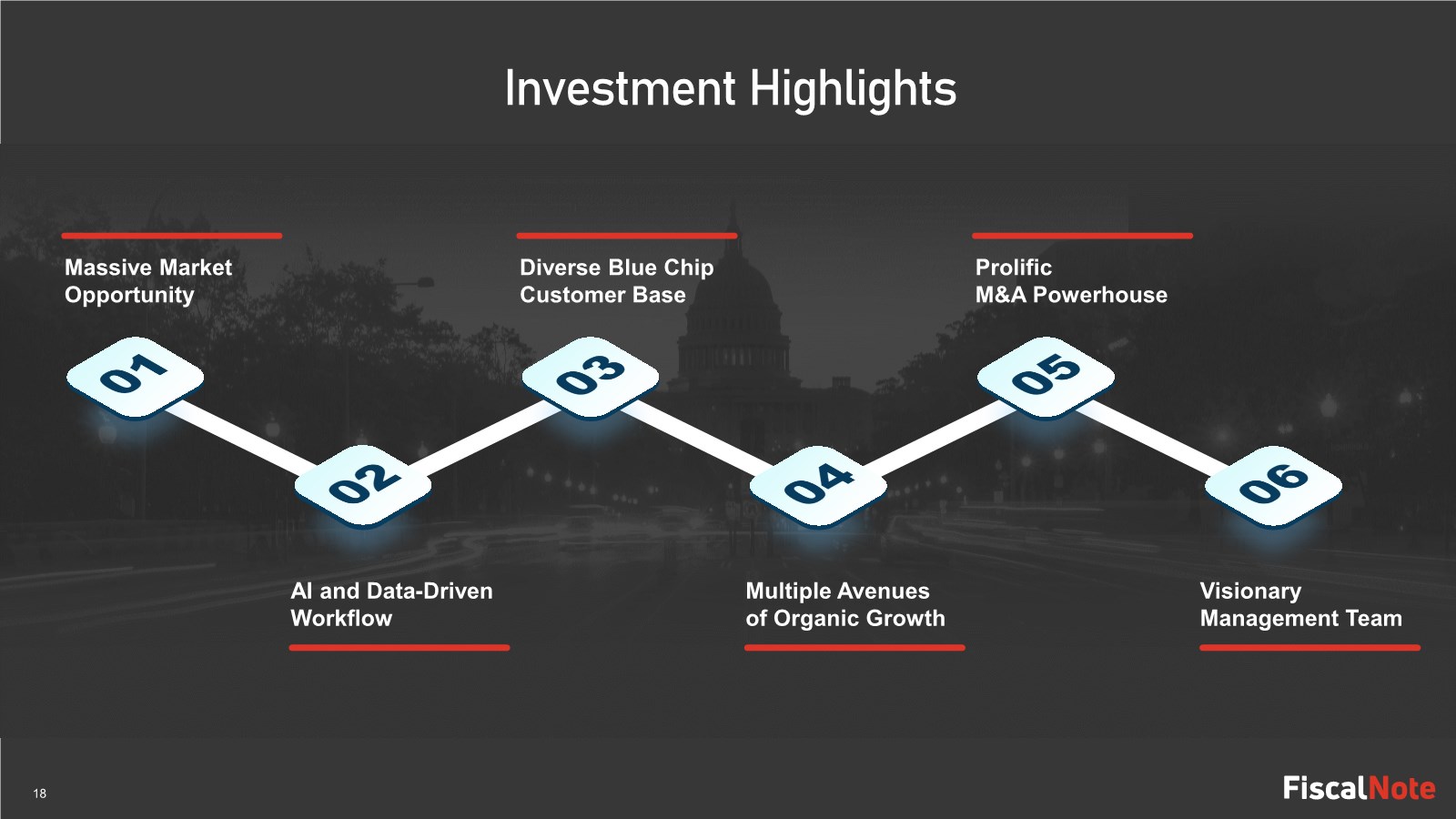

| 18 Investment Highlights Massive Market Opportunity AI and Data-Driven Workflow Diverse Blue Chip Customer Base Multiple Avenues of Organic Growth Prolific M&A Powerhouse Visionary Management Team |

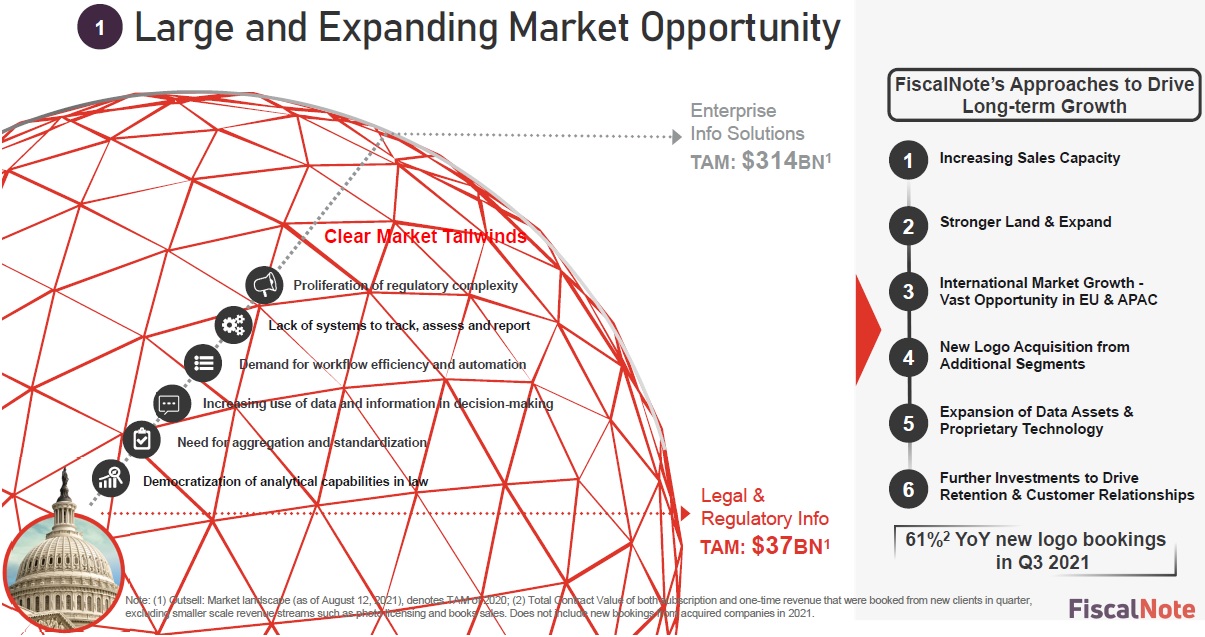

| 19 Large and Expanding Market Opportunity 1 Clear Market Tailwinds Democratization of analytical capabilities in law Need for aggregation and standardization Demand for workflow efficiency and automation Lack of systems to track, assess and report Proliferation of regulatory complexity Legal & Regulatory Info TAM: $37BN1 Enterprise Info Solutions TAM: $314BN1 FiscalNote’s Approaches to Drive Long-term Growth Increasing Sales Capacity 1 Stronger Land & Expand 2 International Market Growth - Vast Opportunity in EU & APAC 3 New Logo Acquisition from Additional Segments 4 Expansion of Data Assets & Proprietary Technology 5 61%2 YoY new logo bookings in Q3 2021 Note: (1) Outsell: Market landscape (as of August 12, 2021), denotes TAM of 2020; (2) Total Contract Value of both subscription and one-time revenue that were booked from new clients in quarter, excluding smaller scale revenue streams such as photo licensing and books sales. Does not include new bookings from acquired companies in 2021. Increasing use of data and information in decision-making Further Investments to Drive Retention & Customer Relationships 6 |

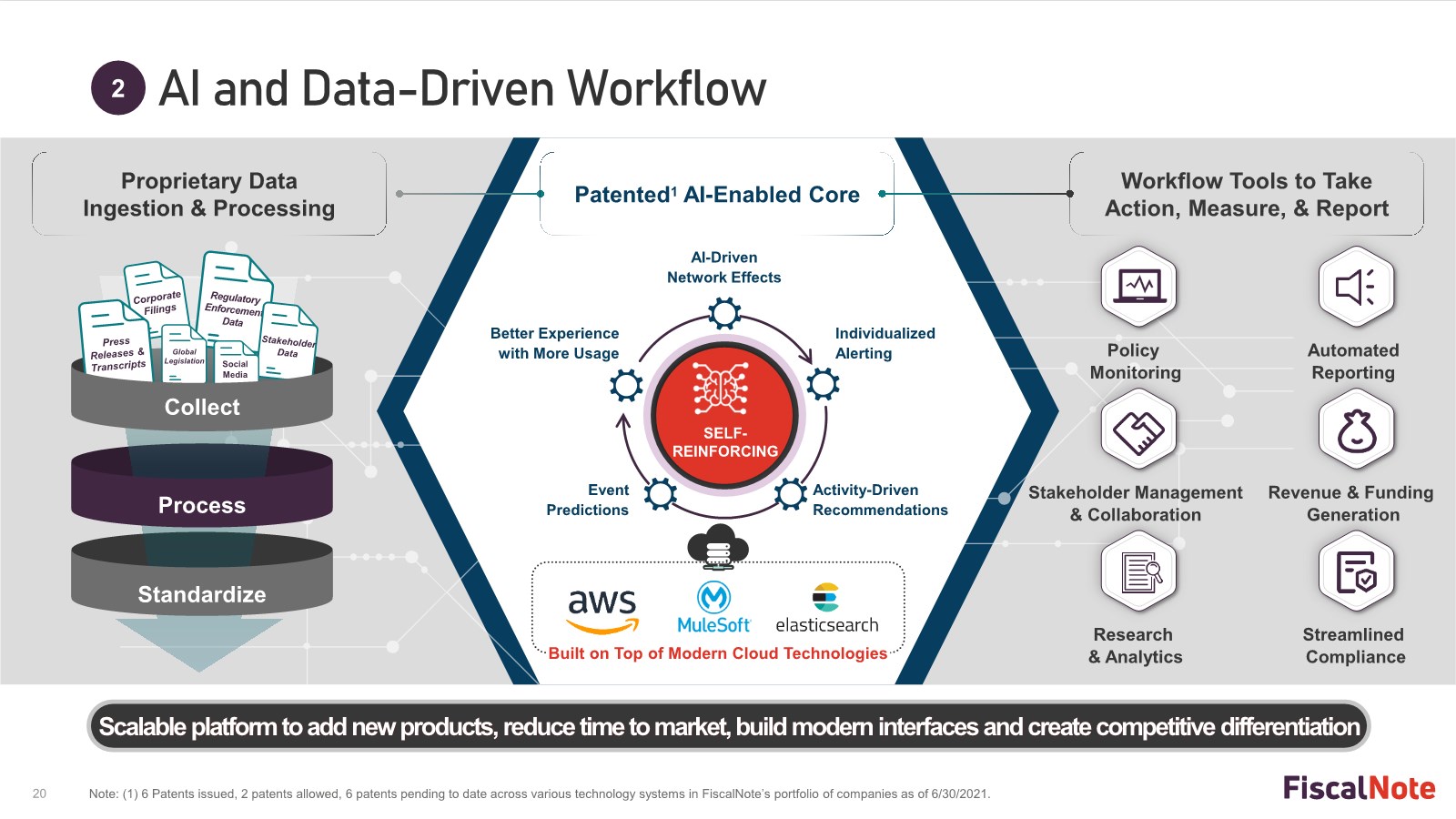

| 20 Better Experience with More Usage Policy Monitoring Automated Reporting Individualized Alerting Event Predictions Activity-Driven Recommendations Stakeholder Management & Collaboration Revenue & Funding Generation Research & Analytics Streamlined Compliance Process Standardize Global Legislation Social Media Collect AI and Data-Driven Workflow 2 Proprietary Data Ingestion & Processing Workflow Tools to Take Action, Measure, & Report Patented1 AI-Enabled Core AI-Driven Network Effects Built on Top of Modern Cloud Technologies SELF- REINFORCING Scalable platform to add new products, reduce time to market, build modern interfaces and create competitive differentiation Note: (1) 6 Patents issued, 2 patents allowed, 6 patents pending to date across various technology systems in FiscalNote’s portfolio of companies as of 6/30/2021. |

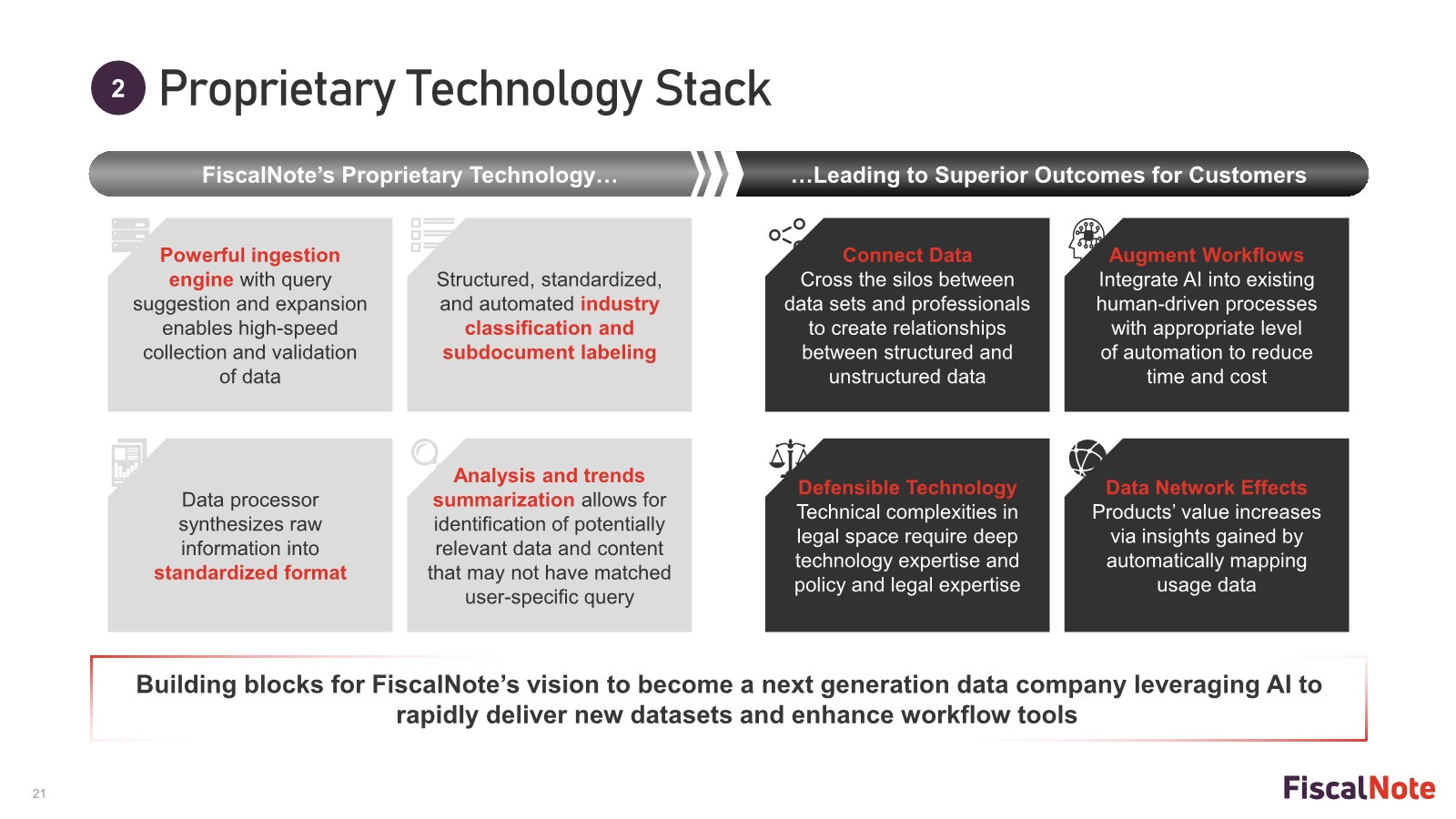

| 21 Building blocks for FiscalNote’s vision to become a next generation data company leveraging AI to rapidly deliver new datasets and enhance workflow tools Proprietary Technology Stack 2 FiscalNote’s Proprietary Technology… …Leading to Superior Outcomes for Customers Connect Data Cross the silos between data sets and professionals to create relationships between structured and unstructured data Augment Workflows Integrate AI into existing human-driven processes with appropriate level of automation to reduce time and cost Defensible Technology Technical complexities in legal space require deep technology expertise and policy and legal expertise Data Network Effects Products’ value increases via insights gained by automatically mapping usage data Structured, standardized, and automated industry classification and subdocument labeling Data processor synthesizes raw information into standardized format Analysis and trends summarization allows for identification of potentially relevant data and content that may not have matched user-specific query Powerful ingestion engine with query suggestion and expansion enables high-speed collection and validation of data |

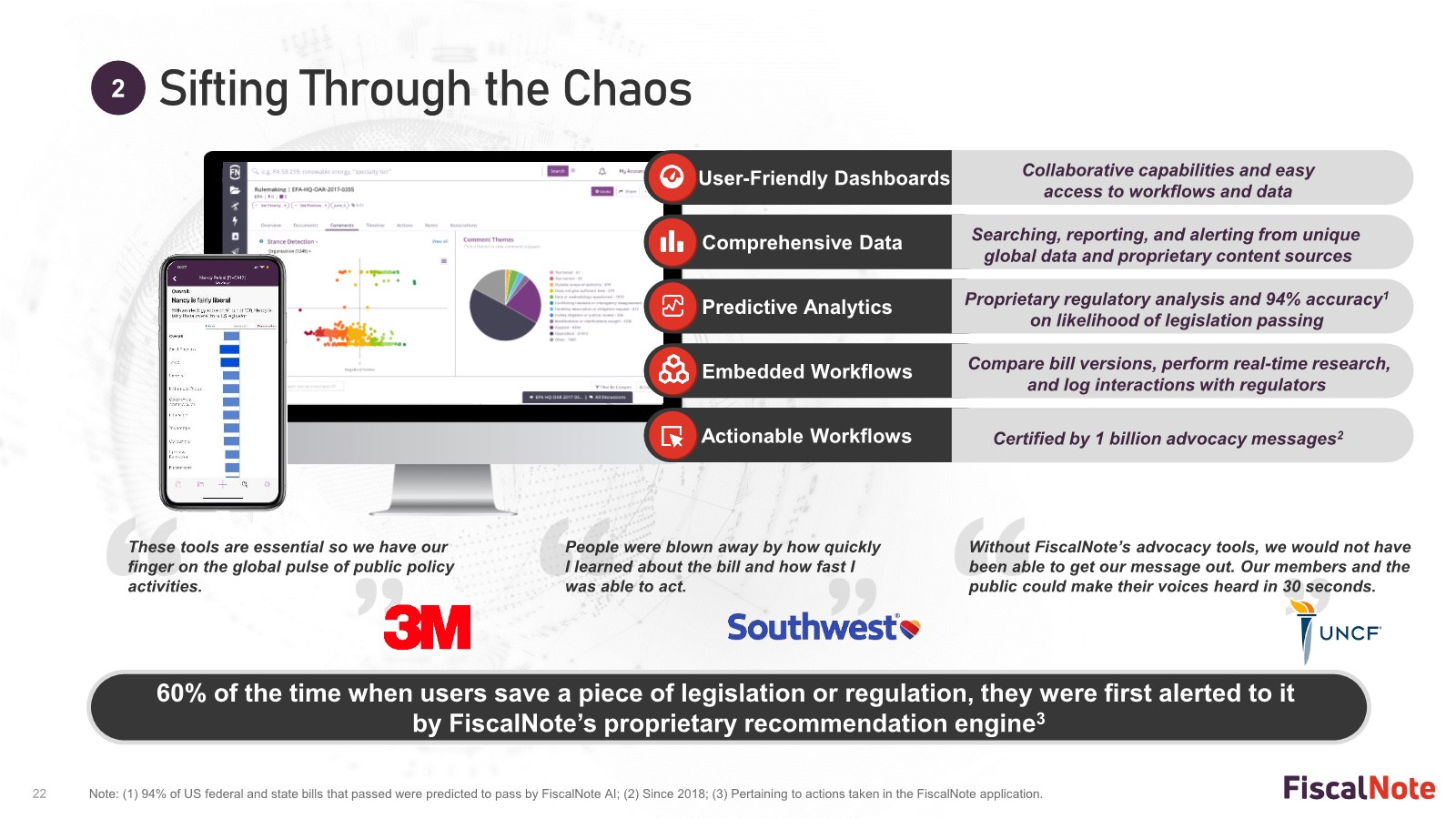

| 22 These tools are essential so we have our finger on the global pulse of public policy activities. People were blown away by how quickly I learned about the bill and how fast I was able to act. Without FiscalNote’s advocacy tools, we would not have been able to get our message out. Our members and the public could make their voices heard in 30 seconds. Sifting Through the Chaos 2 Note: (1) 94% of US federal and state bills that passed were predicted to pass by FiscalNote AI; (2) Since 2018; (3) Pertaining to actions taken in the FiscalNote application. User-Friendly Dashboards Collaborative capabilities and easy access to workflows and data Actionable Workflows Certified by 1 billion advocacy messages2 Predictive Analytics Proprietary regulatory analysis and 94% accuracy1 on likelihood of legislation passing Comprehensive Data Searching, reporting, and alerting from unique global data and proprietary content sources 60% of the time when users save a piece of legislation or regulation, they were first alerted to it by FiscalNote’s proprietary recommendation engine3 Embedded Workflows Compare bill versions, perform real-time research, and log interactions with regulators |

| 23 Healthcare (~14%) Consumer & Retail (~2%) Energy (~3%) Finance (~5%) TMT (~5%) Education (~5%) Transport (~2%) Business Services (~5%) Government (~24%) Blue Chip Diverse Client Base 3 Relied upon and recognized across major public and private sector customers Note: Figures and logos exclude products acquired in 2021. |

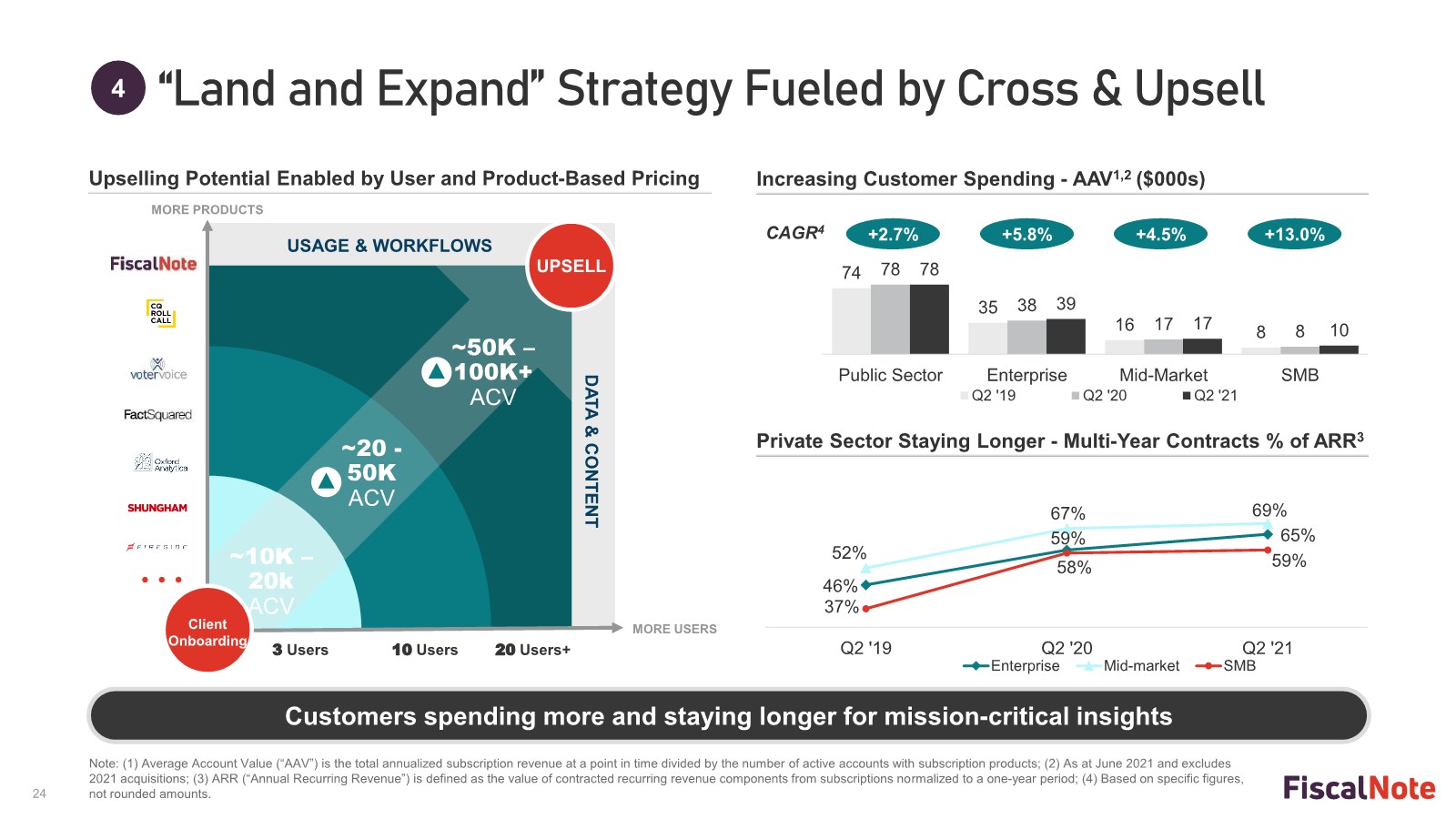

| 24 Private Sector Staying Longer - Multi-Year Contracts % of ARR3 74 35 16 8 78 38 17 8 78 39 17 10 Public Sector Enterprise Mid-Market SMB Q2 '19 Q2 '20 Q2 '21 +2.7% +5.8% +4.5% CAGR4 46% 59% 65% 52% 67% 69% 37% 58% 59% Q2 '19 Q2 '20 Q2 '21 Enterprise Mid-market SMB Increasing Customer Spending - AAV1,2 ($000s) Upselling Potential Enabled by User and Product-Based Pricing “Land and Expand” Strategy Fueled by Cross & Upsell 4 UPSELL 3 Users 10 Users 20 Users+ MORE USERS MORE PRODUCTS USAGE & WORKFLOWS Client Onboarding DATA & CONTENT ~10K – 20k ACV ~20 - 50K ACV ~50K – 100K+ ACV Note: (1) Average Account Value (“AAV”) is the total annualized subscription revenue at a point in time divided by the number of active accounts with subscription products; (2) As at June 2021 and excludes 2021 acquisitions;(3) ARR (“Annual Recurring Revenue”) is defined as the value of contracted recurring revenue components from subscriptions normalized to a one-year period; (4) Based on specific figures, not rounded amounts. Customers spending more and staying longer for mission-critical insights +13.0% |

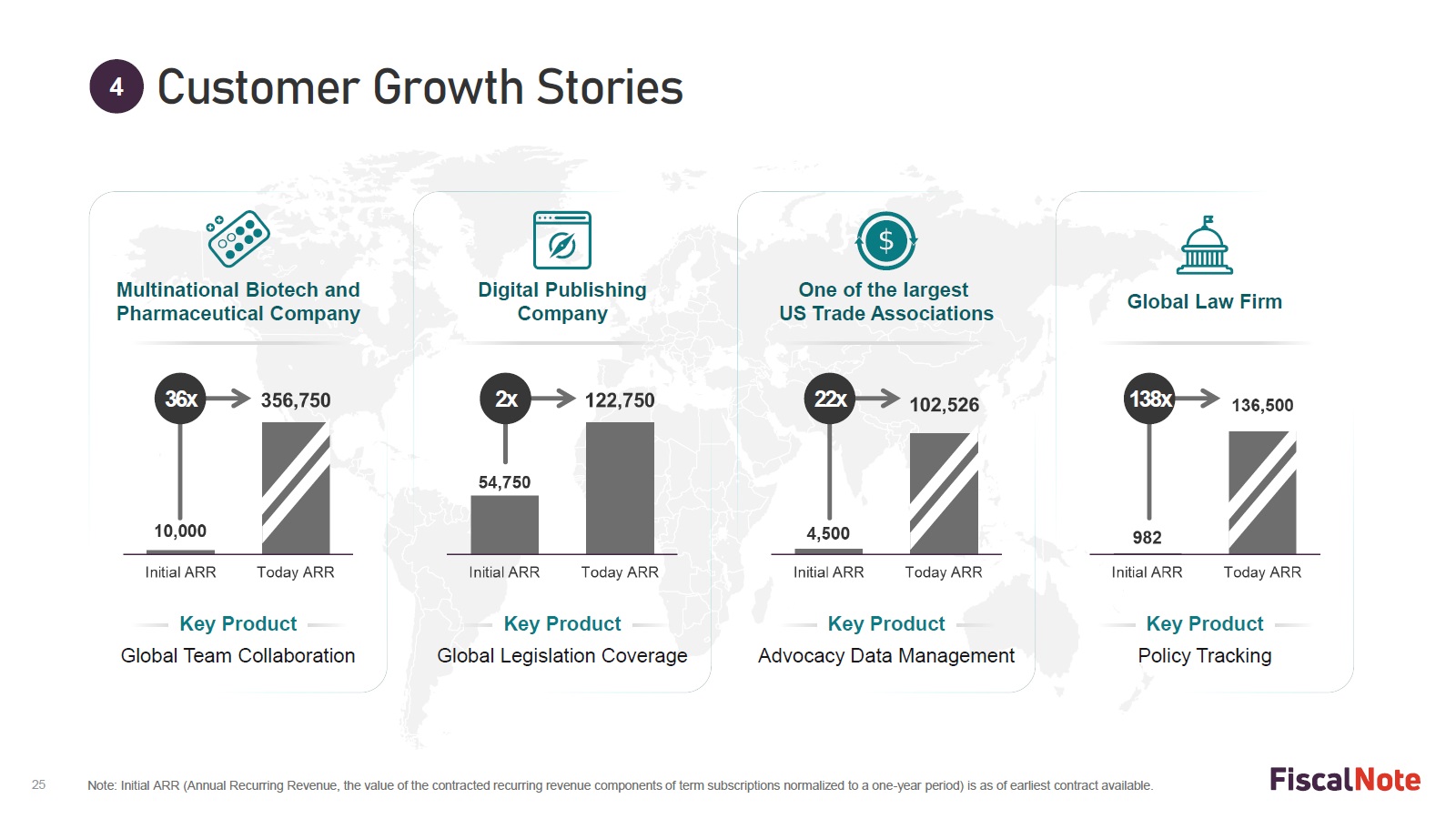

| 25 Multinational Biotech and Pharmaceutical Company One of the largest US Trade Associations Digital Publishing Company Global Law Firm Global Team Collaboration Global Legislation Coverage Advocacy Data Management Policy Tracking Customer Growth Stories 4 Key Product 36x 2x 22x 138x Key Product Key Product Key Product Note: Initial ARR (Annual Recurring Revenue, the value of the contracted recurring revenue components of term subscriptions normalized to a one-year period) is as of earliest contract available. |

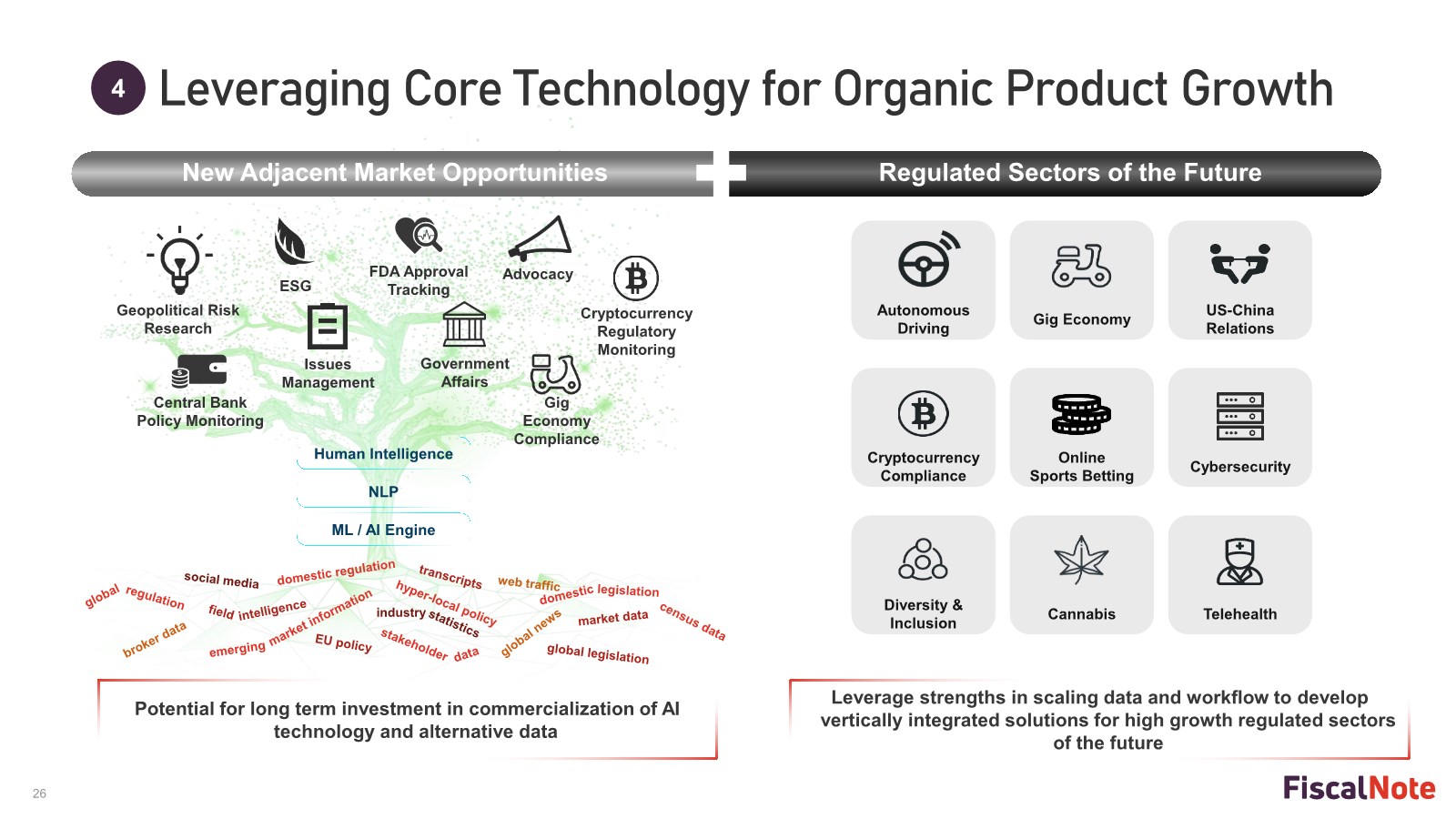

| 26 Leveraging Core Technology for Organic Product Growth 4 New Adjacent Market Opportunities Geopolitical Risk Research Central Bank Policy Monitoring Issues Management ESG FDA Approval Tracking Advocacy Government Affairs Autonomous Driving Gig Economy US-China Relations Human Intelligence ML / AI Engine NLP Diversity & Inclusion Telehealth Cannabis industry Gig Economy Compliance Cryptocurrency Regulatory Monitoring Leverage strengths in scaling data and workflow to develop vertically integrated solutions for high growth regulated sectors of the future Regulated Sectors of the Future Cryptocurrency Compliance Online Sports Betting Cybersecurity Potential for long term investment in commercialization of AI technology and alternative data |

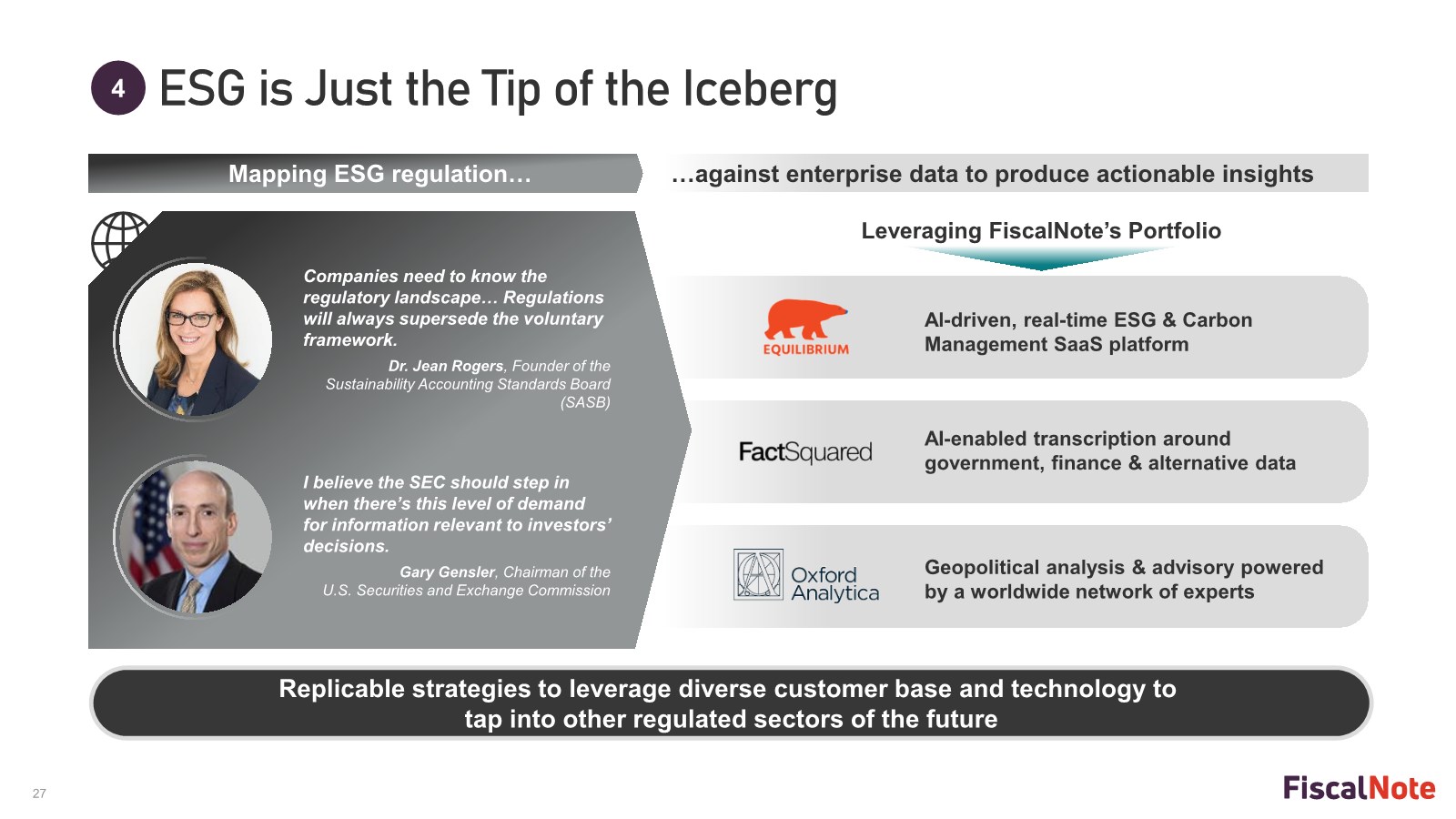

| 27 AI-enabled transcription around government, finance & alternative data Geopolitical analysis & advisory powered by a worldwide network of experts Al-driven, real-time ESG & Carbon Management SaaS platform ESG is Just the Tip of the Iceberg 4 Replicable strategies to leverage diverse customer base and technology to tap into other regulated sectors of the future I believe the SEC should step in when there’s this level of demand for information relevant to investors’ decisions. Gary Gensler, Chairman of the U.S. Securities and Exchange Commission Companies need to know the regulatory landscape… Regulations will always supersede the voluntary framework. Dr. Jean Rogers, Founder of the Sustainability Accounting Standards Board (SASB) Mapping ESG regulation… …against enterprise data to produce actionable insights Leveraging FiscalNote’s Portfolio |

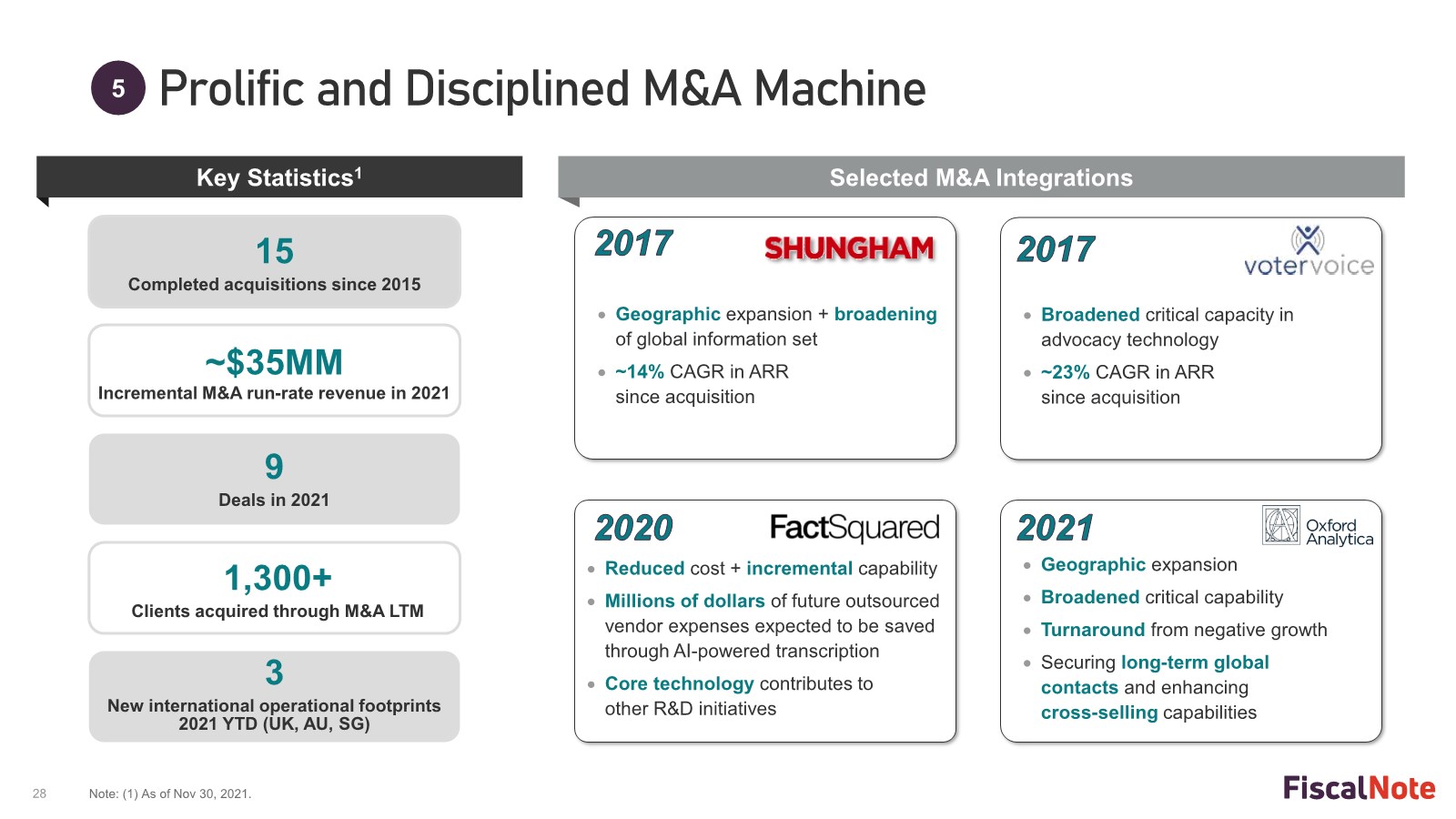

| 28 • Geographic expansion + broadening of global information set • ~14% CAGR in ARR since acquisition Selected M&A Integrations • Broadened critical capacity in advocacy technology • ~23% CAGR in ARR since acquisition • Reduced cost + incremental capability •Millions of dollars of future outsourced vendor expenses expected to be saved through AI-powered transcription • Core technology contributes to other R&D initiatives 15 Completed acquisitions since 2015 9 Deals in 2021 1,300+ Clients acquired through M&A LTM 3 New international operational footprints 2021 YTD (UK, AU, SG) • Geographic expansion • Broadened critical capability • Turnaround from negative growth • Securing long-term global contacts and enhancing cross-selling capabilities Key Statistics1 ~$35MM Incremental M&A run-rate revenue in 2021 Prolific and Disciplined M&A Machine 5 Note: (1) As of Nov 30, 2021. |

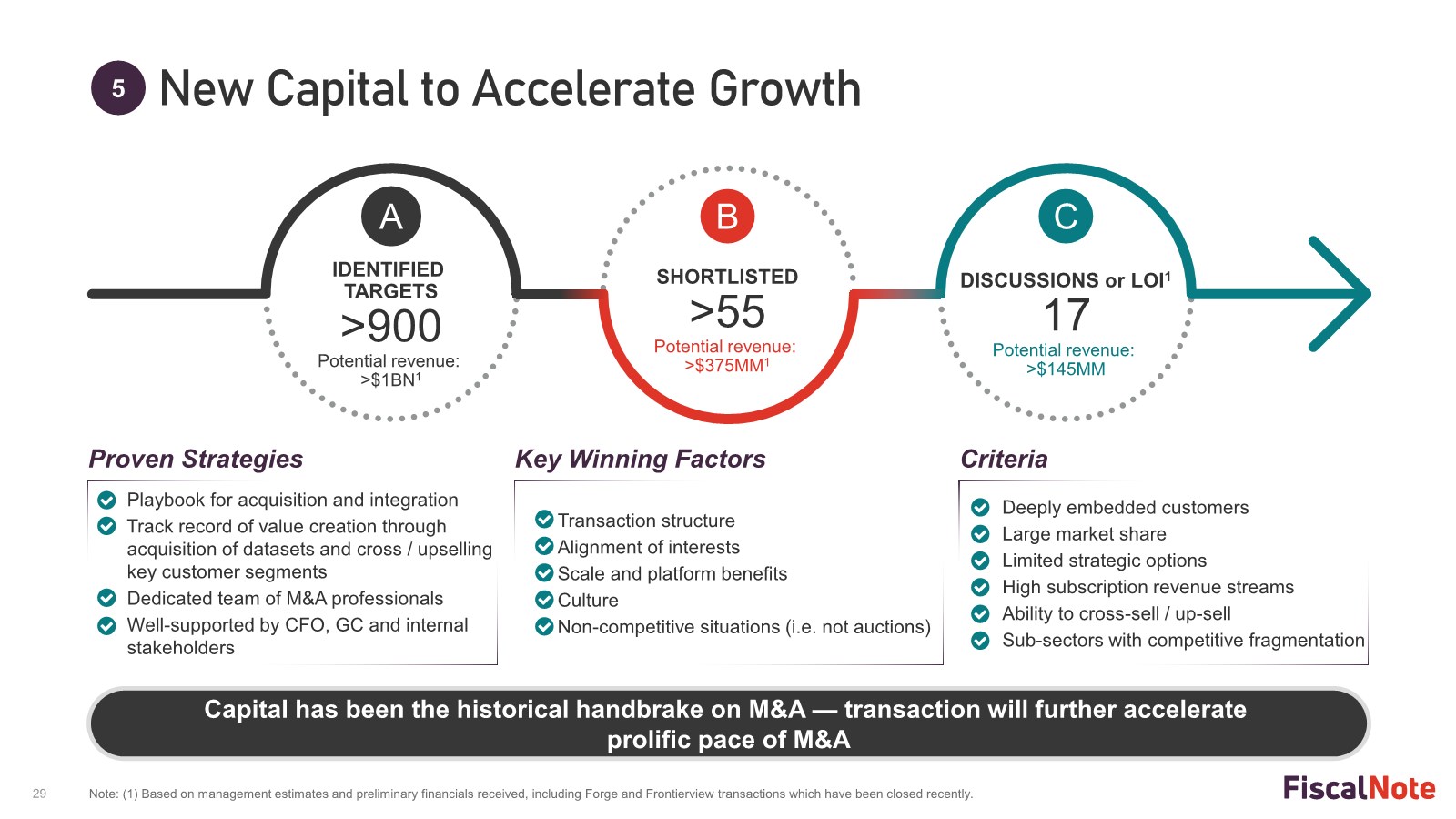

| 29 Transaction structure Alignment of interests Scale and platform benefits Culture Non-competitive situations (i.e. not auctions) Deeply embedded customers Large market share Limited strategic options High subscription revenue streams Ability to cross-sell / up-sell Sub-sectors with competitive fragmentation Note: (1) Based on management estimates and preliminary financials received, including Forge and Frontierview transactions which have been closed recently. Playbook for acquisition and integration Track record of value creation through acquisition of datasets and cross / upselling key customer segments Dedicated team of M&A professionals Well-supported by CFO, GC and internal stakeholders Proven Strategies Key Winning Factors IDENTIFIED TARGETS >900 Potential revenue: >$1BN1 A SHORTLISTED >55 Potential revenue: >$375MM1 B DISCUSSIONS or LOI1 17 Potential revenue: >$145MM C Capital has been the historical handbrake on M&A — transaction will further accelerate prolific pace of M&A Criteria New Capital to Accelerate Growth 5 |

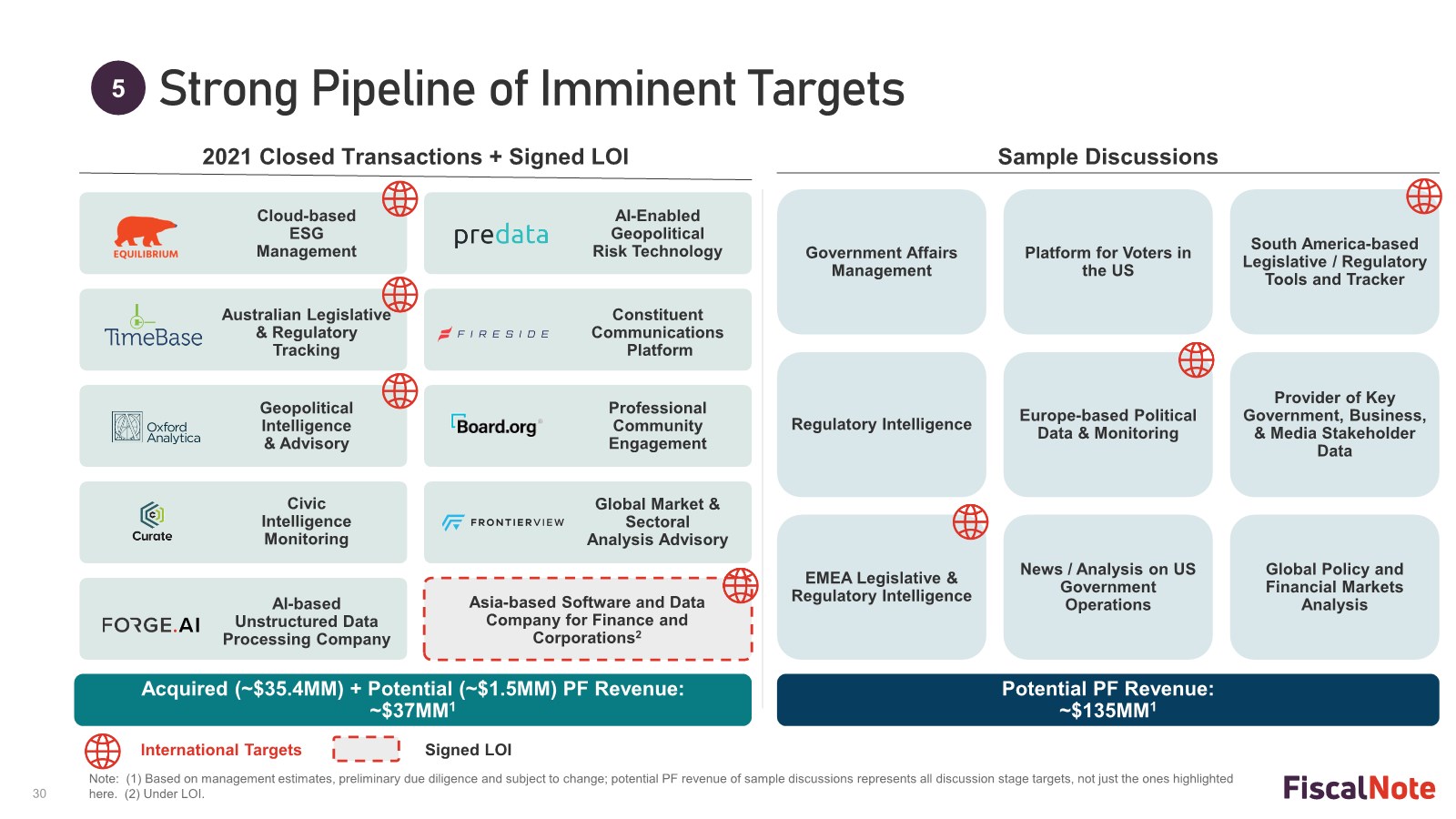

| 30 Acquired (~$35.4MM) + Potential (~$1.5MM) PF Revenue: ~$37MM1 2021 Closed Transactions + Signed LOI Potential PF Revenue: ~$135MM1 Note: (1) Based on management estimates, preliminary due diligence and subject to change; potential PF revenue of sample discussions represents all discussion stage targets, not just the ones highlighted here. (2) Under LOI. Sample Discussions Strong Pipeline of Imminent Targets 5 Government Affairs Management Platform for Voters in the US South America-based Legislative / Regulatory Tools and Tracker Regulatory Intelligence Europe-based Political Data & Monitoring Provider of Key Government, Business, & Media Stakeholder Data EMEA Legislative & Regulatory Intelligence News / Analysis on US Government Operations Global Policy and Financial Markets Analysis International Targets Cloud-based ESG Management AI-Enabled Geopolitical Risk Technology Australian Legislative & Regulatory Tracking Constituent Communications Platform Geopolitical Intelligence & Advisory Civic Intelligence Monitoring Professional Community Engagement Global Market & Sectoral Analysis Advisory AI-based Unstructured Data Processing Company Asia-based Software and Data Company for Finance and Corporations2 Signed LOI |

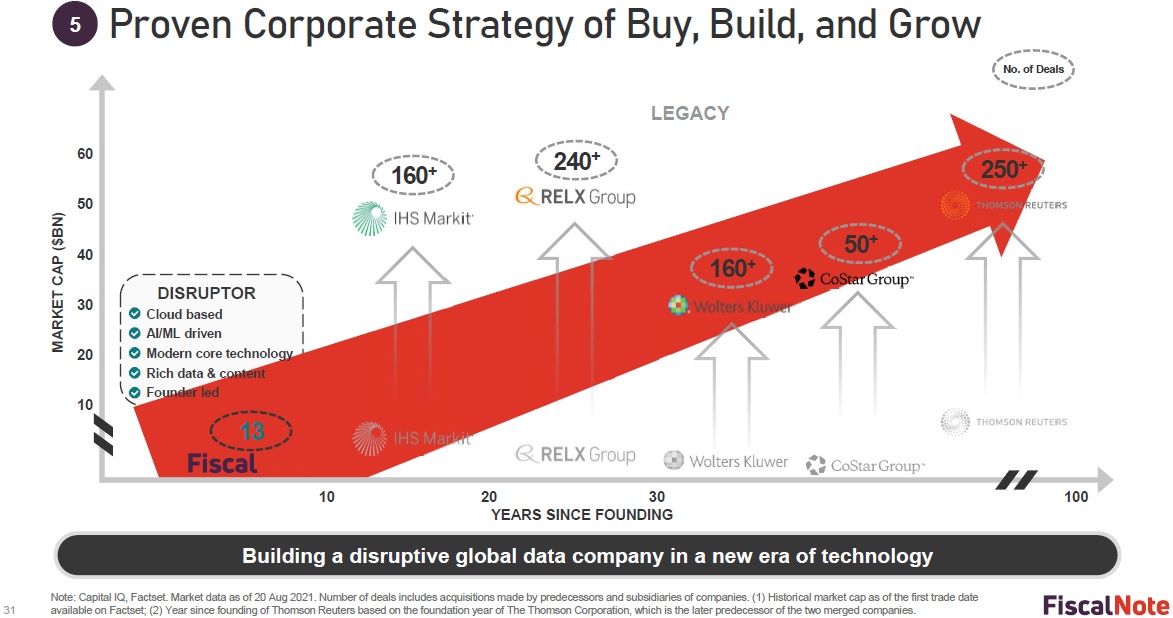

| 31 No. of Deals YEARS SINCE FOUNDING MARKET CAP ($BN ) 30 20 40 50 60 10 10 20 LEGACY 30 100 13 160+ 240+ 160+ 250+ Cloud based AI/ML driven Modern core technology Rich data & content Founder led DISRUPTOR 50+ Note: Capital IQ, Factset. Market data as of 20 Aug 2021. Number of deals includes acquisitions made by predecessors and subsidiaries of companies. (1) Historical market cap as of the first trade date available on Factset; (2) Year since founding of Thomson Reuters based on the foundation year of The Thomson Corporation, which is the later predecessor of the two merged companies. Proven Corporate Strategy of Buy, Build, and Grow 5 Building a disruptive global data company in a new era of technology |

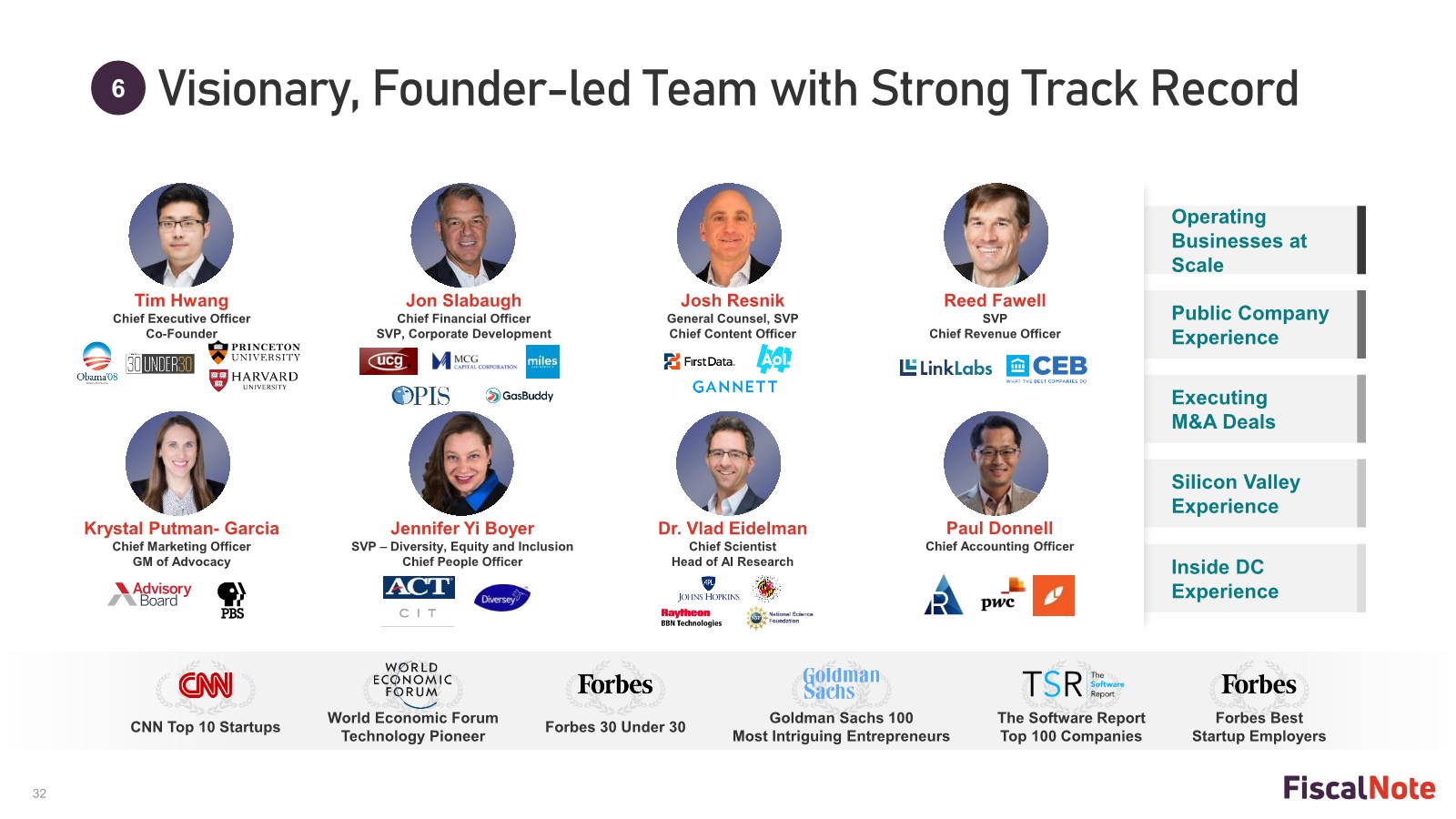

| 32 Operating Businesses at Scale Public Company Experience Executing M&A Deals Silicon Valley Experience Inside DC Experience Reed Fawell SVP Chief Revenue Officer Paul Donnell Chief Accounting Officer Dr. Vlad Eidelman Chief Scientist Head of AI Research Josh Resnik General Counsel, SVP Chief Content Officer Krystal Putman- Garcia Chief Marketing Officer GM of Advocacy Tim Hwang Chief Executive Officer Co-Founder Jennifer Yi Boyer SVP – Diversity, Equity and Inclusion Chief People Officer Jon Slabaugh Chief Financial Officer SVP, Corporate Development CNN Top 10 Startups World Economic Forum Technology Pioneer Forbes 30 Under 30 Goldman Sachs 100 Most Intriguing Entrepreneurs The Software Report Top 100 Companies Forbes Best Startup Employers Visionary, Founder-led Team with Strong Track Record 6 |

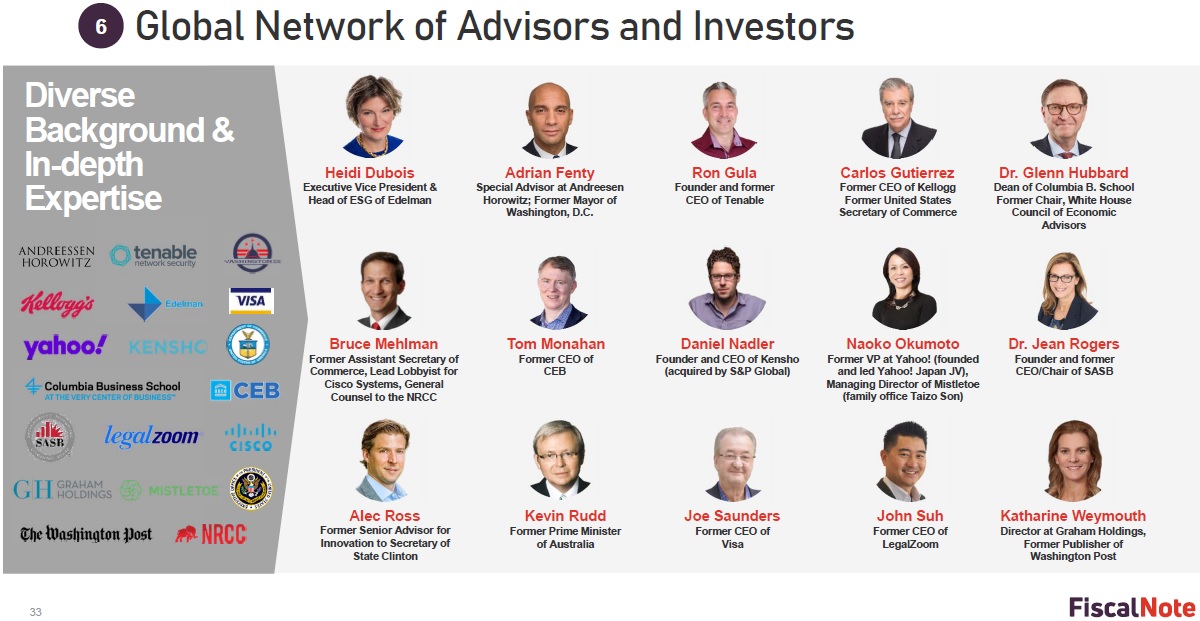

| 33 Diverse Background & In-depth Expertise Adrian Fenty Special Advisor at Andreesen Horowitz; Former Mayor of Washington, D.C. Tom Monahan Former CEO of CEB Kevin Rudd Former Prime Minister of Australia Ron Gula Founder and former CEO of Tenable Daniel Nadler Founder and CEO of Kensho (acquired by S&P Global) Joe Saunders Former CEO of Visa Bruce Mehlman Former Assistant Secretary of Commerce, Lead Lobbyist for Cisco Systems, General Counsel to the NRCC Alec Ross Former Senior Advisor for Innovation to Secretary of State Clinton Katharine Weymouth Director at Graham Holdings, Former Publisher of Washington Post Carlos Gutierrez Former CEO of Kellogg Former United States Secretary of Commerce Naoko Okumoto Former VP at Yahoo! (founded and led Yahoo! Japan JV), Managing Director of Mistletoe (family office Taizo Son) John Suh Former CEO of LegalZoom Dr. Glenn Hubbard Dean of Columbia B. School Former Chair, White House Council of Economic Advisors Dr. Jean Rogers Founder and former CEO/Chair of SASB Heidi Dubois Executive Vice President & Head of ESG of Edelman Global Network of Advisors and Investors 6 |

| 34 >$255MM2 Total funding raised Jerry Yang Mark Cuban Steve Case Note: (1) Visionnaire Ventures is the joint fund between Temasek Holding and Taizo Son; (2) Includes equity, convertible instruments and debt; (3) as of January 2021. 1 Backed by Influential List of Equity Investors and Funds 6 $1.0BN3 Valuation last round |

| 35 Financial Snapshot |

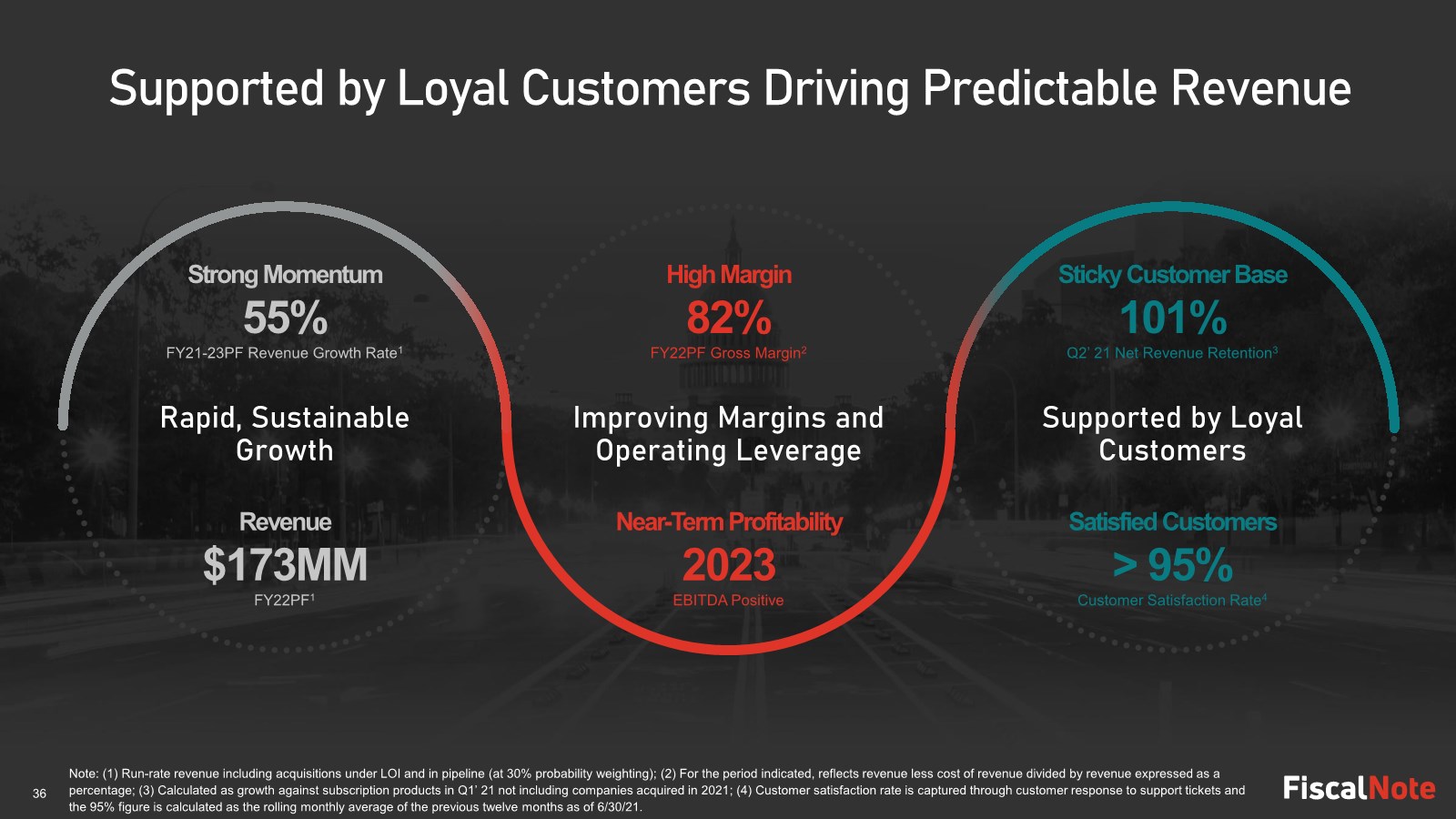

| 36 Supported by Loyal Customers Driving Predictable Revenue Note: (1) Run-rate revenue including acquisitions under LOI and in pipeline (at 30% probability weighting);(2) For the period indicated, reflects revenue less cost of revenue divided by revenue expressed as a percentage; (3) Calculated as growth against subscription products in Q1’ 21 not including companies acquired in 2021;(4) Customer satisfaction rate is captured through customer response to support tickets and the 95% figure is calculated as the rolling monthly average of the previous twelve months as of 6/30/21. Rapid, Sustainable Growth Improving Margins and Operating Leverage Supported by Loyal Customers Strong Momentum 55% FY21-23PF Revenue Growth Rate1 Revenue $173MM FY22PF1 High Margin 82% FY22PF Gross Margin2 Near-Term Profitability 2023 EBITDA Positive Sticky Customer Base 101% Q2’ 21 Net Revenue Retention3 Satisfied Customers > 95% Customer Satisfaction Rate4 |

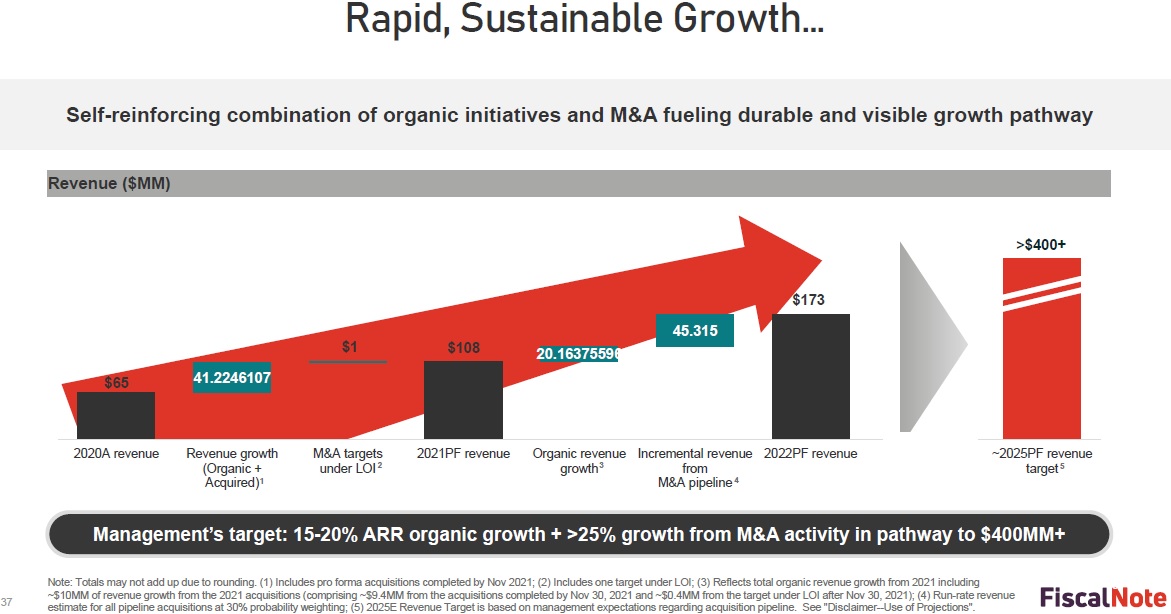

| 37 $65 $108 $173 41.2246107 $1 20.16375596 45.315 2020A revenue Revenue growth (Organic + Acquired) M&A targets under LOI 2021PF revenue Organic revenue growth Incremental revenue from M&A pipeline 2022PF revenue ~2025PF revenue target Self-reinforcing combination of organic initiatives and M&A fueling durable and visible growth pathway 37 Revenue ($MM) >$400+ 1 4 2 Management’s target: 15-20% ARR organic growth + >25% growth from M&A activity in pathway to $400MM+ 5 Rapid, Sustainable Growth… Note: Totals may not add up due to rounding. (1) Includes pro forma acquisitions completed by Nov 2021; (2) Includes one target under LOI; (3) Reflects total organic revenue growth from 2021 including ~$10MM of revenue growth from the 2021 acquisitions (comprising ~$9.4MM from the acquisitions completed by Nov 30, 2021 and ~$0.4MM from the target under LOI after Nov 30, 2021); (4) Run-rate revenue estimate for all pipeline acquisitions at 30% probability weighting; (5) 2025E Revenue Target is based on management expectations regarding acquisition pipeline. See "Disclaimer--Use of Projections". +63% 3 |

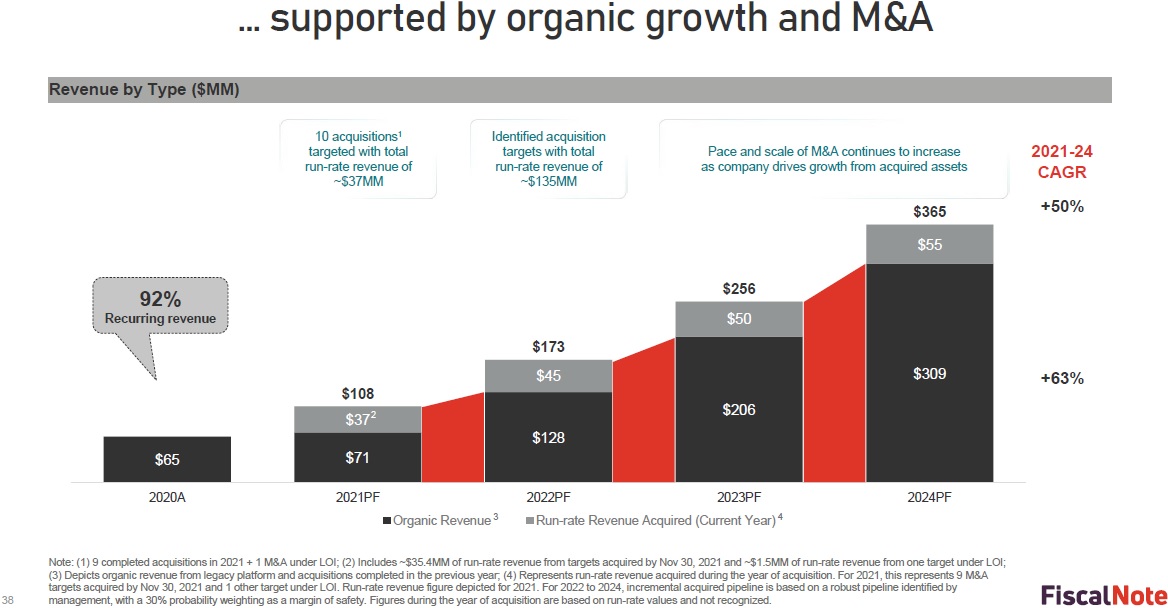

| 38 $65 $71 $128 $206 $309 $37 $45 $50 $55 $108 $173 $256 $365 2020A 2021PF 2022PF 2023PF 2024PF Organic Revenue Run-rate Revenue Acquired (Current Year) 92% Recurring revenue +63% 2021-24 CAGR 2 +50% Note: (1) 9 completed acquisitions in 2021 + 1 M&A under LOI; (2) Includes ~$35.4MM of run-rate revenue from targets acquired by Nov 30, 2021 and ~$1.5MM of run-rate revenue from one target under LOI; (3) Depicts organic revenue from legacy platform and acquisitions completed in the previous year; (4) Represents run-rate revenue acquired during the year of acquisition. For 2021, this represents 9 M&A targets acquired by Nov 30, 2021 and 1 other target under LOI. Run-rate revenue figure depicted for 2021. For 2022 to 2024, incremental acquired pipeline is based on a robust pipeline identified by management, with a 30% probability weighting as a margin of safety. Figures during the year of acquisition are based on run-rate values and not recognized. … supported by organic growth and M&A Revenue by Type ($MM) 3 4 10 acquisitions1 targeted with total run-rate revenue of ~$37MM Identified acquisition targets with total run-rate revenue of ~$135MM Pace and scale of M&A continues to increase as company drives growth from acquired assets 2 |

| 39 A Highly Efficient Business Model at Scale Gross Margin1 Sales & Marketing Research & Development Editorial General & Administrative EBITDA Margin 82% 31% 25% 20% 27% (21%) ~88% ~20% ~13% ~12% ~12% ~30% High incremental margins Seller productivity; using automation for sales operations and CRM Unified platform for quicker integration of new products/acquisitions Economies of scale in editorial and licensing Focus on operational excellence and M&A synergies FY21E Long-term Scale (Expected) Key Drivers + ~10-15% Organic Growth =Rule of 40% 51% contribution margin 68% contribution margin Note: (1) For the period indicated, reflects revenue less cost of revenue divided by revenue expressed as a percentage. |

| 40 Valuation Overview |

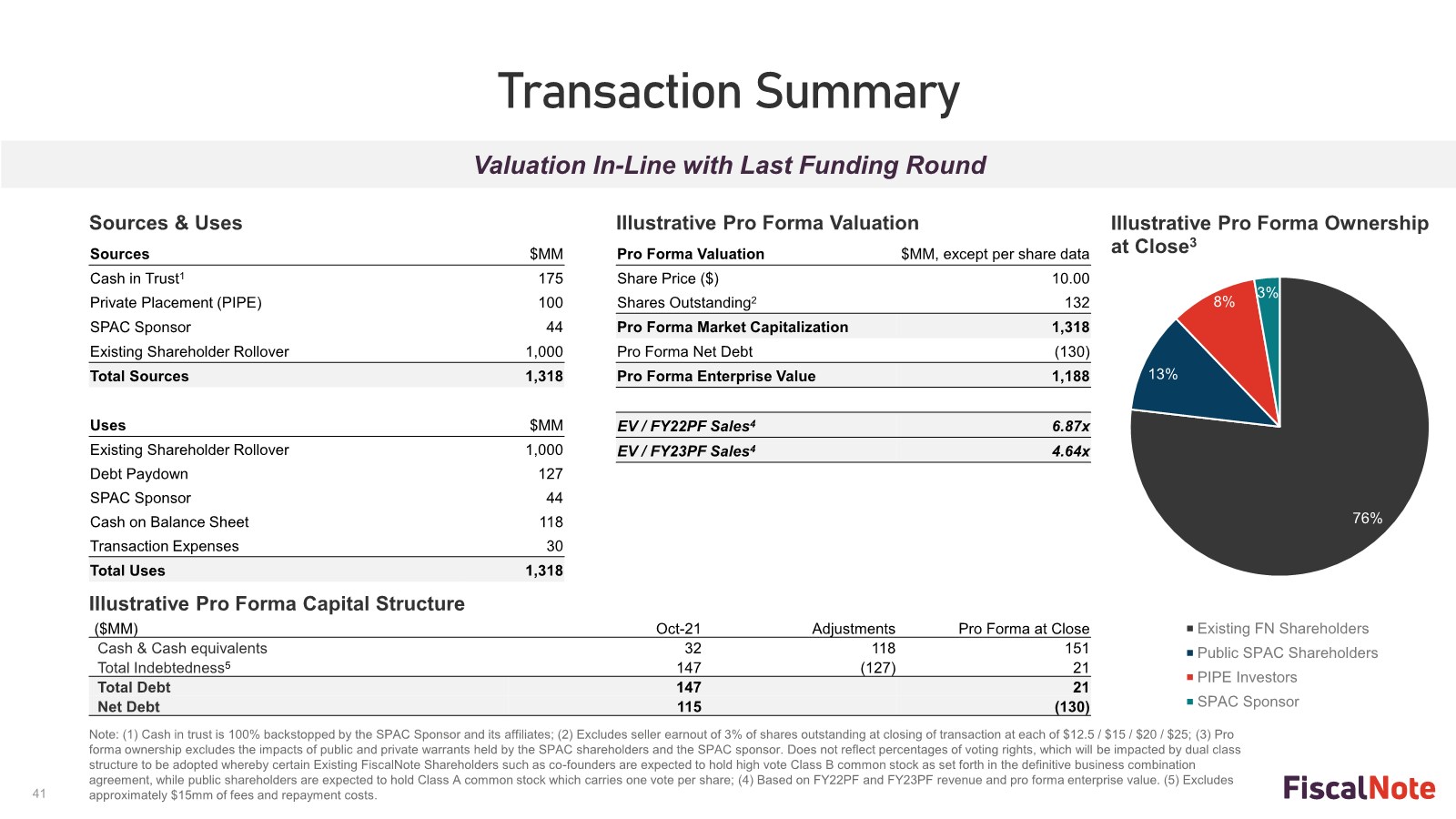

| 41 Sources & Uses Transaction Summary Illustrative Pro Forma Capital Structure Illustrative Pro Forma Valuation Illustrative Pro Forma Ownership at Close3 Sources $MM Cash in Trust1 175 Private Placement (PIPE) 100 SPAC Sponsor 44 Existing Shareholder Rollover 1,000 Total Sources 1,318 Uses $MM Existing Shareholder Rollover 1,000 Debt Paydown 127 SPAC Sponsor 44 Cash on Balance Sheet 118 Transaction Expenses 30 Total Uses 1,318 Pro Forma Valuation $MM, except per share data Share Price ($) 10.00 Shares Outstanding2 132 Pro Forma Market Capitalization 1,318 Pro Forma Net Debt (130) Pro Forma Enterprise Value 1,188 EV / FY22PF Sales4 6.87x EV / FY23PF Sales4 4.64x ($MM) Oct-21 Adjustments Pro Forma at Close Cash & Cash equivalents 32 118 151 Total Indebtedness5 147 (127) 21 Total Debt 147 21 Net Debt 115 (130) Note: (1) Cash in trust is 100% backstopped by the SPAC Sponsor and its affiliates; (2) Excludes seller earnout of 3% of shares outstanding at closing of transaction at each of $12.5 / $15 / $20 / $25; (3) Pro forma ownership excludes the impacts of public and private warrants held by the SPAC shareholders and the SPAC sponsor. Does not reflect percentages of voting rights, which will be impacted by dual class structure to be adopted whereby certain Existing FiscalNote Shareholders such as co-founders are expected to hold high vote Class B common stock as set forth in the definitive business combination agreement, while public shareholders are expected to hold Class A common stock which carries one vote per share; (4) Based on FY22PF and FY23PF revenue and pro forma enterprise value. (5) Excludes approximately $15mm of fees and repayment costs. 76% 13% 8% 3% Existing FN Shareholders Public SPAC Shareholders PIPE Investors SPAC Sponsor Valuation In-Line with Last Funding Round |

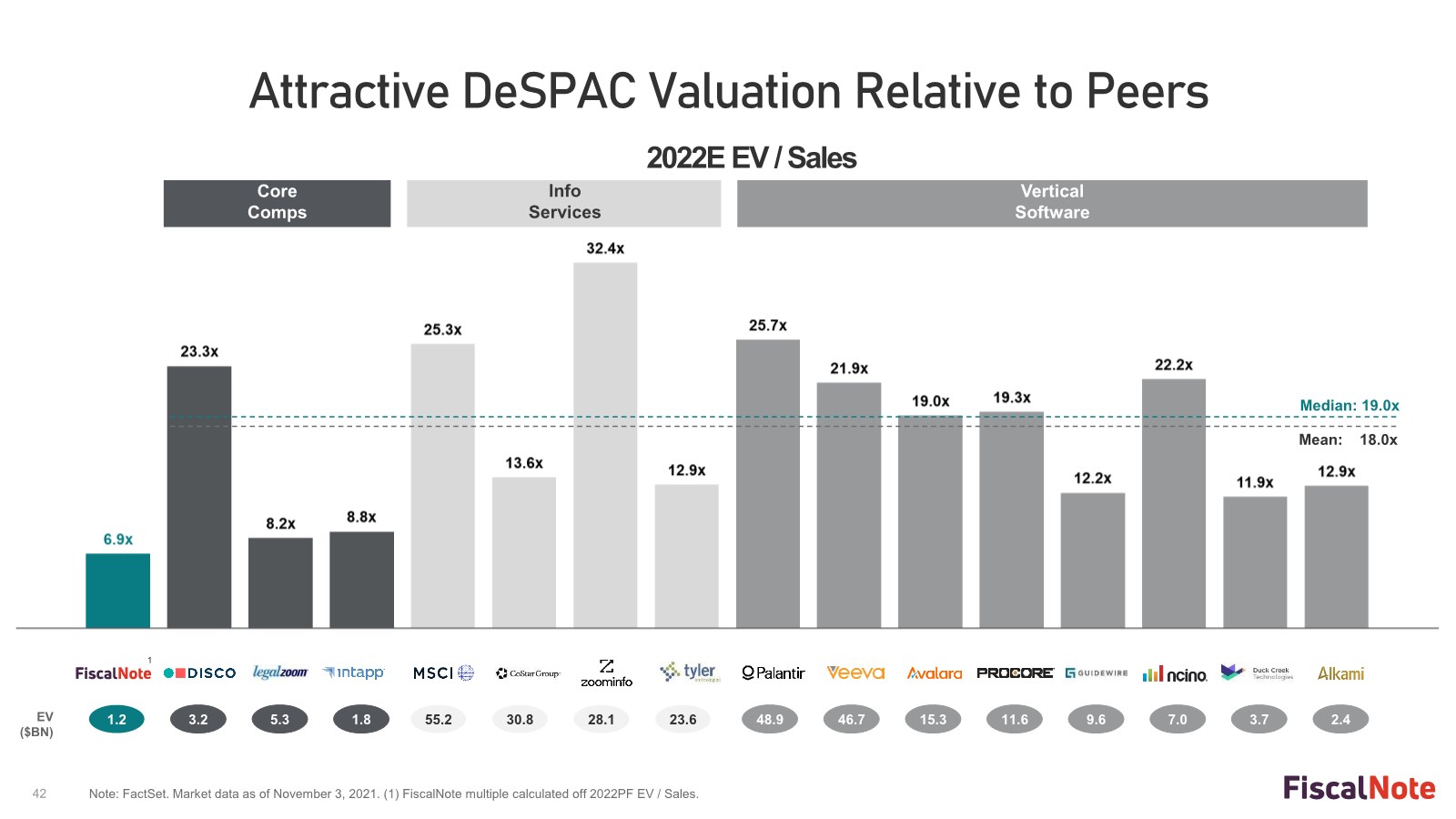

| 42 Attractive DeSPAC Valuation Relative to Peers Note: FactSet. Market data as of November 3, 2021. (1) FiscalNote multiple calculated off 2022PF EV / Sales. Median: 19.0x Mean: 18.0x 2022E EV / Sales Vertical Software Info Services Core Comps 1 EV ($BN) 1.2 1.8 3.2 5.3 48.9 46.7 15.3 11.6 9.6 7.0 3.7 2.4 55.2 28.1 23.6 30.8 |

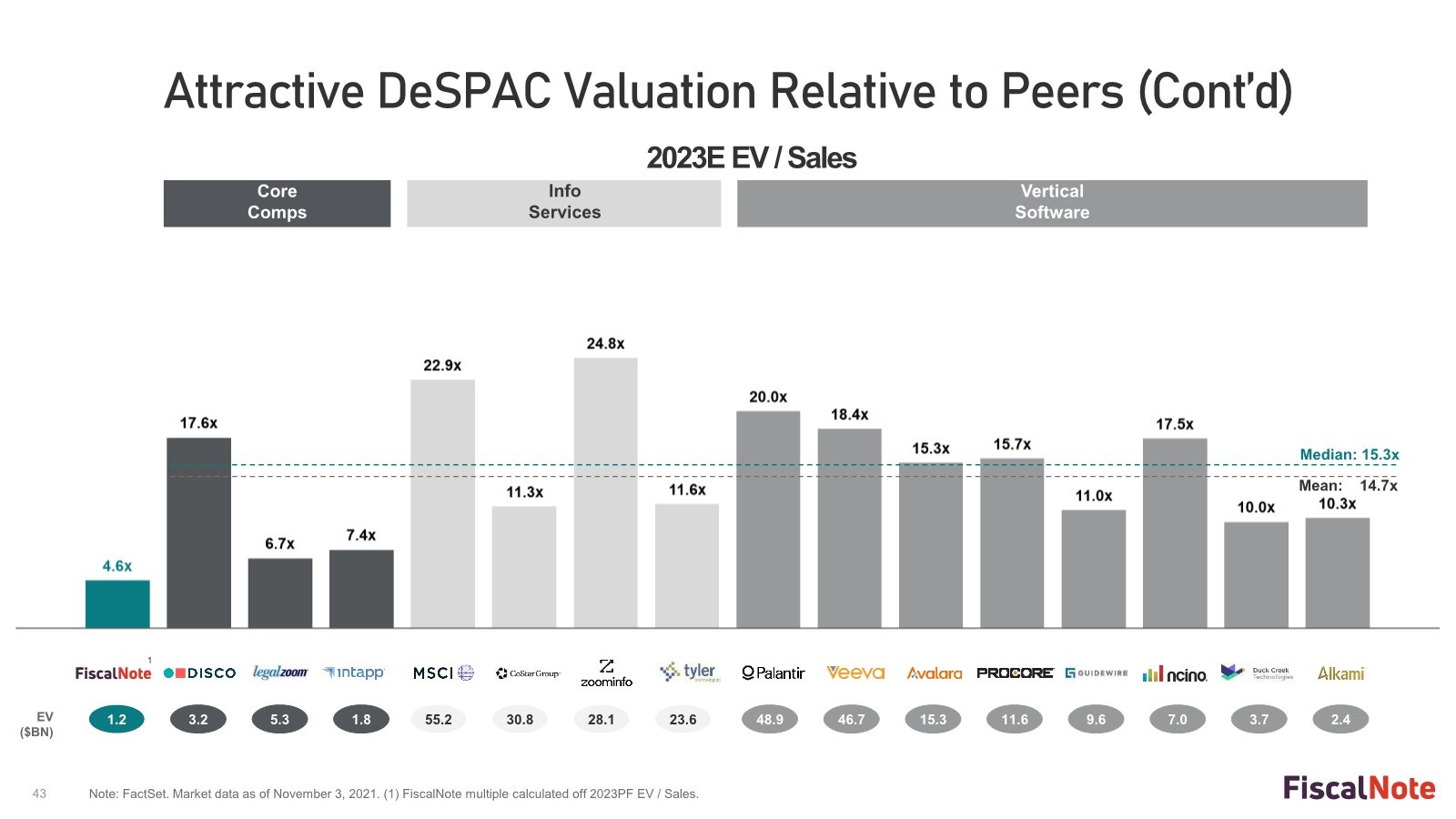

| 43 Attractive DeSPAC Valuation Relative to Peers (Cont’d) Note: FactSet. Market data as of November 3, 2021. (1) FiscalNote multiple calculated off 2023PF EV / Sales. 2023E EV / Sales Median: 15.3x Mean: 14.7x Vertical Software Info Services Core Comps EV ($BN) 1.2 1.8 3.2 5.3 48.9 46.7 15.3 11.6 9.6 7.0 3.7 2.4 55.2 28.1 23.6 30.8 1 |

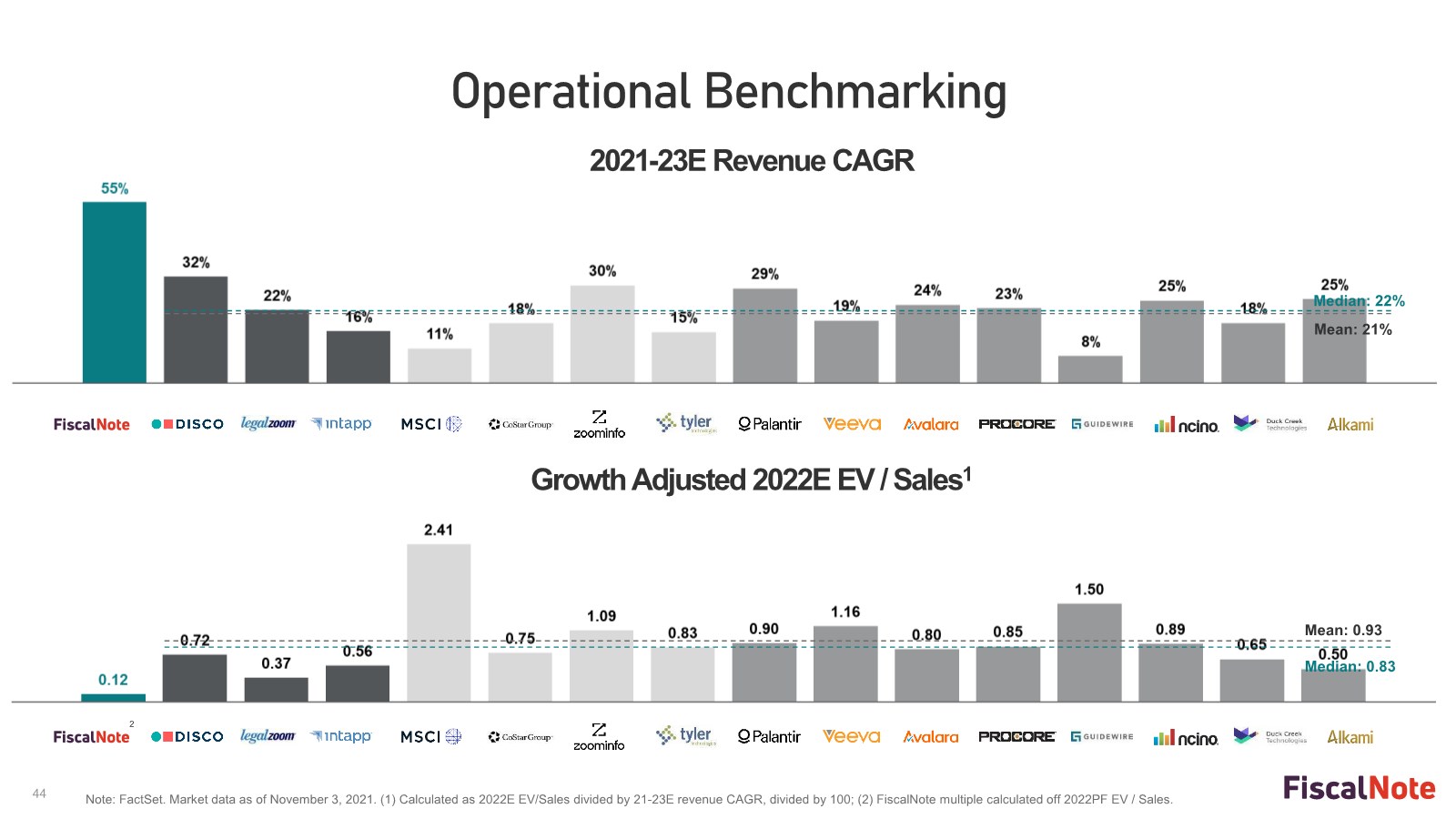

| 44 Operational Benchmarking Note: FactSet. Market data as of November 3, 2021. (1) Calculated as 2022E EV/Sales divided by 21-23E revenue CAGR, divided by 100; (2) FiscalNote multiple calculated off 2022PF EV / Sales. Growth Adjusted 2022E EV / Sales1 2021-23E Revenue CAGR Median: 22% Mean: 21% Median: 0.83 Mean: 0.93 2 |

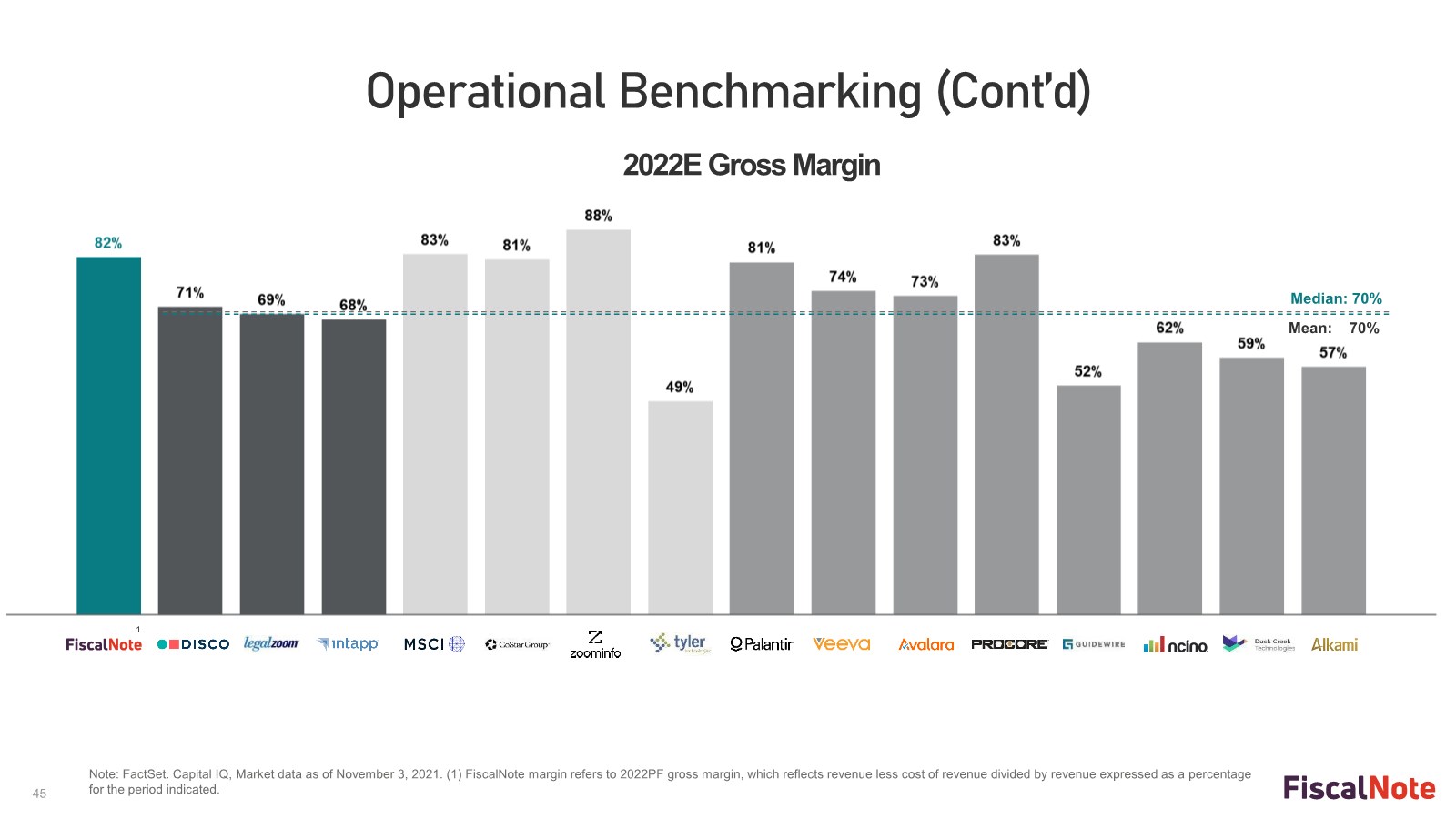

| 45 Operational Benchmarking (Cont’d) Note: FactSet. Capital IQ, Market data as of November 3, 2021. (1) FiscalNote margin refers to 2022PF gross margin, which reflects revenue less cost of revenue divided by revenue expressed as a percentage for the period indicated. 2022E Gross Margin Median: 70% Mean: 70% 1 |

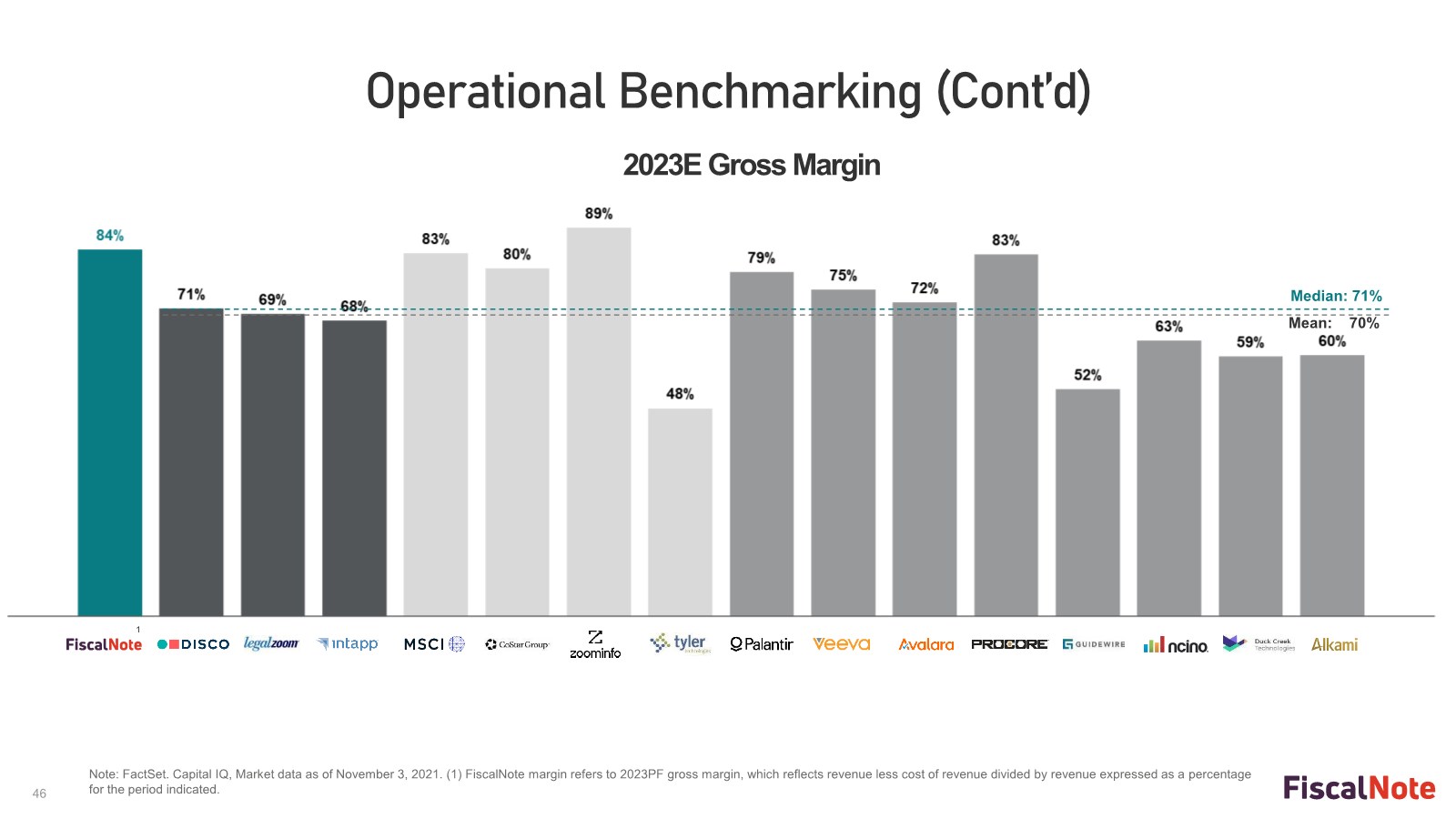

| 46 Operational Benchmarking (Cont’d) Note: FactSet. Capital IQ, Market data as of November 3, 2021. (1) FiscalNote margin refers to 2023PF gross margin, which reflects revenue less cost of revenue divided by revenue expressed as a percentage for the period indicated. 2023E Gross Margin Median: 71% Mean: 70% 1 |

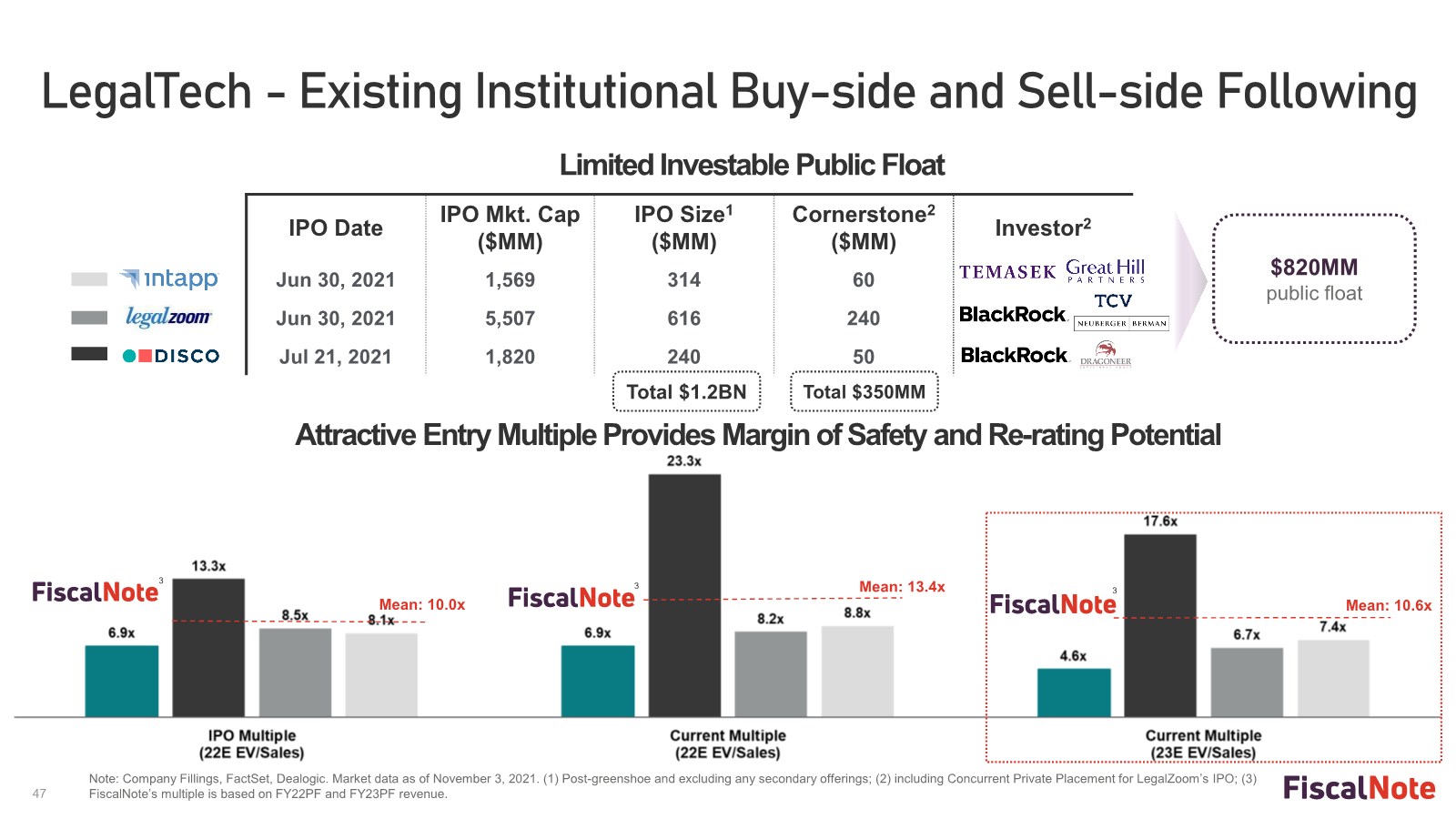

| 47 IPO Date IPO Mkt. Cap ($MM) IPO Size1 ($MM) Cornerstone2 ($MM) Investor2 Jun 30, 2021 1,569 314 60 Jun 30, 2021 5,507 616 240 Jul 21, 2021 1,820 240 50 LegalTech - Existing Institutional Buy-side and Sell-side Following Attractive Entry Multiple Provides Margin of Safety and Re-rating Potential Limited Investable Public Float $820MM public float Total $1.2BN Total $350MM Note: Company Fillings, FactSet, Dealogic. Market data as of November 3, 2021. (1) Post-greenshoe and excluding any secondary offerings; (2) including Concurrent Private Placement for LegalZoom’s IPO; (3) FiscalNote’s multiple is based on FY22PF and FY23PF revenue. Mean: 10.0x Mean: 13.4x 3 Mean: 10.6x 3 3 |

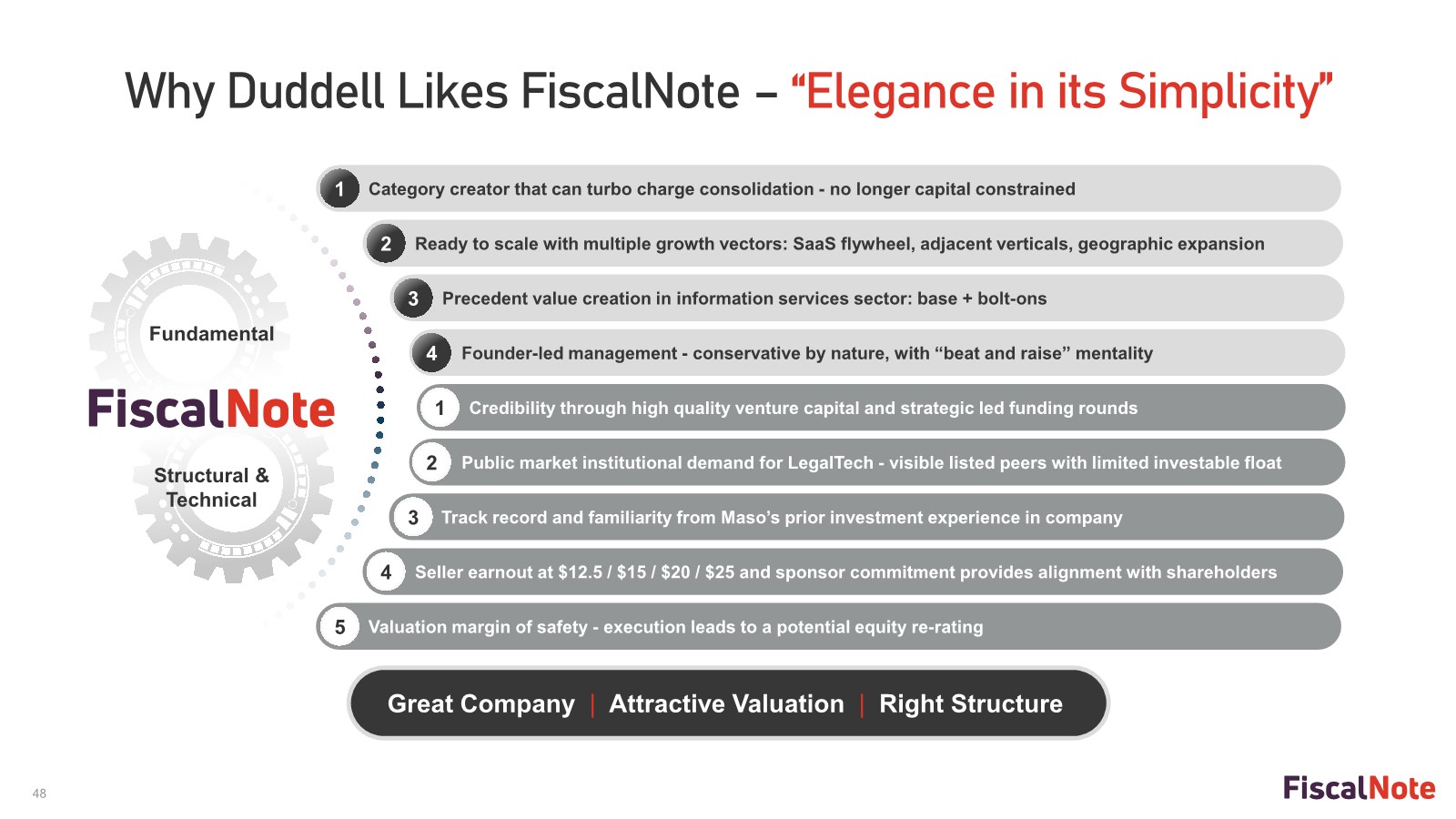

| 48 Category creator that can turbo charge consolidation - no longer capital constrained Ready to scale with multiple growth vectors: SaaS flywheel, adjacent verticals, geographic expansion Precedent value creation in information services sector: base + bolt-ons Founder-led management - conservative by nature, with “beat and raise” mentality Credibility through high quality venture capital and strategic led funding rounds Public market institutional demand for LegalTech - visible listed peers with limited investable float Track record and familiarity from Maso’s prior investment experience in company Seller earnout at $12.5 / $15 / $20 / $25 and sponsor commitment provides alignment with shareholders Valuation margin of safety - execution leads to a potential equity re-rating Why Duddell Likes FiscalNote –“Elegance in its Simplicity” Great Company | Attractive Valuation | Right Structure Fundamental Structural & Technical 1 2 3 4 1 2 3 4 5 |

| 49 Thank You |

| 50 Appendix |

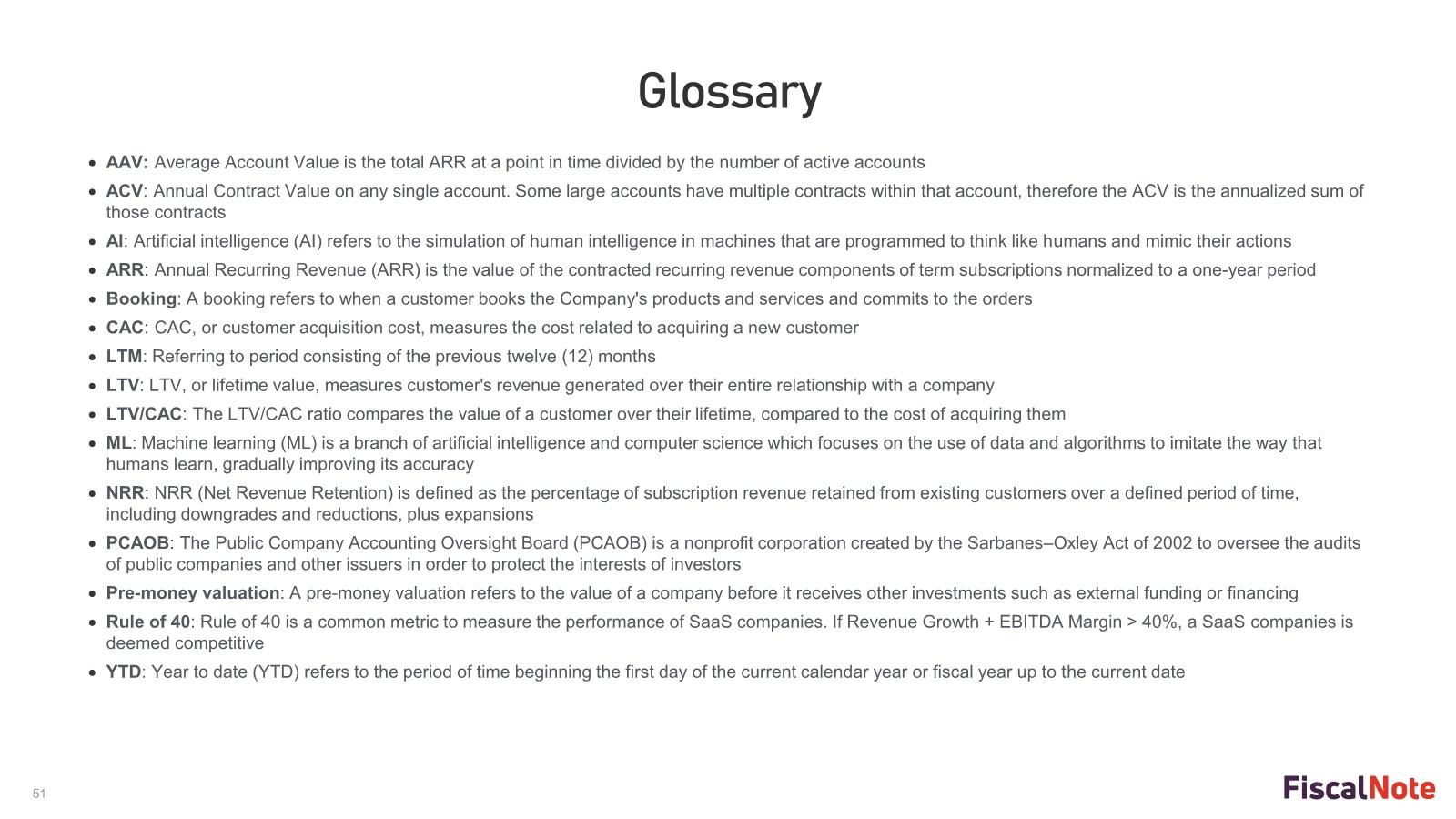

| 51 • AAV: Average Account Value is the total ARR at a point in time divided by the number of active accounts • ACV: Annual Contract Value on any single account. Some large accounts have multiple contracts within that account, therefore the ACV is the annualized sum of those contracts • AI: Artificial intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions • ARR: Annual Recurring Revenue (ARR) is the value of the contracted recurring revenue components of term subscriptions normalized to a one-year period • Booking: A booking refers to when a customer books the Company's products and services and commits to the orders • CAC: CAC, or customer acquisition cost, measures the cost related to acquiring a new customer • LTM: Referring to period consisting of the previous twelve (12) months • LTV: LTV, or lifetime value, measures customer's revenue generated over their entire relationship with a company • LTV/CAC: The LTV/CAC ratio compares the value of a customer over their lifetime, compared to the cost of acquiring them • ML: Machine learning (ML) is a branch of artificial intelligence and computer science which focuses on the use of data and algorithms to imitate the way that humans learn, gradually improving its accuracy • NRR: NRR (Net Revenue Retention) is defined as the percentage of subscription revenue retained from existing customers over a defined period of time, including downgrades and reductions, plus expansions • PCAOB: The Public Company Accounting Oversight Board (PCAOB) is a nonprofit corporation created by the Sarbanes–Oxley Act of 2002 to oversee the audits of public companies and other issuers in order to protect the interests of investors • Pre-money valuation: A pre-money valuation refers to the value of a company before it receives other investments such as external funding or financing • Rule of 40: Rule of 40 is a common metric to measure the performance of SaaS companies. If Revenue Growth + EBITDA Margin > 40%, a SaaS companies is deemed competitive • YTD: Year to date (YTD) refers to the period of time beginning the first day of the current calendar year or fiscal year up to the current date Glossary |

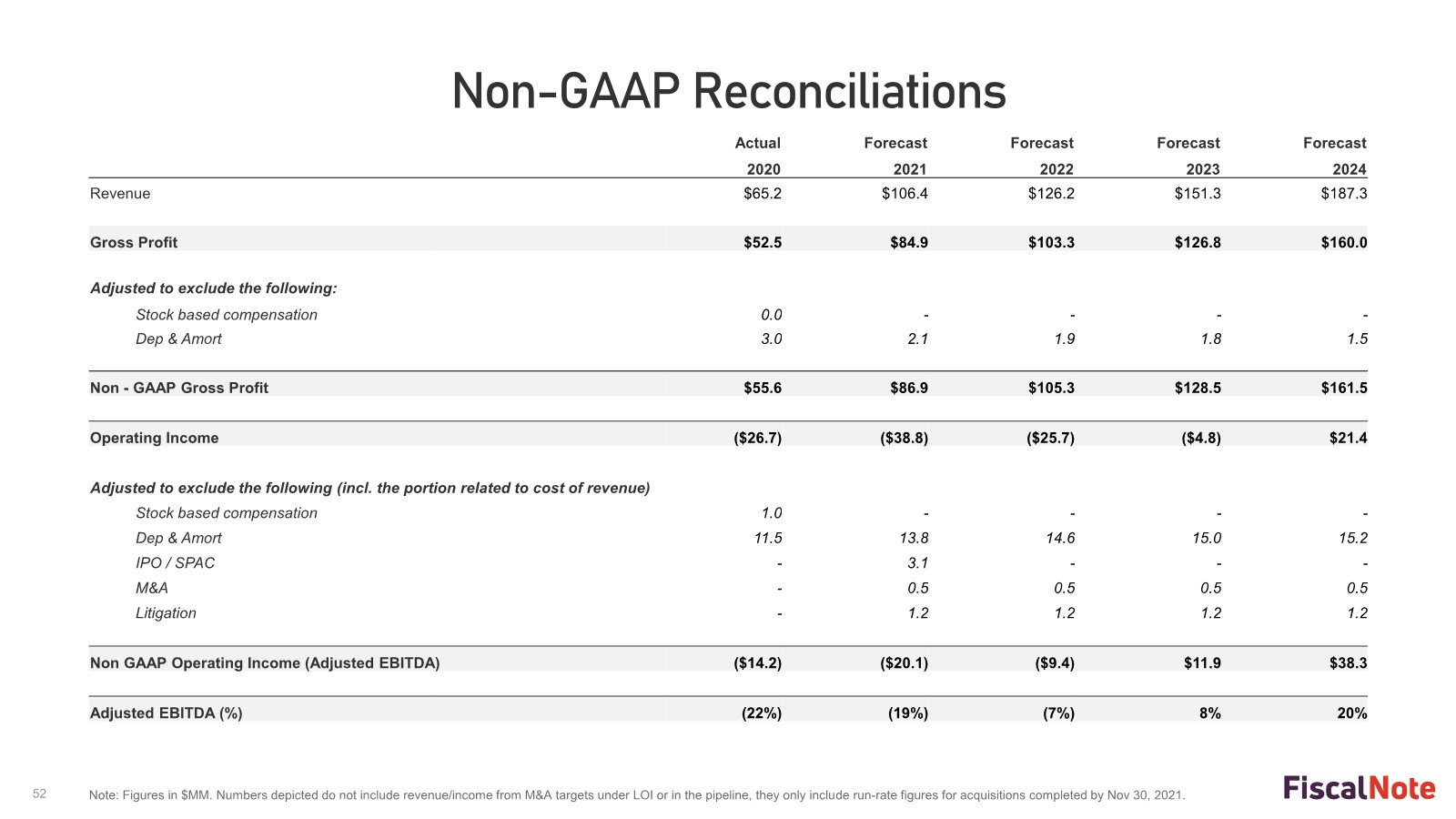

| 52 Non-GAAP Reconciliations Note: Figures in $MM. Numbers depicted do not include revenue/income from M&A targets under LOI or in the pipeline, they only include run-rate figures for acquisitions completed by Nov 30, 2021. Actual Forecast Forecast Forecast Forecast 2020 2021 2022 2023 2024 Revenue $65.2 $106.4 $126.2 $151.3 $187.3 Gross Profit $52.5 $84.9 $103.3 $126.8 $160.0 Adjusted to exclude the following: Stock based compensation 0.0 ---- Dep & Amort 3.0 2.1 1.9 1.8 1.5 Non - GAAP Gross Profit $55.6 $86.9 $105.3 $128.5 $161.5 Operating Income ($26.7) ($38.8) ($25.7) ($4.8) $21.4 Adjusted to exclude the following (incl. the portion related to cost of revenue) Stock based compensation 1.0 ---- Dep & Amort 11.5 13.8 14.6 15.0 15.2 IPO / SPAC - 3.1 --- M&A - 0.5 0.5 0.5 0.5 Litigation - 1.2 1.2 1.2 1.2 Non GAAP Operating Income (Adjusted EBITDA) ($14.2) ($20.1) ($9.4) $11.9 $38.3 Adjusted EBITDA (%) (22%) (19%) (7%) 8% 20% |

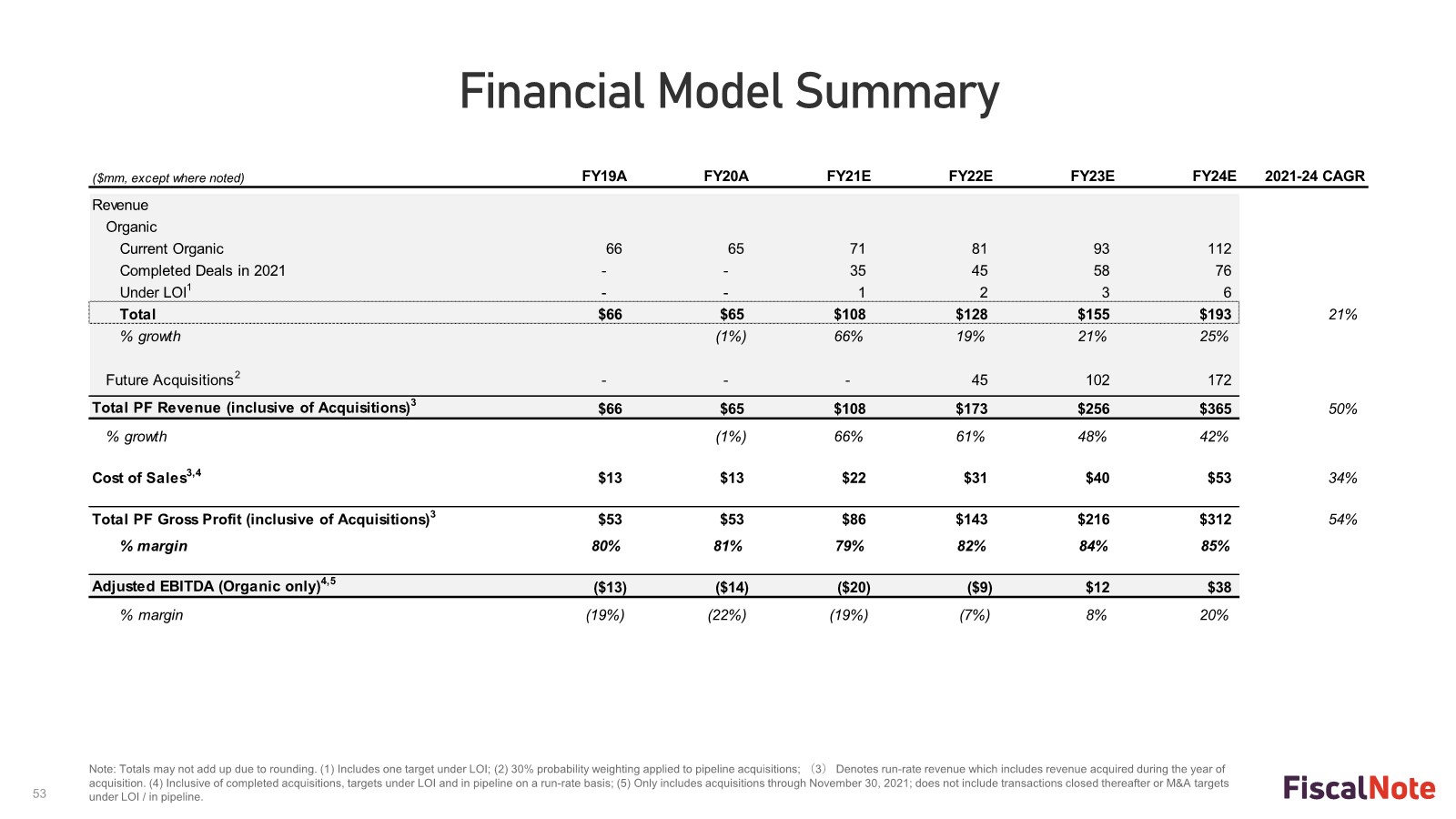

| 53 Financial Model Summary Note: Totals may not add up due to rounding. (1) Includes one target under LOI; (2) 30% probability weighting applied to pipeline acquisitions; (3) Denotes run-rate revenue which includes revenue acquired during the year of acquisition. (4) Inclusive of completed acquisitions, targets under LOI and in pipeline on a run-rate basis; (5) Only includes acquisitions through November 30, 2021; does not include transactions closed thereafter or M&A targets under LOI / in pipeline. ($mm, except where noted) FY19A FY20A FY21E FY22E FY23E FY24E 2021-24 CAGR Revenue Organic Current Organic 66 65 71 81 93 112 Completed Deals in 2021 - - 35 45 58 76 Under LOI1 - - 1 2 3 6 Total $66 $65 $108 $128 $155 $193 21% % growth (1%) 66% 19% 21% 25% Future Acquisitions2 - - - 45 102 172 Total PF Revenue (inclusive of Acquisitions)3 $66 $65 $108 $173 $256 $365 50% % growth (1%) 66% 61% 48% 42% Cost of Sales3,4 $13 $13 $22 $31 $40 $53 34% Total PF Gross Profit (inclusive of Acquisitions)3 $53 $53 $86 $143 $216 $312 54% % margin 80% 81% 79% 82% 84% 85% Adjusted EBITDA (Organic only)4,5 ($13) ($14) ($20) ($9) $12 $38 % margin (19%) (22%) (19%) (7%) 8% 20% |

| 54 Risks Related to FiscalNote’s Business • FiscalNote has recently experienced rapid growth that may not be indicative of future growth, which makes it difficult to forecast its revenue and evaluate its business and prospects. • If FiscalNote fails to manage its growth effectively, its business, financial condition, results of operations and prospects could be materially and adversely affected. • FiscalNote has a history of net losses, anticipates increasing operating expenses in the future, and may not be able to achieve and, if achieved, maintain profitability. • FiscalNote generates a significant percentage of its revenues from recurring subscription-based arrangements, and if it is unable to maintain a high renewal rate, its business, financial condition, results of operations and prospects could be materially and adversely affected. • If FiscalNote is unable to attract new customers, retain existing customers, expand its products and services offerings with existing customers, expand into new geographic markets or identify areas of higher growth, its revenue growth and profitability will be harmed. • FiscalNote’s efforts to expand its service offerings and to develop and integrate its existing services in order to keep pace with policy, regulatory, political and technological developments may not succeed. • A principal focus of FiscalNote’s business strategy is to grow and expand its business through acquisitions. FiscalNote may not be able to successfully identify attractive acquisition opportunities or make acquisitions on terms that are satisfactory to it from a commercial perspective. • FiscalNote may not realize expected business or financial benefits from acquisitions or integrate acquired businesses in an efficient and effective manner, or such acquisitions could divert management’s attention, increase capital requirements or dilute stockholder value and materially and adversely affect FiscalNote’s business, financial condition, results of operations and prospects. • FiscalNote recognizes revenues over the term of the agreements for its subscriptions and, as a result, there is often a lag in realizing the impact of current sales or cancellations in reported revenues by FiscalNote, and a significant downturn in FiscalNote’s business may not be reflected immediately in its operating results. • FiscalNote’s sales cycles are variable, depend upon factors outside its control, and could cause it to expend significant time and resources prior to generating revenues. • FiscalNote may experience fluctuations in its quarterly and annual operating results. • If FiscalNote has overestimated the size of its total addressable market, FiscalNote’s future growth rate may be limited. • FiscalNote relies on third parties, including public sources, for data, information and other products and services, and FiscalNote’s relationships with such third parties may not be successful or may change, which could adversely affect its results of operations. • If FiscalNote is not able to obtain and maintain accurate, comprehensive, or reliable data, it could experience reduced demand for its products and services. • FiscalNote’s CQ Roll Call business currently relies on sources of revenues that have been, and likely will continue to be, negatively affected by digital commerce and media. • FiscalNote’s ability to introduce new features, integrations, capabilities, and enhancements is dependent on adequate research and development resources. If FiscalNote does not adequately fund its research and development efforts, or if its research and development investments do not translate into material enhancements to its products and services, FiscalNote may not be able to compete effectively, and its business, financial condition, results of operations and prospects may be adversely affected. • FiscalNote’s ability to introduce new features, integrations, capabilities, and enhancements is dependent on adequate research and development resources. If FiscalNote does not adequately fund its research and development efforts, or if its research and development investments do not translate into material enhancements to its products and services, FiscalNote may not be able to compete effectively, and its business, financial condition, results of operations and prospects may be adversely affected. • Increased accessibility to free or relatively inexpensive information sources that offer comparable value to customers may reduce demand for FiscalNote’s products and services. Risk Factors |

| 55 • If FiscalNote fails to maintain and improve its methods and technologies, or anticipate new methods or technologies, for data collection, organization, and analysis, competing products and services could surpass those of FiscalNote in depth, breadth, or accuracy of its data or in other respects. • Larger and more well-funded companies with access to significant resources, large amounts of data or data collection methods, and sophisticated technologies may shift their business model to become direct competitors to FiscalNote. • If FiscalNote fails to protect and maintain its brands, its ability to attract and retain customers will be impaired, its reputation may be harmed, and its business, financial condition, results of operations and prospects may suffer. • FiscalNote has a significant portion of its sales to U.S. and foreign government agencies and other highly regulated organizations, which are subject to a number of challenges and risks. • FiscalNote assists customers in certain legislative and other governmental relations matters, which activities may be deemed to be lobbying efforts. • FiscalNote’s international operations subject it to additional risks that can adversely affect its business, results of operations and financial condition. • FiscalNote has significant operations and assets in the UK, Belgium, Australia, South Korea, India, Singapore, and Hong Kong and, as a result, will be subject to risks inherent in doing business in those jurisdictions, which may adversely affect its financial performance and operating results. • FiscalNote’s company culture has contributed to its success and if FiscalNote cannot maintain and evolve its culture as it grows, including through acquisition, its business could be materially and adversely affected. • FiscalNote relies on the performance of highly skilled personnel, including its management and other key employees, and the loss of one or more of such personnel, or of a significant number of team members, could harm its business. • If FiscalNote does not effectively maintain and grow its research and development team with top talent, including employees who are trained in artificial intelligence, machine learning and advanced algorithms, FiscalNote may be unable to continue to improve its artificial intelligence capabilities, and its revenues and other results of operations could be adversely affected. • Regulators in the U.S. and other jurisdictions where FiscalNote operates may limit FiscalNote’s ability to develop or implement its proprietary artificial intelligence algorithms and/or may eliminate or restrict the confidentiality of its proprietary technology, which could have a material adverse effect on FiscalNote’s financial condition and results of operations. • Issues in the use of artificial intelligence (including machine learning) in FiscalNote’s platforms may result in reputational harm or liability. • Failure to effectively develop and expand FiscalNote’s marketing and sales capabilities could harm its ability to increase its customer base, expand its engagements with existing customers, and achieve broader market acceptance of its products and services. • Any failure to offer high-quality support and professional services for FiscalNote’s customers may harm its relationships with its customers and, consequently, FiscalNote’s business. • FiscalNote’s business is subject to numerous legal and regulatory risks that could have an adverse impact on its business. • FiscalNote has incurred a significant amount of debt, some of which is secured by substantially all of FiscalNote’s assets, and may in the future incur additional indebtedness. FiscalNote’s payment obligations under such indebtedness may limit the funds available to FiscalNote, and the terms of FiscalNote’s debt agreements may restrict its flexibility in operating its business. • FiscalNote is currently and may in the future be involved in legal actions and claims arising in the ordinary course of business. Adverse litigation judgments or settlements resulting from legal proceedings in which FiscalNote may be involved could expose FiscalNote to monetary damages or limit the ability to operate its business. Risk Factors (Cont’d) |