Exhibit 3.1

CERTIFICATE OF INCORPORATION OF

FISCALNOTE HOLDINGS, INC.

ARTICLE I

NAME

The name of the corporation is FiscalNote Holdings, Inc. (hereinafter called the “Corporation”).

ARTICLE II

REGISTERED OFFICE AND AGENT

The address of the Corporation’s registered office in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, Delaware 19801. The name of its registered agent at such address is The Corporation Trust Company.

ARTICLE III

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware or any applicable successor act thereto, as the same may be amended from time to time (the “DGCL”).

The Corporation is being incorporated in connection with the domestication of Duddell Street Acquisition Corp., a Cayman Islands exempted company limited by shares, to a Delaware corporation, which domestication is being effected in connection with the transactions contemplated by that certain Agreement and Plan of Merger entered into by the Cayman Company, Grassroots Merger Sub, Inc. and FiscalNote Holdings, Inc., a Delaware corporation, on November 7, 2021, and this Certificate of Incorporation (as amended and/or restated from time to time, including pursuant to any Preferred Stock Designation (as defined below), this “Certificate of Incorporation”) is being filed simultaneously with a certificate of corporate domestication effecting such domestication.

ARTICLE IV

CAPITAL STOCK

The total number of shares of all classes of capital stock which the Corporation shall have authority to issue is 1,809,000,000 shares, consisting of 1,700,000,000 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), 9,000,000 shares of Class B Common Stock, par value $0.0001 per share (“Class B Common Stock”), and 100,000,000 shares of Preferred Stock, par value $0.0001 per share (“Preferred Stock”). The number of authorized shares of Class A Common Stock, Class B Common Stock or Preferred Stock may be increased or decreased (but not below (i) the number of shares thereof then outstanding and (ii) with respect to the Class A Common Stock, the number of shares of Class A Common Stock reserved pursuant to Section 8 of Part A of this Article IV) by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares of capital stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL.

1

The following is a statement of the designations and the powers, preferences, privileges and rights, and the qualifications, limitations or restrictions thereof in respect of each class of capital stock of the Corporation.

A. CLASS A COMMON STOCK AND CLASS B COMMON STOCK.

Unless otherwise indicated, references to “Sections” or “Subsections” in this Part A of this Article IV refer to sections and subsections of Part A of this Article IV.

1. Equal Status; General. Except as otherwise provided in this Certificate of Incorporation or required by applicable law, shares of Class A Common Stock and Class B Common Stock shall have the same rights, privileges and powers, rank equally (including as to dividends and distributions, and upon any liquidation, dissolution, distribution of assets or winding up of the Corporation), share ratably and be identical in all respects and as to all matters. The voting, dividend, liquidation and other rights, powers and preferences of the holders of Class A Common Stock and Class B Common Stock are subject to and qualified by the rights, powers and preferences of the holders of the Preferred Stock of any series as may be designated by the Board of Directors of the Corporation (the “Board”) upon any issuance of the Preferred Stock of any series.

2. Voting. Except as otherwise required by applicable law, at all meetings of stockholders and on all matters properly submitted to a vote of stockholders of the Corporation generally, each holder of Class A Common Stock, as such, shall have the right to one (1) vote per share of Class A Common Stock held of record by such holder and each holder of Class B Common Stock, as such, shall have the right to 25 votes per share of Class B Common Stock held of record by such holder. Except as otherwise required by applicable law or provided in this Certificate of Incorporation, the holders of shares of Class A Common Stock and Class B Common Stock, as such, shall (a) at all times vote together as a single class on all matters (including the election of directors) submitted to a vote of the stockholders of the Corporation generally, (b) be entitled to notice of any stockholders’ meeting in accordance with the Bylaws of the Corporation, as the same may be amended and/or restated from time to time (the “Bylaws”), and (c) be entitled to vote upon such matters and in such manner as may be provided by applicable law; provided, however, that, except as otherwise required by applicable law, holders of Class A Common Stock and Class B Common Stock, as such, shall not be entitled to vote on any amendment to this Certificate of Incorporation (including any Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series of Preferred Stock are exclusively entitled, either separately or together with the holders of one or more other such series of Preferred Stock, to vote thereon pursuant to this Certificate of Incorporation or applicable law. There shall be no cumulative voting.

3. Dividend and Distribution Rights. Shares of Class A Common Stock and Class B Common Stock shall be treated equally, identically and ratably, on a per share basis, with respect to any dividends or distributions as may be declared and paid from time to time by the Board out of any assets or funds of the Corporation legally available therefor; provided, however, that in the event a dividend is paid in the form of shares of Class A Common Stock or Class B Common Stock (or rights to acquire, or securities convertible into or exchangeable for, such shares), then holders of Class A Common Stock shall be entitled to receive shares of Class A Common Stock (or rights to acquire, or securities convertible into or exchangeable for, such shares, as the case may be), and holders of Class B Common Stock shall be entitled to receive shares of Class B Common Stock (or rights to acquire, or securities convertible into or exchangeable for, such shares, as the case may be), with holders of shares of Class A Common Stock and Class B Common Stock receiving, on a per share basis, an identical number of shares of Class A Common Stock or Class B Common Stock (or rights to acquire, or securities convertible into or exchangeable for, such shares, as the case may be), as

2

applicable. Notwithstanding the foregoing, the Board may pay or make a disparate dividend or distribution per share of Class A Common Stock or Class B Common Stock (whether in the amount of such dividend or distribution payable per share, the form in which such dividend or distribution is payable, the timing of the payment, or otherwise) if such disparate dividend or distribution is approved by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and Class B Common Stock, each voting separately as a class.

4. Subdivisions, Combinations or Reclassifications. Shares of Class A Common Stock or Class B Common Stock may not be subdivided, combined or reclassified unless the shares of the other class is concurrently therewith proportionately subdivided, combined or reclassified in a manner that maintains the same proportionate equity ownership between the holders of the outstanding Class A Common Stock and Class B Common Stock on the record date for such subdivision, combination or reclassification; provided, however, that shares of one such class may be subdivided, combined or reclassified in a different or disproportionate manner if such subdivision, combination or reclassification is approved by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and Class B Common Stock, each voting separately as a class.

5. Liquidation, Dissolution or Winding Up. Subject to the preferential or other rights of any holders of Preferred Stock then outstanding, upon the dissolution, distribution of assets, liquidation or winding up of the Corporation, whether voluntary or involuntary, after payment or provision for payment of the debts and other liabilities of the Corporation, holders of Class A Common Stock and Class B Common Stock will be entitled to receive ratably all assets of the Corporation available for distribution to its stockholders unless disparate or different treatment of the shares of each such class with respect to distributions upon any such liquidation, dissolution, distribution of assets or winding up is approved by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and Class B Common Stock, each voting separately as a class.

6. Certain Transactions.

6.1 Merger or Consolidation. In the case of any distribution or payment in respect of the shares of Class A Common Stock or Class B Common Stock, or any consideration into which such shares are converted, upon the consolidation or merger of the Corporation with or into any other entity, such distribution, payment or consideration that the holders of shares of Class A Common Stock or Class B Common Stock have the right to receive, or the right to elect to receive, shall be made ratably on a per share basis among the holders of the Class A Common Stock and Class B Common Stock as a single class; provided, however, that shares of such classes may receive, or have the right to elect to receive, different or disproportionate distribution, payment or consideration in connection with such consolidation, merger or other transaction in order to reflect the special rights, powers and privileges of holders of shares of Class B Common Stock under this Certificate of Incorporation (which may include, without limitation, securities distributable to the holders of, or issuable upon the conversion of, each share of Class B Common Stock outstanding immediately prior to such transaction having up to 25 times the voting power of any securities distributable to the holders of, or issuable upon the conversion of, each share of Class A Common Stock outstanding immediately prior to such transaction) or such other rights, powers, privileges or other terms that are no more favorable, in the aggregate, to the holders of the Class B Common Stock relative to the holders of the Class A Common Stock than those contained in this Certificate of Incorporation.

6.2 Third-Party Tender or Exchange Offers. The Corporation may not enter into any agreement pursuant to which a third party may by tender or exchange offer acquire any shares of Class A Common Stock or Class B Common Stock unless the holders of (a) the Class A Common Stock shall have the right to receive, or the right to elect to receive, the same form of consideration and the same amount of consideration on a per share basis as

3

the holders of the Class B Common Stock would receive, or have the right to elect to receive, and (b) the Class B Common Stock shall have the right to receive, or the right to elect to receive, the same form of consideration and the same amount of consideration on a per share basis as the holders of the Class A Common Stock would receive, or have the right to elect to receive; provided, however, that shares of such classes may receive, or have the right to elect to receive, different or disproportionate consideration in connection with such tender or exchange offer in order to reflect the special rights, powers and privileges of the holders of shares of the Class B Common Stock under this Certificate of Incorporation (which may include, without limitation, securities exchangeable for each share of Class B Common Stock having up to 25 times the voting power of any securities exchangeable for each share of Class A Common Stock) or such other rights, powers, privileges or other terms that are no more favorable, in the aggregate, to the holders of the Class B Common Stock relative to the holders of the Class A Common Stock than those contained in this Certificate of Incorporation.

7. Conversion.

7.1 Optional Conversion of Class B Common Stock. Each share of Class B Common Stock shall be convertible, at any time or from time to time, into one (1) fully paid and nonassessable share of Class A Common Stock at the option of the holder thereof at any time upon written notice to the Corporation (an “Optional Class B Conversion Event”). Before any holder of shares of Class B Common Stock shall be entitled to convert any shares of Class B Common Stock into shares of Class A Common Stock, such holder shall surrender the certificate or certificates therefor (if any), duly endorsed, at the principal corporate office of the Corporation or of any transfer agent for the Class B Common Stock, and shall provide written notice to the Corporation at its principal corporate office, of such conversion election and shall state therein the name or names (i) in which the certificate or certificates representing the shares of Class A Common Stock into which the shares of Class B Common Stock are so converted are to be issued (if such shares of Class A Common Stock are certificated) or (ii) in which such shares of Class A Common Stock are to be registered in book-entry form (if such shares of Class A Common Stock are uncertificated). If the shares of Class A Common Stock into which the shares of Class B Common Stock are to be converted are to be issued in a name or names other than the name of the holder of the shares of Class B Common Stock being converted, such notice shall be accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the holder. The Corporation shall, as soon as practicable thereafter, issue and deliver at such office to such holder, or to the nominee or nominees of such holder, a certificate or certificates representing the number of shares of Class A Common Stock to which such holder shall be entitled upon such conversion (if such shares of Class A Common Stock are certificated) or shall register such shares of Class A Common Stock in book-entry form (if such shares of Class A Common Stock are uncertificated). Such conversion shall be deemed to be effective immediately prior to the close of business on the date of such surrender of the certificate or certificates representing, or the notice or notices of issuance (if held in book-entry form) of, the shares of Class B Common Stock to be converted following or contemporaneously with the provision of written notice of such conversion election as required by this Subsection 7.1, the shares of Class A Common Stock issuable upon such conversion shall be deemed to be outstanding as of such time, and the Person or Persons entitled to receive the shares of Class A Common Stock issuable upon such conversion shall be deemed to be the record holder or holders of such shares of Class A Common Stock as of such time. Notwithstanding anything herein to the contrary, shares of Class B Common Stock represented by a lost, stolen or destroyed stock certificate may be converted pursuant to an Optional Class B Conversion Event if the holder thereof notifies the Corporation or its transfer agent that such certificate has been lost, stolen or destroyed and makes an affidavit of that fact acceptable to the Corporation and executes an agreement acceptable to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificate.

4

7.2 Automatic Conversion of Class B Common Stock. To the extent set forth below, each applicable share of Class B Common Stock shall automatically convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the occurrence of an event described below (a “Mandatory Class B Conversion Event”):

(a) Transfers. Each share of Class B Common Stock that is subject to a Transfer (as defined in Section 10), other than a Permitted Transfer (as defined in Section 10), shall automatically, without further action by the Corporation or the holder thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the occurrence of such Transfer (other than a Permitted Transfer).

(b) Death or Permanent Disability of Holder of Class B Common Stock. Each outstanding share of Class B Common Stock held by a holder of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the earliest to occur of the death or Permanent Disability of such holder of Class B Common Stock.

(c) Reduction in Voting Power. Each outstanding share of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the first date on which the number of outstanding shares of Class B Common Stock (as such number of shares is equitably adjusted in respect of any reclassification, stock dividend, subdivision, combination or recapitalization of the Class B Common Stock) represents less than fifty percent (50%) of the number of shares of Class B Common Stock that were outstanding as of the Effective Date.

(d) Affirmative Vote. Each outstanding share of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the date specified by the affirmative vote of the holders of more than fifty percent (50%) of the then outstanding shares of Class B Common Stock, voting as a separate class.

(e) Seven (7) Years from the Effective Date. Each outstanding share of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock upon the date that is seven (7) years from the Effective Date.

7.3 Certificates. Each outstanding stock certificate (if shares are in certificated form) that, immediately prior to the occurrence of a Mandatory Class B Conversion Event, represented one or more shares of Class B Common Stock subject to such Mandatory Class B Conversion Event shall, upon such Mandatory Class B Conversion Event, be deemed to represent an equal number of shares of Class A Common Stock, without the need for surrender or exchange thereof. The Corporation shall, upon the request of any holder whose shares of Class B Common Stock have been converted into shares of Class A Common Stock as a result of an Optional Class B Conversion Event or a Mandatory Class B Conversion Event (either of the foregoing, a “Conversion Event”) and upon surrender by such holder to the Corporation of the outstanding certificate(s) formerly representing such holder’s shares of Class B Common Stock, if any (or, in the case of any lost, stolen or destroyed certificate, upon such holder providing an affidavit of that fact acceptable to the Corporation and executing an agreement acceptable to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificate), issue and deliver to such holder (or such other Person specified pursuant to Subsection 7.1) certificate(s) representing the shares of Class A Common Stock into which such holder’s shares of Class B Common Stock were converted as a result of such Conversion Event (if such shares are certificated) or, if such shares are uncertificated, register such shares in book-entry form. Each share of Class B Common Stock that is converted pursuant to Subsection 7.1 or 7.2 shall thereupon automatically be retired and shall not be available for reissuance.

5

7.4 Policies and Procedures. The Corporation may, from time to time, establish such policies and procedures, not in violation of applicable law or the other provisions of this Certificate of Incorporation or Bylaws of the Corporation, relating to the conversion of the Class B Common Stock into Class A Common Stock, as it may deem necessary or advisable in connection therewith (it being understood, for the avoidance of doubt, that this sentence shall not authorize or empower the Corporation to expand upon the events that constitute a Mandatory Class B Conversion Event). If the Corporation has reason to believe that a Transfer or other Conversion Event giving rise to a conversion of shares of Class B Common Stock into Class A Common Stock has occurred but has not theretofore been reflected on the books of the Corporation (or in book-entry as maintained by the transfer agent of the Corporation), the Corporation may request that the holder of such shares furnish affidavits or other evidence to the Corporation as the Corporation reasonably deems necessary to determine whether a conversion of shares of Class B Common Stock to Class A Common Stock has occurred, and if such holder does not within ten (10) days after the date of such request furnish sufficient evidence to the Corporation (in the manner provided in the request) to enable the Corporation to determine that no such conversion has occurred, any such shares of Class B Common Stock, to the extent not previously converted, shall be immediately and automatically converted into shares of Class A Common Stock and the same shall thereupon be registered on the books and records of the Corporation (or in book-entry as maintained by the transfer agent of the Corporation). In connection with any action of stockholders taken at a meeting or by written consent, the stock ledger of the Corporation (or in book-entry as maintained by the transfer agent of the Corporation) shall be presumptive evidence as to who are the stockholders entitled to vote in person or by proxy at any meeting of stockholders or in connection with any written consent and the class or classes or series of shares held by each such stockholder and the number of shares of each class or classes or series held by such stockholder.

8. Reservation of Stock. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Class A Common Stock, solely for the purpose of effecting the conversion of the shares of Class B Common Stock, such number of shares of Class A Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Class B Common Stock into Class A Common Stock; and if at any time the number of authorized but unissued shares of Class A Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Class B Common Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Class A Common Stock to such number of shares as shall be sufficient for such purpose.

9. Protective Provisions. Unless such action is first approved by the affirmative vote (or written consent) of the holders of two-thirds (2/3) of the then-outstanding shares of Class B Common Stock, voting as a separate class, in addition to any other vote required by applicable law, this Certificate of Incorporation or the Bylaws, prior to the Final Conversion Date, the Corporation shall not, whether by merger, consolidation, certificate of designation or otherwise (i) amend, alter, repeal or waive any provision of Part A of this Article IV (or adopt any provision inconsistent therewith), or (ii) authorize, or issue any shares of, any class or series of capital stock of the Corporation entitling the holder thereof to more than (1) vote for each share thereof or entitling any class or series of securities to designate or elect directors as a class or series separate from the Class A Common Stock and Class B Common Stock.

10. Issuance of Additional Shares. From and after the Effective Date, additional shares of Class B Common Stock may be issued only to a Qualified Stockholder.

11. Definitions. For purposes of this Certificate of Incorporation:

6

“Change of Control Transaction” means (i) the sale, lease, exchange, or other disposition (other than liens and encumbrances created in the ordinary course of business, including liens or encumbrances to secure indebtedness for borrowed money that are approved by the Board, so long as no foreclosure occurs in respect of any such lien or encumbrance) of all or substantially all of the Corporation’s property and assets (which shall for such purpose include the property and assets of any direct or indirect subsidiary of the Corporation), provided that any sale, lease, exchange or other disposition of property or assets exclusively between or among the Corporation and any direct or indirect subsidiary or subsidiaries of the Corporation shall not be deemed a “Change of Control Transaction”; (ii) the merger, consolidation, business combination, or other similar transaction of the Corporation with any other entity, other than a merger, consolidation, business combination, or other similar transaction that would result in the voting securities of the Corporation outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its Parent) more than fifty percent (50%) of the total voting power represented by the voting securities of the Corporation and more than fifty percent (50%) of the total number of outstanding shares of the Corporation’s capital stock, in each case as outstanding immediately after such merger, consolidation, business combination, or other similar transaction, and the stockholders of the Corporation immediately prior to the merger, consolidation, business combination, or other similar transaction continuing to own voting securities of the Corporation, the surviving entity or its Parent immediately following the merger, consolidation, business combination, or other similar transaction in substantially the same proportions (vis a vis each other) as such stockholders owned of the voting securities of the Corporation immediately prior to the transaction; and (iii) a recapitalization, liquidation, dissolution, or other similar transaction involving the Corporation, other than a recapitalization, liquidation, dissolution, or other similar transaction that would result in the voting securities of the Corporation outstanding immediately prior thereto continuing to represent (either by remaining outstanding or being converted into voting securities of the surviving entity or its Parent) more than fifty percent (50%) of the total voting power represented by the voting securities of the Corporation and more than fifty percent (50%) of the total number of outstanding shares of the Corporation’s capital stock, in each case as outstanding immediately after such recapitalization, liquidation, dissolution or other similar transaction, and the stockholders of the Corporation immediately prior to the recapitalization, liquidation, dissolution or other similar transaction continuing to own voting securities of the Corporation, the surviving entity or its Parent immediately following the recapitalization, liquidation, dissolution or other similar transaction in substantially the same proportions (vis a vis each other) as such stockholders owned of the voting securities of the Corporation immediately prior to the transaction.

“Effective Date” means the date on which this Certificate of Incorporation is first effective.

“Family Member” means with respect to any natural person who is a Qualified Stockholder (a) the spouse of such Qualified Stockholder, (b) the parents, grandparents, lineal descendants, siblings or lineal descendants of siblings of such Qualified Stockholder or (c) the parents, grandparents, lineal descendants, siblings or lineal descendants of siblings of the spouse of such Qualified Stockholder. Lineal descendants shall include adopted persons, but only so long as they are adopted during minority.

“Fiduciary” means a Person who (a) is an executor, personal representative, administrator, trustee, manager, managing member, general partner, director, officer or any other agent of a Person and (b) manages, controls or otherwise has decision-making authority with respect to such Person, but, in each case, only to the extent that such Person may be removed, directly or indirectly, by one or more Qualified Stockholders and replaced with another Fiduciary selected, directly or indirectly, by one or more Qualified Stockholders.

“Final Conversion Date” means the date on which no shares of Class B Common Stock shall remain outstanding.

7

“Founders” means, collectively, Timothy Hwang and Gerald Yao.

“Liquidation Event” means any liquidation, dissolution, or winding up of the Corporation, whether voluntary or involuntary, or any Change of Control Transaction.

“Parent” of an entity means any entity that directly or indirectly owns or controls a majority of the voting power of the voting securities of such entity.

“Permanent Disability” means a permanent and total disability such that the holder of Class B Common Stock is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which would reasonably be expected to result in death within twelve (12) months or which has lasted or would reasonably be expected to last for a continuous period of not less than twelve (12) months as determined by a licensed medical practitioner.

“Permitted Entity” means:

(a) a Permitted Trust for so long as such Permitted Trust is solely for the current benefit of a Qualified Beneficiary (and, for the avoidance of doubt, notwithstanding that a remainder interest in such Permitted Trust is for the benefit of any Person other than a Qualified Beneficiary);

(b) any general partnership, limited partnership, limited liability company, corporation, public benefit corporation or other entity, in each case, for so long as such entity is exclusively owned, by (1) one or more Qualified Stockholders, (2) one or more Family Members of such Qualified Stockholders and/or (3) any other Permitted Entity of such Qualified Stockholders;

(c) any foundation or similar entity or any Qualified Charity for so long as (i) one or more Qualified Stockholders continues to, directly or indirectly, exercise Voting Control over any shares of Class B Common Stock from time to time Transferred to such foundation or similar entity or Qualified Charity, and/or (ii) a Fiduciary of such foundation or similar entity or Qualified Charity exercises Voting Control over such shares of Class B Common Stock;

(d) an Individual Retirement Account, as defined in Section 408(a) of the Internal Revenue Code, or a pension, profit sharing, stock bonus or other type of plan or trust of which such Qualified Stockholder is a participant or beneficiary and which satisfies the requirements for qualification under Section 401 of the Internal Revenue Code for so long as such Qualified Stockholder has sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock held in such account, plan or trust;

(e) the executor or personal representative of the estate of a Qualified Stockholder upon the death of such Qualified Stockholder solely to the extent the executor or personal representative is acting in the capacity of executor or personal representative of such estate;

(f) a revocable living trust, which revocable living trust is itself both a Permitted Trust and a Qualified Stockholder, during the lifetime of the natural person grantor of such trust; or

(g) a revocable living trust (including any irrevocable administrative trust resulting from the death of the natural person grantor of such trust) which trust is itself both a Permitted Trust and a Qualified Stockholder, following the death of the natural person grantor of such trust, solely to the extent that such shares are held in such trust pending distribution to the beneficiaries designated in such trust.

8

Except as explicitly provided for herein, a Permitted Entity of a Qualified Stockholder shall not cease to be a Permitted Entity solely by reason of the death of that Qualified Stockholder.

“Permitted Transfer” means, and is restricted to, any Transfer of a share of Class B Common Stock:

(a) by a Qualified Stockholder that is not a Permitted Entity to (i) one or more Family Members of such Qualified Stockholder, (ii) any Permitted Entity of such Qualified Stockholder, or (iii) any Permitted Entity of one or more Family Members of such Qualified Stockholder;

(b) by a Permitted Entity of a Qualified Stockholder to (i) such Qualified Stockholder or one or more Family Members of such Qualified Stockholder, (ii) any other Permitted Entity of such Qualified Stockholder, or (iii) any Permitted Entity of one or more Family Members of such Qualified Stockholder; or

(c) any Transfer approved in advance by the Board, or a duly authorized committee of the Board, upon a determination that such Transfer is not inconsistent with the purposes of the foregoing provisions of this definition of “Permitted Transfer.”

For the avoidance of doubt, the direct Transfer of any share or shares of Class B Common Stock by a holder thereof to any other Person shall qualify as a “Permitted Transfer” within the meaning of this Section, if such Transfer could have been completed indirectly through one or more transactions involving more than one Transfer, so long as each Transfer in such transaction or transactions would otherwise have qualified as a “Permitted Transfer” within the meaning of this Section. For the further avoidance of doubt, a Transfer may qualify as a “Permitted Transfer” within the meaning of this Section under any one or more than one of the clauses of this Section as may be applicable to such Transfer, without regard to any proviso in, or requirement of, any other clause(s) of this Section.

“Permitted Transferee” means, as of any date of determination, a Person that is entitled to be a transferee of shares of Class B Common Stock in a Transfer that, as of such date, would constitute a Permitted Transfer.

“Permitted Trust” means a bona fide trust where each trustee is (a) a Qualified Stockholder; (b) a Family Member of a Qualified Stockholder; or (c) a professional in the business of providing trustee services, including private professional fiduciaries, trust companies, accounting, legal or financial advisor, or bank trust departments.

“Person” means any individual, corporation, limited liability company, limited or general partnership, joint venture, association, joint-stock company, trust, unincorporated organization or other entity, whether domestic or foreign.

“Qualified Beneficiary” means (i) one or more Qualified Stockholders, (ii) one or more Family Members of a Qualified Stockholder and/or (iii) any other Permitted Entities of one or more Qualified Stockholders.

“Qualified Charity” means a domestic U.S. charitable organization, contributions to which are deductible for federal income, estate, gift and generation skipping transfer tax purposes.

“Qualified Stockholder” means (i) the Founders, and (ii) any Person that is a Permitted Transferee.

9

“Requisite Stockholder Consent” means (i) prior to the Voting Threshold Date, the action at a meeting or by written consent (to the extent permitted under this Certificate of Incorporation) of the holders of a majority in voting power of the shares of capital stock of the Corporation that would then be entitled to vote in the election of directors at an annual meeting of stockholders, and (ii) on and after the Voting Threshold Date, the action at a meeting or by written consent (to the extent permitted under this Certificate of Incorporation) of the holders of two-thirds (2/3) of the voting power of the shares of capital stock of the Corporation that would then be entitled to vote in the election of directors at an annual meeting of stockholders.

“Transfer” of a share of Class B Common Stock means, directly or indirectly, any sale, assignment, transfer, conveyance, hypothecation or other transfer or disposition of such share or any legal or beneficial interest in such share, whether or not for value and whether voluntary or involuntary or by operation of law (including by merger, consolidation or otherwise), including, without limitation, the transfer of a share of Class B Common Stock to a broker or other nominee or the transfer of, or entering into a binding agreement with respect to, Voting Control over such share by proxy or otherwise. A Transfer shall also be deemed to have occurred with respect to a share of Class B Common Stock beneficially held by a Person that received shares in a Permitted Transfer if there occurs any act or circumstance that causes such Person to no longer be a Permitted Transferee. In addition, for the avoidance of doubt, a Transfer shall be deemed to have occurred if a holder that is a partnership, limited partnership, limited liability company or corporation distributes or otherwise transfers its shares of Class B Common Stock to its partners, stockholders, members or other equity owners. Notwithstanding the foregoing, the following shall not be considered a Transfer:

(a) the granting of a revocable proxy to officers or directors of the Corporation at the request of the Board in connection with (i) actions to be taken at an annual or special meeting of stockholders, or (ii) any other action of the stockholders permitted by this Certificate of Incorporation;

(b) entering into a voting trust, agreement or arrangement (with or without granting a proxy) solely with stockholders who are holders of Class B Common Stock, which voting trust, agreement or arrangement does not involve any payment of cash, securities or other property to the holder of the shares subject thereto other than the mutual promise to vote shares in a designated manner; for the avoidance of doubt, any voting trust, agreement or arrangement entered into prior to the Effective Date shall not constitute a Transfer;

(c) the pledge of shares of Class B Common Stock by a stockholder that creates a mere security interest in such shares pursuant to a bona fide loan or indebtedness transaction for so long as such stockholder continues to exercise Voting Control over such pledged shares; provided, however, that a foreclosure on such shares or other similar action by the pledgee shall constitute a Transfer unless such foreclosure or similar action qualifies as a Permitted Transfer at such time;

(d) any change in the trustee(s) or the Person(s) and/or entity(ies) having or exercising Voting Control over shares of Class B Common Stock held by a Permitted Entity, provided that following such change such Permitted Entity continues to be a Permitted Entity;

(e) (1) the assignment, transfer, conveyance, hypothecation or other transfer or disposition of shares of Class B Common Stock by a Qualified Stockholder to a grantor retained annuity trust (a “GRAT”) for which the trustee is (A) such Qualified Stockholder, (B) a Family Member of such Qualified Stockholder, (C) a professional in the business of providing trustee services, including private professional fiduciaries, trust companies, accounting, legal or financial advisors, or bank trust departments, (D) an employee of the Corporation or a member of the Board or (E) solely in the case of any such trust established by a natural Person grantor, any other bona fide trustee; (2) the change in trustee for such a GRAT from one of the Persons identified in the foregoing subclauses (A) through (E) to another Person identified in the foregoing subclauses (A) through (E); and (3) the distribution of such shares of Class B Common Stock from such GRAT to such Qualified Stockholder (provided, however, that the distribution of shares of Class B Common Stock to any beneficiary of such GRAT except such Qualified Stockholder shall constitute a Transfer unless such distribution qualifies as a Permitted Transfer at such time);

10

(f) any Transfer of shares of Class B Common Stock, whether by a Qualified Stockholder or a Permitted Entity, to a broker or other nominee for so long as the transferor retains (i) Voting Control, (ii) sole dispositive power over such shares of Class B Common Stock, and (iii) the economic consequences of ownership of such shares of Class B Common Stock;

(g) entering into a trading plan pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, with a broker or other nominee; provided, however, that a sale of such shares of Class B Common Stock pursuant to such plan shall constitute a “Transfer” at the time of such sale;

(h) in connection with a Change of Control Transaction (1) the entering into a support, voting, tender or similar agreement or arrangement, (2) the granting of any proxy and/or (3) the tendering of any shares in any tender or exchange offer for all of the outstanding shares of Class A Common Stock and Class B Common Stock;

(i) due to the fact that the spouse of any holder of shares of Class B Common Stock possesses or obtains an interest in such holder’s shares of Class B Common Stock arising solely by reason of the application of the community property laws of any jurisdiction, so long as no other event or circumstance shall exist or have occurred that constitutes a “Transfer” of such shares of Class B Common Stock; provided that any transfer of shares by any holder of shares of Class B Common Stock to such holder’s spouse, including a transfer in connection with a divorce proceeding, domestic relations order or similar legal requirement, shall constitute a “Transfer” of such shares of Class B Common Stock unless (1) otherwise exempt from the definition of Transfer, or (2) in connection with such divorce proceeding, domestic relations order or similar legal requirement, a Qualified Stockholder is entitled to retain (and for so long as a Qualified Stockholder does actually retain) either (x) the exclusive right to exercise the power to vote or direct the voting of such shares of Class B Common Stock, or (y) sole dispositive power over such shares of Class B Common Stock; and

(j) entering into a support, voting, tender or similar agreement, arrangement or understanding (with or without granting a proxy) in connection with a Liquidation Event or consummating the actions or transactions contemplated therein (including, without limitation, tendering shares of Class B Common Stock in connection with a Liquidation Event, the consummation of a Liquidation Event or the sale, assignment, transfer, conveyance, hypothecation or other transfer or disposition of shares of Class B Common Stock or any legal or beneficial interest in shares of Class B Common Stock in connection with a Liquidation Event), provided that such Liquidation Event was approved by the Board.

“Voting Control” means, with respect to a share of Class B Common Stock, the power (whether exclusive or shared) to vote or direct the voting of such share by proxy, voting agreement or otherwise.

“Voting Threshold Date” means the first date on which the issued and outstanding shares of Class B Common Stock represents less than 50% of the total voting power of the then outstanding shares of capital stock of the Corporation that would then be entitled to vote in the election of directors at an annual meeting of stockholders.

B. PREFERRED STOCK

Subject to Article IV, Section 9, Preferred Stock may be issued from time to time in one or more series, each of such series to have such terms as stated or expressed herein and in the resolution or resolutions providing for the issue of such series adopted by the Board as hereinafter provided. Any shares of Preferred Stock which may be redeemed, purchased or acquired by the Corporation may be reissued except as otherwise provided by law.

11

Subject to Article IV, Section 9, authority is hereby expressly granted to the Board from time to time to issue the Preferred Stock in one or more series, and in connection with the creation of any such series, by adopting a resolution or resolutions providing for the issuance of the shares thereof and by filing a certificate of designations relating thereto in accordance with the DGCL (a “Preferred Stock Designation”), to determine and fix the number of shares of such series and such voting powers (if any) and such designations, preferences and relative participating, optional or other special rights, and qualifications, limitations or restrictions thereof, including without limitation thereof, dividend rights, conversion rights, redemption privileges and liquidation preferences, as shall be stated and expressed in such resolutions, all to the full extent now or hereafter permitted by the DGCL. Without limiting the generality of the foregoing, the resolutions providing for issuance of any series of Preferred Stock may provide that such series shall be superior or rank equally or be junior to any other series of Preferred Stock to the extent permitted by law.

ARTICLE V

AMENDMENT OF THE CERTIFICATE OF INCORPORATION AND CHANGE OF CONTROL TRANSACTIONS

The Corporation reserves the right to amend, alter, change, adopt or repeal any provision contained in this Certificate of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation; provided, however, that, notwithstanding any other provision of this Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any vote of the holders of shares of any class or series of capital stock of the Corporation required by law or by this Certificate of Incorporation, so long as any shares of Class A Common Stock and Class B Common Stock remain outstanding, the Corporation shall not, without the prior affirmative vote of the holders of two-thirds (2/3) of the outstanding shares of Class A Common Stock and Class B Common Stock, voting together as a single class, directly or indirectly, whether by amendment, or through merger, recapitalization, consolidation or otherwise amend, alter, change, repeal or adopt any provision of this Certificate of Incorporation or approve any Change of Control Transaction. For the avoidance of doubt, (i) nothing in the immediately preceding proviso shall limit the rights of the Board as specified in Article IV, Part B (as qualified by Section 9 of Part A of Article IV) or Article VI of this Certificate of Incorporation, and (ii) notwithstanding anything in this Article V to the contrary, any amendment to a provision that contemplates a specific approval requirement by the stockholders (or any class of capital stock of the Corporation) in this Certificate of Incorporation (including the definition of Requisite Stockholder Consent and Voting Threshold Date) shall require the greater of (x) the specific approval requirement by the stockholders (or any class of capital stock of the Corporation) contemplated in such provision, and (y) the approval requirements contemplated by this Article V.

ARTICLE VI

AMENDMENT OF THE BYLAWS

In furtherance and not in limitation of the powers conferred upon it by the DGCL, and subject to the terms of any series of Preferred Stock, the Board shall have the power to adopt, amend, alter or repeal the Bylaws of the Corporation by the affirmative vote of a majority of the directors present at any regular or special meeting of the Board at which a quorum is present in any manner not inconsistent with the laws of the State of Delaware or this Certificate of Incorporation. The stockholders may not adopt, amend, alter or repeal the Bylaws of the Corporation, or adopt any provision inconsistent therewith, unless such action is approved, in addition to any other vote required by this Certificate of Incorporation, by the Requisite Stockholder Consent.

12

ARTICLE VII

BOARD OF DIRECTORS

This Article VII is inserted for the management of the business and for the conduct of the affairs of the Corporation, and for further definition, limitation and regulation of the powers of the Corporation and of its directors and stockholders.

(A) General Powers The business and affairs of the Corporation shall be managed by or under the direction of the Board, except as otherwise provided by law.

(B) Number of Directors. Subject to the rights of holders of any series of Preferred Stock to elect directors, the number of the directors of the Corporation shall be fixed from time to time by the Board; provided, further, that unless otherwise approved by the Requisite Stockholder Consent, the number of the directors shall be no less than five (5) and shall not exceed twelve (12). For the avoidance of doubt, no decrease in the number of directors constituting the Board shall shorten the term of any incumbent director.

(C) Classified Board. Subject to the special rights of the holders of any series of Preferred Stock to elect directors, the directors of the Corporation shall be divided, with respect to the time for which they severally hold office, into three classes designated as Class I, Class II and Class III, respectively (the “Classified Board”). The Board is authorized to assign members of the Board already in office to such classes of the Classified Board. The number of directors in each class shall be divided as nearly equal as is practicable. The initial term of office of the Class I directors shall expire at the Corporation’s first annual meeting of stockholders following the Effective Date, the initial term of office of the Class II directors shall expire at the Corporation’s second annual meeting of stockholders following the Effective Date, and the initial term of office of the Class III directors shall expire at the Corporation’s third annual meeting of stockholders following the Effective Date. At each annual meeting of stockholders following the Effective Date, directors elected to succeed those directors of the class whose terms then expire shall be elected for a term of office expiring at the third succeeding annual meeting of stockholders after their election.

(D) Tenure. Each director shall be elected or appointed for a term of office continuing until the annual meeting of stockholders of the Corporation at which such director’s term expires. Each director shall hold office until such director’s successor is elected and qualified, or until such director’s earlier death, resignation, retirement, disqualification or removal from office. Any director may resign at any time upon notice to the Corporation given in writing by any electronic transmission permitted in the Corporation’s Bylaws or in accordance with applicable law. In the event of any increase or decrease in the authorized number of directors, (a) each director then serving as such shall nevertheless continue as a director of the class of which he or she is a member and (b) the newly created or eliminated directorships resulting from such increase or decrease shall be apportioned by the Board among the classes of directors so as to make all classes as nearly equal in number as is practicable, provided that no decrease in the number of directors constituting the Board shall shorten the term of any director.

(E) Vacancies; Newly Created Directorships. Subject to the rights of holders of any series of Preferred Stock and subject to any contractual rights duly granted by the Corporation in connection therewith, and notwithstanding the requirement that the three classes shall be as nearly equal in number of directors as possible, newly created directorship that results from an increase in the number of directors or any vacancy on the Board that results from the death, disability, resignation, retirement, disqualification or removal of any director or from any other cause shall be filled: (i) prior to the Voting Threshold Date, solely by the stockholders of the Corporation with the Requisite Stockholder Consent unless any such vacancy or newly created directorships remains unfilled for at least sixty (60) days, in which case such vacancy or newly created directorships may also be filled by the affirmative vote of a majority of the total number of directors then in office, even if less than a quorum, or by a sole remaining director; or (ii) on or after the Voting Threshold Date solely by the affirmative vote of a majority of

13

the total number of directors then in office, even if less than a quorum, or by a sole remaining director. Any director elected in accordance with the preceding sentence shall hold office for a term expiring at the annual meeting of stockholders at which the term of office of the class to which the director has been assigned expires or until such director’s successor shall have been duly elected and qualified, or until such director’s earlier death, resignation, disqualification or removal. If the number of such directors is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as nearly equal as possible. No decrease in the authorized number of directors shall shorten the term of any incumbent director. If any newly created directorship may be assigned to more than one class consistent with the requirement that the number of directors in each class shall be divided as nearly equal as is practicable, the Board shall assign such directorship to the available class with the earliest expiring term of office.

(F) Removal. Subject to the rights of the holders of any series of Preferred Stock expressly set forth in a Preferred Stock Designation adopted in compliance with this Certification of Incorporation, no director may be removed from office except for cause and only with and immediately upon the Requisite Stockholder Consent.

(G) Committees. Pursuant to the Bylaws of the Corporation, the Board may establish one or more committees to which may be delegated any or all of the powers and duties of the Board to the full extent permitted by law.

(H) Stockholder Nominations and Introduction of Business. Advance notice of stockholder nominations for election of directors and other business to be brought by stockholders before a meeting of stockholders shall be given in the manner provided by the Bylaws.

(I) Preferred Stock Directors. During any period when the holders of any series of Preferred Stock have the right to elect additional directors as provided for or fixed pursuant to and in accordance with the provisions of Article IV hereof or any Preferred Stock Designation, then upon commencement and for the duration of the period during which such right continues: (i) the then otherwise total number of authorized directors of the Corporation shall automatically be increased by such specified number of directors, and the holders of such Preferred Stock shall be entitled to elect the additional directors so provided for or fixed pursuant to said provisions, and (ii) each such additional director shall serve until such director’s successor shall have been duly elected and qualified, or until such director’s right to hold such office terminates pursuant to said provisions, whichever occurs earlier, subject to his earlier death, disqualification, resignation or removal. Except as otherwise provided for or fixed pursuant to and in accordance with the provisions of Article IV hereof or any Preferred Stock Designation, whenever the holders of any series of Preferred Stock having such right to elect additional directors are divested of such right pursuant to the provisions of such stock, all such additional directors elected by the holders of such stock, or elected or appointed to fill any vacancies resulting from the death, resignation, disqualification or removal of such additional directors shall automatically cease to be qualified as directors, the terms of office of all such directors shall forthwith terminate and the total authorized number of directors of the Corporation shall be reduced accordingly.

ARTICLE VIII

ELECTION OF DIRECTORS

Unless and except to the extent that the Bylaws shall so require, the election of directors of the Corporation need not be by written ballot. The vote required for election of a director by the stockholders at a meeting of stockholders in which a quorum is present shall be the affirmative vote of a plurality of the votes cast by stockholders entitled to vote in such election.

14

ARTICLE IX

LIMITATION OF DIRECTOR LIABILITY

To the fullest extent permitted by the DGCL as the same exists or as may hereafter be amended, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director; provided, however, that nothing contained in this Article IX shall eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to the provisions of Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit. No repeal or modification of this Article IX shall apply to or have any adverse effect on any right or protection of, or any limitation of the liability of, a director of the Corporation existing at the time of such repeal or modification with respect to acts or omissions occurring prior to such repeal or modification.

ARTICLE X

INDEMNIFICATION

The Corporation may indemnify, and advance expenses to, to the fullest extent permitted by law, any person who was or is a party to or is threatened to be made a party to any threatened, pending or completed action, suit, investigation, arbitration or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”) by reason of the fact that the person is or was a director, officer, employee or agent of the Corporation or any of its subsidiaries or, while a director or officer of the Corporation or any of its subsidiaries, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture or trust (an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent, or in any other capacity while serving as a director, officer, employee or agent, against all liability and loss suffered and expenses (including, without limitation, attorneys’ fees, judgments, fines, ERISA excise taxes, and penalties and amounts paid in settlement) reasonably incurred by such indemnitee in connection with such proceeding. The Corporation shall to the fullest extent not prohibited by applicable law pay as incurred the expenses (including attorneys’ fees) incurred by an indemnitee in defending or otherwise participating in any proceeding in advance of its final disposition (including by making payment directly to applicable third parties if requested by the indemnitee); provided, however, that, to the extent required by applicable law, such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt of an undertaking, by or on behalf of the indemnitee, to repay all amounts so advanced if it shall ultimately be determined that the indemnitee is not entitled to be indemnified under this Article X or otherwise. The rights to indemnification and advancement of expenses conferred by this Article X shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators. Notwithstanding the foregoing provisions of this Article X, except for proceedings to enforce rights to indemnification and advancement of expenses (which are, for the avoidance of doubt, indemnified proceedings and expenses), the Corporation shall indemnify and advance expenses to an indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was, or is, authorized by the Board. The rights to indemnification and advancement of expenses conferred on any indemnitee by this Article X shall not be exclusive of any other rights that any indemnitee may have or hereafter acquire under law, this Certificate of Incorporation, the Bylaws, an agreement, vote of stockholders or disinterested directors, or otherwise. Any repeal or amendment of this Article X by the stockholders of the Corporation or by changes in law, or the adoption of any other provision of this Certificate of Incorporation inconsistent with this Article X, shall, unless otherwise required by law, be prospective only (except to the extent such amendment or change in law permits the Corporation to provide broader indemnification rights on a retroactive basis than permitted prior thereto), and shall not in any way diminish or adversely affect any right or protection existing at the time of such repeal or amendment or adoption of such inconsistent provision in respect of any proceeding (regardless of when such proceeding is first threatened, commenced or completed) arising out of, or related to, any act or omission occurring prior to such repeal or amendment or adoption of such inconsistent provision. This Article X shall not limit the right of the Corporation, to the extent and in the manner authorized or permitted by law, to indemnify and to advance expenses to persons other than indemnitees.

15

ARTICLE XI

CONSENT OF STOCKHOLDERS IN LIEU OF MEETING

Subject to the terms of any series of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation must be effected at an annual or special meeting of the stockholders and may not be effected by written consent in lieu of a meeting; provided, that prior to the Voting Threshold Date, any action required or permitted to be taken at any annual or special meeting of stockholders of the Corporation may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation by delivery to its registered office in the State of Delaware, its principal place of business, or an officer or agent of the Corporation having custody of the books in which proceedings of meetings of stockholders are recorded. Delivery made to the Corporation’s registered office shall be made by hand, overnight courier or by certified or registered mail, return receipt requested.

ARTICLE XII

SPECIAL MEETING OF STOCKHOLDERS

Special meetings of stockholders for any purpose or purposes may be called at any time by the Board, the Chairperson of the Board or the Chief Executive Officer of the Corporation, and may not be called by another other Person or Persons; provided that, prior to the Final Conversion Date, special meetings of stockholders for any purpose or purposes may also be called by or at the request of stockholders of the Corporation collectively holding shares of capital stock of the Corporation with voting power sufficient to provide the Requisite Stockholder Consent. Business transacted at any special meeting of stockholders shall be limited to matters relating to the purpose or purposes stated in the notice of meeting.

ARTICLE XIII

FORUM SELECTION

Unless the Corporation consents in writing to the selection of an alternative forum, (i) the Court of Chancery (the “Chancery Court”) of the State of Delaware (or, in the event that the Chancery Court does not have jurisdiction, the federal district court for the District of Delaware or other state courts of the State of Delaware) shall, to the fullest extent permitted by law, be the sole and exclusive forum for (1) any derivative action or proceeding brought on behalf of the Corporation, (2) any action asserting a claim of breach of a fiduciary duty owed by, or any other wrongdoing by, any current or former director, officer, other employee or stockholder of the Corporation, (3) any action asserting a claim against the Corporation arising pursuant to any provision of the DGCL, this Certificate of Incorporation or the Bylaws or as to which the DGCL confers jurisdiction on the Court of Chancery, (4) any action to interpret, apply, enforce or determine the validity of any provisions of this Certificate of Incorporation or the Bylaws, or (5) any other action asserting a claim governed by the internal affairs doctrine and (ii) notwithstanding anything to the contrary herein, but subject to the foregoing provisions of this Article XIII, the federal district courts of the United States shall be the exclusive forum for the resolution of any action, suit or proceeding asserting a cause of action arising under the Securities Act of 1933, as amended. If any action the subject matter of which is within the scope of the preceding sentence is filed in a court other than the applicable courts specified in the immediately preceding sentence (a “Foreign Action”) in the name of

16

any stockholder, such stockholder shall, to the fullest extent permitted by applicable law, be deemed to have consented to (a) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce the preceding sentence and (b) having service of process made upon such stockholder in any such action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder. This provision will not apply to claims arising under the Securities Exchange Act of 1934, as amended, or other federal securities laws for which there is exclusive federal jurisdiction. Any Person or entity purchasing or otherwise acquiring or holding any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article XIII.

ARTICTLE XIV

MISCELLANEOUS

If any provision or provisions of this Certificate of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (i) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Certificate of Incorporation (including, without limitation, each portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (ii) to the fullest extent possible and without limiting any other provisions of this Certificate of Incorporation (or any other provision of the Bylaws or any agreement entered into by the Corporation), the provisions of this Certificate of Incorporation (including, without limitation, each such portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service to, or for the benefit of, the Corporation to the fullest extent permitted by law.

To the fullest extent permitted by law, each and every Person purchasing or otherwise acquiring any interest (of any nature whatsoever) in any shares of the capital stock of the Corporation shall be deemed, by reason of and from and after the time of such purchase or other acquisition, to have notice of and to have consented to all of the provisions of (a) this Certificate of Incorporation, (b) the Bylaws and (c) any amendment to this Certificate of Incorporation or the Bylaws enacted or adopted in accordance with this Certificate of Incorporation, the Bylaws and applicable law.

[Remainder of Page Intentionally Left Blank]

17

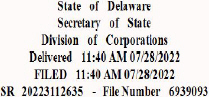

IN WITNESS WHEREOF, this Certificate of Incorporation has been executed this 28th day of July, 2022.

/s/ Manoj Jain |

MANOJ JAIN, Incorporator

8/F Printing House 6 Duddell Street |

| Hong Kong. |

Signature Page to Certificate of Incorporation