amalgamatedbank.com Member FDIC Amalgamated Financial Corp. First Quarter 2023 Earnings Presentation April 27, 2023

2 Safe Harbor Statements INTRODUCTION On March 1, 2021 (the “Effective Date”), Amalgamated Financial Corp. (the “Company”) completed its holding company reorganization and acquired all of the outstanding stock of Amalgamated Bank (the “Bank”). In this presentation, unless the context indicates otherwise, references to “we,” “us,” and “our” refer to the Company and the Bank. However, if the discussion relates to a period before the Effective Date, the terms refer only to the Bank. FORWARD-LOOKING STATEMENTS Statements included in this presentation that are not historical in nature are intended to be, and are hereby identified as, forward-looking statements within the meaning of the Private Securities Litigation Reform Act, Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified through the use of forward-looking terminology such as “may,” “will,” “anticipate,” “aspire,” “should,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “in the future,” “may” and “intend,” as well as other similar words and expressions of the future. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors, any or all of which could cause actual results to differ materially from the results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, our 2023 Guidance, and statements related to future loss/income (including projected non-interest income) of solar tax equity investments. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors, many of which are beyond our control and any or all of which could cause actual results to differ materially from the results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: • uncertain conditions in the banking industry and in national, regional and local economies in our core markets, which may have an adverse impact on our business, operations and financial performance; • deterioration in the financial condition of borrowers resulting in significant increases in loan losses and provisions for those losses • deposit outflows and subsequent declines in liquidity caused by factors that could include lack of confidence in the banking system, a deterioration in market conditions or the financial condition of depositors; • changes in our deposits, including an increase in uninsured deposits; • unfavorable conditions in the capital markets, which may cause declines in our stock price and the value of our investments; • negative economic and political conditions that adversely affect the general economy, housing prices, the real estate market, the job market, consumer confidence, the financial condition of our borrowers and consumer spending habits, which may affect, among other things, the level of non-performing assets, charge-offs and provision expense; • the rate of growth (or lack thereof) in the economy and employment levels, as well as general business and economic conditions, coupled with the risk that adverse conditions may be greater than anticipated in the markets that we serve; • continued fluctuation of the interest rate environment including changes in net interest margin or changes that affect the yield curve on investments; • potential deterioration in real estate collateral values • changes in legislation, regulation, public policies, or administrative practices impacting the banking industry, including increased regulation and FDIC assessments in the aftermath of the Silicon Valley and Signature Bank failures • the outcome of any legal proceedings that may be instituted against us • fluctuations or unanticipated changes in interest rates on loans or deposits or that affect the yield curve; • our inability to maintain the historical growth rate of our loan portfolio; • changes in loan underwriting, credit review or loss reserve policies associated with economic conditions, examination conclusions, or regulatory developments; • the impact of competition with other financial institutions, many of which are larger and have greater resources, and fintechs, as well as changes in the competitive environment; • any matter that would cause us to conclude that there was impairment of any asset, including intangible assets; • the risk that the preliminary financial information reported herein and our current preliminary analysis could be different when our review is finalized; • increased competition for experienced members of the workforce including executives in the banking industry; • our ability to meet heightened regulatory and supervisory requirements; • our ability to grow and retain low-cost core deposits and retain large, uninsured deposits; • inability to comply with regulatory capital requirements, including those resulting from changes to capital calculation methodologies, required capital maintenance levels or regulatory requests or directives; • risks associated with litigation, including the applicability of insurance coverage; • the risk of not achieving anticipated cost savings related to reduction in the number of branch locations and other expense areas; • a failure in or breach of our operational or security systems or infrastructure, or those of third party vendors or other service providers, including as a result of unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches; • a downgrade in our credit rating; • increased political opposition to Environmental, Social and Governance (“ESG”) practices; • recessionary conditions; • the ongoing economic effects of the COVID-19 pandemic • volatile credit and financial markets both domestic and foreign; • unexpected challenges related to our executive officer retention; and • physical and transitional risks related to climate change as they impact our business and the businesses that we finance. Additional factors which could affect the forward-looking statements can be found in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC and available on the SEC’s website at www.sec.gov/. We disclaim any obligation to update or revise any forward-looking statements contained in this presentation, which speak only as of the date hereof, or to update the reasons why actual results could differ from those contained in or implied by such statements, whether as a result of new information, future events or otherwise, except as required by law.

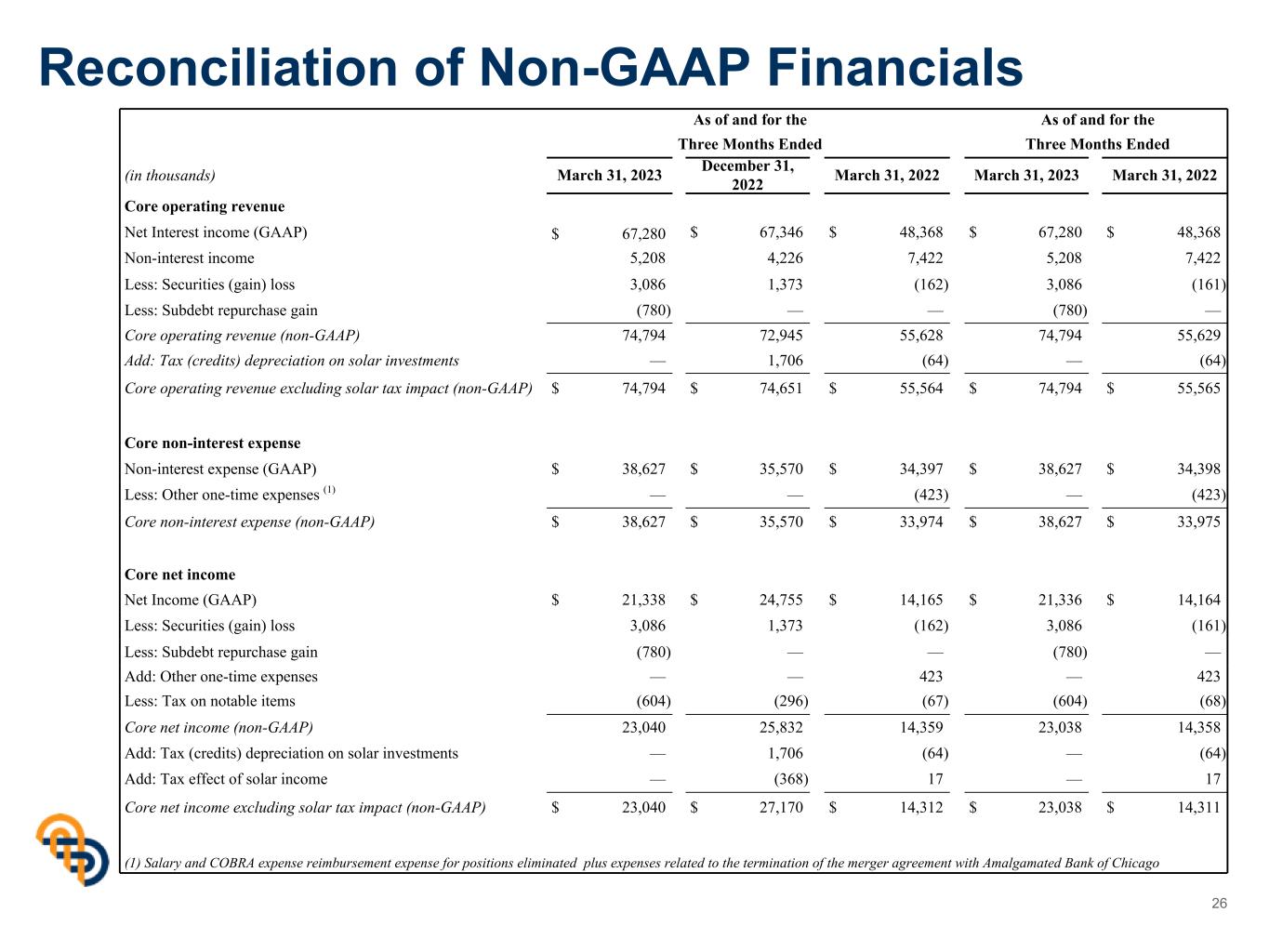

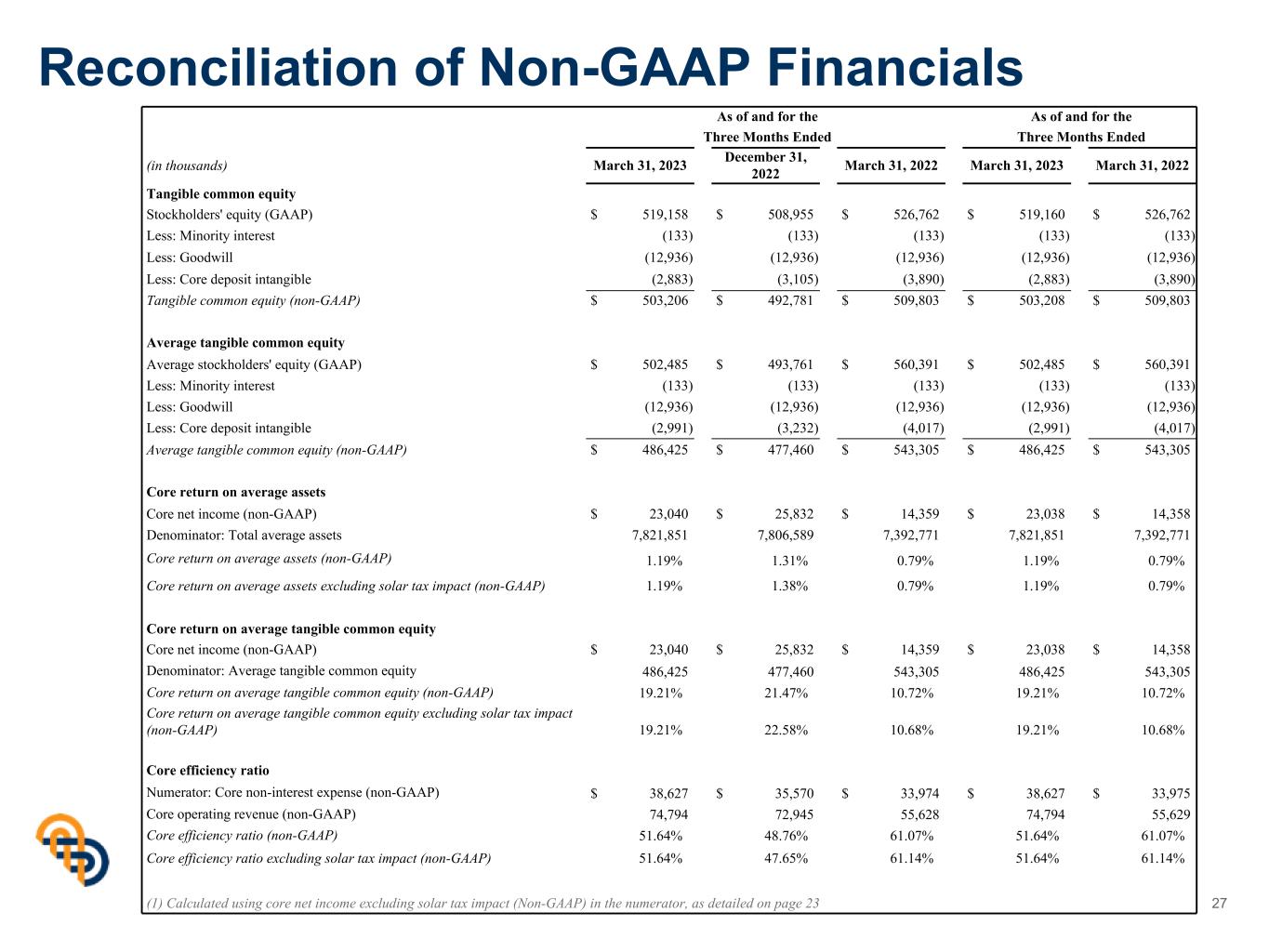

3 Safe Harbor Statements cont. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures including, without limitation, “Core Operating Revenue,” “Core Non-interest Expense,” “Tangible Common Equity,” “Average Tangible Common Equity,” “Core Efficiency Ratio,” “Core Net Income,” “Core ROAA,” and “Core ROATCE.” We believe these non-GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP. Specifically, we believe these non-GAAP financial measures (a) allow management and investors to better assess our performance by removing volatility that is associated with discrete items that are unrelated to our core business, and (b) enable a more complete understanding of factors and trends affecting our business. Non-GAAP financial measures, however, have inherent limitations, are not required to be uniformly applied, and are not audited. Accordingly, these non-GAAP financial measures should not be considered as substitutes for GAAP financial measures, and we strongly encourage investors to review the GAAP financial measures included in this presentation and not to place undue reliance on any single financial measure. In addition, because non-GAAP financial measures are not standardized, it may not be possible to compare the non-GAAP financial measures presented in this presentation with other companies’ non-GAAP financial measures having the same or similar names. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. Reconciliations of non-GAAP financial disclosures to what we believe to be the most directly comparable GAAP measures found in this presentation are set forth in the final pages of this presentation and also may be viewed on the bank’s website, amalgamatedbank.com. You should assume that all numbers presented are unaudited unless otherwise noted.

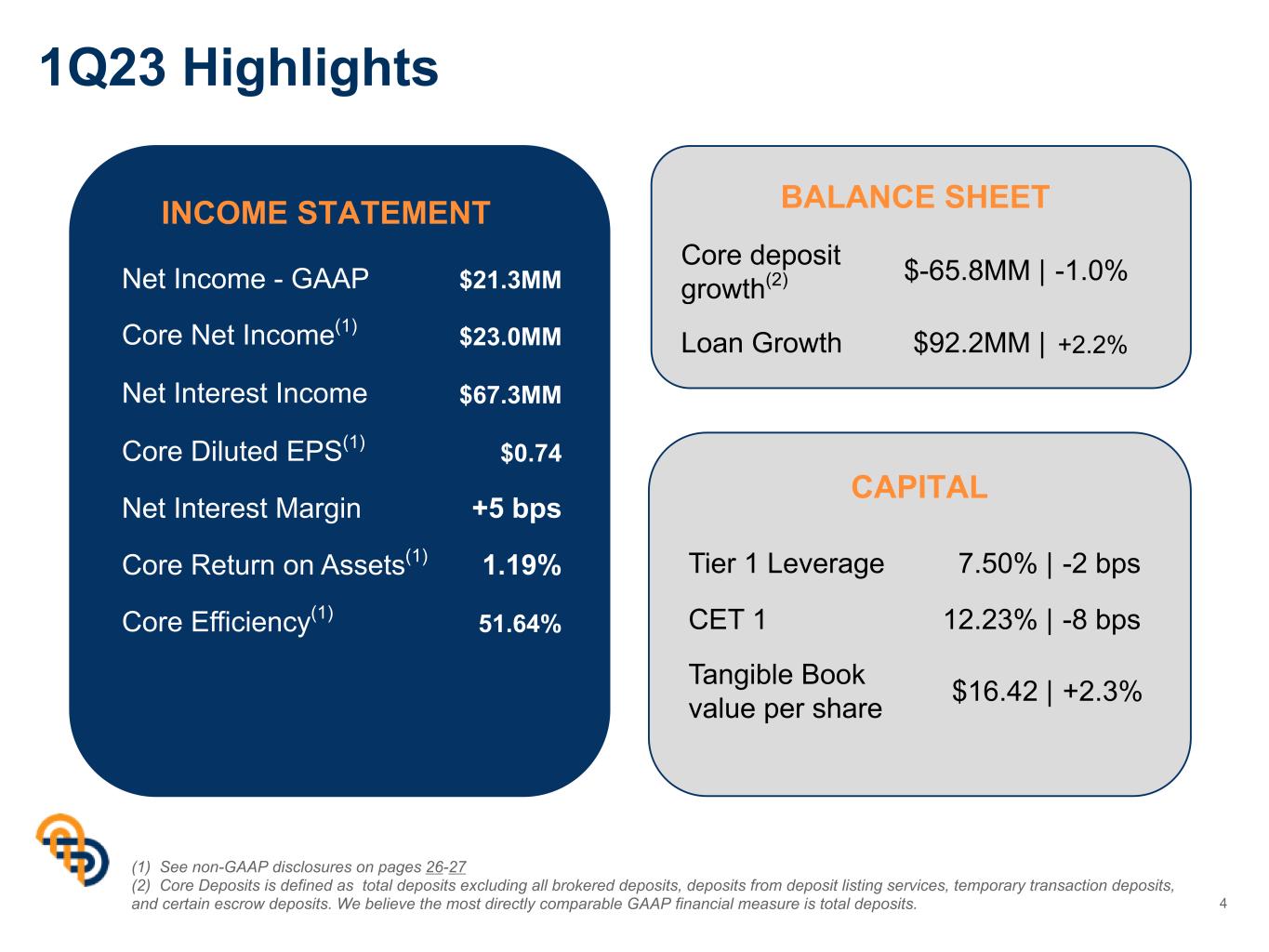

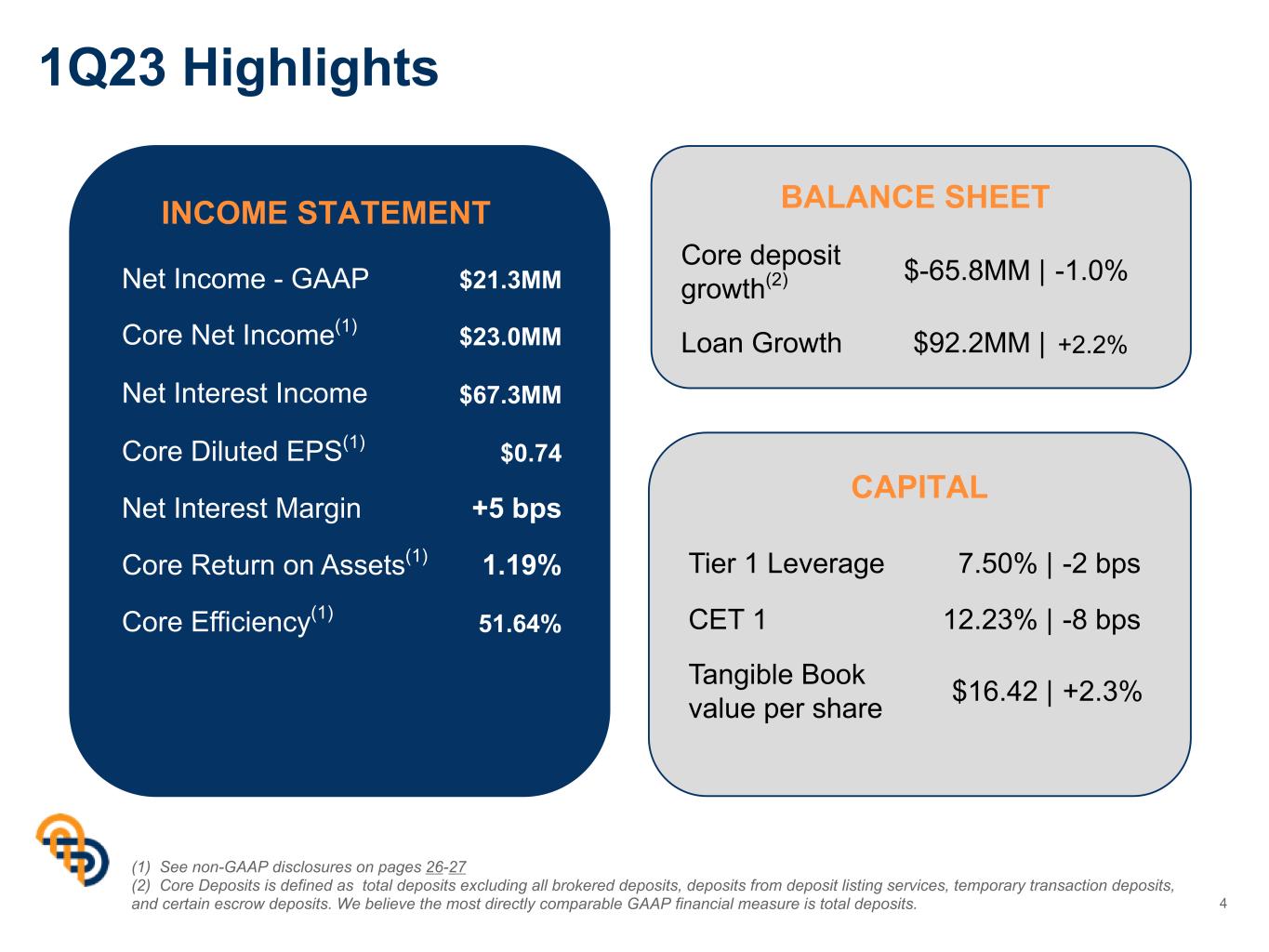

1Q23 Highlights 4 (1) See non-GAAP disclosures on pages 26-27 (2) Core Deposits is defined as total deposits excluding all brokered deposits, deposits from deposit listing services, temporary transaction deposits, and certain escrow deposits. We believe the most directly comparable GAAP financial measure is total deposits. INCOME STATEMENT BALANCE SHEET CAPITAL Net Income - GAAP $21.3MM Core Net Income(1) $23.0MM Net Interest Income $67.3MM Core Diluted EPS(1) $0.74 Net Interest Margin +5 bps Core Return on Assets(1) 1.19% Core Efficiency(1) 51.64% Core deposit growth(2) $-65.8MM | -1.0% Loan Growth $92.2MM | +2.2% Tier 1 Leverage 7.50% | -2 bps CET 1 12.23% | -8 bps Tangible Book value per share $16.42 | +2.3%

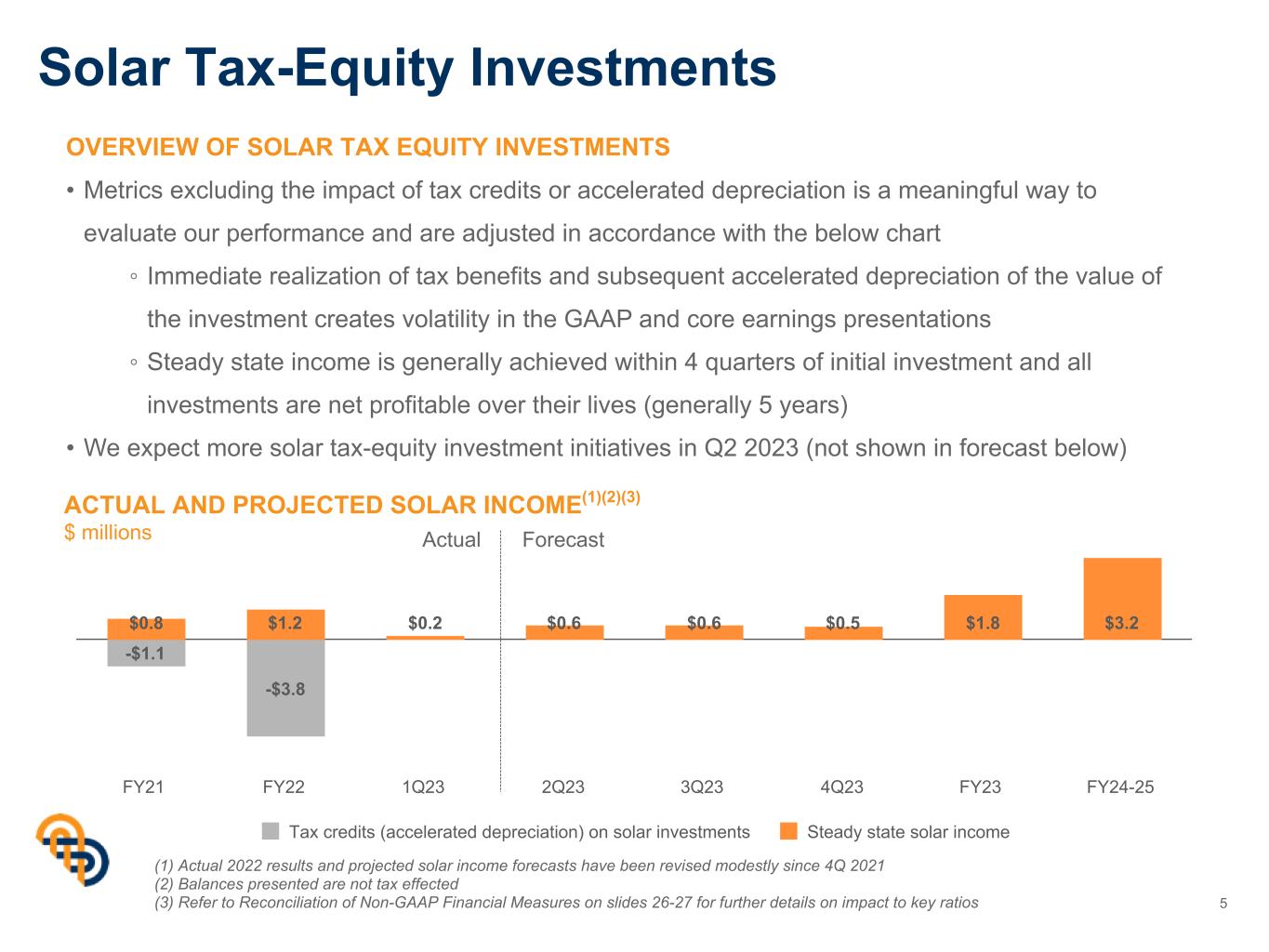

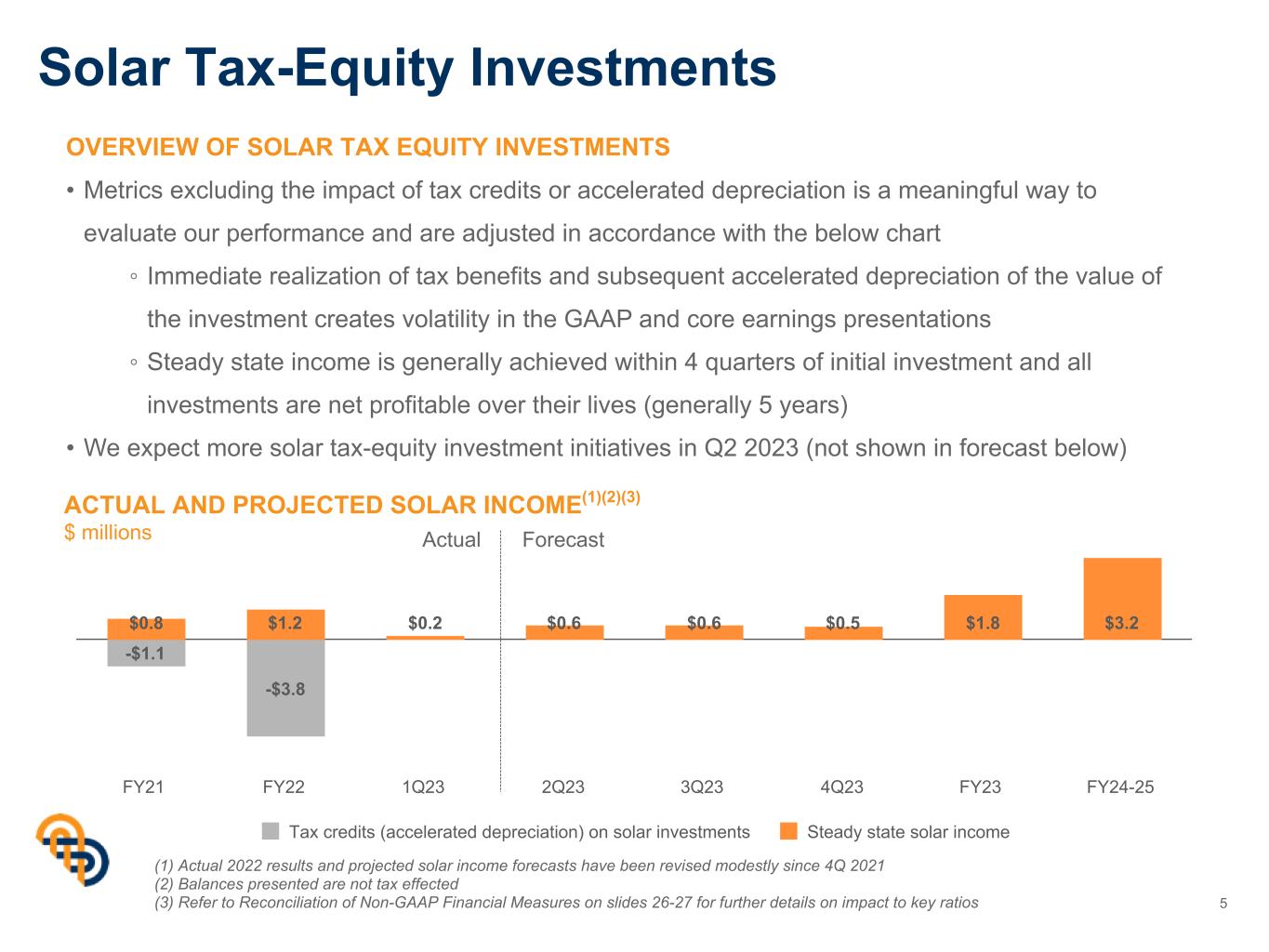

-$1.1 -$3.8 $0.8 $1.2 $0.2 $0.6 $0.6 $0.5 $1.8 $3.2 Tax credits (accelerated depreciation) on solar investments Steady state solar income FY21 FY22 1Q23 2Q23 3Q23 4Q23 FY23 FY24-25 Solar Tax-Equity Investments OVERVIEW OF SOLAR TAX EQUITY INVESTMENTS • Metrics excluding the impact of tax credits or accelerated depreciation is a meaningful way to evaluate our performance and are adjusted in accordance with the below chart ◦ Immediate realization of tax benefits and subsequent accelerated depreciation of the value of the investment creates volatility in the GAAP and core earnings presentations ◦ Steady state income is generally achieved within 4 quarters of initial investment and all investments are net profitable over their lives (generally 5 years) • We expect more solar tax-equity investment initiatives in Q2 2023 (not shown in forecast below) 5 ACTUAL AND PROJECTED SOLAR INCOME(1)(2)(3) $ millions Actual Forecast (1) Actual 2022 results and projected solar income forecasts have been revised modestly since 4Q 2021 (2) Balances presented are not tax effected (3) Refer to Reconciliation of Non-GAAP Financial Measures on slides 26-27 for further details on impact to key ratios

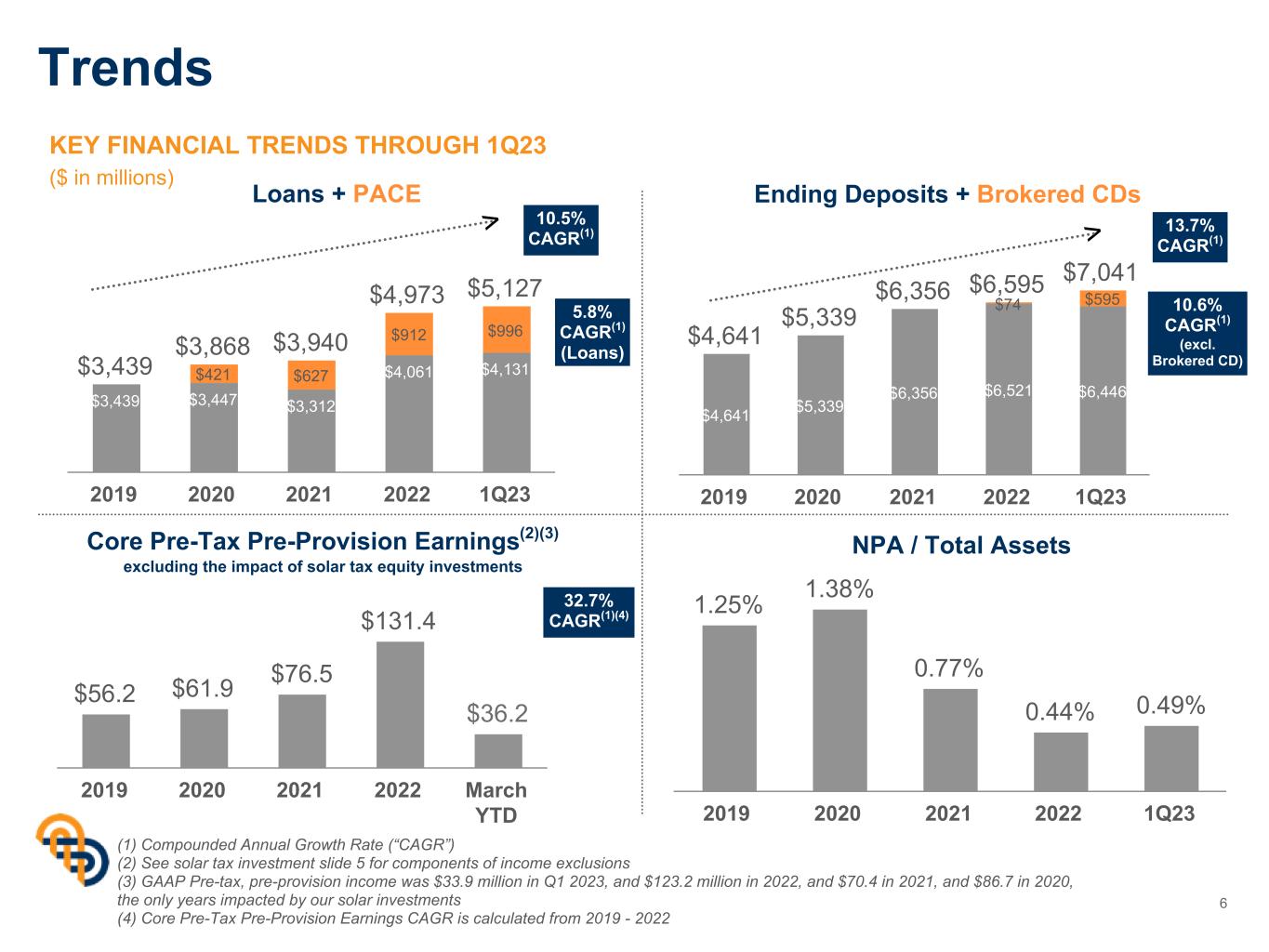

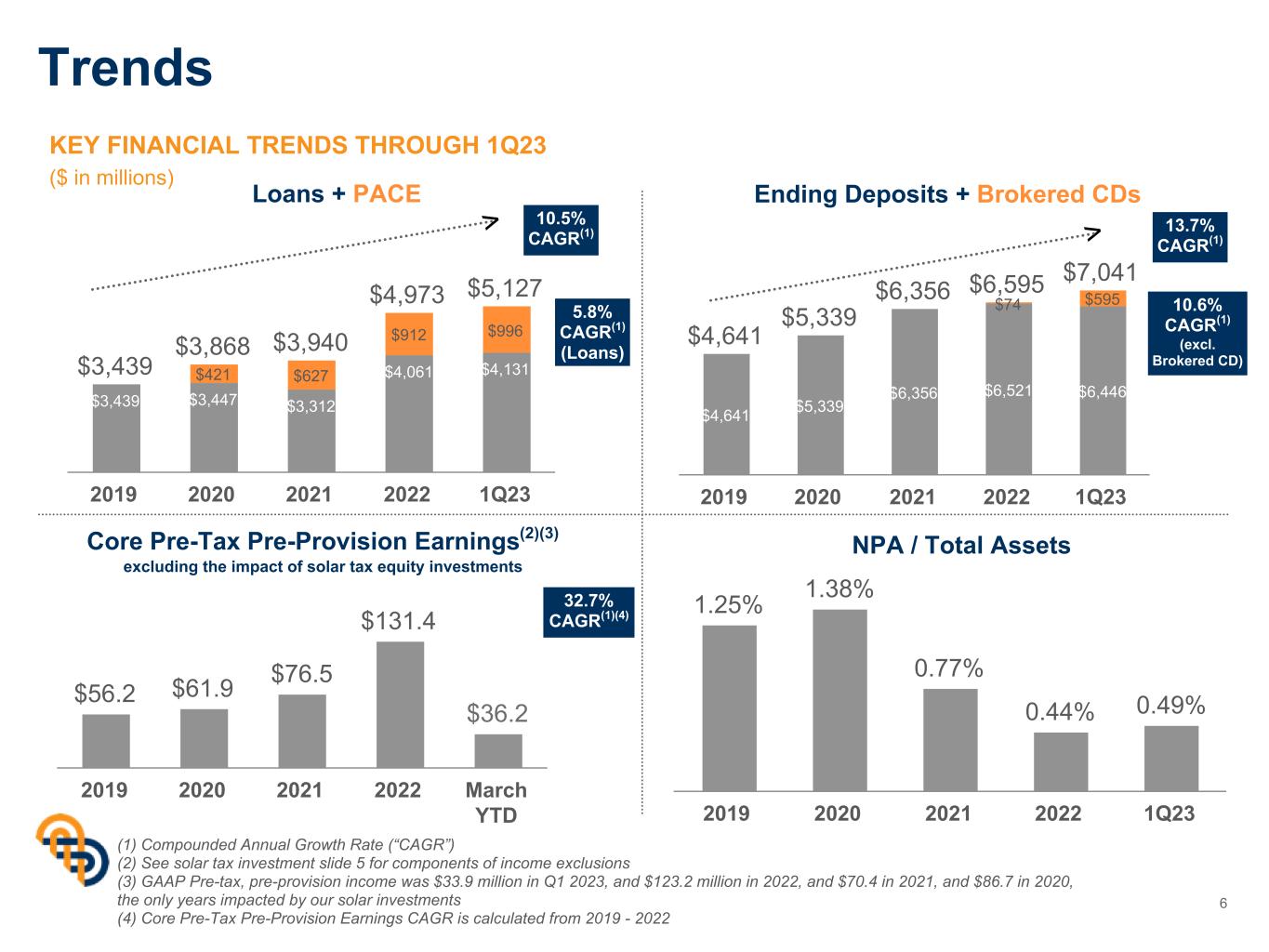

Ending Deposits + Brokered CDs $56.2 $61.9 $76.5 $131.4 $36.2 2019 2020 2021 2022 March YTD Trends 6 KEY FINANCIAL TRENDS THROUGH 1Q23 ($ in millions) (1) Compounded Annual Growth Rate (“CAGR”) (2) See solar tax investment slide 5 for components of income exclusions (3) GAAP Pre-tax, pre-provision income was $33.9 million in Q1 2023, and $123.2 million in 2022, and $70.4 in 2021, and $86.7 in 2020, the only years impacted by our solar investments (4) Core Pre-Tax Pre-Provision Earnings CAGR is calculated from 2019 - 2022 10.5% CAGR(1) 13.7% CAGR(1) 32.7% CAGR(1)(4) NPA / Total Assets Loans + PACE $4,641 $5,339 $6,356 $6,595 $7,041 $4,641 $5,339 $6,356 $6,521 $6,446 $74 $595 2019 2020 2021 2022 1Q23 1.25% 1.38% 0.77% 0.44% 0.49% 2019 2020 2021 2022 1Q23 $3,439 $3,868 $3,940 $4,973 $5,127 $3,439 $3,447 $3,312 $4,061 $4,131$421 $627 $912 $996 2019 2020 2021 2022 1Q23 >> 5.8% CAGR(1) (Loans) Core Pre-Tax Pre-Provision Earnings(2)(3) excluding the impact of solar tax equity investments 10.6% CAGR(1) (excl. Brokered CD)

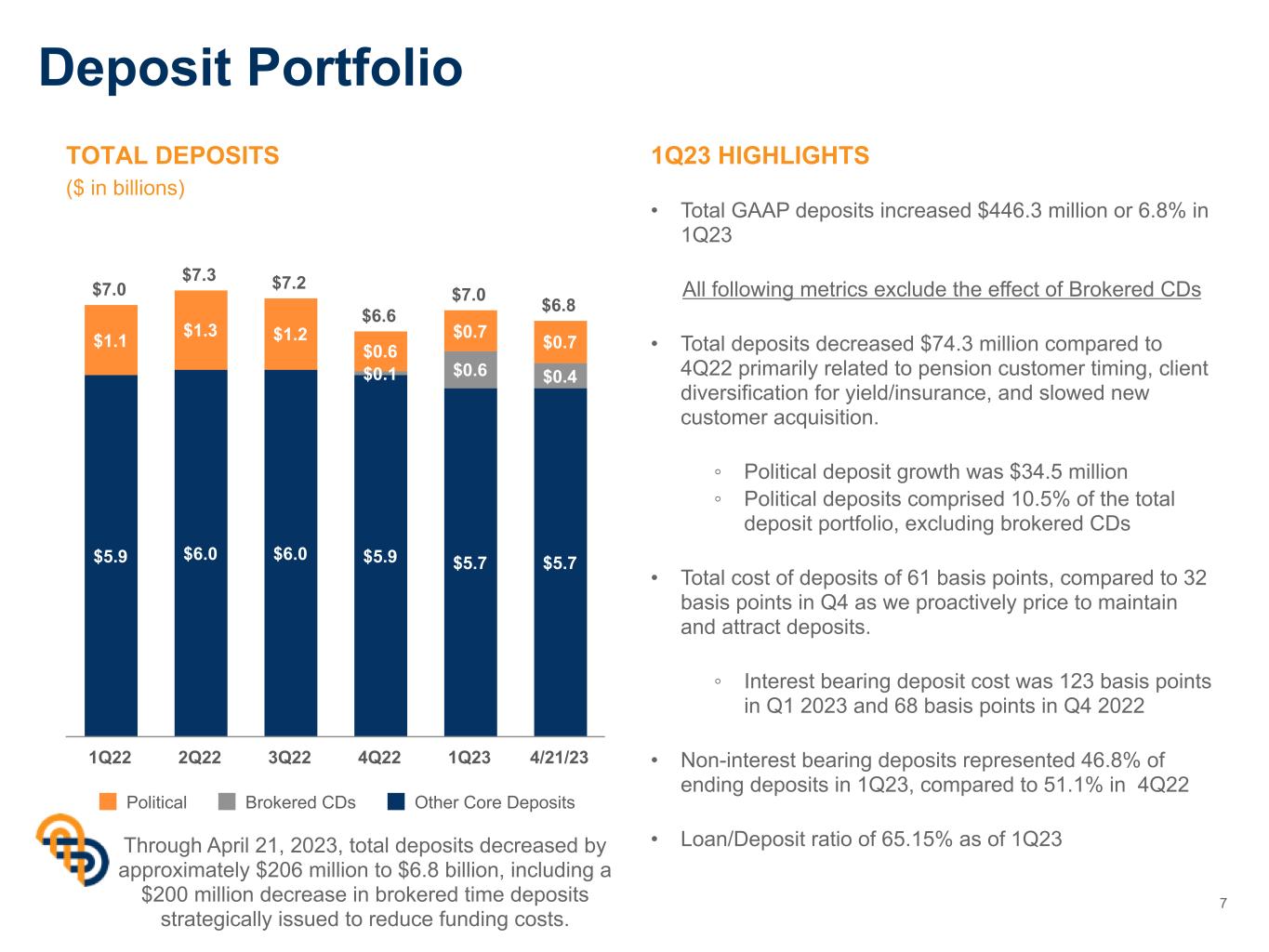

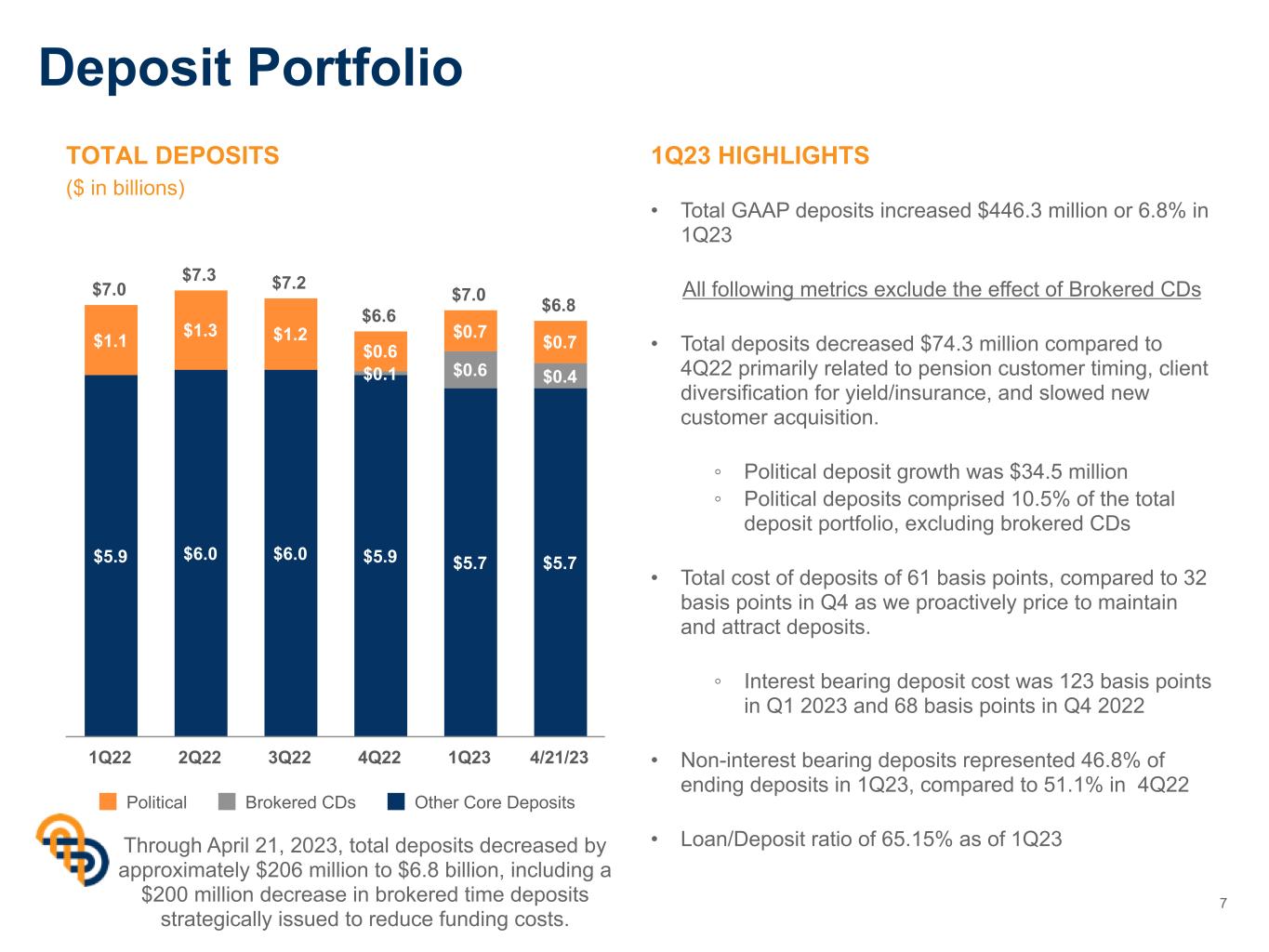

Deposit Portfolio 7 1Q23 HIGHLIGHTS • Total GAAP deposits increased $446.3 million or 6.8% in 1Q23 All following metrics exclude the effect of Brokered CDs • Total deposits decreased $74.3 million compared to 4Q22 primarily related to pension customer timing, client diversification for yield/insurance, and slowed new customer acquisition. ◦ Political deposit growth was $34.5 million ◦ Political deposits comprised 10.5% of the total deposit portfolio, excluding brokered CDs • Total cost of deposits of 61 basis points, compared to 32 basis points in Q4 as we proactively price to maintain and attract deposits. ◦ Interest bearing deposit cost was 123 basis points in Q1 2023 and 68 basis points in Q4 2022 • Non-interest bearing deposits represented 46.8% of ending deposits in 1Q23, compared to 51.1% in 4Q22 • Loan/Deposit ratio of 65.15% as of 1Q23 TOTAL DEPOSITS ($ in billions) $7.0 $7.3 $7.2 $6.6 $7.0 $6.8 $5.9 $6.0 $6.0 $5.9 $5.7 $5.7 $0.1 $0.6 $0.4 $1.1 $1.3 $1.2 $0.6 $0.7 $0.7 Political Brokered CDs Other Core Deposits 1Q22 2Q22 3Q22 4Q22 1Q23 4/21/23 Through April 21, 2023, total deposits decreased by approximately $206 million to $6.8 billion, including a $200 million decrease in brokered time deposits strategically issued to reduce funding costs.

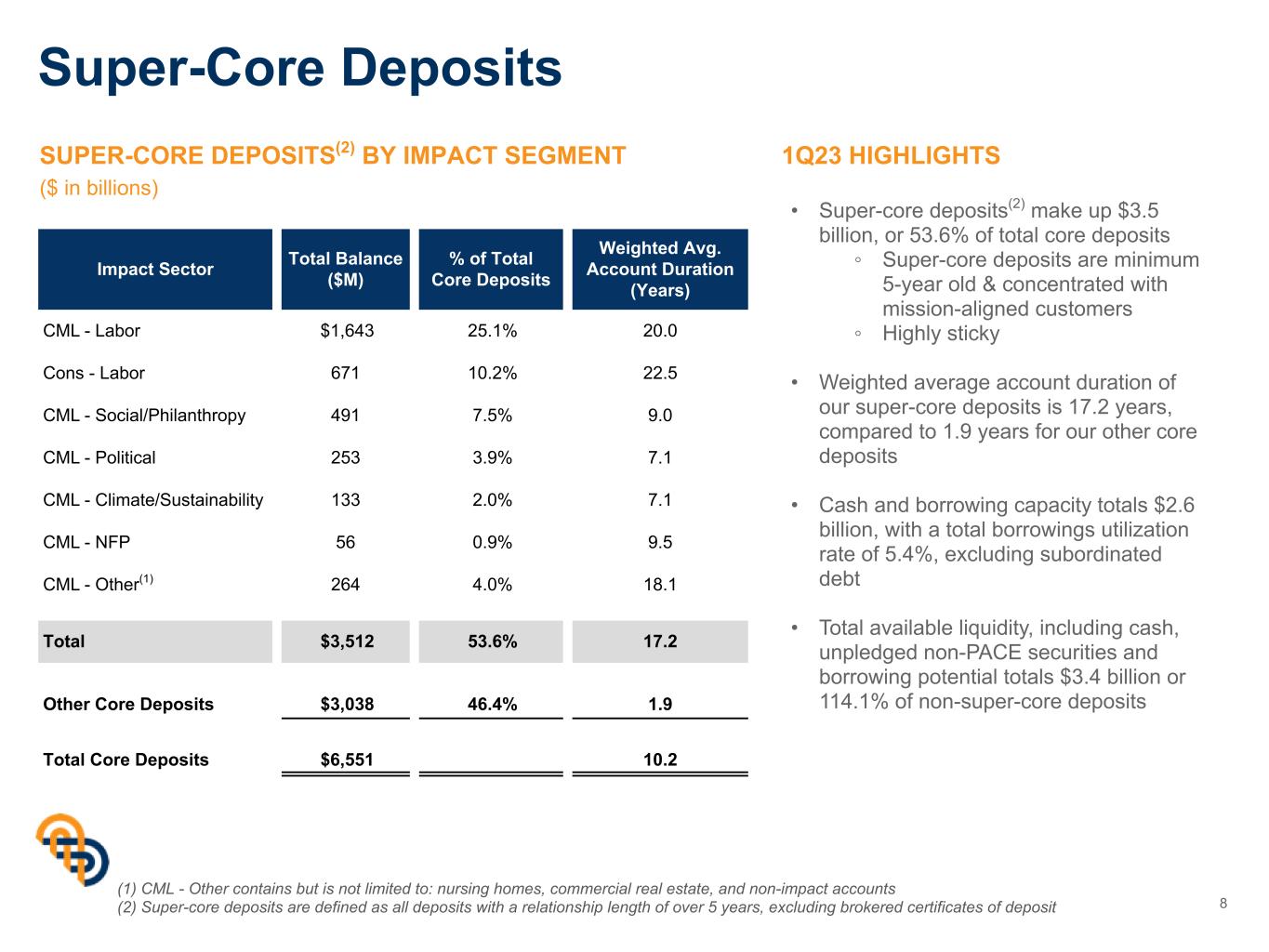

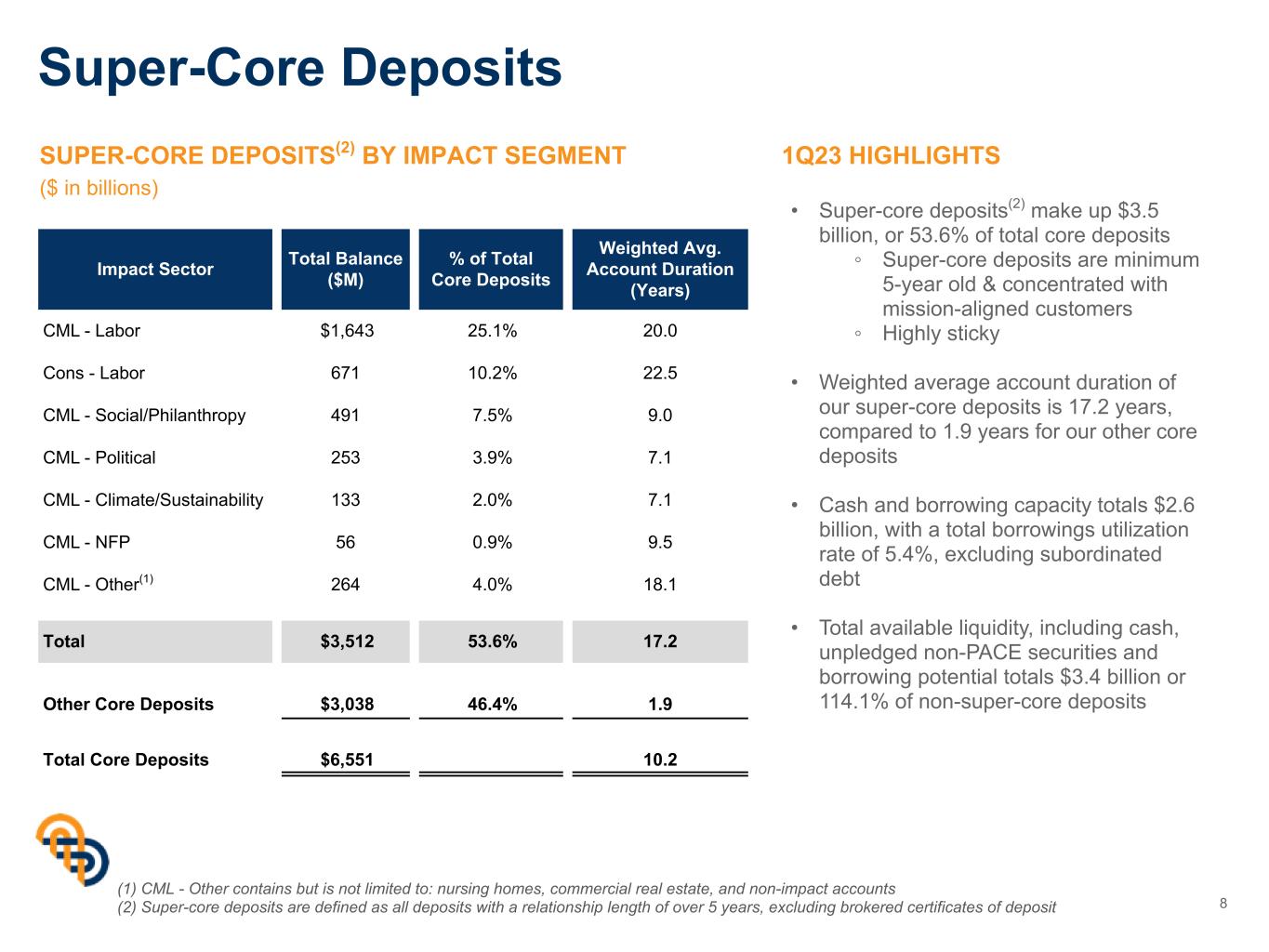

Super-Core Deposits 8 SUPER-CORE DEPOSITS(2) BY IMPACT SEGMENT ($ in billions) 1Q23 HIGHLIGHTS (1) CML - Other contains but is not limited to: nursing homes, commercial real estate, and non-impact accounts (2) Super-core deposits are defined as all deposits with a relationship length of over 5 years, excluding brokered certificates of deposit • Super-core deposits(2) make up $3.5 billion, or 53.6% of total core deposits ◦ Super-core deposits are minimum 5-year old & concentrated with mission-aligned customers ◦ Highly sticky • Weighted average account duration of our super-core deposits is 17.2 years, compared to 1.9 years for our other core deposits • Cash and borrowing capacity totals $2.6 billion, with a total borrowings utilization rate of 5.4%, excluding subordinated debt • Total available liquidity, including cash, unpledged non-PACE securities and borrowing potential totals $3.4 billion or 114.1% of non-super-core deposits Impact Sector Total Balance ($M) % of Total Core Deposits Weighted Avg. Account Duration (Years) CML - Labor $1,643 25.1% 20.0 Cons - Labor 671 10.2% 22.5 CML - Social/Philanthropy 491 7.5% 9.0 CML - Political 253 3.9% 7.1 CML - Climate/Sustainability 133 2.0% 7.1 CML - NFP 56 0.9% 9.5 CML - Other(1) 264 4.0% 18.1 Total $3,512 53.6% 17.2 Other Core Deposits $3,038 46.4% 1.9 Total Core Deposits $6,551 10.2

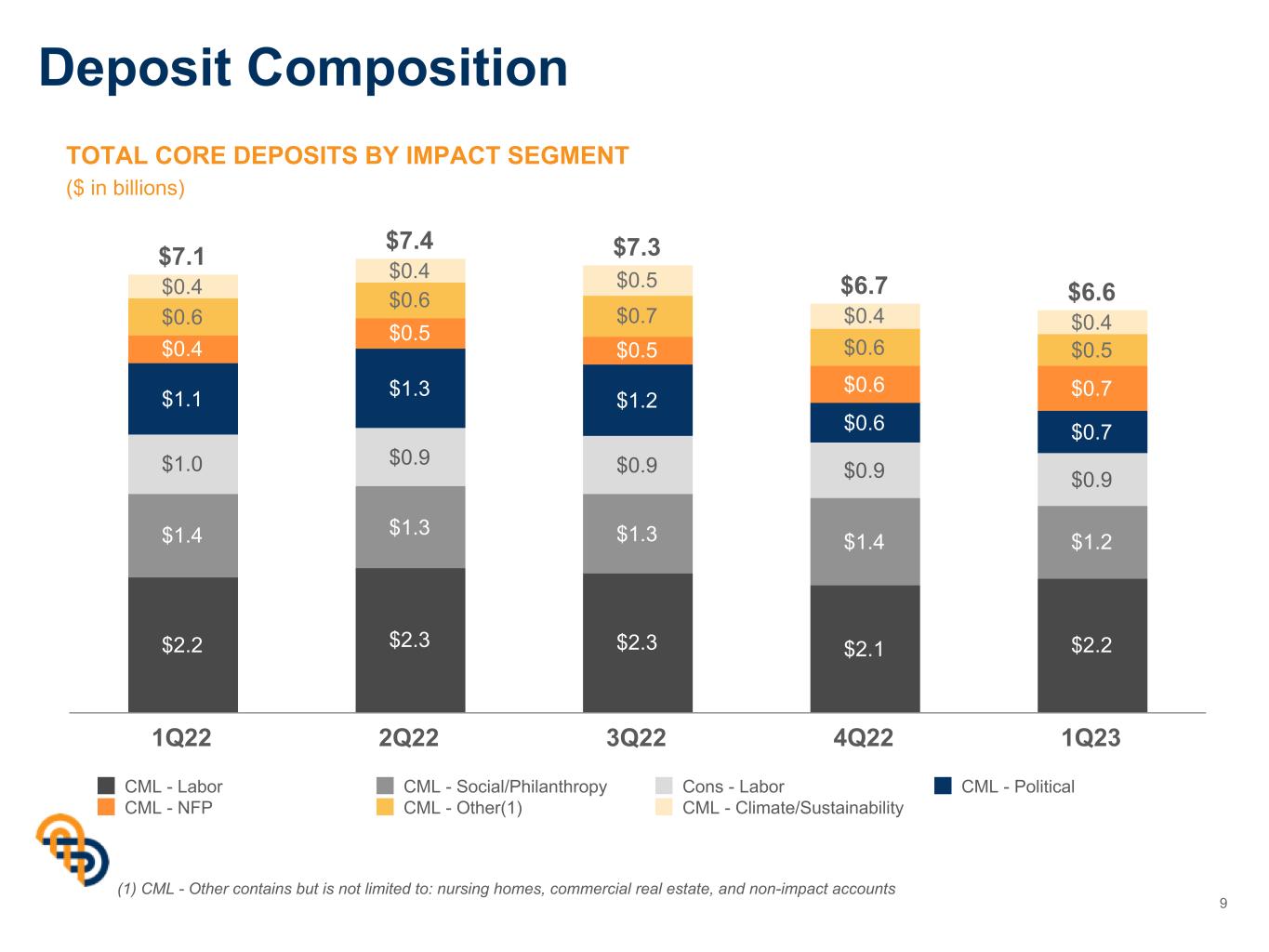

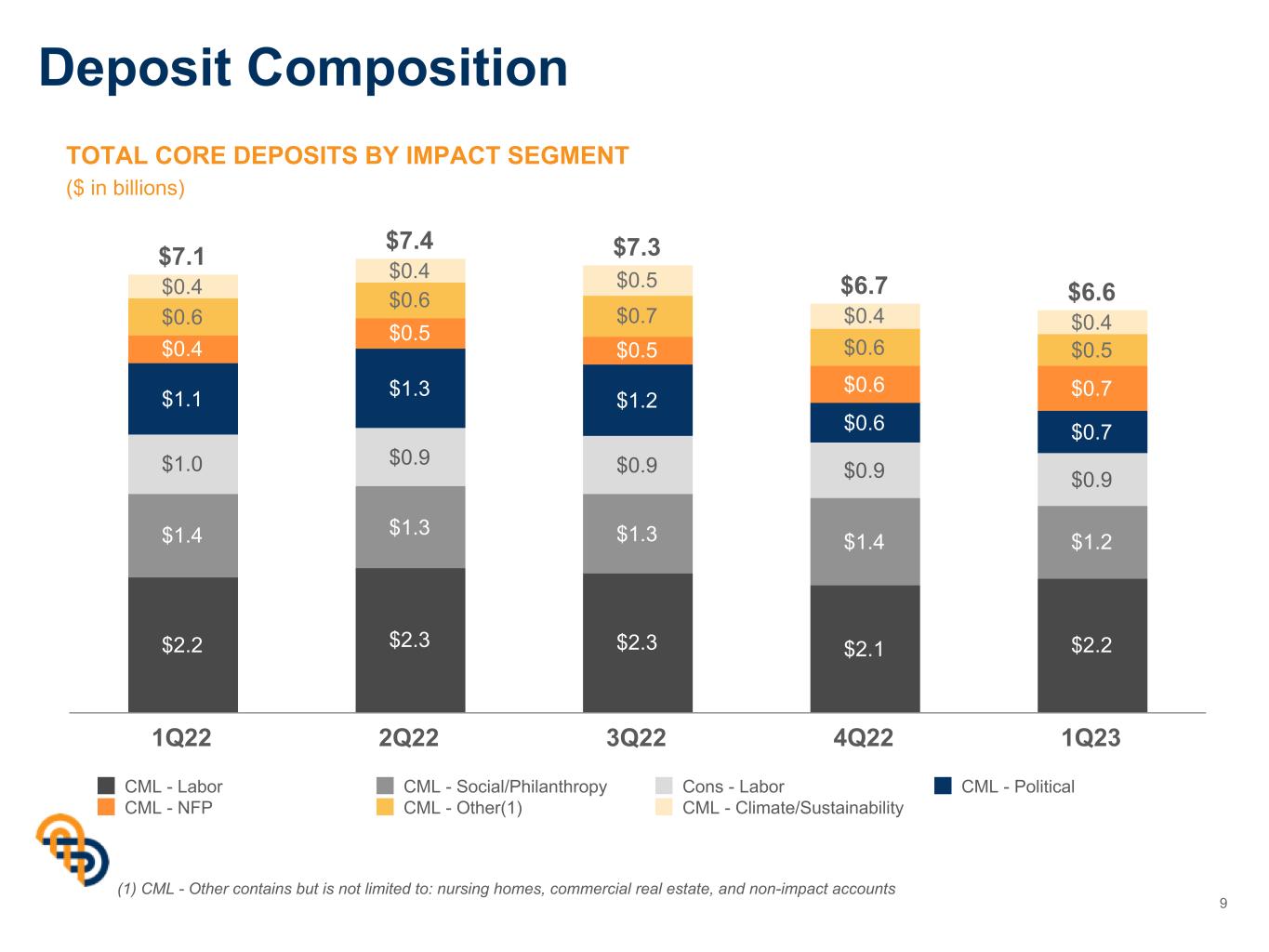

Deposit Composition 9 TOTAL CORE DEPOSITS BY IMPACT SEGMENT ($ in billions) $7.1 $7.4 $7.3 $6.7 $6.6 $2.2 $2.3 $2.3 $2.1 $2.2 $1.4 $1.3 $1.3 $1.4 $1.2 $1.0 $0.9 $0.9 $0.9 $0.9 $1.1 $1.3 $1.2 $0.6 $0.7 $0.4 $0.5 $0.5 $0.6 $0.7 $0.6 $0.6 $0.7 $0.6 $0.5 $0.4 $0.4 $0.5 $0.4 $0.4 CML - Labor CML - Social/Philanthropy Cons - Labor CML - Political CML - NFP CML - Other(1) CML - Climate/Sustainability 1Q22 2Q22 3Q22 4Q22 1Q23 (1) CML - Other contains but is not limited to: nursing homes, commercial real estate, and non-impact accounts

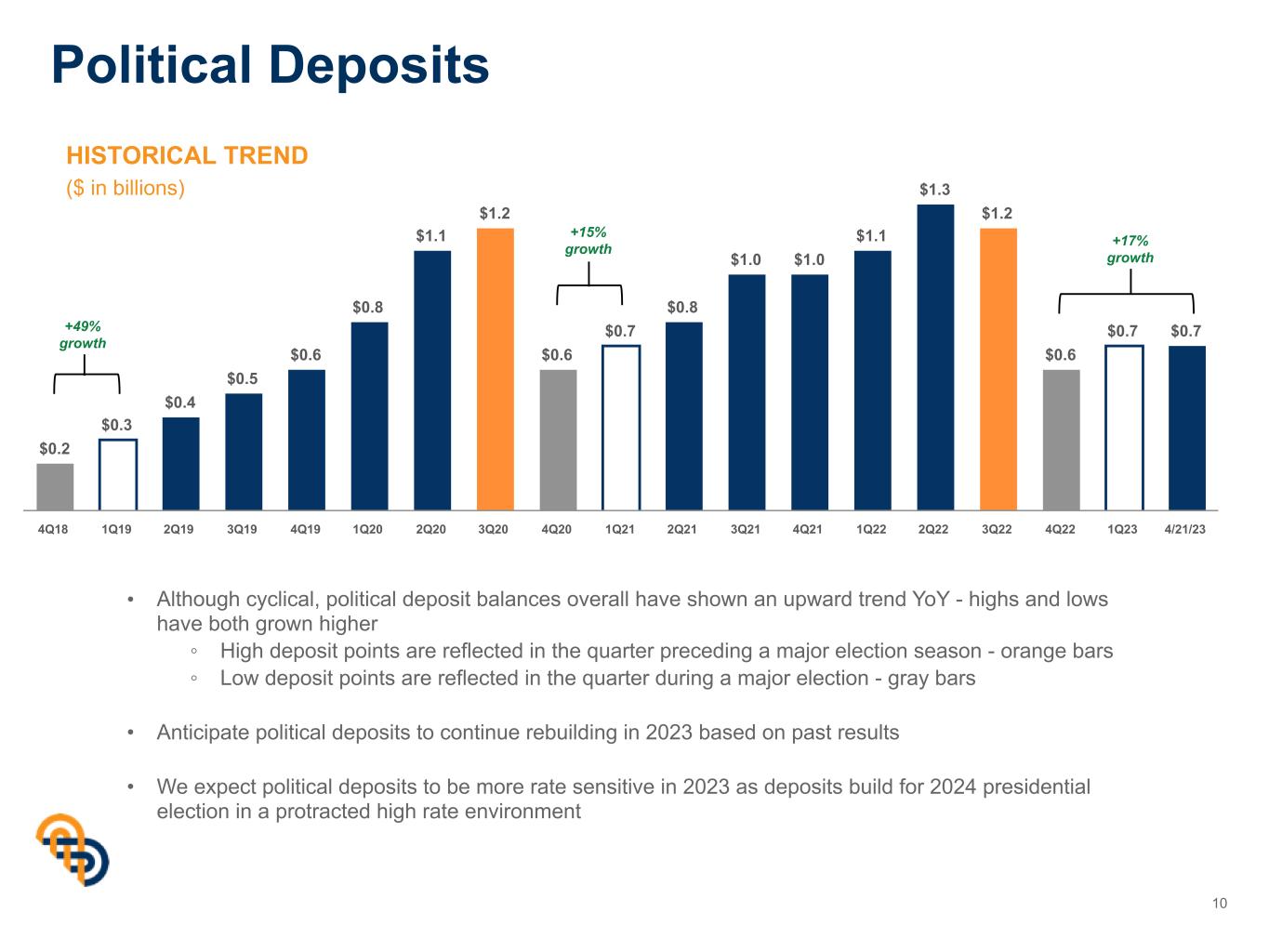

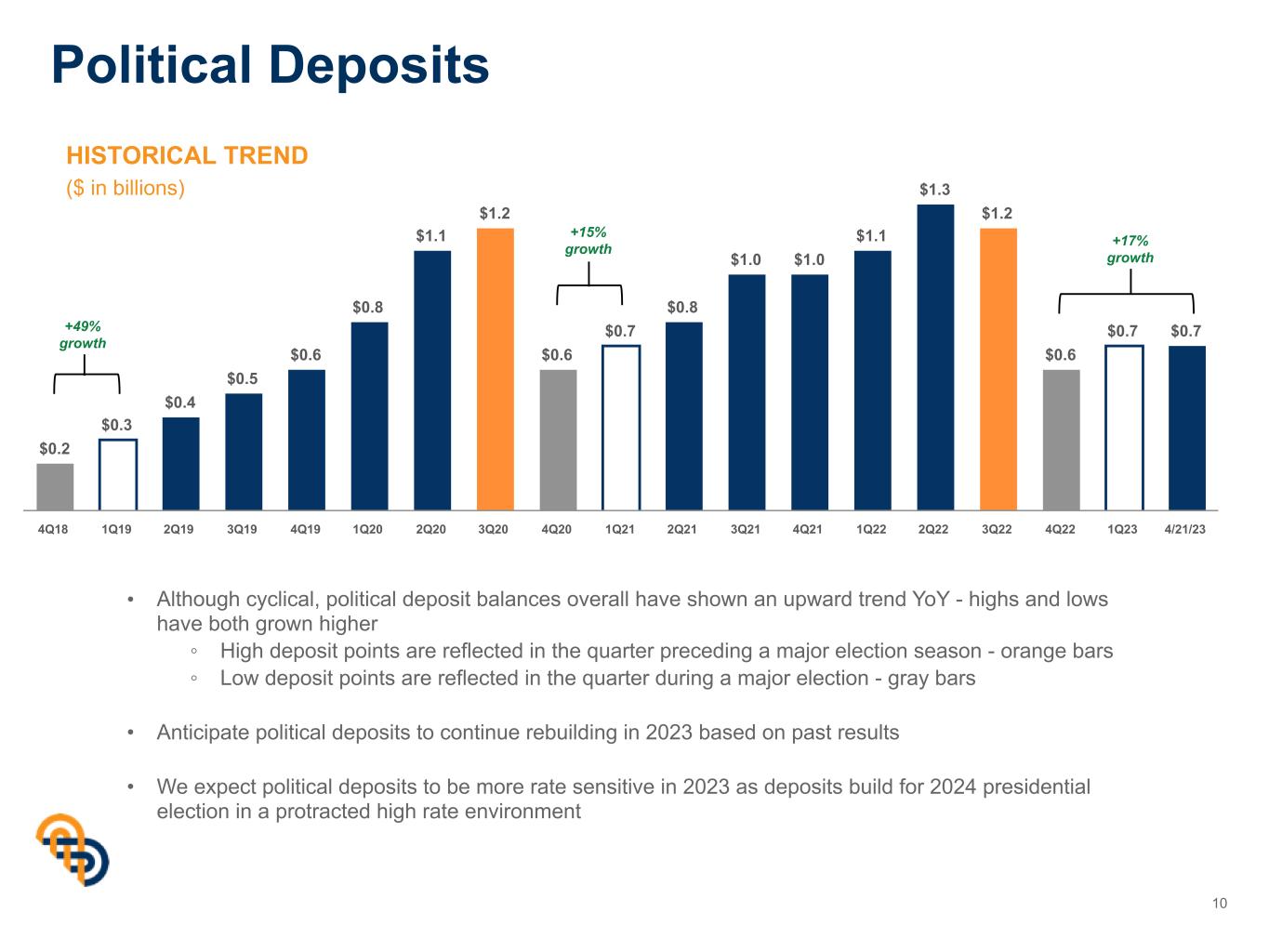

$0.2 $0.3 $0.4 $0.5 $0.6 $0.8 $1.1 $1.2 $0.6 $0.7 $0.8 $1.0 $1.0 $1.1 $1.3 $1.2 $0.6 $0.7 $0.7 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 4/21/23 10 HISTORICAL TREND ($ in billions) Political Deposits • Although cyclical, political deposit balances overall have shown an upward trend YoY - highs and lows have both grown higher ◦ High deposit points are reflected in the quarter preceding a major election season - orange bars ◦ Low deposit points are reflected in the quarter during a major election - gray bars • Anticipate political deposits to continue rebuilding in 2023 based on past results • We expect political deposits to be more rate sensitive in 2023 as deposits build for 2024 presidential election in a protracted high rate environment +15% growth +49% growth +17% growth

Investment Securities $2.3B PACE $1.0B Cash and Other $0.1B Residential $1.4B Multifamily & Commercial Real Estate $1.4B C&I, Consumer and Other $1.4B Interest Earning Assets 11 INTEREST EARNING ASSETS OF $7.6B AS OF MARCH 31, 2023 We maintain a diverse, low risk profile of interest earning assets • No fossil fuel exposure • $233mm of government guaranteed loans • $374mm residential solar loans with strong credit scores • Predominantly NYC properties with low LTV: MF = 55%, CRE = 49% • 99% first lien mortgages • Low LTV = 62% • 81%/19% originated to purchased portfolio $7.6B as of 1Q23 • $828mm agency securities • $1,551mm of non-agency securities • All non-agency MBS/ABS securities are top of the capital structure • $262mm of Commercial PACE and $734mm securities with low LTV • Total Pace LTV of 12%

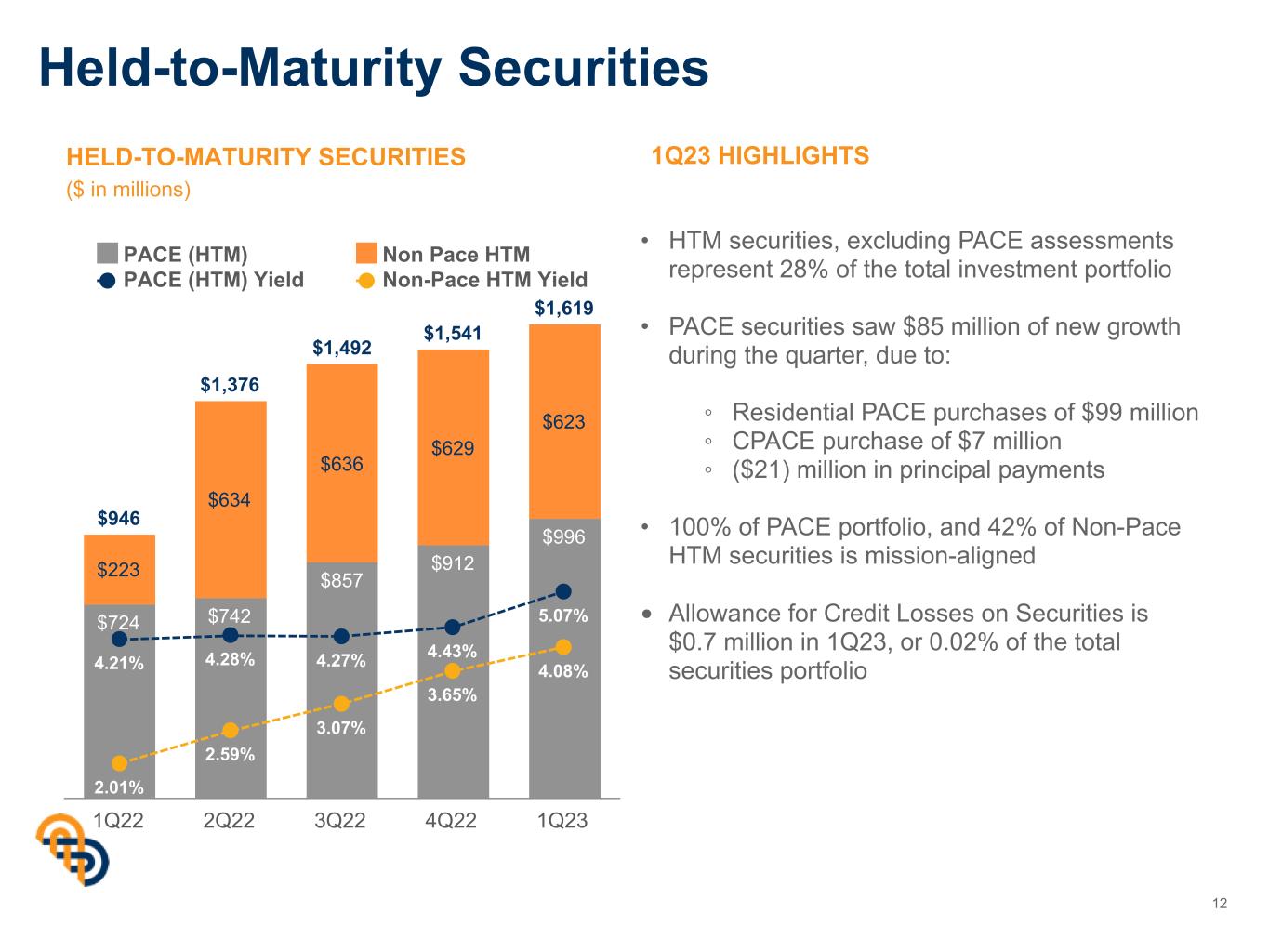

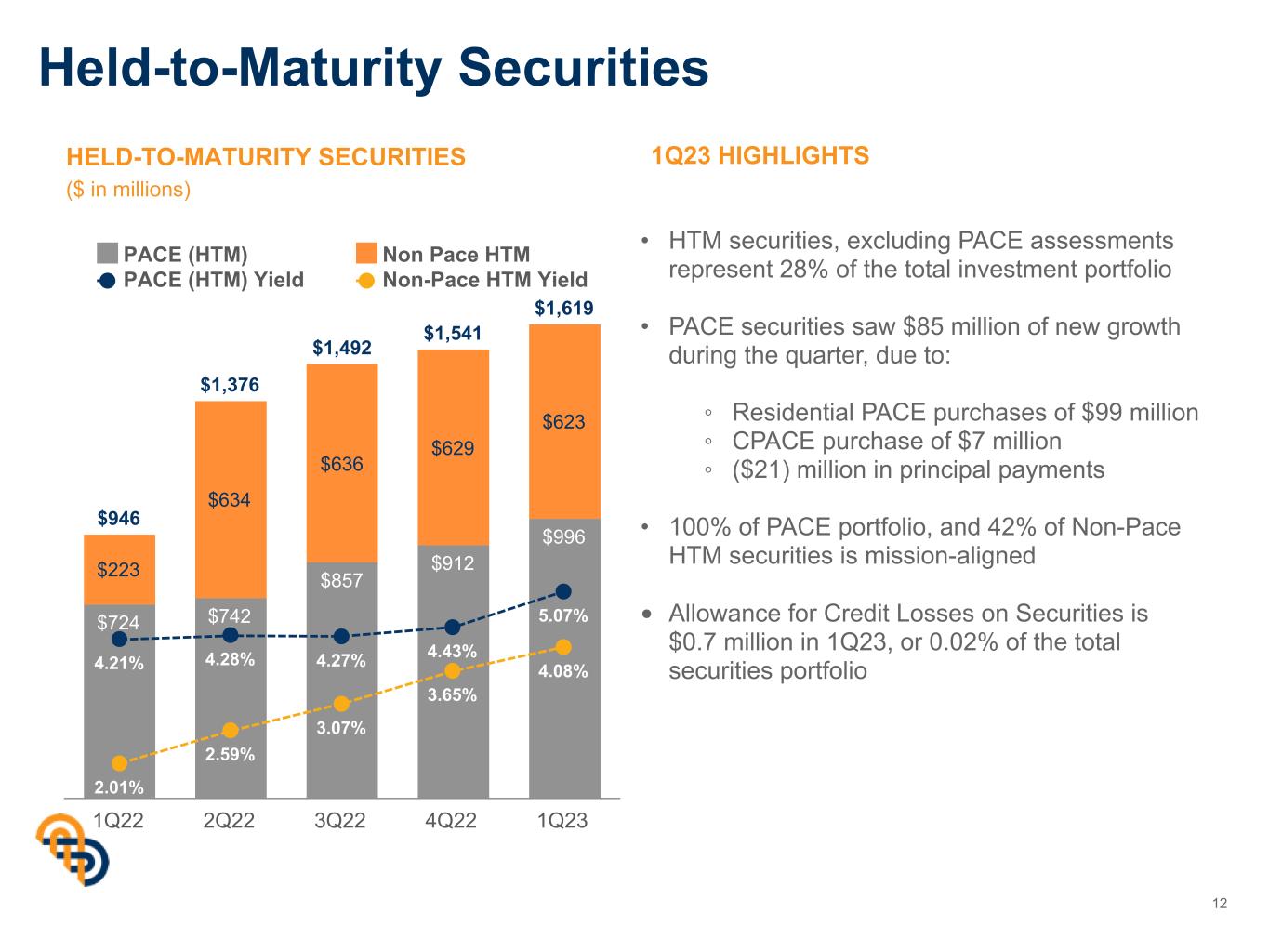

• HTM securities, excluding PACE assessments represent 28% of the total investment portfolio • PACE securities saw $85 million of new growth during the quarter, due to: ◦ Residential PACE purchases of $99 million ◦ CPACE purchase of $7 million ◦ ($21) million in principal payments • 100% of PACE portfolio, and 42% of Non-Pace HTM securities is mission-aligned • Allowance for Credit Losses on Securities is $0.7 million in 1Q23, or 0.02% of the total securities portfolio Held-to-Maturity Securities 12 HELD-TO-MATURITY SECURITIES ($ in millions) 1Q23 HIGHLIGHTS $946 $1,376 $1,492 $1,541 $1,619 $724 $742 $857 $912 $996 $223 $634 $636 $629 $623 4.21% 4.28% 4.27% 4.43% 5.07% 2.01% 2.59% 3.07% 3.65% 4.08% PACE (HTM) Non Pace HTM PACE (HTM) Yield Non-Pace HTM Yield 1Q22 2Q22 3Q22 4Q22 1Q23

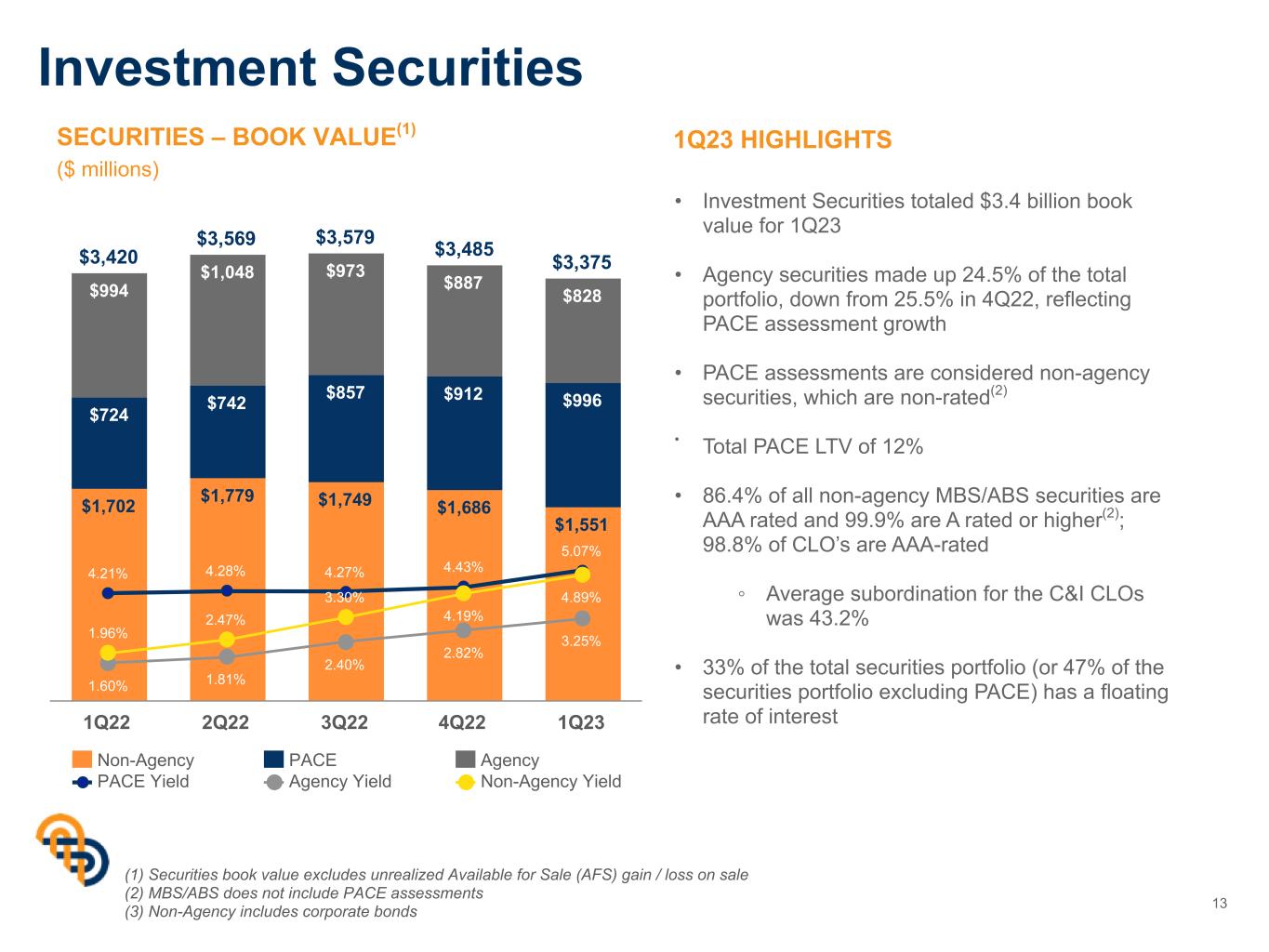

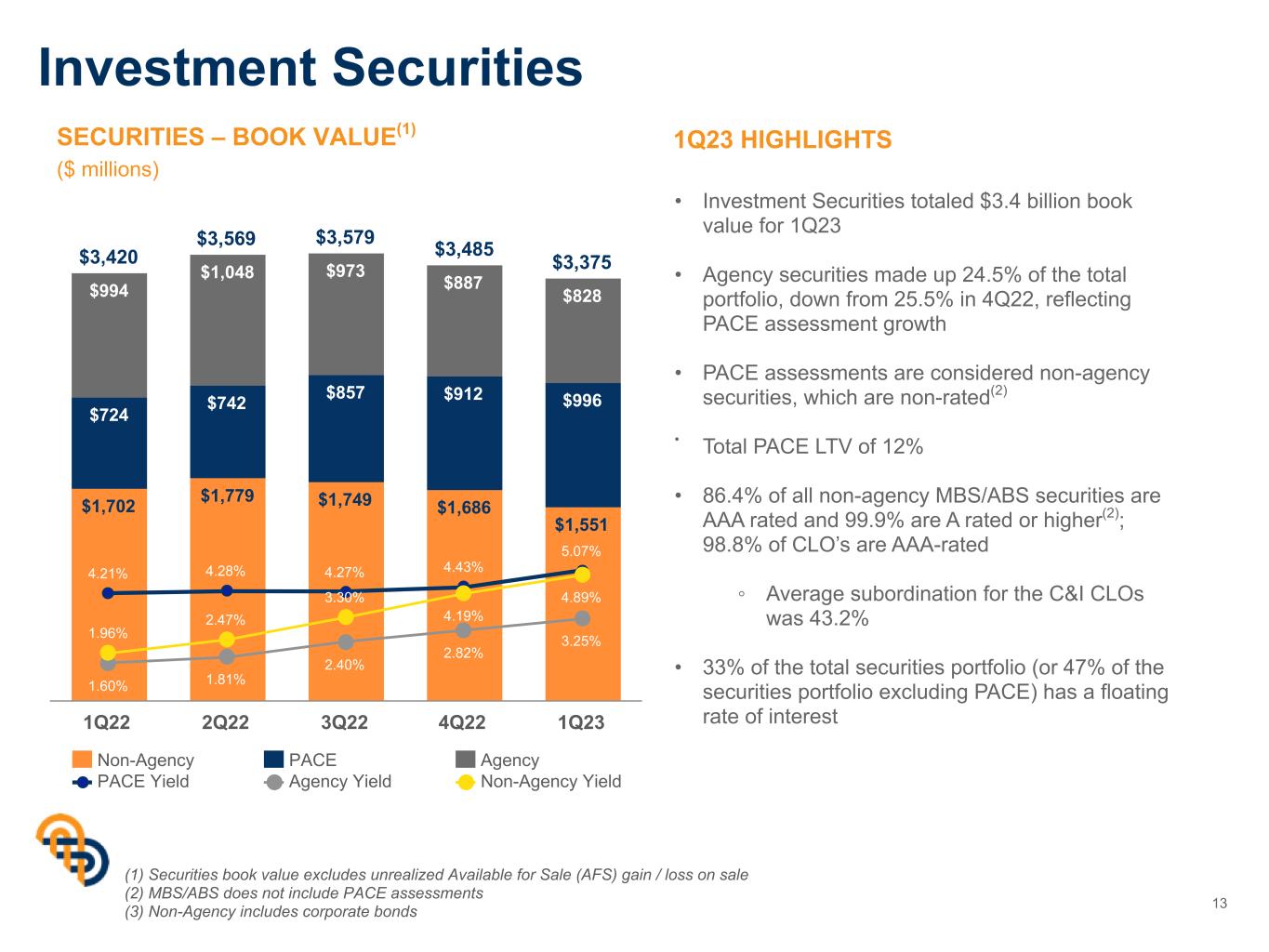

Investment Securities 13 SECURITIES – BOOK VALUE(1) ($ millions) (1) Securities book value excludes unrealized Available for Sale (AFS) gain / loss on sale (2) MBS/ABS does not include PACE assessments (3) Non-Agency includes corporate bonds • Investment Securities totaled $3.4 billion book value for 1Q23 • Agency securities made up 24.5% of the total portfolio, down from 25.5% in 4Q22, reflecting PACE assessment growth • PACE assessments are considered non-agency securities, which are non-rated(2) • Total PACE LTV of 12% • 86.4% of all non-agency MBS/ABS securities are AAA rated and 99.9% are A rated or higher(2); 98.8% of CLO’s are AAA-rated ◦ Average subordination for the C&I CLOs was 43.2% • 33% of the total securities portfolio (or 47% of the securities portfolio excluding PACE) has a floating rate of interest 1Q23 HIGHLIGHTS $3,420 $3,569 $3,579 $3,485 $3,375 $1,702 $1,779 $1,749 $1,686 $1,551 $724 $742 $857 $912 $996 $994 $1,048 $973 $887 $828 4.21% 4.28% 4.27% 4.43% 5.07% 1.60% 1.81% 2.40% 2.82% 3.25%1.96% 2.47% 3.30% 4.19% 4.89% Non-Agency PACE Agency PACE Yield Agency Yield Non-Agency Yield 1Q22 2Q22 3Q22 4Q22 1Q23

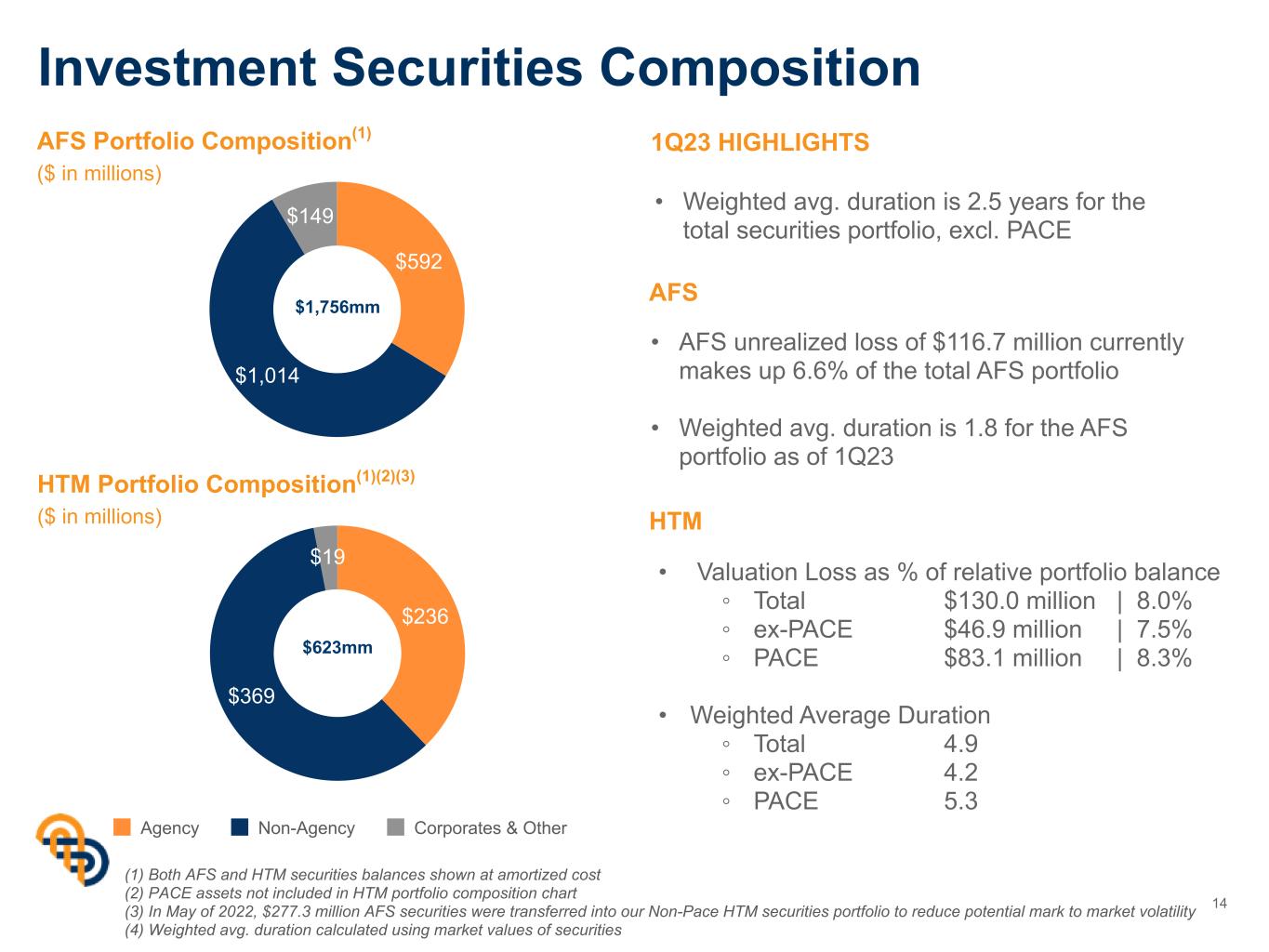

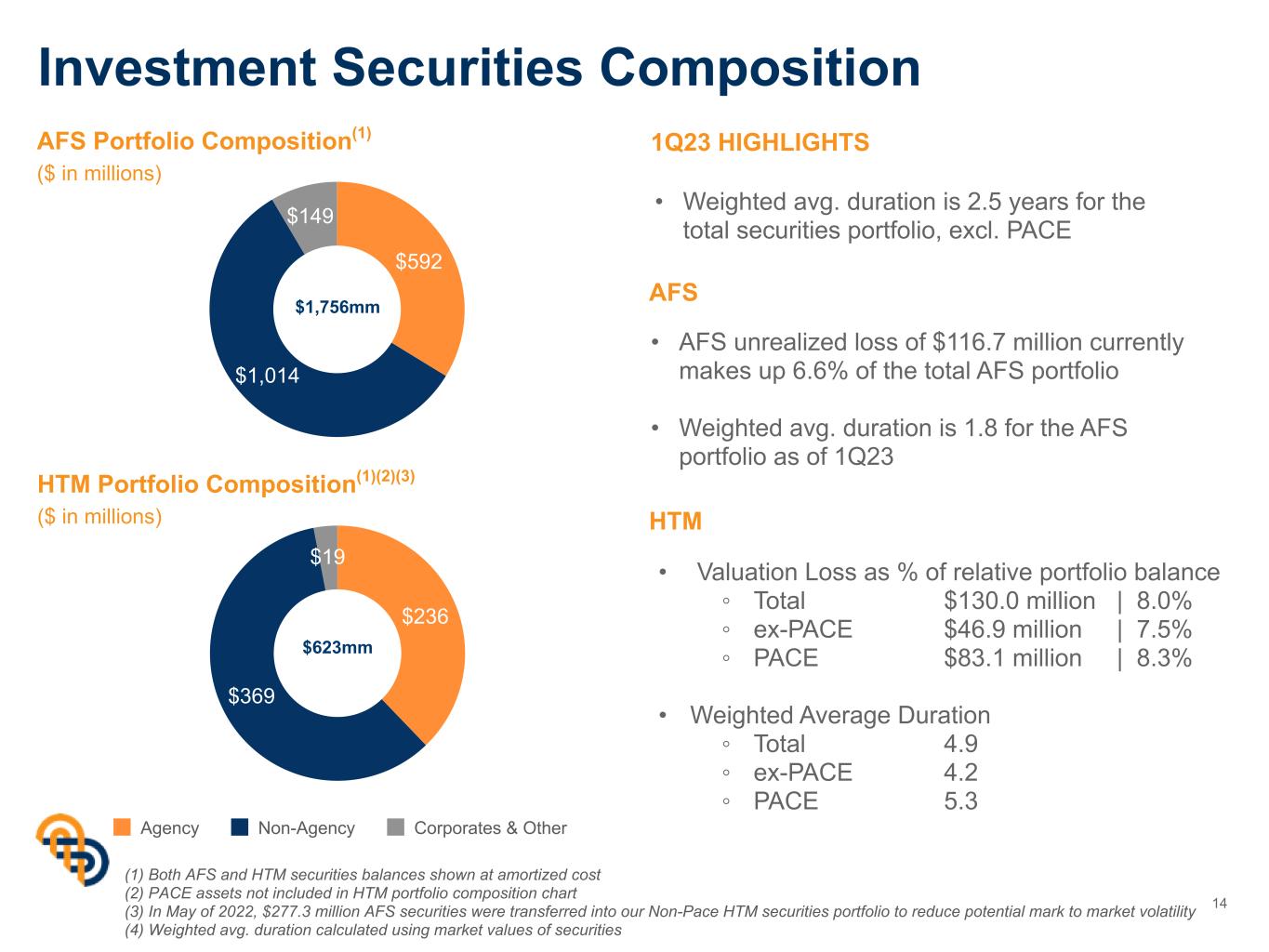

$592 $1,014 $149 Investment Securities Composition AFS Portfolio Composition(1) ($ in millions) HTM Portfolio Composition(1)(2)(3) ($ in millions) $236 $369 $19 Agency Non-Agency Corporates & Other (1) Both AFS and HTM securities balances shown at amortized cost (2) PACE assets not included in HTM portfolio composition chart (3) In May of 2022, $277.3 million AFS securities were transferred into our Non-Pace HTM securities portfolio to reduce potential mark to market volatility (4) Weighted avg. duration calculated using market values of securities 1Q23 HIGHLIGHTS • Weighted avg. duration is 2.5 years for the total securities portfolio, excl. PACE $1,756mm $623mm AFS • AFS unrealized loss of $116.7 million currently makes up 6.6% of the total AFS portfolio • Weighted avg. duration is 1.8 for the AFS portfolio as of 1Q23 HTM • Valuation Loss as % of relative portfolio balance ◦ Total $130.0 million | 8.0% ◦ ex-PACE $46.9 million | 7.5% ◦ PACE $83.1 million | 8.3% • Weighted Average Duration ◦ Total 4.9 ◦ ex-PACE 4.2 ◦ PACE 5.3 14

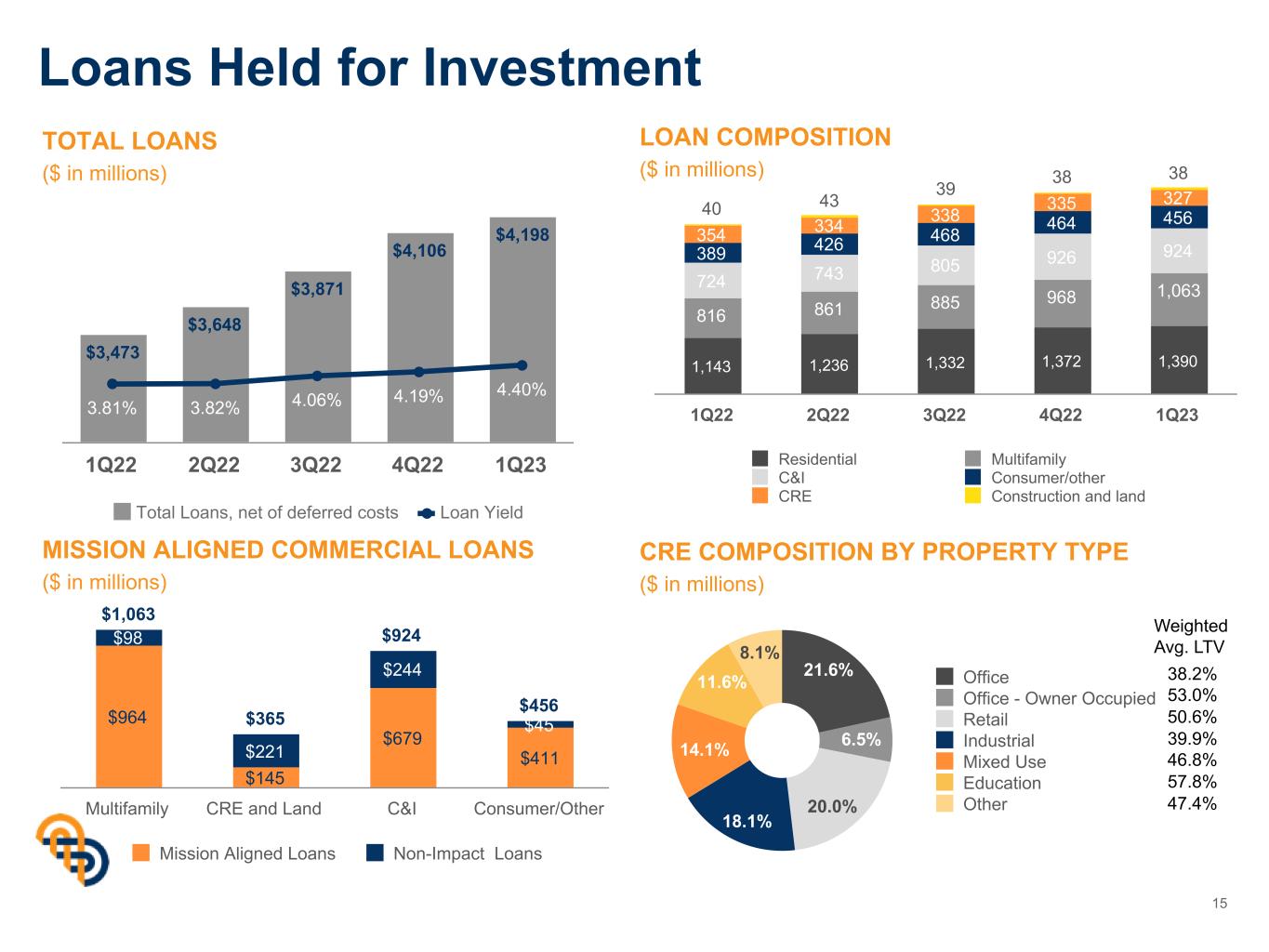

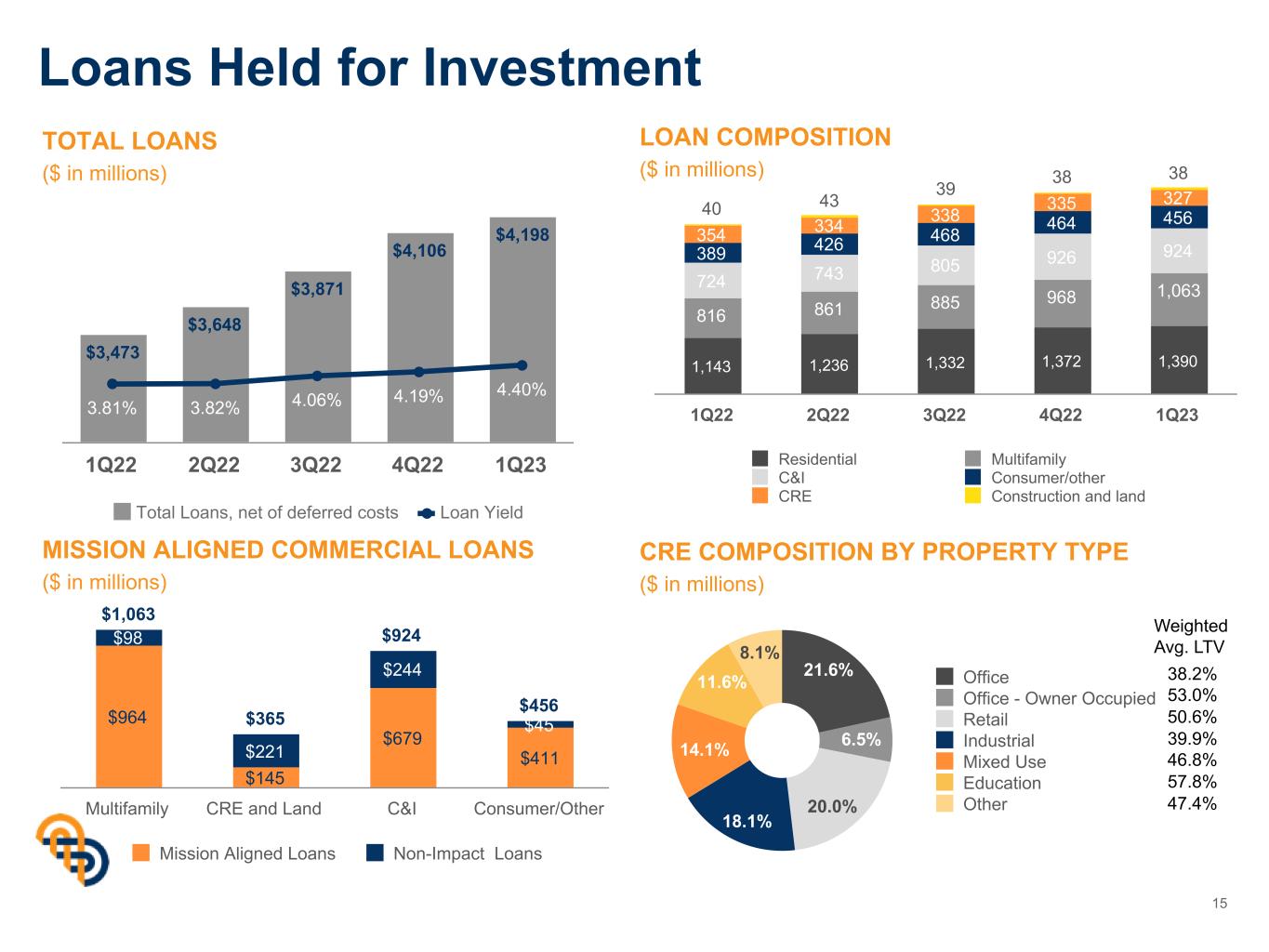

Loans Held for Investment 15 TOTAL LOANS ($ in millions) $3,473 $3,648 $3,871 $4,106 $4,198 3.81% 3.82% 4.06% 4.19% 4.40% Total Loans, net of deferred costs Loan Yield 1Q22 2Q22 3Q22 4Q22 1Q23 MISSION ALIGNED COMMERCIAL LOANS ($ in millions) $1,063 $365 $924 $456 $964 $145 $679 $411 $98 $221 $244 $45 Mission Aligned Loans Non-Impact Loans Multifamily CRE and Land C&I Consumer/Other 21.6% 6.5% 20.0% 18.1% 14.1% 11.6% 8.1% Office Office - Owner Occupied Retail Industrial Mixed Use Education Other 1,143 1,236 1,332 1,372 1,390 816 861 885 968 1,063724 743 805 926 924389 426 468 464 456 354 334 338 335 32740 43 39 38 38 Residential Multifamily C&I Consumer/other CRE Construction and land 1Q22 2Q22 3Q22 4Q22 1Q23 LOAN COMPOSITION ($ in millions) CRE COMPOSITION BY PROPERTY TYPE ($ in millions) 38.2% 53.0% 50.6% 39.9% 46.8% 57.8% 47.4% Weighted Avg. LTV

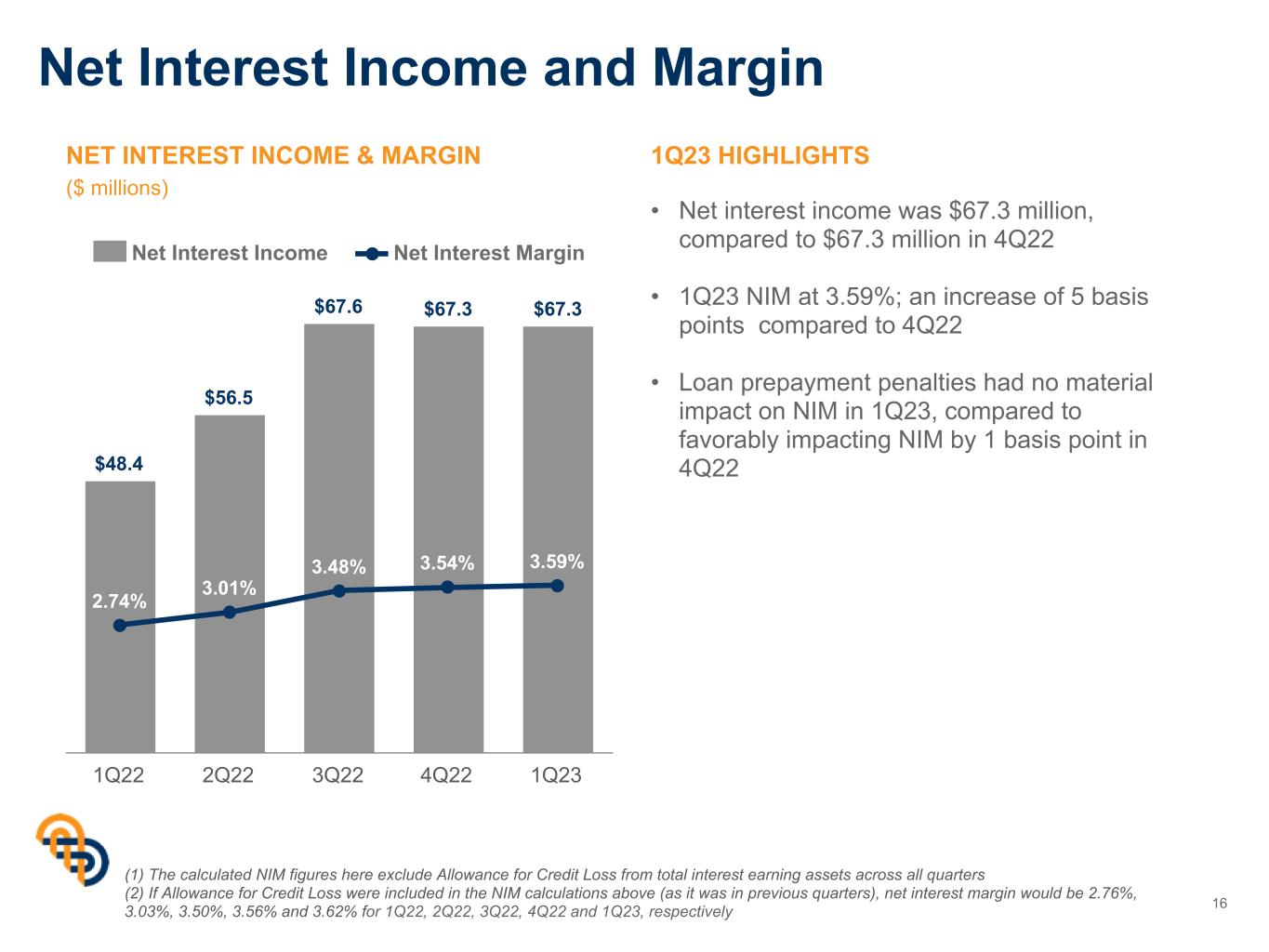

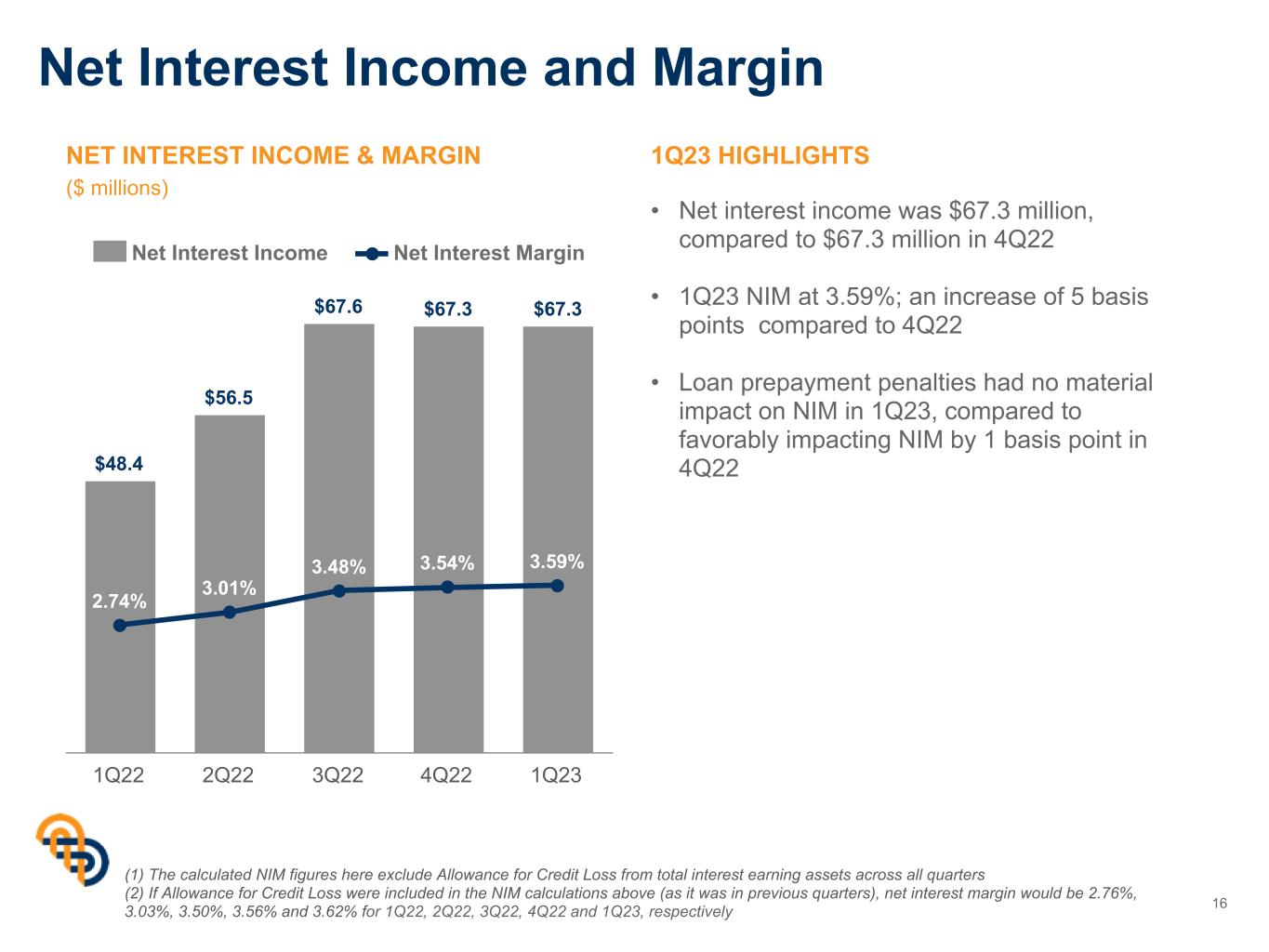

Net Interest Income and Margin 16 NET INTEREST INCOME & MARGIN ($ millions) • Net interest income was $67.3 million, compared to $67.3 million in 4Q22 • 1Q23 NIM at 3.59%; an increase of 5 basis points compared to 4Q22 • Loan prepayment penalties had no material impact on NIM in 1Q23, compared to favorably impacting NIM by 1 basis point in 4Q22 1Q23 HIGHLIGHTS $48.4 $56.5 $67.6 $67.3 $67.3 2.74% 3.01% 3.48% 3.54% 3.59% Net Interest Income Net Interest Margin 1Q22 2Q22 3Q22 4Q22 1Q23 (1) The calculated NIM figures here exclude Allowance for Credit Loss from total interest earning assets across all quarters (2) If Allowance for Credit Loss were included in the NIM calculations above (as it was in previous quarters), net interest margin would be 2.76%, 3.03%, 3.50%, 3.56% and 3.62% for 1Q22, 2Q22, 3Q22, 4Q22 and 1Q23, respectively

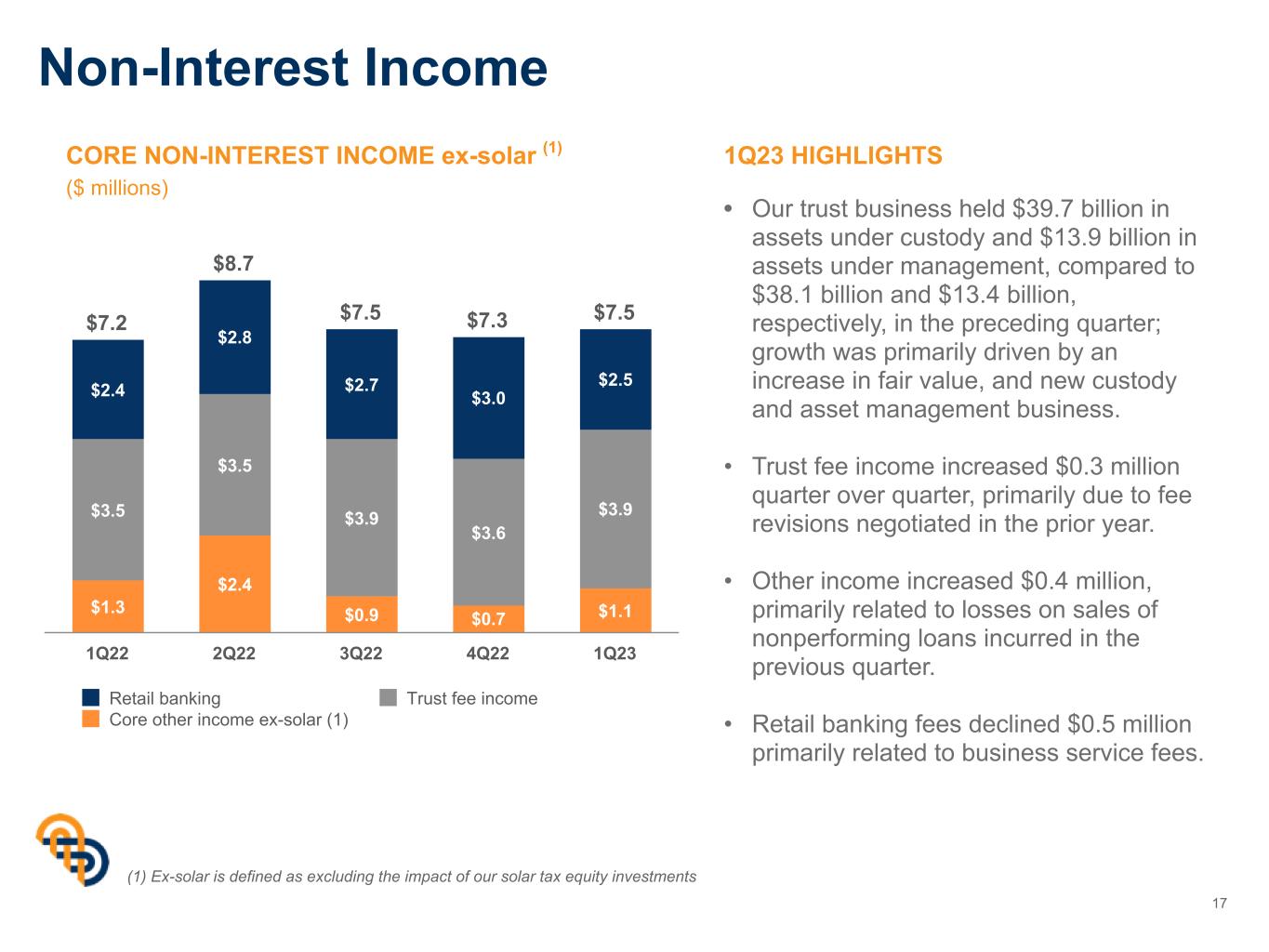

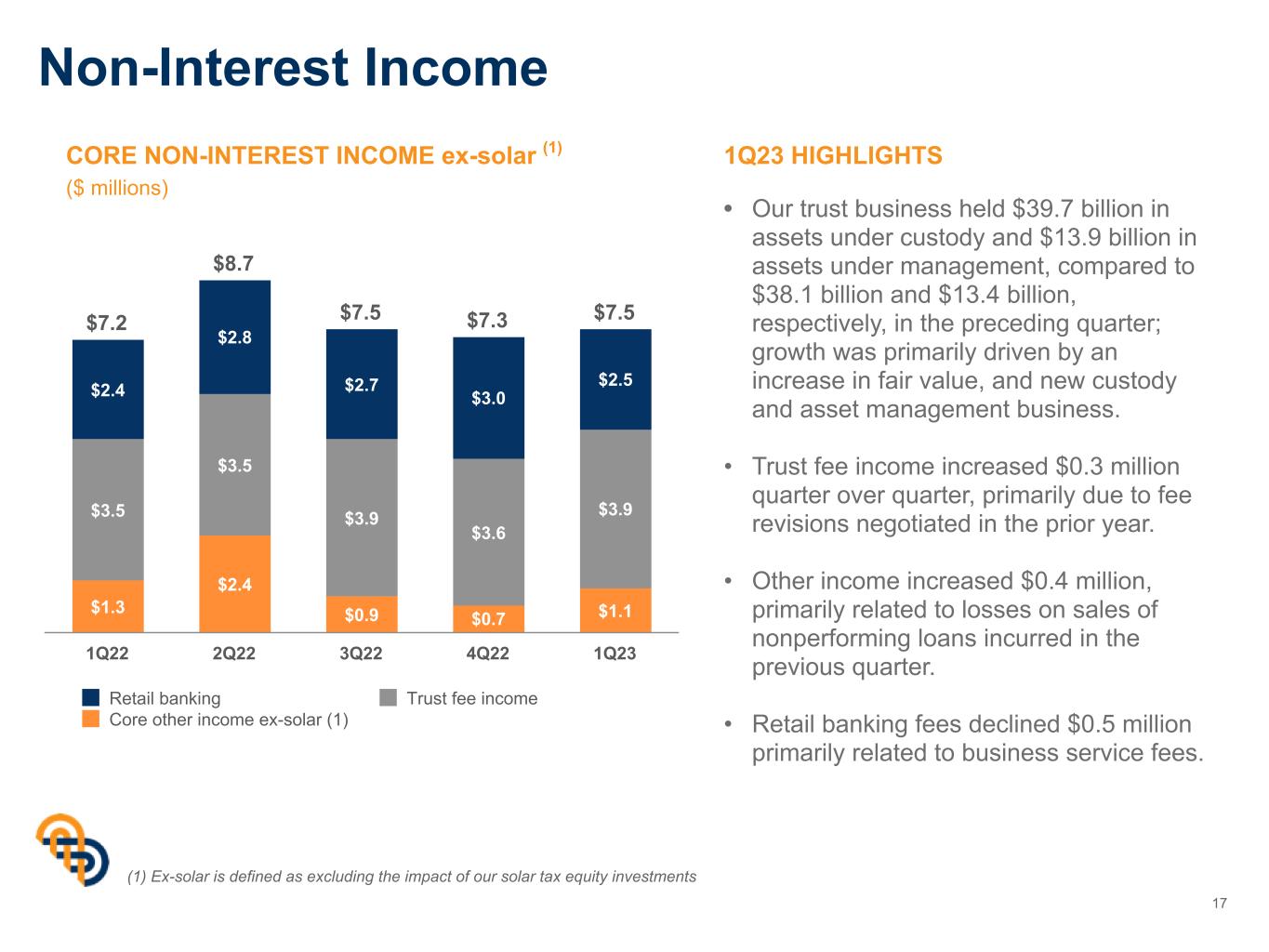

Non-Interest Income 17 CORE NON-INTEREST INCOME ex-solar (1) ($ millions) • Our trust business held $39.7 billion in assets under custody and $13.9 billion in assets under management, compared to $38.1 billion and $13.4 billion, respectively, in the preceding quarter; growth was primarily driven by an increase in fair value, and new custody and asset management business. • Trust fee income increased $0.3 million quarter over quarter, primarily due to fee revisions negotiated in the prior year. • Other income increased $0.4 million, primarily related to losses on sales of nonperforming loans incurred in the previous quarter. • Retail banking fees declined $0.5 million primarily related to business service fees. 1Q23 HIGHLIGHTS (1) Ex-solar is defined as excluding the impact of our solar tax equity investments $7.2 $8.7 $7.5 $7.3 $7.5 $1.3 $2.4 $0.9 $0.7 $1.1 $3.5 $3.5 $3.9 $3.6 $3.9 $2.4 $2.8 $2.7 $3.0 $2.5 Retail banking Trust fee income Core other income ex-solar (1) 1Q22 2Q22 3Q22 4Q22 1Q23

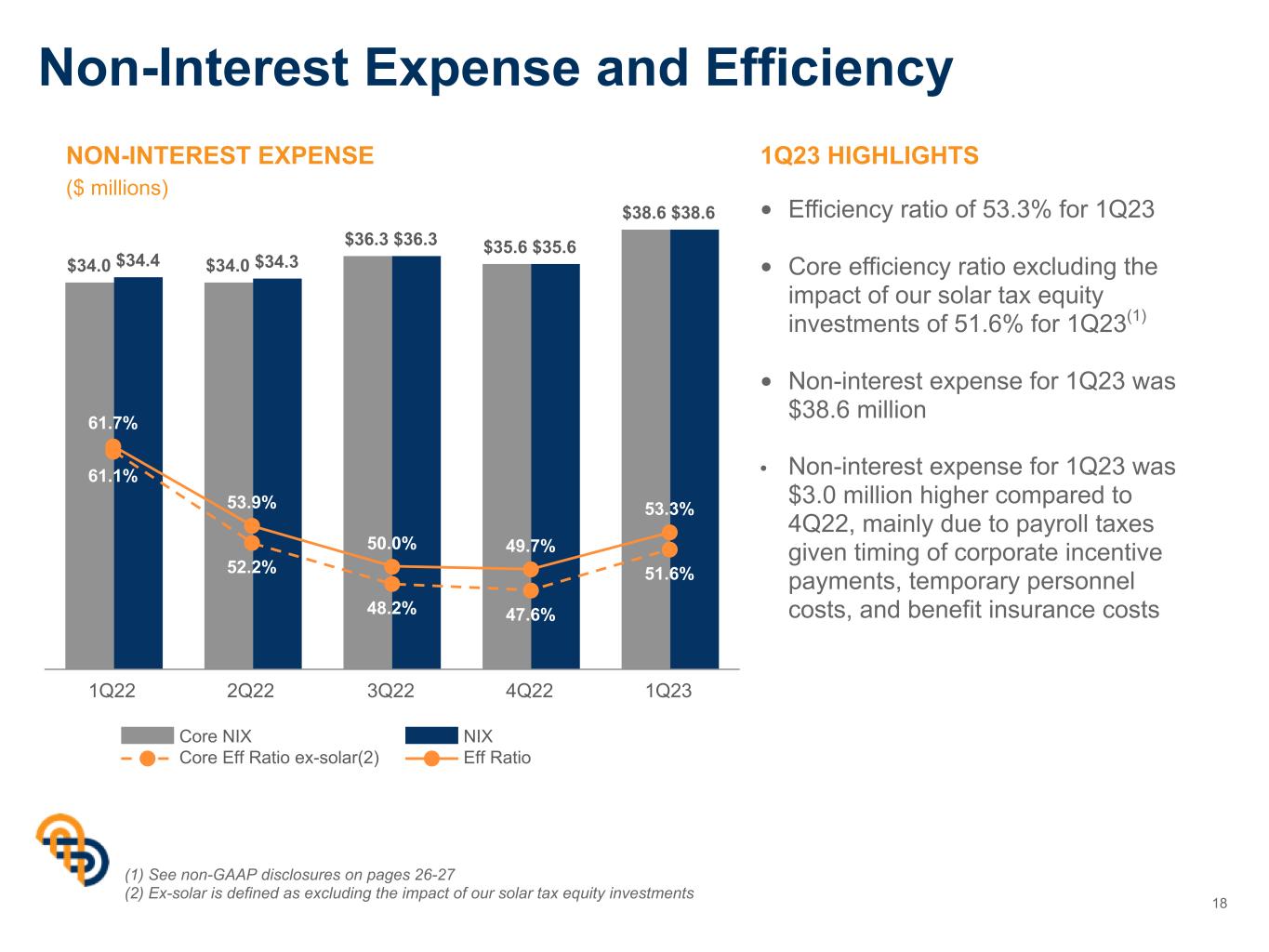

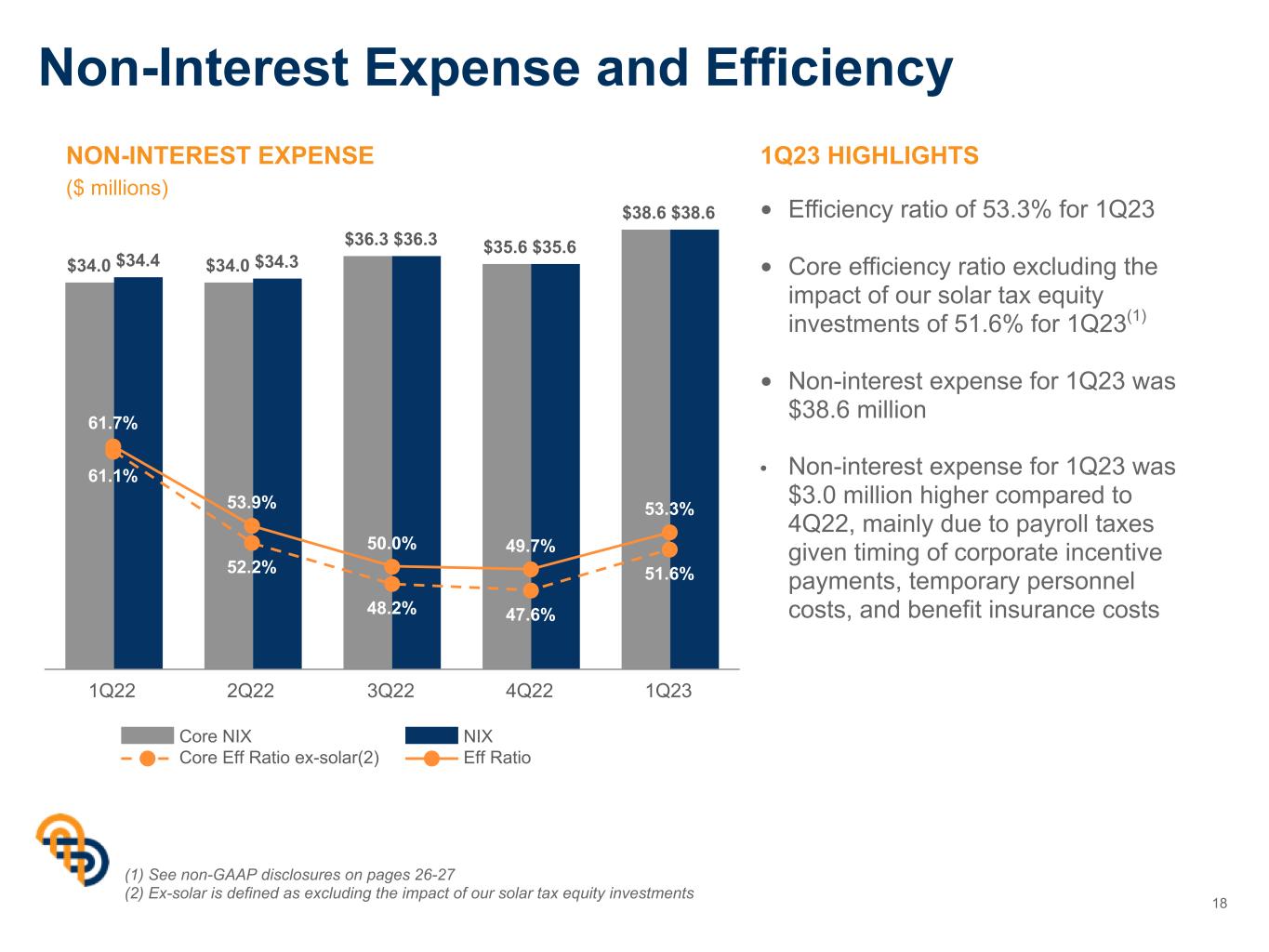

Non-Interest Expense and Efficiency 18 NON-INTEREST EXPENSE ($ millions) • Efficiency ratio of 53.3% for 1Q23 • Core efficiency ratio excluding the impact of our solar tax equity investments of 51.6% for 1Q23(1) • Non-interest expense for 1Q23 was $38.6 million • Non-interest expense for 1Q23 was $3.0 million higher compared to 4Q22, mainly due to payroll taxes given timing of corporate incentive payments, temporary personnel costs, and benefit insurance costs 1Q23 HIGHLIGHTS (1) See non-GAAP disclosures on pages 26-27 (2) Ex-solar is defined as excluding the impact of our solar tax equity investments $34.0 $34.0 $36.3 $35.6 $38.6 $34.4 $34.3 $36.3 $35.6 $38.6 61.1% 52.2% 48.2% 47.6% 51.6% 61.7% 53.9% 50.0% 49.7% 53.3% Core NIX NIX Core Eff Ratio ex-solar(2) Eff Ratio 1Q22 2Q22 3Q22 4Q22 1Q23

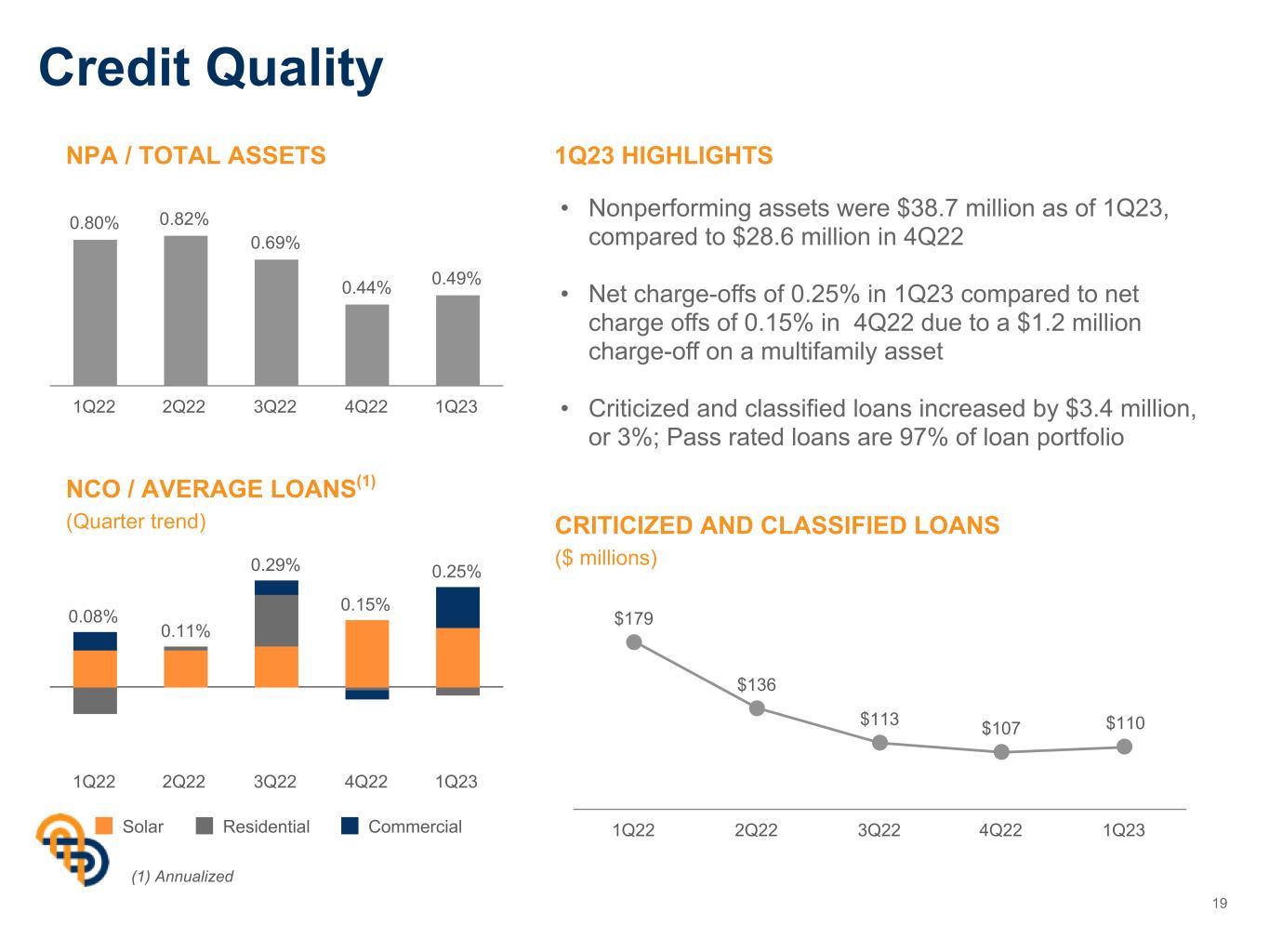

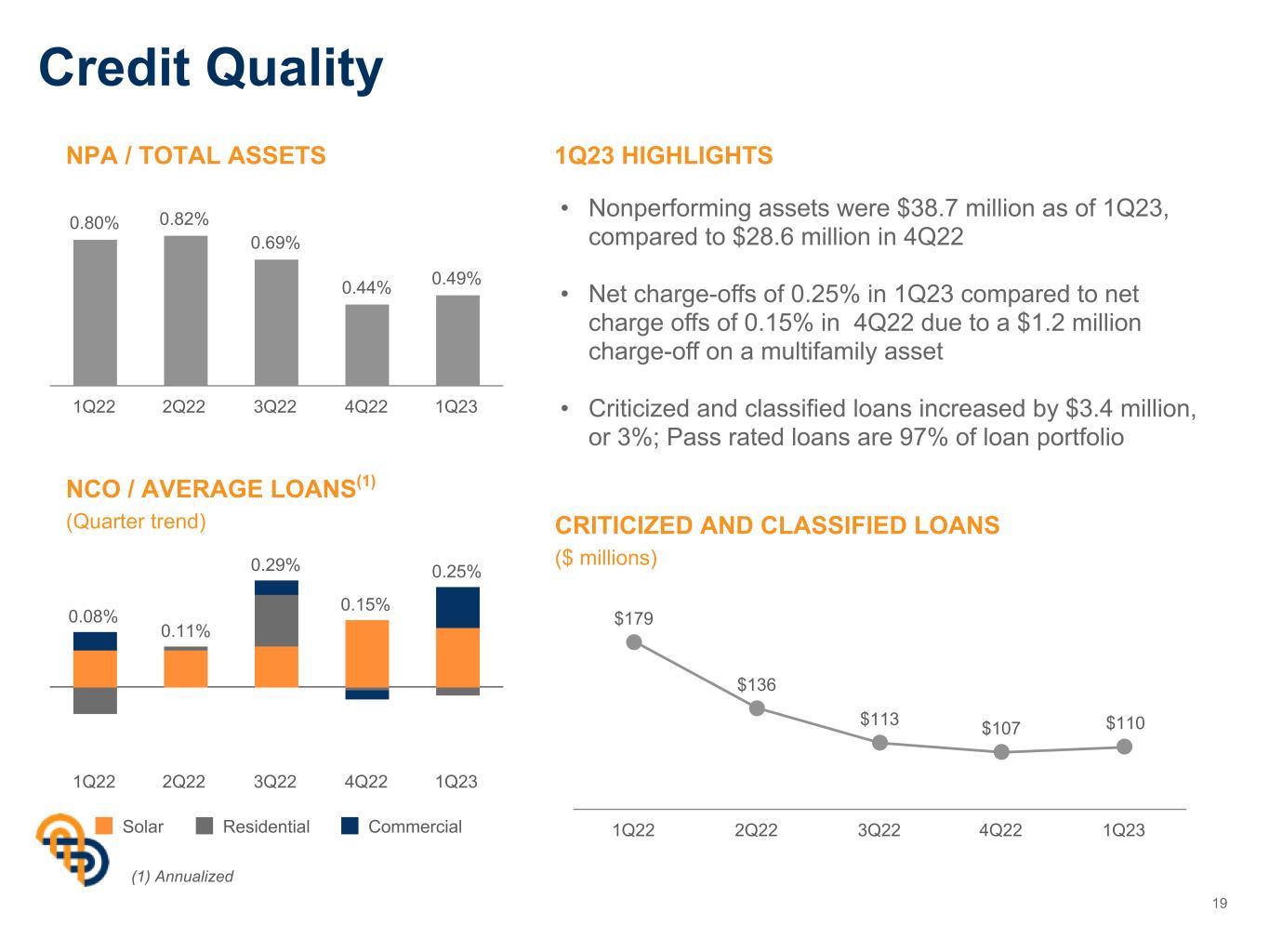

Credit Quality 19 NPA / TOTAL ASSETS NCO / AVERAGE LOANS(1) (Quarter trend) 1Q23 HIGHLIGHTS • Nonperforming assets were $38.7 million as of 1Q23, compared to $28.6 million in 4Q22 • Net charge-offs of 0.25% in 1Q23 compared to net charge offs of 0.15% in 4Q22 due to a $1.2 million charge-off on a multifamily asset • Criticized and classified loans increased by $3.4 million, or 3%; Pass rated loans are 97% of loan portfolio (1) Annualized CRITICIZED AND CLASSIFIED LOANS ($ millions) 0.80% 0.82% 0.69% 0.44% 0.49% 1Q22 2Q22 3Q22 4Q22 1Q23 0.15% 0.08% 0.11% 0.29% 0.25% Solar Residential Commercial 1Q22 2Q22 3Q22 4Q22 1Q23 $179 $136 $113 $107 $110 1Q22 2Q22 3Q22 4Q22 1Q23

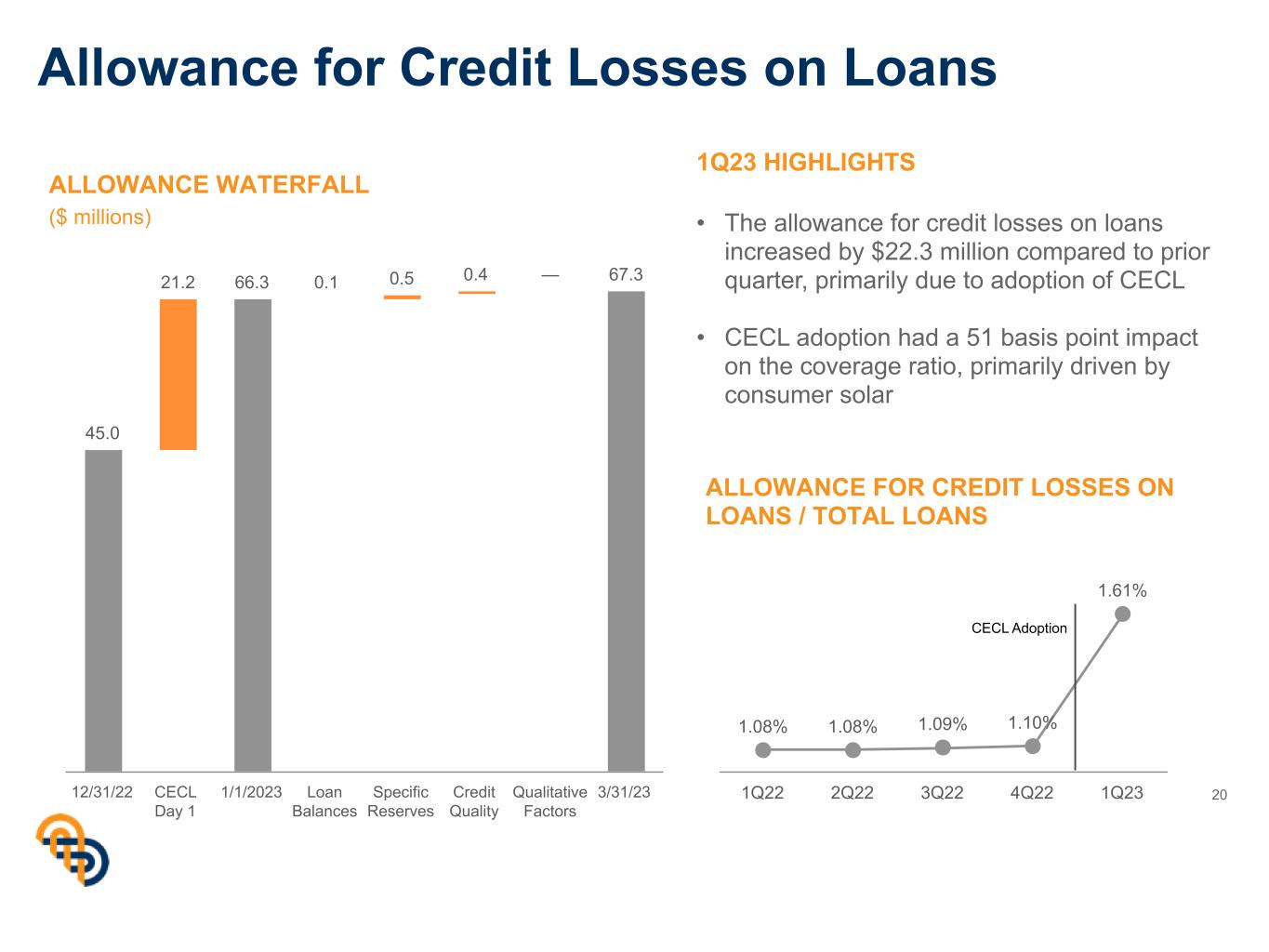

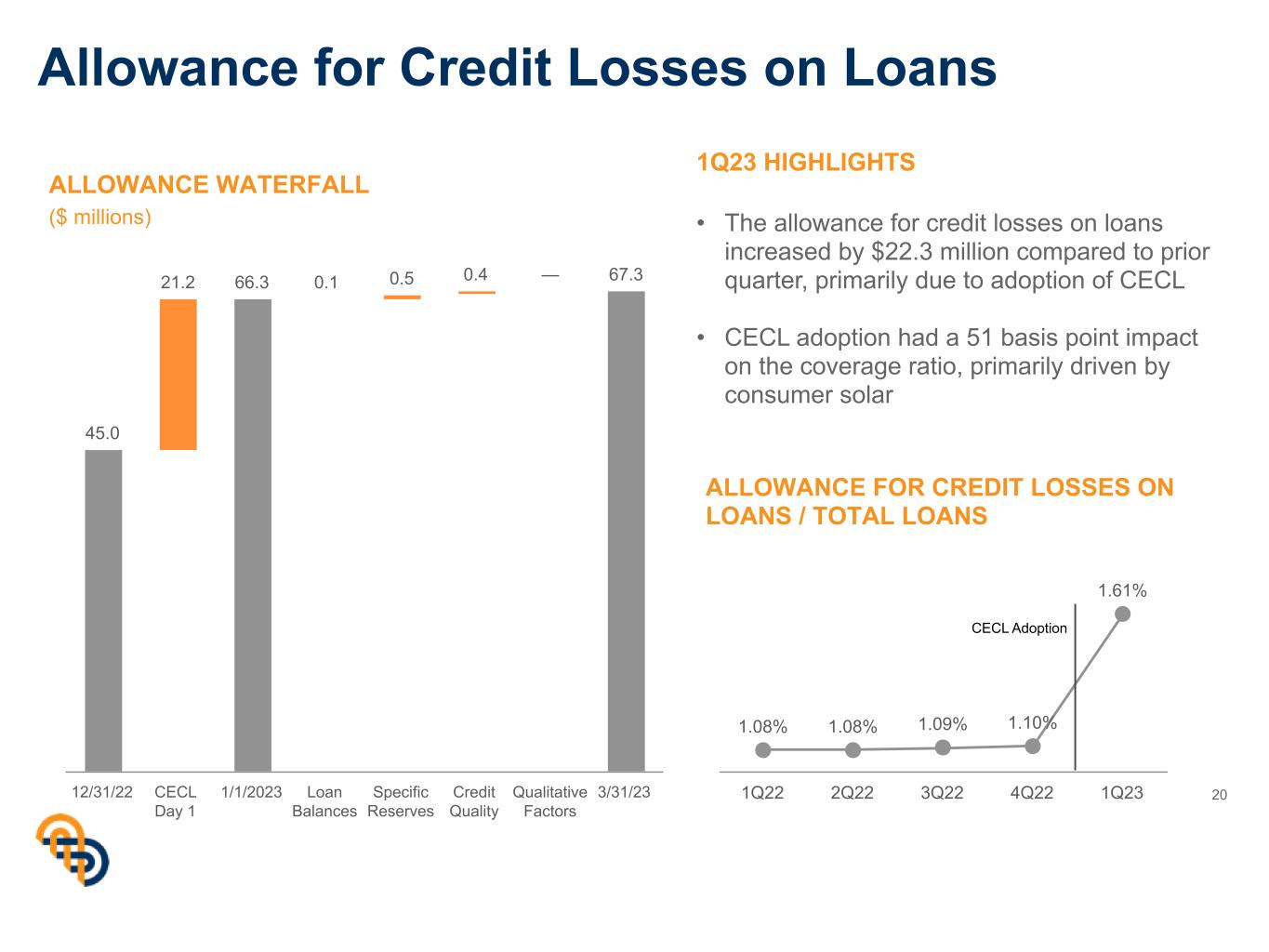

Allowance for Credit Losses on Loans 20 ALLOWANCE FOR CREDIT LOSSES ON LOANS / TOTAL LOANS ALLOWANCE WATERFALL ($ millions) 1.08% 1.08% 1.09% 1.10% 1.61% 1Q22 2Q22 3Q22 4Q22 1Q23 45.0 21.2 66.3 0.1 0.5 0.4 — 67.3 12/31/22 CECL Day 1 1/1/2023 Loan Balances Specific Reserves Credit Quality Qualitative Factors 3/31/23 CECL Adoption • The allowance for credit losses on loans increased by $22.3 million compared to prior quarter, primarily due to adoption of CECL • CECL adoption had a 51 basis point impact on the coverage ratio, primarily driven by consumer solar 1Q23 HIGHLIGHTS

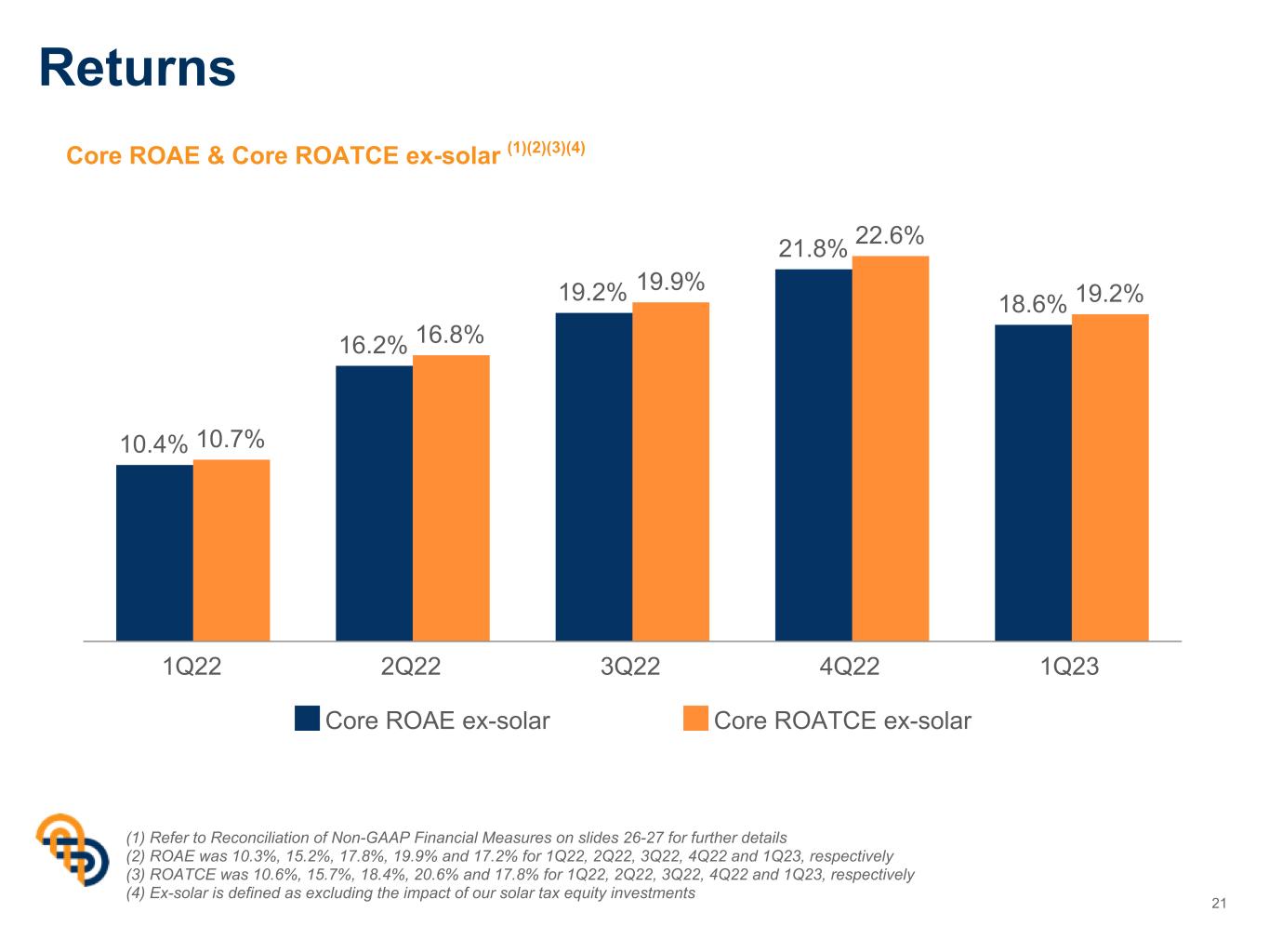

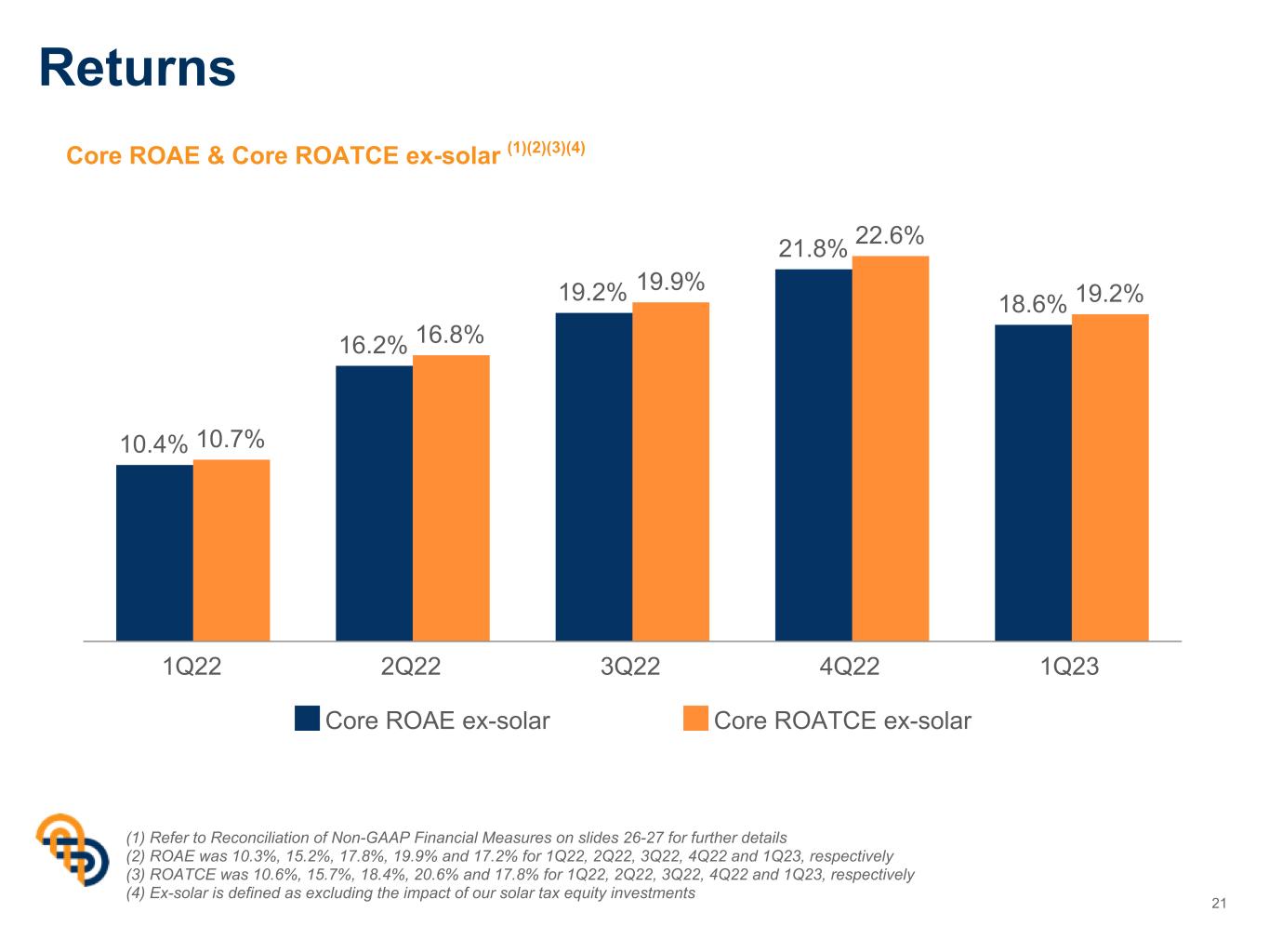

Returns 21 (1) Refer to Reconciliation of Non-GAAP Financial Measures on slides 26-27 for further details (2) ROAE was 10.3%, 15.2%, 17.8%, 19.9% and 17.2% for 1Q22, 2Q22, 3Q22, 4Q22 and 1Q23, respectively (3) ROATCE was 10.6%, 15.7%, 18.4%, 20.6% and 17.8% for 1Q22, 2Q22, 3Q22, 4Q22 and 1Q23, respectively (4) Ex-solar is defined as excluding the impact of our solar tax equity investments Core ROAE & Core ROATCE ex-solar (1)(2)(3)(4) 10.4% 16.2% 19.2% 21.8% 18.6% 10.7% 16.8% 19.9% 22.6% 19.2% Core ROAE ex-solar Core ROATCE ex-solar 1Q22 2Q22 3Q22 4Q22 1Q23

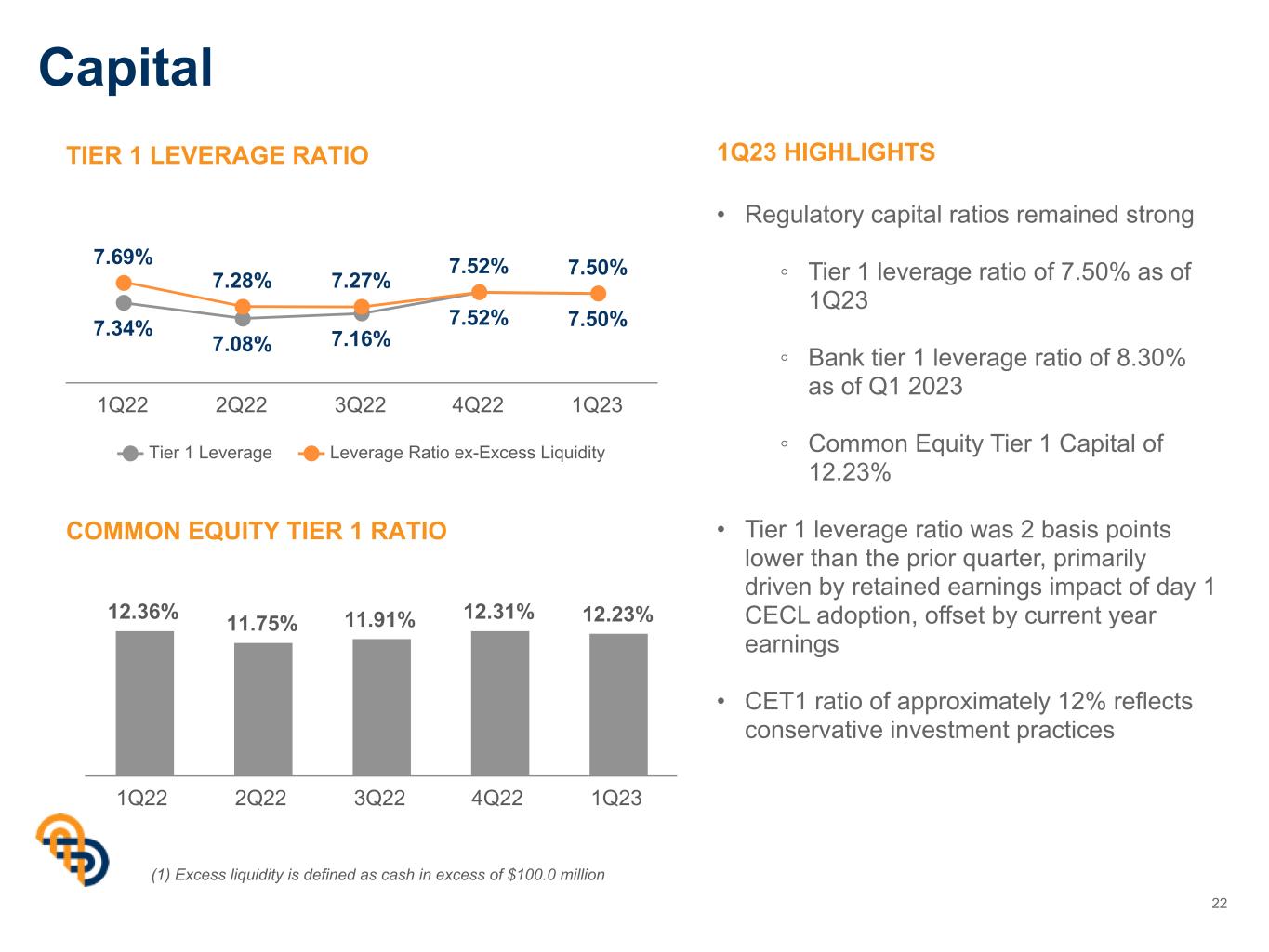

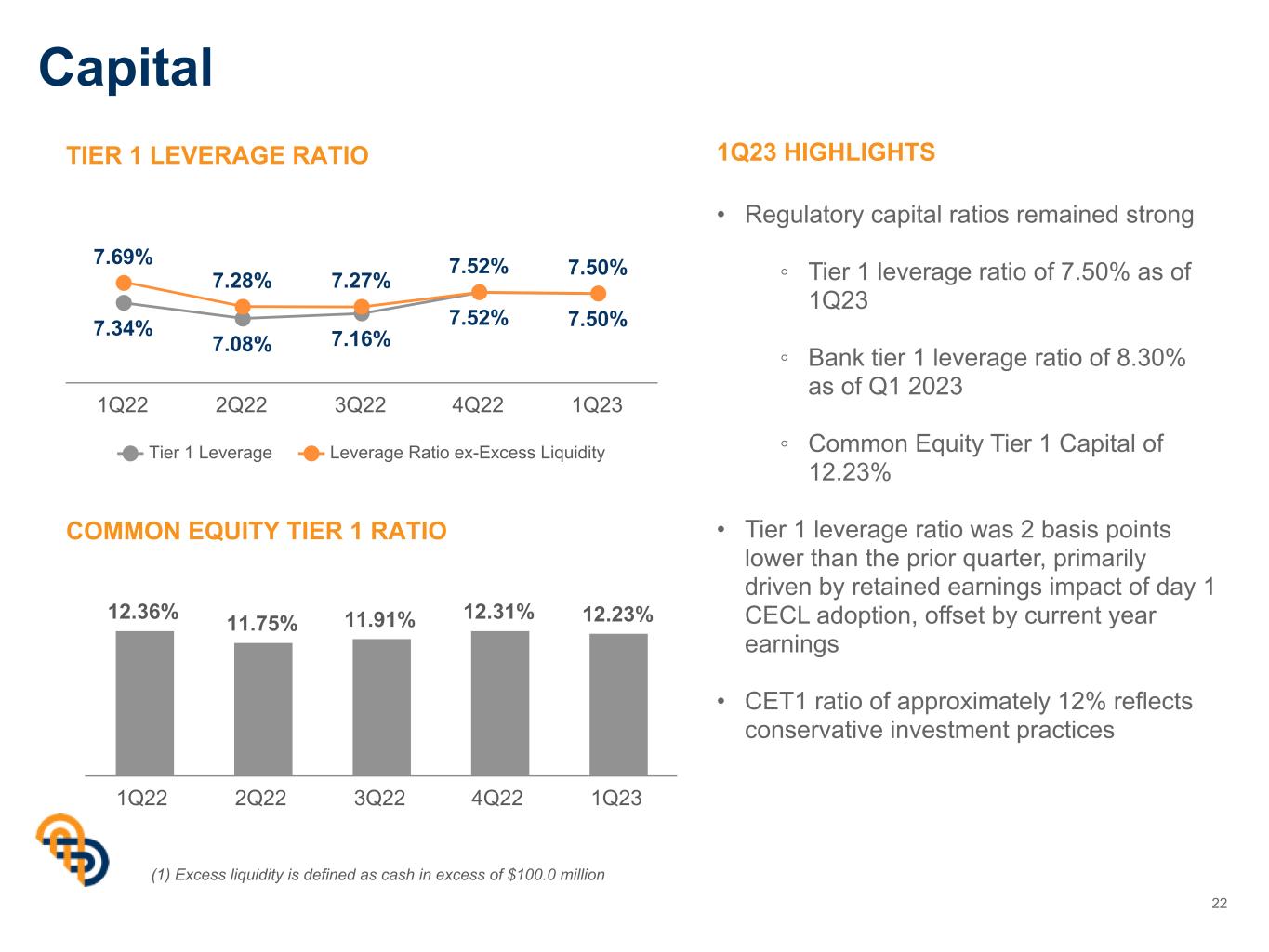

Capital 22 TIER 1 LEVERAGE RATIO COMMON EQUITY TIER 1 RATIO • Regulatory capital ratios remained strong ◦ Tier 1 leverage ratio of 7.50% as of 1Q23 ◦ Bank tier 1 leverage ratio of 8.30% as of Q1 2023 ◦ Common Equity Tier 1 Capital of 12.23% • Tier 1 leverage ratio was 2 basis points lower than the prior quarter, primarily driven by retained earnings impact of day 1 CECL adoption, offset by current year earnings • CET1 ratio of approximately 12% reflects conservative investment practices 1Q23 HIGHLIGHTS 7.34% 7.08% 7.16% 7.52% 7.50% 7.69% 7.28% 7.27% 7.52% 7.50% Tier 1 Leverage Leverage Ratio ex-Excess Liquidity 1Q22 2Q22 3Q22 4Q22 1Q23 12.36% 11.75% 11.91% 12.31% 12.23% 1Q22 2Q22 3Q22 4Q22 1Q23 (1) Excess liquidity is defined as cash in excess of $100.0 million

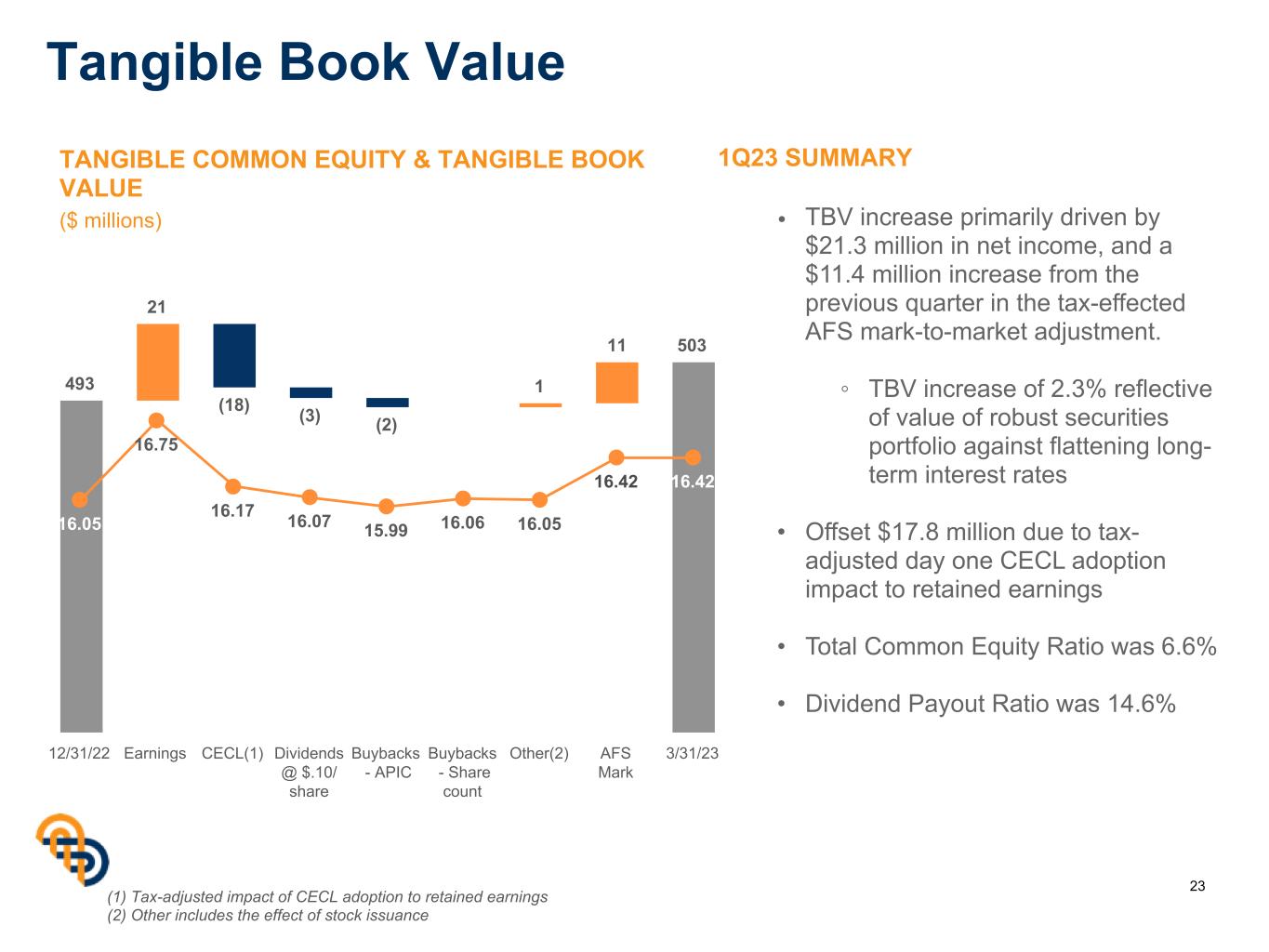

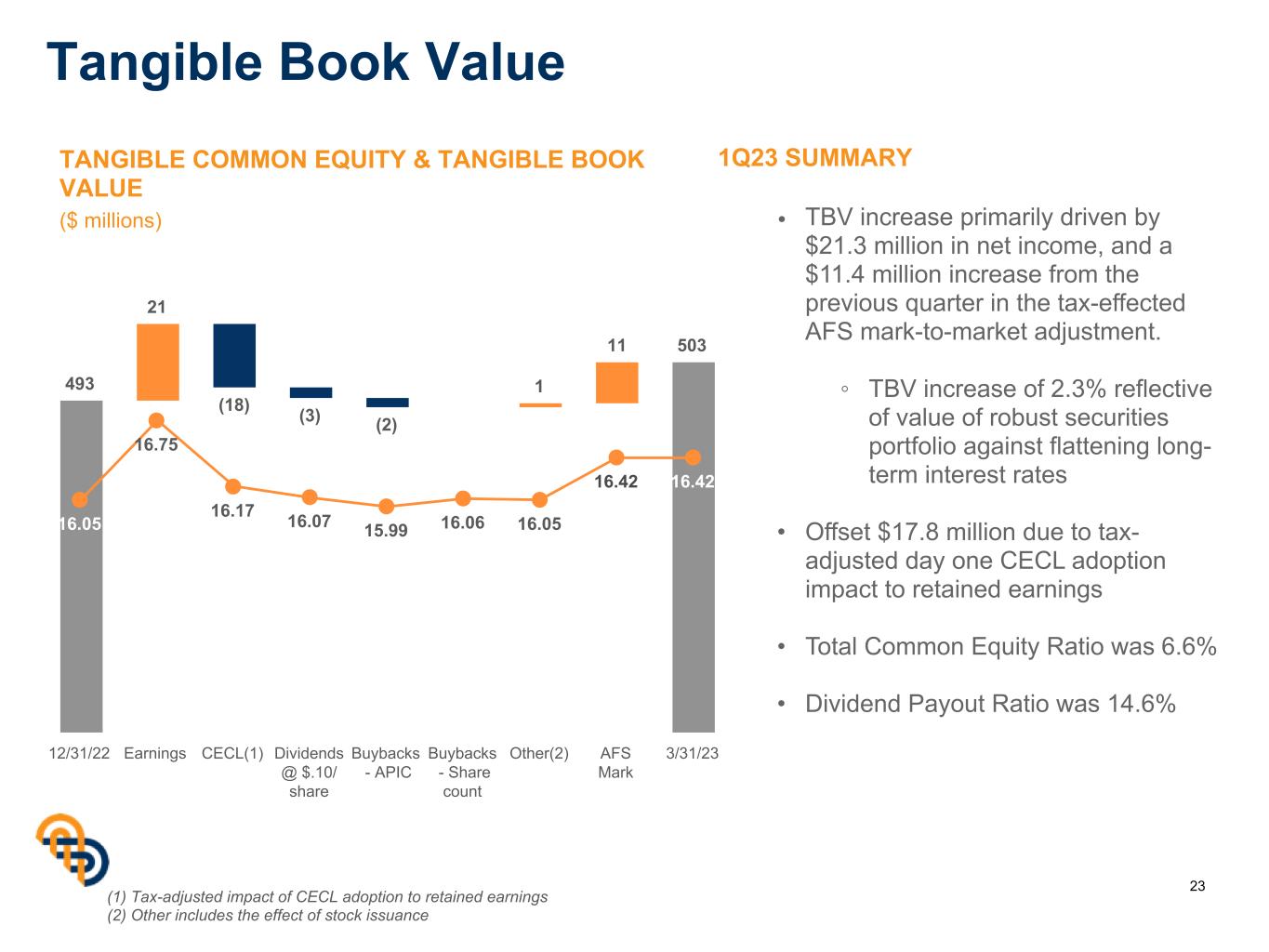

Tangible Book Value 493 21 (18) (3) (2) 1 11 503 16.05 16.75 16.17 16.07 15.99 16.06 16.05 16.42 16.42 12/31/22 Earnings CECL(1) Dividends @ $.10/ share Buybacks - APIC Buybacks - Share count Other(2) AFS Mark 3/31/23 TANGIBLE COMMON EQUITY & TANGIBLE BOOK VALUE ($ millions) 1Q23 SUMMARY • TBV increase primarily driven by $21.3 million in net income, and a $11.4 million increase from the previous quarter in the tax-effected AFS mark-to-market adjustment. ◦ TBV increase of 2.3% reflective of value of robust securities portfolio against flattening long- term interest rates • Offset $17.8 million due to tax- adjusted day one CECL adoption impact to retained earnings • Total Common Equity Ratio was 6.6% • Dividend Payout Ratio was 14.6% 23 (1) Tax-adjusted impact of CECL adoption to retained earnings (2) Other includes the effect of stock issuance

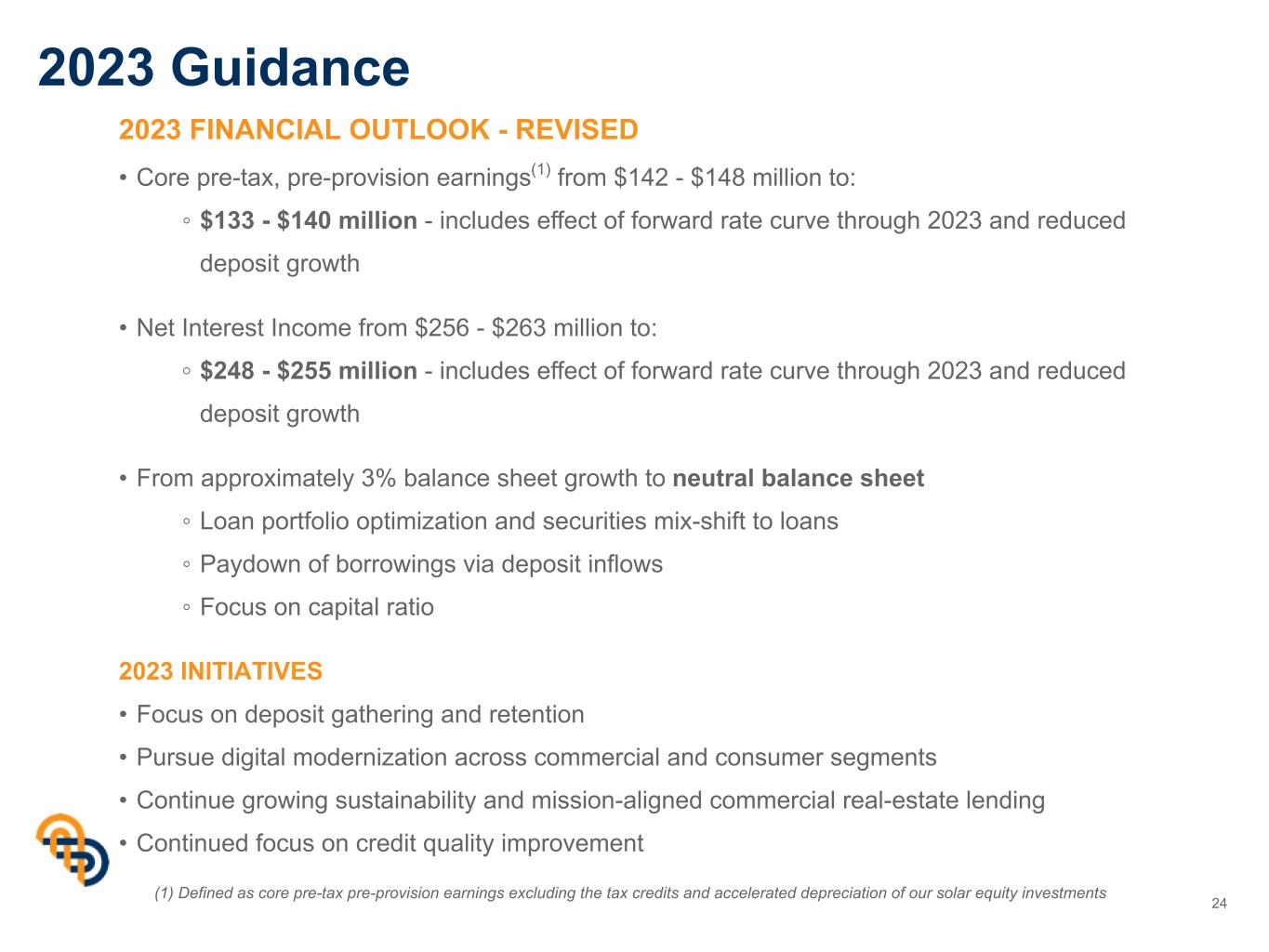

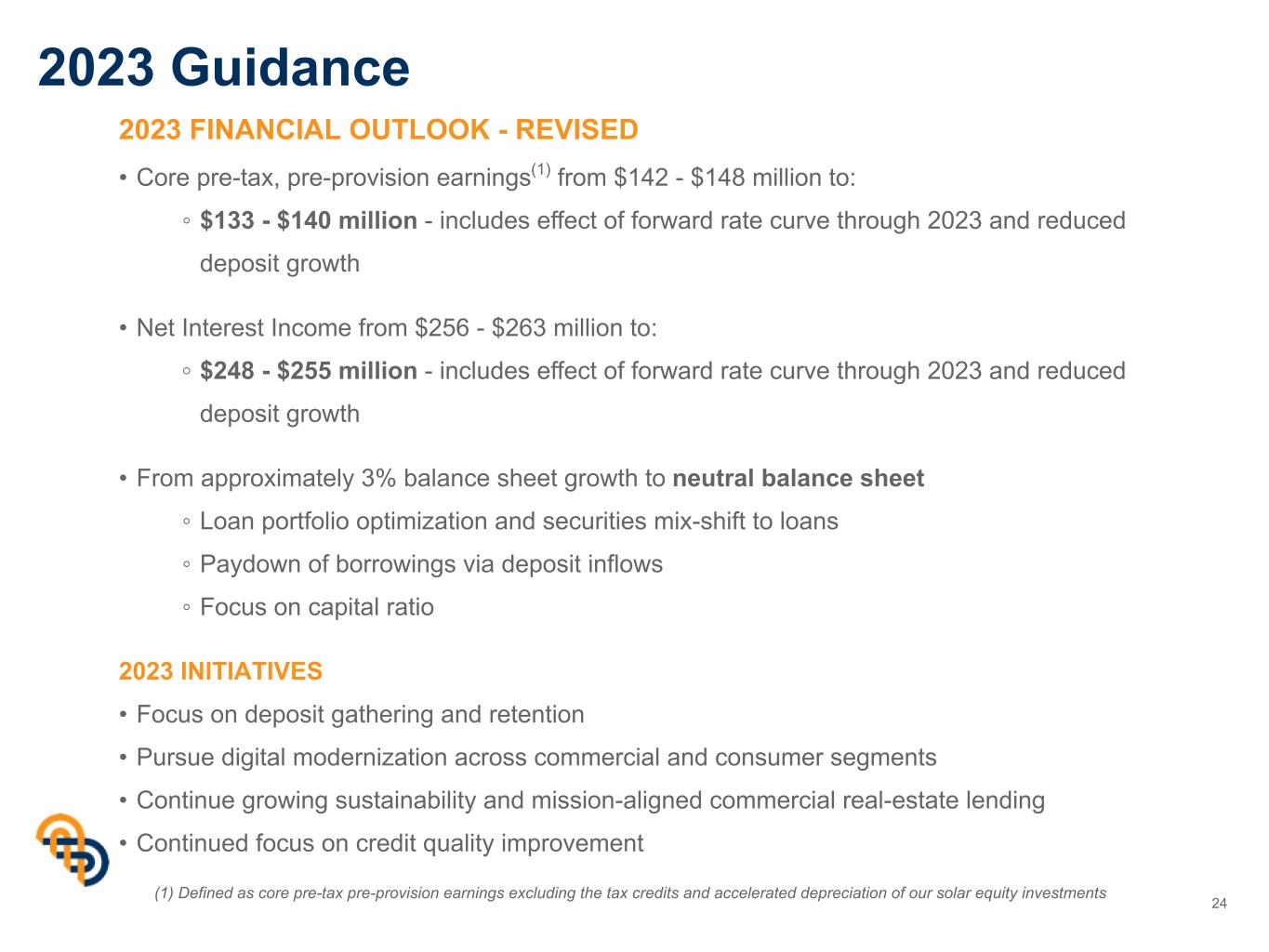

2023 Guidance 24 2023 FINANCIAL OUTLOOK - REVISED • Core pre-tax, pre-provision earnings(1) from $142 - $148 million to: ◦ $133 - $140 million - includes effect of forward rate curve through 2023 and reduced deposit growth • Net Interest Income from $256 - $263 million to: ◦ $248 - $255 million - includes effect of forward rate curve through 2023 and reduced deposit growth • From approximately 3% balance sheet growth to neutral balance sheet ◦ Loan portfolio optimization and securities mix-shift to loans ◦ Paydown of borrowings via deposit inflows ◦ Focus on capital ratio 2023 INITIATIVES • Focus on deposit gathering and retention • Pursue digital modernization across commercial and consumer segments • Continue growing sustainability and mission-aligned commercial real-estate lending • Continued focus on credit quality improvement (1) Defined as core pre-tax pre-provision earnings excluding the tax credits and accelerated depreciation of our solar equity investments

Appendix

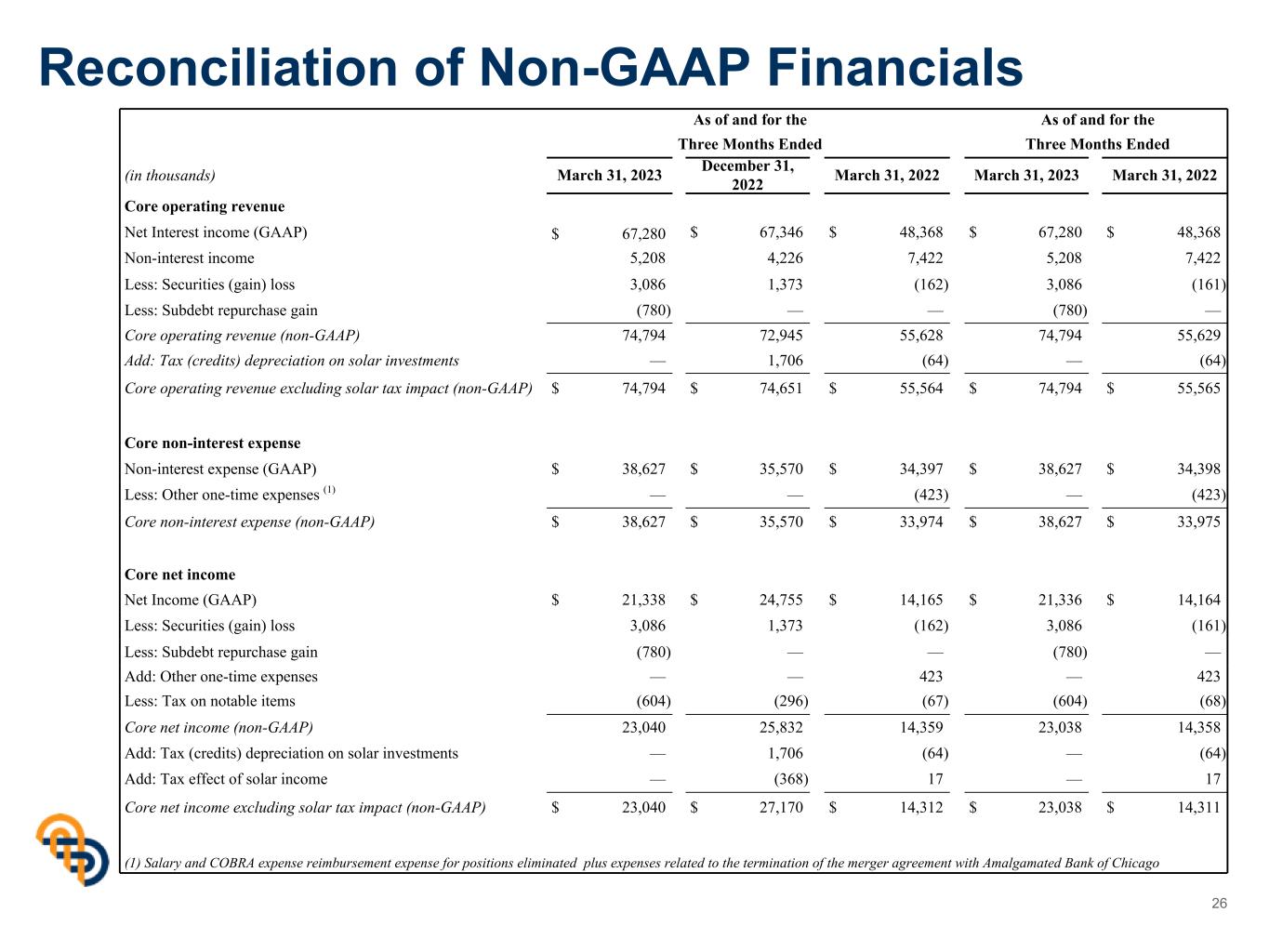

Reconciliation of Non-GAAP Financials 26 As of and for the As of and for the Three Months Ended Three Months Ended (in thousands) March 31, 2023 December 31, 2022 March 31, 2022 March 31, 2023 March 31, 2022 Core operating revenue Net Interest income (GAAP) $ 67,280 $ 67,346 $ 48,368 $ 67,280 $ 48,368 Non-interest income 5,208 4,226 7,422 5,208 7,422 Less: Securities (gain) loss 3,086 1,373 (162) 3,086 (161) Less: Subdebt repurchase gain (780) — — (780) — Core operating revenue (non-GAAP) 74,794 72,945 55,628 74,794 55,629 Add: Tax (credits) depreciation on solar investments — 1,706 (64) — (64) Core operating revenue excluding solar tax impact (non-GAAP) $ 74,794 $ 74,651 $ 55,564 $ 74,794 $ 55,565 Core non-interest expense Non-interest expense (GAAP) $ 38,627 $ 35,570 $ 34,397 $ 38,627 $ 34,398 Less: Other one-time expenses (1) — — (423) — (423) Core non-interest expense (non-GAAP) $ 38,627 $ 35,570 $ 33,974 $ 38,627 $ 33,975 Core net income Net Income (GAAP) $ 21,338 $ 24,755 $ 14,165 $ 21,336 $ 14,164 Less: Securities (gain) loss 3,086 1,373 (162) 3,086 (161) Less: Subdebt repurchase gain (780) — — (780) — Add: Other one-time expenses — — 423 — 423 Less: Tax on notable items (604) (296) (67) (604) (68) Core net income (non-GAAP) 23,040 25,832 14,359 23,038 14,358 Add: Tax (credits) depreciation on solar investments — 1,706 (64) — (64) Add: Tax effect of solar income — (368) 17 — 17 Core net income excluding solar tax impact (non-GAAP) $ 23,040 $ 27,170 $ 14,312 $ 23,038 $ 14,311 (1) Salary and COBRA expense reimbursement expense for positions eliminated plus expenses related to the termination of the merger agreement with Amalgamated Bank of Chicago

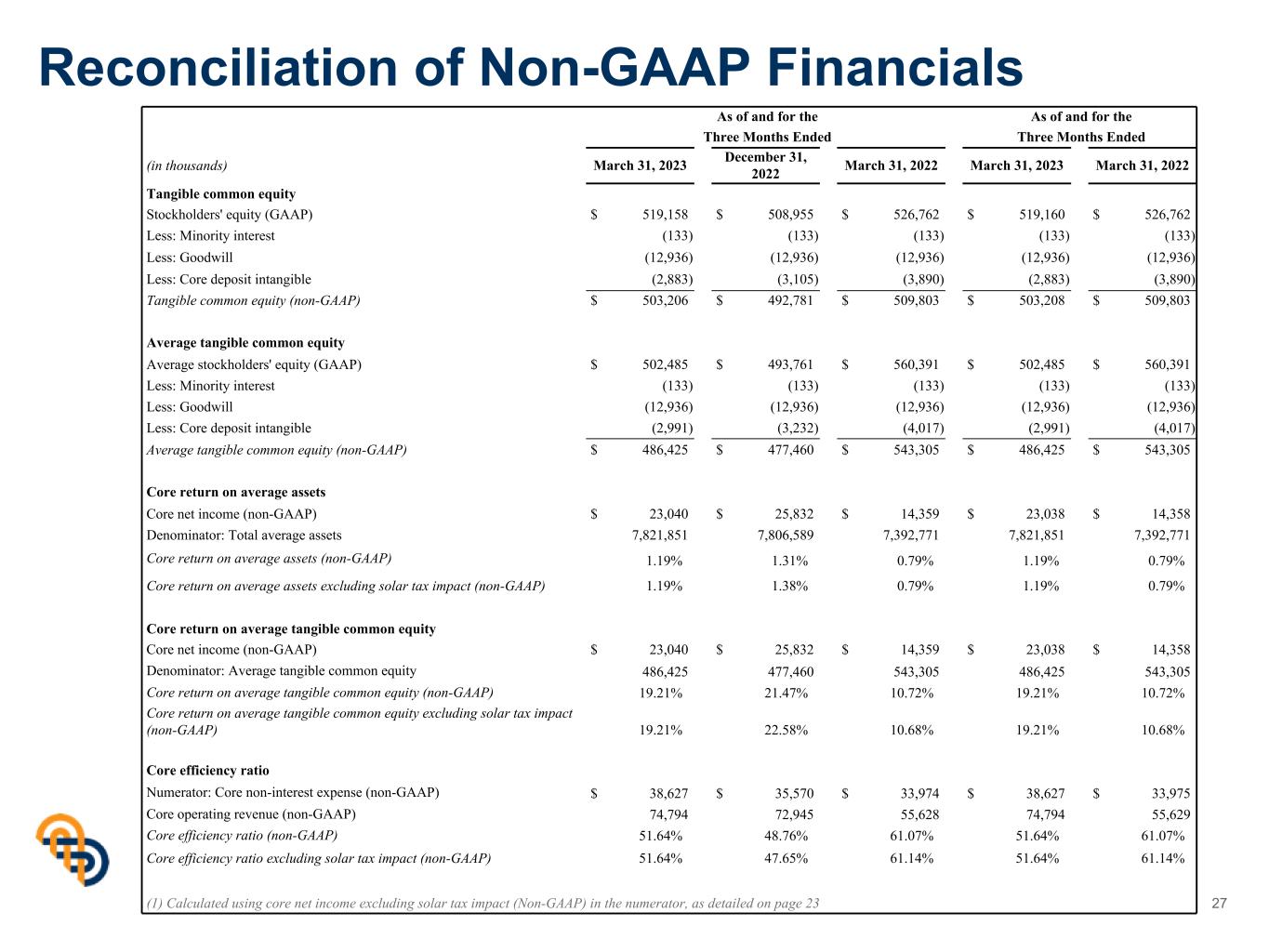

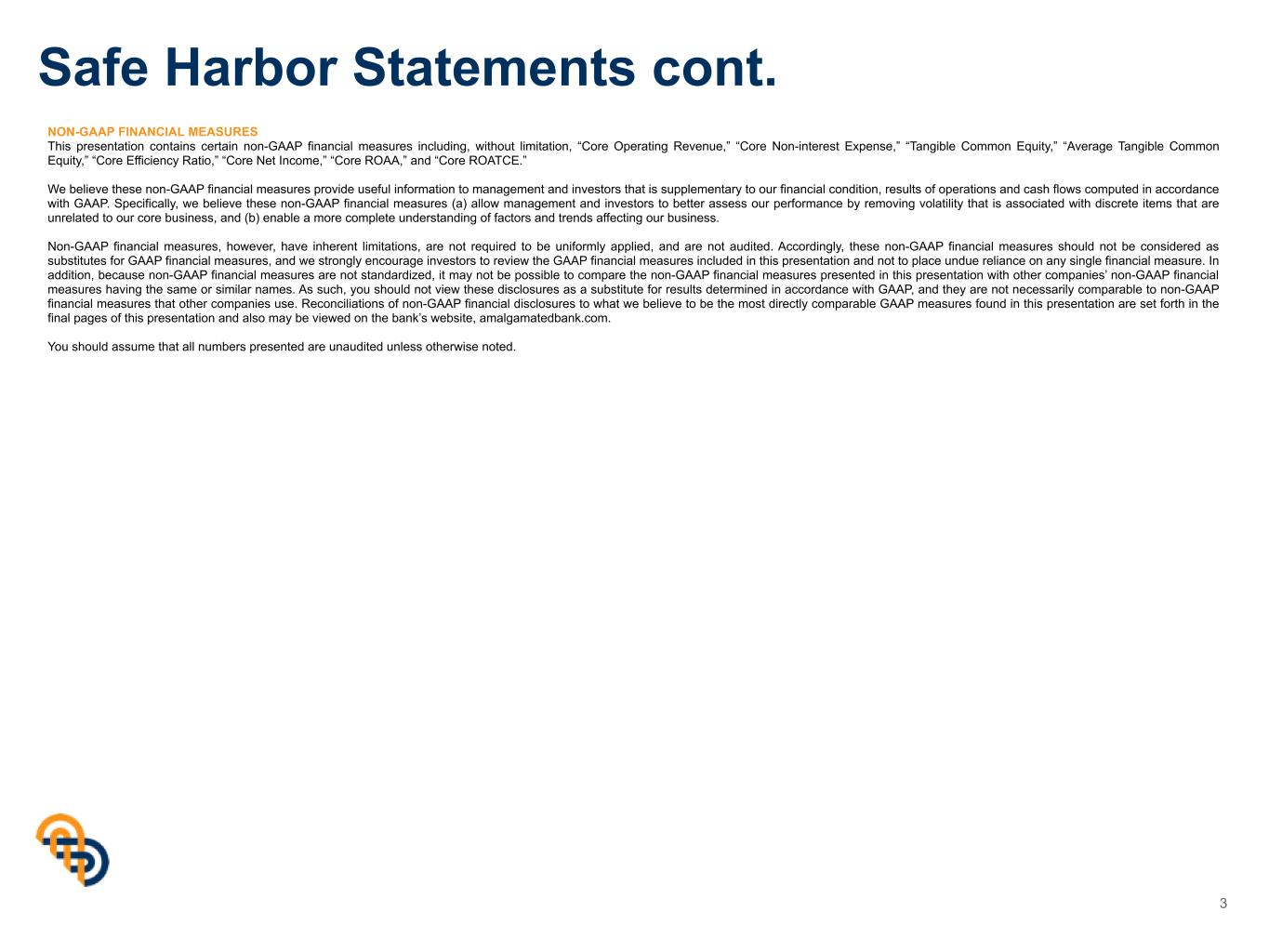

Reconciliation of Non-GAAP Financials 27 As of and for the As of and for the Three Months Ended Three Months Ended (in thousands) March 31, 2023 December 31, 2022 March 31, 2022 March 31, 2023 March 31, 2022 Tangible common equity Stockholders' equity (GAAP) $ 519,158 $ 508,955 $ 526,762 $ 519,160 $ 526,762 Less: Minority interest (133) (133) (133) (133) (133) Less: Goodwill (12,936) (12,936) (12,936) (12,936) (12,936) Less: Core deposit intangible (2,883) (3,105) (3,890) (2,883) (3,890) Tangible common equity (non-GAAP) $ 503,206 $ 492,781 $ 509,803 $ 503,208 $ 509,803 Average tangible common equity Average stockholders' equity (GAAP) $ 502,485 $ 493,761 $ 560,391 $ 502,485 $ 560,391 Less: Minority interest (133) (133) (133) (133) (133) Less: Goodwill (12,936) (12,936) (12,936) (12,936) (12,936) Less: Core deposit intangible (2,991) (3,232) (4,017) (2,991) (4,017) Average tangible common equity (non-GAAP) $ 486,425 $ 477,460 $ 543,305 $ 486,425 $ 543,305 Core return on average assets Core net income (non-GAAP) $ 23,040 $ 25,832 $ 14,359 $ 23,038 $ 14,358 Denominator: Total average assets 7,821,851 7,806,589 7,392,771 7,821,851 7,392,771 Core return on average assets (non-GAAP) 1.19% 1.31% 0.79% 1.19% 0.79% Core return on average assets excluding solar tax impact (non-GAAP) 1.19% 1.38% 0.79% 1.19% 0.79% Core return on average tangible common equity Core net income (non-GAAP) $ 23,040 $ 25,832 $ 14,359 $ 23,038 $ 14,358 Denominator: Average tangible common equity 486,425 477,460 543,305 486,425 543,305 Core return on average tangible common equity (non-GAAP) 19.21% 21.47% 10.72% 19.21% 10.72% Core return on average tangible common equity excluding solar tax impact (non-GAAP) 19.21% 22.58% 10.68% 19.21% 10.68% Core efficiency ratio Numerator: Core non-interest expense (non-GAAP) $ 38,627 $ 35,570 $ 33,974 $ 38,627 $ 33,975 Core operating revenue (non-GAAP) 74,794 72,945 55,628 74,794 55,629 Core efficiency ratio (non-GAAP) 51.64% 48.76% 61.07% 51.64% 61.07% Core efficiency ratio excluding solar tax impact (non-GAAP) 51.64% 47.65% 61.14% 51.64% 61.14% (1) Calculated using core net income excluding solar tax impact (Non-GAAP) in the numerator, as detailed on page 23

Thank You amalgamatedbank.com Member FDIC