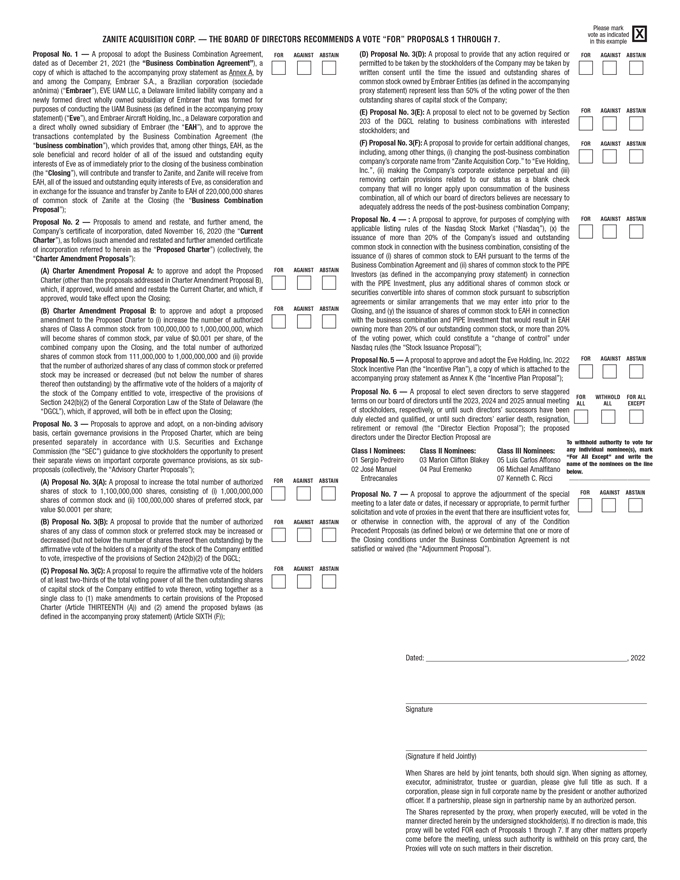

Please mark vote as indicated X ZANITE ACQUISITION CORP. — THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 THROUGH 7. in this example Proposal No. 1 — A proposal to adopt the Business Combination Agreement, FOR AGAINST ABSTAIN (D) Proposal No. 3(D): A proposal to provide that any action required or FOR AGAINST ABSTAIN dated as of December 21, 2021 (the “Business Combination Agreement”), a permitted to be taken by the stockholders of the Company may be taken by copy of which is attached to the accompanying proxy statement as Annex A, by written consent until the time the issued and outstanding shares of and among the Company, Embraer S.A., a Brazilian corporation (sociedade common stock owned by Embraer Entities (as defined in the accompanying anônima) (“Embraer”), EVE UAM LLC, a Delaware limited liability company and a proxy statement) represent less than 50% of the voting power of the then newly formed direct wholly owned subsidiary of Embraer that was formed for outstanding shares of capital stock of the Company; purposes of conducting the UAM Business (as defined in the accompanying proxy FOR AGAINST ABSTAIN statement) (“Eve”), and Embraer Aircraft Holding, Inc., a Delaware corporation and (E) Proposal No. 3(E): A proposal to elect not to be governed by Section a direct wholly owned subsidiary of Embraer (the “EAH”), and to approve the 203 of the DGCL relating to business combinations with interested transactions contemplated by the Business Combination Agreement (the stockholders; and “business combination”), which provides that, among other things, EAH, as the (F) Proposal No. 3(F): A proposal to provide for certain additional changes, FOR AGAINST ABSTAIN sole beneficial and record holder of all of the issued and outstanding equity including, among other things, (i) changing the post-business combination interests of Eve as of immediately prior to the closing of the business combination company’s corporate name from “Zanite Acquisition Corp.” to “Eve Holding, (the “Closing”), will contribute and transfer to Zanite, and Zanite will receive from Inc.”, (ii) making the Company’s corporate existence perpetual and (iii) EAH, all of the issued and outstanding equity interests of Eve, as consideration and removing certain provisions related to our status as a blank check in exchange for the issuance and transfer by Zanite to EAH of 220,000,000 shares company that will no longer apply upon consummation of the business of common stock of Zanite at the Closing (the “Business Combination combination, all of which our board of directors believes are necessary to Proposal”); adequately address the needs of the post-business combination Company; Proposal No. 4 — : A proposal to approve, for purposes of complying with FOR AGAINST ABSTAIN Proposal No. 2 — Proposals to amend and restate, and further amend, the Company’s certificate of incorporation, dated November 16, 2020 (the “Current applicable listing rules of the Nasdaq Stock Market (“Nasdaq”), (x) the Charter”), as follows (such amended and restated and further amended certificate issuance of more than 20% of the Company’s issued and outstanding of incorporation referred to herein as the “Proposed Charter”) (collectively, the common stock in connection with the business combination, consisting of the “Charter Amendment Proposals”): issuance of (i) shares of common stock to EAH pursuant to the terms of the (A) Charter Amendment Proposal A: to approve and adopt the Proposed FOR AGAINST ABSTAIN Business Combination Agreement and (ii) shares of common stock to the PIPE Charter (other than the proposals addressed in Charter Amendment Proposal B), Investors (as defined in the accompanying proxy statement) in connection which, if approved, would amend and restate the Current Charter, and which, if with the PIPE Investment, plus any additional shares of common stock or approved, would take effect upon the Closing; securities convertible into shares of common stock pursuant to subscription agreements or similar arrangements that we may enter into prior to the (B) Charter Amendment Proposal B: to approve and adopt a proposed FOR AGAINST ABSTAIN Closing, and (y) the issuance of shares of common stock to EAH in connection amendment to the Proposed Charter to (i) increase the number of authorized with the business combination and PIPE Investment that would result in EAH shares of Class A common stock from 100,000,000 to 1,000,000,000, which owning more than 20% of our outstanding common stock, or more than 20% will become shares of common stock, par value of $0.001 per share, of the of the voting power, which could constitute a “change of control” under combined company upon the Closing, and the total number of authorized Nasdaq rules (the “Stock Issuance Proposal”); shares of common stock from 111,000,000 to 1,000,000,000 and (ii) provide FOR AGAINST ABSTAIN that the number of authorized shares of any class of common stock or preferred Proposal No. 5 — A proposal to approve and adopt the Eve Holding, Inc. 2022 stock may be increased or decreased (but not below the number of shares Stock Incentive Plan (the “Incentive Plan”), a copy of which is attached to the thereof then outstanding) by the affirmative vote of the holders of a majority of accompanying proxy statement as Annex K (the “Incentive Plan Proposal”); the stock of the Company entitled to vote, irrespective of the provisions of Proposal No. 6 — A proposal to elect seven directors to serve staggered FOR WITHHOLD FOR ALL Section 242(b)(2) of the General Corporation Law of the State of Delaware (the terms on our board of directors until the 2023, 2024 and 2025 annual meeting ALL ALL EXCEPT “DGCL”), which, if approved, will both be in effect upon the Closing; of stockholders, respectively, or until such directors’ successors have been duly elected and qualified, or until such directors’ earlier death, resignation, Proposal No. 3 — Proposals to approve and adopt, on a non-binding advisory retirement or removal (the “Director Election Proposal”); the proposed basis, certain governance provisions in the Proposed Charter, which are being directors under the Director Election Proposal are To withhold authority to vote for presented separately in accordance with U.S. Securities and Exchange Commission (the “SEC”) guidance to give stockholders the opportunity to present Class I Nominees: Class II Nominees: Class III Nominees: any individual nominee(s), mark “For All Except” and write the their separate views on important corporate governance provisions, as six sub- 01 Sergio Pedreiro 03 Marion Clifton Blakey 05 Luis Carlos Affonso 02 José Manuel 04 Paul Eremenko 06 Michael Amalfitano name of the nominees on the line proposals (collectively, the “Advisory Charter Proposals”); below. Entrecanales 07 Kenneth C. Ricci _________________________ (A) Proposal No. 3(A): A proposal to increase the total number of authorized FOR AGAINST ABSTAIN shares of stock to 1,100,000,000 shares, consisting of (i) 1,000,000,000 FOR AGAINST ABSTAIN Proposal No. 7 — A proposal to approve the adjournment of the special shares of common stock and (ii) 100,000,000 shares of preferred stock, par meeting to a later date or dates, if necessary or appropriate, to permit further value $0.0001 per share; solicitation and vote of proxies in the event that there are insufficient votes for, (B) Proposal No. 3(B): A proposal to provide that the number of authorized FOR AGAINST ABSTAIN or otherwise in connection with, the approval of any of the Condition shares of any class of common stock or preferred stock may be increased or Precedent Proposals (as defined below) or we determine that one or more of decreased (but not below the number of shares thereof then outstanding) by the the Closing conditions under the Business Combination Agreement is not affirmative vote of the holders of a majority of the stock of the Company entitled satisfied or waived (the “Adjournment Proposal”). to vote, irrespective of the provisions of Section 242(b)(2) of the DGCL; (C) Proposal No. 3(C): A proposal to require the affirmative vote of the holders FOR AGAINST ABSTAIN of at least two-thirds of the total voting power of all the then outstanding shares of capital stock of the Company entitled to vote thereon, voting together as a single class to (1) make amendments to certain provisions of the Proposed Charter (Article THIRTEENTH (A)) and (2) amend the proposed bylaws (as defined in the accompanying proxy statement) (Article SIXTH (F)); Dated: , 2022 Signature (Signature if held Jointly) When Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder(s). If no direction is made, this proxy will be voted FOR each of Proposals 1 through 7. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion.