| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-226850-07 | ||

| Dated October 6, 2020 | BBCMS 2020-C8 |

Free Writing Prospectus Structural and Collateral Term Sheet | |

BBCMS Mortgage Trust 2020-C8

$700,244,660

(Approximate Mortgage Pool Balance)

$615,340,000

(Approximate Offered Certificates)

Barclays Commercial Mortgage Securities LLC

Depositor

Commercial Mortgage Pass-Through Certificates,

Series 2020-C8

Barclays Capital Real Estate Inc.

Starwood Mortgage Capital LLC

Societe Generale Financial Corporation

Bank of America, National Association

LMF Commercial, LLC

Mortgage Loan Sellers

| Barclays | Société | BofA Securities |

| Générale |

Co-Lead Managers and Joint Bookrunners

| Drexel Hamilton | Academy Securities | |

| Co-Manager | Co-Manager |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Dated October 6, 2020 | BBCMS 2020-C8 |

This material is for your information, and none of Barclays Capital Inc., SG Americas Securities, LLC, BofA Securities, Inc., Drexel Hamilton, LLC or Academy Securities, Inc. (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-226850) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Barclays Capital Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-603-5847. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2020-C8 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation 2017/1129/EU (as amended or superceded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Indicative Capital Structure | |

Publicly Offered Certificates

| Class | Expected Ratings (Moody’s / Fitch / DBRS MSTAR) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Available Certificate Balance or Notional Amount(1) | Approximate Initial Retained Certificate Balance or Notional Amount(1)(2) | Approximate Initial Credit Support(3) | Expected Weighted Avg. Life (years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| A-1 | Aaa(sf) / AAAsf / AAA(sf) | $15,340,000 | $14,656,000 | $684,000 | 30.000% | 2.97 | 11/20-8/25 | 40.0% | 15.4% |

| A-3 | Aaa(sf) / AAAsf / AAA(sf) | $92,700,000 | $88,570,000 | $4,130,000 | 30.000% | 6.90 | 9/27-10/27 | 40.0% | 15.4% |

| A-4 | Aaa(sf) / AAAsf / AAA(sf) | (7) | (7) | (7) | 30.000% | (7) | (7) | 40.0% | 15.4% |

| A-5 | Aaa(sf) / AAAsf / AAA(sf) | (7) | (7) | (7) | 30.000% | (7) | (7) | 40.0% | 15.4% |

| A-SB | Aaa(sf) / AAAsf / AAA(sf) | $30,631,000 | $29,266,000 | $1,365,000 | 30.000% | 7.04 | 8/25-12/29 | 40.0% | 15.4% |

| X-A | Aaa(sf) / AAAsf / AAA(sf) | $490,171,000(8) | $468,332,000(8) | $21,839,000(8) | N/A | N/A | N/A | N/A | N/A |

| X-B | NR / A-sf / AA(low)(sf) | $125,169,000(9) | $119,592,000(9) | $5,577,000(9) | N/A | N/A | N/A | N/A | N/A |

| A-S | Aa1(sf) / AAAsf / AAA(sf) | $64,772,000 | $61,886,000 | $2,886,000 | 20.750% | 9.97 | 10/30-10/30 | 45.3% | 13.6% |

| B | NR / AA-sf / AA(high)(sf) | $29,761,000 | $28,435,000 | $1,326,000 | 16.500% | 9.97 | 10/30-10/30 | 47.7% | 12.9% |

| C | NR / A-sf / A(high)(sf) | $30,636,000 | $29,271,000 | $1,365,000 | 12.125% | 9.97 | 10/30-10/30 | 50.2% | 12.3% |

Privately Offered Certificates(10)

| Class | Expected Ratings (Moody’s / Fitch / DBRS MSTAR) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Available Certificate Balance or Notional Amount(1) | Approximate Initial Retained Certificate Balance or Notional Amount(1)(2) | Approximate Initial Credit Support(3) | Expected Weighted Avg. Life (years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| X-D | NR / BBB-sf / A(low)(sf) | $34,136,000(11) | $32,615,000(11) | $1,521,000(11) | N/A | N/A | N/A | N/A | N/A |

| X-FG | NR / BB-sf / BBB(low)(sf) | $17,507,000(12) | $16,727,000(12) | $780,000(12) | N/A | N/A | N/A | N/A | N/A |

| X-H | NR / B-sf / BB(sf) | $7,877,000(13) | $7,526,000(13) | $351,000(13) | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBBsf / A(low)(sf) | $18,381,000 | $17,562,000 | $819,000 | 9.500% | 9.97 | 10/30-10/30 | 51.7% | 11.9% |

| E | NR / BBB-sf / BBB(high)(sf) | $15,755,000 | $15,053,000 | $702,000 | 7.250% | 9.97 | 10/30-10/30 | 53.0% | 11.6% |

| F | NR / BB+sf / BB(high)(sf) | $8,753,000 | $8,363,000 | $390,000 | 6.000% | 9.97 | 10/30-10/30 | 53.7% | 11.5% |

| G | NR / BB-sf / BB(high)(sf) | $8,754,000 | $8,364,000 | $390,000 | 4.750% | 9.97 | 10/30-10/30 | 54.4% | 11.3% |

| H | NR / B-sf / BB(low)(sf) | $7,877,000 | $7,526,000 | $351,000 | 3.625% | 9.97 | 10/30-10/30 | 55.0% | 11.2% |

| J-RR | NR / NR / B(sf) | $10,504,000 | $10,036,000 | $468,000 | 2.125% | 9.97 | 10/30-10/30 | 55.9% | 11.0% |

| K-RR | NR / NR / NR | $14,880,660 | $14,217,000 | $663,660 | 0.000% | 9.97 | 10/30-10/30 | 57.1% | 10.8% |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%, including in connection with any variation in the certificate balances and notional amounts of the classes comprising the VRR Interest following the calculation of the actual fair value of the ABS interests (as such term is defined in Regulation RR) issued by the issuing entity. |

| (2) | On the Closing Date, SMC (a sponsor and an affiliate of the special servicer) will cause a majority-owned affiliate to purchase from the underwriters the certificates (other than the Class S and Class R certificates) with the initial certificate balances or notional amounts, as applicable, as set forth in the table above under “Approximate Initial Retained Certificate Balance or Notional Amount” as well as an approximately 4.455% interest in the Class S certificates, as further described in “Credit Risk Retention” in the Preliminary Prospectus. |

| (3) | The credit support percentages set forth for Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates in the aggregate. |

| (4) | Assumes 0% CPR / 0% CDR and an October 27, 2020 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated October 6, 2020 (the “Preliminary Prospectus”). |

| (5) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and expected principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $351,500,000, subject to a variance of plus or minus 5%. The initial certificate balance of the certificates to be retained by SMC related to the Class A-4 and Class A-5 certificates will be an amount equal to approximately 4.455% of the approximate initial certificate balance of such class, as further described in “Credit Risk |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Indicative Capital Structure | |

| Retention.” In the event that the Class A-5 certificates are issued with an initial certificate balance of $351,500,000, the Class A-4 certificates will not be issued and the Class A-5 will be renamed the Class A-4. |

| Class of Certificates | Expected Range of Approximate Initial Certificate Balance | Expected Range of Approximate Initial Available Certificate Balance | Expected Range of Approximate Initial Retained Certificate Balance | Expected Range of Weighted Avg. Life (Yrs) | Expected Range of Principal Window | |||||

| Class A-4 | $0 - $170,000,000 | $0 - $162,426,000 | $0 - $7,574,000 | N/A – 9.47 | N/A – 12/29-8/30 | |||||

| Class A-5 | $181,500,000 – $351,500,000 | $173,414,000 - $335,840,000 | $8,086,000 – $15,660,000 | 9.89 – 9.69 | 8/30-10/30 – 12/29-10/30 |

| (8) | The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates outstanding from time to time. |

| (9) | The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, Class B and Class C Certificates outstanding from time to time. |

| (10) | The Class X-D, Class X-FG, Class X-H, Class D, Class E, Class F, Class G, Class H, Class J-RR and Class K-RR Certificates are not being offered by the Preliminary Prospectus and this Term Sheet. The Class S and Class R Certificates are not shown above. |

| (11) | The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and Class E Certificates outstanding from time to time. |

| (12) | The Notional Amount of the Class X-FG Certificates will be equal to the aggregate Certificate Balance of the Class F and Class G Certificates outstanding from time to time. |

| (13) | The Notional Amount of the Class X-H Certificates will be equal to the Certificate Balance of the Class H Certificates outstanding from time to time. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Summary of Transaction Terms | ||

| Securities Offered: | $615,340,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | Barclays Capital Inc., BofA Securities, Inc. and SG Americas Securities, LLC |

| Co-Managers: | Drexel Hamilton, LLC and Academy Securities, Inc. |

| Mortgage Loan Sellers: | Starwood Mortgage Capital LLC (“SMC”) (33.1%), Barclays Capital Real Estate Inc. (“Barclays”) (29.4%), Societe Generale Financial Corporation (“SGFC”) (13.1%), Bank of America, National Association (“BANA”) (12.5%) and LMF Commercial, LLC (“LMF”) (11.8%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | LNR Partners, LLC |

| Trustee: | Wilmington Trust, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and DBRS, Inc. (“DBRS MSTAR”). |

| U.S. Credit Risk Retention: | SMC is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirements (i) through the purchase by Starwood Conduit CMBS Vertical Retention I LLC, a “majority-owned affiliate,” of an “eligible vertical interest” (each as defined in Regulation RR), which will consist of approximately 4.455% of the certificate balance, notional amount or percentage interest of each class of certificates (other than the Class R Certificates) (the “VRR Interest”) issued by the issuing entity and (ii) through the purchase by Starwood Conduit CMBS Horizontal BBCMS 2020-C8 LLC, a “majority-owned affiliate,” of an “eligible horizontal residual interest” (each as defined in Regulation RR), which will consist of the portion of the Class J-RR and Class K-RR Certificates not included in the VRR Interest. SMC, in its capacity as the “retaining sponsor” for this transaction, will be required to comply with the hedging, transfer and financing restrictions applicable to a “retaining sponsor” under the credit risk retention rules, which generally prohibit the transfer of the applicable certificates except to a “majority-owned affiliate” of the “retaining sponsor”. The restrictions on hedging and transfer under the credit risk retention rules as in effect on the closing date of this transaction will expire on and after the date that is the latest of (i) the date on which the aggregate principal balance of the mortgage loans has been reduced to 33% of the aggregate principal balance of the mortgage loans as of the Cut-off Date; (ii) the date on which the total unpaid principal obligations under the certificates has been reduced to 33% of the aggregate total unpaid principal obligations under the certificates as of the Closing Date; or (iii) two years after the Closing Date. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Closing Date: | On or about October 27, 2020. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in October 2020, or in the case of any mortgage loan that has its first due date after October 2020, the date that would have been its due date in October 2020 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in November 2020. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in November 2020. |

| Assumed Final Distribution Date: | The Distribution Date in October 2030 which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in October 2053. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class X-FG, Class X-H, Class D, Class E, Class F, Class G, Class H, Class J-RR, Class K-RR, Class S and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the cut-off date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Summary of Transaction Terms | ||

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., BlackRock Financial Management, Inc., Interactive Data Corp., CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, MBS Data, LLC, RealInsight, Thomson Reuters Corporation and DealView Technologies Ltd. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Collateral Characteristics | ||

Mortgage Loan Seller | Number of | Number of | Aggregate | % of IPB |

| SMC | 16 | 24 | $231,845,419 | 33.1% |

| Barclays | 11 | 38 | 161,336,000 | 23.0 |

| BANA | 5 | 5 | 87,725,000 | 12.5 |

| LMF | 9 | 25 | 82,838,241 | 11.8 |

| Barclays; SGFC | 1 | 2 | 69,500,000 | 9.9 |

| SGFC | 6 | 33 | 67,000,000 | 9.6 |

| Total: | 48 | 127 | $700,244,660 | 100.0% |

| Loan Pool | ||

| Initial Pool Balance (“IPB”): | $700,244,660 | |

| Number of Mortgage Loans: | 48 | |

| Number of Mortgaged Properties: | 127 | |

| Average Cut-off Date Balance per Mortgage Loan: | $14,588,430 | |

| Weighted Average Current Mortgage Rate: | 3.70357% | |

| 10 Largest Mortgage Loans as % of IPB: | 55.9% | |

| Weighted Average Remaining Term to Maturity/ARD: | 113 months | |

| Weighted Average Seasoning: | 2 months | |

| Credit Statistics | ||

| Weighted Average UW NCF DSCR(1)(2): | 2.54x | |

| Weighted Average UW NOI Debt Yield(1)(3): | 10.8% | |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3)(4): | 57.1% | |

| Weighted Average Maturity Date/ARD LTV(1)(3)(4): | 52.4% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 19.9% | |

| % of Mortgaged Loans with Single Tenants(5): | 11.2% | |

| % of Mortgaged Loans secured by Multiple Properties: | 41.6% | |

| Amortization | ||

| Weighted Average Original Amortization Term(6): | 360 months | |

| Weighted Average Remaining Amortization Term(6): | 360 months | |

| % of Mortgage Loans with Interest-Only: | 38.1% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 36.4% | |

| % of Mortgage Loans with Amortizing Balloon: | 15.6% | |

| % of Mortgage Loans with Interest-Only followed by ARD-Structure: | 9.9% | |

| Lockboxes(7) | ||

| % of Mortgage Loans with Hard Lockboxes: | 48.5% | |

| % of Mortgage Loans with Springing Lockboxes: | 41.5% | |

| % of Mortgage Loans with Soft Lockboxes: | 10.0% | |

| % of Mortgage Loans with No Lockbox: | 0.0% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 67.5% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 43.2% | |

| % of Mortgage Loans Requiring Monthly CapEx Reserves: | 72.1% | |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 51.2% | |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 6, 10, 13 and 34, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1 and 3, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. In the case of Loan No. 3, with an anticipated repayment date, Maturity Date/ARD LTV is calculated as of the related anticipated repayment date. In the case of Loan No. 3, the UW NCF DSCR and UW NOI Debt Yield Calculations are based on master lease rent; see “Annex A-3” for further details. |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 12, the Cut-off Date LTV, Maturity Date/ARD LTV and UW NOI Debt Yield calculations exclude $550,000 on a deposit in an economic holdback reserve. Including the amount on deposit in such reserve, the Cut-off Date LTV, Maturity Date/ARD LTV and UW NOI Debt Yield calculations are 66.1%, 53.4% and 9.1%, respectively. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 1, 2, 3, 4, 9, 12 and 16, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on certain hypothetical, as portfolio or as stabilized assumptions. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

| (6) | Excludes 16 mortgage loans that are interest-only for the entire term or until the anticipated repayment date. |

| (7) | For a more detailed description of Lockboxes, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, mixed use and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| COVID-19 Update(1) |

Mortgage Loan Seller | Information as of Date | Origination Date | Property Name | Property Type | August Debt Service Payment Received | September Debt Service Payment Received | Forbearance or Other Debt Service Relief Requested | Other Loan Modification Requested | Lease Modification or Rent Relief Requested | PPP Loan Received by Borrower (Y/N) | Occupied SF/Unit Making Full August Payment | UW August Base Rent Paid (%) | Occupied SF/Unit Making Full September Payment | UW September Base Rent Paid (%) |

| Barclays | 9/22/2020 | 8/28/2020 | One Manhattan West | Office | NAP | NAP | N | N | N | N | 100.0%(5) | 100.0%(5) | 100.0%(5) | 100.0%(5) |

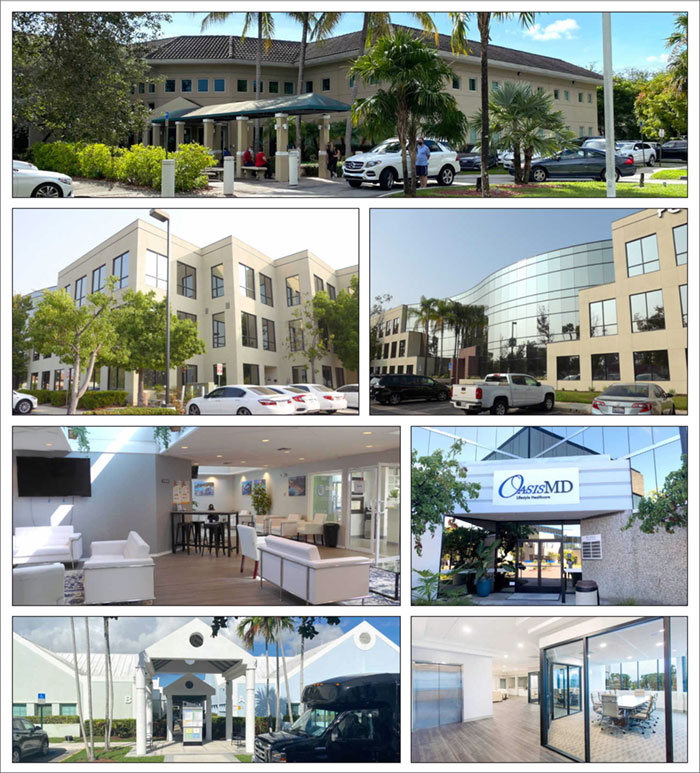

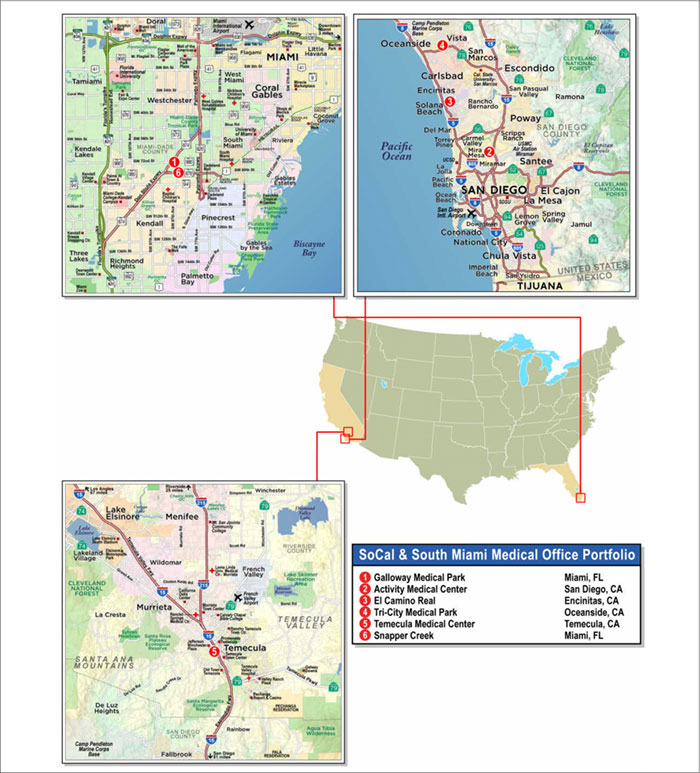

| SMC | 9/16/2020 | 9/25/2020 | SoCal & South Miami Medical Office Portfolio | Office | NAP | NAP | N | N | Y(6) | N | 100.0% | 100.0% | 100.0% | 100.0% |

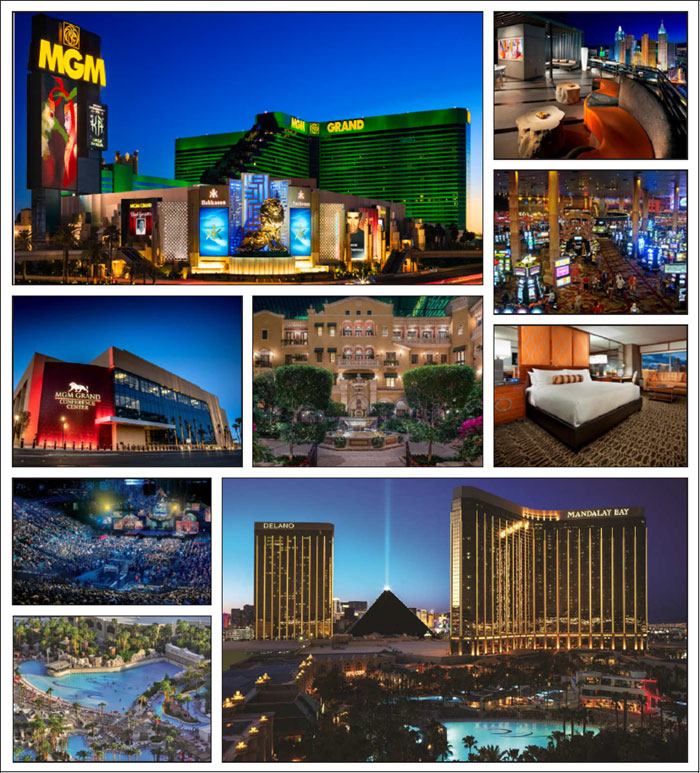

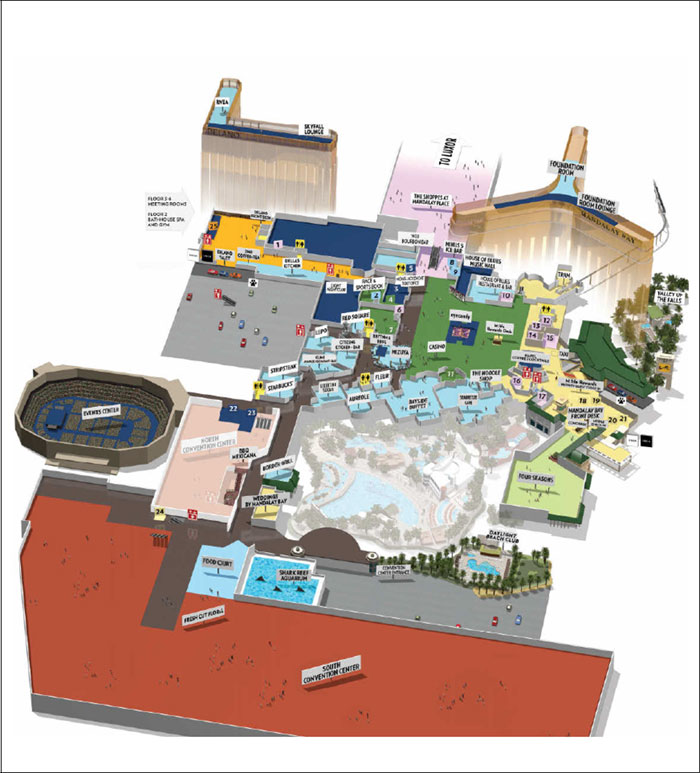

| Barclays; SGFC | 9/22/2020 | 2/14/2020 | MGM Grand & Mandalay Bay | Hotel | Y | Y | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 7/28/2020 | 7/21/2020 | PGH17 Self Storage Portfolio | Self Storage | Y | Y | N | N | N | N | (7) | (7) | (7) | (7) |

| Barclays | 9/22/2020 | 7/29/2020 | ExchangeRight Net Leased Portfolio 38 | Retail | NAP | Y | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BANA | 9/8/2020 | 9/4/2020 | 9th & Thomas | Office | NAP | NAP | N | N | Y(8) | N | 96.1% | 96.2% | 97.1% | 97.2% |

| SMC | 9/3/2020 | 9/3/2020 | Abele Business Park | Office | NAP | NAP | N | N | Y(9) | N | 100.0% | 98.9% | 100.0% | 97.9% |

| SMC | 9/10/2020 | 9/25/2020 | Airport Plaza | Office | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BANA | 9/25/2020 | 9/30/2020 | Newpark Town Center | Mixed Use | NAP | NAP | N | N | Y(10) | Y(11) | 100.0% | 100.0% | 100.0% | 100.0% |

| BANA | 9/22/2020 | 3/6/2020 | 711 Fifth Avenue | Mixed Use | Y | Y | N | N | Y(12) | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/10/2020 | 9/15/2020 | Museo Vault Storage | Self Storage | NAP | NAP | N | N | N | N | 97.4% | 100.0%(13) | 95.2% | 85.3%(13) |

| SMC | 9/16/2020 | 8/3/2020 | Southeast Texas Multifamily Portfolio | Multifamily | NAP | Y | N | N | N | N | 97.5% | 96.9% | NAV(14) | NAV(14) |

| SGFC | 9/22/2020 | 2/11/2020 | ExchangeRight Net Leased Portfolio 32 | Various | Y | Y | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| Barclays | 9/22/2020 | 9/25/2020 | 7 Powder Horn Drive | Industrial | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BANA | 9/25/2020 | 9/24/2020 | 3700 Geary Boulevard | Mixed Use | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SGFC | 9/22/2020 | 9/30/2020 | FedEx Portfolio | Industrial | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| Barclays | 9/24/2020 | 7/28/2020 | Goldman Chicago Multifamily Portfolio | Multifamily | NAP | Y | N | N | N | N | 96.5%(15) | 96.5%(15) | 94.3%(15) | 94.3%(15) |

| SMC | 9/16/2020 | 9/14/2020 | 313 Powell Street | Other | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/10/2020 | 9/15/2020 | BoxVault Storage | Self Storage | NAP | NAP | N | N | N | N | 97.1% | 96.3%(16) | 96.0% | 90.2%(16) |

| LMF | 9/17/2020 | 9/9/2020 | Cedar Branch Apartments | Multifamily | NAP | NAP | N | N | N | N | 98.7% | 98.9% | 84.8% | 90.2% |

| SGFC | 9/22/2020 | 9/28/2020 | Rio San Diego | Office | NAP | NAP | N | N | Y(17) | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SGFC | 9/22/2020 | 9/23/2020 | CH Robinson Plano | Office | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/16/2020 | 9/10/2020 | 2260 University Drive | Office | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 9/16/2020 | 9/16/2020 | Augusta Park | Office | NAP | NAP | N | N | Y(18) | N | 100.0% | 100.0% | 100.0% | 100.0% |

| Barclays | 9/22/2020 | 9/25/2020 | Mochica Apartments Portfolio | Multifamily | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/16/2020 | 11/26/2019 | 44 Mercer Street & 471 Broadway | Retail | Y | Y | N | N | N | N | 100.0% | 68.1%(19) | 100.0% | 68.1%(19) |

| SMC | 9/17/2020 | 9/10/2020 | Value Store It Fort Lauderdale | Self Storage | NAP | NAP | N | N | N | N | 96.4% | 94.7%(20) | 93.7% | 79.0%(20) |

| SGFC | 9/2/2020 | 9/30/2020 | Benton Road Storage Center | Self Storage | NAP | NAP | N | N | Y(21) | N | NAV | 95.7% | NAV | 77.0%(22) |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| COVID-19 Update(1) | ||||||||||||||

Mortgage Loan Seller | Information as of Date | Origination Date | Property Name | Property Type | August Debt Service Payment Received (Y/N)(2) | September Debt Service Payment Received (Y/N)(2) | Forbearance or Other Debt Service Relief Requested (Y/N)(3) | Other Loan Modification Requested (Y/N)(3) | Lease Modification or Rent Relief Requested (Y/N)(4) | PPP Loan Received by Borrower (Y/N) | Occupied SF/Unit Making Full August Payment (%) | UW August Base Rent Paid (%) | Occupied SF/Unit Making Full September Payment (%) | UW September Base Rent Paid (%) |

| SMC | 9/16/2020 | 8/31/2020 | Midgard Eastanollee | Self Storage | NAP | NAP | N | N | N | N | 93.9% | 95.1% | NAV(23) | 93.2%(23) |

| Barclays | 9/22/2020 | 10/1/2020 | 21 Airport Road | Industrial | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 8/31/2020 | 8/31/2020 | 1001 Apartments | Multifamily | NAP | NAP | N | N | N | N | NAV | 97.0% | NAV | NAV |

| LMF | 7/31/2020 | 9/16/2020 | WoodSpring Suites San Angelo | Hotel | NAP | NAP | N | N | N | N | (24) | (24) | (24) | (24) |

| LMF | 7/31/2020 | 9/18/2020 | Pleasantdale Self Storage | Self Storage | NAP | NAP | N | N | N | N | (25) | (25) | (25) | (25) |

| SMC | 9/16/2020 | 1/24/2020 | McCarthy Ranch | Retail | Y | Y | N | N | Y(26) | N | 97.0% | 84.0% | 97.0% | 84.0% |

| SGFC | 9/22/2020 | 9/24/2020 | Freedom Storage Las Vegas | Self Storage | NAP | NAP | N | N | N | N | NAV | 96.8% | NAV | 82.3%(27) |

| Barclays | 9/22/2020 | 9/18/2020 | 228 Spaces | Multifamily | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 8/27/2020 | 8/27/2020 | Cypress Shops | Retail | NAP | NAP | N | N | N | N | 100.0%(28) | 100.0%(28) | 100.0%(28) | 100.0%(28) |

| Barclays | 9/22/2020 | 8/20/2020 | Walgreens Newport News | Retail | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BANA | 9/17/2020 | 9/24/2020 | Springboro Plaza | Retail | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/16/2020 | 9/4/2020 | Summer Winds MHP | Manufactured Housing | NAP | NAP | N | N | N | N | 100.0% | 98.0% | 84.6% | 92.2% |

| Barclays | 9/22/2020 | 9/15/2020 | Walgreens Williamson | Retail | NAP | NAP | N | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| SMC | 9/3/2020 | 7/31/2020 | Magnolia Village | Retail | NAP | Y | N | N | Y(29) | N | 100.0% | 97.5% | 100.0% | 97.3% |

| LMF | 7/31/2020 | 8/5/2020 | Secure Storage Highland | Self Storage | NAP | Y | N | N | N | N | (30) | (30) | (30) | (30) |

| SMC | 9/16/2020 | 12/16/2019 | Parkside Townhomes | Multifamily | Y | Y | N | N | N | N | 100.0% | 99.4% | NAV(14) | NAV(14) |

| LMF | 7/27/2020 | 8/20/2020 | Airline Self Storage | Self Storage | NAP | NAP | N | N | N | N | (31) | (31) | (31) | (31) |

| Barclays | 9/28/2020 | 9/24/2020 | Security Mini Storage | Self Storage | NAP | NAP | N | N | N | N | 97.2%(32) | 97.2%(32) | 88.6%(32) | 88.6%(32) |

| SMC | 9/16/2020 | 9/14/2020 | Coronado Village MHP | Manufactured Housing | NAP | NAP | N | N | N | N | 100.0% | 100.0% | NAV(33) | NAV(33) |

| Barclays | 9/15/2020 | 9/14/2020 | A Quality Storage | Self Storage | NAP | NAP | N | N | N | N | 87.4%(34) | 87.4%(34) | NAV(34) | NAV(34) |

| (1) | The table contains information regarding the status of the Mortgage Loans and of the related Mortgaged Properties, in each case as of the date found in the “Information as-of Date” column below. The information provided in the columns labeled “Lease Modification or Rent Relief Requested (Y/N)”, “PPP Loan Received by Borrower (Y/N)”, “Occupied SF/Unit Making Full August Payment (%)” and “Occupied SF/Unit Making Full August Payment (%)” as well as the information found in the footnotes to the table (such information collectively, the “Borrower Information”) was provided by the related borrower sponsors via phone conversations and email communications. The Borrower Information has not been independently verified by the Mortgage Loan Sellers, the Underwriters or any other party, and there can be no assurances that the Borrower Information was comprehensive and accurate when received, or as of the date of this term sheet. For additional information, see “Description of the Mortgage Pool—Mortgage Pool Characteristics—COVID-19 Considerations” in the Preliminary Prospectus. |

The cumulative effects of the COVID-19 pandemic on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the Mortgage Loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the Certificates. See “Risk Factors—Risks Related to Market Conditions and Other External Factors—Current Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus.

| (2) | Some loans are newly originated and therefore, the August Debt Service Payment Received (Y/N) and September Debt Service Payment Received (Y/N) fields are not applicable. See Annex A-1 for each loan’s first payment date. |

| (3) | Forbearance or Other Debt Service Relief Requested (Y/N) and Other Loan Modification Requested (Y/N) reflects situations where a request was made and not withdrawn. |

| (4) | Lease Modification or Rent Relief Requested (Y/N) excludes residential tenants and self-storage tenants and includes any commercial tenant that has requested a lease modification or rent relief. |

| (5) | The One Manhattan West Property was newly constructed in 2019. Some tenants are still in their free rent periods, but all tenants are current under their lease obligations. |

| (6) | Two tenants (4.3% of NRA and 6.0% of UW Base Rent) received COVID-19 related rent relief and two tenants (1.2% of NRA) ceased operations due to the impact of the COVID-19 pandemic, which tenants have been underwritten as vacant. No rent was forgiven; all COVID-19 relief requests consisted of applying security deposits towards base rent or deferring one to two months of base rent. Of the two tenants that received COVID-19 related relief, one tenant will have an outstanding repayment obligation as of the origination date, totaling approximately $4,736 (equal to one half month’s total rent), which is required to be repaid by October 2020. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| COVID-19 Update(1) |

| (7) | Tenant due dates are based on the date in the month of their start date (which in most cases is not the 1st of month), so collections are not tracked on calendar month basis. As of July 28, 2020, 4.0% of monthly rents were 31-60 days past due and 2.7% of monthly rents were 61-90 days past due. |

| (8) | Thomas Street Warehouse Restaurant (2.5% of NRA and 2.4% of UW Base Rent), a full service restaurant and bar, was provided with a base rent abatement for April, August and September 2020 and is currently under negotiations for a rent deferral strategy that would allow the tenant flexibility and time to implement a menu that could be supported by delivery and to-go sales. Jack’s BBQ (1.0% of NRA and 1.0% of UW Base Rent) was provided with a base rent abatement for April and August 2020 and resumed full rental payments in September 2020. Elm Coffee (0.4% of NRA and 0.4% of UW Base Rent) was provided with five months of base rent abatement (May through September 2020). |

| (9) | Three tenants (collectively representing 5.6% of NRA and 6.3% of UW Base Rent) entered into rent deferment agreements for the payments due in May, June and July 2020. These tenants include: (i) Wesley Spectrum, who paid 50% of rent due from May through July 2020 and will have an abatement of $2,077 per month through December 2020 (abatement escrowed), (ii) Crossmark, who paid no rent from May through July and paid full rent in August and (iii) Ridgeview Physical Therapy and Wellness Center, LLC, who paid partial rent from May through July and paid full rent in August. Each of the tenants has entered into an agreement to repay deferred rent. |

| (10) | The borrower has provided partial rent abatements to nine tenants (23.7% of NRA and 25.2% of UW Base Rent) and rent deferrals to eight tenants (45.4% of NRA and 45.4% of UW Base Rent). All tenants have repaid the deferred rent, except Best Buy (24.4% of NRA and 28.0% of UW Base Rent). Best Buy’s deferred rent is required to be repaid in two installments on November 1 and December 1, 2020. All tenants have paid rent for August and September 2020. |

| (11) | The borrower accepted a loan in the amount of $48,725.81 pursuant to the Paycheck Protection Program through the U.S. Small Business Administration from Utah First Federal Credit Union under Division A, Title I of the Coronavirus Aid, Relief, and Economic Security Act. |

| (12) | As of May 18, 2020, the borrower has entered into a rent deferral agreement with the sixth largest tenant, The Swatch Group (4.2% of NRA and 37.3% of UW Base Rent). For the months of April, May and June 2020, The Swatch Group base rent was reduced to 50.0%. The abated 50% of base rent is required to be repaid by December 31, 2020 (50.0%) and March 31, 2021 (50.0%). All tenants have paid rent for August and September 2020. |

| (13) | Rent at the storage facility is collected on a rolling basis throughout the month and dictated by each individual tenant's occupancy date and payment method. As such, UW September Base Rent Paid (%) is based on a partial month's collections and does not accurately reflect the total monthly collections that will be received by the end of the month. |

| (14) | Due to the timing of the request, the related borrower sponsors were unable to provide full month collections for September 2020. |

| (15) | Occupied SF/Unit Making Full August Payment (%) and UW August Base Rent Paid (%) are based on rent collections through August 31, 2020 and Occupied SF/Unit Making Full September Payment (%), UW September Base Rent Paid (%) are based on rent collections through September 24, 2020. |

| (16) | Rent at the storage facility is collected on a rolling basis throughout the month and dictated by each individual tenant's occupancy date and payment method. As such, UW September Base Rent Paid (%) is based on a partial month's collections and does not accurately reflect the total monthly collections that will be received by the end of the month. |

| (17) | All tenants except for Ideal Match (2.8% of NRA and 2.7% of UW Base Rent) have made their respective August 2020 rent payments. Ideal Match was granted deferred rent for March and April 2020 and a 50% rent abatement from May 2020 until further notice. Ideal Match is expected to pay all amounts owed in full prior to its lease expiration on January 31, 2021. Ideal Match is expected to vacate its suite upon the expiration of its lease. As a result, the suite occupied by Ideal Match is currently being marketed to prospective tenants. |

| (18) | Rent relief inquiries were received from Henderson Executive (19.4% of NRA and 19.0% of UW Base Rent) (rent deferment executed), The Day Chiropractic (4.0% of NRA and 3.9% of UW Base Rent) (tenant elected not to sign), Horizon Family Therapy (2.0% of NRA and 2.3% of UW Base Rent) (rent deferment executed), and David P. Smith, O.D. (2.7% of NRA and 4.6% of UW Base Rent) (landlord declined to offer). Henderson Executive received a deferment of its base rent in May 2020 totaling $18,892.90 due to the COVID-19 pandemic, which is required to be repaid in six monthly installments of $3,148.82 from July to December 2020. However, the tenant agreed to an early lease extension in August 2020, and in connection with the extension, the borrower agreed to waive the last four months of base rent deferments, otherwise due September 2020 through December 2020. Horizon Family Therapy received a deferment of the base rent in April 2020 totaling $2,306.40 due to the COVID-19 pandemic, which is required to be repaid in six monthly installments of $384.40 from June to November 2020. |

| (19) | Think Coffee (54.8% of NRA and 41.3% of UW Base Rent) is currently paying $5,000 of its $25,000 monthly base rent. |

| (20) | Rent at the storage facility is collected on a rolling basis throughout the month and dictated by each individual tenant's occupancy date and payment method. As such, UW September Base Rent Paid (%) is based on a partial month's collections and does not accurately reflect the total monthly collections that will be received by the end of the month. One retail tenant, Estrella Insurance (1.8% of NRA and 2.9% of UW Base Rent), requested free rent for the month of May 2020. The tenant agreed to repay the abated rent in seven monthly installments from June through December 2020 in addition to the contractual monthly rent payments owed under the lease. |

| (21) | Subway (0.8% of NRA and 2.6% of UW Base Rent) requested rent relief due to the impact of the COVID-19 pandemic. The request was denied and Subway has continued to make full rental payments through September 2020. |

| (22) | UW September Base Rent Paid (%) is as of September 22, 2020; however, rents are collected throughout the month. The UW August Base Rent Paid % and UW September Base Rent Paid % are based on self storage collections only. The retail tenants at the Benton Road Self Storage Property had 100.0% collections in August and September 2020, respectively. The self storage units at the Benton Road Self Storage Property have averaged approximately 94.8% UW Base Rent collections between March and August 2020. |

| (23) | Rent at the storage facility is collected on a rolling basis throughout the month and dictated by each individual tenant's occupancy date and payment method. Additionally, the Midgard Eastanollee Property was recently acquired. As such, August and September reporting is based on partial months' collections and do not accurately reflect the total monthly collections that were received in August or are expected to be received by the end of September. |

| (24) | June and July 2020 occupancy, ADR and RevPAR information was 95.3%, $48.35 and $46.05 and 88.0%, $48.46 and $42.63, respectively. |

| (25) | As of July 31, 2020, 1.1% of units, representing 3.4% of base rent were 31-60 days past due and 0.4% of units, representing 1.7% of base rent were 61-90 days past due. |

| (26) | Three tenants (collectively representing 2.5% of NRA and 5.8% of UW Base Rent) have not paid rent for August or September 2020. Best Buy (19.3% of NRA and 19.0% of UW Base Rent) is paying 50% rent through December 2020 with deferred rent required to be repaid beginning in January 2021. |

| (27) | UW September Base Rent Paid (%) is as of September 25, 2020; however, rents are collected throughout the month. The self storage units at Freedom Storage Las Vegas Property have averaged 88.0% collections between March and August 2020. |

| (28) | The second and third largest tenants (collectively representing 34.4% of NRA and 41.4% of UW Base Rent) are currently paying partially abated rent, based on the terms in new leases executed in 2019. Full rent payments are scheduled to commence October 1, 2020 and January 1, 2021, respectively. A free rent reserve of $94,876 was established at origination. Rent relief related to COVID-19 was not requested. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| COVID-19 Update(1) |

| (29) | Otsuka Ramen and Bar (6.4% of NRA and 10.5% of UW Base Rent) did not pay rent from March through June 2020. They received a $1,500 per month discount from July through October 2020. 50% of the unpaid balance of such rent abatement will be forgiven. World Nail (3.9% of NRA and 2.8% of UW Base Rent) paid discounted rent from April through June 2020; World Nail has agreed to pay the unpaid balance of such rent abatement over a six-month period ending in January 2021. Magnolia Village Cleaners (3.1% of NRA and 2.6% of UW Base Rent) did not pay rent from March through June 2020; they are negotiating a plan to repay delinquent rent. Inizio Insurance Solutions (2.5% of NRA and 1.8% of UW Base Rent) did not pay rent in May 2020 and is negotiating a payment plan for the balance due. Pacific Mini Mart (6.3% of NRA and 4.7% of UW Base Rent) did not pay rent in April 2020 and is negotiating a payment plan for the balance due. |

| (30) | As of July 31, 2020, 2.0% of base rent was 31-60 days past due and 0.9% of base rent was 61-90 days past due. |

| (31) | As of July 27, 2020, 1.7% of UW Base Rent was 0-90 days past due and 0.8% of UW Base Rent was 360 days past due. |

| (32) | Occupied SF/Unit Making Full August Payment (%) and UW August Base Rent Paid (%) is based on storage unit rent collections through August 31, 2020. Occupied SF/Unit Making Full September Payment (%) and UW September Base Rent Paid (%) are as of September 28, 2020; however, rents are collected throughout the month. The Security Mini Storage Property has averaged 98.9% collections since March 2020. |

| (33) | The Coronado Village MHP Property was acquired on September 14, 2020, thus full month collections for September 2020 are not available. |

| (34) | Occupied SF/Unit Making Full August Payment (%) and UW August Base Rent Paid (%) is based on storage unit rent collections through August 31, 2020. Occupied SF/Unit Making Full September Payment (%) and UW September Base Rent Paid (%) are not currently available. However, according to the borrower sponsor, 92.4% of storage unit rent collections have been received since the onset of the COVID-19 pandemic, and all tenants are expected to repay any missed rent. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Collateral Characteristics | ||

| Ten Largest Mortgage Loans |

| No. | Loan Name | City, State | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Rooms / Units | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date/ARD LTV(1)(2) |

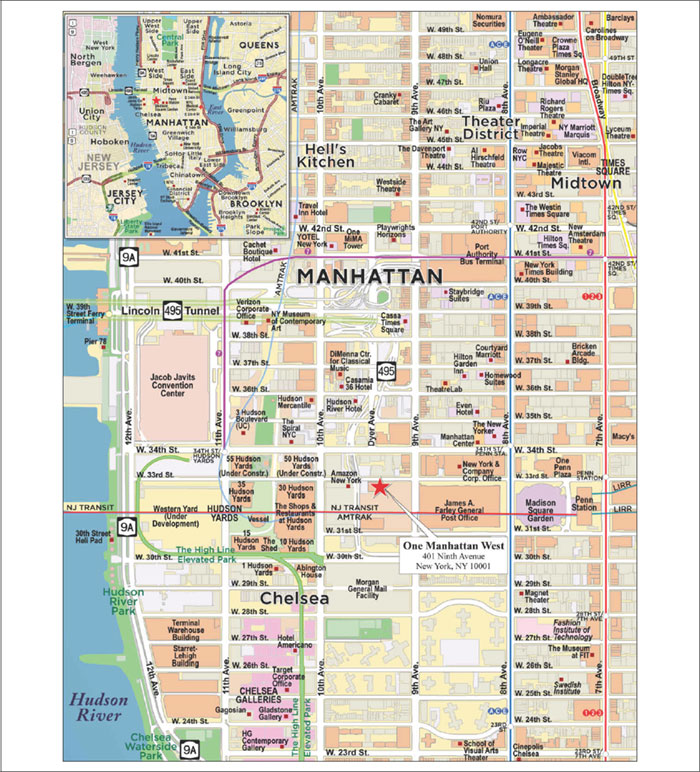

| 1 | One Manhattan West | New York, NY | Barclays | 1 | $70,000,000 | 9.997% | 2,081,035 | Office | 4.46x | 10.7% | 45.5% | 45.5% |

| 2 | SoCal & South Miami Medical Office Portfolio | Various | SMC | 6 | $70,000,000 | 9.997% | 297,839 | Office | 1.40x | 8.8% | 59.9% | 52.1% |

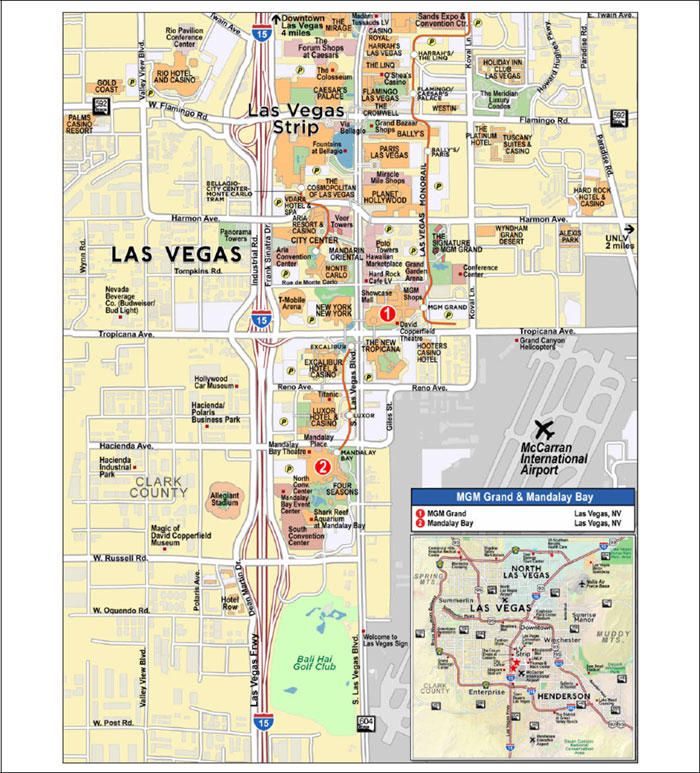

| 3 | MGM Grand & Mandalay Bay | Las Vegas, NV | Barclays; SGFC | 2 | $69,500,000 | 9.9% | 9,748 | Hotel | 4.95x | 17.9% | 35.5% | 35.5% |

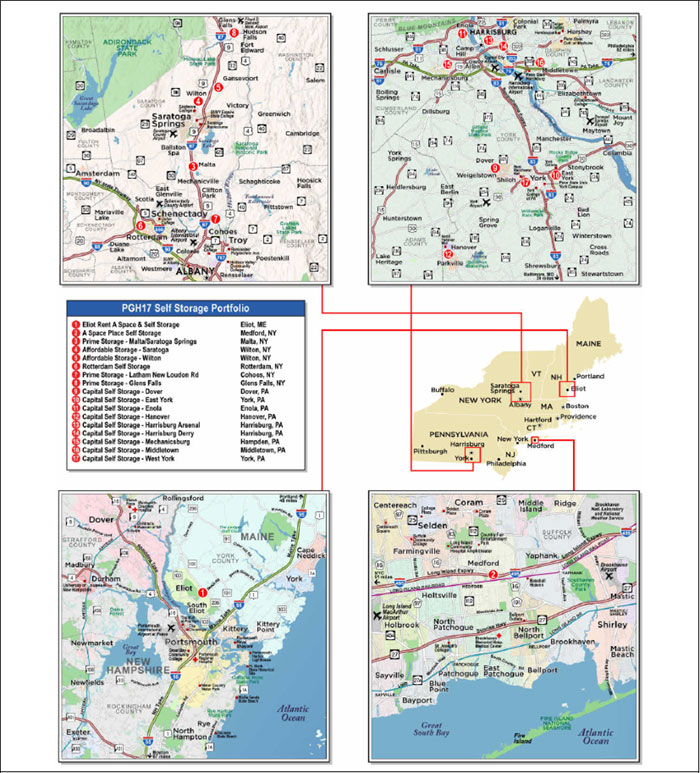

| 4 | PGH17 Self Storage Portfolio | Various | LMF | 17 | $37,000,000 | 5.3% | 7,500 | Self Storage | 1.27x | 8.1% | 68.6% | 63.1% |

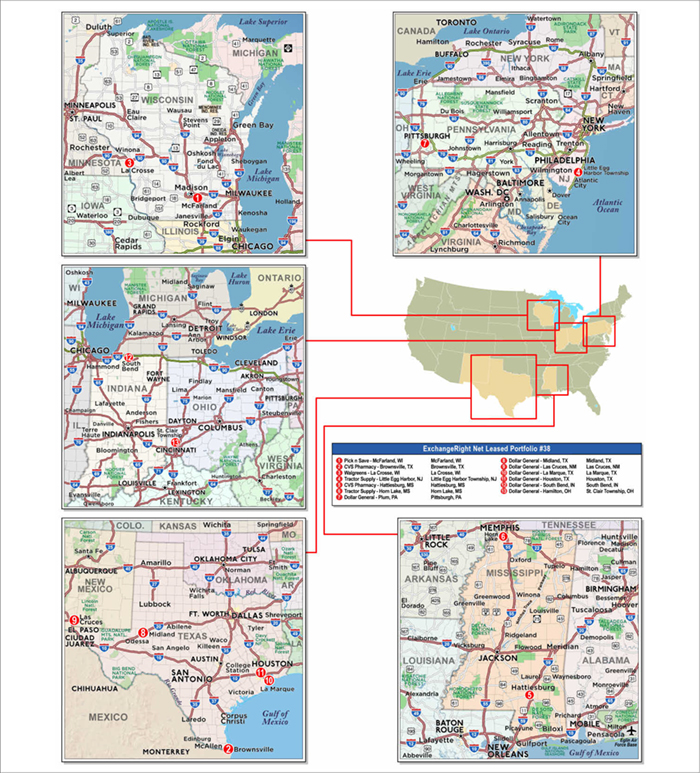

| 5 | ExchangeRight Net Leased Portfolio 38 | Various | Barclays | 13 | $29,608,000 | 4.2% | 192,083 | Retail | 2.28x | 9.5% | 62.0% | 62.0% |

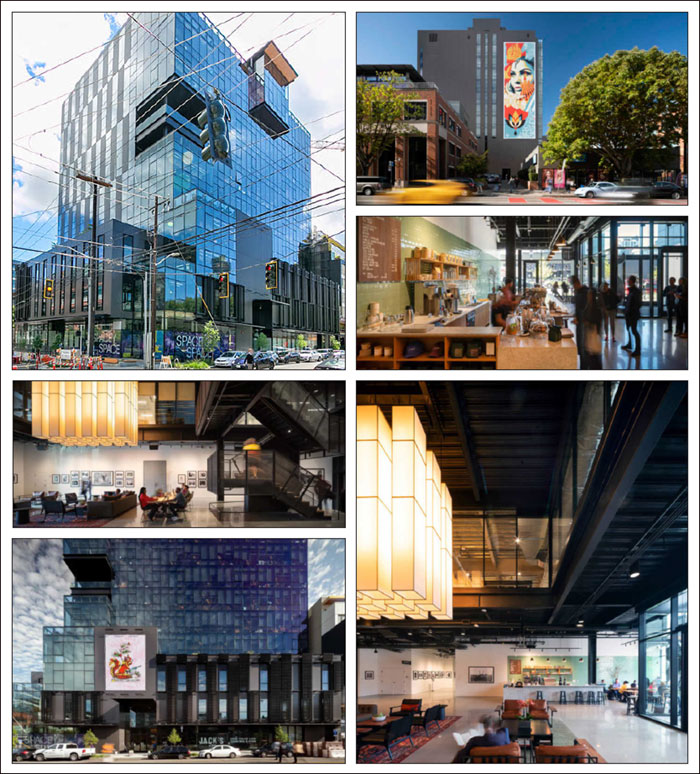

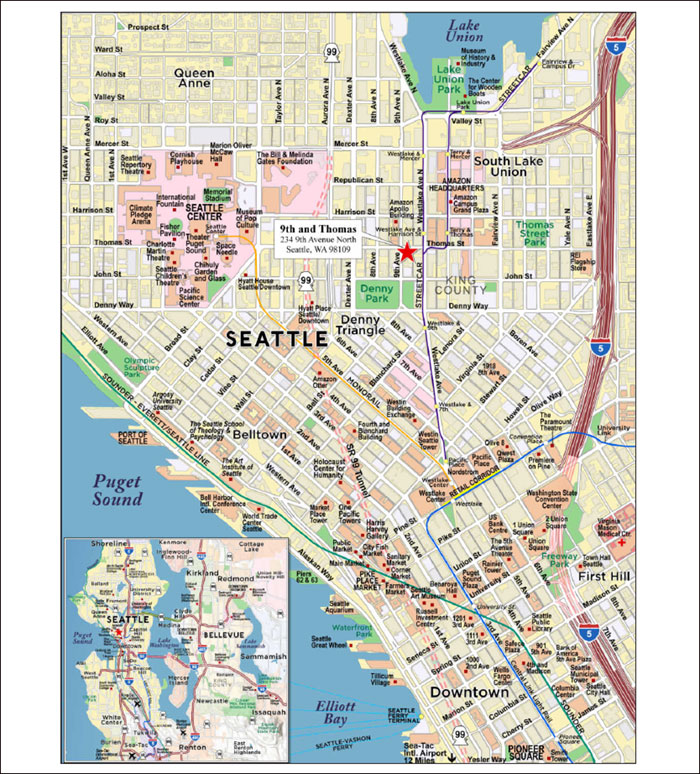

| 6 | 9th & Thomas | Seattle, WA | BANA | 1 | $26,000,000 | 3.7% | 170,812 | Office | 2.13x | 7.8% | 60.2% | 60.2% |

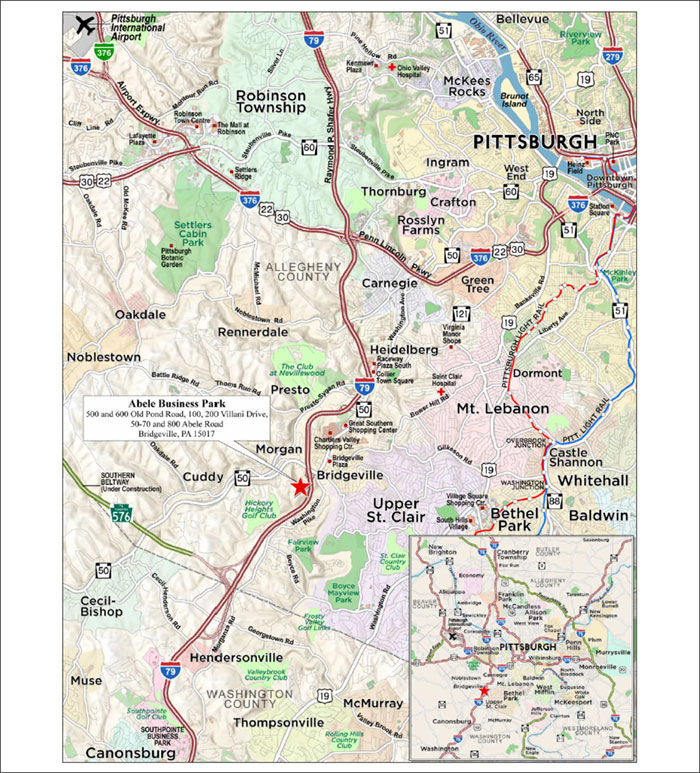

| 7 | Abele Business Park | Bridgeville, PA | SMC | 1 | $25,800,000 | 3.7% | 301,230 | Office | 1.75x | 11.3% | 62.2% | 53.8% |

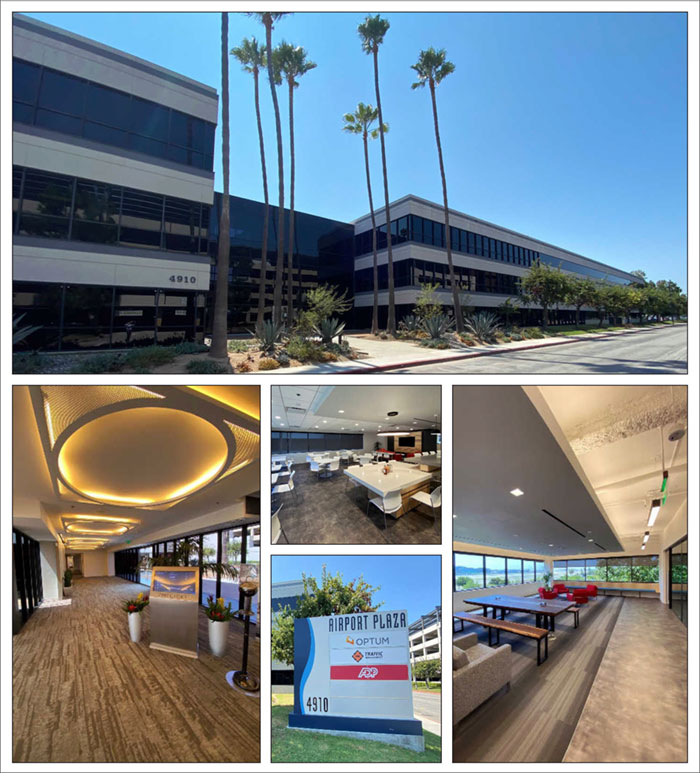

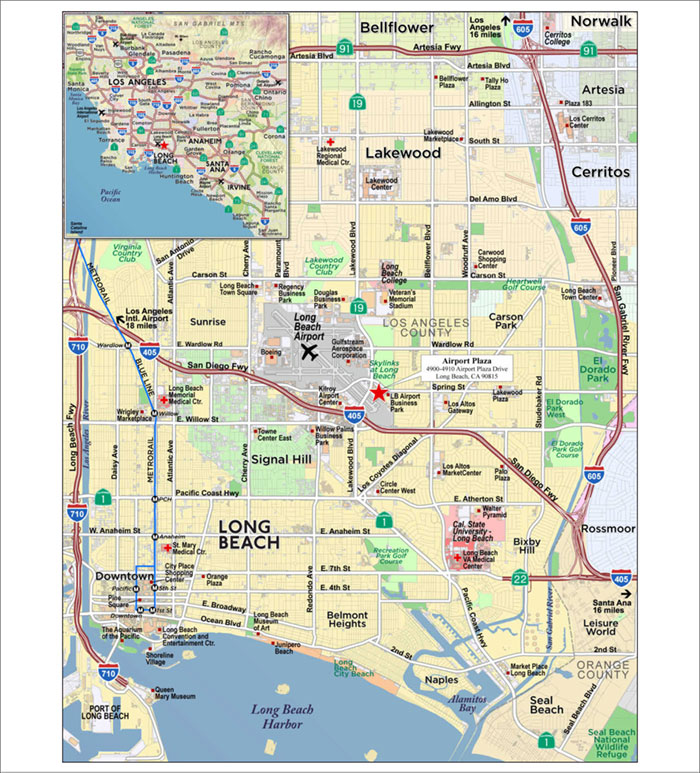

| 8 | Airport Plaza | Long Beach, CA | SMC | 1 | $22,000,000 | 3.1% | 150,730 | Office | 1.81x | 11.5% | 63.8% | 50.6% |

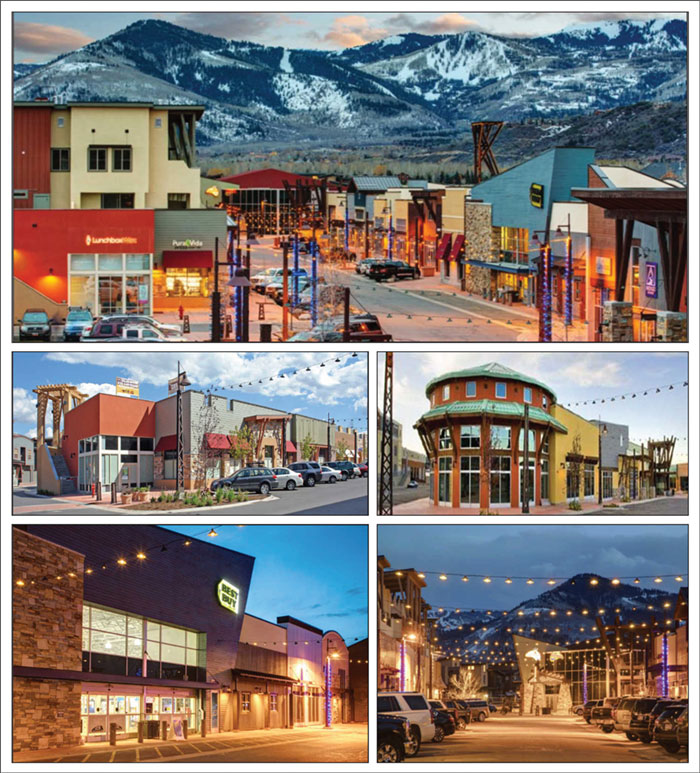

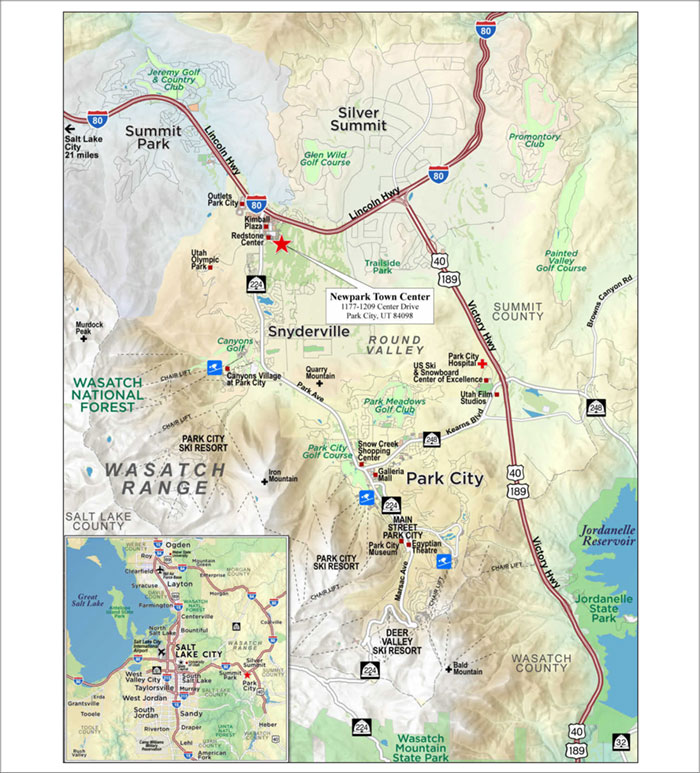

| 9 | Newpark Town Center | Park City, UT | BANA | 1 | $21,750,000 | 3.1% | 122,211 | Mixed Use | 2.19x | 12.0% | 54.5% | 48.7% |

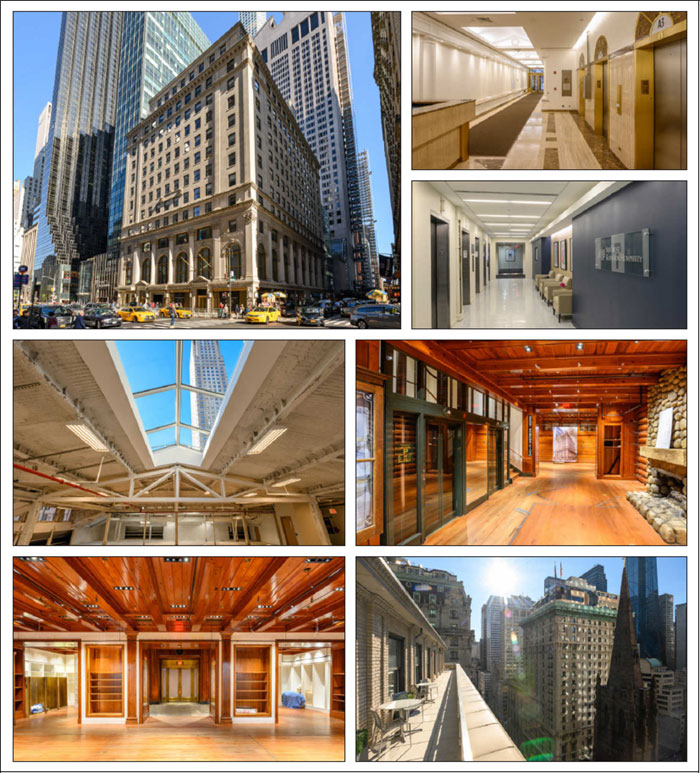

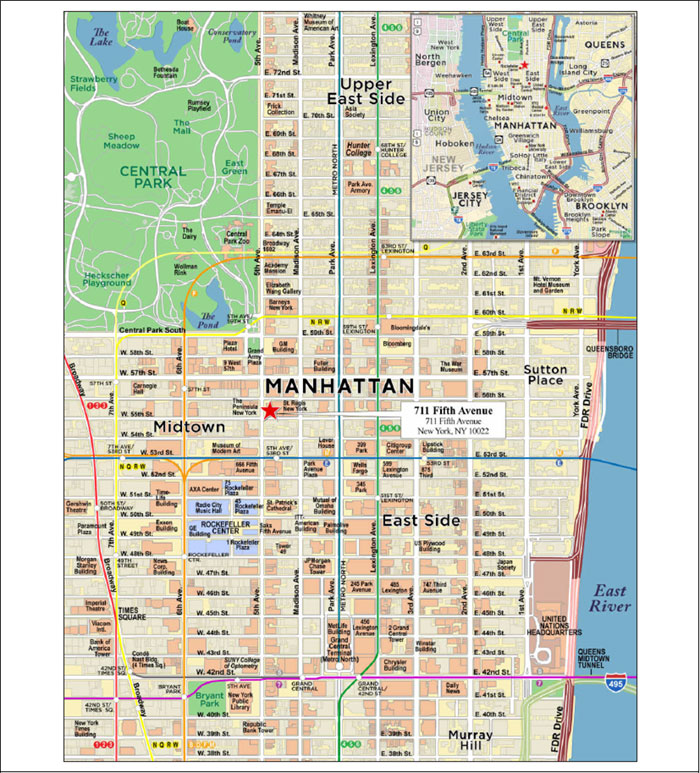

| 10 | 711 Fifth Avenue | New York, NY | BANA | 1 | $20,000,000 | 2.9% | 340,024 | Mixed Use | 2.90x | 9.4% | 54.5% | 54.5% |

| Top 3 Total/Weighted Average | 9 | $209,500,000 | 29.9% | 3.60x | 12.5% | 47.0% | 44.4% | |||||

| Top 5 Total/Weighted Average | 39 | $276,108,000 | 39.4% | 3.15x | 11.6% | 51.5% | 48.8% | |||||

| Top 10 Total/Weighted Average | 44 | $391,658,000 | 55.9% | 2.85x | 11.2% | 53.8% | 50.3% | |||||

| Non-Top 10 Total/Weighted Average | 83 | $308,586,660 | 44.1% | 2.15x | 10.3% | 61.3% | 55.0% | |||||

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 6 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1 and 3, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. In the case of Loan No. 3, with an anticipated repayment date, Maturity Date/ARD LTV is calculated as of the related anticipated repayment date. In the case of Loan No. 3, the UW NCF DSCR and UW NOI Debt Yield Calculations are based on master lease rent; see “Annex A-3” for further details. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4 and 9, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on certain hypothetical or as portfolio assumptions. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| Pari Passu Companion Loan Summary | |||||||||

No. | Loan Name | Mortgage Loan Seller | Trust Cut-off Date Balance(1) | Total Mortgage Loan Cut-off Date Balance(1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Loan(s) Original Balance |

| 1 | One Manhattan West | Barclays | $70,000,000 | $1,150,000,000 | OMW 2020-1MW(2) | Wells | Situs | OMW 2020-1MW | $1,080,000,000 |

| 2 | SoCal & South Miami Medical Office Portfolio | SMC | $70,000,000 | $89,000,000 | BBCMS 2020-C8 | Midland | LNR | Future Securitization(s) | $19,000,000 |

| 3 | MGM Grand & Mandalay Bay | Barclays/SGFC | $69,500,000 | $1,634,200,000 | BX 2020-VIVA(2) | KeyBank | Situs | BX 2020-VIVA BX 2020-VIV2 BX 2020-VIV3 BMARK 2020-B18 DBJPM 2020-C9 BMARK 2020-B19 Future Securitization(s) | $670,139 $794,861 $1,000,000 $65,000,000 $50,000,000 $80,000,000 $1,367,235,000 |

| 4 | PGH17 Self Storage Portfolio | LMF | $37,000,000 | $93,000,000 | WFCM 2020-C57 | Wells | Midland | WFCM 2020-C57 | $56,000,000 |

| 6 | 9th & Thomas | BANA | $26,000,000 | $96,000,000 | BANK 2020-BNK28 | Wells | KeyBank | BANK 2020-BNK28 | $70,000,000 |

| 10 | 711 Fifth Avenue | BANA | $20,000,000 | $545,000,000 | GSMS 2020-GC47 | Wells | KeyBank | GSMS 2020-GC47 BANK 2020-BNK28 BMARK 2020-B18 BANK 2020-BNK27 JPMDB 2020-COR7 DBJPM 2020-C9 BMARK 2020-B19 Future Securitization(s) | $62,500,000 $60,000,000 $45,000,000 $43,000,000 $40,000,000 $25,000,000 $10,000,000 $239,500,000 |

| 13 | ExchangeRight Net Leased Portfolio 32 | SGFC | $19,270,000 | $64,270,000 | BBCMS 2020-C7 | Wells | Rialto | BBCMS 2020-C7 | $45,000,000 |

| 34 | McCarthy Ranch | SMC | $5,000,000 | $45,000,000 | MSC 2020-L4 | Midland | LNR | MSC 2020-L4 Future Securitization(s) | $25,000,000 $15,000,000 |

| (1) | In the case of Loan Nos. 1 and 3, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan Nos. 1 and 3, control rights are currently exercised by the holder of the related Subordinate Companion Loan(s) until the occurrence and during the continuance of a control appraisal period for the related Whole Loan, as described under “Description of the Mortgage Pool—The Whole Loans—The A/B Whole Loans” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Structural and Collateral Term Sheet | BBCMS 2020-C8 |

| Collateral Characteristics | |

| Additional Debt Summary |

No. | Loan Name | Trust | Pari Passu Loan(s) Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan | Total Debt Cut-off Date LTV | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 1 | One Manhattan West | $70,000,000 | $1,080,000,000 | $650,000,000 | $1,800,000,000 | 4.46x | 2.27x | 45.5% | 71.3% | 10.7% | 6.8% |

| 3 | MGM Grand & Mandalay Bay | $69,500,000 | $1,564,700,000 | $1,365,800,000 | $3,000,000,000 | 4.95x | 2.70x | 35.5% | 65.2% | 17.9% | 9.7% |

| (1) | In the case of Loan No. 1, subordinate debt represents one or more Subordinate Companion Loans and a mezzanine loan. In the case of Loan No. 3, subordinate debt represents one or more Subordinate Companion Loans. |

| (2) | Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans (if applicable), but exclude the related Subordinate Companion Loans and mezzanine loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Type(1) |

Weighted Average | ||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2)(4) | Cut-off Date LTV(2)(4)(5) | Maturity Date/ARD LTV(2)(4)(5) |

| Office | CBD | 2 | $96,000,000 | 13.7% | 3.83x | 9.9% | 49.5% | 49.5% |

| Medical | 9 | 72,641,492 | 10.4 | 1.44x | 8.8% | 60.0% | 52.5% | |

| Suburban | 5 | 60,650,000 | 8.7 | 2.00x | 11.1% | 61.1% | 51.2% | |

| Flex | 1 | 25,800,000 | 3.7 | 1.75x | 11.3% | 62.2% | 53.8% | |

| Subtotal: | 17 | $255,091,492 | 36.4% | 2.50x | 10.0% | 56.5% | 51.2% | |

| Self Storage | 28 | $110,328,653 | 15.8% | 1.82x | 9.4% | 62.2% | 56.6% | |

| Retail | Freestanding | 39 | $53,763,508 | 7.7% | 2.28x | 9.3% | 62.9% | 61.9% |

| Anchored | 2 | 8,725,000 | 1.2 | 2.02x | 9.7% | 64.7% | 60.3% | |

| Single Tenant | 2 | 7,500,000 | 1.1 | 1.73x | 7.3% | 60.0% | 60.0% | |

| Unanchored | 2 | 7,489,659 | 1.1 | 2.06x | 12.7% | 54.4% | 45.9% | |

| Subtotal: | 45 | $77,478,166 | 11.1% | 2.17x | 9.5% | 62.0% | 60.0% | |

| Hotel | Full Service | 2 | $69,500,000 | 9.9% | 4.95x | 17.9% | 35.5% | 35.5% |

| Extended Stay | 1 | 5,550,000 | 0.8 | 2.62x | 18.1% | 58.4% | 47.8% | |

| Subtotal: | 3 | $75,050,000 | 10.7% | 4.78x | 17.9% | 37.2% | 36.4% | |

| Multifamily | Garden | 7 | $43,965,348 | 6.3% | 1.51x | 9.6% | 64.9% | 54.1% |

| Low Rise | 17 | 23,050,000 | 3.3 | 1.96x | 10.9% | 69.1% | 57.1% | |

| Subtotal: | 24 | $67,015,348 | 9.6% | 1.66x | 10.0% | 66.3% | 55.1% | |

| Mixed Use | Office/Retail | 2 | $41,750,000 | 6.0% | 2.53x | 10.8% | 54.5% | 51.5% |

| Retail/Medical Office | 1 | 16,250,000 | 2.3 | 2.25x | 8.6% | 56.8% | 56.8% | |

| Subtotal: | 3 | $58,000,000 | 8.3% | 2.45x | 10.2% | 55.1% | 53.0% | |

| Industrial | Flex | 1 | $16,531,000 | 2.4% | 4.05x | 14.4% | 58.6% | 58.6% |

| Warehouse/Distribution | 2 | 15,500,000 | 2.2 | 3.01x | 10.2% | 64.0% | 64.0% | |

| Flex/Manufacturing | 1 | 6,050,000 | 0.9 | 2.54x | 10.8% | 53.5% | 53.5% | |

| Subtotal: | 4 | $38,081,000 | 5.4% | 3.39x | 12.1% | 60.0% | 60.0% | |

| Leased Fee | 1 | $13,500,000 | 1.9% | 1.44x | 8.6% | 62.2% | 50.1% | |

| Manufactured Housing | 2 | $5,700,000 | 0.8% | 1.72x | 10.0% | 57.9% | 46.8% | |

| Total / Weighted Average: | 127 | $700,244,660 | 100.0% | 2.54x | 10.8% | 57.1% | 52.4% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 10, 13 and 34, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1 and 3, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. In the case of Loan No. 3 with an anticipated repayment date, Maturity Date/ARD LTV is calculated as of the related anticipated repayment date. In the case of Loan No. 3, the UW NCF DSCR and UW NOI Debt Yield Calculations are based on master lease rent; see “Annex A-3” for further details. |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 12, the Cut-off Date LTV, Maturity/ARD Date LTV and UW NOI Debt Yield calculations exclude $550,000 on a deposit in an economic holdback reserve. Including the amount on deposit in such reserve, the Cut-off Date LTV, Maturity Date/ARD LTV and UW NOI Debt Yield calculations are 66.1%, 53.4% and 9.1%, respectively. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (5) | In the case of Loan Nos. 1, 2, 3, 4, 9, 12 and 16, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on certain hypothetical, as portfolio or as stabilized assumptions. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Collateral Characteristics | ||

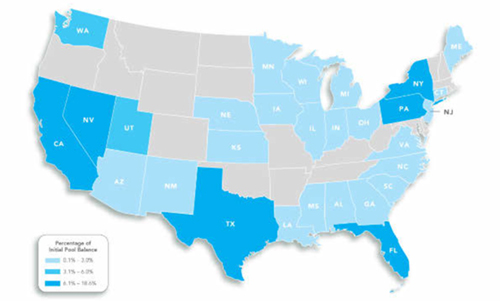

| Mortgaged Properties by Location(1) |

Weighted Average | |||||||

State | Number of | Cut-off Date | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2)(4) | Cut-off Date LTV(2)(4)(5) | Maturity Date/ARD LTV(2)(4)(5) |

| New York | 14 | $130,082,161 | 18.6% | 3.35x | 9.9% | 52.3% | 50.2% |

| California | 11 | 111,595,403 | 15.9% | 1.89x | 10.1% | 58.6% | 51.5% |

| Nevada | 4 | 83,030,000 | 11.9% | 4.43x | 16.7% | 39.8% | 38.1% |

| Florida | 6 | 69,164,710 | 9.9% | 1.77x | 9.4% | 58.9% | 53.6% |

| Texas | 17 | 66,262,964 | 9.5% | 1.75x | 10.3% | 63.5% | 54.9% |

| Pennsylvania | 15 | 54,802,737 | 7.8% | 1.58x | 9.7% | 65.1% | 58.6% |

| Washington | 1 | 26,000,000 | 3.7% | 2.13x | 7.8% | 60.2% | 60.2% |

| Utah | 1 | 21,750,000 | 3.1% | 2.19x | 12.0% | 54.5% | 48.7% |

| New Jersey | 2 | 20,576,000 | 2.9% | 3.70x | 13.4% | 59.3% | 59.3% |

| Georgia | 5 | 15,531,190 | 2.2% | 1.74x | 9.3% | 63.6% | 53.5% |

| Illinois | 10 | 14,850,000 | 2.1% | 2.07x | 11.4% | 73.0% | 59.4% |

| Wisconsin | 5 | 11,337,138 | 1.6% | 2.35x | 9.4% | 62.0% | 62.0% |

| Maine | 2 | 10,305,462 | 1.5% | 2.56x | 9.7% | 65.2% | 63.8% |

| Connecticut | 7 | 8,200,000 | 1.2% | 1.77x | 10.0% | 61.9% | 52.9% |

| South Carolina | 1 | 7,884,000 | 1.1% | 3.01x | 10.2% | 64.0% | 64.0% |

| Louisiana | 1 | 7,000,000 | 1.0% | 3.83x | 12.2% | 59.4% | 59.4% |

| New Mexico | 3 | 6,816,000 | 1.0% | 1.81x | 10.0% | 58.5% | 49.3% |

| Virginia | 2 | 6,296,542 | 0.9% | 1.92x | 9.2% | 61.8% | 57.3% |

| Nebraska | 1 | 5,550,000 | 0.8% | 1.49x | 9.5% | 67.7% | 59.0% |

| Ohio | 2 | 4,785,000 | 0.7% | 1.99x | 11.0% | 68.5% | 60.4% |

| Mississippi | 2 | 4,715,000 | 0.7% | 2.28x | 9.5% | 62.0% | 62.0% |

| Iowa | 1 | 4,500,000 | 0.6% | 1.83x | 10.7% | 62.5% | 49.2% |

| Michigan | 4 | 2,086,809 | 0.3% | 2.53x | 9.2% | 62.0% | 62.0% |

| North Carolina | 3 | 1,786,980 | 0.3% | 2.53x | 9.2% | 62.0% | 62.0% |

| Indiana | 3 | 1,627,682 | 0.2% | 2.37x | 9.4% | 62.0% | 62.0% |

| Arizona | 1 | 1,376,214 | 0.2% | 2.53x | 9.2% | 62.0% | 62.0% |

| Kansas | 1 | 1,325,244 | 0.2% | 2.53x | 9.2% | 62.0% | 62.0% |

| Minnesota | 1 | 506,711 | 0.1% | 2.53x | 9.2% | 62.0% | 62.0% |

| Alabama | 1 | 500,714 | 0.1% | 2.53x | 9.2% | 62.0% | 62.0% |

| Total / Weighted Average: | 127 | $700,244,660 | 100.0% | 2.54x | 10.8% | 57.1% | 52.4% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 10, 13 and 34, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1 and 3, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. In the case of Loan No. 3 with an anticipated repayment date, Maturity Date/ARD LTV is calculated as of the related anticipated repayment date. In the case of Loan No. 3, the UW NCF DSCR and UW NOI Debt Yield calculations are based on master lease rent; see “Annex A-3” for further details. |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 12, the Cut-off Date LTV, Maturity Date/ARD LTV and UW NOI Debt Yield calculations exclude $550,000 on a deposit in an economic holdback reserve. Including the amount on deposit in such reserve, the Cut-off Date LTV, Maturity Date/ARD LTV and UW NOI Debt Yield calculations are 66.1%, 53.4% and 9.1%, respectively. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (5) | In the case of Loan Nos. 1, 2, 3, 4, 9, 12 and 16, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on certain hypothetical, as portfolio or as stabilized assumptions. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Structural and Collateral Term Sheet | BBCMS 2020-C8 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | |||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) | ||

| $1,800,000 | - | $4,999,999 | 14 | $45,895,890 | 6.6% | 3.87737% | 119 | 1.84x | 10.5% | 60.6% | 50.9% |

| $5,000,000 | - | $9,999,999 | 13 | 91,690,412 | 13.1% | 3.97166% | 116 | 1.94x | 10.2% | 61.8% | 54.5% |

| $10,000,000 | - | $19,999,999 | 10 | 151,000,358 | 21.6% | 3.70153% | 115 | 2.42x | 10.4% | 62.0% | 57.4% |

| $20,000,000 | - | $29,999,999 | 7 | 165,158,000 | 23.6% | 3.69862% | 119 | 2.12x | 10.2% | 59.2% | 54.7% |

| $30,000,000 | - | $39,999,999 | 1 | 37,000,000 | 5.3% | 4.77500% | 118 | 1.27x | 8.1% | 68.6% | 63.1% |

| $40,000,000 | - | $70,000,000 | 3 | 209,500,000 | 29.9% | 3.36431% | 105 | 3.60x | 12.5% | 47.0% | 44.4% |

| Total / Weighted Average: | 48 | $700,244,660 | 100.0% | 3.70357% | 113 | 2.54x | 10.8% | 57.1% | 52.4% | ||

| Mortgage Interest Rates |

Weighted Average | |||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) | ||

| 2.34130 | - | 3.24999 | 6 | $150,781,000 | 21.5% | 2.77036% | 98 | 3.70x | 11.1% | 52.0% | 51.1% |

| 3.25000 | - | 3.74999 | 17 | 234,375,071 | 33.5% | 3.57613% | 117 | 3.01x | 12.2% | 52.7% | 49.8% |

| 3.75000 | - | 3.99999 | 4 | 35,391,699 | 5.1% | 3.92615% | 114 | 1.96x | 11.3% | 61.3% | 50.4% |

| 4.00000 | - | 4.24999 | 12 | 171,147,532 | 24.4% | 4.11199% | 119 | 1.68x | 9.5% | 61.8% | 55.1% |

| 4.25000 | - | 4.49999 | 6 | 61,999,358 | 8.9% | 4.40169% | 119 | 1.44x | 9.1% | 63.4% | 52.4% |

| 4.50000 | - | 4.74999 | 1 | 4,000,000 | 0.6% | 4.54000% | 119 | 1.60x | 10.1% | 63.9% | 56.0% |

| 4.75000 | - | 4.88000 | 2 | 42,550,000 | 6.1% | 4.78870% | 118 | 1.45x | 9.4% | 67.3% | 61.1% |

| Total / Weighted Average: | 48 | $700,244,660 | 100.0% | 3.70357% | 113 | 2.54x | 10.8% | 57.1% | 52.4% | ||

| Original Term to Maturity in Months |

Weighted Average | |||||||||

| Original Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) |

| 84 | 3 | $92,581,000 | 13.2% | 2.59747% | 83 | 4.26x | 11.4% | 48.4% | 48.4% |

| 120 | 45 | 607,663,660 | 86.8% | 3.87209% | 118 | 2.28x | 10.7% | 58.4% | 53.0% |

| Total / Weighted Average: | 48 | $700,244,660 | 100.0% | 3.70357% | 113 | 2.54x | 10.8% | 57.1% | 52.4% |

| Remaining Term to Maturity in Months |

| Weighted Average | |||||||||||

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(3)(4) | ||

| 83 | - | 84 | 3 | $92,581,000 | 13.2% | 2.59747% | 83 | 4.26x | 11.4% | 48.4% | 48.4% |

| 110 | - | 113 | 6 | 123,985,990 | 17.7% | 3.52968% | 113 | 3.86x | 14.0% | 45.9% | 45.6% |

| 118 | - | 120 | 39 | 483,677,670 | 69.1% | 3.95986% | 119 | 1.87x | 9.9% | 61.6% | 54.9% |

| Total / Weighted Average: | 48 | $700,244,660 | 100.0% | 3.70357% | 113 | 2.54x | 10.8% | 57.1% | 52.4% | ||