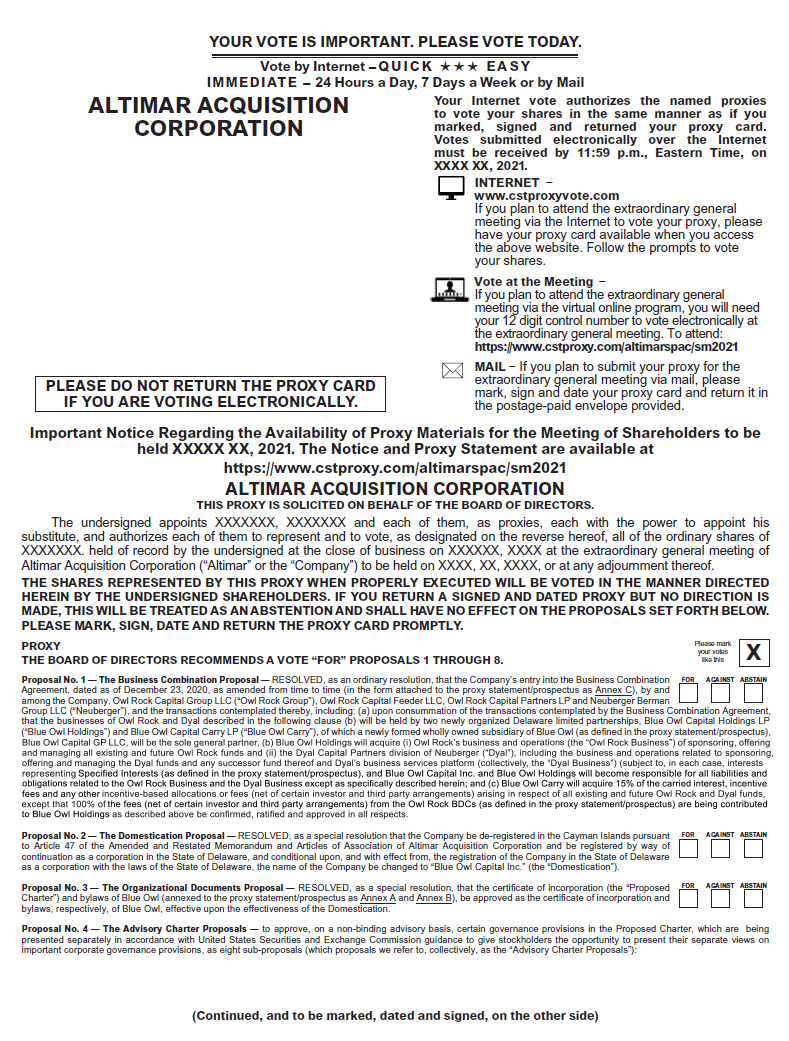

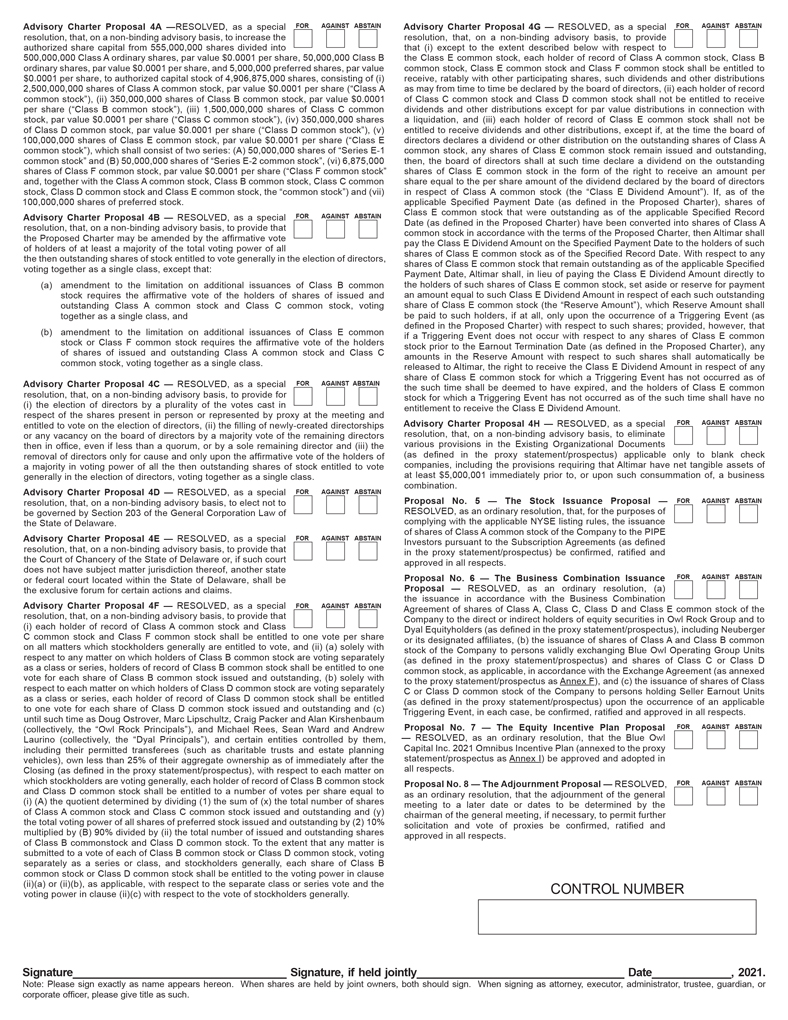

Advisory Charter Proposal 4A —RESOLVED, as a special resolution, that, on a non-binding advisory basis, to increase the authorized share capital from 555,000,000 shares divided into 500,000,000 Class A ordinary shares, par value $0.0001 per share, 50,000,000 Class B ordinary shares, par value $0.0001 per share, and 5,000,000 preferred shares, par value $0.0001 per share, to authorized capital stock of 4,906,875,000 shares, consisting of (i) 2,500,000,000 shares of Class A common stock, par value $0.0001 per share (“Class A common stock”), (ii) 350,000,000 shares of Class B common stock, par value $0.0001 per share (“Class B common stock”), (iii) 1,500,000,000 shares of Class C common stock, par value $0.0001 per share (“Class C common stock”), (iv) 350,000,000 shares of Class D common stock, par value $0.0001 per share (“Class D common stock”), (v) 100,000,000 shares of Class E common stock, par value $0.0001 per share (“Class E common stock”), which shall consist of two series: (A) 50,000,000 shares of “Series E-1 common stock” and (B) 50,000,000 shares of “Series E-2 common stock”, (vi) 6,875,000 shares of Class F common stock, par value $0.0001 per share (“Class F common stock” and, together with the Class A common stock, Class B common stock, Class C common stock, Class D common stock and Class E common stock, the “common stock”) and (vii) 100,000,000 shares of preferred stock. Advisory Charter Proposal 4B — RESOLVED, as a special resolution, that, on a non-binding advisory basis, to provide that the Proposed Charter may be amended by the affirmative vote of holders of at least a majority of the total voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors, voting together as a single class, except that: (a) amendment to the limitation on additional issuances of Class B common stock requires the affirmative vote of the holders of shares of issued and outstanding Class A common stock and Class C common stock, voting together as a single class, and (b) amendment to the limitation on additional issuances of Class E common stock or Class F common stock requires the affirmative vote of the holders of shares of issued and outstanding Class A common stock and Class C common stock, voting together as a single class. Advisory Charter Proposal 4C — RESOLVED, as a special resolution, that, on a non-binding advisory basis, to provide for (i) the election of directors by a plurality of the votes cast in respect of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors, (ii) the filling of newly-created directorships or any vacancy on the board of directors by a majority vote of the remaining directors then in office, even if less than a quorum, or by a sole remaining director and (iii) the removal of directors only for cause and only upon the affirmative vote of the holders of a majority in voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors, voting together as a single class. Advisory Charter Proposal 4D — RESOLVED, as a special resolution, that, on a non-binding advisory basis, to elect not to be governed by Section 203 of the General Corporation Law of the State of Delaware.

Advisory Charter Proposal 4E — RESOLVED, as a special

resolution, that, on a non-binding advisory basis, to provide that

the Court of Chancery of the State of Delaware or, if such court

does not have subject matter jurisdiction thereof, another state

or federal court located within the State of Delaware, shall be

the exclusive forum for certain actions and claims.

Advisory Charter Proposal 4F — RESOLVED, as a special

resolution, that, on a non-binding advisory basis, to provide that

(i) each holder of record of Class A common stock and Class

C common stock and Class F common stock shall be entitled to one vote per share

on all matters which stockholders generally are entitled to vote, and (ii) (a) solely with

respect to any matter on which holders of Class B common stock are voting separately

as a class or series, holders of record of Class B common stock shall be entitled to one

vote for each share of Class B common stock issued and outstanding, (b) solely with

respect to each matter on which holders of Class D common stock are voting separately

as a class or series, each holder of record of Class D common stock shall be entitled

to one vote for each share of Class D common stock issued and outstanding and (c)

until such time as Doug Ostrover, Marc Lipschultz, Craig Packer and Alan Kirshenbaum

(collectively, the “Owl Rock Principals”), and Michael Rees, Sean Ward and Andrew

Laurino (collectively, the “Dyal Principals”), and certain entities controlled by them,

including their permitted transferees (such as charitable trusts and estate planning

vehicles), own less than 25% of their aggregate ownership as of immediately after the

Closing (as defined in the proxy statement/prospectus), with respect to each matter on

which stockholders are voting generally, each holder of record of Class B common stock

and Class D common stock shall be entitled to a number of votes per share equal to

(i) (A) the quotient determined by dividing (1) the sum of (x) the total number of shares

of Class A common stock and Class C common stock issued and outstanding and (y)

the total voting power of all shares of preferred stock issued and outstanding by (2) 10%

multiplied by (B) 90% divided by (ii) the total number of issued and outstanding shares

of Class B commonstock and Class D common stock. To the extent that any matter is

submitted to a vote of each of Class B common stock or Class D common stock, voting

separately as a series or class, and stockholders generally, each share of Class B

common stock or Class D common stock shall be entitled to the voting power in clause

(ii)(a) or (ii)(b), as applicable, with respect to the separate class or series vote and the

voting power in clause (ii)(c) with respect to the vote of stockholders generally.

Advisory Charter Proposal 4G — RESOLVED, as a special

resolution, that, on a non-binding advisory basis, to provide

that (i) except to the extent described below with respect to

the Class E common stock, each holder of record of Class A common stock, Class B

common stock, Class E common stock and Class F common stock shall be entitled to

receive, ratably with other participating shares, such dividends and other distributions

as may from time to time be declared by the board of directors, (ii) each holder of record

of Class C common stock and Class D common stock shall not be entitled to receive

dividends and other distributions except for par value distributions in connection with

a liquidation, and (iii) each holder of record of Class E common stock shall not be

entitled to receive dividends and other distributions, except if, at the time the board of

directors declares a dividend or other distribution on the outstanding shares of Class A

common stock, any shares of Class E common stock remain issued and outstanding,

then, the board of directors shall at such time declare a dividend on the outstanding

shares of Class E common stock in the form of the right to receive an amount per

share equal to the per share amount of the dividend declared by the board of directors

in respect of Class A common stock (the “Class E Dividend Amount”). If, as of the

applicable Specified Payment Date (as defined in the Proposed Charter), shares of

Class E common stock that were outstanding as of the applicable Specified Record

Date (as defined in the Proposed Charter) have been converted into shares of Class A

common stock in accordance with the terms of the Proposed Charter, then Altimar shall

pay the Class E Dividend Amount on the Specified Payment Date to the holders of such

shares of Class E common stock as of the Specified Record Date. With respect to any

shares of Class E common stock that remain outstanding as of the applicable Specified

Payment Date, Altimar shall, in lieu of paying the Class E Dividend Amount directly to

the holders of such shares of Class E common stock, set aside or reserve for payment

an amount equal to such Class E Dividend Amount in respect of each such outstanding

share of Class E common stock (the “Reserve Amount”), which Reserve Amount shall

be paid to such holders, if at all, only upon the occurrence of a Triggering Event (as

defined in the Proposed Charter) with respect to such shares; provided, however, that

if a Triggering Event does not occur with respect to any shares of Class E common

stock prior to the Earnout Termination Date (as defined in the Proposed Charter), any

amounts in the Reserve Amount with respect to such shares shall automatically be

released to Altimar, the right to receive the Class E Dividend Amount in respect of any

share of Class E common stock for which a Triggering Event has not occurred as of

the such time shall be deemed to have expired, and the holders of Class E common

stock for which a Triggering Event has not occurred as of the such time shall have no

entitlement to receive the Class E Dividend Amount.

Advisory Charter Proposal 4H — RESOLVED, as a special

resolution, that, on a non-binding advisory basis, to eliminate

various provisions in the Existing Organizational Documents

(as defined in the proxy statement/prospectus) applicable only to blank check

companies, including the provisions requiring that Altimar have net tangible assets of

at least $5,000,001 immediately prior to, or upon such consummation of, a business

combination.

Proposal No. 5 — The Stock Issuance Proposal —

RESOLVED, as an ordinary resolution, that, for the purposes of

complying with the applicable NYSE listing rules, the issuance

of shares of Class A common stock of the Company to the PIPE

Investors pursuant to the Subscription Agreements (as defined

in the proxy statement/prospectus) be confirmed, ratified and approved in all respects.

Proposal No. 6 — The Business Combination Issuance

Proposal — RESOLVED, as an ordinary resolution, (a) the

issuance in accordance with the Business Combination

Agreement of shares of Class A, Class C, Class D and Class

E common stock of the Company to the direct or indirect holders of equity securities

in Owl Rock Group and to Dyal Equityholders (as defined in the proxy statement/

prospectus), including Neuberger or its designated affiliates, (b) the issuance of shares

of Class A and Class B common stock of the Company to persons validly exchanging

Blue Owl Operating Group Units (as defined in the proxy statement/prospectus) and shares

of Class C or Class D common stock, as applicable, in accordance with the Exchange

Agreement (as annexed to the proxy statement/prospectus as Annex F), and (c) the

issuance of shares of Class C or Class D common stock of the Company to persons

holding Seller Earnout Units (as defined in the proxy statement/prospectus) upon the

occurrence of an applicable Triggering Event, in each case, be

confirmed, ratified and approved in all respects.

Proposal No. 7 — The Equity Incentive Plan Proposal —

RESOLVED, as an ordinary resolution, that the Blue Owl

Capital Inc. 2021 Omnibus Incentive Plan (annexed to the proxy

statement/prospectus as Annex I) be approved and adopted in

all respects.

Proposal No. 8 — The Adjournment Proposal — RESOLVED,

as an ordinary resolution, that the adjournment of the general

meeting to a later date or dates to be determined by the chairman of the general meeting,

if necessary, to permit further solicitation and vote of proxies be confirmed, ratified and

approved in all respects.

CONTROL NUMBER

Signature

Signature, if held jointly

Date , 2021.

Note: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee, guardian, or corporate officer, please give title as such.