- OWL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Blue Owl Capital (OWL) POS AMProspectus update (post-effective amendment)

Filed: 21 Apr 22, 9:11am

Delaware | 6282 | 86-3906032 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

| ii | ||||

| ii | ||||

| iii | ||||

| xii | ||||

| 1 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 77 | ||||

| 99 | ||||

| 106 | ||||

| 118 | ||||

| 133 | ||||

| 139 | ||||

| 153 | ||||

| 161 | ||||

| 165 | ||||

| 171 | ||||

| 172 | ||||

| F-1 |

| • | “ Adjusted EBITDA non-GAAP measure, is used to assess the Company’s ability to service its borrowings. Adjusted EBITDA is derived from and reconciled to, but not equivalent to, its most directly comparable GAAP measure of net income (loss) before income taxes. Adjusted EBITDA represents Distributable Earnings plus (a) interest expense, (b) income tax expense (benefits), and (c) depreciation and amortization. |

| • | “ Adjusted Revenues non-GAAP measure, is used to assess the net revenue expected to be received by the Company. Adjusted Revenues are derived from and reconciled to, but not equivalent to its most directly comparable GAAP measure of total revenues, net. Adjusted Revenues differ from total revenues computed in accordance with GAAP as it excludes reimbursed expenses and dealer manager revenues, if applicable, that have an offsetting amount included within expenses on the consolidated and combined statement of operations. |

| • | “ Adjusted Compensation non-GAAP measure, is used to assess the net cash settled compensation to be paid by the Company. Adjusted Compensation is derived from and reconciled to, but not equivalent to its most directly comparable GAAP measure of compensation and benefits. Adjusted Compensation differs from compensation and benefits computed in accordance with GAAP as it excludes equity compensation expense and compensation and benefits reimbursed through the receipt of administrative revenues. The administrative revenues reflect allocable compensation and expenses incurred by certain professionals of the Company and reimbursed by products managed by the Company. |

| • | “ Advisers Act |

| • | “ Altimar |

| • | “ Altimar Founders |

| • | “ Altimar Sponsor |

| • | “ assets under management AUM |

| • | “ AUM not yet paying fees |

| • | “ available capital |

| • | “ BCA Business Combination Agreement |

| • | “ BDC |

| • | “ Blue Owl, Company Registrant our we us |

| • | “ Blue Owl Carry |

| • | “ Blue Owl Carry Units |

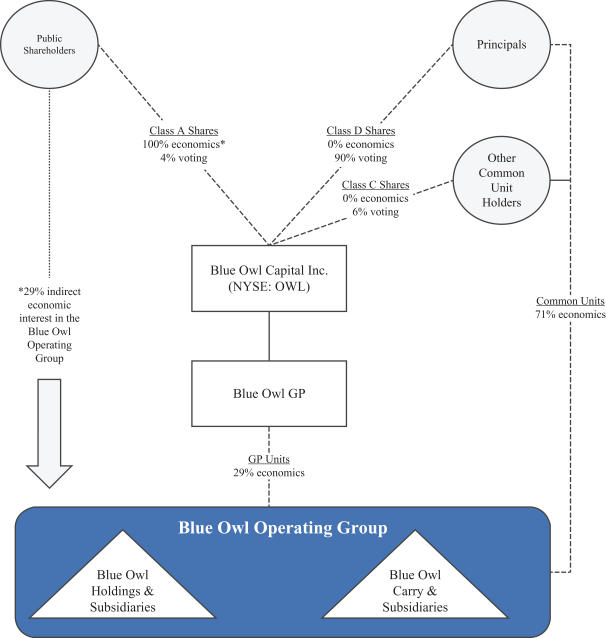

| • | “ Blue Owl GP |

| • | “ Blue Owl Holdings |

| • | “ Blue Owl Holdings Units |

| • | “ Blue Owl Limited Partnership Agreements |

| • | “ Blue Owl Operating Group |

| • | “ Blue Owl Operating Group Unit |

| • | “ Blue Owl Operating Partnerships |

| • | “ Board |

| • | “ Business Combination |

| • | “ Business Combination Date |

| • | “ Business Securities |

| • | “ Business Services Platform |

| • | “ Capital Commitments |

| • | “ carried interest carried interest allocations |

| • | “ Class A Shares |

| • | “ Class B Shares |

| • | “ Class C Shares |

| • | “ Class D Shares |

| • | “ Class E Shares |

| • | “ Class E-1 SharesClass E-1 common stock of the Company. The SeriesE-1 Class E Shares had a Class E Triggering Event on July 21, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $12.50 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. |

| • | “ Class E-2 SharesClass E-2 common stock of the Company. The SeriesE-2 Class E Shares had a Class E Triggering Event on November 3, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $15.00 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. |

| • | “ Closing |

| • | “ common stock |

| • | “ DE non-GAAP measure, which is used to assess performance and amounts available for dividends to members. DE is derived from and reconciled to, but not equivalent to its most directly comparable GAAP measure of net income (loss) before income taxes. Distributable Earnings is FRE less current income taxes and includes (other than with respect to Owl Rock) net realized gains, realized performance income and performance related compensation. DE differs from income before taxes computed in accordance with GAAP as it adjusts for certain items that we believe are indicative of our ability to make our dividend payments. Our presentation of DE represents our operating performance, as further adjusted for performance income and performance related compensation, as applicable. Management believes that these adjustments enable investors to better understand the Company’s earnings that are available for distribution. |

| • | “ DGCL |

| • | “ Direct Lending |

| • | “ dollars |

| • | “ Domestication |

| • | “ Dyal Capital |

| • | “ Dyal Equity Funds |

| • | “ Dyal Equityholders |

| • | “ Dyal Financing Fund |

| • | “ Dyal HomeCourt Fund |

| • | “ Dyal Principals |

| • | “ Electing Owl Rock Equityholders |

| • | “ fee paying AUM FPAUM |

| • | “ fee related earnings non-GAAP measure, is used to assess our operating performance by determining whether recurring revenue, primarily consisting of management fees, is sufficient to cover operating expenses and to generate profits. FRE is derived from and reconciled to, but not equivalent to its most directly comparable GAAP measure of net income (loss) before income taxes. FRE differs from income before taxes computed in accordance with GAAP as it adjusts for transaction-related charges, equity-based compensation,non-controlling interests in subsidiaries of the Company and certain other items that we believe reflects our operating performance. Other than for Owl Rock, the calculation of FRE also adjusts for performance income, performance related compensation and investment net gains (losses). Management believes that adding these adjustments assist in clarifying stable and predictable cash flows that cover operating expenses and lead to the generation of profits. |

| • | “ our funds co-managed by Blue Owl, Owl Rock or Dyal Capital. |

| • | “ FIC Assets |

| • | “ Financial Statements 10-K for the fiscal year ended December 31, 2021. |

| • | “ FINRA |

| • | “ GAAP |

| • | “ GP Capital Solutions co-investments and structured equity. GP Capital Solutions products are managed by the Dyal Capital division of Blue Owl. |

| • | “ GP Debt Financing strategy |

| • | “ GP Minority Equity Investments strategy |

| • | “ incentive fees |

| • | “ Investment Company Act |

| • | “ Investor Rights Agreement |

| • | “ IPO |

| • | “ Key Individuals |

| • | “ long dated |

| • | “ management fees |

| • | “ NBA |

| • | “ Neuberger |

| • | “ NYSE |

| • | “ Oak Street |

| • | “ Oak Street Acquisition |

| • | “ our BDCs |

| • | “ Owl Rock |

which was the predecessor of Blue Owl for accounting and financial reporting purposes. References to the Owl Rock division refer to Owl Rock Capital Group and its subsidiaries that manage our Direct Lending products. |

| • | “ Owl Rock Capital carve-out of Owl Rock Group and its consolidated operating subsidiaries (whichcarve-out excludes such operating subsidiaries constituting FIC assets) after giving effect to apre-Closing reorganization. |

| • | “ Owl Rock Capital Partners |

| • | “ Owl Rock Equityholders |

| • | “ Owl Rock Feeder |

| • | “ Owl Rock Group |

| • | “ Owl Rock Principals |

| • | “ Owl Rock Securities |

| • | “ Part I Fees |

| • | “ Part II Fees |

| • | “ partner manager |

| • | “ performance income |

| • | “ permanent capital lock-up periods. Such products may be required, or elect, to return all or a portion of capital gains and investment income. Permanent capital may be subject to management fee step downs or roll-offs over time. |

| • | “ PIPE Investment |

| • | “ PIPE Investors |

| • | “ PIPE Securities |

| • | “ portfolio companies portfolio investments |

| • | “ Principals |

| • | “ Private Placement Warrants |

| • | “ Public Warrants |

| • | “ Real Estate |

| • | “ reimbursed expenses |

| • | “SEC” |

| • | “ Securities Act |

| • | “ Seller Earnout Securities |

| • | “ Seller Earnout Shares E-1 common stock and SeriesE-2 common stock that were issued to the Owl Rock Equityholders that are not Electing Owl Rock Equityholders in connection with the Business Combination. For the avoidance of doubt, a “Seller Earnout Share” shall refer to either (i) one share of SeriesE-1 common stock or (ii) one share of SeriesE-2 common stock, as applicable. The SeriesE-1 Class E Shares had a Class E Triggering Event on July 21, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $12.50 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. The SeriesE-2 Class E Shares had a Class E Triggering Event on November 3, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $15.00 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. |

| • | “ Seller Earnout Units E-1 Units and SeriesE-2 Units of each of Blue Owl Holdings and Blue Owl Carry that were issued to the Dyal Equityholders and the Electing Owl Rock Equityholders in connection with the Business Combination in lieu of Seller Earnout Shares. The SeriesE-1 Class E Shares had a Class E Triggering Event on July 21, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $12.50 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. The |

Series E-2 Class E Shares had a Class E Triggering Event on November 3, 2021, which occurred when the volume weighted-average price of a Class A Share exceeded $15.00 for 20 consecutive trading days, at which time 7,495,432 Class E Shares were converted into an equal number of Class A Shares. |

| • | “ Specified Interests |

| • | “ Subscription Agreements |

| • | “Tax Receivable Agreement TRA |

| • | “ transfer agent |

| • | “ UBT |

| • | “ Warrant Agent |

| • | “ Warrants |

| • | “ Wellfleet |

| • | “ Wellfleet Acquisition |

| • | “ Working Capital |

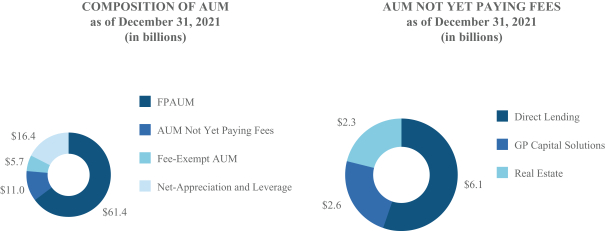

Blue Owl AUM: $94.5 billion FPAUM: $61.4 billion | ||||

Direct Lending Products AUM: $39.2 billion FPAUM: $32.0 billion | GP Capital Solutions Products AUM: $39.9 billion FPAUM: $21.2 billion | Real Estate Products AUM: $15.4 billion FPAUM: $8.2 billion | ||

Diversified Lending Commenced 2016 AUM: $25.8 billion FPAUM: $21.6 billion | GP Minority Equity Commenced 2010 AUM: $38.7 billion FPAUM: $20.4 billion | Net Lease Commenced 2009 AUM: $15.4 billion FPAUM: $8.2 billion | ||

Technology Lending Commenced 2018 AUM: $7.9 billion FPAUM: $6.9 billion | GP Debt Financing Commenced 2019 AUM: $1.0 billion FPAUM: $0.7 billion | |||

First Lien Lending Commenced 2018 AUM: $3.5 billion FPAUM: $2.3 billion | Professional Sports Minority Investments Commenced 2021 AUM: $0.2 billion FPAUM: $0.2 billion | |||

Opportunistic Lending Commenced 2020 AUM: $2.0 billion FPAUM: $1.2 billion | ||||

| • | Diversified Lending: |

| • | Technology Lending: |

| • | First Lien Lending: |

| • | Opportunistic Lending: (iv) debtor-in-possession |

| • | GP Minority Equity Investments: closed-end, permanent capital funds. A fundamental component of the fundraising efforts for our investment programs is the ability to identify and executeco-investment opportunities for our investors. We may offer, fromtime-to-time co-investment opportunities in certain fund investments, generally with no management or incentive-based fee. |

| • | GP Debt Financing: |

| • | Professional Sports Minority Investments: NBA-focused. |

| • | Net Lease: net-leased, long-term to investment grade and creditworthy tenants. Oak Street’s Net Lease real estate strategies focus on acquiring single tenant properties, across industrial, essential retail and mission critical office sectors. By combining our proprietary origination platform, enhanced lease structures and a disciplined investment criteria, we seek to provide investors with predictable current income, and potential for appreciation, while focusing on limiting downside risk. |

| • | shifting allocations by retail institutional investors. |

| • | rotation onto alternatives given the search for yield and reliability of returns. |

| • | rising need for private debt driven by sponsor demand. |

| • | evolving landscape of the private debt market. |

| • | de-leveraging of the global banking system. |

| • | increasing need for flexible capital solutions by private capital managers. |

| • | High proportion of permanent capital. closed-end, permanent (or potentially permanent) funds with no mandatory redemption and potentially unlimited duration once listed. Substantially all of the AUM in our GP Capital Solutions and Real Estate products are also structured as permanent capital vehicles. The high proportion of permanent capital in our AUM provides a stable base and allows for our AUM to grow more predictably without having reductions in our asset levels due to ordinary redemptions. Our permanent capital base also lends stability and flexibility to our portfolio companies and Partner Managers, providing us the opportunity to grow alongside these companies and positioning us to be a preferred source of capital and the incumbent lender forfollow-ons and other capital solutions to high-performing companies. As such, we are able to be a compelling partner for these firms as they seek capital to support their long-term vision and business development goals. The stability of our AUM base enables us to focus on generating attractive returns by investing in assets with a long-term focus across different periods in the market cycle. |

| • | Significant embedded growth in current AUM with built-in mechanisms for fee revenue increases. |

| • | Stable earnings model with attractive margin profile. |

| • | Extensive, long-term relationships with a robust and vast network of alternative asset managers. |

| • | Increasing benefits of scale. |

| • | Diverse, global and growing high-quality investor base. high-net worth investors. As we continue to grow, we expect to retain our existing clients through our breadth of offerings. As of December 31, 2021, approximately 36% of our institutional investors are invested in more than one product, with many increasing their commitment to their initial strategy and additionally committing additional capital across our other strategies. We believe our diligent management of investors’ capital, combined with our strong performance and increasingly diversified product offerings has helped retain and attract investors which has furthered our growth in FPAUM and facilitated further expansion of our strategies. We also believe the global nature of our investor base enables significant cross-selling opportunities between our products and strategies. We are committed to providing our clients with a superior level of service. We believe our client-focused nature, rooted in our culture of transparency will help us continue to retain and attract high quality investors to our platform. |

| • | Industry-leading management team with proven track record. best-in-class |

| • | Alignment of interests with stakeholders. |

totaled approximately $1.9 billion, which aligns their interests with our clients’ interests by motivating the continued high-performance and retention of our dedicated team of professionals. |

| • | Organically grow our core business. |

| • | Expand our product offering. |

| • | Leverage complementary global distribution networks. |

| • | Enhance our distribution channels. |

In addition, we have continued to grow our relationships in the consultant community. We intend to be the premier direct lending and GP minority investing platform for investors across the institutional and retail distribution channels. |

| • | Deepen and expand strong strategic relationships with key institutional investors. |

| • | Opportunistically pursue accretive acquisitions. |

| • | Embracing our differences. |

| • | Strategic priorities. |

| • | Corporate practices. |

| • | Leadership. |

MUTUAL RESPECT | EXCELLENCE | CONSTRUCTIVE DIALOGUE | ONE TEAM | |||

BLUE OWL’S CORE VALUES | ||||||

| • | The COVID-19 pandemic has caused severe disruptions in the US and global economy, has disrupted, and may continue to disrupt, industries in which we, our products and our products’ portfolio companies and investments operate and could potentially negatively impact our business, financial condition and results of operations. |

| • | Intense competition among alternative asset managers may make fundraising and the deployment of capital more difficult, thereby limiting our ability to grow or maintain our FPAUM. Such competition may be amplified by changes in fund investor allocations away from alternative asset managers. |

| • | We recently ceased to be an emerging growth company, and now are being required to comply with certain heightened reporting requirements. Fulfilling our obligations incident to being a public company, including compliance with the Exchange Act and the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, are expensive and time-consuming, and any delays or difficulties in satisfying these obligations could have a material adverse effect on our future results of operations and our stock price. |

| • | Difficult market and political conditions, including tensions between Russia and Ukraine, may reduce the value or hamper the performance of the investments made by our products or impair the ability of our products to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition. |

| • | Management fees comprise the majority of our revenues and a reduction in fees could have an adverse effect on our results of operations and the level of cash available for distributions to our shareholders. |

| • | Our growth depends in large part on our ability to raise new and successor funds. If we were unable to raise such funds, the growth of our FPAUM and management fees, and ability to deploy capital into investments, earning the potential for performance income, would slow or decrease, all of which would materially reduce our revenues and cash flows and adversely affect our financial condition. |

| • | Our GP Capital Solutions products may suffer losses if our Partner Managers are unable to raise new funds or grow their AUM. |

| • | Conflicts of interest may arise in our allocation of capital and co-investment opportunities or in circumstances where we hold investments at different levels of the capital structure. |

| • | Our business is currently focused on multiple investment strategies. |

| • | Our entitlement and that of certain of our shareholders, Principals and employees to receive realized performance income from certain of our funds may create an incentive for us to make more speculative investments and determinations on behalf of our funds than would be the case in the absence of such performance income. |

| • | Our use of leverage to finance our businesses exposes us to substantial risks. Any security interests or negative covenants required by a credit facility we enter into may limit our ability to create liens on assets to secure additional debt. |

| • | Employee misconduct could harm us by impairing our ability to attract and retain fund investors and subjecting us to significant legal liability, regulatory scrutiny and reputational harm. |

| • | Cybersecurity risks and cyber incidents could adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information and confidential information in our possession and damage to our business relationships, any of which could negatively impact our business, financial condition and operating results. |

| • | The use of leverage by our products may materially increase the returns of such funds but may also result in significant losses or a total loss of capital. |

| • | The multi-class structure of our common stock has the effect of concentrating voting power with the Principals, which will limit an investor’s ability to influence the outcome of important transactions, including a change in control. |

| • | The Registrant is a holding company and its only material source of cash is its indirect interest (held through Blue Owl GP) in the Blue Owl Operating Partnerships, and it is accordingly dependent upon distributions made by its subsidiaries to pay taxes, cause Blue Owl GP to make payments under the Tax Receivable Agreement, and pay dividends. |

Issuer | Blue Owl Capital Inc. |

Class A Shares offered by the Selling Holders | Up to 1,320,591,340 Class A Shares (including 1,010,627,237 Class A Shares that were issued upon the conversion or conversion and exchange of Seller Earnout Securities, as applicable, and the exchange of Common Units and the cancellation of an equal number of Class C or Class D Shares, as applicable) |

Class A Shares issued or issuable upon the exchange of all outstanding Common Units and the conversion or conversion and exchange of all Seller Earnout Securities | 1,343,042,262 |

Use of proceeds | We will not receive any of the proceeds from the sale of the Class A Shares by the Selling Holders. |

Market for our shares of common stock | Our Class A Shares are currently listed on the NYSE under the symbol “OWL.” |

Risk factors | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “ Risk Factors |

($ amounts in thousands) | December 31, 2021 | December 31, 2020 | December 31, 2019 | |||||||||

Consolidated statements of financial condition data | ||||||||||||

Total assets | $ | 8,266,398 | $ | 121,597 | $ | 56,718 | ||||||

Debt obligations, net | 1,174,167 | 356,386 | 287,104 | |||||||||

Total liabilities | 2,418,828 | 622,758 | 407,215 | |||||||||

Non-controlling interests | 4,184,003 | 6,526 | 2,259 | |||||||||

Total shareholders’ equity attributable to Blue Owl Inc. (After May 19, 2021) / members of Owl Rock Capital and sole member of Owl Rock Capital Securities LLC (Prior to May 19, 2021) | 1,663,567 | (507,687 | ) | (352,756 | ) | |||||||

Total shareholders’ equity (deficit) | 5,847,570 | (501,161 | ) | (350,497 | ) | |||||||

For the Years Ended December 31, | ||||||||||||

($ amounts in thousands) | 2021 | 2020 | 2019 | |||||||||

Consolidated statements of operations data | ||||||||||||

Total revenues, net | $ | 823,878 | $ | 249,815 | $ | 190,850 | ||||||

Total expenses | 1,751,145 | 308,542 | 163,483 | |||||||||

Interest expense | (27,275) | (23,816) | (6,662) | |||||||||

Net income (loss) before income taxes | (1,867,477) | (82,543) | 20,705 | |||||||||

Income tax (benefit) expense | (65,211) | (102) | 240 | |||||||||

Net income (loss) including non-controlling interests | (1,802,266) | (82,441) | 20,465 | |||||||||

Add: Net (income) loss attributed to non-controlling interests | 1,426,095 | 4,610 | 2,493 | |||||||||

Net income (loss) attributable to Blue Owl Capital Inc. (After May 19, 2021) / members of Owl Rock Capital and sole member of Owl Rock Capital Securities LLC (Prior to May 19, 2021) | $ | (376,171) | $ | (77,831) | $ | 22,958 | ||||||

| • | Volatile economic and market conditions, which could cause fund investors to delay making new commitments to alternative investment funds or limit the ability of our existing funds to deploy capital; |

| • | Intense competition among alternative asset managers may make fundraising and the deployment of capital more difficult, thereby limiting our ability to grow or maintain our FPAUM. Competition may be amplified by changes in fund investors allocating increased amounts of capital away from alternative asset managers; and |

| • | Continuation or amplification of general trends within the investment management industry towards lower fees including through direct reductions, deferrals, rebates or other means, which may also result in our competitors operating based on fee structures with which we are unable to successfully compete. |

| • | Poor performance of one or more of our products, either relative to market benchmarks or in absolute terms (e.g., based on market value or net asset value of our BDCs’ shares), or compared to our competitors may cause fund investors to regard our funds less favorably than those of our competitors, thereby adversely affecting our ability to raise new or successor funds; |

| • | Our funds may engage in strategic transactions or other dispositions that reduce the cost basis upon which we charge management fees with respect to one or more of our funds. For example, a fund may sell all or a portion of its interests in portfolio companies that causes such fund’s management fee base to be reduced; and |

| • | Certain of our funds contain “key person” provisions or other provisions allowing investors to take actions following certain specified events. The occurrence of one or more of those events prior to the end of a fund’s investment period could result in the termination of a fund’s investment period and a material decrease in the management fees paid by such fund or, in certain cases, cessation of the funds. |

| • | A number of our competitors may have or are perceived to have more expertise or financial, technical, marketing and other resources and more personnel than we do; |

| • | Some of our products may not perform as well as competitors’ funds or other available investment products; |

| • | Several of our competitors have raised significant amounts of capital, and many of them have similar investment objectives to ours, which may create additional competition for investment opportunities; |

| • | Some of our competitors may have lower fees or alternative fee arrangements that potential clients of ours may find more appealing; |

| • | Some of our competitors may have a lower cost of capital and access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to our products, including our products that directly use leverage or rely on debt financing of their portfolio investments to generate superior investment returns; |

| • | Some of our competitors may have higher risk tolerances, different risk assessments or lower return thresholds than us, which could allow them to consider a wider variety of investments and to bid more aggressively than us or to agree to less restrictive legal terms and protections for investments that we want to make; |

| • | Some of our competitors may be subject to less regulation or conflicts of interest and, accordingly, may have more flexibility to undertake and execute certain businesses or investments than we do, bear less compliance expense than we do or be viewed differently in the marketplace; |

| • | Some of our competitors may have more flexibility than us in raising and deploying certain types of funds under the investment management contracts they have negotiated with their fund investors; and |

| • | Some of our competitors may offer a broader investment platform and more partnership opportunities to portfolio companies than we are able to offer. |

| • | combining the leadership teams and corporate cultures of us and Oak Street; |

| • | the diversion of management’s attention from ongoing business concerns and performance shortfalls at one or both of the businesses as a result of the devotion of management’s attention to the continuing integration of the businesses; |

| • | managing a larger combined business; |

| • | maintaining employee morale and retaining key management and other employees at the combined company, including by offering sufficiently attractive terms of employment; |

| • | retaining existing business and operational relationships, and attracting new business and operational relationships; |

| • | the possibility of faulty assumptions underlying expectations regarding the integration process; |

| • | consolidating corporate and administrative infrastructures and eliminating duplicative operations; |

| • | managing expense loads and maintaining currently anticipated operating margins given that our two businesses are different in nature and therefore may require additional personnel and compensation expenses, which expenses may be borne by us, rather than our products; |

| • | difficulty replicating or replacing functions, systems and infrastructure provided by Neuberger or certain of its affiliates or the loss of benefits from Neuberger’s global contracts; and |

| • | unanticipated issues in integrating information technology, communications and other systems. |

| • | the required investment of capital and other resources; |

| • | the diversion of management’s attention from our core businesses; |

| • | the assumption of liabilities in any acquired business; |

| • | the disruption of our ongoing businesses; |

| • | entry into markets or lines of business in which we may have limited or no experience, and which may subject us to new laws and regulations which we are not familiar or from which we are currently exempt; |

| • | increasing demands on our operational and management systems and controls; |

| • | compliance with or applicability to our businesses or our funds’ portfolio companies of regulations and laws, including, in particular, local regulations and laws (for example, consumer protection related laws) and the impact that noncompliance or even perceived noncompliance could have on us and our funds’ portfolio companies; |

| • | conflicts between business lines in deal flow or objectives; |

| • | we may be dependent upon, and subject to liability, losses or reputational damage relating to, systems, controls and personnel that are not under our control; |

| • | potential increase in fund investor concentration; and |

| • | the broadening of our geographic footprint, increasing the risks associated with conducting operations in foreign jurisdictions where we currently have little or no presence, such as different legal, tax and regulatory regimes and currency fluctuations, which require additional resources to address. |

| • | maintaining adequate financial, regulatory (legal, tax and compliance) and business controls; |

| • | providing current and future fund investors and stockholders with accurate and consistent reporting; |

| • | implementing new or updated information and financial systems and procedures; and |

| • | training, managing and appropriately sizing our work force and other components of our businesses on a timely and cost-effective basis. |

| • | market conditions during previous periods may have been significantly more favorable for generating positive performance than the market conditions we may experience in the future; |

| • | our products’ rates of returns, which are calculated on the basis of net asset value of the funds’ investments, reflect unrealized gains, which may never be realized; |

| • | our products’ returns have previously benefited from investment opportunities and general market conditions that may not recur, including the availability of debt capital on attractive terms and the availability of distressed debt opportunities, and we may not be able to achieve the same returns or profitable investment opportunities or deploy capital as quickly; |

| • | the historical returns that we present in this prospectus derive largely from the performance of our earlier funds, whereas future fund returns will depend increasingly on the performance of our newer funds or funds not yet formed, which may have little or no realized investment track record; |

| • | our products’ historical investments were made over a long period of time and over the course of various market and macroeconomic cycles, and the circumstances under which our current or future funds may make future investments may differ significantly from those conditions prevailing in the past; |

| • | the attractive returns of certain of our products have been driven by the rapid return on invested capital, which has not occurred with respect to all of our products and we believe is less likely to occur in the future; |

| • | in recent years, there has been increased competition for investment opportunities resulting from the increased amount of capital invested in alternative funds and high liquidity in debt markets, and the increased competition for investments may reduce our returns in the future; and |

| • | our newly established funds may generate lower returns during the period that they take to deploy their capital. |

| • | general and local economic conditions; |

| • | changes in supply of and demand for competing properties in an area (as a result, for example, of overbuilding); |

| • | the financial resources of tenants; |

| • | changes in building, environmental and other laws; |

| • | energy and supply shortages; |

| • | various uninsured or uninsurable risks; |

| • | natural disasters; |

| • | changes in government regulations (such as rent control and tax laws); |

| • | changes in interest rates; |

| • | the reduced availability of mortgage funds which may render the sale or refinancing of properties difficult or impracticable; |

| • | negative developments in the economy that depress travel activity; |

| • | environmental liabilities; |

| • | contingent liabilities on disposition of assets; |

| • | unexpected cost overruns in connection with development projects; and |

| • | terrorist attacks, war (including tensions between Russia and Ukraine) and other factors that are beyond our control. |

| • | a classified board of directors with three-year staggered terms, which could delay the ability of stockholders to change the membership of a majority of the Board; |

| • | the ability of the Board to issue preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

| • | the limitation of the liability of, and the indemnification of, our directors and officers; |

| • | the right of the Board to elect a director to fill a vacancy created by the expansion of the Board or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on the Board; |

| • | the requirement that directors may only be removed from the Board for cause; |

| • | the inability of stockholders to act by written consent following the Sunset Date; |

| • | the requirement that a special meeting of stockholders may be called only by the Board, the chairman of the Board of directors or Blue Owl’s chief executive officer, which could delay the ability of stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | controlling the procedures for the conduct and scheduling of the Board and stockholder meetings; |

| • | the ability of the Board of directors to amend the bylaws, which may allow the Board to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend the bylaws to facilitate an unsolicited takeover attempt; and |

| • | advance notice procedures with which stockholders must comply to nominate candidates to the Board or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in the composition of the Board and also may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company. |

| • | the impact of COVID-19 pandemic on Blue Owl’s business; |

| • | the inability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, Blue Owl’s inability to grow and manage growth profitably, and retain its key employees; |

| • | adverse market reaction to any indebtedness we may incur or securities we may issue in the future; |

| • | changes in market valuations of similar companies; |

| • | speculation in the press or investment community; |

| • | a lack of liquidity in the trading of our Class A Shares; |

| • | changes in applicable laws or regulations; |

| • | risks relating to the uncertainty of Blue Owl’s projected financial information; and |

| • | risks related to the organic and inorganic growth of Blue Owl’s business and the timing of expected business milestones. |

Blue Owl AUM: $94.5 billion FPAUM: $61.4 billion | ||||

Direct Lending Products AUM: $39.2 billion FPAUM: $32.0 billion | GP Capital Solutions Products AUM: $39.9 billion FPAUM: $21.2 billion | Real Estate Products AUM: $15.4 billion FPAUM: $8.2 billion | ||

Diversified Lending Commenced 2016 AUM: $25.8 billion FPAUM: $21.6 billion | GP Minority Equity Commenced 2010 AUM: $38.7 billion FPAUM: $20.4 billion | Net Lease Commenced 2009 AUM: $15.4 billion FPAUM: $8.2 billion | ||

Technology Lending Commenced 2018 AUM: $7.9 billion FPAUM: $6.9 billion | GP Debt Financing Commenced 2019 AUM: $1.0 billion FPAUM: $0.7 billion | |||

First Lien Lending Commenced 2018 AUM: $3.5 billion FPAUM: $2.3 billion | Professional Sports Minority Investments Commenced 2021 AUM: $0.2 billion FPAUM: $0.2 billion | |||

Opportunistic Lending Commenced 2020 AUM: $2.0 billion FPAUM: $1.2 billion | ||||

| • | Diversified Lending: |

| • | Technology Lending: |

| • | First Lien Lending: |

| • | Opportunistic Lending: (iv) debtor-in-possession |

| • | GP Minority Equity Investments: closed-end, permanent capital funds. A fundamental component of the fundraising efforts for our investment programs is the ability to identify and executeco-investment opportunities for our investors. We may offer, fromtime-to-time co-investment opportunities in certain fund investments, generally with no management or incentive-based fee. |

| • | GP Debt Financing: |

| • | Professional Sports Minority Investments: NBA-focused. |

| • | Net Lease: net-leased, long-term to investment grade and creditworthy tenants. Oak Street’s Net Lease real estate strategies focus on acquiring single tenant properties, across industrial, essential retail and mission critical office sectors. By combining our proprietary origination platform, enhanced lease structures and a disciplined investment criteria, we seek to provide investors with predictable current income, and potential for appreciation, while focusing on limiting downside risk. |

| • | shifting allocations by retail institutional investors. |

| • | rotation onto alternatives given the search for yield and reliability of returns. |

| • | rising need for private debt driven by sponsor demand. |

| • | evolving landscape of the private debt market. |

| • | de-leveraging of the global banking system. |

| • | increasing need for flexible capital solutions by private capital managers. |

| • | High proportion of permanent capital. closed-end, permanent (or potentially permanent) funds with no mandatory redemption and potentially unlimited duration once listed. Substantially all of the AUM in our GP Capital Solutions and Real Estate products are also structured as permanent capital vehicles. The high proportion of permanent capital in our AUM provides a stable base and allows for our AUM to grow more predictably without having reductions in our asset levels due to ordinary redemptions. Our permanent capital base also lends stability and flexibility to our portfolio companies and Partner Managers, providing us the opportunity to grow alongside these companies and positioning us to be a preferred source of capital and the incumbent lender forfollow-ons and other capital solutions to high-performing companies. As such, we are able to be a compelling partner for these firms as they seek capital to support their long-term vision and business development goals. The stability of our AUM base enables us to focus on generating attractive returns by investing in assets with a long-term focus across different periods in the market cycle. |

| • | Significant embedded growth in current AUM with built-in mechanisms for fee revenue increases. |

| • | Stable earnings model with attractive margin profile. |

| • | Extensive, long-term relationships with a robust and vast network of alternative asset managers. |

| • | Increasing benefits of scale. |

| • | Diverse, global and growing high-quality investor base. high-net worth investors. As we continue to grow, we expect to retain our existing clients through our breadth of offerings. As of December 31, 2021, approximately 36% of our institutional investors are invested in more than one product, with many increasing their commitment to their initial strategy and additionally committing additional capital across our other strategies. We believe our diligent management of investors’ capital, combined with our strong performance and increasingly diversified product offerings has helped retain and attract investors which has furthered our growth in FPAUM and facilitated further expansion of our strategies. We also believe the global nature of our investor base enables significant cross-selling opportunities between our products and strategies. We are committed to providing our clients with a superior level of service. We believe our client-focused nature, rooted in our culture of transparency will help us continue to retain and attract high quality investors to our platform. |

| • | Industry-leading management team with proven track record. best-in-class |

| • | Alignment of interests with stakeholders. |

| • | Organically grow our core business. |

successor products in existing strategies, will continue to play a key role in our growth profile. We also expect to enhance our AUM growth by expanding our current investor relationships and also continuing to attract new investors. |

| • | Expand our product offering. |

| • | Leverage complementary global distribution networks. |

| • | Enhance our distribution channels. |

| • | Deepen and expand strong strategic relationships with key institutional investors. |

organically and through product and geographic expansion, we will continue to pursue the addition of incremental key strategic partners. |

| • | Opportunistically pursue accretive acquisitions. |

| • | Embracing our differences. |

| • | Strategic priorities. |

| • | Corporate practices. |

| • | Leadership. |

MUTUAL RESPECT | EXCELLENCE | CONSTRUCTIVE DIALOGUE | ONE TEAM | |||

BLUE OWL’S CORE VALUES | ||||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

Net Loss Attributable to Blue Owl Capital Inc. (After May 19, 2021) / Owl Rock (Prior to May 19, 2021) | $ | (376,171 | ) | $ | (77,831 | ) | ||

Fee-Related Earnings(1) | $ | 451,684 | $ | 36,408 | ||||

Distributable Earnings (1) | $ | 427,322 | $ | 12,219 | ||||

| (1) | For the specific components and calculations of these Non-GAAP measures, as well as a reconciliation of these measures to the most comparable measure in accordance with GAAP, see“—Non-GAAP Analysis”“—Non-GAAP Reconciliations.” |

Blue Owl | ||||

| AUM: $94.5 billion | ||||

| FPAUM: $61.4 billion | ||||

Direct Lending Products AUM: $39.2 billion FPAUM: $32.0 billion | GP Capital Solutions Products AUM: $39.9 billion FPAUM: $21.2 billion | Real Estate Products AUM: $15.4 billion FPAUM: $8.2 billion | ||

Diversified Lending Commenced 2016 AUM: $25.8 billion FPAUM: $21.6 billion | GP Minority Equity Commenced 2010 AUM: $38.7 billion FPAUM: $20.4 billion | Net Lease Commenced 2009 AUM: $15.4 billion FPAUM: $8.2 billion | ||

Technology Lending Commenced 2018 AUM: $7.9 billion FPAUM: $6.9 billion | GP Debt Financing Commenced 2019 AUM: $1.0 billion FPAUM: $0.7 billion | |||

First Lien Lending Commenced 2018 AUM: $3.5 billion FPAUM: $2.3 billion | Professional Sports Minority Investments Commenced 2021 AUM: $0.2 billion FPAUM: $0.2 billion | |||

Opportunistic Lending Commenced 2020 AUM: $2.0 billion FPAUM: $1.2 billion | ||||

Year Ended December 31, 2021 | Year Ended December 31, 2020 | |||||||||||||||||||||||||||||||

(dollars in millions) | Direct Lending | GP Capital Solutions | Real Estate | Total | Direct Lending | GP Capital Solutions | Real Estate | Total | ||||||||||||||||||||||||

Beginning Balance | $ | 27,101 | $ | 26,220 | $ | — | $ | 53,321 | $ | 18,636 | $ | 23,001 | $ | — | $ | 41,637 | ||||||||||||||||

Acquisition | — | — | 15,362 | 15,362 | — | 2,130 | — | 2,130 | ||||||||||||||||||||||||

New capital raised | 4,163 | 4,466 | — | 8,629 | 4,160 | — | — | 4,160 | ||||||||||||||||||||||||

Change in debt | 7,325 | — | — | 7,325 | 4,458 | — | — | 4,458 | ||||||||||||||||||||||||

Distributions | (848 | ) | (579 | ) | — | (1,427 | ) | (779 | ) | (1,104 | ) | — | (1,883 | ) | ||||||||||||||||||

Change in value | 1,486 | 9,799 | — | 11,285 | 626 | 2,193 | — | 2,819 | ||||||||||||||||||||||||

Ending Balance | $ | 39,227 | $ | 39,906 | $ | 15,362 | $ | 94,495 | $ | 27,101 | $ | 26,220 | $ | — | $ | 53,321 | ||||||||||||||||

| • | $2.5 billion new capital raised in Diversified Lending, primarily driven by retail fundraising in ORCIC. |

| • | $0.9 billion new capital raised in Technology Lending, driven by the initial launch of ORTF II, our second technology-focused BDC. |

| • | $0.6 billion new capital raised in Opportunistic Lending, driven by additional commitments to our Owl Rock Opportunistic private fund. |

| • | $7.3 billion of debt deployment across all of Direct Lending, as we continue to opportunistically deploy leverage in our BDCs. |

Year Ended December 31, 2021 | Year Ended December 31, 2020 | |||||||||||||||||||||||||||||||

(dollars in millions) | Direct Lending | GP Capital Solutions | Real Estate | Total | Direct Lending | GP Capital Solutions | Real Estate | Total | ||||||||||||||||||||||||

Beginning Balance | $ | 20,862 | $ | 17,608 | $ | — | $ | 38,470 | $ | 15,278 | $ | 17,546 | $ | — | $ | 32,824 | ||||||||||||||||

Acquisition | — | — | 8,203 | 8,203 | — | — | — | — | ||||||||||||||||||||||||

New capital raised / deployed | 10,598 | 3,700 | — | 14,298 | 5,766 | 353 | — | 6,119 | ||||||||||||||||||||||||

Distributions | (824 | ) | (96 | ) | — | (920 | ) | (764 | ) | (291 | ) | — | (1,055 | ) | ||||||||||||||||||

Change in value | 1,393 | — | — | 1,393 | 582 | — | — | 582 | ||||||||||||||||||||||||

Ending Balance | $ | 32,029 | $ | 21,212 | $ | 8,203 | $ | 61,444 | $ | 20,862 | $ | 17,608 | $ | — | $ | 38,470 | ||||||||||||||||

Year of | Capital Raised | Invested Capital | Realized Proceeds | Unrealized Value | Total | MoIC | IRR | |||||||||||||||||||||||||||||||||||||

(dollars in millions) | Inception | AUM | (1) | (2) | (3) | (4) | Value | Gross (5) | Net (6) | Gross (7) | Net (8) | |||||||||||||||||||||||||||||||||

Diversified Lending | ||||||||||||||||||||||||||||||||||||||||||||

ORCC | 2016 | $ | 14,515 | $ | 6,006 | $ | 6,006 | $ | 1,901 | $ | 5,938 | $ | 7,839 | 1.39x | 1.30x | 12.1 | % | 9.3 | % | |||||||||||||||||||||||||

ORCC II (9) | 2017 | $ | 2,633 | $ | 1,387 | $ | 1,360 | $ | 246 | $ | 1,360 | $ | 1,606 | NM | 1.18x | NM | 7.3 | % | ||||||||||||||||||||||||||

ORCC III | 2020 | $ | 3,497 | $ | 1,702 | $ | 1,653 | $ | 64 | $ | 1,668 | $ | 1,732 | NM | NM | NM | NM | |||||||||||||||||||||||||||

ORCIC | 2020 | $ | 3,996 | $ | 1,584 | $ | 1,577 | $ | 31 | $ | 1,581 | $ | 1,612 | NM | NM | NM | NM | |||||||||||||||||||||||||||

Technology Lending | ||||||||||||||||||||||||||||||||||||||||||||

ORTF | 2018 | $ | 7,084 | $ | 3,187 | $ | 3,187 | $ | 230 | $ | 3,531 | $ | 3,761 | 1.23x | 1.18x | 18.6 | % | 14.1 | % | |||||||||||||||||||||||||

First Lien Lending (10) | ||||||||||||||||||||||||||||||||||||||||||||

Owl Rock First Lien Fund Levered | 2018 | $ | 2,960 | $ | 1,161 | $ | 813 | $ | 101 | $ | 848 | $ | 949 | 1.21x | 1.17x | 11.2 | % | 8.9 | % | |||||||||||||||||||||||||

Owl Rock First Lien Fund Unlevered | 2019 | $ | 150 | $ | 137 | $ | 6 | $ | 141 | $ | 147 | 1.11x | 1.08x | 5.6 | % | 3.8 | % | |||||||||||||||||||||||||||

| (1) | Includes reinvested dividends, if applicable. |

| (2) | Invested capital includes capital calls, reinvested dividends and periodic investor closes, as applicable. |

| (3) | Realized proceeds represent the sum of all cash distributions to investors. |

| (4) | Unrealized value represents the product’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated. |

| (5) | Gross multiple of invested capital (“MoIC”) is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is before giving effect to management fees (including Part I Fees) and Part II Fees, as applicable. |

| (6) | Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees (including Part I Fees) and Part II Fees, as applicable, and all other expenses. |

| (7) | Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees (including Part I Fees) and Part II Fees, as applicable. |

| (8) | Net IRRs are calculated consistent with gross IRRs, but after giving effect to management fees (including Part I Fees) and Part II Fees, as applicable, and all other expenses. An individual investor’s IRR may be different to the reported IRR based on the timing of capital transactions. |

| (9) | For the purposes of calculating Gross IRR, the expense support provided to the fund would be impacted when assuming a performance excluding management fees (including Part I Fees) and Part II Fees, and therefore is not meaningful for ORCC II. |

| (10) | Owl Rock First Lien Fund is comprised of three feeder funds: Onshore Levered, Offshore Levered and Insurance Unlevered. The gross and net MoIC and IRR presented in the chart are for Onshore Levered and Insurance Unlevered as those are the largest of the levered and unlevered feeder funds. The gross and net MoIC for the Offshore Levered feeder fund is 1.20x and 1.14x, respectively. The gross and net IRR for the Offshore Levered feeder is 10.4% and 7.0%, respectively. All other values for Owl Rock First Lien Fund Levered are for Onshore Levered and Offshore Levered combined. AUM is presented as the aggregate of the three Owl Rock First Lien Fund feeders. Owl Rock First Lien Fund Unlevered Investor equity and note commitments are both treated as capital for all values. |

Year of | Capital | Invested Capital | Realized Proceeds | Unrealized Value | Total | MoIC | IRR | |||||||||||||||||||||||||||||||||||||

(dollars in millions) | Inception | AUM | Raised | (2) | (3) | (4) | Value | Gross (5) | Net (6) | Gross (7) | Net (8) | |||||||||||||||||||||||||||||||||

GP Minority Equity (1) | ||||||||||||||||||||||||||||||||||||||||||||

Dyal Fund I | 2011 | $ | 930 | $ | 1,284 | $ | 1,248 | $ | 583 | $ | 697 | $ | 1,280 | 1.17x | 1.03x | 3.5 | % | 0.5 | % | |||||||||||||||||||||||||

Dyal Fund II | 2014 | $ | 2,681 | $ | 2,153 | $ | 1,846 | $ | 421 | $ | 2,087 | $ | 2,508 | 1.48x | 1.36x | 12.5 | % | 9.0 | % | |||||||||||||||||||||||||

Dyal Fund III | 2015 | $ | 8,359 | $ | 5,318 | $ | 3,241 | $ | 2,493 | $ | 4,231 | $ | 6,724 | 2.48x | 2.07x | 32.3 | % | 24.2 | % | |||||||||||||||||||||||||

Dyal Fund IV | 2018 | $ | 14,244 | $ | 9,041 | $ | 4,076 | $ | 2,178 | $ | 6,142 | $ | 8,320 | 2.44x | 2.04x | 146.5 | % | 96.0 | % | |||||||||||||||||||||||||

Dyal Fund V | 2020 | $ | 6,724 | $ | 5,826 | $ | 593 | $ | — | $ | 1,321 | $ | 1,321 | NM | NM | NM | NM | |||||||||||||||||||||||||||

| (1) | Valuation-related amounts and performance metrics are presented on a quarter lag and are exclusive of investments made by us and the related carried interest vehicles of the respective products. |

| (2) | Invested capital includes capital calls. |

| (3) | Realized proceeds represent the sum of all cash distributions to investors. |

| (4) | Unrealized value represents the product’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated. |

| (5) | Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is before giving effect to management fees and carried interest, as applicable. |

| (6) | Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. |

| (7) | Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees and carried interest, as applicable. |

| (8) | Net IRR is an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs reflect returns to all investors. Net IRRs are calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. An individual investor’s IRR may be different to the reported IRR based on the timing of capital transactions. |

Year of | Capital | Invested Capital | Realized Proceeds | Unrealized Value | Total | MoIC | IRR | |||||||||||||||||||||||||||||||||||||

(dollars in millions) | Inception | AUM | Raised | (2) | (3) | (4) | Value | Gross (5) | Net (6) | Gross (7) | Net (8) | |||||||||||||||||||||||||||||||||

Net Lease (1) | ||||||||||||||||||||||||||||||||||||||||||||

Oak Street Real Estate Capital Fund IV | 2017 | $ | 1,358 | $ | 1,250 | $ | 1,239 | $ | 911 | $ | 821 | $ | 1,732 | 1.52x | 1.40x | 26.1 | % | 20.3 | % | |||||||||||||||||||||||||

Oak Street Real Estate Capital Net Lease Property | 2019 | $ | 5,669 | $ | 3,161 | $ | 1,732 | $ | 126 | $ | 1,972 | $ | 2,098 | 1.21x | 1.21x | 21.3 | % | 20.3 | % | |||||||||||||||||||||||||

Oak Street Real Estate Capital Fund V | 2020 | $ | 3,818 | $ | 2,500 | $ | 637 | $ | 108 | $ | 747 | $ | 855 | NM | NM | NM | NM | |||||||||||||||||||||||||||

Oak Street Asset-Backed Securitization (9) | 2020 | $ | 3,001 | $ | 2,716 | $ | 258 | $ | 16 | $ | 296 | $ | 312 | NM | NM | NM | NM | |||||||||||||||||||||||||||

| (1) | Valuation-related amounts and performance metrics, as well as invested capital and realized proceeds, are presented on a quarter lag where applicable. |

| (2) | Invested capital includes investments by the general partner, capital calls, dividends reinvested and periodic investors closes, as applicable. |

| (3) | Realized proceeds represent the sum of all cash distributions to all investors. |

| (4) | Unrealized value represents the fund’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated. |

| (5) | Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is before giving effect to management fees and carried interest, as applicable. |

| (6) | Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. |

| (7) | Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees and carried interest, as applicable. |

| (8) | Net IRR is an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs reflect returns to all investors. Net IRRs are calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. An individual investor’s IRR may be different to the reported IRR based on the timing of capital transactions. |

| (9) | Capital raised for this product includes the par value of notes issued in the securitization. Invested capital, realized proceeds, unrealized and total values relate to the subordinated notes/equity of the securitization. |

Year Ended December 31, | ||||||||||||

(dollars in thousands) | 2021 | 2020 | $ Change | |||||||||

Revenues | ||||||||||||

Management fees, net (includes Part I Fees of $150,370 and $34,404) | $ | 667,935 | $ | 194,906 | $ | 473,029 | ||||||

Administrative, transaction and other fees | 150,037 | 54,909 | 95,128 | |||||||||

Realized performance income | 5,906 | — | 5,906 | |||||||||

Total Revenues, Net | 823,878 | 249,815 | 574,063 | |||||||||

Expenses | ||||||||||||

Compensation and benefits | 1,496,988 | 240,731 | 1,256,257 | |||||||||

Amortization of intangible assets | 113,889 | — | 113,889 | |||||||||

General, administrative and other expenses | 140,268 | 67,811 | 72,457 | |||||||||

Total Expenses | 1,751,145 | 308,542 | 1,442,603 | |||||||||

Other Loss | ||||||||||||

Net losses on investments | (3,526 | ) | — | (3,526 | ) | |||||||

Net losses on retirement of debt | (17,636 | ) | — | (17,636 | ) | |||||||

Interest expense | (27,275 | ) | (23,816 | ) | (3,459 | ) | ||||||

Change in TRA liability | (13,848 | ) | — | (13,848 | ) | |||||||

Change in warrant liability | (43,670 | ) | — | (43,670 | ) | |||||||

Change in earnout liability | (834,255 | ) | — | (834,255 | ) | |||||||

Total Other Loss | (940,210 | ) | (23,816 | ) | (916,394 | ) | ||||||

Loss Before Income Taxes | (1,867,477 | ) | (82,543 | ) | (1,784,934 | ) | ||||||

Income tax benefit | (65,211 | ) | (102 | ) | (65,109 | ) | ||||||

Consolidated and Combined Net Loss | (1,802,266 | ) | (82,441 | ) | (1,719,825 | ) | ||||||

Net loss attributable to noncontrolling interests | 1,426,095 | 4,610 | 1,421,485 | |||||||||

Net Loss Attributable to Blue Owl Capital Inc. | $ | (376,171 | ) | $ | (77,831 | ) | $ | (298,340 | ) | |||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

FRE revenues | $ | 785,901 | $ | 233,310 | ||||

FRE expenses | (330,256 | ) | (201,512 | ) | ||||

Net (income) loss allocated to noncontrolling interests included in Fee-Related Earnings | (3,961 | ) | 4,610 | |||||

Fee-Related Earnings | $ | 451,684 | $ | 36,408 | ||||

Distributable Earnings | $ | 427,322 | $ | 12,219 | ||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

Direct Lending Products | ||||||||

Diversified lending | $ | 348,363 | $ | 140,153 | ||||

Technology lending | 66,089 | 42,052 | ||||||

First lien lending | 15,185 | 12,335 | ||||||

Opportunistic lending | 3,993 | 366 | ||||||

Management Fees, Net | 433,630 | 194,906 | ||||||

Administrative, transaction and other fees | 106,973 | 38,404 | ||||||

FRE Revenues—Direct Lending Products | 540,603 | 233,310 | ||||||

GP Capital Solutions Products | ||||||||

GP minority equity investments | 233,505 | — | ||||||

GP debt financing | 10,215 | — | ||||||

Professional sports minority investments | 477 | — | ||||||

Management Fees, Net | 244,197 | — | ||||||

Administrative, transaction and other fees | 1,101 | — | ||||||

FRE Revenues—GP Capital Solutions Products | 245,298 | — | ||||||

Total FRE Revenues | $ | 785,901 | $ | 233,310 | ||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

FRE compensation and benefits | $ | (255,626 | ) | $ | (137,197 | ) | ||

FRE general, administrative and other expenses | (74,630 | ) | (64,315 | ) | ||||

Total FRE Expenses | $ | (330,256 | ) | $ | (201,512 | ) | ||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

GAAP Loss Before Income Taxes | $ | (1,867,477 | ) | $ | (82,543 | ) | ||

Net (income) loss allocated to noncontrolling interests included in Fee-Related Earnings | (3,961 | ) | 4,610 | |||||

Strategic Revenue-Share Purchase consideration amortization | 9,892 | — | ||||||

Realized performance compensation | 2,067 | — | ||||||

Equity-based compensation | 1,205,336 | 90,525 | ||||||

Capital-related compensation | 1,416 | — | ||||||

Amortization of intangible assets | 113,889 | — | ||||||

Transaction Expenses | 56,218 | — | ||||||

Interest expense | 27,275 | 23,816 | ||||||

Realized performance income | (5,906 | ) | — | |||||

Net losses on investments | 3,526 | — | ||||||

Net losses on early retirement of debt | 17,636 | — | ||||||

Change in TRA liability | 13,848 | — | ||||||

Change in warrant liability | 43,670 | — | ||||||

Change in earnout liability | 834,255 | — | ||||||

Fee-Related Earnings | 451,684 | 36,408 | ||||||

Realized performance income | 5,906 | — | ||||||

Realized performance compensation | (2,067 | ) | — | |||||

Interest expense | (27,275 | ) | (23,816 | ) | ||||

Taxes and TRA payments | (926 | ) | (373 | ) | ||||

Distributable Earnings | 427,322 | 12,219 | ||||||

Interest expense | 27,275 | 23,816 | ||||||

Taxes and TRA payments | 926 | 373 | ||||||

Fixed assets depreciation and amortization | 665 | 673 | ||||||

Adjusted EBITDA | $ | 456,188 | $ | 37,081 | ||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

GAAP Revenues | $ | 823,878 | $ | 249,815 | ||||

Strategic Revenue-Share Purchase consideration amortization | 9,892 | — | ||||||

Realized performance income | (5,906 | ) | — | |||||

Administrative and other fees | (41,963 | ) | (16,505 | ) | ||||

FRE Revenues | $ | 785,901 | $ | 233,310 | ||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

GAAP Compensation and Benefits | $ | 1,496,988 | $ | 240,731 | ||||

Realized performance compensation | (2,067 | ) | — | |||||

Equity-based compensation | (1,204,119 | ) | (90,525 | ) | ||||

Capital-related compensation | (1,416 | ) | — | |||||

Administrative and other expenses | (33,760 | ) | (13,009 | ) | ||||

FRE Compensation and Benefits | $ | 255,626 | $ | 137,197 | ||||

Year Ended December 31, | ||||||||

(dollars in thousands) | 2021 | 2020 | ||||||

GAAP General, Administrative and Other Expenses | $ | 140,268 | $ | 67,811 | ||||

Transaction Expenses | (56,218 | ) | — | |||||

Equity-based compensation | (1,217 | ) | — | |||||

Administrative and other expenses | (8,203 | ) | (3,496 | ) | ||||

FRE General, Administrative and Other Expenses | $ | 74,630 | $ | 64,315 | ||||

| • | Grow our existing investment management business. |

| • | Expand, or acquire, into businesses that are complementary to our existing investment management businesses or other strategic growth initiatives. |

| • | Pay operating expenses, including cash compensation to our employees. |

| • | Repay debt obligations and interest thereon. |

| • | Opportunistically repurchase Class A Shares pursuant to the Share Repurchase Program (as defined below). |

| • | Pay income taxes and amounts due under the TRA. |

| • | Pay dividends to holders of our Class A Shares, as well as make corresponding distributions to holders of Common Units at the Blue Owl Operating Group level. |

| • | Fund investment commitments to existing or future products. |

| • | The amount and timing of our taxable income will impact the payments to be made under the TRA. To the extent that we do not have sufficient taxable income to utilize the amortization deductions available as a result of the increased tax basis in the Blue Owl Operating Partnerships’ assets, payments required under the TRA would be reduced. |

| • | The price of our Class A Shares at the time of any exchange will determine the actual increase in tax basis of the Blue Owl Operating Partnerships’ assets resulting from such exchange; payments under the TRA resulting from future exchanges, if any, will be dependent in part upon such actual increase in tax basis. |

| • | The composition of the Blue Owl Operating Group assets at the time of any exchange will determine the extent to which we may benefit from amortizing the increased tax basis in such assets and thus will impact the amount of future payments under the TRA resulting from any future exchanges. |

| • | The extent to which future exchanges are taxable will impact the extent to which we will receive an increase in tax basis of the Blue Owl Operating Group assets as a result of such exchanges, and thus will impact the benefit derived by us and the resulting payments, if any, to be made under the TRA. |

| • | The tax rates in effect at the time any potential tax savings are realized, which would affect the amount of any future payments under the TRA. |

Year Ended December 31, | ||||||||||||

(dollars in thousands) | 2021 | 2020 | $ Change | |||||||||

Net cash provided by (used in): | ||||||||||||

Operating activities | $ | 281,658 | $ | 5,234 | $ | 276,424 | ||||||

Investing activities | (1,598,872 | ) | (652 | ) | (1,598,220 | ) | ||||||

Financing activities | 1,348,151 | (295 | ) | 1,348,446 | ||||||||

Net Change in Cash and Cash Equivalents | $ | 30,937 | $ | 4,287 | $ | 26,650 | ||||||

Name | Age | Position with Blue Owl | ||||

Douglas I. Ostrover | 59 | Chief Executive Officer and Chairman of the Board | ||||

Marc S. Lipschultz | 53 | Co-President and Director | ||||

Michael Rees | 47 | Co-President and Director | ||||

Craig W. Packer | 55 | Senior Managing Director and Director | ||||

Sean Ward | 43 | Senior Managing Director and Director | ||||

Marc Zahr | 42 | President of the Oak Street Division and Director | ||||

Alan J. Kirshenbaum | 50 | Chief Financial Officer | ||||

Andrew Laurino | 46 | Senior Managing Director | ||||

Andrew R. Polland | 47 | Chief Operating Officer | ||||

Neena A. Reddy | 44 | General Counsel and Secretary | ||||

Dana Weeks | 51 | Director | ||||

Claudia Holz | 64 | Director | ||||

Andrew S. Komaroff | 53 | Director | ||||

Stacy Polley | 53 | Director | ||||

| • | maintain open communications with the independent accountants, internal auditors or other personnel responsible for the internal audit function outside valuation experts, executive management, and the Board; |

| • | meet separately, from time to time, with management, internal auditors or other personnel responsible for the internal audit function and the independent accountants to discuss matters warranting attention by the audit committee; |

| • | regularly report committee actions to the Board and make recommendations as the audit committee deems appropriate; |

| • | review the financial results presented in all reports filed with the SEC; |

| • | review reports issued by regulatory examinations and consider the results of those reviews to determine if any findings could have a material effect on the Company’s financial statements or its internal controls and procedures; |

| • | discuss the Company’s disclosure, oversight of and conformity with the Company’s Code of Business Conduct and Code of Ethics, and matters that may have a material effect on the Company’s financial statements, operations, compliance policies, and programs; |

| • | review and reassess the adequacy of the audit committee’s charter at least annually and recommend any changes to the full Board; and |

| • | take other actions required of the audit committee by law, applicable regulations, or as requested by the Board. |

| • | the presumption that directors are acting in good faith, on an informed basis, and with a view to the interests of Blue Owl has been rebutted; and |

| • | it is proven that the director’s act or failure to act constituted a breach of his or her fiduciary duties as a director and such breach involved intentional misconduct, fraud or a knowing violation of law. |

Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($)(3) | Non-Equity Incentive Plan Compensation ($)(4) | All Other Compensation ($)(5) | Total ($) | |||||||||||||||||||||

Douglas Ostrover | 2021 | 500,000 | — | — | 10,898,160 | 239,018 | 11,637,178 | |||||||||||||||||||||

Chief Executive Officer | 2020 | 500,000 | — | — | 5,238,236 | 72,159 | 5,810,395 | |||||||||||||||||||||

Alan Kirshenbaum | 2021 | 500,000 | 3,233,781 | 3,662,481 | — | 55,046 | 7,451,308 | |||||||||||||||||||||

Chief Financial Officer | ||||||||||||||||||||||||||||

Michael Rees | 2021 | 311,546 | — | 693,673,522 | 6,606,809 | 75,616 | 700,667,493 | |||||||||||||||||||||

Co-President | 2020 | 500,000 | — | 99,520,200 | 41,412,500 | 11,087,500 | 152,520,200 | |||||||||||||||||||||

Sean Ward | 2021 | 311,546 | 3,829,654 | 170,614,779 | — | — | 174,755,979 | |||||||||||||||||||||

Senior Managing Director | 2020 | 500,000 | — | 21,461,400 | 12,712,500 | 3,337,500 | 38,011,400 | |||||||||||||||||||||

Marc Zahr | 2021 | — | — | 284,992,422 | — | — | 284,992,422 | |||||||||||||||||||||

President of Oak Street Division | ||||||||||||||||||||||||||||

| (1) | Represents annualized based salaries of $500,000 per NEO. For Messrs. Rees and Ward, salaries paid by the Company represent amounts earned from the date of the Business Combination. For Mr. Zahr, no amounts are reported, as the Oak Street Acquisition closed on December 29, 2021. |

| (2) | Represents the discretionary cash bonuses described in further detail above under the section titled “Elements of Compensation — Short-Term Cash Bonus Payments.” |

| (3) | Represents the grant date fair value of awards computed in accordance with ASC 718. For Messrs. Rees and Ward, $693,673,522 and $149,589,779, respectively, of these amounts relate to the exchange of Messrs. Rees’s and Ward’s pre-merger Dyal Profits Interests for (i) Common Units and (ii) Seller Earnout Units in connection with the Business Combination and not as a result of any compensation decisions made by the Management Committee; however, such amounts are required to be accounted for as compensation under GAAP. For Mr. Kirshenbaum, $2,206,481 of the amount relates to the issuance of Seller Earnout Units to Mr. Kirshenbaum (and other related parties of Mr. Kirshenbaum) in connection with the Business Combination. The remaining portion of the amounts presented for Messrs. Kirshenbaum and Ward relate to Incentive Units. For Mr. Zahr, this amount represents the Oak Street Earnouts issued in connection with the Oak Street Acquisition that were required to be accounted for as compensation rather than consideration under GAAP. See the table below and Note 13 to our Financial Statements for additional information. |

| (4) | For 2021, with respect to Messrs. Ostrover and Rees, represents quarterly payments in an amount equal to 1.33% of the management fees of Blue Owl that were earned subsequent to the date of the Business Combination (subject to, in certain circumstances, approval rights in each case as set forth in the Investor Rights Agreement) less the NEO’s base salary. For 2021, with respect to Mr. Ostrover, for periods prior to the date of the Business Combination, represents 2.5% of gross revenues of Owl Rock that Mr. Ostrover received. |

| (5) | For 2021, represents (i) with respect to Mr. Ostrover, $217,397 for wealth management services, $9,396 for supplemental medical insurance provided to certain executives, and $12,225 for tax gross-ups paid to Mr. Ostrover to cover the costs of the employee portion of the related payroll taxes due in respect of Mr. Ostrover’s compensation prior to the Business Combination; (ii) with respect to Mr. Kirshenbaum, $33,425 for wealth management services, $9,396 for supplemental medical insurance provided to certain executives, and $12,225 for taxgross-ups paid prior to the Business Combination; and (iii) with respect to Mr. Rees, $75,616 for wealth management services. |

Name | Grant Date | All Other Stock Awards: Number of Shares of Stock or Units (#) | Grant Date Fair Value of Stock and Option Awards ($) | |||||||||

Alan Kirshenbaum | 5/19/2021 | (1)(2) | 203,175 | 1,298,288 | ||||||||

| 5/19/2021 | (3)(4) | 203,175 | 908,192 | |||||||||

| 12/15/2021 | (5) | 100,000 | 1,456,000 | |||||||||

Michael Rees | 5/19/2021 | (6) | 73,428,587 | 660,857,292 | ||||||||

| 5/19/2021 | (1) | 3,021,752 | 19,308,997 | |||||||||

| 5/19/2021 | (3) | 3,021,753 | 13,507,233 | |||||||||

Sean Ward | 5/19/2021 | (6) | 15,834,778 | 142,513,002 | ||||||||

| 5/19/2021 | (1) | 651,637 | 4,163,960 | |||||||||

| 5/19/2021 | (3) | 651,637 | 2,912,817 | |||||||||

| 10/22/2021 | (7) | 1,500,000 | 21,025,000 | |||||||||

Marc Zahr | 12/29/2021 | (8) | 11,376,943 | 144,373,407 | ||||||||

| 12/29/2021 | (9) | 11,376,943 | 140,619,015 | |||||||||

| (1) | (Represents Series E-1 Seller Earnout Units issued in connection with the Business Combination. Such SeriesE-1 Seller Earnout Units vested upon the occurrence of theE-1 Triggering Event. |

| (2) | 196,403 of these Series E-1 Seller Earnout Units were deposited into the Alan Kirshenbaum 2015 Family Trust and the Kirshenbaum 2019 Family Trust on the grant date. Additionally, 3,386 of these SeriesE-1 Seller Earnout Units were transferred to a third party during 2021. |

| (3) | Represents Series E-2 Seller Earnout Units issued in connection with the Business Combination. Such SeriesE-2 Seller Earnout Units vested upon the occurrence of theE-2 Triggering Event. |

| (4) | 196,403 of these Series E-2 Seller Earnout Units were deposited into the Alan Kirshenbaum 2015 Family Trust and the Kirshenbaum 2019 Family Trust on the grant date. Additionally, 3,386 of these SeriesE-2 Seller Earnout Units were transferred to a third party during 2021. |

| (5) | Represents Incentive Units that were fully vested at grant. |

| (6) | Represents Common Units issued in exchange for Messrs. Rees’s and Ward’s Dyal Profits Interests in connection with the Business Combination. Such Common Units were fully vested at grant. |

| (7) | Represents Incentive Units that will vest in three equal installments on August 15, 2024, 2025 and 2026, subject to continued service of Mr. Ward and in accordance with the applicable Incentive Unit grant certificate. |

| (8) | Represents the grant of the first Oak Street Earnout Units in connection with the Oak Street Acquisition. Such earnouts will be settled in Common Units upon occurrence of the first Oak Street Earnout Triggering Event. |

| (9) | Represents the grant of the second Oak Street Earnout Units in connection with the Oak Street Acquisition. Such earnouts will be settled in Common Units upon occurrence of the second Oak Street Earnout Triggering Event. |

Stock Awards | ||||||||

Name | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | ||||||

Sean Ward | 1,500,000 | 22,365,000 | (1) | |||||

Marc Zahr | 11,376,943 | 169,630,220 | (2) | |||||

| 11,376,943 | 169,630,220 | (2) | ||||||