Q2 2024 Shareholder Letter UNLOCK THE SKIES™ JUNE 2024 | ARCHER MIDNIGHT TRANSITION FLIGHT

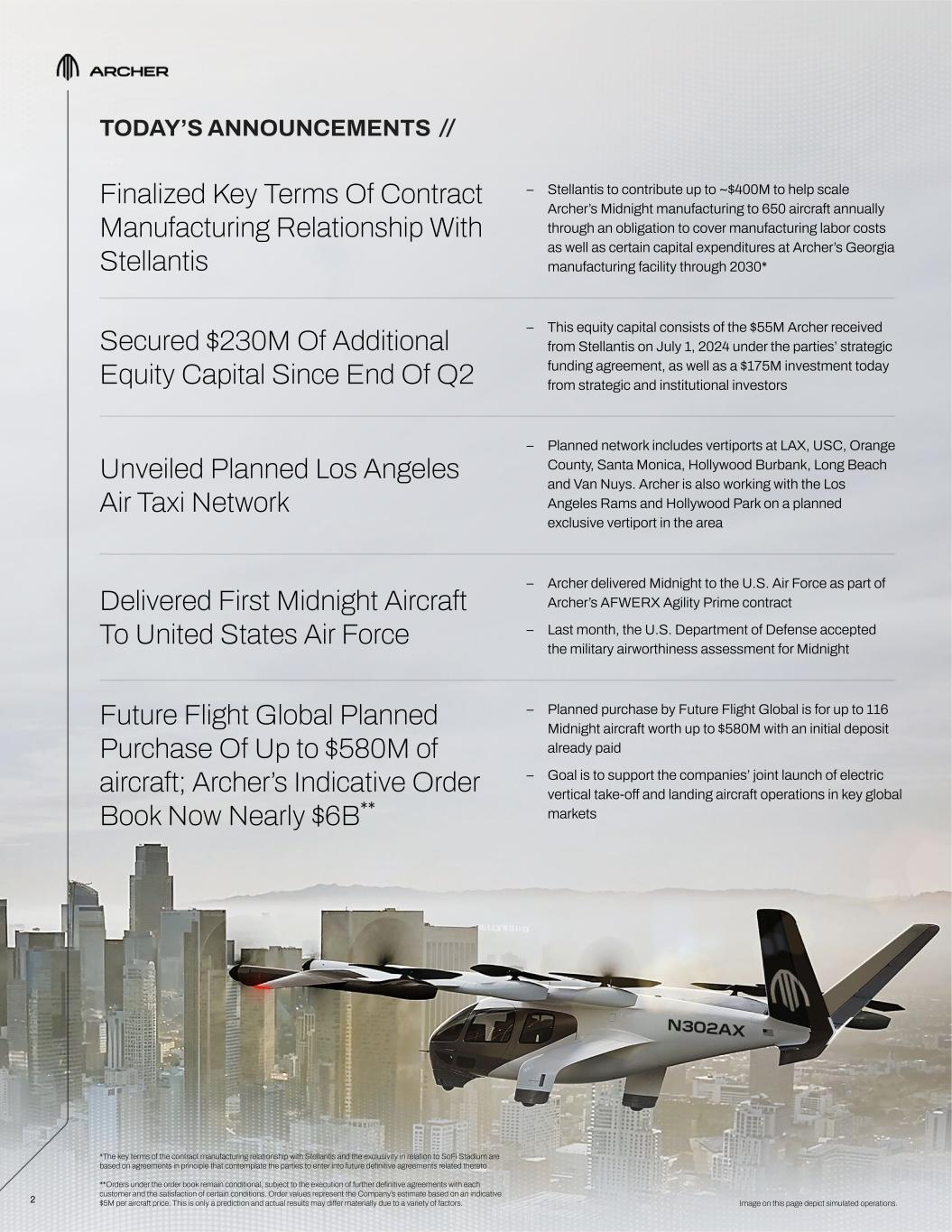

2 Unveiled Planned Los Angeles Air Taxi Network Future Flight Global Planned Purchase Of Up to $580M of aircraft; Archer’s Indicative Order Book Now Nearly $6B** Finalized Key Terms Of Contract Manufacturing Relationship With Stellantis Delivered First Midnight Aircraft To United States Air Force – Stellantis to contribute up to ~$400M to help scale Archer’s Midnight manufacturing to 650 aircraft annually through an obligation to cover manufacturing labor costs as well as certain capital expenditures at Archer’s Georgia manufacturing facility through 2030* TODAY’S ANNOUNCEMENTS // – Planned network includes vertiports at LAX, USC, Orange County, Santa Monica, Hollywood Burbank, Long Beach and Van Nuys. Archer is also working with the Los Angeles Rams and Hollywood Park on a planned exclusive vertiport in the area – Archer delivered Midnight to the U.S. Air Force as part of Archer’s AFWERX Agility Prime contract – Last month, the U.S. Department of Defense accepted the military airworthiness assessment for Midnight – Planned purchase by Future Flight Global is for up to 116 Midnight aircraft worth up to $580M with an initial deposit already paid – Goal is to support the companies’ joint launch of electric vertical take-off and landing aircraft operations in key global markets Secured $230M Of Additional Equity Capital Since End Of Q2 – This equity capital consists of the $55M Archer received from Stellantis on July 1, 2024 under the parties’ strategic funding agreement, as well as a $175M investment today from strategic and institutional investors Image on this page depict simulated operations. *The key terms of the contract manufacturing relationship with Stellantis and the exclusivity in relation to SoFi Stadium are based on agreements in principle that contemplate the parties to enter into future definitive agreements related thereto **Orders under the order book remain conditional, subject to the execution of further definitive agreements with each customer and the satisfaction of certain conditions. Order values represent the Company’s estimate based on an indicative $5M per aircraft price. This is only a prediction and actual results may differ materially due to a variety of factors.

3 Signed MoU With Southwest Airlines to Develop Operational Concepts for Air Taxi Network Received FAA Certification to Begin Operating Commercial Airline Completed Midnight’s Transition Flight & 70+ Flights Since Transition FAA Finalizes Airworthiness Criteria For Midnight – Midnight completed the transition flight on June 8th flying at speeds of 100+ MPH – At ~6,500 lb MTOW, Midnight is believed to be one of the largest eVTOL aircraft to complete transition – Southwest and Archer to collaborate on concept of operations that lays the foundation for integrated electric air taxi networks that would support California airports and the surrounding communities that Southwest serves – The final airworthiness criteria provides the solidified path for the company to achieve Type Certification for Midnight – One of only two companies in the world to achieve this certification progress with the FAA for an eVTOL aircraft – This certificate allows Archer to begin operating aircraft commercially to refine its systems and procedures in advance of launching Midnight into service for airlines like United Airlines when it receives Midnight’s Type Certification – Features takeoff and landing locations in South San Francisco, Napa, San Jose, Oakland, and Livermore – Archer and Kilroy Realty have identified Kilroy’s Oyster Point South San Francisco development as a critical hub in Archer’s planned network Announced Air Taxi Network Connecting Five Locations Across the San Francisco Bay Area Q2 HIGHLIGHTS //

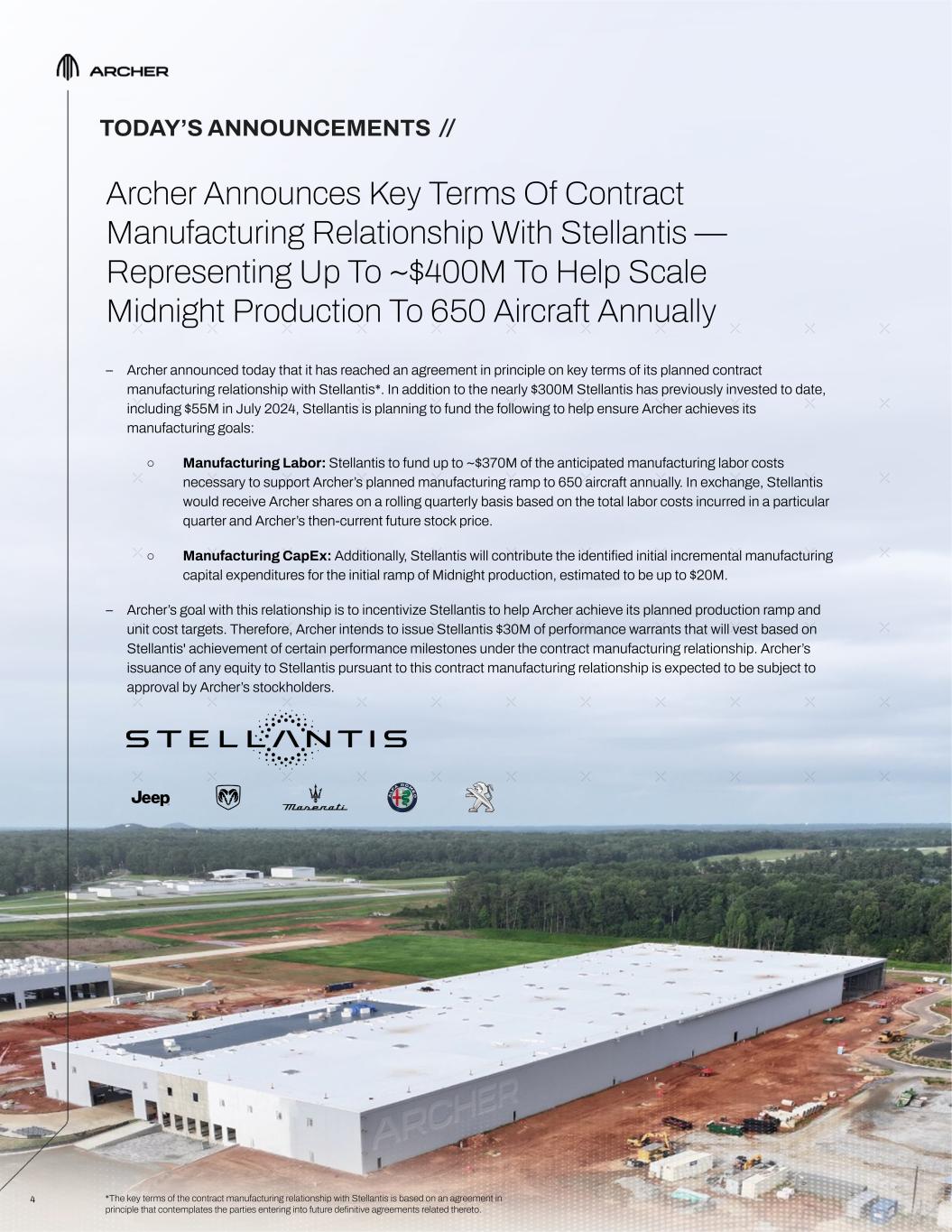

4 Archer Announces Key Terms Of Contract Manufacturing Relationship With Stellantis — Representing Up To ~$400M To Help Scale Midnight Production To 650 Aircraft Annually – Archer announced today that it has reached an agreement in principle on key terms of its planned contract manufacturing relationship with Stellantis*. In addition to the nearly $300M Stellantis has previously invested to date, including $55M in July 2024, Stellantis is planning to fund the following to help ensure Archer achieves its manufacturing goals: ○ Manufacturing Labor: Stellantis to fund up to ~$370M of the anticipated manufacturing labor costs necessary to support Archer’s planned manufacturing ramp to 650 aircraft annually. In exchange, Stellantis would receive Archer shares on a rolling quarterly basis based on the total labor costs incurred in a particular quarter and Archer’s then-current future stock price. ○ Manufacturing CapEx: Additionally, Stellantis will contribute the identified initial incremental manufacturing capital expenditures for the initial ramp of Midnight production, estimated to be up to $20M. – Archer’s goal with this relationship is to incentivize Stellantis to help Archer achieve its planned production ramp and unit cost targets. Therefore, Archer intends to issue Stellantis $30M of performance warrants that will vest based on Stellantis' achievement of certain performance milestones under the contract manufacturing relationship. Archer’s issuance of any equity to Stellantis pursuant to this contract manufacturing relationship is expected to be subject to approval by Archer’s stockholders. TODAY’S ANNOUNCEMENTS // *The key terms of the contract manufacturing relationship with Stellantis is based on an agreement in principle that contemplates the parties entering into future definitive agreements related thereto.

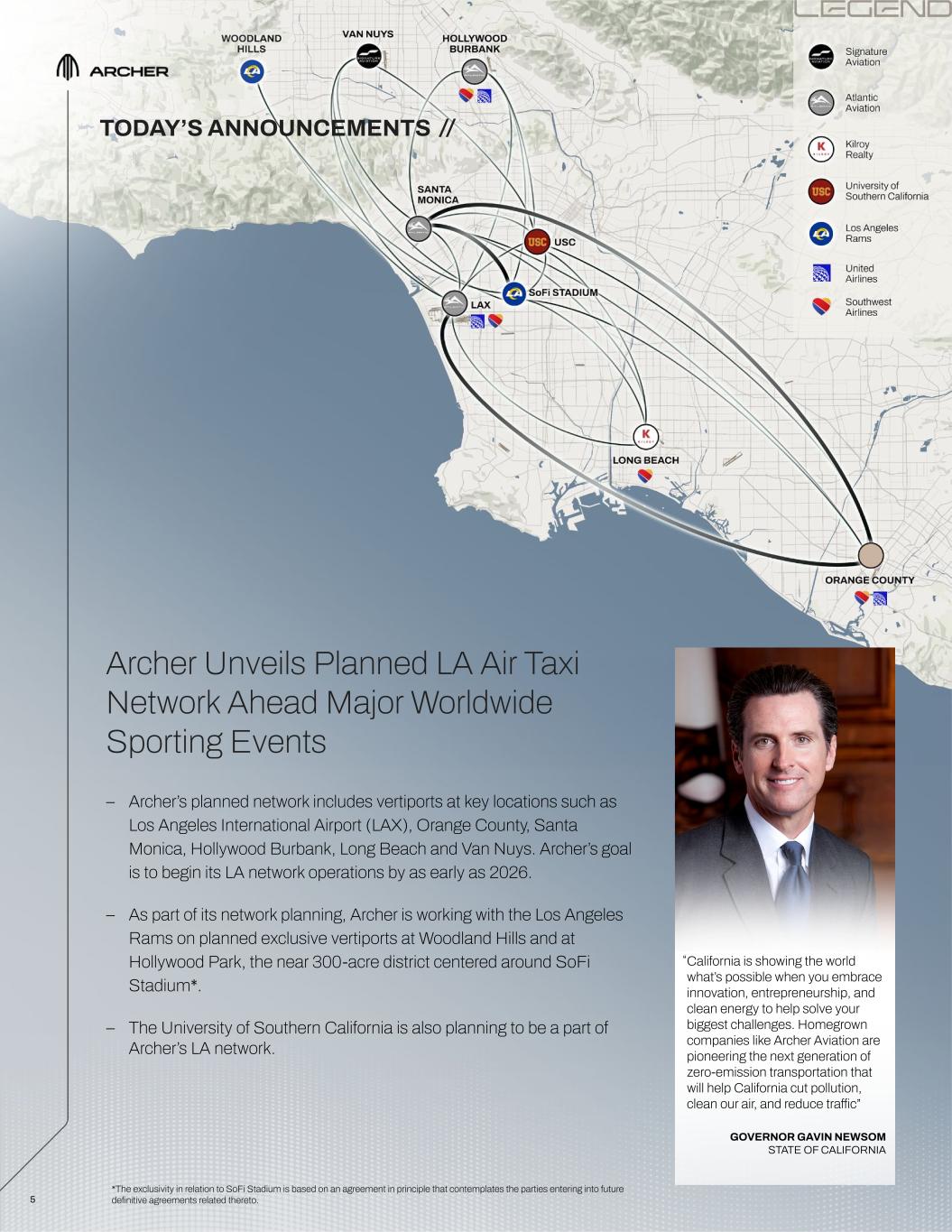

5 Archer Unveils Planned LA Air Taxi Network Ahead Major Worldwide Sporting Events – Archer’s planned network includes vertiports at key locations such as Los Angeles International Airport (LAX), Orange County, Santa Monica, Hollywood Burbank, Long Beach and Van Nuys. Archer’s goal is to begin its LA network operations by as early as 2026. – As part of its network planning, Archer is working with the Los Angeles Rams on planned exclusive vertiports at Woodland Hills and at Hollywood Park, the near 300-acre district centered around SoFi Stadium*. – The University of Southern California is also planning to be a part of Archer’s LA network. California is showing the world what’s possible when you embrace innovation, entrepreneurship, and clean energy to help solve your biggest challenges. Homegrown companies like Archer Aviation are pioneering the next generation of zero-emission transportation that will help California cut pollution, clean our air, and reduce traffic” GOVERNOR GAVIN NEWSOM STATE OF CALIFORNIA “ TODAY’S ANNOUNCEMENTS // *The exclusivity in relation to SoFi Stadium is based on an agreement in principle that contemplates the parties entering into future definitive agreements related thereto. SoFi Stadium

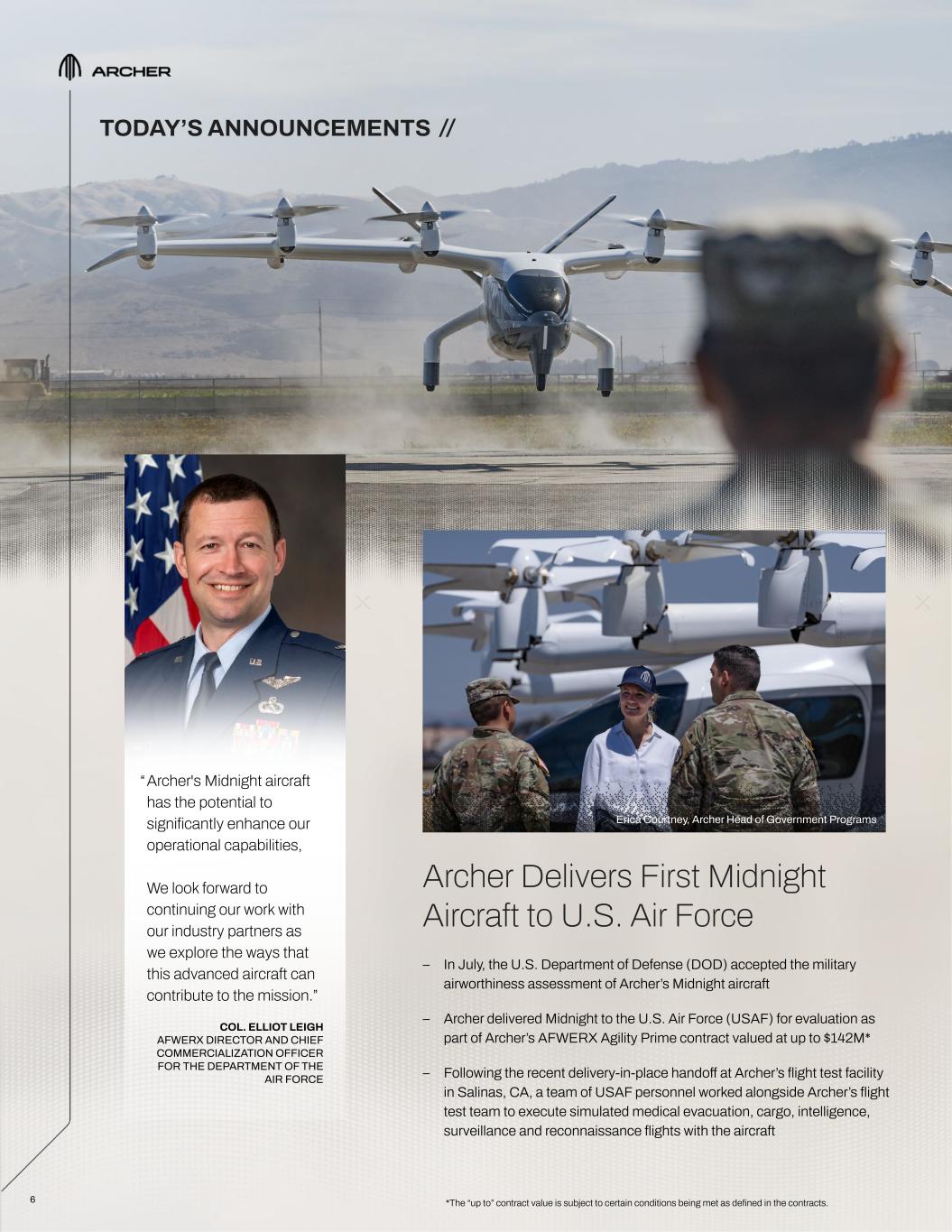

6 Archer Delivers First Midnight Aircraft to U.S. Air Force – In July, the U.S. Department of Defense (DOD) accepted the military airworthiness assessment of Archer’s Midnight aircraft – Archer delivered Midnight to the U.S. Air Force (USAF) for evaluation as part of Archer’s AFWERX Agility Prime contract valued at up to $142M* – Following the recent delivery-in-place handoff at Archer’s flight test facility in Salinas, CA, a team of USAF personnel worked alongside Archer’s flight test team to execute simulated medical evacuation, cargo, intelligence, surveillance and reconnaissance flights with the aircraft *The “up to” contract value is subject to certain conditions being met as defined in the contracts. “Archer's Midnight aircraft has the potential to significantly enhance our operational capabilities, We look forward to continuing our work with our industry partners as we explore the ways that this advanced aircraft can contribute to the mission.” COL. ELLIOT LEIGH AFWERX DIRECTOR AND CHIEF COMMERCIALIZATION OFFICER FOR THE DEPARTMENT OF THE AIR FORCE TODAY’S ANNOUNCEMENTS // Erica Courtney, Archer Head of Government Programs

7 “ This new relationship with FFG increases our access to customers globally and opens up Archer’s global reach to premium international markets.” ADAM GOLDSTEIN CHIEF EXECUTIVE OFFICER ARCHER Image on this page depict simulated operations. “ Archer And Future Flight Global Announce Planned Purchase of up to 116 Midnight Aircraft Worth up to $580M With Pre-Delivery Payments – Archer and Future Flight Global have signed a memorandum of understanding (MOU) for the planned purchase of up to 116 Midnight Aircraft worth up to $580M* – Future Flight Global made an initial deposit and the MOU sets out additional significant pre-delivery payments to be paid upon the completion of the parties’ definitive aircraft purchase agreement – Future Flight Global was founded by members of the core leadership team at Titan Aviation, which has been operating business jets worldwide for over two decades – This aircraft purchase is planned to support the companies’ joint launch of vertical take-off and landing services in key global markets TODAY’S ANNOUNCEMENTS // *Orders under the order book remain conditional, subject to the execution of further definitive agreements with each customer and the satisfaction of certain conditions. Order values represent the Company’s estimate based on an indicative $5M per aircraft price. This is only a prediction and actual results may differ materially due to a variety of factors.

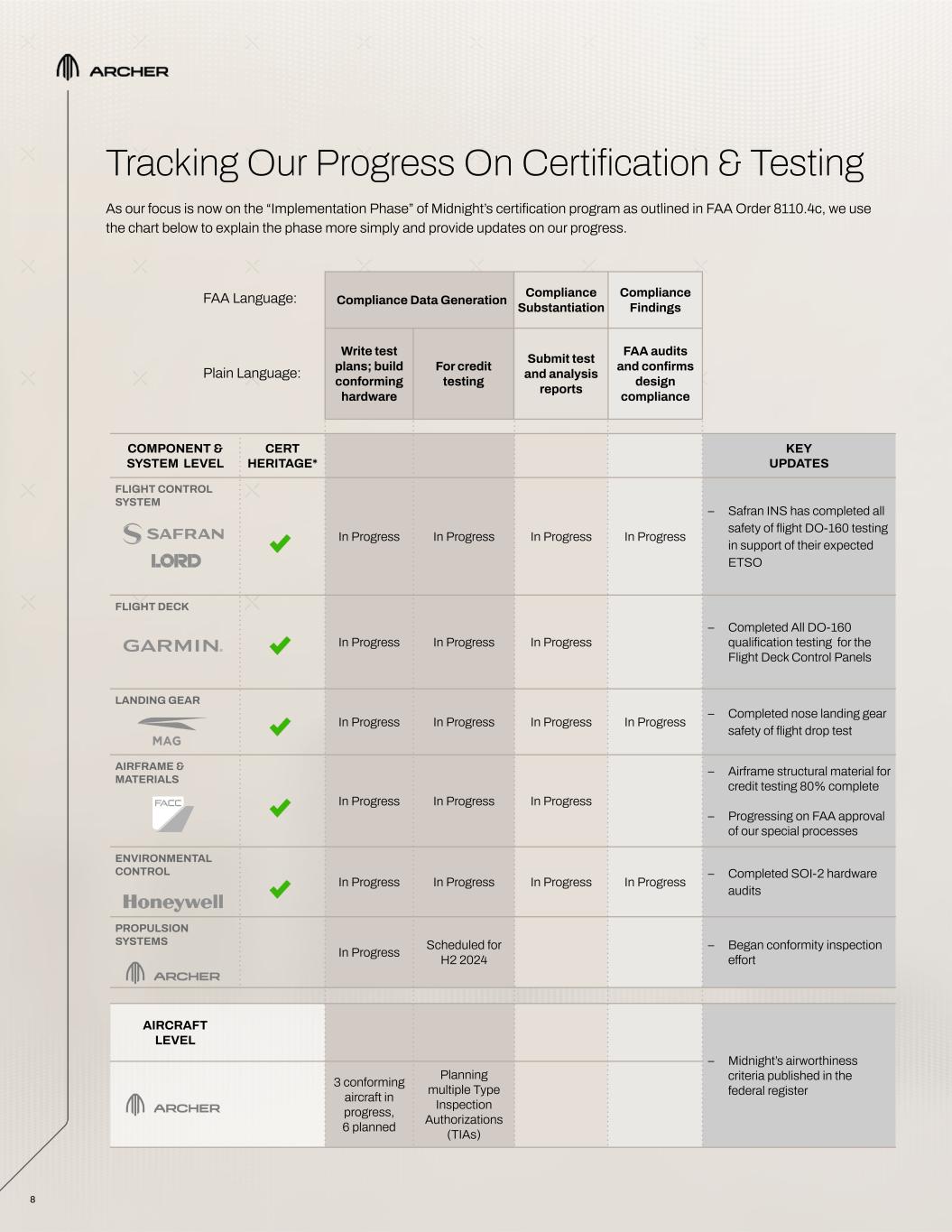

8 Tracking Our Progress On Certification & Testing COMPONENT & SYSTEM LEVEL CERT HERITAGE* KEY UPDATES FLIGHT CONTROL SYSTEM In Progress In Progress In Progress In Progress – Safran INS has completed all safety of flight DO-160 testing in support of their expected ETSO FLIGHT DECK In Progress In Progress In Progress – Completed All DO-160 qualification testing for the Flight Deck Control Panels LANDING GEAR In Progress In Progress In Progress In Progress – Completed nose landing gear safety of flight drop test AIRFRAME & MATERIALS In Progress In Progress In Progress – Airframe structural material for credit testing 80% complete – Progressing on FAA approval of our special processes ENVIRONMENTAL CONTROL In Progress In Progress In Progress In Progress – Completed SOI-2 hardware audits PROPULSION SYSTEMS In Progress Scheduled for H2 2024 – Began conformity inspection effort AIRCRAFT LEVEL – Midnight’s airworthiness criteria published in the federal register3 conforming aircraft in progress, 6 planned Planning multiple Type Inspection Authorizations (TIAs) Write test plans; build conforming hardware For credit testing Submit test and analysis reports Compliance Data Generation Compliance Substantiation FAA Language: Plain Language: FAA audits and confirms design compliance Compliance Findings As our focus is now on the “Implementation Phase” of Midnight’s certification program as outlined in FAA Order 8110.4c, we use the chart below to explain the phase more simply and provide updates on our progress.

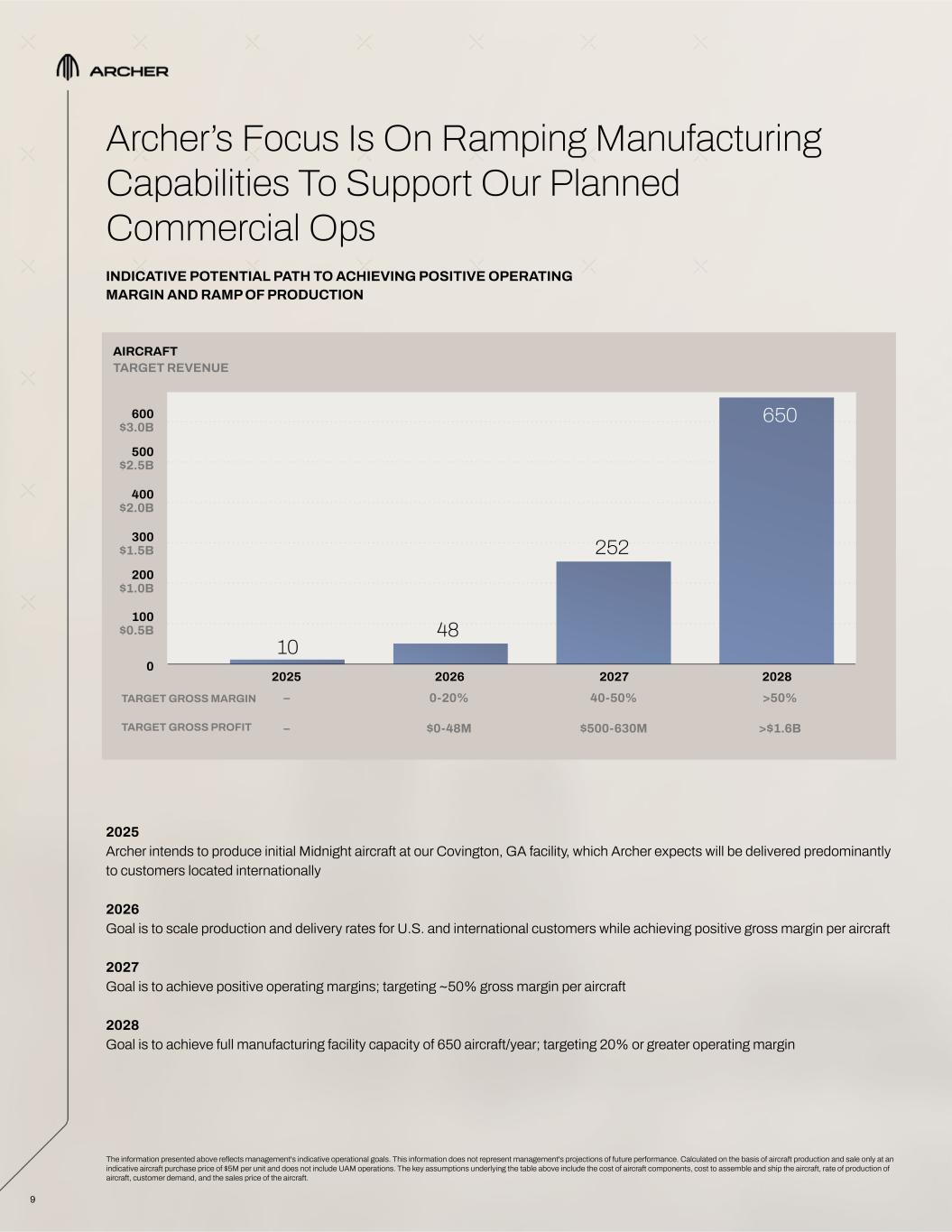

9 Archer’s Focus Is On Ramping Manufacturing Capabilities To Support Our Planned Commercial Ops INDICATIVE POTENTIAL PATH TO ACHIEVING POSITIVE OPERATING MARGIN AND RAMP OF PRODUCTION 2025 Archer intends to produce initial Midnight aircraft at our Covington, GA facility, which Archer expects will be delivered predominantly to customers located internationally 2026 Goal is to scale production and delivery rates for U.S. and international customers while achieving positive gross margin per aircraft 2027 Goal is to achieve positive operating margins; targeting ~50% gross margin per aircraft 2028 Goal is to achieve full manufacturing facility capacity of 650 aircraft/year; targeting 20% or greater operating margin 200 $1.0B 400 $2.0B 600 $3.0B AIRCRAFT TARGET REVENUE 300 $1.5B 500 $2.5B 100 $0.5B 0 2025 2026 2027 2028 TARGET GROSS MARGIN TARGET GROSS PROFIT – – 0-20% $0-48M 40-50% $500-630M >50% >$1.6B The information presented above reflects management's indicative operational goals. This information does not represent management's projections of future performance. Calculated on the basis of aircraft production and sale only at an indicative aircraft purchase price of $5M per unit and does not include UAM operations. The key assumptions underlying the table above include the cost of aircraft components, cost to assemble and ship the aircraft, rate of production of aircraft, customer demand, and the sales price of the aircraft. 10 48 252 650

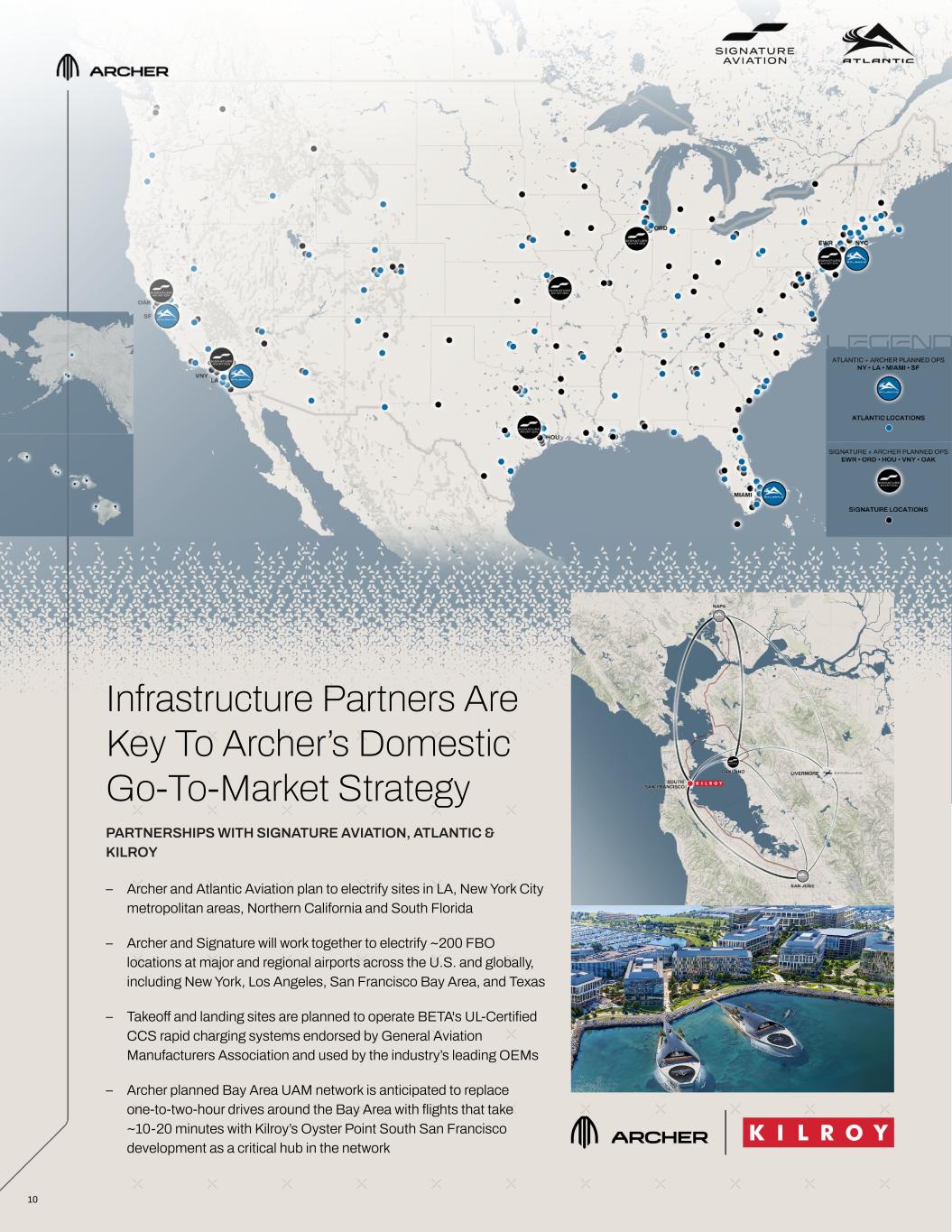

10 Infrastructure Partners Are Key To Archer’s Domestic Go-To-Market Strategy – Archer and Atlantic Aviation plan to electrify sites in LA, New York City metropolitan areas, Northern California and South Florida – Archer and Signature will work together to electrify ~200 FBO locations at major and regional airports across the U.S. and globally, including New York, Los Angeles, San Francisco Bay Area, and Texas – Takeoff and landing sites are planned to operate BETA's UL-Certified CCS rapid charging systems endorsed by General Aviation Manufacturers Association and used by the industry’s leading OEMs – Archer planned Bay Area UAM network is anticipated to replace one-to-two-hour drives around the Bay Area with flights that take ~10-20 minutes with Kilroy’s Oyster Point South San Francisco development as a critical hub in the network PARTNERSHIPS WITH SIGNATURE AVIATION, ATLANTIC & KILROY

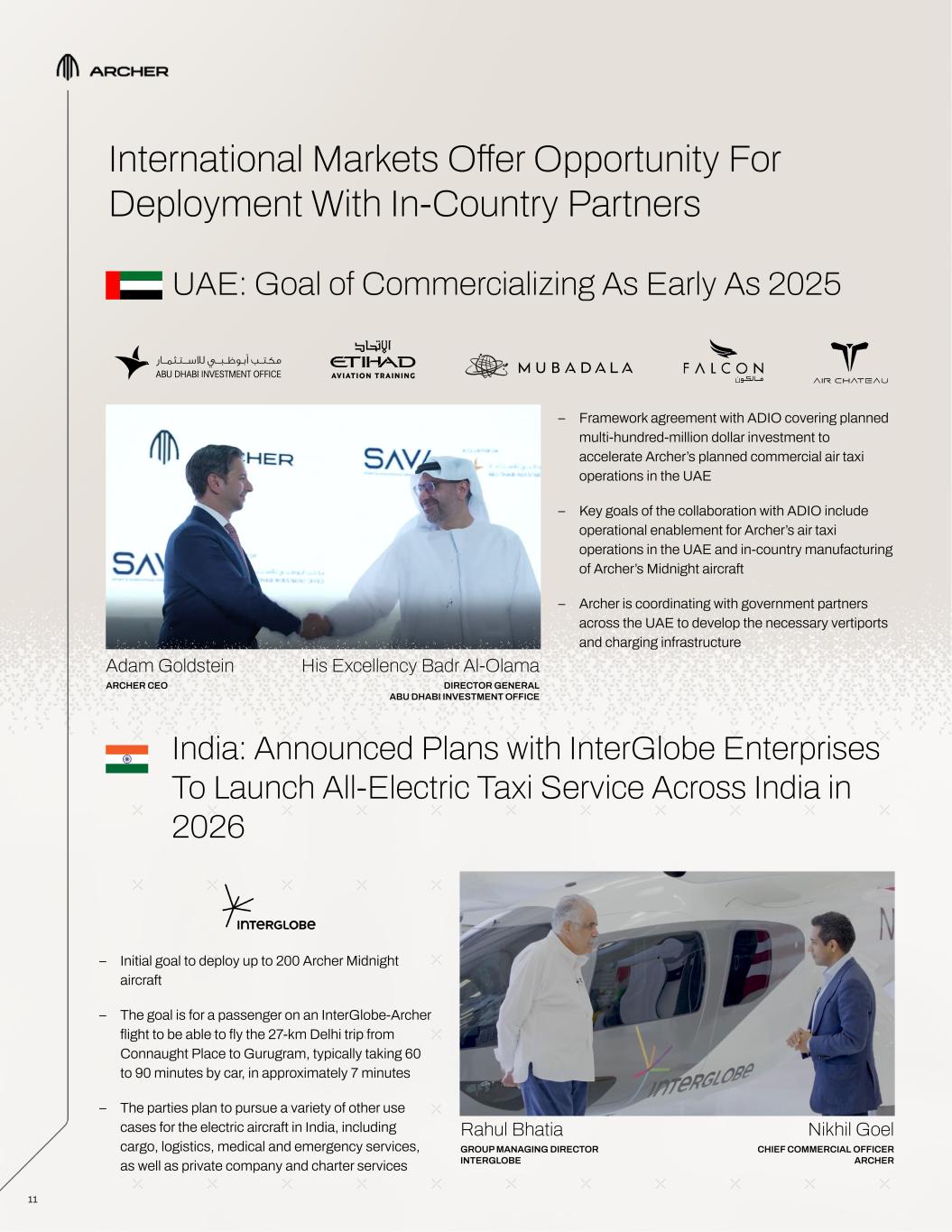

11 UAE: Goal of Commercializing As Early As 2025 India: Announced Plans with InterGlobe Enterprises To Launch All-Electric Taxi Service Across India in 2026 – Initial goal to deploy up to 200 Archer Midnight aircraft – The goal is for a passenger on an InterGlobe-Archer flight to be able to fly the 27-km Delhi trip from Connaught Place to Gurugram, typically taking 60 to 90 minutes by car, in approximately 7 minutes – The parties plan to pursue a variety of other use cases for the electric aircraft in India, including cargo, logistics, medical and emergency services, as well as private company and charter services Rahul Bhatia GROUP MANAGING DIRECTOR INTERGLOBE Nikhil Goel CHIEF COMMERCIAL OFFICER ARCHER International Markets Offer Opportunity For Deployment With In-Country Partners – Framework agreement with ADIO covering planned multi-hundred-million dollar investment to accelerate Archer’s planned commercial air taxi operations in the UAE – Key goals of the collaboration with ADIO include operational enablement for Archer’s air taxi operations in the UAE and in-country manufacturing of Archer’s Midnight aircraft – Archer is coordinating with government partners across the UAE to develop the necessary vertiports and charging infrastructure Adam Goldstein ARCHER CEO His Excellency Badr Al-Olama DIRECTOR GENERAL ABU DHABI INVESTMENT OFFICE

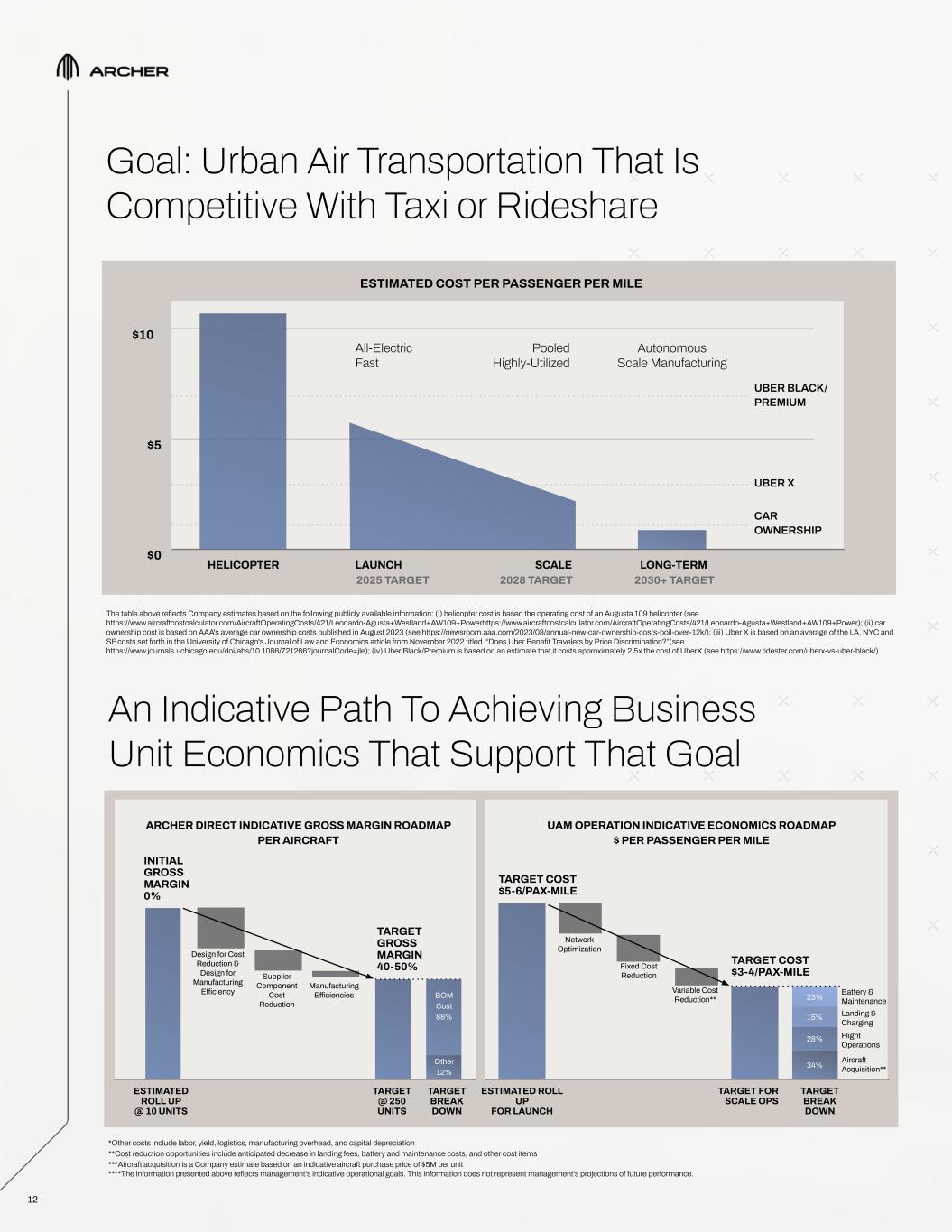

12 An Indicative Path To Achieving Business Unit Economics That Support That Goal $0 $10 SCALELAUNCHHELICOPTER LONG-TERM $5 All-Electric Fast Pooled Highly-Utilized Autonomous Scale Manufacturing UBER BLACK/ PREMIUM UBER X CAR OWNERSHIP 2025 TARGET 2028 TARGET 2030+ TARGET Goal: Urban Air Transportation That Is Competitive With Taxi or Rideshare ESTIMATED COST PER PASSENGER PER MILE ARCHER DIRECT INDICATIVE GROSS MARGIN ROADMAP PER AIRCRAFT INITIAL GROSS MARGIN 0% Design for Cost Reduction & Design for Manufacturing Efficiency Supplier Component Cost Reduction Manufacturing Efficiencies TARGET GROSS MARGIN 40-50% BOM Cost 88% Other 12% ESTIMATED ROLL UP @ 10 UNITS TARGET @ 250 UNITS TARGET BREAK DOWN UAM OPERATION INDICATIVE ECONOMICS ROADMAP $ PER PASSENGER PER MILE TARGET COST $5-6/PAX-MILE ESTIMATED ROLL UP FOR LAUNCH TARGET FOR SCALE OPS TARGET BREAK DOWN TARGET COST $3-4/PAX-MILE Network Optimization Fixed Cost Reduction Variable Cost Reduction** 23% 15% 28% 34% Battery & Maintenance Landing & Charging Flight Operations Aircraft Acquisition** *Other costs include labor, yield, logistics, manufacturing overhead, and capital depreciation **Cost reduction opportunities include anticipated decrease in landing fees, battery and maintenance costs, and other cost items ***Aircraft acquisition is a Company estimate based on an indicative aircraft purchase price of $5M per unit ****The information presented above reflects management's indicative operational goals. This information does not represent management's projections of future performance. The table above reflects Company estimates based on the following publicly available information: (i) helicopter cost is based the operating cost of an Augusta 109 helicopter (see https://www.aircraftcostcalculator.com/AircraftOperatingCosts/421/Leonardo-Agusta+Westland+AW109+Powerhttps://www.aircraftcostcalculator.com/AircraftOperatingCosts/421/Leonardo-Agusta+Westland+AW109+Power); (ii) car ownership cost is based on AAA's average car ownership costs published in August 2023 (see https://newsroom.aaa.com/2023/08/annual-new-car-ownership-costs-boil-over-12k/); (iii) Uber X is based on an average of the LA, NYC and SF costs set forth in the University of Chicago's Journal of Law and Economics article from November 2022 titled “Does Uber Benefit Travelers by Price Discrimination?”(see https://www.journals.uchicago.edu/doi/abs/10.1086/721266?journalCode=jle); (iv) Uber Black/Premium is based on an estimate that it costs approximately 2.5x the cost of UberX (see https://www.ridester.com/uberx-vs-uber-black/)

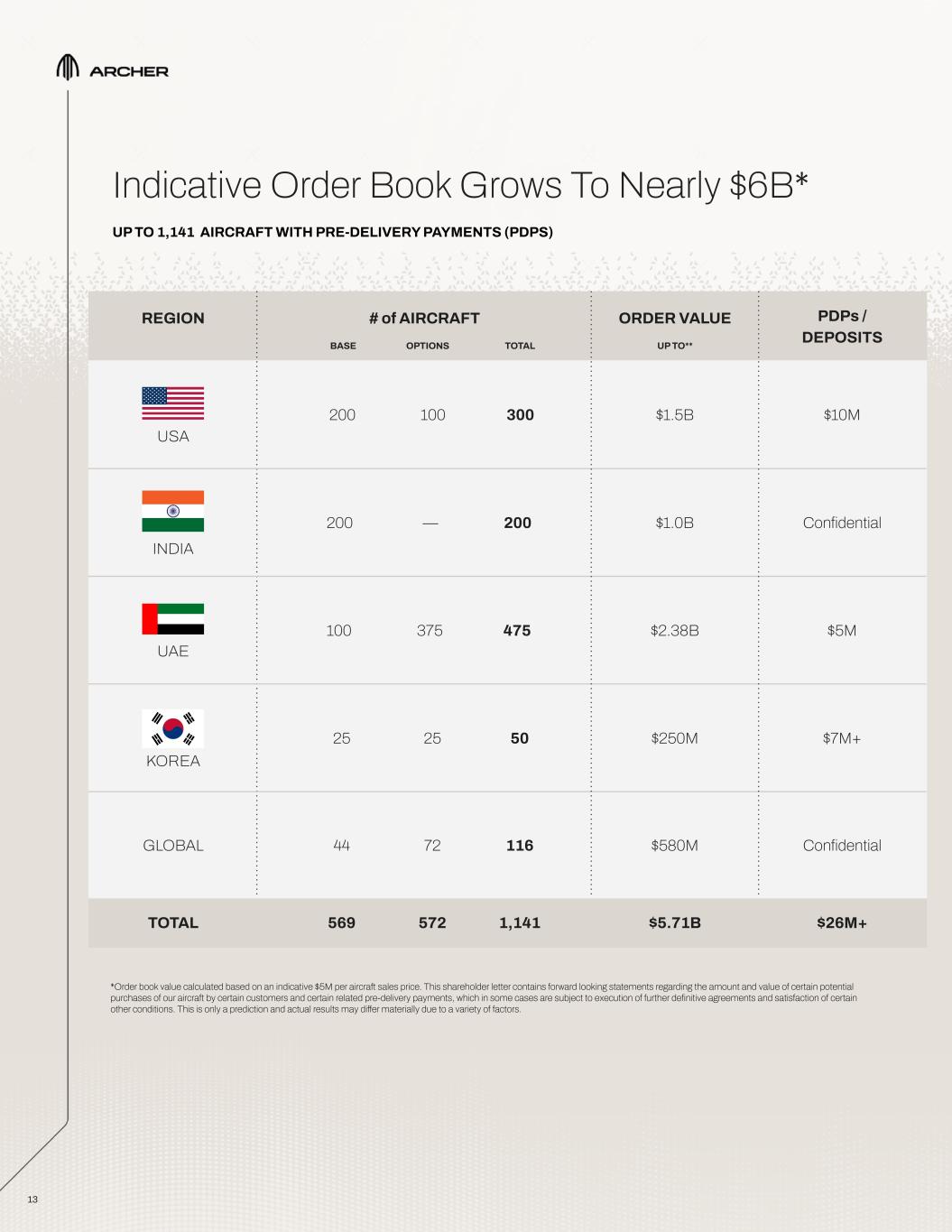

13 Indicative Order Book Grows To Nearly $6B* UP TO 1,141 AIRCRAFT WITH PRE-DELIVERY PAYMENTS (PDPS) *Order book value calculated based on an indicative $5M per aircraft sales price. This shareholder letter contains forward looking statements regarding the amount and value of certain potential purchases of our aircraft by certain customers and certain related pre-delivery payments, which in some cases are subject to execution of further definitive agreements and satisfaction of certain other conditions. This is only a prediction and actual results may differ materially due to a variety of factors. Indicative Order Book is Now $3.5B* # of AIRCRAFT ORDER VALUEREGION PDPs / DEPOSITS TOTAL $5.71B569 572 $26M+1,141 $1.5B200 100 $10M USA 300 $1.0B200 — Confidential INDIA 200 $2.38B100 375 $5M UAE 475 $250M25 25 $7M+ KOREA 50 $580M44 72 ConfidentialGLOBAL 116 UP TO**TOTALOPTIONSBASE

14 AUG 13 CANACCORD ANNUAL GROWTH CONFERENCE Boston, MA AUG 31 ECONOMIC TIMES WORLD LEADERS’ FORUM New Delhi, India SEP 3-5 DEUTSCHE BANK ANNUAL AIRCRAFT FINANCING & LEASING CONFERENCE New York, NY SEP 9-11 GLOBAL AEROSPACE SUMMIT Washington, D.C. SEP 9-11 HC WAINWRIGHT ANNUAL GLOBAL INVESTMENT CONFERENCE New York, NY SEP 9-12 ALL-IN SUMMIT Los Angeles, CA SEP 9-12 ICAO AAM SUMMIT Montreal, Canada SEP 19 HONEYWELL AAM SUMMIT Washington, D.C. SEP 30- UP SUMMIT OCT 2 Bentonville, AK OCT 29-31 FUTURE INVESTMENT INITIATIVE Riyadh, Saudi Arabia NOV 11-14 WEB SUMMIT Lisbon, Portugal Today’s Webcast & Conference Call Details TIME 2 PM PT (5 PM ET) WEBCAST Accessible via our IR website (investors.archer.com) CONFERENCE 404-975-4839 (domestic) CALL +1 833-470-1428 (international) Access code: 013488 Upcoming Events

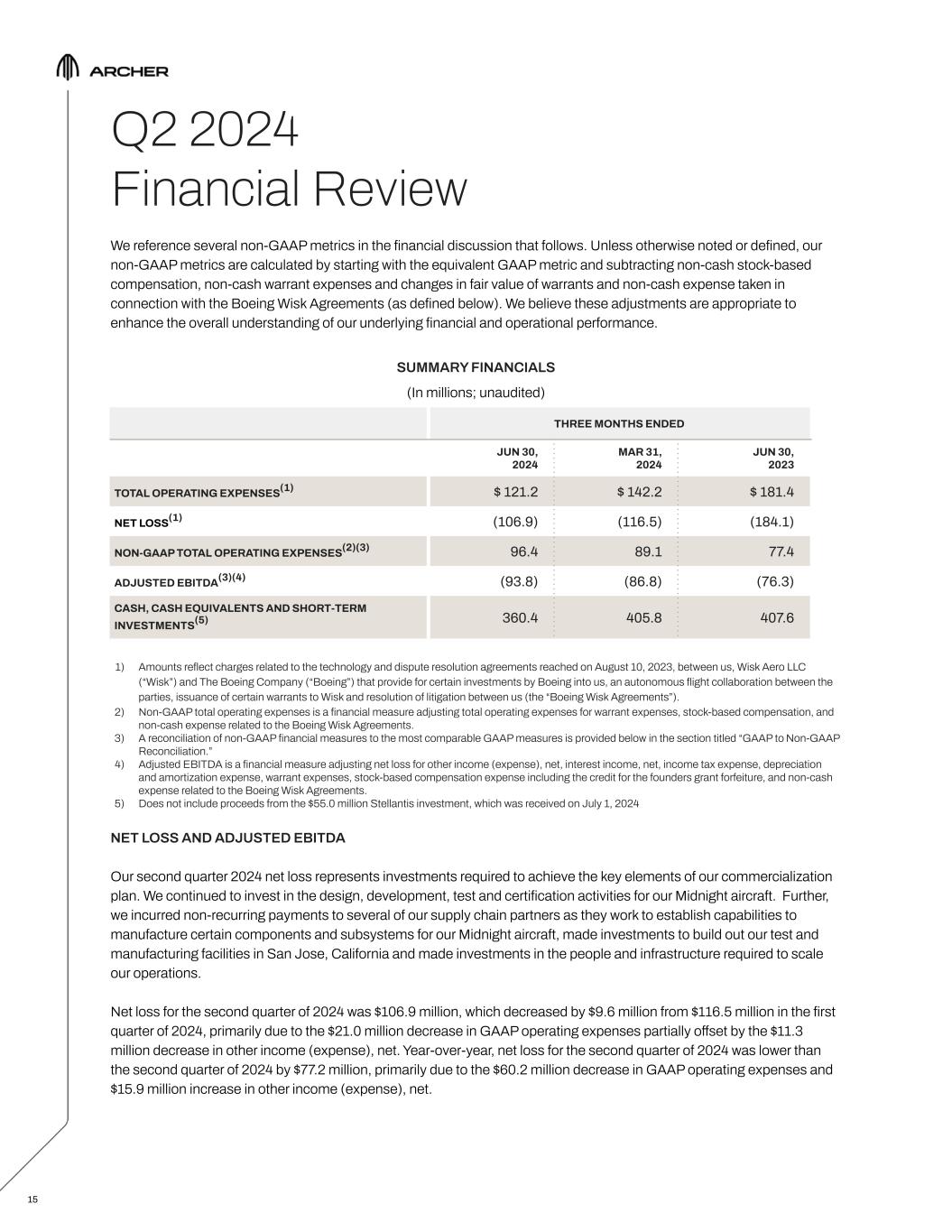

Q2 2024 Financial Review We reference several non-GAAP metrics in the financial discussion that follows. Unless otherwise noted or defined, our non-GAAP metrics are calculated by starting with the equivalent GAAP metric and subtracting non-cash stock-based compensation, non-cash warrant expenses and changes in fair value of warrants and non-cash expense taken in connection with the Boeing Wisk Agreements (as defined below). We believe these adjustments are appropriate to enhance the overall understanding of our underlying financial and operational performance. SUMMARY FINANCIALS (In millions; unaudited) 1) Amounts reflect charges related to the technology and dispute resolution agreements reached on August 10, 2023, between us, Wisk Aero LLC (“Wisk”) and The Boeing Company (“Boeing”) that provide for certain investments by Boeing into us, an autonomous flight collaboration between the parties, issuance of certain warrants to Wisk and resolution of litigation between us (the “Boeing Wisk Agreements”). 2) Non-GAAP total operating expenses is a financial measure adjusting total operating expenses for warrant expenses, stock-based compensation, and non-cash expense related to the Boeing Wisk Agreements. 3) A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided below in the section titled “GAAP to Non-GAAP Reconciliation.” 4) Adjusted EBITDA is a financial measure adjusting net loss for other income (expense), net, interest income, net, income tax expense, depreciation and amortization expense, warrant expenses, stock-based compensation expense including the credit for the founders grant forfeiture, and non-cash expense related to the Boeing Wisk Agreements. 5) Does not include proceeds from the $55.0 million Stellantis investment, which was received on July 1, 2024 NET LOSS AND ADJUSTED EBITDA Our second quarter 2024 net loss represents investments required to achieve the key elements of our commercialization plan. We continued to invest in the design, development, test and certification activities for our Midnight aircraft. Further, we incurred non-recurring payments to several of our supply chain partners as they work to establish capabilities to manufacture certain components and subsystems for our Midnight aircraft, made investments to build out our test and manufacturing facilities in San Jose, California and made investments in the people and infrastructure required to scale our operations. Net loss for the second quarter of 2024 was $106.9 million, which decreased by $9.6 million from $116.5 million in the first quarter of 2024, primarily due to the $21.0 million decrease in GAAP operating expenses partially offset by the $11.3 million decrease in other income (expense), net. Year-over-year, net loss for the second quarter of 2024 was lower than the second quarter of 2024 by $77.2 million, primarily due to the $60.2 million decrease in GAAP operating expenses and $15.9 million increase in other income (expense), net. 15 THREE MONTHS ENDED JUN 30, 2024 MAR 31, 2024 JUN 30, 2023 TOTAL OPERATING EXPENSES(1) $ 121.2 $ 142.2 $ 181.4 NET LOSS(1) (106.9) (116.5) (184.1) NON-GAAP TOTAL OPERATING EXPENSES(2)(3) 96.4 89.1 77.4 ADJUSTED EBITDA(3)(4) (93.8) (86.8) (76.3) CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS(5) 360.4 405.8 407.6

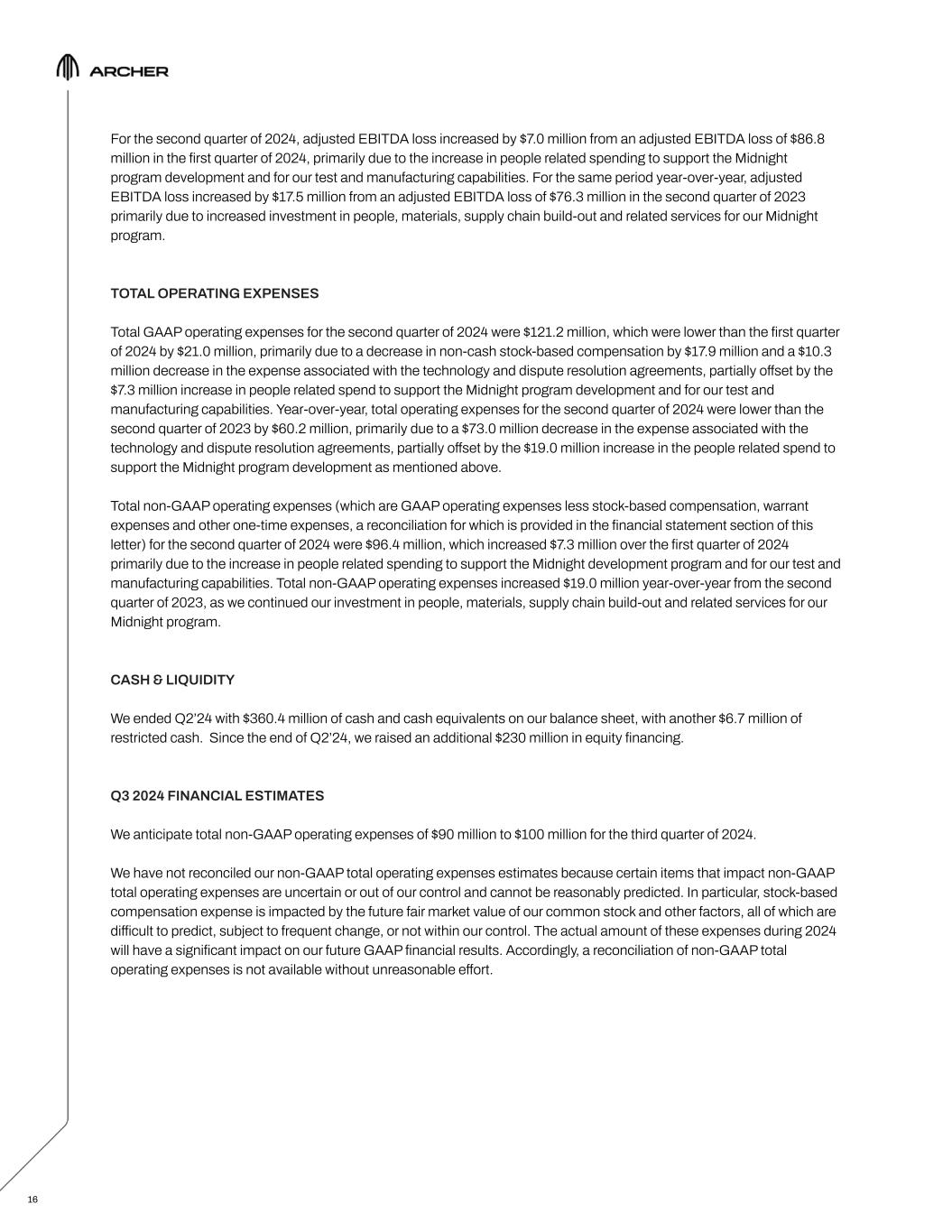

16 For the second quarter of 2024, adjusted EBITDA loss increased by $7.0 million from an adjusted EBITDA loss of $86.8 million in the first quarter of 2024, primarily due to the increase in people related spending to support the Midnight program development and for our test and manufacturing capabilities. For the same period year-over-year, adjusted EBITDA loss increased by $17.5 million from an adjusted EBITDA loss of $76.3 million in the second quarter of 2023 primarily due to increased investment in people, materials, supply chain build-out and related services for our Midnight program. TOTAL OPERATING EXPENSES Total GAAP operating expenses for the second quarter of 2024 were $121.2 million, which were lower than the first quarter of 2024 by $21.0 million, primarily due to a decrease in non-cash stock-based compensation by $17.9 million and a $10.3 million decrease in the expense associated with the technology and dispute resolution agreements, partially offset by the $7.3 million increase in people related spend to support the Midnight program development and for our test and manufacturing capabilities. Year-over-year, total operating expenses for the second quarter of 2024 were lower than the second quarter of 2023 by $60.2 million, primarily due to a $73.0 million decrease in the expense associated with the technology and dispute resolution agreements, partially offset by the $19.0 million increase in the people related spend to support the Midnight program development as mentioned above. Total non-GAAP operating expenses (which are GAAP operating expenses less stock-based compensation, warrant expenses and other one-time expenses, a reconciliation for which is provided in the financial statement section of this letter) for the second quarter of 2024 were $96.4 million, which increased $7.3 million over the first quarter of 2024 primarily due to the increase in people related spending to support the Midnight development program and for our test and manufacturing capabilities. Total non-GAAP operating expenses increased $19.0 million year-over-year from the second quarter of 2023, as we continued our investment in people, materials, supply chain build-out and related services for our Midnight program. CASH & LIQUIDITY We ended Q2’24 with $360.4 million of cash and cash equivalents on our balance sheet, with another $6.7 million of restricted cash. Since the end of Q2’24, we raised an additional $230 million in equity financing. Q3 2024 FINANCIAL ESTIMATES We anticipate total non-GAAP operating expenses of $90 million to $100 million for the third quarter of 2024. We have not reconciled our non-GAAP total operating expenses estimates because certain items that impact non-GAAP total operating expenses are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP total operating expenses is not available without unreasonable effort.

ARCHER AVIATION INC. CONSOLIDATED BALANCE SHEETS (In millions, except share and per share data; unaudited) 17 THREE MONTHS ENDED JUN 30, 2024 DEC 31, 2023 Assets Current assets Cash and cash equivalents $ 360.4 $ 464.6 Restricted cash 6.7 6.9 Prepaid expenses 5.4 7.9 Other current assets 2.5 0.8 Total current assets 375.0 480.2 Property and equipment, net 92.9 57.6 Intangible assets, net 0.4 0.4 Right-of-use assets 8.0 8.9 Other long-term assets 7.7 7.2 Total assets $ 484.0 $ 554.3 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 25.1 $ 14.3 Current portion of lease liabilities 3.3 2.8 Accrued expenses and other current liabilities 55.2 96.9 Total current liabilities 83.6 114.0 Notes payable 32.7 7.2 Lease liabilities, net of current portion 11.5 13.2 Warrant liabilities 9.6 39.9 Other long-term liabilities 12.6 12.9 Total liabilities 150.0 187.2 Stockholders’ equity Preferred stock, $0.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of June 30, 2024 and December 31, 2023 - - Class A common stock, $0.0001 par value; 700,000,000 shares authorized; 298,571,164 and 265,617,341 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively - - Class B common stock, $0.0001 par value; 300,000,000 shares authorized; 37,216,756 and 38,165,615 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively - - Additional paid-in capital 1,706.3 1,515.9 Accumulated deficit (1,372.2) (1,148.8) Accumulated other comprehensive loss (0.1) - Total stockholders’ equity 334.0 367.1 Total liabilities and stockholders’ equity $ 484.0 $ 554.3

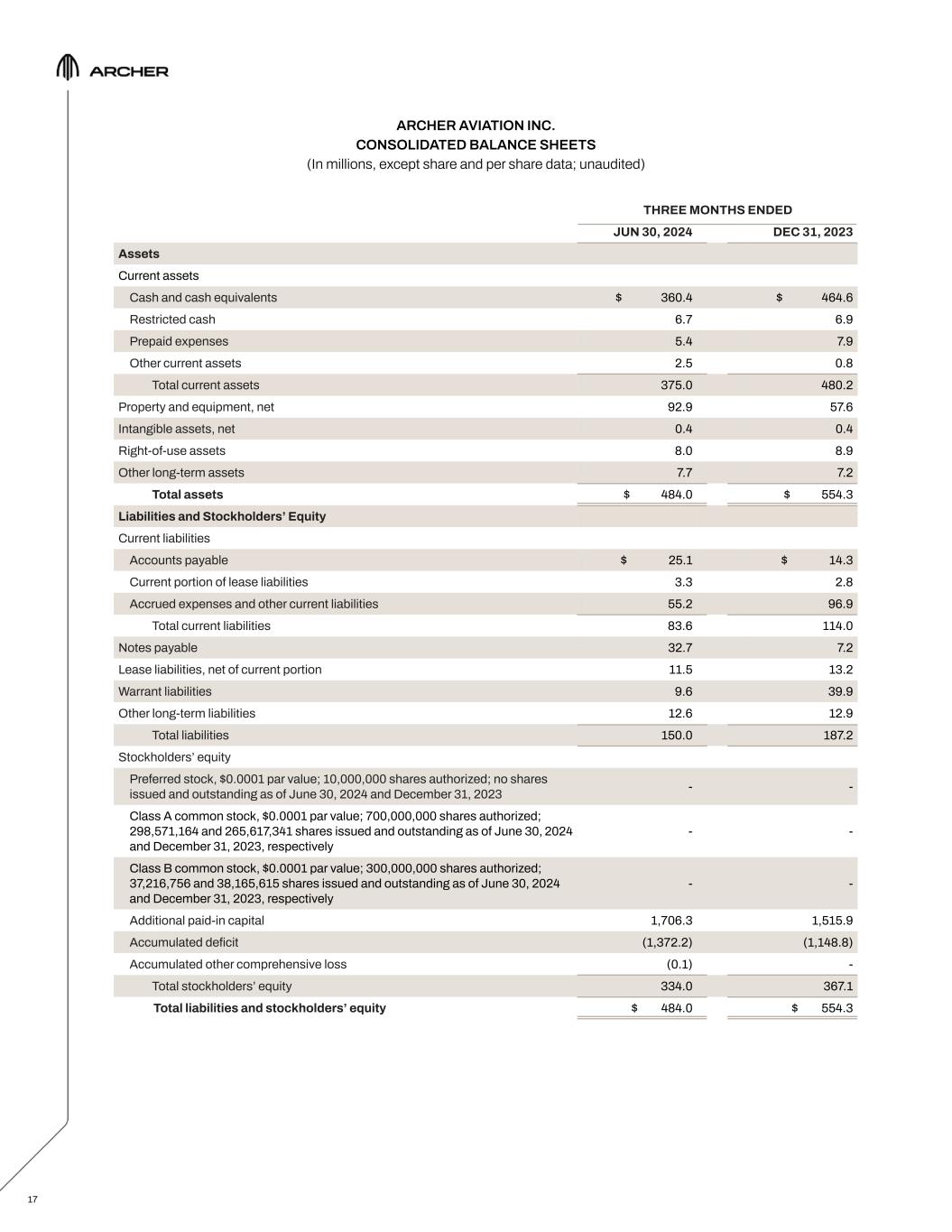

ARCHER AVIATION INC. CONSOLIDATED STATEMENT OF OPERATIONS (In millions, except share and per share data; unaudited) 18 THREE MONTHS ENDED JUNE 30, 2024 2023 OPERATING EXPENSES Research and development $ 89.8 $ 63.3 General and administrative 31.4 118.1 Total operating expenses 121.2 181.4 Loss from operations (121.2) (181.4) Other income (expense), net 9.3 (6.6) Interest income, net 5.1 4.1 Loss before income taxes (106.8) (183.9) Income tax expense (0.1) (0.2) Net loss $ (106.9) $ (184.1) Net loss per share, basic and diluted $ (0.32) $ (0.73) Weighted-average shares outstanding, basic and diluted 334,072,229 251,018,612

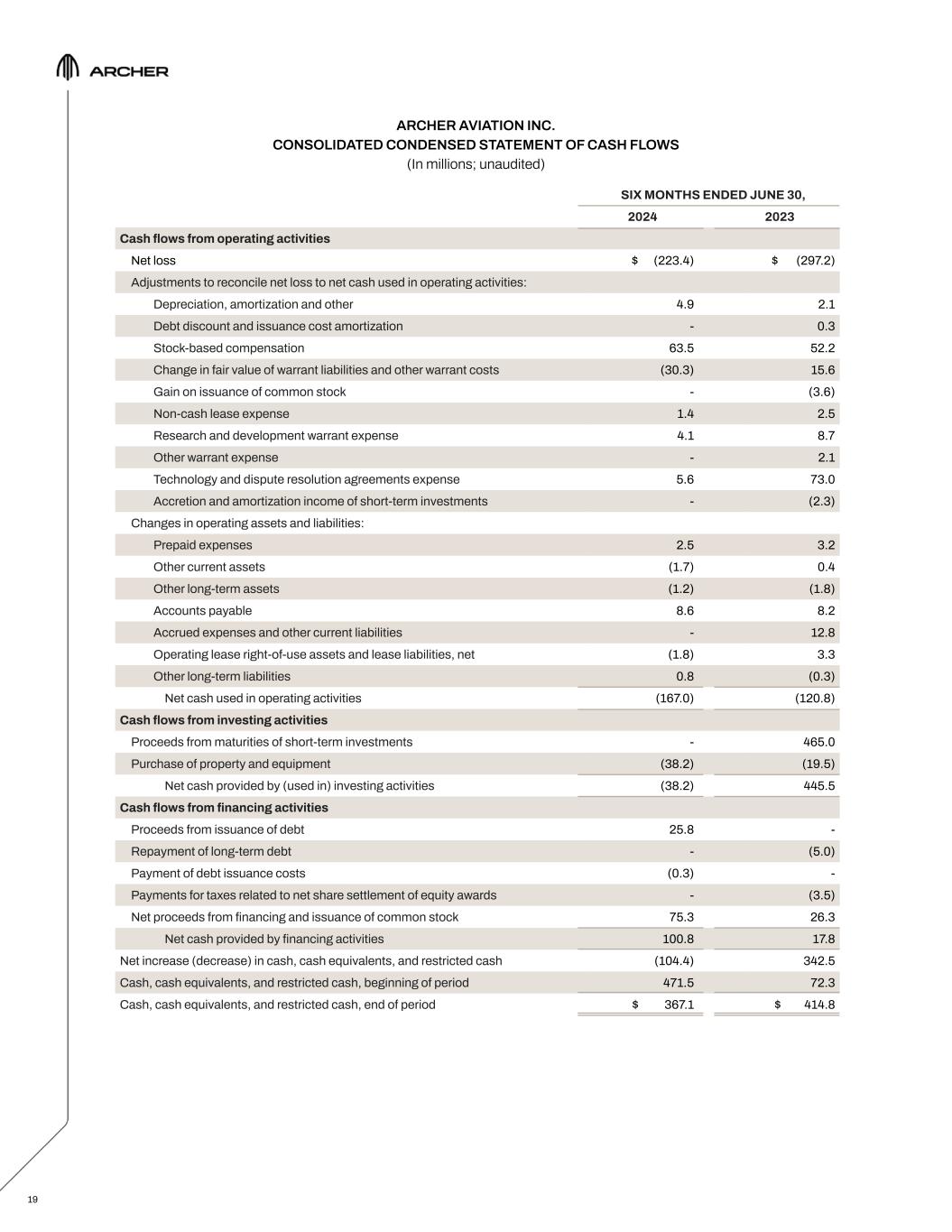

ARCHER AVIATION INC. CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS (In millions; unaudited) 19 SIX MONTHS ENDED JUNE 30, 2024 2023 Cash flows from operating activities Net loss $ (223.4) $ (297.2) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation, amortization and other 4.9 2.1 Debt discount and issuance cost amortization - 0.3 Stock-based compensation 63.5 52.2 Change in fair value of warrant liabilities and other warrant costs (30.3) 15.6 Gain on issuance of common stock - (3.6) Non-cash lease expense 1.4 2.5 Research and development warrant expense 4.1 8.7 Other warrant expense - 2.1 Technology and dispute resolution agreements expense 5.6 73.0 Accretion and amortization income of short-term investments - (2.3) Changes in operating assets and liabilities: Prepaid expenses 2.5 3.2 Other current assets (1.7) 0.4 Other long-term assets (1.2) (1.8) Accounts payable 8.6 8.2 Accrued expenses and other current liabilities - 12.8 Operating lease right-of-use assets and lease liabilities, net (1.8) 3.3 Other long-term liabilities 0.8 (0.3) Net cash used in operating activities (167.0) (120.8) Cash flows from investing activities Proceeds from maturities of short-term investments - 465.0 Purchase of property and equipment (38.2) (19.5) Net cash provided by (used in) investing activities (38.2) 445.5 Cash flows from financing activities Proceeds from issuance of debt 25.8 - Repayment of long-term debt - (5.0) Payment of debt issuance costs (0.3) - Payments for taxes related to net share settlement of equity awards - (3.5) Net proceeds from financing and issuance of common stock 75.3 26.3 Net cash provided by financing activities 100.8 17.8 Net increase (decrease) in cash, cash equivalents, and restricted cash (104.4) 342.5 Cash, cash equivalents, and restricted cash, beginning of period 471.5 72.3 Cash, cash equivalents, and restricted cash, end of period $ 367.1 $ 414.8

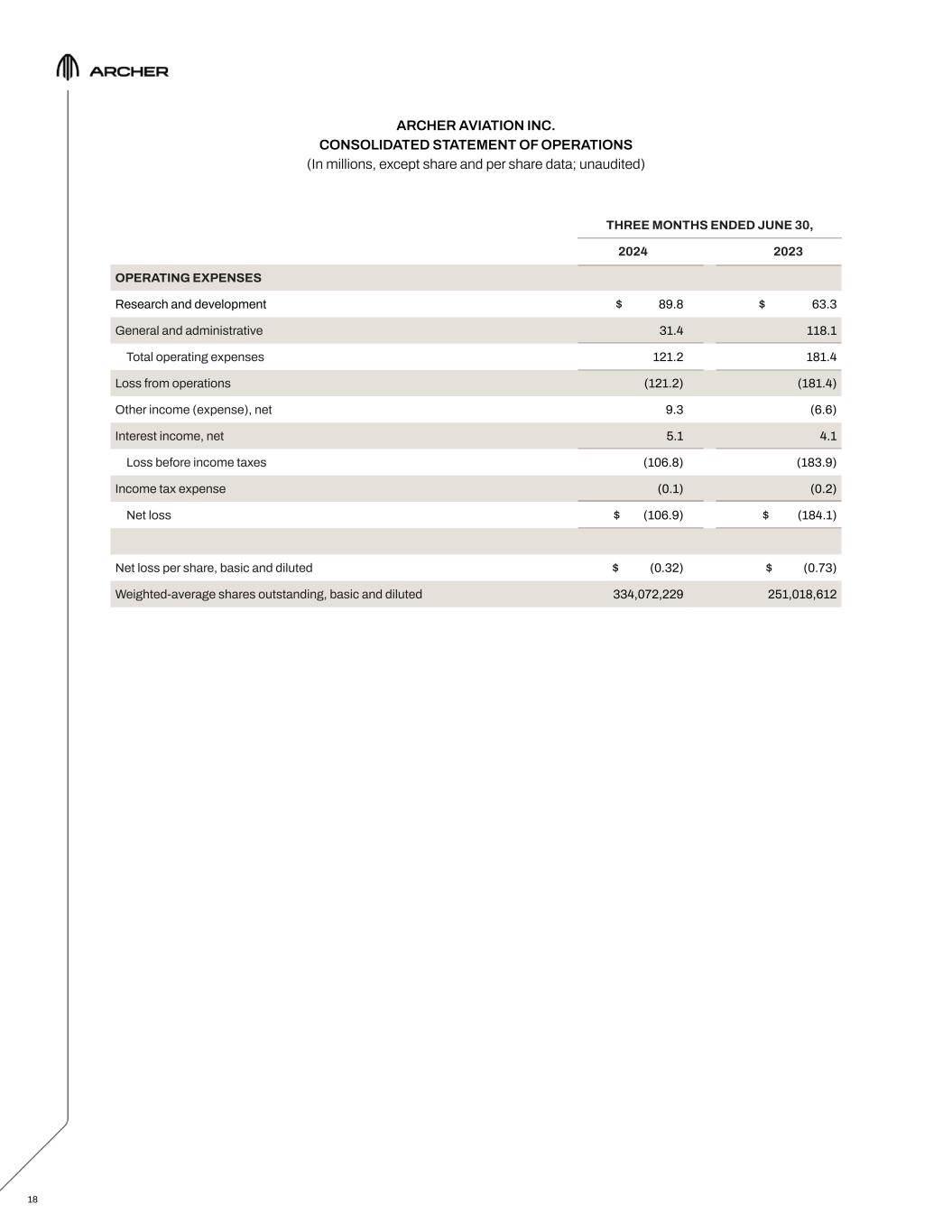

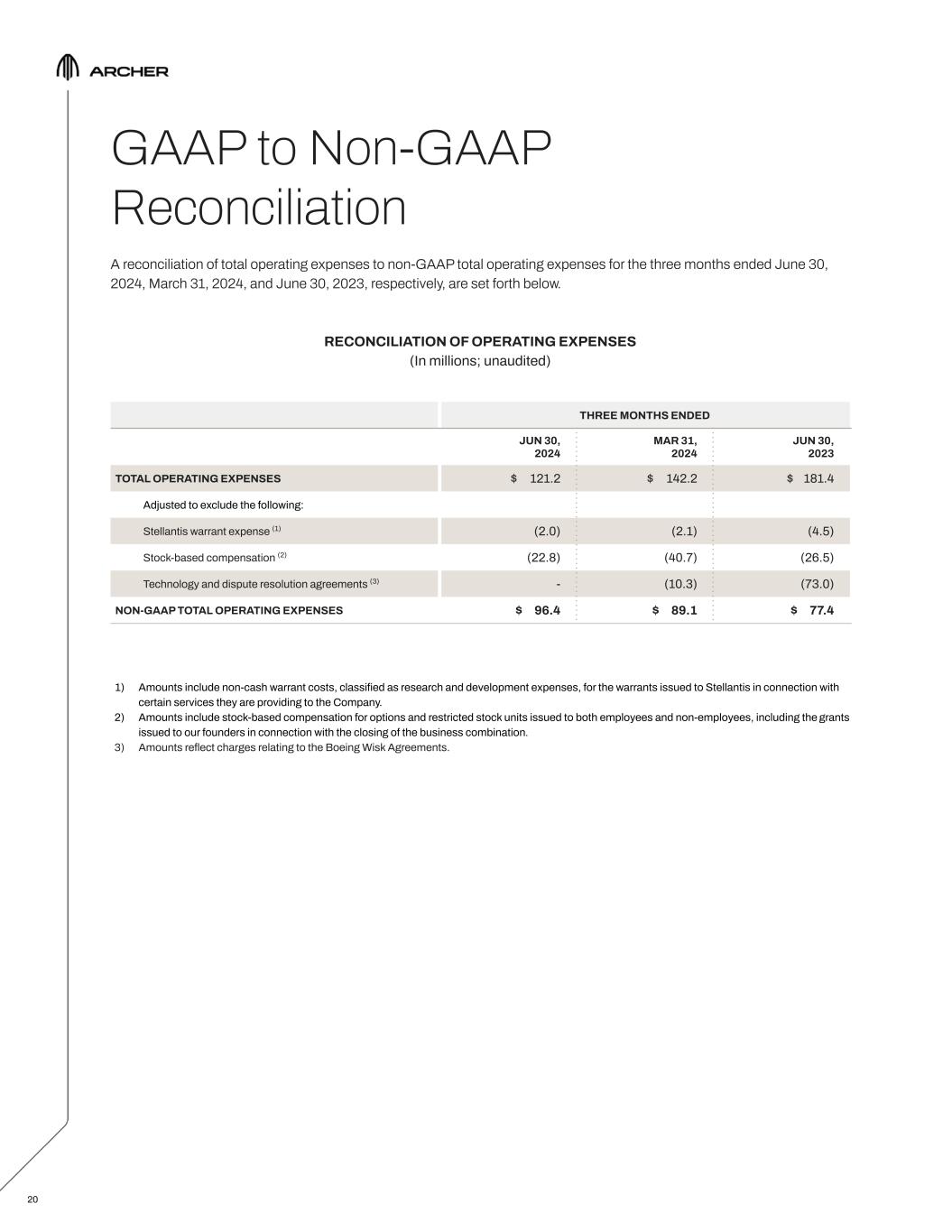

GAAP to Non-GAAP Reconciliation A reconciliation of total operating expenses to non-GAAP total operating expenses for the three months ended June 30, 2024, March 31, 2024, and June 30, 2023, respectively, are set forth below. RECONCILIATION OF OPERATING EXPENSES (In millions; unaudited) 1) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 2) Amounts include stock-based compensation for options and restricted stock units issued to both employees and non-employees, including the grants issued to our founders in connection with the closing of the business combination. 3) Amounts reflect charges relating to the Boeing Wisk Agreements. 20 THREE MONTHS ENDED JUN 30, 2024 MAR 31, 2024 JUN 30, 2023 TOTAL OPERATING EXPENSES $ 121.2 $ 142.2 $ 181.4 Adjusted to exclude the following: Stellantis warrant expense (1) (2.0) (2.1) (4.5) Stock-based compensation (2) (22.8) (40.7) (26.5) Technology and dispute resolution agreements (3) - (10.3) (73.0) NON-GAAP TOTAL OPERATING EXPENSES $ 96.4 $ 89.1 $ 77.4

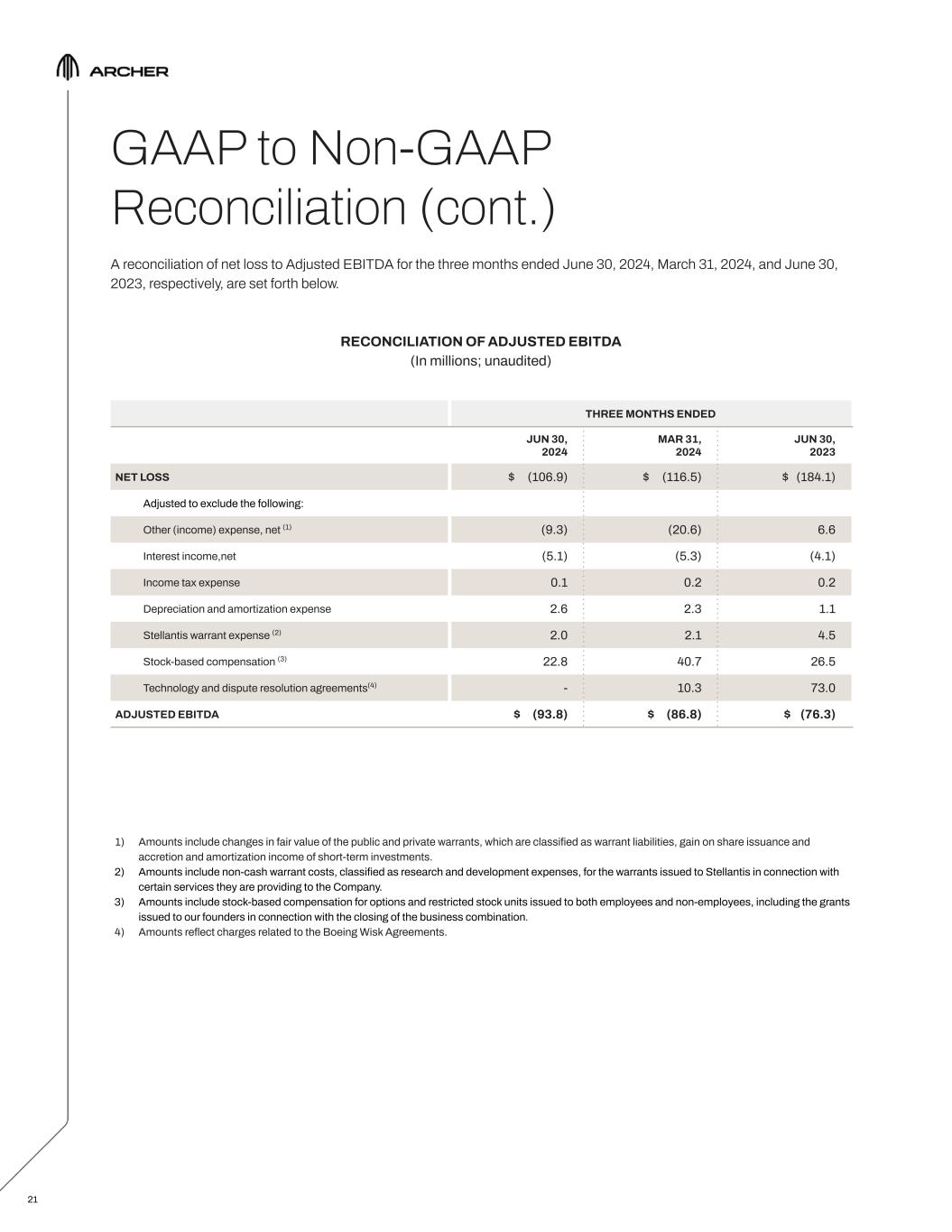

21 GAAP to Non-GAAP Reconciliation (cont.) A reconciliation of net loss to Adjusted EBITDA for the three months ended June 30, 2024, March 31, 2024, and June 30, 2023, respectively, are set forth below. RECONCILIATION OF ADJUSTED EBITDA (In millions; unaudited) 1) Amounts include changes in fair value of the public and private warrants, which are classified as warrant liabilities, gain on share issuance and accretion and amortization income of short-term investments. 2) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 3) Amounts include stock-based compensation for options and restricted stock units issued to both employees and non-employees, including the grants issued to our founders in connection with the closing of the business combination. 4) Amounts reflect charges related to the Boeing Wisk Agreements. THREE MONTHS ENDED JUN 30, 2024 MAR 31, 2024 JUN 30, 2023 NET LOSS $ (106.9) $ (116.5) $ (184.1) Adjusted to exclude the following: Other (income) expense, net (1) (9.3) (20.6) 6.6 Interest income,net (5.1) (5.3) (4.1) Income tax expense 0.1 0.2 0.2 Depreciation and amortization expense 2.6 2.3 1.1 Stellantis warrant expense (2) 2.0 2.1 4.5 Stock-based compensation (3) 22.8 40.7 26.5 Technology and dispute resolution agreements(4) - 10.3 73.0 ADJUSTED EBITDA $ (93.8) $ (86.8) $ (76.3)

22 GAAP to Non-GAAP Reconciliation (cont.) NON-GAAP FINANCIAL MEASURES To supplement our condensed consolidated financial results prepared in accordance with GAAP, we use a number of non-GAAP financial measures to help us in analyzing and assessing our overall business performance, for making operating decisions and for forecasting and planning future periods. We consider the use of non-GAAP financial measures helpful in assessing our current financial performance, ongoing operations and prospects for the future as well as understanding financial and business trends relating to our financial condition and results of operations. While we use non-GAAP financial measures as a tool to enhance our understanding of certain aspects of our financial performance and to provide incremental insight into the underlying factors and trends affecting our performance, we do not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial measures. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides useful supplemental data that, while not a substitute for GAAP financial measures, can offer insight in the review of our financial and operational performance and enables investors to more fully understand trends in our current and future performance. In assessing our business during the second quarter ended June 30, 2024, we excluded items in the following general categories from one or more of our non-GAAP financial measures, certain of which are described below: – STOCK-BASED COMPENSATION EXPENSE We believe that providing non-GAAP measures excluding stock-based compensation expense, in addition to the GAAP measures, allows for better comparability of our financial results from period to period. We prepare and maintain our budgets and forecasts for future periods on a basis consistent with this non-GAAP financial measure. Further, companies use a variety of types of equity awards as well as a variety of methodologies, assumptions and estimates to determine stock-based compensation expense. We believe that excluding stock-based compensation expenses enhances our ability and the ability of investors to understand the impact of non-cash stock-based compensation on our operating results and to compare our results against the results of other companies. – WARRANT EXPENSE & GAINS OR LOSSES FROM REVALUATION OF WARRANTS Expense from our common stock warrants issued to Stellantis, which is recurring (but non-cash) and gains or losses from change in fair value of public and private warrants from revaluation will be reflected in our financial results for the foreseeable future. We exclude warrant expense and gains or losses from change in fair value for similar reasons to our stock-based compensation expense. Each of the non-GAAP financial measures presented in this letter to shareholders should not be considered in isolation from, or as a substitute for, a measure of financial performance prepared in accordance with GAAP and are presented for supplemental informational purposes only. Further, investors are cautioned that there are inherent limitations associated with the use of each of these non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures have no standardized meaning prescribed by GAAP and are not based on a comprehensive set of accounting rules or principles and many of the adjustments to the GAAP financial measures reflect the exclusion of items that are recurring and may be reflected in our financial results for the foreseeable future. In addition, the non-GAAP measures we use may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information in the reconciliation included in this letter to shareholders regarding the GAAP amounts excluded from the non-GAAP financial measures. In addition, as noted above, we evaluate the non-GAAP financial measures together with the most directly comparable GAAP financial information. Investors are encouraged to review the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures included in this letter to shareholders.

23 Forward-Looking Statements & Disclaimers This shareholder letter includes forward-looking statements. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the third quarter of fiscal year 2024, our business strategy and plans, aircraft performance, the design and target specifications of our aircraft, the design of our manufacturing and automation processes, the pace at which we intend to design, develop, certify, conduct test flights, manufacture and commercialize our planned eVTOL aircraft, operational goals with respect to the timing of the launch of our commercial operations, the rate of scaling aircraft production and operating margins, the buildout and collaboration with Stellantis of our planned manufacturing facility and processes, including the ability to reach definitive documentation with respect to ongoing negotiations, the buildout and deployment of our UAM network,including the ability to reach definitive documentation with respect to our planned Los Angeles UAM network, our ability to produce aircraft on our anticipated timeline to fulfill order demand, timing of the closing of the equity investment round and use of proceeds, the design, development and implementation of vertiport infrastructure, the development, and projected market size of, the future urban air mobility market, total expected contract value with the DoD, indicative orders for aircraft in agreements with third-party partners, and the expected timeline for the receipt of regulatory certification from the FAA and international regulatory agencies. In addition, this shareholder letter refers to certain memorandums of understanding that are conditioned on the future execution by the parties of additional binding definitive agreements incorporating the terms outlined in each memorandum of understanding, which definitive agreements may not be completed or may contain different terms than those set forth in each memorandum of understanding. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date hereof, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: the early stage nature of our business and our past and projected future losses; our ability to design, develop, certify, manufacture and commercialize our aircraft and UAM ecosystem; the operation of aircraft and manufacturing processes to meet the Company’s designed-for targets and goals; our dependence on a limited number of customers for our current indicative aircraft orders, which are subject to conditions, further negotiation and reaching mutual agreement on certain material terms, and the risk that such parties may cancel those orders or never place them; the effectiveness of our marketing and growth strategies, including our ability to effectively market electric air transportation as a substitute for conventional methods of transportation; our ability to compete in the UAM and eVTOL industries; our ability to obtain any required certifications, licenses, approvals, or authorizations from governmental authorities; our ability to achieve our business milestones, such as the completion of our manufacturing facility in Georgia, commencing the manufacturing of aircraft, and launch products and services on anticipated timelines; our dependence on suppliers for the parts and components in our aircraft; our ability to develop commercial-scale manufacturing capabilities; regulatory requirements and other obstacles outside of our control that slow market adoption of electric aircraft, such as the inability to obtain and maintain adequate vertiport infrastructure; our ability to hire, train and retain qualified personnel; risks related to our UAM ecosystem operating in densely populated metropolitan areas and heavily regulated airports; adverse publicity from accidents involving electric aircraft or lithium-ion battery cells; the impact of labor and union activities on our workforce; losses resulting from indexed price escalation clauses in purchase orders; regulatory risks related to evolving laws and regulations in our industry; the impact of macroeconomic conditions, inflation, interest rates, war and geopolitical conflicts, natural disasters, infectious disease outbreaks and pandemics; our need for and the availability of additional capital; and cybersecurity risks; and risks related to the dual class structure of our common stock, which has the effect of concentrating voting power with holders of our Class B common stock, including Adam Goldstein, Archer’s Chief Executive Officer and a member of Archer’s board of directors, and which Class B common stock will automatically convert into shares of Class A common stock, and therefore no longer have concentrated voting power on the last trading date of the fiscal year in which the number of Class B common stock represents less than 10% of the total number of common stock outstanding.

24 Forward-Looking Statements & Disclaimers (cont.) The indicative operational goals referenced in this document reflect numerous estimates and assumptions with respect to general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to the our business, all of which are difficult to predict and many of which are beyond the our control including, among other things, the timing of the receipt of required certifications, licenses, approvals or authorizations from governmental authorities, the timing of the completion of the manufacturing facility in Georgia, the actual price per vehicle paid by customers and the costs of manufacturing the aircraft, consumer demand for our aircraft and the other matters described above. These operational goals should not be relied upon as being indicative of future economic performance or results. The inclusion of the operational goals in this document is not an admission or representation that such information is material. The assumptions and estimates underlying the operational goals are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual operating results to differ materially from those presented. There can be no assurance that these goals are indicative of our future performance or that actual results will not differ materially from those presented in the operational goals. Inclusion of the operational goals in this document should not be regarded as a representation by any person that the operational goals will be achieved. The information concerning our operational goals is subjective in many respects and thus is susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. Additional risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in our filings with the Securities and Exchange Commission (SEC), including our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are or will be available on our investor relations website at http://investors.archer.com and on the SEC website at www.sec.gov. All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements.

TM Unlock The Skies