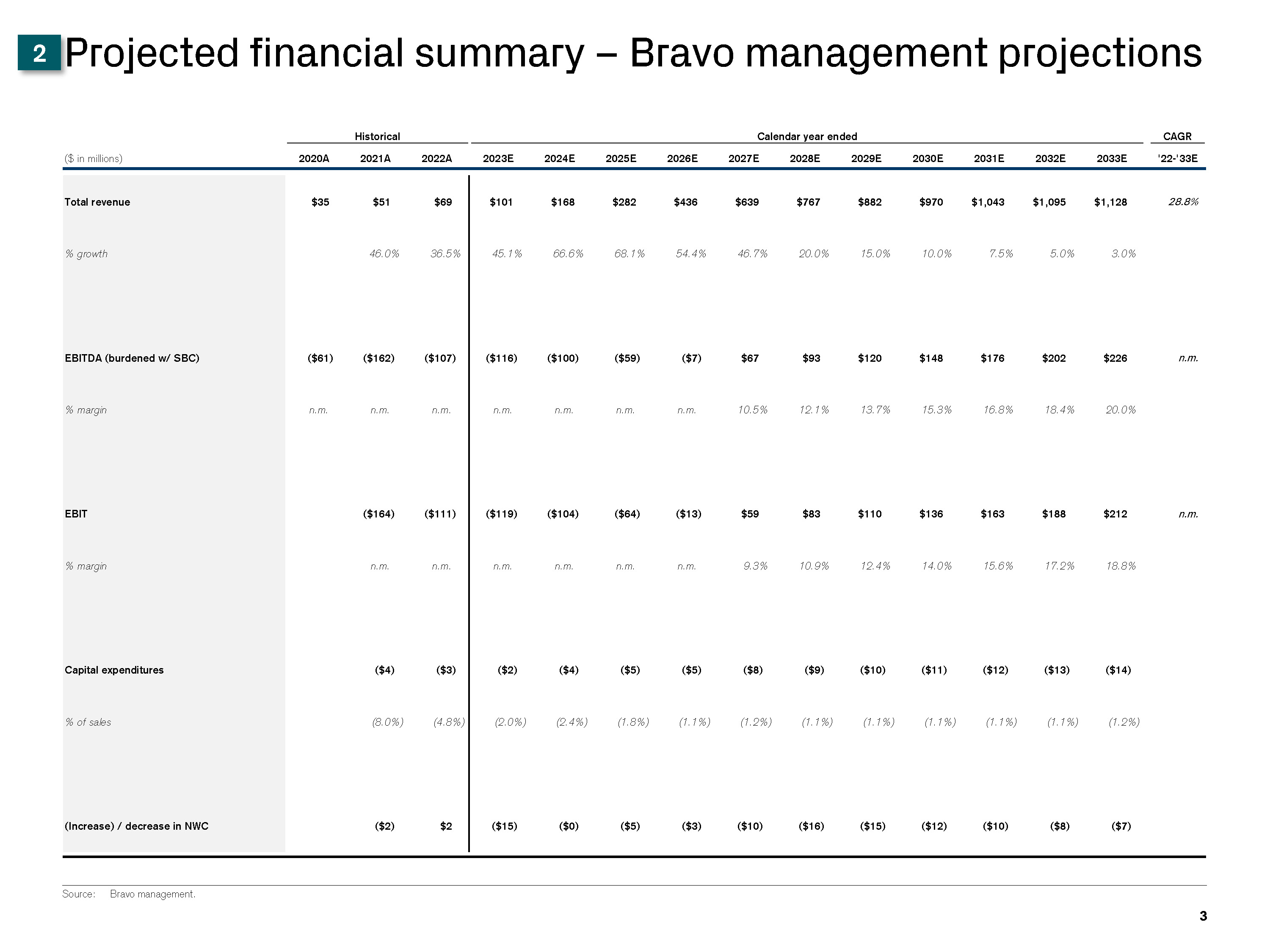

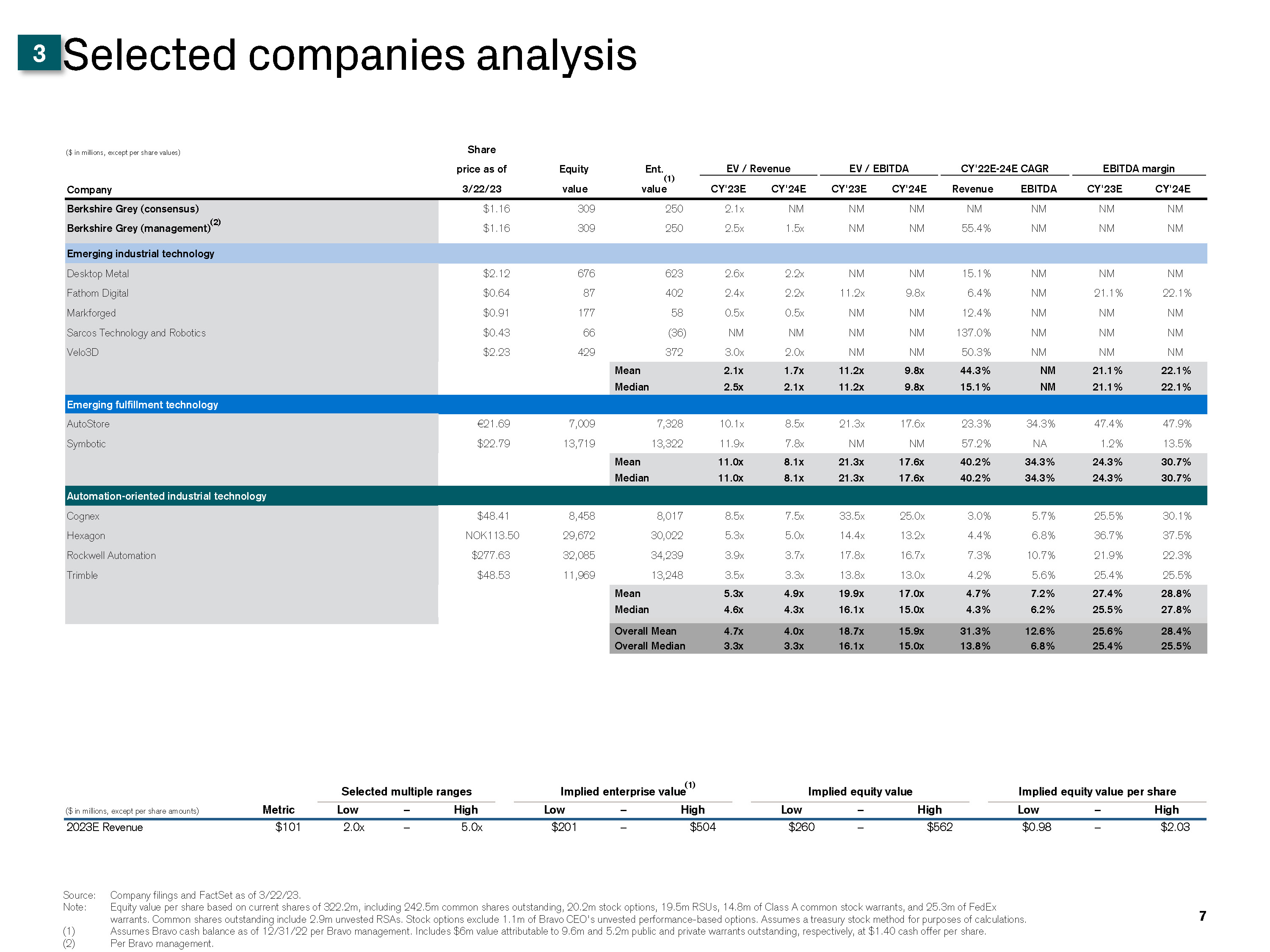

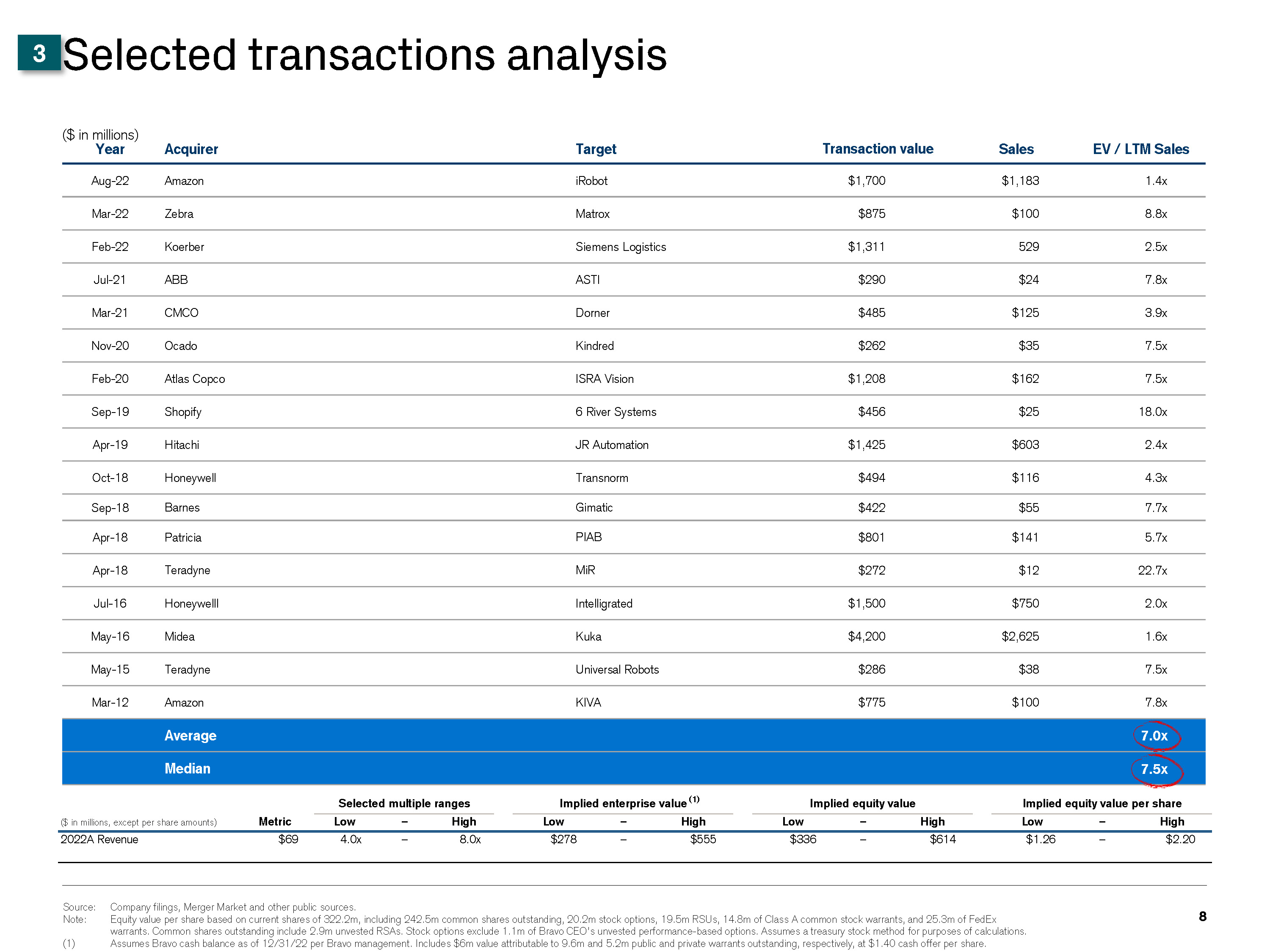

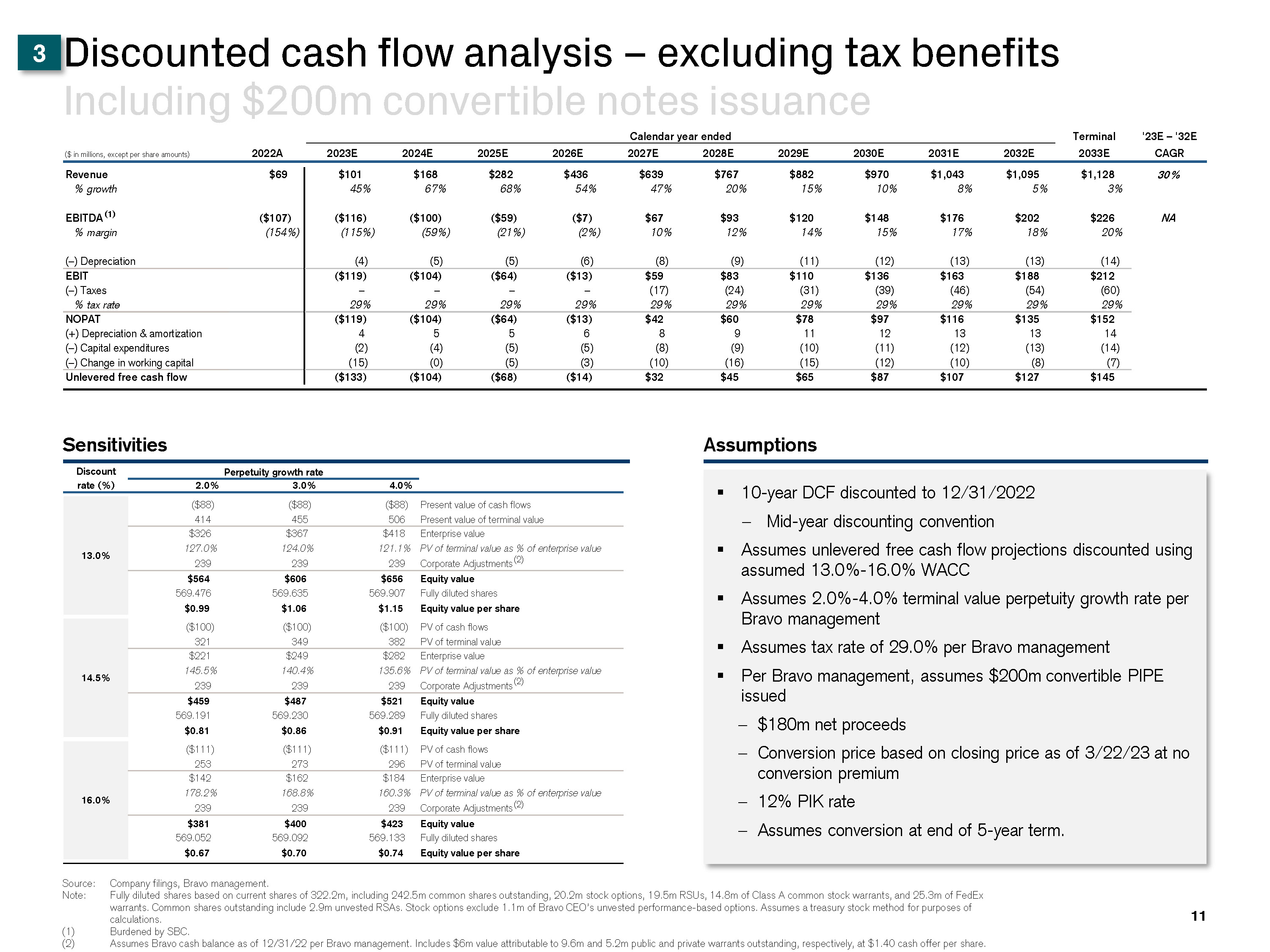

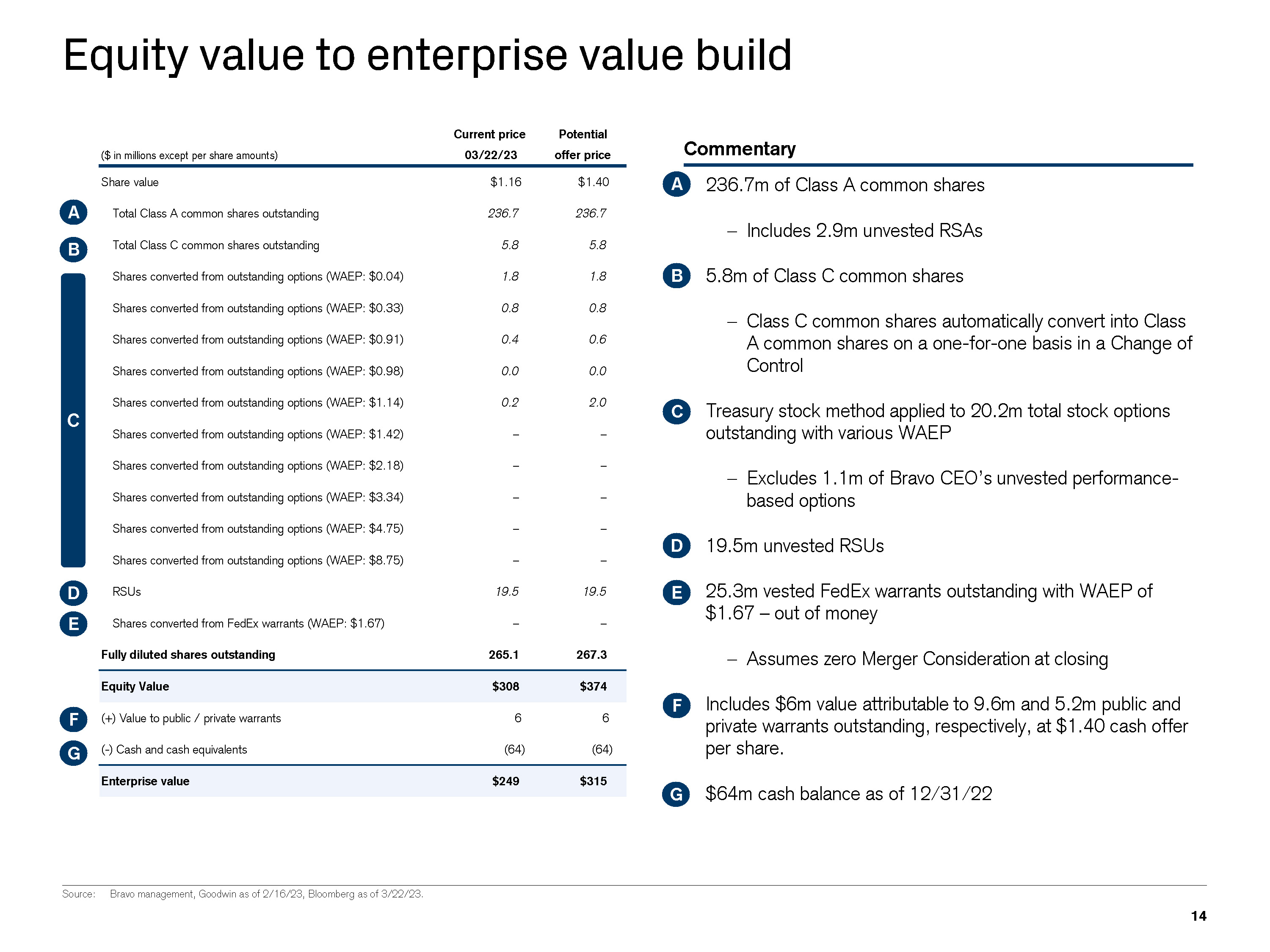

I Draft I N:\IBD_Regional_Documents_Repository_AM_Clients\Berkshire Grey(BQWF)\Spider\S03939\01. PPT\SoftBank\Project Flash_BoD_v14.pptx ($ in millions, except per share values) Company Share price as of 3/22/23 Equity value EV / Revenue EV / EBITDA CY'22E-24E CAGR EBITDA margin CY'23E CY'24E CY'23E CY'24E Revenue EBITDA CY'23E CY'24E Overall Mean 4.7x 4.0x 18.7x 15.9x 31.3% 12.6% 25.6% 28.4% Overall Median 3.3x 3.3x 16.1x 15.0x 13.8% 6.8% 25.4% 25.5% 7 Selected companies analysis Source: Company filings and FactSet as of 3/22/23. Note: Equity value per share based on current shares of 322.2m, including 242.5m common shares outstanding, 20.2m stock options, 19.5m RSUs, 14.8m of Class A common stock warrants, and 25.3m of FedEx warrants. Common shares outstanding include 2.9m unvested RSAs. Stock options exclude 1.1m of Bravo CEO’s unvested performance-based options. Assumes a treasury stock method for purposes of calculations. Assumes Bravo cash balance as of 12/31/22 per Bravo management. Includes $6m value attributable to 9.6m and 5.2m public and private warrants outstanding, respectively, at $1.40 cash offer per share. Per Bravo management. Ent. (1) value Berkshire Grey (consensus) Berkshire Grey (managemen (2) t) $1.16 $1.16 309 309 250 250 2.1x 2.5x NM 1.5x NM NM NM NM NM 55.4% NM NM NM NM NM NM Emerging industrial technology Desktop Metal $2.12 676 623 2.6x 2.2x NM NM 15.1% NM NM NM Fathom Digital $0.64 87 402 2.4x 2.2x 11.2x 9.8x 6.4% NM 21.1% 22.1% Markforged $0.91 177 58 0.5x 0.5x NM NM 12.4% NM NM NM Sarcos Technology and Robotics $0.43 66 (36) NM NM NM NM 137.0% NM NM NM Velo3D $2.23 429 372 3.0x 2.0x NM NM 50.3% NM NM NM Mean Median 2.1x 2.5x 1.7x 2.1x 11.2x 11.2x 9.8x 9.8x 44.3% 15.1% NM NM 21.1% 21.1% 22.1% 22.1% Emerging fulfillment technology AutoStore €21.69 7,009 7,328 10.1x 8.5x 21.3x 17.6x 23.3% 34.3% 47.4% 47.9% Symbotic $22.79 13,719 13,322 11.9x 7.8x NM NM 57.2% NA 1.2% 13.5% Mean 11.0x 8.1x 21.3x 17.6x 40.2% 34.3% 24.3% 30.7% Median 11.0x 8.1x 21.3x 17.6x 40.2% 34.3% 24.3% 30.7% Automation-oriented industrial technology Cognex $48.41 8,458 8,017 8.5x 7.5x 33.5x 25.0x 3.0% 5.7% 25.5% 30.1% Hexagon NOK113.50 29,672 30,022 5.3x 5.0x 14.4x 13.2x 4.4% 6.8% 36.7% 37.5% Rockwell Automation $277.63 32,085 34,239 3.9x 3.7x 17.8x 16.7x 7.3% 10.7% 21.9% 22.3% Trimble $48.53 11,969 13,248 3.5x 3.3x 13.8x 13.0x 4.2% 5.6% 25.4% 25.5% Mean 5.3x 4.9x 19.9x 17.0x 4.7% 7.2% 27.4% 28.8% Median 4.6x 4.3x 16.1x 15.0x 4.3% 6.2% 25.5% 27.8% Selected multiple ranges Implied enterprise value(1) Implied equity value Implied equity value per share ($ in millions, except per share amounts) Metric Low – High Low – High Low – High Low – High 2023E Revenue $101 2.0x – 5.0x $201 – $504 $260 – $562 $0.98 – $2.03 3