dMY Technology Group, Inc. III, p. 2

Merger will be consummated in accordance therewith and as described therein (and no transaction or condition described therein and affecting this opinion will be waived or modified); (3) neither dMY, the Company, nor any of their respective Affiliates is or will be a party to any oral or written agreement relating to the Merger that may cause any of the statements and representations set forth in the Officer’s Certificate or the Company Officer’s Certificate to be untrue, incorrect, or incomplete in any respect; and (4) dMY, the Company and their respective subsidiaries will treat the Merger, for U.S. federal income tax purposes, in a manner consistent with the opinion set forth below. If any of the above described assumptions are untrue for any reason or if the transaction is consummated in a manner that is different from the manner described in the Registration Statement or the documents referenced herein, our opinion as expressed below may be adversely affected.

Our opinion relates solely to the specific matters set forth below, and no opinion is expressed, or should be inferred, as to any other U.S. federal, state, local or non-U.S. income, estate, gift, transfer, sales, use or other tax consequences that may result from the Merger. Our opinion is based on the Internal Revenue Code of 1986, as amended (the “Code”), the U.S. Treasury Regulations, case law and published rulings and other pronouncements of the Internal Revenue Service, as in effect on the date hereof. No assurances can be given that such authorities will not be amended or otherwise changed at any time, possibly with retroactive effect. Future legislative, judicial or administrative changes, on either a prospective or retroactive basis, could affect our opinion. Further, our opinion is limited to legal rather than factual matters and has no official status or binding effect of any kind, including upon the Internal Revenue Service or the courts. Accordingly, there is no assurance that the Internal Revenue Service or a court will not take a contrary position to those expressed in this opinion. We undertake no responsibility to advise you of any future change in the matters stated herein or in the federal income tax laws or the application or interpretation thereof, including if such change applies retroactively.

Based upon the foregoing and subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the Registration Statement under the heading “U.S. Federal Income Tax Considerations of the Business Combination to Holders of IonQ Capital Stock that are United States Persons” we are of the opinion that, under current U.S. federal income tax law, the Merger will constitute a reorganization within the meaning of Section 368(a) of the Code.

The opinion expressed herein is being furnished in connection with the filing of the Registration Statement and the description of U.S. federal income tax consequences of the Merger to holders of IonQ capital stock as described therein, and may not be used or relied upon for any other purpose. We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an Exhibit to the Registration Statement and to the references to this opinion in the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules or regulations of the Securities and Exchange Commission promulgated thereunder. Our opinion is being delivered prior to the consummation of the Merger and therefore is prospective and dependent on future events. We are under no obligation to supplement or revise our opinion to reflect any legal developments or factual matters arising subsequent to the date hereof or the impact of any information, document, certificate, record, statement, representation, covenant or assumption relied upon herein that becomes incorrect or untrue, inaccurate or incomplete, in which case, our opinions shall be void and of no force or effect, but only to the extent that such untruth, in accuracy or incompletion affects the accuracy of the opinion provided herein.

| | |

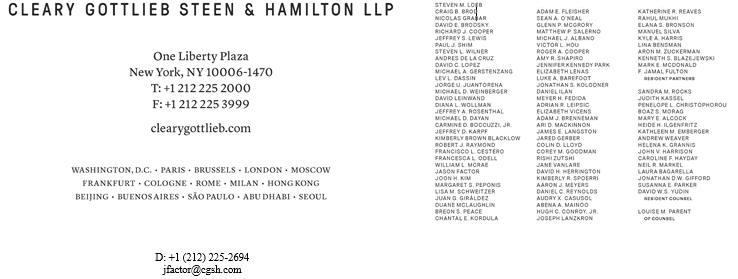

Very truly yours, CLEARY GOTTLIEB STEEN & HAMILTON LLP |

|

| | |

| By: | |  |

| | Jason R. Factor, a Partner |