otherwise be in favor of consummating the potential partnering transaction. If the Extension Proposal is not approved and a partnering transaction is not completed on or before the Termination Date, PCPC will: (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem 100% of the outstanding shares of Class A common stock, par value $0,001 per share (the “Class A Common Stock” or “Public Shares”), at a per share price, payable in cash, equal to the aggregate amount then on deposit in a U.S.-based trust account maintained by Continental Stock Transfer & Trust Company, acting as trustee (the “Trust Account”), including interest not previously released to PCPC to pay franchise and income taxes (less up to $100,000 of such interest to pay dissolution expenses), divided by the number of then outstanding Public Shares, which redemption will completely extinguish Public Stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, dissolve and liquidate, subject (in the case of (ii) and (iii) above) to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

If the Extension Proposal is approved, as contemplated by the Certificate of Incorporation, the holders of PCPC’s Public Shares may elect to redeem all or a portion of their Public Shares in exchange for their pro rata portion of the funds held in the Trust Account (the “Redemption”). Holders who hold Public Shares as of the redemption deadline may exercise their redemption rights in connection with the Extension Proposal regardless of how they vote, or if they vote, at the Special Meeting. If the Extension Proposal is not approved, these Public Shares will not be redeemed in connection with the Extension Proposal and the Special Meeting.

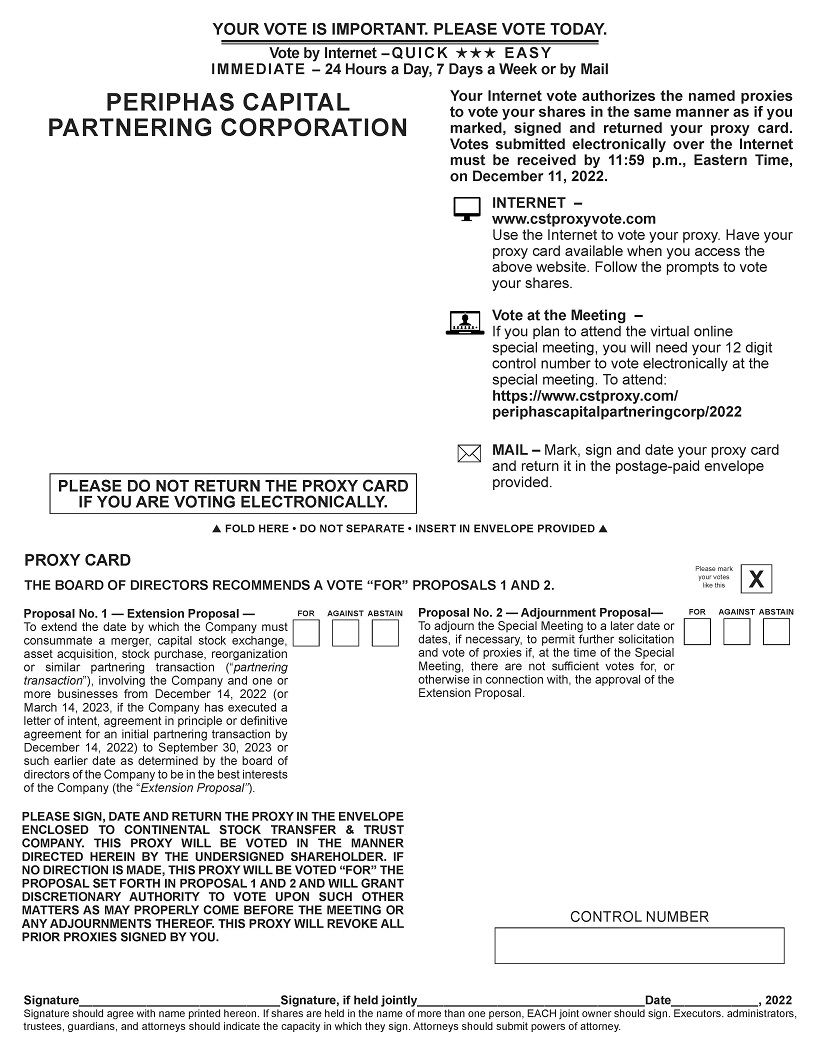

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST ELECT TO HAVE PCPC REDEEM YOUR SHARES FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT AND TENDER YOUR SHARES TO PCPC’S TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE SPECIAL MEETING. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE EXTENSION IS NOT APPROVED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

The withdrawal of funds from the Trust Account in connection with the Redemption will reduce the amount held in the Trust Account following the Redemption. In such event, the Company may need to obtain additional funds to complete the potential partnering transaction, and there can be no assurance that such funds will be available on terms acceptable to the parties or at all. Anchor investors, Board members and operating partners holding approximately 10.4% of our outstanding Public Shares have agreed not to redeem their public shares in connection with the Special Meeting.

There will be no distribution from the Trust Account with respect to the Company’s warrants, which will expire worthless in the event of our winding up. In the event of a liquidation, the Sponsor will not receive any monies held in the Trust Account as a result of their ownership of 120,000 shares of our Class B Common Stock, par value $0.0001 per share (“Class B Common Stock”), and 828,000 shares of our Class F Common Stock, par value $0.0001 per share (“Class F Common Stock”), where which were issued to the Sponsor prior to our initial public offering, 245,600 shares of our Class A Common Stock and 61,400 private placement warrants, which we refer to as the “private placement shares” and the “private placement warrants”, respectively, and which were purchased by the Sponsor in a private placement which occurred simultaneously with the completion of the initial public offering. As a consequence, a liquidating distribution will be made only with respect to the Public Shares.

The Board has fixed the close of business on November 11, 2022 (the “Record Date”) as the date for determining PCPC’s stockholders entitled to receive notice of and vote at the Special Meeting and any adjournment thereof. Only holders of record of Common Stock on that date are entitled to have their votes counted at the Special Meeting or any adjournment thereof.

ii