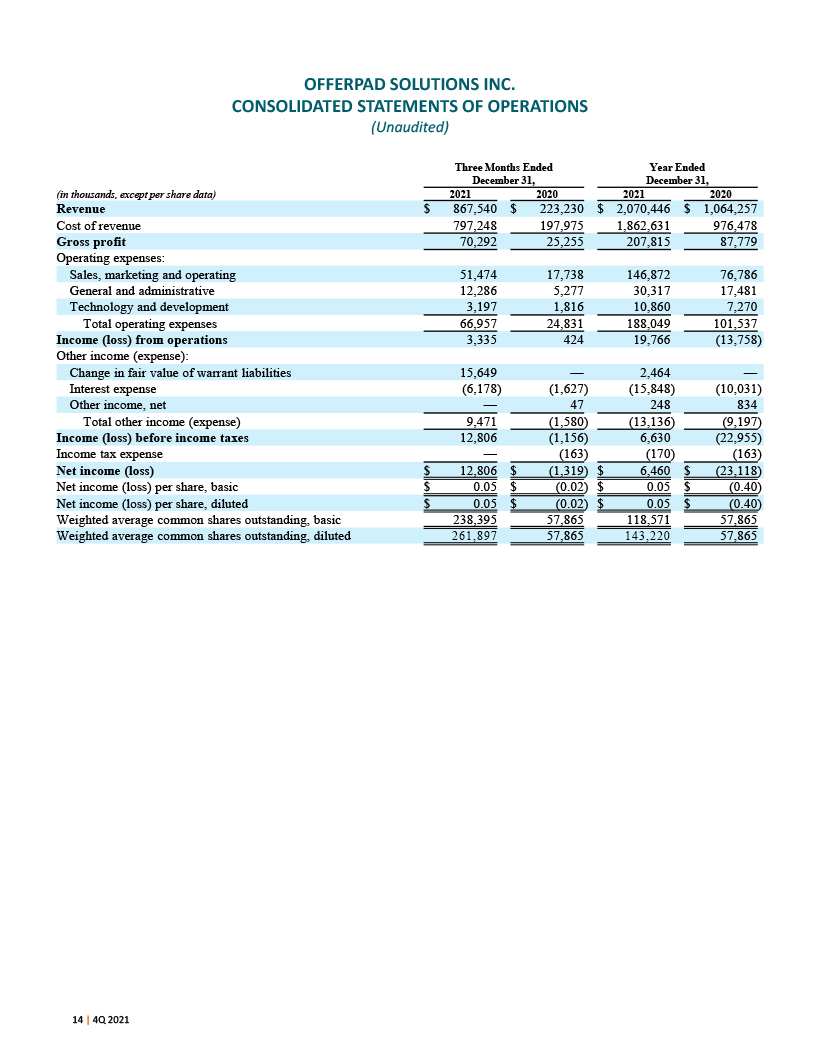

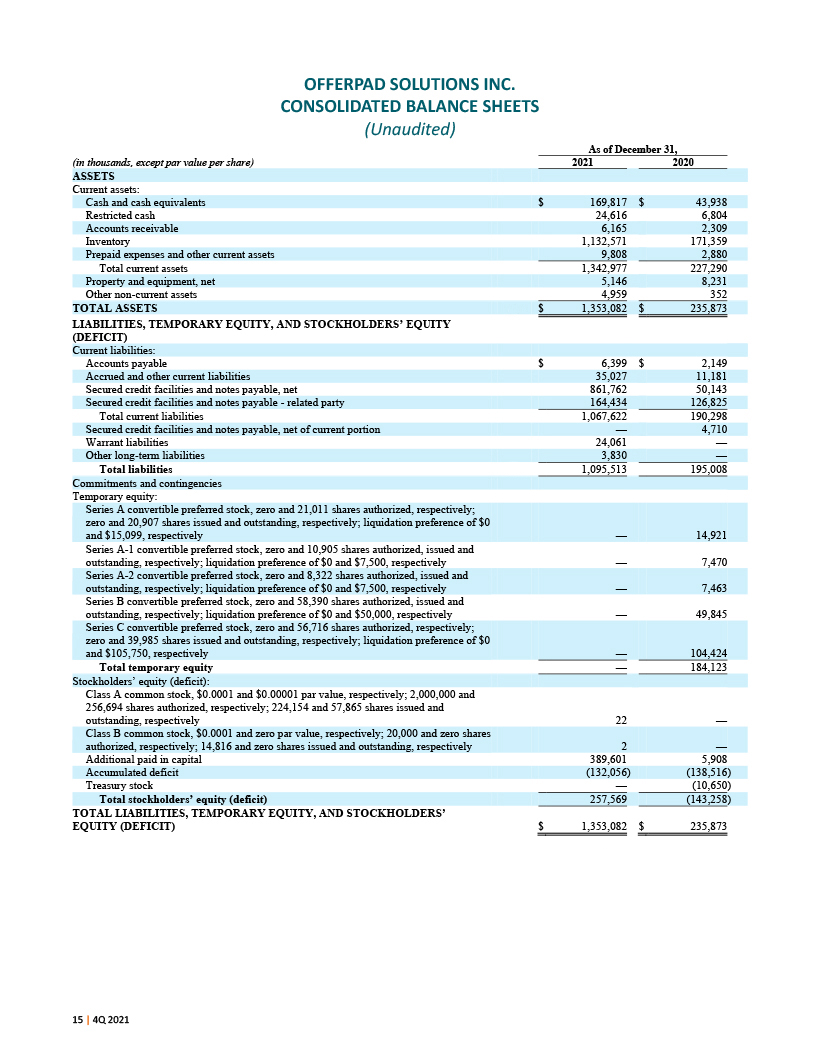

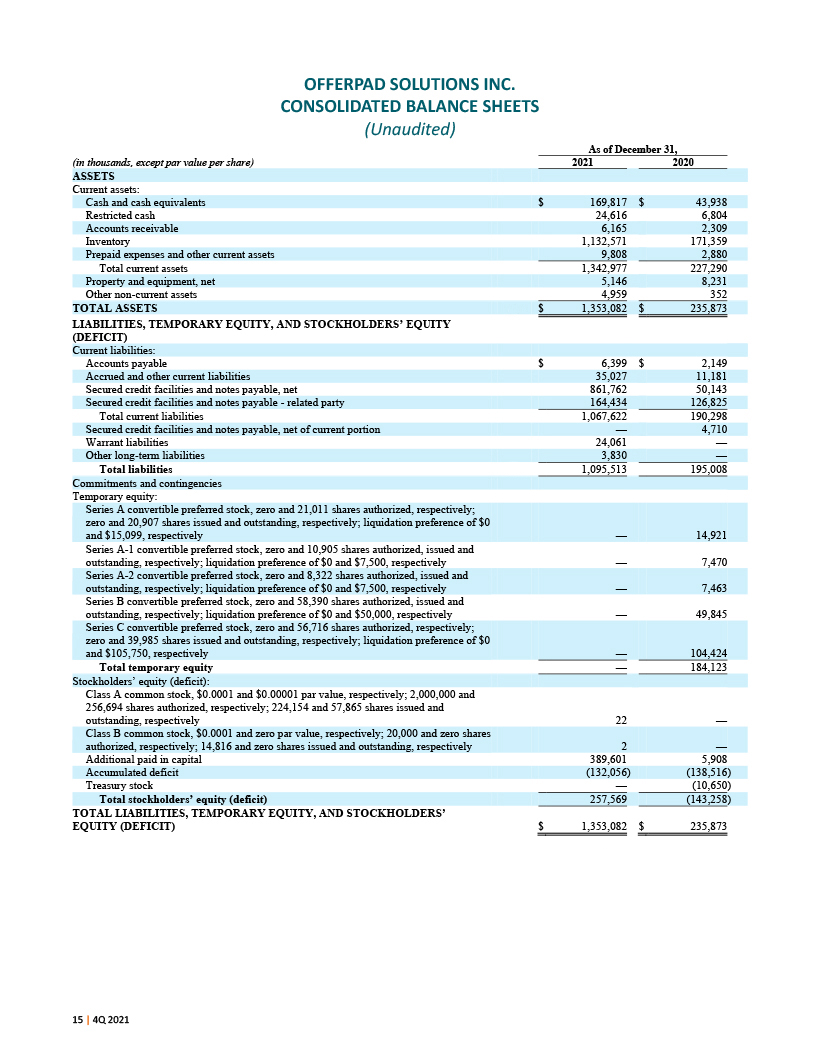

OFFERPAD SOLUTIONS INC. CONSOLIDATED BALANCE SHEETS (Unaudited) As of December 31, (in thousands, except par value per share) 2021 2020 ASSETS Current assets: Cash and cash equivalents $ 169,817 $ 43,938 Restricted cash 24,616 6,804 Accounts receivable 6,165 2,309 Inventory 1,132,571 171,359 Prepaid expenses and other current assets 9,808 2,880 Total current assets 1,342,977 227,290 Property and equipment, net 5,146 8,231 Other non-current assets 4,959 352 TOTAL ASSETS $ 1,353,082 $ 235,873 LIABILITIES, TEMPORARY EQUITY, AND STOCKHOLDERS’ EQUITY (DEFICIT) Current liabilities: Accounts payable $ 6,399 $ 2,149 Accrued and other current liabilities 35,027 11,181 Secured credit facilities and notes payable, net 861,762 50,143 Secured credit facilities and notes payable—related party 164,434 126,825 Total current liabilities 1,067,622 190,298 Secured credit facilities and notes payable, net of current portion — 4,710 Warrant liabilities 24,061 — Other long-term liabilities 3,830 — Total liabilities 1,095,513 195,008 Commitments and contingencies Temporary equity: Series A convertible preferred stock, zero and 21,011 shares authorized, respectively; zero and 20,907 shares issued and outstanding, respectively; liquidation preference of $0 and $15,099, respectively — 14,921 Series A-1 convertible preferred stock, zero and 10,905 shares authorized, issued and outstanding, respectively; liquidation preference of $0 and $7,500, respectively — 7,470 Series A-2 convertible preferred stock, zero and 8,322 shares authorized, issued and outstanding, respectively; liquidation preference of $0 and $7,500, respectively — 7,463 Series B convertible preferred stock, zero and 58,390 shares authorized, issued and outstanding, respectively; liquidation preference of $0 and $50,000, respectively — 49,845 Series C convertible preferred stock, zero and 56,716 shares authorized, respectively; zero and 39,985 shares issued and outstanding, respectively; liquidation preference of $0 and $105,750, respectively — 104,424 Total temporary equity — 184,123 Stockholders’ equity (deficit): Class A common stock, $0.0001 and $0.00001 par value, respectively; 2,000,000 and 256,694 shares authorized, respectively; 224,154 and 57,865 shares issued and outstanding, respectively 22 — Class B common stock, $0.0001 and zero par value, respectively; 20,000 and zero shares authorized, respectively; 14,816 and zero shares issued and outstanding, respectively 2 — Additional paid in capital 389,601 5,908 Accumulated deficit (132,056) (138,516) Treasury stock — (10,650) Total stockholders’ equity (deficit) 257,569 (143,258) TOTAL LIABILITIES, TEMPORARY EQUITY, AND STOCKHOLDERS’ EQUITY (DEFICIT) $ 1,353,082 $ 235,873