Non-GAAP Financial Measures

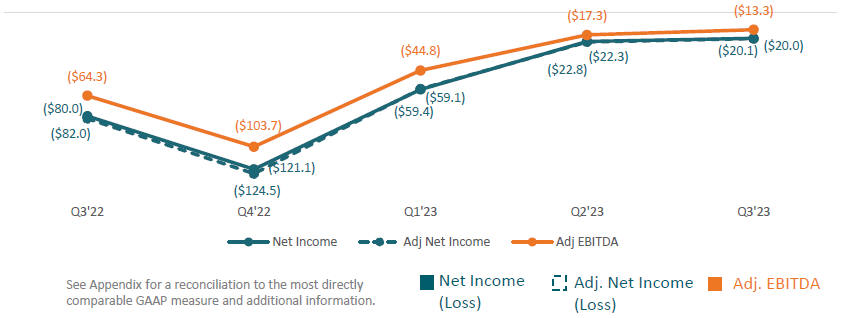

In addition to our results of operations above, we report certain financial measures that are not required by, or presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). These measures have limitations as analytical tools when assessing our operating performance and should not be considered in isolation or as a substitute for GAAP measures, including gross profit and net income.

We may calculate or present our non-GAAP financial measures differently than other companies who report measures with similar titles and, as a result, the non-GAAP financial measures we report may not be comparable with those of companies in our industry or in other industries. We have not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted net income (loss) or Contribution Profit After Interest to Gross profit within this shareholder letter because we are unable to calculate certain reconciling items without making unreasonable efforts. With respect to Adjusted EBITDA, these items include, but are not limited to, stock-based compensation with respect to future grants and forfeitures, and with respect to Contribution Profit After Interest, these items include, but are not limited to, inventory valuation adjustments, inventory sales timing or product mix, which could materially affect the computation of forward-looking net income (loss) and Gross Profit, respectively, and are inherently uncertain and depend on various factors, some of which are outside of our control.

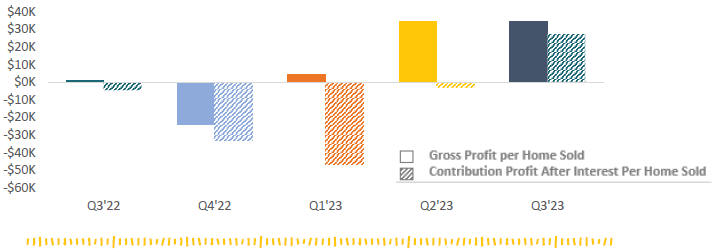

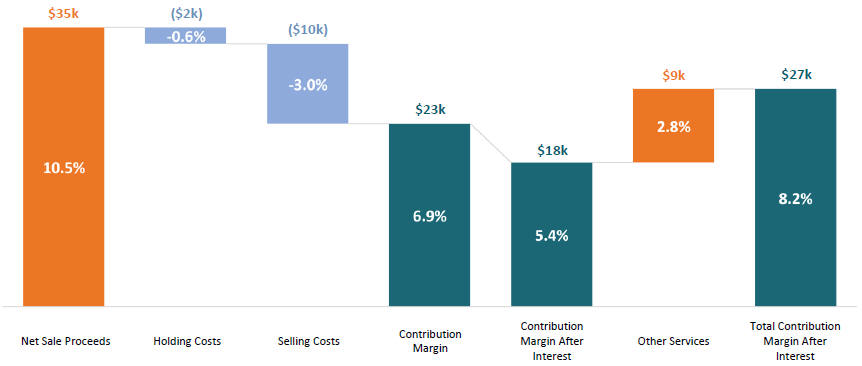

Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest (and related margins)

To provide investors with additional information regarding our margins, we have included Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest (and related margins), which are non-GAAP financial measures. We believe that Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest are useful financial measures for investors as they are used by management in evaluating unit level economics and operating performance across our markets. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and ancillary services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in real estate inventory as of the end of the period presented. Contribution Profit provides investors a measure to assess Offerpad’s ability to generate returns on homes sold during a reporting period after considering home acquisition costs, renovation and repair costs, and adjusting for holding costs and selling costs. Contribution Profit After Interest further impacts gross profit by including interest costs (including senior and mezzanine secured credit facilities) attributable to homes sold during a reporting period. We believe these measures facilitate meaningful period over period comparisons and illustrate our ability to generate returns on assets sold after considering the costs directly related to the assets sold in a presented period.

Adjusted Gross Profit, Contribution Profit and Contribution Profit After Interest (and related margins) are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in real estate inventory at the end of the period, costs required to be recorded under GAAP in the same period.

Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit.

9 | Q3 2023