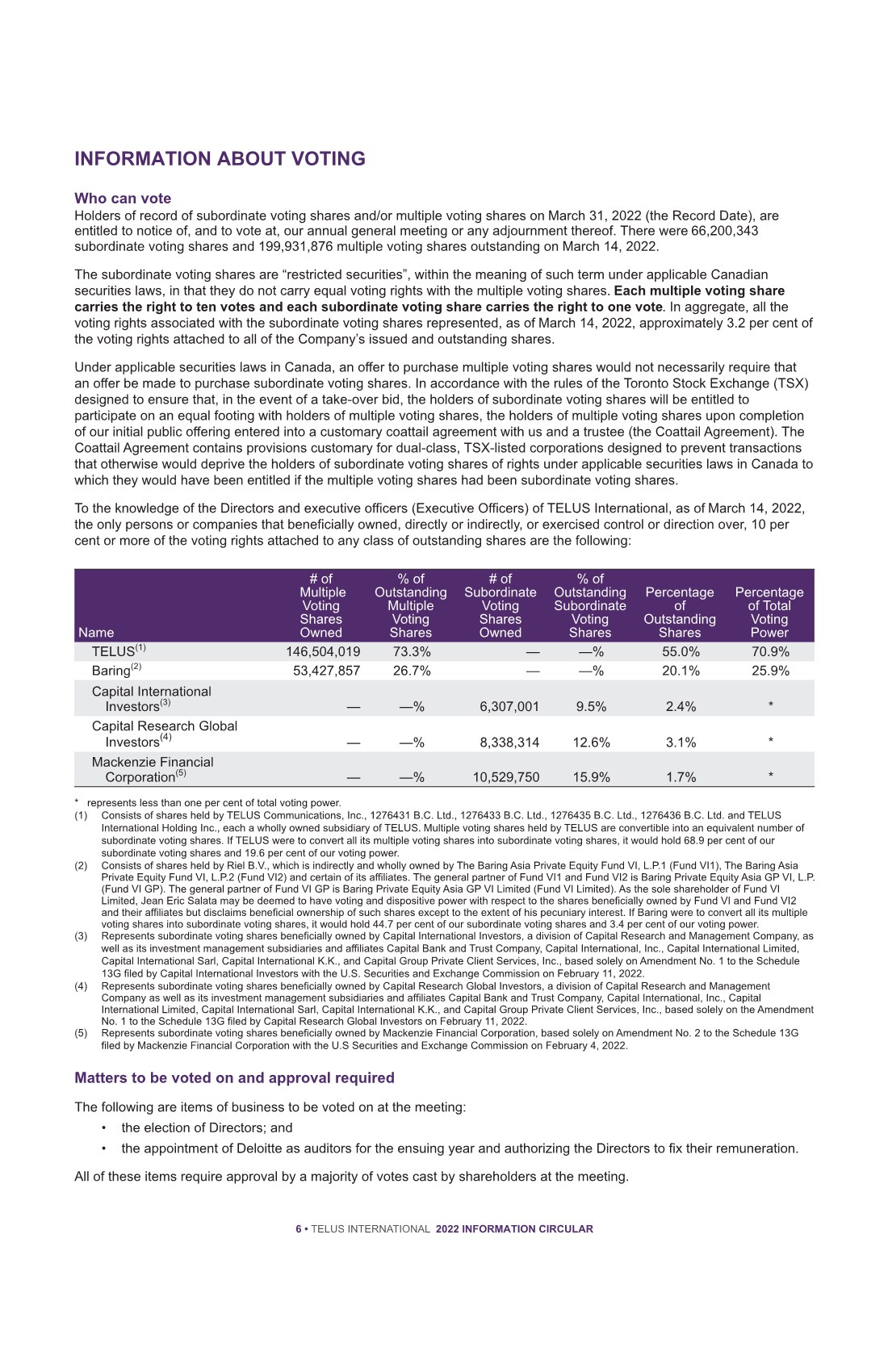

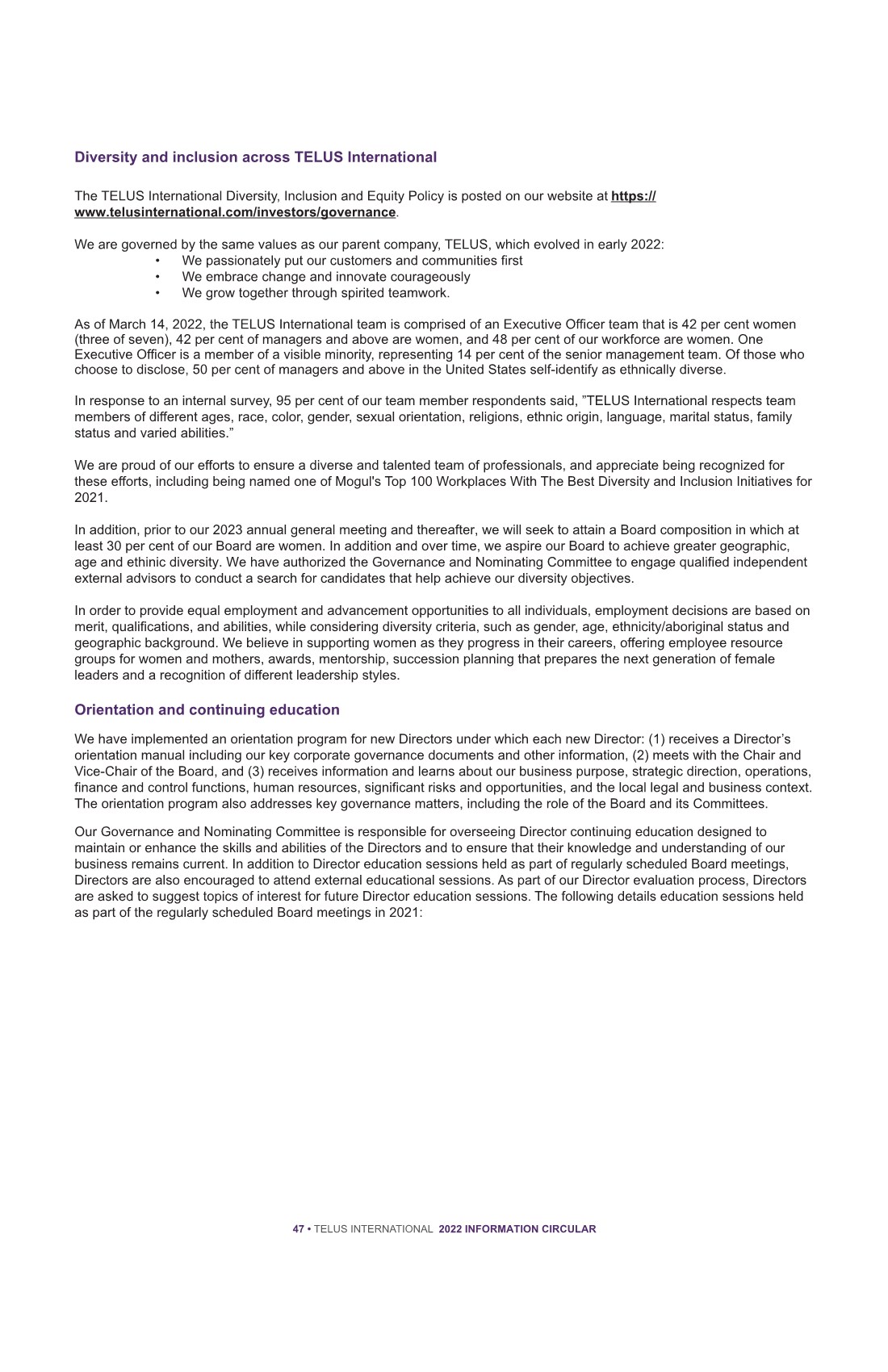

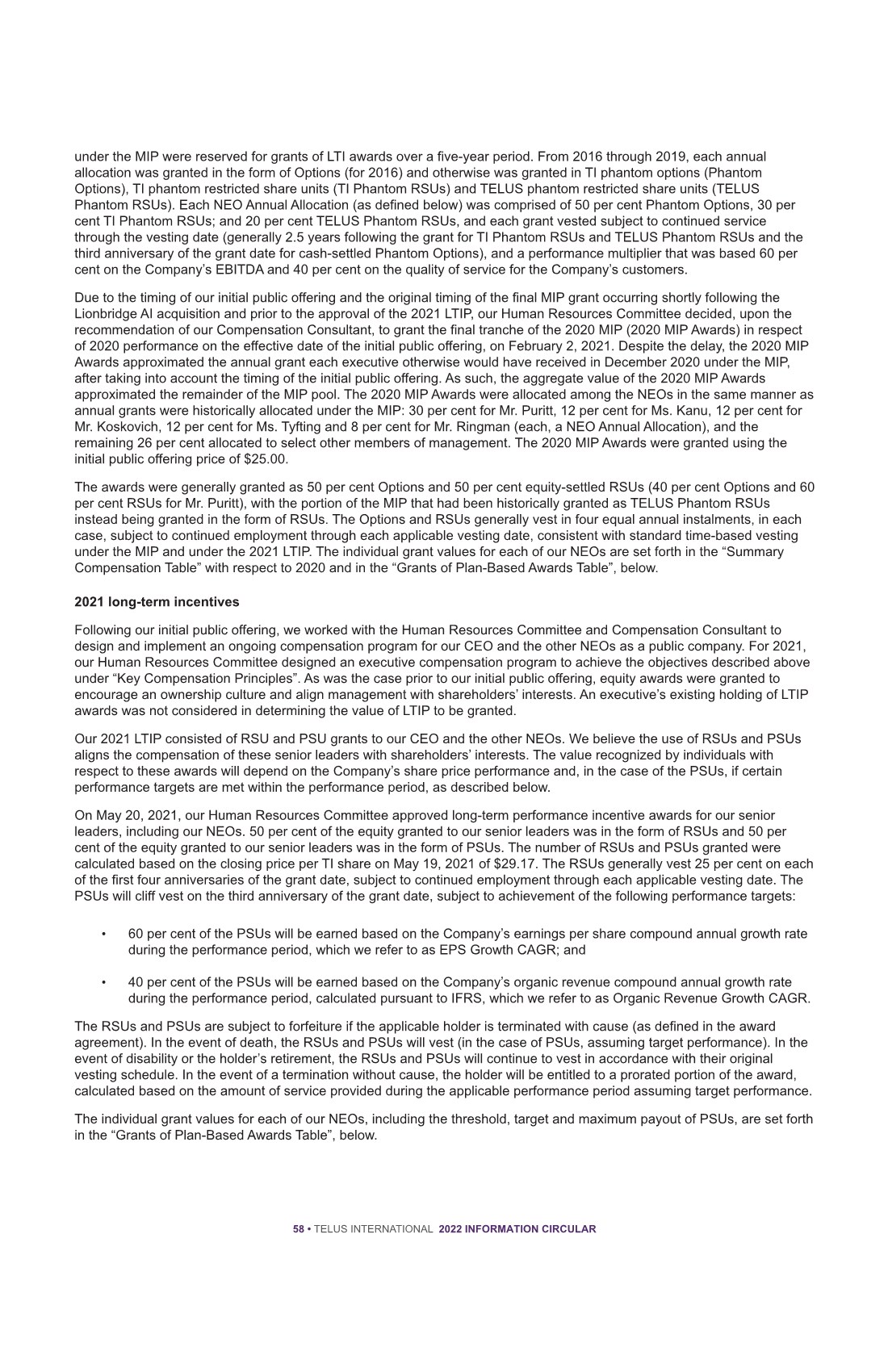

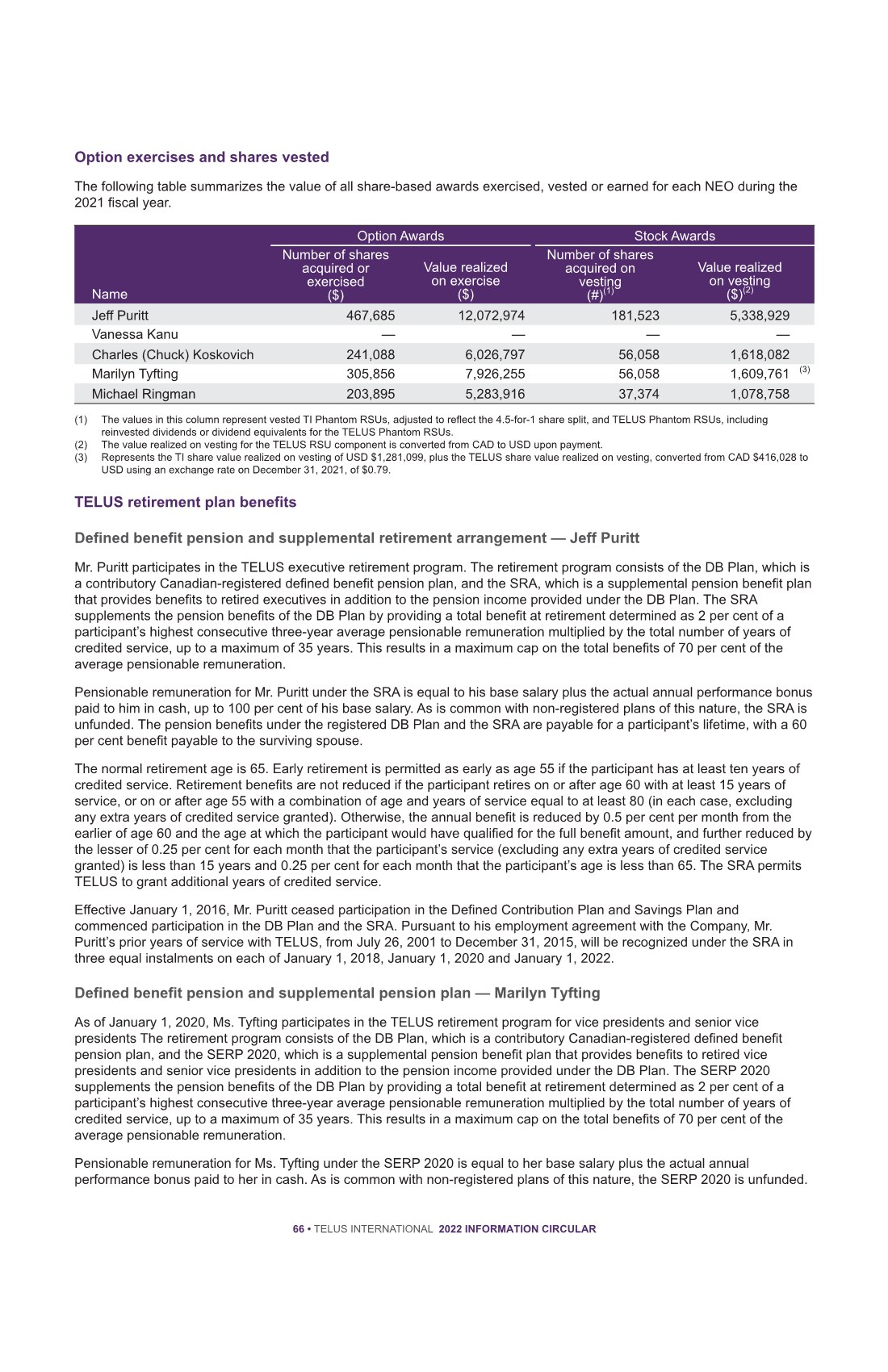

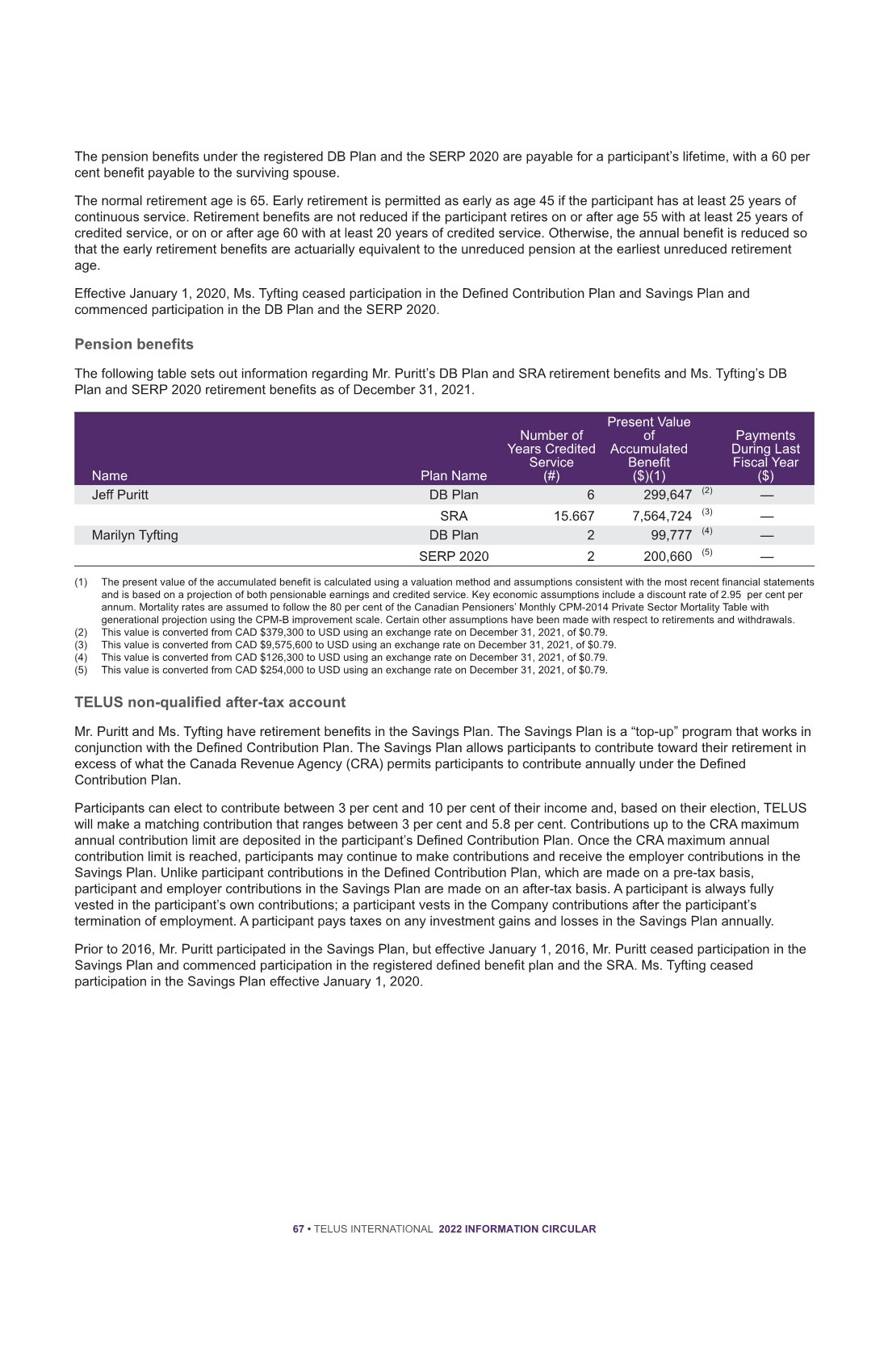

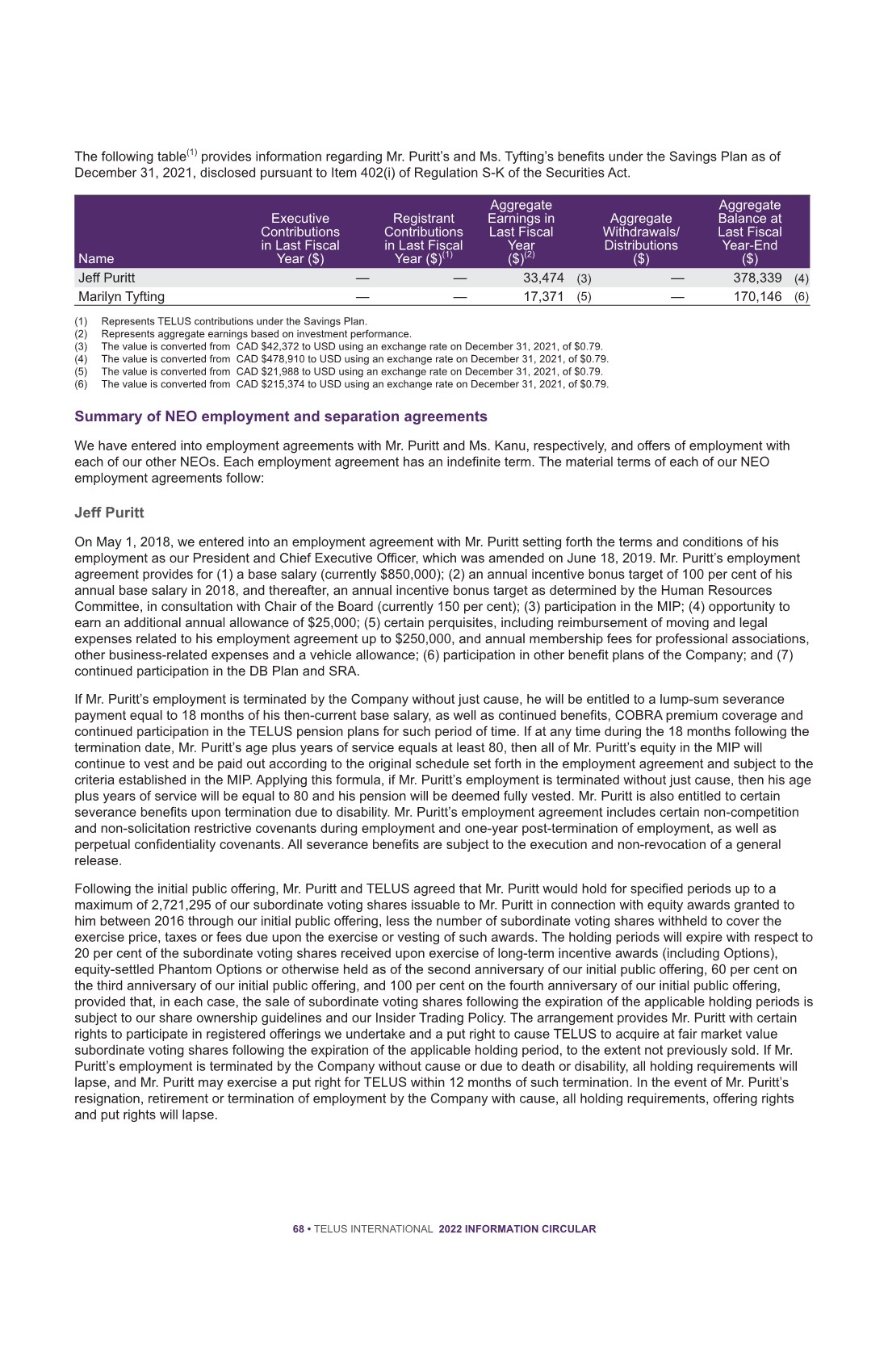

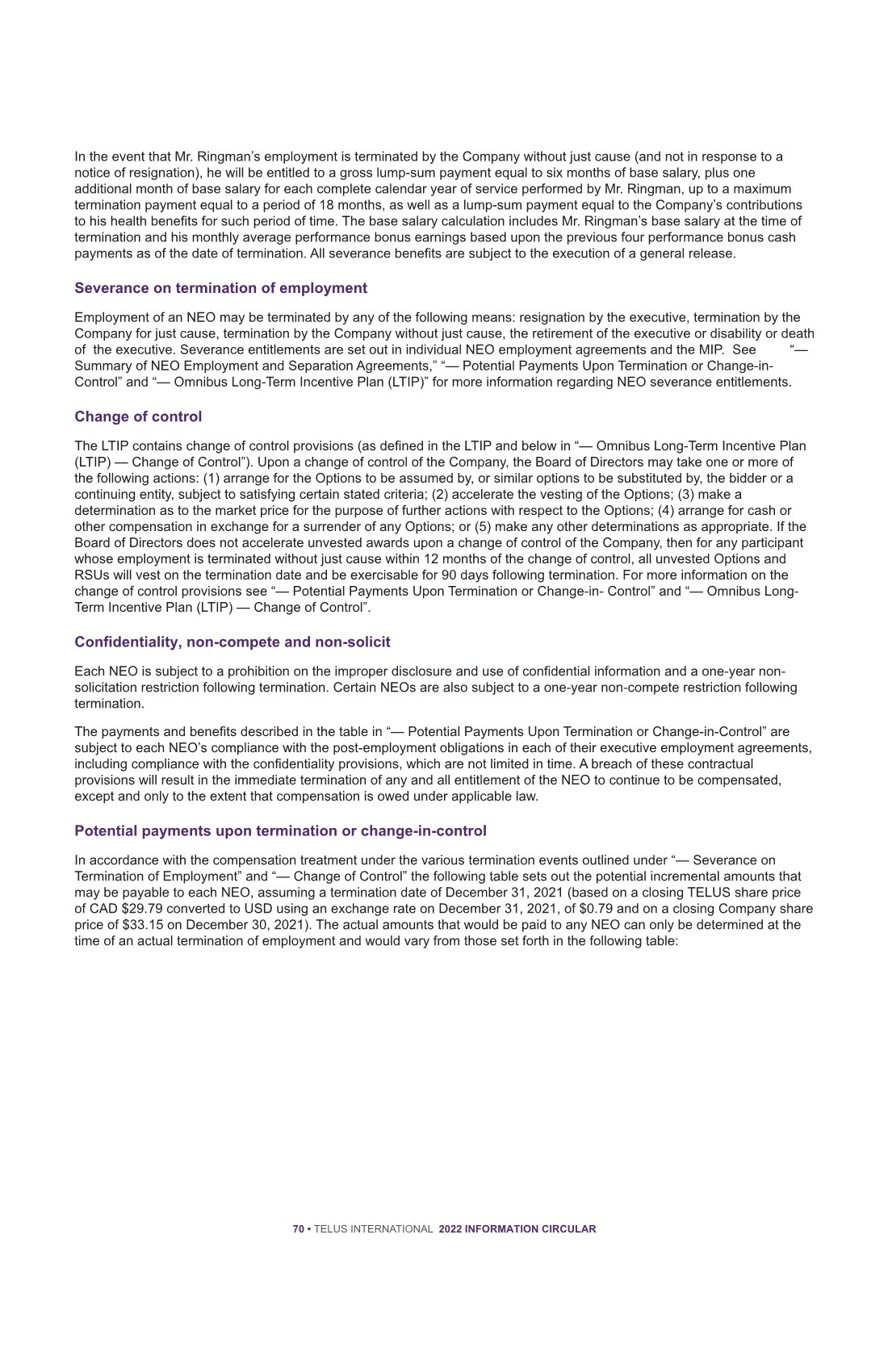

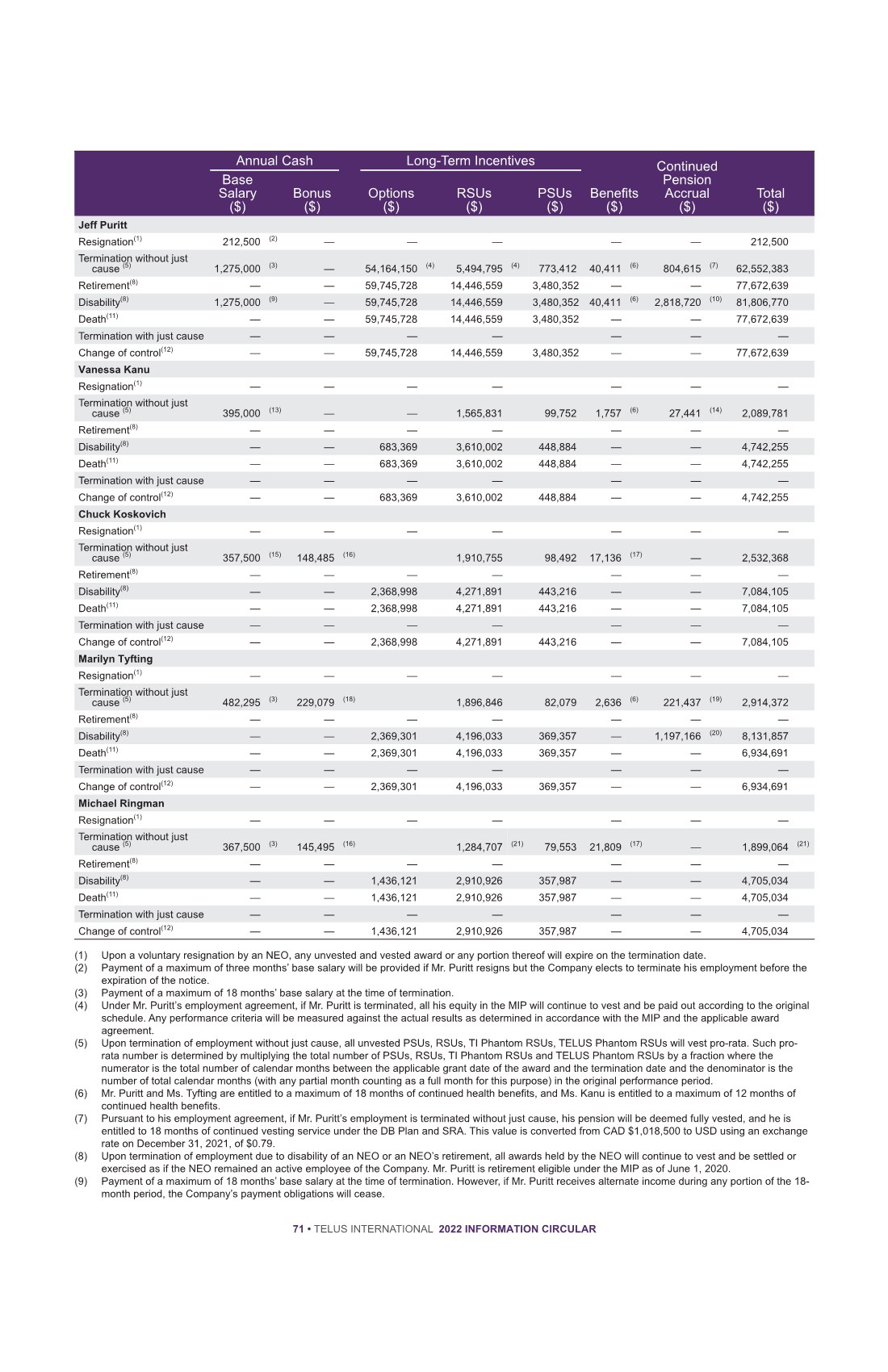

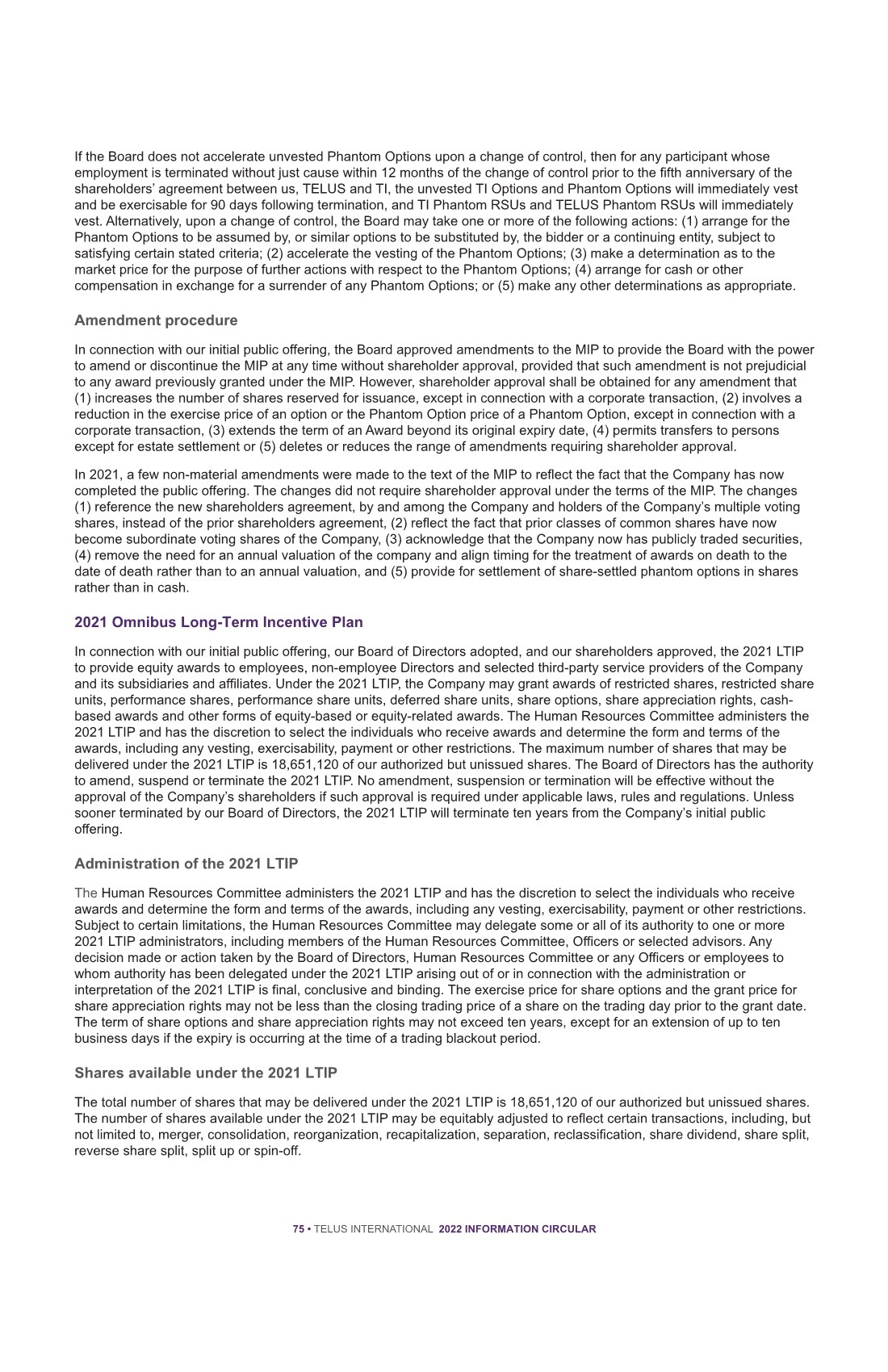

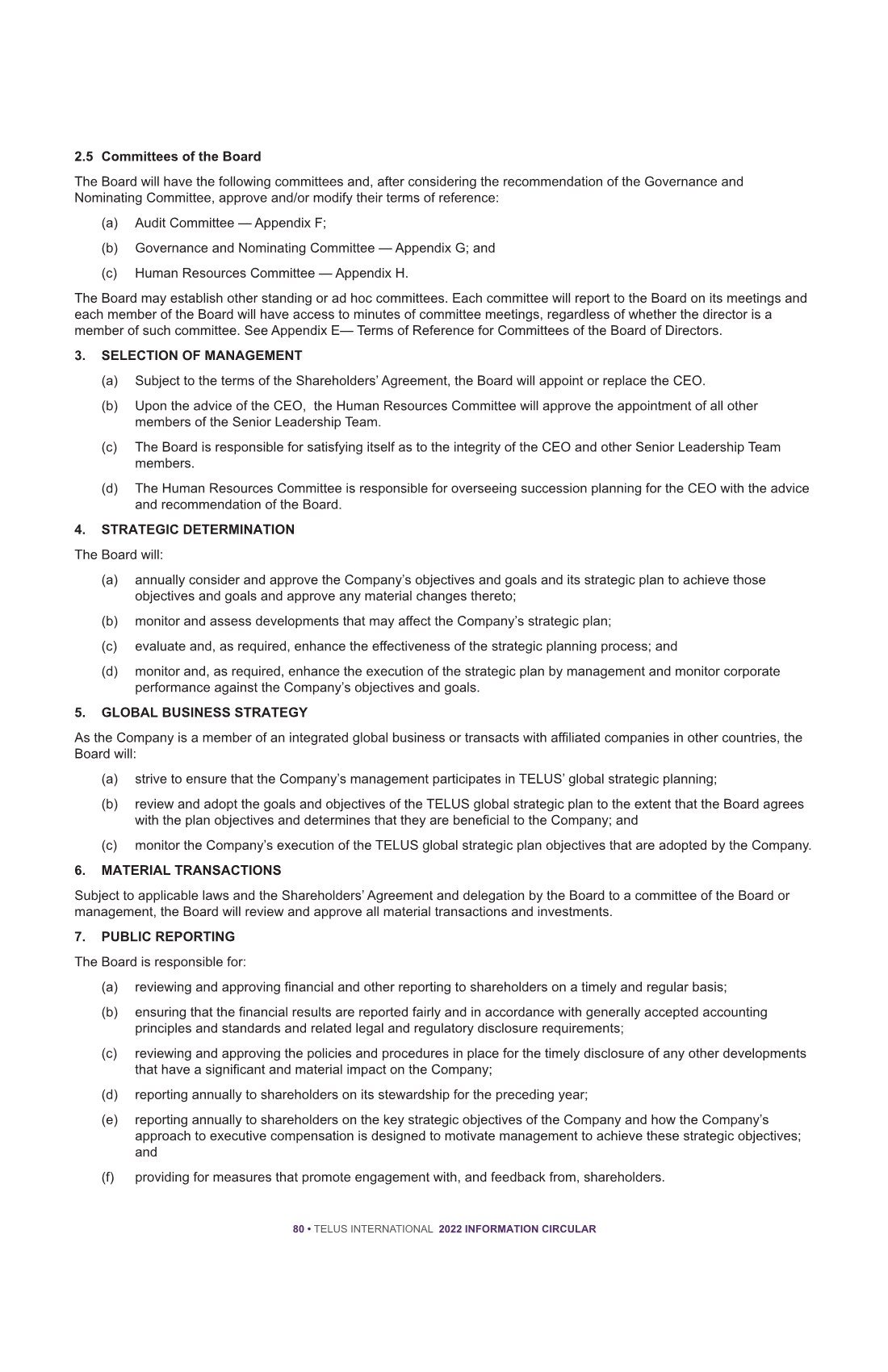

| Annual Cash Long-Term Incentives Benefits ($) Continued Pension Accrual ($) Total ($) Base Salary ($) Bonus ($) Options ($) RSUs ($) PSUs ($) Jeff Puritt Resignation(1) 212,500 (2) — — — — — 212,500 Termination without just cause (5) 1,275,000 (3) — 54,164,150 (4) 5,494,795 (4) 773,412 40,411 (6) 804,615 (7) 62,552,383 Retirement(8) — — 59,745,728 14,446,559 3,480,352 — — 77,672,639 Disability(8) 1,275,000 (9) — 59,745,728 14,446,559 3,480,352 40,411 (6) 2,818,720 (10) 81,806,770 Death(11) — — 59,745,728 14,446,559 3,480,352 — — 77,672,639 Termination with just cause — — — — — — — Change of control(12) — — 59,745,728 14,446,559 3,480,352 — — 77,672,639 Vanessa Kanu Resignation(1) — — — — — — — Termination without just cause (5) 395,000 (13) — — 1,565,831 99,752 1,757 (6) 27,441 (14) 2,089,781 Retirement(8) — — — — — — — Disability(8) — — 683,369 3,610,002 448,884 — — 4,742,255 Death(11) — — 683,369 3,610,002 448,884 — — 4,742,255 Termination with just cause — — — — — — — Change of control(12) — — 683,369 3,610,002 448,884 — — 4,742,255 Chuck Koskovich Resignation(1) — — — — — — — Termination without just cause (5) 357,500 (15) 148,485 (16) 1,910,755 98,492 17,136 (17) — 2,532,368 Retirement(8) — — — — — — — Disability(8) — — 2,368,998 4,271,891 443,216 — — 7,084,105 Death(11) — — 2,368,998 4,271,891 443,216 — — 7,084,105 Termination with just cause — — — — — — — Change of control(12) — — 2,368,998 4,271,891 443,216 — — 7,084,105 Marilyn Tyfting Resignation(1) — — — — — — — Termination without just cause (5) 482,295 (3) 229,079 (18) 1,896,846 82,079 2,636 (6) 221,437 (19) 2,914,372 Retirement(8) — — — — — — — Disability(8) — — 2,369,301 4,196,033 369,357 — 1,197,166 (20) 8,131,857 Death(11) — — 2,369,301 4,196,033 369,357 — — 6,934,691 Termination with just cause — — — — — — — Change of control(12) — — 2,369,301 4,196,033 369,357 — — 6,934,691 Michael Ringman Resignation(1) — — — — — — — Termination without just cause (5) 367,500 (3) 145,495 (16) 1,284,707 (21) 79,553 21,809 (17) — 1,899,064 (21) Retirement(8) — — — — — — — Disability(8) — — 1,436,121 2,910,926 357,987 — — 4,705,034 Death(11) — — 1,436,121 2,910,926 357,987 — — 4,705,034 Termination with just cause — — — — — — — Change of control(12) — — 1,436,121 2,910,926 357,987 — — 4,705,034 (1) Upon a voluntary resignation by an NEO, any unvested and vested award or any portion thereof will expire on the termination date. (2) Payment of a maximum of three months’ base salary will be provided if Mr. Puritt resigns but the Company elects to terminate his employment before the expiration of the notice. (3) Payment of a maximum of 18 months’ base salary at the time of termination. (4) Under Mr. Puritt’s employment agreement, if Mr. Puritt is terminated, all his equity in the MIP will continue to vest and be paid out according to the original schedule. Any performance criteria will be measured against the actual results as determined in accordance with the MIP and the applicable award agreement. (5) Upon termination of employment without just cause, all unvested PSUs, RSUs, TI Phantom RSUs, TELUS Phantom RSUs will vest pro-rata. Such pro- rata number is determined by multiplying the total number of PSUs, RSUs, TI Phantom RSUs and TELUS Phantom RSUs by a fraction where the numerator is the total number of calendar months between the applicable grant date of the award and the termination date and the denominator is the number of total calendar months (with any partial month counting as a full month for this purpose) in the original performance period. (6) Mr. Puritt and Ms. Tyfting are entitled to a maximum of 18 months of continued health benefits, and Ms. Kanu is entitled to a maximum of 12 months of continued health benefits. (7) Pursuant to his employment agreement, if Mr. Puritt’s employment is terminated without just cause, his pension will be deemed fully vested, and he is entitled to 18 months of continued vesting service under the DB Plan and SRA. This value is converted from CAD $1,018,500 to USD using an exchange rate on December 31, 2021, of $0.79. (8) Upon termination of employment due to disability of an NEO or an NEO’s retirement, all awards held by the NEO will continue to vest and be settled or exercised as if the NEO remained an active employee of the Company. Mr. Puritt is retirement eligible under the MIP as of June 1, 2020. (9) Payment of a maximum of 18 months’ base salary at the time of termination. However, if Mr. Puritt receives alternate income during any portion of the 18- month period, the Company’s payment obligations will cease. 71 • TELUS INTERNATIONAL 2022 INFORMATION CIRCULAR |