Consolidated Financial Statements Franklin BSP Lending Corporation As of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021

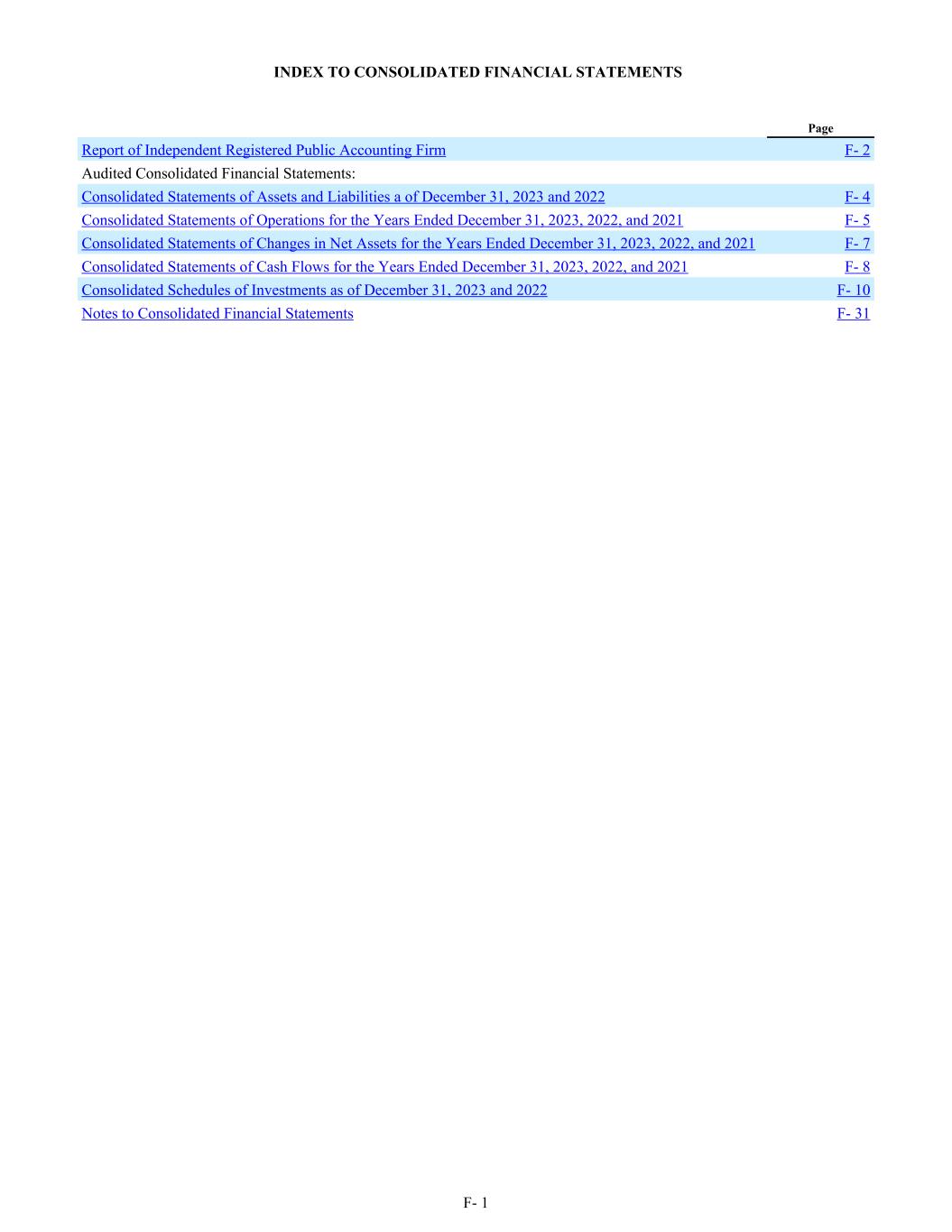

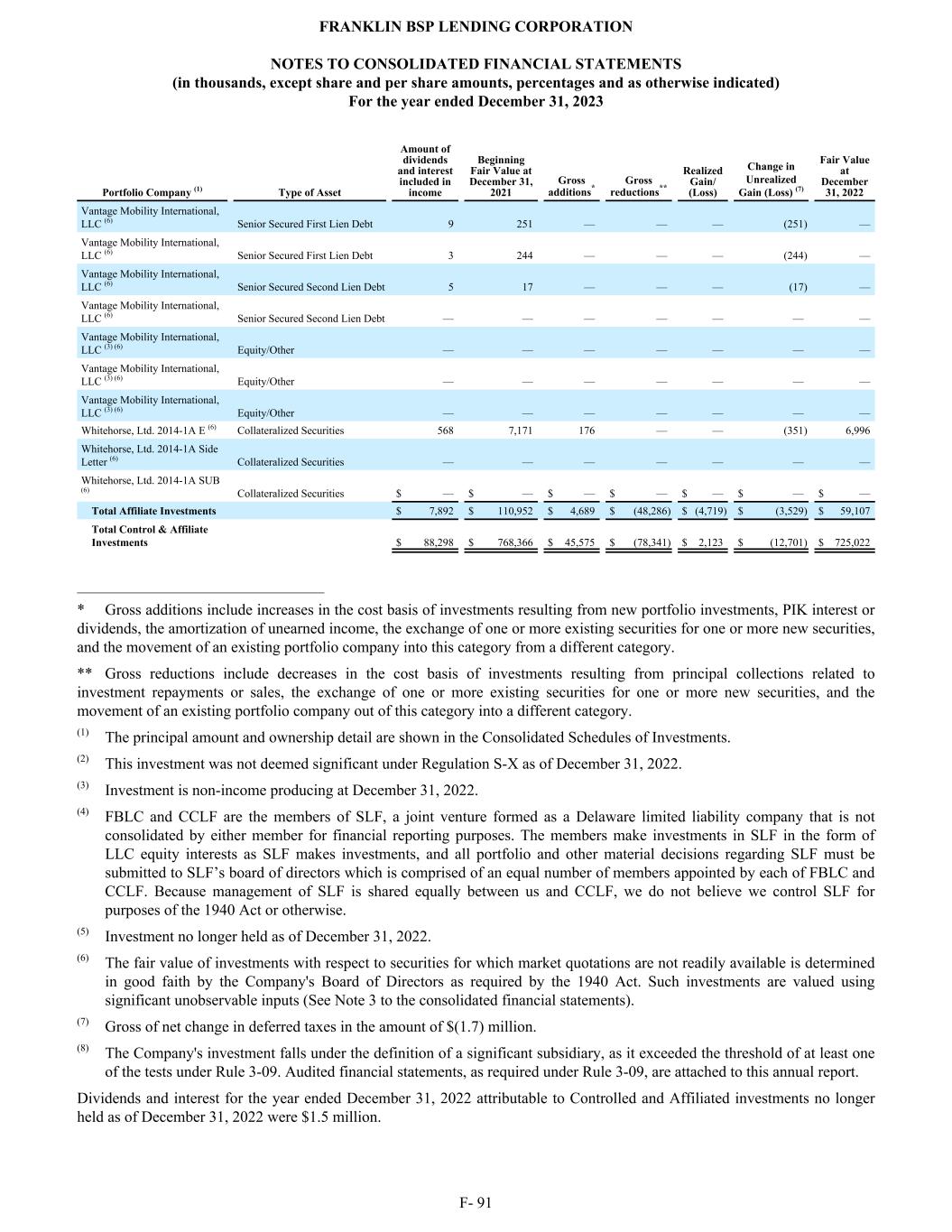

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm F- 2 Audited Consolidated Financial Statements: Consolidated Statements of Assets and Liabilities a of December 31, 2023 and 2022 F- 4 Consolidated Statements of Operations for the Years Ended December 31, 2023, 2022, and 2021 F- 5 Consolidated Statements of Changes in Net Assets for the Years Ended December 31, 2023, 2022, and 2021 F- 7 Consolidated Statements of Cash Flows for the Years Ended December 31, 2023, 2022, and 2021 F- 8 Consolidated Schedules of Investments as of December 31, 2023 and 2022 F- 10 Notes to Consolidated Financial Statements F- 31 F- 1

Report of Independent Registered Public Accounting Firm To the Shareholders and the Board of Directors of Franklin BSP Lending Corporation Opinion on the Financial Statements We have audited the accompanying consolidated statements of assets and liabilities of Franklin BSP Lending Corporation (the “Company”), including the consolidated schedules of investments, as of December 31, 2023 and 2022, the related consolidated statements of operations, changes in net assets, and cash flows for each of the three years in the period ended December 31, 2023, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2023 and 2022, and the results of its operations, changes in its net assets, and its cash flows for each of the three years in the period ended December 31, 2023, in conformity with U.S. generally accepted accounting principles. Basis for Opinion These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB and in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of December 31, 2023 and 2022, by correspondence with the custodian or the underlying investee. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. Critical Audit Matter The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective or complex judgments. The communication of the critical audit matter does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the account or disclosures to which it relates. F- 2

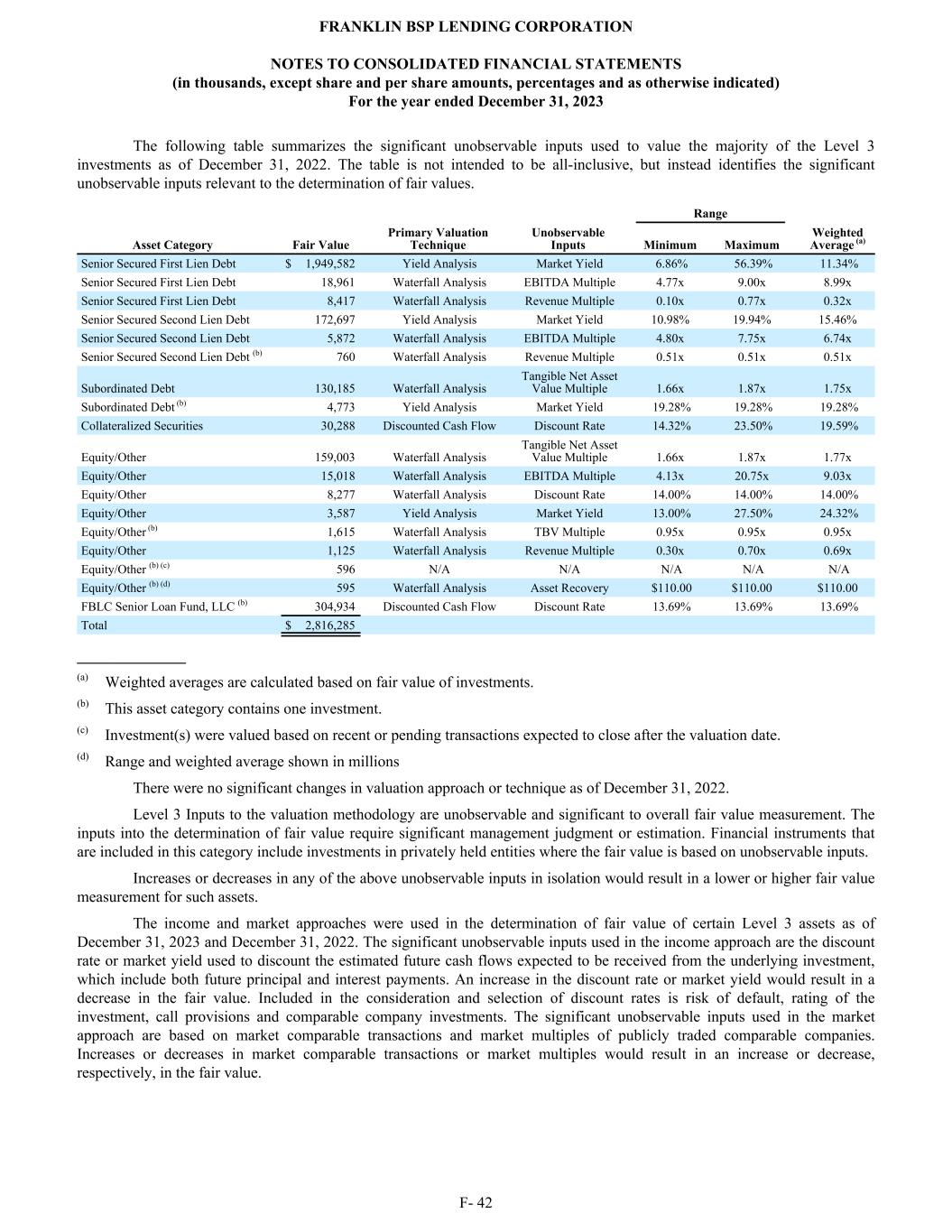

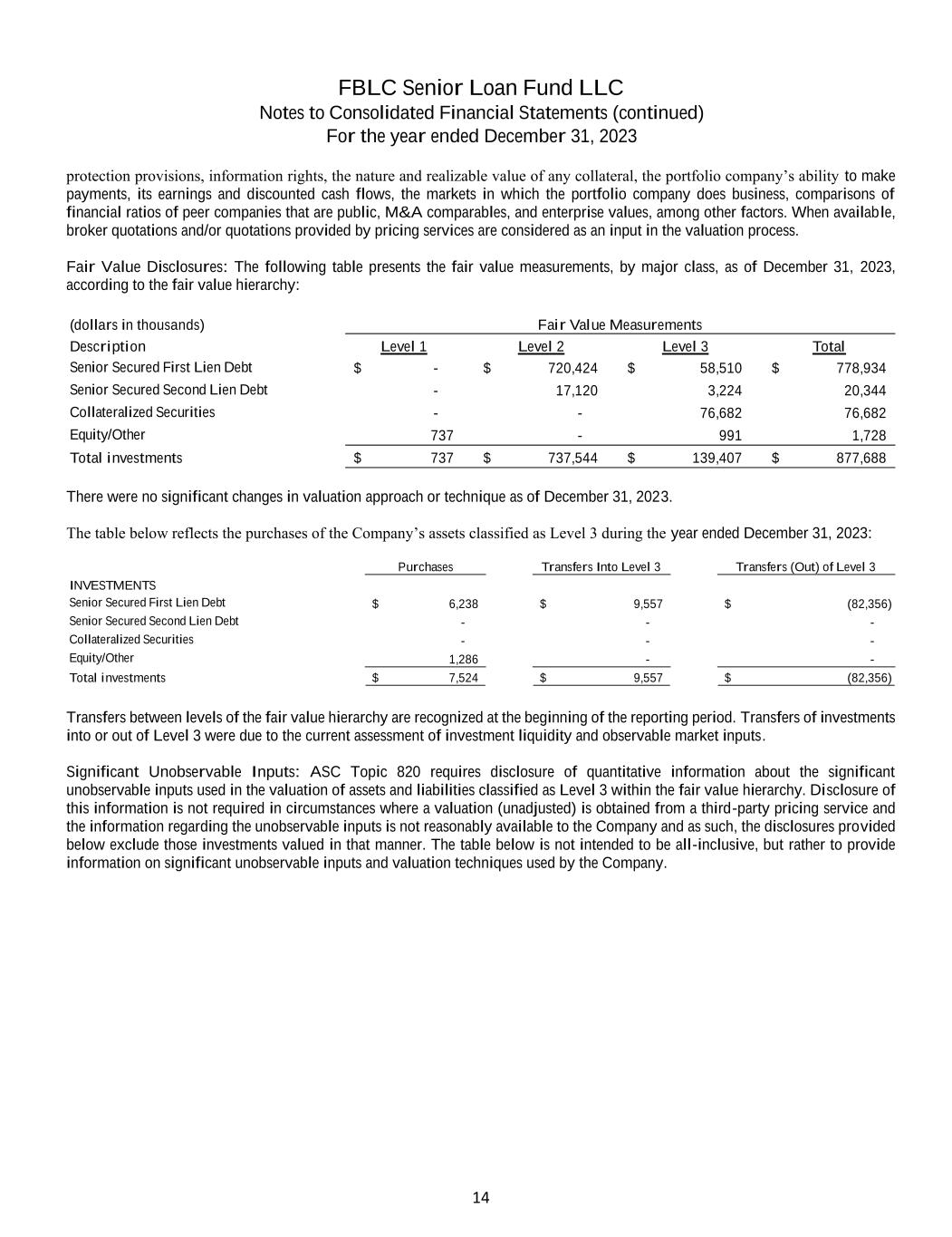

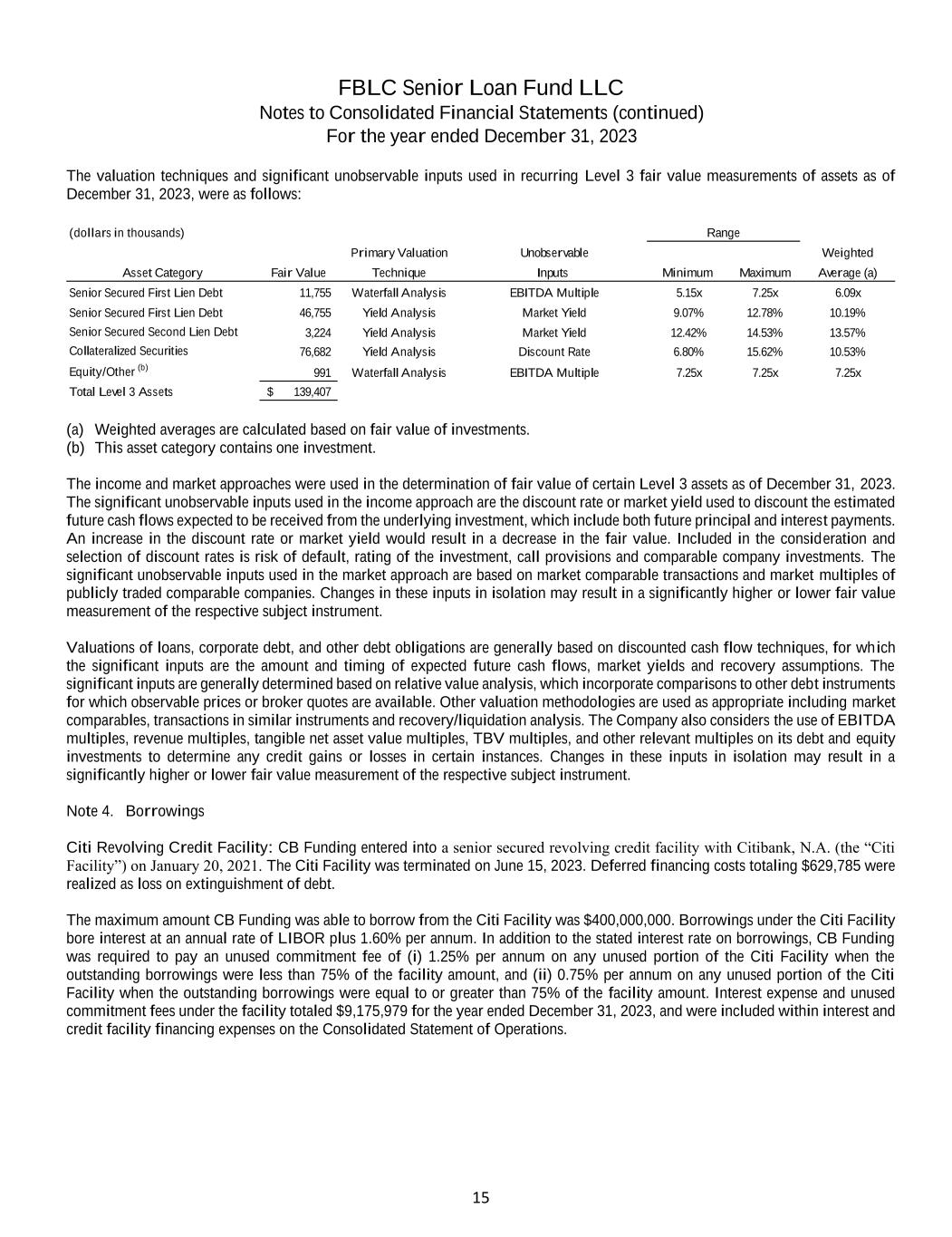

Valuation of investments using significant unobservable inputs and assumptions Description of the Matter At December 31, 2023, the fair value of the Company’s investments categorized as Level 3 of the fair value hierarchy (Level 3 investments) totaled $2,755,455,000. The Company determines the fair value of these investments by using the valuation approaches and techniques and significant unobservable inputs and assumptions described in Notes 2 and 3 to the consolidated financial statements. The valuation approaches primarily used by the Company are the income approach, the market approach, or both approaches, as appropriate, and the primary valuation techniques used are a discounted cash flow, a waterfall analysis or a yield analysis. The significant unobservable inputs include discount rates, market yields, revenue multiples, EBITDA multiples, tangible book value (TBV) multiples, asset recovery and tangible net asset value multiples. Auditing the fair value of the Company’s Level 3 investments was complex and, at times, required the involvement of our valuation specialists due to the significant judgments utilized in determining fair value. The significant judgments relate to the determination of the significant unobservable inputs and the valuation approaches and techniques used by the Company, as described above. The selection of these unobservable inputs and valuation approaches and techniques has a significant effect on the valuation of these investments. Also, applying audit procedures to address the estimation uncertainty involves a high degree of auditor subjectivity. How We Addressed the Matter in Our Audit To test the valuation of the Company’s Level 3 investments, our audit procedures included, among others, evaluating the valuation approaches and techniques used by the Company by assessing whether they were consistent with valuation practice relative to the characteristics of the investments being measured and testing significant unobservable inputs and the mathematical accuracy of the Company’s valuation models. For example, as applicable, we compared the significant assumptions to current industry, market and economic trends, the historical results of the portfolio company’s business and other guideline companies within the same industry and to other relevant factors; we considered recent market transactions in the portfolio company or comparable companies; we involved valuation specialists to assist in independently developing fair value estimates for certain investments using portfolio company and market information and comparing them to the Company's estimates; and, as applicable, we compared the significant unobservable inputs and agreed the underlying data used in the Company’s valuations to agreements, information available from third-party sources and market data (for example, deal terms, portfolio company operating results and changes in market yields), where available. We also reviewed the information considered by the Adviser, acting as the Valuation Designee and subject to the oversight of the Board of Directors relating to the Company’s determination of fair value, searched for and evaluated information that corroborated or contradicted the Company’s significant unobservable inputs and assumptions, and reviewed subsequent events and transactions and considered whether they corroborated or contradicted the Company’s year-end valuations. /s/ Ernst & Young LLP We have served as the Company’s auditor since 2017. New York, NY March 15, 2024 F- 3

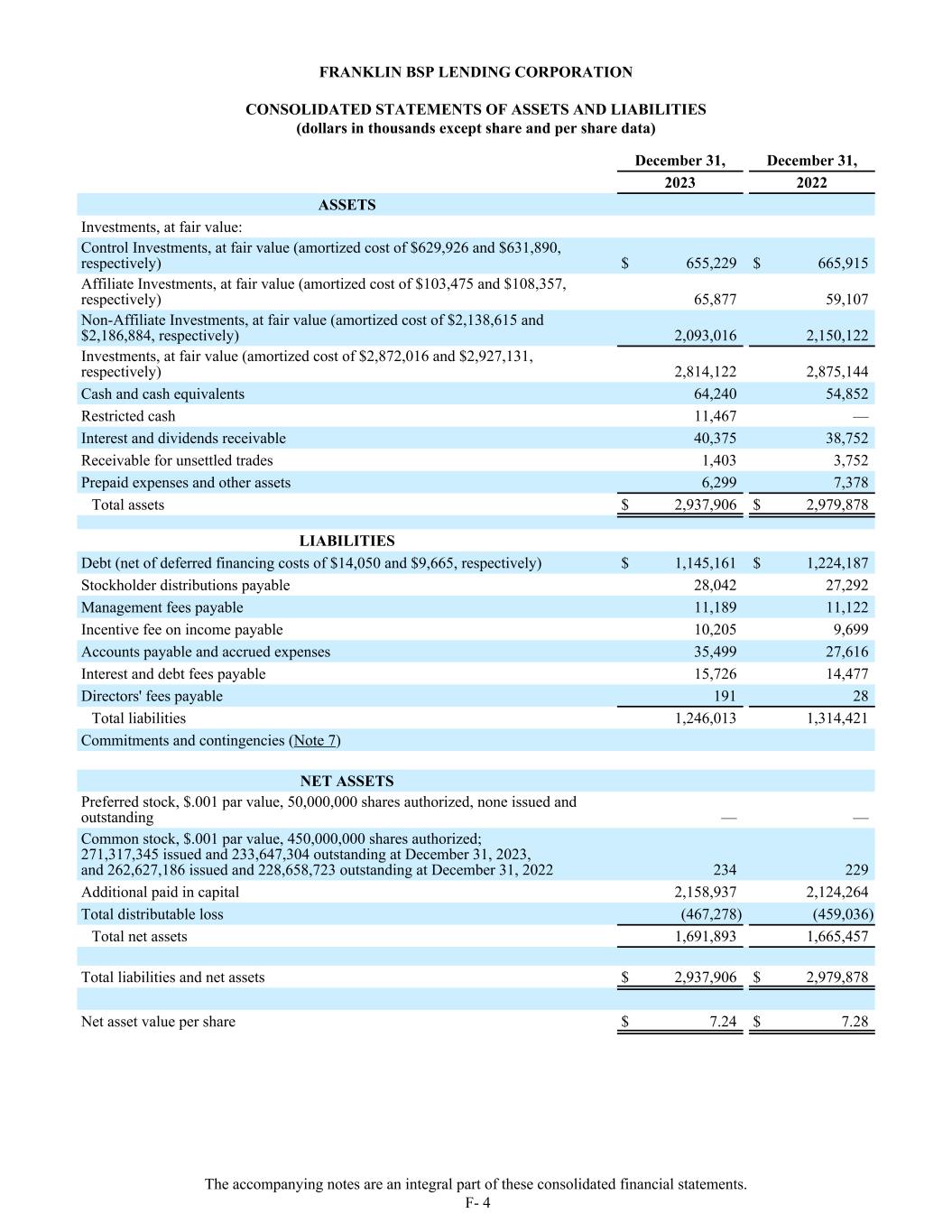

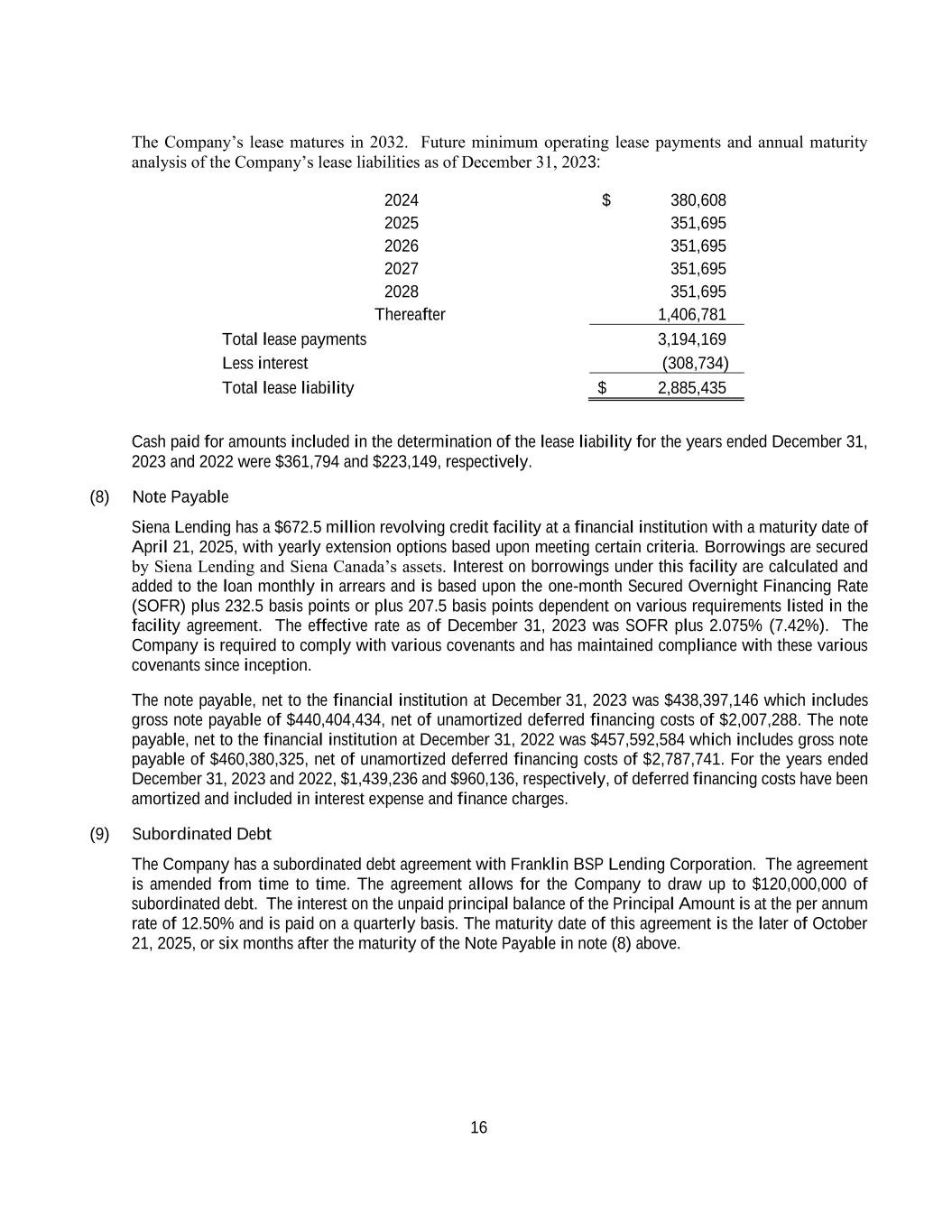

FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES (dollars in thousands except share and per share data) December 31, December 31, 2023 2022 ASSETS Investments, at fair value: Control Investments, at fair value (amortized cost of $629,926 and $631,890, respectively) $ 655,229 $ 665,915 Affiliate Investments, at fair value (amortized cost of $103,475 and $108,357, respectively) 65,877 59,107 Non-Affiliate Investments, at fair value (amortized cost of $2,138,615 and $2,186,884, respectively) 2,093,016 2,150,122 Investments, at fair value (amortized cost of $2,872,016 and $2,927,131, respectively) 2,814,122 2,875,144 Cash and cash equivalents 64,240 54,852 Restricted cash 11,467 — Interest and dividends receivable 40,375 38,752 Receivable for unsettled trades 1,403 3,752 Prepaid expenses and other assets 6,299 7,378 Total assets $ 2,937,906 $ 2,979,878 LIABILITIES Debt (net of deferred financing costs of $14,050 and $9,665, respectively) $ 1,145,161 $ 1,224,187 Stockholder distributions payable 28,042 27,292 Management fees payable 11,189 11,122 Incentive fee on income payable 10,205 9,699 Accounts payable and accrued expenses 35,499 27,616 Interest and debt fees payable 15,726 14,477 Directors' fees payable 191 28 Total liabilities 1,246,013 1,314,421 Commitments and contingencies (Note 7) NET ASSETS Preferred stock, $.001 par value, 50,000,000 shares authorized, none issued and outstanding — — Common stock, $.001 par value, 450,000,000 shares authorized; 271,317,345 issued and 233,647,304 outstanding at December 31, 2023, and 262,627,186 issued and 228,658,723 outstanding at December 31, 2022 234 229 Additional paid in capital 2,158,937 2,124,264 Total distributable loss (467,278) (459,036) Total net assets 1,691,893 1,665,457 Total liabilities and net assets $ 2,937,906 $ 2,979,878 Net asset value per share $ 7.24 $ 7.28 The accompanying notes are an integral part of these consolidated financial statements. F- 4

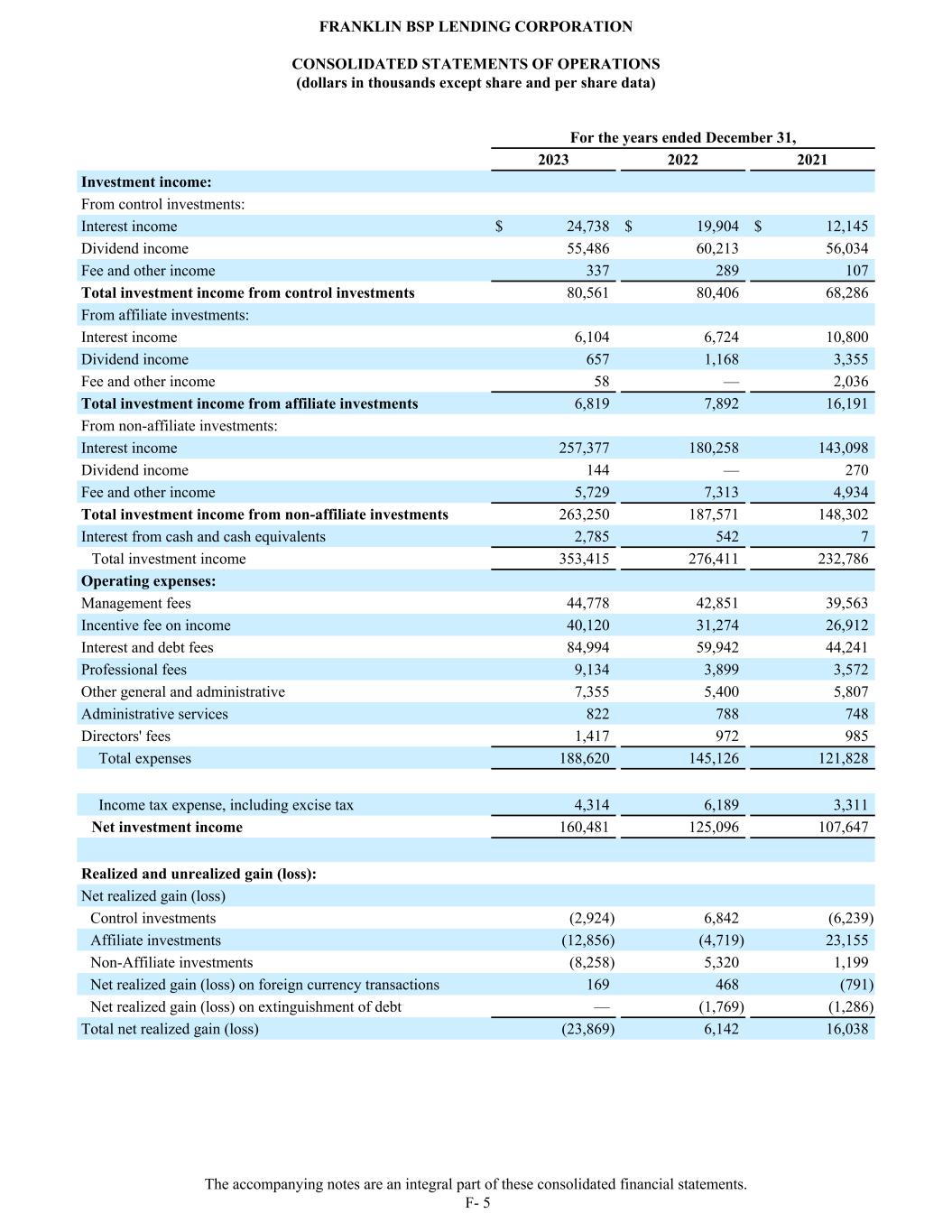

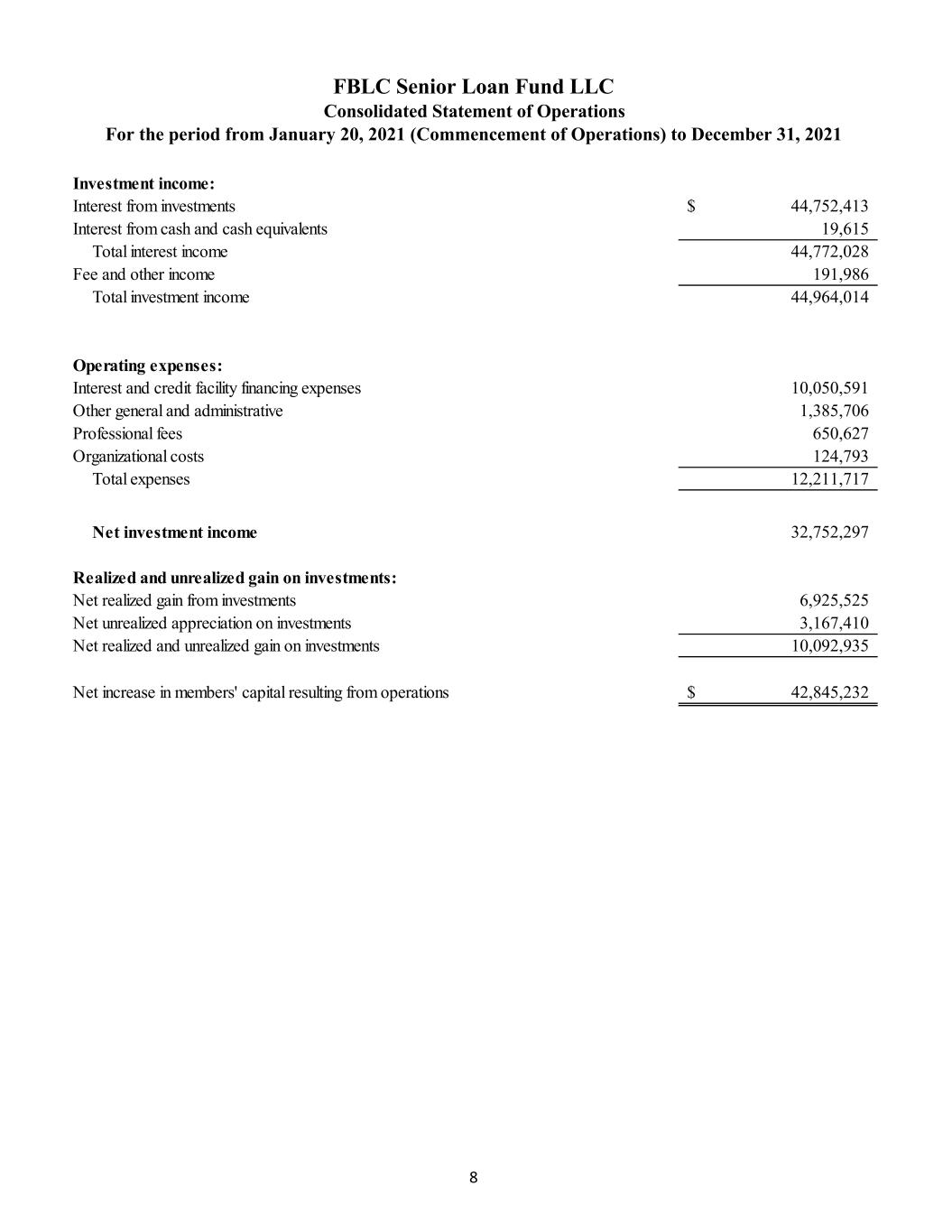

Investment income: From control investments: Interest income $ 24,738 $ 19,904 $ 12,145 Dividend income 55,486 60,213 56,034 Fee and other income 337 289 107 Total investment income from control investments 80,561 80,406 68,286 From affiliate investments: Interest income 6,104 6,724 10,800 Dividend income 657 1,168 3,355 Fee and other income 58 — 2,036 Total investment income from affiliate investments 6,819 7,892 16,191 From non-affiliate investments: Interest income 257,377 180,258 143,098 Dividend income 144 — 270 Fee and other income 5,729 7,313 4,934 Total investment income from non-affiliate investments 263,250 187,571 148,302 Interest from cash and cash equivalents 2,785 542 7 Total investment income 353,415 276,411 232,786 Operating expenses: Management fees 44,778 42,851 39,563 Incentive fee on income 40,120 31,274 26,912 Interest and debt fees 84,994 59,942 44,241 Professional fees 9,134 3,899 3,572 Other general and administrative 7,355 5,400 5,807 Administrative services 822 788 748 Directors' fees 1,417 972 985 Total expenses 188,620 145,126 121,828 Income tax expense, including excise tax 4,314 6,189 3,311 Net investment income 160,481 125,096 107,647 Realized and unrealized gain (loss): Net realized gain (loss) Control investments (2,924) 6,842 (6,239) Affiliate investments (12,856) (4,719) 23,155 Non-Affiliate investments (8,258) 5,320 1,199 Net realized gain (loss) on foreign currency transactions 169 468 (791) Net realized gain (loss) on extinguishment of debt — (1,769) (1,286) Total net realized gain (loss) (23,869) 6,142 16,038 For the years ended December 31, 2023 2022 2021 FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (dollars in thousands except share and per share data) The accompanying notes are an integral part of these consolidated financial statements. F- 5

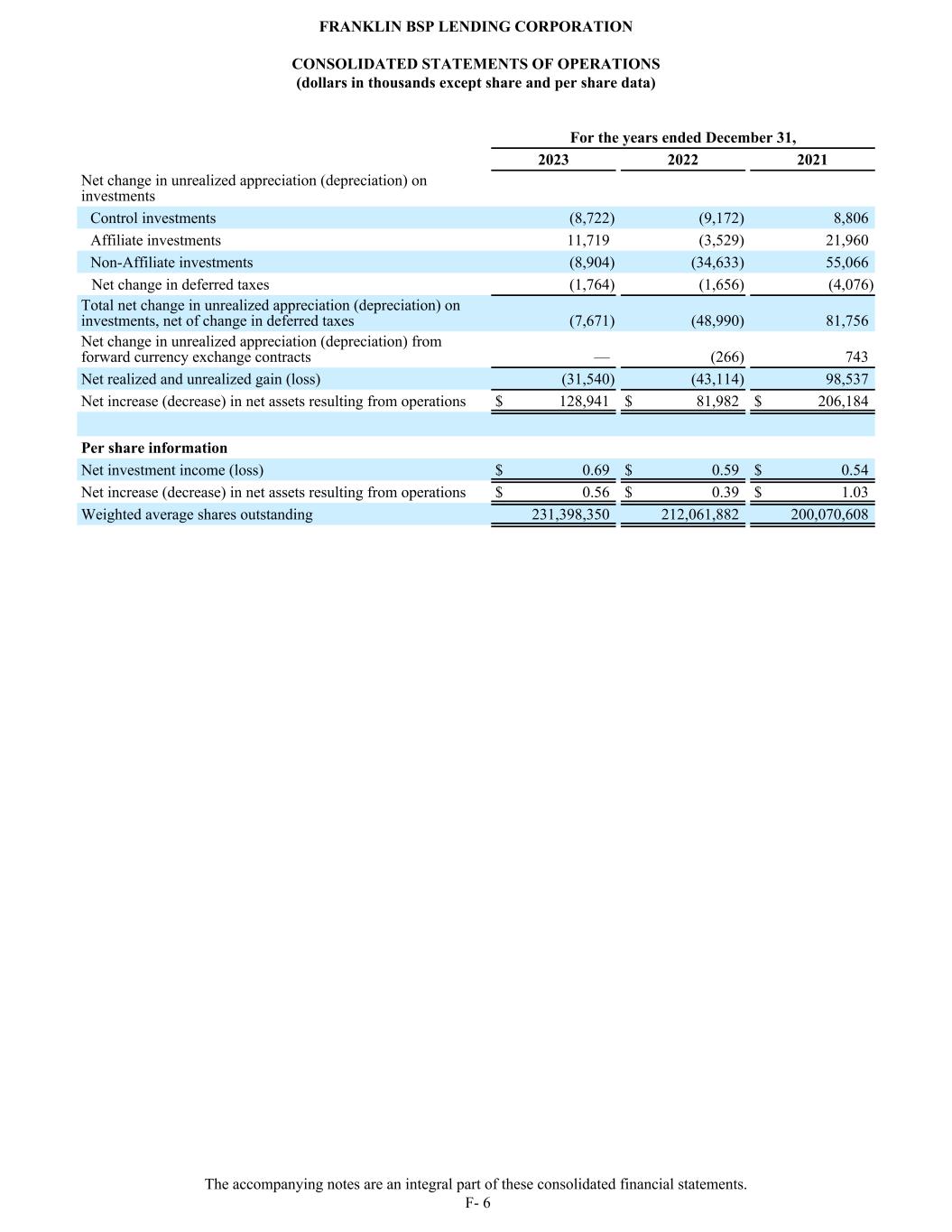

Net change in unrealized appreciation (depreciation) on investments Control investments (8,722) (9,172) 8,806 Affiliate investments 11,719 (3,529) 21,960 Non-Affiliate investments (8,904) (34,633) 55,066 Net change in deferred taxes (1,764) (1,656) (4,076) Total net change in unrealized appreciation (depreciation) on investments, net of change in deferred taxes (7,671) (48,990) 81,756 Net change in unrealized appreciation (depreciation) from forward currency exchange contracts — (266) 743 Net realized and unrealized gain (loss) (31,540) (43,114) 98,537 Net increase (decrease) in net assets resulting from operations $ 128,941 $ 81,982 $ 206,184 Per share information Net investment income (loss) $ 0.69 $ 0.59 $ 0.54 Net increase (decrease) in net assets resulting from operations $ 0.56 $ 0.39 $ 1.03 Weighted average shares outstanding 231,398,350 212,061,882 200,070,608 For the years ended December 31, 2023 2022 2021 FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (dollars in thousands except share and per share data) The accompanying notes are an integral part of these consolidated financial statements. F- 6

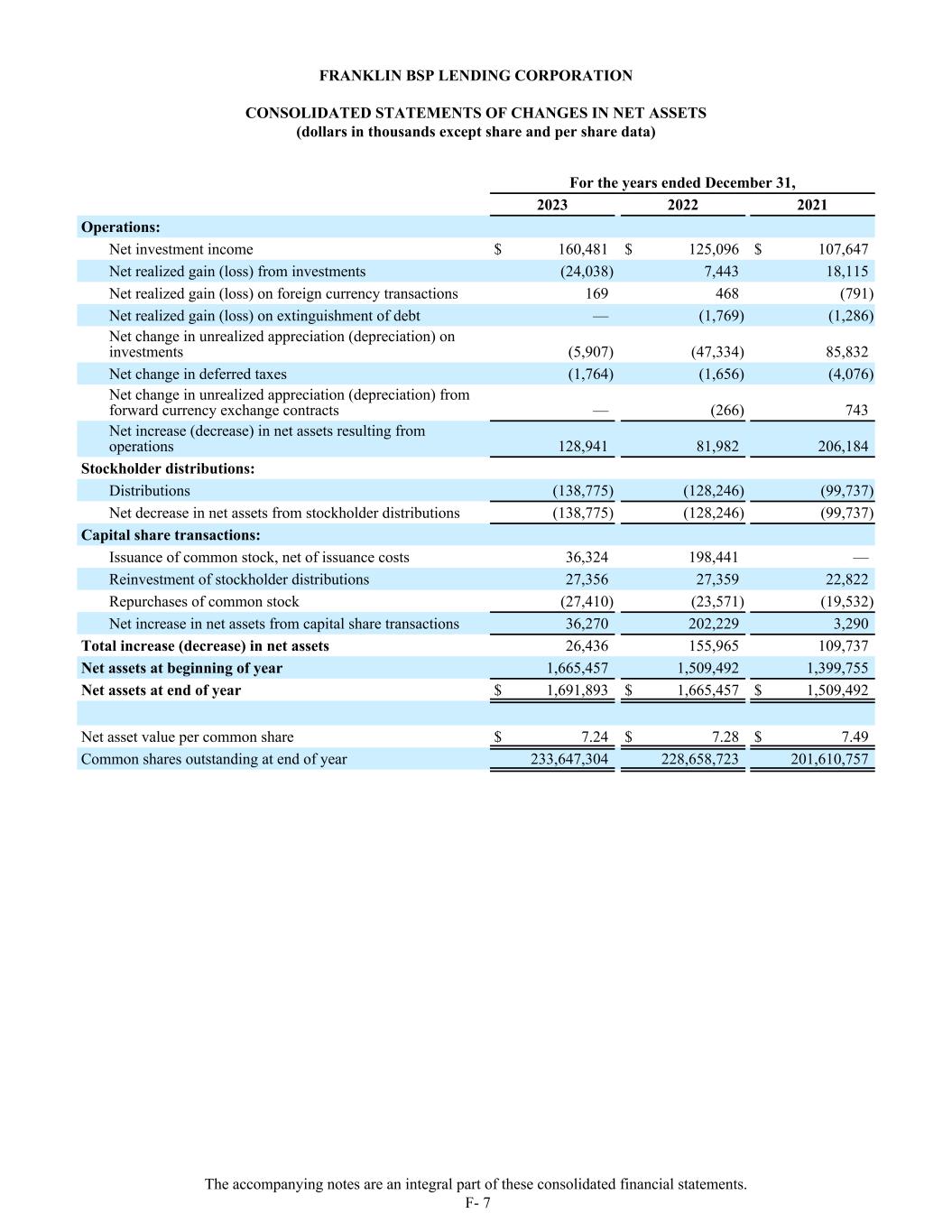

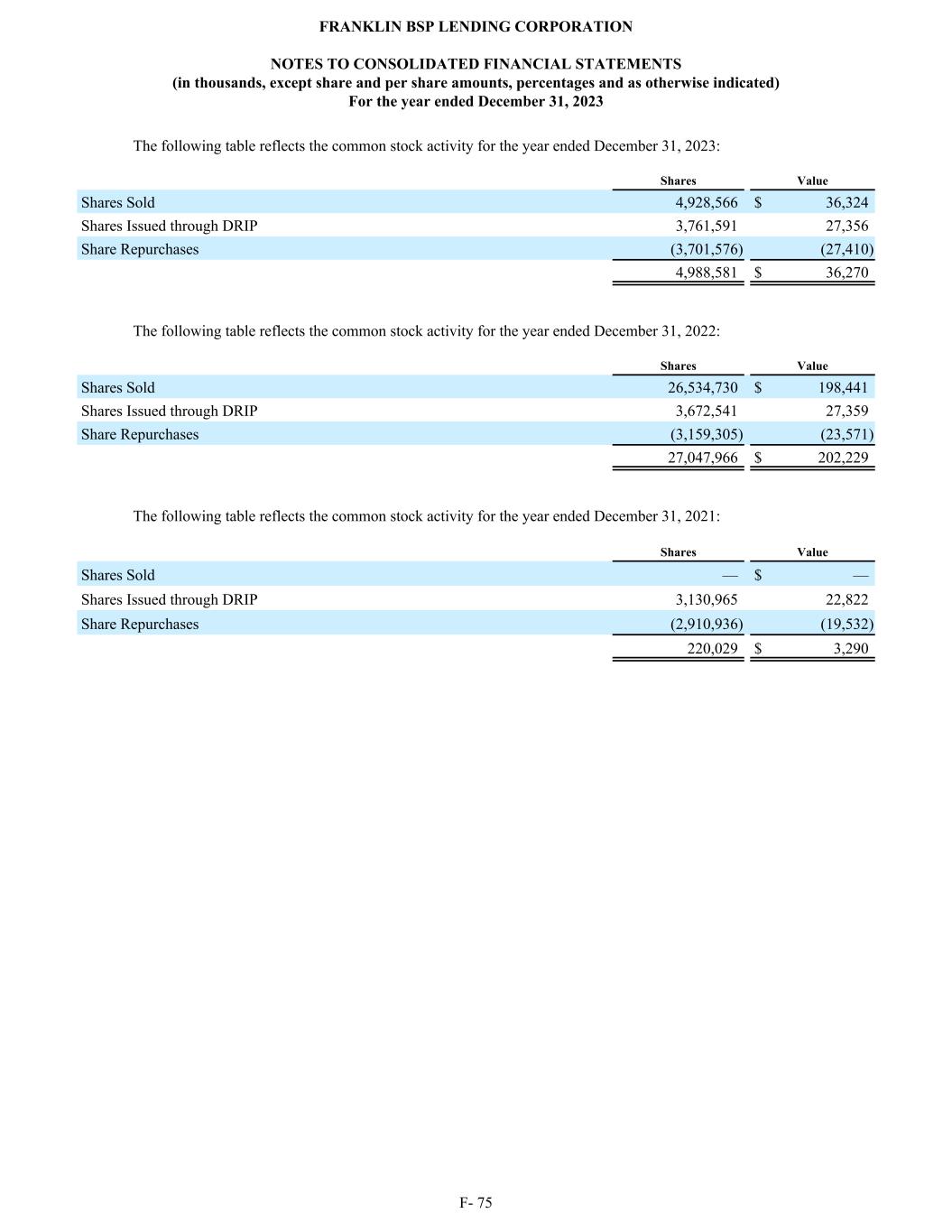

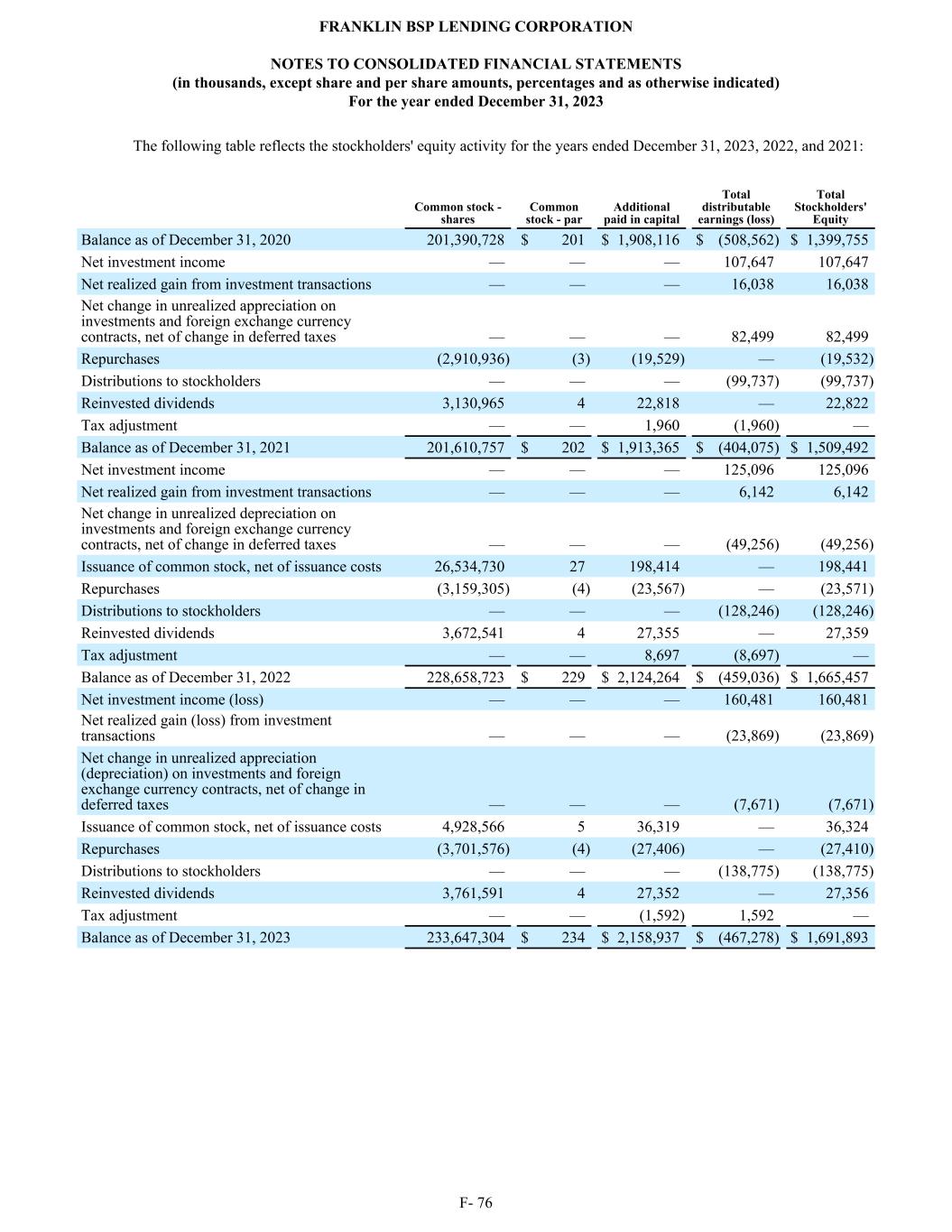

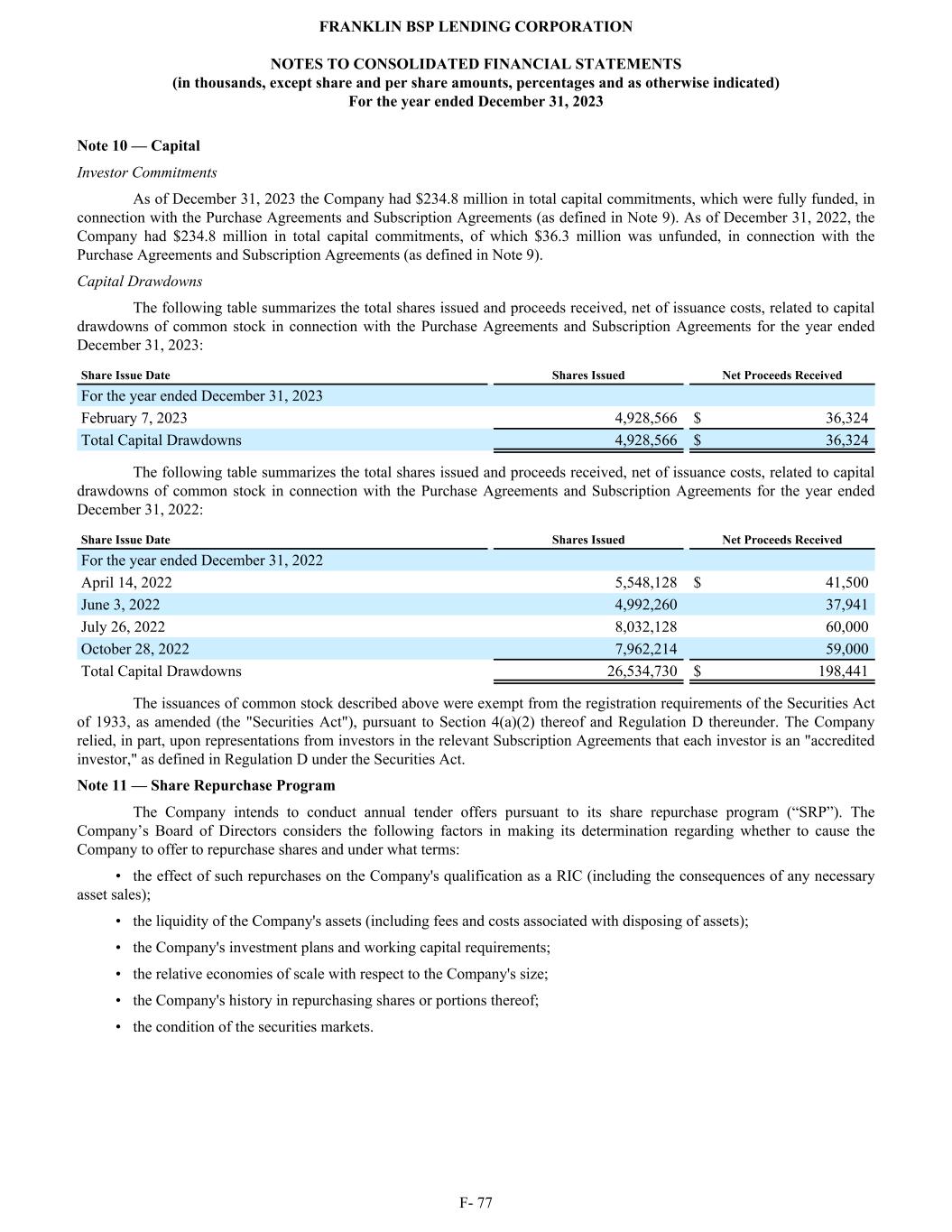

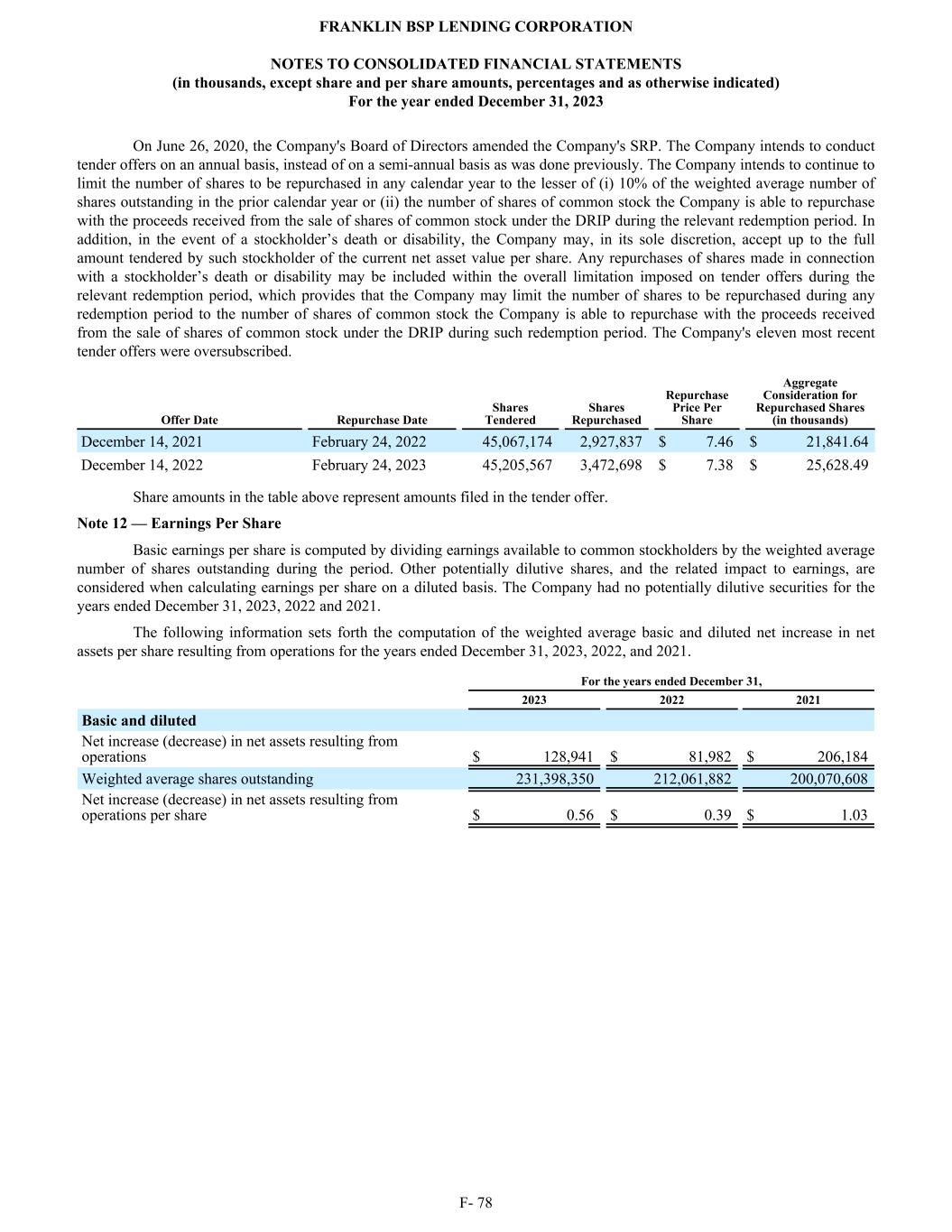

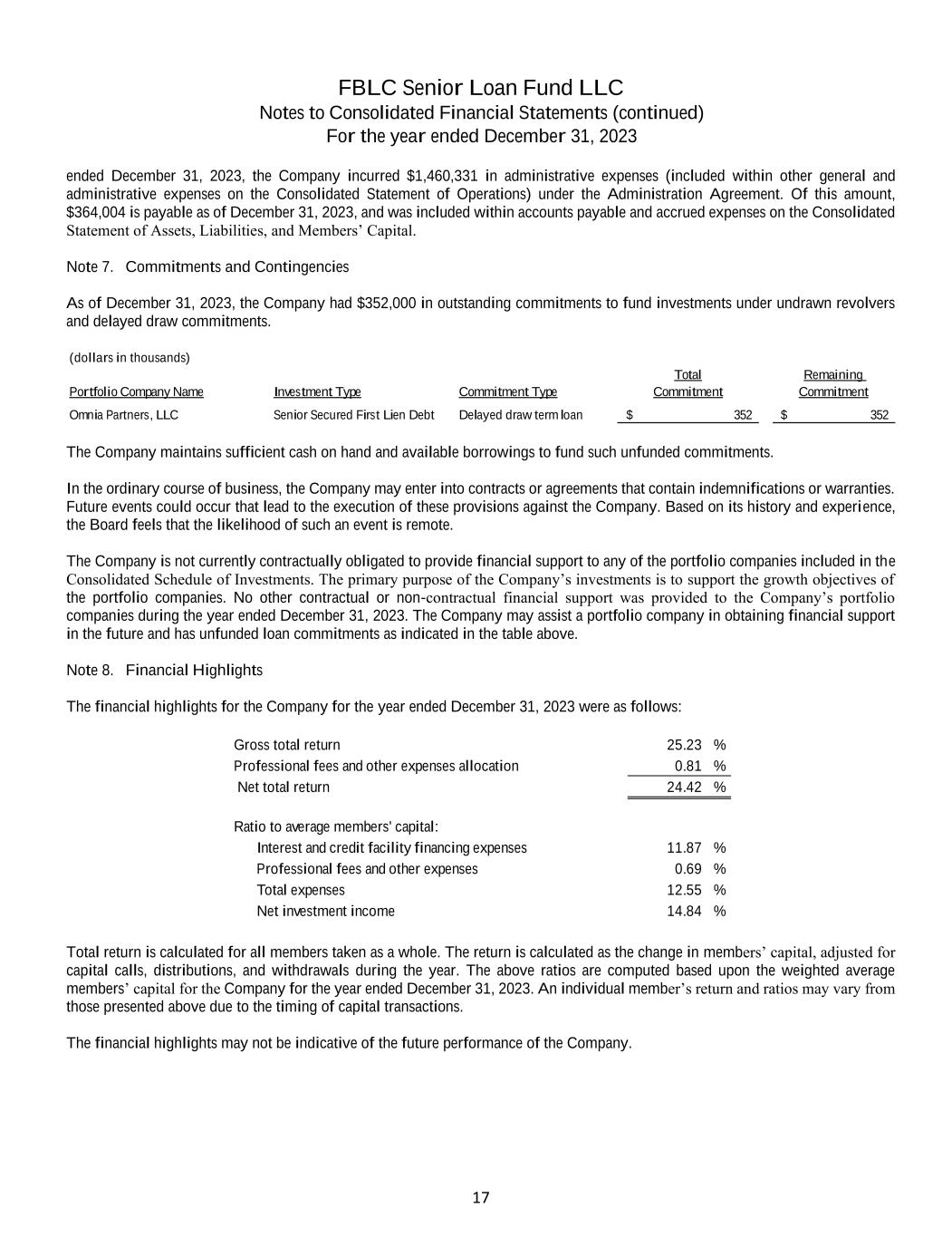

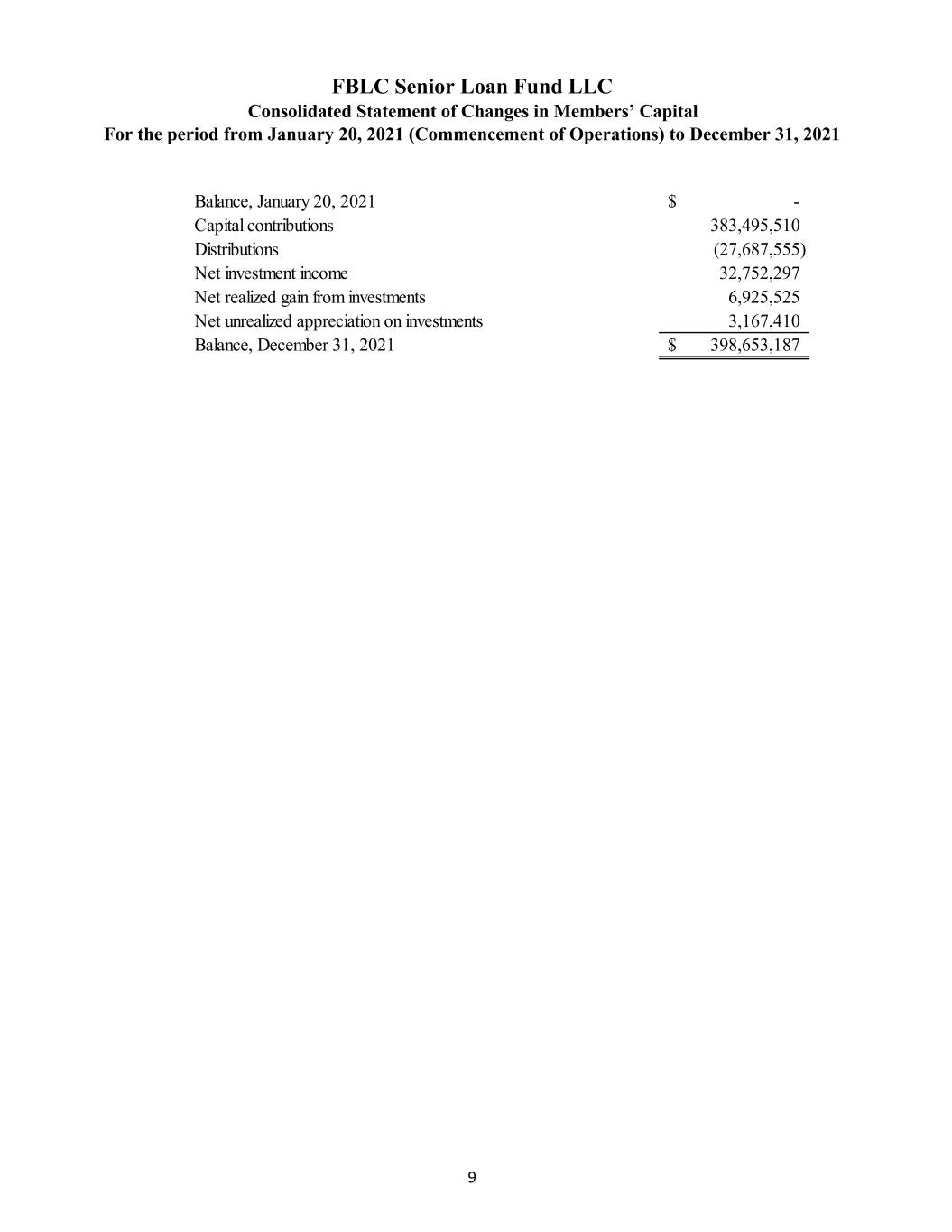

FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS (dollars in thousands except share and per share data) For the years ended December 31, 2023 2022 2021 Operations: Net investment income $ 160,481 $ 125,096 $ 107,647 Net realized gain (loss) from investments (24,038) 7,443 18,115 Net realized gain (loss) on foreign currency transactions 169 468 (791) Net realized gain (loss) on extinguishment of debt — (1,769) (1,286) Net change in unrealized appreciation (depreciation) on investments (5,907) (47,334) 85,832 Net change in deferred taxes (1,764) (1,656) (4,076) Net change in unrealized appreciation (depreciation) from forward currency exchange contracts — (266) 743 Net increase (decrease) in net assets resulting from operations 128,941 81,982 206,184 Stockholder distributions: Distributions (138,775) (128,246) (99,737) Net decrease in net assets from stockholder distributions (138,775) (128,246) (99,737) Capital share transactions: Issuance of common stock, net of issuance costs 36,324 198,441 — Reinvestment of stockholder distributions 27,356 27,359 22,822 Repurchases of common stock (27,410) (23,571) (19,532) Net increase in net assets from capital share transactions 36,270 202,229 3,290 Total increase (decrease) in net assets 26,436 155,965 109,737 Net assets at beginning of year 1,665,457 1,509,492 1,399,755 Net assets at end of year $ 1,691,893 $ 1,665,457 $ 1,509,492 Net asset value per common share $ 7.24 $ 7.28 $ 7.49 Common shares outstanding at end of year 233,647,304 228,658,723 201,610,757 The accompanying notes are an integral part of these consolidated financial statements. F- 7

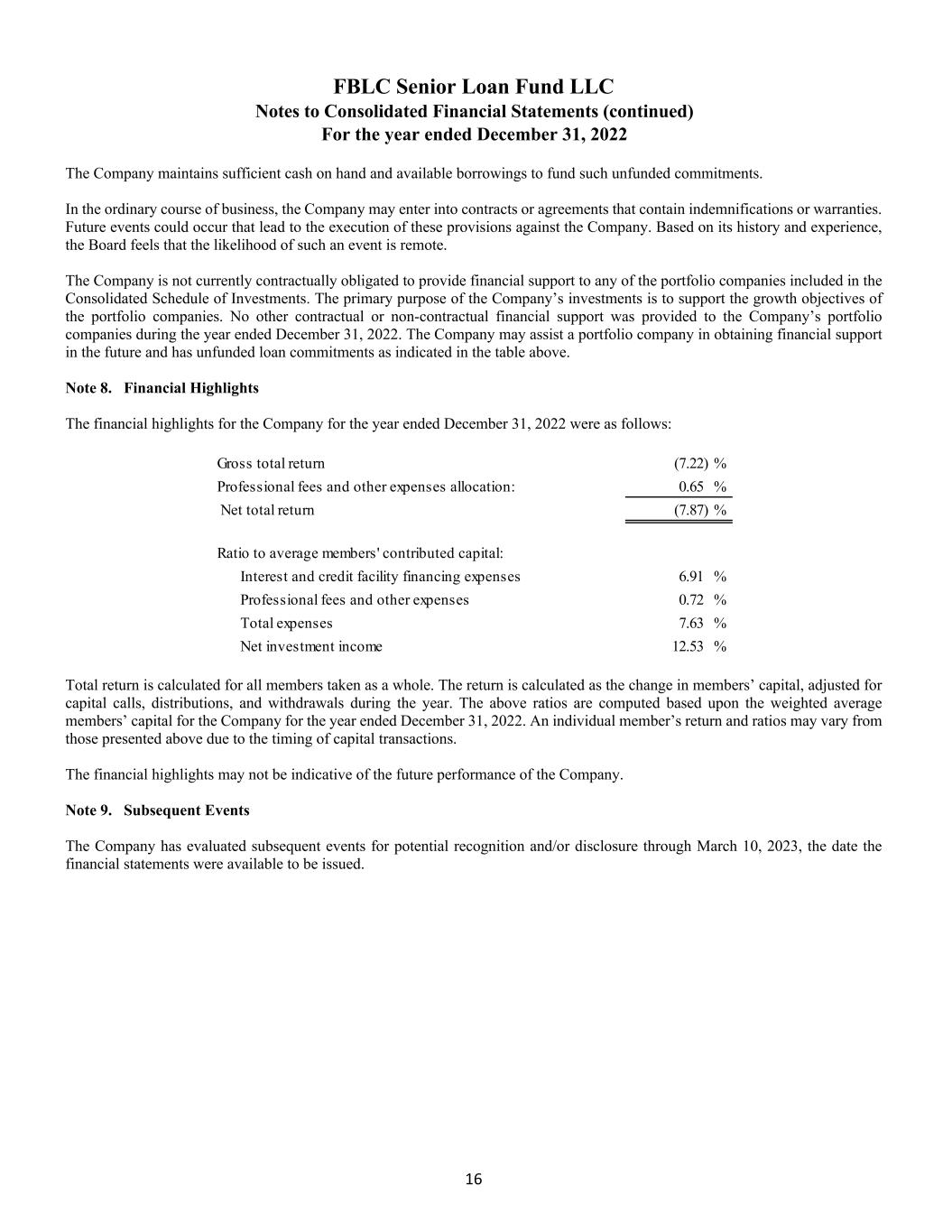

Operating activities: Net increase (decrease) in net assets resulting from operations $ 128,941 $ 81,982 $ 206,184 Adjustments to reconcile net increase (decrease) in net assets from operations to net cash provided by (used in) operating activities: Payment-in-kind interest income (17,103) (13,524) (8,114) Net accretion of discount on investments (7,692) (8,568) (8,640) Amortization of deferred financing costs 3,290 3,252 3,228 Amortization of discount on unsecured notes 1,045 1,248 1,063 Sales and repayments of investments 343,619 396,020 1,233,840 Purchases of investments (287,747) (509,999) (1,612,937) Net realized (gain) loss from investments 24,038 (7,443) (18,115) Net realized (gain) loss on foreign currency transactions (169) (468) 791 Net realized (gain) loss on extinguishment of debt — 1,769 1,286 Net change in unrealized (appreciation) depreciation on investments 5,907 47,334 (85,832) Net change in unrealized (appreciation) depreciation from forward currency exchange contracts — 266 (743) (Increase) decrease in operating assets: Interest and dividends receivable (1,623) (9,663) (14,214) Receivable for unsettled trades 2,349 33,627 10,971 Prepaid expenses and other assets 1,079 (629) (4,074) Increase (decrease) in operating liabilities: Management fees payable 67 623 941 Incentive fee on income payable 506 2,530 946 Accounts payable and accrued expenses 7,883 (2,228) 21,370 Payable for unsettled trades — (34,394) (157,614) Interest and debt fees payable 1,249 6,433 2,113 Directors' fees payable 163 (93) 35 Net cash provided by (used in) operating activities 205,802 (11,925) (427,515) Financing activities: Proceeds from issuance of shares of common stock, net 36,324 198,441 — Repurchases of common stock (27,410) (23,571) (19,532) Proceeds from debt 243,325 550,276 1,208,294 Payments on debt (319,011) (599,500) (701,000) Payments of financing costs (7,675) (5,263) (708) Stockholder distributions (110,669) (96,848) (69,156) Net cash provided by (used in) financing activities (185,116) 23,535 417,898 Net increase (decrease) in cash, cash equivalents and restricted cash 20,686 11,610 (9,617) Effect of foreign currency exchange rates 169 468 (791) Cash, cash equivalents and restricted cash, beginning of year 54,852 42,774 53,182 Cash, cash equivalents and restricted cash, end of year $ 75,707 $ 54,852 $ 42,774 For the years ended December 31, 2023 2022 2021 FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 8

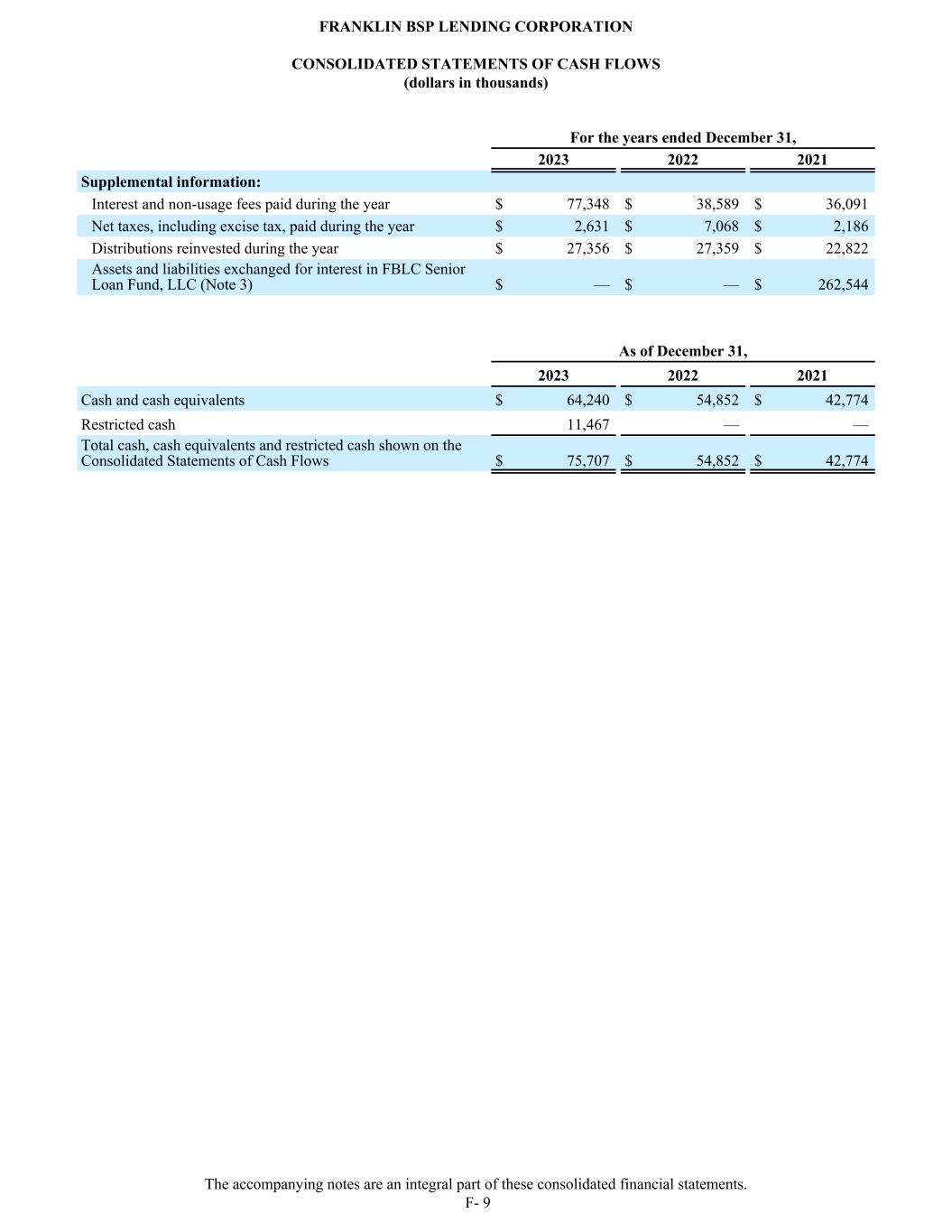

Supplemental information: Interest and non-usage fees paid during the year $ 77,348 $ 38,589 $ 36,091 Net taxes, including excise tax, paid during the year $ 2,631 $ 7,068 $ 2,186 Distributions reinvested during the year $ 27,356 $ 27,359 $ 22,822 Assets and liabilities exchanged for interest in FBLC Senior Loan Fund, LLC (Note 3) $ — $ — $ 262,544 For the years ended December 31, 2023 2022 2021 As of December 31, 2023 2022 2021 Cash and cash equivalents $ 64,240 $ 54,852 $ 42,774 Restricted cash 11,467 — — Total cash, cash equivalents and restricted cash shown on the Consolidated Statements of Cash Flows $ 75,707 $ 54,852 $ 42,774 FRANKLIN BSP LENDING CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 9

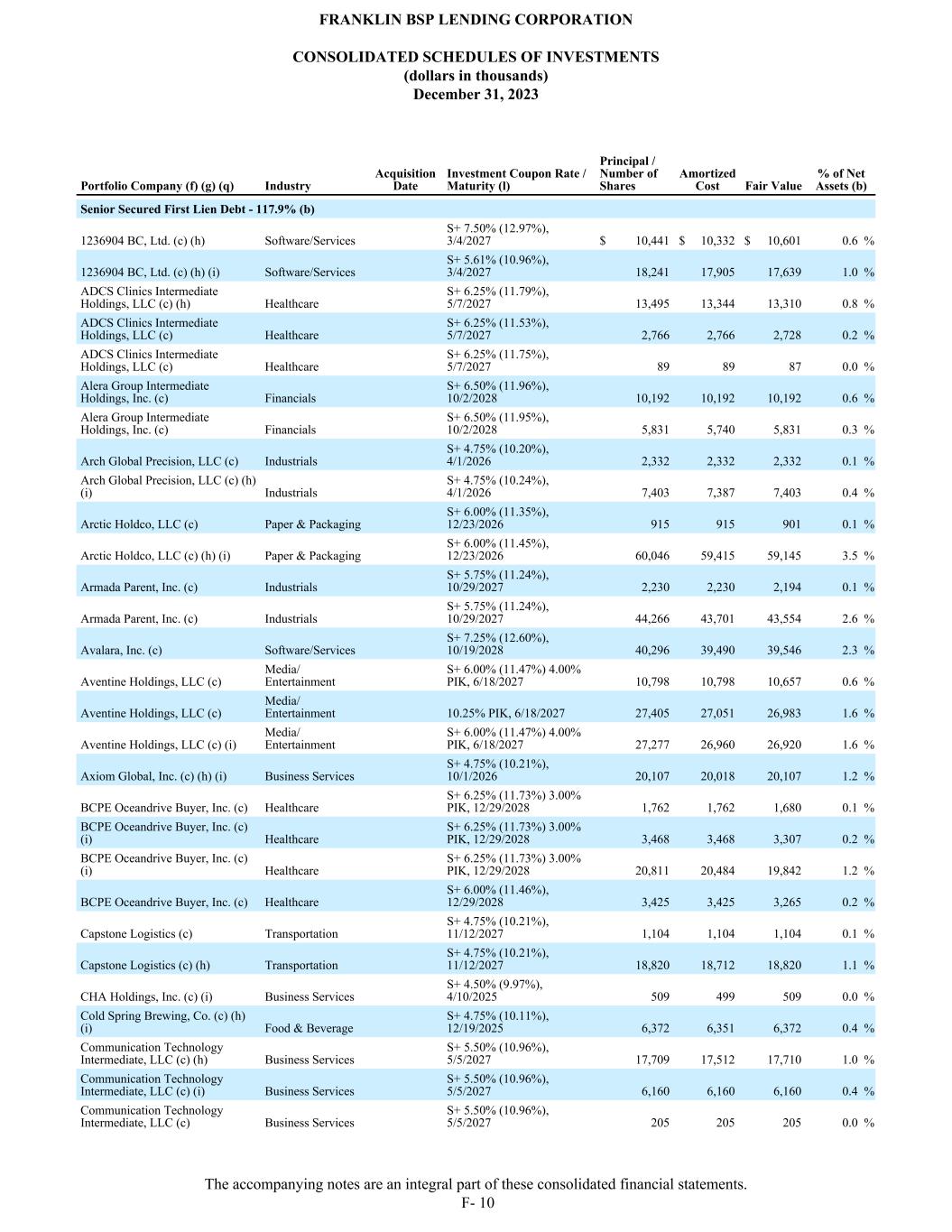

Senior Secured First Lien Debt - 117.9% (b) 1236904 BC, Ltd. (c) (h) Software/Services S+ 7.50% (12.97%), 3/4/2027 $ 10,441 $ 10,332 $ 10,601 0.6 % 1236904 BC, Ltd. (c) (h) (i) Software/Services S+ 5.61% (10.96%), 3/4/2027 18,241 17,905 17,639 1.0 % ADCS Clinics Intermediate Holdings, LLC (c) (h) Healthcare S+ 6.25% (11.79%), 5/7/2027 13,495 13,344 13,310 0.8 % ADCS Clinics Intermediate Holdings, LLC (c) Healthcare S+ 6.25% (11.53%), 5/7/2027 2,766 2,766 2,728 0.2 % ADCS Clinics Intermediate Holdings, LLC (c) Healthcare S+ 6.25% (11.75%), 5/7/2027 89 89 87 0.0 % Alera Group Intermediate Holdings, Inc. (c) Financials S+ 6.50% (11.96%), 10/2/2028 10,192 10,192 10,192 0.6 % Alera Group Intermediate Holdings, Inc. (c) Financials S+ 6.50% (11.95%), 10/2/2028 5,831 5,740 5,831 0.3 % Arch Global Precision, LLC (c) Industrials S+ 4.75% (10.20%), 4/1/2026 2,332 2,332 2,332 0.1 % Arch Global Precision, LLC (c) (h) (i) Industrials S+ 4.75% (10.24%), 4/1/2026 7,403 7,387 7,403 0.4 % Arctic Holdco, LLC (c) Paper & Packaging S+ 6.00% (11.35%), 12/23/2026 915 915 901 0.1 % Arctic Holdco, LLC (c) (h) (i) Paper & Packaging S+ 6.00% (11.45%), 12/23/2026 60,046 59,415 59,145 3.5 % Armada Parent, Inc. (c) Industrials S+ 5.75% (11.24%), 10/29/2027 2,230 2,230 2,194 0.1 % Armada Parent, Inc. (c) Industrials S+ 5.75% (11.24%), 10/29/2027 44,266 43,701 43,554 2.6 % Avalara, Inc. (c) Software/Services S+ 7.25% (12.60%), 10/19/2028 40,296 39,490 39,546 2.3 % Aventine Holdings, LLC (c) Media/ Entertainment S+ 6.00% (11.47%) 4.00% PIK, 6/18/2027 10,798 10,798 10,657 0.6 % Aventine Holdings, LLC (c) Media/ Entertainment 10.25% PIK, 6/18/2027 27,405 27,051 26,983 1.6 % Aventine Holdings, LLC (c) (i) Media/ Entertainment S+ 6.00% (11.47%) 4.00% PIK, 6/18/2027 27,277 26,960 26,920 1.6 % Axiom Global, Inc. (c) (h) (i) Business Services S+ 4.75% (10.21%), 10/1/2026 20,107 20,018 20,107 1.2 % BCPE Oceandrive Buyer, Inc. (c) Healthcare S+ 6.25% (11.73%) 3.00% PIK, 12/29/2028 1,762 1,762 1,680 0.1 % BCPE Oceandrive Buyer, Inc. (c) (i) Healthcare S+ 6.25% (11.73%) 3.00% PIK, 12/29/2028 3,468 3,468 3,307 0.2 % BCPE Oceandrive Buyer, Inc. (c) (i) Healthcare S+ 6.25% (11.73%) 3.00% PIK, 12/29/2028 20,811 20,484 19,842 1.2 % BCPE Oceandrive Buyer, Inc. (c) Healthcare S+ 6.00% (11.46%), 12/29/2028 3,425 3,425 3,265 0.2 % Capstone Logistics (c) Transportation S+ 4.75% (10.21%), 11/12/2027 1,104 1,104 1,104 0.1 % Capstone Logistics (c) (h) Transportation S+ 4.75% (10.21%), 11/12/2027 18,820 18,712 18,820 1.1 % CHA Holdings, Inc. (c) (i) Business Services S+ 4.50% (9.97%), 4/10/2025 509 499 509 0.0 % Cold Spring Brewing, Co. (c) (h) (i) Food & Beverage S+ 4.75% (10.11%), 12/19/2025 6,372 6,351 6,372 0.4 % Communication Technology Intermediate, LLC (c) (h) Business Services S+ 5.50% (10.96%), 5/5/2027 17,709 17,512 17,710 1.0 % Communication Technology Intermediate, LLC (c) (i) Business Services S+ 5.50% (10.96%), 5/5/2027 6,160 6,160 6,160 0.4 % Communication Technology Intermediate, LLC (c) Business Services S+ 5.50% (10.96%), 5/5/2027 205 205 205 0.0 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 10

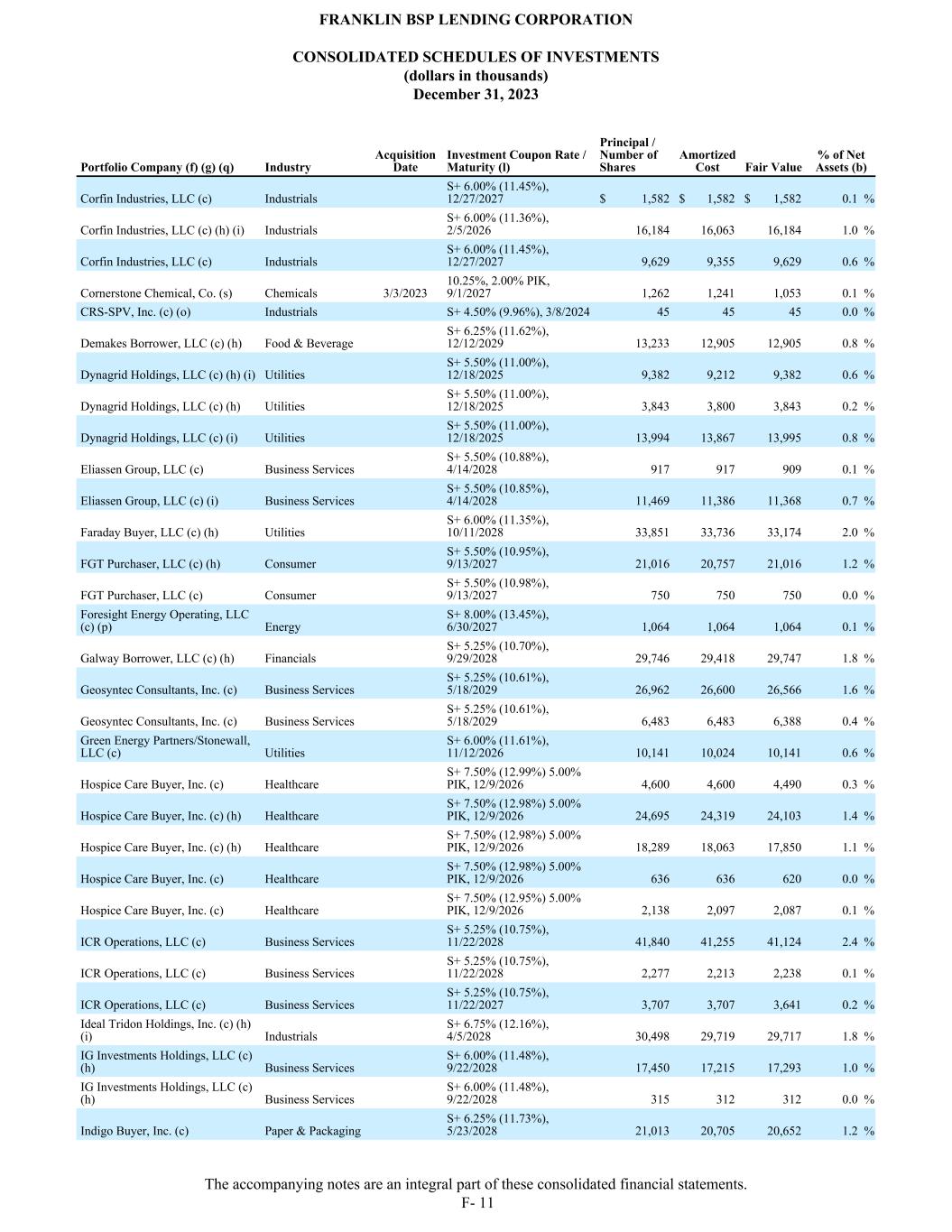

Corfin Industries, LLC (c) Industrials S+ 6.00% (11.45%), 12/27/2027 $ 1,582 $ 1,582 $ 1,582 0.1 % Corfin Industries, LLC (c) (h) (i) Industrials S+ 6.00% (11.36%), 2/5/2026 16,184 16,063 16,184 1.0 % Corfin Industries, LLC (c) Industrials S+ 6.00% (11.45%), 12/27/2027 9,629 9,355 9,629 0.6 % Cornerstone Chemical, Co. (s) Chemicals 3/3/2023 10.25%, 2.00% PIK, 9/1/2027 1,262 1,241 1,053 0.1 % CRS-SPV, Inc. (c) (o) Industrials S+ 4.50% (9.96%), 3/8/2024 45 45 45 0.0 % Demakes Borrower, LLC (c) (h) Food & Beverage S+ 6.25% (11.62%), 12/12/2029 13,233 12,905 12,905 0.8 % Dynagrid Holdings, LLC (c) (h) (i) Utilities S+ 5.50% (11.00%), 12/18/2025 9,382 9,212 9,382 0.6 % Dynagrid Holdings, LLC (c) (h) Utilities S+ 5.50% (11.00%), 12/18/2025 3,843 3,800 3,843 0.2 % Dynagrid Holdings, LLC (c) (i) Utilities S+ 5.50% (11.00%), 12/18/2025 13,994 13,867 13,995 0.8 % Eliassen Group, LLC (c) Business Services S+ 5.50% (10.88%), 4/14/2028 917 917 909 0.1 % Eliassen Group, LLC (c) (i) Business Services S+ 5.50% (10.85%), 4/14/2028 11,469 11,386 11,368 0.7 % Faraday Buyer, LLC (c) (h) Utilities S+ 6.00% (11.35%), 10/11/2028 33,851 33,736 33,174 2.0 % FGT Purchaser, LLC (c) (h) Consumer S+ 5.50% (10.95%), 9/13/2027 21,016 20,757 21,016 1.2 % FGT Purchaser, LLC (c) Consumer S+ 5.50% (10.98%), 9/13/2027 750 750 750 0.0 % Foresight Energy Operating, LLC (c) (p) Energy S+ 8.00% (13.45%), 6/30/2027 1,064 1,064 1,064 0.1 % Galway Borrower, LLC (c) (h) Financials S+ 5.25% (10.70%), 9/29/2028 29,746 29,418 29,747 1.8 % Geosyntec Consultants, Inc. (c) Business Services S+ 5.25% (10.61%), 5/18/2029 26,962 26,600 26,566 1.6 % Geosyntec Consultants, Inc. (c) Business Services S+ 5.25% (10.61%), 5/18/2029 6,483 6,483 6,388 0.4 % Green Energy Partners/Stonewall, LLC (c) Utilities S+ 6.00% (11.61%), 11/12/2026 10,141 10,024 10,141 0.6 % Hospice Care Buyer, Inc. (c) Healthcare S+ 7.50% (12.99%) 5.00% PIK, 12/9/2026 4,600 4,600 4,490 0.3 % Hospice Care Buyer, Inc. (c) (h) Healthcare S+ 7.50% (12.98%) 5.00% PIK, 12/9/2026 24,695 24,319 24,103 1.4 % Hospice Care Buyer, Inc. (c) (h) Healthcare S+ 7.50% (12.98%) 5.00% PIK, 12/9/2026 18,289 18,063 17,850 1.1 % Hospice Care Buyer, Inc. (c) Healthcare S+ 7.50% (12.98%) 5.00% PIK, 12/9/2026 636 636 620 0.0 % Hospice Care Buyer, Inc. (c) Healthcare S+ 7.50% (12.95%) 5.00% PIK, 12/9/2026 2,138 2,097 2,087 0.1 % ICR Operations, LLC (c) Business Services S+ 5.25% (10.75%), 11/22/2028 41,840 41,255 41,124 2.4 % ICR Operations, LLC (c) Business Services S+ 5.25% (10.75%), 11/22/2028 2,277 2,213 2,238 0.1 % ICR Operations, LLC (c) Business Services S+ 5.25% (10.75%), 11/22/2027 3,707 3,707 3,641 0.2 % Ideal Tridon Holdings, Inc. (c) (h) (i) Industrials S+ 6.75% (12.16%), 4/5/2028 30,498 29,719 29,717 1.8 % IG Investments Holdings, LLC (c) (h) Business Services S+ 6.00% (11.48%), 9/22/2028 17,450 17,215 17,293 1.0 % IG Investments Holdings, LLC (c) (h) Business Services S+ 6.00% (11.48%), 9/22/2028 315 312 312 0.0 % Indigo Buyer, Inc. (c) Paper & Packaging S+ 6.25% (11.73%), 5/23/2028 21,013 20,705 20,652 1.2 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 11

Indigo Buyer, Inc. (c) Paper & Packaging S+ 6.25% (11.73%), 5/23/2028 $ 8,987 $ 8,987 $ 8,833 0.5 % Indigo Buyer, Inc. (c) Paper & Packaging S+ 6.25% (11.73%), 5/23/2028 7,942 7,942 7,805 0.5 % Indigo Buyer, Inc. (c) Paper & Packaging S+ 6.25% (11.72%), 5/23/2028 1,452 1,452 1,427 0.1 % Integrated Efficiency Solutions, Inc. (c) (o) Industrials 7.50%, 12/31/2025 1,407 1,407 1,407 0.1 % Integrated Global Services, Inc. (c) (i) Industrials S+ 6.00% (11.52%), 2/4/2026 10,611 10,537 10,611 0.6 % Internap Corp. (c) (h) (o) Business Services 8.00%, 7.00% PIK, 7/31/2028 739 739 739 0.0 % International Cruise & Excursions, Inc. (c) (i) Business Services S+ 5.35% (10.70%), 6/6/2025 4,799 4,789 4,579 0.3 % IQN Holding Corp. (c) (i) Software/Services S+ 5.25% (10.64%), 5/2/2029 11,609 11,526 11,514 0.7 % J&K Ingredients, LLC (c) (h) Food & Beverage S+ 6.50% (11.85%), 11/16/2028 9,200 8,976 8,976 0.5 % K2 Intelligence Holdings, Inc. (c) (h) (i) Business Services P+ 4.75% (13.25%), 9/23/2024 6,172 6,154 5,586 0.3 % KidKraft, Inc. (c) Consumer P+ 6.50% (15.00%), 6/30/2024 1,060 1,060 167 0.0 % Kissner Milling Co., Ltd. (s) Industrials 4/16/2021 4.88%, 5/1/2028 2,983 2,983 2,807 0.2 % Knowledge Pro Buyer, Inc. (c) Business Services S+ 5.75% (11.19%), 12/10/2027 2,299 2,299 2,299 0.1 % Knowledge Pro Buyer, Inc. (c) (i) Business Services S+ 5.75% (11.21%), 12/10/2027 24,304 23,985 24,304 1.4 % Knowledge Pro Buyer, Inc. (c) Business Services S+ 5.75% (11.21%), 12/10/2027 607 607 607 0.0 % Labrie Environmental Group, LLC (a) (c) Industrials S+ 5.50% (10.96%), 9/1/2026 22,123 21,926 21,238 1.3 % Lakeland Tours, LLC (c) (h) (i) Education 8.00%, 9/25/2027 6,092 4,991 4,934 0.3 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (14.50%) PIK, 10/15/2024 714 714 714 0.0 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (14.50%) PIK, 10/15/2024 227 227 227 0.0 % Lakeview Health Holdings, Inc. (c) (o) (t) Healthcare P+ 4.50% (13.00%) PIK, 10/15/2024 1,957 664 618 0.0 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (14.50%) PIK, 10/15/2024 65 65 65 0.0 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (14.50%) PIK, 10/15/2024 65 65 65 0.0 % LSF12 Donnelly Bidco, LLC (c) (h) Industrials S+ 6.50% (11.86%), 10/2/2029 14,139 13,800 13,799 0.8 % Manna Pro Products, LLC (c) Consumer S+ 6.00% (11.46%), 12/10/2026 3,956 3,956 3,797 0.2 % Manna Pro Products, LLC (c) (i) Consumer S+ 6.00% (11.46%), 12/10/2026 23,919 23,626 22,963 1.4 % Manna Pro Products, LLC (c) (i) Consumer S+ 6.00% (11.46%), 12/10/2026 1,886 1,865 1,810 0.1 % Manna Pro Products, LLC (c) (i) Consumer S+ 6.00% (11.46%), 12/10/2026 6,781 6,701 6,511 0.4 % Manna Pro Products, LLC (c) Consumer S+ 6.00% (11.46%), 12/10/2026 1,962 1,962 1,883 0.1 % McDonald Worley, P.C. (c) Business Services 26.00% PIK, 12/31/2024 19,132 19,132 11,549 0.7 % Mckissock Investment Holdings, LLC (h) Education S+ 5.00% (10.38%), 3/12/2029 2,569 2,506 2,562 0.2 % MCS Acquisition Corp. (c) (p) Business Services S+ 6.00% (11.68%), 10/2/2025 764 764 764 0.0 % Medical Depot Holdings, Inc. (c) (h) (i) Healthcare S+ 9.50% (14.95%) 4.00% PIK, 6/1/2025 21,186 21,016 19,572 1.2 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 12

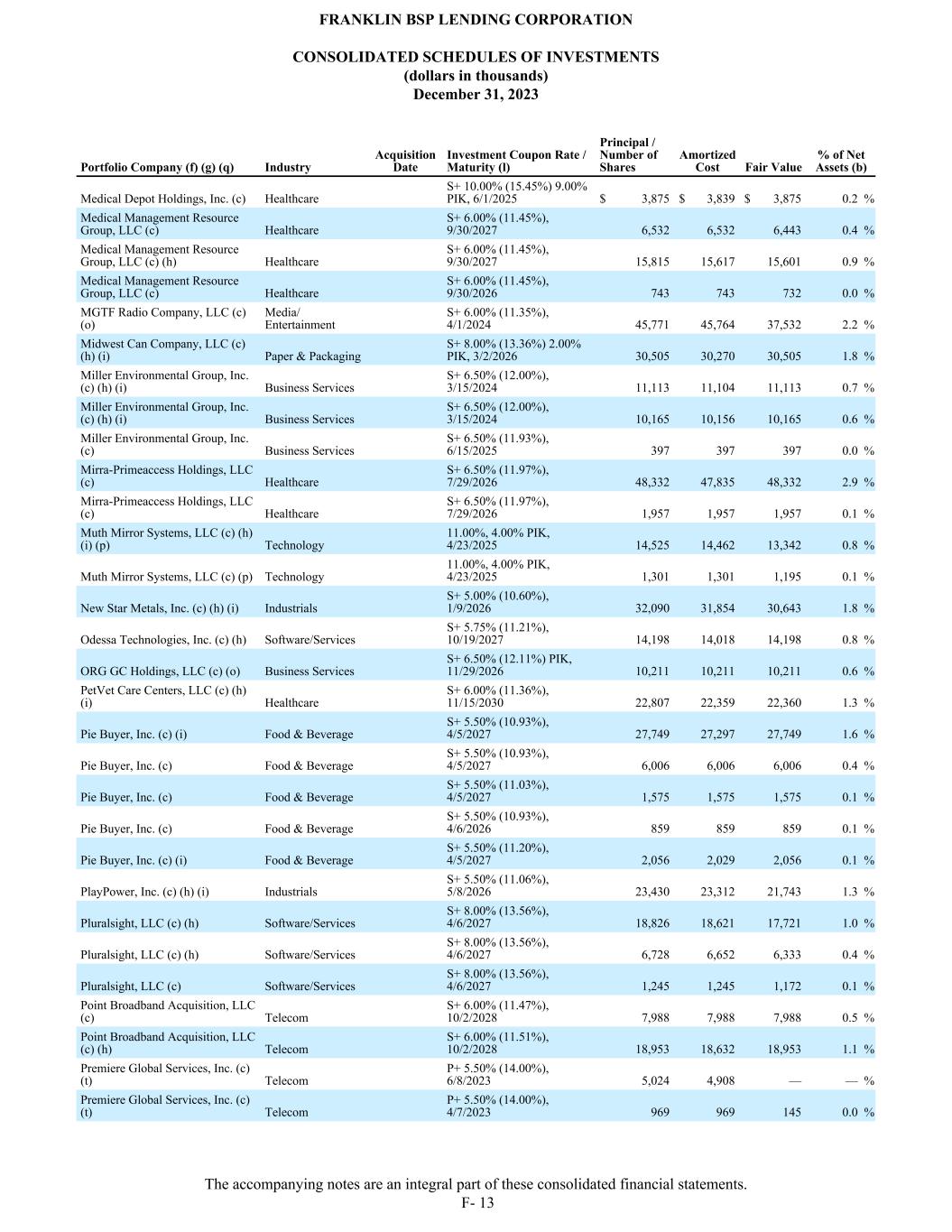

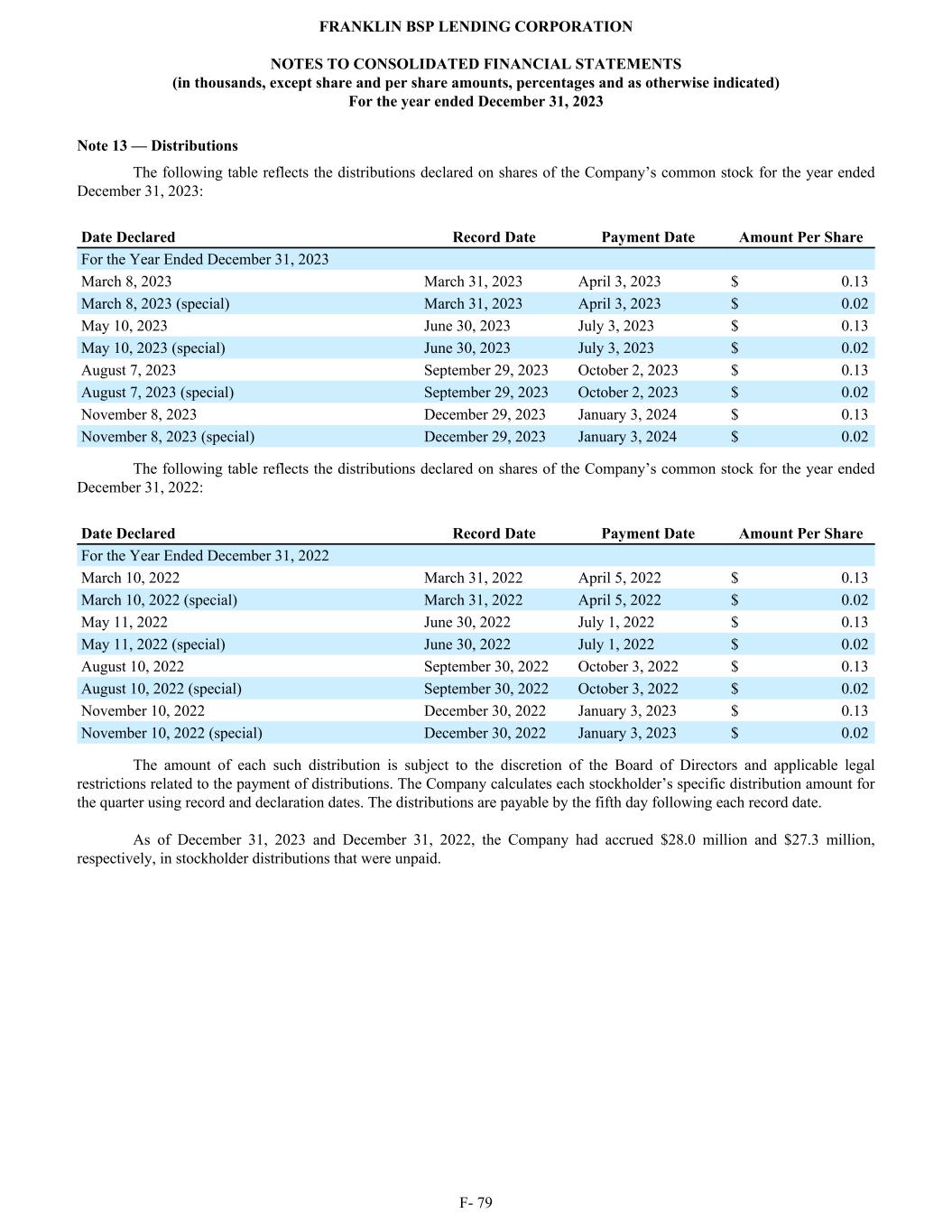

Medical Depot Holdings, Inc. (c) Healthcare S+ 10.00% (15.45%) 9.00% PIK, 6/1/2025 $ 3,875 $ 3,839 $ 3,875 0.2 % Medical Management Resource Group, LLC (c) Healthcare S+ 6.00% (11.45%), 9/30/2027 6,532 6,532 6,443 0.4 % Medical Management Resource Group, LLC (c) (h) Healthcare S+ 6.00% (11.45%), 9/30/2027 15,815 15,617 15,601 0.9 % Medical Management Resource Group, LLC (c) Healthcare S+ 6.00% (11.45%), 9/30/2026 743 743 732 0.0 % MGTF Radio Company, LLC (c) (o) Media/ Entertainment S+ 6.00% (11.35%), 4/1/2024 45,771 45,764 37,532 2.2 % Midwest Can Company, LLC (c) (h) (i) Paper & Packaging S+ 8.00% (13.36%) 2.00% PIK, 3/2/2026 30,505 30,270 30,505 1.8 % Miller Environmental Group, Inc. (c) (h) (i) Business Services S+ 6.50% (12.00%), 3/15/2024 11,113 11,104 11,113 0.7 % Miller Environmental Group, Inc. (c) (h) (i) Business Services S+ 6.50% (12.00%), 3/15/2024 10,165 10,156 10,165 0.6 % Miller Environmental Group, Inc. (c) Business Services S+ 6.50% (11.93%), 6/15/2025 397 397 397 0.0 % Mirra-Primeaccess Holdings, LLC (c) Healthcare S+ 6.50% (11.97%), 7/29/2026 48,332 47,835 48,332 2.9 % Mirra-Primeaccess Holdings, LLC (c) Healthcare S+ 6.50% (11.97%), 7/29/2026 1,957 1,957 1,957 0.1 % Muth Mirror Systems, LLC (c) (h) (i) (p) Technology 11.00%, 4.00% PIK, 4/23/2025 14,525 14,462 13,342 0.8 % Muth Mirror Systems, LLC (c) (p) Technology 11.00%, 4.00% PIK, 4/23/2025 1,301 1,301 1,195 0.1 % New Star Metals, Inc. (c) (h) (i) Industrials S+ 5.00% (10.60%), 1/9/2026 32,090 31,854 30,643 1.8 % Odessa Technologies, Inc. (c) (h) Software/Services S+ 5.75% (11.21%), 10/19/2027 14,198 14,018 14,198 0.8 % ORG GC Holdings, LLC (c) (o) Business Services S+ 6.50% (12.11%) PIK, 11/29/2026 10,211 10,211 10,211 0.6 % PetVet Care Centers, LLC (c) (h) (i) Healthcare S+ 6.00% (11.36%), 11/15/2030 22,807 22,359 22,360 1.3 % Pie Buyer, Inc. (c) (i) Food & Beverage S+ 5.50% (10.93%), 4/5/2027 27,749 27,297 27,749 1.6 % Pie Buyer, Inc. (c) Food & Beverage S+ 5.50% (10.93%), 4/5/2027 6,006 6,006 6,006 0.4 % Pie Buyer, Inc. (c) Food & Beverage S+ 5.50% (11.03%), 4/5/2027 1,575 1,575 1,575 0.1 % Pie Buyer, Inc. (c) Food & Beverage S+ 5.50% (10.93%), 4/6/2026 859 859 859 0.1 % Pie Buyer, Inc. (c) (i) Food & Beverage S+ 5.50% (11.20%), 4/5/2027 2,056 2,029 2,056 0.1 % PlayPower, Inc. (c) (h) (i) Industrials S+ 5.50% (11.06%), 5/8/2026 23,430 23,312 21,743 1.3 % Pluralsight, LLC (c) (h) Software/Services S+ 8.00% (13.56%), 4/6/2027 18,826 18,621 17,721 1.0 % Pluralsight, LLC (c) (h) Software/Services S+ 8.00% (13.56%), 4/6/2027 6,728 6,652 6,333 0.4 % Pluralsight, LLC (c) Software/Services S+ 8.00% (13.56%), 4/6/2027 1,245 1,245 1,172 0.1 % Point Broadband Acquisition, LLC (c) Telecom S+ 6.00% (11.47%), 10/2/2028 7,988 7,988 7,988 0.5 % Point Broadband Acquisition, LLC (c) (h) Telecom S+ 6.00% (11.51%), 10/2/2028 18,953 18,632 18,953 1.1 % Premiere Global Services, Inc. (c) (t) Telecom P+ 5.50% (14.00%), 6/8/2023 5,024 4,908 — — % Premiere Global Services, Inc. (c) (t) Telecom P+ 5.50% (14.00%), 4/7/2023 969 969 145 0.0 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 13

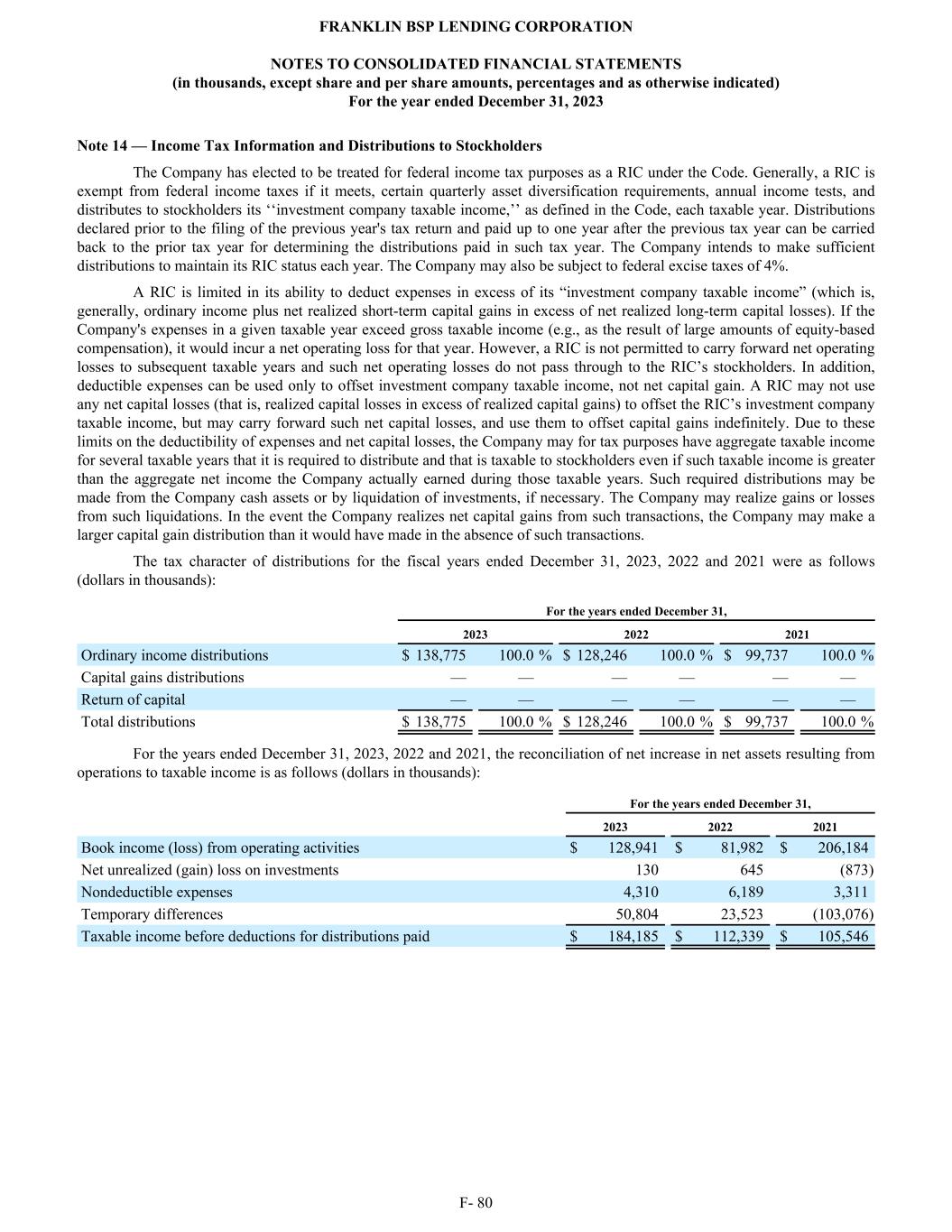

PSKW, LLC (c) (h) (i) Healthcare S+ 6.25% (11.71%), 3/9/2026 $ 28,875 $ 28,612 $ 28,875 1.7 % Questex, Inc. (c) (h) (i) Media/ Entertainment S+ 4.25% (9.77%), 9/9/2024 14,531 14,498 14,232 0.8 % Reddy Ice Corp. (c) Food & Beverage S+ 5.00% (10.46%), 7/1/2025 5,664 5,664 5,574 0.3 % Reddy Ice Corp. (c) (h) (i) Food & Beverage S+ 5.00% (10.46%), 7/1/2025 3,668 3,597 3,609 0.2 % Reddy Ice Corp. (c) Food & Beverage S+ 5.00% (10.57%), 7/1/2025 1,760 1,755 1,732 0.1 % Reddy Ice Corp. (c) Food & Beverage S+ 5.00% (10.57%), 7/1/2025 1,446 1,446 1,423 0.1 % Reddy Ice Corp. (c) Food & Beverage S+ 5.00% (10.57%), 7/1/2025 4,765 4,765 4,690 0.3 % Reddy Ice Corp. (c) (h) (i) Food & Beverage S+ 5.00% (10.57%), 7/1/2025 18,754 18,614 18,456 1.1 % Relativity Oda, LLC (c) (i) Software/Services S+ 6.50% (11.96%), 5/12/2027 5,426 5,362 5,426 0.3 % REP TEC Intermediate Holdings, Inc. (c) (h) (i) Software/Services S+ 6.50% (12.00%), 6/19/2025 22,694 22,531 22,694 1.3 % Roadsafe Holdings, Inc. (c) (i) Industrials S+ 5.75% (11.22%), 10/19/2027 7,674 7,585 7,674 0.5 % Roadsafe Holdings, Inc. (c) Industrials S+ 5.75% (11.14%), 10/19/2027 10,042 10,042 10,042 0.6 % RSC Acquisition, Inc. (c) Financials S+ 6.00% (11.35%), 11/1/2029 506 506 506 0.0 % RSC Acquisition, Inc. (c) Financials S+ 6.00% (11.43%), 11/1/2029 1,136 1,136 1,136 0.1 % RSC Acquisition, Inc. (c) Financials S+ 5.50% (11.04%), 11/1/2029 5,028 5,028 5,028 0.3 % RSC Acquisition, Inc. (c) (i) Financials S+ 5.50% (11.00%), 11/1/2029 15,036 15,026 15,036 0.9 % Saturn SHC Buyer Holdings, Inc. (c) (h) Healthcare S+ 5.50% (10.97%), 11/18/2027 32,658 32,235 32,658 1.9 % SCIH Salt Holdings, Inc. (c) Industrials S+ 4.00% (9.47%), 3/17/2025 1,310 1,310 1,304 0.1 % Sherlock Buyer Corp. (c) (i) Business Services S+ 5.75% (11.20%), 12/8/2028 10,929 10,775 10,929 0.6 % Simplifi Holdings, Inc. (c) (h) Media/ Entertainment S+ 5.50% (10.96%), 10/1/2027 34,751 34,317 34,230 2.0 % Simplifi Holdings, Inc. (c) Media/ Entertainment S+ 5.50% (10.96%), 10/1/2026 709 709 698 0.0 % Skillsoft Corp. (h) Technology S+ 5.25% (10.72%), 7/14/2028 1,359 1,346 1,268 0.1 % St. Croix Hospice Acquisition Corp. (c) (i) Healthcare S+ 6.00% (11.48%), 10/30/2026 25,161 24,924 25,161 1.5 % St. Croix Hospice Acquisition Corp. (c) Healthcare S+ 6.00% (11.48%), 10/30/2026 2,780 2,780 2,780 0.2 % Striper Buyer, LLC (c) (h) Paper & Packaging S+ 5.50% (10.95%), 12/30/2026 12,142 12,080 12,142 0.7 % Subsea Global Solutions, LLC (c) Business Services S+ 6.75% (12.29%), 4/19/2024 2,720 2,716 2,720 0.2 % Subsea Global Solutions, LLC (c) (i) Business Services S+ 6.75% (12.25%), 4/19/2024 4,602 4,597 4,602 0.3 % Subsea Global Solutions, LLC (c) (i) Business Services S+ 6.75% (12.25%), 4/19/2024 6,976 6,971 6,976 0.4 % Subsea Global Solutions, LLC (c) Business Services S+ 6.75% (12.20%), 4/19/2024 963 963 963 0.1 % SunMed Group Holdings, LLC (c) (h) Healthcare S+ 5.50% (10.96%), 6/16/2028 8,873 8,774 8,741 0.5 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 14

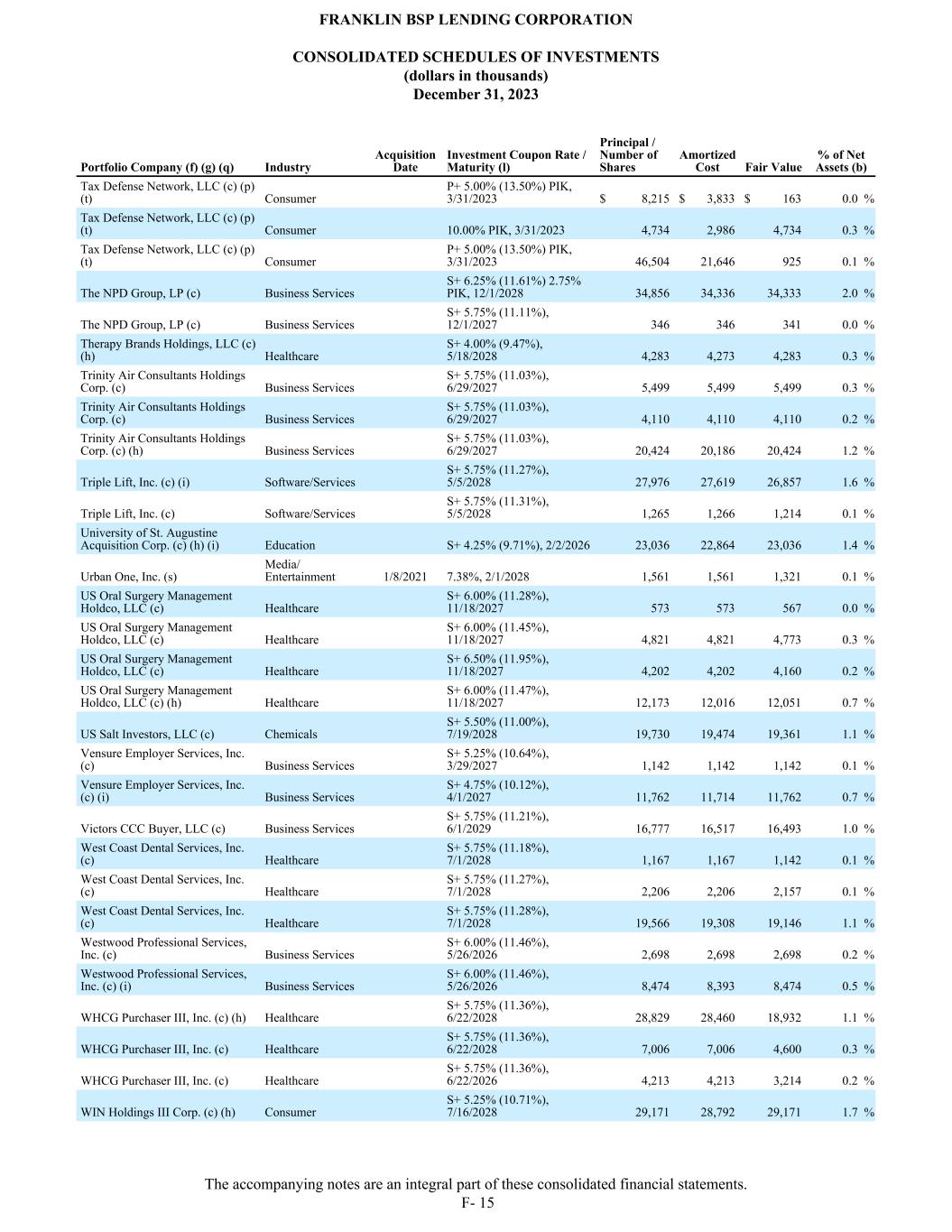

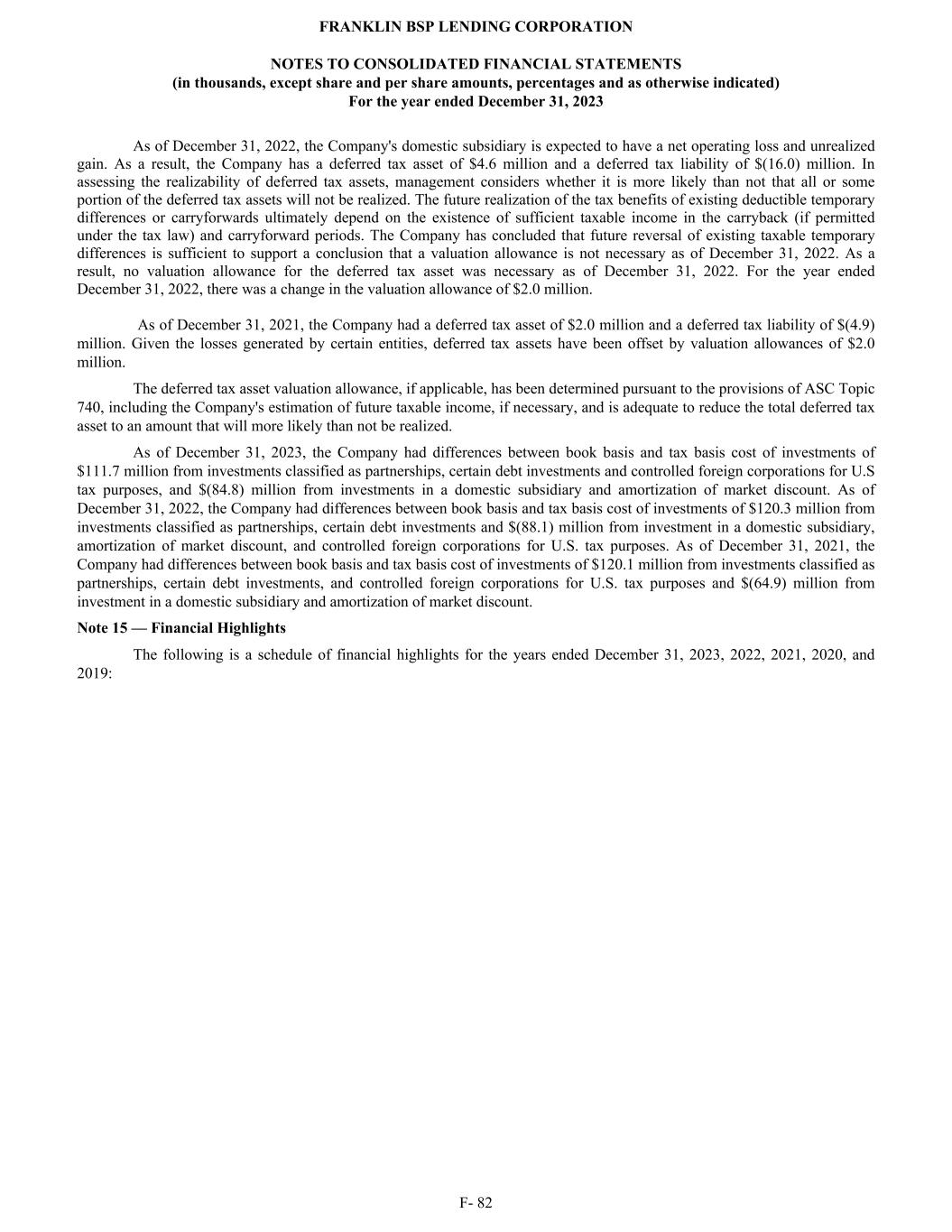

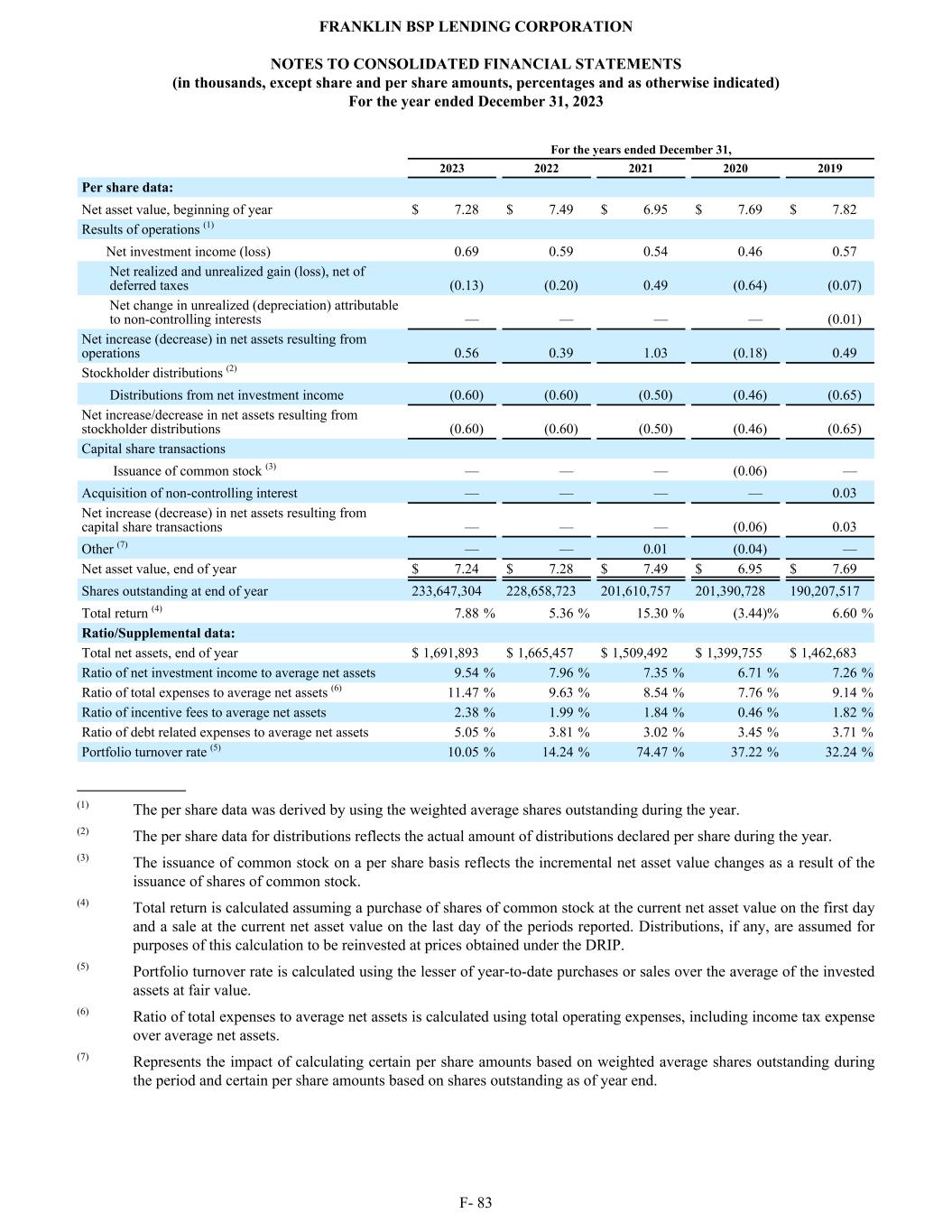

Tax Defense Network, LLC (c) (p) (t) Consumer P+ 5.00% (13.50%) PIK, 3/31/2023 $ 8,215 $ 3,833 $ 163 0.0 % Tax Defense Network, LLC (c) (p) (t) Consumer 10.00% PIK, 3/31/2023 4,734 2,986 4,734 0.3 % Tax Defense Network, LLC (c) (p) (t) Consumer P+ 5.00% (13.50%) PIK, 3/31/2023 46,504 21,646 925 0.1 % The NPD Group, LP (c) Business Services S+ 6.25% (11.61%) 2.75% PIK, 12/1/2028 34,856 34,336 34,333 2.0 % The NPD Group, LP (c) Business Services S+ 5.75% (11.11%), 12/1/2027 346 346 341 0.0 % Therapy Brands Holdings, LLC (c) (h) Healthcare S+ 4.00% (9.47%), 5/18/2028 4,283 4,273 4,283 0.3 % Trinity Air Consultants Holdings Corp. (c) Business Services S+ 5.75% (11.03%), 6/29/2027 5,499 5,499 5,499 0.3 % Trinity Air Consultants Holdings Corp. (c) Business Services S+ 5.75% (11.03%), 6/29/2027 4,110 4,110 4,110 0.2 % Trinity Air Consultants Holdings Corp. (c) (h) Business Services S+ 5.75% (11.03%), 6/29/2027 20,424 20,186 20,424 1.2 % Triple Lift, Inc. (c) (i) Software/Services S+ 5.75% (11.27%), 5/5/2028 27,976 27,619 26,857 1.6 % Triple Lift, Inc. (c) Software/Services S+ 5.75% (11.31%), 5/5/2028 1,265 1,266 1,214 0.1 % University of St. Augustine Acquisition Corp. (c) (h) (i) Education S+ 4.25% (9.71%), 2/2/2026 23,036 22,864 23,036 1.4 % Urban One, Inc. (s) Media/ Entertainment 1/8/2021 7.38%, 2/1/2028 1,561 1,561 1,321 0.1 % US Oral Surgery Management Holdco, LLC (c) Healthcare S+ 6.00% (11.28%), 11/18/2027 573 573 567 0.0 % US Oral Surgery Management Holdco, LLC (c) Healthcare S+ 6.00% (11.45%), 11/18/2027 4,821 4,821 4,773 0.3 % US Oral Surgery Management Holdco, LLC (c) Healthcare S+ 6.50% (11.95%), 11/18/2027 4,202 4,202 4,160 0.2 % US Oral Surgery Management Holdco, LLC (c) (h) Healthcare S+ 6.00% (11.47%), 11/18/2027 12,173 12,016 12,051 0.7 % US Salt Investors, LLC (c) Chemicals S+ 5.50% (11.00%), 7/19/2028 19,730 19,474 19,361 1.1 % Vensure Employer Services, Inc. (c) Business Services S+ 5.25% (10.64%), 3/29/2027 1,142 1,142 1,142 0.1 % Vensure Employer Services, Inc. (c) (i) Business Services S+ 4.75% (10.12%), 4/1/2027 11,762 11,714 11,762 0.7 % Victors CCC Buyer, LLC (c) Business Services S+ 5.75% (11.21%), 6/1/2029 16,777 16,517 16,493 1.0 % West Coast Dental Services, Inc. (c) Healthcare S+ 5.75% (11.18%), 7/1/2028 1,167 1,167 1,142 0.1 % West Coast Dental Services, Inc. (c) Healthcare S+ 5.75% (11.27%), 7/1/2028 2,206 2,206 2,157 0.1 % West Coast Dental Services, Inc. (c) Healthcare S+ 5.75% (11.28%), 7/1/2028 19,566 19,308 19,146 1.1 % Westwood Professional Services, Inc. (c) Business Services S+ 6.00% (11.46%), 5/26/2026 2,698 2,698 2,698 0.2 % Westwood Professional Services, Inc. (c) (i) Business Services S+ 6.00% (11.46%), 5/26/2026 8,474 8,393 8,474 0.5 % WHCG Purchaser III, Inc. (c) (h) Healthcare S+ 5.75% (11.36%), 6/22/2028 28,829 28,460 18,932 1.1 % WHCG Purchaser III, Inc. (c) Healthcare S+ 5.75% (11.36%), 6/22/2028 7,006 7,006 4,600 0.3 % WHCG Purchaser III, Inc. (c) Healthcare S+ 5.75% (11.36%), 6/22/2026 4,213 4,213 3,214 0.2 % WIN Holdings III Corp. (c) (h) Consumer S+ 5.25% (10.71%), 7/16/2028 29,171 28,792 29,171 1.7 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 15

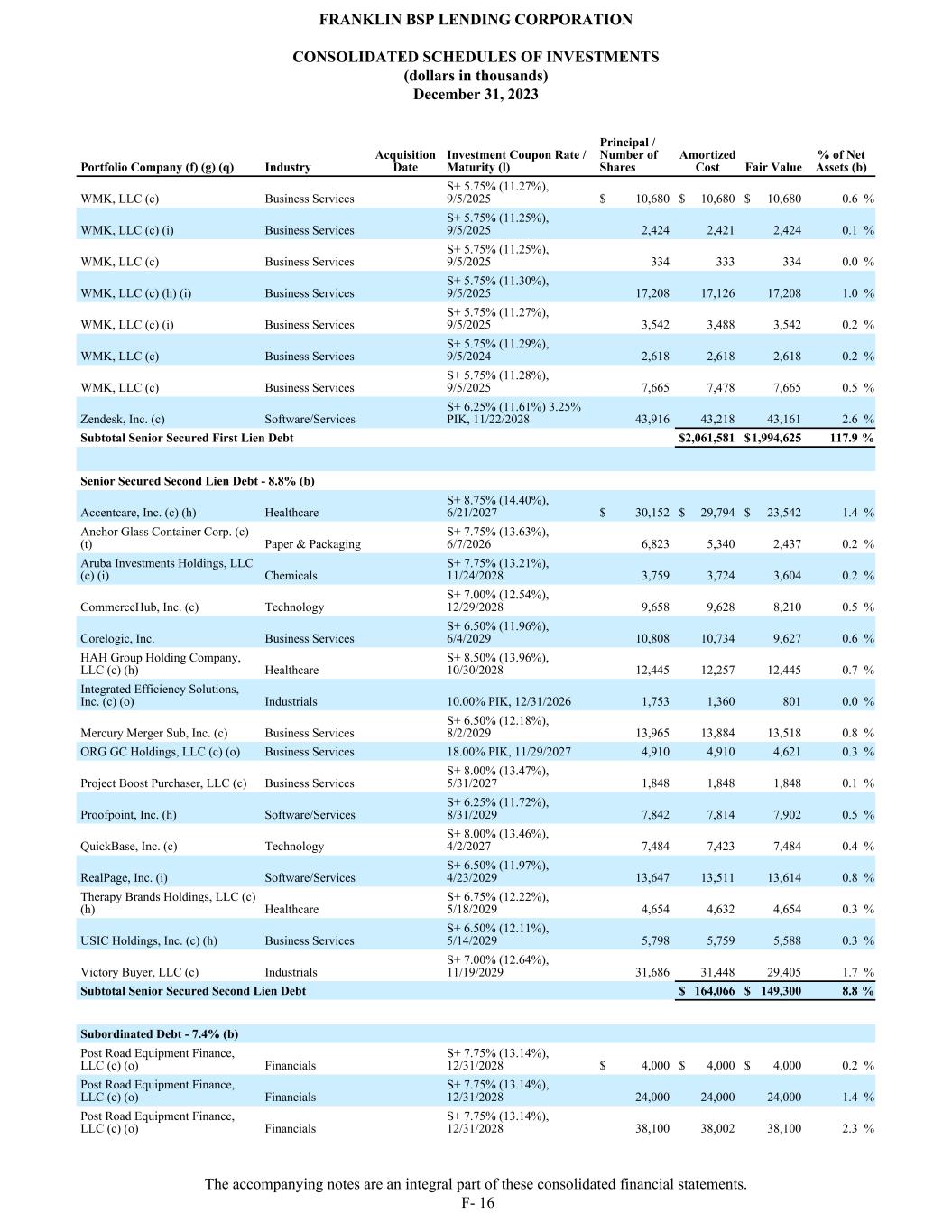

WMK, LLC (c) Business Services S+ 5.75% (11.27%), 9/5/2025 $ 10,680 $ 10,680 $ 10,680 0.6 % WMK, LLC (c) (i) Business Services S+ 5.75% (11.25%), 9/5/2025 2,424 2,421 2,424 0.1 % WMK, LLC (c) Business Services S+ 5.75% (11.25%), 9/5/2025 334 333 334 0.0 % WMK, LLC (c) (h) (i) Business Services S+ 5.75% (11.30%), 9/5/2025 17,208 17,126 17,208 1.0 % WMK, LLC (c) (i) Business Services S+ 5.75% (11.27%), 9/5/2025 3,542 3,488 3,542 0.2 % WMK, LLC (c) Business Services S+ 5.75% (11.29%), 9/5/2024 2,618 2,618 2,618 0.2 % WMK, LLC (c) Business Services S+ 5.75% (11.28%), 9/5/2025 7,665 7,478 7,665 0.5 % Zendesk, Inc. (c) Software/Services S+ 6.25% (11.61%) 3.25% PIK, 11/22/2028 43,916 43,218 43,161 2.6 % Subtotal Senior Secured First Lien Debt $ 2,061,581 $ 1,994,625 117.9 % Senior Secured Second Lien Debt - 8.8% (b) Accentcare, Inc. (c) (h) Healthcare S+ 8.75% (14.40%), 6/21/2027 $ 30,152 $ 29,794 $ 23,542 1.4 % Anchor Glass Container Corp. (c) (t) Paper & Packaging S+ 7.75% (13.63%), 6/7/2026 6,823 5,340 2,437 0.2 % Aruba Investments Holdings, LLC (c) (i) Chemicals S+ 7.75% (13.21%), 11/24/2028 3,759 3,724 3,604 0.2 % CommerceHub, Inc. (c) Technology S+ 7.00% (12.54%), 12/29/2028 9,658 9,628 8,210 0.5 % Corelogic, Inc. Business Services S+ 6.50% (11.96%), 6/4/2029 10,808 10,734 9,627 0.6 % HAH Group Holding Company, LLC (c) (h) Healthcare S+ 8.50% (13.96%), 10/30/2028 12,445 12,257 12,445 0.7 % Integrated Efficiency Solutions, Inc. (c) (o) Industrials 10.00% PIK, 12/31/2026 1,753 1,360 801 0.0 % Mercury Merger Sub, Inc. (c) Business Services S+ 6.50% (12.18%), 8/2/2029 13,965 13,884 13,518 0.8 % ORG GC Holdings, LLC (c) (o) Business Services 18.00% PIK, 11/29/2027 4,910 4,910 4,621 0.3 % Project Boost Purchaser, LLC (c) Business Services S+ 8.00% (13.47%), 5/31/2027 1,848 1,848 1,848 0.1 % Proofpoint, Inc. (h) Software/Services S+ 6.25% (11.72%), 8/31/2029 7,842 7,814 7,902 0.5 % QuickBase, Inc. (c) Technology S+ 8.00% (13.46%), 4/2/2027 7,484 7,423 7,484 0.4 % RealPage, Inc. (i) Software/Services S+ 6.50% (11.97%), 4/23/2029 13,647 13,511 13,614 0.8 % Therapy Brands Holdings, LLC (c) (h) Healthcare S+ 6.75% (12.22%), 5/18/2029 4,654 4,632 4,654 0.3 % USIC Holdings, Inc. (c) (h) Business Services S+ 6.50% (12.11%), 5/14/2029 5,798 5,759 5,588 0.3 % Victory Buyer, LLC (c) Industrials S+ 7.00% (12.64%), 11/19/2029 31,686 31,448 29,405 1.7 % Subtotal Senior Secured Second Lien Debt $ 164,066 $ 149,300 8.8 % Subordinated Debt - 7.4% (b) Post Road Equipment Finance, LLC (c) (o) Financials S+ 7.75% (13.14%), 12/31/2028 $ 4,000 $ 4,000 $ 4,000 0.2 % Post Road Equipment Finance, LLC (c) (o) Financials S+ 7.75% (13.14%), 12/31/2028 24,000 24,000 24,000 1.4 % Post Road Equipment Finance, LLC (c) (o) Financials S+ 7.75% (13.14%), 12/31/2028 38,100 38,002 38,100 2.3 % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 16

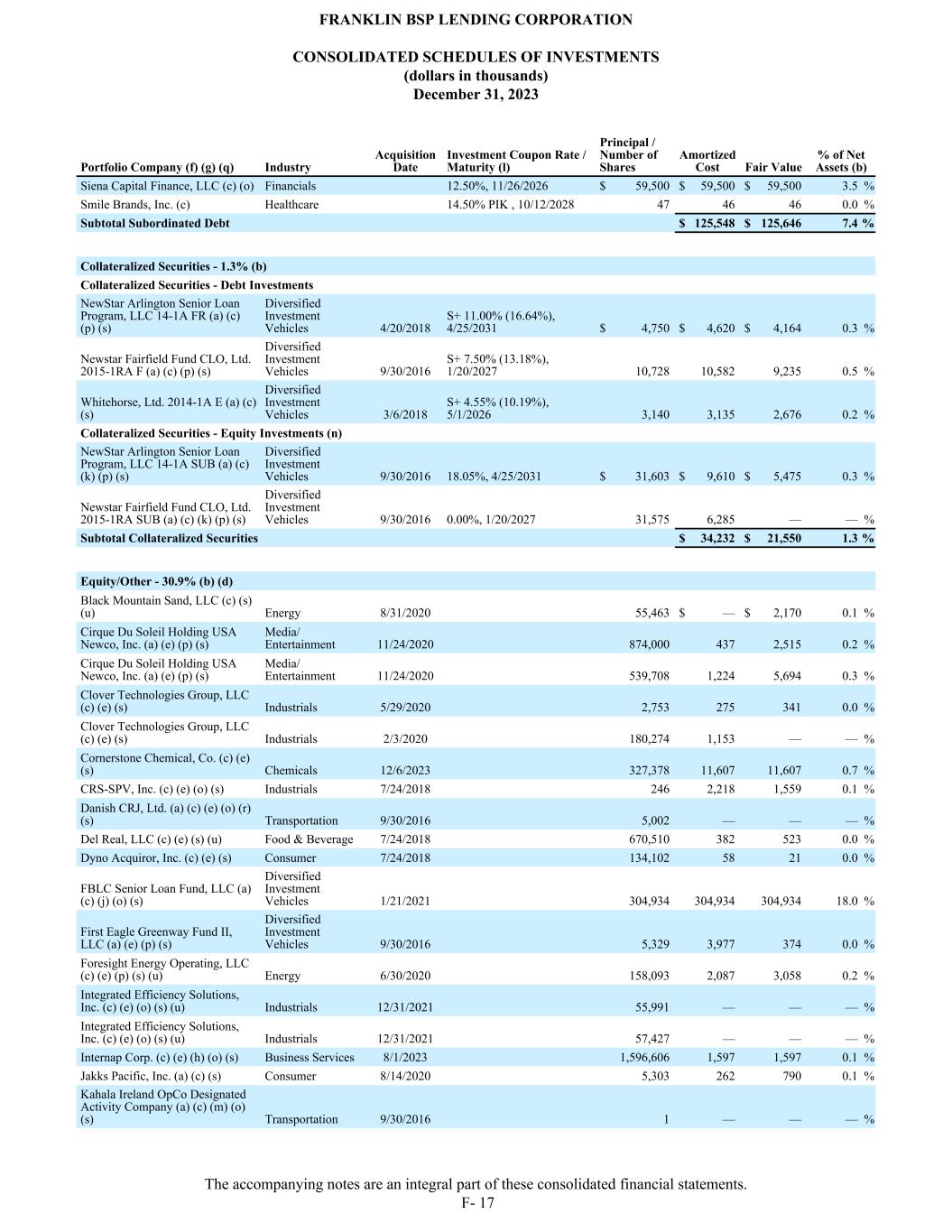

Siena Capital Finance, LLC (c) (o) Financials 12.50%, 11/26/2026 $ 59,500 $ 59,500 $ 59,500 3.5 % Smile Brands, Inc. (c) Healthcare 14.50% PIK , 10/12/2028 47 46 46 0.0 % Subtotal Subordinated Debt $ 125,548 $ 125,646 7.4 % Collateralized Securities - 1.3% (b) Collateralized Securities - Debt Investments NewStar Arlington Senior Loan Program, LLC 14-1A FR (a) (c) (p) (s) Diversified Investment Vehicles 4/20/2018 S+ 11.00% (16.64%), 4/25/2031 $ 4,750 $ 4,620 $ 4,164 0.3 % Newstar Fairfield Fund CLO, Ltd. 2015-1RA F (a) (c) (p) (s) Diversified Investment Vehicles 9/30/2016 S+ 7.50% (13.18%), 1/20/2027 10,728 10,582 9,235 0.5 % Whitehorse, Ltd. 2014-1A E (a) (c) (s) Diversified Investment Vehicles 3/6/2018 S+ 4.55% (10.19%), 5/1/2026 3,140 3,135 2,676 0.2 % Collateralized Securities - Equity Investments (n) NewStar Arlington Senior Loan Program, LLC 14-1A SUB (a) (c) (k) (p) (s) Diversified Investment Vehicles 9/30/2016 18.05%, 4/25/2031 $ 31,603 $ 9,610 $ 5,475 0.3 % Newstar Fairfield Fund CLO, Ltd. 2015-1RA SUB (a) (c) (k) (p) (s) Diversified Investment Vehicles 9/30/2016 0.00%, 1/20/2027 31,575 6,285 — — % Subtotal Collateralized Securities $ 34,232 $ 21,550 1.3 % Equity/Other - 30.9% (b) (d) Black Mountain Sand, LLC (c) (s) (u) Energy 8/31/2020 55,463 $ — $ 2,170 0.1 % Cirque Du Soleil Holding USA Newco, Inc. (a) (e) (p) (s) Media/ Entertainment 11/24/2020 874,000 437 2,515 0.2 % Cirque Du Soleil Holding USA Newco, Inc. (a) (e) (p) (s) Media/ Entertainment 11/24/2020 539,708 1,224 5,694 0.3 % Clover Technologies Group, LLC (c) (e) (s) Industrials 5/29/2020 2,753 275 341 0.0 % Clover Technologies Group, LLC (c) (e) (s) Industrials 2/3/2020 180,274 1,153 — — % Cornerstone Chemical, Co. (c) (e) (s) Chemicals 12/6/2023 327,378 11,607 11,607 0.7 % CRS-SPV, Inc. (c) (e) (o) (s) Industrials 7/24/2018 246 2,218 1,559 0.1 % Danish CRJ, Ltd. (a) (c) (e) (o) (r) (s) Transportation 9/30/2016 5,002 — — — % Del Real, LLC (c) (e) (s) (u) Food & Beverage 7/24/2018 670,510 382 523 0.0 % Dyno Acquiror, Inc. (c) (e) (s) Consumer 7/24/2018 134,102 58 21 0.0 % FBLC Senior Loan Fund, LLC (a) (c) (j) (o) (s) Diversified Investment Vehicles 1/21/2021 304,934 304,934 304,934 18.0 % First Eagle Greenway Fund II, LLC (a) (e) (p) (s) Diversified Investment Vehicles 9/30/2016 5,329 3,977 374 0.0 % Foresight Energy Operating, LLC (c) (e) (p) (s) (u) Energy 6/30/2020 158,093 2,087 3,058 0.2 % Integrated Efficiency Solutions, Inc. (c) (e) (o) (s) (u) Industrials 12/31/2021 55,991 — — — % Integrated Efficiency Solutions, Inc. (c) (e) (o) (s) (u) Industrials 12/31/2021 57,427 — — — % Internap Corp. (c) (e) (h) (o) (s) Business Services 8/1/2023 1,596,606 1,597 1,597 0.1 % Jakks Pacific, Inc. (a) (c) (s) Consumer 8/14/2020 5,303 262 790 0.1 % Kahala Ireland OpCo Designated Activity Company (a) (c) (m) (o) (s) Transportation 9/30/2016 1 — — — % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 17

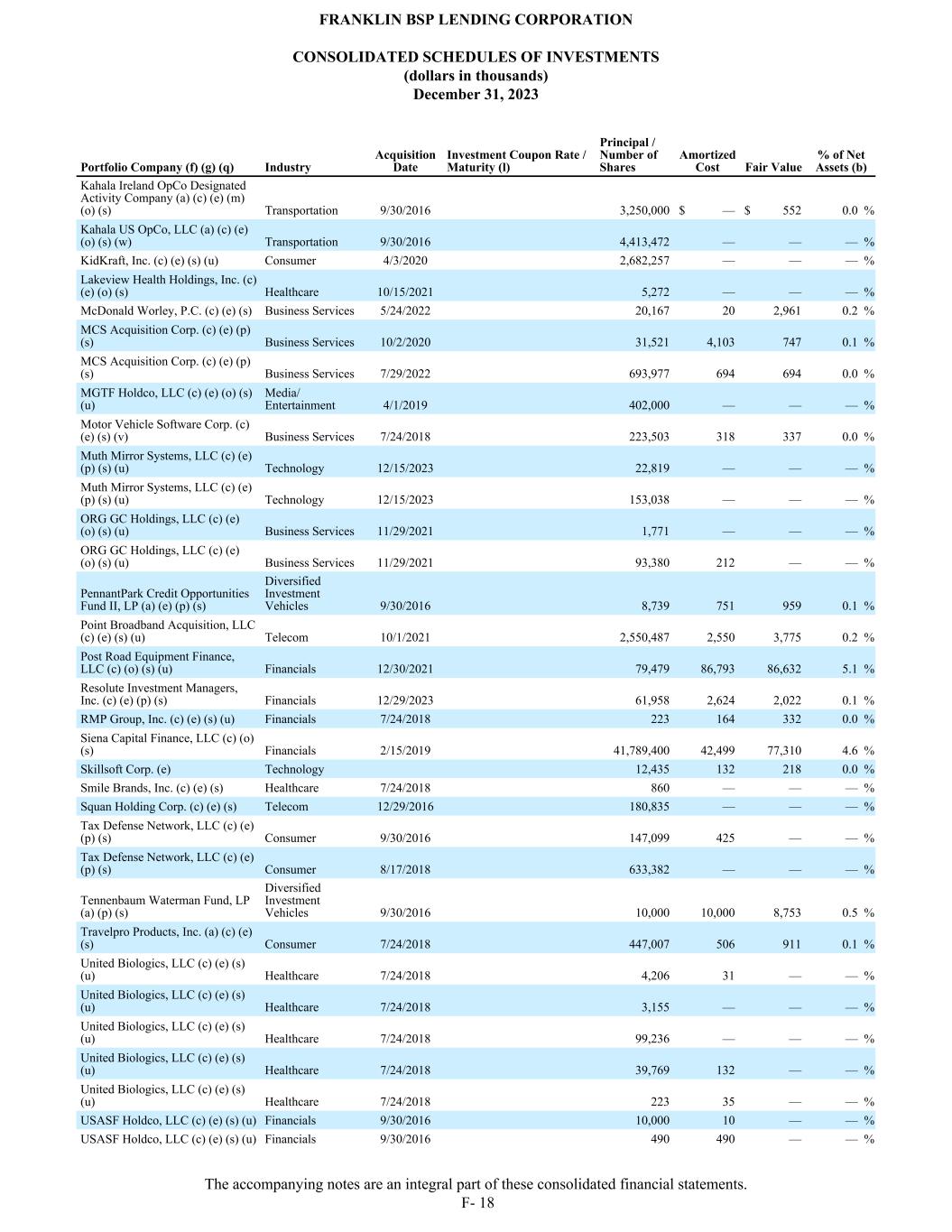

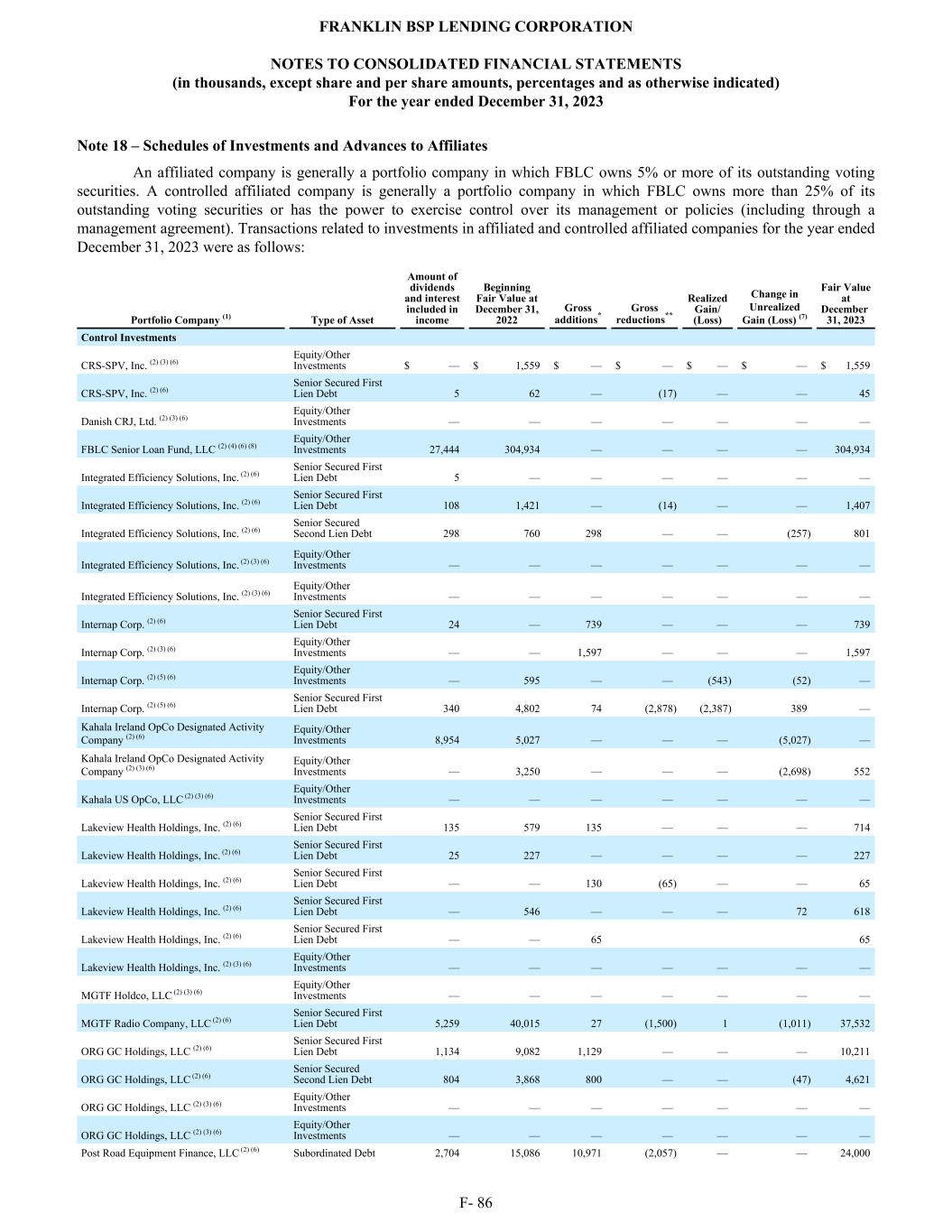

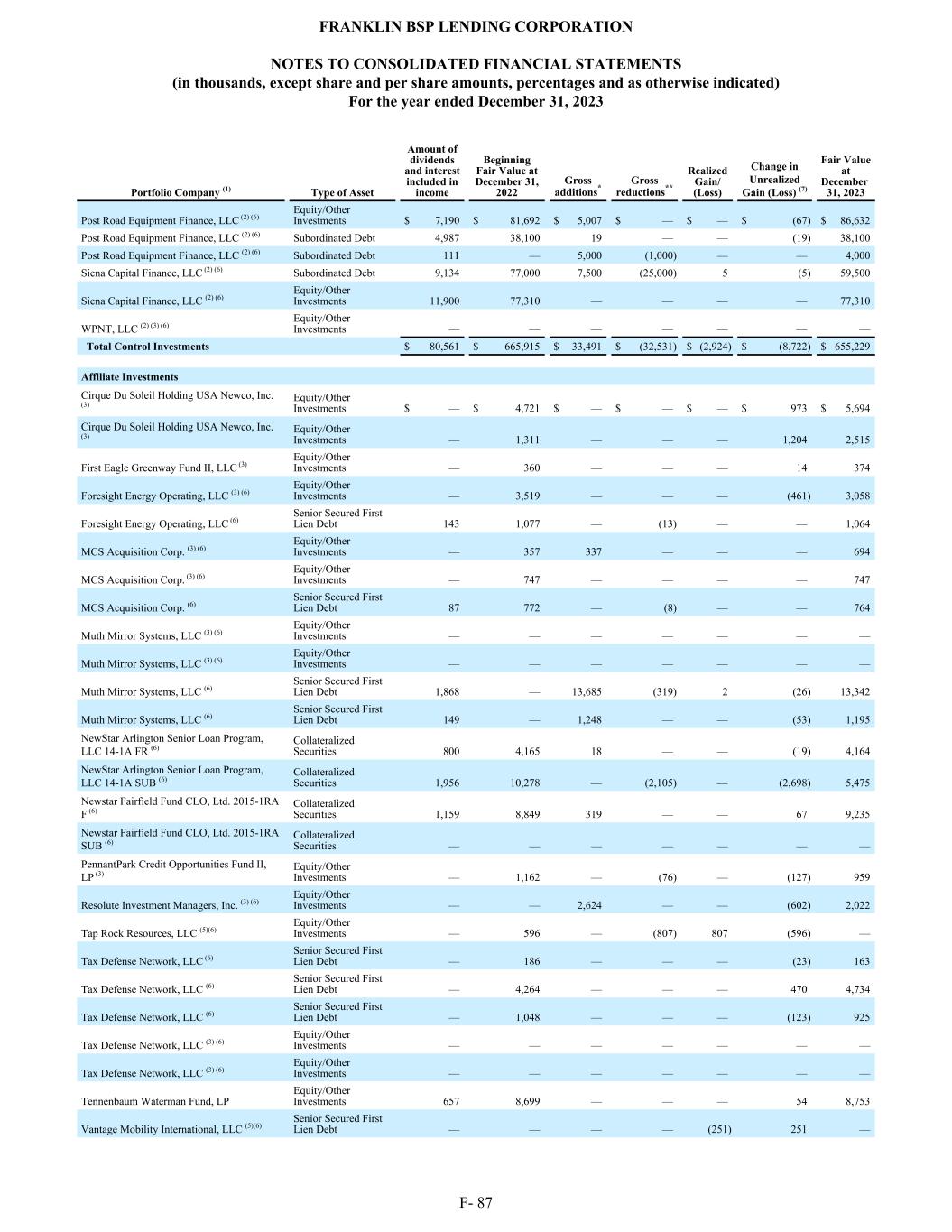

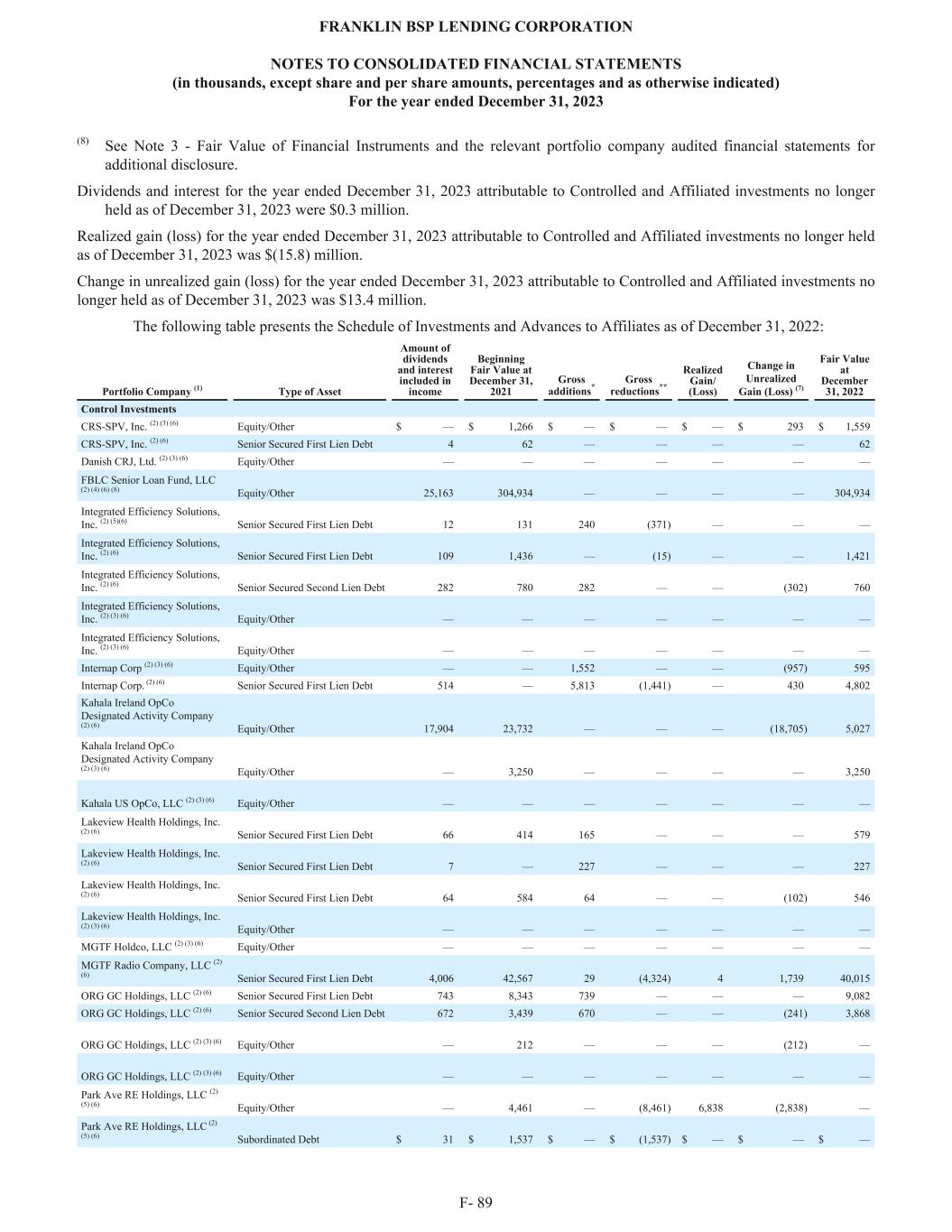

Kahala Ireland OpCo Designated Activity Company (a) (c) (e) (m) (o) (s) Transportation 9/30/2016 3,250,000 $ — $ 552 0.0 % Kahala US OpCo, LLC (a) (c) (e) (o) (s) (w) Transportation 9/30/2016 4,413,472 — — — % KidKraft, Inc. (c) (e) (s) (u) Consumer 4/3/2020 2,682,257 — — — % Lakeview Health Holdings, Inc. (c) (e) (o) (s) Healthcare 10/15/2021 5,272 — — — % McDonald Worley, P.C. (c) (e) (s) Business Services 5/24/2022 20,167 20 2,961 0.2 % MCS Acquisition Corp. (c) (e) (p) (s) Business Services 10/2/2020 31,521 4,103 747 0.1 % MCS Acquisition Corp. (c) (e) (p) (s) Business Services 7/29/2022 693,977 694 694 0.0 % MGTF Holdco, LLC (c) (e) (o) (s) (u) Media/ Entertainment 4/1/2019 402,000 — — — % Motor Vehicle Software Corp. (c) (e) (s) (v) Business Services 7/24/2018 223,503 318 337 0.0 % Muth Mirror Systems, LLC (c) (e) (p) (s) (u) Technology 12/15/2023 22,819 — — — % Muth Mirror Systems, LLC (c) (e) (p) (s) (u) Technology 12/15/2023 153,038 — — — % ORG GC Holdings, LLC (c) (e) (o) (s) (u) Business Services 11/29/2021 1,771 — — — % ORG GC Holdings, LLC (c) (e) (o) (s) (u) Business Services 11/29/2021 93,380 212 — — % PennantPark Credit Opportunities Fund II, LP (a) (e) (p) (s) Diversified Investment Vehicles 9/30/2016 8,739 751 959 0.1 % Point Broadband Acquisition, LLC (c) (e) (s) (u) Telecom 10/1/2021 2,550,487 2,550 3,775 0.2 % Post Road Equipment Finance, LLC (c) (o) (s) (u) Financials 12/30/2021 79,479 86,793 86,632 5.1 % Resolute Investment Managers, Inc. (c) (e) (p) (s) Financials 12/29/2023 61,958 2,624 2,022 0.1 % RMP Group, Inc. (c) (e) (s) (u) Financials 7/24/2018 223 164 332 0.0 % Siena Capital Finance, LLC (c) (o) (s) Financials 2/15/2019 41,789,400 42,499 77,310 4.6 % Skillsoft Corp. (e) Technology 12,435 132 218 0.0 % Smile Brands, Inc. (c) (e) (s) Healthcare 7/24/2018 860 — — — % Squan Holding Corp. (c) (e) (s) Telecom 12/29/2016 180,835 — — — % Tax Defense Network, LLC (c) (e) (p) (s) Consumer 9/30/2016 147,099 425 — — % Tax Defense Network, LLC (c) (e) (p) (s) Consumer 8/17/2018 633,382 — — — % Tennenbaum Waterman Fund, LP (a) (p) (s) Diversified Investment Vehicles 9/30/2016 10,000 10,000 8,753 0.5 % Travelpro Products, Inc. (a) (c) (e) (s) Consumer 7/24/2018 447,007 506 911 0.1 % United Biologics, LLC (c) (e) (s) (u) Healthcare 7/24/2018 4,206 31 — — % United Biologics, LLC (c) (e) (s) (u) Healthcare 7/24/2018 3,155 — — — % United Biologics, LLC (c) (e) (s) (u) Healthcare 7/24/2018 99,236 — — — % United Biologics, LLC (c) (e) (s) (u) Healthcare 7/24/2018 39,769 132 — — % United Biologics, LLC (c) (e) (s) (u) Healthcare 7/24/2018 223 35 — — % USASF Holdco, LLC (c) (e) (s) (u) Financials 9/30/2016 10,000 10 — — % USASF Holdco, LLC (c) (e) (s) (u) Financials 9/30/2016 490 490 — — % Portfolio Company (f) (g) (q) Industry Acquisition Date Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 18

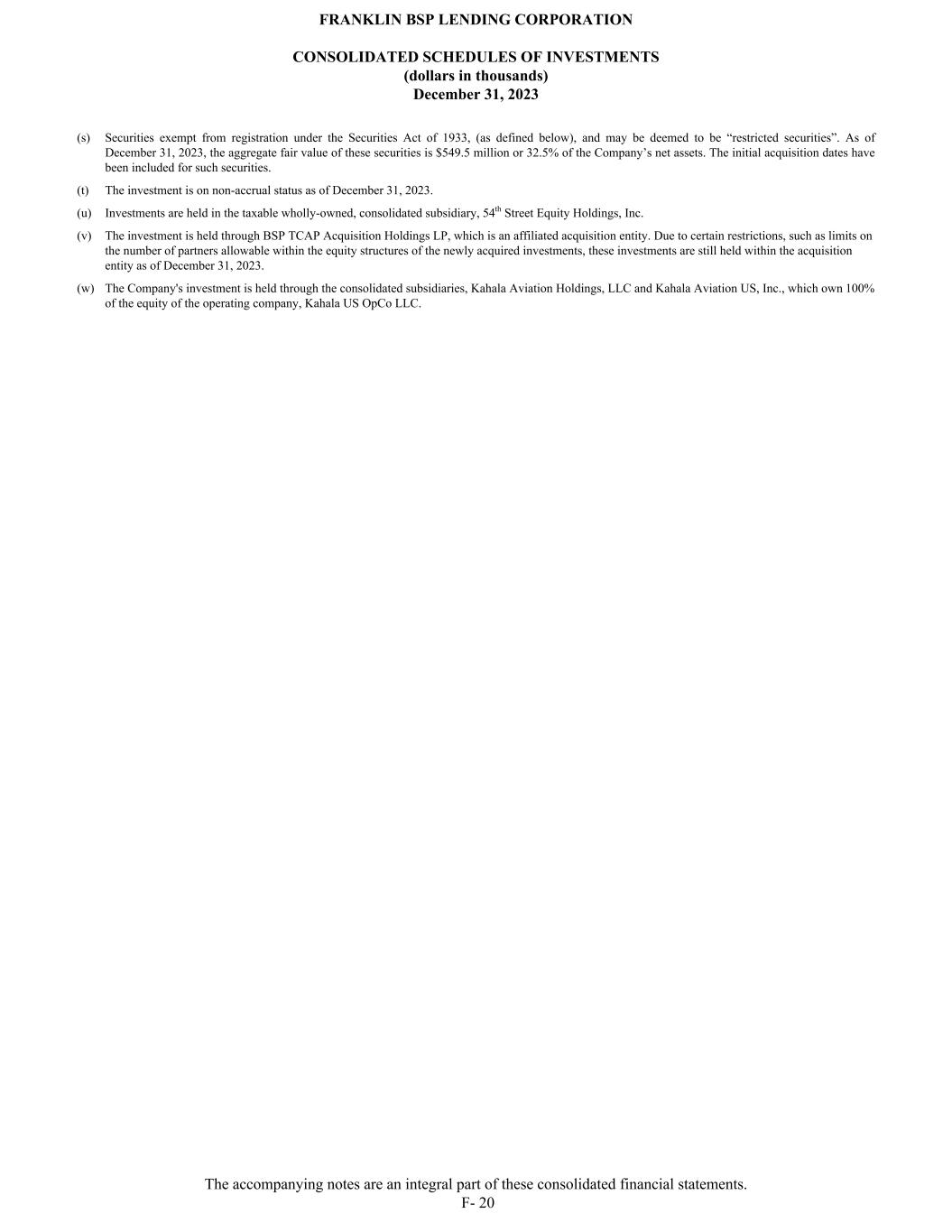

(s) Securities exempt from registration under the Securities Act of 1933, (as defined below), and may be deemed to be “restricted securities”. As of December 31, 2023, the aggregate fair value of these securities is $549.5 million or 32.5% of the Company’s net assets. The initial acquisition dates have been included for such securities. (t) The investment is on non-accrual status as of December 31, 2023. (u) Investments are held in the taxable wholly-owned, consolidated subsidiary, 54th Street Equity Holdings, Inc. (v) The investment is held through BSP TCAP Acquisition Holdings LP, which is an affiliated acquisition entity. Due to certain restrictions, such as limits on the number of partners allowable within the equity structures of the newly acquired investments, these investments are still held within the acquisition entity as of December 31, 2023. (w) The Company's investment is held through the consolidated subsidiaries, Kahala Aviation Holdings, LLC and Kahala Aviation US, Inc., which own 100% of the equity of the operating company, Kahala US OpCo LLC. FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 20

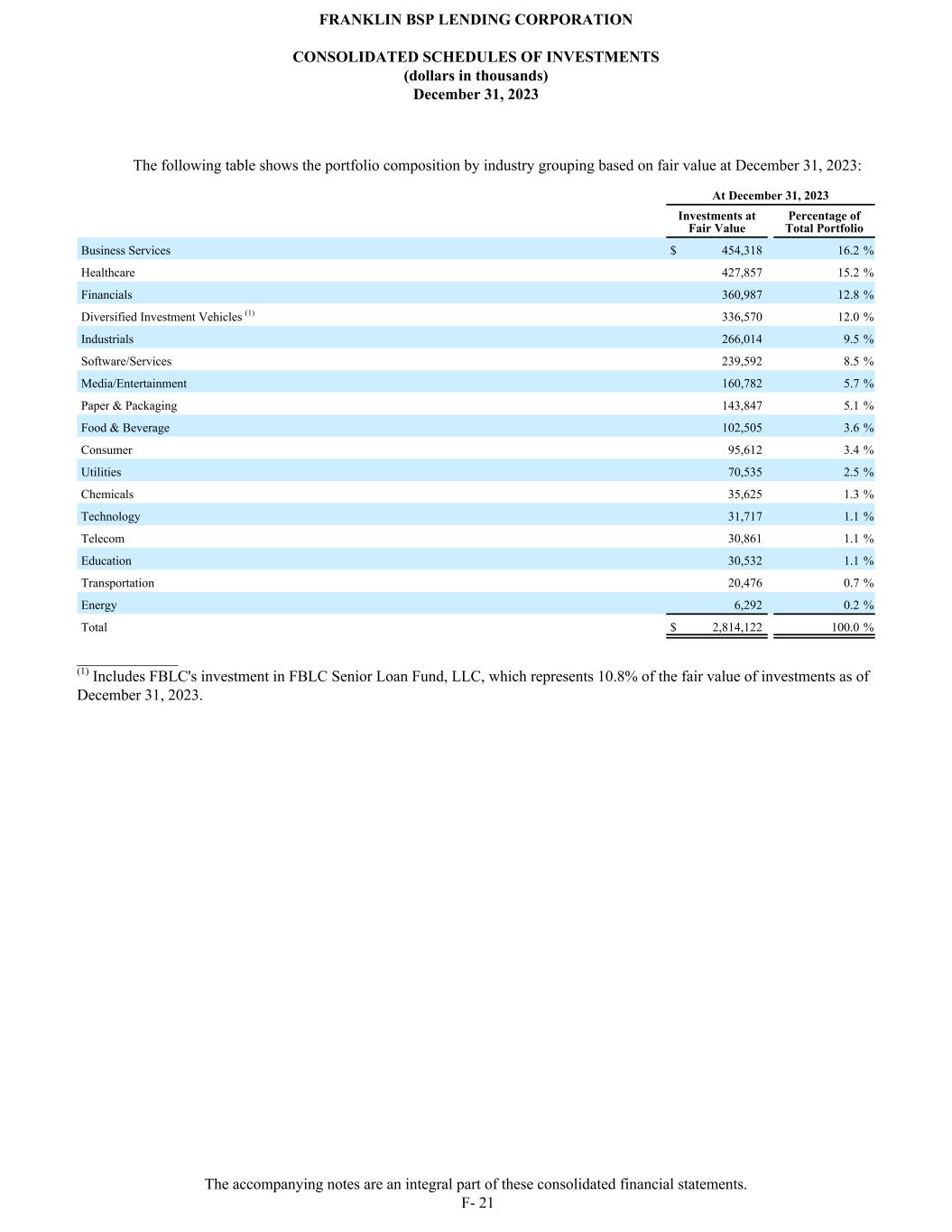

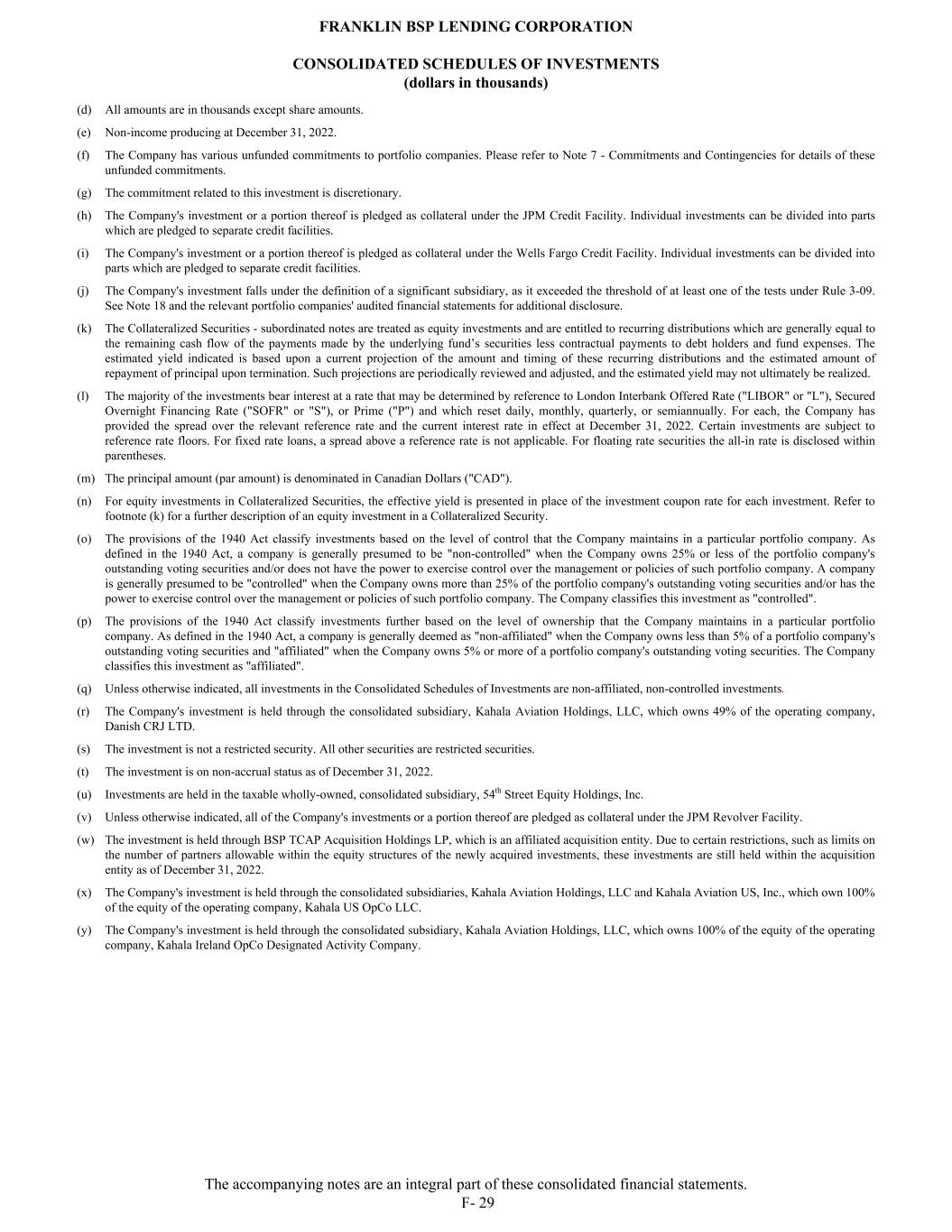

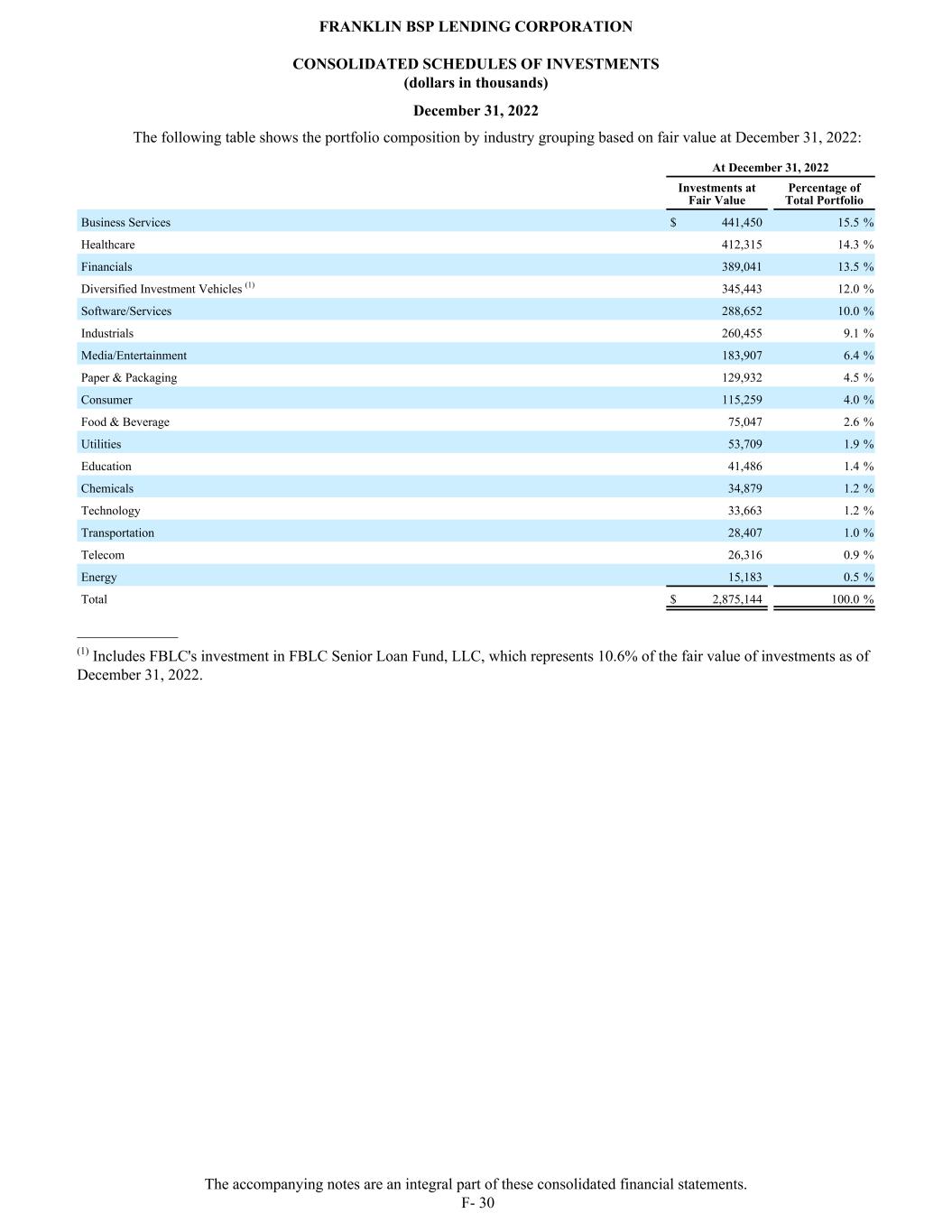

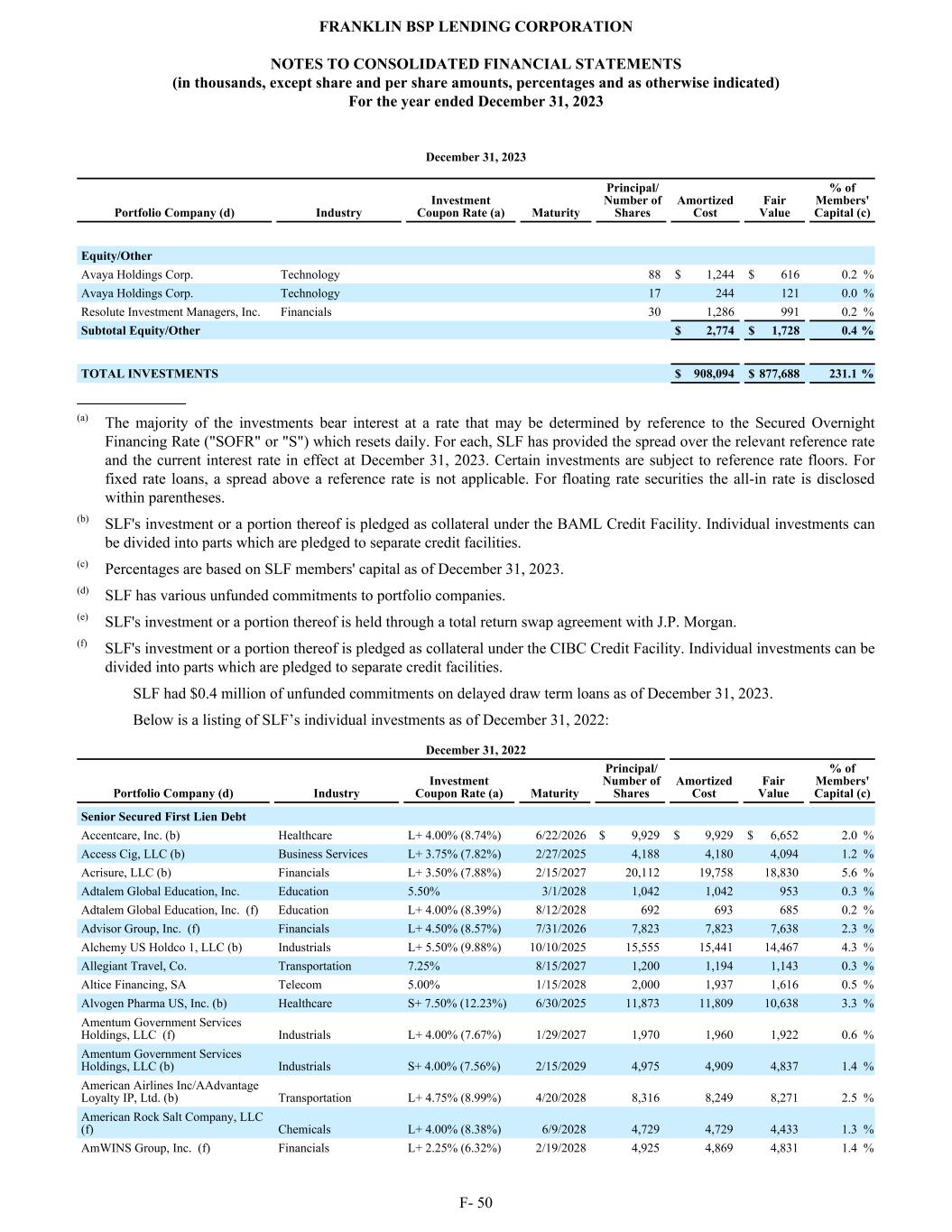

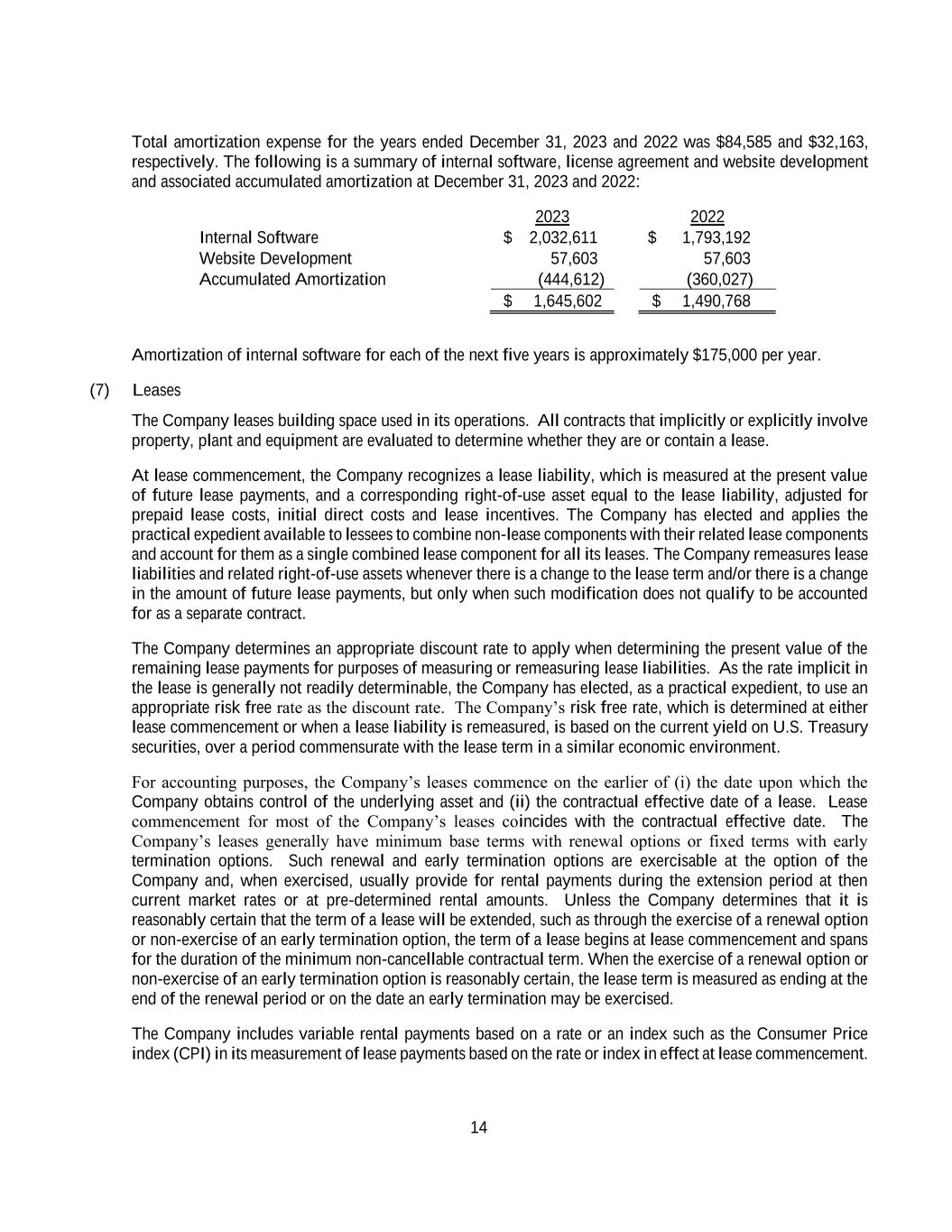

The following table shows the portfolio composition by industry grouping based on fair value at December 31, 2023: At December 31, 2023 Investments at Fair Value Percentage of Total Portfolio Business Services $ 454,318 16.2 % Healthcare 427,857 15.2 % Financials 360,987 12.8 % Diversified Investment Vehicles (1) 336,570 12.0 % Industrials 266,014 9.5 % Software/Services 239,592 8.5 % Media/Entertainment 160,782 5.7 % Paper & Packaging 143,847 5.1 % Food & Beverage 102,505 3.6 % Consumer 95,612 3.4 % Utilities 70,535 2.5 % Chemicals 35,625 1.3 % Technology 31,717 1.1 % Telecom 30,861 1.1 % Education 30,532 1.1 % Transportation 20,476 0.7 % Energy 6,292 0.2 % Total $ 2,814,122 100.0 % _____________ (1) Includes FBLC's investment in FBLC Senior Loan Fund, LLC, which represents 10.8% of the fair value of investments as of December 31, 2023. FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) December 31, 2023 The accompanying notes are an integral part of these consolidated financial statements. F- 21

Senior Secured First Lien Debt - 119.8% (b) 1236904 BC, Ltd. (c) (h) Software/Services L+ 7.50% (11.85%), 3/4/2027 $ 10,441 $ 10,298 $ 10,600 0.6 % 1236904 BC, Ltd. (c) (h) (i) Software/Services L+ 5.50% (9.88%), 3/4/2027 18,450 18,003 17,841 1.1 % Absolute Software Corp. (a) (c) (i) Software/Services L+ 6.00% (10.73%), 7/1/2027 45,093 44,417 44,416 2.7 % ADCS Clinics Intermediate Holdings, LLC (c) (h) Healthcare L+ 6.50% (11.43%), 5/7/2027 13,633 13,436 13,379 0.8 % ADCS Clinics Intermediate Holdings, LLC (c) Healthcare L+ 6.50% (11.70%), 5/7/2027 2,794 2,794 2,742 0.2 % Alera Group Intermediate Holdings, Inc. (c) Financials S+ 6.50% (10.92%), 10/2/2028 5,890 5,779 5,779 0.3 % Alera Group Intermediate Holdings, Inc. (c) Financials S+ 6.50% (10.92%), 10/2/2028 6,598 6,598 6,473 0.4 % Arch Global Precision, LLC (c) Industrials L+ 4.75% (8.42%), 4/1/2026 2,356 2,356 2,356 0.1 % Arch Global Precision, LLC (c) (h) (i) Industrials L+ 4.75% (9.17%), 4/1/2026 7,479 7,457 7,479 0.4 % Arctic Holdco, LLC (c) Paper & Packaging S+ 6.00% (10.68%), 12/23/2026 2,439 2,439 2,403 0.1 % Arctic Holdco, LLC (c) (h) (i) Paper & Packaging S+ 6.00% (10.68%), 12/23/2026 60,674 59,823 59,764 3.6 % Armada Parent, Inc. (c) Industrials L+ 5.75% (10.13%), 10/29/2027 44,717 43,998 43,997 2.6 % Armada Parent, Inc. (c) Industrials L+ 5.75% (10.13%), 10/29/2027 2,253 2,253 2,217 0.1 % Avalara, Inc. (c) Software/Services S+ 7.25% (11.83%), 10/19/2028 40,296 39,323 39,321 2.4 % Aveanna Healthcare, LLC (h) Healthcare L+ 3.75% (7.77%), 7/17/2028 910 905 696 0.0 % Aventine Holdings, LLC (c) Media/Entertainment L+ 6.00% (10.38%) 4.00% PIK, 6/18/2027 9,584 9,584 9,459 0.6 % Aventine Holdings, LLC (c) Media/Entertainment 10.25% PIK, 6/18/2027 24,798 24,342 24,265 1.5 % Aventine Holdings, LLC (c) (i) Media/Entertainment L+ 6.00% (10.38%) 4.00% PIK, 6/18/2027 26,220 25,811 25,876 1.6 % Axiom Global, Inc. (c) (h) (i) Business Services L+ 4.75% (9.04%), 10/1/2026 20,316 20,195 20,316 1.2 % BCPE Oceandrive Buyer, Inc. (c) (i) Healthcare L+ 6.25% (10.67%), 12/29/2028 3,399 3,399 3,284 0.2 % BCPE Oceandrive Buyer, Inc. (c) (i) Healthcare L+ 6.25% (10.67%), 12/29/2028 20,396 20,003 19,701 1.2 % BCPE Oceandrive Buyer, Inc. (c) Healthcare L+ 6.25% (10.99%), 12/30/2026 3,425 3,425 3,308 0.2 % BCPE Oceandrive Buyer, Inc. (c) Healthcare L+ 6.25% (10.67%), 12/29/2028 1,727 1,727 1,668 0.1 % Black Mountain Sand, LLC (c) Energy L+ 9.00% (13.70%), 6/30/2024 8,332 8,310 8,332 0.5 % Capstone Logistics (c) Transportation L+ 4.75% (9.13%), 11/12/2027 1,115 1,115 1,115 0.1 % Capstone Logistics (c) (h) Transportation L+ 4.75% (9.13%), 11/12/2027 19,014 18,882 19,015 1.1 % CHA Holdings, Inc. (c) (i) Business Services L+ 4.50% (9.23%), 4/10/2025 514 496 514 0.0 % Cold Spring Brewing, Co. (c) (h) (i) Food & Beverage S+ 4.75% (9.07%), 12/19/2025 7,008 6,973 7,008 0.4 % Communication Technology Intermediate, LLC (c) (h) Business Services L+ 5.50% (9.88%), 5/5/2027 17,891 17,632 17,891 1.1 % Communication Technology Intermediate, LLC (c) (i) Business Services L+ 5.50% (9.88%), 5/5/2027 6,223 6,223 6,223 0.4 % Communication Technology Intermediate, LLC (c) Business Services L+ 5.50% (9.88%), 5/5/2027 205 205 205 0.0 % Corfin Industries, LLC (c) Industrials L+ 5.75% (9.82%), 12/27/2027 1,602 1,602 1,602 0.1 % Corfin Industries, LLC (c) (h) (i) Industrials L+ 5.75% (9.42%), 2/5/2026 16,394 16,212 16,394 1.0 % Cornerstone Chemical, Co. Chemicals 6.75%, 8/15/2024 14,850 14,541 11,919 0.7 % CRS-SPV, Inc. (c) (o) Industrials L+ 4.50% (8.88%), 3/8/2023 62 62 62 0.0 % Drilling Info Holdings, Inc. (c) (i) Business Services L+ 4.25% (8.63%), 7/30/2025 6,952 6,816 6,952 0.4 % Dynagrid Holdings, LLC (c) (h) Utilities L+ 6.00% (10.02%), 12/18/2025 3,897 3,832 3,897 0.2 % Dynagrid Holdings, LLC (c) (i) Utilities L+ 6.00% (9.67%), 12/18/2025 14,191 14,012 14,191 0.9 % Eliassen Group, LLC (c) (i) Business Services S+ 5.50% (10.08%), 4/14/2028 11,586 11,482 11,484 0.7 % Eliassen Group, LLC (c) Business Services S+ 5.50% (8.88%), 4/14/2028 439 439 435 0.0 % Faraday Buyer, LLC (c) Utilities S+ 7.00% (11.32%), 10/11/2028 26,132 25,377 25,377 1.5 % FGT Purchaser, LLC (c) (h) Consumer S+ 5.50% (10.18%), 9/13/2027 21,231 20,898 21,231 1.3 % FGT Purchaser, LLC (c) Consumer L+ 5.50% (10.18%), 9/13/2027 815 815 815 0.0 % First Eagle Holdings, Inc. (c) Financials S+ 6.50% (10.73%), 3/1/2027 15,000 14,590 14,592 0.9 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 22

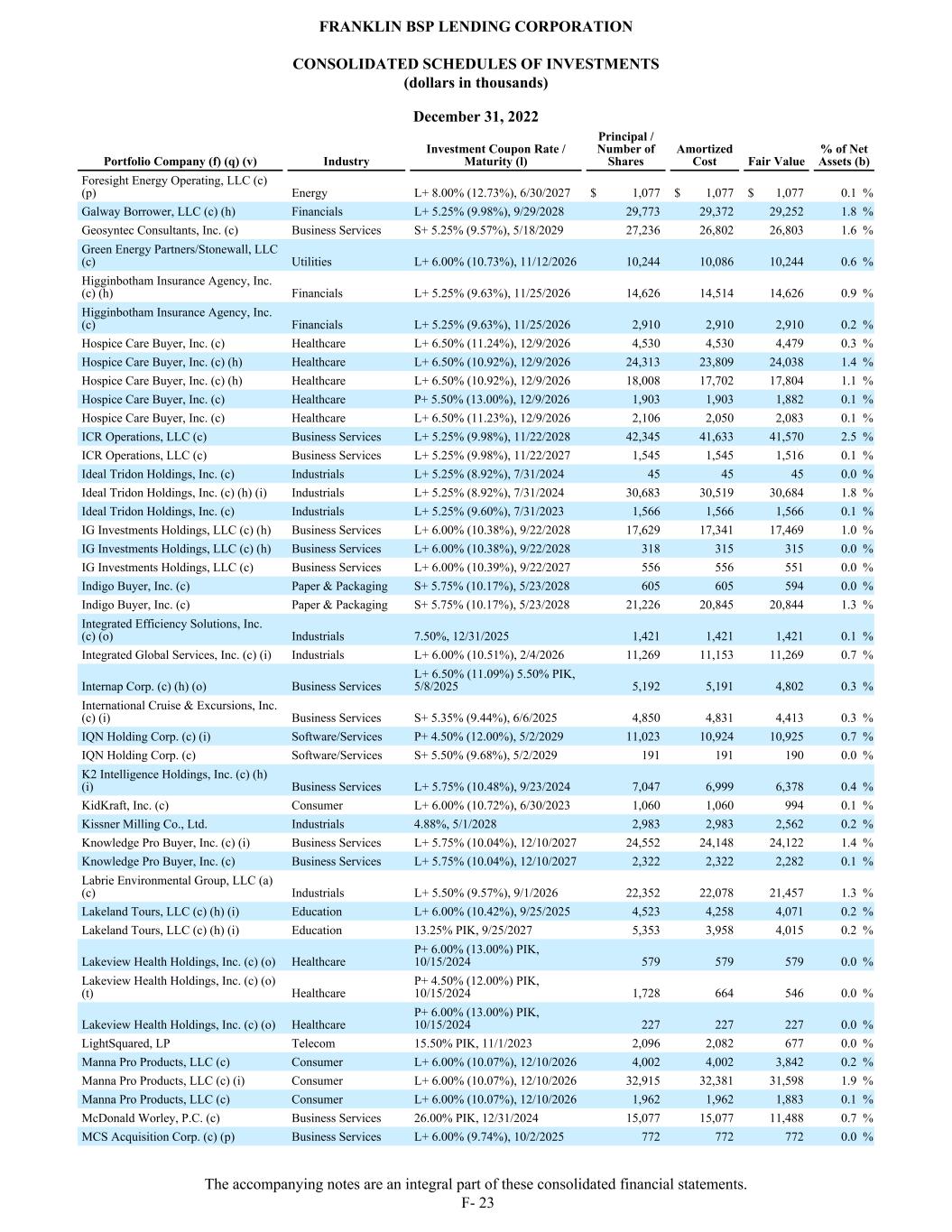

Foresight Energy Operating, LLC (c) (p) Energy L+ 8.00% (12.73%), 6/30/2027 $ 1,077 $ 1,077 $ 1,077 0.1 % Galway Borrower, LLC (c) (h) Financials L+ 5.25% (9.98%), 9/29/2028 29,773 29,372 29,252 1.8 % Geosyntec Consultants, Inc. (c) Business Services S+ 5.25% (9.57%), 5/18/2029 27,236 26,802 26,803 1.6 % Green Energy Partners/Stonewall, LLC (c) Utilities L+ 6.00% (10.73%), 11/12/2026 10,244 10,086 10,244 0.6 % Higginbotham Insurance Agency, Inc. (c) (h) Financials L+ 5.25% (9.63%), 11/25/2026 14,626 14,514 14,626 0.9 % Higginbotham Insurance Agency, Inc. (c) Financials L+ 5.25% (9.63%), 11/25/2026 2,910 2,910 2,910 0.2 % Hospice Care Buyer, Inc. (c) Healthcare L+ 6.50% (11.24%), 12/9/2026 4,530 4,530 4,479 0.3 % Hospice Care Buyer, Inc. (c) (h) Healthcare L+ 6.50% (10.92%), 12/9/2026 24,313 23,809 24,038 1.4 % Hospice Care Buyer, Inc. (c) (h) Healthcare L+ 6.50% (10.92%), 12/9/2026 18,008 17,702 17,804 1.1 % Hospice Care Buyer, Inc. (c) Healthcare P+ 5.50% (13.00%), 12/9/2026 1,903 1,903 1,882 0.1 % Hospice Care Buyer, Inc. (c) Healthcare L+ 6.50% (11.23%), 12/9/2026 2,106 2,050 2,083 0.1 % ICR Operations, LLC (c) Business Services L+ 5.25% (9.98%), 11/22/2028 42,345 41,633 41,570 2.5 % ICR Operations, LLC (c) Business Services L+ 5.25% (9.98%), 11/22/2027 1,545 1,545 1,516 0.1 % Ideal Tridon Holdings, Inc. (c) Industrials L+ 5.25% (8.92%), 7/31/2024 45 45 45 0.0 % Ideal Tridon Holdings, Inc. (c) (h) (i) Industrials L+ 5.25% (8.92%), 7/31/2024 30,683 30,519 30,684 1.8 % Ideal Tridon Holdings, Inc. (c) Industrials L+ 5.25% (9.60%), 7/31/2023 1,566 1,566 1,566 0.1 % IG Investments Holdings, LLC (c) (h) Business Services L+ 6.00% (10.38%), 9/22/2028 17,629 17,341 17,469 1.0 % IG Investments Holdings, LLC (c) (h) Business Services L+ 6.00% (10.38%), 9/22/2028 318 315 315 0.0 % IG Investments Holdings, LLC (c) Business Services L+ 6.00% (10.39%), 9/22/2027 556 556 551 0.0 % Indigo Buyer, Inc. (c) Paper & Packaging S+ 5.75% (10.17%), 5/23/2028 605 605 594 0.0 % Indigo Buyer, Inc. (c) Paper & Packaging S+ 5.75% (10.17%), 5/23/2028 21,226 20,845 20,844 1.3 % Integrated Efficiency Solutions, Inc. (c) (o) Industrials 7.50%, 12/31/2025 1,421 1,421 1,421 0.1 % Integrated Global Services, Inc. (c) (i) Industrials L+ 6.00% (10.51%), 2/4/2026 11,269 11,153 11,269 0.7 % Internap Corp. (c) (h) (o) Business Services L+ 6.50% (11.09%) 5.50% PIK, 5/8/2025 5,192 5,191 4,802 0.3 % International Cruise & Excursions, Inc. (c) (i) Business Services S+ 5.35% (9.44%), 6/6/2025 4,850 4,831 4,413 0.3 % IQN Holding Corp. (c) (i) Software/Services P+ 4.50% (12.00%), 5/2/2029 11,023 10,924 10,925 0.7 % IQN Holding Corp. (c) Software/Services S+ 5.50% (9.68%), 5/2/2029 191 191 190 0.0 % K2 Intelligence Holdings, Inc. (c) (h) (i) Business Services L+ 5.75% (10.48%), 9/23/2024 7,047 6,999 6,378 0.4 % KidKraft, Inc. (c) Consumer L+ 6.00% (10.72%), 6/30/2023 1,060 1,060 994 0.1 % Kissner Milling Co., Ltd. Industrials 4.88%, 5/1/2028 2,983 2,983 2,562 0.2 % Knowledge Pro Buyer, Inc. (c) (i) Business Services L+ 5.75% (10.04%), 12/10/2027 24,552 24,148 24,122 1.4 % Knowledge Pro Buyer, Inc. (c) Business Services L+ 5.75% (10.04%), 12/10/2027 2,322 2,322 2,282 0.1 % Labrie Environmental Group, LLC (a) (c) Industrials L+ 5.50% (9.57%), 9/1/2026 22,352 22,078 21,457 1.3 % Lakeland Tours, LLC (c) (h) (i) Education L+ 6.00% (10.42%), 9/25/2025 4,523 4,258 4,071 0.2 % Lakeland Tours, LLC (c) (h) (i) Education 13.25% PIK, 9/25/2027 5,353 3,958 4,015 0.2 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (13.00%) PIK, 10/15/2024 579 579 579 0.0 % Lakeview Health Holdings, Inc. (c) (o) (t) Healthcare P+ 4.50% (12.00%) PIK, 10/15/2024 1,728 664 546 0.0 % Lakeview Health Holdings, Inc. (c) (o) Healthcare P+ 6.00% (13.00%) PIK, 10/15/2024 227 227 227 0.0 % LightSquared, LP Telecom 15.50% PIK, 11/1/2023 2,096 2,082 677 0.0 % Manna Pro Products, LLC (c) Consumer L+ 6.00% (10.07%), 12/10/2026 4,002 4,002 3,842 0.2 % Manna Pro Products, LLC (c) (i) Consumer L+ 6.00% (10.07%), 12/10/2026 32,915 32,381 31,598 1.9 % Manna Pro Products, LLC (c) Consumer L+ 6.00% (10.07%), 12/10/2026 1,962 1,962 1,883 0.1 % McDonald Worley, P.C. (c) Business Services 26.00% PIK, 12/31/2024 15,077 15,077 11,488 0.7 % MCS Acquisition Corp. (c) (p) Business Services L+ 6.00% (9.74%), 10/2/2025 772 772 772 0.0 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 23

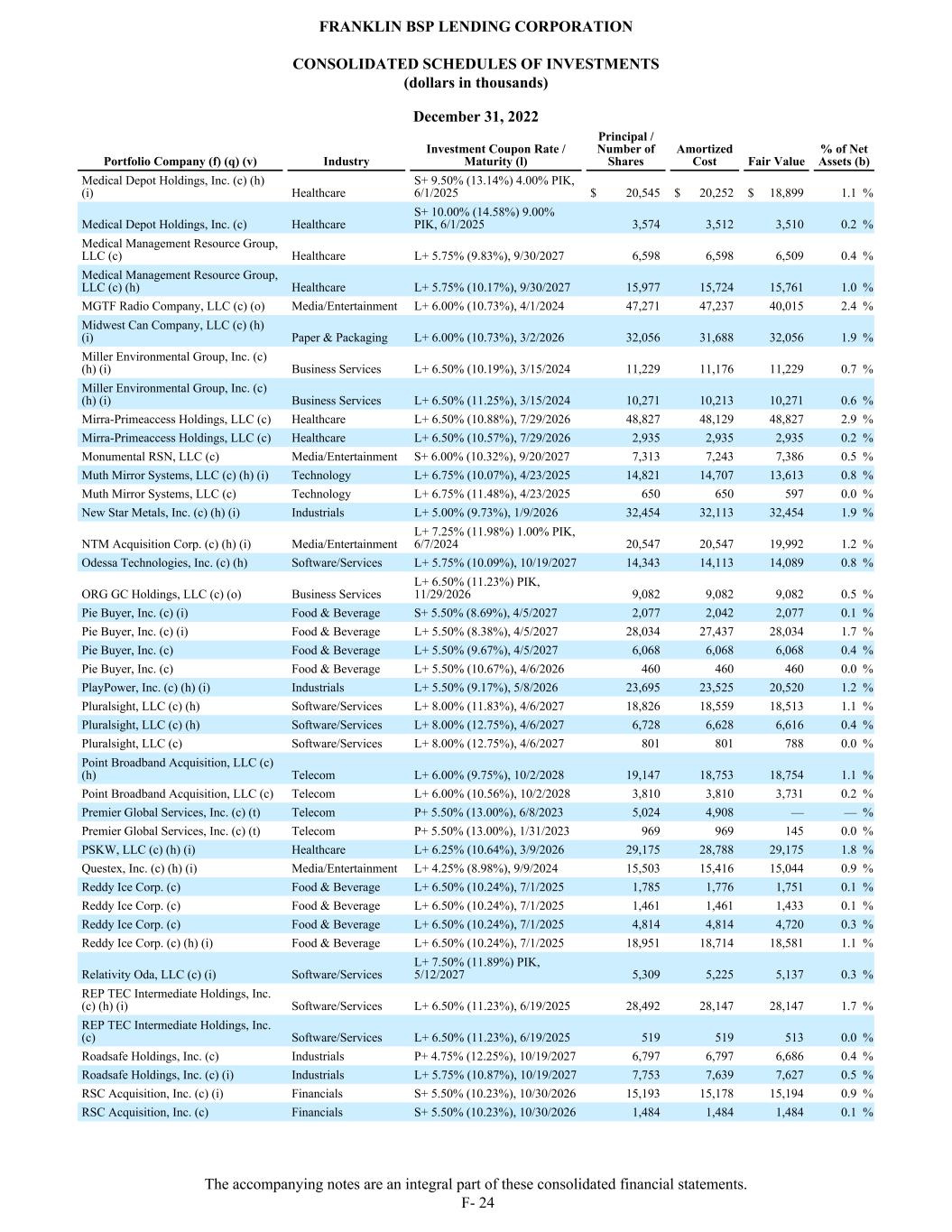

Medical Depot Holdings, Inc. (c) (h) (i) Healthcare S+ 9.50% (13.14%) 4.00% PIK, 6/1/2025 $ 20,545 $ 20,252 $ 18,899 1.1 % Medical Depot Holdings, Inc. (c) Healthcare S+ 10.00% (14.58%) 9.00% PIK, 6/1/2025 3,574 3,512 3,510 0.2 % Medical Management Resource Group, LLC (c) Healthcare L+ 5.75% (9.83%), 9/30/2027 6,598 6,598 6,509 0.4 % Medical Management Resource Group, LLC (c) (h) Healthcare L+ 5.75% (10.17%), 9/30/2027 15,977 15,724 15,761 1.0 % MGTF Radio Company, LLC (c) (o) Media/Entertainment L+ 6.00% (10.73%), 4/1/2024 47,271 47,237 40,015 2.4 % Midwest Can Company, LLC (c) (h) (i) Paper & Packaging L+ 6.00% (10.73%), 3/2/2026 32,056 31,688 32,056 1.9 % Miller Environmental Group, Inc. (c) (h) (i) Business Services L+ 6.50% (10.19%), 3/15/2024 11,229 11,176 11,229 0.7 % Miller Environmental Group, Inc. (c) (h) (i) Business Services L+ 6.50% (11.25%), 3/15/2024 10,271 10,213 10,271 0.6 % Mirra-Primeaccess Holdings, LLC (c) Healthcare L+ 6.50% (10.88%), 7/29/2026 48,827 48,129 48,827 2.9 % Mirra-Primeaccess Holdings, LLC (c) Healthcare L+ 6.50% (10.57%), 7/29/2026 2,935 2,935 2,935 0.2 % Monumental RSN, LLC (c) Media/Entertainment S+ 6.00% (10.32%), 9/20/2027 7,313 7,243 7,386 0.5 % Muth Mirror Systems, LLC (c) (h) (i) Technology L+ 6.75% (10.07%), 4/23/2025 14,821 14,707 13,613 0.8 % Muth Mirror Systems, LLC (c) Technology L+ 6.75% (11.48%), 4/23/2025 650 650 597 0.0 % New Star Metals, Inc. (c) (h) (i) Industrials L+ 5.00% (9.73%), 1/9/2026 32,454 32,113 32,454 1.9 % NTM Acquisition Corp. (c) (h) (i) Media/Entertainment L+ 7.25% (11.98%) 1.00% PIK, 6/7/2024 20,547 20,547 19,992 1.2 % Odessa Technologies, Inc. (c) (h) Software/Services L+ 5.75% (10.09%), 10/19/2027 14,343 14,113 14,089 0.8 % ORG GC Holdings, LLC (c) (o) Business Services L+ 6.50% (11.23%) PIK, 11/29/2026 9,082 9,082 9,082 0.5 % Pie Buyer, Inc. (c) (i) Food & Beverage S+ 5.50% (8.69%), 4/5/2027 2,077 2,042 2,077 0.1 % Pie Buyer, Inc. (c) (i) Food & Beverage L+ 5.50% (8.38%), 4/5/2027 28,034 27,437 28,034 1.7 % Pie Buyer, Inc. (c) Food & Beverage L+ 5.50% (9.67%), 4/5/2027 6,068 6,068 6,068 0.4 % Pie Buyer, Inc. (c) Food & Beverage L+ 5.50% (10.67%), 4/6/2026 460 460 460 0.0 % PlayPower, Inc. (c) (h) (i) Industrials L+ 5.50% (9.17%), 5/8/2026 23,695 23,525 20,520 1.2 % Pluralsight, LLC (c) (h) Software/Services L+ 8.00% (11.83%), 4/6/2027 18,826 18,559 18,513 1.1 % Pluralsight, LLC (c) (h) Software/Services L+ 8.00% (12.75%), 4/6/2027 6,728 6,628 6,616 0.4 % Pluralsight, LLC (c) Software/Services L+ 8.00% (12.75%), 4/6/2027 801 801 788 0.0 % Point Broadband Acquisition, LLC (c) (h) Telecom L+ 6.00% (9.75%), 10/2/2028 19,147 18,753 18,754 1.1 % Point Broadband Acquisition, LLC (c) Telecom L+ 6.00% (10.56%), 10/2/2028 3,810 3,810 3,731 0.2 % Premier Global Services, Inc. (c) (t) Telecom P+ 5.50% (13.00%), 6/8/2023 5,024 4,908 — — % Premier Global Services, Inc. (c) (t) Telecom P+ 5.50% (13.00%), 1/31/2023 969 969 145 0.0 % PSKW, LLC (c) (h) (i) Healthcare L+ 6.25% (10.64%), 3/9/2026 29,175 28,788 29,175 1.8 % Questex, Inc. (c) (h) (i) Media/Entertainment L+ 4.25% (8.98%), 9/9/2024 15,503 15,416 15,044 0.9 % Reddy Ice Corp. (c) Food & Beverage L+ 6.50% (10.24%), 7/1/2025 1,785 1,776 1,751 0.1 % Reddy Ice Corp. (c) Food & Beverage L+ 6.50% (10.24%), 7/1/2025 1,461 1,461 1,433 0.1 % Reddy Ice Corp. (c) Food & Beverage L+ 6.50% (10.24%), 7/1/2025 4,814 4,814 4,720 0.3 % Reddy Ice Corp. (c) (h) (i) Food & Beverage L+ 6.50% (10.24%), 7/1/2025 18,951 18,714 18,581 1.1 % Relativity Oda, LLC (c) (i) Software/Services L+ 7.50% (11.89%) PIK, 5/12/2027 5,309 5,225 5,137 0.3 % REP TEC Intermediate Holdings, Inc. (c) (h) (i) Software/Services L+ 6.50% (11.23%), 6/19/2025 28,492 28,147 28,147 1.7 % REP TEC Intermediate Holdings, Inc. (c) Software/Services L+ 6.50% (11.23%), 6/19/2025 519 519 513 0.0 % Roadsafe Holdings, Inc. (c) Industrials P+ 4.75% (12.25%), 10/19/2027 6,797 6,797 6,686 0.4 % Roadsafe Holdings, Inc. (c) (i) Industrials L+ 5.75% (10.87%), 10/19/2027 7,753 7,639 7,627 0.5 % RSC Acquisition, Inc. (c) (i) Financials S+ 5.50% (10.23%), 10/30/2026 15,193 15,178 15,194 0.9 % RSC Acquisition, Inc. (c) Financials S+ 5.50% (10.23%), 10/30/2026 1,484 1,484 1,484 0.1 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 24

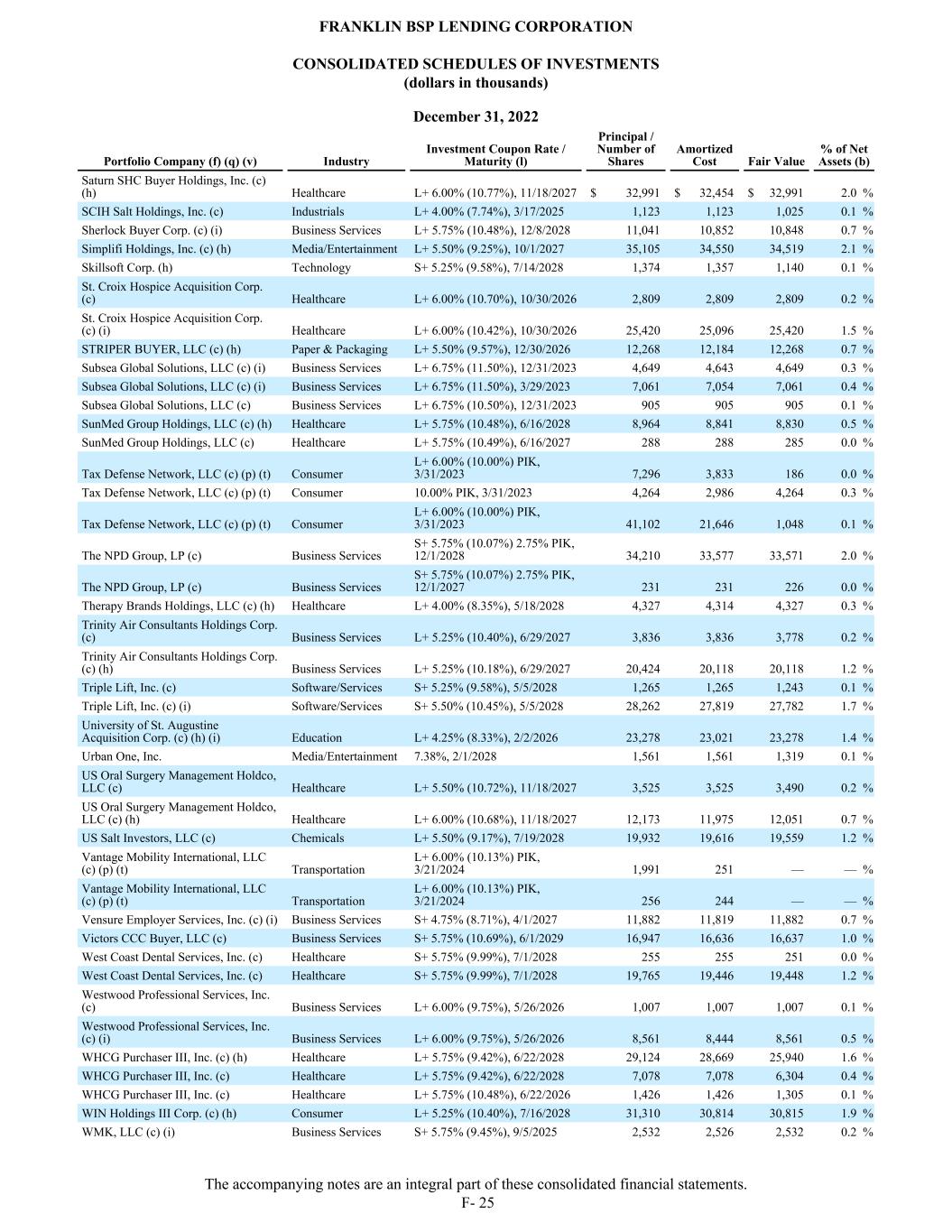

Saturn SHC Buyer Holdings, Inc. (c) (h) Healthcare L+ 6.00% (10.77%), 11/18/2027 $ 32,991 $ 32,454 $ 32,991 2.0 % SCIH Salt Holdings, Inc. (c) Industrials L+ 4.00% (7.74%), 3/17/2025 1,123 1,123 1,025 0.1 % Sherlock Buyer Corp. (c) (i) Business Services L+ 5.75% (10.48%), 12/8/2028 11,041 10,852 10,848 0.7 % Simplifi Holdings, Inc. (c) (h) Media/Entertainment L+ 5.50% (9.25%), 10/1/2027 35,105 34,550 34,519 2.1 % Skillsoft Corp. (h) Technology S+ 5.25% (9.58%), 7/14/2028 1,374 1,357 1,140 0.1 % St. Croix Hospice Acquisition Corp. (c) Healthcare L+ 6.00% (10.70%), 10/30/2026 2,809 2,809 2,809 0.2 % St. Croix Hospice Acquisition Corp. (c) (i) Healthcare L+ 6.00% (10.42%), 10/30/2026 25,420 25,096 25,420 1.5 % STRIPER BUYER, LLC (c) (h) Paper & Packaging L+ 5.50% (9.57%), 12/30/2026 12,268 12,184 12,268 0.7 % Subsea Global Solutions, LLC (c) (i) Business Services L+ 6.75% (11.50%), 12/31/2023 4,649 4,643 4,649 0.3 % Subsea Global Solutions, LLC (c) (i) Business Services L+ 6.75% (11.50%), 3/29/2023 7,061 7,054 7,061 0.4 % Subsea Global Solutions, LLC (c) Business Services L+ 6.75% (10.50%), 12/31/2023 905 905 905 0.1 % SunMed Group Holdings, LLC (c) (h) Healthcare L+ 5.75% (10.48%), 6/16/2028 8,964 8,841 8,830 0.5 % SunMed Group Holdings, LLC (c) Healthcare L+ 5.75% (10.49%), 6/16/2027 288 288 285 0.0 % Tax Defense Network, LLC (c) (p) (t) Consumer L+ 6.00% (10.00%) PIK, 3/31/2023 7,296 3,833 186 0.0 % Tax Defense Network, LLC (c) (p) (t) Consumer 10.00% PIK, 3/31/2023 4,264 2,986 4,264 0.3 % Tax Defense Network, LLC (c) (p) (t) Consumer L+ 6.00% (10.00%) PIK, 3/31/2023 41,102 21,646 1,048 0.1 % The NPD Group, LP (c) Business Services S+ 5.75% (10.07%) 2.75% PIK, 12/1/2028 34,210 33,577 33,571 2.0 % The NPD Group, LP (c) Business Services S+ 5.75% (10.07%) 2.75% PIK, 12/1/2027 231 231 226 0.0 % Therapy Brands Holdings, LLC (c) (h) Healthcare L+ 4.00% (8.35%), 5/18/2028 4,327 4,314 4,327 0.3 % Trinity Air Consultants Holdings Corp. (c) Business Services L+ 5.25% (10.40%), 6/29/2027 3,836 3,836 3,778 0.2 % Trinity Air Consultants Holdings Corp. (c) (h) Business Services L+ 5.25% (10.18%), 6/29/2027 20,424 20,118 20,118 1.2 % Triple Lift, Inc. (c) Software/Services S+ 5.25% (9.58%), 5/5/2028 1,265 1,265 1,243 0.1 % Triple Lift, Inc. (c) (i) Software/Services S+ 5.50% (10.45%), 5/5/2028 28,262 27,819 27,782 1.7 % University of St. Augustine Acquisition Corp. (c) (h) (i) Education L+ 4.25% (8.33%), 2/2/2026 23,278 23,021 23,278 1.4 % Urban One, Inc. Media/Entertainment 7.38%, 2/1/2028 1,561 1,561 1,319 0.1 % US Oral Surgery Management Holdco, LLC (c) Healthcare L+ 5.50% (10.72%), 11/18/2027 3,525 3,525 3,490 0.2 % US Oral Surgery Management Holdco, LLC (c) (h) Healthcare L+ 6.00% (10.68%), 11/18/2027 12,173 11,975 12,051 0.7 % US Salt Investors, LLC (c) Chemicals L+ 5.50% (9.17%), 7/19/2028 19,932 19,616 19,559 1.2 % Vantage Mobility International, LLC (c) (p) (t) Transportation L+ 6.00% (10.13%) PIK, 3/21/2024 1,991 251 — — % Vantage Mobility International, LLC (c) (p) (t) Transportation L+ 6.00% (10.13%) PIK, 3/21/2024 256 244 — — % Vensure Employer Services, Inc. (c) (i) Business Services S+ 4.75% (8.71%), 4/1/2027 11,882 11,819 11,882 0.7 % Victors CCC Buyer, LLC (c) Business Services S+ 5.75% (10.69%), 6/1/2029 16,947 16,636 16,637 1.0 % West Coast Dental Services, Inc. (c) Healthcare S+ 5.75% (9.99%), 7/1/2028 255 255 251 0.0 % West Coast Dental Services, Inc. (c) Healthcare S+ 5.75% (9.99%), 7/1/2028 19,765 19,446 19,448 1.2 % Westwood Professional Services, Inc. (c) Business Services L+ 6.00% (9.75%), 5/26/2026 1,007 1,007 1,007 0.1 % Westwood Professional Services, Inc. (c) (i) Business Services L+ 6.00% (9.75%), 5/26/2026 8,561 8,444 8,561 0.5 % WHCG Purchaser III, Inc. (c) (h) Healthcare L+ 5.75% (9.42%), 6/22/2028 29,124 28,669 25,940 1.6 % WHCG Purchaser III, Inc. (c) Healthcare L+ 5.75% (9.42%), 6/22/2028 7,078 7,078 6,304 0.4 % WHCG Purchaser III, Inc. (c) Healthcare L+ 5.75% (10.48%), 6/22/2026 1,426 1,426 1,305 0.1 % WIN Holdings III Corp. (c) (h) Consumer L+ 5.25% (10.40%), 7/16/2028 31,310 30,814 30,815 1.9 % WMK, LLC (c) (i) Business Services S+ 5.75% (9.45%), 9/5/2025 2,532 2,526 2,532 0.2 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 25

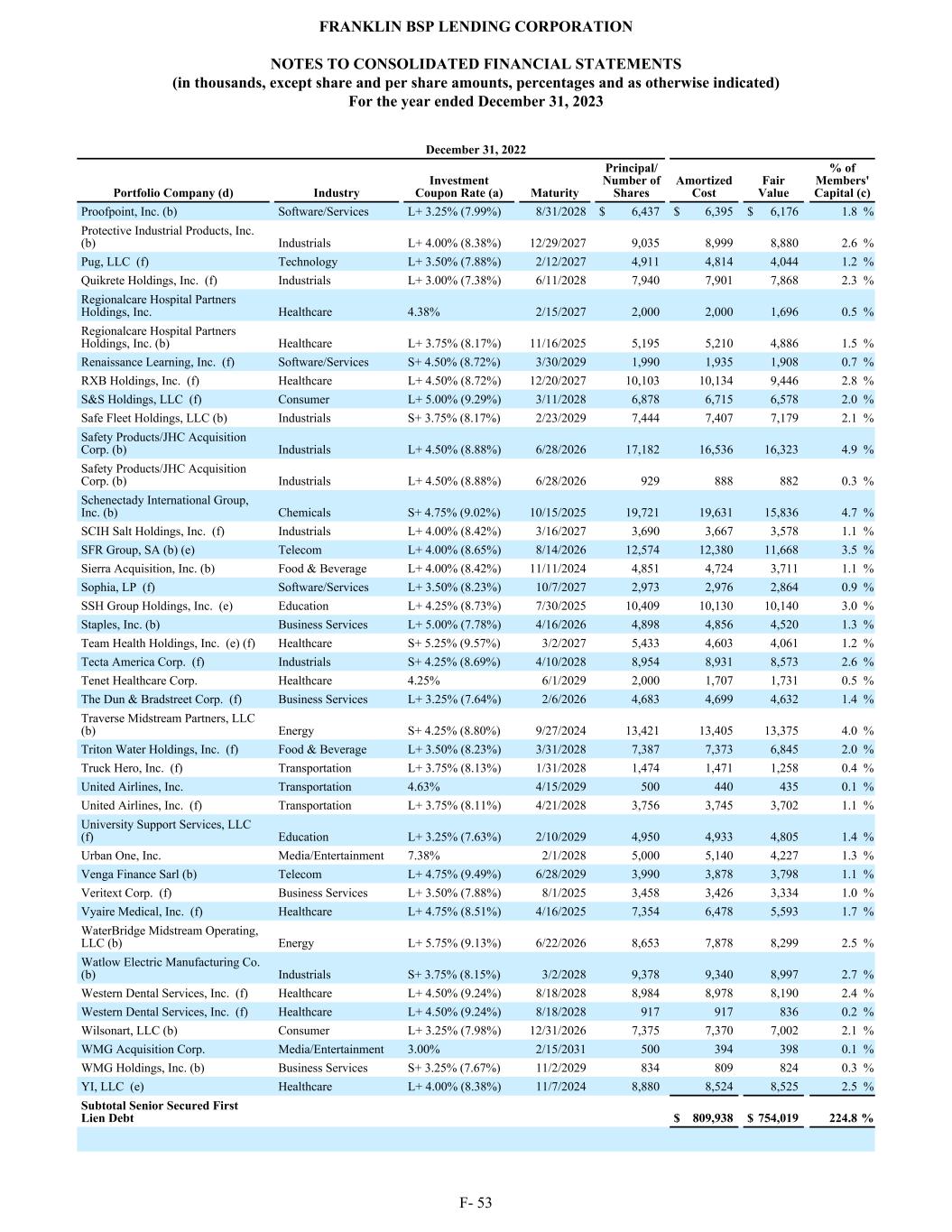

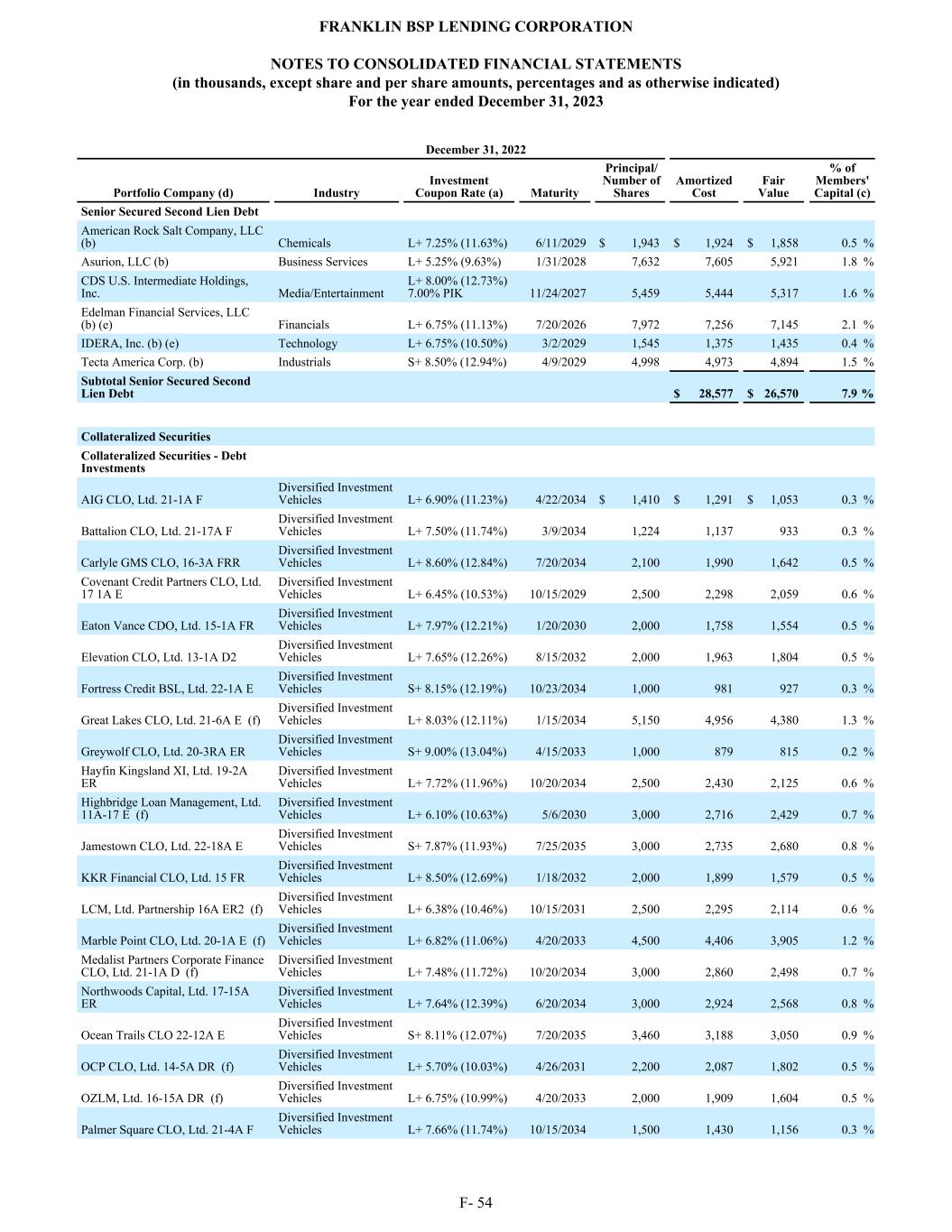

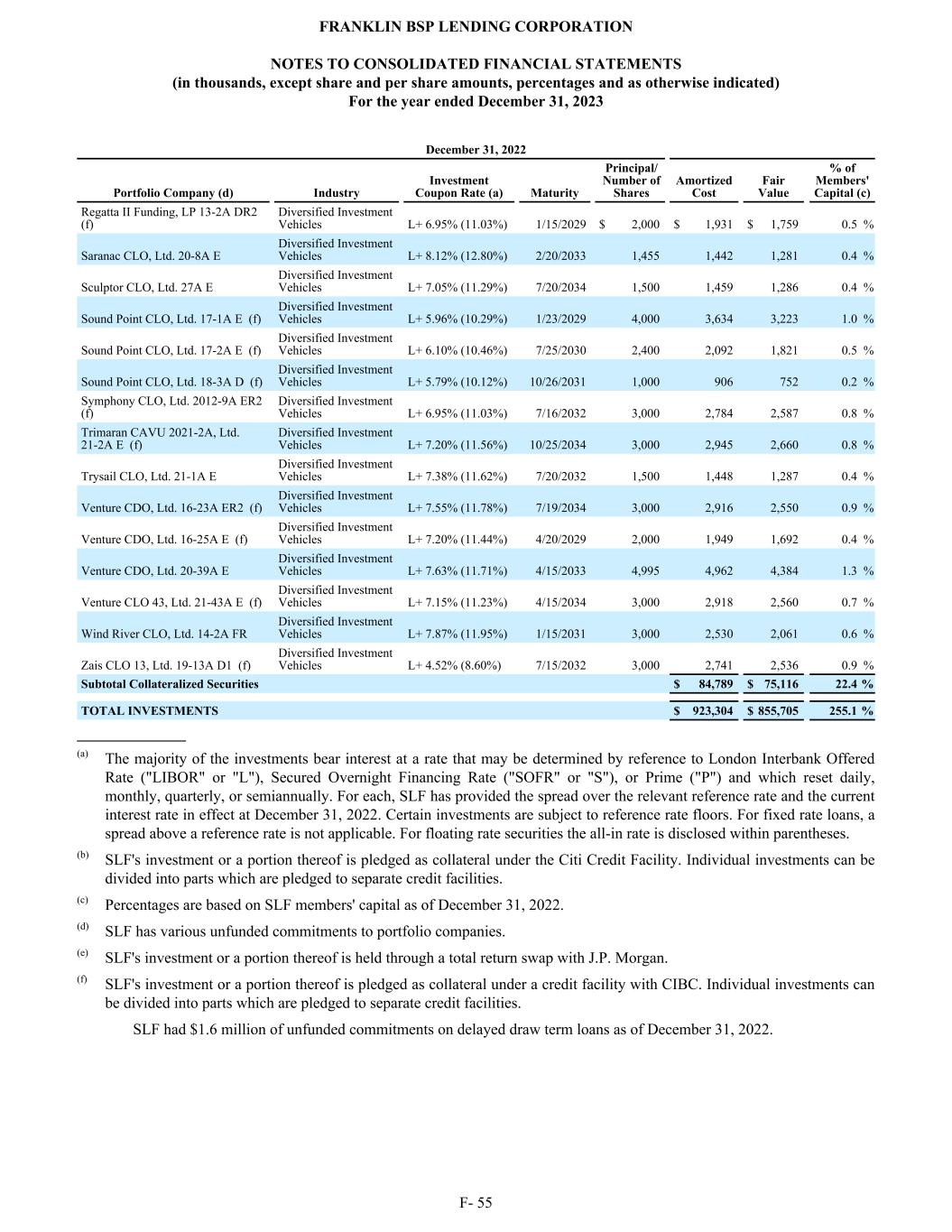

WMK, LLC (c) Business Services S+ 5.75% (10.48%), 9/5/2025 $ 349 $ 347 $ 349 0.0 % WMK, LLC (c) (h) (i) Business Services S+ 5.75% (9.73%), 9/5/2025 17,975 17,838 17,975 1.1 % WMK, LLC (c) Business Services L+ 5.75% (9.99%), 9/5/2024 2,618 2,618 2,618 0.2 % WMK, LLC (c) Business Services S+ 5.75% (10.15%), 9/5/2025 11,118 11,118 11,118 0.7 % WMK, LLC (c) (i) Business Services S+ 5.75% (10.17%), 9/5/2025 3,697 3,627 3,697 0.2 % WMK, LLC (c) Business Services S+ 5.75% (10.30%), 9/5/2025 8,000 7,690 8,000 0.5 % Zendesk, Inc. (c) Software/Services S+ 6.50% (11.04%) 3.50% PIK, 11/22/2028 42,801 41,961 41,962 2.5 % Subtotal Senior Secured First Lien Debt $ 2,048,997 $ 1,995,273 119.8 % Senior Secured Second Lien Debt - 12.2% (b) Accentcare, Inc. (c) (h) Healthcare L+ 8.75% (13.49%), 6/21/2027 $ 30,152 $ 29,691 $ 25,026 1.5 % Anchor Glass Container Corp. (c) (t) Paper & Packaging L+ 7.75% (11.53%), 12/7/2024 6,667 6,150 2,003 0.1 % Aruba Investments Holdings, LLC (i) Chemicals L+ 7.75% (12.14%), 11/24/2028 3,759 3,717 3,401 0.2 % Astro AB Merger Sub, Inc. (a) (c) (h) Financials L+ 8.00% (12.42%), 4/30/2025 8,162 8,145 7,560 0.5 % Carlisle FoodService Products, Inc. (c) Consumer L+ 7.75% (11.32%), 3/20/2026 10,719 10,633 10,166 0.6 % CommerceHub, Inc. (c) Technology S+ 7.00% (11.53%), 12/29/2028 12,360 12,314 10,506 0.6 % Corelogic, Inc. (c) Business Services L+ 6.50% (10.94%), 6/4/2029 10,808 10,721 9,252 0.6 % HAH Group Holding Company, LLC (c) (h) Healthcare L+ 8.50% (12.89%), 10/30/2028 12,445 12,218 12,445 0.7 % Integrated Efficiency Solutions, Inc. (c) (o) Industrials 10.00% PIK, 12/31/2026 1,586 1,062 760 0.0 % Mercury Merger Sub, Inc. (c) Business Services L+ 6.50% (10.25%), 8/2/2029 13,965 13,869 13,518 0.8 % ORG GC Holdings, LLC (c) (o) Business Services 18.00% PIK, 11/29/2027 4,109 4,109 3,868 0.2 % PetVet Care Centers, LLC (c) (h) Healthcare L+ 6.25% (10.63%), 2/13/2026 3,539 3,532 3,464 0.2 % Project Boost Purchaser, LLC (c) Business Services L+ 8.00% (12.38%), 5/31/2027 1,848 1,848 1,848 0.1 % Proofpoint, Inc. (h) Software/Services L+ 6.25% (10.99%), 8/31/2029 7,842 7,809 7,502 0.5 % QuickBase, Inc. (c) Technology L+ 8.00% (12.38%), 4/2/2027 7,484 7,404 7,484 0.4 % RealPage, Inc. (i) Software/Services L+ 6.50% (10.88%), 4/23/2029 13,647 13,485 13,067 0.8 % Recess Holdings, Inc. (c) (h) Industrials L+ 7.75% (12.17%), 9/29/2025 16,134 16,038 16,134 1.0 % SSH Group Holdings, Inc. (c) Education L+ 8.25% (12.98%), 7/30/2026 10,122 10,077 10,122 0.6 % Therapy Brands Holdings, LLC (c) (h) Healthcare L+ 6.75% (11.10%), 5/18/2029 4,654 4,628 4,654 0.3 % Travelpro Products, Inc. (a) (c) Consumer 13.00%, 2.00% PIK, 11/20/2024 2,983 2,983 2,983 0.2 % Travelpro Products, Inc. (a) (c) (m) Consumer 13.00%, 2.00% PIK, 11/20/2024 CAD 3,445 2,671 2,542 0.2 % USIC Holdings, Inc. (c) (h) Business Services L+ 6.50% (10.57%), 5/14/2029 5,798 5,751 5,589 0.3 % Vantage Mobility International, LLC (c) (p) (t) Transportation L+ 6.00% (10.13%) PIK, 3/21/2024 1,212 17 — — % Vantage Mobility International, LLC (c) (p) (t) Transportation L+ 6.00% (10.13%) PIK, 3/21/2024 3,936 2,914 — — % Victory Buyer, LLC (c) Industrials L+ 7.00% (11.35%), 11/19/2029 31,686 31,407 29,405 1.8 % Subtotal Senior Secured Second Lien Debt $ 223,193 $ 203,299 12.2 % Subordinated Debt - 8.1% (b) Del Real, LLC (c) Food & Beverage 16.00%, 12.00% PIK, 4/7/2023 $ 4,848 $ 4,679 $ 4,772 0.3 % Post Road Equipment Finance, LLC (c) (o) Financials L+ 7.75% (11.94%), 12/31/2028 15,086 15,086 15,086 0.9 % Post Road Equipment Finance, LLC (c) (o) Financials L+ 7.75% (11.94%), 12/31/2028 38,100 37,982 38,100 2.3 % Siena Capital Finance, LLC (c) (j) (o) Financials 12.50%, 11/26/2026 77,000 76,995 77,000 4.6 % Subtotal Subordinated Debt $ 134,742 $ 134,958 8.1 % Collateralized Securities - 1.8% (b) Collateralized Securities - Debt Investments NewStar Arlington Senior Loan Program, LLC 14-1A FR (a) (c) (p) Diversified Investment Vehicles L+ 11.00% (15.36%), 4/25/2031 $ 4,750 $ 4,603 $ 4,165 0.3 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 26

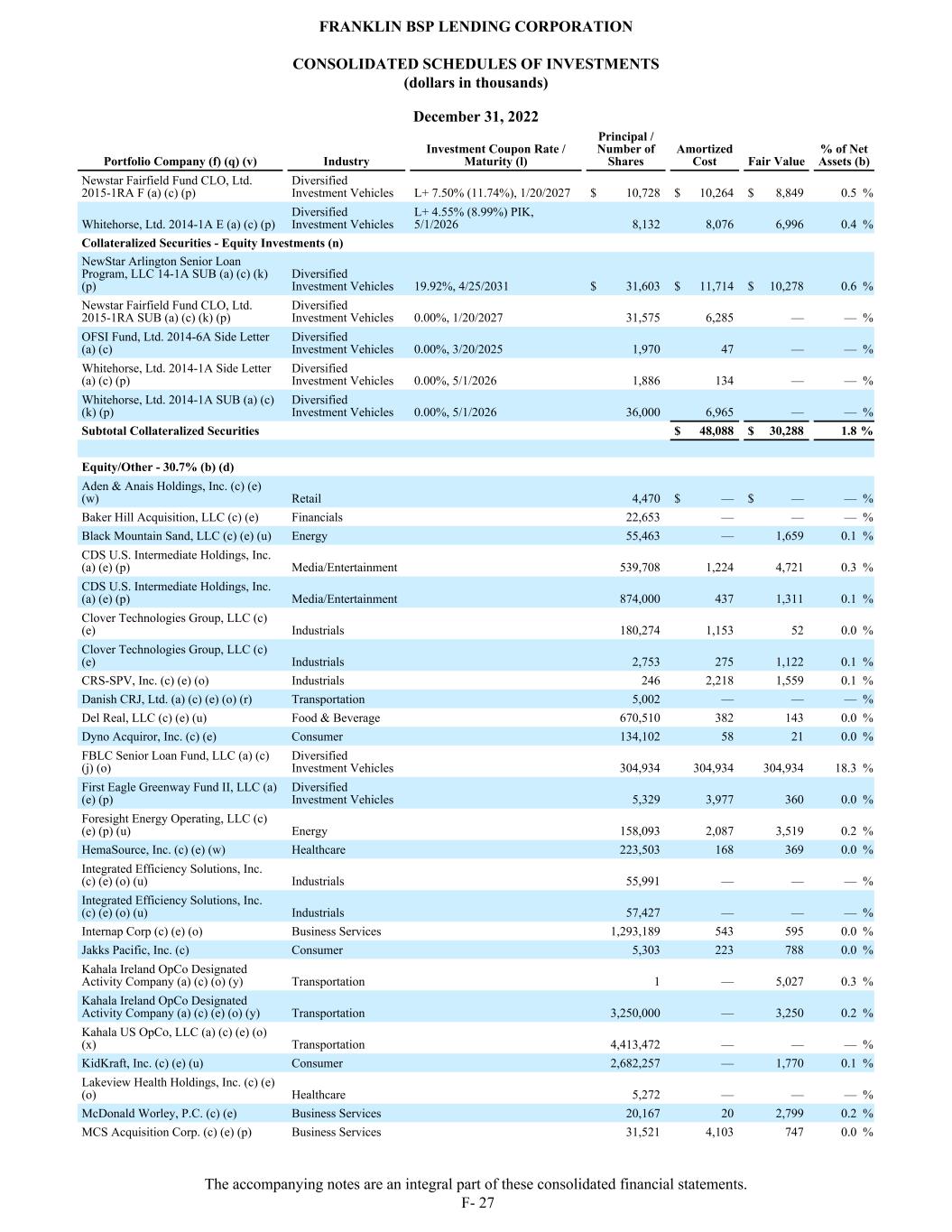

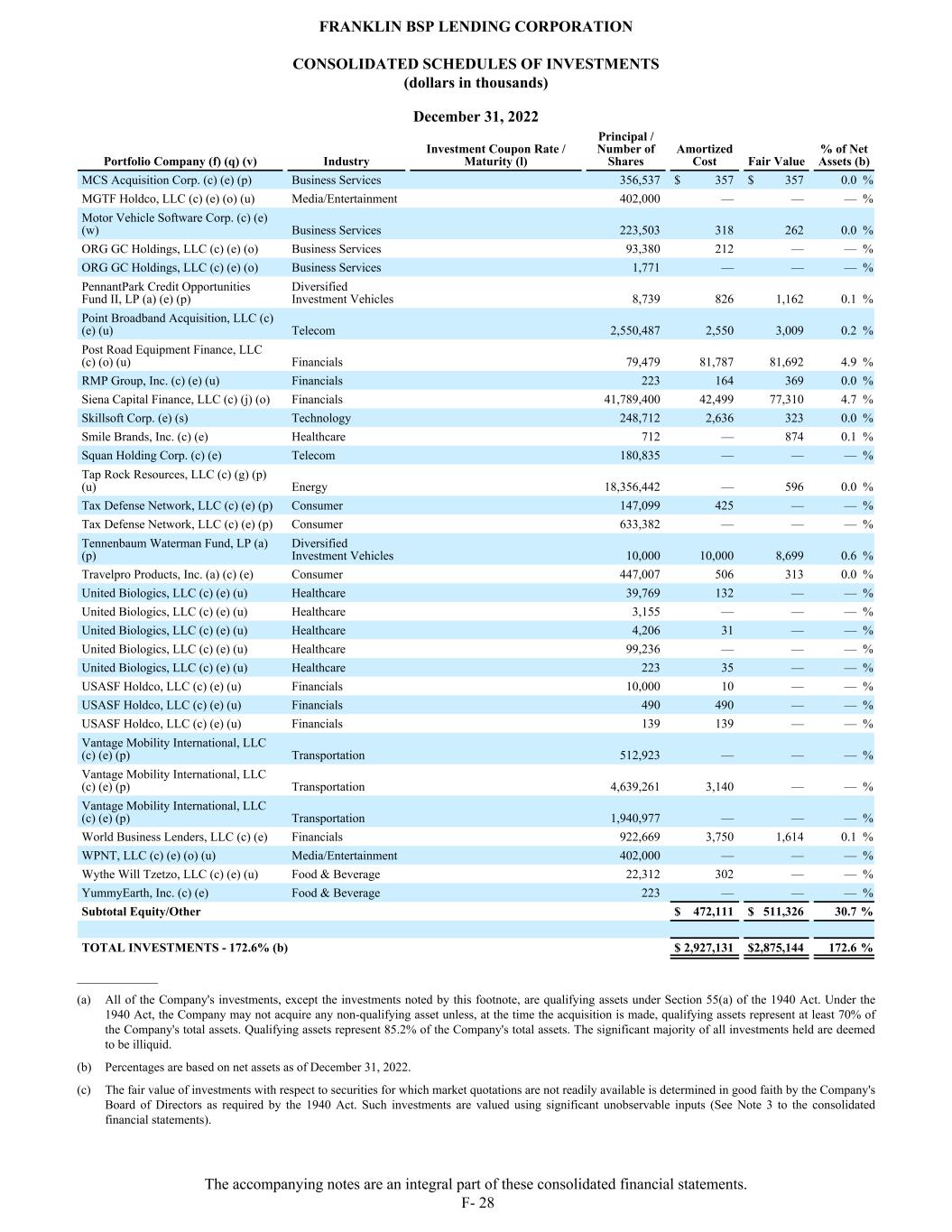

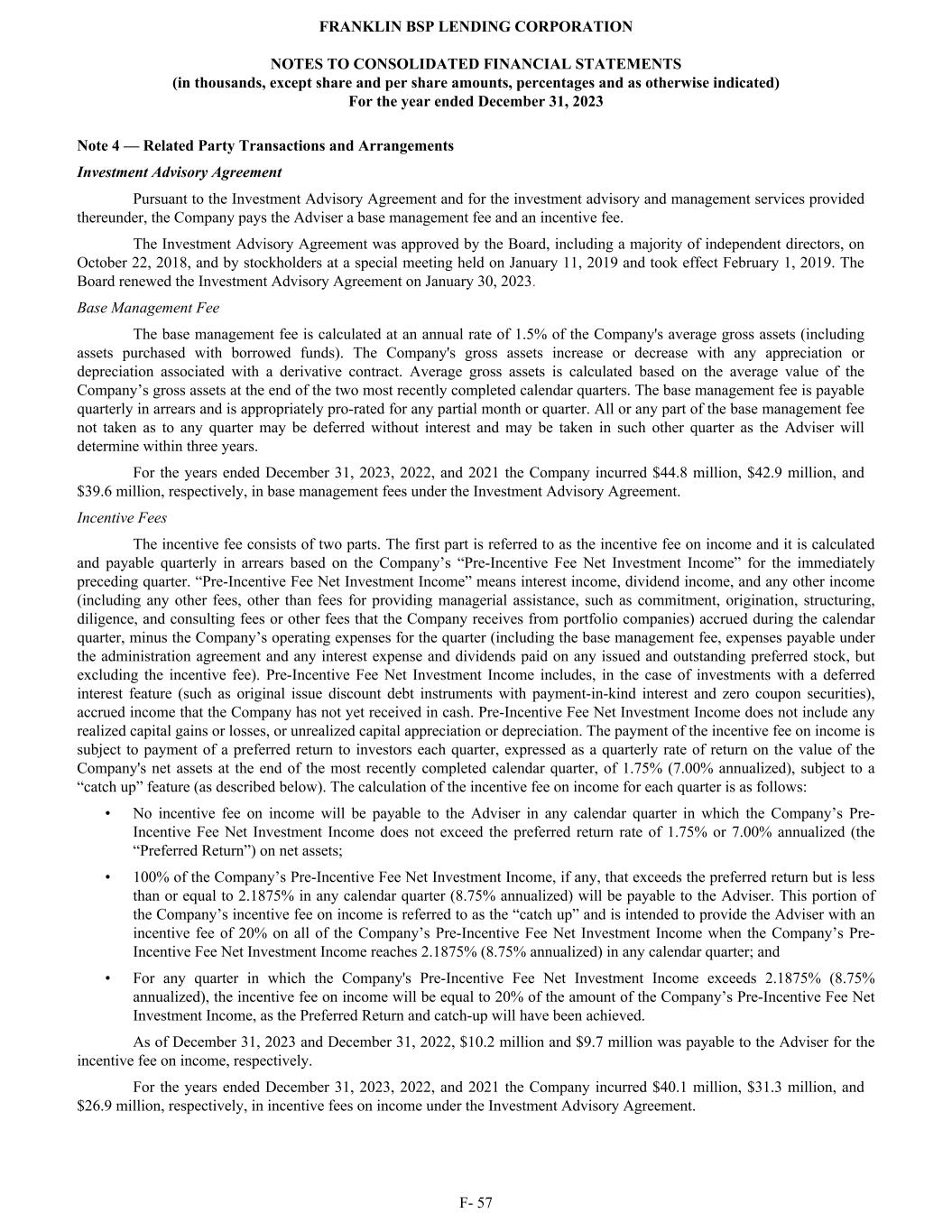

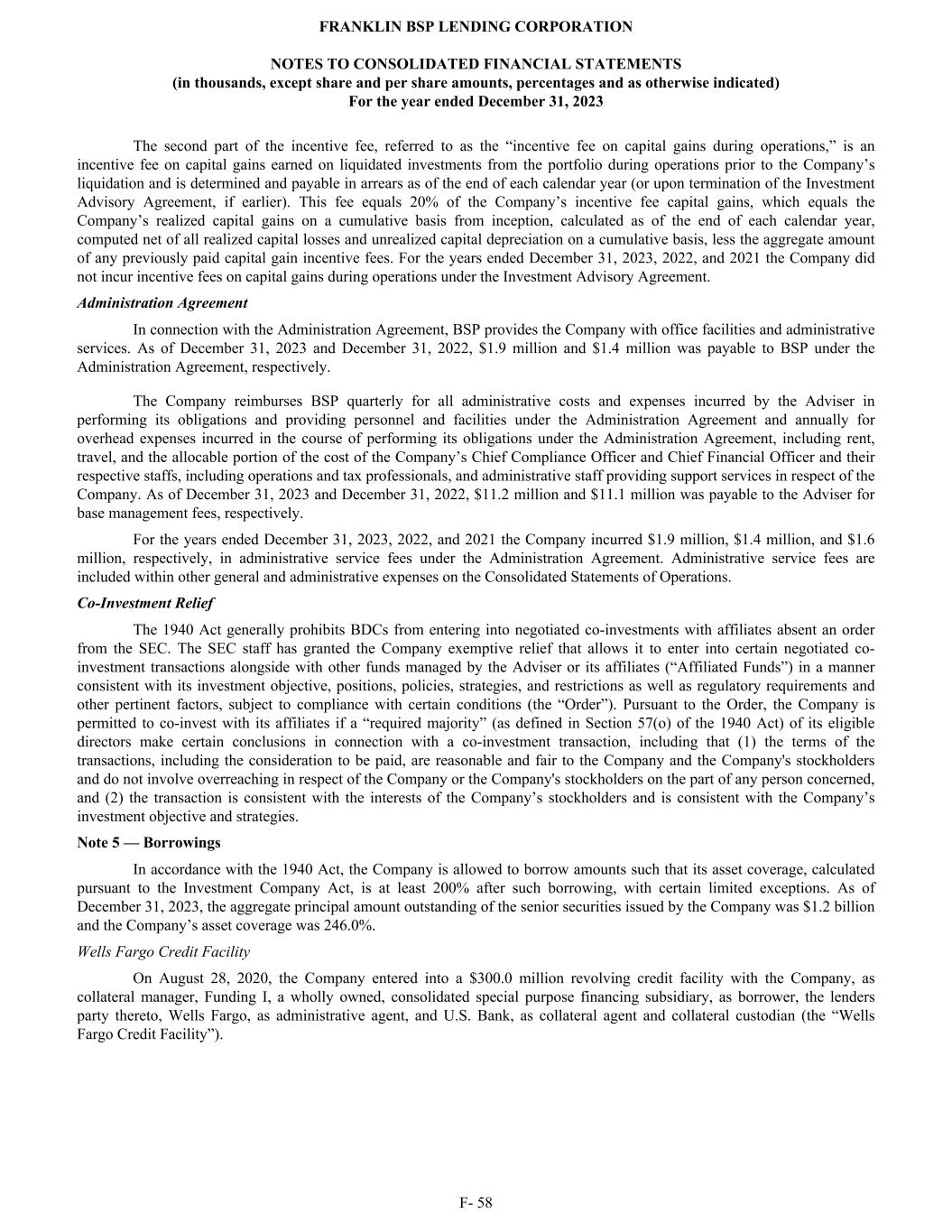

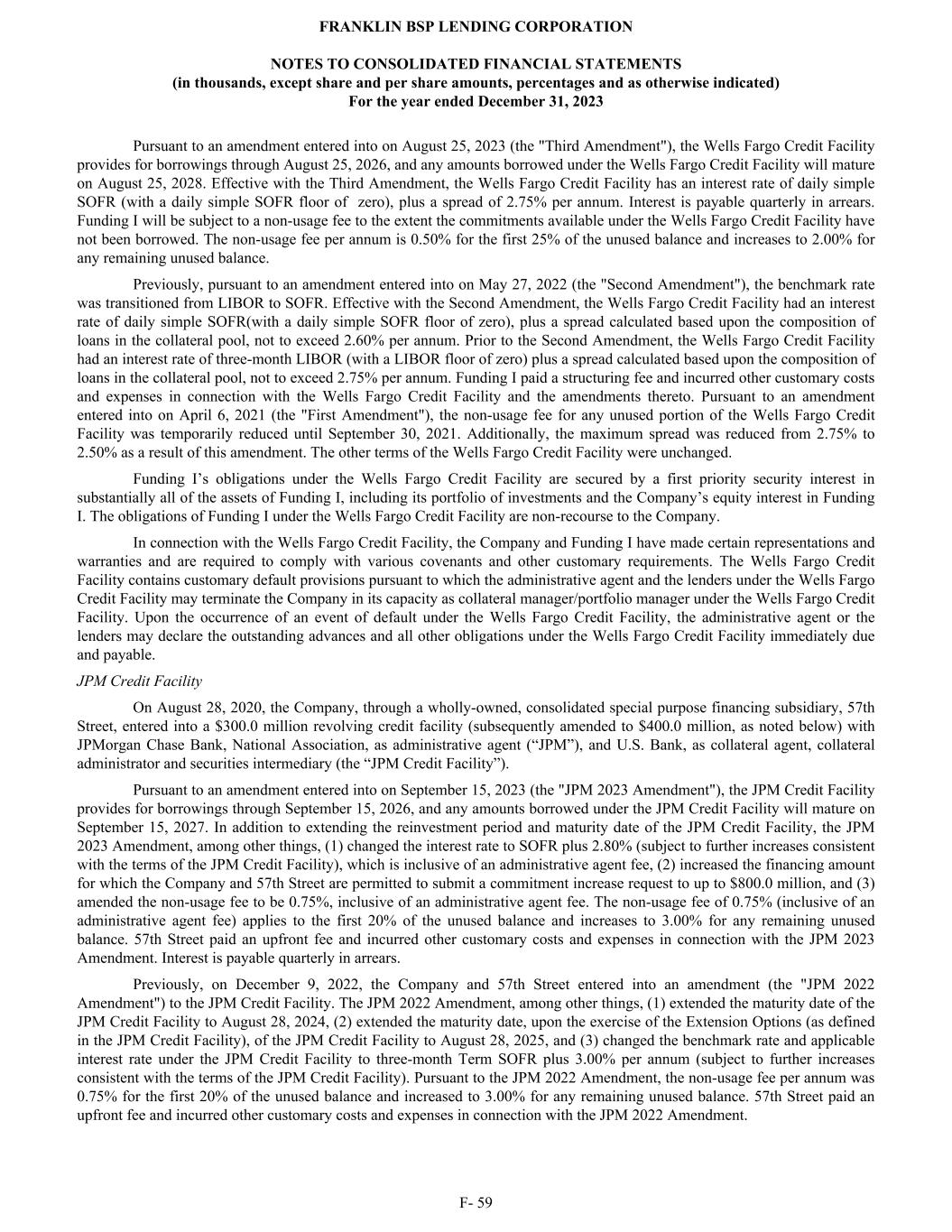

Newstar Fairfield Fund CLO, Ltd. 2015-1RA F (a) (c) (p) Diversified Investment Vehicles L+ 7.50% (11.74%), 1/20/2027 $ 10,728 $ 10,264 $ 8,849 0.5 % Whitehorse, Ltd. 2014-1A E (a) (c) (p) Diversified Investment Vehicles L+ 4.55% (8.99%) PIK, 5/1/2026 8,132 8,076 6,996 0.4 % Collateralized Securities - Equity Investments (n) NewStar Arlington Senior Loan Program, LLC 14-1A SUB (a) (c) (k) (p) Diversified Investment Vehicles 19.92%, 4/25/2031 $ 31,603 $ 11,714 $ 10,278 0.6 % Newstar Fairfield Fund CLO, Ltd. 2015-1RA SUB (a) (c) (k) (p) Diversified Investment Vehicles 0.00%, 1/20/2027 31,575 6,285 — — % OFSI Fund, Ltd. 2014-6A Side Letter (a) (c) Diversified Investment Vehicles 0.00%, 3/20/2025 1,970 47 — — % Whitehorse, Ltd. 2014-1A Side Letter (a) (c) (p) Diversified Investment Vehicles 0.00%, 5/1/2026 1,886 134 — — % Whitehorse, Ltd. 2014-1A SUB (a) (c) (k) (p) Diversified Investment Vehicles 0.00%, 5/1/2026 36,000 6,965 — — % Subtotal Collateralized Securities $ 48,088 $ 30,288 1.8 % Equity/Other - 30.7% (b) (d) Aden & Anais Holdings, Inc. (c) (e) (w) Retail 4,470 $ — $ — — % Baker Hill Acquisition, LLC (c) (e) Financials 22,653 — — — % Black Mountain Sand, LLC (c) (e) (u) Energy 55,463 — 1,659 0.1 % CDS U.S. Intermediate Holdings, Inc. (a) (e) (p) Media/Entertainment 539,708 1,224 4,721 0.3 % CDS U.S. Intermediate Holdings, Inc. (a) (e) (p) Media/Entertainment 874,000 437 1,311 0.1 % Clover Technologies Group, LLC (c) (e) Industrials 180,274 1,153 52 0.0 % Clover Technologies Group, LLC (c) (e) Industrials 2,753 275 1,122 0.1 % CRS-SPV, Inc. (c) (e) (o) Industrials 246 2,218 1,559 0.1 % Danish CRJ, Ltd. (a) (c) (e) (o) (r) Transportation 5,002 — — — % Del Real, LLC (c) (e) (u) Food & Beverage 670,510 382 143 0.0 % Dyno Acquiror, Inc. (c) (e) Consumer 134,102 58 21 0.0 % FBLC Senior Loan Fund, LLC (a) (c) (j) (o) Diversified Investment Vehicles 304,934 304,934 304,934 18.3 % First Eagle Greenway Fund II, LLC (a) (e) (p) Diversified Investment Vehicles 5,329 3,977 360 0.0 % Foresight Energy Operating, LLC (c) (e) (p) (u) Energy 158,093 2,087 3,519 0.2 % HemaSource, Inc. (c) (e) (w) Healthcare 223,503 168 369 0.0 % Integrated Efficiency Solutions, Inc. (c) (e) (o) (u) Industrials 55,991 — — — % Integrated Efficiency Solutions, Inc. (c) (e) (o) (u) Industrials 57,427 — — — % Internap Corp (c) (e) (o) Business Services 1,293,189 543 595 0.0 % Jakks Pacific, Inc. (c) Consumer 5,303 223 788 0.0 % Kahala Ireland OpCo Designated Activity Company (a) (c) (o) (y) Transportation 1 — 5,027 0.3 % Kahala Ireland OpCo Designated Activity Company (a) (c) (e) (o) (y) Transportation 3,250,000 — 3,250 0.2 % Kahala US OpCo, LLC (a) (c) (e) (o) (x) Transportation 4,413,472 — — — % KidKraft, Inc. (c) (e) (u) Consumer 2,682,257 — 1,770 0.1 % Lakeview Health Holdings, Inc. (c) (e) (o) Healthcare 5,272 — — — % McDonald Worley, P.C. (c) (e) Business Services 20,167 20 2,799 0.2 % MCS Acquisition Corp. (c) (e) (p) Business Services 31,521 4,103 747 0.0 % December 31, 2022 Portfolio Company (f) (q) (v) Industry Investment Coupon Rate / Maturity (l) Principal / Number of Shares Amortized Cost Fair Value % of Net Assets (b) FRANKLIN BSP LENDING CORPORATION CONSOLIDATED SCHEDULES OF INVESTMENTS (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. F- 27