Exhibit 99.1

Developing Cutting - Edge Treatments for Debilitating Fibrotic and Neurodegenerative Diseases January 2022

Disclaimer and Other Important Information 2 This Presentation (the “Presentation”) is for informational purposes only to assist interested parties in evaluating a propos ed initial business combination (the “Transaction” or “Business Combination”) between Biotech Acquisition Company ("BAC") and Bl ade Therapeutics, Inc. (the “Target”), pursuant to which the Target will become wholly - owned subsidiary of BAC. In connection with the closing of the Business Combination, BAC will re - domesticate as a Delaware corporation and will change its name to “Blade Biotherapeutics, Inc.” The continuing combined entity is hereinafter referred to as the “Company” or the “Combined Entity”. The information contained herein does not purport to be all - inclusive and none of BAC , the Target, nor any of their respective subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, mana ger s, directors, officers, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability o f t he information contained in this Presentation. Prospective investors should consult with their own counsel and tax and financ ial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you co nfi rm that you are not relying solely upon the information contained herein to make any investment decision. To the fullest exte nt permitted by law, in no circumstances will BAC , the Target or any of its subsidiaries, stockholders , affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agen ts be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reli anc e on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection the rewith. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to ma ke a full analysis of BAC, the Target, or the Business Combination. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Additional Information: In connection with the proposed Business Combination, BAC intends to file with the Securities and Ex cha nge Commission (the “SEC”), a registration statement on Form S - 4, containing a preliminary proxy statement/prospectus of BAC and after the registration statement is declared effective, BAC and the Target will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to their respe cti ve shareholders. This Presentation does not contain any information that should be considered by BAC’s or the Target’s respective shareholders concerning the proposed Business Combination and is not in tended to constitute the basis of any voting or investment decision in respect of the Business Combination or the securities of BAC. BAC’s and the Target’s respective shareholders and other interested persons are advised to read, when available, the prelimin ary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about BAC, the Ta rge t and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for th e proposed Business Combination will be mailed to shareholders of BAC and the Target as of a record date to be established for vot ing on the proposed Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/ prospectus and other documents filed with the SEC, without charge, once av ailable, at the SEC’s website at www.sec.gov, or by directing a request to: Biotech Acquisition Company, 545 West 25th Street, 20th Floor, New York, NY 10001. No Offer or Solicitation: This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Exchange Act. This Presentation does not constitute ( i ) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securit y o f BAC, the Target, or any of their respective affiliates nor shall there be any sale of securities, investment or other speci fic product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec uri ties laws of any such jurisdiction. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESE NTA TION IS TRUTHFUL OR COMPLETE. Forward Looking Statements: Certain statements included in this Presentation are not historical facts but are forward - looking s tatements. Forward - looking statements generally are accompanied by words such as "believe," "may," "will," "estimate," "continue ," "anticipate," "intend," "expect," "should," "would," "plan," "future," "outlook," and similar expressions that predict or ind ica te future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward - looking. These forward - looking statements include, but are not limited to, statements regarding estimat es and forecasts of other performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation and on the current expectations of BAC’s and Target’s respective management and are no t p redictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a def initive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will dif fer from assumptions. Many actual events and circumstances are beyond the control of BAC and the Target. Some important factors that could cause actual results to differ materially from those in any forward - looking statements could include changes in domestic and foreign business, market, financial, political and legal conditions.

Disclaimer and Other Important Information (cont’d) 3 These forward - looking statements are subject to a number of risks and uncertainties, including, the inability of the parties to successfully or timely consummate the Transaction, including the risk that any required regulatory approvals are not obtained , a re delayed or are subject to unanticipated conditions that could adversely affect the Combined Entity or the expected benefits o f t he Transaction, if not obtained; the failure to realize the anticipated benefits of the Transaction; matters discovered by th e p arties as they complete their respective due diligence investigation of the other parties; the ability of BAC prior to the Business Com bin ation, and the Combined Entity following the Business Combination, to maintain the listing of the Company’s shares on Nasdaq; co sts related to the Transaction; future financial performance of the Company following the Business Combination; the ability of th e C ompany to forecast and maintain an adequate rate of revenue growth and appropriately plan its expenses; expectations regarding future expenditures of the Company following the Business Combination; the future mix of revenue and effect on gross margins of the Company following the Business Combination; the Company’s ability to execute its business plans and strategy; the failure to satisfy the conditions to the consummation of the Transaction, including the approval of the definitive merger agreement by t he shareholders of BAC, the satisfaction of the minimum cash requirements of the definitive merger agreement following any redemptions by BAC’s public shareholders; the risk that the Transaction may not be completed by the stated deadline and the p ote ntial failure to obtain an extension of the stated deadline; the inability to complete a PIPE transaction; the outcome of any le gal proceedings that may be instituted against BAC or the Target related to the Transaction; the attraction and retention of qual ifi ed directors, officers, employees and key personnel of BAC and the Target prior to the Business Combination, and the Company following the Business Combination; the ability of the Company to compete effectively in a highly competitive market; neither BA C nor the Target are currently generating revenues and there can be no assurance that following the Business Combination, the Company will ever achieve revenues or profitability; the ability to protect and enhance the Target’s respective corporate rep uta tion and brand; the impact from future regulatory, judicial, and legislative changes in the Target’s or the Company’s industr y; the timing, costs, conduct, and outcome of clinical trials and future preclinical studies and clinical trials, including the timi ng of the initiation and availability of data from such trials; the timing and likelihood of regulatory filings and approvals fo r p roduct candidates; whether regulatory authorities determine that additional trials or data are necessary in order to obtain approval; the potential market size and the size of the patient populations for product candidates, if approved for co mmercial use, and the market opportunities for product candidates; the ability to locate and acquire complementary products or product candidates and inte gra te those into the Company’s business; and, the uncertain effects of the COVID - 19 pandemic; and those factors set forth in documents of BAC filed, or to be filed, with SEC. The foregoing list of risks is not exhaustive. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be add itional risks that neither BAC nor the Target presently know or that BAC and the Target currently believe are immaterial that could also cause actual results to differ from those contained in the forwar d - l ooking statements. In addition, forward - looking statements reflect BAC's and the Target’s current expectations, plans and foreca sts of future events and views as of the date of this Presentation. Nothing in this Presentation should be regarded as a representa tio n by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this Presentat ion, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary stateme nts herein and the risk factors of BAC and the Target described above. BAC and the Target anticipate that subsequent events and d eve lopments will cause BAC's and the Target’s assessments to change. However, while BAC and the Target may elect to update thes e forward - looking statements at some point in the future, BAC and the Target specifically disclaim any obligation to do so. These forward - looking statements should not be relied upon as representing BAC's or the Target’s assessments as of any date subsequen t to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. Use of Data: The data contained herein are derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein are not an indication as to future pe rfo rmance. Important Information for Investors : This Presentation does not purport to contain all information which may be material to an investor and recipients of this Pre sentation should conduct their own independent evaluation and due diligence of BAC and the Target. Neither BAC nor the Target intend to update or otherwise revise this Presentation following its distribution and neit her BAC nor the Target makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this Presentation after the date of the Presentation. Participants in Solicitation: BAC and the Target and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of BAC's shareholders in connection with the Business Combination. I nv estors and security holders may obtain more detailed information regarding the names and interests in the Business Combination of BAC's dir ectors and officers in BAC's filings with the SEC, including BAC's 10 - K for the fiscal year ended December 31, 2020. Informatio n regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to BAC's shareholders i n c onnection with the Business Combination is set forth in the proxy statement/prospectus on Form S - 4 for the Business Combination, which is expected to be filed by BAC with the SEC. This Presentation is not a substitute for the proxy statement/prospectus o r f or any other document that BAC may file with the SEC in connection with the Business Combination. INVESTORS AND SECURITYHOLDE RS ARE ADVISED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY WHEN THEY BECO ME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders may obtain free copies of other docu men ts filed with the SEC by BAC through the website maintained by the SEC at www.sec.gov. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO TH E C ONTRARY IS A CRIMINAL OFFENSE.

Biotech Acquisition Company (Nasdaq: BIOT) Overview 4 • Nasdaq - listed SPAC completed $230 million IPO on January 28, 2021 • Unique SPAC affiliated with SPRIM, a global healthcare consulting firm and clinical research organization • SPRIM Global Investments is a leading life sciences venture capital firm with in - depth understanding of clinical - stage biotech companies BAC’s Competitive Differentiation Decades of diverse experience operating businesses and driving value creation across 17 countries Management team has worked together for more than 20 years and has strong record of working with clinical - stage biotech companies Deep industry and life science experience

Uses ($mm) Equity Issued to Blade Shareholders $280.0 Cash to Balance Sheet $229.3 Estimated Transaction Expenses $25.0 Total Uses $534.3 Transaction Overview 5 Post - Money Valuation Transaction Sources and Uses Pro Forma Ownership (1) Assumes 28.0 million shares issued to Blade’s existing shareholders (with no portion of the merger consideration rolled into assumed in - the - money options), approximately 2.4 million PIPE shares, 23.0 million BAC public shares, and 4.6 million founder shares. Assumes no redemptions by BAC’s existing shareholders. Excludes the impact of 6.0 million BAC private placement warrants and 11.5 million BAC public warrants. (2) Excludes 3.5 million Blade earn - out shares not yet issued (to be issued to Blade if the VWAP of BAC is greater or equal to $15.00 over 20 trading days within any 30 trading days within 5 years after close) and any awards to be issued under an expected new equity incentive plan. Founder shares exclude 1.15 million previously issued shares that will be placed in escrow (to be released to the sponsor if the VWAP of BAC is greater or equal to $15.00 over 20 trading days within any 30 trading days within 5 years after close). Assumes PIPE shares are issued at a price of $10.00. (3) Blade estimated closing cash balance of $1mm and estimated closing debt balance of $2.8mm (4) Assumes no redemptions by BAC’s existing shareholders. (5) Consists of existing Blade investors. (1) (3) (3) (4) (4) (2) (4) 48.3% 4.2% 39.6% 7.9% Existing Blade Shareholders PIPE Investors BAC Public Shareholders BAC Sponsor Shares Sources ($mm) Blade Shareholder Equity Rollover $280.0 BAC Cash in Trust 230.0 PIPE 24.3 Total Sources $534.3 (5) PF Transaction ($mm or mm, except share price) Combined Company Share Price $10.00 PF Shares Outstanding 58.0 Total Equity Value $580.3 Less: Pro Forma Cash (230.3) Plus: Debt 2.8 Total Enterprise Value $352.8

Developing Cutting - Edge Treatments for Debilitating Fibrotic and Neurodegenerative Diseases 6 * Effects demonstrated in preclinical studies. Experts in Biology of Cell and Tissue Damage Responses • Researching novel biological pathways foundational to cell - and tissue - damage responses • Developing potential disease - modifying therapeutics in fibrosis and neurodegeneration Differentiated Pipeline Led By Phase 2 - Ready Program in Fibrosis • Non - competitive autotaxin inhibitor with direct anti - fibrotic activity and differentiating characteristics* – planned phase 2 study in lung fibrosis in 1H - 2022 • CNS - penetrant calpain inhibitor* for genetic orphan neurodegenerative conditions approaching phase 1 study in 1H - 2022 Deep Scientific & Industry Experience • Experienced management team and advisors with extensive expertise in fibrosis and neurodegeneration • Strong track record of development and approvals of innovative medicines at prior companies

Leadership with Deep Scientific and Industry Experience 7 Wendye Robbins, MD Chief Executive Officer Jean - Frédéric Viret , PhD Chief Financial Officer Prabha Ibrahim, PhD Chief Technical Officer Felix Karim, PhD EVP, Business Development Bassem Elmankabadi, MD SVP, Clinical Development Daven Mody SVP, Regulatory Affairs Michael Blash SVP, Communications

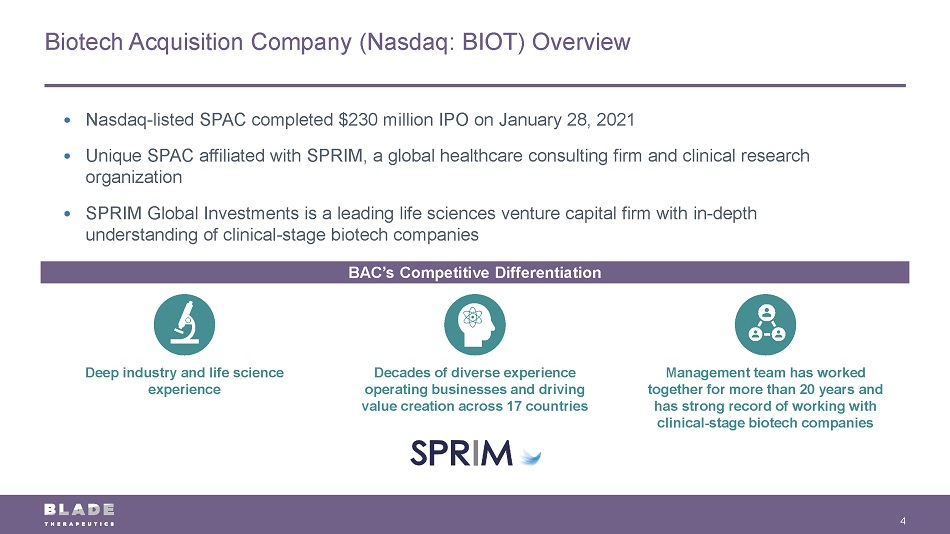

Developing Therapies to Target Key Pathways in Disease Progression 8 Target Pathway Potential Treatment Effects Diseases Autotaxin (ATX) Non - competitive, reversible inhibition supports potential for differentiated profile in fibrotic diseases and epithelial tumors Dimeric Calpains (CAPN) Inhibition shown to enhance autophagy and reduce protein aggregates in preclinical models Inhibition blocks myofibroblast activation / differentiation, thereby inhibiting extracellular matrix production, in preclinical models Huntington’s SCA3/MJD IPF, dSSc ILD IPF, ILD NASH NASH Fibrotic diseases – idiopathic pulmonary fibrosis (IPF), interstitial lung disease (ILD), non - alcoholic steatohepatitis (NASH) Neurodegenerative diseases – Huntington’s disease (HD), spinocerebellar ataxia type 3 (SCA3) or Machado - Joseph disease (MJD) Oncology

Differentiated Pipeline of Novel Product Candidates 9 * Pirfenidone and nintedanib Name MoA Indication Est. Prevalence PC Phase 1 Phase 2 Patent Expiry Anticipated Milestones Fibrosis Cudetaxestat (BLD - 0409) ATX Inhibitor Idiopathic Pulmonary Fibrosis (IPF) <200K (US) ~5M (WW) (IPF Prevalence) 2034 – 2036 • Jul - 2021: IND activated • Sep - 2021: Completed phase 1 relative bioavailability (RBA) study • Nov - 2021: Completed phase 1 CYP drug - drug interaction (DDI) study • Jan - 2022: Completed phase 1 DDI study with approved IPF therapies* • 2Q - 2022: Initiate phase 2 IPF study • 2H - 2022: Initiate phase 2 dSSc basket trial • 1H - 2023: First interim data readout for phase 2 IPF study Systemic Sclerosis ( dSSC ) ~100K (US) ~2.3M (WW) Liver Fibrosis ~16M (US) up to 505M (WW) (NASH Prevalence) Neurodegeneration BLD - 2184 CAPN Inhibitor Poly - Q (e.g., SCA3/MJD, HD) Orphan diseases 2037 – 2040 • 1H - 2022: Initiate phase 1 study • 1H - 2023: First data readout for phase 1 study

10 Fibrosis – Cudetaxestat Non - Competitive Autotaxin Inhibitor Targeting IPF

Autotaxin / Lysophosphatidic Acid (LPA) Drives Fibrosis 11 Innate Lymphoid Cells Macrophages LPA LPC LPA receptor Choline Autotaxin 1 Dysregulated Damage Response Fibrosis is triggered by dysregulated cell / tissue damage response following epithelial injury. 2 Release of Pro - fibrotic Mediators Pro - fibrotic mediators, cytokines and the enzyme autotaxin are released. Increased autotaxin levels produce excessive lysophosphatidic acid (LPA). 3 Autotaxin Production of LPA LPA binds to LPAR1 (receptor on myofibroblasts) and triggers signaling cascade resulting in migration, activation and release of additional mediators. 4 Myofibroblast Activation Excessive LPA activates myofibroblasts. 5 Secretion of ECM Proteins Activated myofibroblasts secrete ECM proteins (scarring) that disrupt normal organ architecture and function. 1 2 3 4 5 Damaged Epithelium Myofibroblasts Activated ECM Proteins Pro - fibrotic Mediators

Cudetaxestat – Non - Competitive Autotaxin Inhibitor Targeting IPF 12 Direct Anti - Fibrotic Activity Robust in vivo anti - fibrotic activity in preclinical models of lung and liver fibrosis Non - Competitive Inhibition Differentiating characteristics support potential treatment profile in fibrosis Favorable Clinical Safety Profile Phase 1 data demonstrated pharmacokinetic/pharmacodynamic (PK / PD) correlation; biomarker activity; favorable DDI and safety profile Advancing to Phase 2 Study Regulatory input clarifies pathway to initiate planned phase 2 clinical study in lung fibrosis

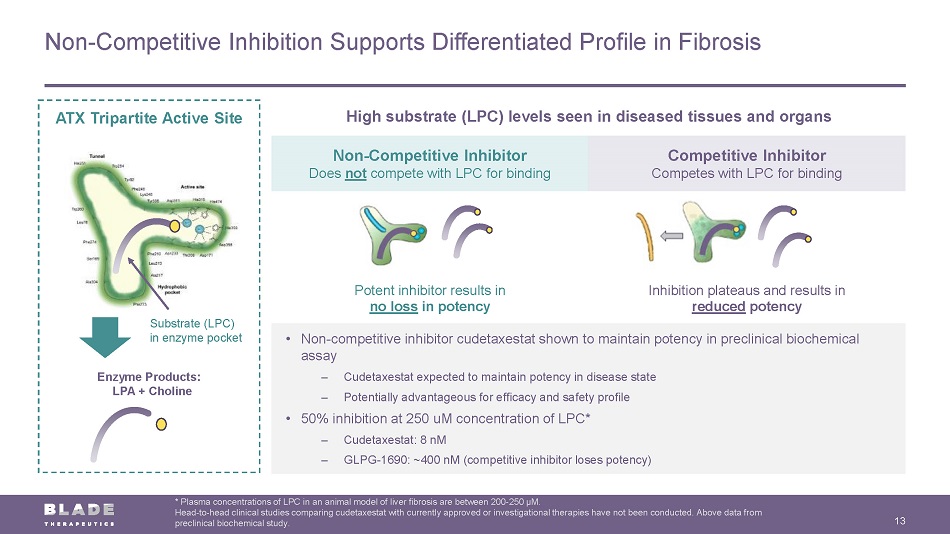

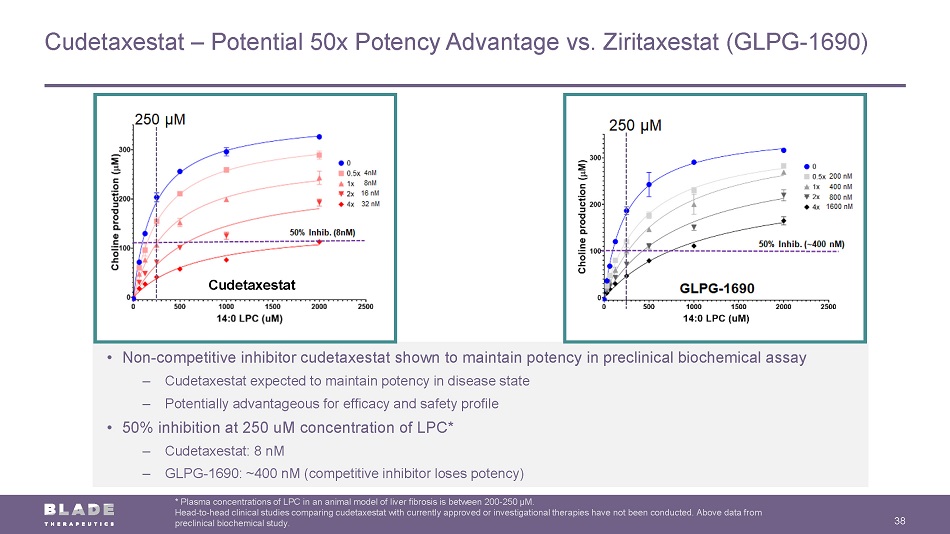

Non - Competitive Inhibitor Does not compete with LPC for binding Competitive Inhibitor Competes with LPC for binding Potent inhibitor results in no loss in potency Inhibition plateaus and results in reduced potency Non - Competitive Inhibition Supports Differentiated Profile in Fibrosis 13 * Plasma concentrations of LPC in an animal model of liver fibrosis are between 200 - 250 µM. Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conducte d. Above data from preclinical biochemical study. ATX Tripartite Active Site Substrate (LPC) in enzyme pocket Enzyme Products: LPA + Choline • Non - competitive inhibitor cudetaxestat shown to maintain potency in preclinical biochemical assay – Cudetaxestat expected to maintain potency in disease state – Potentially advantageous for efficacy and safety profile • 50% inhibition at 250 uM concentration of LPC* – Cudetaxestat: 8 nM – GLPG - 1690: ~400 nM (competitive inhibitor loses potency) High substrate (LPC) levels seen in diseased tissues and organs

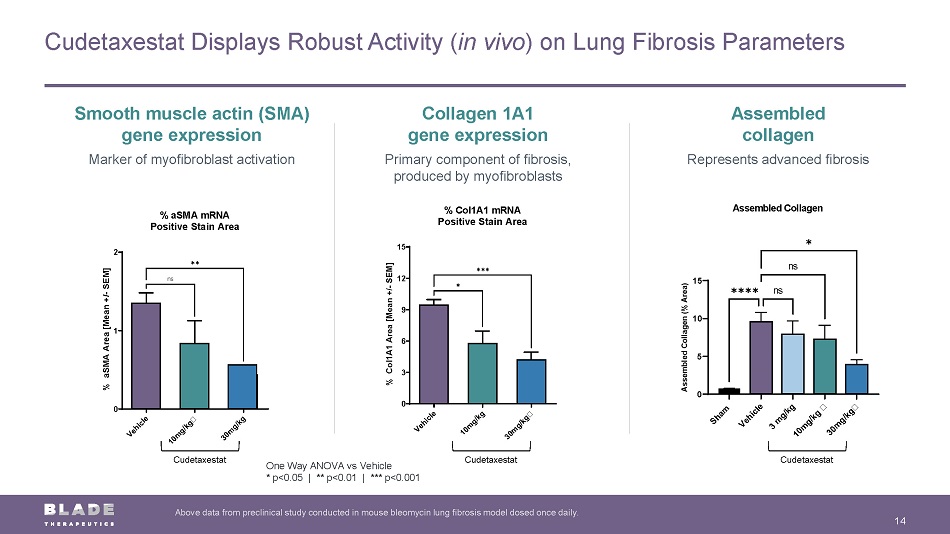

Cudetaxestat Displays Robust Activity ( in vivo ) on Lung Fibrosis Parameters 14 Above data from preclinical study conducted in mouse bleomycin lung fibrosis model dosed once daily. Smooth muscle actin (SMA) gene expression Marker of myofibroblast activation Collagen 1A1 gene expression Primary component of fibrosis, produced by myofibroblasts Assembled collagen Represents advanced fibrosis One Way ANOVA vs Vehicle * p<0.05 | ** p<0.01 | *** p<0.001 V e h i c l e 1 0 m g / k g 3 0 m g / k g 0 3 6 9 12 15 % Col1A1 mRNA Positive Stain Area % C o l 1 A 1 A r e a [ M e a n + / - S E M ] ✱ ✱✱✱ V e h i c l e 1 0 m g / k g 3 0 m g / k g 0 1 2 % aSMA mRNA Positive Stain Area % a S M A A r e a [ M e a n + / - S E M ] ns ✱✱ Cudetaxestat Cudetaxestat Cudetaxestat

ANOVA One - Way *p<0.05 | **p<0.01 | ***p<0.001 | ****p<0.0001 Cudetaxestat Reduces Pro - fibrotic Gene Expression ( in vivo ) in Lung Fibrosis Above data from preclinical study conducted in mouse bleomycin lung fibrosis model dosed twice daily. 15 IL - 6 gene expression Pro - fibrotic cytokine Cudetaxestat S a l i n e V e h i c l e 3 m g / k g 1 0 m g / k g 3 0 m g / k g 0 1 2 3 4 5 PAI-1 mRNA P A I - 1 / P P I A + / - S E M ✱✱✱ ✱✱ ✱ ✱ PAI - 1 gene expression Contributes to excessive ECM accumulation Cudetaxestat CTGF gene expression Pro - fibrotic growth factor Cudetaxestat

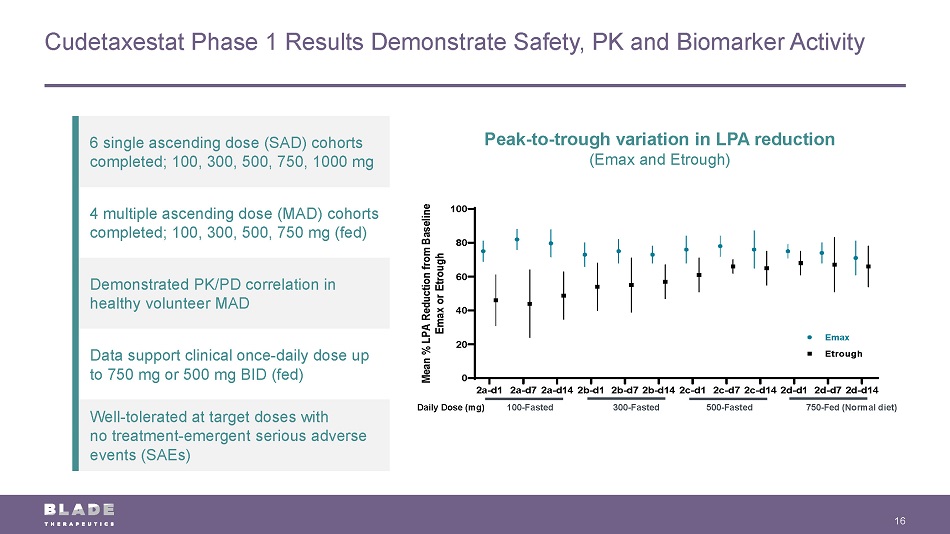

Cudetaxestat Phase 1 Results Demonstrate Safety, PK and Biomarker Activity 16 6 single ascending dose (SAD) cohorts completed; 100, 300, 500, 750, 1000 mg 4 multiple ascending dose (MAD) cohorts completed; 100, 300, 500, 750 mg (fed) Demonstrated PK/PD correlation in healthy volunteer MAD Data support clinical once - daily dose up to 750 mg or 500 mg BID (fed) Well - tolerated at target doses with no treatment - emergent serious adverse events (SAEs) 100 - Fasted 300 - Fasted 500 - Fasted 750 - Fed (Normal diet) Daily Dose (mg) Peak - to - trough variation in LPA reduction (Emax and Etrough ) 2a-d1 2a-d72a-d142b-d1 2b-d72b-d142c-d1 2c-d72c-d142d-d1 2d-d72d-d14 0 20 40 60 80 100 M e a n % L P A R e d u c t i o n f r o m B a s e l i n e E m a x o r E t r o u g h Emax Etrough

Completed Preclinical Studies Support Safety Profile of Cudetaxestat 17 * 13 - week dosing tolerated up to 300 mpk . Completed Studies Findings Next Steps Toxicology Rat 4 - week GLP tox NOAEL 100 mpk 26 - week GLP tox completed Dog 4 - week GLP tox NOAEL 300 mpk 39 - week GLP tox ongoing Rat 26 - week GLP tox NOAEL 30 mpk (male) / 75 mpk (female) N/A Dog 39 - week GLP tox* In - life completed Analyses pending Safety Pharmacology Dog cardiovascular No adverse findings; NOAEL 1000 mpk N/A Rat respiratory No adverse findings; NOAEL 750 mpk N/A Rat Irwin No adverse findings; NOAEL 750 mpk N/A hERG in vitro IC 50 = 49.4 µM (corrected for plasma protein binding) Thorough QT requirement under review Gene Tox Ames Negative In vivo genotox planned In vivo MNT Negative Drug - Drug Interactions In vitro and in vivo profiling vs. approved IPF therapies (pirfenidone, nintedanib) Unlikely DDI potential with approved IPF therapies N/A

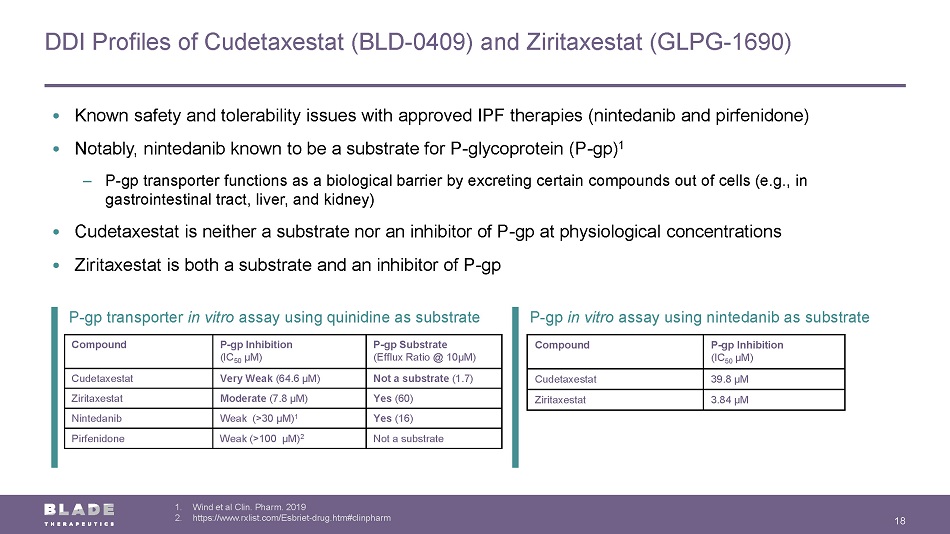

P - gp in vitro assay using nintedanib as substrate P - gp transporter in vitro assay using quinidine as substrate DDI Profiles of Cudetaxestat (BLD - 0409) and Ziritaxestat (GLPG - 1690) 18 1. Wind et al Clin. Pharm. 2019 2. https://www.rxlist.com/Esbriet - drug.htm#clinpharm Compound P - gp Inhibition (IC 50 µM) P - gp Substrate (Efflux Ratio @ 10µM) Cudetaxestat Very Weak (64.6 µM) Not a substrate (1.7) Ziritaxestat Moderate (7.8 µM) Yes (60) Nintedanib Weak (>30 µM) 1 Yes (16) Pirfenidone Weak (>100 µM) 2 Not a substrate Compound P - gp Inhibition (IC 50 µM) Cudetaxestat 39.8 µM Ziritaxestat 3.84 µM • Known safety and tolerability issues with approved IPF therapies (nintedanib and pirfenidone) • Notably, nintedanib known to be a substrate for P - glycoprotein (P - gp ) 1 ‒ P - gp transporter functions as a biological barrier by excreting certain compounds out of cells (e.g., in gastrointestinal tract, liver, and kidney) • Cudetaxestat is neither a substrate nor an inhibitor of P - gp at physiological concentrations • Ziritaxestat is both a substrate and an inhibitor of P - gp

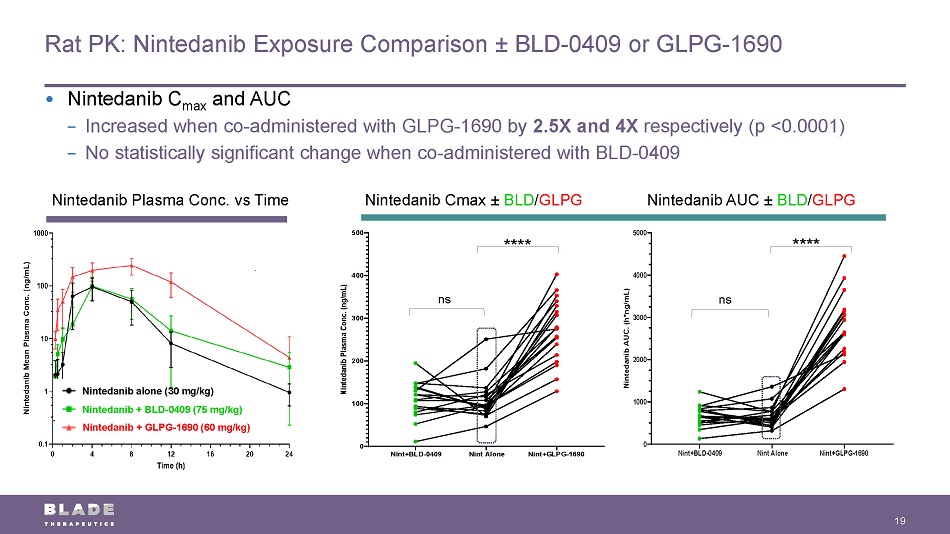

Rat PK: Nintedanib Exposure Comparison ± BLD - 0409 or GLPG - 1690 19 Nintedanib Plasma Conc. vs Time Nintedanib alone (30 mg/kg) Nintedanib + BLD - 0409 (75 mg/kg) Nintedanib + GLPG - 1690 (60 mg/kg) Nint+BLD-0409 Nint Alone Nint+GLPG-1690 0 100 200 300 400 500 N i n t e d a n i b P l a s m a C o n c . ( n g / m L ) • Nintedanib C max and AUC − Increased when co - administered with GLPG - 1690 by 2.5X and 4X respectively (p <0.0001) − No statistically significant change when co - administered with BLD - 0409 ns ns **** **** Nintedanib Cmax ± BLD / GLPG Nintedanib AUC ± BLD / GLPG

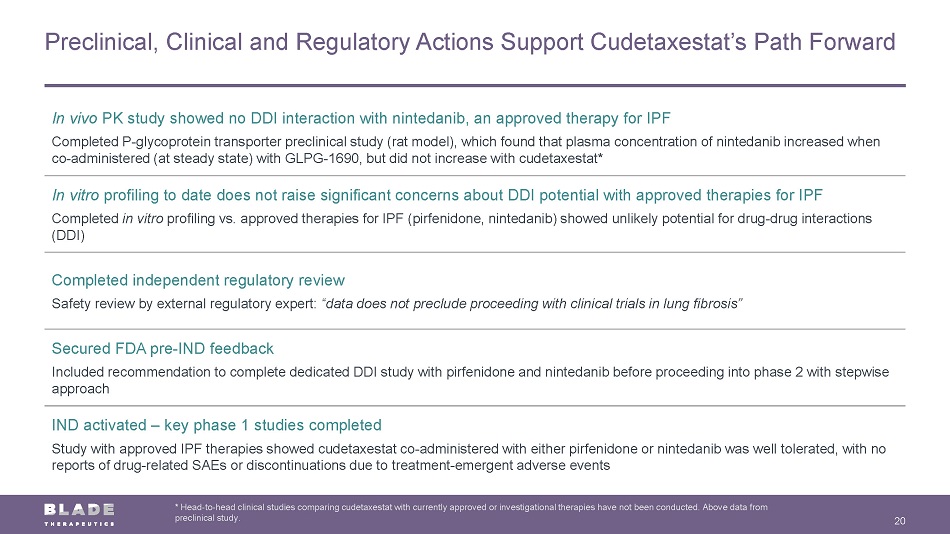

Preclinical, Clinical and Regulatory Actions Support Cudetaxestat’s Path Forward 20 * Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conduc ted. Above data from preclinical study. In vivo PK study showed no DDI interaction with nintedanib, an approved therapy for IPF Completed P - glycoprotein transporter preclinical study (rat model), which found that plasma concentration of nintedanib increase d when co - administered (at steady state) with GLPG - 1690, but did not increase with cudetaxestat* In vitro profiling to date does not raise significant concerns about DDI potential with approved therapies for IPF Completed in vitro profiling vs . approved therapies for IPF (pirfenidone, nintedanib) showed unlikely potential for drug - drug interactions (DDI) Completed independent regulatory review Safety review by external regulatory expert: “data does not preclude proceeding with clinical trials in lung fibrosis” Secured FDA pre - IND feedback Included recommendation to complete dedicated DDI study with pirfenidone and nintedanib before proceeding into phase 2 with s tep wise approach IND activated – key phase 1 studies completed Study with approved IPF therapies showed cudetaxestat co - administered with either pirfenidone or nintedanib was well tolerated, with no reports of drug - related SAEs or discontinuations due to treatment - emergent adverse events

Cudetaxestat Progressing to Planned Phase 2 Study in IPF 21 N=160 (40/arm) IPF patients +/ - SoC; stratified enrollment for SoC, 3 dose levels vs. placebo, randomized 1:1:1:1 52 - week study with 12 - and 26 - week interim analyses Planned study initiation 2Q - 2022 First interim analysis expected 1H - 2023 Design Expected Outcomes Key endpoints – rate of decline in Forced Vital Capacity (FVC) over 52 weeks, safety, and disease progression Interim analyses at 12 weeks and at 26 weeks to evaluate LPA inhibition (target engagement) Assess fibrotic biomarkers at baseline, 12 - and 24 - week interims to build evidence of disease - modification mechanism

Planned Clinical Development Programs Present Opportunities in Fibrosis and Neurodegeneration 22 2H - 2021 1H - 20 22 2H - 2022 1H - 2023 2H - 2023 IND Ph1 Ph2 Ph2 IPF PoC Ph1 CYP - DDI & RBA IA#1 (12W) IA#2 (24W) Ph1 DDI w/ approved IPF therapies Ph2 dSSc basket Cudetaxestat IPF BLD - 2184 Poly - Q ND

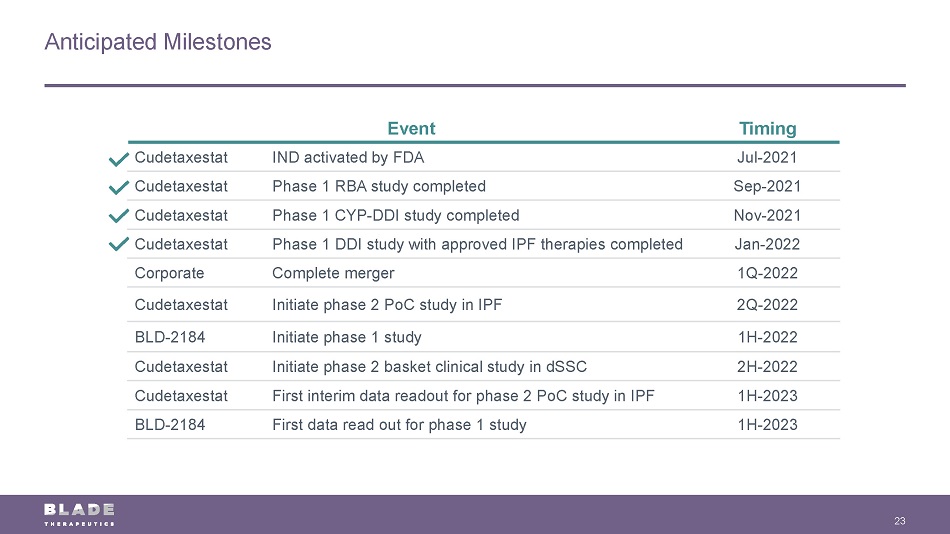

Anticipated Milestones 23 Event Timing Cudetaxestat IND activated by FDA Jul - 2021 Cudetaxestat Phase 1 RBA study completed Sep - 2021 Cudetaxestat Phase 1 CYP - DDI study completed Nov - 2021 Cudetaxestat Phase 1 DDI study with approved IPF therapies completed Jan - 2022 Corporate Complete merger 1Q - 2022 Cudetaxestat Initiate phase 2 PoC study in IPF 2Q - 2022 BLD - 2184 Initiate phase 1 study 1H - 2022 Cudetaxestat Initiate phase 2 basket clinical study in dSSC 2H - 2022 Cudetaxestat First interim data readout for phase 2 PoC study in IPF 1H - 2023 BLD - 2184 First data read out for phase 1 study 1H - 2023

Developing Cutting - Edge Treatments for Debilitating Fibrotic and Neurodegenerative Diseases 24 * Effects demonstrated in preclinical studies. Experts in Biology of Cell and Tissue Damage Responses • Researching novel biological pathways foundational to cell - and tissue - damage responses • Developing potential disease - modifying therapeutics in fibrosis and neurodegeneration Differentiated Pipeline Led By Phase 2 - Ready Program in Fibrosis • Non - competitive autotaxin inhibitor with direct anti - fibrotic activity and differentiating characteristics* – planned phase 2 study in lung fibrosis in 1H - 2022 • CNS - penetrant calpain inhibitor* for genetic orphan neurodegenerative conditions approaching phase 1 study in 1H - 2022 Deep Scientific & Industry Experience • Experienced management team and advisors with extensive expertise in fibrosis and neurodegeneration • Strong track record of development and approvals of innovative medicines at prior companies

Risks Related to the Business Combination 25 BAC’s shareholders will experience dilution due to the issuance of shares of common stock of BAC (after its re - domestication fro m the Cayman Islands to Delaware), and securities that are exchangeable for shares of common stock of BAC, to: (i) the Target’s security holders as consideration in the merger and (ii) certain PIPE investors in the PIPE financing. The consummation of the Business Combination is subject to a number of conditions, including those set forth in the definitiv e A greement and Plan of Merger (the “Merger Agreement”), and if those conditions are not satisfied or waived, the Merger Agreement may be terminated in accordance with its terms and the Bus iness Combination may not be completed. If the Business Combination benefits do not meet the expectation of investors or securities analysts, the market price of BAC ’s securities, or following the consummation of the Business Combination, the securities of the combined company (the “Combined Entity”), may decline . Potential legal proceedings in connection with the Business Combination, the outcome of which may be uncertain, could delay o r p revent the completion of the Business Combination. Following the consummation of the Business Combination, the Combined Entity will be an “emerging growth company” and it canno t b e certain if the disclosure requirements applicable to emerging growth companies will make the Combined Entity’s common stock less attractive to investors and may make it more diff icu lt to compare performance with other public companies. The Combined Entity will incur significantly increased expenses and administrative burdens as a public company, which could h ave an adverse effect. The ability of BAC’s shareholders to exercise redemption rights with respect to a large number of BAC’s shares may not allow BAC to complete the Business Combination or for the Combined Entity to have the full cash available to execute its development and capital expenditure plans. There is no assurance that BAC’s diligence will reveal all material risks that may present with regard to the Target . BAC may issue additional shares of common or preferred stock to complete the Business Combination or under an equity incentiv e p lan after completion of the Business Combination, any one of which would dilute the interest of BAC’s shareholders and likely present other risks. BAC’s key personnel may negotiate employment or consulting agreements with the Combined Entity in connection with the Busines s C ombination. These agreements may provide for them to receive compensation following the Business Combination and as a result, may cause them to have conflicts of interest in d ete rmining whether the Business Combination is advantageous. Because BAC’s initial shareholders, executive officers and directors will lose their entire investment in BAC if the Business Co mbination or an alternative business combination is not completed, and because BAC’s Sponsor, executive officers and directors will not be eligible to be reimbursed for their out - of - po cket expenses if the Business Combination is not completed, a conflict of interest may have arisen in determining whether the Target is appropriate for BAC’s initial business combination. Some of the officers and directors of BAC, on the one hand, and the Target, on the other hand, may be argued to have conflicts of interest that may influence them to support or approve the Business Combination without regard to your interests. The value of the Sponsor’s founder shares following completion of the Business Combination is likely to be substantially high er than the nominal price paid for them, even if the trading price of BAC’s common stock at such time is substantially less than $10.00 per share.

Risks Related to the Business Combination (cont’d) 26 BAC’s shareholders and the Target’s stockholders may not realize a benefit from the Business Combination commensurate with the ownership dilutio n t hey will experience in connection with the Business Combination. During the pendency of the Business Combination, BAC and the Target may not be able to enter into a business combination with an other party because of restrictions in the Merger Agreement, which could adversely affect their respective businesses. Furthermore, certain provisions of the Merger Agreement may discourage third parties from submitting alternative takeover proposals, including proposals that may be superior to the arrangements contemplated by the Merger Agreement. If the conditions to the Merger are not met, including the approval by each party’s respective shareholders, the Business Com bin ation may not occur. Each of BAC and the Target may waive one or more of the conditions to the Business Combination , subject to certain limitations as set out in the Merger Agreement . U.S. federal income tax reform could adversely affect the Combined Entity and holders of the Combined Entity’s securities. The Combined Entity will be affected by extensive laws, governmental regulations, administrative determinations, court decisi ons and similar constraints both domestically and abroad. Delaware law and the Combined Entity’s proposed charter and bylaws may contain certain provisions, including anti - takeover provi sions that limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts that stockholders may consider favorable, as well as certain provisio ns limiting the ability of the Combined Entity’s stockholders to choose the judicial forum for disputes with the Combined Entity or its directors, officers, or employees. The proposed charter will not limit the ability of the Sponsor or its affiliates to compete with the Combined Entity. The Combined Entity’s business and operations could be negatively affected if it becomes subject to any securities litigation or stockholder activism, which could cause the Combined Entity to incur significant expense, hinder execution of business and growth strategy and impact its stock price. Upon effectiveness of the proposed domestication of BAC from the Cayman Islands to Delaware in connection with the Business C omb ination, the rights of holders of the Combined Entity’s common stock arising under the Delaware General Corporate Law will differ from and may be less favorable to the rights of hol der s of BAC’s shares arising under the Cayman Islands Companies Act. There is a risk that a U.S. Holder may recognize taxable gain with respect to its BAC shares at the effective time of the pro pos ed domestication. BAC identified material weaknesses in its internal controls over financial reporting with respect to the accounting treatment of certain of its warrants. Failure to maintain effective internal controls over financial reporting could cause BAC to inaccurately report its financial results or fail to prevent fraud.

Risks Related to Combined Entity’s Business 27 The Target is very early in its development efforts, has completed few clinical trials, has no products approved for commercial sale, and has no historical product revenues, which makes it difficult to assess the Target’s future prospects and financial results. The Target’s ability to generate revenue and achieve profitability depends significantly on its a bility to achieve its objectives relating to the discovery, development and commercialization of its product candidates. The Target has limited sales and distribution experience and needs to build a marketing and sales organization. We expect to inv est significant financial and management resources to build these capabilities. To the extent any of the Target’s product candidates for which it maintains commercial rights is approved for marketing, if we are unable to establish marketin g a nd sales capabilities or enter into agreements with third parties to market and sell such product candidates, we may not be able to market and sell any product candidates e ffe ctively or generate product revenues. The marketing and sale of cudetaxestat or future approved products may be unsuccessful or less successful than anticipated. T he Target is heavily dependent on the success of cudetaxestat, which has not been approved for the treatment of idiopathic pulmonary fibrosis or nonalcoholic steatohepatitis. If the Target is unable to ad vance cudetaxestat or our other product candidates through clinical development, obtain regulatory approval and ultimately commercialize our product candidates, or experience significant delays in doing so, th e Target’s business will be materially harmed. The Target is also dependent on the success of its other preclinical product candidates (BLD - 2184 and other candidates). We cannot give any assurance that any product candidate will successfully complete clinical trials or receive regulatory approval, which is necessary before it can be commercialized. The clinical and commercial success of the Target’s product candidates will depend on a number of factors, many of which are bey ond the Target’s control. The Target’s future commercial success depends upon attaining significant market acceptance of its product candidates, if approved, among physicians, patients, third - party pay ors, and others in the health care community. Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials as well as data from any interim analysis of ongoing clinical trials may not be predictive of future trial results or approved label for clinical use. Clinical failure can occur at any stage of clinical de vel opment. Due to the Target’s limited resources and access to capital in the past, the Target has decided to prioritize development of cer tain product candidates and may have forgone the opportunity to capitalize on product candidates or indications that may ultimately have been more profitable or for which there was a greater likelihood o f s uccess. If the Target is unable to raise substantial additional capital to finance its operations when needed, or on acceptable terms, the Target may be forced to delay, reduce or eliminate one or more of its res ear ch and drug development programs, future commercialization efforts, product development or other operations. The approach the Target is taking to discover and develop drugs is novel and may never lead to approved or marketable product s. The Target may not be successful in its efforts to use and expand its novel, proprietary target discovery platform to build a pi peline of product candidates . The Target’s product candidates may fail in development or suffer delays that adversely affect their commercial viability. The regulatory approval processes of the FDA and other comparable regulatory authorities are lengthy, time consuming and inhe ren tly unpredictable, which may affect the commercial viability of the Target’s products in development. If the Target is unable ultimately to obtain regulatory approval for its product candidates, its bus ine ss will be substantially harmed. In connection with the Target’s global clinical trials, local regulatory authorities may have differing perspectives on clini cal protocols and safety parameters, which impacts the manner in which the Target conducts these global clinical trials and could negatively impact the Target’s chances for obtaining regulatory approvals or mar keting authorization in different jurisdictions, or for obtaining the requested label or dosage for the Target’s product candidates, if regulatory approvals or marketing authorizations are obtained. The results of th e Target’s clinical trials may not satisfy the requirements of different regulatory authorities.

Risks Related to Combined Entity’s Business (cont’d) 28 Even if the Target receives regulatory approval for any of its product candidates, the Target will be subject to ongoing obli gat ions and continued regulatory review, which may result in significant additional expense. Additionally, the Target’s product candidates, if approved, could be subject to labeling and other restrictions and mar ket withdrawal and the Target may be subject to penalties if it fails to comply with regulatory requirements or experience unanticipated problems with its products. The Target’s preclinical studies and its future clinical trials or those of any of its collaborators may fail to adequately d emo nstrate the safety and efficacy of any of its product candidates or reveal significant adverse events not seen in its preclinical studies or earlier clinical trials which would prevent or delay the development, r egu latory approval, and commercialization of any of the Target’s product candidates. The Target has limited experience as a company in conducting clinical trials. If the Target experiences delays or difficulties in the enrollment or maintenance of subjects in clinical trials, its regulat ory submissions or the receipt of necessary marketing approvals could be delayed or prevented. Legislative and regulatory activity may exert downward pressure on potential pricing and reimbursement for any of the Target’ s p roduct candidates, if approved, that could materially affect the opportunity to commercialize. The Target faces significant competition for its drug discovery and development efforts, and if the Target does not compete effectively, i ts commercial opportunities will be reduced or eliminated. The Target relies on adequate protection of its proprietary rights to compete effectively in its market. The Target’s ability to compete may decline if it does not adequately protect its proprietary rights. The cost of maintaining the Target’s patent protection is high and requires continuous review and compliance. The Target may not be able to effectively maintain i ts intellectual property position throughout our market. The Target may be involved in intellectual property disputes with third parties and competitors that could be costly and time co nsuming and negatively affect its competitive position. The Target relies on third parties for the conduct of most of its preclinical studies and clinical trials for its product can did ates, and if its third - party contractors do not properly and successfully perform their obligations under the Target’s agreements with them, the Target may not be able to obtain or may be delayed in receiving regu lat ory approvals for its product candidates. The Target current relies, and expects to continue to rely, on third parties to conduct many aspects of its product candidate ma nufacturing activities and the Target intends to rely on third parties for potential commercial product manufacturing. The Target’s business could be harmed if those third parties fail to provide us with suffic ien t quantities of product or fail to do so at acceptable quality levels or prices. The Target’s business, results of operations and future growth prospects could be materially and adversely affected by the CO VID - 19 pandemic. If the Target is unable to obtain, maintain and enforce patent protection for its technology and product candidates, or if th e s cope of patent protection obtained is not sufficiently broad, the Target’s competitors could develop and commercialize technology and products similar or identical to thos e of the Target and the Target’s ability to successfully develop and commercialize its technology and product candidates may be adversely affected.

Developing Cutting - Edge Treatments for Debilitating Fibrotic and Neurodegenerative Diseases January 2022

Appendix

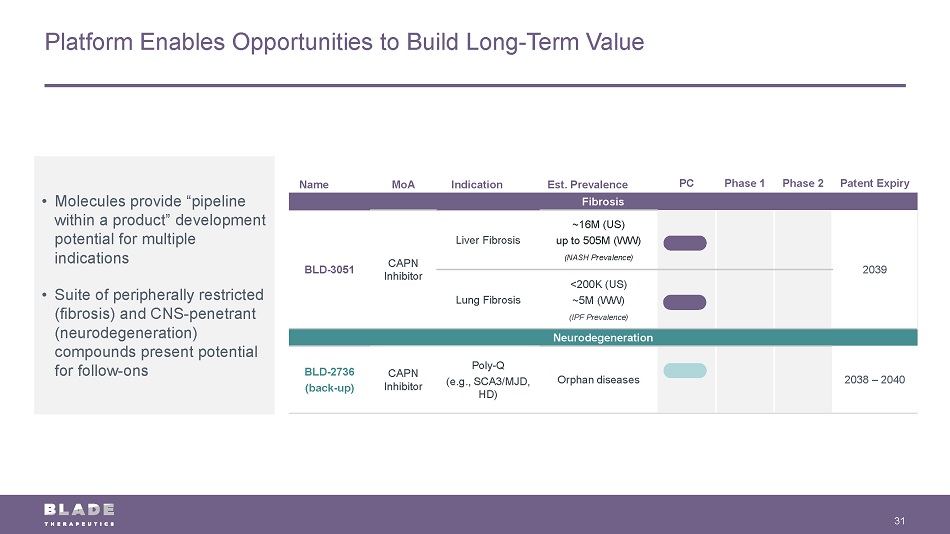

Platform Enables Opportunities to Build Long - Term Value 31 Name MoA Indication Est. Prevalence PC Phase 1 Phase 2 Patent Expiry Fibrosis BLD - 3051 CAPN Inhibitor Liver Fibrosis ~16M (US) up to 505M (WW) (NASH Prevalence) 2039 Lung Fibrosis <200K (US) ~5M (WW) (IPF Prevalence) Neurodegeneration BLD - 2736 (back - up) CAPN Inhibitor Poly - Q (e.g., SCA3/MJD, HD) Orphan diseases 2038 – 2040 • Molecules provide “pipeline within a product” development potential for multiple indications • Suite of peripherally restricted (fibrosis) and CNS - penetrant (neurodegeneration) compounds present potential for follow - ons

Portfolio Underpinned by Strong IP Protections and Commercial Rights 32 ATXi CAPNi Composition of Matter + Others (formulation, etc.) 2034 – 2036 2037 – 2040 ~15 CoM patents granted / allowed Pipeline discovered in - house Commercial Rights Full global rights Full global rights

Selected Fibrosis Comps 33 Sources: Press Releases, Company Websites, PitchBook and Capital IQ as of September 16, 2021. 1. Data only includes recent IPOs since 2019. Public and IPO Comps Lead Program / Pre Money Val Recent Price ($) FD Equity Enterprise Company Indication Current Phase at IPO ($ mm) (1) IPO Date (1) 09/16/21 Value ($ mm)Value ($ mm) Morphic Holding, Inc. MORF-057 / Ulcerative Colitis Phase 1 $354 06/27/19 $66.79 $2,696 $2,265 Madrigal Pharmaceuticals, Inc. MGL-3196 / NASH Phase 3 80.15 1,330 1,008 FibroGen, Inc. Pamrevlumab / IPF Phase 3 11.72 1,086 722 Akero Therapeutics, Inc. AKR-001 / NASH Phase 2 341 06/20/19 23.89 877 648 Aligos Therapeutics, Inc. ALG-010133 / CHB Phase 1 430 10/16/20 16.38 722 544 Pliant Therapeutics, Inc. PLN-74809 / IPF Phase 2 423 06/03/20 19.00 700 456 Viking Therapeutics, Inc. VK2809 / NASH Phase 2 6.57 520 292 Intercept Pharmaceuticals, Inc. Obeticholic Acid / PBC Commercial 15.41 461 782 89bio, Inc. BIO89-100 / NASH Phase 2 123 11/11/19 20.06 412 242 Terns Pharmaceuticals, Inc. TERN-101 / NASH Phase 2 280 02/04/21 10.97 280 95 Vicore Pharma VP01 / IPF Phase 2 2.32 166 107 Mean $325 $841 $651 Median $347 $700 $544

Program / Product Candidate Pamrevlumab PRM - 151 Treprostinil BMS - 986278 CC - 90001 GB - 0139 PLN - 74809 Stage of Development Phase 3 Phase 3 Phase 3 Phase 2b Phase 2b Phase 2b Phase 2a Mechanistic Approach Anti - CTGF antibody Recombinant pentraxin - 2 Prostacyclin analog LPA1 antagonist JNK inhibitor Galectin - 3 inhibitor Integrin avb6/avb1 antagonist ROA, Molecule IV mAb IV biologic Inhaled small molecule Oral small molecule Oral small molecule Inhaled small molecule Oral small molecule Disease Indication(s) IPF, DMD, pancreatic cancer IPF, myelofibrosis IPF, IPF - PH, PAH PF IPF, NASH IPF IPF, PSC Comments • Currently in 2 Ph3 studies in IPF • First topline IPF results expected mid - 2023 • Topline results in IPF expected in Feb 2023 • Effective as add - on in Ph2 but not monotherapy • Approved in PAH and IPF - PH • We believe candidate unlikely to confer fibrotic benefit • Ongoing Ph2b study is enrolling both IPF and PF patients • Topline results expected May 2023 • Topline results in IPF expected Sep 2022 • Also in an ongoing Ph2b in NASH • Removed SOC add - on and high dose cohorts from Ph2b after DSMB review • Now only pursued as low - dose monotherapy • Currently in a Ph2a target engagement study and Ph2a POC efficacy study • Announced positive interim results from a Phase 2a PET imaging based clinical trial Key Competitors – IPF Includes all phase 3 programs and key phase 2 programs. 34

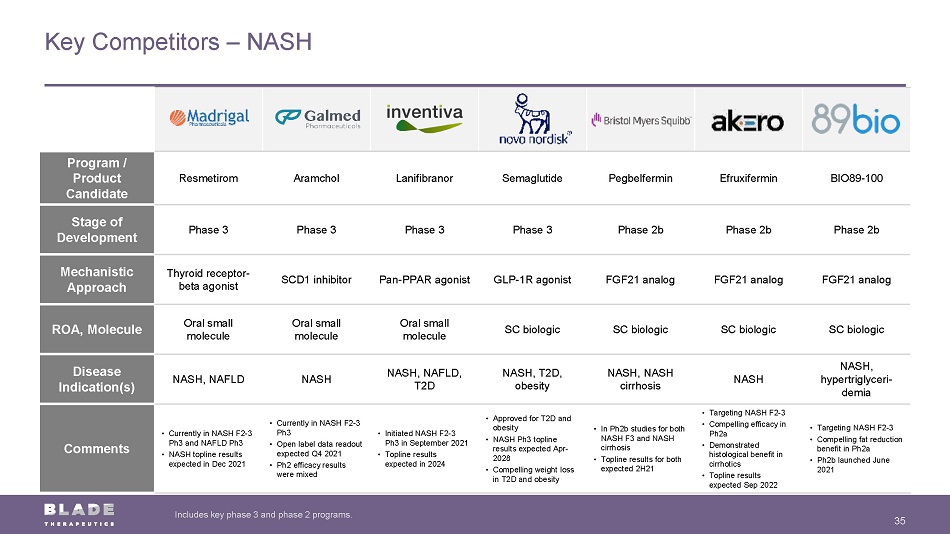

Program / Product Candidate Resmetirom Aramchol Lanifibranor Semaglutide Pegbelfermin Efruxifermin BIO89 - 100 Stage of Development Phase 3 Phase 3 Phase 3 Phase 3 Phase 2b Phase 2b Phase 2b Mechanistic Approach Thyroid receptor - beta agonist SCD1 inhibitor Pan - PPAR agonist GLP - 1R agonist FGF21 analog FGF21 analog FGF21 analog ROA, Molecule Oral small molecule Oral small molecule Oral small molecule SC biologic SC biologic SC biologic SC biologic Disease Indication(s) NASH, NAFLD NASH NASH, NAFLD, T2D NASH, T2D, obesity NASH, NASH cirrhosis NASH NASH, hypertriglyceri - demia Comments • Currently in NASH F2 - 3 Ph3 and NAFLD Ph3 • NASH topline results expected in Dec 2021 • Currently in NASH F2 - 3 Ph3 • Open label data readout expected Q4 2021 • Ph2 efficacy results were mixed • Initiated NASH F2 - 3 Ph3 in September 2021 • Topline results expected in 2024 • Approved for T2D and obesity • NASH Ph3 topline results expected Apr - 2028 • Compelling weight loss in T2D and obesity • In Ph2b studies for both NASH F3 and NASH cirrhosis • Topline results for both expected 2H21 • Targeting NASH F2 - 3 • Compelling efficacy in Ph2a • Demonstrated histological benefit in cirrhotics • Topline results expected Sep 2022 • Targeting NASH F2 - 3 • Compelling fat reduction benefit in Ph2a • Ph2b launched June 2021 Key Competitors – NASH 35 Includes key phase 3 and phase 2 programs.

36 Fibrosis – Cudetaxestat Non - Competitive Autotaxin Inhibitor Targeting IPF

Cudetaxestat – Well - Defined Development Pathway in Lung Fibrosis 37 IND activated by FDA Jul - 2021 Orphan drug designation granted by FDA for treatment of IPF and for treatment of systemic sclerosis (SSC) Feb - 2021 Oct - 2021 Phase 1 RBA study completed • Compared solid dosage form to previous dose delivery vehicle Sep - 2021 Phase 1 CYP - DDI study completed • CYP inhibitors / inducers Nov - 2021 Phase 1 DDI study with approved IPF therapies completed • Approved therapies – pirfenidone, nintedanib Jan - 2022 Initiate planned phase 2 clinical study in IPF 2Q - 2022 • Provide proof - of - concept and dose ranging for safety, dose selection, and efficacy • 52 - week study (N=160) o Interim 12 - week analysis o Interim 26 - week analysis o Study completion 1H - 2023 2H - 2023 1H - 2024 Initiate planned phase 2 basket clinical study in dSSC 2H - 2022 Anticipated Timing

Cudetaxestat – Potential 50x Potency Advantage vs. Ziritaxestat (GLPG - 1690) 38 * Plasma concentrations of LPC in an animal model of liver fibrosis is between 200 - 250 µM. Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conducte d. Above data from preclinical biochemical study. • Non - competitive inhibitor cudetaxestat shown to maintain potency in preclinical biochemical assay – Cudetaxestat expected to maintain potency in disease state – Potentially advantageous for efficacy and safety profile • 50% inhibition at 250 uM concentration of LPC* – Cudetaxestat: 8 nM – GLPG - 1690: ~400 nM (competitive inhibitor loses potency) Cudetaxestat

Cudetaxestat Displays Robust Activity ( in vivo ) on Lung Fibrosis Parameters 39 Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conducte d. Above data from preclinical study conducted in mouse bleomycin lung fibrosis model dosed once daily. Smooth muscle actin (SMA) gene expression Marker of myofibroblast activation Collagen 1A1 gene expression Primary component of fibrosis, produced by myofibroblasts Assembled collagen Represents advanced fibrosis One Way ANOVA vs Vehicle *: p<0.05 | ** : p<0.01 | *** : p<0.001 V e h i c l e 4 0 9 , 1 0 m g / k g 4 0 9 , 3 0 m g / k g 1 6 9 0 , 1 0 m g / k g 1 6 9 0 , 3 0 m g / k g 0 1 2 % aSMA mRNA Positive Stained Area % a S M A A r e a [ M e a n + / - S E M ] ns ✱✱ ns ✱ V e h i c l e 4 0 9 , 1 0 m g / k g 4 0 9 , 3 0 m g / k g 1 6 9 0 , 1 0 m g / k g 1 6 9 0 , 3 0 m g / k g 0 5 10 15 % Col1A1 mRNA Positive Stain Area % C o l 1 A 1 A r e a [ M e a n + / - S E M ] ✱ ✱✱✱ ✱ ✱

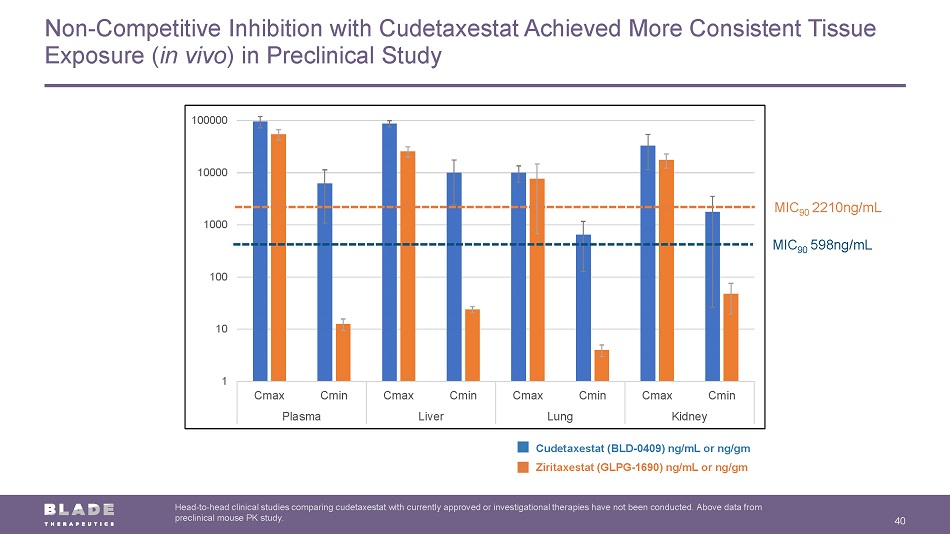

Non - Competitive Inhibition with Cudetaxestat Achieved More Consistent Tissue Exposure ( in vivo ) in Preclinical Study 40 Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conducte d. Above data from preclinical mouse PK study. 1 10 100 1000 10000 100000 Cmax Cmin Cmax Cmin Cmax Cmin Cmax Cmin Plasma Liver Lung Kidney MIC 90 598ng/mL MIC 90 2210ng/mL Cudetaxestat (BLD - 0409) ng/mL or ng/gm Ziritaxestat (GLPG - 1690) ng/mL or ng/gm

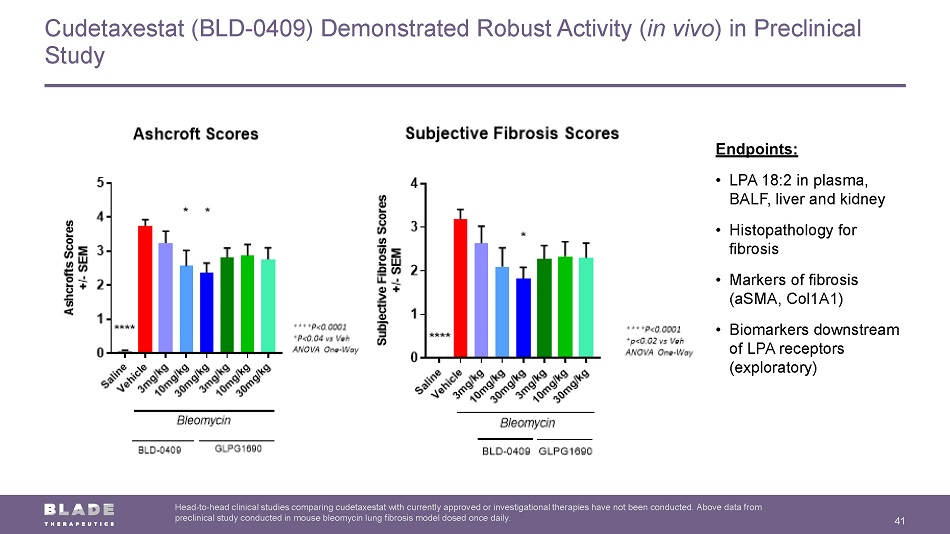

Cudetaxestat (BLD - 0409) Demonstrated Robust Activity ( in vivo ) in Preclinical Study 41 Head - to - head clinical studies comparing cudetaxestat with currently approved or investigational therapies have not been conducte d. Above data from preclinical study conducted in mouse bleomycin lung fibrosis model dosed once daily. Endpoints: • LPA 18:2 in plasma, BALF, liver and kidney • Histopathology for fibrosis • Markers of fibrosis ( aSMA , Col1A1) • Biomarkers downstream of LPA receptors (exploratory)

42 Neurodegeneration – BLD - 2184 CNS - Penetrant Calpain Inhibitor for Poly - Q Neurodegenerative Conditions

Calpain Inhibitors Demonstrate Preclinical Evidence of Neuroprotective Effects 43 Novel Target for Disease Progression Calpains shown in preclinical studies to regulate formation of toxic proteins and autophagy (intracellular clearance), key components in incurable neurodegenerative Poly - Q diseases Preclinical Evidence of Neuroprotection Improvements in biomarkers, motor function and enhanced autophagy in SCA3/MJD preclinical models (mouse, zebrafish models) Development Candidate Selection Ongoing preclinical and nonclinical activities in preparation for initiating planned phase 1 study (1H - 2022)

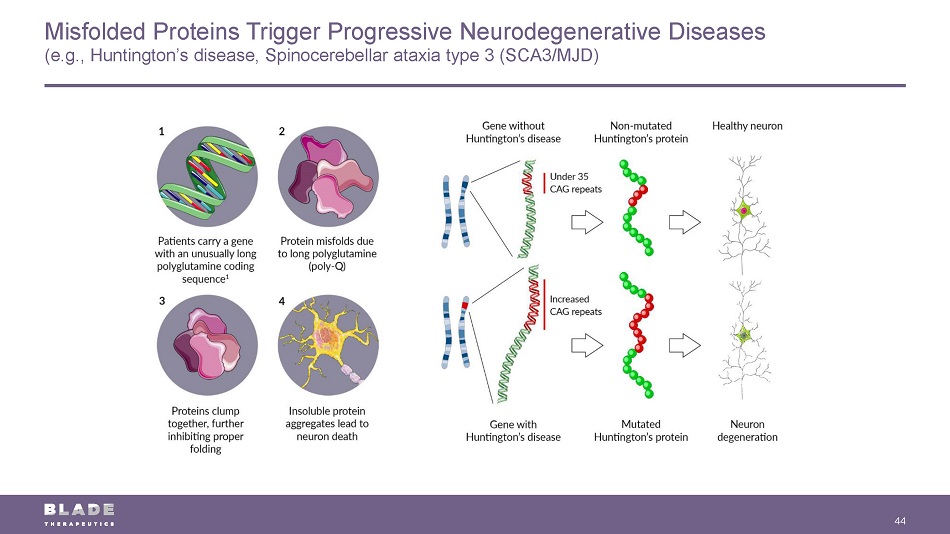

Misfolded Proteins Trigger Progressive Neurodegenerative Diseases (e.g., Huntington’s disease, Spinocerebellar ataxia type 3 (SCA3/MJD) 44

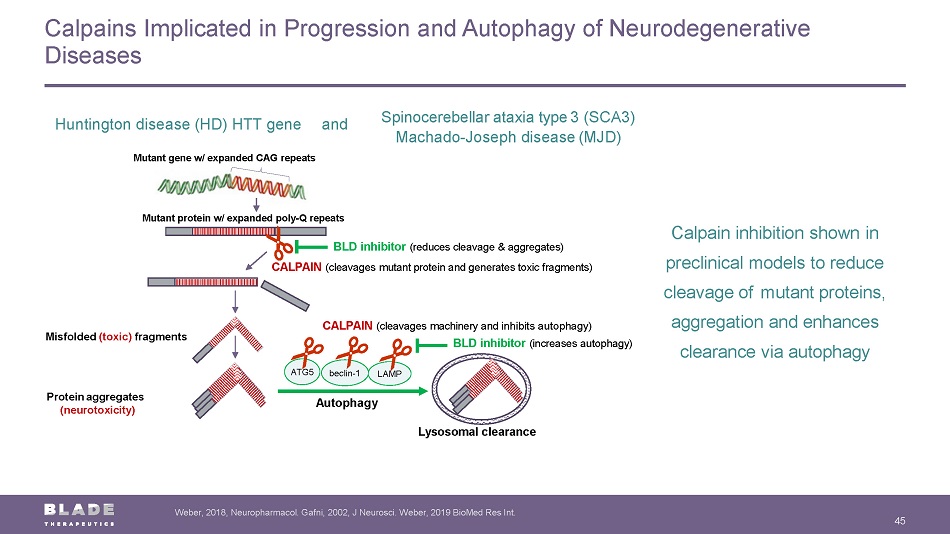

Calpains Implicated in Progression and Autophagy of Neurodegenerative Diseases 45 Weber, 2018, Neuropharmacol . Gafni, 2002, J Neurosci . Weber, 2019 BioMed Res Int. Calpain inhibition shown in preclinical models to r educe cleavage of mutant proteins, aggregation and enhances clearance via autophagy Mutant gene w/ expanded CAG repeats Mutant protein w/ expanded poly - Q repeats CALPAIN (cleavages mutant protein and generates toxic fragments) BLD inhibitor (reduces cleavage & aggregates) Protein a ggregates (neurotoxicity) M isfolded (toxic) fragments CALPAIN (cleavages machinery and inhibit s autophagy) Lysosomal clearance ATG5 beclin - 1 LAMP A utophagy BLD inhibitor (increases autophagy) Huntington d isease (HD) HTT gene Spinocerebellar ataxia type 3 (SCA3) Machado - Joseph d isease (MJD) a nd

Calpain Inhibitors Enhance Autophagy in Preclinical Studies ( in vitro, in vivo ) 46 BLD - 2736 increases autophagic flux in zebrafish larvae ( in vivo ) Increased autophagic flux (measured as ratio of LC3 - II to LC3 - I) Increased autophagic flux as measured by LC3B - II (in presence of chloroquine, which blocks lysosomal degradation) BLD - 2184 increases autophagic flux in neuro2A cells ( in vitro )

BLD - 2184 – Development Candidate for Poly - Q Neurodegenerative Diseases 47 Neuroprotective Effects Fewer Ataxin - 3 inclusions and decreased loss of dopaminergic neurons (mutant hATXN3 lentiviral mouse model) Potent and active against cysteine proteases in preclinical models Good oral bioavailability and CNS penetration with long half - life Preclinical evidence in mouse models Attenuation of disease effects in SCA3/MJD model IND - enabling studies completed Phase 1 planned to initiate 1H - 2022

Neuroprotective Effects Demonstrated in Zebrafish Model with Calpain Inhibitor 48 Bioavailability in CNS and PNS High solubility with bioavailability demonstrated in central and peripheral nervous systems Pilot toxicology completed 7 - day pilot toxicology package completed, and p reparing for study in murine model of neurodegeneration Ready for IND - enabling studies Improved motor function (swimming) and decreased aggregates (BLD - 2736 in mutant hATXN3 zebrafish model)