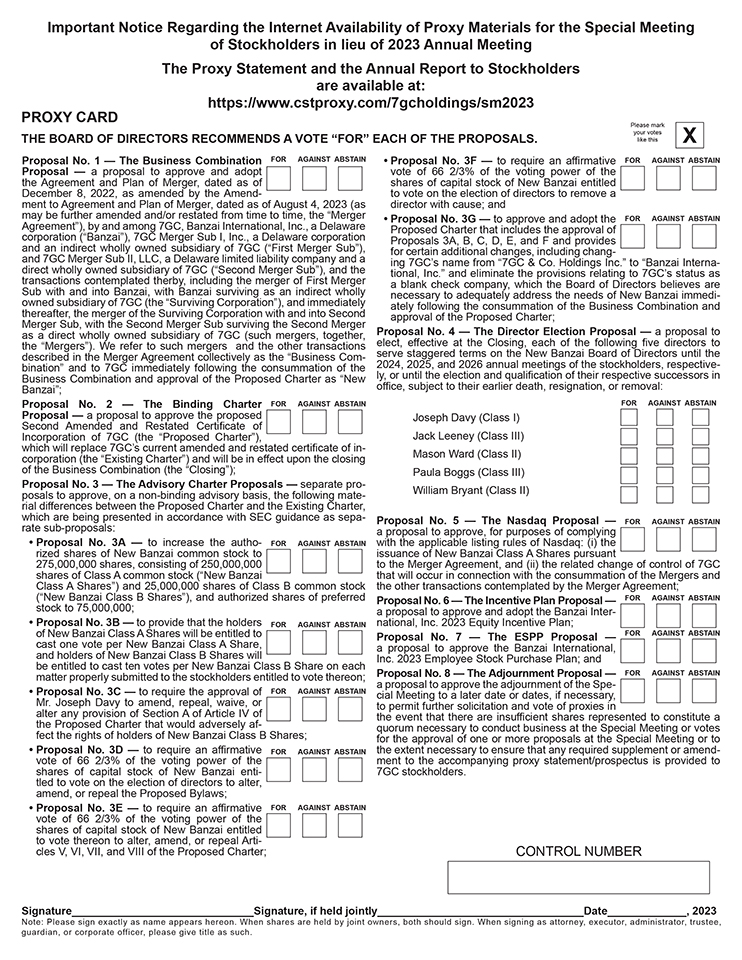

Proposal No. 1 — The Business Combination Proposal — a proposal to approve and adopt the Agreement and Plan of Merger, dated as of December 8, 2022, as amended by the Amendment to Agreement and Plan of Merger, dated as of August 4, 2023 (as may be further amended and/or restated from time to time, the “Merger Agreement”), by and among 7GC, Banzai International, Inc., a Delaware corporation (“Banzai”), 7GC Merger Sub I, Inc., a Delaware corporation and an indirect wholly owned subsidiary of 7GC (“First Merger Sub”), and 7GC Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of 7GC (“Second Merger Sub”), and the transactions contemplated therby, including the merger of First Merger Sub with and into Banzai, with Banzai surviving as an indirect wholly owned subsidiary of 7GC (the “Surviving Corporation”), and immediately thereafter, the merger of the Surviving Corporation with and into Second Merger Sub, with the Second Merger Sub surviving the Second Merger as a direct wholly owned subsidiary of 7GC (such mergers, together, the “Mergers”). We refer to such mergers and the other transactions described in the Merger Agreement collectively as the “Business Combination” and to 7GC immediately following the consummation of the Business Combination and approval of the Proposed Charter as “New Banzai”; Proposal No. 2 — The Binding Charter Proposal — a proposal to approve the proposed Second Amended and Restated Certificate of Incorporation of 7GC (the “Proposed Charter”), which will replace 7GC’s current amended and restated certificate of incorporation (the “Existing Charter”) and will be in effect upon the closing of the Business Combination (the “Closing”); Proposal No. 3 — The Advisory Charter Proposals — separate proposals to approve, on a non-binding advisory basis, the following material differences between the Proposed Charter and the Existing Charter, which are being presented in accordance with SEC guidance as separate sub-proposals: • Proposal No. 3A — to increase the authorized shares of New Banzai common stock to 275,000,000 shares, consisting of 250,000,000 shares of Class A common stock (“New Banzai Class A Shares”) and 25,000,000 shares of Class B common stock (“New Banzai Class B Shares”), and authorized shares of preferred stock to 75,000,000; • Proposal No. 3B — to provide that the holders of New Banzai Class A Shares will be entitled to cast one vote per New Banzai Class A Share, and holders of New Banzai Class B Shares will be entitled to cast ten votes per New Banzai Class B Share on each matter properly submitted to the stockholders entitled to vote thereon; • Proposal No. 3C — to require the approval of Mr. Joseph Davy to amend, repeal, waive, or alter any provision of Section A of Article IV of the Proposed Charter that would adversely affect the rights of holders of New Banzai Class B Shares; • Proposal No. 3D — to require an affirmative vote of 66 2/3% of the voting power of the shares of capital stock of New Banzai entitled to vote on the election of directors to alter, amend, or repeal the Proposed Bylaws; • Proposal No. 3E — to require an affirmative vote of 66 2/3% of the voting power of the shares of capital stock of New Banzai entitled to vote thereon to alter, amend, or repeal Articles V, VI, VII, and VIII of the Proposed Charter; • Proposal No. 3F — to require an affirmative vote of 66 2/3% of the voting power of the shares of capital stock of New Banzai entitled to vote on the election of directors to remove a director with cause; and • Proposal No. 3G — to approve and adopt the Proposed Charter that includes the approval of Proposals 3A, B, C, D, E, and F and provides for certain additional changes, including changing 7GC’s name from “7GC & Co. Holdings Inc.” to “Banzai International, Inc.” and eliminate the provisions relating to 7GC’s status as a blank check company, which the Board of Directors believes are necessary to adequately address the needs of New Banzai immediately following the consummation of the Business Combination and approval of the Proposed Charter; Proposal No. 4 — The Director Election Proposal — a proposal to elect, effective at the Closing, each of the following five directors to serve staggered terms on the New Banzai Board of Directors until the 2024, 2025, and 2026 annual meetings of the stockholders, respectively, or until the election and qualification of their respective successors in office, subject to their earlier death, resignation, or removal: Joseph Davy (Class I) Jack Leeney (Class III) Mason Ward (Class II) Paula Boggs (Class III) William Bryant (Class II) Proposal No. 5 — The Nasdaq Proposal — a proposal to approve, for purposes of complying with the applicable listing rules of Nasdaq: (i) the issuance of New Banzai Class A Shares pursuant to the Merger Agreement, and (ii) the related change of control of 7GC that will occur in connection with the consummation of the Mergers and the other transactions contemplated by the Merger Agreement; Proposal No. 6 — The Incentive Plan Proposal — a proposal to approve and adopt the Banzai International, Inc. 2023 Equity Incentive Plan; Proposal No. 7 — The ESPP Proposal — a proposal to approve the Banzai International, Inc. 2023 Employee Stock Purchase Plan; and Proposal No. 8 — The Adjournment Proposal — a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient shares represented to constitute a quorum necessary to conduct business at the Special Meeting or votes for the approval of one or more proposals at the Special Meeting or to the extent necessary to ensure that any required supplement or amendment to the accompanying proxy statement/prospectus is provided to 7GC stockholders. 23177 7GC & Co. Holdings Inc. (“VII”) Proxy Card_REV3 - Back Signature Signature, if held jointly Date, 2023 Note: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee, guardian, or corporate officer, please give title as such. CONTROL NUMBER PROXY CARD THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE PROPOSALS. Please mark your votes like this X FOR AGAINST ABSTAIN Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting of Stockholders in lieu of 2023 Annual Meeting The Proxy Statement and the Annual Report to Stockholders are available at: https://www.cstproxy.com/7gcholdings/sm2023 FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN