Exhibit 99.1

Rover Reports Second Quarter 2021 Financial Results

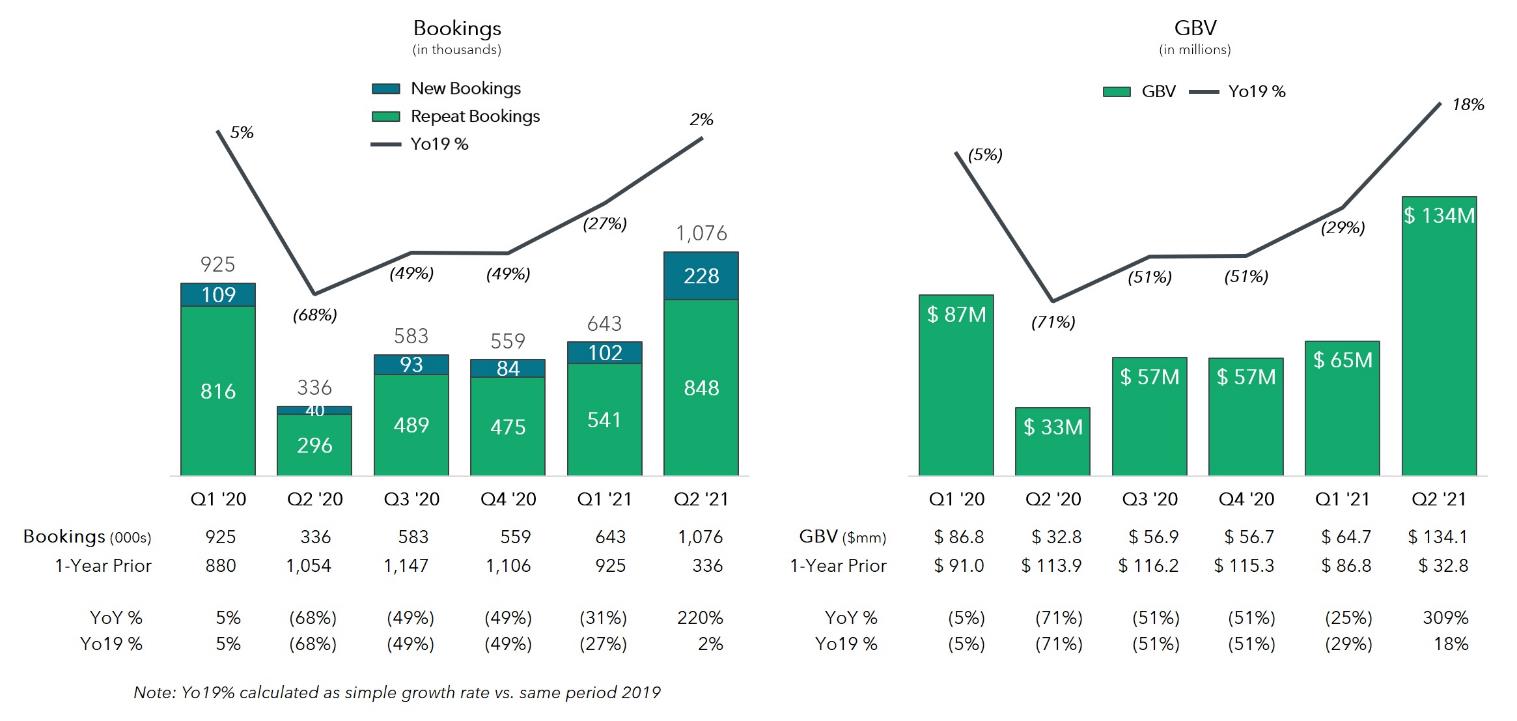

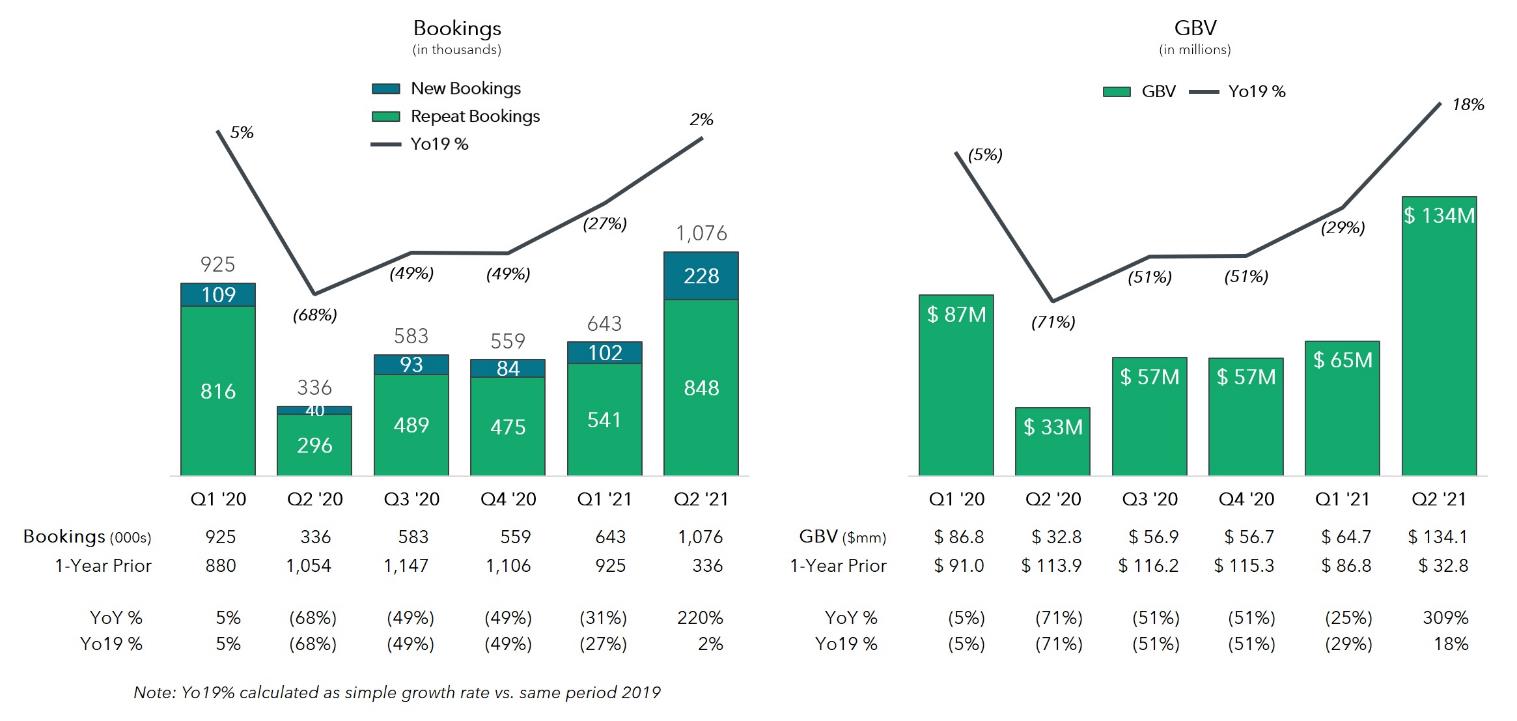

| ● | Q2 GBV of $134 million, Rover’s highest GBV quarter ever |

| ● | Q2 new bookings of ~228,000 at ~$9 average customer acquisition cost |

| ● | Q2 net loss significantly narrows |

| ● | Achieves Adjusted EBITDA profitability for the first time |

| ● | Company raises full year 2021 guidance |

SEATTLE, WA – August 9, 2021 – Rover Group, Inc. (“Rover” or the “Company”) (NASDAQ: ROVR), the world’s largest online marketplace for pet care, today announced financial results for the second quarter ended June 30, 2021 reported by A Place for Rover, Inc. prior to its merger with Nebula Caravel Acquisition Corp. on July 30, 2021.

“We are pleased with our strong second quarter financial results, as we drove growth in our core service offerings and reported a record number of new customers largely driven by organic channels,” said Rover co-founder and CEO, Aaron Easterly. "With the completion of our business combination adding approximately $240 million to our balance sheet, we feel well positioned to pursue the opportunities ahead.”

Unless otherwise noted, all comparisons for Q2 2021 are relative to Q2 2019, due to the irregularity in Rover’s 2020 business metrics caused by COVID.

Second Quarter 2021 Financial Highlights:

| ● | Revenue of $24.5 million, compared to $23.8 million, an increase of 3%. |

| ● | GAAP net loss of $2.8 million, compared to net loss of $12.0 million. |

| ● | Adjusted EBITDA of $2.5 million, marking the Company’s first quarter of positive Adjusted EBITDA. The Q2 result was an improvement of $10.4 million from the second quarter of 2019 resulting from strong revenue performance and organic new customer acquisition. |

Second Quarter 2021 Business Metrics:

| ● | Gross bookings value (GBV) of $134.1 million, compared to $113.9 million. This was Rover’s largest GBV quarter ever, surpassing the previous high achieved in Q3 2019 by 15%. |

| ● | Total demand grew each month as early summer travel began to normalize to 2019 levels, growing 18% in aggregate over Q2 2019. |

| ● | Total bookings of 1.08 million, compared to 1.05 million. |

| ● | New bookings of 228,000, compared to 175,000 in Q2 2019. This was Rover’s largest new customer quarter ever, driven by organic acquisition, surpassing the previous high achieved in Q3 2019 by 16%. |

| ● | New customer acquisition efficiency continued, with Customer acquisition cost (CAC) of $9, compared to $38 in Q2 2019. |

| ● | Average take rate of 24.7% for bookings that were booked in the quarter, compared to 23.5% in Q2 2019. |

| ● | In June, pre pandemic cohorts reached 80% of expected behavior if the pandemic did not happen. We saw this maintain in July, holding at ~80%. |

Second Quarter 2021 Geographic Highlights:

| ● | For U.S. bookings, California increased 83%, Florida increased 50%, New York increased 90%, and Texas increased 73% from Q1 to Q2 2021. Historically, the average seasonal trend has been a 17% decrease during the same time period for these states. Rover expects the exact rate of recovery to continue to vary by locale. |

| ● | International markets have been slower to recover and are pacing behind their historical levels. In the second quarter of 2021, international markets represented 3% of total GBV, down from 6% in Q2 2019. |

| ● | Canada showed modest recovery, with second quarter 2021 GBV growing 80% compared to Q1 2021, but still down 20% from Q2 2019 levels. |

| ● | The United Kingdom, the biggest European market for Rover, has seen a recent improvement in GBV levels, with Q2 2021 GBV growing 250% compared to Q1 2021 GBV as domestic travel in the U.K. has increased, but is still down 40% from Q2 2019 levels. |

| ● | The rest of Europe has also seen a recent improvement in Q2 2021 GBV levels, growing 170% compared to Q1 2021 GBV as restrictions for travel within the EU continue to vary, but are still down 50% from Q2 2019 levels. |

Growth in GBV represents increasing activity on our platform from repeat and new pet parents and may differ from bookings growth depending on the mix of daytime and overnight services for each period.

“We were encouraged by the strong new customer volume and ongoing travel recovery evidenced throughout the quarter and into July. At the same time, we are closely tracking the impact of COVID-19 and the Delta variant, as we have recently seen a slight increase in cancellations,” said Tracy Knox, CFO. “Our outlook for the remainder of the year balances the strong recent performance and trends in both top and bottom line with some COVID-19 related uncertainty in the near to medium term.”

Raised 2021 Guidance

| ○ | Rover anticipates Revenue in the range of $102 - $110 million, an increase from the projection of $100 - $105 million disclosed in its press release on June 9, 2021. |

| ○ | Rover anticipates Adjusted EBITDA to be in the range of breakeven to low single digit millions, an improvement from the projection of ($2) - ($7) million disclosed in its press release on June 9, 2021. |

Guidance for 2021 anticipates increases in paid marketing activities resulting in a trend towards normalized CAC, as well as increased investments in product and technology as we expand our teams and G&A to account for new public company costs. It also anticipates slightly elevated cancellation rates relative to 2019 as there remains some uncertainty related to COVID-19 and the Delta variant and the impact on travel and return to office.

About Rover

Founded in 2011 and based in Seattle, Rover (Nasdaq: ROVR) is the world’s largest online marketplace for pet care. Rover connects pet parents with pet providers who offer overnight services, including boarding and in-home pet sitting, as well as daytime services, including doggy daycare, dog walking, drop-in visits, and grooming. To learn more about Rover, please visit http://www.rover.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Rover’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events, or results of operations, including 2021 guidance and projections, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “could,” “can,” “would,” “predict,” “potential,” “poised,” “continue,” “ongoing,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negative of these words or similar terms or expressions, and include statements regarding COVID recovery, changes in travel and working behavior, and the impact on Rover’s business and operating results. Such forward-looking statements involve risks and uncertainties that may cause actual events, results, or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in the section titled “Risk Factors” in the definitive proxy statement/prospectus filed by Nebula Caravel Acquisition Corp. with the SEC on July 9, 2021 (the “Proxy Statement”). These risk factors will be important to consider in determining future results and should be reviewed in their entirety.

These forward-looking statements are based on Rover’s management’s current expectations and beliefs, as well as several assumptions concerning future events. However, there can be no assurance that the events, results, or trends identified in these forward-looking statements will occur or be achieved. Investors are cautioned not to place undue reliance on these forward-looking statements and reported results should not be considered as an indication of future performance.

Forward-looking statements speak only as of the date they are made, and Rover is under no obligation, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports which Rover has filed or will file from time to time with the SEC, including the Proxy Statement.

In addition to factors previously disclosed in Rover’s reports filed with the SEC, including the Proxy Statement, and those identified elsewhere in this press release, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: failure to realize the anticipated benefits of Rover’s recent business combination with Nebula Caravel Acquisition Corp.; Rover’s financial performance following the business combination; risks related to Rover’s ability to execute on its business strategy, attract and retain users, develop new offerings, enhance existing offerings, compete effectively, and manage growth and costs; the strength of Rover’s network, effectiveness of its technology, and quality of the offerings provided through its platform; Rover’s ability to retain existing or attract new pet parents and pet care providers; the duration and global impact of COVID-19, including with respect to new variants such as the delta variant; Rover’s ability to maintain and protect its brand reputation; Rover’s assessment of its trust and safety record; ability to attract and retain talent and the effectiveness of its compensation strategies and leadership; changes in applicable laws or regulations; technological disruptions, privacy or data breaches, the loss of data or cyberattacks; the outcome of any known and unknown litigation and regulatory proceedings; costs related to the business combination; and those factors discussed in documents of Rover filed, or to be filed, with the SEC, including the Proxy Statement.

Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in Rover’s most recent filings with the SEC which are available, free of charge, at the SEC’s website at www.sec.gov, and in the Proxy Statement.

This press release is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Rover and is not intended to form the basis of an investment decision in Rover. All subsequent written and oral forward-looking statements concerning Rover or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

Definitions

| ● | A booking is defined as a single arrangement, prior to cancellation, between a pet parent and pet care provider, which can be for a single night or multiple nights for our overnight services, or for a single walk/day/drop-in/groom or multiple walks/days/drop-ins for our daytime services. New bookings is defined as the total number of first-time bookings that new users, which Rover refers to as pet parents, book on our platform in a period. Repeat bookings are defined as the total number of bookings from pet parents who have had a previous booking on Rover. |

| ● | Gross Booking Value, or GBV, represents the dollar value of bookings on our platform in a period and is inclusive of pet care provider earnings, service fees, add-ons, taxes, and alterations that occurred during that period. |

| ● | Average take rate for any period is defined as total service fees divided by in-period GBV |

| ● | Yo19% is calculated as the non-compounding growth rate of the current period metric vs. that of the same period in 2019. |

| ● | CAC for any period is defined as advertising expenses less brand, content and marketing tools divided by in-period new bookings. |

Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, Rover has disclosed in this earnings release Adjusted EBITDA, a non-GAAP financial measure. Reconciliation to the most comparable GAAP measure, net income (loss), is contained in tabular form in the unaudited financial statements below.

Adjusted EBITDA is defined as net loss excluding depreciation and amortization, stock-based compensation expense, income tax expense or benefit, interest expense, interest income, other income (expense), net, and non-routine items such as restructuring, impairment, and certain acquisition and merger related costs. Rover believes that this non-GAAP financial measure, when taken together with net loss, the corresponding U.S. GAAP financial measure, provides meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its business, results of operations, or outlook. Rover management

considers Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in Rover’s business and its historical operating performance on a more consistent basis. Rover believes that the use of Adjusted EBITDA is helpful to its investors as it is a metric used by management in assessing the health of our business and our operating performance. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as used by Rover’s management may not be comparable to similarly titled amounts used by other companies.

Our 2021 guidance also includes Adjusted EBITDA. Due to the forward-looking nature of these projections, specific quantifications of the amounts that would be required to reconcile such projections to GAAP measures are not available and Rover’s management believes that it is not feasible to provide accurate forecasted non-GAAP reconciliations.

A PLACE FOR ROVER, INC.

Key Business Metrics

(Bookings in thousands, GBV in millions)

(unaudited)

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2019 | | | 2020 | | | 2021 | | | 2019 | | | 2020 | | | 2021 | |

Bookings: | | | | | | | | | | | | | | | | | | | | | | | | |

New bookings | | | 175 | | | | 40 | | | | 228 | | | | 301 | | | | 149 | | | | 330 | |

Repeat bookings | | | 879 | | | | 296 | | | | 848 | | | | 1,633 | | | | 1,112 | | | | 1,389 | |

Total bookings | | | 1,054 | | | | 336 | | | | 1,076 | | | | 1,934 | | | | 1,261 | | | | 1,719 | |

GBV | | $ | 113.9 | | | $ | 32.8 | | | $ | 134.1 | | | $ | 204.9 | | | $ | 119.6 | | | $ | 198.8 | |

A PLACE FOR ROVER, INC.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2020 | | | 2021 | | | 2020 | | | 2021 | |

Revenue | | $ | 5,381 | | | $ | 24,482 | | | $ | 22,372 | | | $ | 36,678 | |

Costs and expenses: | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of depreciation and amortization shown separately below) | | | 6,209 | | | | 6,283 | | | | 11,627 | | | | 10,459 | |

Operations and support | | | 2,482 | | | | 3,482 | | | | 7,537 | | | | 5,715 | |

Marketing | | | 2,146 | | | | 4,462 | | | | 11,496 | | | | 7,128 | |

Product development | | | 4,927 | | | | 5,086 | | | | 13,738 | | | | 9,554 | |

General and administrative | | | 4,601 | | | | 5,732 | | | | 10,803 | | | | 12,368 | |

Depreciation and amortization | | | 2,100 | | | | 1,849 | | | | 4,862 | | | | 3,699 | |

Total costs and expenses | | | 22,465 | | | | 26,894 | | | | 60,063 | | | | 48,923 | |

Loss from operations | | | (17,084 | ) | | | (2,412 | ) | | | (37,691 | ) | | | (12,245 | ) |

Other income (expense), net: | | | | | | | | | | | | | | | | |

Interest income | | | 129 | | | | 4 | | | | 461 | | | | 8 | |

Interest expense | | | (1,009 | ) | | | (703 | ) | | | (1,258 | ) | | | (1,400 | ) |

Other expense, net | | | (144 | ) | | | (26 | ) | | | (188 | ) | | | (77 | ) |

Total other income (expense), net | | | (1,024 | ) | | | (725 | ) | | | (985 | ) | | | (1,469 | ) |

Loss before benefit from income taxes | | | (18,108 | ) | | | (3,137 | ) | | | (38,676 | ) | | | (13,714 | ) |

Benefit from income taxes | | | 29 | | | | 331 | | | | 52 | | | | 317 | |

Net loss | | $ | (18,079 | ) | | $ | (2,806 | ) | | $ | (38,624 | ) | | $ | (13,397 | ) |

Net loss per share attributable to common stockholders, basic and diluted | | $ | (0.63 | ) | | $ | (0.09 | ) | | $ | (1.35 | ) | | $ | (0.45 | ) |

Weighted-average shares used in computing net loss per share, basic and diluted | | | 28,699 | | | | 30,189 | | | | 28,660 | | | | 29,837 | |

A PLACE FOR ROVER, INC.

Condensed Consolidated Balance Sheets

(in thousands, except per share data)

(unaudited)

| | December 31, | | | June 30, | |

| | 2020 | | | 2021 | |

Assets | | | | | | | | |

Current assets | | | | | | | | |

Cash and cash equivalents | | $ | 80,848 | | | $ | 103,386 | |

Accounts receivable, net | | | 2,992 | | | | 12,187 | |

Prepaid expenses and other current assets | | | 3,629 | | | | 2,782 | |

Total current assets | | | 87,469 | | | | 118,355 | |

Property and equipment, net | | | 24,923 | | | | 22,914 | |

Operating lease right-of-use assets | | | — | | | | 21,876 | |

Intangible assets, net | | | 7,967 | | | | 6,162 | |

Goodwill | | | 33,159 | | | | 33,159 | |

Deferred tax asset, net | | | 1,235 | | | | 1,574 | |

Other noncurrent assets | | | 134 | | | | 4,955 | |

Total assets | | $ | 154,887 | | | $ | 208,995 | |

Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Deficit | | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable | | $ | 1,301 | | | $ | 2,813 | |

Accrued compensation and related expenses | | | 3,269 | | | | 4,381 | |

Accrued expenses and other current liabilities | | | 2,747 | | | | 5,545 | |

Deferred revenue | | | 751 | | | | 8,167 | |

Pet parent deposits | | | 7,931 | | | | 33,838 | |

Pet service provider liabilities | | | 6,140 | | | | 8,680 | |

Debt, current portion | | | 4,128 | | | | 7,746 | |

Operating lease liabilities, current portion | | | — | | | | 2,303 | |

Total current liabilities | | | 26,267 | | | | 73,473 | |

Deferred rent, net of current portion | | | 2,248 | | | | — | |

Debt, net of current portion | | | 33,398 | | | | 29,969 | |

Operating lease liabilities, net of current portion | | | — | | | | 26,193 | |

Other noncurrent liabilities | | | 4,659 | | | | 783 | |

Total liabilities | | | 66,572 | | | | 130,418 | |

Commitments and contingencies (Note 8) | | | | | | | | |

Redeemable convertible preferred stock, $0.00001 par value, 87,611 shares authorized as of December 31, 2020 and June 30, 2021; 87,497 shares issued and outstanding as of December 31, 2020 and June 30, 2021; aggregate liquidation preference of $294,802 as of December 31, 2020 and June 30, 2021 | | | 290,427 | | | | 290,427 | |

Stockholders’ deficit: | | | | | | | | |

Common stock, $0.00001 par value, 144,250 shares authorized as of December 31, 2020 and June 30, 2021; 29,288 and 30,437 shares issued and outstanding as of December 31, 2020 and June 30, 2021, respectively | | | — | | | | — | |

Additional paid-in capital | | | 53,912 | | | | 57,542 | |

Accumulated other comprehensive income | | | 253 | | | | 282 | |

Accumulated deficit | | | (256,277 | ) | | | (269,674 | ) |

Total stockholders’ deficit | | | (202,112 | ) | | | (211,850 | ) |

Total liabilities, redeemable convertible preferred stock and stockholders’ deficit | | $ | 154,887 | | | $ | 208,995 | |

A PLACE FOR ROVER, INC.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | Six Months Ended June 30, | |

| | 2020 | | | 2021 | |

OPERATING ACTIVITIES | | | | | | | | |

Net loss | | $ | (38,624 | ) | | $ | (13,397 | ) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | | | | | | |

Stock-based compensation | | | 2,479 | | | | 2,148 | |

Depreciation and amortization | | | 11,243 | | | | 7,177 | |

Non-cash operating lease costs | | | — | | | | 950 | |

Net amortization of investment premiums | | | 9 | | | | — | |

Amortization of debt issuance costs | | | 240 | | | | 238 | |

Deferred income taxes | | | (96 | ) | | | (329 | ) |

Loss on disposal of property and equipment | | | 177 | | | | 10 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 760 | | | | (9,188 | ) |

Prepaid expenses and other current assets | | | 518 | | | | 712 | |

Other noncurrent assets | | | — | | | | 38 | |

Accounts payable | | | (4,730 | ) | | | 1,512 | |

Accrued expenses and other current liabilities | | | (4,727 | ) | | | 980 | |

Deferred revenue and pet parent deposits | | | (11,652 | ) | | | 33,321 | |

Pet service provider liabilities | | | (3,646 | ) | | | 2,540 | |

Operating lease liabilities | | | — | | | | (1,057 | ) |

Other noncurrent liabilities | | | 1,148 | | | | 111 | |

Net cash (used in) provided by operating activities | | | (46,901 | ) | | | 25,766 | |

INVESTING ACTIVITIES | | | | | | | | |

Purchase of property and equipment | | | (455 | ) | | | (393 | ) |

Capitalization of internal-use software | | | (3,969 | ) | | | (2,988 | ) |

Proceeds from disposal of property and equipment | | | — | | | | 19 | |

Purchases of available-for-sale securities | | | (16,286 | ) | | | — | |

Proceeds from sales of available-for-sale securities | | | 5,367 | | | | — | |

Maturities of available-for-sale securities | | | 17,830 | | | | — | |

Net cash provided by (used in) investing activities | | | 2,487 | | | | (3,362 | ) |

FINANCING ACTIVITIES | | | | | | | | |

Proceeds from exercise of common stock options | | | 251 | | | | 1,482 | |

Payment of deferred transaction costs | | | — | | | | (1,352 | ) |

Proceeds from borrowing on credit facilities | | | 64,401 | | | | — | |

Net cash provided by financing activities | | | 64,652 | | | | 130 | |

Effect of exchange rate changes on cash, cash equivalents, and restricted cash | | | 22 | | | | 4 | |

Net increase in cash, cash equivalents, and restricted cash | | | 20,260 | | | | 22,538 | |

Cash, cash equivalents, and restricted cash beginning of period | | | 67,654 | | | | 80,848 | |

Cash, cash equivalents, and restricted cash end of period | | $ | 87,914 | | | $ | 103,386 | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | |

Cash paid for income taxes | | $ | 49 | | | $ | 7 | |

Cash paid for interest | | $ | 729 | | | $ | 1,138 | |

NON-CASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | |

Purchase of property and equipment in accounts payable and accrued liabilities | | $ | 8 | | | $ | — | |

Issuance of common stock warrants under credit facility and subordinated credit facility agreements | | $ | 657 | | | $ | — | |

Issuance of Series G redeemable convertible preferred stock to settle Barking Dog Ventures, Ltd. Holdback | | $ | 62 | | | $ | — | |

Deferred transaction costs included in accrued expenses and other current liabilities | | $ | — | | | $ | 3,430 | |

Reconciliation of Cash, Cash Equivalents and Restricted Cash | | | | | | | | |

Cash and cash equivalents | | $ | 87,870 | | | $ | 103,386 | |

Restricted cash included in prepaid expenses and other current assets | | | 44 | | | | — | |

Total cash, cash equivalents and restricted cash | | $ | 87,914 | | | $ | 103,386 | |

A PLACE FOR ROVER, INC.

Adjusted EBITDA Reconciliation

(in thousands)

(unaudited)

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2020 | | | 2021 | | | 2020 | | | 2021 | |

| | (in thousands) | |

Adjusted EBITDA reconciliation: | | | | | | | | | | | | | | | | |

Net loss | | $ | (18,079 | ) | | $ | (2,806 | ) | | $ | (38,624 | ) | | $ | (13,397 | ) |

Add (deduct): | | | | | | | | | | | | | | | | |

Depreciation and amortization(1) | | | 6,599 | | | | 3,608 | | | | 11,243 | | | | 7,177 | |

Stock-based compensation(2) | | | 894 | | | | 1,147 | | | | 2,479 | | | | 2,148 | |

Interest income | | | (129 | ) | | | (4 | ) | | | (461 | ) | | | (8 | ) |

Interest expense | | | 1,009 | | | | 703 | | | | 1,258 | | | | 1,400 | |

Other expense, net | | | 144 | | | | 26 | | | | 188 | | | | 77 | |

Benefit from income taxes | | | (29 | ) | | | (331 | ) | | | (52 | ) | | | (317 | ) |

Restructuring expense(3) | | | 1,159 | | | | — | | | | 3,239 | | | | — | |

Acquisition and merger-related costs(4) | | | 3 | | | | 151 | | | | 31 | | | | 1,056 | |

Adjusted EBITDA | | $ | (8,429 | ) | | $ | 2,494 | | | $ | (20,699 | ) | | $ | (1,864 | ) |

(1) | Depreciation and amortization include amortization expense related to capitalized internal use software, which is recognized as cost of revenue (exclusive of depreciation and amortization shown separately) in the consolidated statements of operations. |

(2) | Stock-based compensation expense includes equity granted to employees as well as for professional services to non-employees. |

(3) | Restructuring costs include expenses for severance-related and legal costs incurred during the implementation of our restructuring plan. |

(4) | Acquisition and Merger-related costs include accounting, legal, consulting and travel related expenses incurred in connection with business combinations. |

###

Contacts:

MEDIA

pr@rover.com

Kristin Sandberg

(360) 510-6365

INVESTORS

brinlea@blueshirtgroup.com

Brinlea Johnson

(415) 269-2645