UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

GX ACQUISITION CORP. II

(Name of Registrant as Specified in its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

☐ | Fee paid previously with preliminary materials. |

BUSINESS COMBINATION PROPOSED — YOUR VOTE IS VERY IMPORTANT

|

| |

Management Information and Proxy Circular | Proxy Statement |

To the Shareholders of NioCorp Developments Ltd. and the Stockholders of GX Acquisition Corp. II:

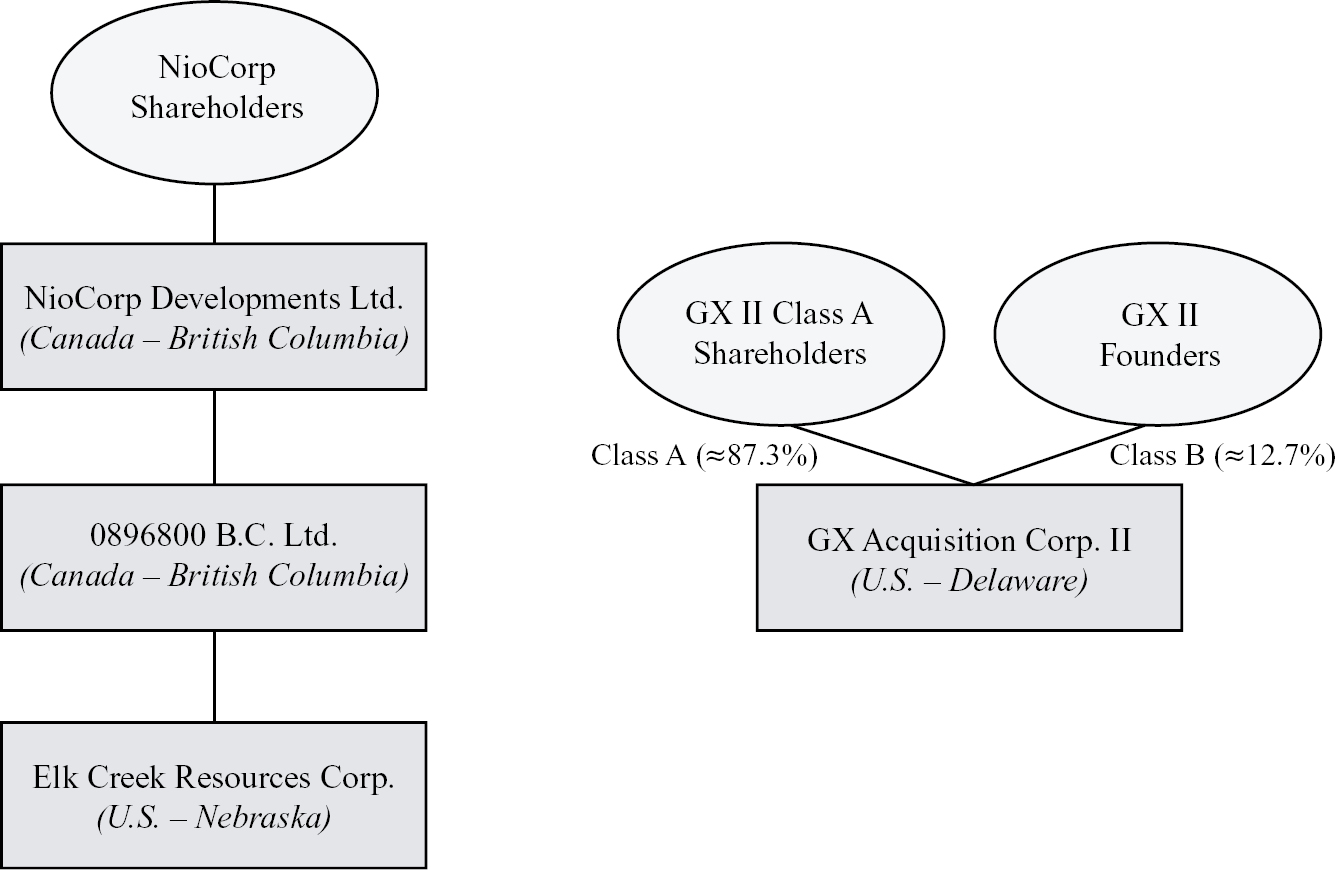

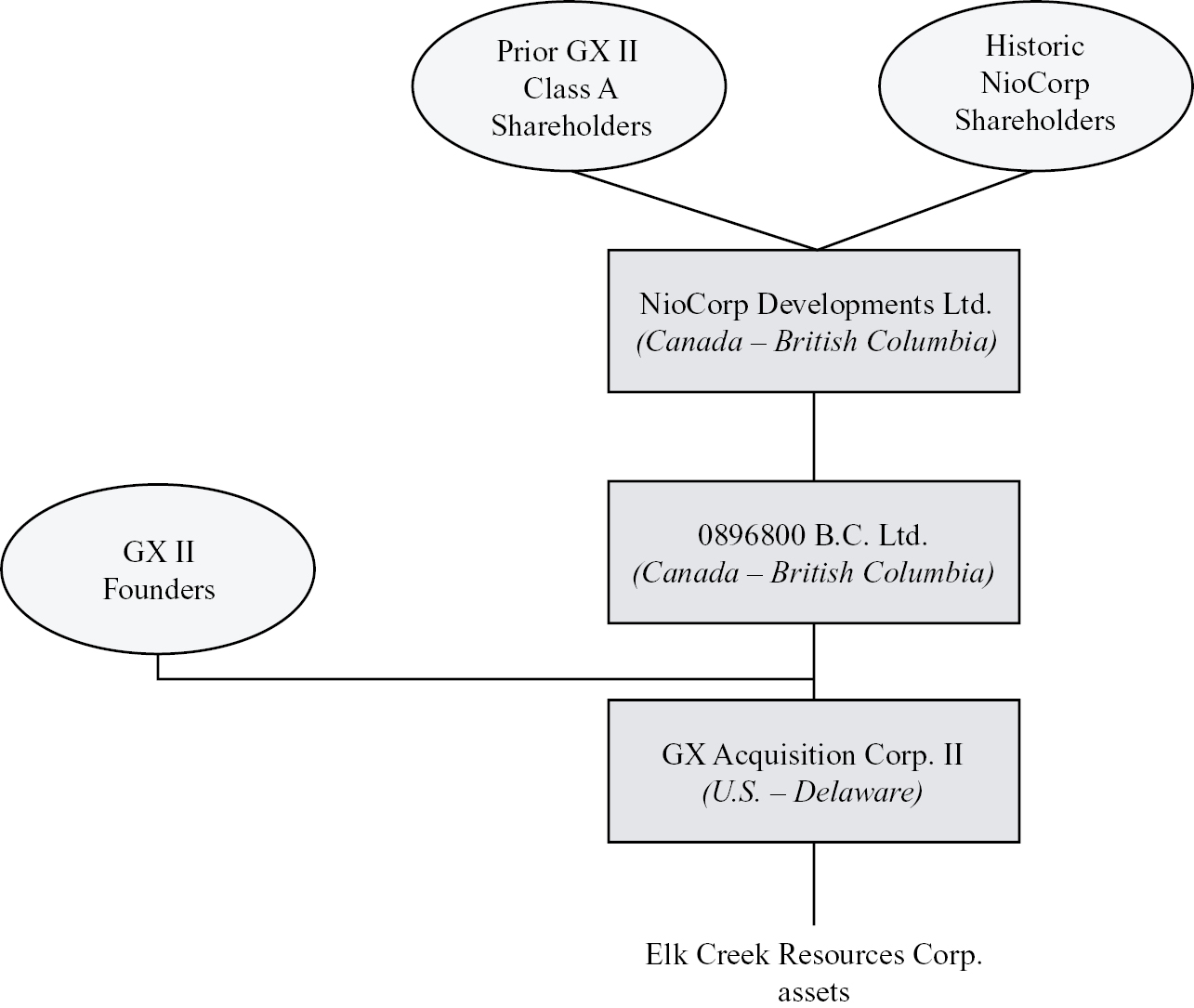

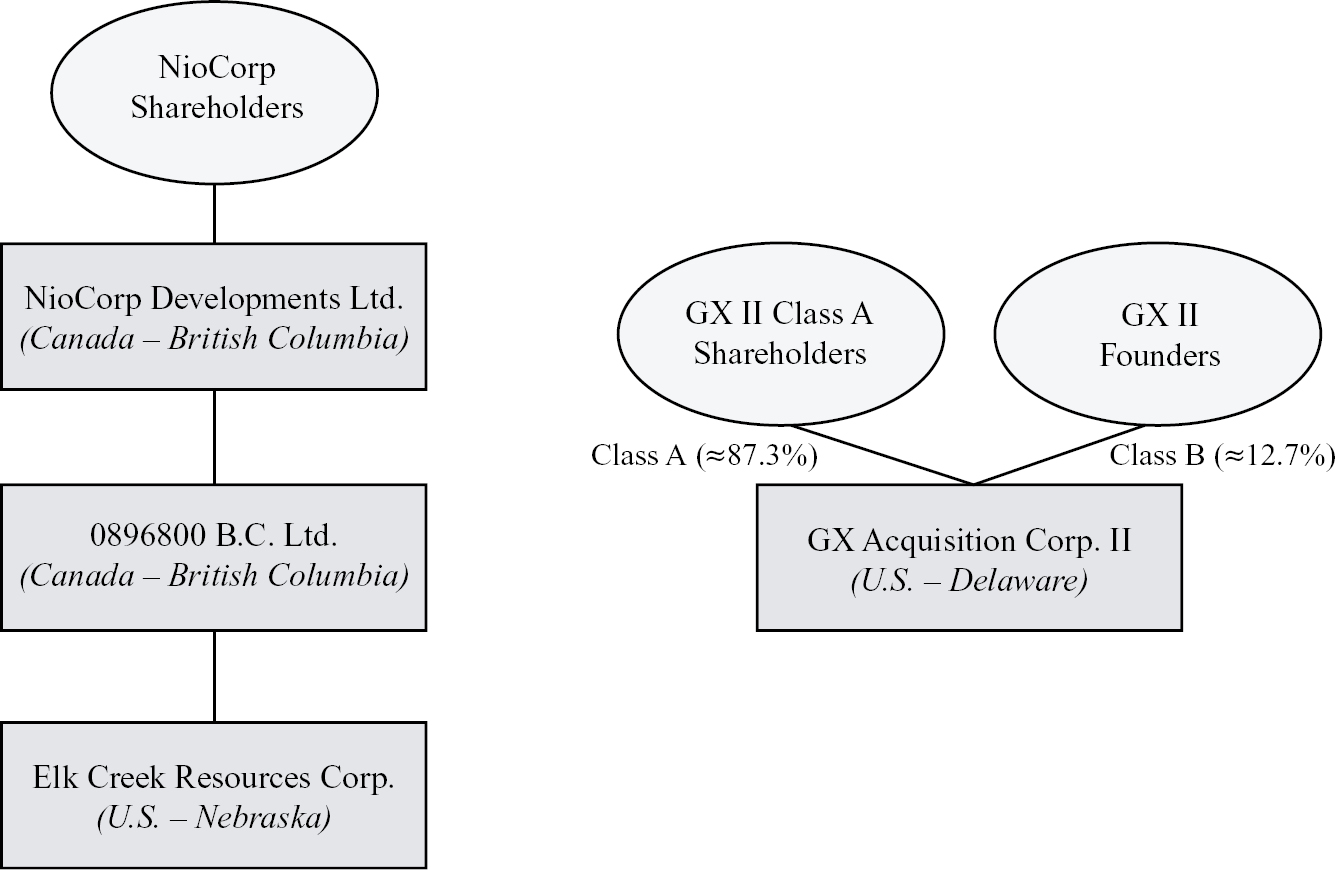

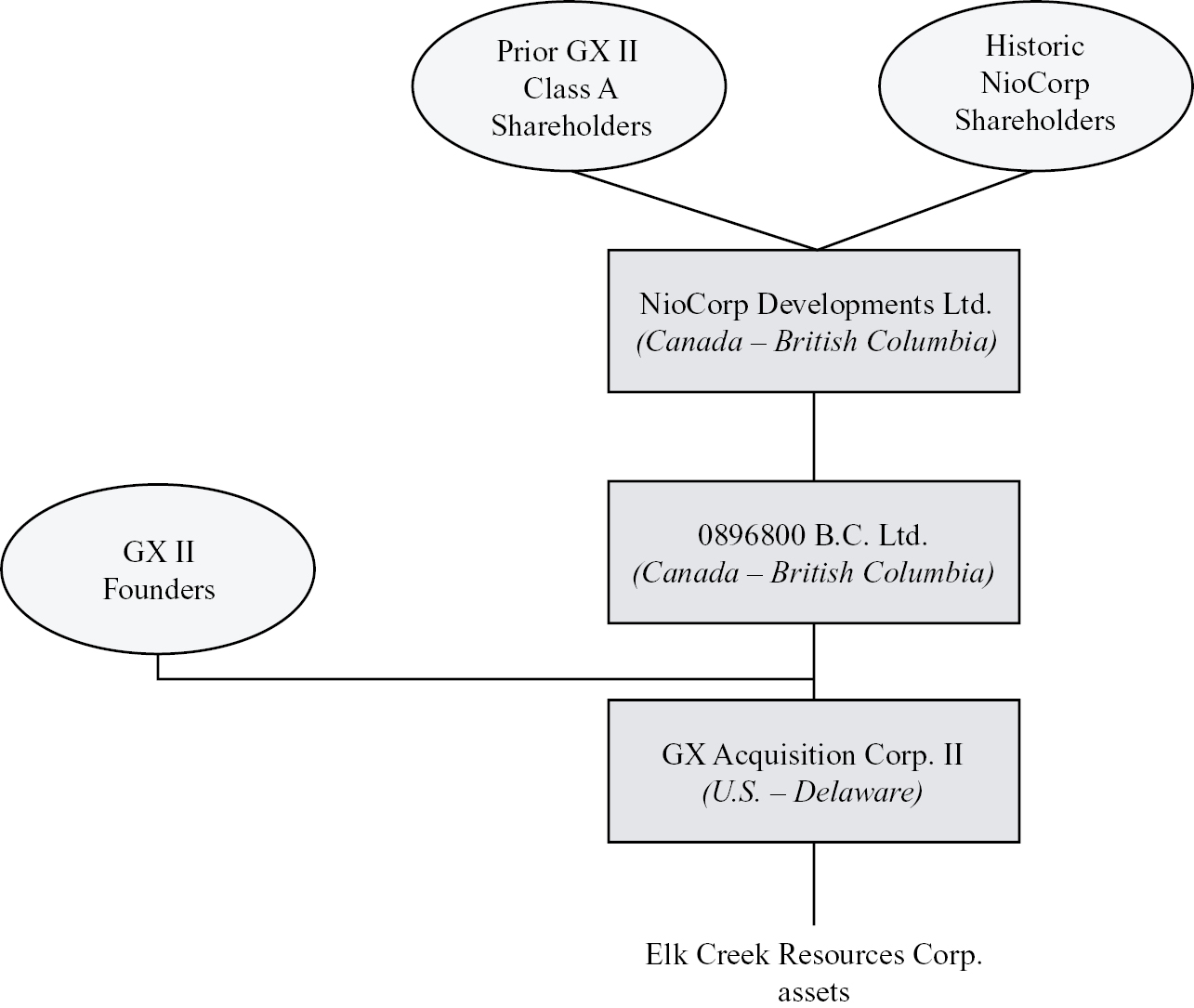

On September 25, 2022, NioCorp Developments Ltd., a company organized under the laws of the Province of British Columbia (“NioCorp”), GX Acquisition Corp. II, a Delaware corporation (“GX”), and Big Red Merger Sub Ltd, a Delaware corporation and a direct, wholly owned subsidiary of NioCorp (“Merger Sub”), entered into a Business Combination Agreement (the “Business Combination Agreement”), pursuant to which, among other transactions, the following transactions will occur: (i) Merger Sub will merge with and into GX, with GX surviving the merger (the “First Merger”); (ii) all Class A shares in GX (the “GX Class A Shares”) that are held by stockholders (the “GX Public Stockholders”) who have not elected to exercise their redemption rights in connection with the Transactions shall be converted into shares of Class A common stock in GX (such shares, the “First Merger Class A Shares”), as the surviving company in the First Merger; (iii) NioCorp will purchase all First Merger Class A Shares in exchange for common shares, no par value, of NioCorp (“NioCorp Common Shares”) (the “Exchange”); (iv) NioCorp will assume the GX Warrant Agreement and each GX Warrant that was issued and outstanding immediately prior to the effective time of the Exchange will be converted into a warrant to acquire NioCorp Common Shares (a “NioCorp Assumed Warrant”); (v) all of the First Merger Class A Shares will be contributed by NioCorp to 0896800 B.C. Ltd., a company organized under the laws of the Province of British Columbia and a direct, wholly owned subsidiary of NioCorp (“Intermediate Holdco”), in exchange for additional shares of Intermediate Holdco, resulting in GX becoming a direct subsidiary of Intermediate Holdco; (vi) Elk Creek Resources Corp., a Nebraska corporation and a direct, wholly owned subsidiary of Intermediate Holdco (“ECRC”), will merge with and into GX, with GX surviving the merger as a direct subsidiary of Intermediate Holdco (the “Second Merger”); and (vii) following the effective time of the Second Merger, each of NioCorp and GX, as the surviving company of the Second Merger, will effectuate a reverse stock split with the ratio to be mutually agreed by the parties. We refer to the transactions contemplated by the Business Combination Agreement and the Ancillary Agreements collectively as the “Transactions.” As a result of the Transactions, GX will become a subsidiary of NioCorp. Capitalized terms used in this letter but not otherwise defined have the meanings given to them in the accompanying joint proxy statement/prospectus. See “Frequently Used Terms.”

Pursuant to the Business Combination Agreement, upon consummation of the First Merger, each GX Class A Share that is held by a GX Public Stockholder shall be converted into a First Merger Class A Share. In connection with the Exchange, NioCorp will exercise its unilateral option to purchase each First Merger Class A Share in exchange for 11.1829212 NioCorp Common Shares. As a result, each GX Public Stockholder who does not elect to exercise their redemption rights in connection with the Transactions will ultimately be issued NioCorp Common Shares.

Pursuant to the Business Combination Agreement, upon consummation of the First Merger, each Class B share in GX (other than certain shares that may be forfeited in accordance with the GX Support Agreement) will be converted into one share of Class B common stock in GX (such shares, the “First Merger Class B Shares”), as the surviving company in the First Merger. Upon consummation of the Second Merger, each of the First Merger Class B Shares shall be converted into 11.1829212 Class B common shares of GX (each, a “Second Merger Class B Share”), as the surviving company in the Second Merger, in a private placement. Each Second Merger Class B Share will be exchangeable into NioCorp Common Shares on a one-for-one basis, subject to certain equitable adjustments.

Pursuant to the Business Combination Agreement, in connection with the First Merger and the assumption by NioCorp of the GX Warrant Agreement, each GX Warrant that is issued and outstanding immediately prior to the Exchange Time shall be converted into one NioCorp Assumed Warrant pursuant to the GX Warrant Agreement. Each NioCorp Assumed Warrant shall be exercisable solely for NioCorp Common Shares, and the number of

NioCorp Common Shares subject to each NioCorp Assumed Warrant shall be equal to the number of shares of GX Common Stock subject to the applicable GX Warrant multiplied by 11.1829212, with the applicable exercise price adjusted accordingly.

Following the effective time of the Second Merger, NioCorp will effectuate a reverse stock split of the issued NioCorp Common Shares and GX will effectuate a proportionate reverse stock split of the Second Merger Class A Shares and Second Merger Class B Shares at a to-be-determined ratio.

Immediately following completion of the Transactions, it is expected that the current NioCorp Shareholders and the current GX Stockholders will own 42% and 58%, respectively, of the outstanding NioCorp Common Shares (assuming no redemptions by GX Stockholders and that all of the Second Merger Class B Shares are exchanged into NioCorp Common Shares, and not including the potential dilutive impact of the Yorkville Financings).

The accompanying joint proxy statement/prospectus constitutes a prospectus of NioCorp with respect to the registration of 510,686,738 NioCorp Common Shares and 15,666,667 NioCorp Assumed Warrants issuable to GX Securityholders pursuant to the Business Combination Agreement.

In connection with the Transactions, NioCorp has also entered into definitive agreements with respect to the following private placement financings with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP (together with YA II PN, Ltd., “Yorkville”): (i) $16,000,000 of unsecured convertible debentures of NioCorp convertible into NioCorp Common Shares and NioCorp Common Share purchase warrants entitling the holders thereof to purchase additional NioCorp Common Shares (the “Yorkville Convertible Debt Financing”); and (ii) a standby equity purchase facility pursuant to which NioCorp will have the right, but not the obligation, subject to the conditions set out therein, to sell NioCorp Common Shares to Yorkville with a maximum aggregate value of $65,000,000 (the “Yorkville Equity Facility Financing” and, together with the Yorkville Convertible Debt Financing, the “Yorkville Financings”). Once completed, the Yorkville Financings could provide NioCorp with access to up to an additional $80,360,000, before related fees and expenses payable by NioCorp.

The NioCorp Common Shares are traded on the Toronto Stock Exchange (the “TSX”) under the symbol “NB” and on the OTC Markets trading platform under the symbol “NIOBF.” GX units, GX Class A Shares and public GX Warrants are currently listed on The Nasdaq Stock Market LLC (“Nasdaq”), under the symbols “GXIIU,” “GXII” and “GXIIW,” respectively. NioCorp currently anticipates that, following the Transactions, the NioCorp Common Shares will trade on Nasdaq under the symbol “NB” and will continue to trade on the TSX under the symbol “NB.” In addition, NioCorp anticipates that, following the Transactions, the NioCorp Assumed Warrants will trade on Nasdaq under the symbol “NIOBW.” NioCorp intends to apply for listing of the NioCorp Common Shares and NioCorp Assumed Warrants on Nasdaq and to apply for listing of the NioCorp Common Shares to be issued in connection with the Transactions and the Yorkville Financings on the TSX. Neither Nasdaq nor TSX has conditionally approved any NioCorp listing application and there is no assurance that such exchanges will approve any listing application.

NioCorp will hold a special meeting of shareholders (the “NioCorp Shareholder Meeting”), and GX will hold a special meeting of stockholders (the “GX Stockholder Meeting”), to vote on the proposals necessary to complete the Transactions. We encourage you to obtain current quotes or trading prices for your NioCorp or GX securities before voting at the NioCorp Shareholder Meeting or the GX Stockholder Meeting.

At the NioCorp Shareholder Meeting, NioCorp Shareholders will be asked to consider and approve (i) the issuance of NioCorp Common Shares in connection with the Transactions (the “Share Issuance Proposal”), (ii) the issuance of NioCorp Common Shares in connection with the Yorkville Equity Facility Financing (the “Yorkville Equity Facility Financing Proposal”), (iii) the issuance of NioCorp Common Shares in connection with the Yorkville Convertible Debt Financing (the “Yorkville Convertible Debt Financing Proposal”), (iv) with or without amendment, an amendment to the NioCorp Articles to require the presence, in person or by proxy, of two or more shareholders representing at least 33 1/3% of the outstanding shares entitled to be voted in order to constitute a quorum at any meeting of NioCorp Shareholders (the “Quorum Amendment Proposal”), and (v) a proposal to adjourn the NioCorp Shareholder Meeting to a later date to permit further solicitation and vote of proxies, if necessary (collectively, the “NioCorp Proposals”). Approval of each of these proposals requires the affirmative vote of a majority of votes cast by NioCorp Shareholders entitled to vote thereon and present in person or represented by proxy at the NioCorp Shareholder Meeting. The NioCorp Board recommends that NioCorp Shareholders vote “FOR” each of the NioCorp Proposals to be considered at the NioCorp Shareholder Meeting.

At the GX Stockholder Meeting, GX Stockholders will be asked to consider and approve (i) the Transactions, (ii) the material changes in the proposed amendments to the current Amended and Restated Certificate of Incorporation of GX (the “GX Existing Charter”), the GX Charter Amendment (to be effective immediately prior to the effective time of the First Merger) and the GX Proposed Charter as a whole, which includes the approval of all other changes in the GX Proposed Charter that will replace the GX Existing Charter, as amended by the GX Charter Amendment, as of the Closing, and (iii) a proposal to adjourn the GX Stockholder Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the GX Stockholder Meeting, there are not sufficient votes to approve one or more proposals presented to stockholders for a vote (collectively, the “GX Proposals”). The GX Board recommends that GX Stockholders vote “FOR” each of the GX Proposals to be considered at the GX Stockholder Meeting.

Your vote on these matters is very important, regardless of the number of shares you own. Whether or not you plan to attend your company’s respective meeting, please vote by proxy over the internet or telephone using the instructions included with the accompanying proxy card, or promptly complete your proxy card and return it in the enclosed postage-paid envelope, in order to authorize the individuals named on your proxy card to vote your shares at the applicable meeting.

The accompanying joint proxy statement/prospectus provides you with important information about NioCorp, GX, the Transactions, the Business Combination Agreement and the meetings and incorporates important business and financial information about NioCorp and GX that is not included or delivered with the accompanying joint proxy statement/prospectus. This information is available without charge to security holders upon written or oral request. The request should be sent to NioCorp Developments Ltd., 7000 South Yosemite Street, Suite 115, Centennial, Colorado 80112, (855) 264-6267 Attn: Corporate Secretary or GX Acquisition Corp. II, 1325 Avenue of the Americas, 28th Floor, New York, NY 10019, Attn: Michael G. Maselli. To obtain timely delivery of requested materials, security holders must request the information no later than five business days before the date they submit their proxies or attend the special meeting. The latest date to request the information to be received timely is March 3, 2023.

We encourage you to read the entire document carefully, particularly the information under “Risk Factors” beginning on page 58 for a discussion of certain risks relevant to the Transactions.

We look forward to the successful completion of the Transactions.

Sincerely,

Mark A. Smith | Jay R. Bloom | |

Chief Executive Officer | Co-Chairman and Chief Executive Officer | |

NioCorp Developments Ltd. | GX Acquisition Corp. II |

Neither the U.S. Securities and Exchange Commission, any U.S. state or Canadian provincial or territorial securities commissions, nor similar securities regulatory authority has approved or disapproved of the securities to be issued under this joint proxy statement/prospectus or determined that this joint proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The accompanying joint proxy statement/prospectus is dated February 8, 2023 and is first being mailed or otherwise delivered to NioCorp Shareholders on or about February 10, 2023 and GX Stockholders on or about February 9, 2023.

NIOCORP DEVELOPMENTS LTD.

7000 SOUTH YOSEMITE STREET, SUITE 115

CENTENNIAL, CO 80112

(720) 639-4647

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON march 10, 2023

NOTICE IS HEREBY GIVEN THAT a special meeting of shareholders (the “NioCorp Shareholder Meeting”) of NioCorp Developments Ltd. (“we” or “NioCorp”) will be held on March 10, 2023, at 10:00 a.m., Mountain Time (12:00 p.m., Eastern Time), at Hilton Denver Inverness, 200 Inverness Drive West, Englewood, Colorado 80112 for the following purposes:

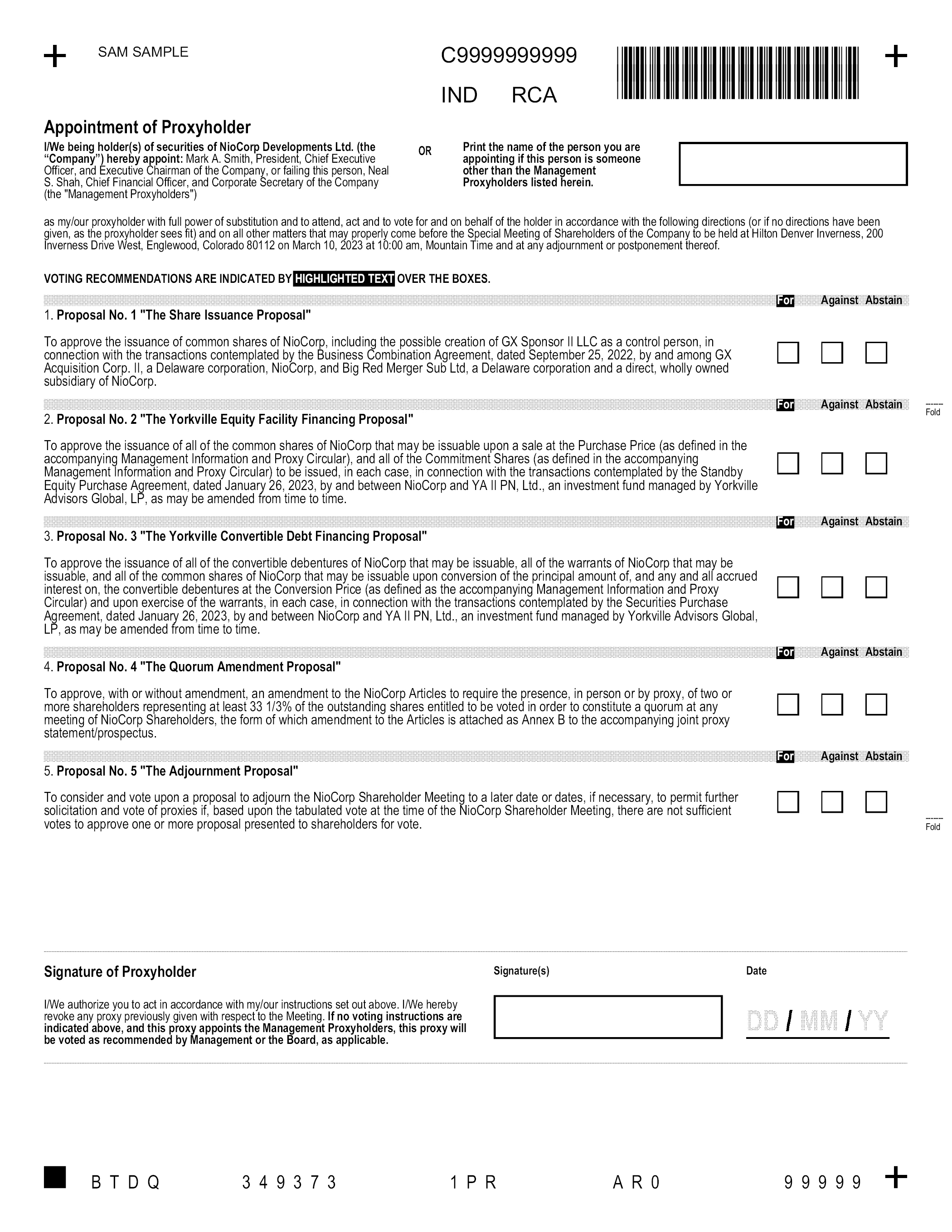

• Proposal No. 1 — The “Share Issuance Proposal” — to approve the issuance of common shares of NioCorp, and including the possible creation of GX Sponsor II LLC as a control person, in connection with the transactions contemplated by the Business Combination Agreement, dated September 25, 2022 (as may be amended from time to time, the “Business Combination Agreement”), by and among GX Acquisition Corp. II, a Delaware corporation (“GX”), NioCorp, and Big Red Merger Sub Ltd, a Delaware corporation and a direct, wholly owned subsidiary of NioCorp. We refer to the transactions contemplated by the Business Combination Agreement collectively as the “Transactions.” The Business Combination Agreement is attached as Annex A to, and is described in more detail in, the accompanying joint proxy statement/prospectus;

• Proposal No. 2 — The “Yorkville Equity Facility Financing Proposal” — to approve the issuance of all of the common shares of NioCorp that may be issuable upon a sale at the Purchase Price (as defined in the accompanying joint proxy statement/prospectus) and all of the Commitment Shares (as defined in the accompanying joint proxy statement/prospectus) to be issued, in each case, in connection with the transactions (the “Yorkville Equity Facility Financing”) contemplated by the Standby Equity Purchase Agreement, dated January 26, 2023 (as may be amended from time to time, the “Yorkville Equity Facility Financing Agreement”), by and between NioCorp and YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP (together with YA II PN, Ltd., “Yorkville”);

• Proposal No. 3 — The “Yorkville Convertible Debt Financing Proposal” — to approve the issuance of all of the convertible debentures of NioCorp that may be issuable, all of the warrants of NioCorp that may be issuable, and all of the common shares of NioCorp that may be issuable upon conversion of the principal amount of, and any and all accrued interest on, the convertible debentures at the Conversion Price (as defined in the accompanying joint proxy statement/prospectus) and upon exercise of the warrants, in each case, in connection with the transactions (the “Yorkville Convertible Debt Financing”) contemplated by the Securities Purchase Agreement, dated January 26, 2023 (as may be amended from time to time, the “Yorkville Convertible Debt Financing Agreement”), by and between NioCorp and Yorkville;

• Proposal No. 4 — The “Quorum Amendment Proposal” — to approve, with or without amendment, an amendment to the NioCorp Articles to require the presence, in person or by proxy, of two or more shareholders representing at least 33 1/3% of the outstanding shares entitled to be voted in order to constitute a quorum at any meeting of NioCorp Shareholders, the form of which amendment to the Articles is attached as Annex B to the accompanying joint proxy statement/prospectus; and

• Proposal No. 5 — The “Adjournment Proposal” — to consider and vote upon a proposal to adjourn the NioCorp Shareholder Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the NioCorp Shareholder Meeting, there are not sufficient votes to approve one or more proposal presented to shareholders for vote.

The approval of each of these proposals (collectively, the “NioCorp Proposals”) requires the affirmative vote of a majority of votes cast by shareholders of NioCorp entitled to vote thereon and present in person or represented by proxy at the NioCorp Shareholder Meeting. We cannot complete the Transactions unless each of the Share Issuance Proposal and the Quorum Amendment Proposal are approved at the NioCorp Shareholder Meeting. We cannot complete the Yorkville Convertible Debt Financing if the Yorkville Convertible Debt Financing Proposal is not approved at the NioCorp Shareholder Meeting, and we cannot complete the Yorkville Equity Facility Financing if the Yorkville Equity Facility Financing Proposal is not approved at the NioCorp Shareholder Meeting.

None of the NioCorp Proposals are conditioned on the approval of any other NioCorp Proposal, as more fully described in the accompanying joint proxy statement/prospectus.

However, the Yorkville Equity Facility Financing Agreement and the Yorkville Convertible Debt Financing Agreement will terminate pursuant to their terms if the Business Combination Agreement is terminated.

Being made available along with this Notice of Meeting are (i) the Management Information and Proxy Circular included as part of the accompanying joint proxy statement/prospectus and (ii) a form of proxy and notes thereto (together, the “NioCorp Meeting Materials”).

The NioCorp Board of Directors has unanimously resolved (i) that the Transactions are fair to the NioCorp Shareholders and (ii) that the Transactions and entering into of the Business Combination Agreement, the other ancillary agreements contemplated thereby, the Yorkville Equity Facility Financing Agreement and the Yorkville Convertible Debt Financing Agreement are in the best interests of NioCorp and unanimously recommends that NioCorp Shareholders vote “FOR” each proposal. The accompanying joint proxy statement/prospectus provides a detailed description of the Business Combination Agreement and the related agreements and Transactions. We urge you to read the accompanying joint proxy statement/prospectus, including any documents incorporated by reference into the accompanying joint proxy statement/prospectus, and its annexes carefully and in their entirety.

The NioCorp Board of Directors has fixed February 1, 2023 as the record date for the NioCorp Shareholder Meeting. NioCorp Shareholders at the close of business on February 1, 2023, will be entitled to receive notice of, attend, and vote at the NioCorp Shareholder Meeting.

YOUR VOTE IS VERY IMPORTANT. If you are a registered shareholder of NioCorp and are unable to attend the NioCorp Shareholder Meeting, you may vote: (i) via the Internet; (ii) by calling a toll-free telephone number; or (iii) if you received your proxy materials by mail, by dating and executing the form of proxy for the NioCorp Shareholder Meeting and depositing it by hand delivery or by mail with Computershare Investor Services Inc., Proxy Dept., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 or by facsimile to 1-866-249-7775 (within North America) or 1-416-263-9524 (outside North America). Instructions for telephone and Internet voting are included in the notice that NioCorp mailed to shareholders on or about February 10, 2023. All instructions are also listed in the form of proxy and notes thereto. Your proxy or voting instructions must be received in each case no later than 10:00 a.m., Mountain time, on March 8, 2023, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the NioCorp Shareholder Meeting is reconvened following any adjournment or postponement.

If you are a non-registered shareholder of NioCorp and receive these materials through your broker or another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or such other intermediary.

The NioCorp Meeting Materials are first being made available to shareholders of NioCorp on or about February 10, 2023.

DATED at Centennial, Colorado, this 8th day of February, 2023.

| By Order of the Board of Directors, | |

| ||

| Mark A. Smith | |

| Chief Executive Officer |

GX ACQUISITION CORP. II

1325 Avenue of the Americas, 28th Floor,

New York, NY, 10019

(212) 616-3700

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 15, 2023

To the Stockholders of GX Acquisition Corp. II:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders (the “GX Stockholder Meeting”) of GX Acquisition Corp. II, a Delaware corporation (“GX”, “we”, “our” or “us”), will be held on March 15, 2023, at 10:30 a.m., Eastern time, via live webcast at the following address: https://www.cstproxy.com/gx2/2023. You will need the 12-digit meeting control number that is printed on your proxy card to enter the GX Stockholder Meeting. GX recommends that you log in at least 15 minutes before the GX Stockholder Meeting to ensure you are logged in when the GX Stockholder Meeting starts. Please note that you will not be able to attend the GX Stockholder Meeting in person. You are cordially invited to attend the GX Stockholder Meeting for the following purposes:

• Proposal No. 1 — The “Business Combination Proposal” — to consider and vote upon a proposal to approve and adopt the Business Combination Agreement, dated September 25, 2022 (as may be amended from time to time, the “Business Combination Agreement”), by and among GX, NioCorp Developments Ltd., a company organized under the laws of the Province of British Columbia (“NioCorp”), and Big Red Merger Sub Ltd, a Delaware corporation and a direct wholly owned subsidiary of NioCorp (“Merger Sub”), and the transactions contemplated thereby, pursuant to which, among other transactions, the following transactions will occur: (i) Merger Sub will merge with and into GX, with GX surviving the merger (the “First Merger”); (ii) all Class A shares in GX (the “GX Class A Shares”) that are held by stockholders (the “GX Public Stockholders”) who have not elected to exercise their redemption rights in connection with the Transactions (as defined below) shall be converted into shares of Class A common stock in GX (such shares, the “First Merger Class A Shares”), as the surviving company in the First Merger; (iii) NioCorp will purchase all First Merger Class A Shares in exchange for common shares of NioCorp (“NioCorp Common Shares”) (the “Exchange”); (iv) NioCorp will assume the GX Warrant Agreement and each GX Warrant (each as defined below) that was issued and outstanding immediately prior to the effective time of the Exchange will be converted into a warrant to acquire NioCorp Common Shares (a “NioCorp Assumed Warrant”); (v) all of the First Merger Class A Shares will be contributed by NioCorp to 0896800 B.C. Ltd., a company organized under the laws of the Province of British Columbia and a direct, wholly owned subsidiary of NioCorp (“Intermediate Holdco”), in exchange for additional shares of Intermediate Holdco, resulting in GX becoming a direct subsidiary of Intermediate Holdco; (vi) Elk Creek Resources Corp., a Nebraska corporation and a direct, wholly owned subsidiary of Intermediate Holdco (“ECRC”), will merge with and into GX, with GX surviving the merger as a direct subsidiary of Intermediate Holdco (the “Second Merger”); and (vii) following the effective time of the Second Merger, each of NioCorp and GX, as the surviving company of the Second Merger, will effectuate the applicable reverse stock split. We refer to the transactions contemplated by the Business Combination Agreement collectively as the “Transactions”.

• Proposal No. 2 — The “Charter Amendment Proposal” — to consider and vote upon a proposal to approve the amendment to the current Amended and Restated Certificate of Incorporation of GX (the “GX Existing Charter”), as of immediately prior to the effective time of the First Merger, to remove the automatic conversion of GX Founder Shares into GX Class A Shares (such amendment, the “GX Charter Amendment”). A copy of the GX Charter Amendment is attached to the accompanying joint proxy statement/prospectus as Annex C.

• Proposal No. 3 through No. 9 — The “Charter Proposal” —

• to consider and vote upon seven separate non-binding, advisory proposals to approve the following material differences in the proposed updated Amended and Restated Certificate of Incorporation of GX (the “GX Proposed Charter”) that will replace the GX Existing Charter, as amended by the GX Charter Amendment, as of the Closing. A copy of the GX Proposed Charter is attached to the accompanying joint proxy statement/prospectus as Annex D;

• a non-binding, advisory proposal to increase the number of authorized shares of GX Class A Shares and GX Founder Shares (Proposal No. 3);

• a non-binding, advisory proposal to increase the number of authorized shares of preferred stock of GX (Proposal No. 4);

• a non-binding, advisory proposal to declassify the board of directors from three classes to one class (Proposal No. 5);

• a non-binding, advisory proposal to provide for the election or removal of directors only upon the vote of holders of GX Class A Shares (Proposal No. 6);

• a non-binding, advisory proposal to require the affirmative vote, approval or consent of the holders of a majority of the GX Founder Shares then held by Exchanging Shareholders (as defined in the Exchange Agreement), voting as a separate class, to amend, alter, change or repeal any provision of the GX Proposed Charter which affects the rights, preferences and privileges of the holders of GX Founder Shares in any material respect (Proposal No. 7);

• a non-binding, advisory proposal to eliminate certain provisions related to the consummation of an initial business combination that will no longer be relevant following the Closing (such as Article IX, which sets forth various provisions related to our operations as a blank check company prior to the consummation of an initial business combination, including with respect to redemptions and the trust account (the “Trust Account”)) (Proposal No. 8); and

• a non-binding, advisory proposal, conditioned upon the approval of Proposals No. 3 through No. 8, to approve the GX Proposed Charter as a whole, which includes the approval of all other changes in the GX Proposed Charter that will replace the GX Existing Charter, as amended by the GX Charter Amendment, as of the Closing (Proposal No. 9 and together with Proposals No. 3 through No. 8, the “Charter Proposal”).

• The non-binding, advisory proposals in GX Proposals No. 3 through No. 9 will not apply to the existing holders of GX Class A Shares because they will not continue to be direct stockholders of GX, as GX will be a subsidiary of NioCorp following the consummation of the Transactions.

• Proposal No. 10 — The “Adjournment Proposal” — to consider and vote upon a proposal to adjourn the GX Stockholder Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the GX Stockholder Meeting, there are not sufficient votes to approve one or more proposals presented to stockholders for a vote.

Only holders of record of GX Class A Shares and GX Founder Shares at the close of business on January 24, 2023 are entitled to notice of the GX Stockholder Meeting and to vote at the GX Stockholder Meeting and any adjournments or postponements of the GX Stockholder Meeting. A complete list of GX’s stockholders of record entitled to vote at the GX Stockholder Meeting will be available for ten days before the GX Stockholder Meeting at GX’s principal executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the GX Stockholder Meeting.

Pursuant to the GX Existing Charter, we are providing the holders of GX Class A Shares originally sold as part of the GX Public Units issued in our initial public offering (the “IPO” and such holders, the “GX Public Stockholders”) with the opportunity to redeem, upon the closing of the Transactions (the “Closing”), GX Class A Shares then held by them for cash equal to their pro rata share of the aggregate amount on deposit (as of two business days prior to the Closing) in the Trust Account that holds the proceeds (including interest not previously released to GX to pay its taxes) from the IPO and a concurrent private placement of warrants to GX Sponsor II LLC (the “Sponsor”). For illustrative purposes, based on the fair value of cash and marketable securities held in the Trust Account as of February 6, 2023 of approximately $304,391,927, the estimated per share redemption price would have been approximately $10.14. GX Public Stockholders may elect to redeem their shares whether or not they are holders as of the record date and whether or not they vote “FOR” the Business Combination Proposal. Notwithstanding the foregoing redemption rights, a GX Public Stockholder, together with any of his, her or its affiliates or any other person with whom he, she or it is acting in concert or as a “group” (as defined under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended), will be restricted from redeeming in the aggregate his, her or its shares or, if part of such a group, the group’s shares, in excess of 15% of the outstanding GX Class A Shares sold in the IPO. Holders of outstanding GX Warrants sold in the IPO, which are exercisable for GX Class A Shares under certain circumstances, do not have redemption rights in connection with the Transactions. GX’s Sponsor, officers and directors have agreed to waive their redemption rights in connection with the consummation of the Transactions with respect to any GX Founder Shares they hold and any GX Class A Shares they may have acquired during or after the IPO. GX Founder Shares will be excluded from the pro rata calculation used to determine the per share redemption price. Currently, GX’s Sponsor, officers and directors own approximately 20.0% of the outstanding issued and outstanding shares of GX Common Stock, including all of the GX Founder Shares. GX’s Sponsor, officers and directors have, for no additional consideration, agreed to vote any GX Class A Shares and GX Founder Shares owned by them in favor of the Transactions.

We may not consummate the Transactions unless each of the Business Combination Proposal, the Charter Amendment Proposal and the Charter Proposal is approved at the GX Stockholder Meeting. Each GX Proposal other than the Adjournment Proposal is conditioned on the approval of each other GX Proposal other than the Adjournment Proposal. The Adjournment Proposal is not conditioned on the approval of any other GX Proposal set forth in the accompanying joint proxy statement/prospectus.

The Board of Directors of GX has unanimously approved the Business Combination Agreement and the Transactions and recommends that you vote “FOR” the Business Combination Proposal, “FOR” the Charter Amendment Proposal, “FOR” the Charter Proposal and “FOR” the Adjournment Proposal.

Your attention is directed to the joint proxy statement/prospectus accompanying this notice (including the financial statements and annexes attached thereto) for a more complete description of the proposed Transactions and each of the proposals. You are encouraged to read this joint proxy statement/prospectus carefully. If you have any questions or need assistance voting your shares, please call GX’s proxy solicitor, Morrow Sodali LLC, at (800) 662-5200; banks and brokers can call collect at (203) 658-9400.

| By Order of the Board of Directors, | |

February 8, 2023 |

| |

| Jay R. Bloom | |

Co-Chairman and Chief Executive Officer |

Page | ||

1 | ||

6 | ||

7 | ||

8 | ||

9 | ||

19 | ||

24 | ||

32 | ||

52 | ||

54 | ||

55 | ||

58 | ||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 88 | |

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 97 | |

103 | ||

105 | ||

112 | ||

NIOCORP PROPOSAL NO. 2 — THE YORKVILLE EQUITY FACILITY FINANCING PROPOSAL | 115 | |

NIOCORP PROPOSAL NO. 3 — THE YORKVILLE CONVERTIBLE DEBT FINANCING | 120 | |

125 | ||

127 | ||

128 | ||

135 | ||

141 | ||

142 | ||

147 | ||

148 | ||

184 | ||

193 | ||

196 | ||

210 | ||

221 | ||

229 | ||

233 | ||

GX’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 240 | |

245 | ||

248 | ||

256 | ||

260 | ||

262 | ||

SECURITY OWNERSHIP OF CERTAIN GX BENEFICIAL OWNERS AND MANAGEMENT | 279 | |

SECURITY OWNERSHIP OF CERTAIN NIOCORP BENEFICIAL OWNERS AND MANAGEMENT | 283 | |

285 | ||

286 | ||

286 | ||

287 |

i

Page | ||

A-1 | ||

B-1 | ||

C-1 | ||

D-1 | ||

E-1 | ||

F-1 | ||

G-1 | ||

H-1 | ||

I-1 | ||

J-1 | ||

Annex K: NioCorp Developments Ltd. Proxy Card | K-1 | |

Annex L: GX Acquisition Corp. II Proxy Card | L-1 |

ii

“Ancillary Agreements” means, collectively, the Registration Rights and Lock-Up Agreement, the Exchange Agreement, the GX Support Agreement, the NioCorp Support Agreement and the Key Employee Agreements and each other schedule, instrument or certificate contemplated by the Business Combination Agreement or by any of the foregoing.

“BCBCA” means the Business Corporations Act (British Columbia).

“Business Combination Agreement” means the Business Combination Agreement, dated September 25, 2022, by and among GX, NioCorp and Merger Sub, as may be amended from time to time.

“Cash Transaction Expenses” means the sum of (a) GX’s unpaid transaction expenses accruing at or prior to the Closing and (b) NioCorp’s unpaid transaction expenses accruing at or prior to the Closing.

“Closing” means the closing of the Transactions.

“Closing Cash Minimum” means $15,000,000 less the amount, if any, by which the Cash Transaction Expenses are, in the aggregate, reduced to less than $15,000,000, as a direct result of Sponsor’s forfeiture or transfer of GX Common Shares in exchange for reducing the cash amounts that would otherwise be payable to a third party with respect to Cash Transaction Expenses.

“Code” means the Internal Revenue Code of 1986, as amended, and the rules and regulations issued thereunder.

“Combined Company” means NioCorp following the completion of the Transactions.

“Company Operating Cash” means cash raised by NioCorp after the signing of the Business Combination Agreement for the sole purpose of funding cash expenses of NioCorp and its subsidiaries in transactions agreed to in writing by GX (such consent not to be unreasonably withheld, conditioned or delayed), up to a cap in the amount to be mutually agreed between GX and NioCorp following the signing of the Business Combination Agreement, taking into account the reasonable operating cash needs of NioCorp (such cap, the “Company Operation Cash Cap”).

“Contribution” means the contribution by NioCorp, immediately following the Exchange Time, of all of the First Merger Class A Shares to Intermediate Holdco in exchange for additional shares in Intermediate Holdco (such time, the “Contribution Time”).

“DGCL” means the Delaware General Corporation Law.

“ECRC” means Elk Creek Resources Corp., a private Nebraska corporation and a direct wholly owned subsidiary of Intermediate Holdco.

“Equity Facility” means the standby equity purchase facility pursuant to which NioCorp will have the right, but not the obligation, subject to the conditions set out therein, to sell NioCorp Common Shares to Yorkville with a maximum aggregate value of $65,000,000.

“Exchange” means the purchase by NioCorp, immediately following the First Merger Effective Time, of all First Merger Class A Shares not held by NioCorp from the holder thereof in exchange for 11.1829212 NioCorp Common Shares per share, as described in the Business Combination Agreement (such time, the “Exchange Time”).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange Agent” means the exchange agent under the Exchange Agreement, such agent to be agreed upon by GX and NioCorp prior to the Closing.

“Exchange Agreement” means the exchange agreement to be entered into by and among NioCorp, GX and Sponsor at the Closing.

“Exchange Ratio” means 11.1829212.

1

“First Merger” means the merger of Merger Sub with and into GX, with GX surviving the First Merger as the “First Merger Surviving Company.”

“First Merger Class A Shares” means the issued and outstanding GX Class A Shares that are not Redemption Shares.

“First Merger Effective Time” means the date and time of the filing of the certificate of merger for the First Merger pursuant to Section 252(c) of the DGCL with the Secretary of State of Delaware, or such later time as is specified in such filing.

“GAAP” means the United States generally accepted accounting principles, consistently applied.

“GX” means GX Acquisition Corp. II, a Delaware corporation.

“GX Board” means the Board of Directors of GX.

“GX Bylaws” means the bylaws of GX.

“GX Class A Shares” means the Class A shares of GX.

“GX Common Stock” means, collectively, the GX Class A Shares and the GX Founder Shares.

“GX Existing Charter” means the current Amended and Restated Certificate of Incorporation of GX.

“GX Founder Shares” means the Class B shares of GX, all of which are held by Sponsor.

“GX Founder Warrants” means the share purchase warrants issued to Sponsor at the closing of the IPO.

“GX Proposals” means the special resolution of GX Stockholders to approve (i) the Transactions, (ii) the GX Charter Amendment, the material differences in the GX Proposed Charter, and the GX Proposed Charter as a whole, which includes the approval of all other changes in the GX Proposed Charter that will replace the GX Existing Charter, as amended by the GX Charter Amendment, as of the Closing, and (iii) a proposal to adjourn the GX Stockholder Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the GX Stockholder Meeting, there are not sufficient votes to approve one or more proposals presented to stockholders for a vote.

“GX Proposed Charter” means the proposed amendment to the Amended and Restated Certificate of Incorporation of GX.

“GX Public Stockholders” means GX Stockholders who hold GX Class A Shares.

“GX Public Units” means the units of GX issued pursuant to the IPO comprised of (a) one GX Class A Share and (b) one-third of a GX Public Warrant.

“GX Public Warrants” means the share purchase warrants of GX entitling the holder thereof to purchase one GX Class A Share included as a component of the GX Public Units.

“GX Securityholders” means the stockholders of GX and the holders of GX Warrants.

“GX Stockholder Meeting” means the special meeting of GX Stockholders, including any adjournment or postponement of such special meeting in accordance with the terms of the Business Combination Agreement, to be called for the purpose of considering and, if thought fit, approving the GX Proposals.

“GX Stockholders” means the stockholders of GX.

“GX Support Agreement” means the Sponsor Support Agreement, dated as of September 25, 2022, by and among Sponsor, in its capacity as a stockholder of GX, GX, NioCorp and the other parties thereto, pursuant to which Sponsor and certain other GX Stockholders agreed, among other things, to vote in favor of each of the GX Proposals.

“GX Warrant Agreement” means the Warrant Agreement, dated March 17, 2021, between GX and Continental Stock Transfer & Trust Company.

2

“GX Warrants” means the GX Public Warrants and the GX Founder Warrants.

“Intermediate Holdco” means 0896800 B.C. Ltd., a company organized under the laws of the Province of British Columbia and a direct wholly owned subsidiary of NioCorp.

“IRS” means the U.S. Internal Revenue Service.

“Key Employee Agreements” means the employment agreements entered into between NioCorp and certain key employees of NioCorp, the effectiveness of which is conditioned on the occurrence of the Closing.

“Merger Sub” means Big Red Merger Sub Ltd, a Delaware corporation and a direct wholly owned subsidiary of NioCorp.

“Mergers” means, collectively, the First Merger and the Second Merger.

“Nasdaq” means the Nasdaq Stock Market LLC.

“NI 43-101” means National Instrument 43-101 — “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators.

“NioCorp” means NioCorp Developments Ltd., a company incorporated under the laws of the Province of British Columbia.

“NioCorp Amended Articles” means the articles of NioCorp, as amended by the amendment attached hereto as Annex B.

“NioCorp Articles” means NioCorp’s articles, as amended, effective as of January 27, 2015.

“NioCorp Assumed Warrants” means the NioCorp Common Share purchase warrants to be issued by NioCorp at the time of the Exchange as a result of the conversion of GX Warrants that are issued and outstanding immediately prior to the Exchange into warrants to acquire NioCorp Common Shares, with each NioCorp Assumed Warrant to be exercisable for a number of NioCorp Common Shares equal to the number of shares of GX Common Stock subject to the applicable GX Warrant multiplied by 11.1829212.

“NioCorp Board” means the Board of Directors of NioCorp.

“NioCorp Common Shares” means the common shares of NioCorp, no par value.

“NioCorp Convertible Debentures” means the unsecured convertible debentures of NioCorp convertible into NioCorp Common Shares to be issued by NioCorp to Yorkville pursuant to the Yorkville Convertible Debt Financing.

“NioCorp Financing Warrants” means the NioCorp Common Share purchase warrants to be issued by NioCorp to Yorkville pursuant to the Yorkville Convertible Debt Financing.

“NioCorp Notice of Articles” means NioCorp’s notice of articles, dated April 5, 2016.

“NioCorp Proposals” means the resolutions of NioCorp Shareholders to approve (i) the Share Issuance Proposal, (ii) the Yorkville Equity Facility Financing Proposal, (iii) the Yorkville Convertible Debt Financing Proposal, (iv) the Quorum Amendment Proposal and (v) the Adjournment Proposal.

“NioCorp Shareholder Meeting” means the special meeting of NioCorp, including any adjournment or postponement of such meeting, to be called for the purpose of considering and, if thought fit, approving the NioCorp Proposals.

“NioCorp Shareholders” means the shareholders of NioCorp.

“NioCorp Support Agreement” means the Company Support Agreement, dated as of September 25, 2022, by and among GX, NioCorp and the NioCorp Shareholders party thereto, pursuant to which such NioCorp Shareholders agreed, among other things, to vote in favor of each of the NioCorp Proposals.

3

“Quorum Amendment Proposal” means the resolution of NioCorp Shareholders to approve, with or without amendment, an amendment to the NioCorp Articles to require the presence, in person or by proxy, of two or more shareholders representing at least 33 1/3% of the outstanding shares entitled to be voted in order to constitute a quorum at any meeting of NioCorp Shareholders.

“Redemption Shares” means the GX Class A Shares held by GX Public Stockholders that are redeemed and cancelled in accordance with the GX Existing Charter.

“Registration Rights and Lock-Up Agreement” means the registration rights and lock-up agreement to be entered into at the Closing by and among NioCorp, certain NioCorp Shareholders, GX, the Sponsor, certain GX Stockholders and the other parties thereto, providing for, among other things, certain registration rights and transfer restrictions contained therein.

“S-K 1300” means Subpart 1300 of Regulation S-K of the Securities Act.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Merger” means the merger of ECRC with and into the First Merger Surviving Company, with the First Merger Surviving Company surviving the Second Merger as the “Second Merger Surviving Company.”

“Second Merger Effective Time” means the date and time of the filing of the certificate of merger for the Second Merger pursuant to Section 252(c) of the DGCL with the Secretary of State of Delaware, or such later time as is specified in such filing.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Share Issuance Proposal” means the resolution of NioCorp Shareholders to approve the issuance of NioCorp Common Shares issuable (a) pursuant to the Exchange, (b) upon the exchange of the Second Merger Class B Shares and (c) upon the exercise of the NioCorp Assumed Warrants.

“Sponsor” means GX Sponsor II LLC.

“Transactions” means the transactions contemplated by the Business Combination Agreement and the Ancillary Agreements.

“TSX” means the Toronto Stock Exchange.

“Yorkville” means, collectively, YA II PN, Ltd. and Yorkville Advisors Global, LP.

“Yorkville Convertible Debt Financing” means the issuance of $16,000,000 aggregate principal amount of NioCorp Convertible Debentures and NioCorp Financing Warrants to Yorkville pursuant to the Yorkville Convertible Debt Financing Agreement.

“Yorkville Convertible Debt Financing Agreement” means the Securities Purchase Agreement, dated January 26, 2023, between NioCorp and Yorkville, as may be amended from time to time.

“Yorkville Convertible Debt Financing Proposal” means the resolution of NioCorp Shareholders to approve the issuance of all of the NioCorp Convertible Debentures that may be issuable, all of the NioCorp Financing Warrants that may be issuable, and all of the NioCorp Common Shares that may be issuable upon conversion of the principal amount of, and any and all accrued interest on, the NioCorp Convertible Debentures at the Conversion Price (as defined herein) and upon exercise of the NioCorp Financing Warrants, in each case, in connection with the transactions contemplated by the Yorkville Convertible Debt Financing Agreement.

“Yorkville Equity Facility Financing” means the issuance of NioCorp Common Shares to Yorkville under the Equity Facility pursuant to the Yorkville Equity Facility Financing Agreement.

“Yorkville Equity Facility Financing Agreement” means the Standby Equity Purchase Agreement, dated January 26, 2023, by and between NioCorp and Yorkville, as may be amended from time to time.

4

“Yorkville Equity Facility Financing Proposal” means the resolution of NioCorp Shareholders to approve the issuance of all of the NioCorp Commons Shares that may be issuable upon a sale at the Purchase Price (as defined herein), and all of the Commitment Shares to be issued, in each case, in connection with the transactions contemplated by the Yorkville Equity Facility Financing Agreement.

“Yorkville Financing Agreements” means the Yorkville Convertible Debt Financing Agreement and the Yorkville Equity Facility Financing Agreement.

“Yorkville Financings” means the Yorkville Convertible Debt Financing and the Yorkville Equity Facility Financing.

5

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This joint proxy statement/prospectus, which forms part of a registration statement on Form S-4 (File No. 333-268227) filed with the SEC by NioCorp, constitutes a prospectus of NioCorp under Section 5 of the Securities Act with respect to the NioCorp Common Shares and NioCorp Assumed Warrants issuable to GX Securityholders pursuant to the Business Combination Agreement. This joint proxy statement/prospectus also constitutes (i) a notice of meeting and management information and proxy circular of NioCorp under Section 14(a) of the Exchange Act and under the BCBCA with respect to the NioCorp Shareholder Meeting, at which meeting NioCorp Shareholders will be asked to consider and vote on the NioCorp Proposals and (ii) a notice of meeting and a proxy statement of GX under Section 14(a) of the Exchange Act with respect to the GX Stockholder Meeting, at which meeting GX Stockholders will be asked to consider and vote on the GX Proposals.

You should rely only on the information contained in, or incorporated by reference into, this joint proxy statement/prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this joint proxy statement/prospectus. This joint proxy statement/prospectus is dated February 8, 2023. The information contained in this joint proxy statement/prospectus is accurate only as of that date or, in the case of information in a document incorporated by reference, as of the date of such document, unless the information specifically indicates that another date applies. Neither the mailing of this joint proxy statement/prospectus to GX Stockholders nor the issuance by NioCorp of NioCorp Common Shares or NioCorp Assumed Warrants pursuant to the Business Combination Agreement will create any implication to the contrary.

This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which it is unlawful to make any such offer or solicitation in such jurisdiction.

The information concerning NioCorp contained in, or incorporated by reference into, this joint proxy statement/prospectus has been provided by NioCorp, and the information concerning GX contained in, or incorporated by reference into, this joint proxy statement/prospectus has been provided by GX.

6

PRESENTATION OF FINANCIAL INFORMATION

The financial statements of each of NioCorp and GX included elsewhere or incorporated by reference in this joint proxy statement/prospectus have been prepared in accordance with GAAP. Unless otherwise specified, amounts in this joint proxy statement/prospectus are presented in United States (“U.S.”) dollars. Some of NioCorp’s material agreements use Canadian dollars and NioCorp Common Shares, as traded on the TSX, are traded in Canadian dollars. As used herein, “CAD$” represents Canadian dollars.

On October 31, 2022, NioCorp filed Amendment No. 1 on Form 10-K/A to the Annual Report on Form 10-K for the fiscal year ended June 30, 2022 (as amended, the “NioCorp Form 10-K”) to restate certain information in NioCorp’s previously issued consolidated financial statements as of and for the fiscal years ended June 30, 2022 and 2021 and the interim periods ended September 30, 2021, December 31, 2021 and March 31, 2022 (collectively, the “Affected Periods”). Any references in this joint proxy statement/prospectus to NioCorp’s consolidated financial statements for any of the Affected Periods refer to such consolidated financial statements as so restated, which restated consolidated financial statements are incorporated by reference into this joint proxy statement/prospectus. See “Where You Can Find Additional Information.”

7

MINERAL RESERVES AND RESOURCES

Unless otherwise indicated, information concerning NioCorp’s mining property included or incorporated by reference into this joint proxy statement/prospectus, including mineral resource and reserve estimates, has been prepared in accordance with the requirements of National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining and Metallurgy (“CIM”) “Definition Standards — For Mineral Resources and Mineral Reserves, May 10, 2014” (the “CIM Definition Standards”). Beginning with the NioCorp Form 10-K, NioCorp’s mining property disclosures included or incorporated by reference in its SEC filings, including mineral resource and reserve estimates, are required to be prepared in accordance with the requirements of subpart 1300 of Regulation S-K (“S-K 1300”). Previously, NioCorp prepared its estimates of mineral resources and mineral reserves following only NI 43-101 and the CIM Definition Standards. On June 28, 2022, NioCorp issued a CIM-compliant NI 43-101 technical report (the “2022 NI 43-101 Elk Creek Technical Report”) for the Elk Creek Project, which is available through the website maintained by the Canadian Securities Administrators at www.sedar.com. On September 6, 2022, NioCorp filed a technical report summary for the Elk Creek Project that conforms to S-K 1300 reporting standards (the “S-K 1300 Elk Creek Technical Report Summary”) as Exhibit 96.1 to the NioCorp Form 10-K, which is available through the website maintained by the SEC at www.sec.gov. The 2022 NI 43-101 Elk Creek Technical Report and S-K 1300 Elk Creek Technical Report Summary are based on a feasibility study (the “June 2022 Feasibility Study”) prepared by qualified persons (within the meaning of both NI 43-101 and S-K 1300, as applicable) and are substantively identical to one another except for internal references to the regulations under which the report is made, and certain organizational differences. The requirements and standards under Canadian securities laws, however, differ from those under S-K 1300. The terms “mineral resource,” “inferred mineral resource,” “indicated mineral resource,” “mineral reserve,” “probable mineral reserve,” and “proven mineral reserve” included or incorporated by reference herein are used as defined in accordance with NI 43-101 under the CIM Definition Standards. While the terms are substantially similar to the same terms defined under S-K 1300, there are differences in the definitions. Accordingly, there is no assurance any mineral resource or mineral reserve estimates that NioCorp may report under NI 43-101 will be the same as the mineral resource or mineral reserve estimates that NioCorp may report under S-K 1300.

NioCorp discloses estimates of both its mineral resources and mineral reserves. You are cautioned that mineral resources are subject to further exploration and development and are subject to additional risks and no assurance can be given that they will eventually convert to future reserves. Under both regimes, inferred resources, in particular, have a great amount of uncertainty as to their existence and their economic and legal feasibility. Investors are cautioned not to assume that any part or all of the inferred resource exists or is economically or legally mineable. See Item 1A, Risk Factors in the NioCorp Form 10-K. Reference should be made to the full text of the 2022 NI 43-101 Elk Creek Technical Report and the S-K 1300 Elk Creek Technical Report Summary for further information regarding the assumptions, qualifications and procedures relating to the estimates of mineral reserves and mineral resources as defined under NI 43-101 and S-K 1300, respectively.

8

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

The following questions and answers are intended to address briefly some commonly asked questions regarding the Transactions. These questions and answers may not address all questions that may be important to you. To better understand these matters, and for a description of the legal terms governing the Transactions, you should carefully read this entire joint proxy statement/prospectus, including the attached annexes, as well as the documents that have been incorporated by reference into this joint proxy statement/prospectus. See the section entitled “Where You Can Find Additional Information” of this joint proxy statement/prospectus.

Q: Why am I receiving this joint proxy statement/prospectus?

A: On September 25, 2022, NioCorp, GX and Merger Sub entered into the Business Combination Agreement. Pursuant to the Business Combination Agreement, among other transactions, the following transactions will occur: (i) Merger Sub will merge with and into GX, with GX surviving the merger, referred to as the First Merger; (ii) all GX Class A Shares that are held by GX Public Stockholders who have not elected to exercise their redemption rights in connection with the Transactions shall be converted into First Merger Class A Shares in GX, as the surviving company in the First Merger; (iii) NioCorp will purchase all First Merger Class A Shares in exchange for NioCorp Common Shares, referred to as the Exchange; (iv) NioCorp will assume the GX Warrant Agreement and each GX Warrant that was issued and outstanding immediately prior to the effective time of the Exchange will be converted into a NioCorp Assumed Warrant; (v) all of the First Merger Class A Shares will be contributed by NioCorp to Intermediate Holdco in exchange for additional shares of Intermediate Holdco, resulting in GX becoming a direct subsidiary of Intermediate Holdco; (vi) ECRC will merge with and into GX, with GX surviving the merger as a direct subsidiary of Intermediate Holdco, referred to as the Second Merger; and (vii) following the effective time of the Second Merger, each of NioCorp and GX, as the surviving company of the Second Merger, will effectuate the applicable reverse stock split. As a result of the Transactions, GX will become a subsidiary of NioCorp. In addition, pursuant to the Business Combination Agreement, the parties will enter into the Exchange Agreement, under which holders of 48,645,707 Second Merger Class B Shares (the “Vested Shares”) are entitled to exchange any or all of the Vested Shares for NioCorp Common Shares on a one-for-one basis, subject to certain equitable adjustments, in accordance with the terms of the Exchange Agreement, which are further described in Note 4 of the Notes to the Unaudited Pro Forma Condensed Combined Financial Information included elsewhere in this joint proxy statement/prospectus.

In order to complete the Transactions, NioCorp Shareholders must approve the Share Issuance Proposal and the Quorum Amendment Proposal and GX Stockholders must approve the Business Combination Proposal, the Charter Amendment Proposal and the Charter Proposal, and all other conditions to the Transactions must be satisfied or waived.

NioCorp will hold the NioCorp Shareholder Meeting and GX will hold the GX Stockholder Meeting to obtain these approvals and vote on other matters. You are receiving this joint proxy statement/prospectus in connection with the separate solicitations by (i) the NioCorp Board of proxies of NioCorp Shareholders in favor of the NioCorp Proposals and (ii) the GX Board of proxies of GX Stockholders in favor of the GX Proposals.

This joint proxy statement/prospectus constitutes a prospectus of NioCorp with respect to the NioCorp Common Shares and NioCorp Assumed Warrants issuable to GX Stockholders and GX warrant holders pursuant to the Business Combination Agreement. This joint proxy statement/prospectus also constitutes (i) a notice of meeting and management information and proxy circular of NioCorp with respect to the NioCorp Shareholder Meeting and (ii) a notice of meeting and a proxy statement of GX with respect to the GX Stockholder Meeting.

Your vote is very important. We encourage you to submit a proxy to have your NioCorp Common Shares or GX Common Stock voted as soon as possible.

Q: What will GX Securityholders receive if the Transactions are completed?

A: Pursuant to the Business Combination Agreement, upon consummation of the First Merger, each GX Class A Share that is held by a GX Public Stockholder shall be converted into a First Merger Class A Share. In connection with the Exchange, NioCorp will exercise its unilateral option to purchase each First Merger

9

Class A Share in exchange for 11.1829212 NioCorp Common Shares. As a result, each GX Public Stockholder who does not elect to exercise their redemption rights in connection with the Transactions will ultimately be issued NioCorp Common Shares.

Pursuant to the Business Combination Agreement, upon consummation of the First Merger, each Class B share in GX (other than certain shares that may be forfeited in accordance with the GX Support Agreement) will be converted into one First Merger Class B Share of GX, as the surviving company in the First Merger. Upon consummation of the Second Merger, each First Merger Class B Share shall be converted into 11.1829212 Second Merger Class B Shares of GX, as the surviving company in the Second Merger. Each Second Merger Class B Share will be exchangeable into NioCorp Common Shares on a one-for-one basis, subject to certain equitable adjustments, in accordance with the terms of the Exchange Agreement as further discussed in Note 4 of the Notes to the Unaudited Pro Forma Condensed Combined Financial Information.

Pursuant to the Business Combination Agreement, in connection with the First Merger and the assumption by NioCorp of the GX Warrant Agreement, each GX Warrant that is issued and outstanding immediately prior to the Exchange Time shall be converted into one NioCorp Assumed Warrant pursuant to the GX Warrant Agreement. Each NioCorp Assumed Warrant shall be exercisable solely for NioCorp Common Shares, and the number of NioCorp Common Shares subject to each NioCorp Assumed Warrant shall be equal to the number of shares of GX Common Stock subject to the applicable GX Warrant multiplied by 11.1829212, with the applicable exercise price to be adjusted accordingly.

Following the effective time of the Second Merger, NioCorp will effectuate a reverse stock split of the issued NioCorp Common Shares and GX will effectuate a reverse stock split of the Second Merger Class A Shares and Second Merger Class B Shares at a to-be-determined ratio.

Q: Will NioCorp issue fractional shares in the Transactions?

A: No fractional NioCorp Common Shares will be issued pursuant to the Transactions. To the extent that the Transactions would result in any GX Stockholder being issued a fractional share, such fraction will be rounded down to the nearest whole share.

Q: Do any of the directors or officers of NioCorp or GX have interests in the Transactions that may differ from or be in addition to my interests as a shareholder?

A: Except as disclosed in this joint proxy statement/prospectus, none of NioCorp’s directors or executive officers, nor any person who has held such a position since the beginning of NioCorp’s last completed financial year, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in the Transactions.

The GX Board and GX’s executive officers may have interests in the Business Combination that are different from, in addition to or in conflict with, yours. These interests include:

• the beneficial ownership of the Sponsor and certain of GX’s directors and officers of an aggregate of 7,500,000 GX Founder Shares and 5,666,667 GX Founder Warrants, which shares and warrants would become worthless if GX does not complete a business combination by March 22, 2023 or obtain the approval of GX Stockholders to extend the deadline for GX to consummate its initial business combination, as the Sponsor and GX’s officers and directors have waived any redemption right with respect to these shares. The Sponsor paid an aggregate of $25,000 for its GX Founder Shares, and $8,500,000 for its GX Founder Warrants, and such shares and warrants have an aggregate market value of approximately $75,525,000 and $2,720,000, respectively, based on the closing price of GX Class A Shares of $10.07 and of GX Public Warrants of $0.48 on Nasdaq on January 24, 2023, the record date for the GX Stockholder Meeting. Each of GX’s officers and directors is a member of the Sponsor. Cooper Road, LLC (an entity controlled by Jay R. Bloom) and Dean C. Kehler are the managing members of the Sponsor, and as such Messrs. Bloom and Kehler have voting and investment discretion with respect to the GX Common Stock and GX Warrants held of record by the Sponsor;

• the expected appointment of Messrs. Maselli and Kehler as directors of the Combined Company;

10

• the fact that four of GX’s directors, Jay R. Bloom, Dean C. Kehler, Hillel Weinberger and Marc Mazur, served as directors of GX Acquisition Corp., a special purpose acquisition company that consummated its initial business combination with Celularity Inc. (the “Celularity Business Combination”) in July 2021;

• the fact that GX’s Sponsor, officers and directors have agreed not to redeem any of their shares in connection with a stockholder vote to approve the Transactions;

• the fact that the Sponsor and GX’s directors and officers will receive material benefits from the completion of an initial business combination and may be incentivized to complete the Transactions with NioCorp rather than liquidate (in which case the Sponsor would lose its entire investment), even if NioCorp is a less favorable target company or the terms of the Transactions are less favorable to GX Stockholders than an alternative transaction;

• that, at the Closing, GX will enter into the Registration Rights and Lock-Up Agreement, which provides for registration rights to the Sponsor and its permitted transferees;

• the continued indemnification of current directors and officers of GX and the continuation of directors’ and officers’ liability insurance after the completion of the Transactions;

• the fact that the Sponsor (including its representatives and affiliates) and GX’s directors and officers, are, or may in the future become, affiliated with entities that are engaged in a similar business to GX. GX’s directors and officers also may become aware of business opportunities which may be appropriate for presentation to GX, and the other entities to which they owe certain fiduciary or contractual duties. Accordingly, they may have had conflicts of interest in determining to which entity a particular business opportunity should be presented. These conflicts may not be resolved in GX’s favor and such potential business opportunities may be presented to other entities prior to their presentation to GX, subject to applicable fiduciary duties under the General Corporation Law of the State of Delaware. The GX Existing Charter provides that GX renounces its interest in any corporate opportunity offered to any director or officer of GX unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of GX and such opportunity is one GX is legally and contractually permitted to undertake and such person is legally permitted to refer such opportunity to GX. GX is not aware of any such conflict or opportunity being presented to any founder, director or officer of GX nor does GX believe that the limitation of the application of the “corporate opportunity” doctrine in the GX Existing Charter had any impact on its search for a potential business combination;

• the fact that the Sponsor has invested an aggregate of $9,010,000 (consisting of $25,000 for the GX Founder Shares, $8,500,000 for the GX Founder Warrants, a $250,000 working capital loan and a second working capital loan for $235,000), which means the Sponsor, following the Transactions, may experience a positive rate of return on its investment, even if other GX Public Stockholders experience a negative rate of return on their investment;

• the fact that the Sponsor is not expected to recognize taxable gain with respect to its GX Founder Shares at closing because it is retaining such shares pursuant to the Transactions (and not engaging in any taxable disposition). Rather, it will benefit from deferring any taxable gain until it ultimately exchanges its GX Founder Shares for NioCorp Common Shares (or cash); by contrast, the GX Public Stockholders generally are expected to recognize gain or loss upon exchanging their GX securities for NioCorp securities pursuant to the Transactions;

• the fact that the Sponsor and GX’s officers and directors will be reimbursed for out-of-pocket expenses incurred in connection with activities on GX’s behalf, such as identifying potential target businesses and performing due diligence on suitable business combinations;

• the fact that as of September 30, 2022, $20,000 was accrued and payable to Trimaran Fund Management, LLC, an affiliate of the Sponsor for monthly fees, and an additional $20,000 will be due and payable, monthly, until the consummation of the Transactions; and

11

• the fact that the Sponsor and GX’s officers and directors will lose their entire investment in GX, a minimum of $9,010,000 in aggregate (consisting of $25,000 for 7,500,000 GX Founder Shares, $8,500,000 for the 5,666,667 GX Founder Warrants, the $250,000 amount outstanding under the working capital loan made by the Sponsor, the $235,000 amount outstanding under the second working capital loan made by the Sponsor, additional working capital loans made, out-of-pocket expenses to be repaid by GX and additional monthly fees due as noted above) if GX does not consummate an initial business combination by March 22, 2023 or, if approved by GX Stockholders, by the extended deadline for GX to consummate its initial business combination.

These interests may influence GX’s directors in making their recommendation that you vote in favor of the approval of the Transactions. GX’s directors were aware of and considered these interests, among other matters, in evaluating the Transactions, and in recommending to GX Stockholders that they approve the Transactions. GX Stockholders should take these interests into account in deciding whether to approve the Transactions.

Q: Is the obligation of each of NioCorp and GX to complete the Transactions subject to any conditions?

A: The consummation of the Transactions is subject to the satisfaction or waiver of certain customary closing conditions contained in the Business Combination Agreement, including, among other things, (i) obtaining required approvals of the Transactions and related matters by the respective shareholders of NioCorp and GX, (ii) the effectiveness of the registration statement of which this joint proxy statement/prospectus forms a part, (iii) receipt of approval for listing on Nasdaq of the NioCorp Common Shares to be issued in connection with the Transactions, (iv) receipt of approval for listing on Nasdaq of the NioCorp Assumed Warrants, (v) receipt of approval from the TSX with respect to the issuance and listing of the NioCorp Common Shares issuable in connection with the Transactions, (vi) that NioCorp and its subsidiaries (including GX, as the surviving company of the Second Merger) will have at least $5,000,001 of net tangible assets upon the consummation of the Transactions, after giving effect to any redemptions by GX Public Stockholders and after payment of underwriters’ fees or commissions, (vii) that, at Closing, NioCorp and its subsidiaries (including GX, as the surviving company of the Second Merger) will have received cash in an amount equal to or greater than $15,000,000, subject to certain adjustments (which amount may be satisfied with funds in the Trust Account or otherwise, as further described under “The Transactions — NioCorp’s Reasons for the Transactions and Recommendation of the NioCorp Board”) and (viii) the absence of any injunctions enjoining or prohibiting the consummation of the

Business Combination Agreement. Each of the foregoing conditions, in addition to the other customary conditions contained in the Business Combination Agreement, may be waived by the party or parties in whose favor such closing condition is made (to the extent permitted by applicable law), except that the first, second and eighth conditions listed above may not be waived pursuant to applicable law and the third and fourth conditions may not be waived without recirculation and resolicitation.

Q: How will NioCorp Shareholders be affected by the Transactions?

A: NioCorp Shareholders will not be issued any additional NioCorp Common Shares in connection with the Transactions. As a result of the Transactions, NioCorp Shareholders will own shares in a larger company with more assets. However, because NioCorp will be issuing additional NioCorp Common Shares to GX Stockholders in exchange for their GX Class A Shares in connection with the Transactions, each NioCorp Common Share outstanding immediately prior to the Transactions will represent a smaller percentage of the aggregate number of NioCorp Common Shares issued and outstanding after the Transactions.

In addition, if the Transactions are consummated, NioCorp will assume the GX Warrant Agreement. An aggregate value of the outstanding NioCorp Assumed Warrants of approximately $7,520,000 (based on the closing price of the GX Public Warrants of $0.48 on the Nasdaq Global Market as of January 24, 2023, the record date for the GX Stockholders Meeting) may be retained by the redeeming stockholders assuming maximum redemptions. Any exercise of NioCorp Assumed Warrants after the completion of the Transactions will also result in dilution to NioCorp Shareholders.

Further, the Yorkville Financings also may result in potential dilution to NioCorp Shareholders. See the section entitled “Yorkville Financings.”

12

Q: What happens if I sell or otherwise transfer my NioCorp Common Shares before the NioCorp Shareholder Meeting?

A: The record date for NioCorp Shareholders entitled to vote at the NioCorp Shareholder Meeting is February 1, 2023, which is earlier than the date of the NioCorp Shareholder Meeting. If you sell or otherwise transfer your shares after the record date but before the NioCorp Shareholder Meeting, unless special arrangements (such as provision of a proxy) are made between you and the person to whom you transfer your shares and each of you notifies NioCorp in writing of such special arrangements, you will retain your right to vote such shares at the NioCorp Shareholder Meeting but will otherwise transfer ownership of and the economic interest in your NioCorp Common Shares.

Q: Who will be the officers and directors of NioCorp if the Transactions are consummated?

A: Following the Closing, it is anticipated that current officers and directors of NioCorp will remain in such roles and that Messrs. Maselli and Kehler will be appointed to the NioCorp Board.

Q: If I sell my GX Class A Shares shortly before the completion of the Transactions, will I still be entitled to receive NioCorp Common Shares?

A: No. In order to receive the NioCorp Common Shares upon completion of the Transactions, you must hold your GX Class A Shares through the effective time of the Transactions.

Q: Do you expect the Transactions to be taxable to me?

A: The parties generally expect that a U.S. or Canadian holder of GX Class A Shares or GX Warrants will be subject to U.S. or Canadian federal income tax, respectively, with respect to any gain resulting from such holder’s exchange of GX Class A Shares or GX Warrants in the Transactions. For a more complete description of the tax consequences of the Transactions, please see the sections entitled “Material U.S. Federal Income Tax Considerations — Material U.S. Federal Income Tax Considerations With Respect to the Redemption and the Transactions” and “Material Canadian Federal Income Tax Considerations — Material Canadian Federal Income Tax Considerations for Existing Holders of GX Securities.”

Q: Are there risks associated with the Transactions?

A: Yes, there are important risks involved. Before making any decision on whether and how to vote, you are urged to read carefully and in its entirety, the section entitled “Risk Factors” beginning on page 58 of this joint proxy statement/prospectus and in any documents incorporated by reference into this joint proxy statement/prospectus.

Q: Have the directors of NioCorp and GX considered the fairness of the Transactions?