Filed by NioCorp Developments Ltd.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: GX Acquisition Corp II

Commission File No.: 001-40226

| https://www.nytimes.com/2023/02/02/climate/nebraska-mine-niobium-rare-earths.html

| https://www.nytimes.com/2023/02/02/climate/nebraska-mine-niobium-rare-earths.html

Nebraskans Are Sitting on Strategic Metals. Is Mining a Patriotic Duty?

One county has a wealth of minerals essential to defense and the green economy. Mining would transform the community, yet many say they feel a patriotic obligation to dig.

By Dionne Searcey Photographs by Arin Yoon

Feb. 2, 2023

ELK CREEK, Neb. — In this rural part of Nebraska, county-board agendas include moratoriums on solar farms and some residents scowl when they pass the handful of wind farms that have sprouted. But the idea of a new mine that could help power the transition to renewable energy has received broad support.

The tenor of these quiet flatlands, where deer bounce across gravel roads and neon sunsets scream across the long horizon, would change dramatically if mining for metals like niobium, scandium, titanium and rare earths begins.

But many people here think Southeast Nebraska, dotted with dying downtowns and aging residents, could play a small part in helping to solve a full-blown geopolitical crisis that Doc Evans, a Johnson County commissioner, summed up like this: “The trouble with China.”

Mr. Evans and numerous others welcome the digging that a company called NioCorp wants to begin because they feel it’s their patriotic duty. For too long, they said, the United States has depended on other countries for metals and minerals the nation could find at home, if only someone were willing to spend the money and effort to retrieve them.

“I think it’s good for our country,” said Don Othmer, who lives in Elk Creek, where the mine would be. Relying on other countries for raw materials means “we’re kind of held hostage,” he said.

Geological fate meted out hundreds of millions of years ago left the United States lacking rich stores of many of the raw materials found on the federal list of minerals critical to the economy and national security. The country has relied on imports of certain minerals and metals that are abundant in China and elsewhere and are needed for America’s fighter jets, building materials and cellphone batteries.

The United States is determined to no longer be dependent on other countries, particularly now as these materials, which are also used in making electric- vehicle batteries and for transmitting energy from wind turbines and solar panels to the power grid, are key ingredients for an economy that relies on renewables. Measures enacted under the Biden Administration offer major incentives to mining companies and processing facilities to do their work domestically.

But the biggest incentive is the market demand that has increased the price of metals including rare earths — a set of elements found together, with names like terbium and dysprosium — making it newly economical for mining companies to scour the nation for even small amounts that can be scraped from underneath the soil.

Downtown Tecumseh, Neb., one of the nearby towns that would feel ripple effects from a new mine.

Coffee at the Harvest Bowl, a cafe and bowling alley that’s a gathering place in Tecumseh.

A wind farm in Du Bois, Neb., roughly 20 miles south of Elk Creek.

NioCorp wants to bring in hundreds of workers and heavy drilling equipment to dig the metals. After decades of exploration and looking for financing, it soon may be able to get started, buoyed by new demand for a domestic supply of critical minerals and metals that can power America’s transition to renewable energy. And the company has embraced the messaging that plays well in this conservative area that counts patriotism as a key value.

“It will help America,” said Mark Smith, chief executive of NioCorp, which is based in Colorado.

The federal government is hoping to find new deposits of minerals and metals by carrying out projects to digitize information from 100-year-old geological maps and by flying survey planes all over the country. The government is also financing programs to comb through waste piles of old mines, including coal ash, for materials once deemed worthless. One program tests ways to sift minerals and metals from Superfund sites.

“Can the U.S. meet its own mineral supply needs? It’s a big, complicated question,” said Graham Lederer, researcher at the United States Geological Survey’s Geology, Energy & Minerals Science Center. “Anything could be a resource. You just need to develop the technology and bring the cost down.”

Just outside Elk Creek, pronounced by some locally as “Elk Crick,” workers from NioCorp are clearing trees to prep the land for digging, should it succeed in getting more financing. The company, now listed on the Toronto Stock Exchange, said it has lined up German buyers for some of its niobium.

Hundreds of people and a new governor-elect turned up for a series of town halls in November held by NioCorp. The meetings drew investors from Kansas City who snapped photos as they wandered Elk Creek’s tiny downtown past a bank, a post office, small grocery store and the Village Tavern, which is known for its signature drink, the Elk Creek Water (Mountain Dew, Squirt, 7 UP, vodka and gin) as well as an annual event where beef testicles are served (the “Nut Feed”).

“We’ve had a harder time keeping the younger generation here,” said Don Gottula, who owns a propane shop on Main Street. “We need a booster shot, I guess you could say.”

As the hunt for more materials used in batteries continues, energy officials predict more scenes across America like the one in Nebraska, a state with abundant cornfields and cattle but no operating mines. In Utah, a mine has begun producing tellurium. A new cobalt mine in Idaho is expected to be operational this year. New lithium mining is planned for North Carolina, and in California companies are trying out new technology to extract lithium from geothermal brines.

The world may need more than 300 new mines in the next decade to meet demand for electric-vehicle and energy-storage batteries, according to Benchmark Mineral Intelligence.

Don Gottula at his propane shop in Elk Creek. “We’ve had a harder time keeping the younger generation here,” he said.

Elk Creek’s tallest building, at the Midwest Farmers Co-Op. The mine would bring, among other things, a 10-story processing facility to the area.

Coffee at Harvest Bowl on a recent morning included conversation about the mine.

In Nebraska, metals that were a distant memory from high school chemistry class have become part of regular conversation. Like most people in the Elk Creek area, any of the dozen or so farmers who gather for morning coffee several days a week before the lanes light up at Harvest Bowl in nearby Tecumseh can speak fluently about niobium.

“Didn’t they put that in Superman’s underwear?” one joked on a recent morning.

Niobium might help batteries hold a charge longer, another said, and that’s a good thing out here where miles separate even gas stations. But did anyone ever consider what happens to the wind turbines and solar panels years from now when they no longer function?

“When they wear out there’s no place to go with them,” said Milton Buchholz, a retired farmer and former county roads department worker.

The conversation turned to the prairie fires and dust storms that swept across parts of Nebraska last summer. The crop-withering drought just won’t let up.

“I’m not convinced whether this is all man-made or God-made,” said Mr. Evans, the county commissioner who sat at a table near farmers in hats advertising pesticides and fertilizer and one that read “cow whisperer.”

“I know that we may be contributing but who did it 100,000 years ago when we had an Ice Age?” he added.

To build the mine here, workers would burrow nearly 2,500 feet into the earth, creating an underground mini city to operate machinery. Construction would take almost three years, requiring 400 workers and convoys of heavy trucks rumbling across the plains surrounding Elk Creek, population 98.

“If we want to give our kids a chance, we’ve got to use the resources we have,” said Harold Richardson, a farmer and retired teacher from Elk Creek.

China is the world’s main producer and processor of scandium and rare earths. America has only one rare earth mine, in Mountain Pass, Calif. It sends its ore to China for processing. (Mr. Smith of NioCorp is the former chief executive of MolyCorp, which used to own the Mountain Pass mine.)

Brazil is by far the world’s biggest producer of niobium, which is used to strengthen steel. China Molybdenum, a state-backed company, bought a key niobium mine in Brazil in 2016.

Mr. Honan, NioCorp’s chief operating officer, on Beverly Beethe’s farm. “The rocks are different here,” he said.

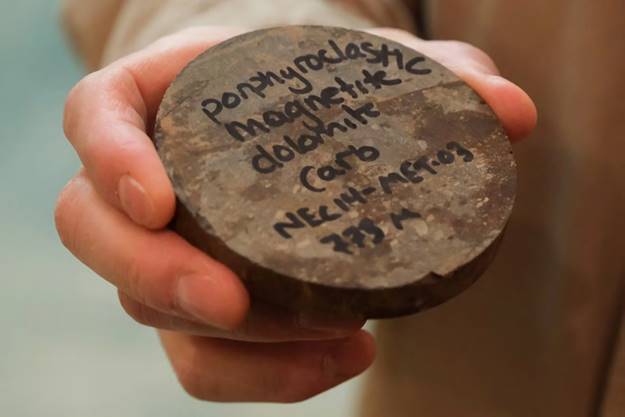

Mr. Honan held a core sample.

Core samples for testing were stacked in sheds on Ms. Beethe’s farm.

The importance of having a domestic stash of metals was highlighted in 2010 when China blocked exports of rare earths to Japan during a dispute over a fishing trawler incident, sending prices soaring. Since then, tensions between the United States and China only have escalated, prompting fears about politically and economically motivated supply-chain disruptions.

NioCorp executives say the amount of metals they could recover at Elk Creek would be scant compared to the Chinese supply; they are still determining whether they can economically retrieve the rare earths. The company plans to dig titanium, too (China, Japan and Russia are among the world’s biggest titanium producers), but niobium is the most abundant metal at the site, and if operations go forward, Elk Creek would be the only niobium mine in America.

Company executives say they expect demand for the metal to increase for use in new versions of lithium ion electric vehicle batteries under development.

NioCorp has obtained all the necessary permits to start digging. But if it digs the rare earths, NioCorp may need to look overseas for processing. A new processing facility that is in the works in Texas could take years to become operational.

“I’d really want to see these activities done in the United States or an allied country” such as Japan or Britain, said Mr. Smith of NioCorp.

New demand for greener sources of energy is fueling interest from Wall Street in the Elk Creek mine. But the messaging from NioCorp tends to focus on the metals’ traditional uses — in oil pipelines and guided missiles, residents said.

“NioCorp is being very thoughtful in how they’re communicating with Southeast Nebraskans,” said State Senator Julie Slama, who represents constituents in Johnson County, which has voted Republican in every presidential election since the 1960s. “In Nebraska, we have a sense of patriotism and desire to serve our country.”

People have been talking about a mine in Elk Creek since the early 1970s when, according to local lore, pilots reported their instruments went haywire while flying over southeast Nebraska. The real story: University researchers received a federal grant to fly over the state with instrumentation that identified changes in the earth’s magnetic field, indicating the possible presence of certain minerals and metals.

“The rocks are different here,” said Scott Honan, NioCorp’s chief operating officer.

Back then local workers were hired to carry out exploratory drilling, digging up hundreds of core samples, tubes of earth, for testing. Stacks of them are stored in metal sheds on Beverly Beethe’s farm, where the mine would be located. Residents signed land leases with the company, which eventually bought 226 acres. Some landowners netted lucrative deals and could receive royalty payouts of as much as $10 million a year.

Ms. Beethe said she and a few others wondered whether they’d received a fair deal.

Lavon Heidemann, a NioCorp spokesman, pointed out Ms. Beethe’s farm on a map at the town’s Frontier Cooperative.

Mr. Heidemann checked on feed prices at the Frontier Cooperative.

But the deals created bad blood. Some residents who were left out were miffed. Others like Ms. Beethe question whether they got a fair deal, especially in an area where the price of farmland has recently skyrocketed.

“The way I got treated, I hope that they don’t treat the community that way,” she said.

Many residents also are worried about damage from the toxic chemicals used in mining and processing.

They wonder about cancer cases near the mine site. Rare earth metals are found alongside radioactive elements. Mr. Smith said that at Elk Creek the amounts are so small they don’t require state licensing, but he said as a precaution NioCorp plans to seek licensing anyway and will carry out required monitoring.

Higher paying jobs would be welcome in the area, residents said, but still they wondered, how will the mine ever be able to find 400 workers? The nearby state prison has tried to fill vacancies by nearly doubling starting pay, to $28 an hour. Staff shortages are so severe at the local school district that the superintendent is pondering a four-day week for the next academic year. He already doubles as a bus driver because he can’t fill the job.

And what if the workers do come? “Where the hell are 400 more people going to eat in this town?” said Tim Weber, who opposes the mine.

Residents like Lavon Heidemann, a former lieutenant governor from Elk Creek, have benefited from the mine already. He was paid to help drill exploratory hole No. 7 back in the 1970s and now works as a local representative for NioCorp, fielding questions from his neighbors.

Mr. Heidemann sometimes stares out from his hilltop farm at the blinking lights on the wind turbines several miles away. They bug him a little. He worries the nation might be transitioning too quickly to renewables. But, he said, the Elk Creek mine would be good for America.

“I wish it wasn’t in my backyard, but it is. Other people sacrificed, and we need to sacrifice too,” Mr. Heidemann said. “I love this country to no end. We have challenges today and if we can help make it a better place in an environmentally safe way then, hot dog, I want to be a part of that.”

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed business combination between NioCorp Developments Ltd. ("NioCorp") and GX Acquisition Corp. II ("GXII") pursuant to the Business Combination Agreement, dated September 25, 2022 (the "Business Combination Agreement"), among NioCorp, GXII and Big Red Merger Sub Ltd. (the transactions contemplated by the Business Combination Agreement, collectively, the "Transaction"), NioCorp has filed a registration statement on Form S-4 (the “registration statement”) with the U.S. Securities and Exchange Commission (“SEC”), which includes a document that serves as a prospectus and proxy circular of NioCorp and a proxy statement of GXII, referred to as a “joint proxy statement/prospectus.” The definitive joint proxy statement/prospectus will be filed with the SEC as part of the registration statement and, in the case of NioCorp, with the applicable Canadian securities regulatory authorities, and will be sent to all NioCorp shareholders and GXII stockholders as of the applicable record date to be established. Each of NioCorp and GXII may also file other relevant documents regarding the proposed Transaction with the SEC and, in the case of NioCorp, with the applicable Canadian securities regulatory authorities. Before making any voting or investment decision, investors and security holders of NioCorp and GXII are urged to read the registration statement, the definitive joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC and, in the case of niocorp, with the applicable canadian securities regulatory authorities in connection with the proposed Transaction, including any amendments or supplements to these documents, carefully and in their entirety because they will contain important information about the proposed Transaction.

Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (if and when available) and all other relevant documents that are filed or that will be filed with the SEC by NioCorp or GXII through the website maintained by the SEC at www.sec.gov. Investors and security holders will be able to obtain free copies of the joint proxy statement/prospectus (if and when available) and all other relevant documents that are filed or that will be filed with the applicable Canadian securities regulatory authorities by NioCorp through the website maintained by the Canadian Securities Administrators at www.sedar.com. The documents filed by NioCorp and GXII with the SEC and, in the case of NioCorp, with the applicable Canadian securities regulatory authorities also may be obtained by contacting NioCorp at 7000 South Yosemite, Suite 115, Centennial CO 80112, or by calling (720) 639-4650; or GXII at 1325 Avenue of the Americas, 28th Floor, New York, NY 10019, or by calling (212) 616-3700.

Participants in the Solicitation

NioCorp, GXII and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from NioCorp’s shareholders and GXII’s stockholders in connection with the proposed Transaction. Information regarding the executive officers and directors of NioCorp is included in its management information and proxy circular for its 2022 annual general meeting of shareholders filed with the SEC and the applicable Canadian securities regulatory authorities on October 28, 2022. Information regarding the executive officers and directors of GXII is included in its Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 25, 2022. Additional information regarding the persons who may be deemed to be participants in the solicitation, including information regarding their interests in the proposed Transaction, are contained in the registration statement and the joint proxy statement/prospectus. NioCorp’s shareholders and GXII’s stockholders and other interested parties may obtain free copies of these documents free of charge by directing a written request to NioCorp or GXII.

No Offer or Solicitation

This communication and the information contained herein do not constitute (i) (a) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Transaction or (b) an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction or (ii) an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies. No offer of securities in the United States or to or for the account or benefit of U.S. persons (as defined in Regulation S under the U.S. Securities Act) shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), or an exemption therefrom. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. In Canada, no offering of securities shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws or an exemption therefrom. This communication is not, and under no circumstances is it to be construed as, a prospectus, offering memorandum, an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus has been filed with any securities commission or similar regulatory authority in respect of any of the securities referred to herein.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements about the parties’ ability to close the proposed Transaction, including NioCorp and GXII being able to receive all required regulatory, third-party and shareholder approvals for the proposed Transaction; the anticipated benefits of the proposed Transaction, including the potential amount of cash that may be available to the combined company upon consummation of the proposed Transaction and the use of the net proceeds following the redemptions by GXII public shareholders; NioCorp’s expectation that its common shares will be accepted for listing on the Nasdaq Stock Market following the closing of the proposed Transaction; the consummation of the convertible debenture transaction and the stand-by equity purchase facility contemplated by the definitive agreements with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP (together with YA II PN, Ltd., “Yorkville”); the financial and business performance of NioCorp; NioCorp’s anticipated results and developments in the operations of NioCorp in future periods; NioCorp’s planned exploration activities; the adequacy of NioCorp’s financial resources; NioCorp’s ability to secure sufficient project financing to complete construction and commence operation of the Elk Creek Project; NioCorp’s expectation and ability to produce niobium, scandium and titanium at the Elk Creek Project; the outcome of current recovery process improvement testing, and NioCorp’s expectation that such process improvements could lead to greater efficiencies and cost savings in the Elk Creek Project; the Elk Creek Project’s ability to produce multiple critical metals; the Elk Creek Project’s projected ore production and mining operations over its expected mine life; the completion of the demonstration plant and technical and economic analyses on the potential addition of magnetic rare earth oxides to NioCorp’s planned product suite; the exercise of options to purchase additional land parcels; the execution of contracts with engineering, procurement and construction companies; NioCorp’s ongoing evaluation of the impact of inflation, supply chain issues and geopolitical unrest on the Elk Creek Project’s economic model; the impact of health epidemics, including the COVID-19 pandemic, on NioCorp’s business and the actions NioCorp may take in response thereto; and the creation of full time and contract construction jobs over the construction period of the Elk Creek Project. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and GXII, as applicable, and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: the future price of metals; the stability of the financial and capital markets; NioCorp and GXII being able to receive all required regulatory, third-party and shareholder approvals for the proposed Transaction; the amount of redemptions by GXII public shareholders; the consummation of the convertible debenture transaction and the stand-by equity purchase facility contemplated by the definitive agreements with Yorkville; and other current estimates and assumptions regarding the proposed Transaction and its benefits. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp and GXII with the SEC and, in the case of NioCorp, with the applicable Canadian securities regulatory authorities and the following: the amount of any redemptions by existing holders of GXII Class A Shares being greater than expected, which may reduce the cash in trust available to NioCorp upon the consummation of the Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement and/or payment of the termination fees; the outcome of any legal proceedings that may be instituted against NioCorp or GXII following announcement of the Business Combination Agreement and the Transaction; the inability to complete the proposed Transaction due to, among other things, the failure to obtain NioCorp shareholder approval or GXII shareholder approval or the consummation of the convertible debenture transaction and the stand-by equity purchase facility contemplated by the definitive agreements with Yorkville; the inability to complete the convertible debenture transaction and the stand-by equity purchase facility contemplated by the definitive agreements with Yorkville due to, among other things, the failure to obtain shareholder approval or regulatory approval; the risk that the announcement and consummation of the proposed Transaction disrupts NioCorp’s current plans; the ability to recognize the anticipated benefits of the proposed Transaction; unexpected costs related to the proposed Transaction; the risks that the consummation of the proposed Transaction is substantially delayed or does not occur, including prior to the date on which GXII is required to liquidate under the terms of its charter documents; NioCorp’s ability to operate as a going concern; NioCorp’s requirement of significant additional capital; NioCorp’s limited operating history; NioCorp’s history of losses; cost increases for NioCorp’s exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp’s information technology systems, including those related to cybersecurity; equipment and supply shortages; current and future offtake agreements, joint ventures, and partnerships; NioCorp’s ability to attract qualified management; the effects of the COVID-19 pandemic or other global health crises on NioCorp’s business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; changes in demand for and price of commodities (such as fuel and electricity) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp’s projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp’s properties; potential future litigation; and NioCorp’s lack of insurance covering all of NioCorp’s operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp and GXII prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the proposed Transaction or other matters addressed in this communication and attributable to NioCorp, GXII or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this communication . Except to the extent required by applicable law or regulation, NioCorp and GXII undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this communication to reflect the occurrence of unanticipated events.