Actively Building Your Health Esteem The Beachbody Company Ticker: BODY April 2023 Exhibit 99.1

This presentation of The Beachbody Company, Inc. (the "Company”) contains “forward-looking” statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which are statements other than historical fact or in the future tense. These statements include but are not limited to statements regarding the Company’s future performance and market opportunity, including expected financial results for the fiscal year 2023, its business strategy, plans, and objectives and future operations. You can identify these statements by the use of terminology such as “believe”, “desire”, “plans”, “expect”, “will”, “should,” “could”, “estimate”, “anticipate” or similar forward-looking terms. You should not rely on these forward-looking statements as they involve risks and uncertainties that may cause actual results to vary materially from the forward-looking statements. Forward-looking statements are based upon various estimates and assumptions, as well as information known to the “Company” as of the date of the release of this presentation, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: the Company’s ability to effectively compete in the fitness and nutrition industries; the ability to successfully enter the Company's target markets and total addressable markets; the ability to successfully acquire and integrate new operations; the reliance on a few key products; market conditions and global and economic factors beyond the Company’s control; intense competition and competitive pressures from other companies worldwide in the industries in which the Company operates; and litigation and the ability to adequately protect the Company’s intellectual property rights. For more information regarding the risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, as well as risks relating to our business in general, refer to the “Risk Factors” section of the Company’s Securities and Exchange Commission (“SEC”) filings, including those risks and uncertainties included in the Form 10-K filed with the SEC on March 16, 2023, which is available on the Investor Relations page of the Beachbody website at https://investors.thebeachbodycompany.com and on the SEC website at www.sec.gov. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, performance, or achievements. The Company undertakes no obligation to update any of these forward-looking statements for any reason after the date of this press release or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements. Forward-Looking Statements

25-Year Track Record Creating Breakout Fitness & Nutrition Brands

Help people achieve their goals and lead healthy, fulfilling lives. For over two decades, the company has achieved that mission through the power of unparalleled at-home fitness and meal planning content, the creation of iconic brands and community, and innovations in social marketing and supplements. These initiatives have made The Beachbody Company the leader in helping people get healthy through step-by-step lifestyle transformation. OUR COMPANY MISSION Ticker: BODY

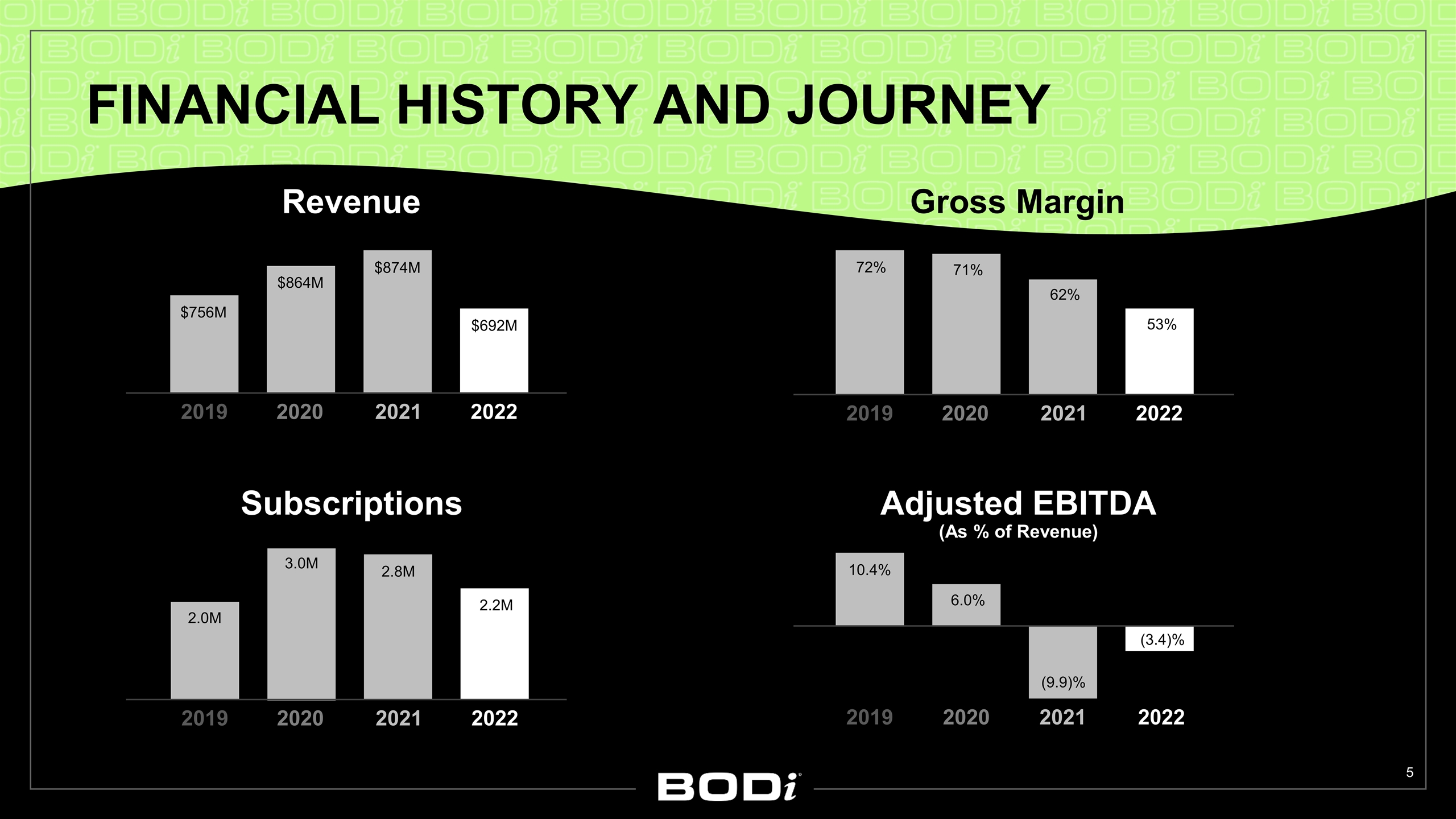

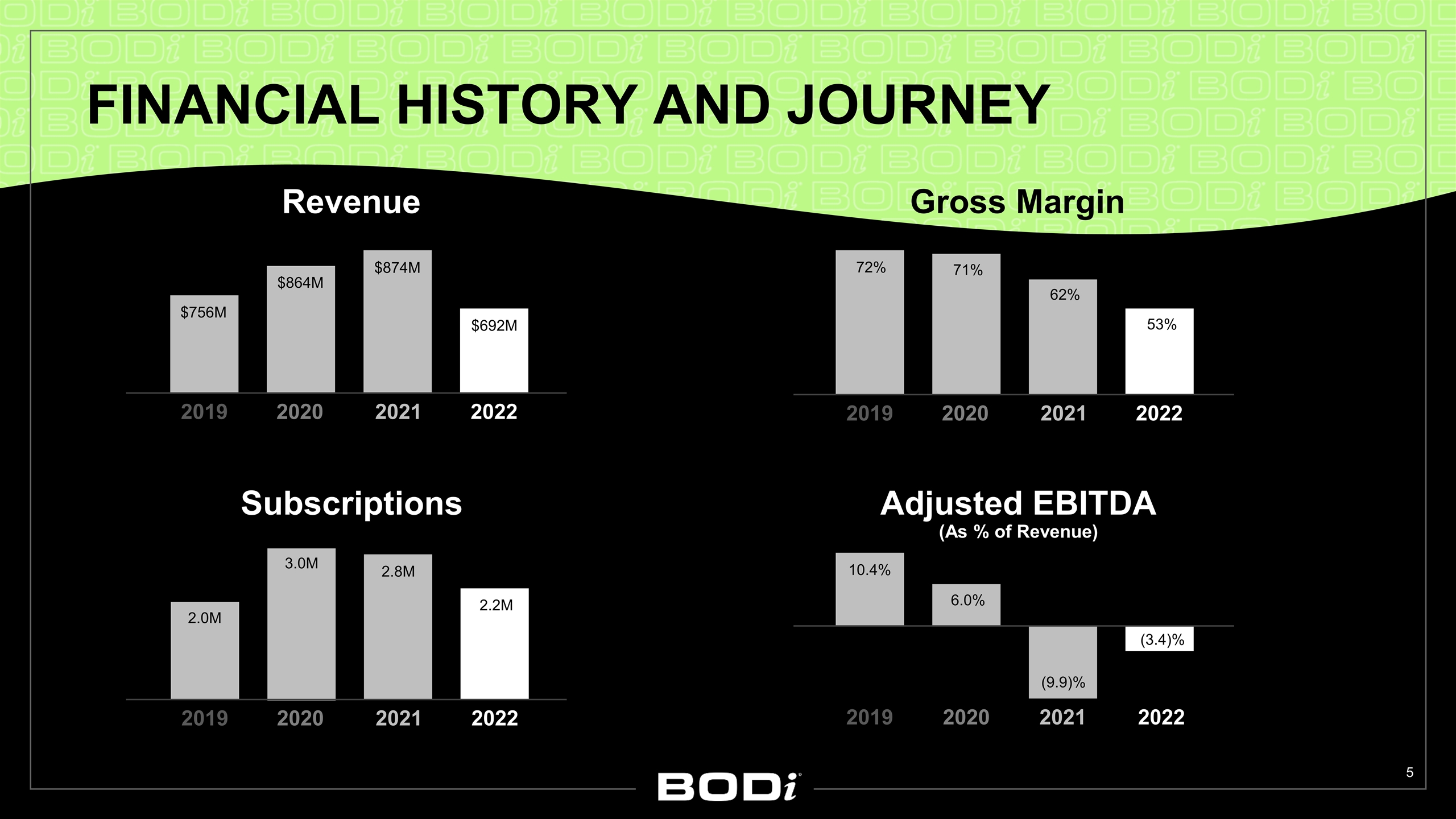

Financial History and Journey Subscriptions 2022 2019 2020 2021 2.2M 2.8M 3.0M 2.0M Gross Margin 2022 2019 2020 2021 53% 62% 71% 72% Adjusted EBITDA (As % of Revenue) 2022 2019 2020 2021 (3.4)% (9.9)% 6.0% 10.4% Revenue 2022 2019 2020 2021 $692M $874M $864M $756M

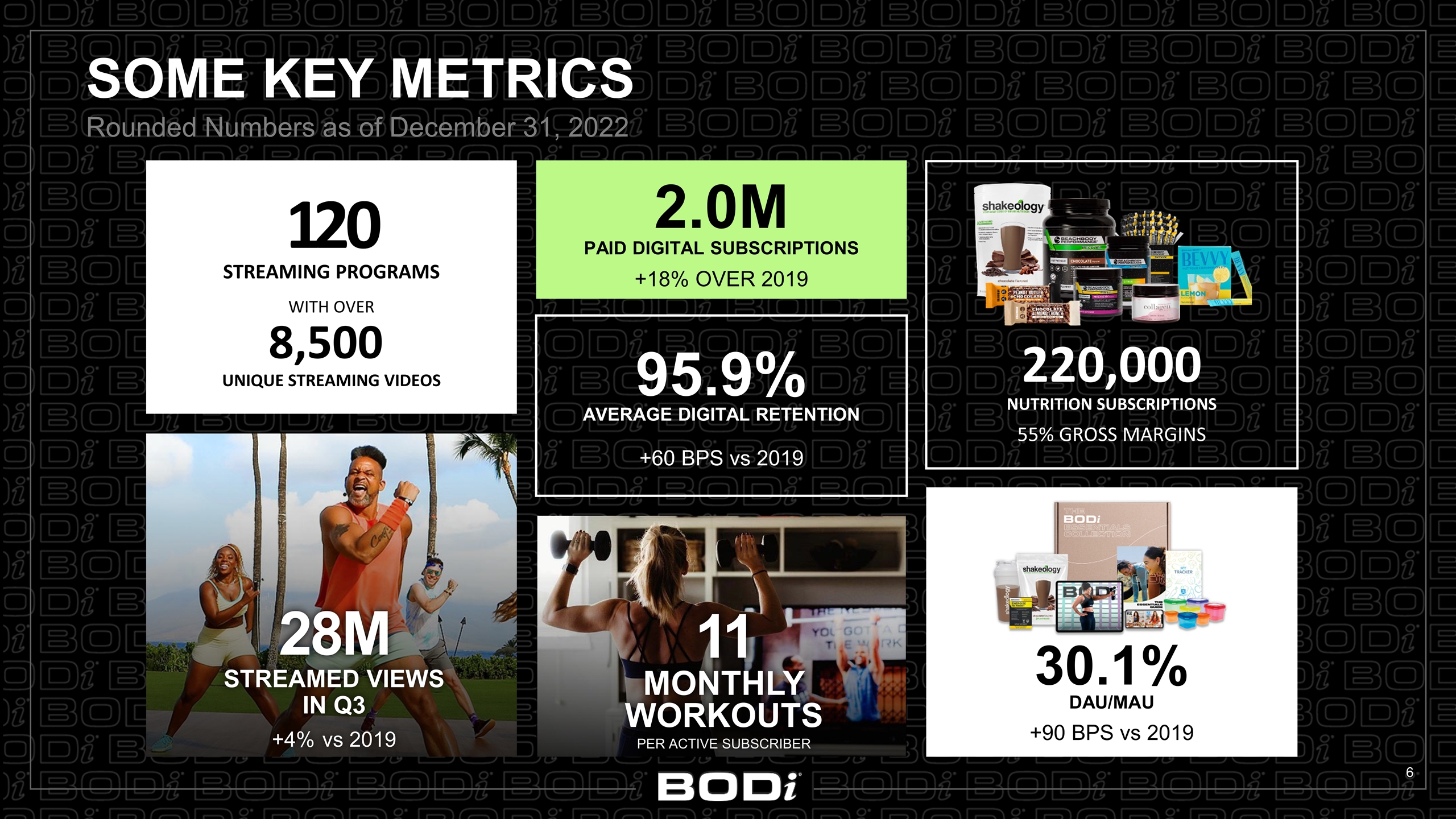

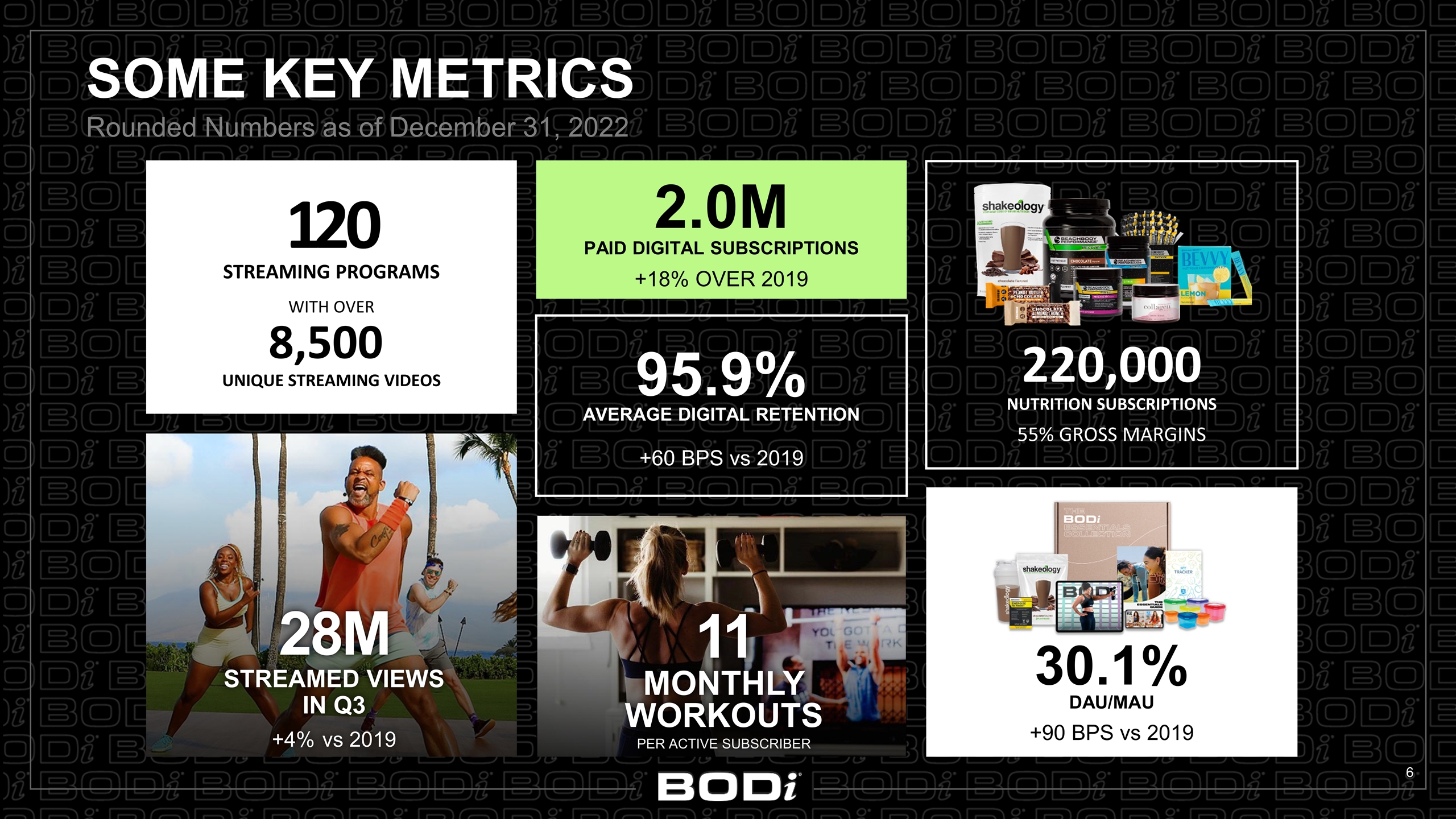

120 STREAMING PROGRAMS WITH OVER 8,500 UNIQUE STREAMING VIDEOS 28M STREAMED VIEWS IN Q3 +4% vs 2019 95.9% AVERAGE DIGITAL RETENTION +60 BPS vs 2019 2.0M PAID DIGITAL SUBSCRIPTIONS +18% OVER 2019 11 MONTHLY WORKOUTS PER ACTIVE SUBSCRIBER SOME KEY METRICS Rounded Numbers as of December 31, 2022 30.1% DAU/MAU +90 BPS vs 2019 220,000 NUTRITION SUBSCRIPTIONS 55% GROSS MARGINS

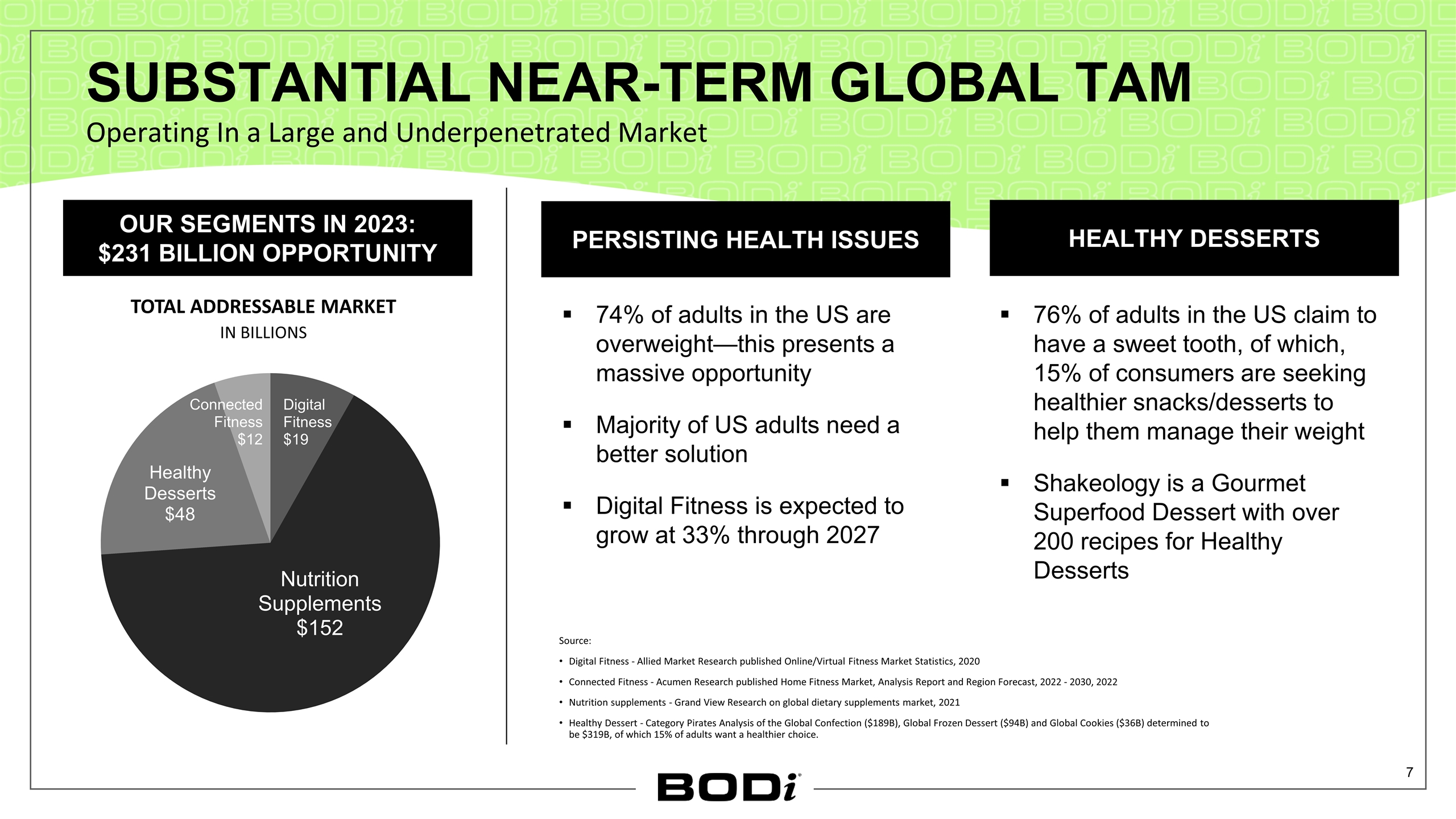

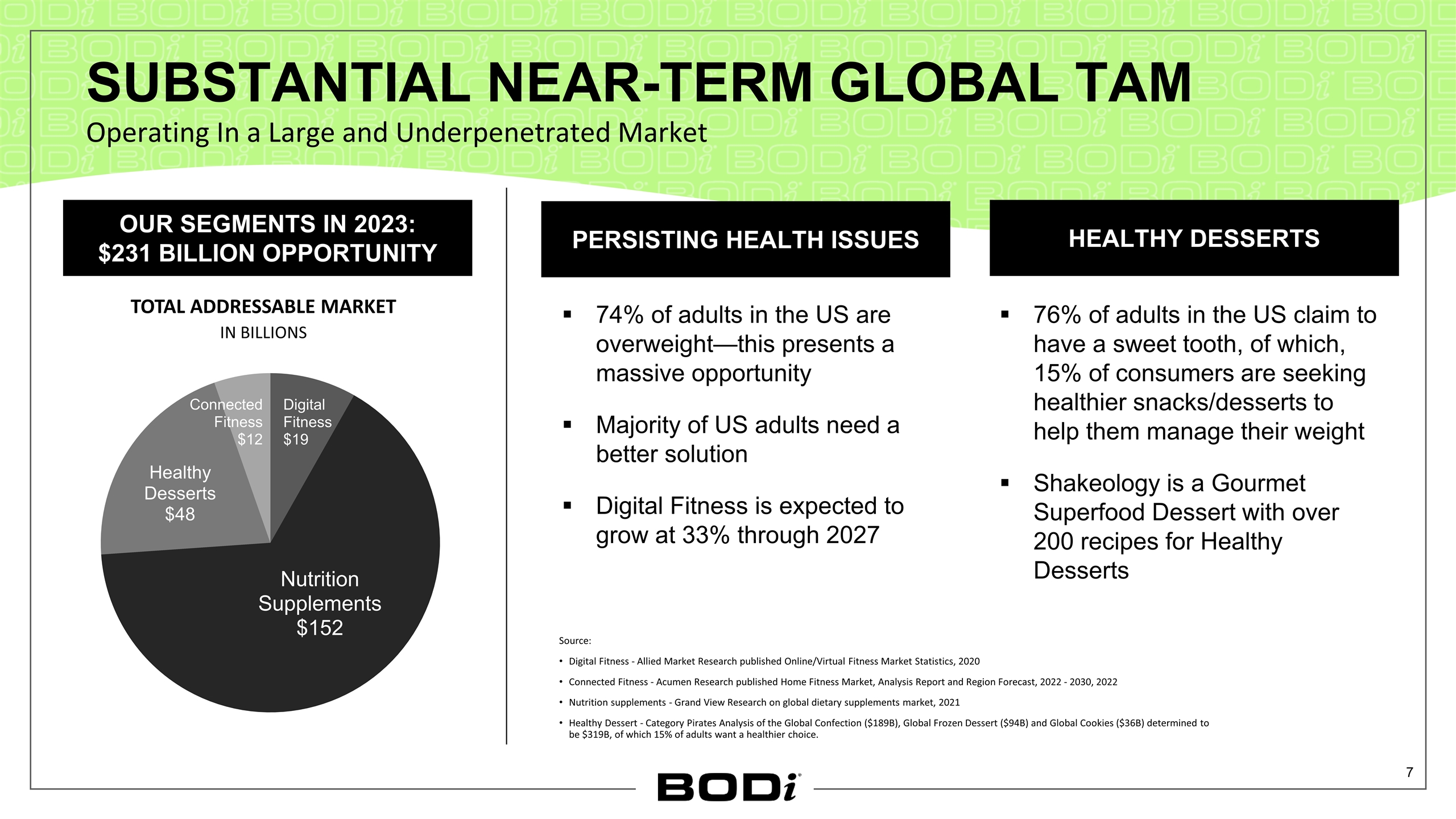

SUBSTANTIAL NEAR-TERM GLOBAL TAM $49B DIGITAL FITNESS $152B NUTRITION Source: Digital Fitness - Allied Market Research published Online/Virtual Fitness Market Statistics, 2020 Connected Fitness - Acumen Research published Home Fitness Market, Analysis Report and Region Forecast, 2022 - 2030, 2022 Nutrition supplements - Grand View Research on global dietary supplements market, 2021 Healthy Dessert - Category Pirates Analysis of the Global Confection ($189B), Global Frozen Dessert ($94B) and Global Cookies ($36B) determined to be $319B, of which 15% of adults want a healthier choice. OUR SEGMENTS IN 2023: $231 BILLION OPPORTUNITY HEALTHY DESSERTS 76% of adults in the US claim to have a sweet tooth, of which, 15% of consumers are seeking healthier snacks/desserts to help them manage their weight Shakeology is a Gourmet Superfood Dessert with over 200 recipes for Healthy Desserts TOTAL ADDRESSABLE MARKET In Billions PERSISTING HEALTH ISSUES 74% of adults in the US are overweight—this presents a massive opportunity Majority of US adults need a better solution Digital Fitness is expected to grow at 33% through 2027 Operating In a Large and Underpenetrated Market

Our Vision and Transformation How did we define our transformation? Market opportunity: 74% of US adults remain overweight We listened to our Coach/Partner network They want more simplicity Super-consumer analysis Moving away from the “Imperfection Economy” We believe that we are uniquely positioned to help with the top-5 new years’ resolutions*: Improve mental health** Improve diet Improve Fitness Lose weight Improve finances How do we plan to address this? Moving to one digital app with 1) Simpler Fitness programming, and 2) new Positive Mindset content Targeting the Healthy Dessert market Making the connected bike more affordable * Source: Forbes Health Survey, 2023 ** Top 2023 New Year Resolutions Health Esteem — A New Health and Wellness Category

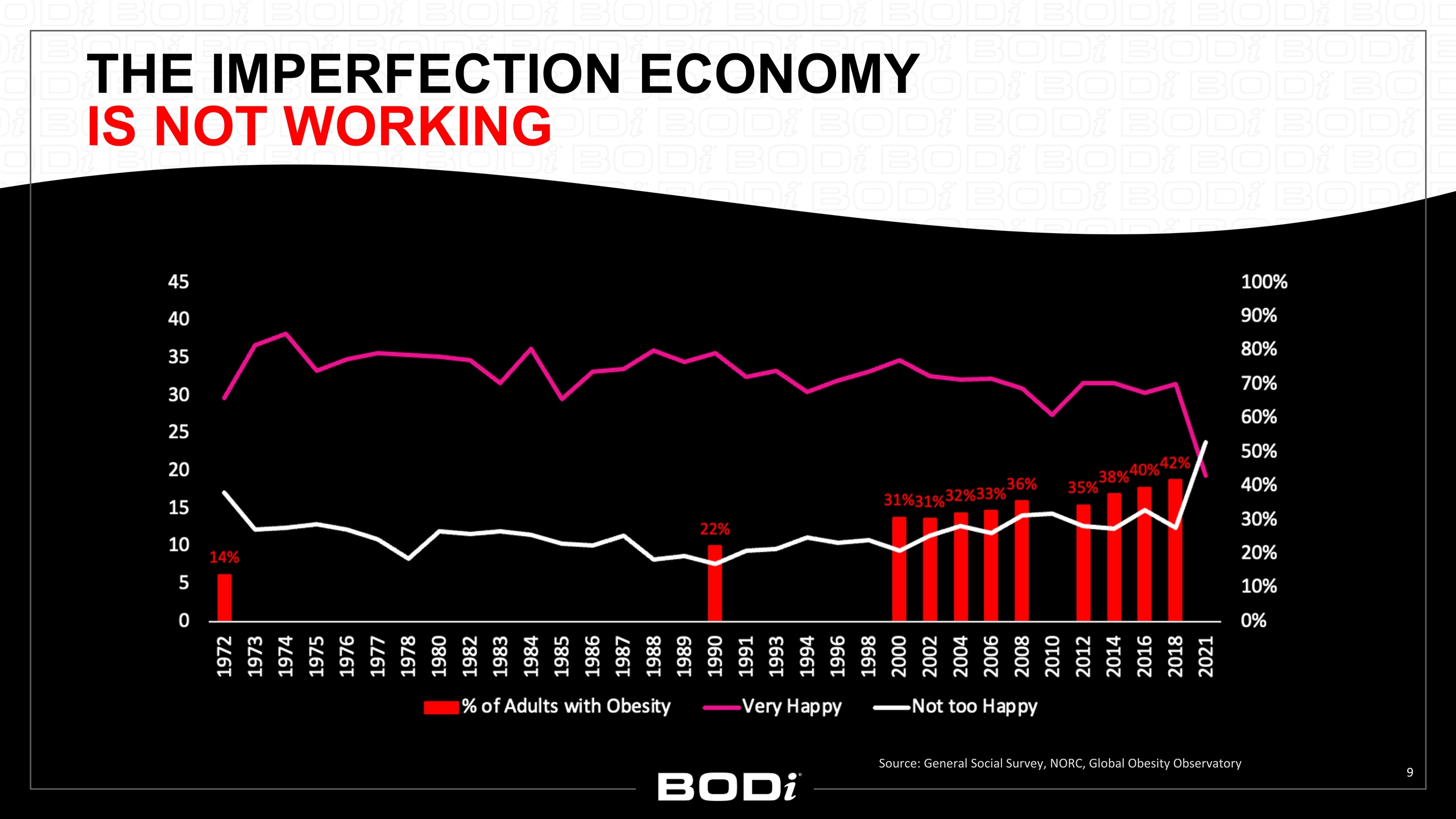

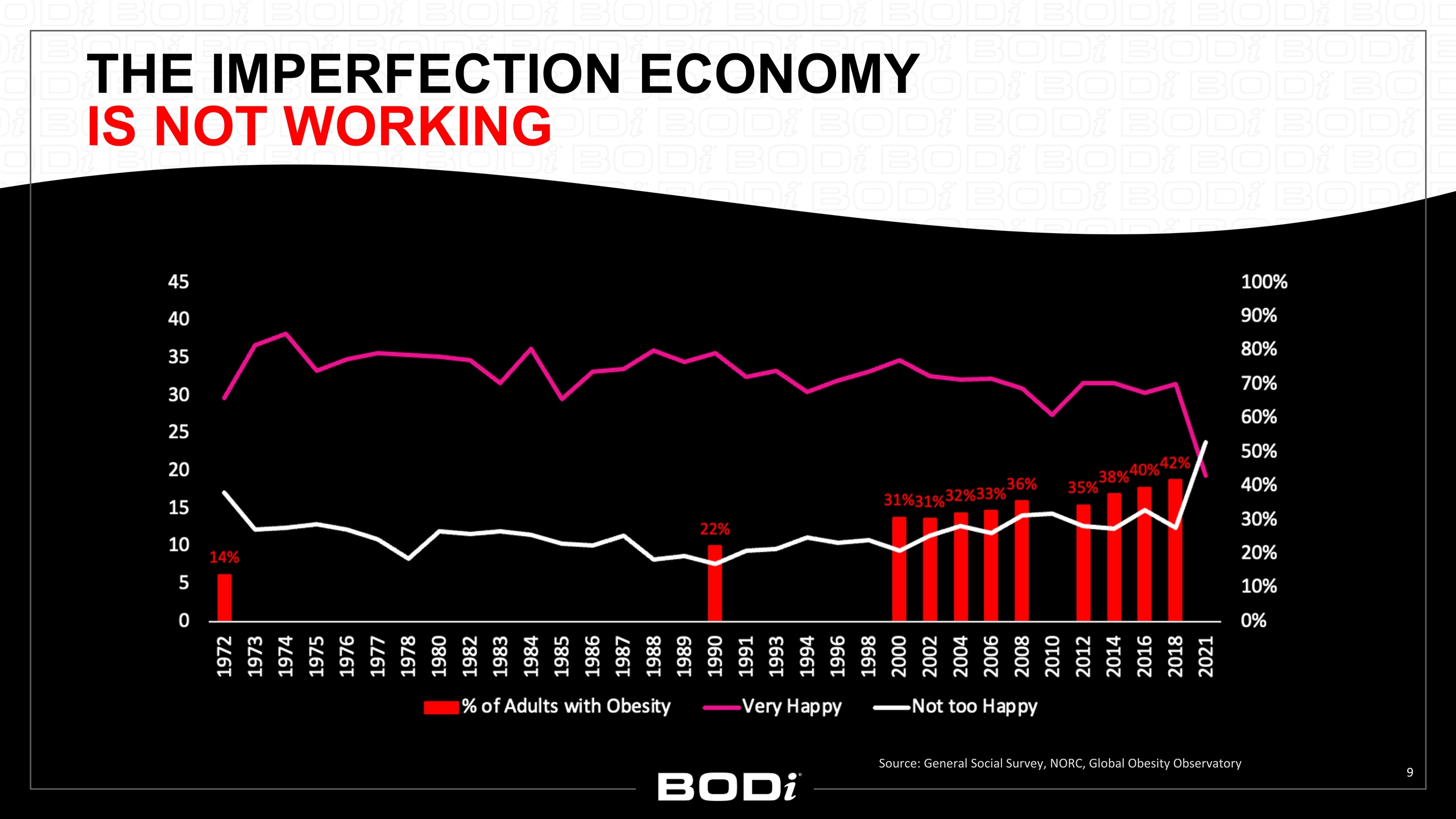

The Imperfection Economy Is Not Working Source: General Social Survey, NORC, Global Obesity Observatory

HEALTH ESTEEM Connected Fitness $50/month The Only Holistic Wellness Subscription Platform Nutrition & Supplements $100 monthly AOV 220K subscriptions Petra Kolber Vice President, Personal Development & Health Esteem Content Digital Streaming Platform $119 annual membership (moving to $179 annually) 1.95 million subscriptions at Dec 31, 2022 Digital Streaming & Live Interactive Programs Nutrition Programs & Eating Plans Personal Development Programs & Events

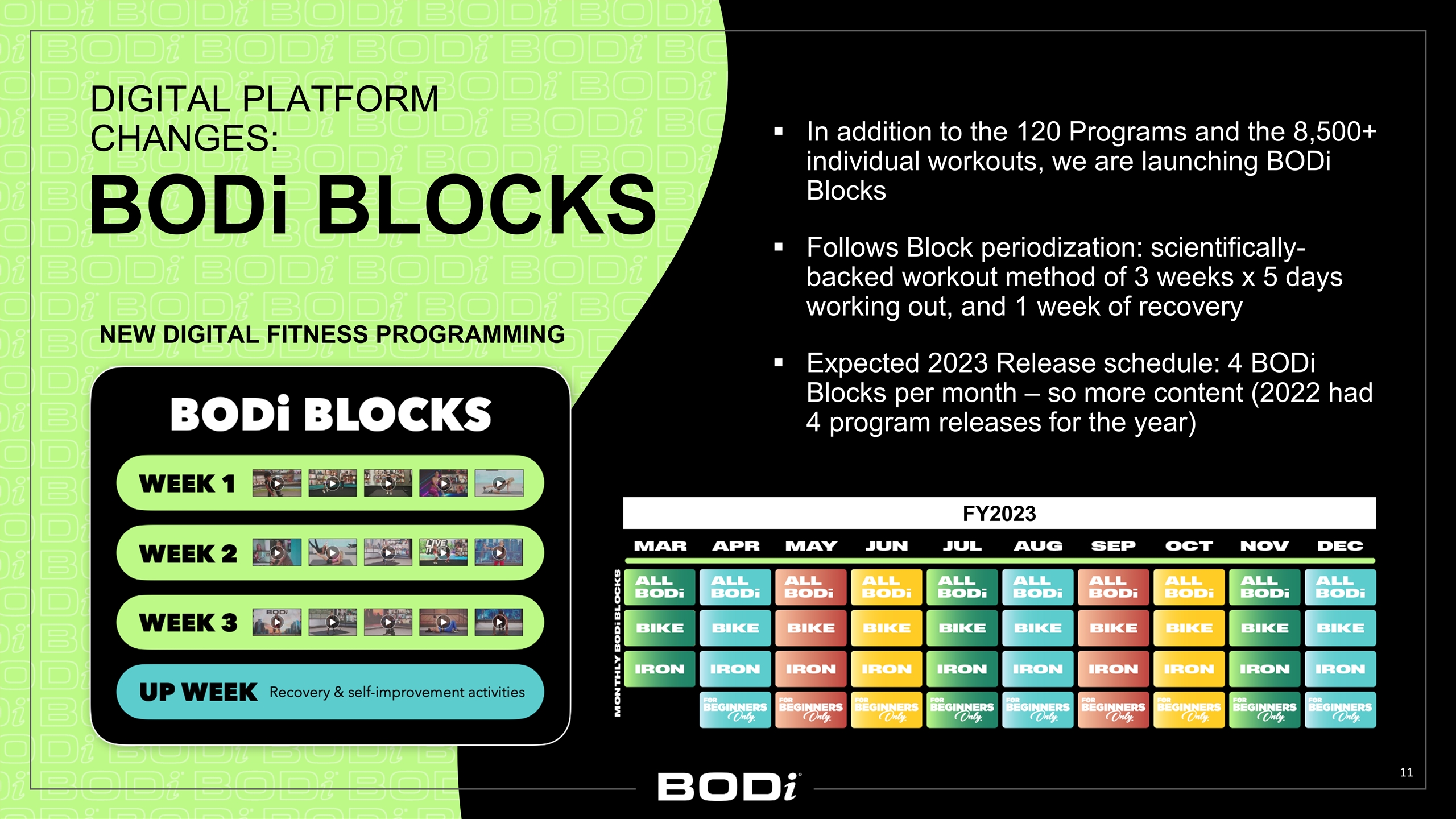

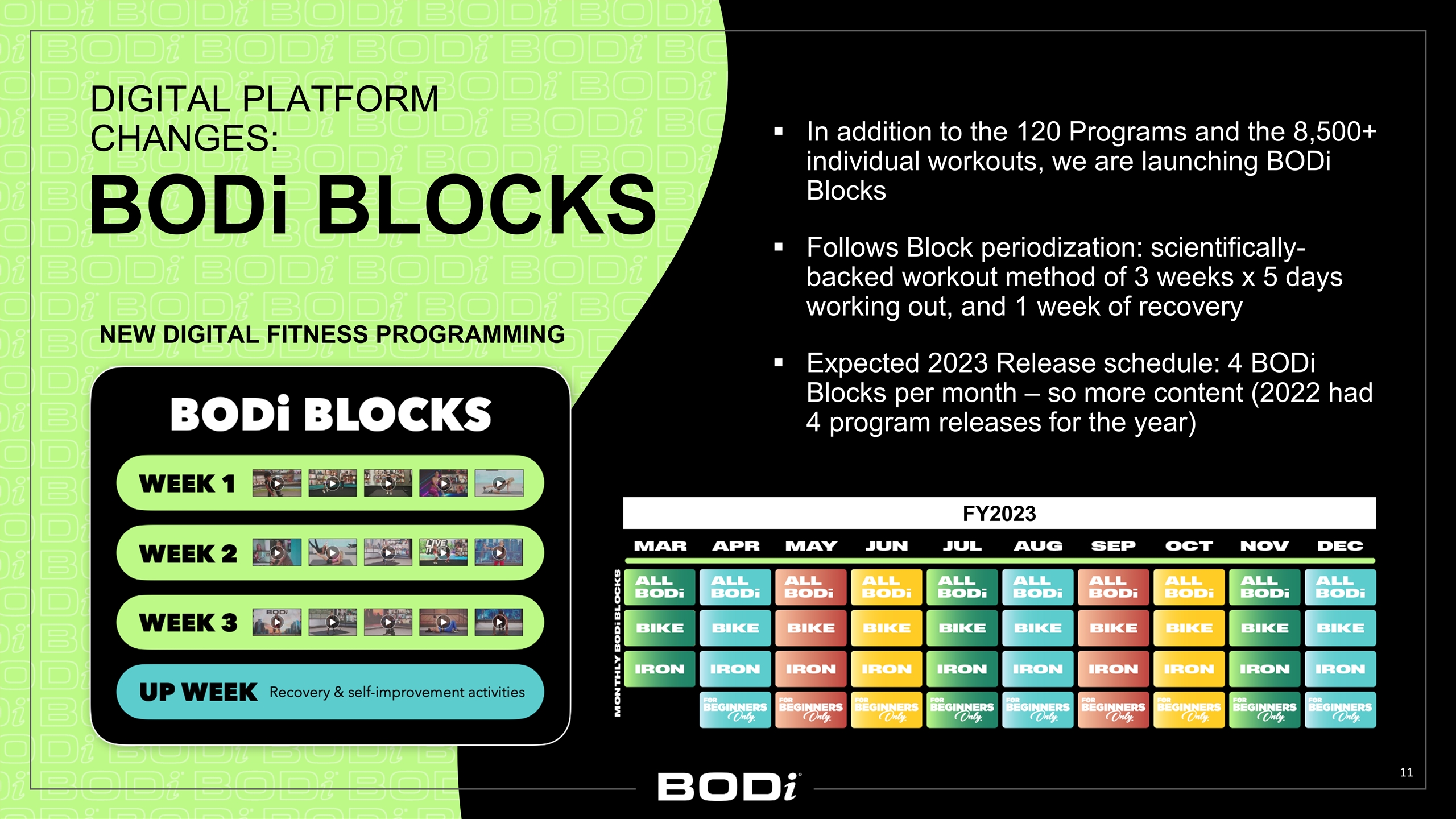

In addition to the 120 Programs and the 8,500+ individual workouts, we are launching BODi Blocks Follows Block periodization: scientifically-backed workout method of 3 weeks x 5 days working out, and 1 week of recovery Expected 2023 Release schedule: 4 BODi Blocks per month – so more content (2022 had 4 program releases for the year) BODi Blocks New Digital Fitness Programming Digital Platform Changes: FY2023

Mindset Digital Platform Changes: Petra Kolber Vice President, Personal Development & Health Esteem Content The Key to Unlocking the 74% of the US Adult Market Our Strategies for 2023: Launching Positive Mindset monthly master classes Incorporating motivational videos into the BODi Block routines: start the week with a QuickShift short video, and end the week with a ThinkSpace short video Launching a “Beginners” monthly BODi Block workout Changing our name from “Beachbody” to “BODi” BEFORE AFTER Beachbody Health Esteem Not Good Enough You Can Do It Impossible to Achieve Inclusive and Accessible No Dessert, No Cheats Eat a Healthy Dessert Daily

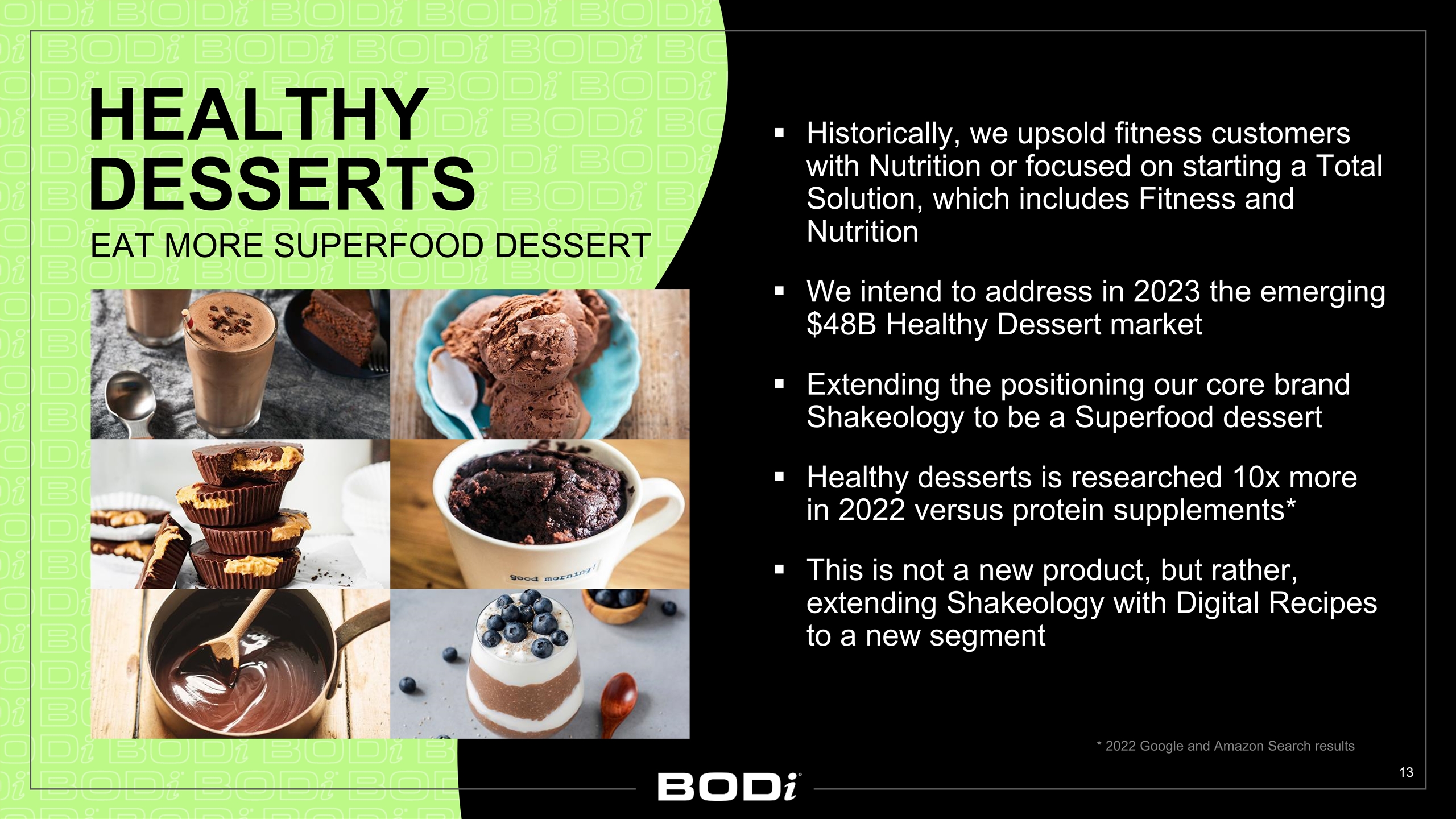

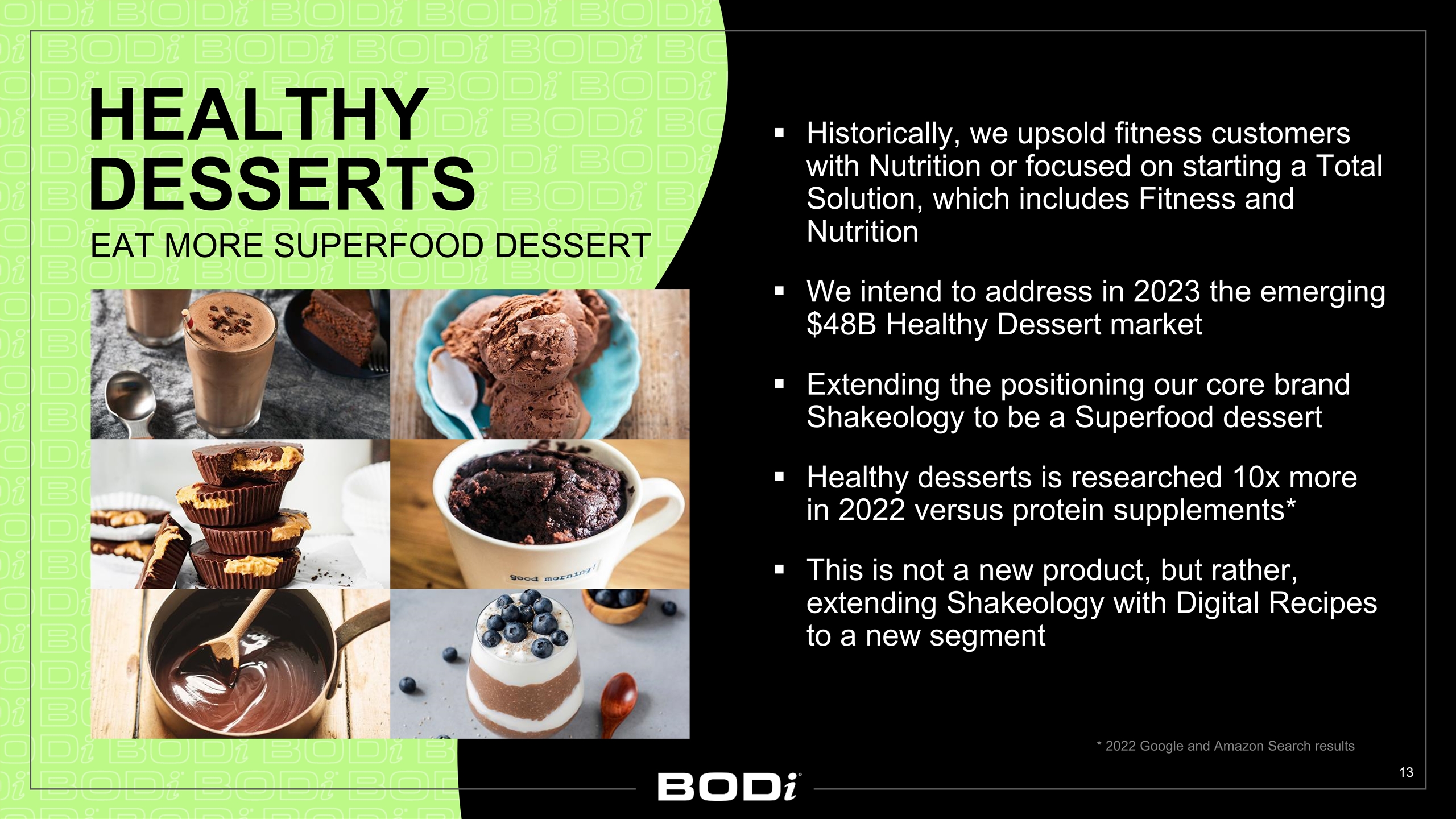

Historically, we upsold fitness customers with Nutrition or focused on starting a Total Solution, which includes Fitness and Nutrition We intend to address in 2023 the emerging $48B Healthy Dessert market Extending the positioning our core brand Shakeology to be a Superfood dessert Healthy desserts is researched 10x more in 2022 versus protein supplements* This is not a new product, but rather, extending Shakeology with Digital Recipes to a new segment Healthy Desserts Eat More Superfood Dessert * 2022 Google and Amazon Search results

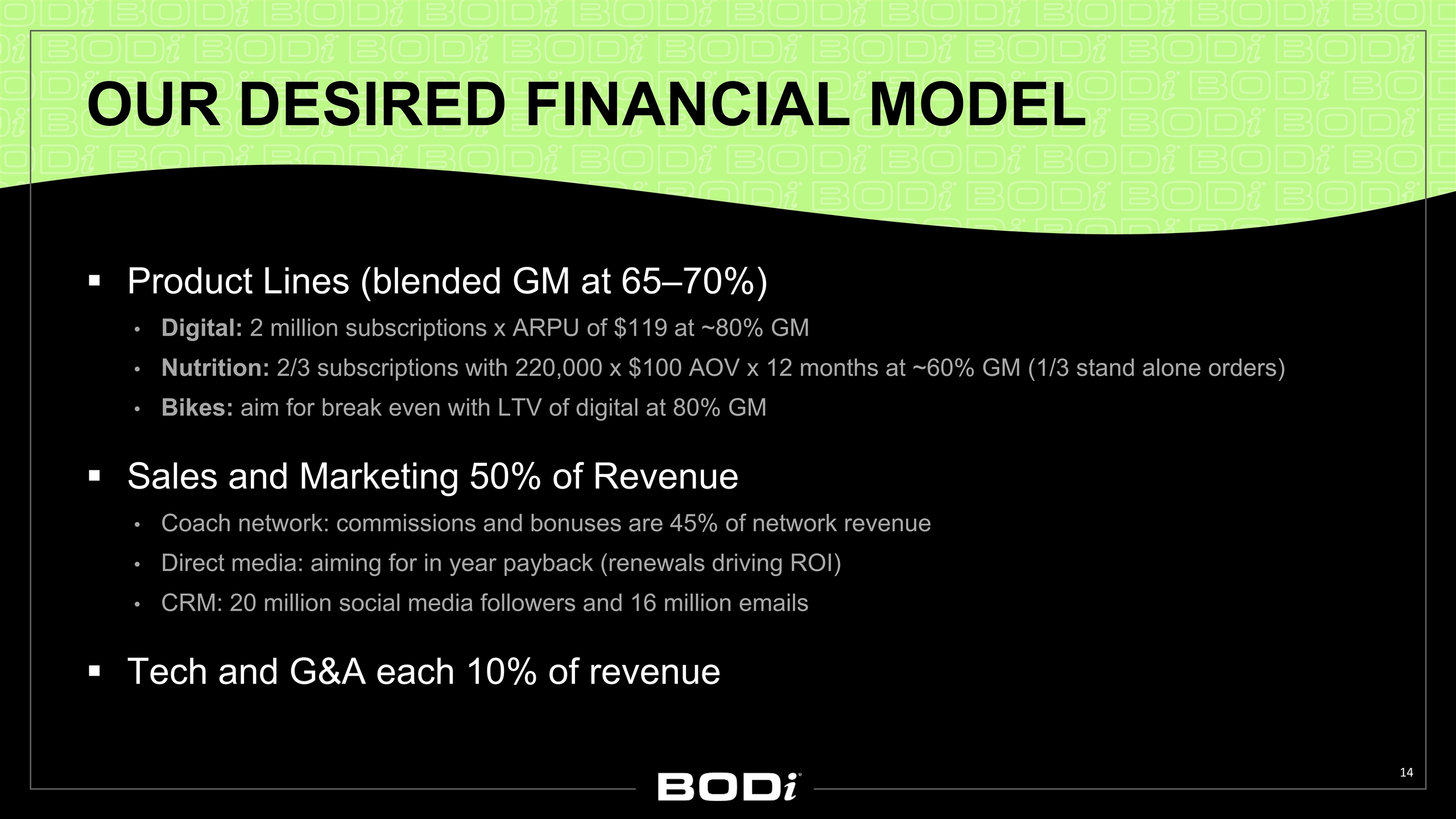

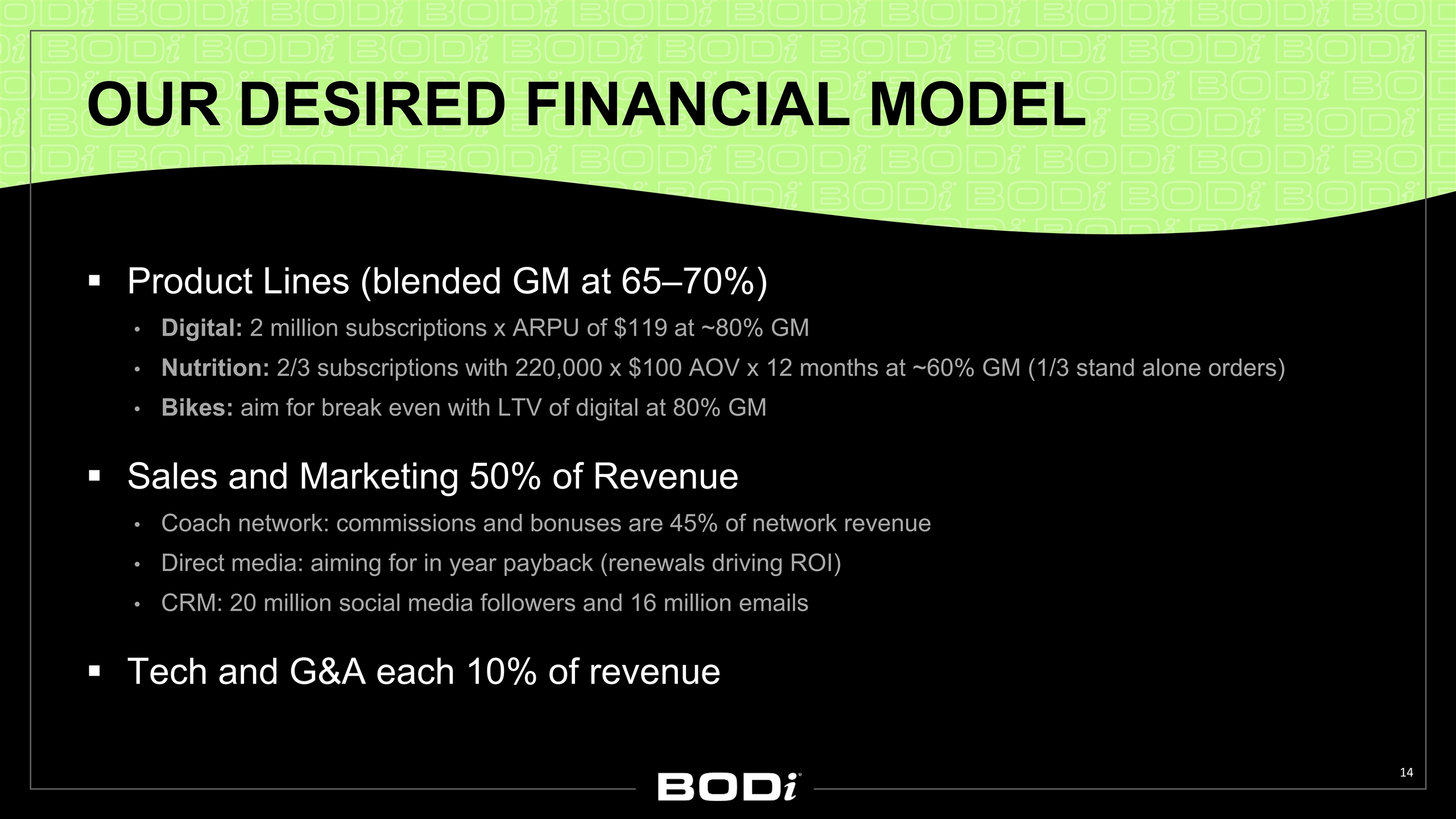

Our Desired Financial Model Product Lines (blended GM at 65–70%) Digital: 2 million subscriptions x ARPU of $119 at ~80% GM Nutrition: 2/3 subscriptions with 220,000 x $100 AOV x 12 months at ~60% GM (1/3 stand alone orders) Bikes: aim for break even with LTV of digital at 80% GM Sales and Marketing 50% of Revenue Coach network: commissions and bonuses are 45% of network revenue Direct media: aiming for in year payback (renewals driving ROI) CRM: 20 million social media followers and 16 million emails Tech and G&A each 10% of revenue

Re-Inventing our LTV to CAC Model for 2023 Coach network – variable commission Direct acquisition (media) in-year Payback CRM (20M+ social media following) – $0 costs HEALTH ESTEEM FLYWHEEL LTV KEY LEVERS ROUTE TO MARKETS (CAC) Pricing Margin/costs Retention Product penetration ATTRACT NEW SUBSCRIBERS SHARE RESULTS FITNESS NUTRITION MINDSET

OUR SOCIAL MEDIA FOLLOWING As of February 2023 Ilana Muhlstein 2.6M Shaun T 4.7M Joel Freeman 0.5M Super Trainers Autumn Calabrese 2.0M Hailey Peters 1.4M Natasha Pehrson 2.3M Emily Fauver 4.9M Micro-Influencers (Coaches/Partners) Jess Dukes 0.6M BODiCoach411 0.8M Shakeology 1.0M Beachbody/BODi 4.3M Carl Daikeler 0.4M Jennifer Jacobs 0.5M Jericho McMatthews 0.5M Amoila Cesar 0.3M Megan Davies 0.3M Company

MANAGEMENT TEAM A Strong, Collaborative Team with Extensive Experience Carl Daikeler Co-Founder, Chairman & CEO Michael Neimand President, Beachbody Kathy Vrabeck Chief Operating Officer Marc Suidan Chief Financial Officer Jennifer Schwartz SVP Digital Product Kit Boyd Chief Supply Chain Officer Christina Cartwright SVP, Nutrition Products Matt Halpern Chief of Staff and SVP, Content Development

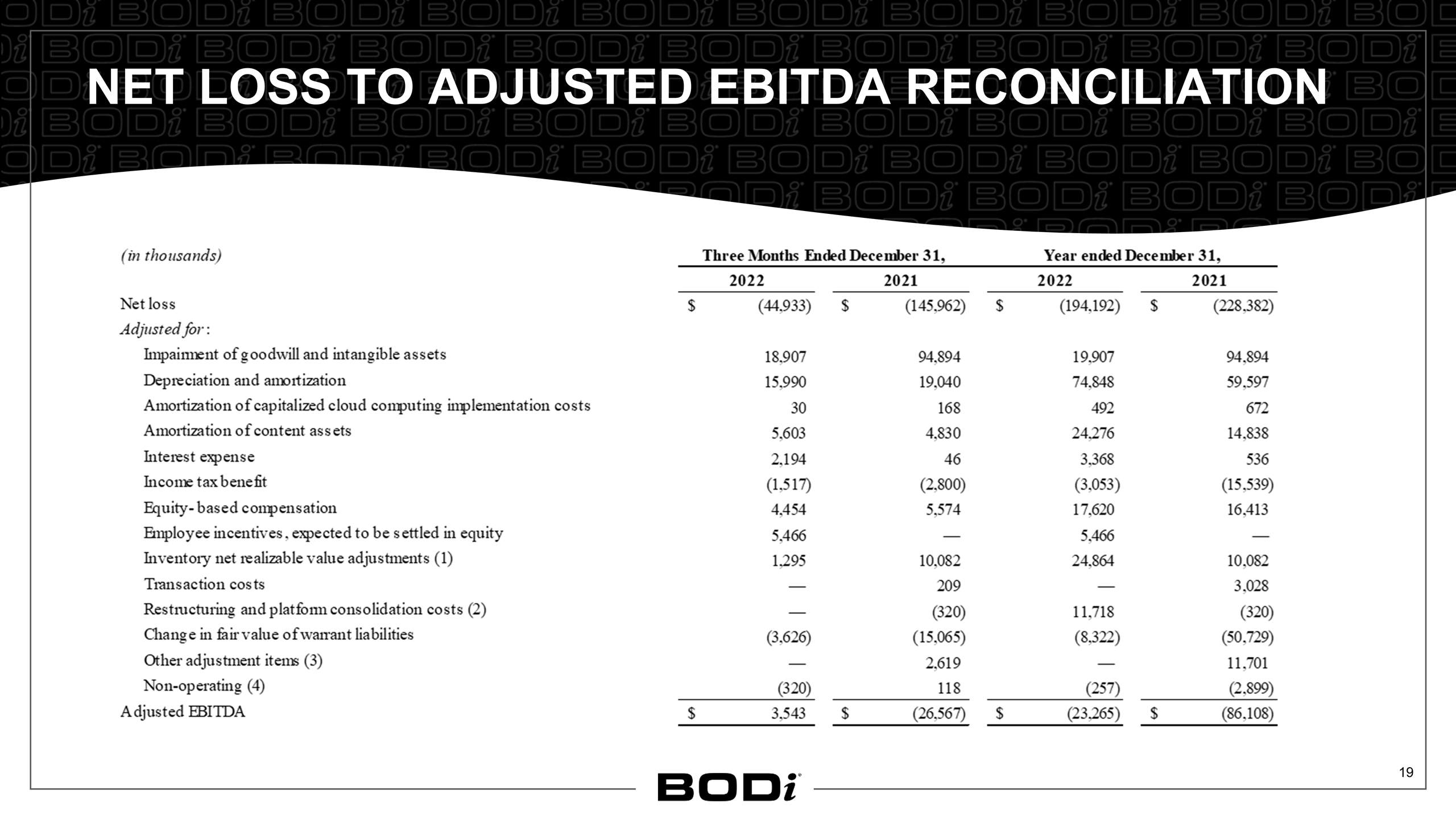

Q4-22 Net Loss of $44.9M and Adjusted EBITDA of $3.5M Reduced operating cash use to $10 million—versus the $76 million in Q4-21 Delivered the $125 million EBITDA and Capex savings in 2022 Ended Q4 with $80 million of cash on hand Entered into a $50 million debt financing agreement with Blue Torch Capital, with the potential to increase by another $25 million Beat or met guidance for all quarters in 2022 Reduced headcount by 40% from the prior year RECAPPING OUR Q4-22 HIGHLIGHTS Making Financial Progress on Our Strategies

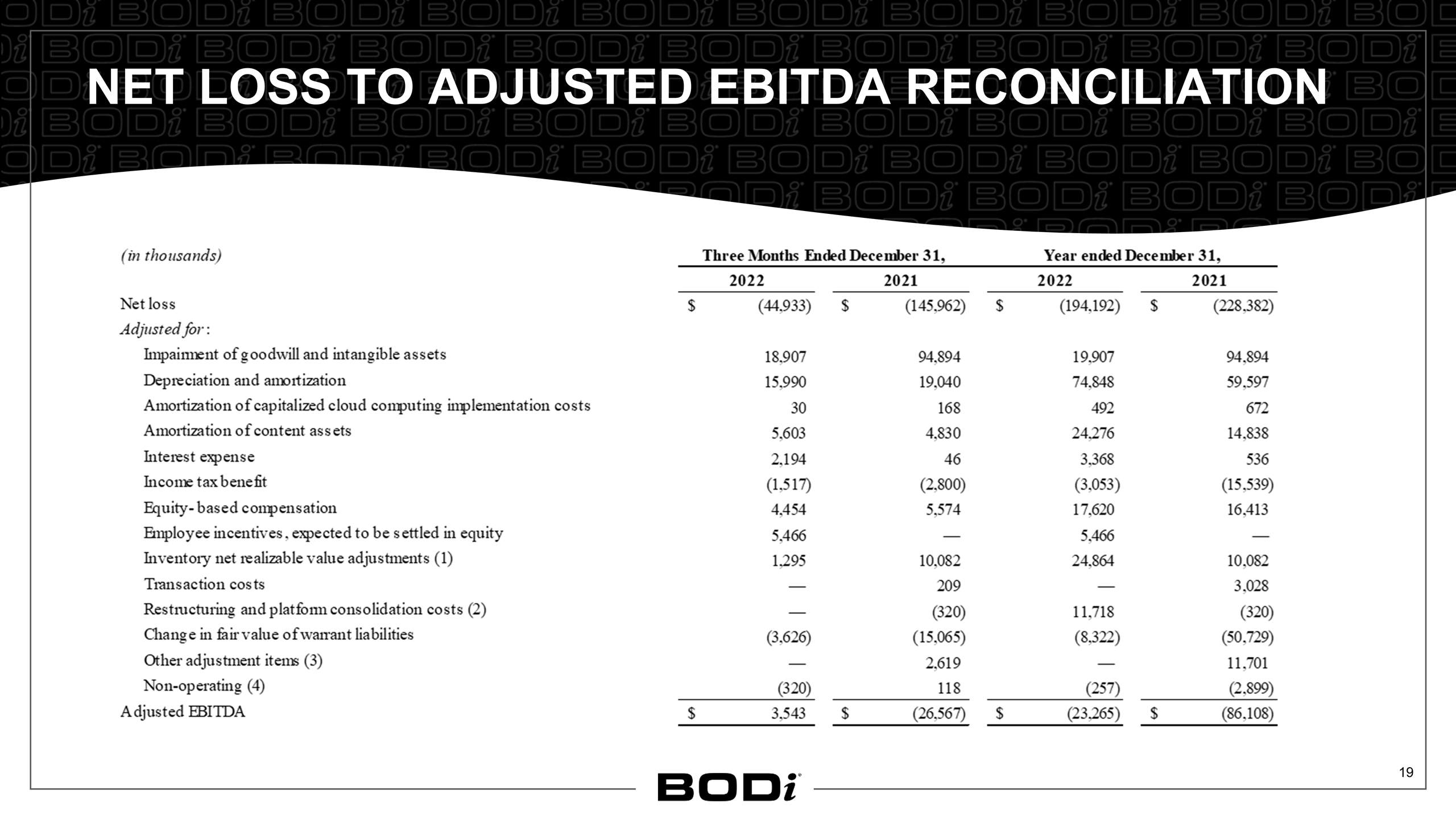

Net Loss to adjusted ebitda reconciliation

Q&A

END