| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-226486-17 | ||

|  |

Free Writing Prospectus

Structural and Collateral Term Sheet

$696,302,595

(Approximate Initial Pool Balance)

$597,385,000

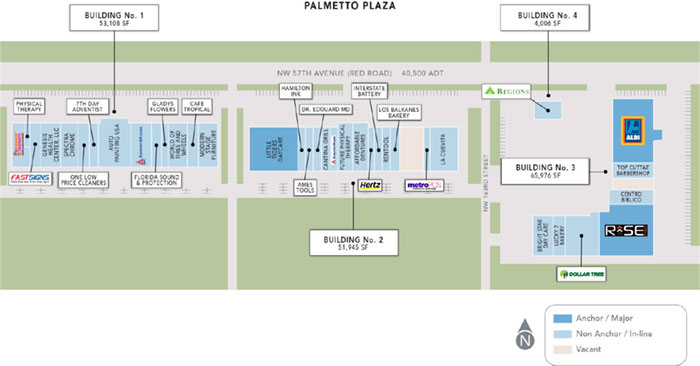

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2020-C58

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Barclays Capital Real Estate Inc.

LMF Commercial, LLC

BSPRT CMBS Finance, LLC

Argentic Real Estate Finance LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2020-C58

November 28, 2020

WELLS FARGO

Co-Lead Manager and Joint Bookrunner | BARCLAYS

Co-Lead Manager and Joint Bookrunner | ||

Academy Securities Co-Manager | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Certificate Structure |

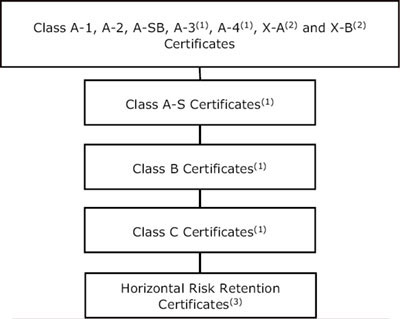

I. Certificate Structure

| Class | Expected Ratings (Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approx. Initial Credit Support(3) | Pass-Through Rate Description | Weighted Average Life (Years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Certificate Principal U/W NOI Debt Yield(6) | ||

| Offered Certificates | ||||||||||

| A-1 | AAAsf/AAA(sf)/Aaa(sf) | $26,019,000 | 30.000% | (7) | 2.82 | 01/21 – 12/25 | 41.9% | 15.4% | ||

| A-2 | AAAsf/AAA(sf)/Aaa(sf) | $6,764,000 | 30.000% | (7) | 5.00 | 12/25 – 12/25 | 41.9% | 15.4% | ||

| A-SB | AAAsf/AAA(sf)/Aaa(sf) | $28,803,000 | 30.000% | (7) | 7.00 | 12/25 – 11/29 | 41.9% | 15.4% | ||

| A-3(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7) | (9) | (9) | 41.9% | 15.4% | ||

| A-4(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7) | (9) | (9) | 41.9% | 15.4% | ||

| X-A | AAAsf/AAA(sf)/Aaa(sf) | $487,411,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A | ||

| X-B(12) | A-sf/AAA(sf)/NR | $109,974,000(13) | N/A | Variable(14) | N/A | N/A | N/A | N/A | ||

| A-S(8) | AAAsf/AAA(sf)/Aa2(sf) | $53,964,000(8) | 22.250% | (7) | 9.91 | 11/30 – 11/30 | 46.6% | 13.9% | ||

| B(8) | AA-sf/AA(sf)/NR | $35,685,000(8) | 17.125% | (7) | 9.97 | 11/30 – 12/30 | 49.7% | 13.0% | ||

| C(8)(12) | A-sf/A(sf)/NR | $20,325,000(8) | 14.206% | (7) | 10.00 | 12/30 – 12/30 | 51.4% | 12.6% | ||

| Risk Retention Certificates | ||||||||||

| D-RR(12) | A-sf/A-(sf)/NR | $10,139,000 | 12.750% | (7) | 10.00 | 12/30 – 12/30 | 52.3% | 12.4% | ||

| E-RR | BBBsf/BBB+(sf)/NR | $20,018,000 | 9.875% | (7) | 10.00 | 12/30 – 12/30 | 54.0% | 12.0% | ||

| F-RR | BBB-sf/BBB-(sf)/NR | $15,667,000 | 7.625% | (7) | 10.00 | 12/30 – 12/30 | 55.3% | 11.7% | ||

| G-RR | BB-sf/BB-(sf)/NR | $16,537,000 | 5.250% | (7) | 10.00 | 12/30 – 12/30 | 56.8% | 11.4% | ||

| H-RR | B-sf/B-(sf)/NR | $6,963,000 | 4.250% | (7) | 10.00 | 12/30 – 12/30 | 57.4% | 11.3% | ||

| J-RR | NR/NR/NR | $29,593,595 | 0.000% | (7) | 10.00 | 12/30 – 12/30 | 59.9% | 10.8% | ||

| Notes: | |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated November 28, 2020 (the “Preliminary Prospectus”). Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A or X-B Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) or trust components whose Certificate Balances comprise such Notional Amounts, and, if, as a result of such pricing, the pass-through rate of the Class X-A or X-B Certificates, as applicable, would be equal to zero at all times, such Class of Certificates may not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-SB, A-3 and A-4 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-SB, A-3 and A-4 Certificates in the aggregate, taking into account the Certificate Balances of the Class A-3 and Class A-4 trust components. The approximate initial credit support set forth for the Class A-S certificates represents the approximate initial credit enhancement for the underlying Class A-S trust component. The approximate initial credit support set forth for the Class B certificates represents the approximate initial credit enhancement for the underlying Class B trust component. The approximate initial credit support set forth for the Class C certificates represents the approximate initial credit enhancement for the underlying Class C trust component. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Classes of Certificates (or, with respect to the Class A-3 or A-4 Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of such Classes of Certificates (or, with respect to the Class A-3 and Class A-4 Certificates, the trust component with the same alphanumeric designation). In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Certificate Structure |

| (7) | The pass-through rates for the Class A-1, A-2, A-SB, A-3, A-4, A-S, B, C, D-RR, E-RR, F-RR, G-RR, H-RR and J-RR Certificates in each case will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |

| (8) | The Class A-3-1, A-3-2, A-3-X1, A-3-X2, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S-1, A-S-2, A-S-X1, A-S-X2, B-1, B-2, B-X1, B-X2, C-1, C-2, C-X1 and C-X2 Certificates are also offered certificates. Such Classes of Certificates, together with the Class A-3, A-4, A-S, B and C Certificates, constitute the “Exchangeable Certificates”. The Class A-1, A-2, A-SB, D-RR, E-RR, F-RR, G-RR, H-RR and J-RR Certificates, together with the Exchangeable Certificates with a Certificate Balance, are referred to as the “Principal Balance Certificates.” Each class of Exchangeable Certificates will have the Certificate Balance or Notional Amount and pass-through rate described below under “Exchangeable Certificates.”

| |

| (9) | The exact initial Certificate Balances or Notional Amounts of the Class A-3, A-3-X1, A-3-X2, A-4, A-4-X1 and A-4-X2 trust components (and consequently, the exact initial Certificate Balances or Notional Amounts of the Exchangeable Certificates with an “A-3” or “A-4” designation) are unknown and will be determined based on the final pricing of the Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-3 and Class A-4 trust components are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-3 and Class A-4 trust components is expected to be approximately $425,825,000, subject to a variance of plus or minus 5%. The Class A-3-X1 and A-3-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-3 trust component. The Class A-4-X1 and A-4-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-4 trust component. In the event that the Class A-3 Certificates are issued at $425,825,000, the Class A-4 Certificates will not be issued. | |

Trust Components | Expected Range of | Expected Range of | Expected Range of Principal Window |

| Class A-3 | $75,000,000 – $425,825,000 | 9.06 – 9.57 | 11/29 – 03/30 / 11/29 – 11/30 |

| Class A-4 | $215,825,000 – $350,825,000 | 9.67 – 9.87 | 03/30 – 11/30 / 10/30 – 11/30 |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2 and A-SB Certificates and the Class A-3 and A-4 trust components outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2 and A-SB Certificates and the Class A-3, A-3-X1, A-3-X2, A-4, A-4-X1 and A-4-X2 trust components for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The initial Certificate Balance of each of the Class C, C-X1 and C-X2 trust components and D-RR Certificates are subject to change based on final pricing of all Certificates and the final determination of the Class D-RR, E-RR, F-RR, G-RR, H-RR and J-RR Certificates (collectively, the “horizontal risk retention certificates”) that will be retained by the retaining sponsor through a third party purchaser as part of the U.S. risk retention requirements. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the horizontal risk retention certificates, see “Credit Risk Retention” in the Preliminary Prospectus. The Class C-X1 and C-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class C trust component. Any variation in the initial Certificate Balance of the Class C trust component would affect the initial Notional Amount of the Class X-B Certificates. |

| (13) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C trust components outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (14) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, A-S-X1, A-S-X2, B, B-X1, B-X2, C, C-X1 and C-X2 trust components for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of | Number of | Aggregate Cut-off | % of Initial Pool |

| Wells Fargo Bank, National Association | 10 | 12 | $233,296,017 | 33.5% |

| Barclays Capital Real Estate Inc. | 9 | 23 | 150,585,000 | 21.6 |

| LMF Commercial, LLC | 17 | 18 | 119,525,069 | 17.2 |

| BSPRT CMBS Finance, LLC | 6 | 9 | 101,526,509 | 14.6 |

| Argentic Real Estate Finance LLC | 6 | 8 | 91,370,000 | 13.1 |

Total | 48 | 70 | $696,302,595 | 100.0% |

Loan Pool:

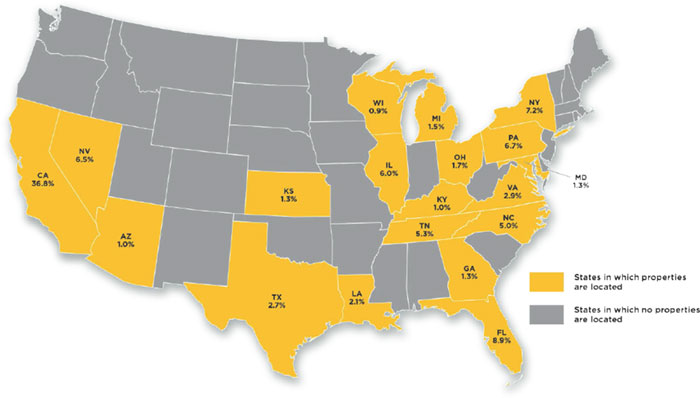

| Initial Pool Balance: | $696,302,595 |

| Number of Mortgage Loans: | 48 |

| Average Cut-off Date Balance per Mortgage Loan: | $14,506,304 |

| Number of Mortgaged Properties: | 70 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $9,947,180 |

| Weighted Average Mortgage Interest Rate: | 3.788% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 48.6% |

| Weighted Average Original Term to Maturity or ARD (months): | 119 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 360 |

| Weighted Average Remaining Amortization Term (months)(2): | 358 |

| Weighted Average Seasoning (months): | 3 |

(1) Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. (2) Excludes any mortgage loan that does not amortize. | |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1)(2): | 2.33x |

| Weighted Average U/W Net Operating Income Debt Yield(1)(2): | 10.8% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1)(2): | 59.9% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1)(2): | 54.0% |

| % of Mortgage Loans with Additional Subordinate Debt(3): | 6.5% |

| % of Mortgage Loans with Single Tenants(4): | 19.6% |

(1) With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. (2) For many of the mortgage loans, underwritten net cash flow, underwritten net operating income and appraised values of the related mortgaged properties were determined, or were calculated based on information as of a date, prior to the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, and the loan-to-value, debt service coverage and debt yield metrics presented in this term sheet may not reflect current market conditions. (3) The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. (4) Excludes mortgage loans that are secured by multiple single tenant properties. | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 51.0% of the mortgage pool (26 mortgage loans) has scheduled amortization, as follows:

27.9% (15 mortgage loans) requires amortization during the entire loan term; and

23.1% (11 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Initial Pool Balance, 49.0% of the mortgage pool (22 mortgage loans) provides for interest-only payments during the entire loan term through maturity or ARD. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 53.5% and 3.03x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 51.3% of the mortgage pool (15 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 74.7% of the pool |

| Insurance: | 48.0% of the pool |

| Capital Replacements: | 66.1% of the pool |

| TI/LC: | 61.2% of the pool(1) |

| (1) The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, retail, mixed use and industrial properties. | |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

75.1% of the mortgage pool (41 mortgage loans) features a lockout period, then defeasance only until an open period;

12.1% of the mortgage pool (2 mortgage loans) features yield maintenance, then yield maintenance or defeasance until an open period.

6.5% of the mortgage pool (1 mortgage loan) features the greater of a prepayment premium (0.5%) or yield maintenance followed by the greater of a prepayment premium (0.5%) or yield maintenance or defeasance until an open period;

6.4% of the mortgage pool (4 mortgage loans) features a lockout period, then the greater of a prepayment premium (1%) or yield maintenance until an open period;

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Transaction Highlights |

III. COVID-19 Update

The following table contains information regarding the status of the mortgage loans and mortgaged properties provided by the respective borrowers as of the date set forth in the “Information As Of Date” column. The information from the borrowers has not been independently verified by the mortgage loan sellers, the underwriters or any other party, and there can be no assurances that the status of the mortgage loans and of the related mortgaged properties has not changed since the date in the “Information As-Of Date” column. The cumulative effects of the COVID-19 emergency on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the mortgage loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the certificates.

Mortgage Loan Seller | Information As Of Date | Origination Date | Mortgaged Property Name | Mortgaged Property Type | October Debt Service Payment Received (Y/N) | November Debt Service Payment Received (Y/N) | Forbearance or Other Debt Service Relief Requested (Y/N) | Other Loan Modification Requested (Y/N) | Lease Modification or Rent Relief Requested (Y/N) | Total SF or Unit Count Making Full October Rent Payment (%)(1) | UW October Base Rent Paid (%) | Total SF or Unit Count Making Full November Rent Payment (%)(1) | UW November Base Rent Paid (%) |

| WFB | 11/20/2020 | 11/13/2020 | McClellan Park | Industrial | NAP(2) | NAP(2) | N | N | Y(3) | 99.0% | 99.0% | 97.0%(3) | 97.0%(3) |

| Barclays | 11/16/2020 | 2/14/2020 | MGM Grand & Mandalay Bay | Hospitality | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 11/12/2020 | 10/7/2020 | Pacific Gateway II | Office | NAP(4) | Y | N | N | Y(5) | 84.7%(6) | 99.1% | (6)(7) | (7) |

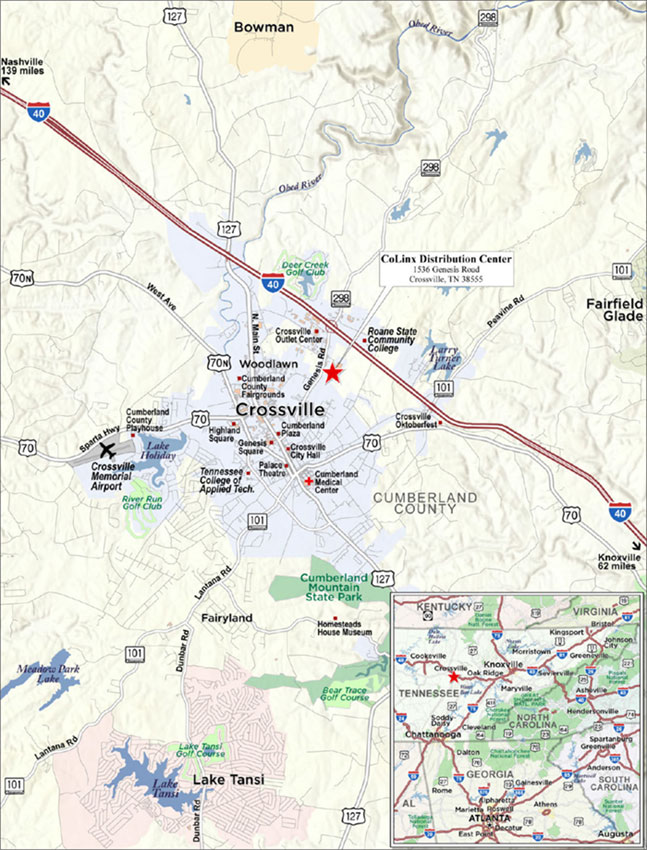

| BSPRT | 11/20/2020 | 11/5/2020 | CoLinx Distribution Center | Industrial | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 11/19/2020 | 10/1/2020 | The Arboretum | Retail | NAP(4) | Y | N | N | Y(8) | 93.9% | 95.7% | 92.8% | 91.9% |

| AREF | 11/10/2020 | 2/21/2020 | HPE Campus | Office | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BSPRT | 11/20/2020 | 10/22/2019 | Alto Pomona | Industrial | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

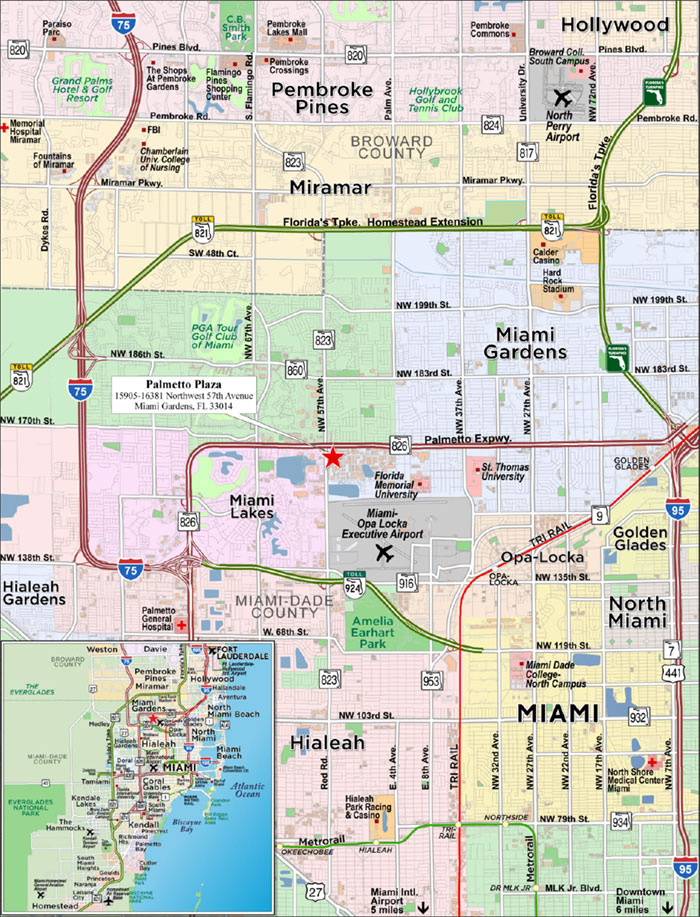

| Barclays | 11/16/2020 | 3/13/2020 | Palmetto Plaza | Retail | Y | Y | N | N | Y(9) | 97.7% | 99.3% | 97.7% | 99.3% |

| Barclays | 11/16/2020 | 11/12/2020 | Goldman Chicago Multifamily Portfolio Tranche 3 | Multifamily | NAP(2) | NAP(2) | N | N | N | 97.8%(10) | 97.8%(10) | 95.8%(10) | 95.8%(10) |

| AREF | 11/13/2020 | 10/20/2020 | Sullyfield Commerce Center I & II | Industrial | NAP(2) | NAP(2) | N | N | Y | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 11/16/2020 | 10/9/2020 | 10725 North De Anza Boulevard | Office | NAP(4) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/20/2020 | 2/5/2020 | Bel Villaggio | Retail | Y | Y | N | N | Y(11) | 71.6% | 68.8% | 41.3% | 61.5% |

| WFB | 11/16/2020 | 8/14/2020 | Home Depot - Gardena | Retail | Y | Y | N | N | Y(12) | 100.0% | 100.0% | 100.0% | 100.0% |

| AREF | 11/18/2020 | 10/23/2020 | Stone & Montague Portfolio | Mixed Use | NAP(2) | NAP(2) | N | N | Y(13) | 83.6% | 86.0% | 83.6% | 86.0% |

| WFB | 10/31/2020 | 10/1/2020 | 120 Wall Street | Office | NAP(4) | Y | N | N | Y(14) | 93.0%(15) | 96.8%(15) | 85.8%(15) | 90.2%(15) |

| Barclays | 11/16/2020 | 11/15/2019 | One Stockton | Retail | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BSPRT | 11/18/2020 | 10/6/2020 | Summerfield Apartments | Multifamily | NAP(4) | Y | N | N | N | 95.0% | 95.0% | 88.2%(16) | 88.2%(16) |

| LMF | 11/19/2020 | 10/22/2020 | Commerce Corporate Center | Office | NAP(2) | NAP(2) | N | N | Y(17) | (7) | 99.4% | 95.1% | 95.4% |

| WFB | 11/5/2020 | 2/27/2020 | Courtyard Marriott Solana Beach | Hospitality | Y | Y | N | Y(18) | N | (19) | (19) | (19) | (19) |

| Barclays | 11/16/2020 | 11/13/2020 | 100 Brandywine Boulevard | Office | NAP(2) | NAP(2) | N | N | Y(20) | 83.1% | 90.8%(20) | 83.1% | 90.8%(20) |

| BSPRT | 11/20/2020 | 11/16/2020 | West River Flats | Multifamily | NAP(2) | NAP(2) | N | N | N | 97.0% | 98.0% | NAV(21) | NAV(21) |

| AREF | 11/18/2020 | 11/18/2020 | 37 East 28th Street | Mixed Use | NAP(2) | NAP(2) | N | N | Y(22) | 81.1% | 75.2% | 81.1% | 71.9% |

| LMF | 11/20/2020 | 10/14/2020 | Centre Point | Office | NAP(2) | NAP(2) | N | N | Y(23) | 100.0% | 100.0% | 100.0% | 100.0% |

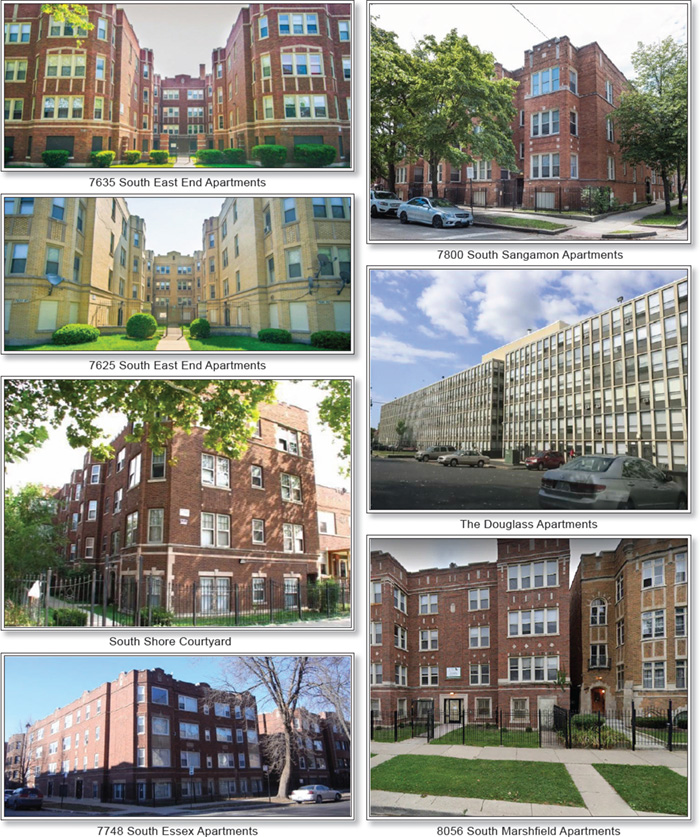

| Barclays | 11/16/2020 | 11/16/2020 | Hyde Park Multifamily Portfolio | Multifamily | NAP(2) | NAP(2) | N | N | N | 98.9%(24) | 98.9%(24) | 93.0%(24) | 93.0%(24) |

| WFB | 11/18/2020 | 2/11/2020 | 284 West Shaw and 1701 Santa Clara | Retail | Y | Y | N | Y(25) | Y(26) | 100.0% | 100.0% | 97.3% | 100.0% |

| Barclays | 11/16/2020 | 11/2/2020 | Goldman Chicago Multifamily Portfolio Tranche 4 | Multifamily | NAP(2) | NAP(2) | N | N | N | 90.7%(27) | 90.7%(27) | 81.7%(27) | 81.7%(27) |

| AREF | 11/13/2020 | 11/19/2020 | Alto 211 | Office | NAP(2) | NAP(2) | N | N | Y(28) | 100.0% | 100.0% | 100.0% | 99.3% |

| LMF | 11/19/2020 | 11/16/2020 | 170 North High Street | Office | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/1/2020 | 2/13/2020 | Holiday Inn Salina | Hospitality | Y | Y | Y(29) | Y(29) | NAP | (30) | (30) | (30) | (30) |

| LMF | 11/18/2020 | 1/31/2020 | Twilley Center | Retail | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 11/6/2020 | 9/29/2020 | Tractor Supply Portfolio | Retail | NAP(4) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BSPRT | 11/20/2020 | 10/6/2020 | Radcliff Apartment Portfolio | Multifamily | NAP(4) | Y | N | N | N | 94.5% | 94.9% | NAV(21) | NAV(21) |

| LMF | 11/19/2020 | 10/20/2020 | Plaza Del Mar | Retail | NAP(2) | NAP(2) | N | N | Y(31) | NAV(32) | NAV(32) | 79.0% | 62.4% |

| WFB | 10/16/2020 | 10/5/2020 | National Self Storage - Dove Mountain | Self Storage | NAP(4) | Y | N | N | Y | 95.9% | 95.2% | 95.9% | 94.3% |

| LMF | 11/19/2020 | 11/18/2020 | Clearfork MHC and Town & Country MHC Portfolio | Manufactured Housing Community | NAP(2) | NAP(2) | N | N | N | 97.4% | 97.4% | 82.1% | 82.1% |

| AREF | 11/13/2020 | 10/22/2020 | Baltimore Station | Mixed Use | NAP(2) | NAP(2) | N | N | Y(33) | 83.4% | 86.2% | 83.4% | 81.9% |

| Barclays | 11/16/2020 | 10/30/2020 | 866 UN Plaza | Office | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/19/2020 | 11/3/2020 | Tree Garden Business Park | Industrial | NAP(2) | NAP(2) | N | N | Y(34) | 100.0% | 100.0% | 87.9% | 88.1% |

| Barclays | 11/16/2020 | 10/6/2020 | 126 N Jefferson | Office | NAP(4) | Y | N | N | N | 100.0% | 100.0%(35) | 100.0% | 100.0%(35) |

| LMF | 11/17/2020 | 10/28/2020 | Golden Cove MHC | Manufactured Housing Community | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| BSPRT | 11/20/2020 | 10/15/2020 | The Meadows and Westwood II & III Apartments | Multifamily | NAP(2) | NAP(2) | N | N | N | 94.4% | 94.9% | 93.5% | 93.4% |

| LMF | 11/17/2020 | 11/13/2020 | Fabric Lofts Apartments | Mixed Use | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/17/2020 | 10/16/2020 | Jefferson Square Plaza | Mixed Use | NAP(2) | NAP(2) | N | N | Y(36) | 93.4% | 98.0% | 58.5% | 59.0% |

| LMF | 11/19/2020 | 10/20/2020 | Satterfield Marketplace | Retail | NAP(2) | NAP(2) | N(37) | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/18/2020 | 10/14/2020 | 5555 West Loop Office | Office | NAP(2) | NAP(2) | N | N | N | 98.4% | 98.5% | 91.1% | 91.8% |

| LMF | 11/19/2020 | 11/13/2020 | 1226 E. 7th Street | Multifamily | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/19/2020 | 11/13/2020 | 1047 E. 7th Street | Multifamily | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 11/19/2020 | 11/13/2020 | 409-413 E. 7th Street | Multifamily | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| (1) | Except as otherwise stated, Total SF or Unit Count Making Full October Rent Payment (%) and Total SF or Unit Count Making Full November Rent Payment (%) are presented as percentages of the total net rentable area. With respect to McClellan Park, The Arboretum, 120 Wall Street and 100 Brandywine Boulevard mortgaged properties, Total SF or Unit Count Making Full Rent Payment and UW Base Rent Paid percentages are based on occupied rather than total SF. |

| (2) | The related mortgage loans have their first due date in December 2020 or January 2021. |

| (3) | With respect to the McClellan Park mortgaged property, six tenants, representing 5.7% of the NRA have requested rent relief. In addition, the November information assumes all federal and state tenants have paid, which they usally pay in arrears in the first week of the following month. |

| (4) | The related mortgage loans have their first due date in November 2020. |

| (5) | With respect to the Pacific Gateway II mortgaged property, one tenant (0.7% of NRA and 0.9% of UW Rent) requested and received a rent deferral from September 2020 through February 2021, to be repaid over the following 10 months from March 2021 through December 2021. |

| (6) | With respect to the Pacific Gateway II mortgaged property, 14.6% of NRA is vacant. |

| (7) | With respect to the Pacific Gateway II mortgaged property, although October collections were reported, an accurate estimate of the percentage of Total SF or Unit Count Making Full Rent Payment (%) for November cannot be determined for the mortgage loan based on information received. With respect to the Commerce Corporate Center mortgaged property, although October collections were reported, an accurate estimate of the percentage of Total SF or Unit Count Making Full Rent Payment (%) for October cannot be determined for the mortgage loans based on information received. |

| (8) | With respect to The Arboretum mortgaged property, 31 tenants, representing 27.5% of UW Rent were granted rent deferrals ranging from one to four months with leases extended by the number of months deferred. |

| (9) | The Palmetto Plaza Property has three tenants, Rise Fitness, (11.3% of NRA and 8.8% of UW Base Rent), Affordable Dentures (2.2% of NRA and 2.5% of UW Base Rent), and Hamilton Ink (1.4% of NRA and 2.1% of UW Base Rent) that were granted rent relief. All three of tenants’ rent relief periods have ended, and they are current on all rent obligations as of November 2020. Additionally, Spectra Chrome (2.3% of NRA and 0.7% of UW Base Rent) has only been paying rent on a portion of its space. The borrower sponsors are negotiating with the tenant about using its security deposit to become current on its rent. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Transaction Highlights |

| (10) | With respect to the Goldman Chicago Multifamily Portfolio Tranche 3 mortgaged properties, Total SF or Unit Count Making Full October Rent Payment (%) and UW October Base Rent Paid (%) are based on rent collections through October 31, 2020 and Total SF or Unit Count Making Full November Rent Payment (%) and UW November Base Rent Paid (%) are based on rent collections through November 16, 2020. |

| (11) | With respect to the Bel Villaggio mortgaged property, Shogun Murrieta, LLC, the largest tenant, representing 6.9% of NRA, executed a lease modification which deferred base rent and reimbursements for April and May 2020, abated base rent in June 2020, and deferred half of the rent and reimbursements in November 2020. Shogun Murrieta, LLC is required to repay deferred rent in equal monthly installments of $10,863 from January 2021 to June 2021. Additionally, 12 tenants, representing 37.1% of NRA) were granted some form of rent relief under verbal agreement with the borrower. |

| (12) | With respect to the Home Depot – Gardena mortgaged property, in August 2020 one tenant, representing 10.0% of NRA and 5.6% of UW Rent, had its lease amendment to defer base rent by 1/3rd for a 12 month period from April 2020 through March 2021, with full contractual rent to resume in April 2021. Provided the tenant is not in default, the landlord will forgive 50% of the deferred rent and the tenant will repay the balance in 12 equal monthly installments beginning April 2021. |

| (13) | With respect to the Stone & Montague Portfolio mortgaged properties, the borrower sponsors reported that one commercial tenant, Murphy's Tavern, representing 15.1% of NRA and 21.0% of UW Base Rent (without rent steps), has been paying reduced rent since April 2020 and is expected to start paying full rent in January 2021 pursuant to a verbal agreement with the borrower. The borrower and guarantors executed a master lease guaranteeing payments under Murphy's Tavern’s lease, which expires two years after the maturity date of the mortgage loan. The mortgage loan is structured with a $300,000 upfront debt service reserve. Furthermore, Satori Laser (8.4% of NRA) was in a free rent period and will begin paying full, unabated rent in December 2020, as such was excluded from the calculations above. A one-month free rent reserve of $13,684 was escrowed upfront for such tenant. |

| (14) | With respect to the 120 Wall Street mortgaged property, two tenants (Foundation for AIDS Research and AFS-USA, Inc.) representing 10.6% of NRA and 9.9% of UW Rent, requested rent relief. The Foundation for AIDS Research’s request was denied and the AFS-USA, Inc.’s request is being evaluated. |

| (15) | With respect to 120 Wall Street mortgaged property, six tenants (11.1% of NRA and 10.4% of UW rent) have not made all of their contractual base rent payments. The Eye-Bank for SightResearch has not made September 2020 rent payments on 7,793 SF of its space (1.2% of NRA and 1.0% of UW Rent). The New Press (1.2% of NRA and 1.3% of UW rent) did not pay rent in April 2020, but it is expected to be paid by year end 2020. Georgoulis / Cohen (0.9% of NRA and 0.8% of UW rent) has not paid rent since July 2020, but has been sending in additional payments to resolve the delinquency. |

| (16) | With respect to the Summerfield Apartments mortgaged property, November percentages are based on total collections on partial month November as of November 18, 2020 and prior month gross potential rent. |

| (17) | With respect to the Commerce Corporate Center mortgaged property, three tenants received rent abatements. PeopleShare, Inc., the 25th-largest tenant, representing 1.2% of NRA received two months of abated rent ($8,155) and the tenant extended its lease by two months. National Discount Cruise Co., the 27th-largest tenant, representing 1.2% of NRA, received two months of abated rent ($7,188) and the tenant extended its lease by two months. Heidi C. Noll, Esquire, the 55th-largest tenant, representing 0.4% of NRA, received one month of abated rent ($1,516) and the tenant extended its lease by two years. |

| (18) | With respect to the Courtyard Marriott Solana Beach mortgage loan, the mortgage loan has been modified to (a) waive springing cash management triggered by a 1.20x DSCR and waive the springing seasonality reserve for 12 months until January 1, 2022 and (b) include a $709,246 debt service reserve, representing approximately 6 months of payments. |

| (19) | With respect to the Courtyard Marriott Solana Beach mortgaged property, the August and September 2020 occupancy, ADR and RevPAR information was 69.9%, $122.77, $85.77 and 59.6%, $126.52, $75.39, respectively. Occupancy, ADR and RevPAR information is due to the lender 30 days after month’s end; therefore, October 2020 and November 2020 information is not available. |

| (20) | The 100 Brandywine Boulevard Property has one tenant, Hearthside Realty (Coldwell Banker), (12.9% of NRA and 18.3% of UW Base Rent) that has requested rent relief. The tenant has reached an agreement with the borrower to continue to pay 50.0% of base rent for June through December 2020, which will be repaid in equal installments over the 15-month period from January 2021 to March 2022. |

| (21) | With respect to the West River Flats and Radcliff Apartment Portfolio mortgaged properties, information regarding November collections is unavailable as it is provided towards the end of the respective month. |

| (22) | With respect the 37 East 28th Street mortgaged property, the borrower sponsor reported that six tenants, representing 29.0% of NRA and 41.9% of UW Base Rent ("Rent Relief Tenants"), have lease modifications or verbal agreements to pay reduced, deferred and/or abated rent, including the months of October and November. The Rent Relief Tenants paid their respective October and November rent payment as agreed and as such were included in the calculation of Total SF Making Full October or November Rent Payment. Abe Health, LLC, representing 3.0% of NRA and 3.2% of the UW Base Rent, is not yet in occupancy of its space and did not pay rent in October or November. In addition, Dianne Harrison USA Inc., representing 2.6% of NRA and 2.7% of UW Base Rent, has not been occupying its space and did not pay rent in October or November. The mortgage loan is structured with a COVID-19 rent reserve of $675,000, equivalent to approximately 12 months’ gross rent for three of the six Rent Relief Tenants and Abe Health, LLC. The COVID-19 rent reserve will be disbursed upon the satisfaction of certain conditions for at least three consecutive months, including, but not limited to: (i) the occupancy level exceeds 80.0%, (ii) the debt yield is at least 8.0% and (iii) all tenants are paying unabated rent. The borrower and guarantors executed a master lease agreement to guarantee rent payments for the spaces leased to the remaining three Rent Relief Tenants, Abe Health, LLC, and tenant Sharon Realty NY Corp., a borrower sponsor affiliate. The master lease is scheduled to expire (i) 15 years after commencement for three tenant spaces and (ii) upon the satisfaction of certain conditions for the remaining spaces, including: when the tenant, or a replacement tenant acceptable to the lender, has (a) taken occupancy and paid full rent for 6 consecutive months or (b) executed a long-term extension or new lease, as applicable. The borrower funded a debt service reserve in the amount of $595,000 and an earnout reserve of $500,000 at origination, which amounts will be disbursed upon the satisfaction of certain conditions including the mortgaged property achieving a debt yield of at least 9.5% for at least one calendar quarter. |

| (23) | With respect to the Centre Point mortgaged property, Ignitist, Inc, the second largest tenant, representing 18.8% of NRA, received a rent deferment in which the tenant was required to pay 50% fixed rent from March through July 2020 (5 months). Beginning January 2021 through April 2021, the tenant will be required to repay the deferred rent in four monthly installments of $17,425.55. |

| (24) | With respect to the Hyde Park Multifamily Portfolio mortgaged properties, Total SF or Unit Count Making Full October Rent Payment (%) and UW October Base Rent Paid (%) are based on rent collections through October 31, 2020 and Total SF or Unit Count Making Full November Rent Payment (%) and UW November Base Rent Paid (%) are based on rent collections through November 16, 2020. The borrower sponsor expects that November 2020 rent collections will ultimately be in-line with October 2020 collections. |

| (25) | With respect to 284 West Shaw and 1701 Santa Clara, the mortgage loan was modified to suspend the cash flow sweep for the sole tenant at 284 West Shaw mortgaged property (Crunch Fitness) being dark; however, the modification effectively ended once the tenant re-opened in June 2020. |

| (26) | With respect to the 1701 Santa Clara mortgaged property, two tenants (Dr. Liro DDS and Farmers Insurance), collectively representing 18.7% of NRA and 18.5% of UW Rent, received rent deferrals in May and June 2020. The deferred rent is required to be paid back over the period of each tenant’s remaining lease term starting in July 2020. |

| (27) | With respect to the Goldman Chicago Multifamily Portfolio Tranche 4 mortgaged properties, Total SF or Unit Count Making Full October Rent Payment (%) and UW October Base Rent Paid (%) are based on rent collections through October 31, 2020 and Total SF or Unit Count Making Full November Rent Payment (%) and UW November Base Rent Paid (%) are based on rent collections through November 16, 2020. |

| (28) | With respect to the Alto 211 mortgaged property, the borrower sponsor reported that 12 tenants representing 38.6% of NRA and 7 tenants representing 20.9% of NRA, were entitled to free rent during the months of October and November, respectively, as such, these tenants were included in the calculation as having paid full rent. When excluding these tenants in the calculation, the percentages are 58.3%, 62.9%, 76.2% and 74.0% for Total SF or Unit Count Making Full October Rent Payment (%), UW October Base Rent Paid (%), Total SF or Unit Count Making Full November Rent Payment (%), and UW November Base Rent Paid (%), respectively. The mortgage loan is structured with an upfront free rent reserve in the amount of $99,018 for the remaining free rent associated with these leases. In addition, an upfront debt service reserve of $450,000 was funded at origination. |

| (29) | With respect to the Holiday Inn Salina mortgaged property, the borrower and lender entered into forbearance agreement dated May 20, 2020 which allowed for the deferral of monthly principal and interest payments and monthly FF&E deposits so long as the borrower continued to make monthly tax and insurance deposit payments. During the forbearance period (May 2020 – July 2020), notwithstanding the forbearance agreement, the borrower made regularly scheduled payments due under the mortgage loan agreement (other than $991.89 not paid in June 2020 due to servicing administrative billing error, which has since been repaid). The forbearance agreement provided for a potential extension but the mortgaged property revenue exceeded that required for an extension under the forbearance agreement and the term of the forbearance agreement expired in July 2020. Commencing March 2020, the borrower stopped paying license fees to the franchisor. The borrower had discussions with the franchisor regarding a deferral/abatement of these fees and never entered into a written agreement. As of November 15, 2020, the borrower had paid in full all outstanding fees (March – November, 2020) due to the franchisor. |

| (30) | With respect to the Holiday Inn Salina mortgaged property, the September and October 2020 occupancy, ADR and RevPAR information was 64.4%, $82.17 and $52.90 and 60.0%, $83.78 and $50.27, respectively. November 2020 information is not available. |

| (31) | With respect to the Plaza Del Mar mortgaged property, Wild Fork Foods, the largest tenant, representing 20.8% of NRA, received 50% rent reduction in May and July 2020 and the borrower and the tenant agreed to reduce base rent by $4,000 per month from November 2020 through December 2021. Cao Cafe, the third-largest tenant, representing 8.1% of NRA, received rent relief of 100% in March and May 2020, and rent relief of 50% in June and August 2020, totaling approximately $36,000. Cao Cafe agreed to repay approximately $18,000 to the seller of the mortgaged property, and the other half was written off (no payment is owed to the borrower). Vanny Nail, the fifth-largest tenant, representing 6.3% of NRA received 100% rent relief in July 2020. |

| (32) | With respect to the Plaza Del Mar mortgaged property, Total SF or Unit Count Making Full October Rent Payment (%) and UW October Base Rent Paid (%) are unavailable because the mortgaged property was acquired in October 2020. |

| (33) | With respect to the Baltimore Station mortgaged property, the borrower sponsor reported that four tenants, representing 17.4% of the unit count for the multifamily component, did not pay full rent in October and November. The borrower sponsor intends to vacate these units when the related eviction moratorium has been lifted. In addition, three of the four commercial tenants, representing 21.6% of total NRA and 21.4% of UW Base Rent, are not yet in occupancy or have not commenced paying rent and as such were excluded from the calculations. An upfront gap rent reserve associated with these tenants in the amount of $53,437 was funded at origination. The percentage for Total SF or Unit Count Making Full Rent Payment was calculated as a weighted average of the mortgaged property by unit with the one in place commercial tenant counting as one unit. |

| (34) | With respect to the Tree Garden Business Park mortgaged property, Textronics, the third-largest tenant, representing 12.1% of NRA paid 50% of its base rent in April, May, June and July 2020, renewed its lease in June 2020 and is repaying approximately $19,000 of rent on a weekly payment plan. |

| (35) | With respect to the 126 N Jefferson mortgaged property, two tenants have been granted abated rent on their respective expansion leases. These tenants are both current as of their October 2020 and November 2020 rent obligations and all abated rent was reserved at origination. |

| (36) | With respect to the Jefferson Square Plaza mortgaged property, the seller of the mortgaged property provided rent relief in response to three formal rent relief requests. Bethlehem Pre-School, the largest tenant, representing 16.0% of NRA, had $11,587 in base rent due in June 2020 waived. Organizacion Cristiana Amor Viviente, the second-largest tenant, representing 11.3% of NRA, had $18,263 in base rent due in May, June and July 2020 waived. New Covenant of Love & Restoration Ministries, the third-largest tenant, representing 5.7% of NRA, had $5,104 in base rent due in May 2020 waived. In addition 23 tenants had rent delinquencies totaling $15,695 through July 31, 2020, which was forgiven in conjunction of the sale of the mortgaged property to the borrower. |

| (37) | With respect to the Satterfield Marketplace mortgaged property, Aspen Dental, the largest tenant, representing 28.6% of NRA received 100% base rent abatement in April and May 2020 and extended its lease through May 2030. My Eyelab, the third-largest tenant, representing 19.8% of NRA received 100% deferral of base rent for the month of February 2020 and 50% deferral of base rent for the months of March 2020 through June 2020. The tenant repaid all deferred rent and reimbursements in August and September. Original Mattress Factory, the fourth-largest tenant, representing 19.6% of NRA received 100% base rent abatement for approximately 1 month in April. Tropical Smoothie Café, the fifth-largest tenant, representing 11.4% of NRA received a 50% base rent abatement from April 2020 through June 2020 and extended its lease by 2 months. |

See “Risk Factors—Risks Related to Market Conditions and Other External Factors—The Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Issue Characteristics |

IV. Issue Characteristics

| Securities Offered: | $597,385,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of thirty classes (Classes A-1, A-2, A-SB, A-3, A-3-1, A-3-2, A-3-X1, A-3-X2, A-4, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S, A-S-1, A-S-2, A-S-X1, A-S-X2, B, B-1, B-2, B-X1, B-X2, C, C-1, C-2, C-X1, C-X2, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Barclays Capital Real Estate Inc. (“Barclays”), LMF Commercial, LLC (“LMF”), BSPRT CMBS Finance, LLC (“BSPRT”) and Argentic Real Estate Finance LLC (“AREF”) |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC and Barclays Capital Inc. |

| Co-Managers: | Academy Securities, Inc. and Drexel Hamilton, LLC |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and Moody’s Investors Service, Inc. |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Initial Majority Controlling Class Certificateholder: | RREF IV-D AIV RR H, LLC or another affiliate of Rialto Capital Advisors, LLC and Rialto Real Estate Fund IV – Debt, LP |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus.

This transaction is being structured with a “third party purchaser” that will acquire an “eligible horizontal residual interest”, which will be comprised of the Class D-RR, E-RR, F-RR, G-RR, H-RR and J-RR Certificates (the “horizontal risk retention certificates”). RREF IV-D AIV RR H, LLC (in satisfaction of the retention obligations of Wells Fargo Bank, National Association, as the retaining sponsor) will be contractually obligated to retain (or to cause its “majority-owned affiliate” to retain) the horizontal risk retention certificates for a minimum of five years after the closing date, subject to certain permitted exceptions provided for under the risk retention rules. During this time, RREF IV-D AIV RR H, LLC will agree to comply with hedging, transfer and financing restrictions that are applicable to third party purchasers under the credit risk retention rules. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus.

|

| EU Credit Risk Retention | None of the sponsors, the depositor, the underwriters, or their respective affiliates, or any other party to the transaction intends or is required to retain a material net economic interest in the securitization constituted by the issue of the Certificates in a manner that would satisfy the requirements of the European Union Regulation (EU) 2017/2402. In addition, no such person undertakes to take any other action which may be required by any investor for the purposes of its compliance with any applicable requirement under such Regulation. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirements of such Regulation. |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in December 2020 (or, in the case of any mortgage loan that has its first due date in January 2021, the date that would have been its due date in December 2020 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Closing Date: | On or about December 16, 2020. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in January 2021. |

| Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in January 2021. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Issue Characteristics |

| Rated Final Distribution Date: | The Distribution Date in July 2053. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| Clean-up Call: | 1.0% |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Interactive Data Corp., Markit Group Limited, BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., KBRA Analytics, LLC, MBS Data, LLC, Thomson Reuters Corporation and RealINSIGHT. |

| Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of two or more REMICs arranged in a tiered structure and a trust (the “grantor trust”). The upper-most REMIC will issue REMIC regular interests some of which will be held by the grantor trust (such grantor trust-held REMIC regular interests, the “trust components”). The Offered Certificates (other than the Exchangeable Certificates) will represent REMIC regular interests (other than the trust components). The Exchangeable Certificates will represent beneficial ownership of one or more of the trust components held by the grantor trust. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Characteristics of the Mortgage Pool |

V. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

| Mortgage Loan Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property Type | Number of SF/ Units/ Rooms | Cut-off Date Balance Per SF/Unit/ Room | Cut-off Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

| WFB | McClellan Park | McClellan | CA | 1 / 1 | $69,000,000 | 9.9% | Industrial | 6,925,484 | $52 | 60.2% | 60.2% | 2.90x | 10.5% |

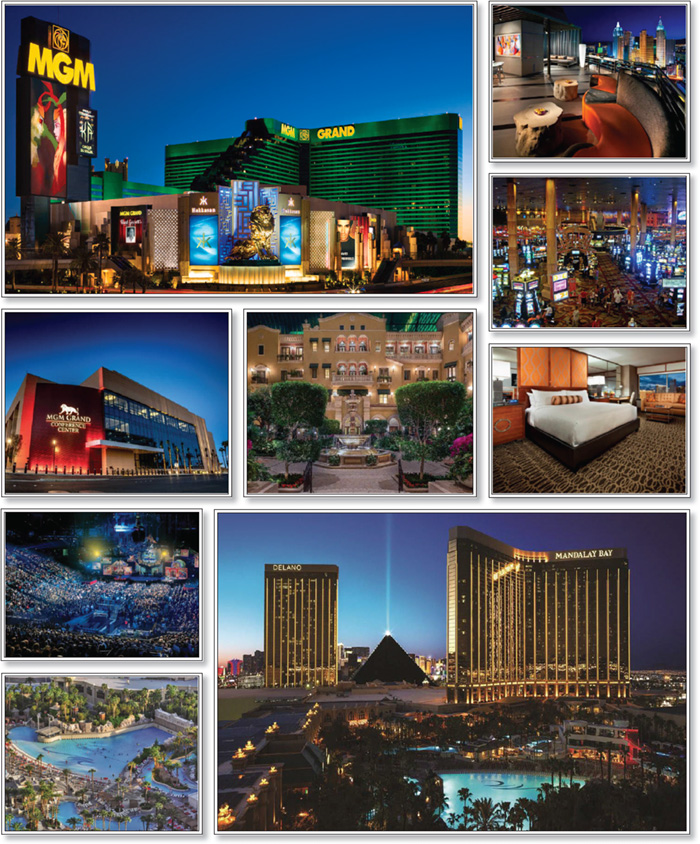

| Barclays | MGM Grand & Mandalay Bay | Las Vegas | NV | 1 / 2 | 45,000,000 | 6.5 | Hospitality | 9,748 | 167,645 | 35.5 | 35.5 | 4.95 | 17.9 |

| WFB | Pacific Gateway II | Torrance | CA | 1 / 1 | 39,300,000 | 5.6 | Office | 237,057 | 166 | 70.6 | 58.9 | 1.79 | 10.8 |

| BSPRT | CoLinx Distribution Center | Crossville | TN | 1 / 1 | 36,699,003 | 5.3 | Industrial | 900,177 | 41 | 65.0 | 52.1 | 1.41 | 9.5 |

| WFB | The Arboretum | Charlotte | NC | 1 / 1 | 34,890,190 | 5.0 | Retail | 555,912 | 179 | 58.6 | 45.6 | 1.70 | 9.6 |

| AREF | HPE Campus | Roseville | CA | 1 / 1 | 26,770,000 | 3.8 | Office | 447,364 | 149 | 64.8 | 64.8 | 2.71 | 9.9 |

| BSPRT | Alto Pomona | Pomona | CA | 1 / 1 | 23,625,000 | 3.4 | Industrial | 288,195 | 82 | 67.7 | 58.1 | 1.28 | 8.6 |

| Barclays | Palmetto Plaza | Miami Gardens | FL | 1 / 1 | 22,650,000 | 3.3 | Retail | 175,035 | 129 | 64.3 | 58.2 | 1.66 | 9.7 |

| Barclays | Goldman Chicago Multifamily Portfolio Tranche 3 | Chicago | IL | 1 / 7 | 20,475,000 | 2.9 | Multifamily | 328 | 62,424 | 75.0 | 61.0 | 2.05 | 11.2 |

| AREF | Sullyfield Commerce Center I & II | Chantilly | VA | 1 / 1 | 20,000,000 | 2.9 | Industrial | 245,888 | 81 | 44.4 | 44.4 | 4.72 | 15.5 |

| Top Three Total/Weighted Average | 3 / 4 | $153,300,000 | 22.0% | 55.6% | 52.6% | 3.22x | 12.7% | ||||||

| Top Five Total/Weighted Average | 5 / 6 | $224,889,193 | 32.3% | 57.6% | 51.4% | 2.69x | 11.7% | ||||||

| Top Ten Total/Weighted Average | 10 / 17 | $338,409,193 | 48.6% | 59.6% | 53.6% | 2.60x | 11.4% | ||||||

| Non-Top Ten Total/Weighted Average | 38 / 53 | $357,893,402 | 51.4% | 60.2% | 54.4% | 2.07x | 10.2% | ||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| No. | Loan Name | Mortgage Loan Seller in WFCM 2020-C58 | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance(1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | McClellan Park | WFB | $69,000,000 | $358,000,000 | BMARK 2020-B21(2)(4) | Midland Loan Services, a Division of PNC Bank, National Association(2) | Midland Loan Services, a Division of PNC Bank, National Association(2) | BMARK 2020-B21(4) | $75,000,000 |

| Future Securitization(s) | $214,000,000 | ||||||||

| 2 | MGM Grand & Mandalay Bay | Barclays | $45,000,000 | $1,634,200,000 | BX 2020-VIVA(3) | KeyBank National Association | Situs Holdings, LLC | BX 2020-VIVA | $670,139 |

| BX 2020-VIV2 | $794,861 | ||||||||

| BX 2020-VIV3 | $1,000,000 | ||||||||

| BMARK 2020-B18 | $65,000,000 | ||||||||

| BMARK 2020-B19 | $80,000,000 | ||||||||

| BMARK 2020-B20 | $70,000,000 | ||||||||

| BMARK 2020-B21(4) | $75,000,000 | ||||||||

| BBCMS 2020-C8 | $69,500,000 | ||||||||

| DBJPM 2020-C9 | $50,000,000 | ||||||||

| Future Securitization(s) | $1,177,235,000 | ||||||||

| 5 | The Arboretum | WFB | $34,890,190 | $99,686,258 | BANK 2020-BNK29(5) | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BANK 2020-BNK29(5) | $40,000,000 |

| Future Securitization(s) | $25,000,000 | ||||||||

| 6 | HPE Campus | AREF | $26,770,000 | $66,770,000 | MSC 2020-HR8 | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | MSC 2020-HR8 | $20,000,000 |

| WFCM 2020-C56 | $20,000,000 | ||||||||

| 15 | 120 Wall Street | WFB | $15,000,000 | $165,000,000 | BANK 2020-BNK29(5) | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BANK 2020-BNK29(5) | $80,000,000 |

| BMARK 2020-B20 | $70,000,000 | ||||||||

| 16 | One Stockton | Barclays | $15,000,000 | $66,000,000 | WFCM 2020-C55 | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | WFCM 2020-C55 | $30,000,000 |

| BBCMS 2020-C7 | $21,000,000 | ||||||||

| 19 | Courtyard Marriott Solana Beach | WFB | $14,303,056 | $25,646,859 | WFCM 2020-C58 | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BANK 2020-BNK29(5) | $11,500,000 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes any related Subordinate Companion Loans. |

| (2) | The related whole loan is expected to initially be serviced under the BMARK 2020-B21 securitization pooling and servicing agreement until the securitization of the related “lead” pari passu note, after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2020-C58 certificates after the closing of such securitization. Control rights with respect to the related whole loan will be exercised by the holder of the “lead” pari passu note. |

| (3) | Control rights are currently exercised by the holder of the related Subordinate Companion Loan until the occurrence and during the continuation of a control appraisal period for the related whole loan, as described under "Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The MGM Grand & Mandalay Bay Whole Loan" in the Preliminary Prospectus |

| (4) | The BMARK 2020-B21 transaction is expected to close on or about November 30, 2020. |

| (5) | The BANK 2020-BNK29 transaction is expected to close on or about November 30, 2020. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Characteristics of the Mortgage Pool |

C. Mortgage Loans with Additional Secured and Mezzanine Financing

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 2 | Barclays | MGM Grand & Mandalay Bay | $45,000,000 | 6.5% | $1,365,800,000 | NAP | 3.5580% | 4.95x | 2.70x | 17.9% | 9.7% | 35.5% | 65.2% |

| Total/Weighted Average | $45,000,000 | 6.5% | $1,365,800,000 | NAP | 3.5580% | 4.95x | 2.70x | 17.9% | 9.7% | 35.5% | 65.2% | ||

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Wells Fargo Commercial Mortgage Trust 2020-C58 | Characteristics of the Mortgage Pool |

D. Previous Securitization History(1)

| Loan No. | Mortgage Loan Seller | Mortgage Loan or Mortgaged Property Name | City | State | Property Type | Mortgage Loan or Mortgaged Property Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Previous Securitization |

| 4 | BSPRT | CoLinx Distribution Center | Crossville | TN | Industrial | $36,699,003 | 5.3% | COMM 2013-LC13 |

| 5 | WFB | The Arboretum | Charlotte | NC | Retail | 34,890,190 | 5.0 | WFRBS 2011-C2 |

| 13 | WFB | Home Depot - Gardena | Gardena | CA | Retail | 15,500,000 | 2.2 | UBSBB 2012-C2 |

| 15 | WFB | 120 Wall Street | New York | NY | Office | 15,000,000 | 2.2 | MSBAM 2014-C14 |

| 17 | BSPRT | Summerfield Apartments | Harvey | LA | Multifamily | 14,500,000 | 2.1 | UBSC 2011-C1 |

| 28 | LMF | 170 North High Street | Columbus | OH | Office | 9,200,000 | 1.3 | WCMT 2015-SBC5 |

| 30 | LMF | Twilley Center | Salisbury | MD | Retail | 9,176,600 | 1.3 | M360 2018-CRE1 |

| Total | $134,965,794 | 19.4% |