Exhibit 99.4

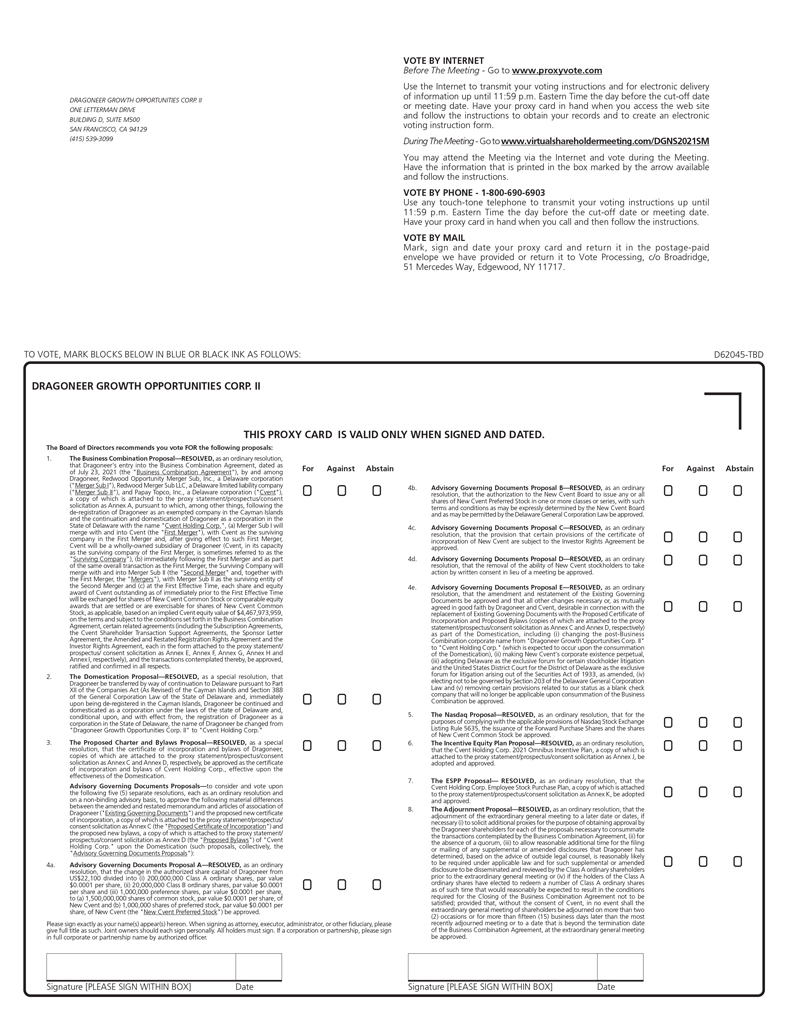

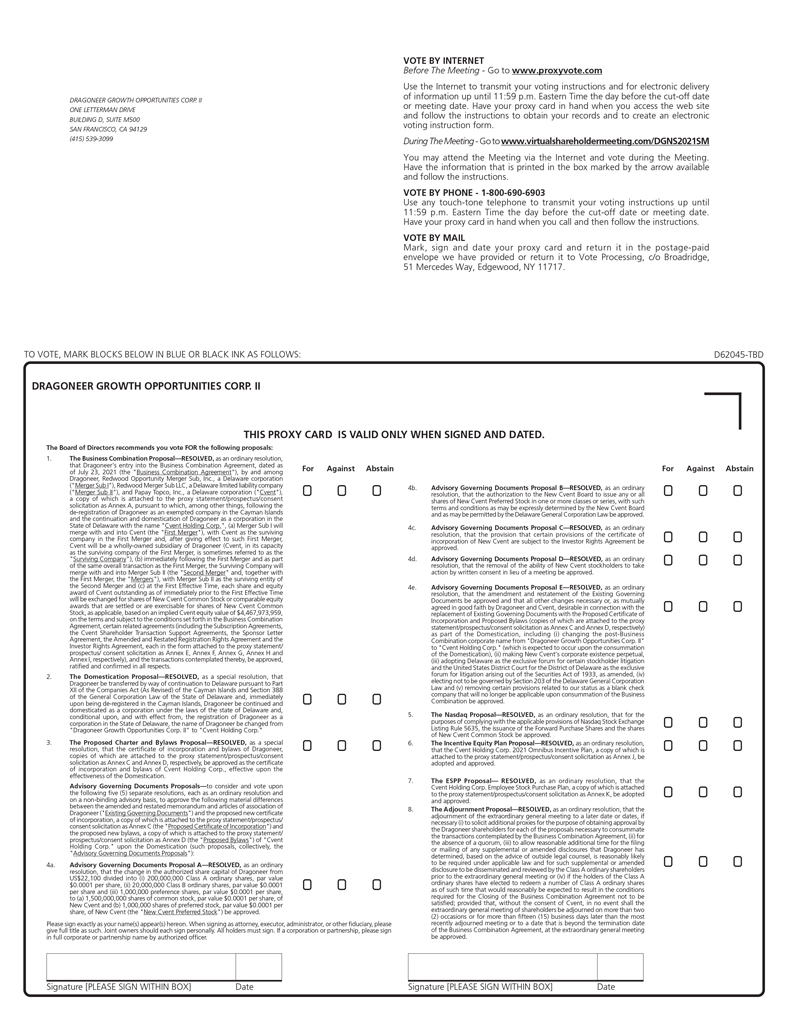

DRAGONEER GROWTH OPPORTUNITIES CORP. II ONE LETTERMAN DRIVE BUILDING D, SUITE M500 SAN FRANCISCO, CA 94129 (415) 539-3099 VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting—Go to www.virtualshareholdermeeting.com/DGNS2021SM You may attend the Meeting via the Internet and vote during the Meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE—1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D62045-TBD DRAGONEER GROWTH OPPORTUNITIES CORP. II THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. The Board of Directors recommends you vote FOR the following proposals: 1. The Business Combination Proposal—RESOLVED, as an ordinary resolution, that Dragoneer’s entry into the Business Combination Agreement, dated as of July 23, 2021 (the “Business Combination Agreement”), by and among Dragoneer, Redwood Opportunity Merger Sub, Inc., a Delaware corporation (“Merger Sub I”), Redwood Merger Sub LLC, a Delaware limited liability company (“Merger Sub II”), and Papay Topco, Inc., a Delaware corporation (“Cvent”), a copy of which is attached to the proxy statement/prospectus/consent solicitation as Annex A, pursuant to which, among other things, following the de-registration of Dragoneer as an exempted company in the Cayman Islands and the continuation and domestication of Dragoneer as a corporation in the State of Delaware with the name “Cvent Holding Corp.”, (a) Merger Sub I will merge with and into Cvent (the “First Merger”), with Cvent as the surviving company in the First Merger and, after giving effect to such First Merger, Cvent will be a wholly-owned subsidiary of Dragoneer (Cvent, in its capacity as the surviving company of the First Merger, is sometimes referred to as the “Surviving Company”), (b) immediately following the First Merger and as part of the same overall transaction as the First Merger, the Surviving Company will merge with and into Merger Sub II (the “Second Merger” and, together with the First Merger, the “Mergers”), with Merger Sub II as the surviving entity of the Second Merger and (c) at the First Effective Time, each share and equity award of Cvent outstanding as of immediately prior to the First Effective Time will be exchanged for shares of New Cvent Common Stock or comparable equity awards that are settled or are exercisable for shares of New Cvent Common Stock, as applicable, based on an implied Cvent equity value of $4,467,973,959, on the terms and subject to the conditions set forth in the Business Combination Agreement, certain related agreements (including the Subscription Agreements, the Cvent Shareholder Transaction Support Agreements, the Sponsor Letter Agreement, the Amended and Restated Registration Rights Agreement and the Investor Rights Agreement, each in the form attached to the proxy statement/ prospectus/ consent solicitation as Annex E, Annex F, Annex G, Annex H and Annex I, respectively), and the transactions contemplated thereby, be approved, ratified and confirmed in all respects. 2. The Domestication Proposal—RESOLVED, as a special resolution, that Dragoneer be transferred by way of continuation to Delaware pursuant to Part XII of the Companies Act (As Revised) of the Cayman Islands and Section 388 of the General Corporation Law of the State of Delaware and, immediately upon being de-registered in the Cayman Islands, Dragoneer be continued and domesticated as a corporation under the laws of the state of Delaware and, conditional upon, and with effect from, the registration of Dragoneer as a corporation in the State of Delaware, the name of Dragoneer be changed from “Dragoneer Growth Opportunities Corp. II” to “Cvent Holding Corp.” 3. The Proposed Charter and Bylaws Proposal—RESOLVED, as a special resolution, that the certificate of incorporation and bylaws of Dragoneer, copies of which are attached to the proxy statement/prospectus/consent solicitation as Annex C and Annex D, respectively, be approved as the certificate of incorporation and bylaws of Cvent Holding Corp., effective upon the effectiveness of the Domestication. Advisory Governing Documents Proposals—to consider and vote upon the following five (5) separate resolutions, each as an ordinary resolution and on a non-binding advisory basis, to approve the following material differences between the amended and restated memorandum and articles of association of Dragoneer (“Existing Governing Documents”) and the proposed new certificate of incorporation, a copy of which is attached to the proxy statement/prospectus/ consent solicitation as Annex C (the “Proposed Certificate of Incorporation”) and the proposed new bylaws, a copy of which is attached to the proxy statement/ prospectus/consent solicitation as Annex D (the “Proposed Bylaws”) of “Cvent Holding Corp.” upon the Domestication (such proposals, collectively, the “Advisory Governing Documents Proposals”): 4a. Advisory Governing Documents Proposal A—RESOLVED, as an ordinary resolution, that the change in the authorized share capital of Dragoneer from US$22,100 divided into (i) 200,000,000 Class A ordinary shares, par value $0.0001 per share, (ii) 20,000,000 Class B ordinary shares, par value $0.0001 per share and (iii) 1,000,000 preference shares, par value $0.0001 per share, to (a) 1,500,000,000 shares of common stock, par value $0.0001 per share, of New Cvent and (b) 1,000,000 shares of preferred stock, par value $0.0001 per share, of New Cvent (the “New Cvent Preferred Stock”) be approved. For Against Abstain 4b. Advisory Governing Documents Proposal B—RESOLVED, as an ordinary resolution, that the authorization to the New Cvent Board to issue any or all shares of New Cvent Preferred Stock in one or more classes or series, with such terms and conditions as may be expressly determined by the New Cvent Board and as may be permitted by the Delaware General Corporation Law be approved. 4c. Advisory Governing Documents Proposal C—RESOLVED, as an ordinary resolution, that the provision that certain provisions of the certificate of incorporation of New Cvent are subject to the Investor Rights Agreement be approved. 4d. Advisory Governing Documents Proposal D—RESOLVED, as an ordinary resolution, that the removal of the ability of New Cvent stockholders to take action by written consent in lieu of a meeting be approved. 4e. Advisory Governing Documents Proposal E—RESOLVED, as an ordinary resolution, that the amendment and restatement of the Existing Governing Documents be approved and that all other changes necessary or, as mutually agreed in good faith by Dragoneer and Cvent, desirable in connection with the replacement of Existing Governing Documents with the Proposed Certificate of Incorporation and Proposed Bylaws (copies of which are attached to the proxy statement/prospectus/consent solicitation as Annex C and Annex D, respectively) as part of the Domestication, including (i) changing the post-Business Combination corporate name from “Dragoneer Growth Opportunities Corp. II” to “Cvent Holding Corp.” (which is expected to occur upon the consummation of the Domestication), (ii) making New Cvent’s corporate existence perpetual, (iii) adopting Delaware as the exclusive forum for certain stockholder litigation and the United States District Court for the District of Delaware as the exclusive forum for litigation arising out of the Securities Act of 1933, as amended, (iv) electing not to be governed by Section 203 of the Delaware General Corporation Law and (v) removing certain provisions related to our status as a blank check company that will no longer be applicable upon consummation of the Business Combination be approved. 5. The Nasdaq Proposal—RESOLVED, as an ordinary resolution, that for the purposes of complying with the applicable provisions of Nasdaq Stock Exchange Listing Rule 5635, the issuance of the Forward Purchase Shares and the shares of New Cvent Common Stock be approved. 6. The Incentive Equity Plan Proposal—RESOLVED, as an ordinary resolution, that the Cvent Holding Corp. 2021 Omnibus Incentive Plan, a copy of which is attached to the proxy statement/prospectus/consent solicitation as Annex J, be adopted and approved. 7. The ESPP Proposal— RESOLVED, as an ordinary resolution, that the Cvent Holding Corp. Employee Stock Purchase Plan, a copy of which is attached to the proxy statement/prospectus/consent solicitation as Annex K, be adopted and approved. 8. The Adjournment Proposal—RESOLVED, as an ordinary resolution, that the adjournment of the extraordinary general meeting to a later date or dates, if necessary (i) to solicit additional proxies for the purpose of obtaining approval by the Dragoneer shareholders for each of the proposals necessary to consummate the transactions contemplated by the Business Combination Agreement, (ii) for the absence of a quorum, (iii) to allow reasonable additional time for the filing or mailing of any supplemental or amended disclosures that Dragoneer has determined, based on the advice of outside legal counsel, is reasonably likely to be required under applicable law and for such supplemental or amended disclosure to be disseminated and reviewed by the Class A ordinary shareholders prior to the extraordinary general meeting or (iv) if the holders of the Class A ordinary shares have elected to redeem a number of Class A ordinary shares as of such time that would reasonably be expected to result in the conditions required for the Closing of the Business Combination Agreement not to be satisfied; provided that, without the consent of Cvent, in no event shall the extraordinary general meeting of shareholders be adjourned on more than two (2) occasions or for more than fifteen (15) business days later than the most recently adjourned meeting or to a date that is beyond the termination date of the Business Combination Agreement, at the extraordinary general meeting be approved. For Against Abstain Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature [PLEASE SIGN WITHIN BOX] Date