Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

VIGIL NEUROSCIENCE, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Securities Exchange Act of 1934 Rules 14a-6(i)(1) and 0-11. |

Table of Contents

VIGIL NEUROSCIENCE, INC.

1 Broadway, 7th Floor, Suite 07-300

Cambridge, MA 02142

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held June 9, 2022

Notice is hereby given that the 2022 Annual Meeting of Stockholders of Vigil Neuroscience, Inc. (the “Annual Meeting”) will be held online on June 9, 2022 at 8:30 a.m. Eastern Time. In light of continuing concerns resulting from the global spread of the SARS-CoV-2 virus (coronavirus) and the COVID-19 pandemic, the Annual Meeting will be held virtually, and you may attend the meeting via the Internet at www.virtualshareholdermeeting.com/VIGL2022, where you will be able to vote electronically and submit questions. You will need the 16-digit control number included with the Notice of Internet Availability of Proxy Materials being mailed to you separately in order to attend the Annual Meeting.

Stockholders of record at the close of business on April 11, 2022, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting. The purpose of the Annual Meeting is the following:

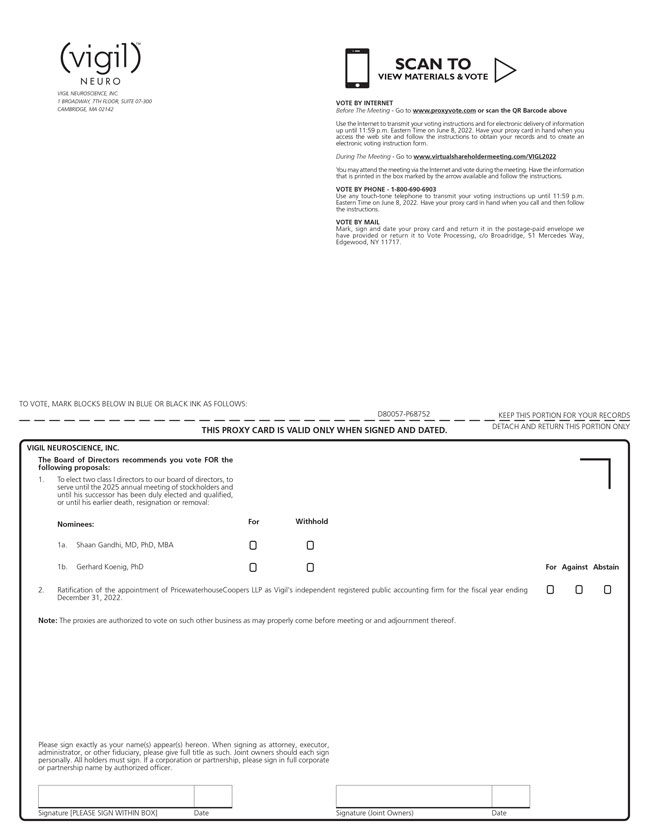

| 1. | To elect two class I directors to our board of directors, to serve until the 2025 annual meeting of stockholders and until his successor has been duly elected and qualified, or until his earlier death, resignation or removal; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 3. | To transact any other business properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

You can find more information on each of the matters to be voted on at the Annual Meeting, including information regarding the nominees for election to our board of directors, in the accompanying proxy statement. The board of directors recommends a vote “FOR” the election of each of the two nominees for class I directors and “FOR” the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2022, as disclosed in the accompanying proxy statement.

This year, the Company is following the Securities and Exchange Commission’s “Notice and Access” rule that allows companies to furnish their proxy materials by posting them on the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of the accompanying proxy statement and our Annual Report for the fiscal year ended December 31, 2021 (the “2021 Annual Report”). We are mailing the Notice on or about April 28, 2022, and it contains instructions on how to access both the 2021 Annual Report and accompanying proxy statement (the “Proxy Materials”) over the Internet. This method provides our stockholders with expedited access to Proxy Materials and not only lowers the cost of printing and distribution but also reduces the environmental impact of the Annual Meeting. If you would like to receive a print version of the Proxy Materials, free of charge, please follow the instructions on the Notice.

To attend the 2022 Annual Meeting virtually via the Internet, please visit www.virtualshareholdermeeting.com/VIGL2022. You will not be able to attend the 2022 Annual Meeting in person.

ii

Table of Contents

Whether or not you expect to attend the Annual Meeting online, we encourage you to read the accompanying proxy statement and vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting on the Internet as described in the instructions included in the Notice by voting online at ww.proxyvote.com. If you requested and received a paper copy of the Proxy Materials, you can vote by signing, dating and returning the enclosed proxy card, calling 1-800-690-6903 and following the recorded instructions, or online at www.proxyvote.com. If you vote your shares on the Internet or by telephone, you will need to enter the 16-digit control number provided in the Notice.

Your vote is important regardless of the number of shares you own. If you attend the Annual Meeting online, you may vote your shares during the Annual Meeting virtually via the Internet even if you previously voted your proxy. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

By order of the board of directors, | ||

/s/ Ivana Magovčević-Liebisch | ||

| Ivana Magovčević-Liebisch, PhD, JD | ||

| President and Chief Executive Officer | ||

Cambridge, Massachusetts

April 28, 2022

iii

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 13 | ||||

| 15 | ||||

| 34 | ||||

| 37 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 |

iv

Table of Contents

VIGIL NEUROSCIENCE, INC.

1 Broadway, 7th Floor, Suite 07-300

Cambridge, MA 02142

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 9, 2022

This proxy statement contains information about the 2022 Annual Meeting of Stockholders, or the Annual Meeting, of Vigil Neuroscience, Inc., which will be held on June 9, 2022 at 8:30 a.m. Eastern Time. The board of directors of Vigil Neuroscience, Inc. is using this proxy statement to solicit proxies for use at the Annual Meeting. In this proxy statement, the terms “Vigil Neuroscience,” “we,” “us,” and “our” refer to Vigil Neuroscience, Inc. The mailing address of our principal executive office is Vigil Neuroscience, Inc., 1 Broadway, 7th Floor, Suite 07-300, Cambridge, MA 02142.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our board of directors with respect to each of the matters set forth in the accompanying Notice of Meeting. You may revoke your proxy at any time before it is exercised at the meeting by giving our corporate secretary written notice to that effect.

We made this proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2021 available to stockholders on or about April 28, 2022.

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year following the fifth anniversary of our initial public offering in January 2022; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or more than $1.07 billion; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission. Even after we are no longer an “emerging growth company,” we may remain a “smaller reporting company.”

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on June 9, 2022:

This proxy statement and our 2021 Annual Report to Stockholders are

available for viewing, printing and downloading at https://materials.proxyvote.com/92673K

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the Securities and Exchange Commission (the “SEC”), except for exhibits, will be furnished without

1

Table of Contents

charge to any stockholder upon written request to Vigil Neuroscience, Inc., 1 Broadway, 7th Floor, Suite 07-300, Cambridge, MA 02142, Attention: Corporate Secretary. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are also available on the SEC’s website at www.sec.gov.

2

Table of Contents

VIGIL NEUROSCIENCE, INC

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

When are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

We have elected to provide access to our proxy materials to our stockholders via the Internet. Accordingly, on or about April 28, 2022, we will begin mailing a Notice of Internet Availability of Proxy Materials, or Notice. Our proxy materials, including the Notice of the 2022 Annual Meeting of Stockholders, this proxy statement and the accompanying proxy card or, for shares held in street name (i.e., held for your account by a broker or other nominee), a voting instruction form, and the 2021 Annual Report to Stockholders, or 2021 Annual Report, will be mailed or made available to stockholders on the Internet on or about the same date.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, for most stockholders, we are providing access to our proxy materials over the Internet rather than printing and mailing our proxy materials. We believe following this process will expedite the receipt of such materials and will help lower our costs and reduce the environmental impact of our annual meeting materials. Therefore, the Notice was mailed to holders of record and beneficial owners of our common stock starting on or about April 28, 2022. The Notice provides instructions as to how stockholders may access and review our proxy materials, including the Notice of the 2022 Annual Meeting of Stockholders, this proxy statement, the proxy card and our 2021 Annual Report, on the website referred to in the Notice or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice also provides voting instructions. In addition, stockholders of record may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future stockholder meetings. Please note that, while our proxy materials are available at the website referenced in the Notice, and our Notice of the 2022 Annual Meeting of Stockholders, this proxy statement and our 2021 Annual Report are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this proxy statement.

Who is soliciting my vote?

Our Board of Directors, or the board of directors, is soliciting your vote for the Annual Meeting, including at any adjournments or postponements of the meeting.

When is the record date for the Annual Meeting?

The record date for determination of stockholders entitled to vote at the Annual Meeting is the close of business on April 11, 2022.

How many votes can be cast by all stockholders?

There were 28,266,815 shares of our common stock, par value $0.0001 per share, outstanding on April 11, 2022, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting on June 9, 2022. Each stockholder of record is entitled to one vote for each share of our common stock held by such stockholder. None of our shares of undesignated preferred stock were outstanding as of April 11, 2022.

Who is entitled to vote?

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. As the stockholder of

3

Table of Contents

record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote on your own behalf at our virtual Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the proxy materials were forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend our virtual Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock on your own behalf at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Note you should also be receiving a voting instruction form for you to use from your broker. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

How do I vote?

If you are a stockholder of record, there are several ways for you to vote your shares.

| • | By Internet. You may vote at www.proxyvote.com, 24 hours a day, seven days a week. You will need the 16-digit control number included on your Notice. Votes submitted through the Internet must be received by 11:59 p.m. Eastern Time, on June 8, 2022. |

| • | By Telephone. You may vote using a touch-tone telephone by calling 1-800-690-6903, 24 hours a day, seven days a week. You will need the 16-digit control number included on your Notice. Votes submitted by telephone must be received by 11:59 p.m. Eastern Time, on June 8, 2022. |

| • | By Mail. If you requested and received a paper copy of the Proxy Materials you may vote by mail by completing, signing and dating the enclosed proxy card and returning it in the enclosed prepaid envelope. Votes submitted through the mail must be received by June 8, 2022. |

| • | During the Annual Meeting. You may vote during the Annual Meeting by going to www.virtualshareholdermeeting.com/VIGL2022. You will need the 16-digit control number included on your proxy card. |

If the Annual Meeting is adjourned or postponed, the deadlines above may be extended.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization. If you hold your shares of Vigil Neuroscience, Inc, common stock in multiple accounts, you should vote your shares as described in each set of Proxy Materials you receive.

By Proxy

If you will not be attending the Annual Meeting, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the enclosed proxy card. Proxies submitted by mail must be received before the start of the Annual Meeting.

If you submit a proxy without giving voting instructions, your shares will be voted in the manner recommended by the board of directors on all matters presented in this proxy statement, and as the persons named as proxies in the proxy card may determine in their discretion with respect to any other matters properly presented at the Annual Meeting. You may also authorize another person or persons to act for you as proxy in a

4

Table of Contents

writing, signed by you or your authorized representative, specifying the details of those proxies’ authority. The original writing must be given to each of the named proxies, although it may be sent to them by electronic transmission if, from that transmission, it can be determined that the transmission was authorized by you.

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in your proxy and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

How can I virtually attend the Annual Meeting?

To attend and participate in the Annual Meeting, stockholders will need to access the live webcast of the meeting. To do so, stockholders of record will need to visit www.virtualshareholdermeeting.com/VIGL2022, and beneficial owners of shares held in street name will need to follow the instructions provided in the voting instructions form by the broker, bank or other nominee that holds their shares.

The live webcast of the Annual Meeting will begin promptly at 8:30 a.m. Eastern Time on June 9, 2022. We encourage stockholders to login to this website and access the webcast before the Annual Meeting’s start time by following the instructions in the email received on the morning of the Annual Meeting. You should allow ample time in advance of the meeting.

Additionally, questions regarding how to attend and participate via the Internet can be answered by following the assistance instructions included on the virtual meeting website (www.virtualshareholdermeeting.com/VIGL2022) or by calling the phone number provided on the virtual meeting website on the day of the Annual Meeting.

If you wish to submit a question during the Annual Meeting, you may log into, and submit a question on, the virtual meeting platform using the unique link provided to you on your proxy card and following the instructions there. Our Annual Meeting will be governed by the Annual Meeting’s Rules of Conduct, which will address the ability of stockholders to ask questions during the meeting and rules for how questions will be recognized and addressed. The Annual Meeting’s Rules of Conduct will be available during the meeting on the virtual meeting website (www.virtualshareholdermeeting.com/VIGL2022).

How do I revoke my proxy?

You may revoke your proxy by (1) following the instructions on the Notice and entering a new vote by mail that we receive before the start of the Annual Meeting or over the Internet by the cutoff time of 11:59 p.m. Eastern Time on June 8, 2022, (2) attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself revoke a proxy), or (3) by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with our Corporate Secretary. Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or sent to our principal executive offices at Vigil Neuroscience, Inc., 1 Broadway, 7th Floor, Suite 07-300, Cambridge, MA 02142, Attention: Corporate Secretary.

If a broker, bank, or other nominee holds your shares, you must contact such broker, bank, or nominee in order to find out how to change your vote.

How is a quorum reached?

Our Amended and Restated Bylaws, or bylaws, provide that a majority of the shares entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

5

Table of Contents

Under the General Corporation Law of the State of Delaware, shares that are voted “abstain” or “withheld” and broker “non-votes” are counted as present for purposes of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained. There were 28,266,815 shares of common stock outstanding and entitled to vote on April 11, 2022, our record date. Therefore, a quorum will be present if 14,133,408 shares of our common stock are present in person or represented by executed proxies timely received by us at the Annual Meeting. Shares present virtually during the Annual Meeting will be considered shares of common stock represented in person at the meeting.

How is the vote counted?

Under our bylaws, any proposal other than an election of directors is decided by a majority of the votes properly cast for and against such proposal, except where a larger vote is required by law or by our Third Amended and Restated Certificate of Incorporation, or certificate of incorporation, or bylaws. Abstentions and broker “non-votes” are not included in the tabulation of the voting results on any such proposal and, therefore, do not have an impact on such proposals. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item, and has not received instructions from the beneficial owner.

If your shares are held in “street name” by a brokerage firm, your brokerage firm is required to vote your shares according to your instructions. If you do not give instructions to your brokerage firm, the brokerage firm will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to “non-discretionary” items. Proposal No. 1 is a “non-discretionary” item. If you do not instruct your broker how to vote with respect to this proposal, your broker may not vote for this proposal, and those votes will be counted as broker “non-votes.” Proposal No. 2 is considered to be a discretionary item, and your brokerage firm will be able to vote on this proposal even if it does not receive instructions from you.

To be elected, each of the directors nominated in Proposal No. 1 must receive a plurality of the votes cast and entitled to vote at the meeting, meaning that the two director nominees receiving the highest number of affirmative votes will be elected as directors. You may vote for all the director nominees, withhold authority to vote your shares for all the director nominees or withhold authority to vote your shares with respect to any one or more of the director nominees. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Broker non-votes are not considered votes cast and will have no effect on the election of the nominees.

Who pays the cost for soliciting proxies?

We are making this solicitation and will pay the entire cost of preparing and distributing the Notice and our proxy materials and soliciting votes. If you choose to access the proxy materials or vote over the Internet, you are responsible for any Internet access charges that you may incur. Our officers and employees may, without compensation other than their regular compensation, solicit proxies through further mailings, personal conversations, facsimile transmissions, e-mails, or otherwise. We have hired Broadridge Financial Solutions, Inc. to assist us in the distribution of proxy materials. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning, and tabulating the proxies.

How may stockholders submit matters for consideration at an annual meeting?

The required notice must be in writing and received by our corporate secretary at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting. However, in the event that the date of the annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the first anniversary of the preceding year’s annual meeting, or if no annual meeting was held in the preceding year, a stockholder’s notice must be so received no earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of (A) the 90th day prior to such annual

6

Table of Contents

meeting and (B) the tenth day following the day on which notice of the date of such annual meeting was mailed or public disclosure of the date of such annual meeting was made, whichever first occurs. As the Annual Meeting is our first annual meeting following the IPO and we made the first public disclosure of its date on March 25, 2022 when we filed our Annual Report on Form 10-K, to be considered timely, stockholder proposals submitted outside of Rule 14a-8 of the Exchange Act and director nominations, in each case intended to be brought before the Annual Meeting, must be received no later than the close of business on Monday, April 4, 2022.

In addition, any stockholder proposal intended to be included in the proxy statement for the next annual meeting of our stockholders in 2023 must also satisfy the requirements of SEC Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and be received not later than December 29, 2022. If the date of the annual meeting is moved by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, then notice must be received within a reasonable time before we begin to print and send proxy materials. If that happens, we will publicly announce the deadline for submitting a proposal in a press release or in a document filed with the SEC.

How can I get help if I have trouble checking in or listening to the meeting online?

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please refer to the instructions on the virtual meeting website and the phone number made available the day of the meeting on the virtual meeting website.

How can I know the voting results?

We plan to announce preliminary voting results at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, or Form 8-K, that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

7

Table of Contents

PROPOSAL NO. 1 – ELECTION OF CLASS I DIRECTORS

Our board of directors currently consists of eight members. In accordance with the terms of our certificate of incorporation and bylaws, our board of directors is divided into three classes, class I, class II and class III, with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

| • | the class I directors are Shaan Gandhi, MD, PhD, MBA, Gerhard Koenig, PhD, and Clay Bernardin Thorp, and their terms will expire at the Annual Meeting; |

| • | the class II directors are Cheryl Renee Blanchard, PhD, Mary Thistle, and Stefan Vitorovic, MS, MBA, and their terms will expire at the annual meeting of stockholders to be held in 2023; and |

| • | the class III directors are Bruce Booth, D.Phil and Ivana Magovčević-Liebisch, PhD, JD, and their terms will expire at the annual meeting of stockholders to be held in 2024. |

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our certificate of incorporation and bylaws provide that the authorized number of directors may be changed only by resolution of our board of directors. Our certificate of incorporation also provides that our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds (2/3) of the outstanding shares then entitled to vote in an annual election of directors, and that any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office.

This year, the term of our Class I directors, Shaan Gandhi, MD, PhD, MBA, Gerhard Koenig, PhD, and Clay Bernardin Thorp, is expiring. Mr. Thorp is not up for re-election to the Board at the Annual Meeting, but will serve as a Class I director and as a member on the Audit Committee until the Annual Meeting. The nominees are presently directors, and have indicated a willingness to continue to serve as directors, if elected. If the nominees become unable or unwilling to serve, however, the proxies may be voted for a substitute nominee selected by our board of directors.

Our nominating and corporate governance committee Policies and Procedures for Director Candidates, or the Director Guidelines, provide that the value of diversity should be considered in determining director candidates as well as other factors such as a candidate’s character, judgment, skills, education, expertise and absence of conflicts of interest. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established records of professional accomplishment, their ability to contribute positively to the collaborative culture among board members, and their knowledge of our business and understanding of the competitive landscape in which we operate and adherence to high ethical standards. The nominating and corporate governance committee and the full board of directors are committed to creating a board of directors with diversity, including diversity of expertise, experience, background and gender, and are committed to identifying, recruiting and advancing candidates offering such diversity in future searches.

In addition to the information presented below regarding each of the nominees and continuing directors’ specific experience, qualifications, attributes and skills that our board of directors and our nominating and corporate governance committee considered in determining that he or she should serve as a director, we also believe that each of our directors has demonstrated business acumen, integrity and an ability to exercise sound judgment, as well as a commitment of service to Vigil and our board of directors.

Nominees for Election as Class I Directors

The following table identifies our director nominees, and sets forth their principal occupation and business experience during the last five years and their ages as of April 11, 2022.

8

Table of Contents

Name | Positions and Offices Held | Director | Age | |||

| Shaan Gandhi, MD, PhD | Director | 2020 | 36 | |||

| Gerhard Koenig, PhD | Director | 2020 | 61 |

Shaan Gandhi, MD, PhD, MBA, has served as a member of our board of directors since September 2020. Since January 2020, Dr. Gandhi has served as a Director at Northpond Ventures, LLC, a global science, medical and technology-focused venture capital firm. Previously, Dr. Gandhi was a Principal at the Longwood Fund from June 2018 to January 2020, where he created and invested in life sciences companies, including Pyxis Oncology, Inc., a cancer immunotherapy company focused on novel modulators of the tumor microenvironment, which he co-founded and served as President. He was an attending hospitalist at Massachusetts General Hospital from June 2018 to July 2019, where he also did his residency in internal medicine from June 2015 to June 2018. He serves on the boards of directors of various private companies, including CAMP4 Therapeutics Corporation, Garuda Therapeutics, Inc., Mestag Therapeutics, Inc., Parthenon Therapeutics Inc. and Totus Medicines Inc., and of public companies, including Candel Therapeutics. Inc. (NASDAQ: CADL) and DICE Therapeutics, Inc. (NASDAQ: DICE). He holds an MD from Harvard Medical School, an MBA from Harvard Business School, where he was a Baker Scholar, a PhD in Medical Oncology from the University of Oxford, where he was a Rhodes Scholar, and a BS with honors in Biochemistry from Case Western Reserve University. We believe that Dr. Gandhi’s financial, managerial and medical experience coupled with his substantial experience as an investor in emerging biotechnology companies provides him with the appropriate set of skills to serve as a member of our board of directors.

Gerhard Koenig, PhD, has served as a member of our board of directors since July 2020. Dr. Koenig currently serves as an Entrepreneur in Residence with Atlas Venture since November 2017 and as Co-Founder, President and Chief Executive Officer of Arkuda Therapeutics, Inc. since February 2018. He also served as an advisor on the scientific advisory board at Disarm Therapeutics, Inc. from February 2017 to December 2020. From June 2016 to October 2017, Dr. Koenig was Chief Executive Officer of Quartet Medicine, Inc., a biotechnology company focused on non-opioid pain medications. Before that, he was Chief Scientific Officer and Senior Vice President of FORUM Pharmaceuticals Inc., a pharmaceutical company owned by Fidelity Investments, from February 2003 to May 2016. Dr. Koenig was Vice President, Scientific Programs and Evaluation of Fidelity Biosciences Group (now F-Prime Capital) from September 2002 to December 2004. Dr. Koenig received his PhD and MS in Molecular and Cellular Neurobiology with a minor in Biochemistry, graduating summa cum laude, from the University of Heidelberg, Germany. We believe Dr. Koenig is qualified to serve on our board of directors because of his extensive R&D leadership and drug discovery and development experience spanning early discovery through Phase 3 clinical trials as well as his experience working in the venture capital industry.

The proxies will be voted in favor of the above nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as our directors if elected. However, if the nominees are unable to serve or for good cause will not serve as a director, the proxies will be voted for the election of such substitute nominee as our board of directors may designate.

The board of directors recommends voting “FOR” the election of Shaan Gandhi, MD, PhD, MBA and Gerhard Koenig, PhD, as the class I directors, to serve for a three-year term ending at the annual meeting of stockholders to be held in 2025.

Directors Continuing in Office

The following table identifies our continuing directors, and sets forth their principal occupation and business experience during the last five years and their ages as of April 11, 2022.

9

Table of Contents

Name | Position and Offices | Director Since | Class and Year in | Age | ||||

| Cheryl Renee Blanchard, PhD | Director | 2020 | Class II – 2023 | 57 | ||||

| Mary Thistle | Director | 2022 | Class II – 2023 | 62 | ||||

| Stefan Vitorovic, MS, MBA | Director | 2021 | Class II – 2023 | 37 | ||||

| Bruce Booth, D.Phil | Director | 2020 | Class III – 2024 | 47 | ||||

| Ivana Magovčević-Liebisch, PhD, JD | Director, President and Chief Executive Officer | 2020 | Class III – 2024 | 54 |

Class II Directors (Term Expires at 2023 Annual Meeting)

Cheryl Renee Blanchard has served as a member of our board of directors since November 2020. Dr. Blanchard has served as President and Chief Executive Officer of Anika Therapeutics, Inc. (NASDAQ: ANIK) since April 2020 after serving as interim Chief Executive Officer since February 2020 and has served on Anika’s board since August of 2018. Dr. Blanchard is also a current board member of Daré Bioscience, Inc. (NASDAQ: DARE). Prior to her work as an executive officer at Anika, she was President and Chief Executive Officer of Microchips Biotech, Inc. from July 2014 until its sale to Daré Bioscience in November 2019. From July 2018 to July 2019, Dr. Blanchard served as President and Chief Executive Officer of Keratin Biosciences, Inc., a privately-held biotechnology company created by the business combination of Microchips Biotech, Inc. and KeraNetics, LLC. From September 2012 to April 2020, Dr. Blanchard was Principal at Blanchard Consulting, LLC, which provided consulting services to life science companies and private equity clients. Dr. Blanchard previously served on the board of directors of SeaSpine Holdings Corp (NASDAQ: SPNE) from July 2015 to May 2019 and Neuronetics, Inc. (NASDAQ: STIM) from February 2019 to July 2020. Dr. Blanchard received her MS and PhD in Materials Science and Engineering from the University of Texas at Austin and her BS in Ceramic Engineering from Alfred University. We believe Dr. Blanchard is qualified to serve on our board of directors because she is a biotech Chief Executive Officer, experienced as a public company board member, and for her strong scientific background in biologics and regenerative medicine and her extensive experience in management, research and product development, business development, and regulatory affairs at multiple companies in the life science industry.

Mary Thistle, has served as a member of our Board of Directors since April 2022. Ms. Thistle has served as Special Advisor to the Bill & Melinda Gates Medical Research Institute, a non-profit biotech organization, since October 2020, and previously served as the organization’s Chief of Staff from January 2018 until she assumed her current role. Prior to that, she held senior leadership positions at Dimension Therapeutics, Inc., a gene therapy company, including Chief Operating Officer from 2016 to 2017 and Chief Business Officer from 2015 to 2016. Prior to joining Dimension Therapeutics, Inc., she held several executive positions, including Senior Vice President, Business Development, at Cubist Pharmaceuticals, Inc., a biopharmaceutical company, from 2014 to 2015, Vice President, Business Development from 2012 to 2013 and Senior Director, Business Development from 2009 to 2012. Ms. Thistle currently serves on the board of directors of Alaunos Therapeutics, Inc. (NASDAQ: TCRT), Entrada Therapeutics, Inc. (NASDAQ: TRDA) and Homology Medicines, Inc. (NASDAQ: FIXX) as well as the boards of several private companies. Ms. Thistle holds a B.S. in Accounting from the University of Massachusetts, Boston. We believe that Ms. Thistle is qualified to serve on our Board of Directors due to her finance background and industry experience.

Stefan Vitorovic, MS, MBA has served as a member of our board of directors since August 2021. Mr. Vitorovic is the co-founder and Managing Director of Vida Ventures, a role he has served in since January 2017. Prior to founding Vida Ventures, Mr. Vitorovic was an investment professional at Third Rock Ventures, an early-stage life sciences venture capital firm, from July 2014 to January 2017. At Third Rock, he was part of the founding team of Decibel Therapeutics, Inc., a hearing-focused drug discovery and development platform

10

Table of Contents

company. Before Third Rock, he was an investor at TPG Capital from August 2012 to June 2014, where he focused on majority, control stakes in healthcare companies. Mr. Vitorovic worked on a variety of equity and debt financings, including Aptalis Pharmaceutical Technologies (now Adare Pharma Solutions) and Biomet, Inc. (now Zimmer Biomet Holdings, Inc. (NYSE: ZBH)). Prior to TPG, Mr. Vitorovic was an investment banker at Credit Suisse’s healthcare banking group from 2004 to 2008. Mr. Vitorovic currently serves on the board of directors of Praxis Precision Medicines, Inc. (NASDAQ: PRAX), Tectonic Therapeutics, and Volastra Therapeutics, Inc. He was previously a board observer of Oyster Point Pharma, Inc. (NASDAQ: OYST), Dyne Therapeutics (NASDAQ: DYN), Sutro Biopharma, Inc. (NASDAQ: STRO) and Volastra Therapeutics, Inc., and a board member of Kyverna Therapeutics, Inc. He received a BS with Honors in Biological Sciences and an MS in Biology from Stanford University, where he conducted biomedical research in the lab of Dr. Helen Blau at Stanford Medical School. Mr. Vitorovic received his MBA from Harvard Business School. We believe Mr. Vitorovic is qualified to serve on our board of directors because of his deep expertise in in life sciences research and investing, as well as his extensive experience in new company formation and operations.

Class III Directors (Term Expires at 2024 Annual Meeting)

Bruce Booth, D.Phil has served as Chairman of our board of directors since June 2020. Dr. Booth joined Atlas Venture in 2005, and currently serves as a partner of Atlas Venture. Dr. Booth currently serves as Chairman of Kymera Therapeutics, Inc. (NASDAQ: KYMR) and AvroBio, Inc. (NASDAQ: AVRO). He is the co-founder of Kymera and was President and Chief Executive Officer of Kymera from September 2015 to August 2017. Dr. Booth is also a board member of several public and privately held companies, including Magenta Therapeutics, Inc. (NASDAQ: MGTA), Nimbus Therapeutics, LLC, HotSpot Therapeutics, Inc., and Arkuda Therapeutics, Inc. Dr. Booth previously served on the boards of directors of Unum Therapeutics, Inc. (NASDAQ: UMRX) from February 2018 to July 2020, Miragen Therapeutics, Inc. (NASDAQ: VRDN) from 2007 to December 2018, and Zafgen, Inc. (now Larimar Therapeutics, Inc. (NASDAQ: LRMR)) from August 2006 to June 2018. Dr. Booth holds a PhD in Molecular Immunology from Oxford University’s Nuffield Department of Medicine and a BS in Biochemistry from Pennsylvania State University. We believe Dr. Booth’s extensive leadership, executive, managerial and business experience with life sciences companies, including experience in the formation, development and business strategy of multiple start-up companies in the life sciences sector qualifies him to serve on our board of directors.

Ivana Magovčević-Liebisch, PhD, JD. has served as our President and Chief Executive Officer and as a member of our board of directors since July 2020. Prior to Vigil, Dr. Magovčević-Liebisch was Executive Vice President, Chief Business Officer at Ipsen, a pharmaceutical company, from March 2018 to April 2020, where she led the External Innovation, Business Development and Alliance Management functions. Prior to Ipsen, Dr. Magovčević-Liebisch was Executive Vice President, Chief Strategy and Corporate Development Officer at Axcella Health Inc. (NASDAQ: AXLA) from May 2017 to March 2018, and Senior Vice President, Head of Global Business Development for the specialty drug business at Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) from March 2013 to May 2017. Dr. Magovčević-Liebisch previously worked at Dyax Corp. (acquired by Shire plc (NASDAQ: SHPG)) from April 2001 to March 2013 in management roles of increasing scope and responsibility, including Executive Vice President and Chief Operating Officer, where she launched the company’s first drug, Kalbitor® for an orphan indication, Hereditary Angiodema. Dr. Magovčević-Liebisch began her biopharma career at Transkaryotic Therapies, Inc., where she was Director of Intellectual Property and Patent Counsel from 1998 to 2001. Dr. Magovčević-Liebisch is currently the Chairperson of the board of directors of ABSCI Corporation (NASDAQ: ABSI), a member of the board of directors of Aeglea BioTherapeutics, Inc. (NASDAQ: AGLE), and was a member of the board of directors of Applied Genetic Technologies Corporation (NASDAQ: AGTC) from June 2014 to March 2022. Dr. Magovčević-Liebisch is also a trustee of the Boston Museum of Science and of the Boston Ballet, and overseer of Beth Israel Deaconess Medical Center. She received a BA in Biology and Chemistry from Wheaton College, a PhD in Genetics from Harvard University, and a JD in High Technology Law from Suffolk University Law School. We believe Dr. Magovčević-Liebisch’s over 20 years of senior management experience in the biotechnology and pharmaceutical industry make her well qualified to serve on our board of directors.

11

Table of Contents

Board Diversity Disclosure

The following table provides certain self-identified personal characteristics of our Board members, in accordance with Rule 5605(f) of the Nasdaq listing standards:

| Board Diversity Matrix (As of April 28, 2022) | ||||||||

| Total Number of Directors | 8 | |||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

Part I: Gender Identity | ||||||||

Directors | 3 | — | — | 5 | ||||

Part II: Demographic Background | ||||||||

African American or Black | — | — | — | — | ||||

Alaskan Native or Native American | — | — | — | — | ||||

Asian | — | — | — | 1 | ||||

Hispanic or Latinx | — | — | — | — | ||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||

White | 1 | — | — | — | ||||

Two or More Races or Ethnicities | — | — | — | — | ||||

LGBTQ+ | — | |||||||

Did Not Disclose Demographic Background | 6 | |||||||

12

Table of Contents

PROPOSAL NO. 2 – RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS VIGIL NEUROSCIENCE’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022

Vigil Neuroscience’s stockholders are being asked to ratify the appointment by the audit committee of the board of directors of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. PricewaterhouseCoopers LLP has served as Vigil Neuroscience’s independent registered public accounting firm since 2021.

The audit committee is solely responsible for selecting Vigil Neuroscience’s independent registered public accounting firm for the fiscal year ending December 31, 2022. Stockholder approval is not required to appoint PricewaterhouseCoopers LLP as Vigil Neuroscience’s independent registered public accounting firm. However, the board of directors believes that submitting the appointment of PricewaterhouseCoopers LLP to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this appointment, the audit committee will reconsider whether to retain PricewaterhouseCoopers LLP. If the selection of PricewaterhouseCoopers LLP is ratified, the audit committee, at its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of Vigil Neuroscience and its stockholders.

A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions from our stockholders.

Principal Accountant Fees and Services

Vigil Neuroscience incurred the following fees from PricewaterhouseCoopers LLP for the audit of the consolidated financial statements and for other services related to the year ended December 31, 2021 and the period June 22, 2020 (inception) to December 31, 2020.

Fee Category | Fiscal Year 2021 ($) | June 22, 2020 (Inception) to December 31, 2020 ($) | ||||||

Audit Fees(1) | 1,445,000 | 70,000 | ||||||

Audit-Related Fees | — | — | ||||||

Tax Fees(2) | 12,500 | — | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total Fees | 1,457,500 | 70,000 | ||||||

|

|

|

| |||||

| (1) | Audit Fees consist of fees for the audit of our annual financial statements, the review of our interim financial statements included in our quarterly reports on Form 10-Q and fees related to our initial public offering, including comfort letters and consents. |

| (2) | Tax Fees consist of fees for tax compliance, advice and tax services. There were no tax fees in fiscal years 2021 and 2020. |

Audit Committee Pre-approval Policy and Procedures

Our audit committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm. This policy provides that we will not engage our independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by our audit committee or the engagement is entered into pursuant to the pre-approval procedure described below.

From time to time, our audit committee may pre-approve specified types of services that are expected to be provided to us by our independent registered public accounting firm during the next 12 months. Any such pre-approval details the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

13

Table of Contents

During the year ended 2021 and the period June 22, 2020 (Inception) to December 31,2020, no services were provided to us by PricewaterhouseCoopers LLP other than in accordance with the pre-approval policies and procedures described above.

The board of directors recommends voting “FOR” Proposal No. 2 to ratify the appointment of PricewaterhouseCoopers LLP as Vigil Neuroscience’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

14

Table of Contents

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board, and recommending such persons to be nominated for election as directors, except where we are legally required by contract, law or otherwise to provide third parties with the right to nominate.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by management, recruiters, members of the committee and our board. The qualifications, qualities and skills that our nominating and corporate governance committee believes must be met by a committee recommended nominee for a position on our board of directors are as follows:

| • | Nominees should demonstrate high standards of personal and professional ethics and integrity. |

| • | Nominees should have proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment. |

| • | Nominees should have the education, expertise and business acumen to make significant contributions to the Company’s success. |

| • | Nominees should have skills that are complementary to those of the existing board. |

| • | Nominees should have the ability to assist and support management and make significant contributions to the Company’s success. |

| • | Nominees should have an understanding of the fiduciary responsibilities that is required of a member of the board of directors and the commitment of time and energy necessary to diligently carry out those responsibilities. |

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates. Any such proposals should be submitted to our corporate secretary at our principal executive offices no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the date of the preceding year’s annual meeting and should include appropriate biographical and background material to allow the nominating and corporate governance committee to properly evaluate the potential director candidate and the number of shares of our stock beneficially owned by the stockholder proposing the candidate. Stockholder proposals should be addressed to Vigil Neuroscience, Inc., One Broadway, Suite 07-300, Cambridge, MA 02142, Attention: Corporate Secretary. Assuming that biographical and background material has been provided on a timely basis in accordance with our bylaws, any recommendations received from stockholders will be evaluated in the same manner as potential nominees proposed by the nominating and corporate governance committee. If our board of directors determines to nominate a stockholder recommended candidate and recommends his or her election, then his or her name will be included on our proxy card for the next annual meeting of stockholders. See “Stockholder Proposals” for a discussion of submitting stockholder proposals.

Director Independence

Applicable Nasdaq Stock Market LLC, or Nasdaq, rules require a majority of a listed company’s board of directors to be comprised of independent directors within one year of listing. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act and that compensation committee members satisfy independence criteria set forth in Rule 10C-1 under the Exchange Act. Under applicable Nasdaq

15

Table of Contents

rules, a director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries. In addition, in affirmatively determining the independence of any director who will serve on a company’s compensation committee, Rule 10C-1 under the Exchange Act requires that a company’s board of directors must consider all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including: the source of compensation to the director, including any consulting, advisory or other compensatory fee paid by such company to the director, and whether the director is affiliated with the company or any of its subsidiaries or affiliates.

Our board of directors has determined that all members of the board of directors, except Ivana Magovčević-Liebisch, PhD, JD are independent directors, including for purposes of the rules of Nasdaq and the SEC. In making such independence determination, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances that our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. In considering the independence of the directors listed above, our board of directors considered the association of our directors with the holders of more than 5% of our common stock. There are no family relationships among any of our directors or executive officers. Dr. Magovčević-Liebisch is not an independent director under these rules because she is an executive officer of the Company.

Board Committees

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. Each of the audit committee, compensation committee and nominating and corporate governance committee operates under a charter that satisfies the applicable standards of the SEC and Nasdaq. Each such committee reviews its respective charter at least annually. A current copy of the charter for each of the audit committee, compensation committee and nominating and corporate governance committee is posted on the corporate governance section of our

website https://investors.vigilneuro.com/corporate-governance/documents-charters.

Audit Committee

Shaan Gandhi, MD, PhD, MBA, Gerhard Koenig, PhD, Mary Thistle, and Clay Thorp serve on the audit committee, which is chaired by Clay Thorp. Our board of directors has determined that each member of the audit committee is “independent” for audit committee purposes as that term is defined by the rules of the SEC and Nasdaq, and that each has sufficient knowledge in financial and auditing matters to serve on the audit committee. Our board of directors has designated Clay Thorp as an “audit committee financial expert,” as defined under the applicable rules of the SEC. Mr. Thorp is not up for re-election to the Board at the Annual Meeting, but will serve as a Class I director and member on the audit committee until the Annual Meeting. Subsequent to the Annual Meeting, Dr. Gandhi, Dr. Koenig and Ms. Thistle will serve as members of the audit committee and we expect that Ms. Thistle will chair the audit committee and be designated as an “audit committee financial expert,” as defined under the applicable rules of the SEC. During the fiscal year ended December 31, 2021, the audit committee met twice. The audit committee’s responsibilities include:

| • | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| • | pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

16

Table of Contents

| • | reviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements; |

| • | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us; |

| • | coordinating the oversight and reviewing the adequacy of our internal control over financial reporting; |

| • | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

| • | recommending, based upon the audit committee’s review and discussions with management and our independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K; |

| • | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; |

| • | preparing the audit committee report required by SEC rules to be included in our annual proxy statement; |

| • | reviewing all related person transactions for potential conflict of interest situations and approving all such transactions; and |

| • | reviewing quarterly earnings releases. |

All audit and non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

Compensation Committee

Cheryl Blanchard, PhD, Bruce Booth, D.Phil and Shaan Gandhi, MD, PhD, MBA serve on the compensation committee, which is chaired by Cheryl Blanchard, PhD. Our board of directors has determined that each member of the compensation committee is “independent” as defined in the applicable Nasdaq rules. During the fiscal year ended December 31, 2021, the compensation committee met five times. The compensation committee’s responsibilities include:

| • | annually reviewing and recommending to the board of directors the corporate goals and objectives relevant to the compensation of our Chief Executive Officer; |

| • | evaluating the performance of our Chief Executive Officer in light of such corporate goals and objectives and, based on such evaluation, recommending to the board of directors the cash compensation of our Chief Executive Officer; |

| • | determining and approving the cash compensation of our other executive officers; |

| • | overseeing our compensation and similar plans; |

| • | reviewing and approving the retention or termination of any consulting firm or outside advisor to assist in the evaluation of compensation matters and evaluating and assessing potential and current compensation advisors in accordance with the independence standards identified in the applicable Nasdaq rules; |

| • | retaining, approving, and overseeing the compensation of any compensation advisors; |

| • | reviewing and approving the grant of equity-based awards; |

| • | reviewing and recommending to the board of directors the compensation of our directors; and |

17

Table of Contents

| • | preparing the compensation committee report required by SEC rules, if and when required, to be included in our annual proxy statement. |

Nominating and Corporate Governance Committee

Cheryl Blanchard, PhD, Bruce Booth, D. Phil and Stefan Vitorovic, MS, MBA serve on the nominating and corporate governance committee, which is chaired by Stefan Vitorovic, MS, MBA. Our board of directors has determined that each member of the nominating and corporate governance committee is “independent” as defined in the applicable Nasdaq rules. Our nominating and corporate governance committee was not established until January 6, 2022, when we became a public company, as such it did not meet during the fiscal year ended December 31, 2021. The nominating and corporate governance committee’s responsibilities include:

| • | developing and recommending to the board of directors criteria for board and committee membership; |

| • | establishing procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders; |

| • | reviewing the composition of the board of directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us; |

| • | identifying individuals qualified to become members of the board of directors; |

| • | recommending to the board of directors the persons to be nominated for election as directors and to each of the board’s committees; |

| • | reviewing and recommending to the board of directors appropriate corporate governance guidelines; |

| • | overseeing the evaluation of our board of directors, its committees and management; and |

| • | reviewing and discussing with the board of directors corporate succession plans for our Chief Executive Officer and other key officers. |

| • | oversee our environmental, social and governance (“ESG”) policies and initiatives. |

The nominating and corporate governance committee considers candidates for Board of Director membership suggested by its members and the Chief Executive Officer. Additionally, in selecting nominees for directors, the nominating and corporate governance committee will review candidates recommended by stockholders in the same manner and using the same general criteria as candidates recruited by the committee and/or recommended by our board of directors. Any stockholder who wishes to recommend a candidate for consideration by the committee as a nominee for director should follow the procedures described later in this proxy statement under the heading “Stockholder Proposals.” The nominating and corporate governance committee will also consider whether to nominate any person proposed by a stockholder in accordance with the provisions of our bylaws relating to stockholder nominations as described later in this proxy statement under the heading “Stockholder Proposals.”

Identifying and Evaluating Director Nominees. Our board of directors is responsible for filling vacancies on our board of directors and for nominating candidates for election by our stockholders each year in the class of directors whose term expires at the relevant annual meeting. The board of directors delegates the selection and nomination process to the nominating and corporate governance committee, with the expectation that other members of the board of directors, and of management, will be requested to take part in the process as appropriate.

Generally, the nominating and corporate governance committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as the nominating and corporate governance committee deems to be helpful to identify candidates. Once candidates have been identified, the

18

Table of Contents

nominating and corporate governance committee confirms that the candidates meet all of the minimum qualifications for director nominees established by the nominating and corporate governance committee. The nominating and corporate governance committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that the nominating and corporate governance committee deems to be appropriate in the evaluation process. The nominating and corporate governance committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our board of directors. based on the results of the evaluation process, the nominating and corporate governance committee recommends candidates for the board of directors’ approval to fill a vacancy or as director nominees for election to the board of directors by our stockholders each year in the class of directors whose term expires at the relevant annual meeting.

Board and Committee Meetings Attendance

The full board of directors met five times during 2021. During 2021, each member of the board of directors attended in person or participated in 75% or more of the aggregate of (i) the total number of meetings of the board of directors (held during the period for which such person has been a director), and (ii) the total number of meetings held by all committees of the board of directors on which such person served (during the periods that such person served).

Director Attendance at Annual Meeting of Stockholders

Directors are responsible for attending the annual meeting of stockholders to the extent practicable.

Policy on Trading, Pledging and Hedging of Company Stock

Certain transactions in our securities (such as purchases and sales of publicly traded put and call options, and short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material, non-public information or otherwise is not permitted to trade in Company securities. Our insider trading policy expressly prohibits derivative transactions of our stock by our executive officers, directors and employees. Our insider trading policy expressly prohibits purchases of any derivative securities that provide the economic equivalent of ownership.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code is posted on the corporate governance section of our website, which is located at

https://investors.vigilneuro.com/corporate-governance/documents-charters. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Board Leadership Structure and Board’s Role in Risk Oversight

Currently, the role of chairman of the board is separated from the role of Chief Executive Officer, and we plan to keep these roles separate. We believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the chairman of the board to lead the board of directors in its fundamental role of providing advice to and independent oversight of management. Our board of directors recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to her position in the

19

Table of Contents

current business environment, as well as the commitment required to serve as our chairman, particularly as the board of directors’ oversight responsibilities continue to grow. While our bylaws and our corporate governance guidelines do not require that our chairman and Chief Executive Officer positions be separate, our board of directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent to every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to our financial condition, development and commercialization activities, operations, strategic direction and intellectual property. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The role of the board of directors in overseeing the management of our risks is conducted primarily through committees of the board of directors, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees. The full board of directors (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on us, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairman of the relevant committee reports on the discussion to the full board of directors during the committee reports portion of the next board meeting. This enables the board of directors and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Communication with the Directors of Vigil Neuroscience

Any interested party with concerns about our company may report such concerns to the board of directors or the chairman of our board of directors and nominating and corporate governance committee, by submitting a written communication to the attention of such director at the following address:

c/o Vigil Neuroscience, Inc.

One Broadway Suite 07-300

Cambridge, Massachusetts 02142

United States

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, customer, supplier or other interested party.

A copy of any such written communication may also be forwarded to Vigil Neuroscience’s legal counsel and a copy of such communication may be retained for a reasonable period of time. The director may discuss the matter with Vigil Neuroscience’ legal counsel, with independent advisors, with non-management directors, or with Vigil Neuroscience’s management, or may take other action or no action as the director determines in good faith, using reasonable judgment and applying his or her own discretion.

Communications may be forwarded to other directors if they relate to important substantive matters and include suggestions or comments that may be important for other directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications.

The audit committee oversees the procedures for the receipt, retention, and treatment of complaints received by Vigil Neuroscience regarding accounting, internal accounting controls, or audit matters, and the confidential,

20

Table of Contents

anonymous submission by employees of concerns regarding questionable accounting, internal accounting controls or auditing matters. Vigil Neuroscience has also established a toll-free telephone number for the reporting of such activity, which is 1-833-869-0464.

Executive Officers Who Are Not Directors

The following table identifies our executive officers who are not directors, and sets forth their current positions at Vigil and their ages as of April 11, 2022.

Name | Position Held with Vigil | Officer Since | Age | |||

Jennifer Ziolkowski, CPA | Chief Financial Officer | 2021 | 48 | |||

Spyros Papapetropoulos, MD, PhD | Chief Medical Officer | 2020 | 49 | |||

Evan A. Thackaberry, PhD, DABT | Senior Vice President, Head of Early Development | 2020 | 49 | |||

Christopher Verni, JD | General Counsel | 2022 | 47 |

Jennifer Ziolkowski, CPA, has served as our Chief Financial Officer since March 2021. Prior to joining Vigil, Ms. Ziolkowski was Chief Financial Officer of Solid Biosciences Inc. (NASDAQ: SLDB) from May 2017 to January 2021, where she played a key role in transforming Solid from a private, preclinical company to a publicly-held, clinical-stage biotech company. Previously, Ms. Ziolkowski held various leadership positions at Philips Healthcare from August 2008 to May 2017, most recently as Head of Sales Operations, North America of Philips Healthcare from 2015 to May 2017. Prior to Phillips, Ms. Ziolkowski was Senior Director of Finance and Corporate Controller of TransMedics, Inc. from April 2007 to July 2008, where she played a critical role in building the company’s financial operations. Ms. Ziolkowski established her career within the healthcare industry at Cytyc Corporation (acquired by Hologic, Inc. (NASDAQ:HOLX)) from May 2001 to April 2007. Ms. Ziolkowski began her career at PricewaterhouseCoopers LLP from September 1996 to April 2001. Ms. Ziolkowski holds a BS in Accounting from Boston College and is a Certified Public Accountant.

Spyros Papapetropoulos, MD, PhD, has served as our Chief Medical Officer since September 2020. Dr. Papapetropoulos also currently serves as a member of the board of directors of Adamas Pharmaceuticals, Inc. (NASDAQ: ADMS) and as a consultant in neurology at Massachusetts General Hospital. He is the founder and President of Encephalos Life Sciences LLC, a neurosciences consulting company. Prior to joining Vigil, Dr. Papapetropoulos served as Chief Development Officer and Senior Vice President, Head of Development at Acadia Pharmaceuticals Inc. (NASDAQ: ACAD) from November 2019 to September 2020, Chief Executive Officer at SwanBio Therapeutics, Inc. from April 2019 to September 2019, and Head of Research & Development and Chief Medical Officer at Cavion, Inc. (acquired by Jazz Pharmaceuticals plc (NASDAQ: JAZZ)) from June 2017 to April 2019. Before Cavion, Dr. Papapetropoulos held management roles at a number of companies, including Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) from February 2015 to June 2017, Pfizer Inc. (NYSE: PFE) from March 2012 to February 2015, Allergan plc (NYSE: AGN) from May 2010 to March 2012, and Biogen Inc. (NASDAQ: BIIB) from April 2008 to May 2010. Dr. Papapetropoulos was a research professor and subsequently a volunteer professor of neurology at the University of Miami, Miller School of Medicine from November 2008 until August 2017. Dr. Papapetropoulos received his MD and PhD from University of Patras, School of Health Sciences.