BRIGHT MINDS BIOSCIENCES INC.

19 Vestry Street

New York, NY 10013

NOTICE OF ANNUAL GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD ON MARCH 24, 2023

AND

INFORMATION CIRCULAR

This document requires immediate attention. If you are in doubt as to how to deal with the documents or matters referred to in this notice and information circular, you should immediately contact your advisor.

BRIGHT MINDS BIOSCIENCES INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual general meeting (the “Meeting”) of shareholders (the “Shareholders”) of Bright Minds Biosciences Inc. (the “Company”) will be held at the offices of McMillan LLP, Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia on Friday, March 24, 2023, at the hour of 10:00 a.m. (Pacific Time).

The Meeting is to be held for the following purposes:

1.to receive the audited financial statements of the Company for the fiscal year ended September 30, 2022, together with the auditor’s report thereon;

2.to elect directors of the Company for the ensuing year;

3.to appoint DeVisser Gray LLP as the auditors of the Company for the ensuing year and to authorize the directors to fix their remuneration;

4.to pass an ordinary resolution to approve the continuation of the Company’s Stock Option Plan, as described in the accompanying management information circular (the “Circular”);

5.to pass an ordinary resolution to approve the continuation of the Company’s Restricted Share Unit Plan, as described in the accompanying Circular; and

6.to transact such other business, including amendments to the foregoing, as may properly come before the Meeting or any adjournment thereof.

In order to be valid and acted upon at the Meeting, proxies must be received no later than 10:00 a.m. (Pacific Time) on Wednesday, March 22, 2023 or not less than 48 hours (excluding Saturdays, Sundays and statutory holidays) before the time for holding the Meeting or any postponement(s) or adjournment(s) thereof. Failure to so deposit a form of proxy will result in its invalidation. Notwithstanding the foregoing, the chair of the Meeting has the discretion to accept proxies received after such deadline.

The Circular accompanies this Notice. The Circular contains details of matters to be considered at the Meeting. No other matters are contemplated, however any permitted amendment to or variation of any matter identified in this Notice may properly be considered at the Meeting. The Meeting may also consider the transaction of such other business as may properly come before the Meeting or any adjournment thereof.

The audited financial statements for the fiscal year ended September 30, 2022 and the report of the auditor thereon will be made available at the Meeting and are available on www.sedar.com.

Registered Shareholders who are unable to attend the Meeting in person and who wish to ensure that their Shares will be voted at the Meeting are requested to complete, date and sign the enclosed form of proxy, or another suitable form of proxy and deliver it in accordance with the instructions set out in the form of proxy and in the Circular.

Non-registered Shareholders who plan to attend the Meeting must follow the instructions set out in the form of proxy or voting instruction form to ensure that their Common Shares will be voted at the Meeting. If you hold your Shares in a brokerage account, you are a non-registered Shareholder.

Due to potential unforeseen changes in the ongoing coronavirus COVID-19 outbreak, we recommend all shareholders submit votes by sending in a properly completed and signed form of proxy (or voting

instruction form) prior to the Meeting following instructions in the Circular. At the date hereof, the Company intends to hold the Meeting at the location stated in this Notice of Meeting. Should any changes to the Meeting occur, the Company will announce any and all changes by way of news release filed under the Company’s profile on SEDAR at www.sedar.com.

DATED at Vancouver, British Columbia, as of this 21st day of February, 2023.

BY ORDER OF THE BOARD

“Ian McDonald”

Ian McDonald

President and Chief Executive Officer

- ii -

BRIGHT MINDS BIOSCIENCES INC.

19 Vestry Street

New York, NY 10013

MANAGEMENT INFORMATION CIRCULAR

(as at February 15, 2023, except as otherwise noted)

This Management Information Circular (“Circular”) is furnished in connection with the solicitation of proxies by the management of Bright Minds Biosciences Inc. for use at the annual general meeting (the “Meeting”) of the Company’s shareholders (the “Shareholders”) to be held on March 24, 2023 at the time and place and for the purposes set forth in the accompanying notice of Meeting.

In this Circular, references to “the Company”, “we” and “our” refer to Bright Minds Biosciences Inc. “Common Shares” means common shares in the capital of the Company. “Beneficial Shareholders” means Shareholders who do not hold Common Shares in their own name and “intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders. “Registered Shareholder” means the person whose name appears on the central securities register maintained by or on behalf of the Company and who holds Common Shares in their own name.

GENERAL PROXY INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The Company will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to beneficial owners of the Common Shares held of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

Appointment of Proxyholders

The individuals named in the accompanying form of proxy (the “Proxy”) are officers and/or directors of the Company. If you are a Shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than either of the persons designated in the Proxy, who need not be a Shareholder, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

Voting by Proxyholder

The persons named in the Proxy will vote or withhold from voting the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The Proxy confers discretionary authority on the persons named therein with respect to:

(a)each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors,

(b)any amndment to or variation of any matter identified therein, and

(c)any other matter that properly comes before the Meeting.

In respect of a matter for which a choice is not specified in the Proxy, the persons named in the Proxy will vote the Common Shares represented by the Proxy for the approval of such matter.

Registered Shareholders

Registered Shareholders may wish to vote by proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a proxy may do so by choosing one of the following methods:

(a)complete, date and sign the enclosed form of proxy and return it to the Company’s transfer agent, Computershare Investor Services Inc. (“Computershare”), by fax within North America at 1-866-249-7775, outside North America at (416) 263-9524, or by mail to the 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or by hand delivery at 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, Canada V6C 3B9;

(b)use a touch-tone phone to transmit voting choices to the toll free number given in the proxy. Registered Shareholders who choose this option must follow the instructions of the voice response system and refer to the enclosed proxy form for the toll free number, the holder's account number and the proxy access number; or

(c)via Computershare’s internet website www.investorvote.com. Registered Shareholders who choose this option must follow the instructions that appear on the screen and refer to the enclosed proxy form for the holder's account number and the proxy access number.

In either case you must ensure the Proxy is received at least 48 hours (excluding Saturdays, Sundays and statutory holidays) before the Meeting or the adjournment thereof. Failure to complete or deposit the Proxy properly may result in its invalidation. The time limit for the deposit of proxies may be waived by the Company’s board of directors (the “Board”) at its discretion without notice. Please note that in order to vote your Common Shares in person at the Meeting, you must attend the Meeting and register with the scrutineer before the Meeting. If you have already submitted a Proxy, but choose to change your method of voting and attend the Meeting to vote, then you should register with the scrutineer before the Meeting and inform them that your previously submitted Proxy is revoked and that you personally will vote your Common Shares at the Meeting.

Beneficial Shareholders

The following information is of significant importance to Shareholders who do not hold Common Shares in their own name. Beneficial Shareholders should note the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of Common Shares) or as set out in the following disclosure.

If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms). In the United States of America (the “U.S.” or the “United States”) the vast majority of such Common Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depository for many U.S. brokerage firms and custodian banks).

- 2 -

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

There are two kinds of Beneficial Shareholders - those who object to their name being made known to the issuers of securities which they own (called “OBOs” for “Objecting Beneficial Owners”) and those who do not object to the issuers of the securities they own knowing who they are (called “NOBOs” for “Non-Objecting Beneficial Owners”).

These securityholder materials are sent to both Registered Shareholders and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent sent these materials directly to you, you are a NOBO and your name, address and information about your holdings of securities, were obtained from the intermediary holding securities on your behalf and in accordance with applicable securities regulatory requirements including, but not limited to, National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer.

Beneficial Shareholders who are OBOs should follow the instructions of their intermediary carefully to ensure that their Common Shares are voted at the Meeting.

The form of proxy supplied to you by your broker will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”) in Canada and in the United States. Broadridge mails a Voting Instruction Form (“VIF”) in lieu of a proxy provided by the Company. The VIF will name the same persons as the Company’s Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), different from the persons designated in the VIF, to represent your Common Shares at the Meeting, and that person may be you. To exercise this right insert the name of your desired representative (which may be you) in the blank space provided in the VIF. Once you have completed and signed your VIF return it to Broadridge by mail or facsimile, or deliver your voting instructions to Broadridge by phone or via the internet, in accordance with Broadridge’s instructions. Broadridge tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. If you receive a VIF from Broadridge, it must be completed and returned to Broadridge, in accordance with Broadridge’s instructions, well in advance of the Meeting in order to: (a) have your Common Shares voted at the Meeting as per your instructions; or (b) have an alternate representative chosen by you duly appointed to attend and vote your Common Shares at the Meeting.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada and securities laws of the provinces of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), are not applicable to the Company or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”), as amended, certain of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a

- 3 -

foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgment by a United States court.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a Proxy may revoke it by:

(a)executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare, or at the address of the registered office of the Company at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, V6E 4N7, at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or

(b)personally attending the Meeting and voting the Registered Shareholder’s Common Shares.

A revocation of a Proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors, as further described below.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Board of the Company has fixed February 15, 2023 as the record date (the “Record Date”) for determination of persons entitled to receive notice of the Meeting. Only Shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver the Proxy in the manner and subject to the provisions described above will be entitled to vote or to have their Common Shares voted at the Meeting.

The Company is authorized to issue an unlimited number of Common Shares without par value, which Common Shares are listed for trading under the stock symbol “DRUG” on both the Canadian Securities Exchange (the “CSE”) and the Nasdaq Capital Market (“Nasdaq”). Prior to the commencement of trading on the Nasdaq on November 8, 2021, the Company’s Common Shares also traded on the Over-the-Counter Markets under stock symbol “BMBIF”. Once the Common Shares were trading on the Nasdaq, the Common Shares ceased to be traded on the Over-the-Counter Markets. The Company is also subject to the reporting obligations under section 13(a) of the United States Securities Exchance Act of 1934, as amended. As of February 15, 2023, there were 18,710,359 Common Shares issued and outstanding, each carrying the right to one vote. No group of Shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Common Shares.

To the knowledge of the directors and executive officers of the Company, only the following persons or company beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying more than 10% of the voting rights attached to the outstanding Common Shares of the Company:

- 4 -

Shareholder Name | Number of Common Shares Held | Percentage of Issued Common Shares(1) |

Alan Kozikowski | 2,002,500 | 10.70% |

Notes:

(1)The percentage is calculated based on 18,710,359 Common Shares that were outstanding as of Record Date.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast in person or by proxy at the Meeting is required to pass the resolutions described herein as ordinary resolutions.

If there are more nominees for election as directors or appointment of the Company’s auditor than there are vacancies to fill, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed by acclamation.

FINANCIAL STATEMENTS

The audited financial statements of the Company’s financial year ended September 30, 2022 and the report of the auditor thereon, will be placed before Shareholders at the Meeting for their consideration. No formal action will be taken at the Meeting to approve the financial statements. If any Shareholder has questions regarding such financial statements, such questions may be brought forward at the Meeting. Copies of the audited financial statements are available through the internet on SEDAR, which can be accessed at www.sedar.com.

ELECTION OF DIRECTORS

The size of the Board was set by resolution of the directors at five directors. Accordingly, to continue the current number of directors and pursuant to the Articles of the Company (the “Articles”) the Board has not changed the number of directors to be elected and five (5) directors will be elected at the Meeting. Shareholders are asked to consider the persons set forth in the table below as director nominees, and to vote at the Meeting to elect them as directors for the ensuing year.

The term of office of each of the current directors will end at the conclusion of the Meeting. Unless a director’s office is vacated earlier in accordance with the provisions of the BCBCA, each director elected will hold office until the conclusion of the next annual general meeting of the Company, or if no director is then elected, until a successor is elected.

Advance Notice Provision

Pursuant to the Advance Notice Provisions contained in the Articles, the Board has determined that notice of nominations of persons for election to the Board at the Meeting must be made in accordance with the requirements of such Advance Notice Provisions. To the date of this Circular, the Company has not received notice of a nomination in compliance with the Articles and, subject to the timely receipt of any such nomination, any nominations other than nominations by or at the direction of the Board or an authorized officer of the Company will be disregarded at the Meeting.

- 5 -

The following table sets out the names of management’s five nominees for election as director, all major offices and positions with the Company and any of its significant affiliates each now holds, each nominee’s principal occupation, business or employment (for the last five years for each director nominee), the period of time during which each has been a director of the Company and the number of Common Shares of the Company beneficially owned by each, directly or indirectly, or over which each exercised control or direction, at February 15, 2023.

Name, Place of Residence and Position(s) with the Company | Principal Occupation, Business or Employment for Last Five Years(1) | Director Since | Number of Common Shares Owned(1) |

Ian McDonald Chief Executive Officer, President & Director Dubai, United Arab Emirates | See director biographies below. | May 31, 2019 | 914,900(6) |

Nils Bottler(2)(3)(4)(5) Director Berlin, Germany | See director biographies below. | September 29, 2020 | 20,000(7) |

Jeremy Fryzuk(2)(3)(4)(5) Director London, UK | See director biographies below. | September 29, 2020 | 30,000(8) |

Jan Pedersen Chief Scientific Officer and Director Region Hovedstaden, Denmark | See director biographies below. | April 27, 2022 | Nil(9) |

David Weiner(2)(3)(4)(5) Director New York, USA | See director biographies below. | February 16, 2023 | Nil (10) |

Notes:

(1)Information has been furnished by the respective nominees individually.

(2)Member of the Company’s Audit Committee.

(3)Member of the Nominating and Corporate Governance Committee.

(4)Member of the Compensation Committee.

(5)Member of the Corporate Disclosure Committee.

(6)Mr. McDonald also owns 600,000 restricted share units: 25% of which vested on December 1, 2022; 25% of which will vest on December 1, 2023; 25% of which will vest on December 1, 2024; and 25% of the which will vest on December 1, 2025.

(7)Mr. Bottler also holds options to purchase 80,000 Common Shares at a price of $1.25 expiring on November 17, 2025.

(8)Mr. Fryzuk also holds options to purchase 80,000 Common Shares at a price of $1.25 expiring on November 17, 2025.

(9)Dr. Pedersen owns 100,000 restricted share units: 25% of which vested on April 27, 2022; 25% of which will vest on April 27, 2024; 25% of which will vest on April 27, 2025; and 25% of which will vest on April 27, 2026. Dr. Pedersen also owns 500,000 restricted share units: 25% of which

- 6 -

vested on December 1, 2022; 25% of which will vest on December 1, 2023; 25% of which will vest on December 1, 2024; and 25% of which will vest on December 1, 2025.

(10)Dr. Weiner holds options to purchase 80,000 Common Shares at a price of $1.05 expiring on February 16, 2028.

None of the proposed nominees for election as a director of the Company are proposed for election pursuant to any arrangement or understanding between the nominee and any other person, except the directors and senior officers of the Company acting solely in such capacity.

Management does not contemplate that any of its nominees will be unable to serve as directors. If any vacancies occur in the slate of nominees listed above before the Meeting, then the designated persons intend to exercise discretionary authority to vote the Common Shares represented by proxies for the election of any other persons as directors.

Biographies of Director Nominees

Ian McDonald

Mr. McDonald is an entrepreneur and former Investment Banker. Prior to joining the Company, Mr. McDonald served on the management team at a TSX-listed gold mining company. In that capacity, Mr. McDonald developed and implemented the corporate strategy as it relates to M&A and capital markets resulting in a $160 million sale within one year. Previously, he worked in a senior role at a Canadian Investment Bank and in private equity in Vancouver, London and Toronto. Under Mr. McDonald’s guidance, clients raised hundreds of millions of dollars in capital. Mr. McDonald has served as a member of the Board of Directors of several TSX Venture Exchange, Canadian Securities Exchange listed and private companies.

Nils Bottler

Mr. Bottler is a Venture Capitalist currently working at Think.Health Ventures as an Associate Partner. The company focuses on investment in early-stage start-ups in the fields of digital health and medical device technology. Think.Health supports its portfolio beyond financial investment with knowledge, experience and access to an extensive business network.

Mr. Bottler’s prior work experience was in the banking industry working mainly on M&A projects as well as on a number of consulting projects in Germany, China, the UK, and the United Arab Emirates. He then moved to digital media and analyzed, developed and executed new business models at the Axel Springer SE in Berlin before taking a deep dive into the German health care market as SVP RHÖN-Innovations and the premier hospital chain RHÖNKLINIKUM AG.

Jeremy Fryzuk

Mr. Fryzuk is a private equity investment professional based in London. He has over 10 years of experience in private equity. He started his career in investment banking in Toronto with BMO Capital Markets. Mr. Fryzuk holds a Bachelor of Commerce with a major in Finance from Dalhousie University in Canada.

Dr. Jan Pedersen

Dr. Pedersen is an innovative and highly experienced leader in drug discovery research, with more than 25 years of expertise in neuroscience research management. Dr. Pedersen’s academic interests include neurodegeneration, bioinformatics, biophysics and drug discovery R&D. He is the founder of Torleif

- 7 -

Science ApS, a consultancy company aimed at delivering innovation and new ideas in neuroscience. Prior to that, Dr. Pedersen spent 20 years at Lundbeck, a global pharmaceutical company specialized in brain diseases, in positions of increasing responsibility, including building its neurodegeneration/Alzheimer’s disease pipeline, and bringing research programs to the clinic. Dr. Pedersen received an MSc in Chemistry from DTU – Technical University of Denmark, and a PhD in biophysics from the University of Bath.

Dr. David Weiner

Dr. Weiner has over 25 years of experience in the discovery and clinical development of novel therapeutics for neurological, psychiatric and rare diseases. He began his career at ACADIA Pharmaceuticals, where he held a series of discovery research and clinical development roles working on multiple central nervous system (CNS) therapeutics, most notably pimavanserin, a 5-HT2A receptor inverse agonist, which is approved for the treatment of Parkinson’s disease psychosis. Dr. Weiner also served as the Chief Medical Officer (CMO) and Interim Chief Executive Officer (CEO) for Proteostasis Therapeutics, CMO at aTyr Pharma and Lumos Pharma, CEO at Amathus Therapeutics, and as an independent board member and senior executive at Eleusis, a company focused on therapeutic development of psychedelics and novel 5-HT2A receptor agonists. He has authored more than 30 scientific publications and patents and serves on multiple clinical and scientific advisory boards, including the Michael J. Fox Foundation for Parkinsons Research. He received his M.D. from the School of Medicine and Biomedical Sciences, SUNY at Buffalo, was a Howard Hughes Medical Institute Research Scholar at the NIH, trained in neurology at New York Hospital, Memorial Sloan Kettering, Cornell Medical Center, and did a post-doctoral fellowship in neuropharmacology at the University of Vermont.

Management recommends the election of each of the nominees listed above as a director of the Company.

Cease Trade Orders or Bankruptcies:

No proposed director is, as at the date of this Circular, or has been, within ten (10) years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that:

(1)was subject to (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

(2)was subject to (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

No proposed director is, as at the date of this Circular, or has been within ten (10) years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager of trustee appointed to hold its assets.

- 8 -

No proposed director has, within ten (10) years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement, or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Penalties and Sanctions

No proposed director of the Company has been subject to:

(1)any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(2)any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable Shareholder in deciding whether to vote for a proposed director.

APPOINTMENT OF AUDITOR

DeVisser Gray LLP, Chartered Professional Accountants, of 401 – 905 West Pender Street, Vancouver, British Columbia V6C 1L6, will be nominated at the Meeting for appointment as auditor of the Company to hold office until the next annual general meeting of Shareholders, at a remuneration to be fixed by the directors.

At the Meeting, Shareholders shall be called upon to appoint DeVisser Gray LLP, Chartered Accountants, as auditors of the Company, to hold office until the next Annual General Meeting of Shareholders, and to authorize the directors to fix their remuneration.

The Board unanimously recommends that the Shareholders vote for the appointment of DeVisser Gray LLP, Chartered Professional Accountants, as auditors of the Company, to hold office until the next Annual General Meeting of Shareholders, and to authorize the directors to fix their remuneration.

AUDIT COMMITTEE DISCLOSURE

The provisions of National Instrument 52-110 – Audit Committees (“NI 52-110”) requires the Company to disclose annually in its Circular certain information concerning the constitution of its audit committee and its relationship with its independent auditor, as set forth below.

The Audit Committee’s Charter

The audit committee of the Company (the “Audit Committee”) has a charter, a copy of which is attached as Schedule “A” hereto.

Composition of Audit Committee

The following persons are members of the Audit Committee:

Nils Bottler (Chair) | Independent | Financially Literate |

- 9 -

Jeremy Fryzuk | Independent | Financially Literate |

David Weiner | Independent | Financially Literate |

An Audit Committee member is independent if the member has no direct or indirect material relationship with the Company that could, in the view of the Board, reasonably interfere with the exercise of a member’s independent judgment.

An Audit Committee member is financially literate if they have the ability to read and understand a set of financial statements that present a breadth of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements.

Relevant Education and Experience

Each member of the Company’s Audit Committee has adequate education and experience relevant to their performance as an Audit Committee member and, in particular, the requisite education and experience that provides the member with:

(a)an understanding of the accounting principles used by the Company to prepare its financial statements and the ability to assess the general application of those principles in connection with estimates, accruals and reserves;

(b)experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements or experience actively supervising individuals engaged in such activities; and

(c)an understanding of internal controls and procedures for financial reporting.

See Biographies of Director Nominees above, in particular the biographies of each Audit Committee member, for more information concerning each Audit Committee member’s education and experience.

Audit Committee Oversight

The Audit Committee has not made any recommendations to the Board to nominate or compensate any auditor other than DeVisser Gray LLP, Chartered Professional Accountants.

Pre-Approval Policies and Procedures

Formal policies and procedures for the engagement of non-audit services have yet to be formulated and adopted. Subject to the requirements of NI 52-110, the engagement of non-audit services is considered by, as applicable, the Board and the Audit Committee, on a case-by-case basis.

External Auditor Service Fees

The Audit Committee has reviewed the nature and amount of the non-audit services provided by DeVisser Gray LLP, Chartered Professional Accountants, to the Company to ensure auditor independence. Payments

- 10 -

to DeVisser Gray LLP, Chartered Professional Accountants, for audit and non-audit services in the years ended September 30, 2022 and September 30, 2021 are outlined in the following table.

Year Ended December 31 | Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) |

2022 | $68,250 | $Nil | $3,700 | $Nil |

2021 | $99,875 | Nil | $4,500 | Nil |

Notes:

(a)“Audit Fees” include fees necessary to perform the annual audit and quarterly reviews of the Company’s consolidated financial statements. Audit Fees include fees for review of tax provisions and for accounting consultations on matters reflected in the consolidated financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits.

(b)“Audit-Related Fees” include services that are traditionally performed by the auditor. These audit-related services include employee benefit audits, due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation.

(c)“Tax Fees” include fees for all tax services other than those included in “Audit Fees” and “Audit-Related Fees”. This category includes fees for tax compliance, tax planning and tax advice. Tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities.

(d)“All Other Fees” include all other non-audit services.

CORPORATE GOVERNANCE

National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”) requires issuers to disclose their corporate governance practices and National Policy 58-201 - Corporate Governance Guidelines (“NP 58-201”) provides guidance on corporate governance practices. This section sets out the Company’s approach to corporate governance and addresses the Company's compliance with NI 58-101.

Corporate governance refers to the policies and structure of the board of directors of a company, whose members are elected by and are accountable to the company’s shareholders. Corporate governance encourages establishing a reasonable degree of independence of the board of directors from executive management and the adoption of policies to ensure the board of directors recognizes the principles of good management. The Board is committed to sound corporate governance practices as such practices are both in the interests of shareholders and help to contribute to effective and efficient decision-making.

Board of Directors

Directors are considered to be independent if they have no direct or indirect material relationship with the Company. A “material relationship” is a relationship which could, in the Board’s opinion, be reasonably expected to interfere with the exercise of a director’s independent judgment.

The Board facilitates its independent supervision over management of the Company through frequent meetings of the Board at which members of management or non-independent directors are not in attendance and by retaining independent consultants where it deems necessary.

Management is delegated the responsibility for meeting defined corporate objectives, implementing approved strategic and operating plans, carrying on the Company’s business in the ordinary course, managing cash flow, evaluating new business opportunities, recruiting staff and complying with applicable regulatory requirements. The Board facilitates its independent supervision over management by reviewing and approving long-term strategic, business and capital plans, material contracts and business transactions, and all debt and equity financing transactions. Through its Audit Committee, the Board examines the

- 11 -

effectiveness of the Company’s internal control processes and management information systems. The Board reviews executive compensation and recommends stock option grants.

The independent members of the Board are Nils Bottler, Jeremy Fryzuk and David Weiner. Ian McDonald and Jan Pedersen are not independent as they are officers of the Company.

The following table sets forth the record of attendance of Board and Audit Committee meetings by Directors for the year ended September 30, 2022:

Director | Board of Directors Meetings | Audit Committee |

Ian McDonald | 6 of 6 | N/A |

Nils Bottler | 4 of 6 | 4 of 4 |

Jeremy Fryzuk | 4 of 6 | 4 of 4 |

Jan Pedersen | 4 of 4 | N/A |

Alan Kozikowski | 3 of 3 | N/A |

Emer Leahy | 2 of 2 | 1 of 1 |

Douglas Williamson | 1 of 1 | 1 of 1 |

The Company does not currently have term limits imposed on its directors and has not implemented any other mechanism for board renewal. The Company became a reporting issuer in 2021, and as such does not believe it is appropriate to impose term limits on its board members at this time.

Directorships

The following directors are currently serving on the the board of directors of other reporting issuers.

Name of Director | Name of Reporting Issuer | Exchange |

Ian McDonald | GK Resources Ltd. | TSXV |

Jeremy Fryzuk | Balta Group NV | Euronext Brussels |

Orientation and Continuing Education

While the Company does not have formal orientation and training programs, new Board members are provided with:

(a)a Board manual which provides information respecting the functioning of the Board of Directors, committees and copies of the Company's corporate governance policies;

(b)access to recent, publicly filed documents of the Company, technical reports and the Company's internal financial information;

(c)access to management and technical experts and consultants; and

(d)information regarding a summary of significant corporate and securities responsibilities.

Board members are encouraged to communicate with management, auditors and technical consultants; to keep themselves current with industry trends and developments and changes in legislation with management’s assistance; and to attend related industry seminars and visit the Company’s operations. Board members have full access to the Company's records.

- 12 -

Ethical Business Conduct

The Board has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of the Company’s employees and officers, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. A copy of the Code of Ethics will be provided to any Shareholder without charge upon request.

The Board has found that the fiduciary duties placed on individual directors by the Company’s governing corporate legislation and the common law, and the restrictions placed by applicable corporate legislation on an individual directors’ participation in decisions of the Board in which the director has an interest, have been sufficient to ensure that the Board operates independently of management and in the best interests of the Company. Further, the Company’s auditor has full and unrestricted access to the Audit Committee at all times to discuss the audit of the Company’s financial statements and any related findings as to the integrity of the financial reporting process.

Diversity and Gender Equality

The Board has not adopted a written policy relating to the identification and nomination of female Directors or a formal diversity policy. The Board, through its direction to management, continues to promote diversity in the workplace. The Company respects and values differences in gender, age, ethnic origin, religion, education, sexual orientation, political belief or disability. The Company recognizes the benefits arising from Board, management and employee diversity, including broadening the Company’s skill sets and experience, accessing different outlooks and perspectives and benefiting from all available talent. Directors are recruited and promoted based upon their qualifications, abilities and contributions.

The Board is committed to fostering a diverse workplace environment where: (a) individual differences and opinions are heard and respected; (b) employment opportunities are based on the qualifications required for a particular position at a particular time, including training, experience, performance, skill and merit; and (c) inappropriate attitudes, behaviors, actions and stereotypes are not tolerated and will be addressed. The Board monitors the Company’s adherence to these principles.

Nominating and Corporate Governance Committee

On June 13, 2021, the Board adopted a Nominating and Corporate Governance Committee Charter and has established a Nominating and Corporate Governance Committee (the “N&CG Committee”) which operates under its Nominating and Corporate Governance Committee Charter. The N&CG Committee is currently comprised of Nils Bottler (Chair), Jeremy Fryzuk and David Weiner. The N&CG Committee is responsible for (a) identifying and recommending to the Board, individuals qualified to be nominated for election to the Board; (b) recommending to the Board, the members and chairperson for each Board committee; and (c) periodically reviewing and assessing the Company’s corporate governance principles contained in the Nominating and Corporate Governance Committee Charter and making recommendations for changes thereto to the Board.

The N&CG Committee is responsible for, among other things:

·leading the Company’s search for individuals qualified to become members of the Board;

·evaluating and recommending to the Board for nomination candidates for election or re-election as directors;

·establishing and overseeing appropriate director orientation and continuing education programs;

- 13 -

·making recommendations to the Board regarding an appropriate organization and structure for the Board;

·evaluating the size, composition, membership qualifications, scope of authority, responsibilities, reporting obligations and charters of each committee of the Board;

·periodically reviewing and assessing the adequacy of the Company’s corporate governance principles as contained in the Nominating and Corporate Governance Committee Charter and, should it deem it appropriate, it may develop and recommend to the Board for adoption of additional corporate governance principles;

·periodically reviewing the Company’s Articles in light of existing corporate governance trends, and shall recommend any proposed changes for adoption by the Board or submission by the Board to Shareholders;

·making recommendations on the structure and logistics of Board meetings and may recommend matters for consideration by the Board;

·considering, adopting and overseeing all processes for evaluating the performance of the Board, each committee and individual directors; and

·annually reviewing and assessing its own performance.

Compensation Committee

On June 13, 2021, the Board adopted a Compensation Committee Charter and established a Compensation Committee (the “Compensation Committee”). The Compensation Committee is comprised of Nils Bottler (Chair), Jeremy Fryzuk and David Weiner. See “Compensation Discussion and Analysis” below.

Corporate Disclosure Committee

The Company’s Corporate Disclosure Committee consists of Nils Bottler (Chair), Jeremy Fryzuk and David Weiner. The Corporate Disclosure Committee oversees the effectiveness of risk management policies, procedures and practices implemented by management of the Company with respect to the Company’s disclosure controls and procedures.

Other Board Committees

The Board committees are: the Audit Committee, the N&GC Committee, the Compensation Committee and the Corporate Disclosure Committee. There are no other committees.

Assessments

The Board monitors the adequacy of information given to directors, communication between the Board and management, and the strategic direction and processes of the Board and Audit Committee.

NASDAQ Corporate Governance

The Company is a “foreign private issuer” as defined under Rule 3b-4 promulgated under the Exchange Act and the Company’s common shares are listed on the Nasdaq. Nasdaq Marketplace Rule 5615(a)(3) permits a foreign private issuer to follow its home country practices in lieu of most of the requirements of the 5600 Series of the Nasdaq Marketplace Rules and the requirement to distribute annual and interim reports set forth in Nasdaq Marketplace Rule 5250(d). In order to claim such an exemption, the Company must disclose the significant differences between its corporate governance practices and those required to

- 14 -

be followed by U.S. domestic issuers under Nasdaq’s corporate governance requirements. Set forth below is a brief summary of such differences.

Shareholder Approval Requirements

Nasdaq Marketplace Rule 5635 requires each issuer to obtain shareholder approval prior to certain dilutive events, including a transaction other than a public offering involving the sale of 20% or more of the issuer's common shares outstanding prior to the transaction for less than the greater of book or market value of the stock. The Company does not follow this Nasdaq Marketplace Rule. Instead, and in accordance with the Nasdaq exemption, the Company complies with British Columbia corporate and securities laws, which do not require shareholder approval for dilutive events unless the Company were to dispose of all or substantially all of its undertaking. In addition, the Company follows the CSE policies which require shareholder approval on the occurrence of a “fundamental change”, defined by the policies of the CSE to be an acquisition pursuant to which at least 50% of the issuer’s assets or anticipated revenues will be a result of the acquisition, in combination with a change of control. The determination of a change of control in such context would include the distribution of 100% of the number of equity securities of the issuer outstanding prior to the transaction, or otherwise may be determined through a substantial change of the management or the board of directors of the issuer.

In addition, Nasdaq Marketplace Rule 5635(c) requires shareholder approval of most equity compensation plans and material revisions to such plans, as well as with respect to the sale of our securities at a discount to their market value to an officer, director, employee or consultant. We do not follow this Nasdaq Marketplace Rule. Instead, and in accordance with the Nasdaq exemption, we comply with British Columbia corporate and securities laws, which do not require shareholder approval of equity compensation plans or most discount to market offerings of securities unless otherwise indicated in the Articles of the Company. In addition, the Company intends to follow the CSE policies and certain provisions of Canadian securities laws which require limitations on the number of equity compensation securities that can be distributed to persons performing investor relations services to 1% of the issued and outstanding amount of listed securities in a 12-month period, and further limit the number of equity compensation securities that can be distributed to a director, officer or a related entity of the issuer, or an associate thereof (each a “related person”), on a fully diluted basis to not exceed 5% of the outstanding securities of the issuer, or collectively to related persons exceeds 10% of the outstanding securities of the issuer.

Quorum Requirement

NASDAQ Marketplace Rule 5620(c) requires that each company that is not a limited partnership shall provide for a quorum as specified in its by-laws for any meeting of holders of common stock; provided, however, that in no case shall such quorum be less than 33 1/3% of the outstanding shares of the company’s common voting stock. The Company does not presently follow this NASDAQ Marketplace Rule. Instead, the Company complies with British Columbia corporate and securities laws and its Articles which do not require a quorum of no less than 33 1/3% of the outstanding shares of the Company’s common voting stock and provides that the quorum for the transaction of business at a meeting of shareholders is the quorum established by the Company’s Articles, which is at least one person who is, or who represents by proxy, one or more shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the meeting.

Executive Sessions

NASDAQ Marketplace Rule 5605(b)(2) requires that the independent board members of a company have regularly scheduled meetings at which only independent directors are present (“executive sessions”). Under

- 15 -

applicable Canadian rules, customs and practice, the Company’s independent directors are not required to hold executive sessions. However, the Company is subject to certain disclosure requirements prescribed in Canadian Form 58-101F1 - Corporate Governance Disclosure. In particular, the Company must disclose whether the independent directors hold executive sessions and, if such executive sessions are held, how many of these meetings have been held since the beginning of the Company’s most recently completed financial year. If the Company does not hold executive sessions, the Company must describe what the Board does to facilitate open and candid discussion among its independent directors.

Proxy Delivery Requirements

Nasdaq Marketplace Rule 5620(b) requires that a listed company that is not a limited partnership to solicit proxies and provide proxy statements for all meetings of shareholders, and also provide copies of such proxy solicitation materials to Nasdaq. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

Distribution of Annual and Interim Reports

Nasdaq Marketplace Rule 5250(d)(1) requires that a listed company (including a limited partnership) make available to shareholders an annual report containing audited financial statements of the Company and its subsidiaries (which, for example may be on Form 10-K, 20-F, 40-F or N-CSR) within a reasonable period of time following the filing of the annual report with the SEC. In addition, under Nasdaq Marketplace Rule 5250(d)(4)(A), each company that is not a limited partnership and is not subject to Rule 13a-13 under the Exchange Act and that is required to file with the SEC, or other regulatory authority, interim reports relating primarily to operations and financial position, shall make available to shareholders reports which reflect the information contained in those interim reports. Such reports shall be made available to shareholders either before or as soon as practicable following filing with the appropriate regulatory authority. If the form of the interim report provided to shareholders differs from that filed with the regulatory authority, the company shall file one copy of the report to shareholders with Nasdaq in addition to the report to the regulatory authority that is filed with Nasdaq pursuant to Rule 5250(c)(1).

The Company currently complies with Nasdaq Marketplace Rules 5250(d)(1) and 5250(d)(4)(A), however, the Company may not do so or on a consistent basis. Instead, the Company may determine to comply with British Columbia corporate and securities laws which do not require the distribution of annual or interim reports to shareholders but do require the Company to place before the annual general meeting the annual financial statements that the Company is required to with the applicable securities commissions in Canada under the Securities Act (British Columbia) in relation to the most recently completed financial year, file annual and interim financial statements on SEDAR at www.sedar.com, and send annually a request form to the registered holders and beneficial owners of its securities that can be used to request a paper copy of the Company's annual financial statements and management discussion and analysis for the annual financial statements, and a copy of the Company’s interim financial reports and management discussion and analysis for the interim financial reports free of charge.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Definitions

In this section “Named Executive Officer” (or “NEO”) means each of the following individuals:

- 16 -

(a)the Chief Executive Officer (“CEO”);

(b)the Chief Financial Officer (“CFO”);

(c)each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and

(d)each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company, nor acting in a similar capacity, at September 30, 2022.

“plan” includes any plan, contract, authorization or arrangement, whether or not set out in any formal document, where cash, compensation securities or any other property may be received, whether for one or more persons.

Compensation Committee

The Compensation Committee is comprised of Nils Bottler (Chair), Jeremy Fryzuk and David Weiner. The Compensation Committee assists the Board in fulfilling its oversight responsibilities relating to officer and director compensation, succession planning for senior management, development and retention of senior management and such other duties as directed by the Board.

The Compensation Committee did not formally meet during the year. The Compensation Committee assists the Board in carrying out its responsibilities relating to executive and director compensation. Mr. Bottler has experience with companies operating as emerging entities in the health care field. Mr. Fryzuk has capital markets experience, sitting on the board of Balta Group NV. Dr. Weiner industry expertise in management role thgouth his work as Chief Medical Officer (CMO) and Interim Chief Executive Officer (CEO) for Proteostasis Therapeutics, CMO at aTyr Pharma and Lumos Pharma, CEO at Amathus Therapeutics, and as an independent board member and senior executive at Eleusis, a company focused on therapeutic development of psychedelics and novel 5-HT2A receptor agonists. See disclosure under “Biographies of Director Nominees” for relevant education and experience of each member of the Compensation Committee.

The members of the Compensation Committee possess the skills and experience that enable the committee to make decisions on the suitability of the Company’s compensation policies and practices.

As a result of their education and experience, each member of the Compensation Committee has familiarity with, an understanding of, or experience in:

(a)reviewing compensation philosophy including base compensation structures & incentive programs;

(b)reviewing specific executive and director compensation;

(c)administering of stock options and other equity based compensation plans and the determination of stock option grants; and

(d)reviewing performance goals and the assessments of corporate officers.

- 17 -

Each of the Compensation Committee members satisfies the “independence” requirements of Nasdaq Listings Rule 5605(a)(2). The Compensation Committee is responsible for, among other things:

·reviewing and approving the Company’s compensation guidelines and structure;

·reviewing and approving on an annual basis the corporate goals and objectives with respect to the CEO of the Company;

·reviewing and approving on an annual basis the evaluation process and compensation structure for the Company’s other officers, including salary, bonus, incentive and equity compensation;

·reviewing the Company’s incentive compensation and other equity-based plans and recommending changes in such plans to the Board as needed;

·periodically making recommendations to the Board regarding the compensation of non-management directors, including Board and committee retainers, meeting fees, equity-based compensation and such other forms of compensation and benefits as it may may consider appropriate; and

·overseeing the appointment and removal of executive officers, and reviewing and approving for executive officers, including the CEO, any employment, severance or change in control agreements.

While the Compensation Committee provides assistance to the Board in reviewing compensation and making recommendations to the Board, traditionally the responsibilities relating to executive and director compensation, including reviewing and recommending compensation of the Company’s officers and employees and overseeing the Company’s base compensation structure and equity-based compensation program, is performed by the Board as a whole. The Board also assumes responsibility for reviewing and monitoring the long-range compensation strategy for the Company’s senior management. The Board generally reviews the compensation of senior management on an annual basis taking into account compensation paid by other issuers of similar size and activity and the performance of officers generally and in light of the Company’s goals and objectives.

The Company is a small biotechnology company with limited resources. The compensation for senior management of the Company is designed to ensure that the level and form of compensation achieves certain objectives, including: (a) attracting and retaining talented, qualified and effective executives; (b) motivating the short and long-term performance of executives; and (c) better aligning the interests of executive officers with those of the Company’s shareholders. In the Board’s view, paying salaries which are competitive in the markets in which the Company operates is a first step to attracting and retaining talented, qualified and effective executives. Competitive salary information on comparable companies is compiled from a variety of sources, including national and international publications.

The Board determines the compensation for the CEO. The compensation of the Company’s executives is determined by the Board after the recommendation of the CEO. In each case, the Board takes into consideration the prior experience of the executive, industry standards, competitive salary information on comparable companies of similar size and stage of development, the degree of responsibility and participation of the executive in the day-to-day affairs of the Company, and the Company’s available cash resources.

- 18 -

In the Board’s view, to attract and retain qualified and effective executives, the Company must pay base salaries which are reasonable in relation to the level of service expected while remaining competitive in the markets in which the Company operates.

The Board has assessed the Company’s compensation plans and programs for its executive officers to ensure alignment with the Company’s business plan and to evaluate the potential risks associated with those plans and programs. The Board has concluded that the compensation policies and practices do not create any risks that are reasonably likely to have a material adverse effect on the Company. The Board considers the risks associated with executive compensation and corporate incentive plans when designing and reviewing such plans and programs.

The Company did not retain a compensation consultant during the financial year ended September 30, 2022.

Philosophy and Objectives

The compensation program for the senior management of the Company is designed within this context with a view that the level and form of compensation achieves certain objectives, including:

·attracting and retaining qualified executives;

·motivating the short and long-term performance of these executives; and

·better aligning their interests with those of the Company’s Shareholders.

The Company’s compensation program is designed to recognize and reward executive performance consistent with the success of the Company’s business. The Company’s compensation program consists of three elements: (1) base salaries and consulting fees; (2) bonus incentive compensation; and (3) equity participation.

The Company has an Anti-Hedging and Pledging Policy restricting its executive officers or directors from purchasing financial instruments that are designated to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by its executive officers or directors.

Base Salary or Consulting Fees

In the Board’s view, paying base salaries which are reasonable in relation to the level of service expected while remaining competitive in the markets in which the Company operates is a first step to attracting and retaining qualified and effective executives.

Base salary ranges for the executive officers were initially determined upon a review of companies within the biotechnology industry, which were of the same size as the Company, at the same stage of development as the Company and considered comparable to the Company.

In determining the base salary of an executive officer, the Board considers the following factors:

·the particular responsibilities related to the position;

·salaries paid by other companies in the biotechnology industry which were similar in size as the Company;

·the experience level of the executive officer;

·the amount of time and commitment which the executive officer devotes to the Company; and

- 19 -

·the executive officer’s overall performance and performance in relation to the achievement of corporate milestones and objectives.

Bonus Incentive Compensation

The Company’s objective is to achieve certain strategic objectives and milestones. The Board considers executive bonus compensation dependent upon the Company meeting those strategic objectives and milestones and sufficient cash resources being available for the granting of bonuses. The Board approves executive bonus compensation dependent upon compensation levels based on recommendations of the CEO. Such recommendations are generally based on information provided by issuers that are similar in size and scope to the Company’s operations.

Equity Participation

The Company believes that encouraging its executives and consultants to become shareholders is the best way of aligning their interests with those of its shareholders. Equity participation is accomplished through the Option Plan and the RSU Plan. Stock options and RSUs are granted to executives and employees taking into account a number of factors, including the amount and term of options and RSUs previously granted, base salary and bonuses and competitive factors. The amounts and terms of options and RSUs granted are determined by the Compensation Committee based on recommendations put forward by the CEO. Prior to the establishment of the Compensation Committee, grants of stock options and RSUs were considered and approved by the Board.

Executive Compensation

Except for the grant of incentive stock options and restricted share unit awards to the NEOs and any compensation payable pursuant to an executive compensation agreement between the CEO or CFO and the Company, there are no arrangements under which NEOs were compensated by the Company during the most recently completed financial year for their services in their capacity as NEOs, directors or consultants.

Director Compensation

The directors receive no cash compensation for acting in their capacity as directors of the Company.

Except for the grant to directors of stock options and restricted share unit awards, there are no arrangements under which directors were compensated by the Company during the two most recently completed financial years for their services in their capacity as directors.

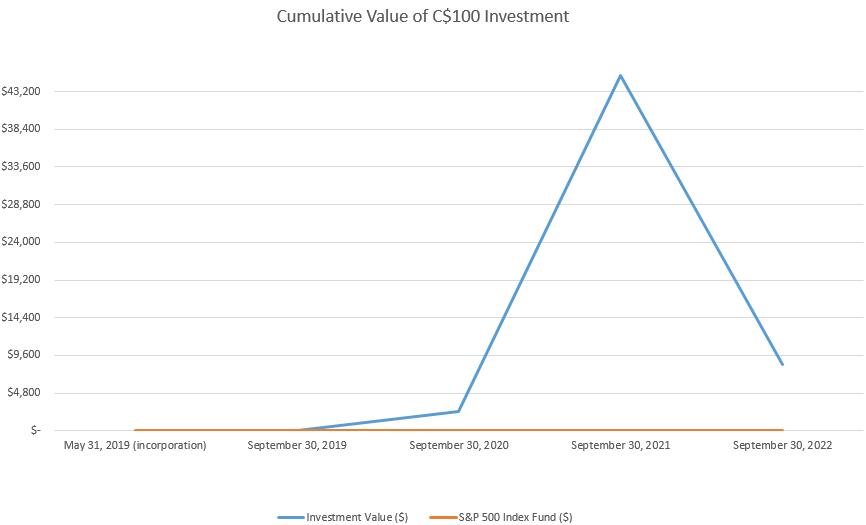

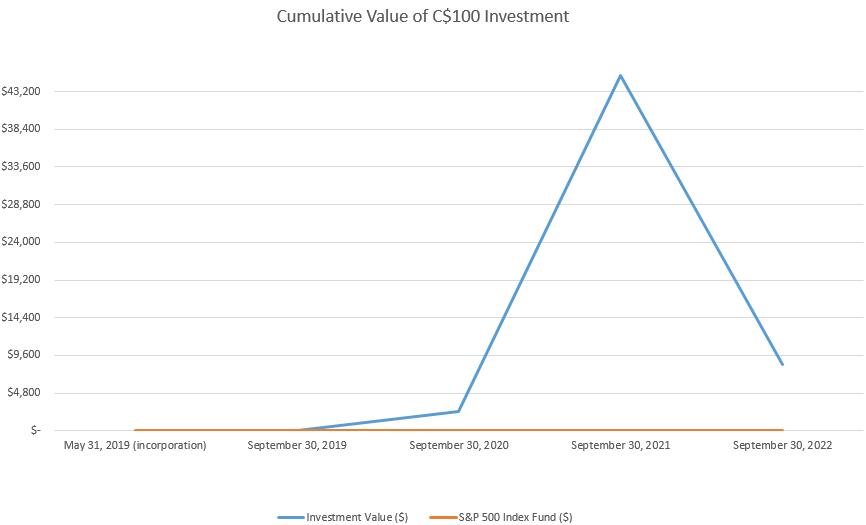

Performance Graph

The following graph compares the cumulative shareholder return on an investment of $100 in the Common Shares of the Company since May 31, 2019 to September 30, 2022 with a cumulative total shareholder return to the S&P 500 Index Fund over the same period.

- 20 -

Summary Compensation Table

The following table sets forth all compensation paid, payable, awarded, granted, given or otherwise provided, directly or indirectly, by Bright Minds or its subsidiaries, to each NEO set out below, in any capacity, including, for greater certainty, all plan and non‐plan compensation, direct or indirect pay, remuneration, economic or financial award, reward, benefit, gift or perquisite paid, payable, awarded, granted, given or otherwise provided to the NEO for services provided and for services to be provided, directly or indirectly, to Bright Minds for the period indicated.

Named Executive Officer and Principal Position | Year | Salary

(C$) | Share based awards

(C$) | Option based awards

(C$)(1) | Non-Equity Incentive Plan Compensation (C$) | Pension Value

(C$) | All Other Compen-sation

(C$) | Total Compen-sation

(C$) |

Annual Incentive Plan

(C$) | Long-term Incentive Plan

(C$) |

Ian McDonald(2) President and CEO | 2022 2021 | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil |

Ryan Cheung(3) CFO | 2022 2021 | 144,000 86,575 | Nil Nil | Nil 23,126 | Nil Nil | Nil Nil | Nil Nil | Nil Nil | 144,000 109,701 |

Revati Shreeniwas(4) Former Chief Medical Officer | 2022 2021 | 383,850 244,084 | Nil 236,652 | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | 383,850 480,736 |

- 21 -

Jan Pedersen(5) Chief Scientific Officer | 2022 | 174,215 | 775,000 | Nil | Nil | Nil | Nil | Nil | 949,215 |

Alan Kozikowski(6) Former Chief Scientific Officer | 2022 2021 | 191,090 246,655 | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | Nil Nil | 191,090 246,655 |

Notes:

(1)Option-based awards represent the fair value of stock options granted in the year under our Stock Option Plan. The fair value of stock options granted is calculated as of the grant date using the Black-Scholes option pricing model. For discussion of the assumptions made in the valuation, refer to Note 6 to our financial statements for our fiscal year ended September 30, 2022.

(2)Mr. McDonald was appointed President of the Company on May 31, 2019 and as CEO on June 5, 2020.

(3)Mr. Cheung was appointed CFO of the Company on May 29, 2020.

(4)Dr. Shreeniwas was engaged as Chief Medical Officer of the Company from June 5, 2020 to November 22, 2022.

(5)Dr. Jan Pedersen was engaged as Interim Chief Scientific Officer of the Company on June 26, 2022 and became Chief Science Officer on a permanent basis as of September 22, 2022.

(6)Dr. Kozikowski was the Chief Science Officer of the Company from October 29, 2020 to June 26, 2022.

Executive Compensation Agreements

The Company has entered into an Independent Contractor Agreement dated October 29, 2020 between the Company and Dr. Alan Kozikowski engaging the services of Dr. Kozikowski as Chief Science Officer of the Company, with compensation to be determined by the Board of Directors of the Company. The agreement contains standard nondisclosure, noncompetition and non-solicitation provisions and automatically renews on an annual basis unless terminated by either party. Dr. Kozikowski resigned as the Chief Science Officer on June 26, 2022 and the Independent Contractor Agreement was terminated on the same day.

The Company entered into an Independent Consultant Agreement dated June 5, 2020, between the Company a corporation controlled by Dr. Revati Shreeniwas, pursuant to which Dr. Revati Shreeniwas was engaged to perform services as Chief Medical Officer of the Company. The agreement contains standard nondisclosure, noncompetition and non-solicitation provisions and automatically renews on an annual basis unless terminated by either party. Dr. Shreeniwas’ appointment as Chief Medical Officer was terminated on November 22, 2022 and the Independent Consultant Agreement was terminated on the same day.

The Company entered into an Independent Contractor Agreement dated December 1, 2022 between the Company and Dr. Mark A. Smith engaging the services of Dr. Smith as Chief Medical Officer of the Company for annual compensation of US$205,000. The agreement contains standard nondisclosure, noncompetition and non-solicitation provisions and automatically renews on an annual basis unless terminated by either party.

Other than as set out above, the Company has not entered into any other contract, agreement, plan or arrangement that provides for payments to a NEO or a director at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement a change in control of the Company or a change in an NEOs or directors responsibilities).

- 22 -

Incentive Awards Plans

10% “rolling” Stock Option Plan (Option-Based Awards)

The Company has in place a 10% rolling stock option plan (the “Option Plan”), which became effective on July 1, 2020. The Option Plan was filed on SEDAR on November 19, 2020 and will be available for inspection at the Meeting.

The principal purpose of the Option Plan is to advance the interests of the Company by encouraging the directors, employees and consultants of the Company and of its subsidiaries or affiliates, if any, by providing them with the opportunity, through options, to acquire Common Shares in the share capital of the Company, thereby increasing their proprietary interest in the Company, encouraging them to remain associated with the Company and furnishing them with additional incentive in their efforts on behalf of the Company in the conduct of its affairs.

The Option Plan provides that the number of Common Shares issuable under the Option Plan, together with all of the Company’s other previously established or proposed share compensation arrangements, may not exceed 10% of the total number of the Company’s issued and outstanding Common Shares.

The Option Plan is administered by the board of directors of the Company or by a special committee of the directors appointed from time to time by the board of directors of the Company. The maximum term may not exceed ten (10) years from the date of grant.

The following information is intended to be a brief description of the Option Plan and is qualified in its entirety by the full text of the Option Plan. All capitalized words used but not defined have the meanings ascribed to such term in the Option Plan:

(a)the maximum number of Options which may be granted to any one holder under the Option Plan within any 12 month period shall be 5% of the number of issued and outstanding Common Shares (unless the Company has obtained disinterested shareholder approval if required by applicable laws);

(b)if required by applicable laws, disinterested shareholder approval is required to grant to related persons, within a 12 month period, of a number of Options which, when added to the number of outstanding Options granted to related persons within the previous 12 months, exceed 10% of the issued Common Shares;

(c)the expiry date of an Option shall be no later than the tenth anniversary of the grant date of such Option;

(d)the maximum number of Options which may be granted to any one consultant within any 12 month period must not exceed 2% of the number of issued and outstanding Common Shares;

(e)the maximum number of Options which may be granted within any 12 month period to employees or consultants engaged in investor relations activities must not exceed 2% of the number of issued and outstanding Common Shares and such Options must vest in stages over 12 months with no more than 25% of the Options vesting in any three month period;

(f)the exercise price of any Option issued under the Stock Option Plan shall not be less than the Market Value (as defined in the Option Plan) of the Common Shares as of the grant date; and

(g)the Board, or any committee to whom the Board delegates, may determine the vesting schedule for any Option.

The foregoing summary of the Option Plan is not complete and is qualified in its entirety by reference to the Option Plan, which is available on the Company’s SEDAR profile page at www.sedar.com.

- 23 -

10% “rolling” Restricted Share Unit Plan (Share-Based Awards)

The Company has in place a restricted share unit plan which became effective July 1, 2020 (the “RSU Plan”). A copy of the RSU Plan was filed on SEDAR on November 19, 2020 and will be available for inspection at the Meeting.

The RSU Plan was designed to provide certain directors, officers, consultants and other key employees (an “Eligible Person”) of the Company and its related entities with the opportunity to acquire restricted share units (“RSUs”) of the Company. The acquisition of RSUs allows an Eligible Person to participate in the long-term success of the Company thus promoting the alignment of an Eligible Persons.

The following is a summary of the RSU Plan. Capitalized terms used but not defined have the meanings ascribed to them in the RSU Plan.

Nature and Administration of the RSU Plan

All Directors, Officers, Consultants and Employees (as defined in the RSU Plan) of the Company and its related entities (“Eligible Persons”) are eligible to participate in the RSU Plan (as “Participants”), and the Company reserves the right to restrict eligibility or otherwise limit the number of persons eligible for participation as Participants in the RSU Plan. Eligibility to participate as a Participant in the RSU Plan does not confer upon any person a right to receive an award of RSUs.