Filed by Omnichannel Acquisition Corp.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Omnichannel Acquisition Corp.

Commission File No.: 001-39726

Date: August 6, 2021

Commerce Ventures

Reflections on Kin’s Journey: Investing with Kin-viction (Part 2)

In our last post, we discussed the origins of Kin (fka Bright Policy), and how we invested primarily based on our excitement about the founding team. In this post, we wanted to share key learnings about the importance of investment conviction.

At Commerce Ventures, our mandate is not to lead rounds with our initial investments, and this has led us to analyze fundraising and round dynamics quite carefully. Some firms like us choose not to lead rounds because of specific investment strategies and mandates. But we have also observed firms that lead sometimes and other times prefer to wait until a lead is identified — in other words, they or their partnerships are waiting for social proof.

Social proof is the habit of copying or taking comfort from the actions of others, in determining one’s own actions.

At Commerce Ventures, we look at opportunities differently. We love to work with other great investors, but we also feel like we need to come to our own views and conviction on investing since that is what our investors expect of us…even if we’re not leading.

Conviction, by definition, is a firmly held belief or opinion that exists (or ought to exist) regardless of social proof.

It also might be intuitive that during a second/follow on investment in a portfolio company, existing investors have better information than new investors. The fallacy that often persists in the venture industry, is that interest from new investors is somehow required to validate the portfolio company, rather than a firm developing its own sense of conviction with the information they already have.

Our Experiment with Kin

We observed some of these dynamics early in our experience with Kin, and the insights we’ve gained as a result have helped us reshape our entire approach to follow on investments. At the outset of multiple Kin rounds, we saw an abundance of prospective non-lead investor interest (sometimes where mandates didn’t permit leading and others who were waiting for social proof), but a shortage of lead investor conviction.

The interesting experiment we decided to run was to see if we could convert CV’s high conviction, non-lead second investment into playing a small round leadership role to help the company catalyze its fundraising.

The short answer was yes — with a $300k ‘lead’ investment, we were able to unlock a $4 million total seed round for Kin. More importantly, this single experiment unveiled a completely new set of opportunities for us to help our portfolio when we have conviction about the company and its trajectory.

What Contributed to Our Kin-viction?

We try to evaluate any investment in a similar way (regardless of initial or follow on), with the same core criteria: team, market, product, and financials.

The benefit of being an existing investor is that you likely already understand how the team operates, the dynamics of the market, the value of the product, and the potential scalabilty of the enterprise. It’s worth noting that the biggest point of ‘re-diligence’ we typically focus on confirming is product-market resonance, and this helps counter the inherent ‘insider bias’ we may have.

Team: In the case of Kin, we saw an impressive and scrappy team of founders demonstrate that they could also scale customer acquisition. More importantly, we saw how they responded to an early speed bump when their initial insurance partners didn’t perform as expected (a common challenge in InsurTech). Their response informed us about the team’s resilience and ability to solve important problems, which resulted in a better, more scalable Kin.

Market: We were always optimistic about the market opportunity in homeowners insurance for reasons shared by Sean in his first deck (the one we included in our last post). If anything, all of the data we saw after our first investment only confirmed how poorly served the market was, especially in catastrophic risk states.

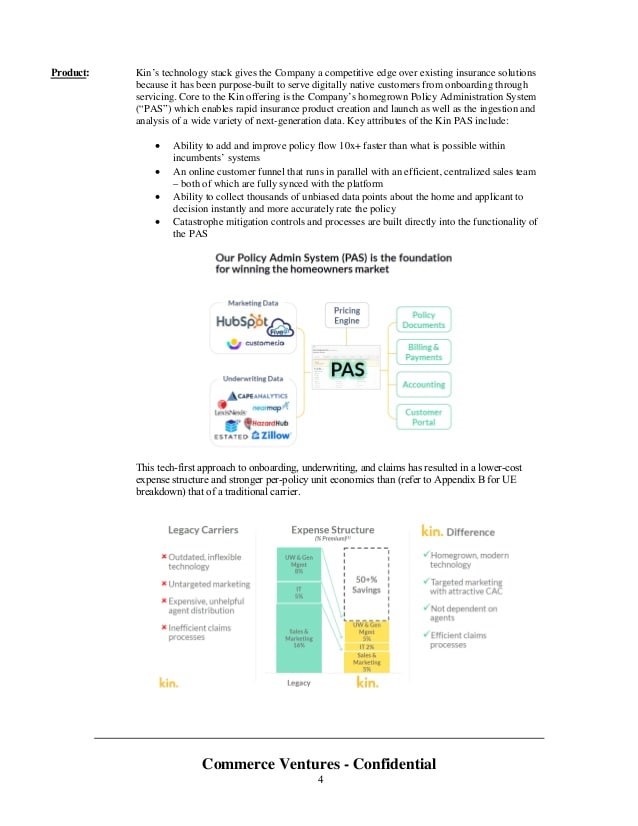

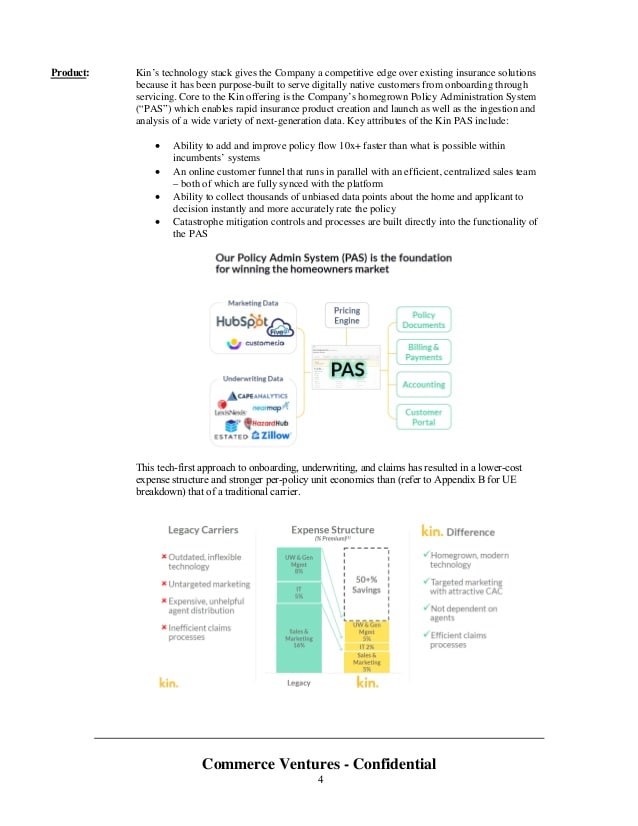

Product: In insurance, product means two things:

| 1. | the digital interfaces and user experiences (UX) |

| 2. | the actual insurance policy (e.g. homeowners, HOA, renters, etc.) and its associated risk and profitability |

We saw from the early days that Kin could create a digital-first product with inherently better UX than the incumbents’. The UX product was also attached to a reasonably priced policy where Kin could manage the risk as well or better than incumbents, because of their early adoption of alternative data sources and analytics. The economics of these policies were attractive with long lifetimes and relatively quick paybacks (and a high LTV/CAC ratio).

Financials: Analyzing the financials of a business really entails placing all of the above in the context of scalability. Insurance businesses are generally capital-intensive, so their scalability is different than other types of businesses. However, Kin’s early decision to set up a reciprocal exchange structure proved they could scale with a relatively capital-efficient approach.

In short, we felt we knew Kin better than any new investor would. We also recognized that we planned to invest in the company regardless of who the lead was. So why not just catalyze the round with our conviction?

This single change in approach helped enable the company to raise nearly $40 million across a couple of different rounds of funding.

So What?

The world of venture is changing in so many ways, the biggest of which is the available capital and levels of competition ramped up to record heights. There are also way more startups raising money at any given time. The implications are:

| 1. | If you’re an investor and you rely on social proof to build or confirm your interest, you likely are and will increasingly be at risk of being left out of the very best opportunities. |

| 2. | If you’re an entrepreneur, you should recognize the difference between investors with conviction and those who require social validation. We’d encourage you to lean towards the former because they are likely to support you over and over again, at times when it’s most helpful. |

| 3. | As you build your businesses, keep in mind that your strongest allies are likely the ones you bring along for the journey and keep informed about your progress. Sharing information in a reasonable, but open way with your investors is just good practice. This is what helps your investors confirm their initial belief in you, your team, and your opportunity. |

| 4. | If an existing investor has high conviction to support your business, relax all preconceived notions about what fundraising norms are and think creatively about how you and that investor can leverage that conviction to incur your success. |

IMPORTANT DISCLOSURE:

The content shared above includes materials prepared for historical fundraising activities and considerations and are NOT intended to be a solicitation for future investment nor inducement towards future investment in Kin or any related entity.

Important Information for Investors and Stockholders

This communication relates to a proposed business combination (the “Business Combination”) between Omnichannel Acquisition Corp. (“Omnichannel”) and Kin Insurance, Inc. (“Kin”). In connection with the proposed Business Combination, Omnichannel intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement of Omnichannel in connection with Omnichannel’s solicitation of proxies for the vote by Omnichannel’s stockholders with respect to the proposed Business Combination and a prospectus of Omnichannel. The proxy statement/prospectus will be sent to all Omnichannel stockholders, and Omnichannel will also file other documents regarding the proposed Business Combination with the SEC. This communication does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Before making any voting or investment decision, investors and security holders are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed Business Combination as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Omnichannel through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Omnichannel may be obtained free of charge by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, New Jersey 07901.

Forward-Looking Statements

This communication includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including insurance premium run-rate and enterprise software revenue. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Omnichannel, Kin or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement and the proposed Business Combination contemplated thereby; (2) the inability to complete the transactions contemplated by the transaction agreement due to the failure to obtain approval of the stockholders of Omnichannel or other conditions to closing in the transaction agreement; (3) the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the transaction agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Kin as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; and (8) the possibility that Kin may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Omnichannel’s Annual Report on Form 10-K, and other documents filed by Omnichannel from time to time with the SEC and the registration statement on Form S-4 and proxy statement/prospectus discussed above. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Omnichannel and Kin assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Any financial and capitalization information or projections in this communication are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Omnichannel’s and Kin’s control. While such information and projections are necessarily speculative, Omnichannel and Kin believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this communication should not be regarded as an indication that Omnichannel or Kin, or their respective representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events.

Participants in the Solicitation

Omnichannel, Kin and their respective directors and executive officers may be deemed participants in the solicitation of proxies of Omnichannel stockholders with respect to the proposed Business Combination. Omnichannel stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of Omnichannel and their ownership of Omnichannel’s securities in Omnichannel’s Annual Report on Form 10-K, which was filed with the SEC on March 31, 2021 and is available free of charge at the SEC's web site at www.sec.gov, or by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., First Floor West, 51 John F Kennedy Pkwy Millburn, NJ 07078.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus that Omnichannel intends to file with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.