Filed by Omnichannel Acquisition Corp.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Omnichannel Acquisition Corp.

Commission File No.: 001-39726

Date: September 22, 2021

For Every New Normal Analyst Day

This presentation (together with oral statements made in connection herewith, the “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Omnichannel Acquisition Corp. (“OCA”) and Kin Insurance, Inc. (“Kin” or the “Company”). By accepting this Presentation, you acknowledge and agree that all of the information contained herein or disclosed orally during this Presentation is confidential, that you will not distribute, reproduce, disclose and use such information for any purpose other than evaluating the Business Combination, that you will not distribute, reproduce, disclosure or use such information in any way detrimental to Kin or OCA, and that you will return to OCA and Kin, delete or destroy this Presentation upon request. You are also being advised that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. The information contained herein does not purport to be all - inclusive and none of OCA or the Company, nor any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. The reader shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment or decision to invest in the Company. To the fullest extent permitted by law, in no circumstances will OCA, the Company, or any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of the Company or the Business Combination. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situation or financial needs. Use of Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and the Company's own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its internal research is reliable, such research has not been verified by any independent source and none of OCA or the Company, nor any of their respective affiliates nor any of their control persons, officers, directors, employees or representatives, make any representation or warranty with respect to the accuracy of such information. Forward - Looking Statements Certain statements in this Presentation may be considered forward - looking statements. Forward - looking statements generally relate to future events or OCA's or the Company's future financial or other performance metrics. For example, statements concerning the following include forward - looking statements: summary financial forecast; projections of operating performance, revenues, expenses, capital expenditures, total addressable market and gross (loss) profit; projections and estimates of market opportunity and market share; future profitability; the Company's business plan; market acceptance of the Company's offerings; the Company's ability to further attract, retain, and expand its customer base; the Company’s ability to expand its business; the Company's ability to develop new products and services and bring them to market in a timely manner; the Company's ability to safeguard its and its customers' data; the Company's expectations concerning relationships with strategic partners, suppliers, and other third parties; the Company's ability to maintain, protect, and enhance its intellectual property; future acquisitions, ventures or investments in companies or products, services, or technologies; the Company's ability to attract and retain qualified employees; continuation of favorable regulations and government incentives affecting the markets in which the Company operates; the proceeds of the Business Combination and the Company's expected cash runway; and the potential effects of the Business Combination on the Company. In some cases, you can identify forward - looking statements by terminology such as “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” or the negatives of these terms or variations of them or similar terminology. Such forward - looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by OCA and its management, and the Company and its management, as the case may be, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management's control including general economic conditions and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in OCA's final prospectus relating to its initial public offering, dated November 19, 2020, and other filings with the Securities and Exchange Commission (SEC), as well as factors associated with companies, such as the Company, that are engaged in providing insurance, including anticipated trends, growth rates and challenges in that business and in the markets in which they operate; macroeconomic conditions related to the global COVID - 19 pandemic; the ability of the Company to capture additional market share; the effects of increased competition; the ability to stay in compliance with laws and regulations that currently apply or become applicable to insurance providers in the markets in which the Company currently operates as well as new markets in which the Company may wish to operate; the failure to realize the anticipated benefits of the Business Combination; the amount of redemption requests made by OCA's public stockholders; the ability of the combined company that results from the Business Combination to issue equity or equity - linked securities or obtain debt financing in connection with the Business Combination or in the future. Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither OCA nor the Company undertakes any duty to update these forward - looking statements. Use of Projections This Presentation contains projected financial information with respect to Kin. Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. See the “Forward - Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither OCA's nor the Company's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation and, accordingly, neither of them has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. In preparing and making certain forward - looking statements contained in this presentation, Kin and OCA made a number of economic, market and operational assumptions. The Company cautions that its assumptions may not materialize and that current economic conditions render such assumptions, although believed reasonable at the time they were made, subject to greater uncertainty. Disclaimer

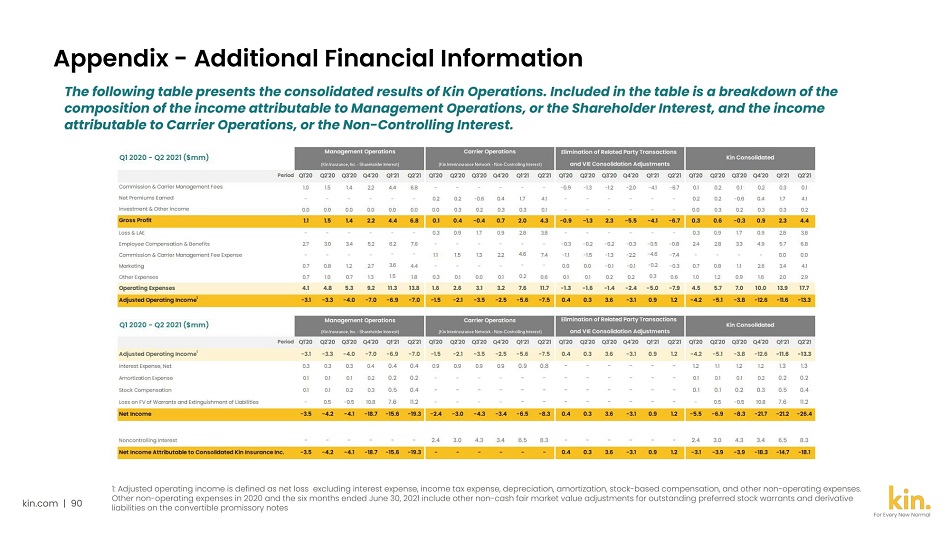

Disclaimer Additional Information In connection with the proposed Business Combination, OCA has filed with the SEC a registration statement on Form S - 4 containing a preliminary proxy statement/prospectus, and after the registration statement is declared effective, OCA will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its stockholders. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. OCA's stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about the Company, OCA and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of OCA as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC's website at www.sec.gov, or by directing a request to: Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, NJ 07901. Financial Information; Non - GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgated under the Securities Act of 1933, as amended (the "Securities Act"). Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, the registration statement to be filed by OCA with the SEC. Some of the financial information and data in this Presentation, such as Operating Income, Earned Surplus Contribution and Total Written Premium, has not been prepared in accordance with United States generally accepted accounting principles (“GAAP"). Kin and OCA believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Kin's financial condition and results of operations. Kin's management uses these non - GAAP measures for trend analyses for budgeting and planning purposes. Kin and OCA believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in comparing Kin's financial condition and results of operations with other similar companies, many of which present similar non - GAAP financial measures to investors. Management does not consider these non - GAAP measures in isolation or an alternative to financial measures determined in accordance with GAAP. The principal limitation of Operating Income is that it excludes significant expenses and income that are required by GAAP to be recorded in Kin's financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded and included in determining these non - GAAP financial measures. A reconciliation of non - GAAP financial measures in this Presentation to the most directly comparable GAAP financial is included on slide [ ]. [UPDATE FOR LIMITATIONS OF OTHER NON - GAAP MEASURES] Participants in the Solicitation OCA, the Company and their respective directors and executive officers may be deemed participants in the solicitation of proxies from OCA's stockholders with respect to the proposed Business Combination. A list of the names of OCA's directors and executive officers and a description of their interests in OCA is contained in OCA's final prospectus relating to its initial public offering, dated November 19, 2020, which was filed with the SEC and is available free of charge at the SEC's web site at www.sec.gov, or by directing a request to Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, NJ 07901. Additional information regarding the interests of the participants in the solicitation of proxies from OCA's stockholders with respect to the proposed Business Combination will be contained in the proxy statement/prospectus for the proposed Business Combination when available. No Offer or Solicitation This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Trademarks and Trade Names Kin and OCA own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties' trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company or OCA, or an endorsement or sponsorship by or of the Company or OCA. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company or OCA will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

agenda ● Overview / introduction ● Sales and Marketing ● Break and Questions ● Pricing, Underwriting Claims ● Break and Questions ● Financials and valuation ● Final Questions

Sean Harper For Every New Normal CEO / Founder of Kin → Founder and CEO - FeeFighters Next generation payments company, started in 2009 and sold to Groupon in 2012. FeeFighters was known for its direct to consumer marketing, developer friendly APIs and instant onboarding. After the sale, stayed at Groupon for three years to run their merchant Payments business (Breadcrumb). → Board Member - Accion USA Served on the board of Accion USA, a direct lender to small businesses located in underserved areas. → Founder TSS - Radio Bootstrapped this business to #94 on the Inc 500. → Consultant at BCG Worked at BCG advising financial services businesses, both before MBA and post MBA.

Customers expect a direct, tech - forward experience Insurance is moving online Consumers favor mission - driven brands More and better - quality data is critical New Reality Proprietary tech provides great user experience Only pure - play Direct to Consumer homeowners Insurtech Tech and direct model allow us to operate in the most lucrative markets Insurance brand of the future with delighted users and risk - sharing model Deep data infrastructure creates sustainable risk advantage Focused on expensive, brick and mortar, traditional agent distribution Reliant on outdated technology Abandon areas that experience more volatility Insurance industry branding and marketing stagnant for decades Antiquated technology keeps them dependent on self - reported data 1. 2. 3. 4. Extreme weather events are increasingly common 5. VS. Insurance Industry Response Kin Built For the Digital Era While Industry Stuck in the Past kin.com | 6 For Every New Normal

Large And Growing Market Customers Are Unhappy 42 Industry Net Promoter Score 3 Competitive Bar Is Low $ 105 Billion Annual Premium Nationally 1 1.9% of Income Insuring Their Hom e 2 A Necessary Product Avg. Homeowner Spends 1: S&P Global Market Intelligence (2020). 2: Bankrate ‘Average cost of homeowners insurance for 2021’ (2021 data). 3: Homeowners insurance industry average NPS (Clearsurance). 10 7 yrs Avg. age of top 10 homeowners insurance carriers kin.com | 7 For Every New Normal Reinventing Homeowners Insurance is a Historic Business Opportunity

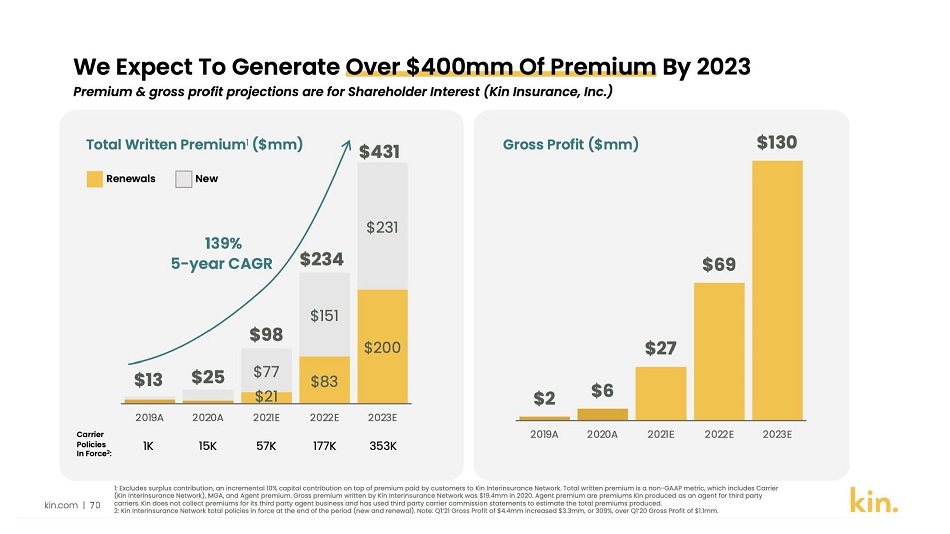

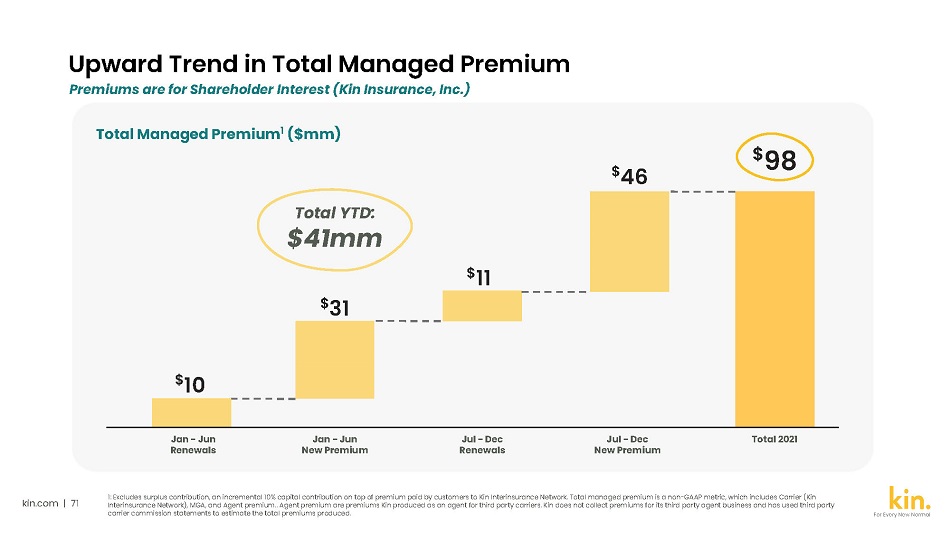

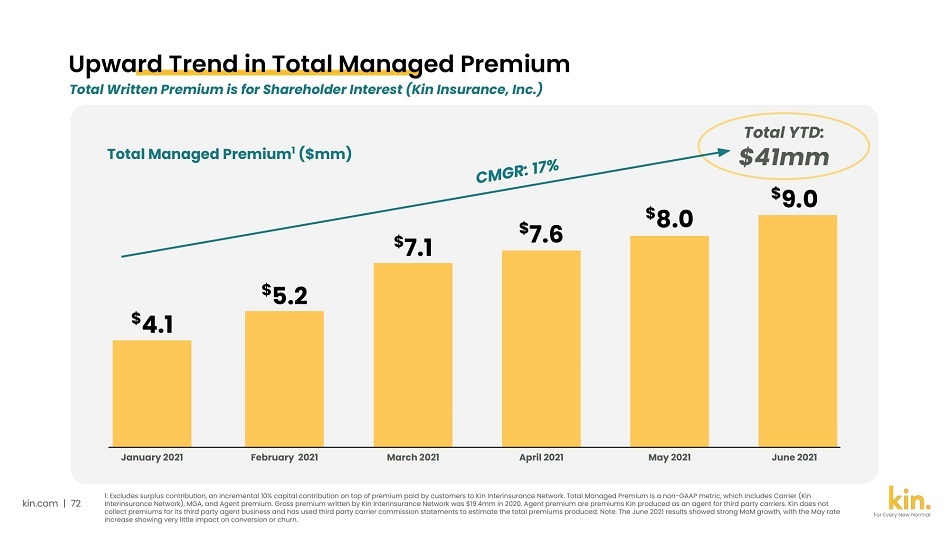

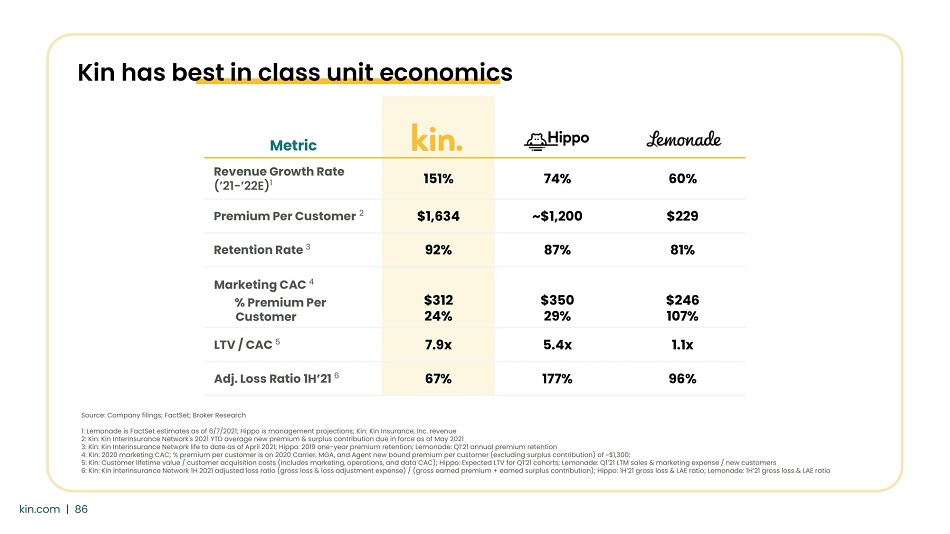

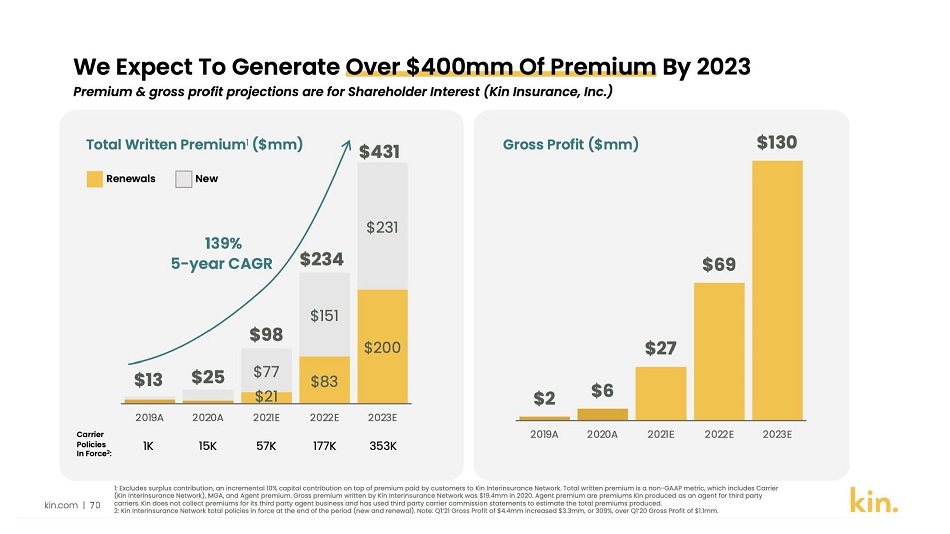

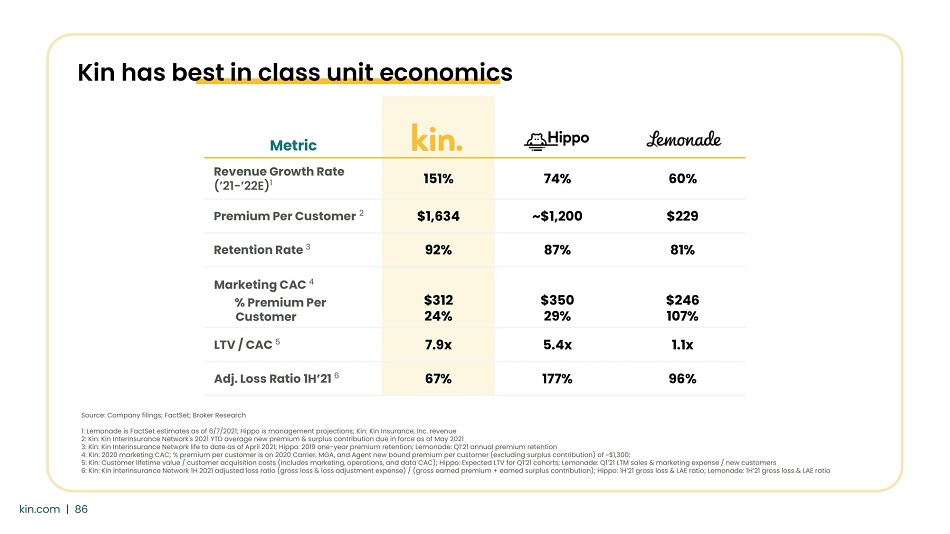

Q2 Year Over Year Growth Rate 1 287% 2022E Gross Profit $ 69mm LTV / CAC 2 7.9x Direct to Consumer 100% 2022E Total Written Premium $ 234mm Net Promoter Score 85 Retention Rate 92% Trust Pilot 5 - Star Ratings 96% High Average Premium 3 $ 1,634 Fast Growth Excellent Unit Economics Happy, Loyal Customers 4 Kin is Winning with Fast Growth, Great Unit Economics and Loyal Customers 1: Shareholder Interest (Kin Insurance, Inc.) Revenue; Based on unaudited Q2 financials. 2: Customer lifetime value / customer acquisition cost (includes marketing, operations, and data CAC). 3: Kin Interinsurance Network's 2021 YTD average new premium and surplus contribution due in force as of May 2021. 4: Kin customers have an average age of approximately 57 and an average LexisNexis insurance score of greater than 770. kin.com | 8 For Every New Normal

For Every New Normal Recent weather activity in North America has led to rate increases in several key states 80 60 40 20 0 100 $ 94 120 140 2020A $ 115 2025E $ 14 0 2010A 2000A 2005A $ 36 $ 62 4% $ 75 5% 4% 11% 4% 2015A 5 - year CAGR U.S. Homeowners’ Insurance Premiums ($ in Billions) kin.com | 9 Source: S&P Global Market Intelligence, William Blair research. Rising proportion of millennials as first - time home buyers Low interest rate environment has fueled home price appreciation and underlying insured values Non - discretionary nature of product lends itself as a “recession proof” revenue model Homeowners insurance is big and growing, driven by climate change

kin.com | 10 Why we intend to go public through the business combination with Omni Attractive unit economics Massive ambition Large and growing market Opportunity to partner strategically with Omni For Every New Normal

Matt Higgins CEO OMNICHANNEL ACQUISITION CORP. → Co - Founder and CEO, RSE Ventures Broad experience as an operator, investor, and acquirer of consumer companies at all growth stages Incubated leading DTC brand and communications firm, Derris. Launched and/or invested in numerous DTC unicorns to date including Glossier, Hims, Everlane and Smile Direct Partners with Gary Vaynerchuk in VaynerMedia, one of the largest pure play social media firms in the US → Executive Fellow, Harvard Business School Co - teaches leading academic course on the DTC space, Moving Beyond DTC → Vice Chairman, Miami Dolphins → Guest Judge, Shark Tank For Every New Normal

Why Omni invested: we know DTC and see the potential of DTC insurance Leveraging tech to improve all aspects of insurance Insurance is an inherently virtual product made for DTC distribution DTC improves underwriting, removes conflicts of interest faced by insurance intermediaries The direct customer relationship supports improved claims processing and higher NPS DTC customer acquisition is both efficient marketing & incremental risk management Substantial moat, both from tech investment & incumbents; risk conflict with agents if they pursue DTC DTC owns the customer relationship, creating flywheel opportunity 1 2 3 6 5 4

Kin is direct to consumer, which is a better model With the highest - value insurance customers Customers prefer Direct to Consumer experience Direct to Consumer is a more profitable model Competitive edge in risk selection For Every New Normal

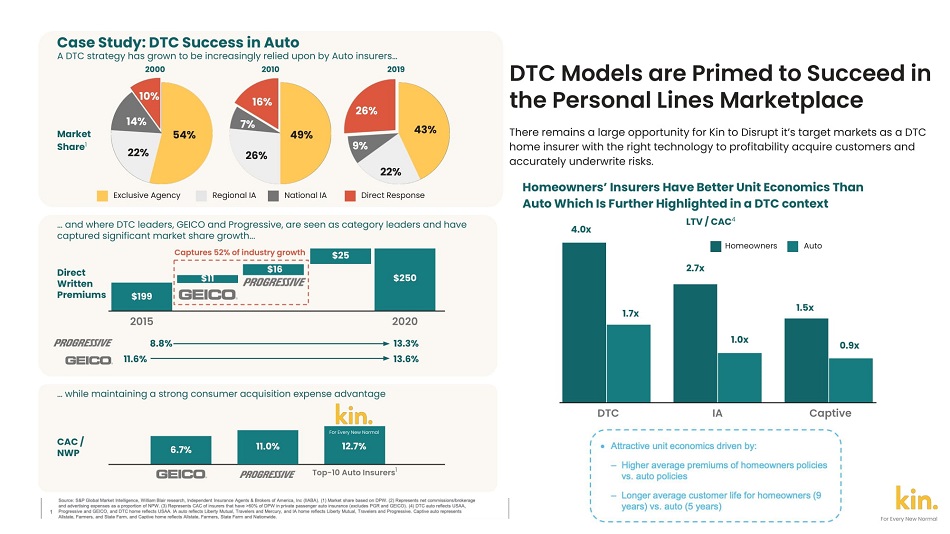

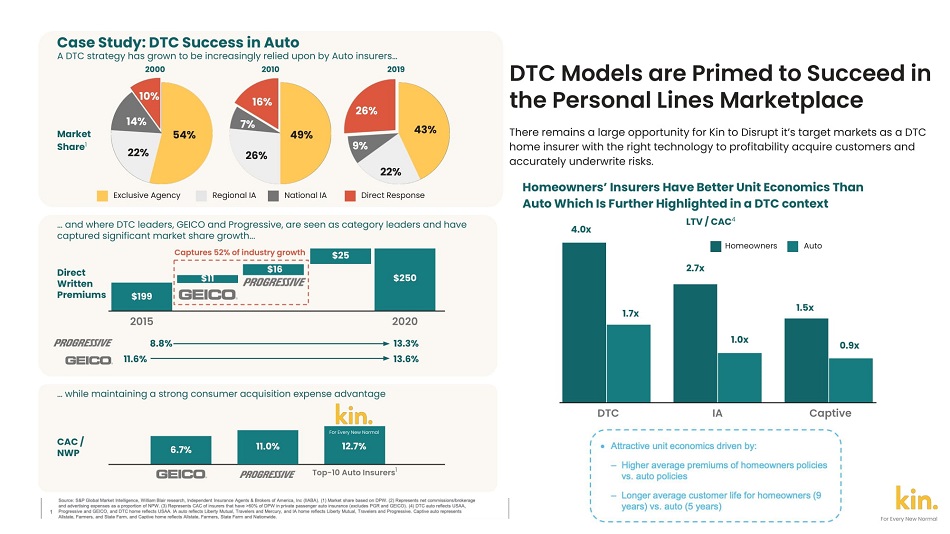

OTC Models are Primed to Succeed in the Personal Lines Marketplace There remains a large opportunity for Kin to disrupt its target markets as a DTC home insurer with the right technology to profitably acquire customers and accurately underwrite risks. Cas e Study : DT C Succes s i n Auto A DTCstrategy has grown to be increasingly relied upon by Auto insurers... 2010 Market Share< 1 l xclusive Agency Ŷ Regional IA Ŷ National IA Ƒ Dire ct Response I . . .where DTC leaders, GEICO and Progressive, are seen as category leaders and have captured significant market share growth ... ($ in bn) Direct Premiums Written Captures 52% of .. i - t . ? -- - ------ - Others PRDDREillVF j : - - " ii -- · j( . ! ' : GEIC O ................... . , Homeowners ' Insurers Have Better Unit Economics Than Auto Which is Further Highlighted in a DTC Context LTV/CAC < 4 l 4.0x 1.7x 2.7x ,, _. ------- 1.5x 0.9x OTC IA Captive ■ Homeowners' ■ Auto 2015 Market Sh are ( 1 ) 2020 PHDOREillVE GEICO CACI N PW< 2 1 8.8•/. 11.6 13.3 ƒ /. 13.6 ... while maintaining a strong consumer acquisition expense advantage 12.7% 11.0% , I GEICO PROGREII/VE Top - 10 Auto lnsurers < 3 > • Attractive unit economics driven by: Higher average premiums of homeowners policies vs . auto policies Longer average customer life for homeowners (9 years) vs. auto (5 years) ' ' Source : S&P Global Market In te lligenc e, William Blair research, Independent Insurance Agents & Brokers of America, Inc (IIABA) . (1) Market share based on DPW . (2) Represents net commissions/brokerage and advert i sing expenses as a proportion of NPW . (3) Represents CAC of insurers thal have =>60% of DPW in private passenger auto i nsurance (excl udes PGR and GEICO). (4) OTC auto reflects USAA, Progressive and GEICO, and DTC home reflects USAA. IA auto reflects Liberty Mutual, Travelers and Mercury, and IA home reflects Liberty Mutual, T ravelers and Progressive. Captive auto represents Allstate, Farmers, and State Farm , and Capt ive home reflects Allstate, Farmers , State Farm and Nationwide .

of customers prefer a digital experience of customers are not willing to pay significantly more for an agent 1 72% 78% 72% of new Kin customers are existing homeowners switching carriers Industry Leading Net Promoter Score 85 42 Home Insurance Customers Prefer to Buy Direct and Kin Delivers an Exceptional Experience For Every New Normal Source: Clearsurance; Accenture US Personal - Lines Consumer Survey. 1: Significantly more = more than 5% kin.com | 15

Direct to Consumer is a Fundamentally Better Ec onomic Model Source: Hippo & Lemonade Company filings. 1: Conning ‘Property - Casualty Insurance Distribution’. No Recurring Agent Commission: Independent Agent Customer Churn is Lower Than Peers: 8% 0% 13% 19% Fully Realizable Cross - Sell Opportunity: 5 x Potential LTV increase 17% 1 kin.com | 16 For Every New Normal

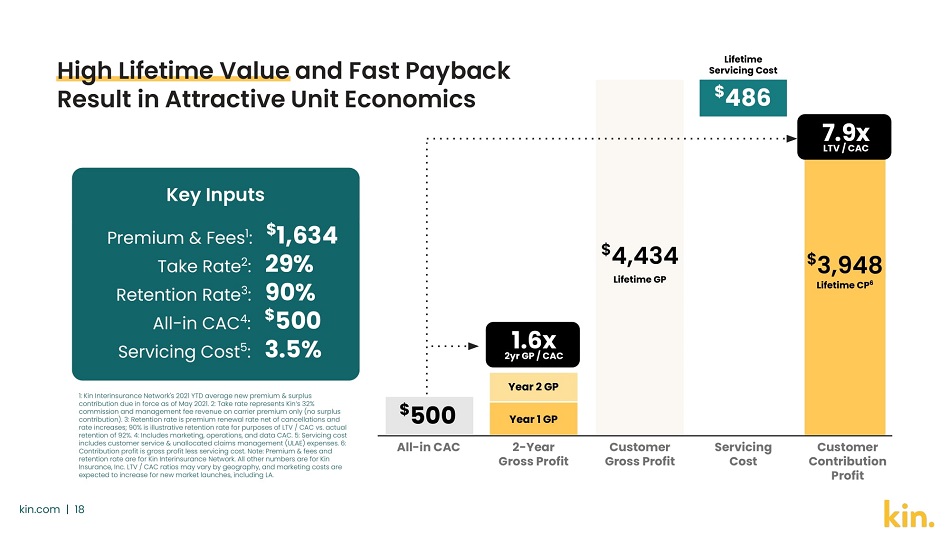

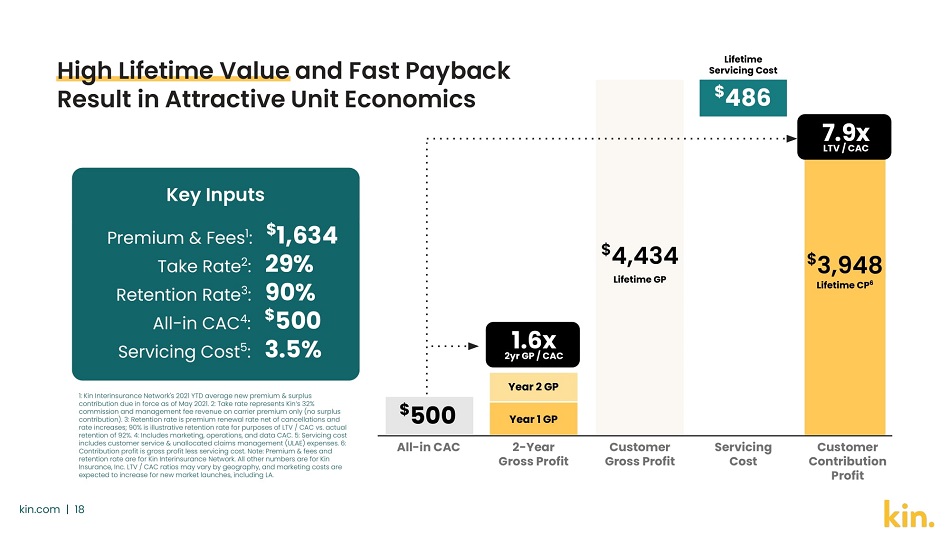

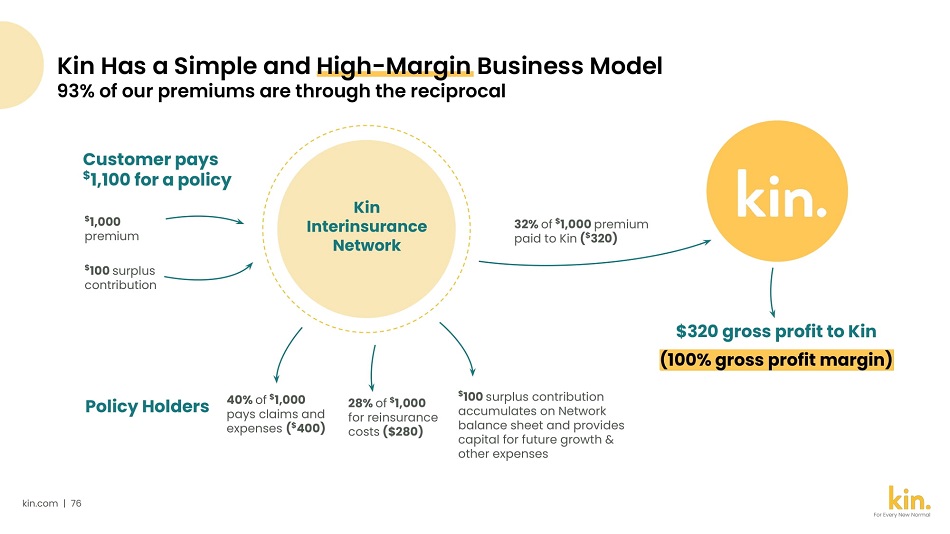

Key Inputs Premium & Fees 1 : $ 1,634 Take Rate 2 : 29% Retention Rate 3 : 90% All - in CAC 4 : $ 500 Servicing Cos t 5 : 3.5% 1: Kin Interinsurance Network's 2021 YTD average new premium & surplus contribution due in force as of May 2021. 2: Take rate represents Kin’s 32% commission and management fee revenue on carrier premium only (no surplus contribution). 3: Retention rate is premium renewal rate net of cancellations and rate increases; 90% is illustrative retention rate for purposes of LTV / CAC vs. actual retention of 92%. 4: Includes marketing, operations, and data CAC. 5: Servicing cost includes customer service & unallocated claims management (ULAE) expenses. 6: Contribution profit is gross profit less servicing cost. Note: Premium & fees and retention rate are for Kin Interinsurance Network. All other numbers are for Kin Insurance, Inc. LTV / CAC ratios may vary by geography, and marketing costs are expected to increase for new market launches, including LA. High Lifetime Value and Fast Payback Result in Attractive Unit Economics kin.com | 18 $ 500 Year 1 GP All - in CAC 2 - Year Gross Profit Customer Gross Profit Year 2 GP 1.6x 2yr GP / CAC $ 4,434 Lifetime GP $ 486 Customer Contribution Profit 7.9x LTV / CAC $ 3,948 Lifetime C P 6 Servicing Cost Lifetime Servicing Cost

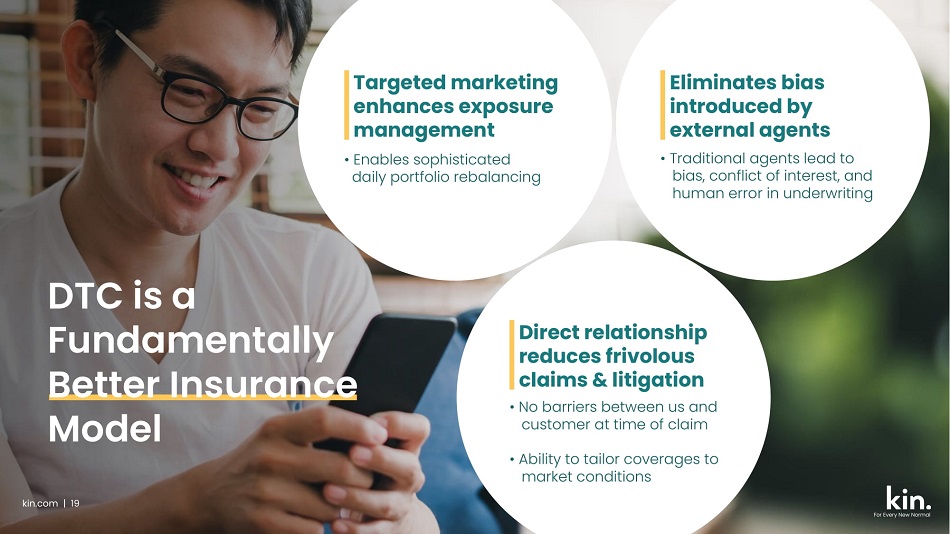

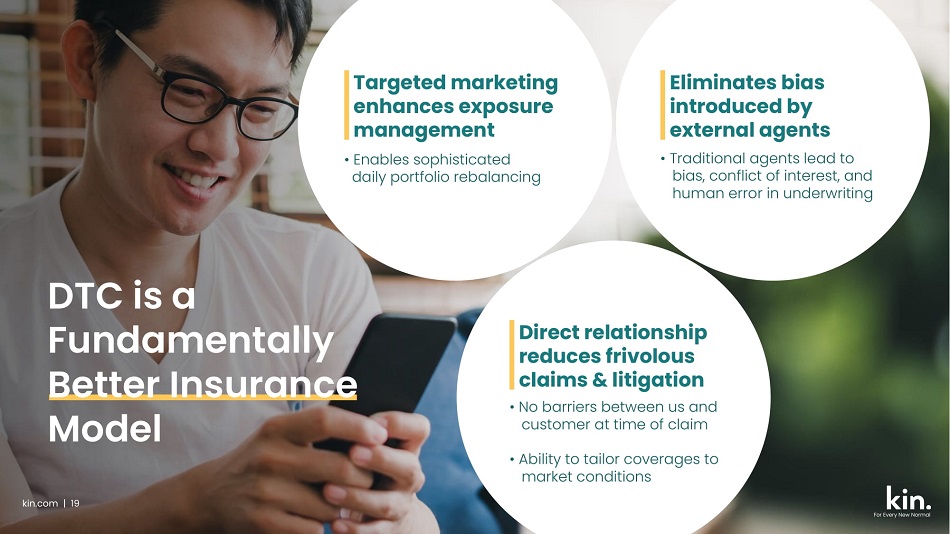

Targeted marketing enhances exposure management • Enables sophisticated daily portfolio rebalancing Eliminates bias introduced by external agents • Traditional agents lead to bias, conflict of interest, and human error in underwriting Direct relationship reduces frivolous claims & litigation • No barriers between us and customer at time of claim • Ability to tailor coverages to market conditions DTC is a Fundamentally Better Insurance Model kin.com | 19 For Every New Normal

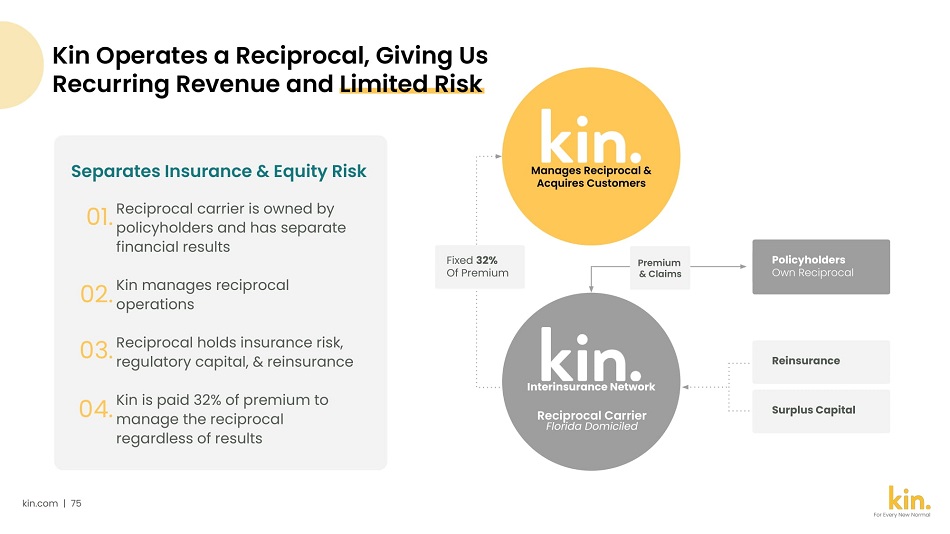

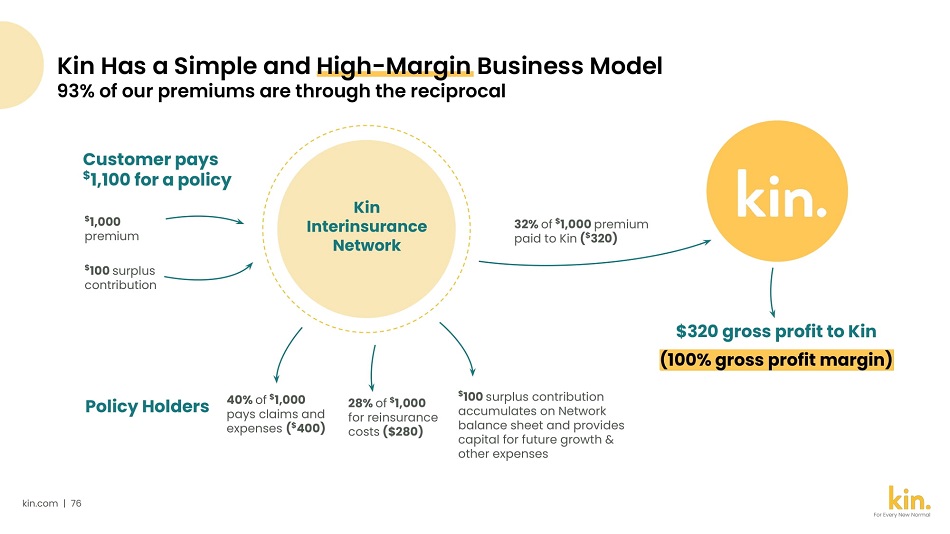

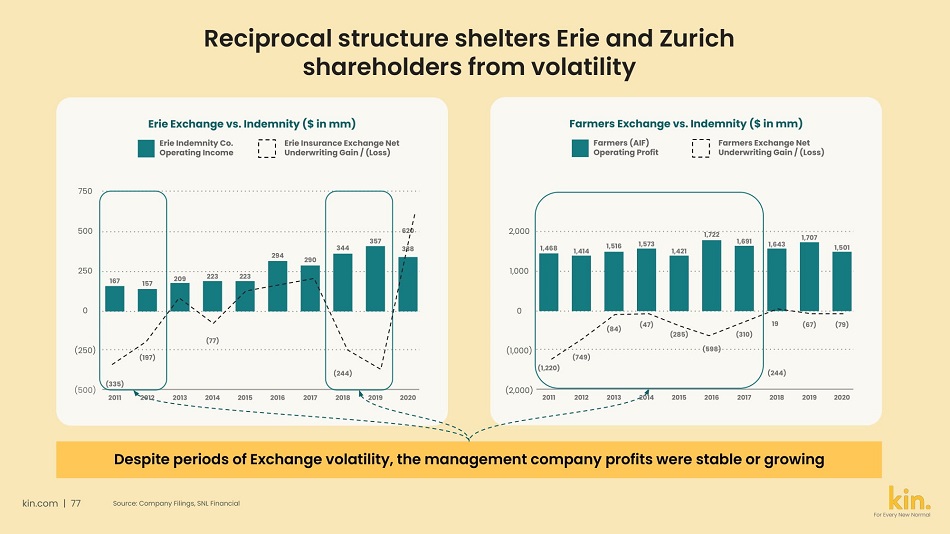

Kin is primarily an insurance distributor and servicer, not an insurance balance sheet kin.com | 20 For Every New Normal

Distributors capture majority of industry profits kin.com | 21 For Every New Normal Illustrative $100 of insurance premium A typical homeowners carrier pays ~68 % 1 of premiums for claims and reinsurance Nearly half of carrier overhead is paid out to agents With ~27% 2 margins, insurance distributors generate ~1.4x more profit than carriers! UW Profit $2.4 2.4% Agent Commissions $12 42 % 1 Underwriting Admin & Other Operating Expenses $17 58% EBITDA $3.3 / 27 % 2 General & Other OpEx $9 73% Total: $100 Premium $29 Overhead $12 Agent Comm. Source: Company filings, S&P Global Market Intelligence, FactSet. 1.Average of aggregate homeowners industry statutory data over the past 6 years (2013 - 2020). 2.Based on the median 2022E EBITDA margin for broker peers (MMC, AON, WLTW, AJG, BRO, GSHD, and BRP) per FactSet consensus estimates. Expense $29 29.2 % 1 Loss & Loss adj. expense $68 68.4 % 1

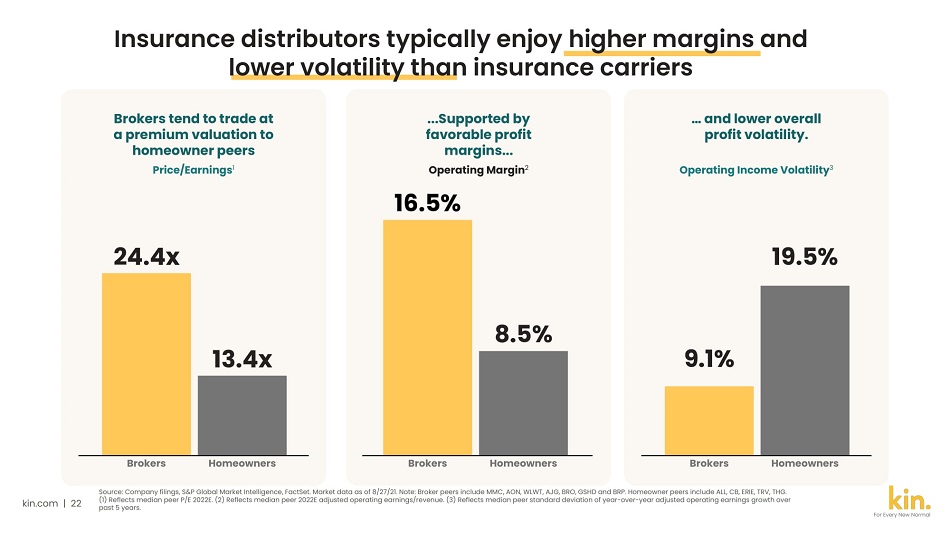

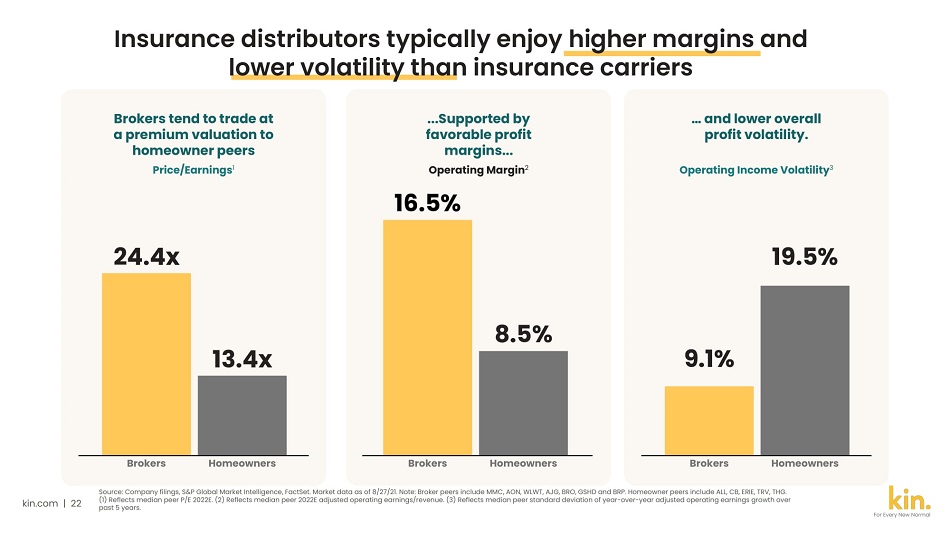

kin.com | 22 24.4x 13.4x 8.5% Brokers Homeowners Brokers Homeowners Brokers Homeowners Source: Company filings, S&P Global Market Intelligence, FactSet. Market data as of 8/27/21. Note: Broker peers include MMC, AON, WLWT, AJG, BRO, GSHD and BRP. Homeowner peers include ALL, CB, ERIE, TRV, THG. (1) Reflects median peer P/E 2022E. (2) Reflects median peer 2022E adjusted operating earnings/revenue. (3) Reflects median peer standard deviation of year - over - year adjusted operating earnings growth over past 5 years. For Every New Normal 9.1% 19.5% … and lower overall profit volatility. Op Income Volatilit y 3 ...Supported by favorable profit margins... Operating Margi n 2 16.5% Brokers tend to trade at a premium valuation to homeowner peers Price/Earnings 1 Insurance distributors typically enjoy higher margins and lower volatility tha n ins urance carriers

Victor Lee For Every New Normal Chief Marketing Officer → Chief Marketing Officer RXBar Oversaw marketing and product development for RXBar after acquisition by Kellogg’s → Adjunct Professor at Boston College Digital Marketing and eCommerce → SVP Digital Marketing Hasbro Led digital, media, content and ecommerce for Transformers, Nerf, My Little Pony, etc. → SVP Marketing Digitas SVP at one of the largest digital agencies in the world representing General Motors, Goodyear, OnStar, etc.

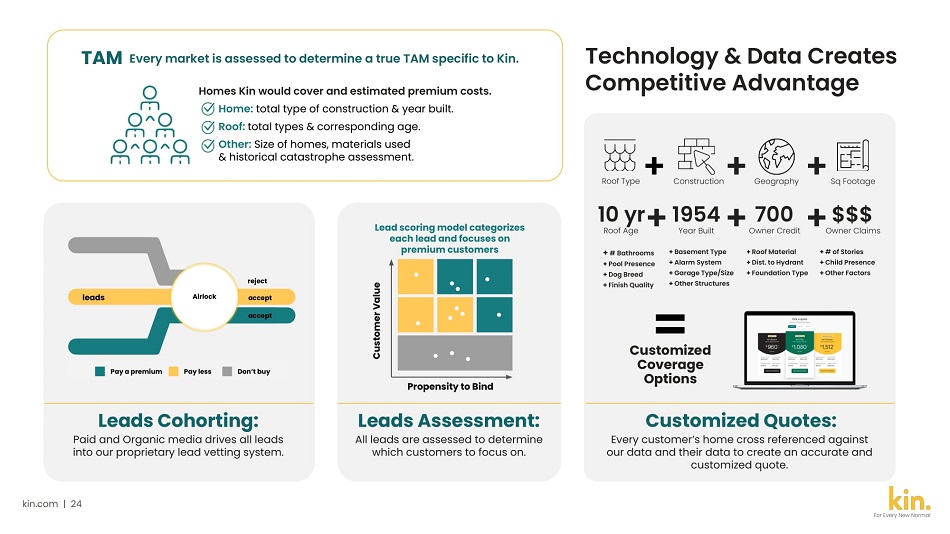

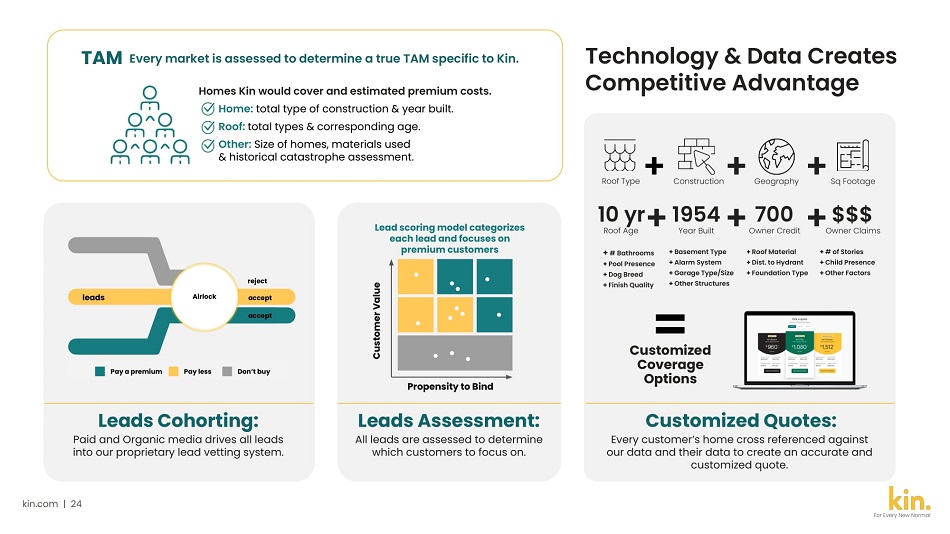

Pay a premium Pay less Don’t buy Airlock accept reject accept Propensity to Bind Customer Value Lead scoring model categorizes each lead and focuses on premium customers Technology & Data Creates Competitive Advantage + # Bathrooms + Pool Presence + Dog Breed + Finish Quality + Roof Material + Dist. to Hydrant + Foundation Type Roof Type Construction Geography Sq Footage + + + + # of Stories + Child Presence + Other Factors + Basement Type + Alarm System + Garage Type/Size + Other Structures Cu s = tomized Coverage Options 10 y r + 1954 + 700 + $$$ Roof Age Year Built Owner Credit Owner Claims Customized Quotes: Every customer’s home cross referenced against our data and their data to create an accurate and customized quote. leads Leads Assessment: All leads are assessed to determine which customers to focus on. Leads Cohorting: Paid and Organic media drives all leads into our proprietary lead vetting system. TAM Every market is assessed to determine a true TAM specific to Kin. Homes Kin would cover and estimated premium costs. Home: total type of construction & year built. Roof: total types & corresponding age. Other: Size of homes, materials used & historical catastrophe assessment. kin.com | 24 For Every New Normal

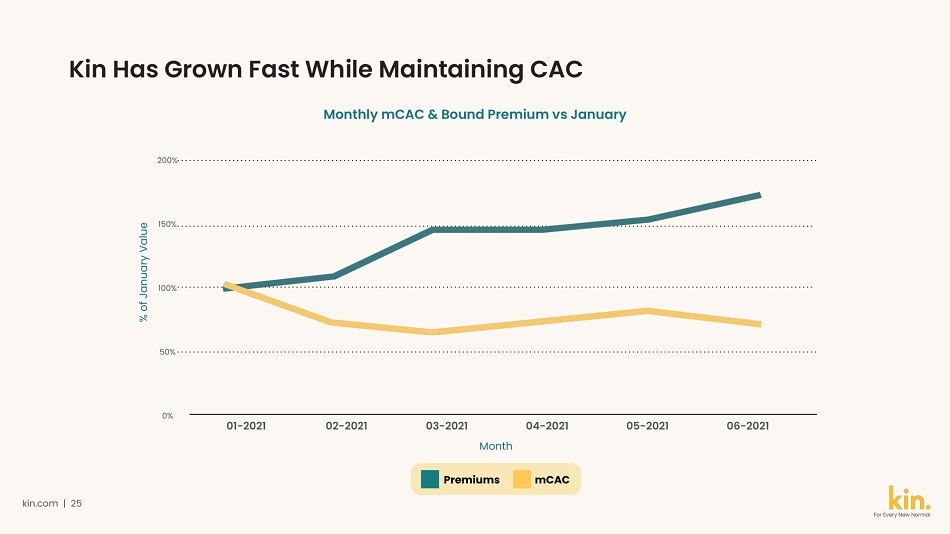

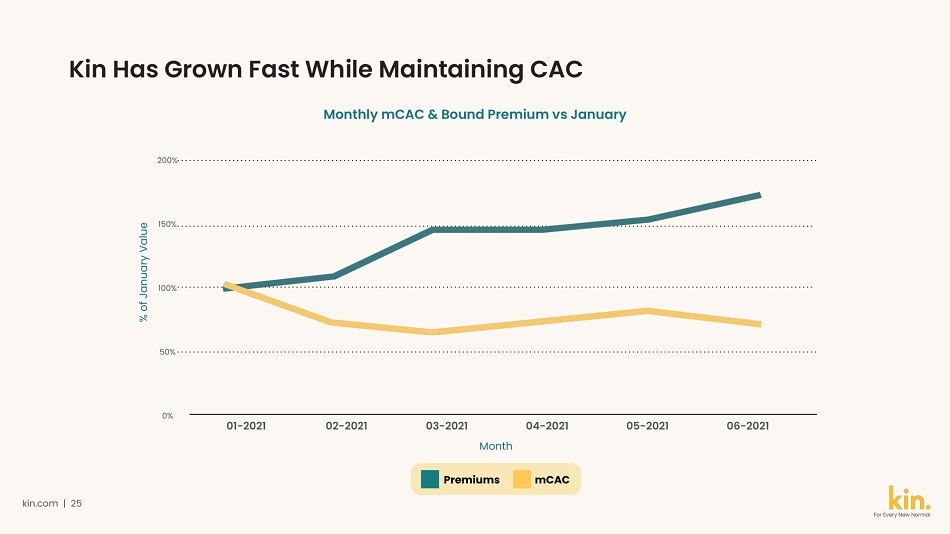

200% 150% 100% 50% 0% 01 - 2021 % of January Value Month Premiums mCAC 02 - 2021 03 - 2021 04 - 2021 05 - 2021 06 - 2021 Monthly mCAC & Bound Premium vs January Kin Has Grown Fast While Maintaining CAC kin.com | 25 For Every New Normal

Performance Marketing Brand Marketing Digital Display Icon Video Icon PR Icon ● Direct buying reduces lead acquisition cost ● Direct buying ● Benefits from brand marketing ● Very focused and specific address targeting using Kin’s existing data models ● Segmentation that cultivates relationship anywhere from 1 day to 45+ days of purchase decision ● Leverages Kin’s high Trust Pilot and satisfaction scores ● Broad brand awareness ● Engaging storytelling ● Validation of brand and business model

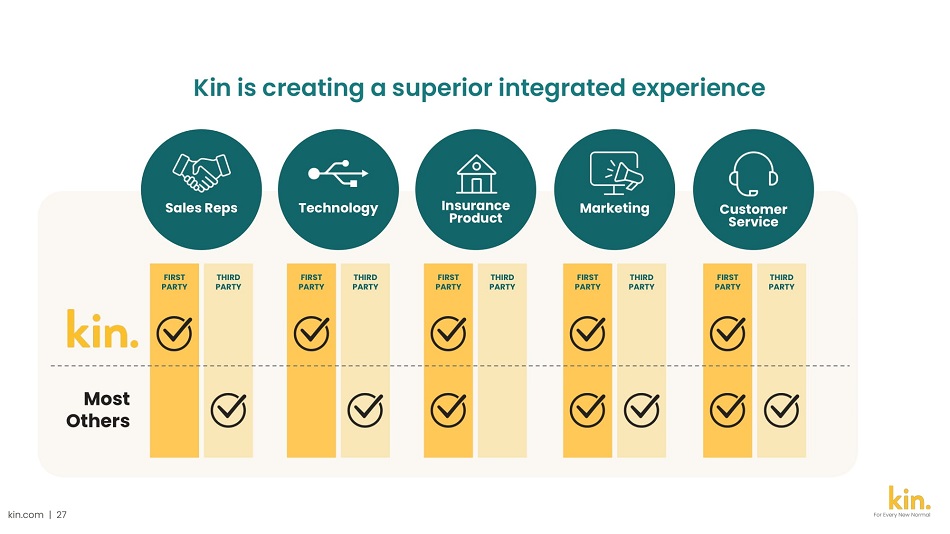

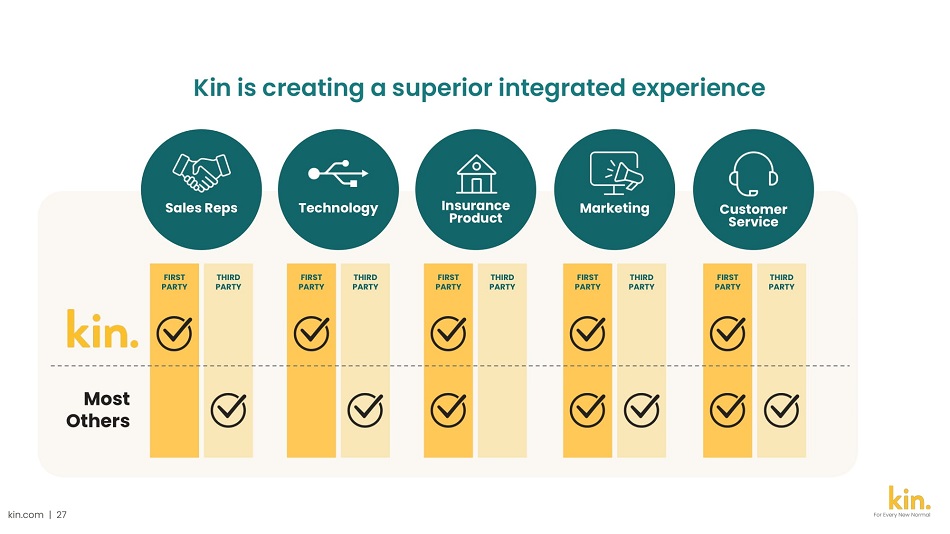

kin.com | 27 For Every New Normal Sales Reps Insurance Product Marketing Customer Service Kin is creating a superior integrated experience Technology Most Others FIRST PARTY THIRD PARTY FIRST PARTY THIRD PARTY FIRST PARTY THIRD PARTY FIRST PARTY THIRD PARTY FIRST PARTY THIRD PARTY

Marketing campaigns developed with local market insights. 100% digital execution. kin.com | 28 Not Your Average Insurance Brand Marketing For Every New Normal

Omnichannel team includes founders and operators who are experts at multi - channel customer acquisition and building enduring brands kin.com | 29 Omnichannel partnership accelerates marketing roadmap Multifaceted marketing strategy with significant pre - close initiatives Contribute marketing human capital Develop “top of funnel” brand strategy with PR and media campaign support Maintain cutting edge customer acquisition strategy with Omni toolkit Elevate brand awareness in key markets with Omni relationships Strategy Action to Date → Thought leadership and support provided by Omni advisors including founders of leading DTC agencies and companies 3 → Identified influencers resonant to Kin customer demographics; brought in Rory McIlroy and Draymond Green as investors → Plan to deploy Miami Dolphins, Hard Rock stadium assets and FL real estate relationships 1 2 → Sourced CMO in April 2021 → Introduced PR relationship in April 2021 → Initiated Kin’s first media campaign; VaynerMedia developed and produced “Florida Man” 4

Brian Pogrund For Every New Normal Vice President of Operations → Director North America - Getaround Responsible for P&L and OKRs for the North America business unit for Softbank - backed car sharing platform → Director of Operations - Whittl Ran operations for venture - backed local services marketplace . → MBA from the University of Chicago Booth School of Business

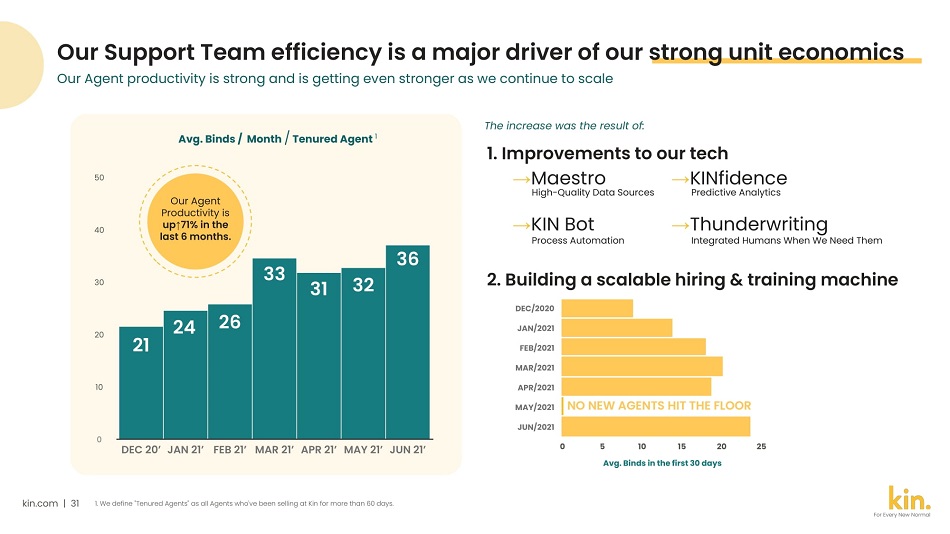

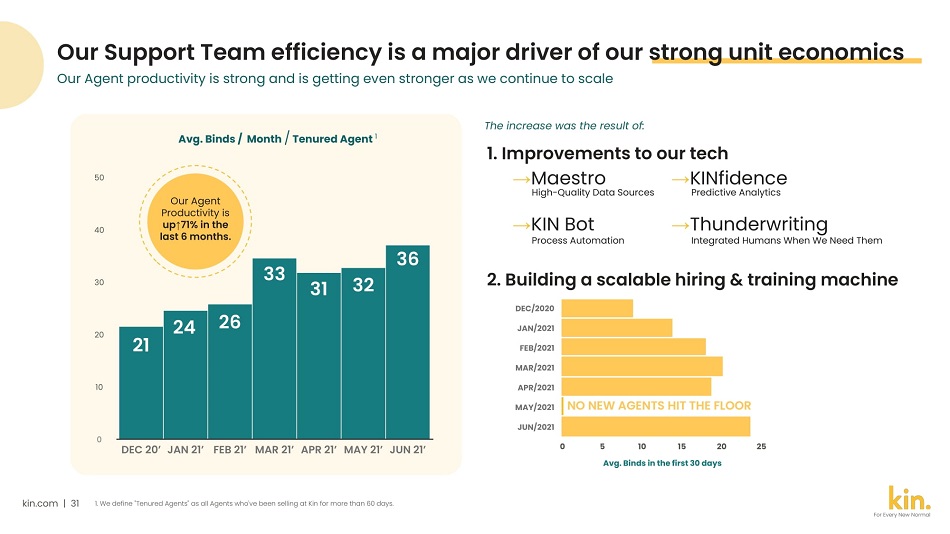

kin.com | 31 Our Agent productivity is strong and is getting even stronger as we continue to scale Our Support Team efficiency is a major driver of our s trong unit economics → Thunderwriting Integrated Humans When We Need Them → Maestro → KINfidence High - Quality Data Sources Predictive Analytics → KIN Bot Process Automation The increase was the result of: 1. Improvements to our tech 2. Building a scalable hiring & training machine 5 10 15 20 Avg. Binds in the first 30 days DEC/2020 JAN/ 2021 FEB/ 2021 MAR/ 2021 APR/ 2021 MAY/ 2021 JUN/ 2021 NO NEW AGENTS HIT THE FLOOR 25 0 Our Agent Productivity is up ↑ 71% in the last 6 months. Avg. Binds / Month / Tenured Agent 1 40 30 20 10 0 DEC 20’ JAN 21’ FEB 21’ MAR 21’ APR 21’ MAY 21’ JUN 21’ 50 21 For Every New Normal 24 26 33 31 32 36 1. We define "Tenured Agents" as all Agents who've been selling at Kin for more than 60 days.

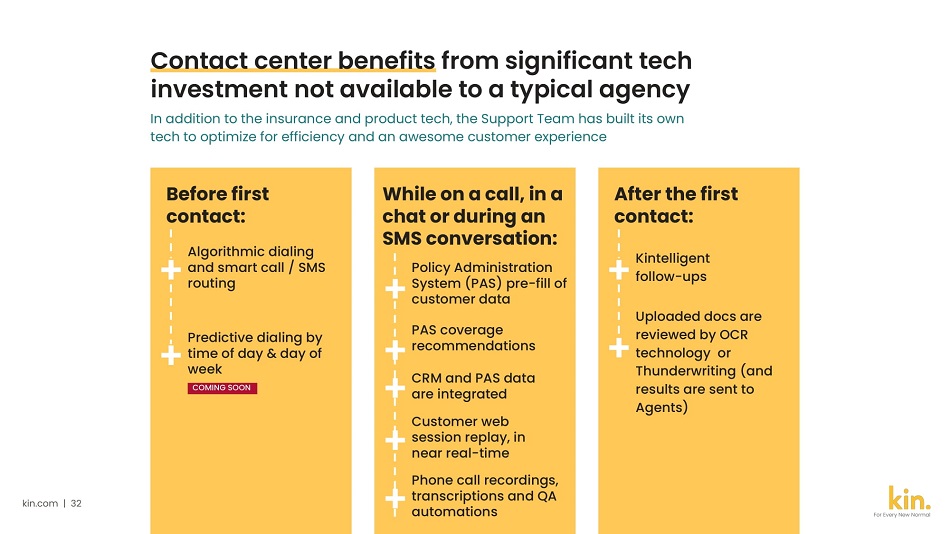

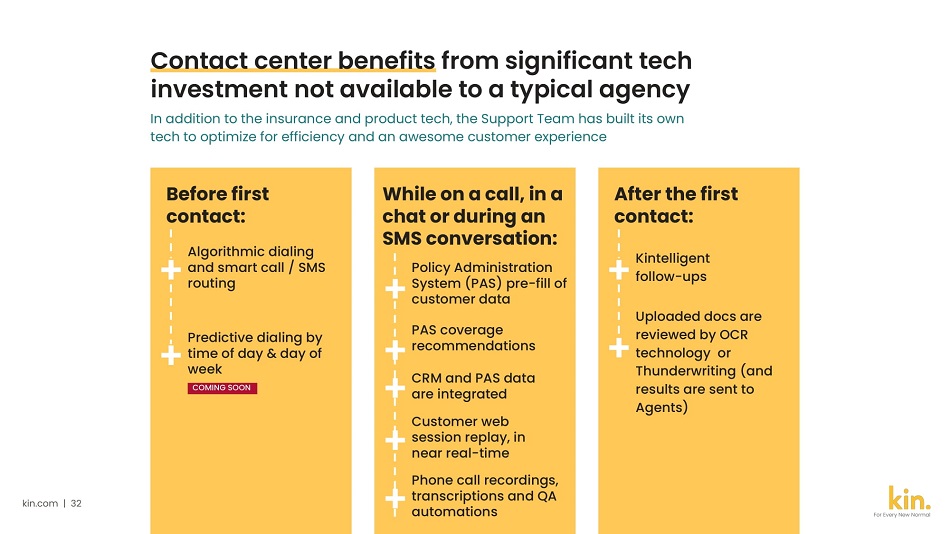

kin.com | 32 For Every New Normal Contact center benefits from significant tech investment not available to a typical agency In addition to the insurance and product tech, the Support Team has built its own tech to optimize for efficiency and an awesome customer experience Before first contact: + Algorithmic dialing and smart call / SMS routing + Predictive dialing by time of day & day of week COMING SOON While on a call, in a chat or during an SMS conversation: + + + + + Policy Administration System (PAS) pre - fill of customer data PAS coverage recommendations CRM and PAS data are integrated Customer web session replay, in near real - time Phone call recordings, transcriptions and QA automations After the first contact: + Kintelligent follow - ups + Uploaded docs are reviewed by OCR technology or Thunderwriting (and results are sent to Agents)

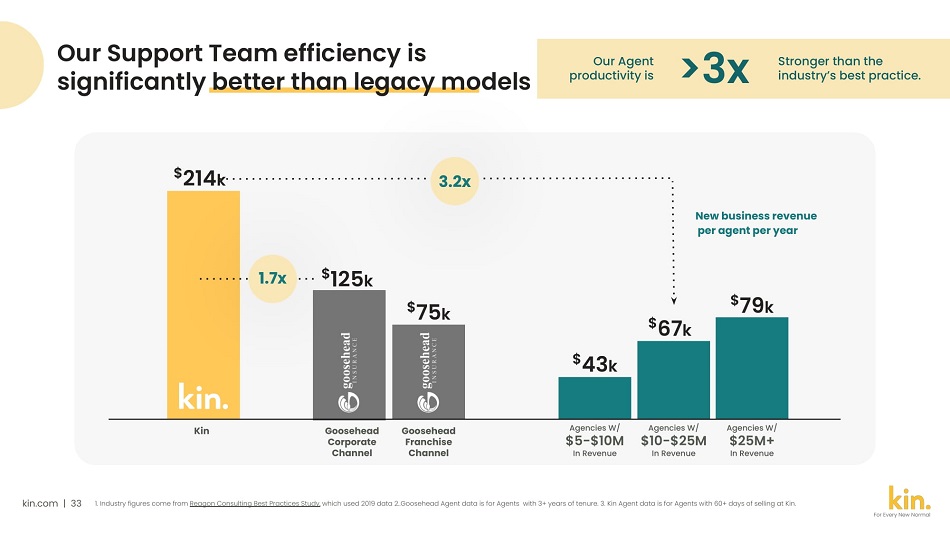

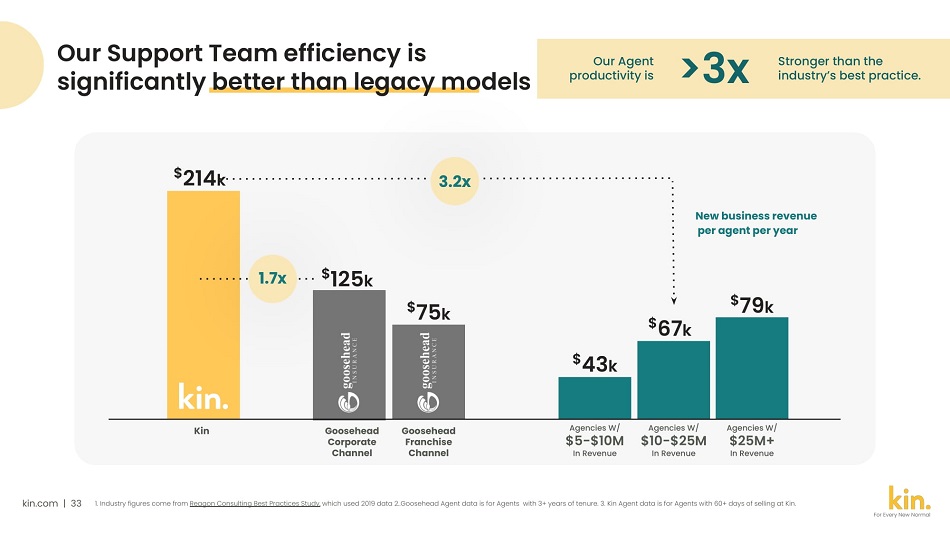

kin.com | 33 1. Industry figures come from Reagon Consulting Best Practices Study , which used 2019 data 2..Goosehead Agent data is for Agents with 3+ years of tenure. 3. Kin Agent data is for Agents with 60+ days of selling at Kin. Kin Goosehead Corporate Channel 3.2x $ 67 k $ 75 k $ 214 k $ 125 k New business revenue per agent per year Agencies W/ $25M+ In Revenue Agencies W/ $10 - $25M In Revenue Agencies W/ $5 - $10M In Revenue $ 79 k $ 43 k Our Support Team efficiency is significantly better than legacy mo dels Our Agent productivity is >3x Stronger than the industry’s best practice. Goosehead Franchise Channel 1.7x For Every New Normal

of Inbound Calls Answered Within 15 seconds 1 74% We want to delight our customers with speedy and comprehensive support via all of our contact channels: Phone, SMS, Email and Chat First Contact Resolution, Email & SMS 2 98% Our Support Team is fast to respond to and solve customer inquiries kin.com | 34 For Every New Normal

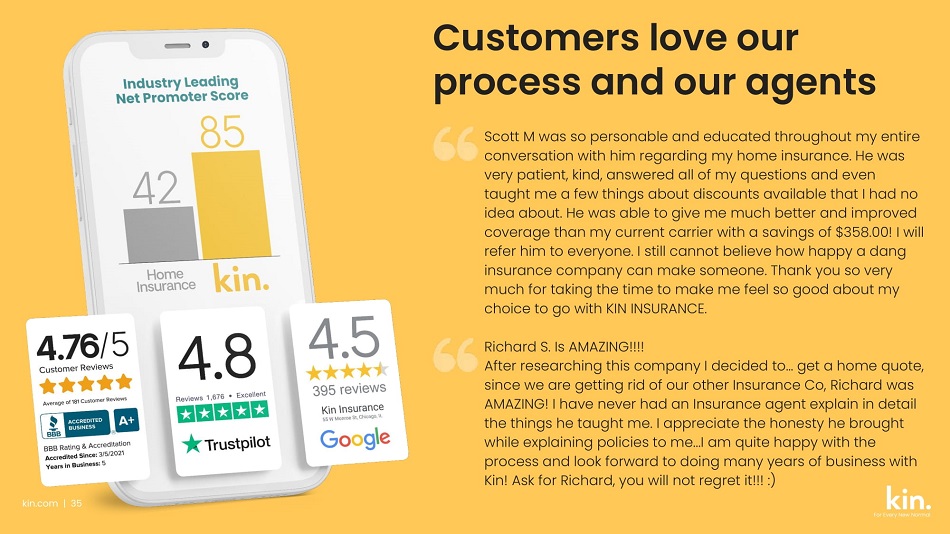

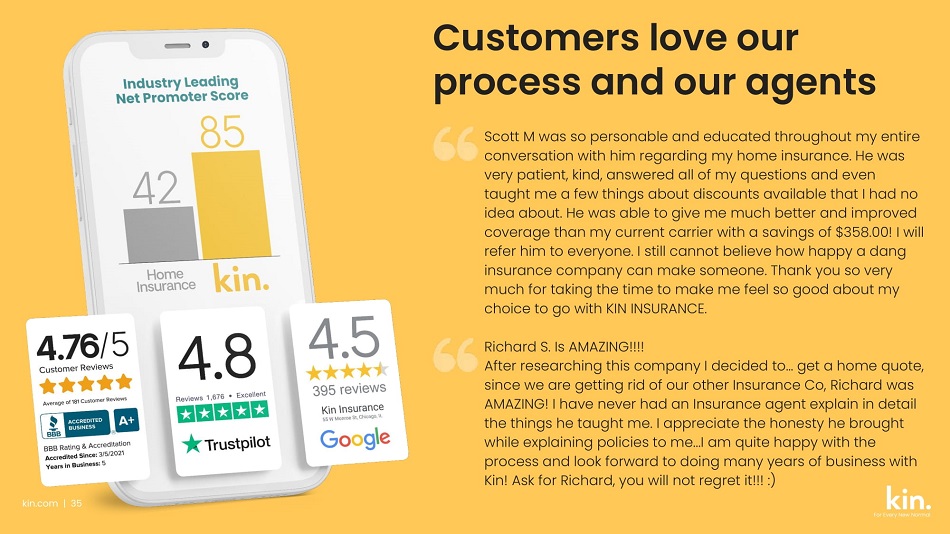

Whether you look at NPS or online reviews, our customers are making it clear that they appreciate the process we’ve built and the agents that we’ve hired. Customers love our process and our agents kin.com | 35 For Every New Normal

Expanding Products And Increasing LTV 5x Through Cross - Sell Other insurance products: Auto Life Umbrella Home services & repair Solar Home finance Smart home products Non - insurance products: New risk segments in home: Flood Older roofs Condos Manufactured homes “Homeowners insurance customers are the single most valuable group of personal lines customers for P&C insurers.” - J.D. Power kin.com | 36 Note: The Company currently expects to have an auto product offering when entering states where bundling is a customer expectation. The Company maintains a proprietary condominium database used in underwriting, which could be used for commercial habitational risks should the Company decide to do so in the future.

Questions and break kin.com | 37 For Every New Normal

kin.com | 38 Hurricane Ida Case Study For Every New Normal

Angel Conlin For Every New Normal Chief Insurance Officer → Chief Legal Officer - ASI Insurance Grew to the 14th largest homeowners insurance company and sold to Progressive. Engineered expansion from 4 to 40 states. → Regional Counsel - Nationwide General counsel for Southeast Region

We are serious about sound pricing & ensuring we have the right rate to risk. When setting prices, we are always driven by our goals of: Actuarially Sound Rates Our rates embed best practices from our own experience and top performers in the industry. Product Diversification Each insurance product performs differently in each market cycle. We can generate more stable returns by writing a range of products. Embedded weather science Our pricing closely tracks the weather models used by re insurers which allows us to hedge our risk efficiently. Concentration Management Our marketing and pricing levers enable us to generate a well diversified portfolio, which limits our risk and manages our reinsurance cost. kin.com | 40 For Every New Normal Performing well in the face of extreme weather begins with groundwork laid years before the event

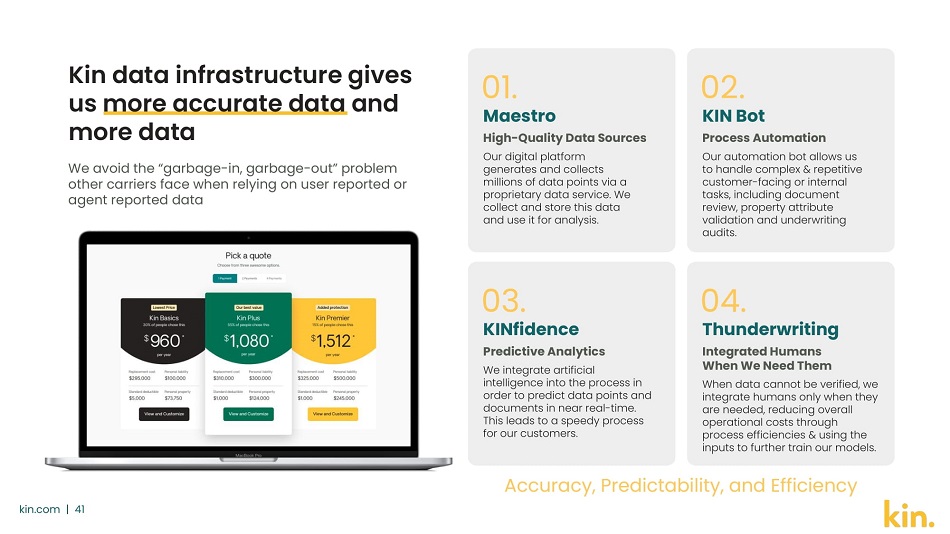

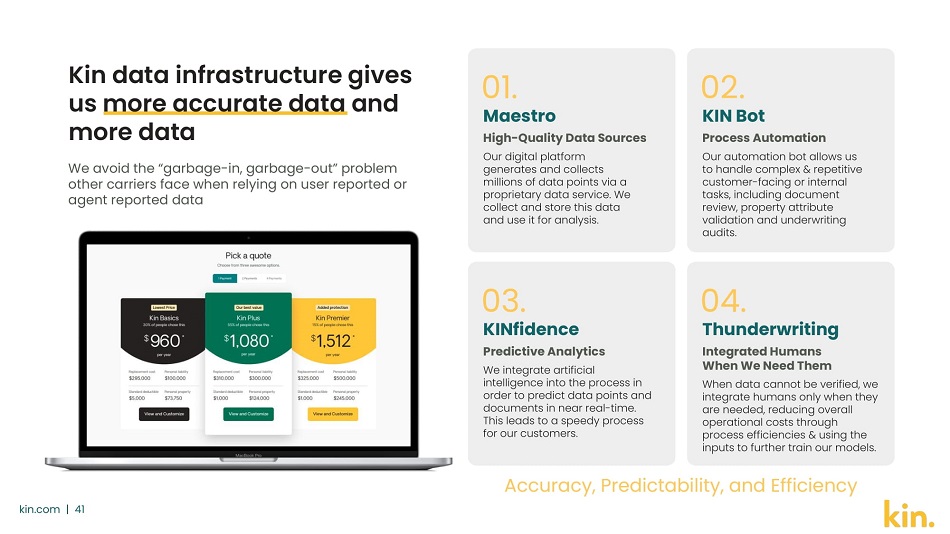

Kin data infrastructure gives us more accurate data and more data We avoid the “garbage - in, garbage - out” problem other carriers face when relying on user reported or agent reported data 01. Maestro High - Quality Data Sources Our digital platform generates and collects millions of data points via a proprietary data service. We collect and store this data and use it for analysis. 02. KIN Bot Process Automation Our automation bot allows us to handle complex & repetitive customer - facing or internal tasks, including document review, property attribute validation and underwriting audits. 03. KINfidence Predictive Analytics We integrate artificial intelligence into the process in order to predict data points and documents in near real - time. This leads to a speedy process for our customers. 04. Thunderwriting Integrated Humans When We Need Them When data cannot be verified, we integrate humans only when they are needed, reducing overall operational costs through process efficiencies & using the inputs to further train our models. Accuracy, Predictability, and Efficiency kin.com | 41

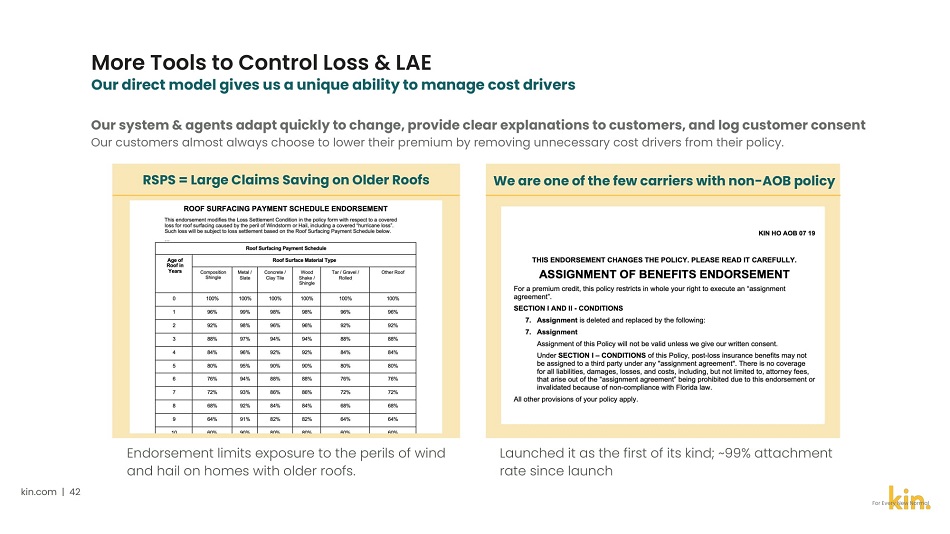

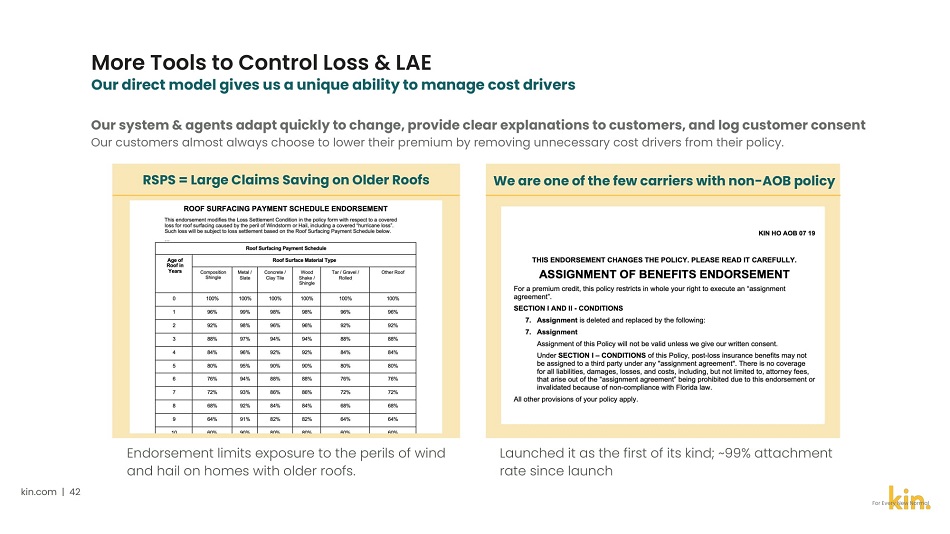

● Endorsement is offered to all policyholders and is defaulted on policies with roofs >10 years old ● Does not expand UW appetite, is for loss control ● Poor roof quality score still ineligible More Tools to Control Loss & LAE Our direct model gives us a unique ability to manage cost drivers Our system & our agents adapt quickly to change and can provide a clear explanation to customers and log the customer’s consent Our customers almost always choose to lower their premium by removing unnecessary cost drivers from their policy. We are one of the few carriers with non - AOB policy RSE = Large Claims Saving on Older Roofs ● Launched it as the first of its kind ● 99.9% attachment rate since launch ● Currently on 97.9% of our book ● 7% of claims had AOB but were invalid under policy kin.com | 42 For Every New Normal

Accurate, current data drives ● Sound, consistent underwriting ● Accurate pricing with sophisticated segmentation ● Responsible, comprehensive exposure management kin.com | 43 For Every New Normal September 2 <1 week after Ida landfall New Orleans, LA Even neighboring homes can perform very differently in a catastrophe

Adam Sturt, FCAS For Every New Normal VP Data Science → Allstate - Property Underwriting R&D Manager of Property Underwriting and Pricing research and development 10 years experience → Masters in Computer Science from the University of Chicago

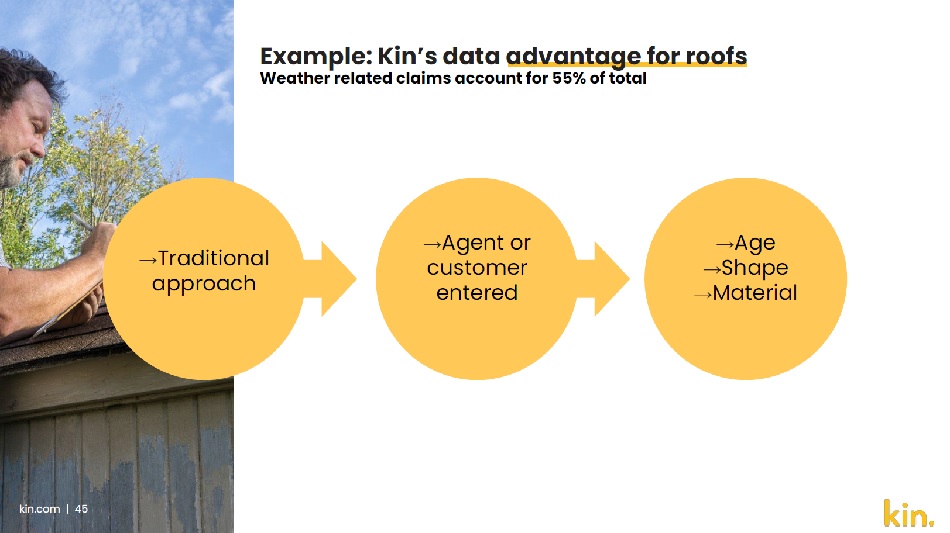

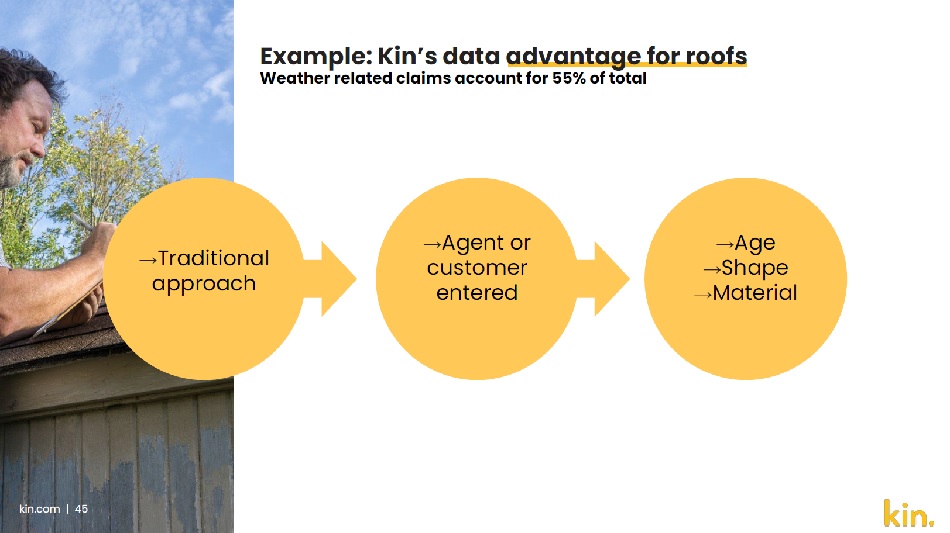

Example: Kin’s data a dvantage for roofs Weather related claims account for 55% of total → Agent or customer entered → Traditional approach → Age → Shape → Material

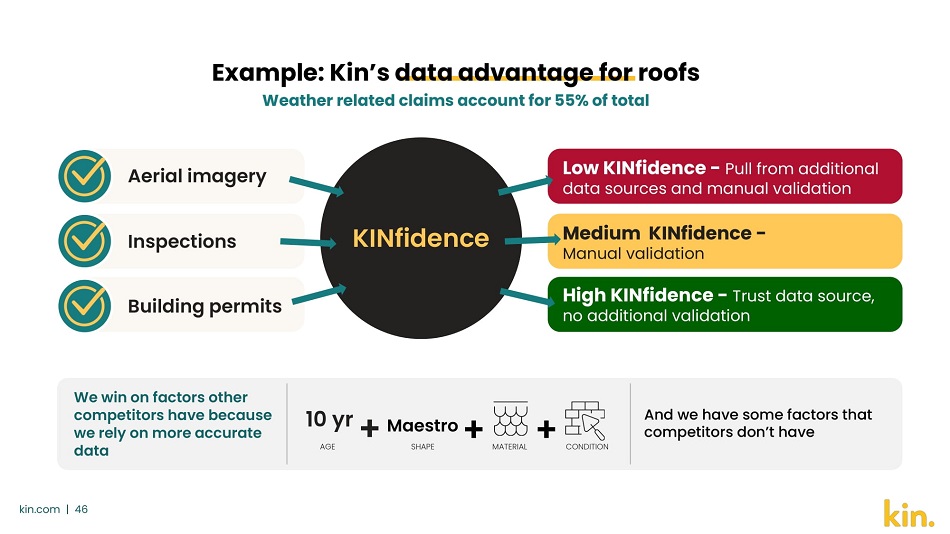

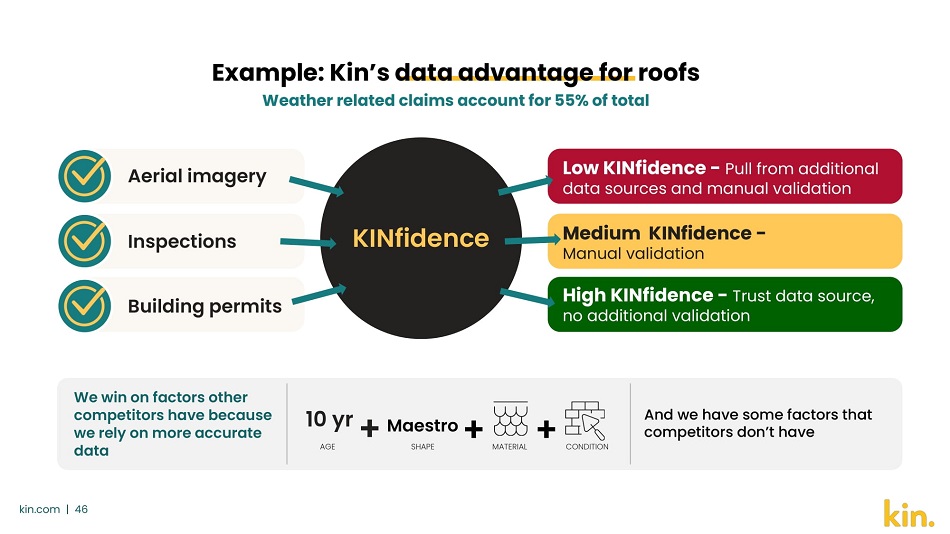

Example: Kin’s data advantage for roofs Weather related claims account for 55% of total + And we have some factors that competitors don’t have 10 yr AGE SHAPE + MATERIAL + CONDITION We win on factors other competitors have because we rely on more accurate data Aerial imagery Inspections Building permits Maestro KINfidence Low KINfidence - Pull from additional data sources and manual validation Medium KINfidence - Manual validation High KINfidence - Trust data source, no additional validation kin.com | 46

Automated pre - event texts help our customers prepare August 27th Ida became a hurricane and looked likely to hit Louisiana IDA TIMELINE Data Science: Projected policy count impact Identified all Kin policies within 5 - day projected path Initial $ projections of anticipated impact Pre - event text sent to all Kin customers in projected path of hurricane Provided link to custom content about how to prepare and mitigate risk T - 2 days kin.com | 47

As our forecast narrowed, our software sent additional texts to customers most at risk August 28th Ida intensified and reaches Category 4. IDA TIMELINE More granular identification of Kin policies by projected wind speed zones; monitoring levels established Known # of Policies in Force (PIF) in TS wind zones (low risk, minimal monitoring) Known # of PIF in intermediate wind zones (moderate risk, monitor but no action) Known # of PIF in Hurricane force wind zones (high risk, closely monitor for damage and customer safety) Updated $ projections of anticipated impact Second pre - event text due to potential severity of event T - 1 days kin.com | 48

Clay Rising For Every New Normal VP Claims → National Large Loss Manager - ASI/Progressive Home : Led the organization in large losses across 46 States, both Catastrophe and non - Catastrophe claims. → Major Case Adjuster - ASI and Travelers

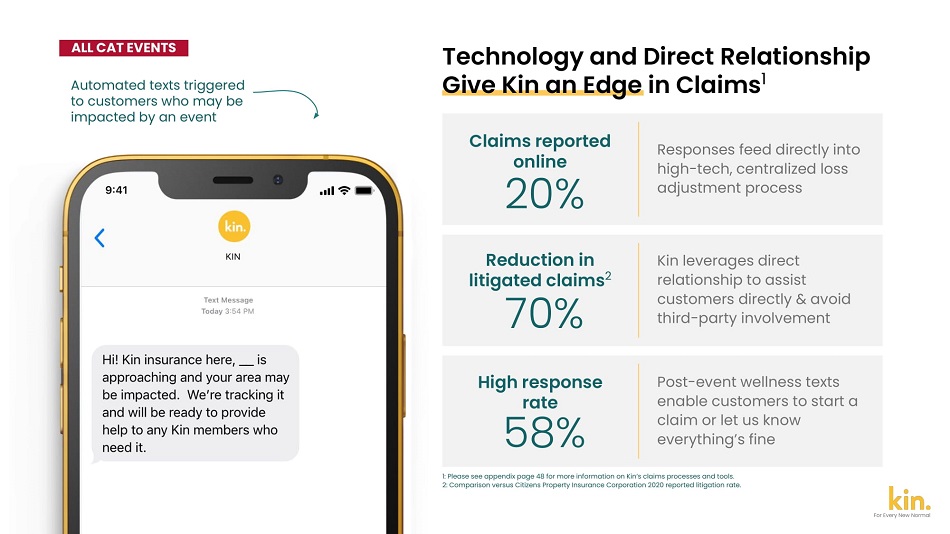

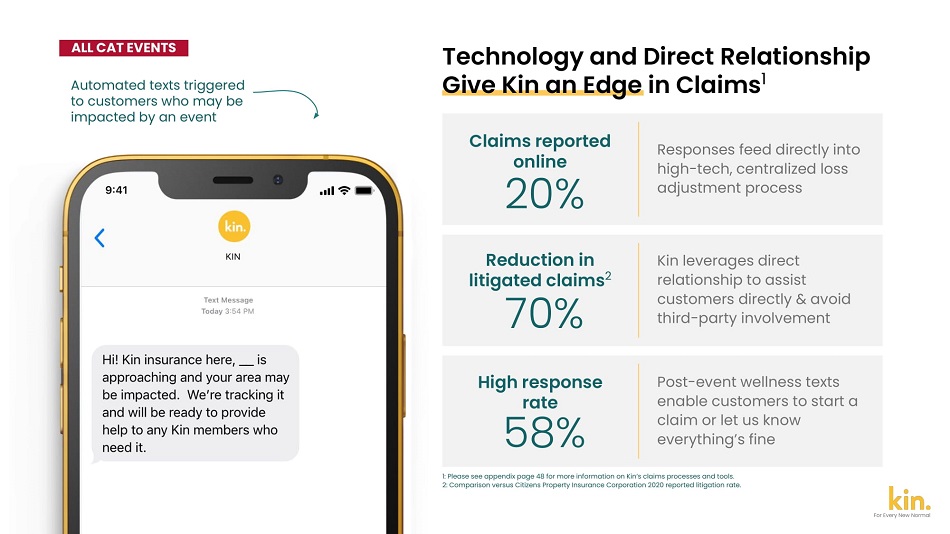

Responses feed directly into high - tech, centralized loss adjustment process Claims reported online Kin leverages direct relationship to assist customers directly & avoid third - party involvement Post - event wellness texts enable customers to start a claim or let us know everything’s fine 20% Reduction in litigated claims 2 70% High response rate 58% Technology and Direct Relationship Give Kin an Edge in Claims 1 1: Please see appendix page 48 for more information on Kin’s claims processes and tools. 2: Comparison versus Citizens Property Insurance Corporation 2020 reported litigation rate. Automated texts triggered to customers who may be impacted by an event ALL CAT EVENTS For Every New Normal

kin.com | 51 Our software monitored wind speeds and texted potentially impacted customers, which customers loved August 29th Ida made landfall as a Category 4. IDA TIMELINE 0 days = Landfall

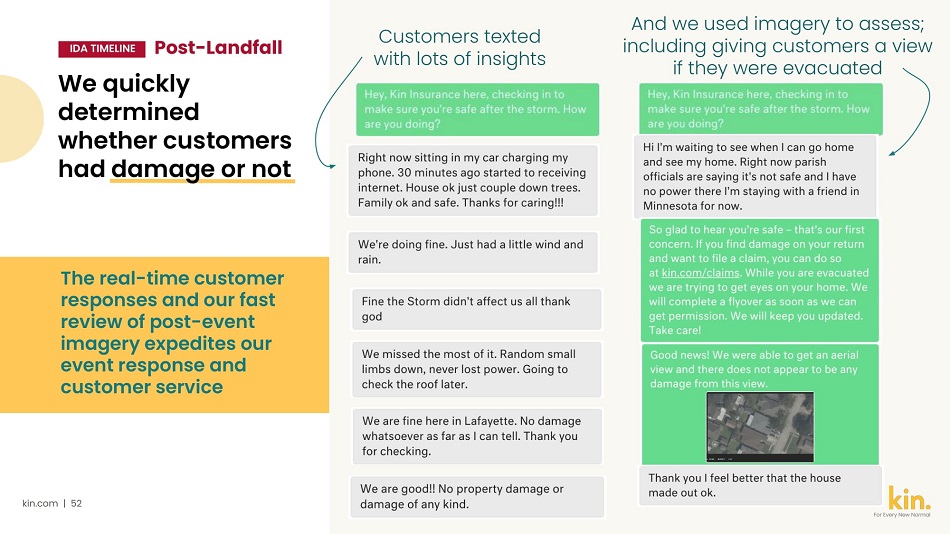

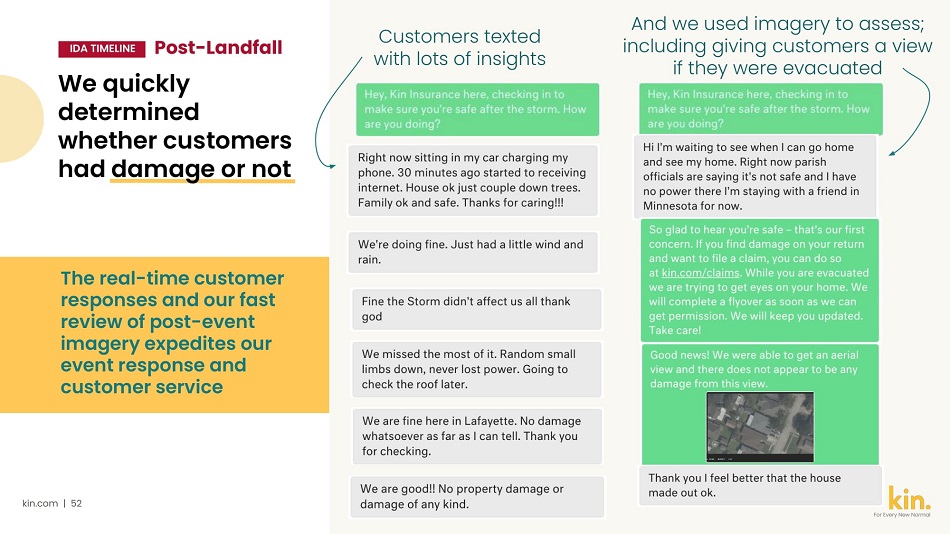

kin.com | 52 For Every New Normal Customers texted us with insights The real - time customer responses and our fast review of post - event imagery expedites our event response and customer service And we used imagery to assess; including giving customers a view if they were evacuated We quickly determined whether customers had damage or not IDA TIMELINE Post - Landfall

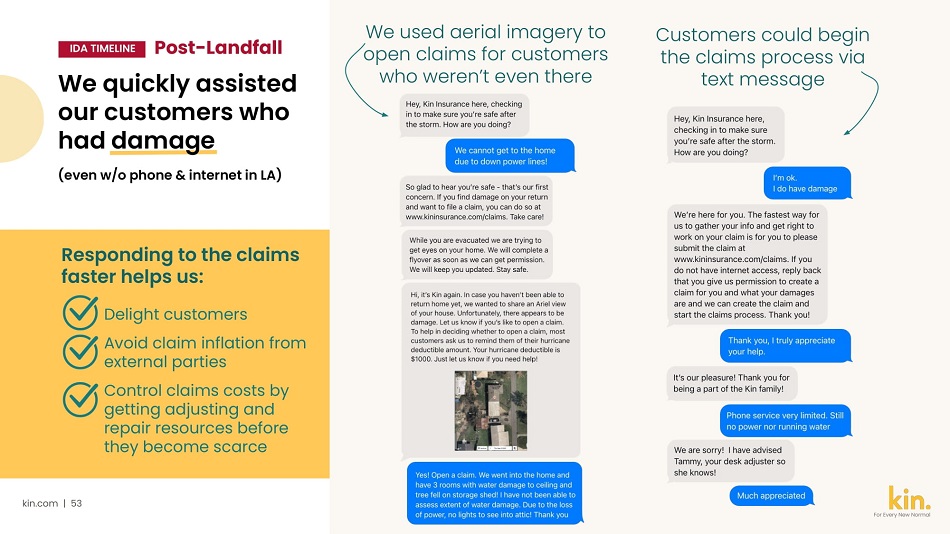

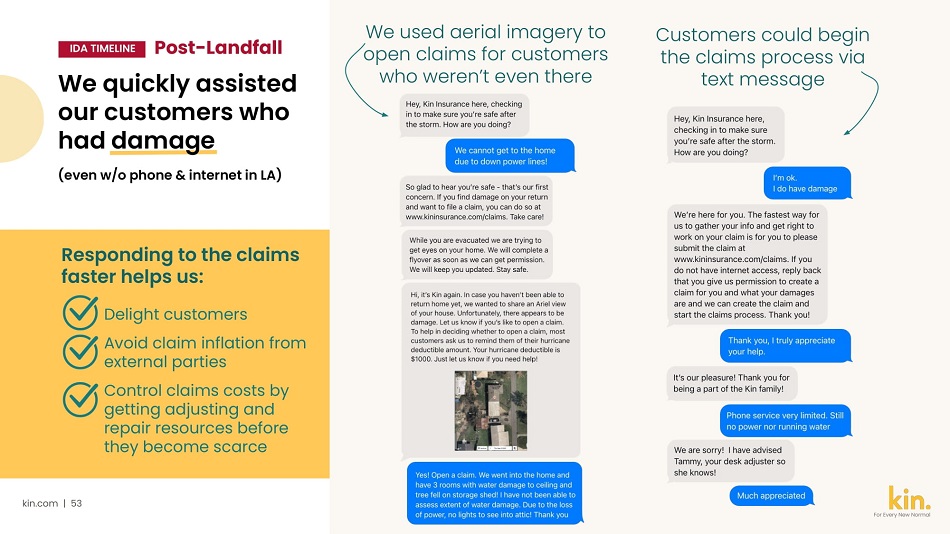

kin.com | 53 For Every New Normal Customers could begin the claims process via text message Responding to the claims faster helps us: Delight customers Avoid claim inflation from external parties Control claims costs by getting adjusting and repair resources before they become scarce We quickly assisted customers with damage (even w/o phone & internet in LA) IDA TIMELINE Post - Landfall We used aerial imagery to open claims for customers who weren’t even there

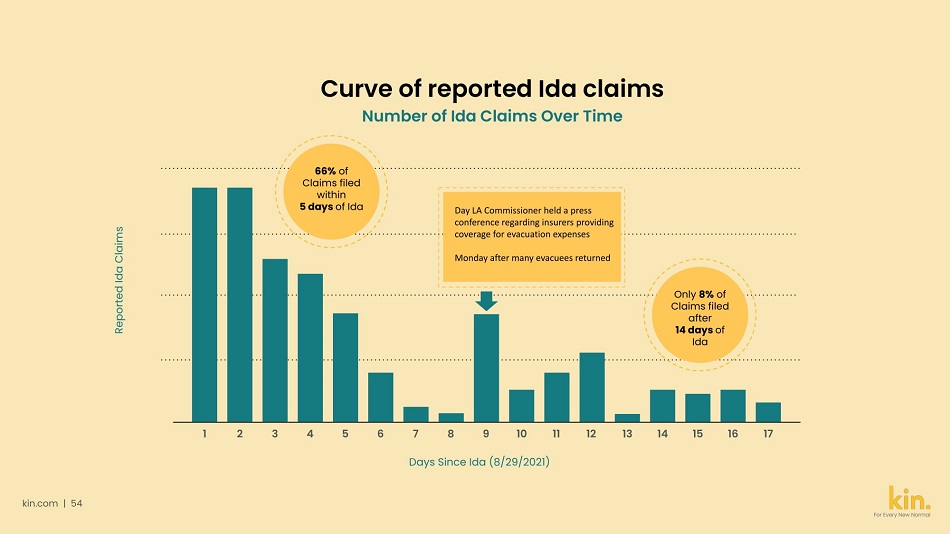

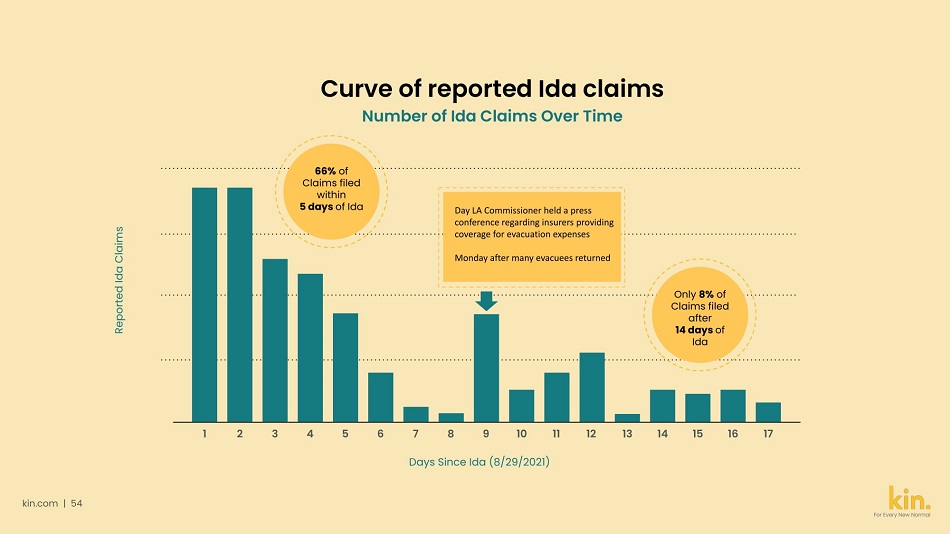

kin.com | 54 Curve of reported Ida claims Number of Ida Claims Over Time 1 2 3 4 5 6 12 13 14 15 16 17 Reported Ida Claims 7 8 9 10 11 Days Since Ida (8/29/2021) 66% of Claims filed within 5 days of Ida Only 8% of Claims filed after 14 days of Ida ● Date LA Commissioner held a press conference ordering coverage for evacuation expenses ● Monday after many evacuees returned For Every New Normal

Dan Ajun For Every New Normal Chief Actuary → Actuary and Product Manager - Cabrillo Coastal Spent six years as actuary and homeowners product manager for top performing catastrophe focused carrier. → Actuary - Rollins Analytics Consultant for Property Insurers operating in the State of Florida

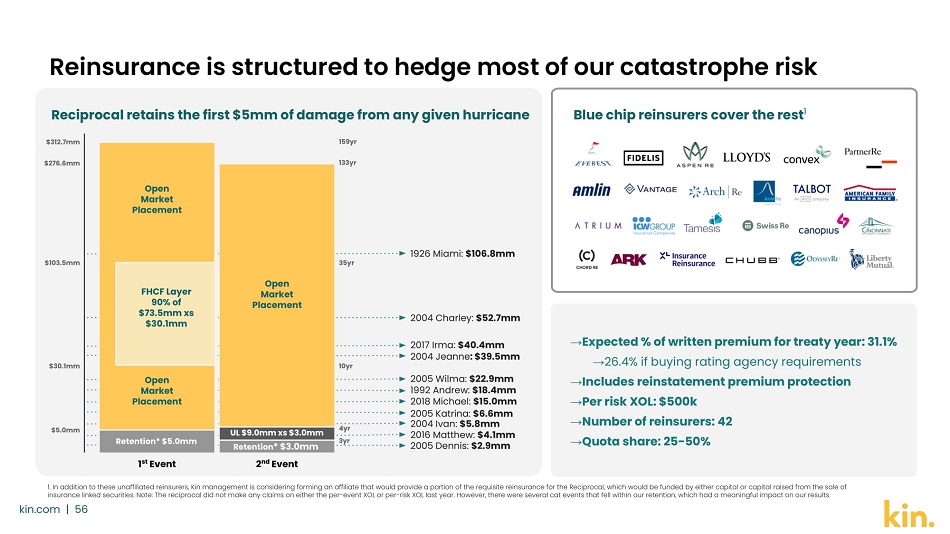

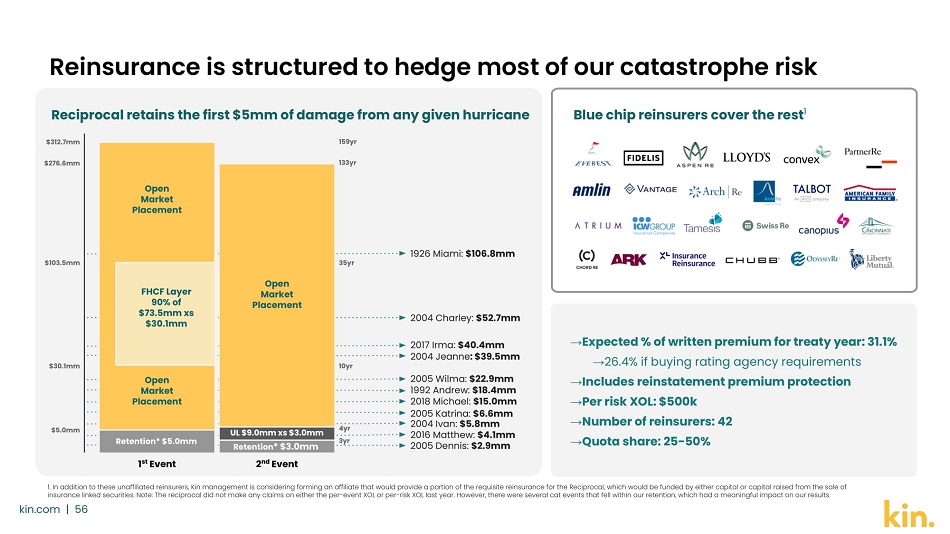

Reciprocal retains the first $5mm of damage from any given hurricane Blue chip reinsurers cover the res t 1 Retention* $5.0mm Open Market Placement $5.0mm $30.1mm FHCF Layer 90% of $73.5mm xs $30.1mm $103.5mm $312.7mm Open Market Placement Retentio n * $3.0mm Open Market Placement $276.6mm UL $9.0mm xs $3.0mm 1 st Event 2 nd Event 1. In addition to these unaffiliated reinsurers, Kin management is considering forming an affiliate that would provide a portion of the requisite reinsurance for the Reciprocal, which would be funded by either capital or capital raised from the sale of insurance linked securities. Note: The reciprocal did not make any claims on either the per - event XOL or per - risk XOL last year. However, there were several cat events that fell within our retention, which had a meaningful impact on our results. kin.com | 56 159yr 35yr 10yr 133yr 4yr 3yr Reinsurance is structured to hedge most of our catastrophe risk → Expected % of written premium for treaty year: 31.1% → 26.4% if buying rating agency requirements → Includes reinstatement premium protection → Per risk XOL: $500k → Number of reinsurers: 42 → Quota share: 25 - 50% 1926 Miami: $106.8mm 2004 Charley: $52.7mm 2017 Irma: $40.4mm 2004 Jeanne : $39.5mm 2005 Wilma: $22.9mm 1992 Andrew: $18.4mm 2018 Michael: $15.0mm 2005 Katrina: $6.6mm 2004 Ivan: $5.8mm 2016 Matthew: $4.1mm 2005 Dennis: $2.9mm

kin.com | 57 Kin has delivered superior underwriting results For Every New Normal

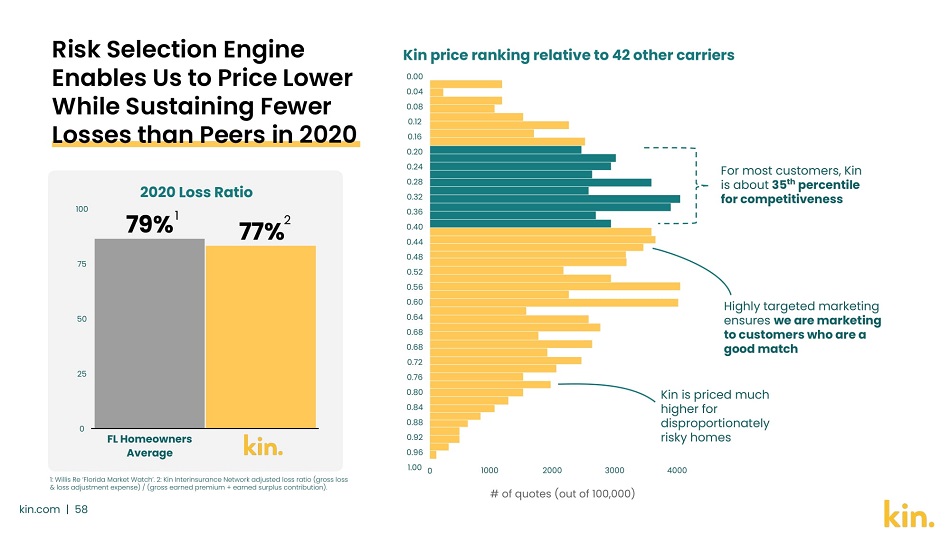

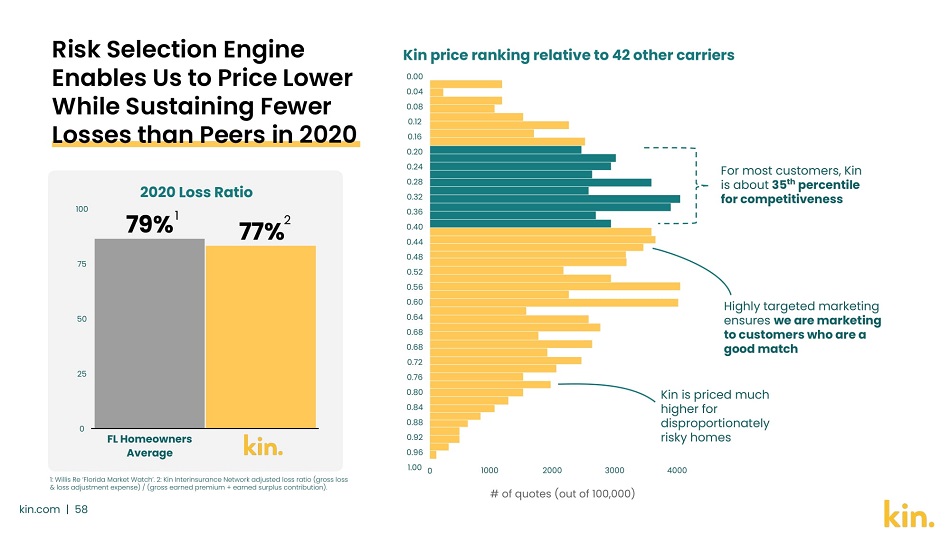

Risk Selection Engine Enables Us to Price Lower While Sustaining Fewer Losses than Peers in 2020 1: Willis Re ‘Florida Market Watch’. 2: Kin Interinsurance Network adjusted loss ratio (gross loss & loss adjustment expense) / (gross earned premium + earned surplus contribution). 1000 2000 3000 # of quotes (out of 100,000) Kin is priced much higher for disproportionately risky homes For most customers, Kin is about 35 th percentile for competitiveness Highly targeted marketing ensures we are marketing to customers who are a good match 2020 Loss Ratio 100 75 50 25 0 FL Homeowners Average 77% 79% 0.00 0.04 0.08 0.12 0.16 0.20 0.24 0.28 0.32 0.36 0.40 0.44 0.48 0.52 0.56 0.60 0.64 0.68 0.68 0.72 0.76 0.80 0.84 0.88 0.92 0.96 1.00 0 4000 Kin price ranking relative to 42 other carriers kin.com | 58 1 2

177% - 100% kin.com | 59 - 11% - 13% - 13% Changes Hippo 1H’21 Kin Out Kin 2020 Adj. Loss Excess Cat 3 Already Launched Already Pro Forma Adj. Loss Ratio 1 Performance Ratio 2 Rate Increases Implemented Loss Ratio Underwriting 77% 2020 Kin hit by 4 hurricanes One in Sept. ’20, One in May ’21 Three major changes implemented last year 40% 1: Q1’21 gross loss & LAE ratio. From HIPO 8 - k filed 9/1/21 2: Kin Interinsurance Network adjusted loss ratio (gross loss & loss adjustment expense) / (gross earned premium + earned surplus contribution). The Company works to apply a conservative IBNR reserving philosophy based on actuarial assessment. The 2020 actual loss experience to date (51% adjusted) is less than the published loss ratio. Kin's 2019 loss ratio was comparable. 3: Catastrophe loss excess of modeled Average Annual Loss (AAL) for our 2020 portfolio. Recent Rate & Underwriting Actions to Achieve T arget Loss Ratio

kin.com | 60 >90% of customers who were offered renewals chose to renew, despite average rate increases >10% New business conversion stayed steady despite higher average premiums per policy Renewal Rate & Average Price Increase RATES Rate Increases Not Impacting Our Retention or Conversion Rates Our rate need is less than our competitors’ and customers choose us for reasons other than price. 25.0% 15.0% 10.0% 5.0% 0.0% 2020 - Q4 17.0% 2021 - Q2 20.0% 12.0% 11.8% 2021 - Q1 100.0% 50.0 25.0% 0.0% 75.0% 94.9% 93.9% 92.4% Price Increase Policy Renewal Rate *Renewal rate for customers who were offered renewals only 0.0% $0 $500 $1,000 $1,500 15.0% $1,389 $1,409 $1,325 $1,399 $1,425 Florida Click Lead Conversion & Average Premiums $1,528 9.5% 9.1% 7.6% 7.6% 8.8% 8.3% 2020 - Q1 2020 - Q2 2020 - Q3 2020 - Q4 2021 - Q1 2021 - Q2 Avg, Policy Conversion 10.0% 5.0%

100.0% 75.0% 50.0% 25.0% 0.0% kin.com | 61 Loss Ratio has responded to our price increases and underwriting actions Loss & LAE Ratio Cat vs Non - Cat 1H 2020 23.7% 72.5% 21.3% 96.2% 55.8% 77.1% 10.5% 56.7% 67.3% FY 2020 1H 2021 Cat Non - Cat For Every New Normal

Important Information for Investors and Stockholders

This communication relates to a proposed business combination (the “Business Combination”) between Omnichannel Acquisition Corp. (“Omnichannel”) and Kin Insurance, Inc. (“Kin”). In connection with the proposed Business Combination, Omnichannel has filed with the SEC a registration statement on Form S-4 that includes a preliminary proxy statement of Omnichannel in connection with Omnichannel’s solicitation of proxies for the vote by Omnichannel’s stockholders with respect to the proposed Business Combination and a preliminary prospectus of Omnichannel. The final proxy statement/prospectus will be sent to all Omnichannel stockholders, and Omnichannel will also file other documents regarding the proposed Business Combination with the SEC. This communication does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Before making any voting or investment decision, investors and security holders are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed Business Combination as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Omnichannel through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Omnichannel may be obtained free of charge by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, New Jersey 07901.

Forward-Looking Statements

This communication includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of Kin or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement and the proposed Business Combination contemplated thereby; (2) the inability to complete the transactions contemplated by the transaction agreement due to the failure to obtain approval of the stockholders of Omnichannel or other conditions to closing in the transaction agreement; (3) the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the transaction agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Kin as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; and (8) the possibility that Kin may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Omnichannel’s Annual Report on Form 10-K, and other documents filed by Omnichannel from time to time with the SEC and the registration statement on Form S-4 and proxy statement/prospectus discussed above. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Omnichannel and Kin assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Any financial and capitalization information or projections in this communication are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Omnichannel’s and Kin’s control. While such information and projections are necessarily speculative, Omnichannel and Kin believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this communication should not be regarded as an indication that Omnichannel or Kin, or their respective representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events.

Participants in the Solicitation

Omnichannel, Kin and their respective directors and executive officers may be deemed participants in the solicitation of proxies of Omnichannel stockholders with respect to the proposed Business Combination. Omnichannel stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of Omnichannel Acquisition Corp. and their ownership of Omnichannel’s securities in Omnichannel’s final prospectus relating to its initial public offering, which was filed with the SEC on November 23, 2020 and is available free of charge at the SEC’s website at www.sec.gov, or by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, New Jersey 07901.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus that Omnichannel intends to file with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

Contacts

Kin

Investor Relations

investors@kin.com

Media Relations

press@kin.com

Omnichannel

Investor Relations

oacir@icrinc.com

Media Relations

oacpr@icrinc.com